OPINION

2021 Oct/12

ESG Rating Divergence and Governance Evaluation Issues

Oct. 12, 2021

PDF

- Summary

- The discrepancy between ESG ratings has been observed with a correlation coefficient of 0.61 between ratings for listed firms provided by Korea’s two major raters. Such divergence is particularly evident in the governance dimension, which is primarily attributable to different evaluation schemes applied to chaebols (conglomerates). As for governance evaluation, ESG rating agencies differ from each other in terms of provisions like a supermajority vote or a golden parachute, indicating that they take different views on governance. ESG raters should strive to prevent the divergence between ratings from widening further to enhance the effectiveness of ESG investing and bolster ESG management strategies. In this regard, the top priority for ESG rating agencies is to keep improving the overall evaluation principles and specific processes including governance evaluation standards, and to disclose relevant information to investors.

Recently, ESG management and investing centering on environmental, social and governance factors has become a hot social topic. A prerequisite for reasonable ESG decision-making is the objective evaluation to find out which companies are better at performing ESG-related activities. However, a comparison of ESG ratings provided by Korea’s raters reveals some discrepancies, which poses a challenge for ESG evaluation. Thus, this article intends to identify characteristics of ESG rating divergence between Korea’s rating agencies with the focus on governance, and to discuss how to resolve such differences.

ESG rating divergence by rater

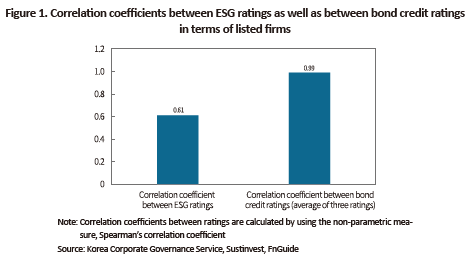

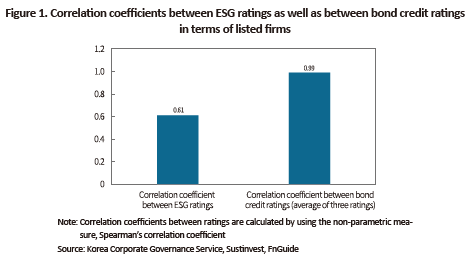

In the ‘Current Trend and Implications of ESG Ratings in Korea and Abroad’ report released in April 2021, the Federation of Korean Industries (FKI) indicated that ESG raters presented different ratings and the divergence between their ESG ratings was huge.1) Experts have continuously pointed out that ESG ratings from different providers disagree substantially even in the US, a country with the longest history of implementing ESG schemes. The 2014 comparative analysis on six major ESG raters2) was jointly conducted by the Massachusetts Institute of Technology (MIT) and the University of Zurich. This analysis reveals that correlation coefficients between their ratings are on average 0.54, a much lower figure than the average correlation coefficient between bond credit ratings of 0.99 (see Figure 1).3)

Such divergence among various rating providers can also be found in the comparison of ratings from Korea’s two major ESG raters—Korea Corporate Governance Service and Sustinvest. In 2020, the correlation coefficient between ratings from the two raters for listed firms4) stood at 0.61. This is fairly low compared with an average correlation coefficient of 0.995) between ratings from three credit rating agencies for listed firms, as is the case with the US.

Main driver of ESG rating divergence

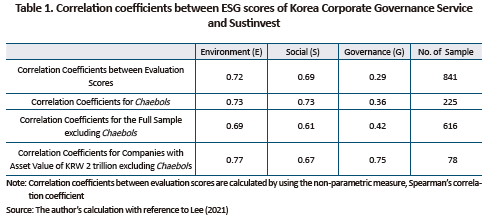

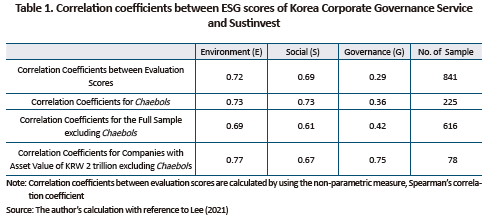

As pointed out in Lee (2021),6) ratings from Korea’s two major ESG raters also disagree in terms of specific dimensions. Lee (2021) reveals that the environmental and social dimensions represent a relatively high correlation between ratings with correlation coefficients of 0.72 and 0.69, respectively, while the governance dimension has a low correlation coefficient of 0.29 (see Table 1). The governance dimension’s lowest correlation among the entire ESG dimensions is primarily attributed to the fact that governance is evaluated based on a wide range of factors including qualitative elements.

