OPINION

2020 Jun/09

Earnings of Global Investment Banks in Q1 2020: Impact of Covid-19

Jun. 09, 2020

PDF

- Summary

- Global investment banks recently released their first earnings since the global outbreak of Covid-19. The 2020 first-quarter earnings showed a mixed picture highlighting both positive and negative aspects. The nine major investment banks that were looked at reported an average 4.2% year-on-year increase in revenue, and even those with negative revenue growth posted a somewhat mild decline. Behind those results appear to be two factors. First, first-quarter earnings only partially reflect Covid-19’s impact because it was only March 2020 when the virus began spreading on a global scale. Second, rising market volatility contributed to an earnings increase in some of areas such as investment banking and trading.

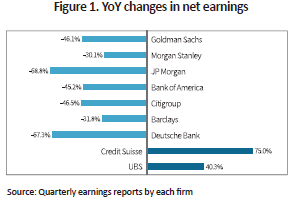

However, major investment banks reported a 48% YoY fall in net earnings in the first quarter in 2020 primarily due to the 5.5-fold increase in their provisions for losses. This clearly shows investment banks are bracing for a full-blown impact of Covid-19 in the second quarter onwards.

In contrast to the 2008 global financial crisis, the current crisis is spreading from the real economy to the financial sector. This time, global investment banks are expected to play a pivotal role in the economic recovery, a stark contrast to the earlier global financial crisis where investment banks were the main culprit.

Global investment banks unveiled their quarterly earnings results for the first time since Covid-19 spread around the globe. The earnings results in the first quarter of 2020 revealed a somewhat mixed picture. Surprisingly, major investment banks reported better than expected revenues this quarter versus the same period last year. Part of this is because Covid-19 has impacted the real economy directly, while affecting the financial sector only indirectly and the impact being positive and negative depending on the business areas.

In contrast to stable revenues, net earnings fell quite drastically. Although no business unit reported heavy losses in this quarter, net earnings in major investment banks fell largely due to large increases in provisions for losses. An increase in their provisions for losses under the current context means an expectation for a full-blown impact of Covid-19 in the upcoming quarter. In particular, this reflects expectations that the economic downturn, as a result of Covid-19, will lead to significant credit events in the future. On the other hand, preemptive measures against Covid-19 varied widely across banks, showing the difficulties of properly gauging the impact of an unprecedented shock that is the Covid-19 pandemic.

Better than expected topline

To assess the impact of Covid-19, nine major investment banks’ performance was compared, including five US banks (Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America, and Citigroup) and four European banks (Barclays Capital, Deutsche Bank, Credit Suisse, and UBS).

Table 1 shows that the major investment banks’ revenues remained solid in the first quarter of 2020. Of the nine investment banks analyzed, the average YoY growth of quarterly revenues was 4.2%. Morgan Stanley showed the highest fall in revenues, but the decline was reasonable at -7.8%. Notably, European investment banks outperformed their US counterparts. All four European investment banks showed a YoY growth in revenues this quarter, with Barclays posting a 19.6% YoY increase. By contrast, US investment banks, with the exception of Citigroup, recorded a mild decline in revenues. However, the performance of the European investment banks needs to take into consideration the baseline effect of the continued deleveraging and scaling down of business since the 2008 global financial crisis.

Overall, the fact that revenues of global investment banks did not see a steep reduction is mainly due to two factors. First, Covid-19’s impact is only partially reflected in the first quarter of this year as the pandemic remained mostly in Asia during January and February, and began spreading to Europe and the US only at the beginning of March. Second, as the spread of Covid-19 led to major asset prices fluctuations, some business units including trading enjoyed increased demand, which offset the contraction in other business units.

