Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Disposal of Treasury Shares by Listed Companies in Korea

Publication date Jun. 28, 2022

Summary

Share repurchases surged in Korea in early 2020 as stock prices plunged amid the Covid-19 crisis. Since then, stock prices have recovered faster than expected, resulting in a decline in share repurchases and remarkable growth of disclosures about treasury share disposal.

A stock buyback aims primarily at stabilizing share prices and enhancing shareholder value while the repurchased shares are used for a range of purposes. About 2/3 of disclosures of treasury share disposal stated that disposal was intended to reward employee performance and 1/4 of such disclosures were conducted to secure surplus funds and improve financial structure by selling overvalued shares.

The discretionary use of treasury shares is guaranteed by law and thus, constitutes a legal business activity but can hardly be viewed as positive in terms of shareholder payout. The shares repurchased for securing operating funds and improving financial structure tend to be disposed of through off-hours block trading and become immediately available in the market. If an employee sells the treasury shares received as performance pay to the market, it is likely to limit the effect of boosting shareholder payout. In addition, if treasury stocks are used in a direction favorable to management or controlling shareholders in the process of strategic alliances or corporate mergers, the interests of minority shareholders could be infringed upon.

More recently, treasury shares are being disposed along with increasing share repurchases, which requires further financial research and additional measures to supplement the existing legal framework. In this respect, a systematic and consistent review of relevant regulations should be conducted to close legal loopholes.

A stock buyback aims primarily at stabilizing share prices and enhancing shareholder value while the repurchased shares are used for a range of purposes. About 2/3 of disclosures of treasury share disposal stated that disposal was intended to reward employee performance and 1/4 of such disclosures were conducted to secure surplus funds and improve financial structure by selling overvalued shares.

The discretionary use of treasury shares is guaranteed by law and thus, constitutes a legal business activity but can hardly be viewed as positive in terms of shareholder payout. The shares repurchased for securing operating funds and improving financial structure tend to be disposed of through off-hours block trading and become immediately available in the market. If an employee sells the treasury shares received as performance pay to the market, it is likely to limit the effect of boosting shareholder payout. In addition, if treasury stocks are used in a direction favorable to management or controlling shareholders in the process of strategic alliances or corporate mergers, the interests of minority shareholders could be infringed upon.

More recently, treasury shares are being disposed along with increasing share repurchases, which requires further financial research and additional measures to supplement the existing legal framework. In this respect, a systematic and consistent review of relevant regulations should be conducted to close legal loopholes.

As prescribed by the Commercial Act and the Financial Investment Services and Capital Markets Act (FSCMA), firms in Korea can buy back their own shares not exceeding the amount of distributable profits without restriction. Notably, the shares repurchased by a firm are not canceled immediately and the firm may keep holding or dispose of them. When the Covid-19 pandemic led to a plunge in stock prices in early 2020, several firms embarked on a stock buyback to avoid an abrupt fall in share prices. As a result, the market saw a surge in the volume of repurchased shares. Amid earlier-than-expected economic recovery, however, liquidity pumped into the market has been flooded to the stock market and triggered stocks to quickly bounce back, resulting in a remarkable increase in the number of firms seeking to sell treasury shares.

As more and more firms repurchase their own shares and a stock buyback emerges as a crucial financial strategy in Korea’s market, it is equally important to pay more attention to disposal of treasury shares. Unfortunately, previous discussions have primarily centered on issues related to share repurchases. Against this backdrop, this article intends to explore how treasury shares have been disposed of since the Covid-19 crisis and analyze the purposes of disposal to present the direction for discussions regarding the market for treasury share disposal.

