OPINION

2022 Aug/24

Treasury Stock Magic: Economic Distortions and Legal Contradictions

Aug. 24, 2022

PDF

- Summary

- Treasury Stock Magic refers to a phenomenon that reinforces controlling shareholders’ power by allotting new shares issued by a newly separated company to treasury shares of a parent company in a spin-off. This has come under fire in that it enables controlling shareholders to gain more control without making additional investments.

In an analysis of a spin-off by Korean listed firms between 2000 and 2021, Treasury Stock Magic has been primarily utilized in conversion to the holding company structure. With a spin-off based on Treasury Stock Magic and the subsequent right offerings through in-kind contribution, the ownership share of controlling shareholders both in the parent and the spun-off companies surges by 15%p and 11%p, respectively, which considerably boosts their controlling power. On the other hand, the proportion of market capitalization represented by outside shareholders declines by 6%p after a spin-off is carried out, indicating that Treasury Stock Magic distorts distribution of wealth as well as controlling power.

Treasury Stock Magic can exert its power in a spin-off because treasury shares that should not be deemed economic assets are recognized as assets under the relevant laws and regulations. This necessitates reducing potential abuse of treasury shares by controlling shareholders and accurately reflecting their economic nature. To this end, a coherent regulatory framework should be established to retire repurchased shares mandatorily.

The so-called Treasury Stock Magic refers to a phenomenon where a controlling shareholder gains more controlling power by means of treasury shares in a corporate spin-off. A spin-off is initiated by creating a new subsidiary through the division of a parent company’s assets and allotting new shares of the new company to existing shareholders according to an ownership share. For instance, a shareholder with a 10% stake in the parent company prior to a spin-off would end up holding a 10% stake in both the parent and the spun-off. If the parent company holds treasury shares, it would be deemed a shareholder and allocated with new shares of the spun-off, which enables its controlling shareholder to gain more controlling power over the spun-off than over the parent. As the controlling shareholder’s power over the new subsidiary can be enhanced without additional investments, this is referred to as ‘Treasury Stock Magic’ that has been continuously criticized for infringing upon the interests of outside shareholders. Notwithstanding a long-standing controversy over it, the relevant regulatory improvement has made little progress. Against this backdrop, this article conducts an empirical study of how Treasury Stock Magic is used in listed firms’ spin-off and explores the nature of treasury shares to raise awareness about the need for regulatory improvement.

How Treasury Stock Magic practically works

Korean listed companies have completed a total of 193 spin-offs over the past 22 years from 2000 to 2021. Among them, 92 have been confirmed to be related to the conversion to a holding company. The fact that 147 listed firms have been designated as the holding company under the Monopoly Regulation and Fair Trade Act demonstrates that a spin-off is a widely-used tool for corporate restructuring in conversion to the holding company structure.

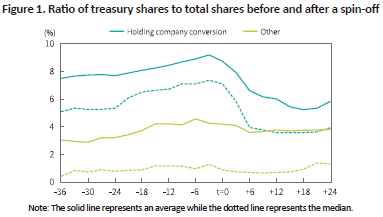

In this respect, it is necessary to look into how Treasury Stock Magic has been capitalized on in a spin-off.1) Figure 1 shows changes in the ratio of treasury shares to total shares for a sample of listed firms that have completed a spin-off, before and after the spin-off date. In a sample related to the conversion to a holding company, the ratio of treasury shares is relatively high, rising continuously until the spin-off date. The ratio already reaches 7.4% 36 months prior to the spin-off, more than double an average of 3.3% for listed firms during the same point of time, which increases by 1.7%p to 9.1% three months before the spin-off. In particular, the increase in the ratio is prominent among those with a lower treasury stock ratio. These findings demonstrate that treasury shares play a critical role in the holding company conversion through a spin-off.

In a sample irrelevant to such conversion, the ratio shows a similar upward trend. However, with a relatively lower ratio of treasury shares at the time of the spin-off, about two thirds of the sample fall short of the average treasury stock ratio of listed firms.

