Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Impacts of Covid-19 Pandemic on Retirement Pensions

Publication date Oct. 27, 2020

Summary

Retirement pensions are severely affected by the Covid-19 pandemic that is impacting the globe already hit by prolonged low growth and low interest rates. It is causing immense hardship for those who lose their job by threatening not only their current standard of living, but also their post-retirement income. Even those who manage to keep their job will be affected because a lower wage growth rate will bring down their future pension benefits. A lower investment return amid today’s economic slowdown will cut the growth rate of retirement pension assets. All of those circumstances are calling for a retirement pension reform that minimizes the loss in pension assets and that takes fully into account the post-pandemic consequences.

The Covid-19 pandemic has been affecting the whole globe. This has been impacting every aspect of life in Korea as well. At the end of August 2020, the Financial Times ran an article that pointed to poorer post-retirement life as one of the hidden legacies of the pandemic.1) As the pandemic came at a time when the low growth and low interest rates become a new normal, its impact on retirement pensions is broad and significant. The pandemic is destabilizing employment and lowering returns on retirement pensions, which is imposing a direct impact on retirement income. Because Korea’s retirement pension plans have a simple structure, the impact of the pandemic on plan members is quite direct as well.

This could also impose significant burden on plan sponsors. In general, defined benefit plans could be more onerous to sponsors. However, in a short-run, the burden of defined contribution plans could be more significant. Although a DB plan sponsor could postpone its contribution payment when the funding ratio falls, such a tactic is not available for DC plans.

The most severe impact could be on those who lost their job during the pandemic. Basically, pensions are an institutional tool that forces an individual to save part of current income for post-retirement income. Without current income, plan members may have to withdraw their retirement assets earlier than expected, not to mention that they cannot make contributions to their plans. The Covid-19 pandemic hit not only wage workers, but also the self-employed and small business owners. Although the self-employed and small business owners have suffered from income declines and been on the verge of bankruptcy, this is unlikely to affect retirement pensions significantly because only few of them subscribe to retirement pension plans. The less the retirement assets, the lower the impact.

One of the ideas currently being discussed to address the hardship is to allow plan members to access bank lending. However, such a short-term measure should be supplemented by long-term fixes such as expanding retirement pensions to the self-employed and small business owners.

At this juncture, this article aims to explore the impacts of the Covid-19 pandemic on Korea’s retirement pension plan members and the plan sponsors, and then to present future responses.

1. Impacts on DB plans

Technically, DB members are not affected in a short run unless they lose their job because their retirement benefit is computed by multiplying the monthly wage right before retirement by the number of service years. Even when the investment return on DB plan assets falls, it increases burden on plan sponsors, leaving no impact on the amount of retirement benefits. However, if plan members see a long-term decrease in their wage amid the pandemic, they are also expected to bear the brunt of the impact. It is also worth mentioning that a long-term decrease in returns on plan assets will force plan sponsors to increase contributions. Otherwise, the funding ratio will fall, which could cause an indirect impact on plan members.

Retirement benefits of a DB plan are paid when a plan member retires. Until then, the money to be paid for retirement benefits is usually deposited in a financial firm that is a plan provider. The ratio of plan assets over plan benefits to be paid out is called a funding ratio. Korea’s statutory funding ratio is over 90% for DB plan sponsors in 2020, but this will rise to over 100% from 2021.2) However, not all plan sponsors could meet the statutory funding ratio in practice. As of 2018, the average funding ratio is estimated to be about 69% among listed companies in Korea.3) Especially, the funding ratio is expected to be even lower than that in companies in the vulnerable sector such as aviation and tourism that have been hit particularly hard by the Covid-19 pandemic.

2. Impacts on DC plans

In a short run, the impact could be insignificant on DB plan members, but relatively significant on DC plan members. First of all, a lower return on plan assets could lower the rate of increase in accumulated plan assets, or even reduce the size of the assets. The possibility of principal losses is quite low because most of the retirement pension assets are invested in principal-guaranteed products. However, investment returns on those products are falling depending on financial market conditions, and most of the assets are held as short-term products that are immediately affected by lower returns.

