OPINION

2020 Jul/21

A Thought on Covid-19 and Rising Demand for Stocks

Jul. 21, 2020

PDF

- Summary

- More and more retail investors have flocked to the stock market amid increased market volatility due to the Covid-19 pandemic this year. A quick look at retail investors’ recent stock purchases reveals an increase in buying of high-risk stocks during the path of stock market recovery from the Covid-19 shock. Also found during the same period is an increase in margin buying of high-volatility, high-skewness stocks. Although investment in risky assets is essential to asset accumulation of households in the low interest rate environment, it’s desirable for investors to properly spread out their risk or avoid excessive leverage as the market is faced with downside risks due to internal and external uncertainties.

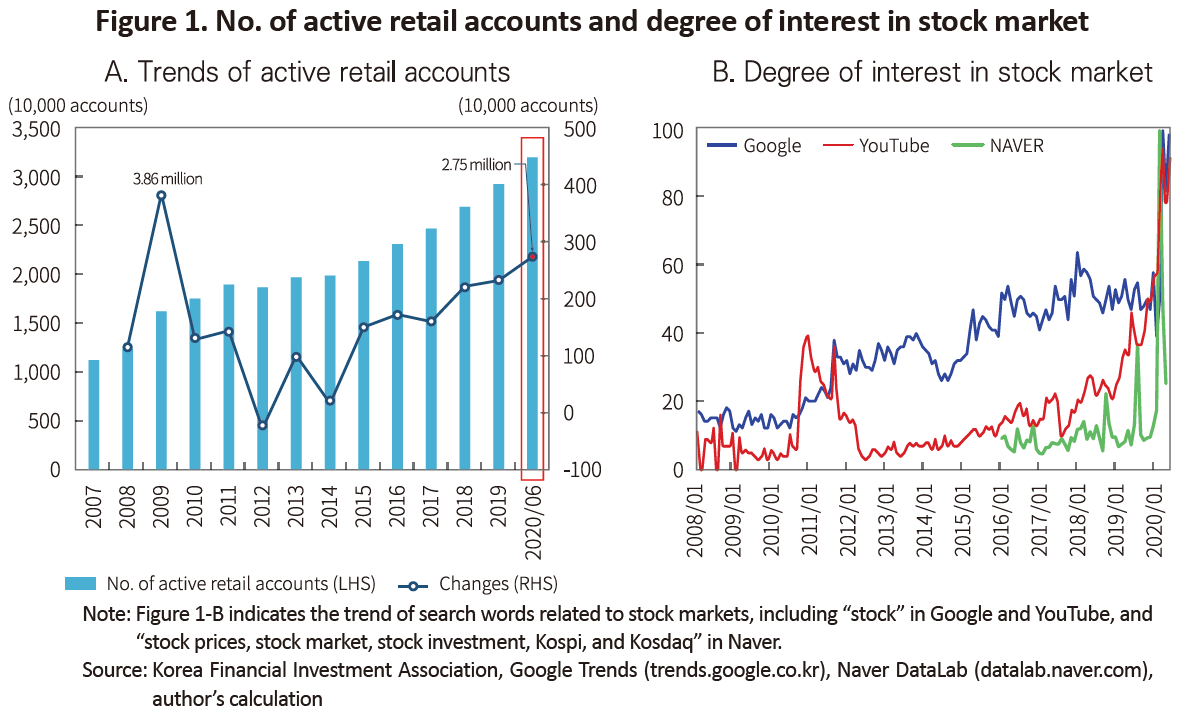

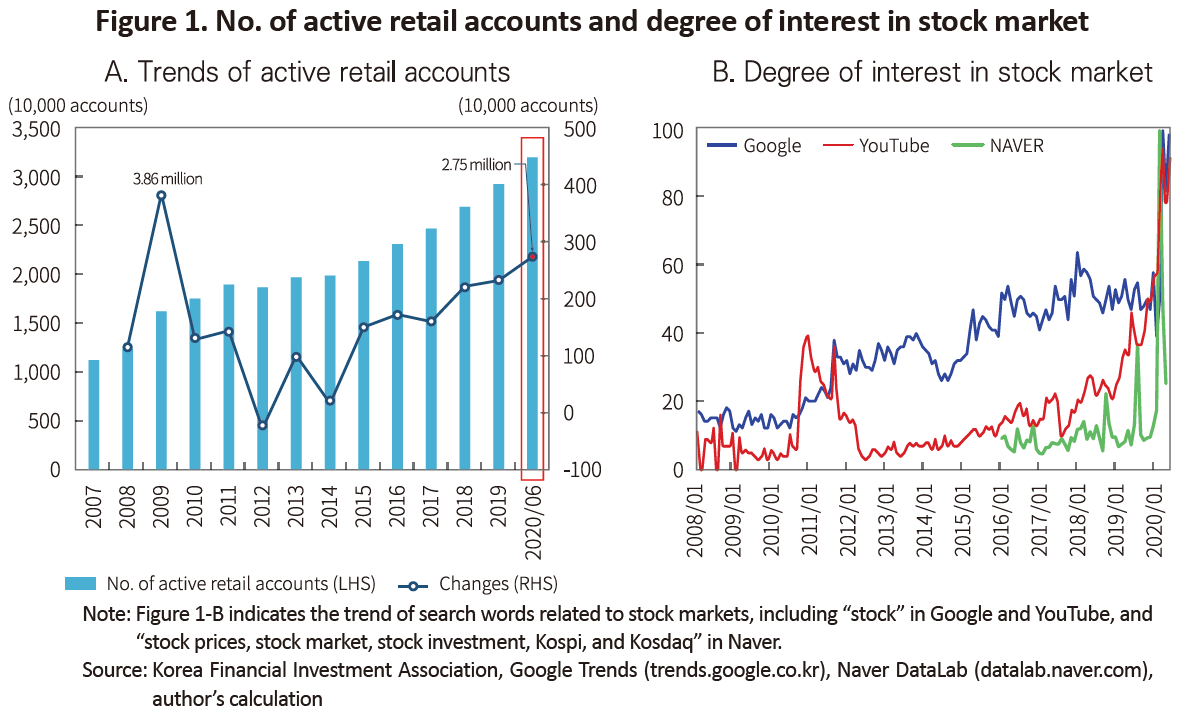

As the Covid-19 pandemic is pushing up stock market volatility, the stock market has come to the fore of attention. During the abrupt market downturn in March 2020, the number of active retail accounts1) surpassed the 30 million mark.2) Furthermore, this year’s increase in the