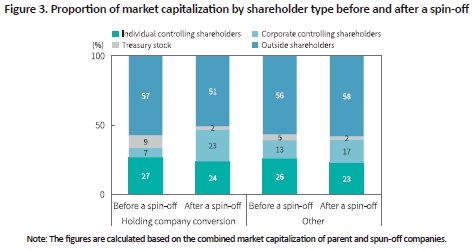

Also notable is the effect that a spin-off has on distribution of wealth. In the holding company conversion sample, the ownership share of controlling shareholders increases both in the parent and the spun-off and thus, outside shareholders are likely to see their wealth relatively declining. For this analysis, it is necessary to examine the proportion of market capitalization represented by controlling shareholders relative to that of outside shareholders before and after a spin-off is conducted.

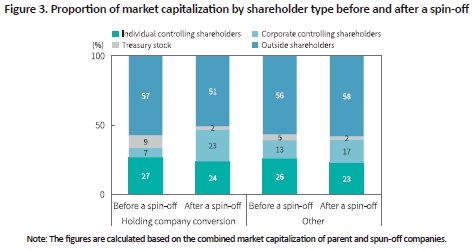

Figure 3 shows that in the holding company conversion sample, controlling shareholders own 34% of total market capitalization prior to a spin-off, which climbs to 47% by 13%p after a spin-off. The proportion declines from 27% to 24% for individual controlling shareholders while that of non-individual controlling shareholders jumps to 23% from 7%. Despite a drop in the market cap ratio, individual controlling shareholders have sought conversion to the holding company structure, suggesting that strengthening controlling power over the parent company (holding company) is the goal of such conversion. On the other hand, outside shareholders take up 57% of total market cap prior to a spin-off, which declines by 6%p to 51% following a spin-off. This means the cost of controlling shareholders’ enhanced control is borne by outside shareholders. Although the conversion to the holding company structure can create synergies, its rewards are not equally distributed between shareholders.

In a sample irrelevant to holding company conversion, wealth distribution remains unchanged prior to or after a spin-off. Controlling shareholders own a 39% market cap prior to and after a spin-off, while the wealth proportion of outside shareholders slightly increases to 58% from 56%.

Intrinsic aspects of treasury stock

Given that a spin-off conducted by virtue of Treasury Stock Magic distorts controlling power and wealth distribution, intrinsic aspects of treasury shares should be analyzed to figure out how Treasury Stock Magic works. Allotting shares issued by a new subsidiary to the parent’s treasury shares means that treasury shares are recognized as having a shareholder right and the parent company is deemed a shareholder. If a shareholder right is accepted, treasury shares are recognized as valuable assets. However, a company acting as a shareholder for itself hardly conforms to the nature of a corporation that should be established through shareholders’ investment. If a company acquires entire shares issued by it, this would be tantamount to distributing residual assets, which results in corporate liquidation. A company itself cannot exert a voting right and paying dividends to itself is of no economic value. A company’s value should be linked to the value of treasury shares it owns as long as treasury shares are deemed to have value as assets, which is apparently contradictory.

Under this context, treasury stocks’ voting right and dividend right are limited and accounting standards do not recognize treasury stocks as assets. A company is allowed to use only profits available for dividends when repurchasing its own shares because a stock buyback is understood as capital outflow rather than investment in assets. In principle, it is reasonable to view share repurchases as equivalent to the cancelation of shares.

In spite of that, new shares issued by a new subsidiary can be allotted to treasury shares held by a parent company, probably because there are laws and regulations and legal precedents that deem treasury stock as assets in absence of an explicit provision on distribution of new shares. Under the current law, share repurchases and disposal of treasury shares are considered as the stock trading and treasury stock can be offered as a consideration for a merger, the divisible assets in a corporate split and a means of paying dividends in kind. It creates legal grounds for the interpretation that treasury stock has a shareholder right and thereby asset value. This makes it rational to allot new shares issued by a spin-off to the treasury shares of the parent company over the course of a corporate split.

