OPINION

2022 Nov/22

Korea’s Potential Inclusion in the WGBI: Significance and Expected Effects

Nov. 22, 2022

PDF

- Summary

- Korea is getting one step closer to joining the World Government Bond Index (WGBI). As a pre-WGBI inclusion stage, it has been added to the FTSE Fixed Income Country Classification Watch List, thanks to the government’s active efforts. It is expected to join the index as early as the first half of next year. Korea’s inclusion in the WGBI, a leading index for global treasury exposure, is likely to invite investment funds benchmarked against the index and stabilize the sovereign debt market and the FX market. With fewer incentives to attract foreign investors to Korea, the inclusion could provide a stable stream of funds to the sovereign debt market and thus, bring about greater economic benefits. In addition, this would help Korea overcome a discount for won-denominated bonds by improving international creditworthiness of the Korea Treasury Bond (KTB) market. However, index membership should entail adverse effects of raising susceptibility to external factors, which requires caution. As FTSE Russell, the operator of the WGBI, specifies conditions for the exclusion from the index, a trigger of the exclusion could lead to capital flight. In this respect, Korea should take measures to alleviate external shocks by expanding the domestic bond investor base while preparing for inclusion in the WGBI.

Recently, Korea has been added to the watch list for potential inclusion in the FTSE World Government Bond Index (WGBI), which increases the possibility of Korea’s joining the index. As the WGBI is a major sovereign debt index that major global pension funds are using as a benchmark, inclusion in the index would bring about various economic benefits including greater capital inflows and enhanced credibility of the sovereign debt market. In this respect, this article provides an overview of the WGBI, explores the possibility of Korea’s inclusion into the index and analyzes its economic effects and expected gains.

Overview of the WGBI and prospects for Korea’s inclusion

The WGBI provided by the UK’s FTSE Russell is a leading benchmark for global treasury exposure which consists of sovereign bonds issued by the US and other major economies. Together with the Bloomberg-Barclays Global Aggregative Index (BBGA) and the Government Bond Index-Emerging Markets (GBI-EM), it is classified as one of the world’s three primary sovereign debt indexes. In terms of the size of funds tracking the index and stability of sovereign bonds included, it is the recognized bond index represented by advanced economies. Currently, the WGBI contains sovereign bonds of 23 countries including key advanced economies, China, Mexico and Malaysia, and each country’s weighting in the index depends on the proportion represented by the market capitalization of a specific sovereign bond.1)

Whether a country is newly added to the WGBI is determined through the semi-annual periodic review. Generally, a potential candidate for inclusion is placed on the FTSE Fixed Income Country Classification Watch List, and the assessment result is announced after the country is confirmed to have met the requirements for inclusion. FTSE Russell takes into consideration quantitative factors such as the market size and sovereign credit ratings as well as qualitative factors regarding market accessibility. A candidate country should fulfill minimum requirements including the outstanding amount of treasury bond issuance (KRW 50 billion) and a sovereign credit rating (over A- level issued by S&P). In addition, the candidate is required to gain the Market Accessibility Level 2 or higher given by FTSE Russell’s Fixed Income Country Classification review.2)

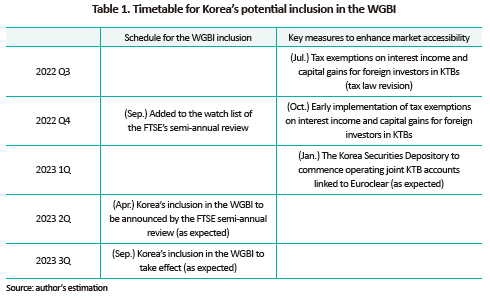

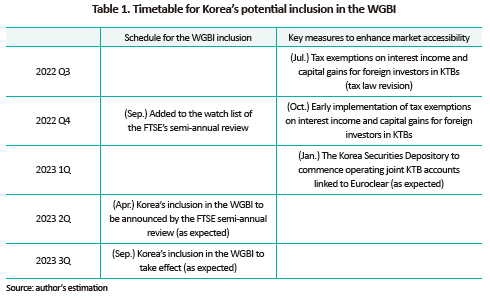

The KTB market has fully met quantitative requirements for inclusion in the WGBI but fails to satisfy the qualitative criteria for market accessibility. The market accessibility factors to be further improved range from the tax burden on non-residents and the openness of the foreign exchange market to convenient access to global depositories. In particular, the withholding tax levied on foreign investors in KTBs served as a crucial obstacle when Korea pushed for the inclusion in 2009. Hence, the Korean government has recently submitted a tax reform containing tax exemptions for non-resident KTB investors to the National Assembly. While seeking prompt implementation of such tax exemptions, it has also worked on better market access by solidifying its connection with the International Central Securities Depository (ICSD) and fully opening up the FX market. Considering these efforts, FTSE is likely to officially add Korea to the WGBI through its periodic review scheduled for the first half of next year. Table 1 above shows Korea’s key improvements in market accessibility and timetable for inclusion into the WGBI.