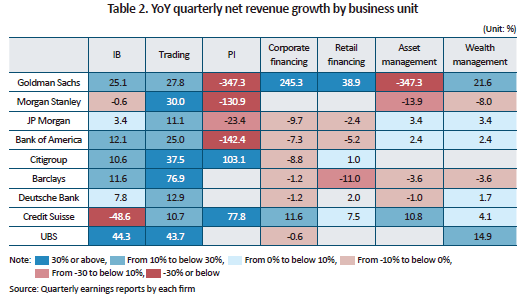

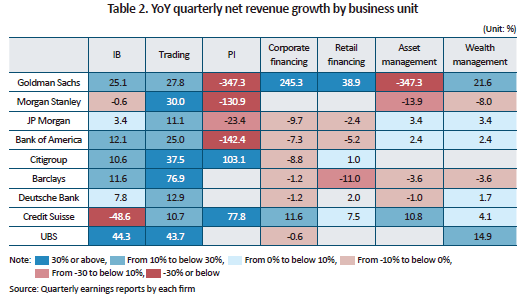

Table 2 shows the YoY revenue growth of nine investment banks by business units in the first quarter of 2020. By business unit, the results are consistent across investment banks, with except for Goldman Sachs. As mentioned above, revenue growth in trading, among others, was a primary factor behind relatively sound performance of investment banks in this quarter. There was a significant jump in trading volume of not only equity and debt, but also interest rates, exchange rates, and commodity-related products. Performance in investment banking was also solid. Although earnings from IPOs and M&As contracted slightly amid falling stock markets and rising business uncertainties, more corporate demand for financing contributed to an earnings increase in equity and debt underwriting. By contrast, investment banks posted large losses on their principal investment business primarily due to a fall in the value of their investments in vulnerable industries such as energy, hotel, leisure, and real estate.

On another front, corporate and retail financing showed a YoY decline. Net revenues in both businesses bore the brunt of falling interest rates and resulting lower net interest margins. Against the backdrop of lingering business uncertainties, corporate financing posted a YoY decrease in new lending. Also on the decline were mortgage, credit card, and other loans in retail financing as the economic slowdown deepened.1)

Most investment banks also reported sluggish performance in asset management and wealth management. Amid the fallout of Covid-19, distribution fees fell as fund outflows surpassed inflows and the fall in market value of investment portfolios led to a decline in performance-based fees.

Fall in bottom line due to provision for losses

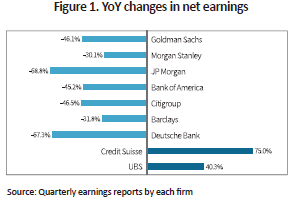

In contrast the stable results of revenues, net earnings of the major investment banks fell substantially in the first quarter of 2020. Figure 1 illustrates YoY changes in net earnings of nine investment banks in the first quarter of 2020. For seven investment banks, except for Credit Suisse and UBS, net earnings fell on average 48.0% versus the same period last year. The drastic decline in net earnings largely stems from a significant increase in provisions for losses, which are expected to materialize from the second quarter onwards.2) Loan-loss provisions of investment banks increased 5.5 times in the first quarter of 2020 compared to the same quarter a year earlier.

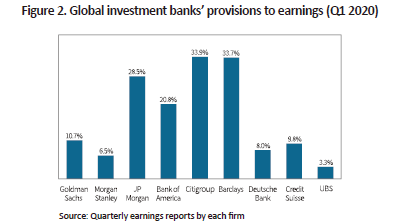

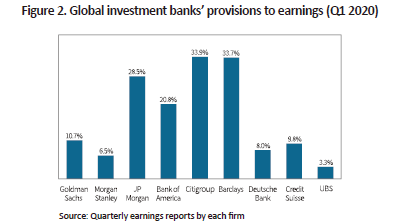

The increase in provision for losses was more prominent among investment banks with substantial corporate and retail financing businesses. Figure 2 shows the ratio of provision for losses to revenues of the major investment banks this quarter. What’s common in banks with the ratio surpassing 20% in this quarter—JP Morgan, Bank of America, Citigroup, and Barclays—is their business structure primarily oriented by corporate and retail financing. By contrast, the ratio is found to be relatively lower among those where the business focus is more on investment banking, trading, asset management, and wealth management, such as Goldman Sachs, Morgan Stanley, and UBS. For some time being, investment banks’ exposure to credit risk, instead of market risk, is expected to have a stronger impact on their earnings.

Conclusions and implications

The global spread of Covid-19 began in earnest in March 2020, and therefore it is still too early to predict its full impact based on the first-quarter earnings of investment banks. Nevertheless, their first-quarter earnings results provide some meaningful implications.

First, investment banks received a milder impact from Covid-19, as it began affecting the real economy before spreading to the financial sector, the opposite situation from the 2008 global financial crisis. While Covid-19 had a direct impact on firms in industries such as aviation, energy, leisure, and automobile, the effect on the financial services sector came through indirectly. Furthermore, unlike in other industries, the major investment banks reported no major problem from having 90% or more of their employees working from home. And in another contrast to the 2008 global financial crisis, financial firms, who were regarded as the main culprits, are expected to play a crucial role in turning around the economy this time around.