Conclusion

The controversy over treasury shares stems from the possibility that they may be used by controlling shareholders for private benefits. As stated above, controlling shareholders tend to strengthen their control in a spin-off based on Treasury Stock Magic. Also, it is easy to find a case where controlling shareholders sell treasury shares to other shareholders in favor of them to defend their control of a company in a corporate control dispute. There is also the possibility that the acquisition and disposal of treasury stock is involved in insider trading. It may be illegitimate to enhance controlling power by using treasury shares acquired with profits available for dividends, not at controlling shareholders’ own cost. Only 2.3% of listed firms have canceled their treasury shares as a way of fulfilling the primary role of treasury stock.5)

With respect to Treasury Stock Magic, nine bills have been proposed since 2015 to prevent allotment of new shares in relation to treasury stock, require mandatory cancelation of treasury shares or limit the voting right of newly allotted shares to the parent company’s treasury shares, but they have not been enacted. If no regulatory measure is implemented to improve the current situation where treasury shares that are not assets are being accepted as assets, it would give a controlling shareholder an incentive to abuse treasury shares for his or her private benefits. Only after treasury stock’s asset value is denied and repurchased shares are canceled mandatorily, it would be possible to curb potential abuse of treasury shares by a controlling shareholder. This also could enhance the signaling role of share repurchases, which is the primary goal of the share repurchase.

1) Among 193 spin-offs, a total of 137 have been analyzed except for a merger with corporate division, an involuntary spin-off (conducted as a result of a workout arrangement or corporate restructuring plan devised by creditors), a spun-off company operated as a non-listed firm, and companies without available data.

2) For an accurate analysis, this article examines only the case where a parent company is converted into a holding company.

3) This includes the ownership share of 11% acquired through Treasury Stock Magic.

4) A sharp drop in the parent company’s treasury stock ratio can be explained by the diluted ownership share that arises from post-spinoff right offerings.

5) Kim, W.J. & Yim, J.E., 2017, The empirical study of disposal and cancelation of treasury shares by Korean firms, Korean Journal of Financial Studies 46(1), 35-60.

How Treasury Stock Magic practically works

Korean listed companies have completed a total of 193 spin-offs over the past 22 years from 2000 to 2021. Among them, 92 have been confirmed to be related to the conversion to a holding company. The fact that 147 listed firms have been designated as the holding company under the Monopoly Regulation and Fair Trade Act demonstrates that a spin-off is a widely-used tool for corporate restructuring in conversion to the holding company structure.

In this respect, it is necessary to look into how Treasury Stock Magic has been capitalized on in a spin-off.1) Figure 1 shows changes in the ratio of treasury shares to total shares for a sample of listed firms that have completed a spin-off, before and after the spin-off date. In a sample related to the conversion to a holding company, the ratio of treasury shares is relatively high, rising continuously until the spin-off date. The ratio already reaches 7.4% 36 months prior to the spin-off, more than double an average of 3.3% for listed firms during the same point of time, which increases by 1.7%p to 9.1% three months before the spin-off. In particular, the increase in the ratio is prominent among those with a lower treasury stock ratio. These findings demonstrate that treasury shares play a critical role in the holding company conversion through a spin-off.

In a sample irrelevant to such conversion, the ratio shows a similar upward trend. However, with a relatively lower ratio of treasury shares at the time of the spin-off, about two thirds of the sample fall short of the average treasury stock ratio of listed firms.

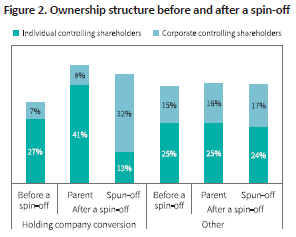

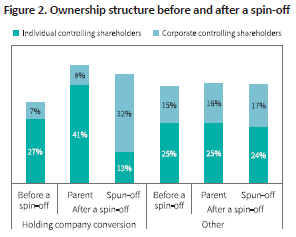

It is also worth considering how a spin-off transforms the ownership structure of the parent and the spun-off. As illustrated by the holding company conversion sample in Figure 2,2) controlling shareholders (including the largest shareholder and related parties) hold 34% of total shares prior to a spin-off (as of the end of the preceding fiscal year), of which 27% is held by individuals (including controlling shareholders and their relatives and executives) and 7% by non-individuals (including affiliated companies and nonprofit organizations). Controlling shareholders of listed firms hold an average of 41% shares during the same period, suggesting that a relatively lower ownership share of controlling shareholders may trigger the conversion to a holding company through a spin-off. It also implies that a higher treasury stock ratio of the sample firms is attributable to the acquisition of treasury shares without a voting right for bolstering controlling shareholders’ controlling power.