Another inevitable factor is the impact of a lower wage increase rate if the low growth trend persists in a long run. But a wage increase rate affects that year’s contribution to the retirement pension plan. In a DB plan, a change in wage growth could affect both that year’s contribution and the accumulated contribution.

In general, DC plans are less onerous to plan sponsors than DB plans. The difference of burden on plan sponsors is one of the main reasons behind the rapid rise in DC plans in Korea as well as in the globe. For some time being, however, DC plans could be more burdensome to plan sponsors. DB plan sponsors could delay their contributions to retirement pensions because there is no legal limitation on a lower funding position. However, such a delay in contributions in DC plans is immediately noticed by plan members who will view this as unpaid wage. From the perspective of plan sponsors, this can pose a liquidity burden at hard times such as now. In the US, some DC plan sponsors announced a delay in their matching contributions to 401(k) plans that are a form of DC plans. As of September 2020, the number of employees affected by that decision stood at approximately 700,000 or only 1.15% of 60 million 401(k) members, but still, this decision is marked as a significant event.4)

In the composition of Korea’s retirement pensions, a high proportion of large-sized firms opt for DB plans. From the perspectives of employers, this stems from two factors. First, large firms can bear relatively larger costs. It’s often observed in overseas cases that smaller-sized firms cannot choose DB plans due to cost burden. In another aspect, large firms may have to pay large one-time contributions when adopting DC plans.5) The two factors are combined to raise the proportion of DB plans in large-sized companies. A more critical factor, of course, lies in employees: Large-firm employees could have chosen DB plans that they think are in favor of themselves because their negotiating power is relatively higher than those in smaller firms.6)

3. Impacts on unemployment insurance claims

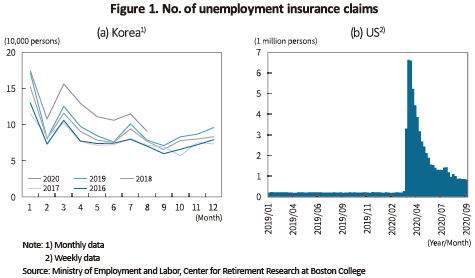

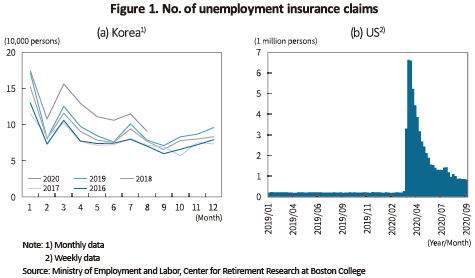

The Covid-19 pandemic also triggered an increase in the number of unemployed persons. In the US, a country severely hit by the pandemic, the number of unemployment insurance claims has ballooned since March 2020 (see Figure 1 (b)). The weekly number of claims stood at about 280,000 in mid-March, but increased more than 10-fold to surpass 3.3 million to finally peak at 6.65 million in the last week of March 2020. Although the figure quickly fell below 900,000 after the end of August, it remains still quite high. It was estimated that instability with regard to post-retirement income shot up significantly in unemployed households, compared to ordinary households.7) Korea is also bearing the harsh brunt of the Covid-19 pandemic. The number of unemployment insurance claims soared after February 2020 compared to other years, but the difference began slightly decreasing in July and August. Compared to 2019, the figure increased by 3,000 in January, by 27,000 in February, and by 30,000 from March through June. But the size of increase fell to 10,000 in July.

The impact of the pandemic on retirement pensions is far more serious for the unemployed than for the employed. Those who lost their job cannot contribute to their pension plans. The longer the period of unemployment, the more likely they are to withdraw their retirement assets. Although it is impossible to accurately gauge each employee’s lifetime service period, one year of unemployment out of the 30-year service period means a 3% loss in the contribution period, and a 3.3% decrease in the income replacement ratio.8) Given that the average service period of the employed stood at 6.5 years as of 2018,9) using all of the retirement assets accumulated until then during the period of unemployment means spending 20% of lifetime retirement assets.

