Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

The Usefulness of ESG Disclosure based on Financial Materiality

Publication date Feb. 21, 2023

Summary

Amid soaring energy prices and higher inflation and interest rates, the anti-ESG movement opposing normative ESG activities has gathered the market’s attention and support in the United States. As corporate ESG strategies are expected to take concrete shape, it is also necessary for Korea to prepare for potential conflicts among stakeholders depending on ESG agenda.

A comprehensive look at the value relevance of ESG activities for Korean firms reveals that only ESG activities with a strong relation to financial materiality guarantee future high stock returns. ESG activities rarely related to financial materiality are not only discouraged under the existing legal framework which aims to protect shareholder interest but are also difficult to gain consistent support from key stakeholders. Therefore, companies need to focus on ESG activities that are financially material. And the ESG disclosure system, which is to be phased in as a mandatory scheme starting from 2025, needs to identify and report financially material risks and opportunities that affect corporate value. Based on the system, it is necessary to promote a virtuous circle where improvement and disclosure of ESG performance serve as the source of sustainable financing.

A comprehensive look at the value relevance of ESG activities for Korean firms reveals that only ESG activities with a strong relation to financial materiality guarantee future high stock returns. ESG activities rarely related to financial materiality are not only discouraged under the existing legal framework which aims to protect shareholder interest but are also difficult to gain consistent support from key stakeholders. Therefore, companies need to focus on ESG activities that are financially material. And the ESG disclosure system, which is to be phased in as a mandatory scheme starting from 2025, needs to identify and report financially material risks and opportunities that affect corporate value. Based on the system, it is necessary to promote a virtuous circle where improvement and disclosure of ESG performance serve as the source of sustainable financing.

Controversy around the anti-ESG movement in the US

Over the past decade, there has been a growing awareness of stakeholders about corporate ESG activities and sustainability. In particular, global asset management firms including BlackRock and Vanguard started reflecting ESG performance in their investment decisions in the late 2010s, which has helped the corporate ESG movement gain momentum (Welch & Yoon, 2022).

However, recently in the US, there has been an increasing trend of anti-ESG shareholder proposals opposing normative ESG activities (Sullivan & Cromwell LLP, August 2, 2022). Amid supply chain disruptions and higher inflation and interest rates, anti-ESG proponents call into question whether sustainability can be boosted by allocating scarce resources to animal welfare improvement and social contribution activities (Skulski et al., October 3, 2022). In addition, disagreements between shareholders are growing deeper as to whether the elimination of fossil fuels is in their best interests in the face of a spike in energy prices and limited alternative options (Rosati et al., October 23, 2022).1)

The anti-ESG controversy in the US offers significant implications for Korea’s companies, most of which are in the stage of setting the ESG management direction.2) In Korea’s capital markets, a growing number of investors, especially institutional investors become increasingly involved in the entire ESG landscape (Korea Institute of Corporate Governance and Sustainability, June 28, 2021). This suggests that as corporate ESG strategies take concrete shape, discord between shareholders could also raise a contentious issue in Korea. Against this backdrop, this article intends to discuss the need for financial materiality-based ESG activities and their disclosure as a way of resolving the anti-ESG controversy.

Improvement effects of ESG performance based on Financial Materiality

If a company focuses on sustainable activities as a member of the social community and generates environmentally and socially meaningful outcomes, it in itself strengthens corporate value as a going concern. This justifies the relevance between ESG performance and enterprise value. For a long time, however, various research papers have presented conflicting results on the relationship between ESG performance and corporate financial performance or enterprise value (Waddock & Graves, 1997; Zhao & Murrell, 2016). In the case of Korea, research papers have hardly demonstrated whether investment decisions made by financial market participants, as well as purchase decisions made in the commodity and service market, systematically reflect corporate ESG performance (Kim et al., 2022).

According to Lee et al. (2022), previous research failed to find a coherent relation between ESG performance and enterprise value, mainly because ESG performance improvements deviated from critical channels for value creation. A company that performs well in terms of ESG is likely to be a good company per se. But an analysis of various channels finds that it remains uncertain whether improvements in ESG performance guarantee a company to be good. In this respect, Lee et al. (2022) empirically prove that a company that enhances ESG performance with a focus on financially material activities tends to gain long-term abnormal returns and sustain higher ESG performance. Building upon such empirical results, the research consolidates incoherent discussions about how ESG activities are associated with enterprise value, and sheds new light on their relevance from the perspective of financial materiality.

