OPINION

2020 Dec/22

Increasing Retail IPO Investors and Importance of IPO Pricing

Dec. 22, 2020

PDF

- Summary

- Recently, Korea’s IPO market has seen a surge of retail investors. In November 2020, Korea’s Financial Services Commission unveiled its plan to give broader investment opportunities to retail investors in IPO shares, which desirably should be supplemented by further plans to shape a sound IPO market. This article tries to assess why retail investors are flocking to the IPO market, and to review the positive and negative aspects. What’s found is the increasing importance of IPO pricing that is helping the IPO market to better protect investors and to stably form demand for IPO stocks. More concretely, it is needed to improve the bookbuilding process, to facilitate over-allotment, and make the market more oriented by underwriter reputation, all of which could help form a sound IPO market.

Recently, Kakao Games attracted over KRW 58 trillion in IPO, the highest preorder deposits for public subscription. This evidences the increased presence of retail investors in the IPO market, but at the same time triggered controversies about how publicly offered shares are allocated to retail investors. In November 2020, Korea’s Financial Services Commission unveiled its plan to broaden the participation of retail investors in IPO subscription, which is expected to give retail investors broader investment opportunities and thus to improve the IPO share allotment that has been condemned as unequal. As more retail investors in the IPO market and boosted market sentiment could increase market volatility, there should be further plans to ease that volatility. Under the context, this article seeks to assess the reason behind increasing retail investors in the IPO market, and to further explore both positive and negative aspects of the trend. Based on those discussions, this article tries to argue the importance of IPO pricing, and future plans to nurture a sound IPO market.

Retail investors increasing in the IPO market: Causes and impacts

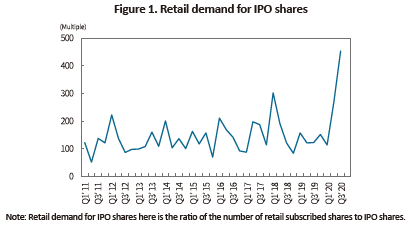

As illustrated in Figure 1, the ratio of the number of shares subscribed by retail investors to IPO shares used to hover around 100 and 200 until the previous year, but rose to a decade high of 450 in the third quarter of 2020. There are two factors that are thought to have triggered such a steep increase in retail investors in the IPO market. First, IPO shares recently had a surprisingly high return on the first day of trading. During the third quarter of 2020, the average return on IPO shares reached 49%, with quite a few shares producing returns over 100%. This could have fueled expectations for IPO shares among retail investors who relatively lack investment experience. In fact, the IPO investment rush is often closely related to first-day returns. This was what happened to the first quarter of 2018 when both IPO shares’ first-day return and retail investors’ subscription rate were unusually high. Such an unusual IPO rush was also found during the IT bubble in the late 1990s.

Second, the IPO market today has a much larger pool of retail investors. Since the Covid-19 outbreak, many new investors have participated in the stock market, with their size of trading dramatically increasing. Notably, there are quite a few retail investors who are capable of carrying out IPO investment properly. For example, some of them would assess the value of their investment based on in-depth understanding about the business of an IPO firm. Also, many of those who have experienced investing in IPO shares would look up a securities registration statement, aiming for a thorough analysis on an IPO firm’s financial performance and growth potential. There are many information channels via which retail investors can assess the inherent value of IPO share. This group of retail investors is highly likely to invest in an IPO firm only after taking into account its long-term performance. A larger pool of retail investors in the IPO market has positive aspects in that this could increase the participation of more financially literate investors, raise the chance of success in an IPO deal, and give a boost to the market.

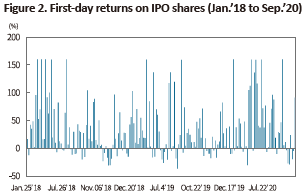

By contrast, this also poses some negative aspects: The market is likely to be filled with an excessive number of retail investors chasing exorbitantly high returns only, which could deepen further in an overheated IPO market. If there is an excessive increase in the number of retail investors unconditionally expecting higher returns on IPO shares or imitating other investors’ decision without questioning it, IPO shares could be more frequently overpriced than the firm’s intrinsic value. In some IPO cases such as Big Hit Entertainment, investors sold off IPO shares after achieving their expected returns. This could lead to a post-IPO plunge. Those return chasers tend to be herding in and out of the IPO market depending on market conditions. An abrupt inflow of such investors in the IPO market usually pushes up the subscription rate, thereby making it hardly likely for long-term value investors to receive IPO shares. By contrast, an exodus of those investors in a short span of time could destabilize demand in the IPO market and thus prevent sound IPO firms from raising capital. Figure 2 illustrates a time series changes in IPO share returns that went up excessively on the first trading day and then fell drastically afterwards. This could evidence the immense influence of those return chasers in Korea’s IPO market.

