OPINION

2019 Aug/27

DIP Financing and Corporate Restructuring via Capital Markets

Aug. 27, 2019

PDF

- Summary

- Debtor-in possession (DIP) financing recently came into the spotlight in Korea as the FSC unveiled that it will focus on DIP as one of measures to facilitate corporate restructuring through capital markets. DIP financing, which is new funding support for corporate rehabilitation, is expected to play an important role in helping companies placed in corporate rehabilitation process raise working capital and be successfully reorganized. Furthermore, DIP financing provides capital market players with an additional corporate restructuring tool on top of traditional tools involving debt and equity investment. To ensure smooth corporate rehabilitation through DIP financing in Korea, it is essential to improve legal stability for DIP financing, grant stronger rights and incentives to DIP lenders with regard to rehabilitation proceedings, and give incentives to managers of funds raised exclusively for DIP financing.

Policy paradigm shift: Corporate restructuring via capital markets

The Financial Services Commission (FSC) unveiled its policy to facilitate corporate restructuring through capital markets on July 26. Three key policy directions set by the FSC include: i) expanding corporate structure improvement funds and diversifying their investment approaches, and strengthening the roles of United Asset Management Corporation (UAMCO) and Korea Asset Management Corporation (KAMCO); ii) invigorating debtor-in-possession (DIP) financing, and sale and lease back (S&LB) so as to generate more success stories in corporate rehabilitation; and iii) uncovering successful restructuring cases to change companies’ negative perception of restructuring, and encourage the sharing of information with investors.

The policy directions are primarily concerned towards measures relating to corporate rehabilitation, one of the most commonly used restructuring tools, along with workouts. Among necessary improvements to ensure smooth restructuring through corporate rehabilitation process, the most important in practice is increasing the availability of DIP financing, which is included in the recently announced policy, in the short run and nurturing professional workforce in corporate restructuring in the long run. Since the corporate restructuring market is not fully fledged in Korea, it has a limited number of investors in corporate restructuring and underdeveloped private corporate restructuring service providers, unlike in other countries where they play an important role in corporate restructuring by sending chief restructuring officers. This article looks at ways to increase the supply of DIP financing, which is a relatively short-term policy priority.

DIP financing for corporate rehabilitation

DIP financing is fresh capital raised by a company placed in corporate rehabilitation to fund its business. The incumbent management is allowed to remain in office and act as a trustee called a debtor-in-possession (DIP) under the U.S. Bankruptcy Code as well as Korea’s Debtor Rehabilitation and Bankruptcy Act (DRBA), unless their misappropriation or concealment of company assets, or gross mismanagement is the primary cause of financial difficulty that eventually placed the company into corporate rehabilitation process.

For the debtor to be successfully rehabilitated, it is essential to raise adequate working capital and funds to terminate the corporate rehabilitation. It is not possible to guarantee anonymity for companies in rehabilitation, unlike those in a workout, making them unable to continue credit-based transactions with their counterparties. Therefore, above all else, working capital financing is the most important for such companies. Nevertheless, new lenders are reluctant to fund companies in corporate rehabilitation because of their heavy debt and uncertainty over rehabilitation outcomes. As a way to tackle the funding difficulty, new debt is granted priority over existing debt, which incentivizes lenders to provide new financing to debtor companies.

There are two types of DIP financing: defensive DIP financing and offensive DIP financing.1) While defensive DIP financing is provided by an existing lender with prior lending relationship with the debtor, offensive DIP financing is provided by a new lender that does not have a pre-lending relationship with the debtor. Empirical studies on the impact of DIP financing on U.S. companies placed into Chapter 11 proceedings found that DIP financing increases the probability of successful reorganization and recovery rates, shortening time spent under Chapter 11 proceedings (Elayan & Meyer, 2001; Chatterjee et al., 2004; Dahiya et al., 2003, etc.).2)

DIP Financing not only provides companies in rehabilitation proceedings with access to new funding, thereby raising the probability of their rehabilitation success, but also provides capital market investors in corporate restructuring with an additional tool for restructuring. Traditional approaches to investing in corporate restructuring are debt and equity investments. Debt investment in corporate restructuring is to take the initiative in the rehabilitation of a company in financial distress by purchasing the distressed debt and take over management control of the company through debt to equity conversion. On the other hand, equity investment in restructuring is to take control of the company in the process of restructuring by acquiring new share issues or business transfer transactions. DIP financing plays a role in diversifying restructuring tools as it enables investors in corporate restructuring to choose the right investment approach case by case, together with traditional approaches.

