OPINION

2020 Dec/08

Digital Innovation in Global Securities Industry under Covid-19 and the Implications

Dec. 08, 2020

PDF

- Summary

- Korea’s securities firms, already known for a highly concentrated business portfolio, have seen their dependency on brokerage even growing higher under the Covid-19 pandemic. With the competition in non-face-to-face financial services expected to intensify further in the pandemic era, those firms should come up with a strategy of diversifying their revenue structure via firm-wide digital innovation. More concretely, they are needed to expand non-face-to-face, tailored wealth management services, and to invest more in innovative startups, while on another front leveraging AI and big data technology seeking to broaden their brokerage services to a wider range of products including unlisted stocks, corporate bonds, and other ESG-related financial investment products.

Covid-19 changing profitability in global securities industry

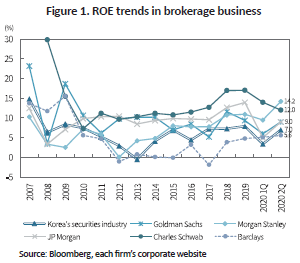

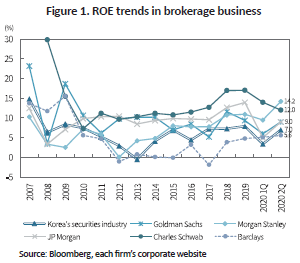

As the spread of Covid-19 resulted in global stock indexes plunging and corporate bond spreads soaring in an abrupt manner, global investment banks1) posted a loss in their principal investment, which led to an industry-wide decline in ROE in the first quarter of 2020 (Figure 1). Fortunately, their profitability returned to the 2019 level as global economic activities slowly began resuming and major global stock indexes rebounded in the second quarter of 2020. Korea’s securities firms also suffered from higher losses in principal investment in the first quarter of 2020, but the increased brokerage revenue in the second quarter helped their profitability turn back almost to the pre-crisis level in the second quarter. However, their ROE level is still far dwarfed by that of their global peers.

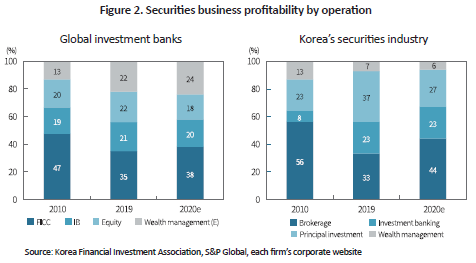

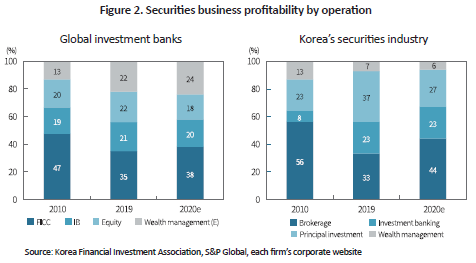

Global investment banks managed to generate revenues from diverse business operations since the Covid-19 outbreak, whereas Korean securities firms have increasingly relied on revenues from a limited range of operations such as brokerage. During the first half of 2020, top 12 global investment banks generated revenues from FICC (38%), wealth management2) (24%), investment banking (20%), and others (principal investment, etc., 18%)(Figure 2). Although their share of FICC in overall revenues fell and that of wealth management increased significantly, they tend to have a balanced revenue structure which creates profits evenly from every operation. During the same period, however, Korea’s securities firms made almost half of their revenues from brokerage which accounts for 44% of their overall revenue. Furthermore, their revenue structure has depended heavily on brokerage and principal investment since the global financial crisis. In particular, their wealth management revenue—that is also small in absolute term—even fell further to 6% of overall revenues in the first half of 2020, which is a stark contrast to their global peers posting higher wealth management revenues in the Covid-19 era.

