OPINION

2019 Dec/17

Global Economic Uncertainty and the Neutral Rate of Interest: Monetary Policy Directions

Dec. 17, 2019

PDF

Noh, Sanha

- Summary

- The recent rise in global economic uncertainty amid the US-China trade conflict could have had a grave impact on the slowed growth in the global economy this year. Rising uncertainty imposes downward pressure on the neutral rate of interest via several paths, e.g., households’ higher precautionary savings, falling corporate investments, and investors’ growing appetite for safe assets. The neutral interest rate in developed countries and Korea plummeted when uncertainty grew in global economic policy. In particular, Korea’s neutral interest rate is falling faster than the potential growth rate in the post-crisis era, which seems to reflect the rising uncertainty in global economic policy. Despite the recent progress in the US-China conflict, uncertainty in the global economy is expected to prolong with the two countries’ disagreement over technological transfers, foreign exchange rates, subsidies to Chinese firms, etc. Also notable is uncertainty surrounding the future monetary and fiscal policy directions, Brexit, and the Hong Kong debacle. All of those factors behind global economic uncertainty could possibly impose downward pressure on Korea’s neutral interest rate. That requires monetary policymakers to pay focused attention to any signs of rising uncertainty in the global economy when making decisions on monetary policy.

With the prolonging trade conflict between the US and China, the two largest nations taking up 42% of the global economy, uncertainty keeps lingering in the global economy. Although the two countries’ recent consensus on a phased approach to end the dispute is raising rosy expectations, policy uncertainty between the US and China dramatically pushed up the Global Economic Policy Uncertainty Index as well as the World Trade Uncertainty Index. Reflecting this trend on top of the slowed growth potential amid sluggish consumption and investments, there’s an increasing amount of uncertainty surrounding the monetary authority’s policy interest rate. According to a BIS report, the amount of government bonds trading at negative yields amounted to $17 trillion, about 20% of the global GDP as of end-August 2019. Such a low interest rate trend and strong appetite for safe assets appear to have stemmed from concerns among economic entities about the rising uncertainty in the global economy. Hence, rising global economic uncertainty is expected to structurally impose a negative impact on potential growth as well as to bring down the natural rate of interest (also called the neutral rate).1) The neutral rate plays a crucial role for monetary policymakers to determine whether the current policy interest rate either boosts or deters economic activity. It also offers an important tool based on which financial market participants estimate the future monetary policy path. As uncertainty has risen in the global economy amid the US-China trade war, the Korea-Japan trade dispute, Brexit, and the Hong Kong debacle, debates over the neutral rate and future monetary policy are becoming more important than ever. Against the backdrop, this article aims to explore the impact of growing global economic uncertainty on the neutral rate of interest, and then to discuss the implications for monetary policy.