Current state of treasury share disposal

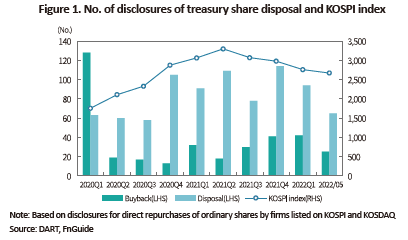

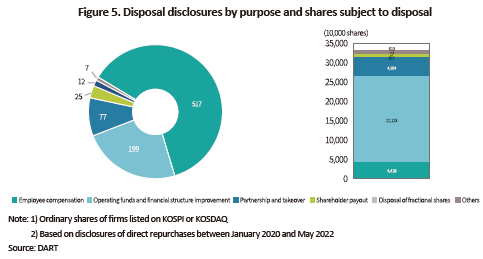

With respect to stocks listed on KOSPI and KOSDAQ, Figure 1 illustrates the number of buyback disclosures and the KOSPI index by quarter between January 2020 and May 2022.1) In early 2020, the Covid-19 outbreak triggered a stock price to plunge in a short period. In response to uncertainties from the stock market, quite a few firms rushed to unveil a share repurchase plan in an effort to prevent share prices from further tumbling and to enhance shareholder value. As a result, the number of disclosures for share repurchases exploded to 128 during the first quarter of 2020.

As stock prices have rebounded earlier than expected since then, stock buyback disclosures have declined sharply while there has been outstanding growth of disclosures for treasury share disposal. A total of 105 disposal disclosures were reported in the fourth quarter of 2020, almost twice the number of disclosures announced in the previous quarter. Around 100 disposal disclosures have been observed per quarter until the first quarter of 2022.

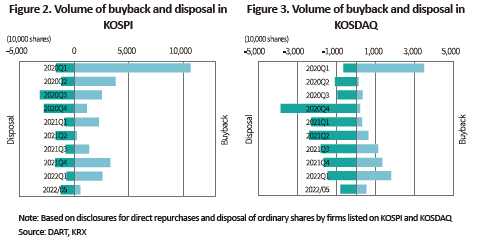

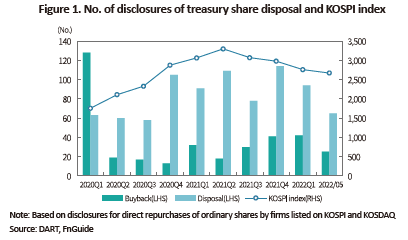

This article classifies Korea’s stock market into the KOSPI and KOSDAQ markets to identify the number of treasury shares repurchased and disposed of on a quarterly basis. The analysis has found that share repurchases were concentrated in the first quarter of 2020 and the second half of 2020 saw an increase in treasury share disposal.2) By market type, in the KOSPI market, the buyback of 167.7 billion shares was disclosed in the first quarter of 2020 while the disposal of 60 million treasury shares was scheduled for the third and fourth quarters of 2020. Compared to the KOSPI market, the KOSDAQ market saw a larger volume of treasury share disposal with buyback disclosures of 34.9 million shares for the first quarter of 2020, followed by disposal disclosures of 38.5 million shares for the third quarter of 2020 well above the first quarter repurchase volume.

During the period from 2020 to May 2022, a total of 280 million shares planned for buyback were disclosed in the KOSPI market with 160 million treasury shares being sold in the market. KOSDAQ-listed firms are found to have been more active in disposing of the repurchased shares. This is well demonstrated by disposal of 169 million treasury shares in KOSDAQ, a greater volume than the 99.3 million shares repurchased by the firms during the same period.

Purposes of treasury share disposal

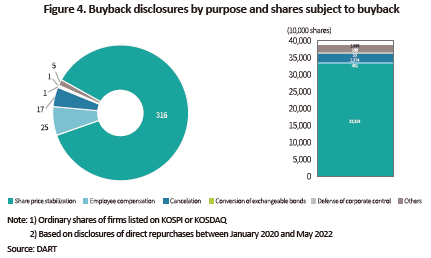

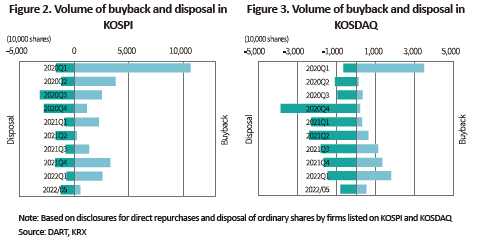

The acquisition and disposal of treasury shares are key corporate activities that could affect investors’ decision. Companies should disclose the quantity of treasury shares to be acquired or disposed of and the purpose of such acquisition or disposal after obtaining a resolution from the board of directors. In Figure 4, listed companies that acquired treasury shares are classified by the purpose of disclosure. The most common purposes specified in the acquisition disclosure include achieving stock price stability and enhancing shareholder value. Out of 365 acquisition disclosures, stock price stabilization was mentioned as the acquisition purpose in 316 cases. During the period analyzed, the stock buyback was concentrated in the first quarter of 2020 because companies decided to repurchase their own shares to actively respond to a decline in stock prices.