Following a spin-off (as of the end of the subsequent fiscal year), the ownership share of controlling shareholders surges in both the parent and the spun-off companies, which transforms the shareholding structure between individual and non-individual controlling shareholders. Controlling shareholders have a 45% stake in the spun-off company, up 11%p compared to the ratio before a spin-off. This is the result of Treasury Stock Magic as new shares issued by the spun-off company are allotted to treasury shares originally held by the parent company. Both a higher ownership share of controlling shareholders for the parent company and the changing shareholding structure of the parent and the spun-off stem from right offerings through in-kind contribution after a spin-off. Individual controlling shareholders exchange their new shares of the spun-off with right offering shares of the parent company and then, this drives up the ownership share of individual controlling shareholders for the parent company (27% to 41%) and the ownership share of non-individual controlling shareholders for the spun-off (18%3) to 32%).4) If a spilt ratio is higher and the per-share value of the spun-off company is relatively higher than that of the parent company, individual controlling shareholders could acquire more shares of the parent company. The additional analysis has found that the holding company conversion sample benefits from more favorable conditions, compared to the other sample. The spin-off based on Treasury Stock Magic and subsequent right offerings through in-kind contribution can be viewed as a process of strengthening controlling shareholders’ control over the holding company (the parent), which also enables the holding company to satisfy legal shareholding requirements for the subsidiaries.

In a sample irrelevant to holding company conversion, no major change in ownership structure is observed before and after a spin-off. The pre-spinoff ownership share of controlling shareholders stands at 40%, which hardly differs from their post-spinoff ownership share of 41% both in the parent and the spun-off.

Following a spin-off (as of the end of the subsequent fiscal year), the ownership share of controlling shareholders surges in both the parent and the spun-off companies, which transforms the shareholding structure between individual and non-individual controlling shareholders. Controlling shareholders have a 45% stake in the spun-off company, up 11%p compared to the ratio before a spin-off. This is the result of Treasury Stock Magic as new shares issued by the spun-off company are allotted to treasury shares originally held by the parent company. Both a higher ownership share of controlling shareholders for the parent company and the changing shareholding structure of the parent and the spun-off stem from right offerings through in-kind contribution after a spin-off. Individual controlling shareholders exchange their new shares of the spun-off with right offering shares of the parent company and then, this drives up the ownership share of individual controlling shareholders for the parent company (27% to 41%) and the ownership share of non-individual controlling shareholders for the spun-off (18%3) to 32%).4) If a spilt ratio is higher and the per-share value of the spun-off company is relatively higher than that of the parent company, individual controlling shareholders could acquire more shares of the parent company. The additional analysis has found that the holding company conversion sample benefits from more favorable conditions, compared to the other sample. The spin-off based on Treasury Stock Magic and subsequent right offerings through in-kind contribution can be viewed as a process of strengthening controlling shareholders’ control over the holding company (the parent), which also enables the holding company to satisfy legal shareholding requirements for the subsidiaries.

Also notable is the effect that a spin-off has on distribution of wealth. In the holding company conversion sample, the ownership share of controlling shareholders increases both in the parent and the spun-off and thus, outside shareholders are likely to see their wealth relatively declining. For this analysis, it is necessary to examine the proportion of market capitalization represented by controlling shareholders relative to that of outside shareholders before and after a spin-off is conducted.

Figure 3 shows that in the holding company conversion sample, controlling shareholders own 34% of total market capitalization prior to a spin-off, which climbs to 47% by 13%p after a spin-off. The proportion declines from 27% to 24% for individual controlling shareholders while that of non-individual controlling shareholders jumps to 23% from 7%. Despite a drop in the market cap ratio, individual controlling shareholders have sought conversion to the holding company structure, suggesting that strengthening controlling power over the parent company (holding company) is the goal of such conversion. On the other hand, outside shareholders take up 57% of total market cap prior to a spin-off, which declines by 6%p to 51% following a spin-off. This means the cost of controlling shareholders’ enhanced control is borne by outside shareholders. Although the conversion to the holding company structure can create synergies, its rewards are not equally distributed between shareholders.