Determinants of the neutral rate, and uncertainty

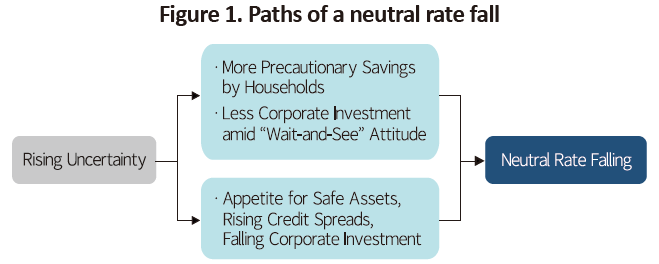

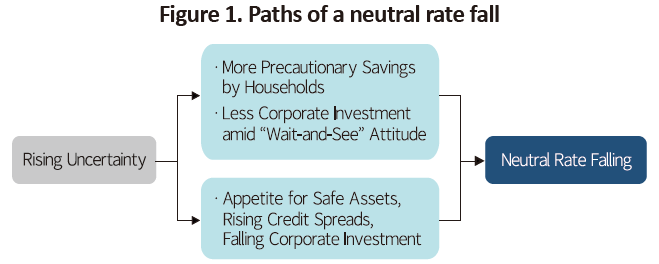

Since the global financial crisis reshaped the structure of the global economy, there have been growing discussions over reassessing the neutral rate level and the determinants. According to the existing literature, the neutral rate is determined by potential growth and many other factors that shape the structural characteristics of the economy. Particularly important in determining the neutral rate among those are labor productivity, the shift in demographic structure, households’ time preference, risk aversion, and economic uncertainty.2) Although each factor has an impact at varying degrees, lower labor productivity and shrinking working-age population due to the demographic shift (population ageing and low birth rates) are found to have a significant impact on a fall in the neutral rate (Baek & Kang, 2018). Economic uncertainty affects the neutral rate mainly via two paths. Figure 1 illustrates the path via which the neutral rate declines due to rising uncertainty.

1) The neural rate refers to a theoretical short-term real interest rate with the economy at full employment and price stability (in other words, the economy at potential growth without any inflationary or deflationary pressure) while maintaining a long-term equilibrium with a balanced money supply (saving) and demand (investment) (Laubach and Williams, 2003). Hence, an increase in savings or investments leads to a decrease in the neutral rate. The neutral rate is unobservable and only estimated by an economic model.

2) Some regard financial headwinds/tailwinds as another key determinant to the neutral rate. A case in point is the view that the neutral rate has been primarily affected by the fall in investment demand amid the post-crisis debt overhang in households and firms (Lo & Rogoff, 2015).

3) Former Fed Chairman Ben Bernanke argues that one of the factors behind the neutral rate fall could be global savings gluts that have resulted from foreign reserves accumulated by export-driven emerging economics such as China and the liberalization of global capital flows. The global savings gluts here could be the cause behind Summers’s excessive increasing savings. However, because a change in global capital flows could reverse the recent fall in the neutral rate, this could be different from long-term factors affecting the secular stagnation.

4) It is known that the long-term downward trend in the neutral rate in developed countries is a common result obtained from other estimations as well (Holston et al., 2017).

5) The 1988 Russian financial crisis pushed up uncertainty, which made the neutral rate in the Eurozone area fall. During the political chaos sparked by the 2016 Brexit, the neutral rates in the UK and US fell in the short run. However, those had a limited impact on the weighted average of the neutral rate in developed countries.

6) I checked the structural shift in global economic policy uncertainty according to Bai and Perron (2003). The result indicates that uncertainty began to rise from 2Q 2011.

7) It's still hard to rule out other possibilities behind the neutral rate fall, e.g., the supply of China's cost-competitive electronic goods in Korea, the low interest rate environment due to intensified competition among firms, low inflationary pressure, contracting capital expenditures, rising household debt, etc. Another possibility is that the fall in potential growth in developed economies could have affected Korea's neutral rate fall (Kim & Park, 2013).

8) When the real interest rate is higher/lower than the neutral rate, monetary policy is contractionary/expansionary (with a positive/negative real rate gap).

References

(Korean)

Kim, M.S., Park, Y.S., 2013, Estimating the neutral real interest rate (NRIR) and analyzing factors of its fluctuation in Korea, Economic Analysis 19(4), 47-86.

Baek, I.S., Kang, H., 2018, Analysis on the recent rate hike in Korea and the US and the possibility of a shift towards low interest rates, Korea Capital Market Institute Issue Paper 2018-04.

(English)

Bai, J., Perron, P., 2003, Computation and analysis of multiple structural change models, Journal of Applied Econometrics 18(1), 1-22.

Bloom, N., 2009, The impact of uncertainty shocks, Econometrica 77(3), 623-685.

Del Negro, M., Giannone, D., Giannoni, M.P., Tambalotti, A., 2017, Safety, liquidity, and the natural rate of interest, Brookings Papers on Economic Activity 2017(1), 235-316.