It is also notable that the pandemic’s severe damage on the self-employed and small business owners. Despite their economic hardships, the impact on their retirement assets is estimated to be relatively small because only few of them have enrolled in retirement pension plans.10) This well exposes the limit of the retirement pension scheme in terms of the range of enrollment.

4. Future responses

When an employee loses income, he or she can access to either existing assets or new debts. Since the outbreak of Covid-19, many nations have placed the focus of their retirement pension policy on how to streamline the process of helping retirement assets to be withdrawn or pledged more easily than before. For example, the US legislated the Coronavirus Aid, Relief, and Economic Security Act (CARES) at the end of March 2020, which relaxed restrictions on withdrawing DC plan assets.11) Korea has been also working on helping plan members to pledge their retirement assets for financing, which allows them to keep their retirement assets intact. Because banks are opposing the idea arguing that this is in effect a credit loan unless banks can pledge retirement pensions as collateral, the Ministry of Employment and Labor is currently working on a regulatory reform that will enable retirement pensions to be used as collateral.12) Such a move seems to prioritize protecting retirement assets ahead of others, given that Korea’s retirement pension scheme has yet to fully take hold. Korea’s Act on the Guarantee of Employees’ Retirement Benefits currently allows retirement pension assets to be used as collateral only under very limited conditions, for example, a home purchase, etc.13) Thus far, there is no provision related to the Covid-19 pandemic. It is possible to relax the rules on loans as well as early withdrawals on a temporary basis.

Currently, DC plan members bear their own risk arising from lower investment returns. Small- to medium-sized business owners opting for DB plans are also in the same position. What’s needed now is an arrangement to distribute and reduce the investment risk. One of the options could be a trust-based occupational pension scheme that has been reviewed by several authorities. It would be worth considering introducing a product or a scheme that enables each plan provider’s assets to be managed collectively. The costs arising from running DB plans have been driving employers away from DB plans, and Korea is no exception to the tendency. Due to the high-cost structure of Korea’s DB plans compared to DC plans, the number of DB plans are likely to fall in a long run. Such a tendency is reinforcing the need for a regulatory fix to investment management of DC plans. What’s notable is a change in employment conditions, leading to a shorter service period at one workplace. Individual retirement pensions (IRPs) are an institutional tool that helps retirement assets be accumulated seamlessly when there is a job shift. An increase in job shifts will naturally increase the proportion of IRPs. Because IRPs have the exactly same structure to DC plans, this also reinforces the importance of DC plan asset management.

Thus far, very few of the self-employed and small business owners enroll in retirement pensions although they have been hit hardest by the Covid-19 pandemic. A desirable retirement pension scheme would have to include those people and be fitted for frequent job shifts going forward. Also necessary is a private pension scheme that integrates personal and occupational pensions taking into account that the self-employed and small business owners often turn to personal pensions and IRPs in preparation for their retirement income.14)

1) Financial Times, August 24, 2020, A poorer retirement is pandemic’s hidden legacy.

2) Although the Act on the Guarantee of Employees’ Retirement Benefits stipulates the statutory funding ratio, there is no tool to force plan sponsors to comply with the ratio, which in effect makes the regulation a recommendation without mandate. It is hard to mandate DB plan sponsors to maintain the funding ratio because such funding is not mandated for severance pay liabilities that is similar in nature to DB plans.

3) The funding ratio herein refers to the ratio of plan assets to the sum of severance pays and DB plan assets (H. Park, 2020, Funding Status of Pension Liabilities and Implications, KCMI Issue Paper 19-09).

4) Center for Retirement Research at Boston College, 2020, COVID-19 Crisis: Economic Data.

