Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Japan’s Best Execution Policy: Reform and Implications

Publication date Dec. 06, 2022

Summary

This year the plan of establishing Korea’s first Alternative Trading System (ATS) is underway. The arrival of the ATS is expected to facilitate the progressive evolvement of trading markets. But it is notable that the ATS itself hardly guarantees brisk competition and greater market efficiency.

Japan adopted the Proprietary Trading System (PTS) earlier than Korea but experienced a lack of transactions executed via PTSs for more than 20 years after the new system was introduced. Discriminatory regulations on PTSs may hamper the development of alternative trading venues including the 5% takeover-bid regulation, the ban on auction-based price discovery and restrictions on margin trading. But a greater problem lies in the best order execution criteria prepared by securities firms which has encouraged them to focus on transactions via the traditional exchange. In response, Japan’s Financial Services Agency has come up with the revised Best Execution Policy this year to ensure meaningful competition between trading markets, which is set to come into force in January 2023.

The case of Japan could offer implications for Korea’s trading market that is about to see the emergence of the first ATS. The Best Execution Policy to be devised by each securities firm in preparation for market fragmentation would have a significant impact on the market share of the ATS and competition between trading venues. In this respect, securities firms should design the Best Execution Policy to help enhance services through fair and efficient competition among trading markets and provide benefits to market participants.

Japan adopted the Proprietary Trading System (PTS) earlier than Korea but experienced a lack of transactions executed via PTSs for more than 20 years after the new system was introduced. Discriminatory regulations on PTSs may hamper the development of alternative trading venues including the 5% takeover-bid regulation, the ban on auction-based price discovery and restrictions on margin trading. But a greater problem lies in the best order execution criteria prepared by securities firms which has encouraged them to focus on transactions via the traditional exchange. In response, Japan’s Financial Services Agency has come up with the revised Best Execution Policy this year to ensure meaningful competition between trading markets, which is set to come into force in January 2023.

The case of Japan could offer implications for Korea’s trading market that is about to see the emergence of the first ATS. The Best Execution Policy to be devised by each securities firm in preparation for market fragmentation would have a significant impact on the market share of the ATS and competition between trading venues. In this respect, securities firms should design the Best Execution Policy to help enhance services through fair and efficient competition among trading markets and provide benefits to market participants.

Korea’s alternative trading system set to be established

The official approval process for establishing the Alternative Trading System (ATS) in November 2022 is underway in Korea’s stock market. Trading markets in various forms, excluding a traditional exchange, are commonly called ATSs. Foreign stock markets have already seen several ATSs being actively operated. Korea founded a legal basis for the ATS through the revision to the Financial Investment Services and Capital Markets Act (FSCMA) in August 2013 but the ATS establishment has yet to be realized. The Korea Financial Investment Association and 34 private financial institutions have created Nextrade to push forward the plan of introducing Korea’s first ATS in a decade after the relevant regulation was adopted by Korea.

Multiple trading venues are expected to promote competition between trading markets and bring about a range of innovative services, thereby contributing to market efficiency. However, the ATS itself hardly guarantees positive effects on the market. As is the case with Korea, Japan adhered to the exchange-centered system for a long period and even the introduction of the Proprietary Trading System (PTS)1) scarcely gave rise to meaningful competition within the stock market. In response, Japan’s Financial Services Agency has amended the Best Execution Policy this year to boost competition between trading markets and the amendment is set to take effect in January 2023. Against this backdrop, this article intends to take a close look at Japan’s ATS—introduced earlier than in Korea—and present relevant implications for Korea.

Current state of Japan’s PTSs and market fragmentation

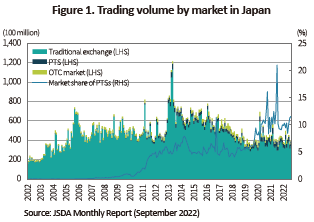

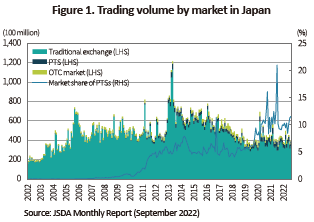

In Japan, stocks are traded on three PTSs including Japannext, Cboe Japan and the Osaka Digital Exchange (ODX) as well as traditional exchanges. In terms of the number of stocks traded, PTSs account for 11.6% of the stock market as of August 2022. Notably, only three PTSs are being operated and it has been only a few months since the ODX, founded in June 2022, started offering its service. Nonetheless, PTSs have gradually taken hold in Japan’s market, representing a significant proportion of the total trading volume.