A stock buyback can be viewed as a means of boosting shareholder payout from a financial perspective. If a firm buys back its own shares, returns are directly transferred in cash to the existing shareholder who has sold the shares to the firm. Aside from the shareholder selling the shares, other shareholders who keep holding the firm’s shares could enjoy indirect benefits. The buyback decision is expected to cut the number of floating stocks by the exact number of shares repurchased by the firm, pushing up earnings per share and the shareholding ratio of existing shareholders.3)

If a firm cancels the repurchased shares, there is no chance for the firm to dispose of the shares, which reduces the number of outstanding shares permanently. In this case, share cancelation can be regarded as a tool for increasing shareholder payout as well as for stabilizing share prices. If share cancelation is added, this means more than 90% of repurchase disclosures state that their purpose is to enhance shareholder payout. Simply put, it is safe to say that recent share repurchases can be interpreted as business activities aiming to increase the interest of shareholders if the buyback purposes are taken as stated in disclosures. This is why a firm’s stock buyback decision tends to be welcomed by shareholders and push up its share prices.

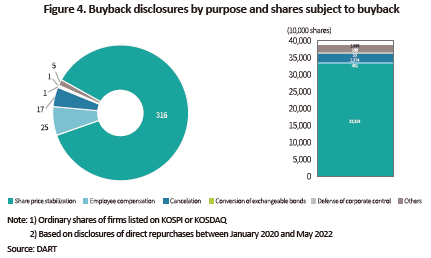

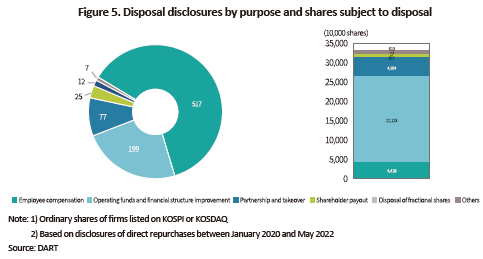

When assessing the effect of a stock buyback for greater shareholder payout, it is worth noting that a considerable volume of shares are sold during the share repurchase period and the repurchased shares tend to be disposed of for the purposes not specified in repurchase disclosures. Disposal of treasury shares has been most frequently conducted for employee compensation. Out of 837 disclosures of treasury share disposal, a total of 517 disclosures specified employee compensation as the main purpose, which account for more than 60% of the entire disclosures. A total of about 220 million shares were disposed of for the purpose of securing operating funds and improving financial structure. This figure represents just 17 disclosures but takes up the largest proportion of the entire disposal cases, five times the number of the shares repurchased for employee compensation. On top of these purposes, treasury shares were sold to affiliates for consolidating a strategic partnership with other corporations, or used in substitute for the issuance of new shares.

Regulation of treasury share disposal and the effects on shareholder payout

The analysis of repurchases and disposal of treasury shares has found that firms can use the repurchased shares at their disposal, which is guaranteed expressly by law. As prescribed by Korea’s Commercial Act, a firm can pay its repurchased shares in return for capital transactions (Article 342), and use its treasury shares to make payments in kind or in consideration for a division or a merger after division, swap of shares, etc. when it carries out corporate restructuring (Article 360-2 and Article 360-3). More than 90% of stock repurchase disclosures said that their purpose was to boost shareholder payout. However, about 2/3 of disposal disclosures specified employee compensation as the primary purpose while raising surplus funds through the sales of overvalued shares was mentioned in about 1/4 of disposal disclosures. A partial amount of the repurchased shares was handed over in consideration for a strategic partnership or a merger deal. In particular, employee compensation is the common purpose mentioned as the purpose of both repurchase and disposal of treasury shares. In terms of the volume of shares specified in disclosures, stock repurchase disclosures for employee compensation represent no more than 4.51 million shares, indicating a big gap with 44 million shares put up for disposal. This implies treasury shares are utilized regardless of stock buyback purposes.