5) This is one of the Korea-specific phenomena. All domestic companies had been subject to the severance pay system that incurs severance pay liabilities. A firm with a large amount of severance pay liabilities could have large one-time expenses when shifting to a DC plan.

6) Employees think DB plans are more in favor of themselves also because they expect large firms, compared to smaller firms, to be more financially stable for paying out pension benefit payments. DC plans are always fully funded because plan assets are transferred to individual accounts. However, DB plans have different funding positions that are not always 100%. This makes employees at smaller firms always concern about the possibility of their pension benefits being unpaid. Hence, employees at smaller firms are more likely to choose a DC plan than large-firm employees do.

7) The National Retirement Risk Index rose from 50.2% before the pandemic to 54.9% after the outbreak in all households, while that in households with job loss jumped from 54.4% to 75.4% during the same period. The NRRI was estimated by comparing each household’s projected income replacement rate with a target replacement rate that allows each household to maintain its pre-retirement living standard (Munnell, A. H., Chen, A., Hou, W., 2020, How Widespread Unemployment Might Affect Retirement Security, Issue Brief #20-11, CRR).

8) It is assumed that a retiree will receive monthly annuity payments from the retirement pension benefit of 30 that is accumulated for 30 years of the service period (30-month wage). With the 4% interest rate, the monthly annuity payment will be 14.3% of the monthly wage of the last service year. The amount can be computed by dividing the benefit (30) by the pension’s present value (PV = [1-1/(1+i )N ]/i , where i denotes the interest rate and N denotes the payment period). With other factors being the same, a shorter service period of 29 years will decrease the income replacement ratio by 3.33% to 13.8%. The size of decrease remains the same even if the interest rate changes.

9) K-indicator (https://www.index.go.kr/main.do)

10) As of end-2019, the Yellow Umbrella Deduction Cooperative had KRW 14.8 trillion assets from a total of 1.64 million enrollees, which is smaller than retirement pension plans of wage employees (Korea Federation of SMEs, Current Stat of Yellow Umbrella Deduction Cooperative). When the number of unemployment insurance claims peaked in April 2020, over 129,000 claims were from wage workers while only 89 claims were filed by the self-employed and small business owners. This well shows those workers are not sufficiently covered by social insurance.

11) The CARES Act allows savers under age 59½ to withdraw up to $100,000 from their DC plans and waives the 10% early withdrawal penalty on a temporary basis until December 30, 2020. It also raises the loan limit from 50% (or $50,000) to 100% (or $100,000) of retirement pension plan assets. For DB plans, it also extended the deadline for contributions (quarterly contributions) to the end of 2020.

12) Moneytoday, September 25, 2020, Dilemma in loans on retirement pensions without collateral.

13) Refer to Grounds, etc. for Providing Entitlement to Benefits under Retirement Pension Plans as Collateral in Article 2 of the Enforcement Decree of the Act on the Guarantee of Employees’ Retirement Benefits effective on April 30, 2020.

14) This includes a uniform deduction ceiling on private pension plans (e.g., two-month wages or 18% of annual income), and a transfer between pension schemes, etc. This should be certainly preceded by sufficient discussions on a target income replacement rate, the amount of contributions necessary to meet the target, how the target is met by public pensions such as the National Pension and private pensions, etc. For example, it’s worth considering to design a dual-account system where after-tax income goes to the Individual Savings Account (ISA) and before-tax income to a private pension account.

This could also impose significant burden on plan sponsors. In general, defined benefit plans could be more onerous to sponsors. However, in a short-run, the burden of defined contribution plans could be more significant. Although a DB plan sponsor could postpone its contribution payment when the funding ratio falls, such a tactic is not available for DC plans.

The most severe impact could be on those who lost their job during the pandemic. Basically, pensions are an institutional tool that forces an individual to save part of current income for post-retirement income. Without current income, plan members may have to withdraw their retirement assets earlier than expected, not to mention that they cannot make contributions to their plans. The Covid-19 pandemic hit not only wage workers, but also the self-employed and small business owners. Although the self-employed and small business owners have suffered from income declines and been on the verge of bankruptcy, this is unlikely to affect retirement pensions significantly because only few of them subscribe to retirement pension plans. The less the retirement assets, the lower the impact.

