Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Potential for Growth of Active ETFs in Korea and Future Challenges

Publication date Mar. 07, 2023

Summary

An active exchange-traded fund (ETF) that pursues alpha compared to benchmark indices shows continuous growth. The number of active ETFs listed in Korea exceeded 100 last year and a wide range of products are now coming to the market. Since they are still in the early stage in terms of asset size, it is hard to predict whether active ETFs will achieve further growth.

As benchmark indices become more diverse, the boundary between passive and active ETFs has been increasingly blurred, which could put constraints on the proliferation of active ETFs. Considering that the advantages of active ETFs become less outstanding compared to passive ETFs, the key to invigorating active ETFs lies in strong investment performance. In a recent analysis of returns on active ETFs listed in Korea, they are found to have generated significant alpha, which is evaluated positively.

The existing regulatory regime should be reformed to give greater autonomy to fund managers to ensure that a wider range of active ETFs are launched and can contribute to the mutual fund market. If this happens, measures to minimize adverse effects from ETFs’ reduced transparency must be a prerequisite. In the long run, it is worth considering creating a system where retail investors can understand and compare various ETF products. Above all, investors also need to focus more on the long-term performance of active ETFs rather than short-term returns.

As benchmark indices become more diverse, the boundary between passive and active ETFs has been increasingly blurred, which could put constraints on the proliferation of active ETFs. Considering that the advantages of active ETFs become less outstanding compared to passive ETFs, the key to invigorating active ETFs lies in strong investment performance. In a recent analysis of returns on active ETFs listed in Korea, they are found to have generated significant alpha, which is evaluated positively.

The existing regulatory regime should be reformed to give greater autonomy to fund managers to ensure that a wider range of active ETFs are launched and can contribute to the mutual fund market. If this happens, measures to minimize adverse effects from ETFs’ reduced transparency must be a prerequisite. In the long run, it is worth considering creating a system where retail investors can understand and compare various ETF products. Above all, investors also need to focus more on the long-term performance of active ETFs rather than short-term returns.

Growth of active ETFs

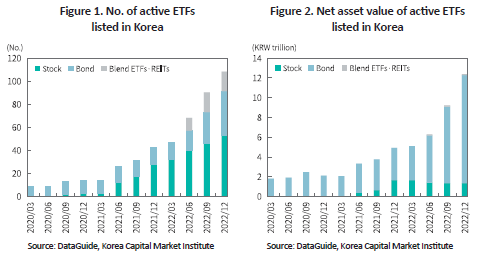

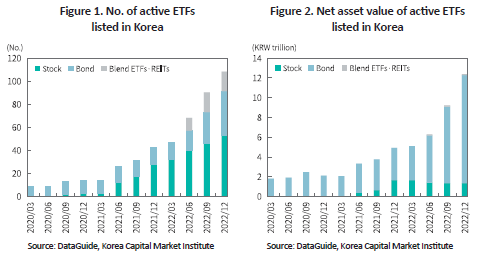

An active ETF is a type of exchange-traded fund that aims to achieve alpha compared to benchmark, rather than utilizing a typical passive management strategy. Korea’s ETF market has seen steady growth in active ETFs. A total of 66 active ETFs were newly listed on the exchange last year and their number increased to more than 100 as of the end of 2022 from less than 20 two years ago (Figure 1). Since the scope of active ETFs was extended to equity-type products in July 2020, the launch of active equity ETFs has gained momentum. More recently, various active ETFs have emerged, such as products that manage global assets, a mix of stocks and bonds (ex. TDF), and REITs. With a wide range of listed active ETFs and the expansion of the ETF market, alpha-seeking investors are likely to move into the ETF market.

As illustrated in Figure 1 and Figure 2, the rise of active equity ETFs has been outstanding in terms of the number of products, despite being in the early stage. Figure 2 reveals that active ETFs amount to KRW 12.4 trillion in net assets as of the end of 2022, of which active bond ETFs represent around KRW 11 trillion. In the total bond ETF market, active products constitute nearly half of the total bond ETFs. On the other hand, active equity ETFs are responsible for only 2% of total equity ETFs, a tiny share compared to passive equity ETFs. This can be attributable to macroeconomic factors including a smaller selection of bond ETFs and a decline in risky asset prices. It should also be noted that passive equity ETFs account for a greater share relative to their active counterparts. The net asset value of active ETFs averages KRW 25.7 billion while passive ETFs reach KRW 123.5 billion in net assets, suggesting that passive ETFs outpace active ones in terms of individual fund size.1) But the AUM of active ETFs—still in the infancy—is likely to grow further depending on future returns, partly because an ETF is a preferred investment vehicle in Korea.

As the role of ETFs as an indirect investment vehicle for domestic households becomes increasingly important amid the slump of general mutual funds and the continued growth of ETFs, it is now necessary to discuss the stable establishment of active ETFs.