DIP financing in the U.S. and Korea

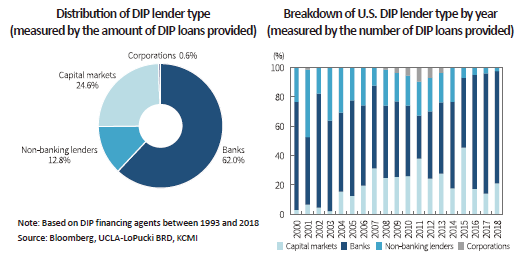

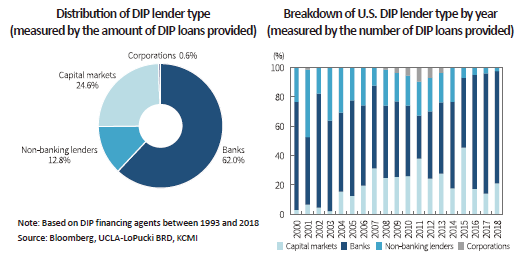

Section 364 of the U.S. Bankruptcy Code that the Korean DRBA is modeled after grants lenders an incentive called super-priority with respect to DIP financing. DIP financing in the U.S. began growing from the mid-1990s onwards after the Bankruptcy Code was amended in 1978. According to Bloomberg data, DIP financing stood at USD 4.3 billion in 2000, hitting its peak of USD 56 billion at the height of the financial crisis in 2009, and hovering around USD 7.1 billion in 2018. From 2000 to 2018, DIP financing was provided to 67% of U.S. Chapter 11 companies with USD 0.1 billion in assets.3) The annual DIP financing averaged USD 10.7 billion during the same period.

In the meantime, capital market players, such as hedge funds, private equity funds (PEFs) and asset management companies, as a percentage of total DIP financing started to rise in the mid-2000s from 2.9% in 2000 to 21.1% in 2018, as measured by the number of investments. This suggests that capital market players have taken hold in the U.S. DIP financing market for corporate rehabilitation. In the 2000s, activist hedge funds provided DIP financing to companies in Chapter 11 proceedings, with the intent to ultimately acquire them. They played a part as creditors in improving the corporate governance of the companies, expanding the role of the capital markets in corporate rehabilitation.

DIP financing in Korea also grew after the amendments to the DCBA in 2016, but its volume is not yet large. Although it is difficult to provide an accurate estimate of the DIP financing volume because related statistics are not publicly available, it is estimated that only limited DIP financing is available in terms of amount and number, when assessing disclosed data from courts and media. In recent years, the number of companies filing for corporate rehabilitation was more than 900 on average, with 980 in 2018. It means that DIP financing is not sufficiently available to meet the working capital needs of companies placed in rehabilitation proceedings. This is why DIP funding should play more important role as an effective corporate restructuring tool in fulfilling corporate rehabilitation.

Ways to facilitate DIP financing

To stimulate corporate rehabilitation as one of restructuring tools via the capital markets, promoting the supply of DIP financing should be geared towards the following: First, what is most important is to increase the recovery ratio of new funds provided to companies in rehabilitation proceedings in order to make DIP financing more active. As in the U.S., therefore, super-priority claim status is granted to DIP financing in Korea. But if a distressed company fails to exit from rehabilitation proceedings and files for liquidation proceedings, the super-priority is not acknowledged, making DIP lenders exposed to recovery risk. Given that, it is crucial to ensure the passage of the pending bill to amend the DRBA in the National Assembly.

Second, DIP lenders should be given greater opportunities to participate in the rehabilitation of a debtor company. At present, DIP lenders are allowed to express their opinions on key rehabilitation decisions regarding a business transfer, a rehabilitation plan, and termination or end of a rehabilitation proceeding. However, the statutory scope of their participation under the DRBA is not broad enough to protect the DIP financing claims of lenders and to encourage them to take the initiative in rehabilitation process, both of which are crucial to vitalize the corporate rehabilitation. Also, strengthening the rights of DIP lenders as creditors would reduce the chances of the DIP scheme being misused by the company’s management to maintain their management control, which, in turn, would help improve the corporate governance of the company.

