OPINION

2021 Apr/20

Fractional Share Trading and Investor Access

Apr. 20, 2021

PDF

- Summary

- Fractional share trading that has been gaining popularity in overseas markets refers to a service that allows investors to trade a fraction of a share. With the rise of direct investment demand among retail investors, there has been a growing interest in fractional trading. By enhancing investor access that is currently limited by investment sizes and stock price levels, this type of trading is expected to contribute to providing small investors broader investment opportunity sets and more effective portfolio diversification. However, there are innate demerits and potential side effects in the current fractional share trading service. It would be wise, therefore, to benchmark overseas cases in improving current policy as part of effort to broaden services and customer experience in portfolio investment.

Fractional share trading refers to a type of trading service where the unit of trading is smaller than one share. With the rise of direct investment by retail investors, fractional trading has been receiving growing interest from the industry as well as the financial authorities. The concept of fractional shares derives from the dividend reinvestment program offered by US retail brokerage firms. When the program automatically reinvests dividend payments in additional shares, the fractional amount is carried to the next dividend payment. In addition, fractional trading was offered as part of a customized portfolio service,1) and more recently, became more widespread in online and mobile brokerage services by Robinhood, Charles Schwab, Fidelity, and others. As fractional trading and commission-free trading are perceived as democratizing the stock markets, many retail brokerage firms are eyeing on this service. Currently, diverse forms of fractional trading have been available in the market.

Although Korea has yet to launch fractional trading in earnest, there have been some discussions to introduce it as part of regulatory exemption. Last year, two domestic brokers were designated for the regulatory sandbox program to provide fractional trading service only for securities listed overseas. However, the service is still at a nascent stage due to the shortfall in the timeliness of trading execution and the limited scope of service. Because the absence of regulation and infrastructure has delayed fractional trading of domestic securities in Korea, many ideas have been mentioned to address the delay. Against the backdrop, this article tries to provide some basic analysis results related to investor access, which will reinforce the need for fractional trading and provide the expected outcomes.

Stock price level and investment access

Demand for fractional trading arises largely because of different levels of investor access depending on stock prices. In a stock market where the trading unit is a full share, the levels of individual stock prices in general serve as an important factor determining investor access. With other conditions being the same, investors with smaller assets, in particular, have a higher incentive to trade a lower-priced stock than a high-priced one. This is why corporate executives try to enhance investor access to their stocks with various tools such as a stock split. For example, Samsung Electronics implemented a 50:1 stock split in 2018, whereas Warren Buffet issued B shares of Berkshire Hathaway (BRK.B) at one-thirty of the A shares (BRK.A), both of which intend to lower the per-share price for enhancing investor access.

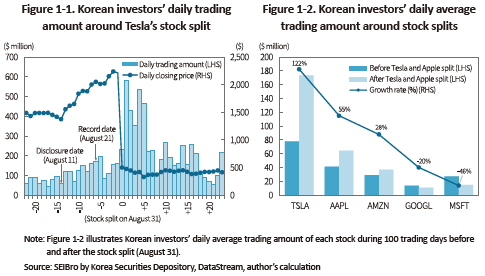

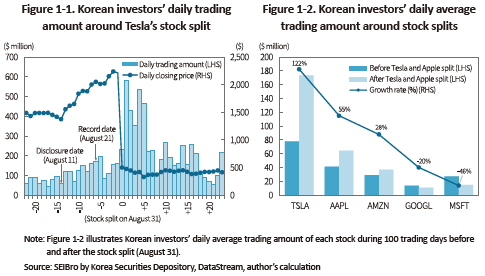

In August 2020, Apple (AAPL) and Tesla (TSLA)—two flagship stocks in the US stock market—decided 4:1 and 5:1 stock splits respectively as part of attempt to make the stock more affordable and thus accessible for investors.2) As shown in Figure 1-1, Tesla, one of the most popular foreign stocks among Korean investors, saw its per-share price fall from over $2,000 to below $500 due to the stock split, which increased the trading value among Korean investors. Especially, the trading value surged for five trading days after the split thanks to enhanced investor access.