De Paoli, B., Zabczyk, P., 2013, Cyclical risk aversion, precautionary saving, and monetary policy, Journal of Money , Credit and Banking 45(1), 1-36.

Holston, K., Laubach, T., Williams, J.C., 2017, Measuring the natural rate of interest: International trends and determinants, Journal of International Economics 108, 59-75.

Laubach, T., Williams,J. C., 2003, Measuring the naturalrate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lansing, K. J., 2017, R-star, Uncertainty, and Monetary Policy, FRB San Francisco Economic Letter, 2017-16.

Lo, S., Rogoff, K., 2015, Secular stagnation, debt overhang and other rationales for sluggish growth, six years on, BIS working paper No. 482.

Summers, L. H., 2016, Secular Stagnation and Monetary Policy, Federal Reserve Bank of St.Louis Review 98(2), 93-110.

Determinants of the neutral rate, and uncertainty

Since the global financial crisis reshaped the structure of the global economy, there have been growing discussions over reassessing the neutral rate level and the determinants. According to the existing literature, the neutral rate is determined by potential growth and many other factors that shape the structural characteristics of the economy. Particularly important in determining the neutral rate among those are labor productivity, the shift in demographic structure, households’ time preference, risk aversion, and economic uncertainty.2) Although each factor has an impact at varying degrees, lower labor productivity and shrinking working-age population due to the demographic shift (population ageing and low birth rates) are found to have a significant impact on a fall in the neutral rate (Baek & Kang, 2018). Economic uncertainty affects the neutral rate mainly via two paths. Figure 1 illustrates the path via which the neutral rate declines due to rising uncertainty.

First, in the face of uncertainty, a risk-averse economic entity tends to increase precautionary savings and take a wait-and-see attitude instead of carrying out aggressive investment (Bloom et al., 2009; De Paoli, & Zabczyk, 2013). The recent global economic uncertainty triggered by trade conflicts predisposed households to increase precautionary savings and cut consumption. Furthermore, a firm has an incentive to delay its decision making to gain more information by adopting a wait-and-see attitude in the face of uncertainty, and thus further postpone its investment plan. This causes an aggregate demand shortfall as well as a saving-investment imbalance in the macroeconomy, which accelerates a long-term recession and triggers a fall in the neutral rate. Former Treasury Secretary Larry Summers points to secular stagnation as a main cause behind the falling neutral rate (Summers, 2016). That is to say that a structural cause and the resultant slump in investment and household consumption could bring down the neutral rate. Summers also mentions that one of the structural causes behind the long-term recession is the increase in excessive savings amid rising uncertainty (a chronic fall in consumption).3) According to his lights, global economic uncertainty triggered by trade conflicts could induce excessive savings that dwarf investment demand, which could have an impact in the direction of bringing down the neutral rate.

Second, appetite for safe assets could push up demand for government bonds, which could be another factor decreasing the neutral rate. Appetite for safe assets could widen credit spreads, and thus push up corporate financing costs, which will deter corporate investment and function as downward pressure on the neutral rate. Since the 2008 global financial crisis, risk aversion becomes a norm among economic entities. With rising uncertainty in the global economy, capital market participants tend to invest in safe assets such as government bonds, instead of risky and more productive assets. This acts as another reason behind the falling neutral rate. Lansing (2017) argues that excessive preference over safe assets that tends to exceed the supply is highly likely to bring down the neutral rate in the long run. Furthermore, according to Del Negro et al. (2017), the rising demand for safe assets and risk premium could make the neutral rate decline.