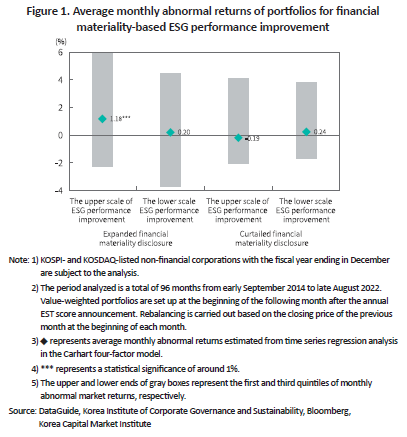

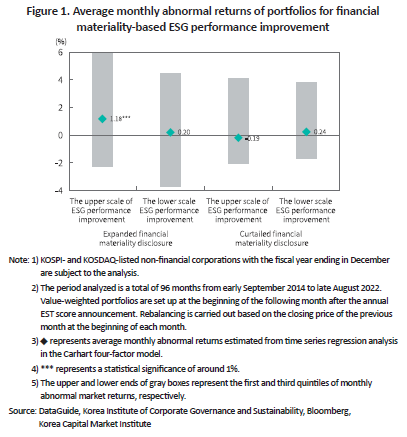

More concretely, the effect of ESG performance improvements driving up future stock returns is apparent only in the group that is better at ESG performance improvement and expands financial materiality disclosure, representing 1.18% on a monthly average basis (Figure 1). This analysis suggests that ESG activities of financial importance are more sustainable as they are deeply linked to long-term value creation. It also implies that capital markets systematically reflect high value relevance of financially material ESG activities in security prices.

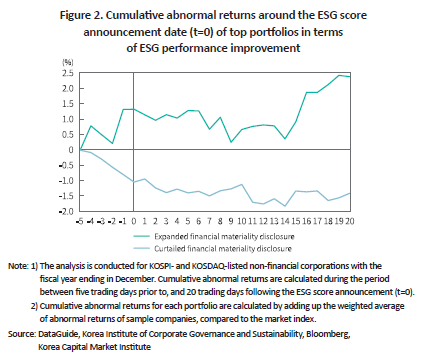

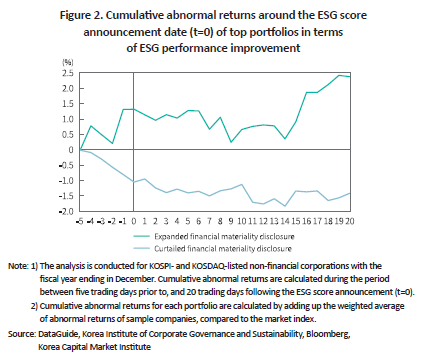

Although financial materiality-based ESG performance is found to have driven up future stock returns, market participants tend to underestimate the effect in the short term. As Figure 2 illustrates cumulative abnormal returns of the top group with highly improved ESG scores, greater disclosure for financial materiality results in the final return of 2.41% (after the lapse of 20 trading days), exhibiting a gradual upward pattern of returns throughout the period analyzed. But when financial materiality disclosure is reduced, the final return declines to -1.41% (after the lapse of 20 trading days) and returns reveal a constant downward pattern.

Policy implications

These findings offer significant implications not only for managers who eager to improve their corporate value through enhancing ESG performance, but also for policymakers who aim to alleviate the “Korea discount” referring to a tendency for Korean companies to have lower valuations in global capital markets. First of all, companies need to conduct financially material ESG activities. ESG practices that hardly bring about long-term financial performance are not only constrained under the current legal system designed to protect shareholder interest, but also difficult to gain continuous support from key stakeholders.

Secondly, since market participants may not fully understand the value relevance of financially material ESG activities in a timely manner, it is essential to clearly inform investors of the financial materiality of ESG activities through disclosure. Although the performance of financially material ESG activities seems to be more comparable than non-financial performance, investors show a tendency of underreacting at least in the short term. This raises the need for tackling evaluation mechanisms in the market. The disclosure regulation for ESG information, set to be phased in as a mandatory scheme starting from 2025, should establish a system of identifying and reporting financially material risks and opportunities that affect corporate value. Based on this, it is necessary to expedite a virtuous circle in which improvement and disclosure of ESG performance serve as the source of sustainable financing.