Figure 1-2 demonstrates the changes in daily average trading value of five stocks—Tesla, Apple, Amazon, class-A shares of Google, and Microsoft that were traded the most by Korean investors before and after Tesla and Apple splits. After the stock split, Tesla’s daily average trading value more than doubled (increasing 122%) compared to the pre-split period, while that of Apple that implemented a 4:1 split on the same day increased more than 1.5 times. By contrast, the pace of increase in the daily average trading value was higher in non-split stocks than split stocks. Some of non-split stocks even saw the trading value fall. Although various other factors could affect the changes in trading value, the data imply a significant relationship between individual stock prices and investor access.

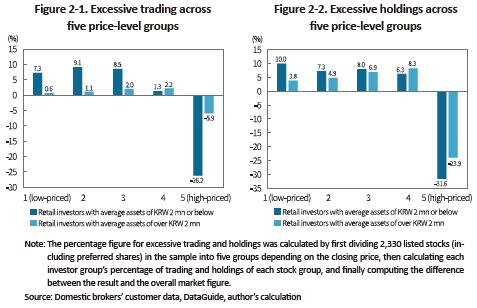

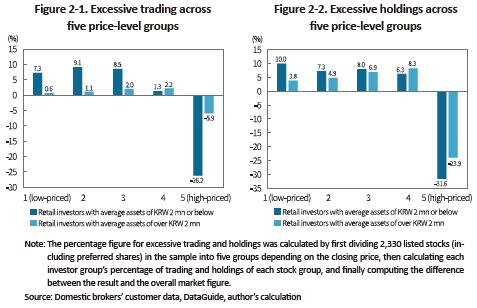

The above argument leads to another question: Do investors with a smaller asset size prefer low-priced stocks? To answer the question, I used the sample of retail customers in Korean brokerage firms to take a look at how their trading and stock holdings differ across the groups with different asset sizes. I divided the sample into two groups of investors—the low-asset group with the average asset size of KRW 2 million or below, and the high-asset group with over KRW 2 million,3) for computing each groups’ stock trading and holdings in excess of the market average.4) The stocks here were divided into groups depending on their prices. The higher percentage figure for trading (or holdings) of one stock group here indicates that the trading (or holdings) of that stock group accounts for a larger proportion compared to the market average.

In Figure 2-1 and Figure 2-2, the listed stocks in the sample were divided into five groups depending on their prices with each group containing the same number of stocks,5) and their proportion of excessive trading and holdings were computed across the two investor groups described above. The analysis results show that, among others, retail investors regardless of the asset size tend not to prefer high-priced stocks (group 5), which is well reflected in the negative excessive trading and holdings. By contrast, low-priced stocks show positive values for excessive trading and holdings. Both results clearly indicate a negative relationship between stock price levels and investor access in Korea’s stock market.

Among others, the differences in stock trading and holdings depending on stock price levels are found more prominent among low-asset investors with the average asset of KRW 2 million or below. For example, excessive trading among those investors stood at 7%-9% in three low-priced groups (group 1, 2, and 3), but the figure was as low as -26.2% in the highest-priced group. On the other hand, the high-asset investor group (whose average asset exceeding KRW 2 million) had excessive trading being as low as 0%–2% in the low-priced stock groups and only -5.9% in the highest-priced stock group. This marks a stark contrast with the low-asset investor group. The results remain consistent in stock holdings, which could be interpreted as small-sum investors’ relative preference to low-priced stocks. One of the factors behind such a finding could be low investor access to high-priced stocks.

Expected outcomes of fractional trading

In line with the results shown in the above results, fractional trading is expected to greatly enhance investor access to high-priced stocks for small investors by making high-priced stocks more affordable. Especially since the average prices of top stocks in terms of market cap are at relatively high levels, fractional trading could make investing in those top stocks more affordable and thus contribute to portfolio diversification of small investors. Also, this enables retail investors with small assets to diversify their portfolios, which would improve risk management by addressing those investors’ behavior of disproportionately concentrating on a small number of stocks.