One of the ideas currently being discussed to address the hardship is to allow plan members to access bank lending. However, such a short-term measure should be supplemented by long-term fixes such as expanding retirement pensions to the self-employed and small business owners.

At this juncture, this article aims to explore the impacts of the Covid-19 pandemic on Korea’s retirement pension plan members and the plan sponsors, and then to present future responses.

1. Impacts on DB plans

Technically, DB members are not affected in a short run unless they lose their job because their retirement benefit is computed by multiplying the monthly wage right before retirement by the number of service years. Even when the investment return on DB plan assets falls, it increases burden on plan sponsors, leaving no impact on the amount of retirement benefits. However, if plan members see a long-term decrease in their wage amid the pandemic, they are also expected to bear the brunt of the impact. It is also worth mentioning that a long-term decrease in returns on plan assets will force plan sponsors to increase contributions. Otherwise, the funding ratio will fall, which could cause an indirect impact on plan members.

Retirement benefits of a DB plan are paid when a plan member retires. Until then, the money to be paid for retirement benefits is usually deposited in a financial firm that is a plan provider. The ratio of plan assets over plan benefits to be paid out is called a funding ratio. Korea’s statutory funding ratio is over 90% for DB plan sponsors in 2020, but this will rise to over 100% from 2021.2) However, not all plan sponsors could meet the statutory funding ratio in practice. As of 2018, the average funding ratio is estimated to be about 69% among listed companies in Korea.3) Especially, the funding ratio is expected to be even lower than that in companies in the vulnerable sector such as aviation and tourism that have been hit particularly hard by the Covid-19 pandemic.

2. Impacts on DC plans

In a short run, the impact could be insignificant on DB plan members, but relatively significant on DC plan members. First of all, a lower return on plan assets could lower the rate of increase in accumulated plan assets, or even reduce the size of the assets. The possibility of principal losses is quite low because most of the retirement pension assets are invested in principal-guaranteed products. However, investment returns on those products are falling depending on financial market conditions, and most of the assets are held as short-term products that are immediately affected by lower returns.

Another inevitable factor is the impact of a lower wage increase rate if the low growth trend persists in a long run. But a wage increase rate affects that year’s contribution to the retirement pension plan. In a DB plan, a change in wage growth could affect both that year’s contribution and the accumulated contribution.

In general, DC plans are less onerous to plan sponsors than DB plans. The difference of burden on plan sponsors is one of the main reasons behind the rapid rise in DC plans in Korea as well as in the globe. For some time being, however, DC plans could be more burdensome to plan sponsors. DB plan sponsors could delay their contributions to retirement pensions because there is no legal limitation on a lower funding position. However, such a delay in contributions in DC plans is immediately noticed by plan members who will view this as unpaid wage. From the perspective of plan sponsors, this can pose a liquidity burden at hard times such as now. In the US, some DC plan sponsors announced a delay in their matching contributions to 401(k) plans that are a form of DC plans. As of September 2020, the number of employees affected by that decision stood at approximately 700,000 or only 1.15% of 60 million 401(k) members, but still, this decision is marked as a significant event.4)

In the composition of Korea’s retirement pensions, a high proportion of large-sized firms opt for DB plans. From the perspectives of employers, this stems from two factors. First, large firms can bear relatively larger costs. It’s often observed in overseas cases that smaller-sized firms cannot choose DB plans due to cost burden. In another aspect, large firms may have to pay large one-time contributions when adopting DC plans.5) The two factors are combined to raise the proportion of DB plans in large-sized companies. A more critical factor, of course, lies in employees: Large-firm employees could have chosen DB plans that they think are in favor of themselves because their negotiating power is relatively higher than those in smaller firms.6)