The low profitability of Korean securities firms after the Covid-19 outbreak largely stems from their long-held business structure: Traditional operations such as brokerage and principal investment contribute greatly to their revenues, with their wealth management business hardly capable of generating meaningful revenues. By contrast, their global peers managed to achieve high profitability during the pandemic era thanks to their years-long drive for digital transformation and massive ICT investment in every corner of their business. According to global research firm data, global investment banks have invested $72 billion or 30% of their operating revenues in ICT every year during the past three years, and will further increase their ICT investment going forward.3) This is based on a projection that Covid-19 will help the contactless economic paradigm to take hold faster than expected, which will make a non-face-to-face financial service a new normal in every area of the financial investment and services industry from trading, wealth management and firm analysis to brokerage, payment and settlement.

Under the circumstances, this article tries to explore the footsteps of global investment banks towards digital innovation in the pandemic era, based on which to present some challenges and implications for Korea’s securities firms in this area.

Growing contactless, personalized wealth management services

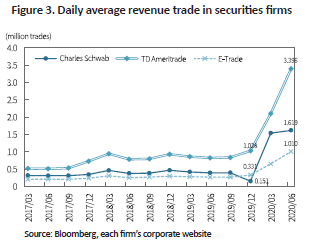

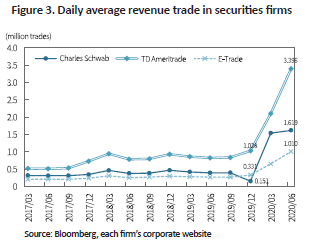

Non-face-to-face transactions have increased rapidly in the global securities market as the spread of Covid-19 has contracted face-to-face contacts and further increased volatility in the capital markets. As of end-June 2020, the daily average revenue trades of selected US securities firms more than tripled to 1 million to 4 million trades compared to end-2019 (Figure 3). The number of active accounts in those firms is also known to have increased 50% to 200% during the same period. Given the massive net outflows from global equity funds in the first half of 2020,4) it is possible to estimate that indirect investment in equity via mutual funds could have fallen dramatically while direct investment in equity mostly by retail investors could have risen sharply since the Covid-19 spread.

For retail investors increasingly participating in the stock market directly, leading global investment banks such as Charles Schwab, Bank of America, Deutsche Bank, and Robinhood have provided non-face-to-face, ICT-based wealth management solutions, generating high revenues. Charles Schwab unveiled in early 2020 its Schwab Intelligent Income solution that calculates the regular withdrawal from an annuity account every month for building an ETF portfolio based on the holder’s risk appetite and target strategy, which is used to automatically execute trading. Furthermore, a $30 monthly subscription to its robo advisor solution Schwab Intelligent Portfolios Premium provides subscribers unlimited one-on-one financial advice. Bank of America’s Merrill Edge is a self-directed, free online wealth management solution, offering research reports and tailored wealth management services. During the first half of 2020, Bank of America achieved high profitability thanks to revenues from its advisor fees and option trading fees. Deutsche Bank has recently launched its online solution Robin for providing an ETF portfolio to suit customer appetite at reasonable fees. Robinhood, a commission-free trading platform, has provided online wealth management services and trading of fractional shares in early 2020. Since the outbreak of Covid-19, its interest income shot up dramatically due to a sharp increase in customer’s deposits and credit-based loans.

Rising equity investment in innovative start-ups

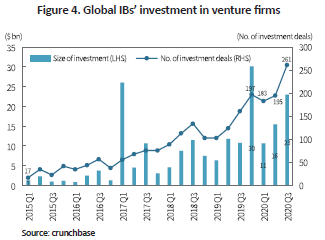

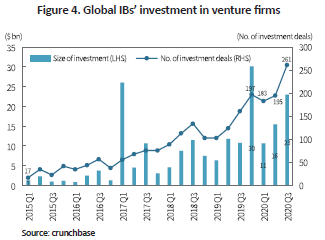

Amid expectations about accelerated digital innovation after Covid-19, global investment banks have significantly increased their equity investment in fintech startups, especially those specialized in AI and big data. Although the pandemic temporarily contracted the market for venture investment in the first quarter of 2020, global investment banks began aggressively carrying out equity investment in innovative startups in the second quarter: The number of equity or debt investment of those banks in venture firms reached 196, similar to that in the fourth quarter of 2019 (Figure 4). However, that number recorded an all-time high at 261 in the third quarter of 2020, with the size of investment increasing for two consecutive quarters to $23 billion. Most of the investment targets are in rapidly-growing ICT sectors with great future potential, for example, fintech, AI, big data, networking and others. By forging strategic partnership with those startups, global investment banks aim to create a synergy, which will help expand their innovative fintech services and cut costs.

