OPINION

2019 Mar/26

Changes in the Revenue Structure of Japanese Securities Firms and Their Implications

Mar. 26, 2019

PDF

Chang, Jung-moh

- Summary

- As Japan moved towards a market-based financial system, it became essential for Japanese securities companies to break away from their traditional business model relying on brokerage commissions. Changes in the revenue structure of the Japanese securities industry over the last 15 years show that the proportion of brokerage commissions in total revenues plummeted whereas the proportions of trading revenue and other commissions grew rapidly over the same period. The change in the share of other commissions indicates that the main source of revenue for asset management business has been being shifted from sales commissions to fees that are based on client assets under management. Meantime, the increase in trading revenue was attributable mainly to the expansion of capital-intensive business by large securities firms, underpinned by their capital strength and high leverage. Recent competition among Japanese securities companies for retail asset management advice and services is directed at maximizing client assets under management with considering their total assets. A comprehensive approach needs to be taken for the elderly given the vast majority of financial assets held by older people in Japan. Large securities firms are in a more advantageous position than smaller or online peers because large independent securities firms have more points of contract with the elderly, and securities subsidiaries of mega banks can benefit from customer referral by their affiliates. It is worth watching how independent securities firms will respond to such move from the megabank subsidiaries.

Japan has strived for a shift from a bank-based to a market-based financial system with the backing of the Financial Instruments and Exchange Act in 2007 following the Financial System Reform Act in 1998. The transition towards the market-based financial system made it necessary for securities firms to move away from their overreliance on brokerage and play new roles in corporate finance and asset management. Similar considerations can be found in the background and rationale for Korea’s enactment of the Financial Investment Services and Capital Markets Act. Here, we explore how the revenue structure of Japan’s securities industry has changed over the past 15 years and examine the likelihood of increasing retail market competition among securities companies.

Changes over the past 15 years

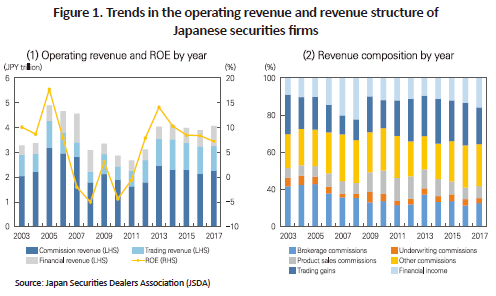

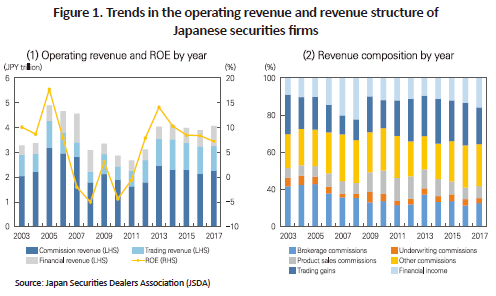

In general, a securities firm’s earnings tend to fluctuate in sync with the stock market. The operating revenue and return on equity (ROE) of the securities industry in Japan also indicate that a securities company’s profitability is very susceptible to macroeconomic and stock market conditions.

As the Japanese economy recovered moderately from 2002 onwards, the securities industry’s operating revenue hit a record high of JPY 4.9 trillion in 2005. However, it turned downward in the wake of the global financial crisis, and fell to JPY 2.7 trillion due to the effects of the 2011 Tohoku earthquake. The impact of Abenomics led to an increase in the operating revenue of the securities industry in three consecutive years from 2012. But uncertainty over the global economy caused securities firms to face operating revenue plateaus. The securities industry’s ROE continued to decline from 14.1% in 2013 to 7.2% at the end of 2017. The industry’s revenue structure shows that trading revenue increased as a proportion of total revenues, but commission revenue still constituted the largest proportion.

Changes in the composition of commission revenue are worth noting. The proportion of brokerage commissions in total revenues decreased from 27.0% in 2003 to 15.6% in 2017. On the other hand, the proportion of other commissions rose from 22.8% to 27.7% over the same period.1) Other commissions include commissions or fees charged for ancillary or non-securities services other than brokerage, underwriting and product sales. M&A and corporate finance advisory fees, and fund sales loads (equivalent to sales commissions in Korea) took the biggest share of other commissions. Given that largest domestic securities firms and foreign-owned securities firms have been in the top list for M&A advisory, fund sales commissions would account for a large portion of other commissions for most Japanese securities firms.2) Starting in early 2000, Japanese securities firms moved gradually toward a new business model driven by asset management, leading to continued growth in fund sales and their outstanding volumes. In addition to the increased fund sales, a sharp rise in discretionary contracts (wrap accounts) resulted in a rapid increase in wrap fee revenue.