number of accounts year-to-date (June 24) reached 2.75 million, recording the largest influx of new investors since 2009. Also notable is an abrupt increase in search queries related to stock investment in top search engines. All of those suggest how popular and prevalent stock trading has become among retail investors (refer to Figure 1).

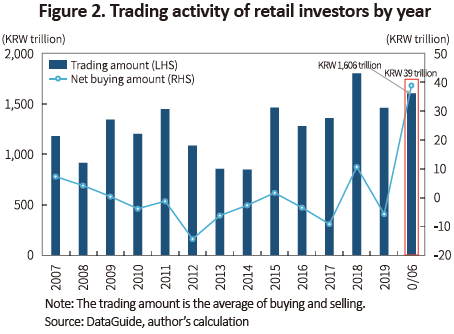

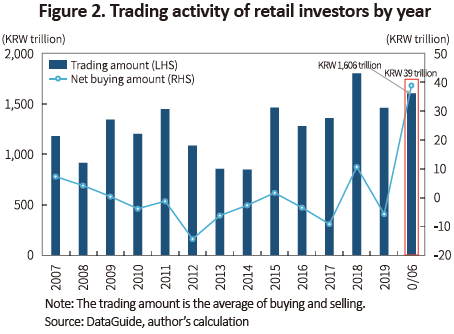

High demand for stock investment is observed clearly in quantitative measures such as trading volume. As illustrated in Figure 2, Korea’s stock market saw a net inflow of KRW 39 trillion from retail investors from January to June 26, 2020, which is far ahead of the inflow during the global financial crisis from 2007 to 2009. Also, retail investors’ trading amount year-to-date already reached KRW 1,606 trillion and surpassed the previous year’s, and is expected to mark the highest ever level.

Demand for stock investment has continued to remain high despite many internal and external uncertainties lingering amid the ongoing spread of Covid-19 pandemic. Under the circumstances, this article tries to assess some potential concerns associated with that issue.