As illustrated in Figure 1, PTSs have achieved rapid growth since 2020. Stock trading on the Tokyo Stock Exchange was suspended throughout the day due to a system failure in October 2020, which spurred PTSs to emerge as a practical alternative market.2) Another contributor to the rise of PTSs is margin trading adopted in 2019.

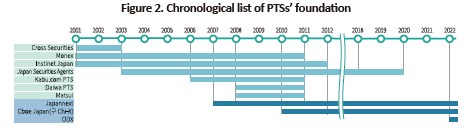

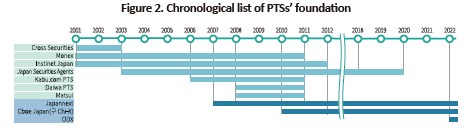

After showing poor performance for about 20 years since their foundation was approved, PTSs have only recently been on a growth trajectory in terms of market share. Japan removed the requirement of exchange-centered order execution in 1998 and then introduced the PTS licensing system. However, PTSs failed to gain a market share of over 1% even in the early 2010s, a decade after the system was adopted. When the 5% takeover-bid regulation was exempted in 2012, their market share soared to around 5% but for the next ten years, remained within the range of 5% without significant changes. In the meantime, a number of PTSs created in the 2000s—including Cross Securities, Monex, Instinet, Japan Securities Agents, Kabu.com, Daiwa, and Matsui—fell into a business slump and were forced to close their operation in the early 2010s.

Factors behind sluggish trading via PTSs: Importance of the Best Execution Policy

In 2005, Japan’s FSA permitted PTSs to opt for auction-based price discovery by revising the Financial Instruments and Exchange Law. It also required financial instrument traders (or securities firms) to prepare and publish a policy to execute transactions on the best terms and conditions (referred to as the “Best Execution Policy”) to deliver the most desirable transactions to customers (Article 40-2 of the Financial Instruments and Exchange Law).

Financial instrument traders are obliged to execute orders with the best terms by taking into account various factors including costs, speed and feasibility of transactions as well as price. No best execution practice commonly applies to both investors and financial instrument traders. Accordingly, the traders can set up specific execution measures at their discretion to serve customers’ best interests. They have no duty of comparing trading terms of all markets to attain the best results but can select one or more trading venues according to their own set of criteria. If a trading venue is selected on reasonable grounds, the choice is deemed the best execution. In this respect, they need to disclose the reasoning behind such selection and are subject to periodic assessment regarding the validity of the market selection.

In the initial phase, the Japan Securities Dealers Association (JSDA) came up with the guideline for the Best Execution Policy to take the burden off securities firms. The JSDA guideline deemed the best execution duty to be observed even if transactions via the traditional exchange took priority over those via the PTS.3) Considering liquidity and the possibility and speed of order execution, the JSDA concluded that executing orders via a regular exchange would deliver better results than using alternatives including the PTS. Back then, PTSs garnered a mere less than 0.1 percent of market share, which could justify the JSDA’s decision of encouraging securities firms to focus on exchange-based transactions.

Once securities firms devise their action plan for the best execution, the FSA determines whether orders executed by the plan have led to the most advantageous consequences through qualitative assessment. Securities firms burdened with such assessment have established the Best Execution Policy in an effort to save themselves the trouble of the FSA’s inspection and focus on transactions via exchanges in compliance with the JSDA guideline.

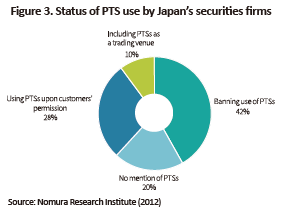

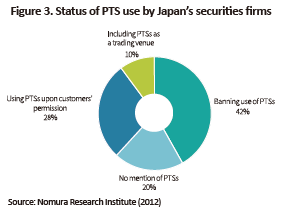

In 2012, Nomura Research Institute conducted a survey on Japan’s top 40 securities firms regarding the Best Execution Policy selected by them. The survey found that around 60% of the firms implemented their Best Execution Policy designed for executing transactions exclusively on the exchange.4) To be more specific, 42% of the 40 securities firms prohibited the execution of orders through a PTS, and 20% hardly offered the option of using a PTS. About 28% of the surveyed had a rule of routing orders to a PTS only if it was permitted by customers in advance. Among them, only 10% allowed the use of PTSs with no strings attached.

This resulted in lackluster competition as transactions flooded into traditional exchanges like before. This practice became entrenched even after the market share of PTSs increased to more than 5%, which continued well into the 2010s.