Fees charged for long-term management of client assets including funds are a steady source of annual revenue, enabling a securities firm to build a stable revenue structure. By contrast, brokerage commissions have been on a steady decline because of commission cuts amid intense competition. And commissions on the sales of funds or other financial instruments are not consistent but one-off revenue. For that reason, there is a long-standing argument that securities companies should shift from commissions (charged for selling financial instruments) to fees (charged based on client assets under management).3) Despite the long-term endeavor on such recognition, Japanese securities firms started to see tangible results only recently. In fact, the number and amount of wrap contracts in Japan just hovered around 50,000 and about JPY 0.8 trillion in 2013, but exceeded 71,000 and roughly JPY 7.9 trillion at the end of 2017, respectively. The impressive growth in wrap accounts was underpinned by a combination of securities companies’ strong sales campaigns for wrap accounts and improved investor sentiment thanks to Abenomics.

Revenue composition by firm type

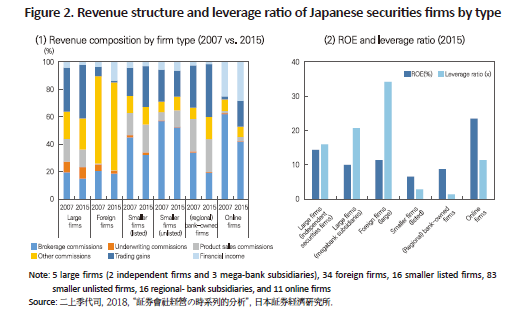

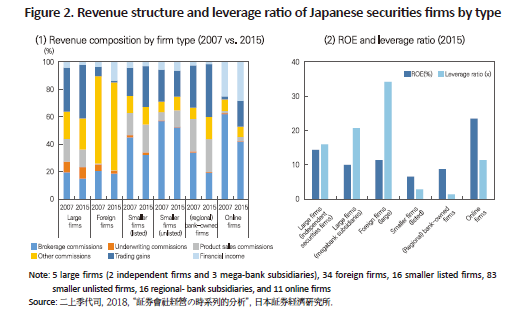

Japanese securities firms can be divided largely into five types: large firms (independent securities firms and securities subsidiaries of mega banks), foreign-owned firms, smaller firms, securities subsidiaries of regional banks, and online firms. Figure 2 below illustrates the revenue composition of securities companies by type in 2007 and 2015, revealing that the proportion of brokerage commissions dropped and the proportions of both trading gains and other commissions increased.4)

The proportion of brokerage revenue in total revenues was already low at 19.5% for large securities companies in 2007 and fell slightly to 15.0% in 2015. The brokerage revenue proportion plunged during the same period from 44.9% to 32.3% for smaller listed securities companies, from 33.9% to 19.1% for regional bank-owned securities companies, and from 61.4% to 41.2% for online securities companies. But brokerage revenue still constituted the significant proportion of total revenues for smaller unlisted securities firms, showing a drop from 56.3% to 51.90%.

The proportion of trading gains increased for almost all types of securities companies except foreign-owned ones, but relative risks varied depending on the firm type. Securities companies usually generate revenue from proprietary trading in foreign exchange or derivatives in proportion to their capital base. Thus, it would be efficient to raise additional capital for short-term capital-intensive business and then increase leverage using the expanded capital base. This explains why large or foreign securities firms have high leverage ratios compared to their smaller peers. The proportion of proprietary trading in trading gains was also high for large or foreign securities companies, but low for smaller ones. The role of a parent or holding company becomes important because unexpected losses would more likely increase when the leverage ratio is too high. For that reason, the leverage ratio is higher for megabank securities subsidiaries with strong capital base that adopted a holding company structure than independent securities firms. In other words, securities arms of mega banking groups have more room to pursue aggressive growth strategy than independent securities firms.