Expected effects of the inclusion into the WGBI

After joining key benchmark indexes such as the WGBI, many global economies have experienced a wide range of economic impacts including the increase in capital influx, changes in yields of the sovereign debt market and exchange rate effects. By analyzing economic effects observed in 16 countries newly added to the GBI-EM, Williams & Pandolfi (2017) have found that the inclusion into the index would have statistically significant effects including greater capital inflows and lower yields on sovereign bonds. After examining cases of the WGBI inclusion, Broner et al. (2021) have indicated that a country’s joining a sovereign debt index would bring about significant changes in bond prices and exchange rates. As for emerging economies, the inclusion into major sovereign debt indexes such as the WGBI serves as a primary factor for the expansion of capital inflows. According to Arslanalp et al. (2020), about 40% of foreign investment funds that flowed into the sovereign debt markets of major emerging economies are estimated to track key sovereign debt indexes.

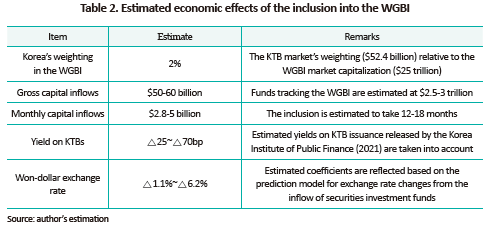

Korea’s joining the WGBI is projected to create KRW 50 to 60 million in foreign investments into the KTB market, which has been derived from Korea’s expected weighting in the WGBI (2%) and the estimated amount of funds benchmarked against the index. Given that the inclusion takes place over 12 to 18 months, the monthly capital inflow would be around $2.8 to $5 billion. The rise in demand for KTBs driven by the inclusion in the WGBI is anticipated to boost bond prices and facilitate prolonged holding of KTBs by foreign investors. If the growth of yields on KTB issuance estimated by the Korea Institute of Public Finance is taken into account, index membership is projected to cut down the yield on five-year KTBs by around 25 to 70bp. As the funds benchmarked against the WGBI are geared towards a long-term investment horizon, foreign investors’ duration for KTB holdings could be prolonged.3)

Rising capital inflows induced by the inclusion are also expected to result in currency appreciation in the domestic FX sector. This article has analyzed how the inclusion in the WGBI affects exchange rates based on estimated fluctuation in exchange rates arising from capital inflows into the domestic stock market. The analysis shows that if $5 billion is injected monthly for 12 months after the inclusion into the WGBI, the decline in the won-dollar exchange rate would range from 1.1% to 6.2%.4) As high volatility in the FX market, investment funds for KTBs and other variables have a huge impact on exchange rates, there may be limitations in accurately predicting exchange rate effects resulting from the inclusion into the WGBI. But other countries have observed significant exchange rate effects after joining the index and Korea is likely to see capital inflows into its sovereign bond market exceeding one third of the current outstanding balance of foreign investors’ bond holdings. Hence, in all probability, index membership would boost capital inflows, thereby raising the pressure for currency revaluation in Korea’s FX market.

Implications

Korea has been added to the FTSE watch list in a pre-WGBI inclusion stage and is expected to join the index as early as the first half of next year. As mentioned above, the inclusion in the WGBI—a widely followed sovereign debt index—would attract long-term private investment funds, alleviate pressures on rate hikes and induce downward stabilization of the won-dollar exchange rate, thereby contributing to greater stability of the financial market. Recently, the depreciation of the won and the widening gap in the policy interest rate between Korea and the US have discouraged the influx of foreign investors. Under this circumstance, Korea’s joining the WGBI would bring about economic benefits as it ensures a stable stream of funds. Additionally, if the inclusion in the index enhances credibility in the KTB market, it would help overcome a discount for won-denominated bonds that has forced Korea to pay higher interest costs for KTBs, relative to other economies with a credit rating similar to Korea’s.