Second, trading and investment banking units shore up sound revenues to counter the decline in other business units, such as corporate and retail financing, asset management and wealth management. This is in contrast to the 2008 global financial crisis where the major losses came from the trading and investment banking units, and investment banks that managed to withstand the crisis relatively well were those with solid performance in corporate and retail financing, asset management, and wealth management. As such, the regulatory environment as well as general sentiment towards the trading business has been rather negative since the last crisis. However, the current pandemic and its fallout are shedding new light on positive aspects of having a balanced business structure, which includes trading. The relative strength of investment banking and trading is expected to offset, albeit partially, potential losses from future credit events in corporate and retail finance business. And this will help investment banks build their capacity for financing activities that support the recovery of the real economy.

Third, this quarter’s results show that there are divergent views among global investment banks on the impact of Covid-19, revealed through their level of provision for losses. While the levels of provision for losses are based on the differences in business structure across investment banks, it also reflects to a degree their differences in outlook on the impact Covid-19 will have going forward. Those investment banks with a more optimistic outlook are choosing a lower level of provision for losses, while those with a more pessimistic outlook are opting to pile up more of the provision for losses this quarter. Ultimately, this shows how difficult it is to fully assess the impact Covid-19 is going to have in the near to mid-term, even amongst the most sophisticated of financial firms.

1) Unlike other investment banks, Goldman Sachs reported a high YoY earnings increase in corporate and retail financing in the fourth quarter of 2020. Goldman Sachs has sought to expand its corporate finance business targeting middle-market firms and entered the retail the finance through internet banking since the 2008 global financial crisis. Those lines of business are still small in size, but an increase in loan demand from both corporate and retail clients amid Covid-19 led to a steep earnings growth.

2) In Deutsche Bank, the absolute size of provisions in this quarter is not quite large. The primary cause behind the bank’s fall in net earnings is charges for the transformation strategy that has been in progress since 2008.

In contrast to stable revenues, net earnings fell quite drastically. Although no business unit reported heavy losses in this quarter, net earnings in major investment banks fell largely due to large increases in provisions for losses. An increase in their provisions for losses under the current context means an expectation for a full-blown impact of Covid-19 in the upcoming quarter. In particular, this reflects expectations that the economic downturn, as a result of Covid-19, will lead to significant credit events in the future. On the other hand, preemptive measures against Covid-19 varied widely across banks, showing the difficulties of properly gauging the impact of an unprecedented shock that is the Covid-19 pandemic.

Better than expected topline

To assess the impact of Covid-19, nine major investment banks’ performance was compared, including five US banks (Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America, and Citigroup) and four European banks (Barclays Capital, Deutsche Bank, Credit Suisse, and UBS).

Table 1 shows that the major investment banks’ revenues remained solid in the first quarter of 2020. Of the nine investment banks analyzed, the average YoY growth of quarterly revenues was 4.2%. Morgan Stanley showed the highest fall in revenues, but the decline was reasonable at -7.8%. Notably, European investment banks outperformed their US counterparts. All four European investment banks showed a YoY growth in revenues this quarter, with Barclays posting a 19.6% YoY increase. By contrast, US investment banks, with the exception of Citigroup, recorded a mild decline in revenues. However, the performance of the European investment banks needs to take into consideration the baseline effect of the continued deleveraging and scaling down of business since the 2008 global financial crisis.

Overall, the fact that revenues of global investment banks did not see a steep reduction is mainly due to two factors. First, Covid-19’s impact is only partially reflected in the first quarter of this year as the pandemic remained mostly in Asia during January and February, and began spreading to Europe and the US only at the beginning of March. Second, as the spread of Covid-19 led to major asset prices fluctuations, some business units including trading enjoyed increased demand, which offset the contraction in other business units.

Table 2 shows the YoY revenue growth of nine investment banks by business units in the first quarter of 2020. By business unit, the results are consistent across investment banks, with except for Goldman Sachs. As mentioned above, revenue growth in trading, among others, was a primary factor behind relatively sound performance of investment banks in this quarter. There was a significant jump in trading volume of not only equity and debt, but also interest rates, exchange rates, and commodity-related products. Performance in investment banking was also solid. Although earnings from IPOs and M&As contracted slightly amid falling stock markets and rising business uncertainties, more corporate demand for financing contributed to an earnings increase in equity and debt underwriting. By contrast, investment banks posted large losses on their principal investment business primarily due to a fall in the value of their investments in vulnerable industries such as energy, hotel, leisure, and real estate.