Retail market competition

If securities operations are segmented into wholesale (corporate finance, trading, etc.) and retail business segments, smaller firms and regional bank-owned subsidiaries can be classified as retail securities firms, foreign-owned firms as wholesale securities firms, and large firms as full-service securities firms. Still, retail securities companies have made no move towards becoming a full-service firm through revenue diversification using leverage. Considering that one of core businesses for large securities companies in Japan is retail operations that cater to domestic individual investors, competition in the retail segment is highly likely to get more intensive. As described above, Japanese securities firms appear to have shifted from the retail business model towards the asset management-driven model. Asset management, unlike corporate finance or trading, has little synergy with other businesses and does not require a great deal of capital. In the asset management market, therefore, smaller securities firms can compete with big players to some extent. Now, asset management becomes an integral part of a securities firm’s business operations.

In these circumstances, how asset management business would evolve going forward is being watched with keen interest. In the past, securities companies concentrated on managing high risk assets. Recently, they are focusing on maximizing assets under management, taking into account the total assets of clients. In particular, it becomes increasingly crucial for securities companies to attract seniors along with their financial assets because people aged 60 or over take up 65% of household savings and 76% of securities held by households in Japan. Gaining the trust of clients is important to get an overall picture of their holdings of assets other than financial assets, such as real estate. There is a growing need for securities companies to take a more comprehensive approach to asset management by obtaining knowledge of the future spending plans and goals of clients through long-term relationships with them. As for existing clients, securities companies need to prevent the transfer of client assets to other financial institutions if the assets are passed on to the next generation through bestowal and inheritance.

It is known that large securities firms have more points of contact with the elderly than smaller or online peers. Large securities firms seems well positioned to strengthen their relationships with senior customers on the back of their existing advantages. As for new clients, megabank securities subsidiaries are in an advantageous position because their affiliates may refer new clients to them. That suggests that alliances between securities subsidiaries and their parent banks will be strengthened further. It is worth watching how independent large securities firms will respond to such alliances.

1) Commission cuts were a driving force behind the decline in the proportion of brokerage revenue despite a marked increase in the value of stock trading from 2013 onwards. Over the same period, underwriting commission rates were reduced by 2.6%p from 6.0% to 3.4% whereas product sales commission rates were up by 1.7%p from 6.3% to 8.0%.

2) JSDA data do not include a detailed breakdown of other commissions.

3) In Japan, this is described as “moving from the current flow-type (commission-based) model toward a stock-type (fee-based) model.”

4) See “Competition and Its Recent Changes in the Japanese Securities Industry” for more information on the evolution and current status of securities companies in Japan by company type (Chang Jung-moh, KCMI Capital Market Focus 2018-08). Securities companies that are part of global financial groups exhibited a very high proportion of other commissions in their total revenues, which come mostly from corporate finance services.

Changes over the past 15 years

In general, a securities firm’s earnings tend to fluctuate in sync with the stock market. The operating revenue and return on equity (ROE) of the securities industry in Japan also indicate that a securities company’s profitability is very susceptible to macroeconomic and stock market conditions.

Changes in the composition of commission revenue are worth noting. The proportion of brokerage commissions in total revenues decreased from 27.0% in 2003 to 15.6% in 2017. On the other hand, the proportion of other commissions rose from 22.8% to 27.7% over the same period.1) Other commissions include commissions or fees charged for ancillary or non-securities services other than brokerage, underwriting and product sales. M&A and corporate finance advisory fees, and fund sales loads (equivalent to sales commissions in Korea) took the biggest share of other commissions. Given that largest domestic securities firms and foreign-owned securities firms have been in the top list for M&A advisory, fund sales commissions would account for a large portion of other commissions for most Japanese securities firms.2) Starting in early 2000, Japanese securities firms moved gradually toward a new business model driven by asset management, leading to continued growth in fund sales and their outstanding volumes. In addition to the increased fund sales, a sharp rise in discretionary contracts (wrap accounts) resulted in a rapid increase in wrap fee revenue.

Fees charged for long-term management of client assets including funds are a steady source of annual revenue, enabling a securities firm to build a stable revenue structure. By contrast, brokerage commissions have been on a steady decline because of commission cuts amid intense competition. And commissions on the sales of funds or other financial instruments are not consistent but one-off revenue. For that reason, there is a long-standing argument that securities companies should shift from commissions (charged for selling financial instruments) to fees (charged based on client assets under management).3) Despite the long-term endeavor on such recognition, Japanese securities firms started to see tangible results only recently. In fact, the number and amount of wrap contracts in Japan just hovered around 50,000 and about JPY 0.8 trillion in 2013, but exceeded 71,000 and roughly JPY 7.9 trillion at the end of 2017, respectively. The impressive growth in wrap accounts was underpinned by a combination of securities companies’ strong sales campaigns for wrap accounts and improved investor sentiment thanks to Abenomics.