The reform of the Best Execution Policy by Japan

As a response to the lack of competition between trading markets, the FSA reexamined the Best Execution Policy in 2020 to strengthen investor protection and enhance transparency. In December 2020, it formed a task force to review the “regulation on the Best Execution Policy of financial instrument traders”. Building upon the examination results, the financial system deliberation council released the “task force report on optimal measures for ensuring the best execution” in June 2021. According to the report, several securities firms adopted the Best Execution Policy aimed at prioritizing order execution via the exchange, thereby hampering the competition-driven improvement. In this context, the report recommended the review and revision of the Best Execution Policy.

The FSA accepted the report’s opinion and published the Cabinet Order for revision to the enforcement decree of the Financial Instruments and Exchange Law on May 18, 2022 after taking into consideration amendments to the Best Execution Policy. The revision covers two key aspects of the Best Execution Policy as follows.

First, securities firms should take a price-oriented approach to orders from retail investors when devising the Best Execution Policy. Unlike institutional investors, retail investors tend to place orders in a small volume and usually give top priority to price. Thus, it is advised that the firms apply the price-oriented Best Execution Policy to retail investors. If other factors come into play, an additional explanation of the purpose and reasons should be provided. To comply with the price-oriented Best Execution Policy, securities firms ought to compare quotes and transaction costs offered by PTSs as well as traditional exchanges. With the revision put in place, it is no longer possible to consider an exchange as the only option unless customers request otherwise.

Second, if the Smart Order Routing (SOR) is used, the revision makes it mandatory to add the purpose and principles of SOR-based order execution to matters to be contained in the Best Execution Policy to ensure better transparency. The SOR is an automated system that routes orders to the trading venue with the best terms after comparing conditions offered by each venue. How a securities firm designs the SOR determines the quality of order execution. If a SOR is designed to regard a certain market as the only trading venue, transactions may not be conducted on the best terms and conditions. If a SOR prioritizes a trading venue affiliated with or in favor of a securities firm when routing orders, this could give rise to a conflict of interest with customers. As a fix to this problem, the revised order execution policy should specify matters, including the scope of trading markets covered by the SOR, principles of order execution, how to handle orders with the same terms offered by multiple trading venues, and the reason for adopting the policy, to help investors understand better. The revised Best Execution Policy will come into force in January 2023.

Implications

As the FSCMA prescribes that securities firms prepare the best execution criteria to meet their best execution obligation, securities firms are obliged to execute transactions to serve customers’ best interests. However, the FSCMA sets forth the best execution obligation as a declaratory provision, rather than presenting specific criteria. Therefore, securities firms should devise explicit action plans for the best execution criteria in order to handle customers’ orders on the best terms.

As shown in the case of Japan, the Best Execution Policy to be prepared by each securities firm would have a significant impact on the market share of ATSs and competition between trading venues. Some firms would prefer using only the Korea Exchange (KRX) for the smooth handling of transactions and lower costs, as they have been before. In this case, most transactions are likely to be executed through the KRX. On the other hand, large securities firms that have taken part in the establishment of the domestic ATS are motivated to actively use the ATS and thus, may put priority on the ATS when preparing the Best Execution Policy.

The following guideline is needed to relieve the burden of preparing and implementing the Best Execution Policy and create the environment for promoting fair competition between trading markets.

First, the aggregate cost should be a top priority when executing transactions for retail investors on the best terms. In Korea, retail investors make up a considerable proportion in the market and actively engage in trading. To guarantee the best execution for retail investors’ trading, it would be desirable to rely on direct costs such as quotes and fees, rather than on a combination of multiple factors including the speed of execution, market shocks and the possibility of order execution.

Second, trading by institutional investors should be allowed to consider a range of factors per their request. Depending on transaction types, the purpose of trading by institutional investors varies from minimizing market shocks and accelerating order execution to executing the entire orders. Accordingly, it is important not to set a boundary for trading venues to serve various purposes of institutional investors.

Third, each exchange should disclose the Best Execution Policy to investors and provide a detailed explanation of the use of the SOR and SOR-based order execution principles. The ownership of the KRX is partially held by securities firms, and several securities firms have a stake in the ATS. This suggests the Best Execution Policy should be disclosed transparently to prevent different interests between the KRX, the ATS and securities firms from influencing the best execution.

Korea’s first ATS is scheduled to commence operation in 2024. Thorough preparation is required to improve the services of trading venues through fair competition and benefit all market participants.

1) The PTS refers to the ATS adopted by Japan.