Although discretionary disposal of treasury shares is not against the law, it cannot be viewed as positive in terms of shareholder payout. From a financial perspective, a stock buyback is regarded as a tool for enhancing shareholder payout, which has a positive impact on stock prices. However, this holds true only as long as the shares repurchased are not disposed of. During the period analyzed, disposal of treasury shares for securing operating funds and improving financial structure accounts for the largest proportion of the total shares to be disposed of, which is primarily carried out through off-hours block trading. This suggests that a considerable volume of treasury shares become available again for trading in the market once disposal disclosures are published. On the other hand, a stock buyback aiming for employee compensation is not expected to have an immediate effect on share prices. Firms frequently dispose of their treasury shares in small volumes to reward employee performance. As disclosures for such a purpose involve only a small quantity of shares, each disclosure is unlikely to have a significant impact on share prices. As for treasury share disposal for employee compensation, also notable is that disposed shares are transferred directly from a firm’s treasury stock account to the buyer’s stock account. Accordingly, disposal designed for employee compensation does not necessarily mean that the shares become immediately available in the market. However, the employee who receives treasury shares as performance pay is likely to sell them at any given time. Consequently, this would increase the number of outstanding shares and weaken the anticipated effect of greater shareholder payout.

Compared to a stock buyback, disposal of treasury shares is more likely to spark controversy over the proper sale price and disposal method. In practice, treasury shares of Korea’s listed companies are largely repurchased on the exchange. By comparison, most treasury shares are sold in the OTC market or are transferred directly to the other party’s stock account when the shares are used for employee compensation, except for only a fraction of them being sold on the exchange. Furthermore, the FSCMA sets forth specific methods only for a share repurchase, not for disposal of treasury shares. How treasury shares are disposed of is specified in the articles of incorporation and other matters not prescribed by the articles of incorporation can be determined by the board of directors (Article 342 of the Commercial Act). This means that in Korea, firms are given considerable discretionary power in determining the shares subject to disposal and the disposal price, due to the conditions of treasury share transactions and legal loopholes.

Additionally, a firm’s management or controlling shareholders may take advantage of treasury shares with an aim of reinforcing their control over the firm. There are cases where a firm’s controlling shareholders tried to induce the firm to make decisions to their advantage by selling shares to a third party in favor of them, or achieved a higher shareholding ratio without acquiring additional shares in the case of a spinoff. This may lead to potential conflicts of interest between controlling shareholders and minority shareholders and infringement on minority shareholders’ interests.

Implications

Recently, treasury shares are being disposed of for a wider range of purposes, which requires further financial research and additional measures to supplement the existing legal framework. Various studies on share repurchases have been actively conducted in Korea and abroad with a focus on purposes and the impact on share prices. Despite the significant size of treasury share disposal, academic circles and ordinary shareholders have paid little attention to this issue, resulting in the limited empirical analysis of treasury share disposal.

From the legal perspective, the 2011 revision to the Commercial Act permits firms to buy back their own shares even including unlisted stocks. Still, there is a debate underway about the legal nature of treasury share disposal and a gap between economic substance and legal interpretation gives rise to a series of problems. Relevant bills have been proposed to prevent newly issued shares from being allocated to a spin-off company or to prohibit a controlling shareholder from exerting the right to vote against the interests of minor shareholders by selling holdings to a third party. However, these bills fall short of revising the existing legal framework.

Concerning the disposal of treasury shares, more empirical studies are needed to help investors better understand how firms are using treasury shares in Korea. Moreover, a systematic and consistent review of relevant regulations should be conducted to close legal loopholes to ensure that treasury share disposal is prevented from having undue influence on controlling power between shareholders and interests of creditors.

1) This analysis includes the direct buyback and disposal of treasury shares, except for a share repurchase via a trust contract.

2) The number of shares repurchased and disposed of has been calculated based on the number of shares specified in disclosures. As a firm may not repurchase or dispose of the volume of treasure shares as stated in the disclosure, the disclosed volume could be different from the volume of actual buyback and disposal. However, direct repurchase and disposal must be completed within three months from disclosure as prescribed by the relevant regulations. Accordingly, this article assumes that all shares specified in the disclosure statement have been bought back or disposed of.

3) Kim, W.J. & Yim, J.E., 2017, An empirical study on disposal and cancelation of treasury shares by firms in Korea, Journal of Korean Securities Association, 46(1), pp. 35-60.