Notably, greater capital inflows resulting from index membership would make the KTB market more susceptible to external factors, which requires extra caution. In addition to requirements for the WGBI inclusion, FTSE specifies conditions for the potential exclusion from the index. Accordingly, if the worst event like failure to meet the credit rating requirement takes place, it could trigger foreign capital flight. Given that funds tracking the WGBI tend to prefer long-term investments, capital flight is unlikely to occur under normal conditions. But sensitivity to external conditions could be aggravated across the economy. Furthermore, it is noteworthy that if Korea’s inclusion in the WGBI improves the efficiency of the FX market, it may cut down foreign investors’ opportunities for arbitrage trading and thus, facilitate investing in products linking futures to spot trading, thereby intensifying volatility of the bond market. In this respect, Korea needs to consider expanding the domestic bond investor base and invigorating overseas stock investments as policy measures to mitigate external shocks while preparing for inclusion in the WGBI.

1) In the country-specific weighting in the WGBI as of end-March 2022, the US (40%) accounts for the largest proportion, followed by Japan (17%) and France (8%).

2) The FTSE Russell Fixed Income Country Classification categorizes market accessibility into three levels (0 to 2 level) by evaluating a candidate country’s macroeconomic conditions, the structure of the FX and bond markets and linkage with global depositories.

3) The duration of WGBI members is averaged at about 9.6 years.

4) Details regarding the prediction model will be contained in the report being prepared by the author.

References

Arslanalp, S., Drakopoulos, D., Goel, R., Koepke, R., 2020, Benchmark driven investments in emerging market bond markets: Taking stock, IMF Working Paper 20/192.

Broner, F., Martin, F., Pandolfi, L., Williams, T., 2021, Winners and losers from sovereign debt inflows, Journal of International Economics, 130(103446).

Williams, T., Pandolfi, L., 2017. Capital flows and sovereign debt markets: Evidence from index rebalancing, Institute for International Economics Policy Working Paper Series 2017-11.

[Korean]

Korea Institute of Public Finance, 2021, The 2021 Preliminary Feasibility Study on Preferential Tax Treatments: Introduction of KTB Products for Retail Investors.

Overview of the WGBI and prospects for Korea’s inclusion

The WGBI provided by the UK’s FTSE Russell is a leading benchmark for global treasury exposure which consists of sovereign bonds issued by the US and other major economies. Together with the Bloomberg-Barclays Global Aggregative Index (BBGA) and the Government Bond Index-Emerging Markets (GBI-EM), it is classified as one of the world’s three primary sovereign debt indexes. In terms of the size of funds tracking the index and stability of sovereign bonds included, it is the recognized bond index represented by advanced economies. Currently, the WGBI contains sovereign bonds of 23 countries including key advanced economies, China, Mexico and Malaysia, and each country’s weighting in the index depends on the proportion represented by the market capitalization of a specific sovereign bond.1)

Whether a country is newly added to the WGBI is determined through the semi-annual periodic review. Generally, a potential candidate for inclusion is placed on the FTSE Fixed Income Country Classification Watch List, and the assessment result is announced after the country is confirmed to have met the requirements for inclusion. FTSE Russell takes into consideration quantitative factors such as the market size and sovereign credit ratings as well as qualitative factors regarding market accessibility. A candidate country should fulfill minimum requirements including the outstanding amount of treasury bond issuance (KRW 50 billion) and a sovereign credit rating (over A- level issued by S&P). In addition, the candidate is required to gain the Market Accessibility Level 2 or higher given by FTSE Russell’s Fixed Income Country Classification review.2)

Expected effects of the inclusion into the WGBI

After joining key benchmark indexes such as the WGBI, many global economies have experienced a wide range of economic impacts including the increase in capital influx, changes in yields of the sovereign debt market and exchange rate effects. By analyzing economic effects observed in 16 countries newly added to the GBI-EM, Williams & Pandolfi (2017) have found that the inclusion into the index would have statistically significant effects including greater capital inflows and lower yields on sovereign bonds. After examining cases of the WGBI inclusion, Broner et al. (2021) have indicated that a country’s joining a sovereign debt index would bring about significant changes in bond prices and exchange rates. As for emerging economies, the inclusion into major sovereign debt indexes such as the WGBI serves as a primary factor for the expansion of capital inflows. According to Arslanalp et al. (2020), about 40% of foreign investment funds that flowed into the sovereign debt markets of major emerging economies are estimated to track key sovereign debt indexes.