2) PRTIMES, 2022. 8. 12, ジャパンネクスト証券 × 大阪デジタルエクスチェンジ PTSウェビナー『市場インフラの一翼を担うPTS —基本的な役割と今後のビジネス展開について—』 を開催.

3) Mitsuhiro Tsunoda, 2012, Are Best Execution Policies Serving customers' Best Interests?, Nomura Research Institute.

4)Mitsuhiro Tsunoda (2012)

The official approval process for establishing the Alternative Trading System (ATS) in November 2022 is underway in Korea’s stock market. Trading markets in various forms, excluding a traditional exchange, are commonly called ATSs. Foreign stock markets have already seen several ATSs being actively operated. Korea founded a legal basis for the ATS through the revision to the Financial Investment Services and Capital Markets Act (FSCMA) in August 2013 but the ATS establishment has yet to be realized. The Korea Financial Investment Association and 34 private financial institutions have created Nextrade to push forward the plan of introducing Korea’s first ATS in a decade after the relevant regulation was adopted by Korea.

Multiple trading venues are expected to promote competition between trading markets and bring about a range of innovative services, thereby contributing to market efficiency. However, the ATS itself hardly guarantees positive effects on the market. As is the case with Korea, Japan adhered to the exchange-centered system for a long period and even the introduction of the Proprietary Trading System (PTS)1) scarcely gave rise to meaningful competition within the stock market. In response, Japan’s Financial Services Agency has amended the Best Execution Policy this year to boost competition between trading markets and the amendment is set to take effect in January 2023. Against this backdrop, this article intends to take a close look at Japan’s ATS—introduced earlier than in Korea—and present relevant implications for Korea.

Current state of Japan’s PTSs and market fragmentation

In Japan, stocks are traded on three PTSs including Japannext, Cboe Japan and the Osaka Digital Exchange (ODX) as well as traditional exchanges. In terms of the number of stocks traded, PTSs account for 11.6% of the stock market as of August 2022. Notably, only three PTSs are being operated and it has been only a few months since the ODX, founded in June 2022, started offering its service. Nonetheless, PTSs have gradually taken hold in Japan’s market, representing a significant proportion of the total trading volume.

Factors behind sluggish trading via PTSs: Importance of the Best Execution Policy

In 2005, Japan’s FSA permitted PTSs to opt for auction-based price discovery by revising the Financial Instruments and Exchange Law. It also required financial instrument traders (or securities firms) to prepare and publish a policy to execute transactions on the best terms and conditions (referred to as the “Best Execution Policy”) to deliver the most desirable transactions to customers (Article 40-2 of the Financial Instruments and Exchange Law).

Financial instrument traders are obliged to execute orders with the best terms by taking into account various factors including costs, speed and feasibility of transactions as well as price. No best execution practice commonly applies to both investors and financial instrument traders. Accordingly, the traders can set up specific execution measures at their discretion to serve customers’ best interests. They have no duty of comparing trading terms of all markets to attain the best results but can select one or more trading venues according to their own set of criteria. If a trading venue is selected on reasonable grounds, the choice is deemed the best execution. In this respect, they need to disclose the reasoning behind such selection and are subject to periodic assessment regarding the validity of the market selection.

In the initial phase, the Japan Securities Dealers Association (JSDA) came up with the guideline for the Best Execution Policy to take the burden off securities firms. The JSDA guideline deemed the best execution duty to be observed even if transactions via the traditional exchange took priority over those via the PTS.3) Considering liquidity and the possibility and speed of order execution, the JSDA concluded that executing orders via a regular exchange would deliver better results than using alternatives including the PTS. Back then, PTSs garnered a mere less than 0.1 percent of market share, which could justify the JSDA’s decision of encouraging securities firms to focus on exchange-based transactions.

Once securities firms devise their action plan for the best execution, the FSA determines whether orders executed by the plan have led to the most advantageous consequences through qualitative assessment. Securities firms burdened with such assessment have established the Best Execution Policy in an effort to save themselves the trouble of the FSA’s inspection and focus on transactions via exchanges in compliance with the JSDA guideline.

This resulted in lackluster competition as transactions flooded into traditional exchanges like before. This practice became entrenched even after the market share of PTSs increased to more than 5%, which continued well into the 2010s.

The reform of the Best Execution Policy by Japan

As a response to the lack of competition between trading markets, the FSA reexamined the Best Execution Policy in 2020 to strengthen investor protection and enhance transparency. In December 2020, it formed a task force to review the “regulation on the Best Execution Policy of financial instrument traders”. Building upon the examination results, the financial system deliberation council released the “task force report on optimal measures for ensuring the best execution” in June 2021. According to the report, several securities firms adopted the Best Execution Policy aimed at prioritizing order execution via the exchange, thereby hampering the competition-driven improvement. In this context, the report recommended the review and revision of the Best Execution Policy.