Third, in addition to legal stability described above, more incentives are needed for DIP lenders in order to boost the availability of DIP financing. The primary reasons for vibrant DIP financing activity in the U.S. are not only that super-priority and customized financial covenant are granted to DIP lenders, but also that DIP lenders are allowed to demand higher commissions and interest rates. The court environment may find it difficult to grant similar levels of discretion to DIP lenders. Nevertheless, DIP lenders should be allowed to set interest rates and customized financial covenants at least to a limited extent.

Lastly, when it comes to DIP financing funds included in the government’s policy announcement, it is required to adjust the compensation structure of fund managers, taking into account the current statutory protection and discretion provided for DIP financing. For instance, it is worth considering the introduction of incentive mechanism that lowers the hurdle rate for DIP financing funds below those for PEFs, and raises carried interest, in line with market DIP loan rate levels which will be formed later on. If needed, it is also worth considering the provision of minimum guarantee for DIP financing through policy finance institutions.

1) American Bankruptcy Institute, 2016, Debtor-In-Possession Financing.

2) See references in the author’s paper, titled Ways to Expand the Role of DIP Financing in Corporate Rehabilitation, KCMI Issue Paper 19-06.

3) This information is based on data from UCLA-LoPucki Bankruptcy database concerning companies filed under Chapter 11 of the Bankruptcy Code. Other statistics used in this article are based on Bloomberg data.

The Financial Services Commission (FSC) unveiled its policy to facilitate corporate restructuring through capital markets on July 26. Three key policy directions set by the FSC include: i) expanding corporate structure improvement funds and diversifying their investment approaches, and strengthening the roles of United Asset Management Corporation (UAMCO) and Korea Asset Management Corporation (KAMCO); ii) invigorating debtor-in-possession (DIP) financing, and sale and lease back (S&LB) so as to generate more success stories in corporate rehabilitation; and iii) uncovering successful restructuring cases to change companies’ negative perception of restructuring, and encourage the sharing of information with investors.

The policy directions are primarily concerned towards measures relating to corporate rehabilitation, one of the most commonly used restructuring tools, along with workouts. Among necessary improvements to ensure smooth restructuring through corporate rehabilitation process, the most important in practice is increasing the availability of DIP financing, which is included in the recently announced policy, in the short run and nurturing professional workforce in corporate restructuring in the long run. Since the corporate restructuring market is not fully fledged in Korea, it has a limited number of investors in corporate restructuring and underdeveloped private corporate restructuring service providers, unlike in other countries where they play an important role in corporate restructuring by sending chief restructuring officers. This article looks at ways to increase the supply of DIP financing, which is a relatively short-term policy priority.

DIP financing for corporate rehabilitation

DIP financing is fresh capital raised by a company placed in corporate rehabilitation to fund its business. The incumbent management is allowed to remain in office and act as a trustee called a debtor-in-possession (DIP) under the U.S. Bankruptcy Code as well as Korea’s Debtor Rehabilitation and Bankruptcy Act (DRBA), unless their misappropriation or concealment of company assets, or gross mismanagement is the primary cause of financial difficulty that eventually placed the company into corporate rehabilitation process.

For the debtor to be successfully rehabilitated, it is essential to raise adequate working capital and funds to terminate the corporate rehabilitation. It is not possible to guarantee anonymity for companies in rehabilitation, unlike those in a workout, making them unable to continue credit-based transactions with their counterparties. Therefore, above all else, working capital financing is the most important for such companies. Nevertheless, new lenders are reluctant to fund companies in corporate rehabilitation because of their heavy debt and uncertainty over rehabilitation outcomes. As a way to tackle the funding difficulty, new debt is granted priority over existing debt, which incentivizes lenders to provide new financing to debtor companies.

There are two types of DIP financing: defensive DIP financing and offensive DIP financing.1) While defensive DIP financing is provided by an existing lender with prior lending relationship with the debtor, offensive DIP financing is provided by a new lender that does not have a pre-lending relationship with the debtor. Empirical studies on the impact of DIP financing on U.S. companies placed into Chapter 11 proceedings found that DIP financing increases the probability of successful reorganization and recovery rates, shortening time spent under Chapter 11 proceedings (Elayan & Meyer, 2001; Chatterjee et al., 2004; Dahiya et al., 2003, etc.).2)

DIP Financing not only provides companies in rehabilitation proceedings with access to new funding, thereby raising the probability of their rehabilitation success, but also provides capital market investors in corporate restructuring with an additional tool for restructuring. Traditional approaches to investing in corporate restructuring are debt and equity investments. Debt investment in corporate restructuring is to take the initiative in the rehabilitation of a company in financial distress by purchasing the distressed debt and take over management control of the company through debt to equity conversion. On the other hand, equity investment in restructuring is to take control of the company in the process of restructuring by acquiring new share issues or business transfer transactions. DIP financing plays a role in diversifying restructuring tools as it enables investors in corporate restructuring to choose the right investment approach case by case, together with traditional approaches.