3. Impacts on unemployment insurance claims

The Covid-19 pandemic also triggered an increase in the number of unemployed persons. In the US, a country severely hit by the pandemic, the number of unemployment insurance claims has ballooned since March 2020 (see Figure 1 (b)). The weekly number of claims stood at about 280,000 in mid-March, but increased more than 10-fold to surpass 3.3 million to finally peak at 6.65 million in the last week of March 2020. Although the figure quickly fell below 900,000 after the end of August, it remains still quite high. It was estimated that instability with regard to post-retirement income shot up significantly in unemployed households, compared to ordinary households.7) Korea is also bearing the harsh brunt of the Covid-19 pandemic. The number of unemployment insurance claims soared after February 2020 compared to other years, but the difference began slightly decreasing in July and August. Compared to 2019, the figure increased by 3,000 in January, by 27,000 in February, and by 30,000 from March through June. But the size of increase fell to 10,000 in July.

It is also notable that the pandemic’s severe damage on the self-employed and small business owners. Despite their economic hardships, the impact on their retirement assets is estimated to be relatively small because only few of them have enrolled in retirement pension plans.10) This well exposes the limit of the retirement pension scheme in terms of the range of enrollment.

4. Future responses

When an employee loses income, he or she can access to either existing assets or new debts. Since the outbreak of Covid-19, many nations have placed the focus of their retirement pension policy on how to streamline the process of helping retirement assets to be withdrawn or pledged more easily than before. For example, the US legislated the Coronavirus Aid, Relief, and Economic Security Act (CARES) at the end of March 2020, which relaxed restrictions on withdrawing DC plan assets.11) Korea has been also working on helping plan members to pledge their retirement assets for financing, which allows them to keep their retirement assets intact. Because banks are opposing the idea arguing that this is in effect a credit loan unless banks can pledge retirement pensions as collateral, the Ministry of Employment and Labor is currently working on a regulatory reform that will enable retirement pensions to be used as collateral.12) Such a move seems to prioritize protecting retirement assets ahead of others, given that Korea’s retirement pension scheme has yet to fully take hold. Korea’s Act on the Guarantee of Employees’ Retirement Benefits currently allows retirement pension assets to be used as collateral only under very limited conditions, for example, a home purchase, etc.13) Thus far, there is no provision related to the Covid-19 pandemic. It is possible to relax the rules on loans as well as early withdrawals on a temporary basis.

Currently, DC plan members bear their own risk arising from lower investment returns. Small- to medium-sized business owners opting for DB plans are also in the same position. What’s needed now is an arrangement to distribute and reduce the investment risk. One of the options could be a trust-based occupational pension scheme that has been reviewed by several authorities. It would be worth considering introducing a product or a scheme that enables each plan provider’s assets to be managed collectively. The costs arising from running DB plans have been driving employers away from DB plans, and Korea is no exception to the tendency. Due to the high-cost structure of Korea’s DB plans compared to DC plans, the number of DB plans are likely to fall in a long run. Such a tendency is reinforcing the need for a regulatory fix to investment management of DC plans. What’s notable is a change in employment conditions, leading to a shorter service period at one workplace. Individual retirement pensions (IRPs) are an institutional tool that helps retirement assets be accumulated seamlessly when there is a job shift. An increase in job shifts will naturally increase the proportion of IRPs. Because IRPs have the exactly same structure to DC plans, this also reinforces the importance of DC plan asset management.

Thus far, very few of the self-employed and small business owners enroll in retirement pensions although they have been hit hardest by the Covid-19 pandemic. A desirable retirement pension scheme would have to include those people and be fitted for frequent job shifts going forward. Also necessary is a private pension scheme that integrates personal and occupational pensions taking into account that the self-employed and small business owners often turn to personal pensions and IRPs in preparation for their retirement income.14)

1) Financial Times, August 24, 2020, A poorer retirement is pandemic’s hidden legacy.