The FSA accepted the report’s opinion and published the Cabinet Order for revision to the enforcement decree of the Financial Instruments and Exchange Law on May 18, 2022 after taking into consideration amendments to the Best Execution Policy. The revision covers two key aspects of the Best Execution Policy as follows.

First, securities firms should take a price-oriented approach to orders from retail investors when devising the Best Execution Policy. Unlike institutional investors, retail investors tend to place orders in a small volume and usually give top priority to price. Thus, it is advised that the firms apply the price-oriented Best Execution Policy to retail investors. If other factors come into play, an additional explanation of the purpose and reasons should be provided. To comply with the price-oriented Best Execution Policy, securities firms ought to compare quotes and transaction costs offered by PTSs as well as traditional exchanges. With the revision put in place, it is no longer possible to consider an exchange as the only option unless customers request otherwise.

Second, if the Smart Order Routing (SOR) is used, the revision makes it mandatory to add the purpose and principles of SOR-based order execution to matters to be contained in the Best Execution Policy to ensure better transparency. The SOR is an automated system that routes orders to the trading venue with the best terms after comparing conditions offered by each venue. How a securities firm designs the SOR determines the quality of order execution. If a SOR is designed to regard a certain market as the only trading venue, transactions may not be conducted on the best terms and conditions. If a SOR prioritizes a trading venue affiliated with or in favor of a securities firm when routing orders, this could give rise to a conflict of interest with customers. As a fix to this problem, the revised order execution policy should specify matters, including the scope of trading markets covered by the SOR, principles of order execution, how to handle orders with the same terms offered by multiple trading venues, and the reason for adopting the policy, to help investors understand better. The revised Best Execution Policy will come into force in January 2023.

Implications

As the FSCMA prescribes that securities firms prepare the best execution criteria to meet their best execution obligation, securities firms are obliged to execute transactions to serve customers’ best interests. However, the FSCMA sets forth the best execution obligation as a declaratory provision, rather than presenting specific criteria. Therefore, securities firms should devise explicit action plans for the best execution criteria in order to handle customers’ orders on the best terms.

As shown in the case of Japan, the Best Execution Policy to be prepared by each securities firm would have a significant impact on the market share of ATSs and competition between trading venues. Some firms would prefer using only the Korea Exchange (KRX) for the smooth handling of transactions and lower costs, as they have been before. In this case, most transactions are likely to be executed through the KRX. On the other hand, large securities firms that have taken part in the establishment of the domestic ATS are motivated to actively use the ATS and thus, may put priority on the ATS when preparing the Best Execution Policy.

The following guideline is needed to relieve the burden of preparing and implementing the Best Execution Policy and create the environment for promoting fair competition between trading markets.

First, the aggregate cost should be a top priority when executing transactions for retail investors on the best terms. In Korea, retail investors make up a considerable proportion in the market and actively engage in trading. To guarantee the best execution for retail investors’ trading, it would be desirable to rely on direct costs such as quotes and fees, rather than on a combination of multiple factors including the speed of execution, market shocks and the possibility of order execution.

Second, trading by institutional investors should be allowed to consider a range of factors per their request. Depending on transaction types, the purpose of trading by institutional investors varies from minimizing market shocks and accelerating order execution to executing the entire orders. Accordingly, it is important not to set a boundary for trading venues to serve various purposes of institutional investors.

Third, each exchange should disclose the Best Execution Policy to investors and provide a detailed explanation of the use of the SOR and SOR-based order execution principles. The ownership of the KRX is partially held by securities firms, and several securities firms have a stake in the ATS. This suggests the Best Execution Policy should be disclosed transparently to prevent different interests between the KRX, the ATS and securities firms from influencing the best execution.

Korea’s first ATS is scheduled to commence operation in 2024. Thorough preparation is required to improve the services of trading venues through fair competition and benefit all market participants.

1) The PTS refers to the ATS adopted by Japan.

2) PRTIMES, 2022. 8. 12, ジャパンネクスト証券 × 大阪デジタルエクスチェンジ PTSウェビナー『市場インフラの一翼を担うPTS —基本的な役割と今後のビジネス展開について—』 を開催.

3) Mitsuhiro Tsunoda, 2012, Are Best Execution Policies Serving customers' Best Interests?, Nomura Research Institute.

4)Mitsuhiro Tsunoda (2012)