1) Over the past two years, 18 states in the US exercised legislative power to suspend transactions with financial institutions that excluded certain local industries from investment targets. This has helped expand the conflict over the legitimacy of ESG activities into the public sector (Meager, October 3, 2022).

2) A total of 654 agenda items were submitted to ESG committees of Korea’s top 30 companies from January 2021 to June 2022. Among them, approval for insider trading and transactions involving a related party took first place with 137 submissions and establishing the strategy and plan for setting the ESG management direction ranked second with 90 submissions (the Federation of Korean Industries, September 20, 2022).

References

Meager, E., 2022. 10. 3, Mapped: The polarisation of ESG in the US.

Rosati, B., Moote, K., Kumar, R., Maiolo, M., 2022. 10. 23, A look back at the 2022 proxy season.

Skulski, T.P., O’Brien, G., Sodali, M., 2022. 10. 3, 2022 Proxy season – Shareholder proposal review.

Sullivan & Cromwell LLP, 2022. 8. 2, 2022 Proxy season review.

Waddock S.A., Graves, S.B., 1997, The corporate social performance-financial performance link, Strategic Management Journal 18(4), 303–319.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies, 1-28.

Zhao, X., Murrell, A.J., 2016, Revisiting the corporate social performance – financial performance link: A replication of waddock and graves, Strategic Management Journal 37(11), 2378-2388.

[Korean]

Kim, S.H.ㆍSeonwu, H.Y.ㆍLee, W.J.ㆍJeong, A.R., 2022, Correlation and Causal Relationship between ESG Activities and Enterprise Value, Korean Accounting Journal 31(3), 31-60.

Lee, S.HㆍLee, I.H.ㆍLee, W.J.ㆍSeonwu, H.Y., 2022, How to Improve Value Relevance of ESG Activities, Korea Capital Market Institute Research Paper 22-04.

The Federation of Korean Industries, September 20, 2022, Analysis of agenda items submitted to ESG committees and relevant implications.

Korea Institute of Corporate Governance and Sustainability, June 28, 2021, Review of general meetings of shareholders (2) – Institutional investors’ involvement as shareholders and expansion of ESG activities.

Over the past decade, there has been a growing awareness of stakeholders about corporate ESG activities and sustainability. In particular, global asset management firms including BlackRock and Vanguard started reflecting ESG performance in their investment decisions in the late 2010s, which has helped the corporate ESG movement gain momentum (Welch & Yoon, 2022).

However, recently in the US, there has been an increasing trend of anti-ESG shareholder proposals opposing normative ESG activities (Sullivan & Cromwell LLP, August 2, 2022). Amid supply chain disruptions and higher inflation and interest rates, anti-ESG proponents call into question whether sustainability can be boosted by allocating scarce resources to animal welfare improvement and social contribution activities (Skulski et al., October 3, 2022). In addition, disagreements between shareholders are growing deeper as to whether the elimination of fossil fuels is in their best interests in the face of a spike in energy prices and limited alternative options (Rosati et al., October 23, 2022).1)

The anti-ESG controversy in the US offers significant implications for Korea’s companies, most of which are in the stage of setting the ESG management direction.2) In Korea’s capital markets, a growing number of investors, especially institutional investors become increasingly involved in the entire ESG landscape (Korea Institute of Corporate Governance and Sustainability, June 28, 2021). This suggests that as corporate ESG strategies take concrete shape, discord between shareholders could also raise a contentious issue in Korea. Against this backdrop, this article intends to discuss the need for financial materiality-based ESG activities and their disclosure as a way of resolving the anti-ESG controversy.

Improvement effects of ESG performance based on Financial Materiality

If a company focuses on sustainable activities as a member of the social community and generates environmentally and socially meaningful outcomes, it in itself strengthens corporate value as a going concern. This justifies the relevance between ESG performance and enterprise value. For a long time, however, various research papers have presented conflicting results on the relationship between ESG performance and corporate financial performance or enterprise value (Waddock & Graves, 1997; Zhao & Murrell, 2016). In the case of Korea, research papers have hardly demonstrated whether investment decisions made by financial market participants, as well as purchase decisions made in the commodity and service market, systematically reflect corporate ESG performance (Kim et al., 2022).