As more and more firms repurchase their own shares and a stock buyback emerges as a crucial financial strategy in Korea’s market, it is equally important to pay more attention to disposal of treasury shares. Unfortunately, previous discussions have primarily centered on issues related to share repurchases. Against this backdrop, this article intends to explore how treasury shares have been disposed of since the Covid-19 crisis and analyze the purposes of disposal to present the direction for discussions regarding the market for treasury share disposal.

Current state of treasury share disposal

With respect to stocks listed on KOSPI and KOSDAQ, Figure 1 illustrates the number of buyback disclosures and the KOSPI index by quarter between January 2020 and May 2022.1) In early 2020, the Covid-19 outbreak triggered a stock price to plunge in a short period. In response to uncertainties from the stock market, quite a few firms rushed to unveil a share repurchase plan in an effort to prevent share prices from further tumbling and to enhance shareholder value. As a result, the number of disclosures for share repurchases exploded to 128 during the first quarter of 2020.

This article classifies Korea’s stock market into the KOSPI and KOSDAQ markets to identify the number of treasury shares repurchased and disposed of on a quarterly basis. The analysis has found that share repurchases were concentrated in the first quarter of 2020 and the second half of 2020 saw an increase in treasury share disposal.2) By market type, in the KOSPI market, the buyback of 167.7 billion shares was disclosed in the first quarter of 2020 while the disposal of 60 million treasury shares was scheduled for the third and fourth quarters of 2020. Compared to the KOSPI market, the KOSDAQ market saw a larger volume of treasury share disposal with buyback disclosures of 34.9 million shares for the first quarter of 2020, followed by disposal disclosures of 38.5 million shares for the third quarter of 2020 well above the first quarter repurchase volume.

Purposes of treasury share disposal

The acquisition and disposal of treasury shares are key corporate activities that could affect investors’ decision. Companies should disclose the quantity of treasury shares to be acquired or disposed of and the purpose of such acquisition or disposal after obtaining a resolution from the board of directors. In Figure 4, listed companies that acquired treasury shares are classified by the purpose of disclosure. The most common purposes specified in the acquisition disclosure include achieving stock price stability and enhancing shareholder value. Out of 365 acquisition disclosures, stock price stabilization was mentioned as the acquisition purpose in 316 cases. During the period analyzed, the stock buyback was concentrated in the first quarter of 2020 because companies decided to repurchase their own shares to actively respond to a decline in stock prices.

If a firm cancels the repurchased shares, there is no chance for the firm to dispose of the shares, which reduces the number of outstanding shares permanently. In this case, share cancelation can be regarded as a tool for increasing shareholder payout as well as for stabilizing share prices. If share cancelation is added, this means more than 90% of repurchase disclosures state that their purpose is to enhance shareholder payout. Simply put, it is safe to say that recent share repurchases can be interpreted as business activities aiming to increase the interest of shareholders if the buyback purposes are taken as stated in disclosures. This is why a firm’s stock buyback decision tends to be welcomed by shareholders and push up its share prices.

Regulation of treasury share disposal and the effects on shareholder payout

The analysis of repurchases and disposal of treasury shares has found that firms can use the repurchased shares at their disposal, which is guaranteed expressly by law. As prescribed by Korea’s Commercial Act, a firm can pay its repurchased shares in return for capital transactions (Article 342), and use its treasury shares to make payments in kind or in consideration for a division or a merger after division, swap of shares, etc. when it carries out corporate restructuring (Article 360-2 and Article 360-3). More than 90% of stock repurchase disclosures said that their purpose was to boost shareholder payout. However, about 2/3 of disposal disclosures specified employee compensation as the primary purpose while raising surplus funds through the sales of overvalued shares was mentioned in about 1/4 of disposal disclosures. A partial amount of the repurchased shares was handed over in consideration for a strategic partnership or a merger deal. In particular, employee compensation is the common purpose mentioned as the purpose of both repurchase and disposal of treasury shares. In terms of the volume of shares specified in disclosures, stock repurchase disclosures for employee compensation represent no more than 4.51 million shares, indicating a big gap with 44 million shares put up for disposal. This implies treasury shares are utilized regardless of stock buyback purposes.