In a sample irrelevant to holding company conversion, wealth distribution remains unchanged prior to or after a spin-off. Controlling shareholders own a 39% market cap prior to and after a spin-off, while the wealth proportion of outside shareholders slightly increases to 58% from 56%.

Intrinsic aspects of treasury stock

Given that a spin-off conducted by virtue of Treasury Stock Magic distorts controlling power and wealth distribution, intrinsic aspects of treasury shares should be analyzed to figure out how Treasury Stock Magic works. Allotting shares issued by a new subsidiary to the parent’s treasury shares means that treasury shares are recognized as having a shareholder right and the parent company is deemed a shareholder. If a shareholder right is accepted, treasury shares are recognized as valuable assets. However, a company acting as a shareholder for itself hardly conforms to the nature of a corporation that should be established through shareholders’ investment. If a company acquires entire shares issued by it, this would be tantamount to distributing residual assets, which results in corporate liquidation. A company itself cannot exert a voting right and paying dividends to itself is of no economic value. A company’s value should be linked to the value of treasury shares it owns as long as treasury shares are deemed to have value as assets, which is apparently contradictory.

Under this context, treasury stocks’ voting right and dividend right are limited and accounting standards do not recognize treasury stocks as assets. A company is allowed to use only profits available for dividends when repurchasing its own shares because a stock buyback is understood as capital outflow rather than investment in assets. In principle, it is reasonable to view share repurchases as equivalent to the cancelation of shares.

In spite of that, new shares issued by a new subsidiary can be allotted to treasury shares held by a parent company, probably because there are laws and regulations and legal precedents that deem treasury stock as assets in absence of an explicit provision on distribution of new shares. Under the current law, share repurchases and disposal of treasury shares are considered as the stock trading and treasury stock can be offered as a consideration for a merger, the divisible assets in a corporate split and a means of paying dividends in kind. It creates legal grounds for the interpretation that treasury stock has a shareholder right and thereby asset value. This makes it rational to allot new shares issued by a spin-off to the treasury shares of the parent company over the course of a corporate split.

Conclusion

The controversy over treasury shares stems from the possibility that they may be used by controlling shareholders for private benefits. As stated above, controlling shareholders tend to strengthen their control in a spin-off based on Treasury Stock Magic. Also, it is easy to find a case where controlling shareholders sell treasury shares to other shareholders in favor of them to defend their control of a company in a corporate control dispute. There is also the possibility that the acquisition and disposal of treasury stock is involved in insider trading. It may be illegitimate to enhance controlling power by using treasury shares acquired with profits available for dividends, not at controlling shareholders’ own cost. Only 2.3% of listed firms have canceled their treasury shares as a way of fulfilling the primary role of treasury stock.5)

With respect to Treasury Stock Magic, nine bills have been proposed since 2015 to prevent allotment of new shares in relation to treasury stock, require mandatory cancelation of treasury shares or limit the voting right of newly allotted shares to the parent company’s treasury shares, but they have not been enacted. If no regulatory measure is implemented to improve the current situation where treasury shares that are not assets are being accepted as assets, it would give a controlling shareholder an incentive to abuse treasury shares for his or her private benefits. Only after treasury stock’s asset value is denied and repurchased shares are canceled mandatorily, it would be possible to curb potential abuse of treasury shares by a controlling shareholder. This also could enhance the signaling role of share repurchases, which is the primary goal of the share repurchase.

1) Among 193 spin-offs, a total of 137 have been analyzed except for a merger with corporate division, an involuntary spin-off (conducted as a result of a workout arrangement or corporate restructuring plan devised by creditors), a spun-off company operated as a non-listed firm, and companies without available data.

2) For an accurate analysis, this article examines only the case where a parent company is converted into a holding company.

3) This includes the ownership share of 11% acquired through Treasury Stock Magic.

4) A sharp drop in the parent company’s treasury stock ratio can be explained by the diluted ownership share that arises from post-spinoff right offerings.

5) Kim, W.J. & Yim, J.E., 2017, The empirical study of disposal and cancelation of treasury shares by Korean firms, Korean Journal of Financial Studies 46(1), 35-60.