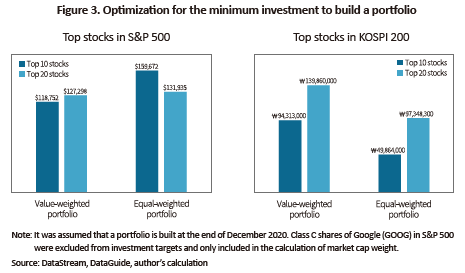

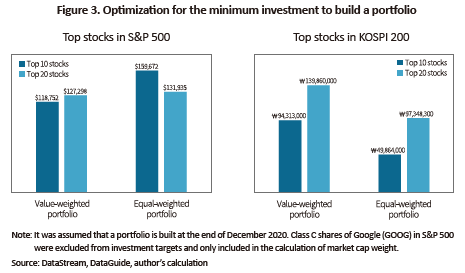

In reality, it takes a sizable amount of funds to build a portfolio of top market-cap stocks. Figure 3 demonstrates the result of the minimum investment required to build value-weighted and equal-weighted portfolios of top stocks in S&P 500 and KOSPI 200 using the optimization method.6) The minimum investment for an equal-weighted portfolio of top 10 market cap stocks would be $159,672 for S&P 500, and KRW 49.864 million for KOSPI 200. Of course, the amount of the minimum investment could vary depending on target weights and optimization conditions. However, the result implies that portfolio diversification with the trading unit being one whole share requires a considerable amount of investment. If the trading unit is reduced to factional shares, for example, 0.01 share, the minimum investment to build a portfolio with the same weights will fall to one-hundredth or $1,596.72 and KRW 498,640. In this regard, fractional trading is expected to make small investors’ portfolio diversification more affordable and convenient.

However, fractional trading is not without demerits that would limit the positive effect mentioned above. First, the market may not have sufficient demand for portfolio diversification using fractional trading. A retail investor wishing to purchase a diverse range of shares may face a high cost of portfolio rebalancing and management that could be larger than the utility of portfolio diversification. Rather, it would be more effective to opt for alternatives such as a mutual fund or ETF on a similar portfolio. Another possibility is that retail investors’ preference to low-priced stocks could be the result of other factors, for example, their excessively high required return, gambling behavior,7) and others. If those factors exist, the enhanced access to high-priced stocks could only produce an adverse effect of increasing unnecessary trading for short-term investment.

Furthermore, fractional trading services in Korea and abroad are not subject to a uniform regulation, with each service provider offering different service targets and processes for related matters such as dividends and other corporate decisions (exercising voting rights, stock splits, etc.). Among others, the way fractional trading is executed is often based on not the limit order, but the market order or the volume-weighted average price that is for brokers collecting internal as well as external orders to satisfy the minimum trading unit required by each stock exchange. Because fractional trading is unable to guarantee liquidity that enables investors to buy or sell anytime at any price they want, the Securities Exchange Commission in the US also warned of such risk factors to investors.8)

Conclusion

As described in this article, fractional trading has some demerits that could lead to adverse effects. This is why many overseas brokerage firms are presenting various tools via which to offset such demerits, to achieve their fundamental service goal of long-term portfolio diversification, and to ultimately widen customer experience. For example, Charles Schwab allows investors to buy or sell a single slice or up to 30 slices of stock with the amount and portfolio weights they want in a single order. Another brokerage M1 Finance provides a portfolio management platform and an automatic trading tool both of which help investors to use fractional trading for managing their portfolio more efficiently.

It appears that it would take a considerable amount of time and effort such as an overhaul in the regulatory framework, an improvement in trading and depository systems, review on IT system stability, etc., before fractional trading fully takes hold in Korea. However, fractional trading is expected to deliver many benefits, such as widening investment opportunity sets and making portfolio diversification more affordable and convenient for small investors. This is why many alternatives are already available in the market. Given that, it would be wise to benchmark overseas cases to reflect them in relevant policy as well as to broaden asset management services in Korea.

1) For example, M1 Finance offers a portfolio service where any customer with the initial investment of $100 can invest in a diversified set of assets (mutual funds, fixed income, stocks, etc.). Investors using the service can trade fractional shares in a diversified portfolio.

2) Both stocks were split as new shares are listed on August 31.

3) The sample includes roughly 200,000 investors. An investor with the average asset size of KRW 2 million is around at the bottom 25% to 30% in this sample.