On another front, corporate and retail financing showed a YoY decline. Net revenues in both businesses bore the brunt of falling interest rates and resulting lower net interest margins. Against the backdrop of lingering business uncertainties, corporate financing posted a YoY decrease in new lending. Also on the decline were mortgage, credit card, and other loans in retail financing as the economic slowdown deepened.1)

Most investment banks also reported sluggish performance in asset management and wealth management. Amid the fallout of Covid-19, distribution fees fell as fund outflows surpassed inflows and the fall in market value of investment portfolios led to a decline in performance-based fees.

Fall in bottom line due to provision for losses

In contrast the stable results of revenues, net earnings of the major investment banks fell substantially in the first quarter of 2020. Figure 1 illustrates YoY changes in net earnings of nine investment banks in the first quarter of 2020. For seven investment banks, except for Credit Suisse and UBS, net earnings fell on average 48.0% versus the same period last year. The drastic decline in net earnings largely stems from a significant increase in provisions for losses, which are expected to materialize from the second quarter onwards.2) Loan-loss provisions of investment banks increased 5.5 times in the first quarter of 2020 compared to the same quarter a year earlier.

The increase in provision for losses was more prominent among investment banks with substantial corporate and retail financing businesses. Figure 2 shows the ratio of provision for losses to revenues of the major investment banks this quarter. What’s common in banks with the ratio surpassing 20% in this quarter—JP Morgan, Bank of America, Citigroup, and Barclays—is their business structure primarily oriented by corporate and retail financing. By contrast, the ratio is found to be relatively lower among those where the business focus is more on investment banking, trading, asset management, and wealth management, such as Goldman Sachs, Morgan Stanley, and UBS. For some time being, investment banks’ exposure to credit risk, instead of market risk, is expected to have a stronger impact on their earnings.

The global spread of Covid-19 began in earnest in March 2020, and therefore it is still too early to predict its full impact based on the first-quarter earnings of investment banks. Nevertheless, their first-quarter earnings results provide some meaningful implications.

First, investment banks received a milder impact from Covid-19, as it began affecting the real economy before spreading to the financial sector, the opposite situation from the 2008 global financial crisis. While Covid-19 had a direct impact on firms in industries such as aviation, energy, leisure, and automobile, the effect on the financial services sector came through indirectly. Furthermore, unlike in other industries, the major investment banks reported no major problem from having 90% or more of their employees working from home. And in another contrast to the 2008 global financial crisis, financial firms, who were regarded as the main culprits, are expected to play a crucial role in turning around the economy this time around.

Second, trading and investment banking units shore up sound revenues to counter the decline in other business units, such as corporate and retail financing, asset management and wealth management. This is in contrast to the 2008 global financial crisis where the major losses came from the trading and investment banking units, and investment banks that managed to withstand the crisis relatively well were those with solid performance in corporate and retail financing, asset management, and wealth management. As such, the regulatory environment as well as general sentiment towards the trading business has been rather negative since the last crisis. However, the current pandemic and its fallout are shedding new light on positive aspects of having a balanced business structure, which includes trading. The relative strength of investment banking and trading is expected to offset, albeit partially, potential losses from future credit events in corporate and retail finance business. And this will help investment banks build their capacity for financing activities that support the recovery of the real economy.

Third, this quarter’s results show that there are divergent views among global investment banks on the impact of Covid-19, revealed through their level of provision for losses. While the levels of provision for losses are based on the differences in business structure across investment banks, it also reflects to a degree their differences in outlook on the impact Covid-19 will have going forward. Those investment banks with a more optimistic outlook are choosing a lower level of provision for losses, while those with a more pessimistic outlook are opting to pile up more of the provision for losses this quarter. Ultimately, this shows how difficult it is to fully assess the impact Covid-19 is going to have in the near to mid-term, even amongst the most sophisticated of financial firms.

1) Unlike other investment banks, Goldman Sachs reported a high YoY earnings increase in corporate and retail financing in the fourth quarter of 2020. Goldman Sachs has sought to expand its corporate finance business targeting middle-market firms and entered the retail the finance through internet banking since the 2008 global financial crisis. Those lines of business are still small in size, but an increase in loan demand from both corporate and retail clients amid Covid-19 led to a steep earnings growth.

2) In Deutsche Bank, the absolute size of provisions in this quarter is not quite large. The primary cause behind the bank’s fall in net earnings is charges for the transformation strategy that has been in progress since 2008.