Although discretionary disposal of treasury shares is not against the law, it cannot be viewed as positive in terms of shareholder payout. From a financial perspective, a stock buyback is regarded as a tool for enhancing shareholder payout, which has a positive impact on stock prices. However, this holds true only as long as the shares repurchased are not disposed of. During the period analyzed, disposal of treasury shares for securing operating funds and improving financial structure accounts for the largest proportion of the total shares to be disposed of, which is primarily carried out through off-hours block trading. This suggests that a considerable volume of treasury shares become available again for trading in the market once disposal disclosures are published. On the other hand, a stock buyback aiming for employee compensation is not expected to have an immediate effect on share prices. Firms frequently dispose of their treasury shares in small volumes to reward employee performance. As disclosures for such a purpose involve only a small quantity of shares, each disclosure is unlikely to have a significant impact on share prices. As for treasury share disposal for employee compensation, also notable is that disposed shares are transferred directly from a firm’s treasury stock account to the buyer’s stock account. Accordingly, disposal designed for employee compensation does not necessarily mean that the shares become immediately available in the market. However, the employee who receives treasury shares as performance pay is likely to sell them at any given time. Consequently, this would increase the number of outstanding shares and weaken the anticipated effect of greater shareholder payout.

Compared to a stock buyback, disposal of treasury shares is more likely to spark controversy over the proper sale price and disposal method. In practice, treasury shares of Korea’s listed companies are largely repurchased on the exchange. By comparison, most treasury shares are sold in the OTC market or are transferred directly to the other party’s stock account when the shares are used for employee compensation, except for only a fraction of them being sold on the exchange. Furthermore, the FSCMA sets forth specific methods only for a share repurchase, not for disposal of treasury shares. How treasury shares are disposed of is specified in the articles of incorporation and other matters not prescribed by the articles of incorporation can be determined by the board of directors (Article 342 of the Commercial Act). This means that in Korea, firms are given considerable discretionary power in determining the shares subject to disposal and the disposal price, due to the conditions of treasury share transactions and legal loopholes.

Additionally, a firm’s management or controlling shareholders may take advantage of treasury shares with an aim of reinforcing their control over the firm. There are cases where a firm’s controlling shareholders tried to induce the firm to make decisions to their advantage by selling shares to a third party in favor of them, or achieved a higher shareholding ratio without acquiring additional shares in the case of a spinoff. This may lead to potential conflicts of interest between controlling shareholders and minority shareholders and infringement on minority shareholders’ interests.

Implications

Recently, treasury shares are being disposed of for a wider range of purposes, which requires further financial research and additional measures to supplement the existing legal framework. Various studies on share repurchases have been actively conducted in Korea and abroad with a focus on purposes and the impact on share prices. Despite the significant size of treasury share disposal, academic circles and ordinary shareholders have paid little attention to this issue, resulting in the limited empirical analysis of treasury share disposal.

From the legal perspective, the 2011 revision to the Commercial Act permits firms to buy back their own shares even including unlisted stocks. Still, there is a debate underway about the legal nature of treasury share disposal and a gap between economic substance and legal interpretation gives rise to a series of problems. Relevant bills have been proposed to prevent newly issued shares from being allocated to a spin-off company or to prohibit a controlling shareholder from exerting the right to vote against the interests of minor shareholders by selling holdings to a third party. However, these bills fall short of revising the existing legal framework.

Concerning the disposal of treasury shares, more empirical studies are needed to help investors better understand how firms are using treasury shares in Korea. Moreover, a systematic and consistent review of relevant regulations should be conducted to close legal loopholes to ensure that treasury share disposal is prevented from having undue influence on controlling power between shareholders and interests of creditors.

1) This analysis includes the direct buyback and disposal of treasury shares, except for a share repurchase via a trust contract.

2) The number of shares repurchased and disposed of has been calculated based on the number of shares specified in disclosures. As a firm may not repurchase or dispose of the volume of treasure shares as stated in the disclosure, the disclosed volume could be different from the volume of actual buyback and disposal. However, direct repurchase and disposal must be completed within three months from disclosure as prescribed by the relevant regulations. Accordingly, this article assumes that all shares specified in the disclosure statement have been bought back or disposed of.

3) Kim, W.J. & Yim, J.E., 2017, An empirical study on disposal and cancelation of treasury shares by firms in Korea, Journal of Korean Securities Association, 46(1), pp. 35-60.