Characteristics of recent stock buying by retail investors

In general, retail investors are known to pursue high-risk and high-return by concentrating their investment in few selected stocks, instead of rationally allocating assets into a well-diversified portfolio.3) This could be partly due to retail investors’ lack of awareness about the importance of portfolio diversification and risk management. However, a more fundamental reason is their limited time and technique for systemically managing a risk asset portfolio. Without proper analysis on their investment and inherent risk in advance, they often trade stocks for short-term profits.4) Investment in risky assets, however, requires a more conservative approach especially at a time such as now when uncertainties are quite high. In particular, there are two lines of concern about retail investors’ latest stock buying spree.

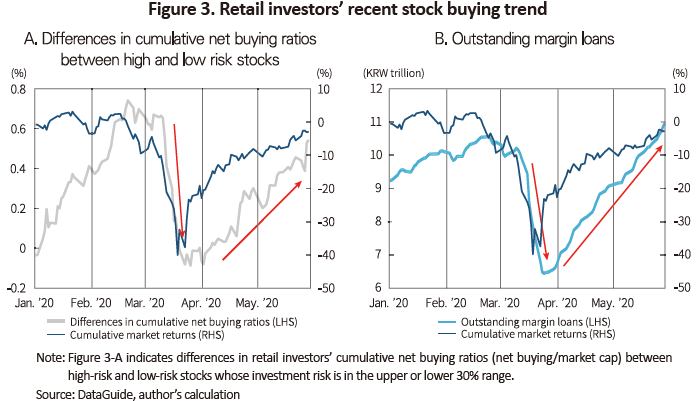

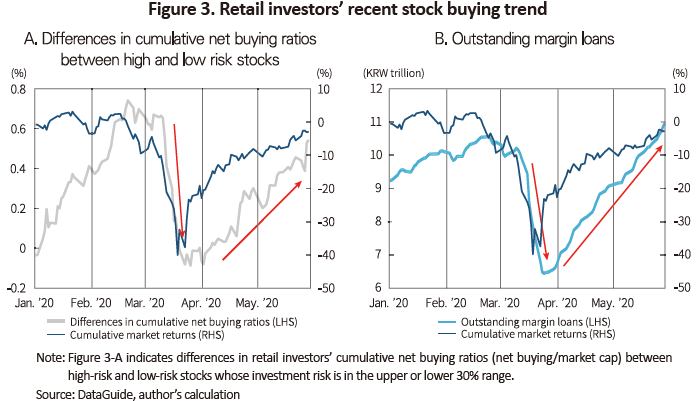

First and foremost, their buying is getting stronger on high-risk stocks as the stock market has been recovering from the Covid-19 shock. Figure 3-A shows differences5) in retail investors’ cumulative net buying ratios between high-risk, and low-risk stocks.6) When the stock market fluctuates and is highly volatile, retail investors tend to net buy relatively safer stocks, which abruptly narrows the gap between the high-risk and low-risk stock groups. This can be interpreted as flight-to-quality where investors prefer safer assets when market risk is accumulating. However, as the stock market began recovering quickly, it seems that retail investors began to increase the proportion of high-risk stocks in their portfolios. Investing in high-risk stocks without proper asset allocation and risk distribution fit for risk tolerance levels could expose retail investors to excessive tail risk especially at a time such as now when the crisis situation is lingering further.

Also concerning is weakened soundness in retail investment: After an abrupt dive of the stock market due to the Covid-19 pandemic, outstanding margin loans shot up quite rapidly. Figure 3-B demonstrates that outstanding margin loans once abruptly fell after a sudden market downfall had triggered forced selling, but shortly began rising rapidly to surpass the pre-pandemic level at a pace faster than the market’s recovery.7)