4) The percentage figure for excessive trading and holdings of a specific retail investor group was obtained by calculating the difference from the percentage of overall investors’ trading value and their market cap.

5) The average prices of the five stock groups are as follows: Group 1 (KRW 1,240), group 2 (KRW 3,050), group 3 (KRW 6,200), group 4 (KRW 14,120), and group 5 (KRW 79,380). Except for group 5, the price levels are not quite high.

6) With the target weight of each stock being wT, the disparate ratio (wP-wT) is the difference between target weight wT and random weight wP obtained when the total investment X is invested in full shares of the investment target. The minimum investment X is a value to make the root mean square of the disparate ratio below 0.1%.

7) Kumar (2009) finds that retail investors prefer low-priced stocks, arguing that they perceive stock investing a type of gambling and thus prefer relatively cheap bets (Kumar, A., 2009, Who gambles in the stock market?, The Journal of Finance 64(4), 1889-1993).

8) Fractional Share Investing – Buying a Slice Instead of the Whole Share, November 9, 2020, Investor Alerts and Bulletins, SEC’s Office of Investor Education and Advocacy.

Although Korea has yet to launch fractional trading in earnest, there have been some discussions to introduce it as part of regulatory exemption. Last year, two domestic brokers were designated for the regulatory sandbox program to provide fractional trading service only for securities listed overseas. However, the service is still at a nascent stage due to the shortfall in the timeliness of trading execution and the limited scope of service. Because the absence of regulation and infrastructure has delayed fractional trading of domestic securities in Korea, many ideas have been mentioned to address the delay. Against the backdrop, this article tries to provide some basic analysis results related to investor access, which will reinforce the need for fractional trading and provide the expected outcomes.

Stock price level and investment access

Demand for fractional trading arises largely because of different levels of investor access depending on stock prices. In a stock market where the trading unit is a full share, the levels of individual stock prices in general serve as an important factor determining investor access. With other conditions being the same, investors with smaller assets, in particular, have a higher incentive to trade a lower-priced stock than a high-priced one. This is why corporate executives try to enhance investor access to their stocks with various tools such as a stock split. For example, Samsung Electronics implemented a 50:1 stock split in 2018, whereas Warren Buffet issued B shares of Berkshire Hathaway (BRK.B) at one-thirty of the A shares (BRK.A), both of which intend to lower the per-share price for enhancing investor access.

In August 2020, Apple (AAPL) and Tesla (TSLA)—two flagship stocks in the US stock market—decided 4:1 and 5:1 stock splits respectively as part of attempt to make the stock more affordable and thus accessible for investors.2) As shown in Figure 1-1, Tesla, one of the most popular foreign stocks among Korean investors, saw its per-share price fall from over $2,000 to below $500 due to the stock split, which increased the trading value among Korean investors. Especially, the trading value surged for five trading days after the split thanks to enhanced investor access.

The above argument leads to another question: Do investors with a smaller asset size prefer low-priced stocks? To answer the question, I used the sample of retail customers in Korean brokerage firms to take a look at how their trading and stock holdings differ across the groups with different asset sizes. I divided the sample into two groups of investors—the low-asset group with the average asset size of KRW 2 million or below, and the high-asset group with over KRW 2 million,3) for computing each groups’ stock trading and holdings in excess of the market average.4) The stocks here were divided into groups depending on their prices. The higher percentage figure for trading (or holdings) of one stock group here indicates that the trading (or holdings) of that stock group accounts for a larger proportion compared to the market average.

In Figure 2-1 and Figure 2-2, the listed stocks in the sample were divided into five groups depending on their prices with each group containing the same number of stocks,5) and their proportion of excessive trading and holdings were computed across the two investor groups described above. The analysis results show that, among others, retail investors regardless of the asset size tend not to prefer high-priced stocks (group 5), which is well reflected in the negative excessive trading and holdings. By contrast, low-priced stocks show positive values for excessive trading and holdings. Both results clearly indicate a negative relationship between stock price levels and investor access in Korea’s stock market.