Policy uncertainty and neutral rates in developed nations

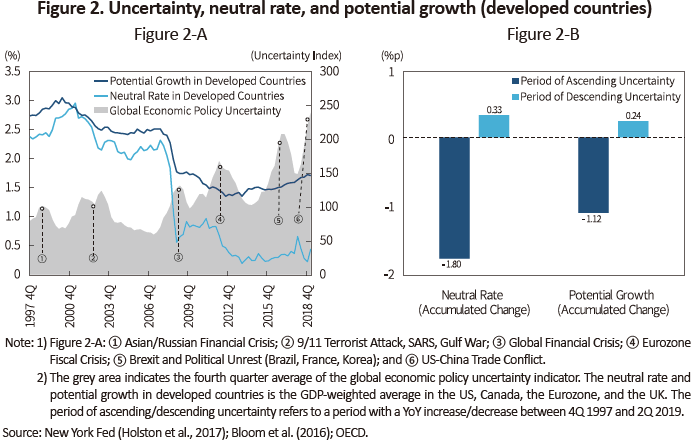

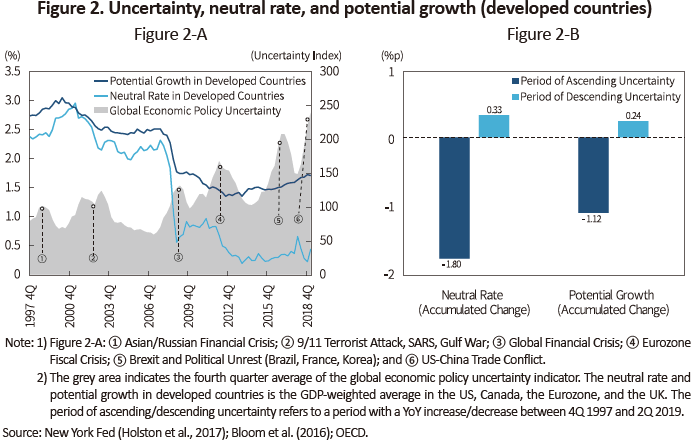

Figure 2-A shows the GDP-weighted average on neutral rates and potential growth in developed countries (the US, Canada, the Eurozone, and the UK). Each nation’s neutral rate is provided by the New York Federal Reserve, estimated by the method of Holston et al. (2017)4) using real GDP, the consumer price index, and the real interest rate. And the shaded area shows uncertainty in global economic policy, one of the causes behind global economic uncertainty. In its World Economic Outlook report in Oct. 2019, the IMF cited rising uncertainty over economic policy as a primary cause of the global economic slump. Moreover, the AFP (Association for Financial Professionals) Risk Survey reported ‘political uncertainty’ and ‘regulatory uncertainty’ as the most influential risk factor affecting corporate earnings for the upcoming three years. Uncertainty ranked the highest at 43% in 2016, and 34% in 2019 among many risk factors surveyed. This suggests that uncertainty in economic policy amid the US-China trade war could be a factor that increases global economic uncertainty.

The neutral rate in developed countries tends to show a long-term decline, reflecting the downward trend of growth potential. A particularly abrupt fall in the neutral rate was observed in the post-crisis era. Especially, the decline in the neutral rate dwarfed the fall in growth in the post-crisis era, implying some other factors affecting the neutral rate. As illustrated in Figure 2-A, during the periods of rising economic policy uncertainty (e.g., the 9/11 terrorist attack, the SARS epidemic, the Gulf War, the global financial crisis, the European fiscal crisis, the US-China trade war, etc.), the neutral rate nosedived in developed countries as compared to other periods of time.5) Since the latter half of 2011, uncertainty in global economic policy climbed with the widespread economic recession triggered by the European fiscal crisis and the resultant structural changes.6) Hence, the upward trend in global economic policy uncertainty in the post-crisis era appears to have imposed downward pressure on the neutral rate in developed countries via the two aforementioned paths.

Figure 2-B demonstrates the changes in potential growth and the neutral rate in developed countries during the periods of ascending and descending levels of uncertainty in global economic policy. Growth potential rose 0.24 percentage points (pp) during the descending period and fell 1.20 pp during the ascending period, while the neutral rate climbed 0.33 pp during the descending period and slid 1.80 pp during the ascending period. This confirms the evident tendency where the neutral rate goes down when uncertainty rises, and the size of the fall is larger than that in potential growth. Thus, a rise in uncertainty, on top of a fall in growth potential, is found to be one of the major causes behind the neutral rate decrease.