2) Although the Act on the Guarantee of Employees’ Retirement Benefits stipulates the statutory funding ratio, there is no tool to force plan sponsors to comply with the ratio, which in effect makes the regulation a recommendation without mandate. It is hard to mandate DB plan sponsors to maintain the funding ratio because such funding is not mandated for severance pay liabilities that is similar in nature to DB plans.

3) The funding ratio herein refers to the ratio of plan assets to the sum of severance pays and DB plan assets (H. Park, 2020, Funding Status of Pension Liabilities and Implications, KCMI Issue Paper 19-09).

4) Center for Retirement Research at Boston College, 2020, COVID-19 Crisis: Economic Data.

5) This is one of the Korea-specific phenomena. All domestic companies had been subject to the severance pay system that incurs severance pay liabilities. A firm with a large amount of severance pay liabilities could have large one-time expenses when shifting to a DC plan.

6) Employees think DB plans are more in favor of themselves also because they expect large firms, compared to smaller firms, to be more financially stable for paying out pension benefit payments. DC plans are always fully funded because plan assets are transferred to individual accounts. However, DB plans have different funding positions that are not always 100%. This makes employees at smaller firms always concern about the possibility of their pension benefits being unpaid. Hence, employees at smaller firms are more likely to choose a DC plan than large-firm employees do.

7) The National Retirement Risk Index rose from 50.2% before the pandemic to 54.9% after the outbreak in all households, while that in households with job loss jumped from 54.4% to 75.4% during the same period. The NRRI was estimated by comparing each household’s projected income replacement rate with a target replacement rate that allows each household to maintain its pre-retirement living standard (Munnell, A. H., Chen, A., Hou, W., 2020, How Widespread Unemployment Might Affect Retirement Security, Issue Brief #20-11, CRR).

8) It is assumed that a retiree will receive monthly annuity payments from the retirement pension benefit of 30 that is accumulated for 30 years of the service period (30-month wage). With the 4% interest rate, the monthly annuity payment will be 14.3% of the monthly wage of the last service year. The amount can be computed by dividing the benefit (30) by the pension’s present value (PV = [1-1/(1+i )N ]/i , where i denotes the interest rate and N denotes the payment period). With other factors being the same, a shorter service period of 29 years will decrease the income replacement ratio by 3.33% to 13.8%. The size of decrease remains the same even if the interest rate changes.

9) K-indicator (https://www.index.go.kr/main.do)

10) As of end-2019, the Yellow Umbrella Deduction Cooperative had KRW 14.8 trillion assets from a total of 1.64 million enrollees, which is smaller than retirement pension plans of wage employees (Korea Federation of SMEs, Current Stat of Yellow Umbrella Deduction Cooperative). When the number of unemployment insurance claims peaked in April 2020, over 129,000 claims were from wage workers while only 89 claims were filed by the self-employed and small business owners. This well shows those workers are not sufficiently covered by social insurance.

11) The CARES Act allows savers under age 59½ to withdraw up to $100,000 from their DC plans and waives the 10% early withdrawal penalty on a temporary basis until December 30, 2020. It also raises the loan limit from 50% (or $50,000) to 100% (or $100,000) of retirement pension plan assets. For DB plans, it also extended the deadline for contributions (quarterly contributions) to the end of 2020.

12) Moneytoday, September 25, 2020, Dilemma in loans on retirement pensions without collateral.

13) Refer to Grounds, etc. for Providing Entitlement to Benefits under Retirement Pension Plans as Collateral in Article 2 of the Enforcement Decree of the Act on the Guarantee of Employees’ Retirement Benefits effective on April 30, 2020.

14) This includes a uniform deduction ceiling on private pension plans (e.g., two-month wages or 18% of annual income), and a transfer between pension schemes, etc. This should be certainly preceded by sufficient discussions on a target income replacement rate, the amount of contributions necessary to meet the target, how the target is met by public pensions such as the National Pension and private pensions, etc. For example, it’s worth considering to design a dual-account system where after-tax income goes to the Individual Savings Account (ISA) and before-tax income to a private pension account.