Importance of IPO pricing

In Korea’s IPO market, retail investors account for a significant proportion not only in IPO subscriptions, but also in post-IPO trading of those shares. The recent rise in retail IPO investors is certainly positive as it helps boost the market. However, this at the same time could raise the danger of overheating or cooling down the market. As mentioned above, continuous underpricing of IPO shares could trigger herding behavior of retail investors, while frequent overpricing could bring investment risk into focus and abruptly drive investors out of the market. In that regard, formation of a proper offer price is highly important in the IPO market that is participated by many retail investors. Expectedly, if a proper offer price brings down IPO market volatility, this could raise the likelihood that the market is led by experienced investors who understand IPO shares. Such a market benefits IPO firms as the stable investor base and the proper offer price help those firms raise capital at lower costs.

The issue of equality in how IPO shares are allocated stems from retail investors’ growing interest in and demand for those shares. Another factor behind the issue could be that retail investors constitute meaningful buying power for post-trading of many IPO shares in Korea. However, others argue that institutional investors—taking into account their price discovery function—should be given upper hand in a bookbuilding process, which appears reasonable enough. This became the point of controversy over the allotment ratio in a policy discussion session held by the Korea Financial Investment Association in November 2020. It’s worth mentioning that this will be no longer an issue if IPO pricing works properly and helps investors to purchase IPO shares via post-IPO trading at reasonable prices without having to participate in IPO subscription.

Challenges towards a sound IPO market

Discussions taken place thus far suggest that the key to future challenges lies in forming a sound IPO market where a proper offer price is set to attract and better protect IPO investors. More concrete suggestions are presented as follows.

First, Korea’s current bookbuilding process needs improving in the direction that ensures more effective price discovery in IPO deals. By nature, bookbuilding is a price-setting mechanism that lets a lead manager play a pivotal role. However, investor protection was at issue when the mechanism was first introduced, which gave rise to many detailed rules on disclosure, share allotment, the process itself, and others. Today, those rules are undermining the lead manager’s autonomy that is important to discover a proper offer price. To sum up, the current bookbuilding process is fair and transparent, but somewhat inefficient in price discovery. As mentioned above, IPO pricing is getting more and more important in the IPO market these days. This is reinforcing the need for improvements in the direction that requires lead managers to have wider discretion and to play a leading role, instead of underscoring transparency only. It’s also worth reviewing the idea of letting lead managers consider retail demand to set an offer price.

Second, lead managers need to take bolder action with regard to an over-allotment option. A lead manager whose underwriting agreement contains the option is allowed to borrow from the largest shareholder for selling investors 15% more IPO shares than originally planned. During a one-month period after listing, the lead manager can defend large price declines by purchasing IPO shares in a number not exceeding that of over-allotment. One month after listing, the lead manager will then pay back the 15% purchased and newly issued shares to the largest shareholder. Such an over-allotment option enables lead managers’ market making that aims to mitigate post-IPO price declines. Due to the difficulty in accurately forecasting demand for IPO shares, it’s not surprising to see a lead manager set an offer price that is higher than market demand. In short, IPO shares can be overpriced. If this is the case, any lead manager with an over-allotment option can engage in market making during first few days of listing, which helps address investor losses arising from the overpriced offer price. More importantly, this predisposes lead managers to determine an offer price that more fully takes into account market demand information obtained during the bookbuilding process.

Third, a reputational market is needed for IPO underwriting. In many cases, Korea’s lead managers are evaluated by their IPO underwriting volume, which only induces fee competition instead of service competition. A sound, well-functioning IPO market needs many elements such as proper IPO pricing, a lead manager’s role in investor protection, and IPO shares’ long-term performance. A reputational market is expected to induce lead managers to improve their services related to those elements. Such a market is expected to form as long as there are qualitative evaluation criteria for lead managers and a channel via which to disseminate relevant information on a regular basis.

Retail investors increasing in the IPO market: Causes and impacts

As illustrated in Figure 1, the ratio of the number of shares subscribed by retail investors to IPO shares used to hover around 100 and 200 until the previous year, but rose to a decade high of 450 in the third quarter of 2020. There are two factors that are thought to have triggered such a steep increase in retail investors in the IPO market. First, IPO shares recently had a surprisingly high return on the first day of trading. During the third quarter of 2020, the average return on IPO shares reached 49%, with quite a few shares producing returns over 100%. This could have fueled expectations for IPO shares among retail investors who relatively lack investment experience. In fact, the IPO investment rush is often closely related to first-day returns. This was what happened to the first quarter of 2018 when both IPO shares’ first-day return and retail investors’ subscription rate were unusually high. Such an unusual IPO rush was also found during the IT bubble in the late 1990s.