Diversified financial products traded via ICT platforms

As the interest rate is expected to be extremely low for a long period of time amid the sluggish real economy, there is a steady increase in the demand for structured products that offer higher returns compared with bank deposits. However, Covid-19 poses challenges for face-to-face sales of those products. Accordingly, more and more firms are capitalizing on an ICT platform for offering bespoke structured products. One of them is JP Morgan. By launching its online-based Structured Investment 360 platform in 2019, it enabled investment advisors to search for structured investment, to manage the risk and expected returns, and to monitor post trades. Goldman Sachs also in 2019 introduced its online-based platform Luminis via which it offered a streamlined issuance process for repack and other major structured products, and provided its high-net-worth customers a tailored structured investment option that has various underlying assets. Given the abrupt increase in sales via the two platforms in the first half of 2020, those ICT-based, non-face-to-face sales platforms for structured products are expected to replace the existing face-to-face channel going forward.

Innovative platforms are also increasingly penetrating into online trading of over-the-exchange equity and debt products, beyond structured products mentioned above. Established as a subsidiary of Morgan Stanley, Shareworks uses its own ICT platform for managing unlisted firms’ financial structure based on valuation, and helping those firms to be better prepared for M&A or IPO deals. Also notable is the platform’s intermediary role that connects equity and debt securities issued by promising unlisted firms to high-net-worth individuals as well as institutional investors. Goldman Sachs also holds a stake in Carta which offers financial analysis, brokerage, and portfolio management services for unlisted firms and the investors interested in those firms. Moreover, JP Morgan’s Execute is another ICT platform that helps high-net-worth individuals and institutional investors to get real-time quotes and to better access diverse vehicles related to foreign exchange rates, commodities, and fixed income. On another front, HSBC established an ESG solution unit in the first half of 2020 amid expectations for rising demand for climate change responses and sustainable investment, broadening their green bond and ESG transition bond strategies.

Digital innovation: Future directions for Korean players

Korean securities firms tend to have a business portfolio that is concentrated in a limited number of areas, compared to their global peers. And their already heavy dependence on brokerage went even higher amid the Covid-19 pandemic. Assuming Covid-19 accelerates the spread of the contactless paradigm further, securities firms are expected to face fiercer competition for more non-face-to-face, innovative services in every corner of their business including brokerage, wealth management, investment banking, and principal investment. Hence, they need to make firm-wide effort to pursue digital innovation while lowering their reliance on conventional operations such as brokerage and principal investment, which is a must to their survival in the contactless business environment.

They need to officially declare a transition to an ICT platform provider and to allocate their resources accordingly, seeking to find sustainable growth drivers and respond to a new contactless economic paradigm that will pan out in the pandemic era. It’s worth taking note of the digital innovation strategies global players have been taking since the Covid-19 outbreak. This will certainly give Korean players guidance to expand their contactless and tailored services, discover more startups, and aggressively finance those firms with both equity and debt. Also important is to ponder upon expanding the range of financial products eligible for trading in an ICT platform based on AI or big data from conventional financial products to unlisted stocks, corporate bonds, and ESG-related financial products.

1) The analysis in this article targets global investment banks engaged in investment banking and brokerage operations.

2) Global investment banks’ wealth management revenues for 2020 were estimated based on the data from Goldman Sachs, JP Morgan and Morgan Stanley.

3) S&P Global, February 19, 2020, Moody’s: Global investment banks’ IT spending averages $73B per year.

4) According to Korea Center for International Finance, an outflow from global equity funds in the first half of 2020 reached $175 billion and $46 billion for global market funds and emerging market funds, respectively.