When firms classified as chaebols are selected from the two ESG raters’ samples, their correlation coefficients turn out to be similar to those calculated for the full sample. In other words, the low correlation in the governance dimension is repeatedly observed in the ratings of chaebols. By contrast, when correlation coefficients for three ESG dimensions are calculated from the full sample excluding chaebols, environmental and social dimensions show a moderate decline with correlation coefficients of 0.69 and 0.61, respectively, while the correlation coefficient for the governance dimension increases to 0.42. This implies that different approaches to evaluating the governance of chaebols play a role in reducing the correlation in the governance dimension. In particular, given that firms belonging to the group of chaebols primarily top the list of corporate asset value, this article calculated correlation coefficients in the three dimensions for the listed firms with asset value of KRW 2 trillion or more except for chaebols. This calculation resulted in a governance correlation coefficient of 0.75—2.6 times higher than the previous figure, indicating that ratings from the two ESG raters agree in the governance dimension.7) This demonstrates that different evaluation schemes on the governance of chaebols act as the main factor behind a weak correlation between governance ratings of two ESG raters.

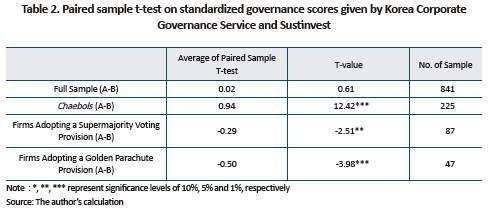

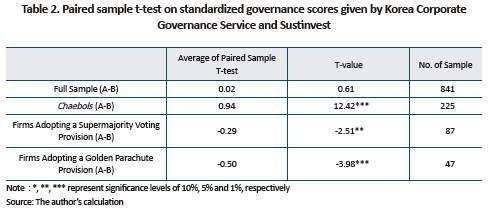

Such disagreement between the two raters in terms of governance of chaebols is also evident in the paired sample t-test results. The paired sample t-test was performed on chaebols’ standardized scores computed by two rating agencies that were extracted from the standardized governance scores for the full sample (see Table 2 below). The discrepancy in governance scores from the full sample is too small to represent any statistical significance, whereas as for chaebols, the difference in average governance scores shows considerably high statistical significance.

However, in terms of the governance dimension, the divergence between the two raters’ evaluation results is not limited to chaebols. This article conducted a comparison of companies including those traded on the KOSDAQ who introduced a supermajority voting provision and a golden parachute measure8) to their articles of incorporation as an anti-takeover measure. The comparative analysis reveals that a rating agency that gives higher scores to governance of chaebols shows a tendency of giving lower scores to those adopting anti-takeover provisions. This implies that the two raters apply a different set of evaluation standards to chaebols and firms adopting an anti-takeover provision in the articles of incorporation, which have a significant impact on governance evaluation. What is also notable is that even within a single rating agency, evaluation results regarding different negative factors of the governance could disagree substantially.

Need for establishment and disclosure of stricter evaluation principles and processes

It is neither necessary nor desirable for independent rating agencies to completely agree on ESG ratings. However, as the MIT-University of Zurich joint study pointed out, large discrepancies between rating providers would cause investors with a strong preference for ESG performance to make investment decisions based on different ESG ratings, thereby dispersing the effect of their preferences on asset prices. Such divergence also could give mixed signals to companies, hampering them from establishing an effective direction for ESG management.

Therefore, ESG raters should put efforts into clarifying ESG evaluation principles including governance evaluation standards as well as specific processes of scope, measurement and weights,9) and disclosing relevant information to resolve discrepancies between ESG ratings. Furthermore, investors should recognize the divergence between ratings from different agencies to make reasonable investment decisions.

1) In particular, the ratings for Korea’s 55 firms provided by three rating agencies in Korea and abroad (MSCI, Refinitv, Korea Corporate Governance Service) show an average difference of 1.4 under the 7-rating framework. Ratings of 22 firms reveal a difference between at least two raters that represents 3 ratings or more. However, the FKI converted Refinitiv’s rating scheme into the 7 ratings-based system with an interval of 14 scores between ratings to fit 100 scores-based Refinitv’s system into the 7-rating framework adopted by the other two raters. Thus, discrepancies stemming from the FKI’s comparison rarely mean actual differences between ratings.