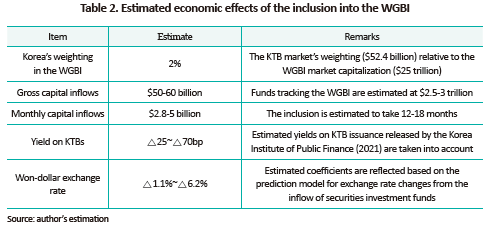

Korea’s joining the WGBI is projected to create KRW 50 to 60 million in foreign investments into the KTB market, which has been derived from Korea’s expected weighting in the WGBI (2%) and the estimated amount of funds benchmarked against the index. Given that the inclusion takes place over 12 to 18 months, the monthly capital inflow would be around $2.8 to $5 billion. The rise in demand for KTBs driven by the inclusion in the WGBI is anticipated to boost bond prices and facilitate prolonged holding of KTBs by foreign investors. If the growth of yields on KTB issuance estimated by the Korea Institute of Public Finance is taken into account, index membership is projected to cut down the yield on five-year KTBs by around 25 to 70bp. As the funds benchmarked against the WGBI are geared towards a long-term investment horizon, foreign investors’ duration for KTB holdings could be prolonged.3)

Rising capital inflows induced by the inclusion are also expected to result in currency appreciation in the domestic FX sector. This article has analyzed how the inclusion in the WGBI affects exchange rates based on estimated fluctuation in exchange rates arising from capital inflows into the domestic stock market. The analysis shows that if $5 billion is injected monthly for 12 months after the inclusion into the WGBI, the decline in the won-dollar exchange rate would range from 1.1% to 6.2%.4) As high volatility in the FX market, investment funds for KTBs and other variables have a huge impact on exchange rates, there may be limitations in accurately predicting exchange rate effects resulting from the inclusion into the WGBI. But other countries have observed significant exchange rate effects after joining the index and Korea is likely to see capital inflows into its sovereign bond market exceeding one third of the current outstanding balance of foreign investors’ bond holdings. Hence, in all probability, index membership would boost capital inflows, thereby raising the pressure for currency revaluation in Korea’s FX market.

Korea has been added to the FTSE watch list in a pre-WGBI inclusion stage and is expected to join the index as early as the first half of next year. As mentioned above, the inclusion in the WGBI—a widely followed sovereign debt index—would attract long-term private investment funds, alleviate pressures on rate hikes and induce downward stabilization of the won-dollar exchange rate, thereby contributing to greater stability of the financial market. Recently, the depreciation of the won and the widening gap in the policy interest rate between Korea and the US have discouraged the influx of foreign investors. Under this circumstance, Korea’s joining the WGBI would bring about economic benefits as it ensures a stable stream of funds. Additionally, if the inclusion in the index enhances credibility in the KTB market, it would help overcome a discount for won-denominated bonds that has forced Korea to pay higher interest costs for KTBs, relative to other economies with a credit rating similar to Korea’s.

Notably, greater capital inflows resulting from index membership would make the KTB market more susceptible to external factors, which requires extra caution. In addition to requirements for the WGBI inclusion, FTSE specifies conditions for the potential exclusion from the index. Accordingly, if the worst event like failure to meet the credit rating requirement takes place, it could trigger foreign capital flight. Given that funds tracking the WGBI tend to prefer long-term investments, capital flight is unlikely to occur under normal conditions. But sensitivity to external conditions could be aggravated across the economy. Furthermore, it is noteworthy that if Korea’s inclusion in the WGBI improves the efficiency of the FX market, it may cut down foreign investors’ opportunities for arbitrage trading and thus, facilitate investing in products linking futures to spot trading, thereby intensifying volatility of the bond market. In this respect, Korea needs to consider expanding the domestic bond investor base and invigorating overseas stock investments as policy measures to mitigate external shocks while preparing for inclusion in the WGBI.

1) In the country-specific weighting in the WGBI as of end-March 2022, the US (40%) accounts for the largest proportion, followed by Japan (17%) and France (8%).

2) The FTSE Russell Fixed Income Country Classification categorizes market accessibility into three levels (0 to 2 level) by evaluating a candidate country’s macroeconomic conditions, the structure of the FX and bond markets and linkage with global depositories.

3) The duration of WGBI members is averaged at about 9.6 years.

4) Details regarding the prediction model will be contained in the report being prepared by the author.

References

Arslanalp, S., Drakopoulos, D., Goel, R., Koepke, R., 2020, Benchmark driven investments in emerging market bond markets: Taking stock, IMF Working Paper 20/192.

Broner, F., Martin, F., Pandolfi, L., Williams, T., 2021, Winners and losers from sovereign debt inflows, Journal of International Economics, 130(103446).

Williams, T., Pandolfi, L., 2017. Capital flows and sovereign debt markets: Evidence from index rebalancing, Institute for International Economics Policy Working Paper Series 2017-11.

[Korean]

Korea Institute of Public Finance, 2021, The 2021 Preliminary Feasibility Study on Preferential Tax Treatments: Introduction of KTB Products for Retail Investors.