As the spread of Covid-19 resulted in global stock indexes plunging and corporate bond spreads soaring in an abrupt manner, global investment banks1) posted a loss in their principal investment, which led to an industry-wide decline in ROE in the first quarter of 2020 (Figure 1). Fortunately, their profitability returned to the 2019 level as global economic activities slowly began resuming and major global stock indexes rebounded in the second quarter of 2020. Korea’s securities firms also suffered from higher losses in principal investment in the first quarter of 2020, but the increased brokerage revenue in the second quarter helped their profitability turn back almost to the pre-crisis level in the second quarter. However, their ROE level is still far dwarfed by that of their global peers.

Global investment banks managed to generate revenues from diverse business operations since the Covid-19 outbreak, whereas Korean securities firms have increasingly relied on revenues from a limited range of operations such as brokerage. During the first half of 2020, top 12 global investment banks generated revenues from FICC (38%), wealth management2) (24%), investment banking (20%), and others (principal investment, etc., 18%)(Figure 2). Although their share of FICC in overall revenues fell and that of wealth management increased significantly, they tend to have a balanced revenue structure which creates profits evenly from every operation. During the same period, however, Korea’s securities firms made almost half of their revenues from brokerage which accounts for 44% of their overall revenue. Furthermore, their revenue structure has depended heavily on brokerage and principal investment since the global financial crisis. In particular, their wealth management revenue—that is also small in absolute term—even fell further to 6% of overall revenues in the first half of 2020, which is a stark contrast to their global peers posting higher wealth management revenues in the Covid-19 era.

Under the circumstances, this article tries to explore the footsteps of global investment banks towards digital innovation in the pandemic era, based on which to present some challenges and implications for Korea’s securities firms in this area.

Growing contactless, personalized wealth management services

Non-face-to-face transactions have increased rapidly in the global securities market as the spread of Covid-19 has contracted face-to-face contacts and further increased volatility in the capital markets. As of end-June 2020, the daily average revenue trades of selected US securities firms more than tripled to 1 million to 4 million trades compared to end-2019 (Figure 3). The number of active accounts in those firms is also known to have increased 50% to 200% during the same period. Given the massive net outflows from global equity funds in the first half of 2020,4) it is possible to estimate that indirect investment in equity via mutual funds could have fallen dramatically while direct investment in equity mostly by retail investors could have risen sharply since the Covid-19 spread.

For retail investors increasingly participating in the stock market directly, leading global investment banks such as Charles Schwab, Bank of America, Deutsche Bank, and Robinhood have provided non-face-to-face, ICT-based wealth management solutions, generating high revenues. Charles Schwab unveiled in early 2020 its Schwab Intelligent Income solution that calculates the regular withdrawal from an annuity account every month for building an ETF portfolio based on the holder’s risk appetite and target strategy, which is used to automatically execute trading. Furthermore, a $30 monthly subscription to its robo advisor solution Schwab Intelligent Portfolios Premium provides subscribers unlimited one-on-one financial advice. Bank of America’s Merrill Edge is a self-directed, free online wealth management solution, offering research reports and tailored wealth management services. During the first half of 2020, Bank of America achieved high profitability thanks to revenues from its advisor fees and option trading fees. Deutsche Bank has recently launched its online solution Robin for providing an ETF portfolio to suit customer appetite at reasonable fees. Robinhood, a commission-free trading platform, has provided online wealth management services and trading of fractional shares in early 2020. Since the outbreak of Covid-19, its interest income shot up dramatically due to a sharp increase in customer’s deposits and credit-based loans.