2) KLD, Sustainalytics, Vigeo Eiris, RobecoSAM, Asset4, MSCI

3) Berg, F., Koelbel, J.F., and Rigobon, R., Aggregate confusion: The divergence of ESG ratings. MIT Sloan School of Management, 2019.

4) The two ESG raters commonly evaluated 841 listed firms in 2020. Since the final evaluation of ESG performance is indicated in ratings that represent rank order, instead of scores, this article uses the non-parametric measure, Spearman’s correlation coefficient and all correlation coefficients mentioned in this article refer to Spearman’s correlation coefficients.

5) This represents an average Spearman correlation coefficient between credit ratings from three credit raters—Korea Ratings, Korea Investors Service and NICE Investors Service, each of which has a correlation coefficient of 0.99.

6) Lee, I.H., 2021, Analysis on ESG Rating Schemes: Current Status and Characteristics, KCMI Issue Paper 21-09.

7) When calculating the two raters’ correlation coefficients between scores for three ESG dimensions and market capitalization, all resulting figures range from 0.26 to 0.54, except for one rater’s 0.14 for the governance dimension. This implies that larger companies tend to receive higher evaluation scores. But as for the governance dimension, the increase in evaluation scores of one rating agency rarely depends on the size of companies.

8) A supermajority voting provision refers to more weighted voting than the shareholder voting at a general meeting, whereas a gold parachute provision in the articles of incorporation guarantees special benefits to top executives including the CEO if they are subject to early termination, which takes a form of generous severance pay if early termination arises from a hostile takeover. For detailed information on anti-takeover measures contained in the articles of incorporation, please see Nam, G.N., 2020, Listed Companies’ Anti-Takeover Provisions in the Articles of Incorporation: Current Status and Implications, KCMI Issue Paper 20-10.

9) The MIT-University of Zurich study found that scope and measurement divergences in ESG evaluation are the main factor behind discrepancies between rating agencies.

ESG rating divergence by rater

In the ‘Current Trend and Implications of ESG Ratings in Korea and Abroad’ report released in April 2021, the Federation of Korean Industries (FKI) indicated that ESG raters presented different ratings and the divergence between their ESG ratings was huge.1) Experts have continuously pointed out that ESG ratings from different providers disagree substantially even in the US, a country with the longest history of implementing ESG schemes. The 2014 comparative analysis on six major ESG raters2) was jointly conducted by the Massachusetts Institute of Technology (MIT) and the University of Zurich. This analysis reveals that correlation coefficients between their ratings are on average 0.54, a much lower figure than the average correlation coefficient between bond credit ratings of 0.99 (see Figure 1).3)

Such divergence among various rating providers can also be found in the comparison of ratings from Korea’s two major ESG raters—Korea Corporate Governance Service and Sustinvest. In 2020, the correlation coefficient between ratings from the two raters for listed firms4) stood at 0.61. This is fairly low compared with an average correlation coefficient of 0.995) between ratings from three credit rating agencies for listed firms, as is the case with the US.

As pointed out in Lee (2021),6) ratings from Korea’s two major ESG raters also disagree in terms of specific dimensions. Lee (2021) reveals that the environmental and social dimensions represent a relatively high correlation between ratings with correlation coefficients of 0.72 and 0.69, respectively, while the governance dimension has a low correlation coefficient of 0.29 (see Table 1). The governance dimension’s lowest correlation among the entire ESG dimensions is primarily attributed to the fact that governance is evaluated based on a wide range of factors including qualitative elements.

When firms classified as chaebols are selected from the two ESG raters’ samples, their correlation coefficients turn out to be similar to those calculated for the full sample. In other words, the low correlation in the governance dimension is repeatedly observed in the ratings of chaebols. By contrast, when correlation coefficients for three ESG dimensions are calculated from the full sample excluding chaebols, environmental and social dimensions show a moderate decline with correlation coefficients of 0.69 and 0.61, respectively, while the correlation coefficient for the governance dimension increases to 0.42. This implies that different approaches to evaluating the governance of chaebols play a role in reducing the correlation in the governance dimension. In particular, given that firms belonging to the group of chaebols primarily top the list of corporate asset value, this article calculated correlation coefficients in the three dimensions for the listed firms with asset value of KRW 2 trillion or more except for chaebols. This calculation resulted in a governance correlation coefficient of 0.75—2.6 times higher than the previous figure, indicating that ratings from the two ESG raters agree in the governance dimension.7) This demonstrates that different evaluation schemes on the governance of chaebols act as the main factor behind a weak correlation between governance ratings of two ESG raters.