Revenue composition by firm type

Japanese securities firms can be divided largely into five types: large firms (independent securities firms and securities subsidiaries of mega banks), foreign-owned firms, smaller firms, securities subsidiaries of regional banks, and online firms. Figure 2 below illustrates the revenue composition of securities companies by type in 2007 and 2015, revealing that the proportion of brokerage commissions dropped and the proportions of both trading gains and other commissions increased.4)

The proportion of trading gains increased for almost all types of securities companies except foreign-owned ones, but relative risks varied depending on the firm type. Securities companies usually generate revenue from proprietary trading in foreign exchange or derivatives in proportion to their capital base. Thus, it would be efficient to raise additional capital for short-term capital-intensive business and then increase leverage using the expanded capital base. This explains why large or foreign securities firms have high leverage ratios compared to their smaller peers. The proportion of proprietary trading in trading gains was also high for large or foreign securities companies, but low for smaller ones. The role of a parent or holding company becomes important because unexpected losses would more likely increase when the leverage ratio is too high. For that reason, the leverage ratio is higher for megabank securities subsidiaries with strong capital base that adopted a holding company structure than independent securities firms. In other words, securities arms of mega banking groups have more room to pursue aggressive growth strategy than independent securities firms.

Retail market competition

If securities operations are segmented into wholesale (corporate finance, trading, etc.) and retail business segments, smaller firms and regional bank-owned subsidiaries can be classified as retail securities firms, foreign-owned firms as wholesale securities firms, and large firms as full-service securities firms. Still, retail securities companies have made no move towards becoming a full-service firm through revenue diversification using leverage. Considering that one of core businesses for large securities companies in Japan is retail operations that cater to domestic individual investors, competition in the retail segment is highly likely to get more intensive. As described above, Japanese securities firms appear to have shifted from the retail business model towards the asset management-driven model. Asset management, unlike corporate finance or trading, has little synergy with other businesses and does not require a great deal of capital. In the asset management market, therefore, smaller securities firms can compete with big players to some extent. Now, asset management becomes an integral part of a securities firm’s business operations.

In these circumstances, how asset management business would evolve going forward is being watched with keen interest. In the past, securities companies concentrated on managing high risk assets. Recently, they are focusing on maximizing assets under management, taking into account the total assets of clients. In particular, it becomes increasingly crucial for securities companies to attract seniors along with their financial assets because people aged 60 or over take up 65% of household savings and 76% of securities held by households in Japan. Gaining the trust of clients is important to get an overall picture of their holdings of assets other than financial assets, such as real estate. There is a growing need for securities companies to take a more comprehensive approach to asset management by obtaining knowledge of the future spending plans and goals of clients through long-term relationships with them. As for existing clients, securities companies need to prevent the transfer of client assets to other financial institutions if the assets are passed on to the next generation through bestowal and inheritance.

It is known that large securities firms have more points of contact with the elderly than smaller or online peers. Large securities firms seems well positioned to strengthen their relationships with senior customers on the back of their existing advantages. As for new clients, megabank securities subsidiaries are in an advantageous position because their affiliates may refer new clients to them. That suggests that alliances between securities subsidiaries and their parent banks will be strengthened further. It is worth watching how independent large securities firms will respond to such alliances.

1) Commission cuts were a driving force behind the decline in the proportion of brokerage revenue despite a marked increase in the value of stock trading from 2013 onwards. Over the same period, underwriting commission rates were reduced by 2.6%p from 6.0% to 3.4% whereas product sales commission rates were up by 1.7%p from 6.3% to 8.0%.

2) JSDA data do not include a detailed breakdown of other commissions.

3) In Japan, this is described as “moving from the current flow-type (commission-based) model toward a stock-type (fee-based) model.”

4) See “Competition and Its Recent Changes in the Japanese Securities Industry” for more information on the evolution and current status of securities companies in Japan by company type (Chang Jung-moh, KCMI Capital Market Focus 2018-08). Securities companies that are part of global financial groups exhibited a very high proportion of other commissions in their total revenues, which come mostly from corporate finance services.