Rising equity investment in innovative start-ups

Amid expectations about accelerated digital innovation after Covid-19, global investment banks have significantly increased their equity investment in fintech startups, especially those specialized in AI and big data. Although the pandemic temporarily contracted the market for venture investment in the first quarter of 2020, global investment banks began aggressively carrying out equity investment in innovative startups in the second quarter: The number of equity or debt investment of those banks in venture firms reached 196, similar to that in the fourth quarter of 2019 (Figure 4). However, that number recorded an all-time high at 261 in the third quarter of 2020, with the size of investment increasing for two consecutive quarters to $23 billion. Most of the investment targets are in rapidly-growing ICT sectors with great future potential, for example, fintech, AI, big data, networking and others. By forging strategic partnership with those startups, global investment banks aim to create a synergy, which will help expand their innovative fintech services and cut costs.

As the interest rate is expected to be extremely low for a long period of time amid the sluggish real economy, there is a steady increase in the demand for structured products that offer higher returns compared with bank deposits. However, Covid-19 poses challenges for face-to-face sales of those products. Accordingly, more and more firms are capitalizing on an ICT platform for offering bespoke structured products. One of them is JP Morgan. By launching its online-based Structured Investment 360 platform in 2019, it enabled investment advisors to search for structured investment, to manage the risk and expected returns, and to monitor post trades. Goldman Sachs also in 2019 introduced its online-based platform Luminis via which it offered a streamlined issuance process for repack and other major structured products, and provided its high-net-worth customers a tailored structured investment option that has various underlying assets. Given the abrupt increase in sales via the two platforms in the first half of 2020, those ICT-based, non-face-to-face sales platforms for structured products are expected to replace the existing face-to-face channel going forward.

Innovative platforms are also increasingly penetrating into online trading of over-the-exchange equity and debt products, beyond structured products mentioned above. Established as a subsidiary of Morgan Stanley, Shareworks uses its own ICT platform for managing unlisted firms’ financial structure based on valuation, and helping those firms to be better prepared for M&A or IPO deals. Also notable is the platform’s intermediary role that connects equity and debt securities issued by promising unlisted firms to high-net-worth individuals as well as institutional investors. Goldman Sachs also holds a stake in Carta which offers financial analysis, brokerage, and portfolio management services for unlisted firms and the investors interested in those firms. Moreover, JP Morgan’s Execute is another ICT platform that helps high-net-worth individuals and institutional investors to get real-time quotes and to better access diverse vehicles related to foreign exchange rates, commodities, and fixed income. On another front, HSBC established an ESG solution unit in the first half of 2020 amid expectations for rising demand for climate change responses and sustainable investment, broadening their green bond and ESG transition bond strategies.

Digital innovation: Future directions for Korean players

Korean securities firms tend to have a business portfolio that is concentrated in a limited number of areas, compared to their global peers. And their already heavy dependence on brokerage went even higher amid the Covid-19 pandemic. Assuming Covid-19 accelerates the spread of the contactless paradigm further, securities firms are expected to face fiercer competition for more non-face-to-face, innovative services in every corner of their business including brokerage, wealth management, investment banking, and principal investment. Hence, they need to make firm-wide effort to pursue digital innovation while lowering their reliance on conventional operations such as brokerage and principal investment, which is a must to their survival in the contactless business environment.

They need to officially declare a transition to an ICT platform provider and to allocate their resources accordingly, seeking to find sustainable growth drivers and respond to a new contactless economic paradigm that will pan out in the pandemic era. It’s worth taking note of the digital innovation strategies global players have been taking since the Covid-19 outbreak. This will certainly give Korean players guidance to expand their contactless and tailored services, discover more startups, and aggressively finance those firms with both equity and debt. Also important is to ponder upon expanding the range of financial products eligible for trading in an ICT platform based on AI or big data from conventional financial products to unlisted stocks, corporate bonds, and ESG-related financial products.

1) The analysis in this article targets global investment banks engaged in investment banking and brokerage operations.

2) Global investment banks’ wealth management revenues for 2020 were estimated based on the data from Goldman Sachs, JP Morgan and Morgan Stanley.

3) S&P Global, February 19, 2020, Moody’s: Global investment banks’ IT spending averages $73B per year.

4) According to Korea Center for International Finance, an outflow from global equity funds in the first half of 2020 reached $175 billion and $46 billion for global market funds and emerging market funds, respectively.