Expected outcomes of fractional trading

In line with the results shown in the above results, fractional trading is expected to greatly enhance investor access to high-priced stocks for small investors by making high-priced stocks more affordable. Especially since the average prices of top stocks in terms of market cap are at relatively high levels, fractional trading could make investing in those top stocks more affordable and thus contribute to portfolio diversification of small investors. Also, this enables retail investors with small assets to diversify their portfolios, which would improve risk management by addressing those investors’ behavior of disproportionately concentrating on a small number of stocks.

However, fractional trading is not without demerits that would limit the positive effect mentioned above. First, the market may not have sufficient demand for portfolio diversification using fractional trading. A retail investor wishing to purchase a diverse range of shares may face a high cost of portfolio rebalancing and management that could be larger than the utility of portfolio diversification. Rather, it would be more effective to opt for alternatives such as a mutual fund or ETF on a similar portfolio. Another possibility is that retail investors’ preference to low-priced stocks could be the result of other factors, for example, their excessively high required return, gambling behavior,7) and others. If those factors exist, the enhanced access to high-priced stocks could only produce an adverse effect of increasing unnecessary trading for short-term investment.

Furthermore, fractional trading services in Korea and abroad are not subject to a uniform regulation, with each service provider offering different service targets and processes for related matters such as dividends and other corporate decisions (exercising voting rights, stock splits, etc.). Among others, the way fractional trading is executed is often based on not the limit order, but the market order or the volume-weighted average price that is for brokers collecting internal as well as external orders to satisfy the minimum trading unit required by each stock exchange. Because fractional trading is unable to guarantee liquidity that enables investors to buy or sell anytime at any price they want, the Securities Exchange Commission in the US also warned of such risk factors to investors.8)

Conclusion

As described in this article, fractional trading has some demerits that could lead to adverse effects. This is why many overseas brokerage firms are presenting various tools via which to offset such demerits, to achieve their fundamental service goal of long-term portfolio diversification, and to ultimately widen customer experience. For example, Charles Schwab allows investors to buy or sell a single slice or up to 30 slices of stock with the amount and portfolio weights they want in a single order. Another brokerage M1 Finance provides a portfolio management platform and an automatic trading tool both of which help investors to use fractional trading for managing their portfolio more efficiently.

It appears that it would take a considerable amount of time and effort such as an overhaul in the regulatory framework, an improvement in trading and depository systems, review on IT system stability, etc., before fractional trading fully takes hold in Korea. However, fractional trading is expected to deliver many benefits, such as widening investment opportunity sets and making portfolio diversification more affordable and convenient for small investors. This is why many alternatives are already available in the market. Given that, it would be wise to benchmark overseas cases to reflect them in relevant policy as well as to broaden asset management services in Korea.

1) For example, M1 Finance offers a portfolio service where any customer with the initial investment of $100 can invest in a diversified set of assets (mutual funds, fixed income, stocks, etc.). Investors using the service can trade fractional shares in a diversified portfolio.

2) Both stocks were split as new shares are listed on August 31.

3) The sample includes roughly 200,000 investors. An investor with the average asset size of KRW 2 million is around at the bottom 25% to 30% in this sample.

4) The percentage figure for excessive trading and holdings of a specific retail investor group was obtained by calculating the difference from the percentage of overall investors’ trading value and their market cap.

5) The average prices of the five stock groups are as follows: Group 1 (KRW 1,240), group 2 (KRW 3,050), group 3 (KRW 6,200), group 4 (KRW 14,120), and group 5 (KRW 79,380). Except for group 5, the price levels are not quite high.

6) With the target weight of each stock being wT, the disparate ratio (wP-wT) is the difference between target weight wT and random weight wP obtained when the total investment X is invested in full shares of the investment target. The minimum investment X is a value to make the root mean square of the disparate ratio below 0.1%.

7) Kumar (2009) finds that retail investors prefer low-priced stocks, arguing that they perceive stock investing a type of gambling and thus prefer relatively cheap bets (Kumar, A., 2009, Who gambles in the stock market?, The Journal of Finance 64(4), 1889-1993).

8) Fractional Share Investing – Buying a Slice Instead of the Whole Share, November 9, 2020, Investor Alerts and Bulletins, SEC’s Office of Investor Education and Advocacy.