DIP financing in the U.S. and Korea

Section 364 of the U.S. Bankruptcy Code that the Korean DRBA is modeled after grants lenders an incentive called super-priority with respect to DIP financing. DIP financing in the U.S. began growing from the mid-1990s onwards after the Bankruptcy Code was amended in 1978. According to Bloomberg data, DIP financing stood at USD 4.3 billion in 2000, hitting its peak of USD 56 billion at the height of the financial crisis in 2009, and hovering around USD 7.1 billion in 2018. From 2000 to 2018, DIP financing was provided to 67% of U.S. Chapter 11 companies with USD 0.1 billion in assets.3) The annual DIP financing averaged USD 10.7 billion during the same period.

In the meantime, capital market players, such as hedge funds, private equity funds (PEFs) and asset management companies, as a percentage of total DIP financing started to rise in the mid-2000s from 2.9% in 2000 to 21.1% in 2018, as measured by the number of investments. This suggests that capital market players have taken hold in the U.S. DIP financing market for corporate rehabilitation. In the 2000s, activist hedge funds provided DIP financing to companies in Chapter 11 proceedings, with the intent to ultimately acquire them. They played a part as creditors in improving the corporate governance of the companies, expanding the role of the capital markets in corporate rehabilitation.

Ways to facilitate DIP financing

To stimulate corporate rehabilitation as one of restructuring tools via the capital markets, promoting the supply of DIP financing should be geared towards the following: First, what is most important is to increase the recovery ratio of new funds provided to companies in rehabilitation proceedings in order to make DIP financing more active. As in the U.S., therefore, super-priority claim status is granted to DIP financing in Korea. But if a distressed company fails to exit from rehabilitation proceedings and files for liquidation proceedings, the super-priority is not acknowledged, making DIP lenders exposed to recovery risk. Given that, it is crucial to ensure the passage of the pending bill to amend the DRBA in the National Assembly.

Second, DIP lenders should be given greater opportunities to participate in the rehabilitation of a debtor company. At present, DIP lenders are allowed to express their opinions on key rehabilitation decisions regarding a business transfer, a rehabilitation plan, and termination or end of a rehabilitation proceeding. However, the statutory scope of their participation under the DRBA is not broad enough to protect the DIP financing claims of lenders and to encourage them to take the initiative in rehabilitation process, both of which are crucial to vitalize the corporate rehabilitation. Also, strengthening the rights of DIP lenders as creditors would reduce the chances of the DIP scheme being misused by the company’s management to maintain their management control, which, in turn, would help improve the corporate governance of the company.

Third, in addition to legal stability described above, more incentives are needed for DIP lenders in order to boost the availability of DIP financing. The primary reasons for vibrant DIP financing activity in the U.S. are not only that super-priority and customized financial covenant are granted to DIP lenders, but also that DIP lenders are allowed to demand higher commissions and interest rates. The court environment may find it difficult to grant similar levels of discretion to DIP lenders. Nevertheless, DIP lenders should be allowed to set interest rates and customized financial covenants at least to a limited extent.

Lastly, when it comes to DIP financing funds included in the government’s policy announcement, it is required to adjust the compensation structure of fund managers, taking into account the current statutory protection and discretion provided for DIP financing. For instance, it is worth considering the introduction of incentive mechanism that lowers the hurdle rate for DIP financing funds below those for PEFs, and raises carried interest, in line with market DIP loan rate levels which will be formed later on. If needed, it is also worth considering the provision of minimum guarantee for DIP financing through policy finance institutions.

1) American Bankruptcy Institute, 2016, Debtor-In-Possession Financing.

2) See references in the author’s paper, titled Ways to Expand the Role of DIP Financing in Corporate Rehabilitation, KCMI Issue Paper 19-06.

3) This information is based on data from UCLA-LoPucki Bankruptcy database concerning companies filed under Chapter 11 of the Bankruptcy Code. Other statistics used in this article are based on Bloomberg data.