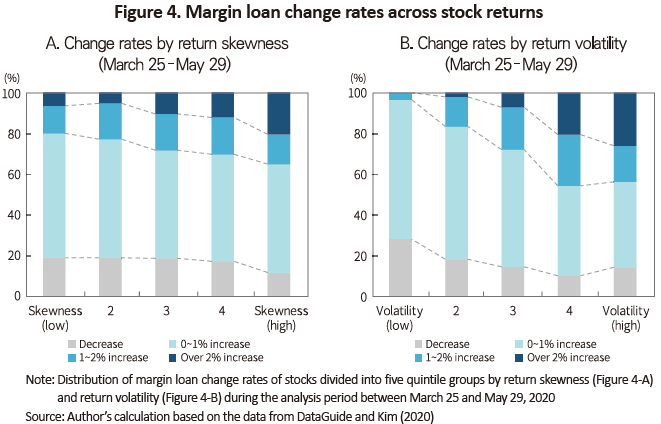

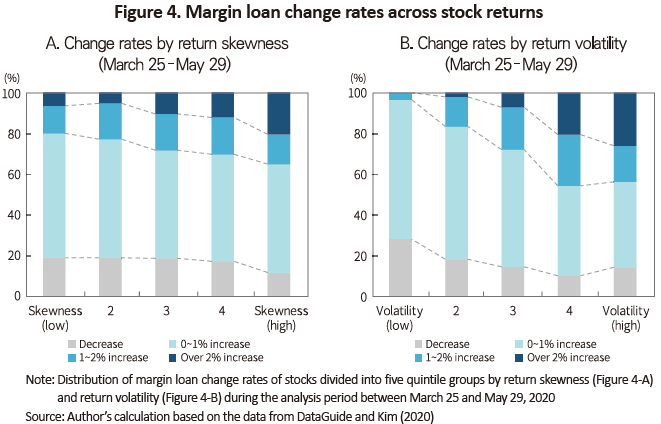

According to a recent report,8) increases in outstanding margin loans were mainly concentrated in the stocks that showed an abrupt, short-term rise. For example, Figure 4 illustrates changes in margin loans of stocks that were classified into five groups depending on return characteristics9) during the period of a margin loan increase between March 25 and May 29, 2020. Return characteristics here mean skewness and volatility. The results show that the group whose returns have a fat-tailed distribution (in other words, a high possibility of short-term, sudden price increases) is more likely to have more stocks showing an increased rate of margin loans. This implies that retail investors could have used more leverage for buying highly volatile stocks whose prices abruptly rose for a short period of time.

As compared to trading in a cash account, buying on margin is regarded riskier as it generates excess returns beating the market in a bull market, but incurs huge losses in a down market. When the stock market volatility rises further, buying stocks using borrowed capital could expose investors to the risk of forced selling. Furthermore, a sudden rise in stock prices without any positive news or event is highly likely followed by a short-term reversal. Hence, investors are required to remain particularly cautious about using leverage.

Future responses and implications

As mentioned above, retail investors were found to show flight-to-quality and to prefer relatively safer stocks when market volatility and risk increased further, while using more leverage to increase the weight of riskier stocks in their buying during market recovery. Such behavior could in the end push up return volatility of investment portfolios, and incur losses larger than their risk tolerance levels.

Although investment in risky assets is a must to asset accumulation of households amid the lingering low interest rate environment, it’s always important for investors to fully consider whether their investment fits with their risk appetite. Korea’s stock market is faced with many downside risks such as the second wave of Covid-19 and the reignition of the US-China trade dispute, which requires a reserved approach. Also necessary is caution against any adverse impact of unnecessary leverage on portfolio returns when downside risk weighs down the stock market.

1) An active retail account here means a stock trading account that has a balance over KRW 100,000 and trades stocks at least once over the past six months.

2) Maeil Business Newspaper, March 11, 2020, Retail accounts reaching 30 million, surpassing Korea’s economically active population.

3) Khil et al. (2008) report that retail investors’ required rate of returns on the stock market stood at 28.8% on average, which is excessively high. The survey also revealed that retail investors prefer small to middle cap stocks over large cap stocks, and their portfolio consists of less than three stocks on average.

Khil, Park, Lee & Park, 2008, A survey on the investment behavior and risk perception of individual investors, Financial Planning Review 1(1), 19-46.

4) Such investor behavior was also evidenced by the emergence of diverse thematic stocks related to politics and contactless services, and the latest craze about preferred stocks.

5) This is a daily cumulative figure of daily net buying ratios (%) that are computed by dividing the sum of retail net buying of stocks in each group into the sum of the stocks’ market cap.

6) Investment risk of each stock is estimated by a hazard model that uses accounting and market information for modeling probabilities of default. For details on the model, refer to the following: Lee & Kim, 2015, An evaluation of bankruptcy prediction models using accounting and market information in Korea, Asian Review of Financial Research 28(4), 625-665.

7) According to Korea Financial Investment Association, outstanding margin accounts recorded the highest level at KRW 12.5 trillion as of June 26, 2020.

8) Kim, M.K., 2020, Retail investors’ stock buying: Recent trend and evaluation, KCMI Issue Report 20-14.

9) This refers to changes in the ratio of the number of listed stocks to outstanding margin loans.