Second, appetite for safe assets could push up demand for government bonds, which could be another factor decreasing the neutral rate. Appetite for safe assets could widen credit spreads, and thus push up corporate financing costs, which will deter corporate investment and function as downward pressure on the neutral rate. Since the 2008 global financial crisis, risk aversion becomes a norm among economic entities. With rising uncertainty in the global economy, capital market participants tend to invest in safe assets such as government bonds, instead of risky and more productive assets. This acts as another reason behind the falling neutral rate. Lansing (2017) argues that excessive preference over safe assets that tends to exceed the supply is highly likely to bring down the neutral rate in the long run. Furthermore, according to Del Negro et al. (2017), the rising demand for safe assets and risk premium could make the neutral rate decline.

Policy uncertainty and neutral rates in developed nations

Figure 2-A shows the GDP-weighted average on neutral rates and potential growth in developed countries (the US, Canada, the Eurozone, and the UK). Each nation’s neutral rate is provided by the New York Federal Reserve, estimated by the method of Holston et al. (2017)4) using real GDP, the consumer price index, and the real interest rate. And the shaded area shows uncertainty in global economic policy, one of the causes behind global economic uncertainty. In its World Economic Outlook report in Oct. 2019, the IMF cited rising uncertainty over economic policy as a primary cause of the global economic slump. Moreover, the AFP (Association for Financial Professionals) Risk Survey reported ‘political uncertainty’ and ‘regulatory uncertainty’ as the most influential risk factor affecting corporate earnings for the upcoming three years. Uncertainty ranked the highest at 43% in 2016, and 34% in 2019 among many risk factors surveyed. This suggests that uncertainty in economic policy amid the US-China trade war could be a factor that increases global economic uncertainty.

The neutral rate in developed countries tends to show a long-term decline, reflecting the downward trend of growth potential. A particularly abrupt fall in the neutral rate was observed in the post-crisis era. Especially, the decline in the neutral rate dwarfed the fall in growth in the post-crisis era, implying some other factors affecting the neutral rate. As illustrated in Figure 2-A, during the periods of rising economic policy uncertainty (e.g., the 9/11 terrorist attack, the SARS epidemic, the Gulf War, the global financial crisis, the European fiscal crisis, the US-China trade war, etc.), the neutral rate nosedived in developed countries as compared to other periods of time.5) Since the latter half of 2011, uncertainty in global economic policy climbed with the widespread economic recession triggered by the European fiscal crisis and the resultant structural changes.6) Hence, the upward trend in global economic policy uncertainty in the post-crisis era appears to have imposed downward pressure on the neutral rate in developed countries via the two aforementioned paths.

Figure 2-B demonstrates the changes in potential growth and the neutral rate in developed countries during the periods of ascending and descending levels of uncertainty in global economic policy. Growth potential rose 0.24 percentage points (pp) during the descending period and fell 1.20 pp during the ascending period, while the neutral rate climbed 0.33 pp during the descending period and slid 1.80 pp during the ascending period. This confirms the evident tendency where the neutral rate goes down when uncertainty rises, and the size of the fall is larger than that in potential growth. Thus, a rise in uncertainty, on top of a fall in growth potential, is found to be one of the major causes behind the neutral rate decrease.