However, in terms of the governance dimension, the divergence between the two raters’ evaluation results is not limited to chaebols. This article conducted a comparison of companies including those traded on the KOSDAQ who introduced a supermajority voting provision and a golden parachute measure8) to their articles of incorporation as an anti-takeover measure. The comparative analysis reveals that a rating agency that gives higher scores to governance of chaebols shows a tendency of giving lower scores to those adopting anti-takeover provisions. This implies that the two raters apply a different set of evaluation standards to chaebols and firms adopting an anti-takeover provision in the articles of incorporation, which have a significant impact on governance evaluation. What is also notable is that even within a single rating agency, evaluation results regarding different negative factors of the governance could disagree substantially.

It is neither necessary nor desirable for independent rating agencies to completely agree on ESG ratings. However, as the MIT-University of Zurich joint study pointed out, large discrepancies between rating providers would cause investors with a strong preference for ESG performance to make investment decisions based on different ESG ratings, thereby dispersing the effect of their preferences on asset prices. Such divergence also could give mixed signals to companies, hampering them from establishing an effective direction for ESG management.

Therefore, ESG raters should put efforts into clarifying ESG evaluation principles including governance evaluation standards as well as specific processes of scope, measurement and weights,9) and disclosing relevant information to resolve discrepancies between ESG ratings. Furthermore, investors should recognize the divergence between ratings from different agencies to make reasonable investment decisions.

1) In particular, the ratings for Korea’s 55 firms provided by three rating agencies in Korea and abroad (MSCI, Refinitv, Korea Corporate Governance Service) show an average difference of 1.4 under the 7-rating framework. Ratings of 22 firms reveal a difference between at least two raters that represents 3 ratings or more. However, the FKI converted Refinitiv’s rating scheme into the 7 ratings-based system with an interval of 14 scores between ratings to fit 100 scores-based Refinitv’s system into the 7-rating framework adopted by the other two raters. Thus, discrepancies stemming from the FKI’s comparison rarely mean actual differences between ratings.

2) KLD, Sustainalytics, Vigeo Eiris, RobecoSAM, Asset4, MSCI

3) Berg, F., Koelbel, J.F., and Rigobon, R., Aggregate confusion: The divergence of ESG ratings. MIT Sloan School of Management, 2019.

4) The two ESG raters commonly evaluated 841 listed firms in 2020. Since the final evaluation of ESG performance is indicated in ratings that represent rank order, instead of scores, this article uses the non-parametric measure, Spearman’s correlation coefficient and all correlation coefficients mentioned in this article refer to Spearman’s correlation coefficients.

5) This represents an average Spearman correlation coefficient between credit ratings from three credit raters—Korea Ratings, Korea Investors Service and NICE Investors Service, each of which has a correlation coefficient of 0.99.

6) Lee, I.H., 2021, Analysis on ESG Rating Schemes: Current Status and Characteristics, KCMI Issue Paper 21-09.

7) When calculating the two raters’ correlation coefficients between scores for three ESG dimensions and market capitalization, all resulting figures range from 0.26 to 0.54, except for one rater’s 0.14 for the governance dimension. This implies that larger companies tend to receive higher evaluation scores. But as for the governance dimension, the increase in evaluation scores of one rating agency rarely depends on the size of companies.

8) A supermajority voting provision refers to more weighted voting than the shareholder voting at a general meeting, whereas a gold parachute provision in the articles of incorporation guarantees special benefits to top executives including the CEO if they are subject to early termination, which takes a form of generous severance pay if early termination arises from a hostile takeover. For detailed information on anti-takeover measures contained in the articles of incorporation, please see Nam, G.N., 2020, Listed Companies’ Anti-Takeover Provisions in the Articles of Incorporation: Current Status and Implications, KCMI Issue Paper 20-10.

9) The MIT-University of Zurich study found that scope and measurement divergences in ESG evaluation are the main factor behind discrepancies between rating agencies.