Characteristics of recent stock buying by retail investors

In general, retail investors are known to pursue high-risk and high-return by concentrating their investment in few selected stocks, instead of rationally allocating assets into a well-diversified portfolio.3) This could be partly due to retail investors’ lack of awareness about the importance of portfolio diversification and risk management. However, a more fundamental reason is their limited time and technique for systemically managing a risk asset portfolio. Without proper analysis on their investment and inherent risk in advance, they often trade stocks for short-term profits.4) Investment in risky assets, however, requires a more conservative approach especially at a time such as now when uncertainties are quite high. In particular, there are two lines of concern about retail investors’ latest stock buying spree.

First and foremost, their buying is getting stronger on high-risk stocks as the stock market has been recovering from the Covid-19 shock. Figure 3-A shows differences5) in retail investors’ cumulative net buying ratios between high-risk, and low-risk stocks.6) When the stock market fluctuates and is highly volatile, retail investors tend to net buy relatively safer stocks, which abruptly narrows the gap between the high-risk and low-risk stock groups. This can be interpreted as flight-to-quality where investors prefer safer assets when market risk is accumulating. However, as the stock market began recovering quickly, it seems that retail investors began to increase the proportion of high-risk stocks in their portfolios. Investing in high-risk stocks without proper asset allocation and risk distribution fit for risk tolerance levels could expose retail investors to excessive tail risk especially at a time such as now when the crisis situation is lingering further.

According to a recent report,8) increases in outstanding margin loans were mainly concentrated in the stocks that showed an abrupt, short-term rise. For example, Figure 4 illustrates changes in margin loans of stocks that were classified into five groups depending on return characteristics9) during the period of a margin loan increase between March 25 and May 29, 2020. Return characteristics here mean skewness and volatility. The results show that the group whose returns have a fat-tailed distribution (in other words, a high possibility of short-term, sudden price increases) is more likely to have more stocks showing an increased rate of margin loans. This implies that retail investors could have used more leverage for buying highly volatile stocks whose prices abruptly rose for a short period of time.

Future responses and implications

As mentioned above, retail investors were found to show flight-to-quality and to prefer relatively safer stocks when market volatility and risk increased further, while using more leverage to increase the weight of riskier stocks in their buying during market recovery. Such behavior could in the end push up return volatility of investment portfolios, and incur losses larger than their risk tolerance levels.

Although investment in risky assets is a must to asset accumulation of households amid the lingering low interest rate environment, it’s always important for investors to fully consider whether their investment fits with their risk appetite. Korea’s stock market is faced with many downside risks such as the second wave of Covid-19 and the reignition of the US-China trade dispute, which requires a reserved approach. Also necessary is caution against any adverse impact of unnecessary leverage on portfolio returns when downside risk weighs down the stock market.

1) An active retail account here means a stock trading account that has a balance over KRW 100,000 and trades stocks at least once over the past six months.

2) Maeil Business Newspaper, March 11, 2020, Retail accounts reaching 30 million, surpassing Korea’s economically active population.

3) Khil et al. (2008) report that retail investors’ required rate of returns on the stock market stood at 28.8% on average, which is excessively high. The survey also revealed that retail investors prefer small to middle cap stocks over large cap stocks, and their portfolio consists of less than three stocks on average.

Khil, Park, Lee & Park, 2008, A survey on the investment behavior and risk perception of individual investors, Financial Planning Review 1(1), 19-46.

4) Such investor behavior was also evidenced by the emergence of diverse thematic stocks related to politics and contactless services, and the latest craze about preferred stocks.

5) This is a daily cumulative figure of daily net buying ratios (%) that are computed by dividing the sum of retail net buying of stocks in each group into the sum of the stocks’ market cap.

6) Investment risk of each stock is estimated by a hazard model that uses accounting and market information for modeling probabilities of default. For details on the model, refer to the following: Lee & Kim, 2015, An evaluation of bankruptcy prediction models using accounting and market information in Korea, Asian Review of Financial Research 28(4), 625-665.

7) According to Korea Financial Investment Association, outstanding margin accounts recorded the highest level at KRW 12.5 trillion as of June 26, 2020.

8) Kim, M.K., 2020, Retail investors’ stock buying: Recent trend and evaluation, KCMI Issue Report 20-14.

9) This refers to changes in the ratio of the number of listed stocks to outstanding margin loans.