According to Lee et al. (2022), previous research failed to find a coherent relation between ESG performance and enterprise value, mainly because ESG performance improvements deviated from critical channels for value creation. A company that performs well in terms of ESG is likely to be a good company per se. But an analysis of various channels finds that it remains uncertain whether improvements in ESG performance guarantee a company to be good. In this respect, Lee et al. (2022) empirically prove that a company that enhances ESG performance with a focus on financially material activities tends to gain long-term abnormal returns and sustain higher ESG performance. Building upon such empirical results, the research consolidates incoherent discussions about how ESG activities are associated with enterprise value, and sheds new light on their relevance from the perspective of financial materiality.

Policy implications

These findings offer significant implications not only for managers who eager to improve their corporate value through enhancing ESG performance, but also for policymakers who aim to alleviate the “Korea discount” referring to a tendency for Korean companies to have lower valuations in global capital markets. First of all, companies need to conduct financially material ESG activities. ESG practices that hardly bring about long-term financial performance are not only constrained under the current legal system designed to protect shareholder interest, but also difficult to gain continuous support from key stakeholders.

Secondly, since market participants may not fully understand the value relevance of financially material ESG activities in a timely manner, it is essential to clearly inform investors of the financial materiality of ESG activities through disclosure. Although the performance of financially material ESG activities seems to be more comparable than non-financial performance, investors show a tendency of underreacting at least in the short term. This raises the need for tackling evaluation mechanisms in the market. The disclosure regulation for ESG information, set to be phased in as a mandatory scheme starting from 2025, should establish a system of identifying and reporting financially material risks and opportunities that affect corporate value. Based on this, it is necessary to expedite a virtuous circle in which improvement and disclosure of ESG performance serve as the source of sustainable financing.

1) Over the past two years, 18 states in the US exercised legislative power to suspend transactions with financial institutions that excluded certain local industries from investment targets. This has helped expand the conflict over the legitimacy of ESG activities into the public sector (Meager, October 3, 2022).

2) A total of 654 agenda items were submitted to ESG committees of Korea’s top 30 companies from January 2021 to June 2022. Among them, approval for insider trading and transactions involving a related party took first place with 137 submissions and establishing the strategy and plan for setting the ESG management direction ranked second with 90 submissions (the Federation of Korean Industries, September 20, 2022).

References

Meager, E., 2022. 10. 3, Mapped: The polarisation of ESG in the US.

Rosati, B., Moote, K., Kumar, R., Maiolo, M., 2022. 10. 23, A look back at the 2022 proxy season.

Skulski, T.P., O’Brien, G., Sodali, M., 2022. 10. 3, 2022 Proxy season – Shareholder proposal review.

Sullivan & Cromwell LLP, 2022. 8. 2, 2022 Proxy season review.

Waddock S.A., Graves, S.B., 1997, The corporate social performance-financial performance link, Strategic Management Journal 18(4), 303–319.

Welch, K., Yoon, A., 2022, Do high-ability managers choose ESG projects that create shareholder value? Evidence from employee opinions, Review of Accounting Studies, 1-28.

Zhao, X., Murrell, A.J., 2016, Revisiting the corporate social performance – financial performance link: A replication of waddock and graves, Strategic Management Journal 37(11), 2378-2388.

[Korean]

Kim, S.H.ㆍSeonwu, H.Y.ㆍLee, W.J.ㆍJeong, A.R., 2022, Correlation and Causal Relationship between ESG Activities and Enterprise Value, Korean Accounting Journal 31(3), 31-60.

Lee, S.HㆍLee, I.H.ㆍLee, W.J.ㆍSeonwu, H.Y., 2022, How to Improve Value Relevance of ESG Activities, Korea Capital Market Institute Research Paper 22-04.

The Federation of Korean Industries, September 20, 2022, Analysis of agenda items submitted to ESG committees and relevant implications.

Korea Institute of Corporate Governance and Sustainability, June 28, 2021, Review of general meetings of shareholders (2) – Institutional investors’ involvement as shareholders and expansion of ESG activities.