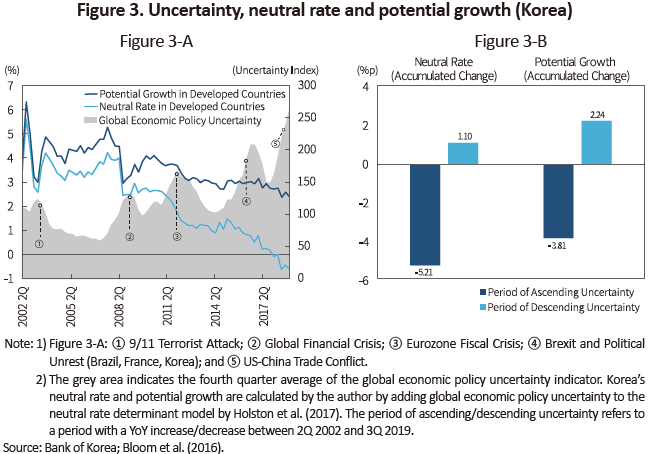

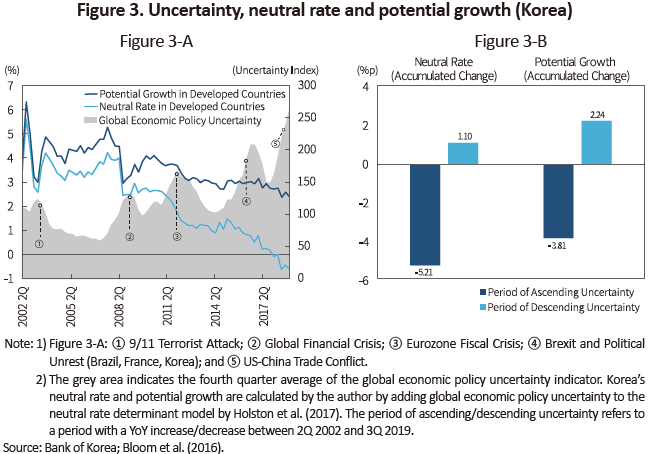

Policy uncertainty and Korea’s neutral rate

Figure 3-A shows the trends of Korea’s neutral rate, potential growth, and uncertainty in global economic policy. Korea’s neutral rate has been falling persistently with the rise of global economic policy uncertainty in the post-crisis era. The neutral rate used to hover around the 3% to 4% range before the 2008 global financial crisis, but it nosedived whenever global economic uncertainty climbed amid the European fiscal crisis, Brexit, and the US-China trade conflict. In particular, the recent rise in global economic policy uncertainty due to the US-China trade conflict brought down Korea’s neutral rate further to the negative level as of 3Q 2019. Such a drastic fall in the neutral rate seems to reflect many factors, e.g., rising precautionary savings by households, declining corporate investments, and investors’ growing appetite for safe assets.7)

In Figure 3-B, Korea’s neutral rate went up 1.1 pp during the descending period between 2Q 2002 and 3Q 2019, while went down 5.2 pp during the ascending period. What’s notable is that the pace of Korea’s neutral rate decline is faster that in developed countries. Also worth mentioning is Korea’s pace of the neutral rate fall is faster than that of the growth potential fall, as shown in developed countries. During the period of rising uncertainty, the decline in the neutral rate (5.2 pp) was significantly larger than that of potential growth (3.81 pp), a phenomenon specific to Korea whose economy is largely affected by external factors.

Figure 3-A shows the trends of Korea’s neutral rate, potential growth, and uncertainty in global economic policy. Korea’s neutral rate has been falling persistently with the rise of global economic policy uncertainty in the post-crisis era. The neutral rate used to hover around the 3% to 4% range before the 2008 global financial crisis, but it nosedived whenever global economic uncertainty climbed amid the European fiscal crisis, Brexit, and the US-China trade conflict. In particular, the recent rise in global economic policy uncertainty due to the US-China trade conflict brought down Korea’s neutral rate further to the negative level as of 3Q 2019. Such a drastic fall in the neutral rate seems to reflect many factors, e.g., rising precautionary savings by households, declining corporate investments, and investors’ growing appetite for safe assets.7)

In Figure 3-B, Korea’s neutral rate went up 1.1 pp during the descending period between 2Q 2002 and 3Q 2019, while went down 5.2 pp during the ascending period. What’s notable is that the pace of Korea’s neutral rate decline is faster that in developed countries. Also worth mentioning is Korea’s pace of the neutral rate fall is faster than that of the growth potential fall, as shown in developed countries. During the period of rising uncertainty, the decline in the neutral rate (5.2 pp) was significantly larger than that of potential growth (3.81 pp), a phenomenon specific to Korea whose economy is largely affected by external factors.