By contrast, this also poses some negative aspects: The market is likely to be filled with an excessive number of retail investors chasing exorbitantly high returns only, which could deepen further in an overheated IPO market. If there is an excessive increase in the number of retail investors unconditionally expecting higher returns on IPO shares or imitating other investors’ decision without questioning it, IPO shares could be more frequently overpriced than the firm’s intrinsic value. In some IPO cases such as Big Hit Entertainment, investors sold off IPO shares after achieving their expected returns. This could lead to a post-IPO plunge. Those return chasers tend to be herding in and out of the IPO market depending on market conditions. An abrupt inflow of such investors in the IPO market usually pushes up the subscription rate, thereby making it hardly likely for long-term value investors to receive IPO shares. By contrast, an exodus of those investors in a short span of time could destabilize demand in the IPO market and thus prevent sound IPO firms from raising capital. Figure 2 illustrates a time series changes in IPO share returns that went up excessively on the first trading day and then fell drastically afterwards. This could evidence the immense influence of those return chasers in Korea’s IPO market.

In Korea’s IPO market, retail investors account for a significant proportion not only in IPO subscriptions, but also in post-IPO trading of those shares. The recent rise in retail IPO investors is certainly positive as it helps boost the market. However, this at the same time could raise the danger of overheating or cooling down the market. As mentioned above, continuous underpricing of IPO shares could trigger herding behavior of retail investors, while frequent overpricing could bring investment risk into focus and abruptly drive investors out of the market. In that regard, formation of a proper offer price is highly important in the IPO market that is participated by many retail investors. Expectedly, if a proper offer price brings down IPO market volatility, this could raise the likelihood that the market is led by experienced investors who understand IPO shares. Such a market benefits IPO firms as the stable investor base and the proper offer price help those firms raise capital at lower costs.

The issue of equality in how IPO shares are allocated stems from retail investors’ growing interest in and demand for those shares. Another factor behind the issue could be that retail investors constitute meaningful buying power for post-trading of many IPO shares in Korea. However, others argue that institutional investors—taking into account their price discovery function—should be given upper hand in a bookbuilding process, which appears reasonable enough. This became the point of controversy over the allotment ratio in a policy discussion session held by the Korea Financial Investment Association in November 2020. It’s worth mentioning that this will be no longer an issue if IPO pricing works properly and helps investors to purchase IPO shares via post-IPO trading at reasonable prices without having to participate in IPO subscription.

Challenges towards a sound IPO market

Discussions taken place thus far suggest that the key to future challenges lies in forming a sound IPO market where a proper offer price is set to attract and better protect IPO investors. More concrete suggestions are presented as follows.

First, Korea’s current bookbuilding process needs improving in the direction that ensures more effective price discovery in IPO deals. By nature, bookbuilding is a price-setting mechanism that lets a lead manager play a pivotal role. However, investor protection was at issue when the mechanism was first introduced, which gave rise to many detailed rules on disclosure, share allotment, the process itself, and others. Today, those rules are undermining the lead manager’s autonomy that is important to discover a proper offer price. To sum up, the current bookbuilding process is fair and transparent, but somewhat inefficient in price discovery. As mentioned above, IPO pricing is getting more and more important in the IPO market these days. This is reinforcing the need for improvements in the direction that requires lead managers to have wider discretion and to play a leading role, instead of underscoring transparency only. It’s also worth reviewing the idea of letting lead managers consider retail demand to set an offer price.

Second, lead managers need to take bolder action with regard to an over-allotment option. A lead manager whose underwriting agreement contains the option is allowed to borrow from the largest shareholder for selling investors 15% more IPO shares than originally planned. During a one-month period after listing, the lead manager can defend large price declines by purchasing IPO shares in a number not exceeding that of over-allotment. One month after listing, the lead manager will then pay back the 15% purchased and newly issued shares to the largest shareholder. Such an over-allotment option enables lead managers’ market making that aims to mitigate post-IPO price declines. Due to the difficulty in accurately forecasting demand for IPO shares, it’s not surprising to see a lead manager set an offer price that is higher than market demand. In short, IPO shares can be overpriced. If this is the case, any lead manager with an over-allotment option can engage in market making during first few days of listing, which helps address investor losses arising from the overpriced offer price. More importantly, this predisposes lead managers to determine an offer price that more fully takes into account market demand information obtained during the bookbuilding process.

Third, a reputational market is needed for IPO underwriting. In many cases, Korea’s lead managers are evaluated by their IPO underwriting volume, which only induces fee competition instead of service competition. A sound, well-functioning IPO market needs many elements such as proper IPO pricing, a lead manager’s role in investor protection, and IPO shares’ long-term performance. A reputational market is expected to induce lead managers to improve their services related to those elements. Such a market is expected to form as long as there are qualitative evaluation criteria for lead managers and a channel via which to disseminate relevant information on a regular basis.