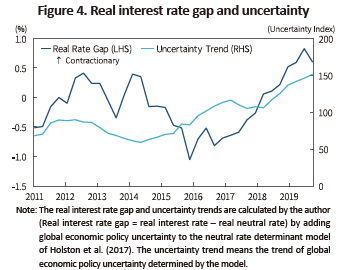

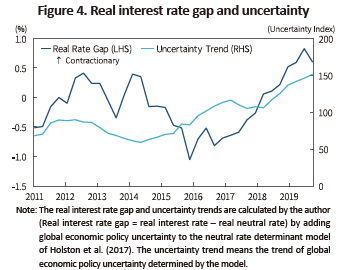

Korea’s monetary policy direction and implications

Korea’s monetary policy stance (tightening or easing monetary policy) could be viewed by using the real interest rate gap, referring to the differences between the real interest rate and the neutral rate.8) Figure 4 shows the trends of the real interest rate gap and uncertainty. Korea’s monetary policy stance remained expansionary in 2011, while it shifted to a contractionary stance amid declining uncertainty between 2H 2012 and 1H 2014. As the policy rate persistently fell and global economic policy uncertainty rose, Korea’s monetary policy returned to an expansionary stance between 2H 2014 and 2H 2017. In response to the European fiscal crisis in 2011 and China’s economic slowdown in 2012, Korea could afford to take monetary easing policy. The policy rate hike in November 2017 reflected less uncertainty and expectations for economic recovery.

However, Korea’s neutral rate began falling again when economic policy uncertainty went up amid the Korea-Japan trade dispute and the US-China trade conflict. On top of that, the recent slump in inflation and the real economy brought down the neutral rate further, and shifted Korea’s monetary policy stance towards tightening between 1H 2018 and 3Q 2019. The Bank of Korea’s policy rate cut to 1.25% on October 16, 2019 could be read as a countermeasure against the widening real interest rate gap. Going forward, the future of the US-China trade conflict and Brexit are expected to affect global economic policy uncertainty and possibly keep functioning as a downside risk for the neutral rate level. This requires policymakers to pay focused attention to any rise in global economic uncertainty in their decision making related to monetary policy.

Korea’s monetary policy stance (tightening or easing monetary policy) could be viewed by using the real interest rate gap, referring to the differences between the real interest rate and the neutral rate.8) Figure 4 shows the trends of the real interest rate gap and uncertainty. Korea’s monetary policy stance remained expansionary in 2011, while it shifted to a contractionary stance amid declining uncertainty between 2H 2012 and 1H 2014. As the policy rate persistently fell and global economic policy uncertainty rose, Korea’s monetary policy returned to an expansionary stance between 2H 2014 and 2H 2017. In response to the European fiscal crisis in 2011 and China’s economic slowdown in 2012, Korea could afford to take monetary easing policy. The policy rate hike in November 2017 reflected less uncertainty and expectations for economic recovery.

However, Korea’s neutral rate began falling again when economic policy uncertainty went up amid the Korea-Japan trade dispute and the US-China trade conflict. On top of that, the recent slump in inflation and the real economy brought down the neutral rate further, and shifted Korea’s monetary policy stance towards tightening between 1H 2018 and 3Q 2019. The Bank of Korea’s policy rate cut to 1.25% on October 16, 2019 could be read as a countermeasure against the widening real interest rate gap. Going forward, the future of the US-China trade conflict and Brexit are expected to affect global economic policy uncertainty and possibly keep functioning as a downside risk for the neutral rate level. This requires policymakers to pay focused attention to any rise in global economic uncertainty in their decision making related to monetary policy.

1) The neural rate refers to a theoretical short-term real interest rate with the economy at full employment and price stability (in other words, the economy at potential growth without any inflationary or deflationary pressure) while maintaining a long-term equilibrium with a balanced money supply (saving) and demand (investment) (Laubach and Williams, 2003). Hence, an increase in savings or investments leads to a decrease in the neutral rate. The neutral rate is unobservable and only estimated by an economic model.

2) Some regard financial headwinds/tailwinds as another key determinant to the neutral rate. A case in point is the view that the neutral rate has been primarily affected by the fall in investment demand amid the post-crisis debt overhang in households and firms (Lo & Rogoff, 2015).

3) Former Fed Chairman Ben Bernanke argues that one of the factors behind the neutral rate fall could be global savings gluts that have resulted from foreign reserves accumulated by export-driven emerging economics such as China and the liberalization of global capital flows. The global savings gluts here could be the cause behind Summers’s excessive increasing savings. However, because a change in global capital flows could reverse the recent fall in the neutral rate, this could be different from long-term factors affecting the secular stagnation.

4) It is known that the long-term downward trend in the neutral rate in developed countries is a common result obtained from other estimations as well (Holston et al., 2017).

5) The 1988 Russian financial crisis pushed up uncertainty, which made the neutral rate in the Eurozone area fall. During the political chaos sparked by the 2016 Brexit, the neutral rates in the UK and US fell in the short run. However, those had a limited impact on the weighted average of the neutral rate in developed countries.

6) I checked the structural shift in global economic policy uncertainty according to Bai and Perron (2003). The result indicates that uncertainty began to rise from 2Q 2011.

7) It's still hard to rule out other possibilities behind the neutral rate fall, e.g., the supply of China's cost-competitive electronic goods in Korea, the low interest rate environment due to intensified competition among firms, low inflationary pressure, contracting capital expenditures, rising household debt, etc. Another possibility is that the fall in potential growth in developed economies could have affected Korea's neutral rate fall (Kim & Park, 2013).

8) When the real interest rate is higher/lower than the neutral rate, monetary policy is contractionary/expansionary (with a positive/negative real rate gap).

References

(Korean)

Kim, M.S., Park, Y.S., 2013, Estimating the neutral real interest rate (NRIR) and analyzing factors of its fluctuation in Korea, Economic Analysis 19(4), 47-86.

Baek, I.S., Kang, H., 2018, Analysis on the recent rate hike in Korea and the US and the possibility of a shift towards low interest rates, Korea Capital Market Institute Issue Paper 2018-04.

(English)

Bai, J., Perron, P., 2003, Computation and analysis of multiple structural change models, Journal of Applied Econometrics 18(1), 1-22.

Bloom, N., 2009, The impact of uncertainty shocks, Econometrica 77(3), 623-685.

Del Negro, M., Giannone, D., Giannoni, M.P., Tambalotti, A., 2017, Safety, liquidity, and the natural rate of interest, Brookings Papers on Economic Activity 2017(1), 235-316.

De Paoli, B., Zabczyk, P., 2013, Cyclical risk aversion, precautionary saving, and monetary policy, Journal of Money , Credit and Banking 45(1), 1-36.

Holston, K., Laubach, T., Williams, J.C., 2017, Measuring the natural rate of interest: International trends and determinants, Journal of International Economics 108, 59-75.

Laubach, T., Williams,J. C., 2003, Measuring the naturalrate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lansing, K. J., 2017, R-star, Uncertainty, and Monetary Policy, FRB San Francisco Economic Letter, 2017-16.

Lo, S., Rogoff, K., 2015, Secular stagnation, debt overhang and other rationales for sluggish growth, six years on, BIS working paper No. 482.

Summers, L. H., 2016, Secular Stagnation and Monetary Policy, Federal Reserve Bank of St.Louis Review 98(2), 93-110.