Potential for growth of active ETFs in Korea

Compared with a passive ETF tracking a specific index, the biggest advantage of an active ETF is that it can pursue relatively aggressive management strategies. Despite some limitations in asset management under the current regulatory framework, active ETFs can deliver excess returns above a benchmark by selecting a specific investment strategy and portfolio constituents. As they are listed on the exchange unlike mutual funds, active ETFs are easily traded on the exchange and entail no sales commissions, and the price risk that arises from fund redemption periods can be minimized. An active ETF is an indirect investment vehicle that can gain excess returns at a cost lower than that charged by mutual funds, as long as it delivers considerable performance.

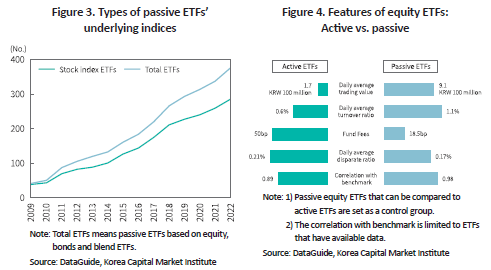

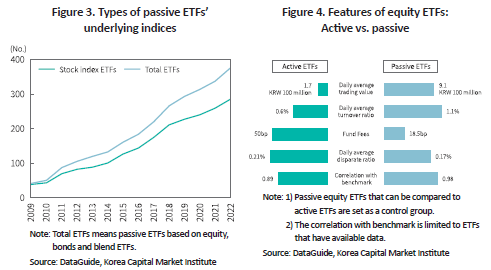

Still, there are constraints on the growth of active ETFs. In addition to a number of active ETFs, a wide range of passive ETFs have been currently listed. As shown in Figure 3, there are more than 280 underlying indices for stock index ETFs in Korea as of the end of 2022 and if bonds and blend ETFs are added, the number of separate underlying indices is ever-growing, reaching as high as 373. Accordingly, passive ETFs are increasingly specialized into sector-based, smart-beta and thematic types. In an analysis of the US-listed ETFs, passive ETFs, depending on the design of their underlying index, have turned into actively managed investment vehicles that can generate alpha (Easley et al., 2021). According to the survey conducted by the Index Industry Association (IIA), there are more than 3.3 million stock indices globally, almost 70 times more than the number of listed stocks.2) This suggests that passive ETFs taking on the same role as active products are expected to steadily emerge going forward, which could restrain active ETFs from thriving further.

Although active ETFs can be regarded as (active) mutual funds having advantages of ETFs, they have different features from passive ETFs. A comparative analysis of equity ETFs listed in Korea reveals that active ETFs are characterized by relatively low liquidity, high fees and low price stability (Figure 4). While passive ETFs have a high trading turnover ratio and great liquidity due to short-term arbitrage trading and other transactions linked to the benchmark index, active ETFs have less trading activity outside of transactions by authorized participants (APs) and retail investors. For these reasons, active ETFs show relatively larger deviations between market prices and the net asset value (NAV). With a lower correlation with the benchmark, they could also be affected by other idiosyncratic factors. Above all, active ETFs require a certain level of management expertise beyond simply tracking the benchmark, resulting in relatively higher fees compared to passive ETFs.

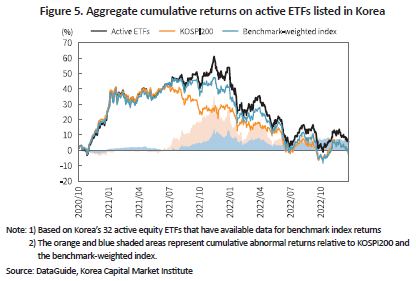

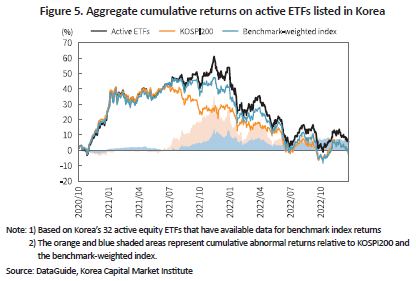

The benefits generally expected from ETF investing seem less noticeable in active ETFs. But one thing that can make up for all the limitations of active ETFs is high profitability. Figure 5 represents the aggregate cumulative returns of active ETFs listed in Korea that invest in Korean stocks.3) The weighted average return of each active ETF at each point in time is calculated from returns on active ETFs based on net asset value. The black solid line in Figure 5 exceeds KOSPI200 by +8.6% and the benchmarked-weighted index4) by +7.5%. This translates into annual cumulative returns between +3.3% and +3.7%, which is remarkable performance considering the operational constraints of domestic active ETFs. But it seems to take more time to predict long-term performance as most active ETFs have a short track record. Future improvements in regulations may lead to the emergence of products having different risk-return patterns. But above all, the key to invigorating active ETFs lies in excess performance and sustainability.

Future challenges

Boosting the growth of active ETFs has been considered a way of revitalizing the stagnant mutual fund market. However, given that active ETFs are quite different from passive ETFs, careful consideration is required and a feasible approach must be sought.

In the short run, there is a need to improve the regulatory framework for the operation of active ETFs, aiming for encouraging fund managers to voluntarily exert their competence. Under the current regulatory framework, active ETFs should maintain a correlation coefficient with underlying indices at 0.7 or higher and disclose the portfolio composition on a daily basis. While transparency is a critical factor in ETFs, daily disclosure can limit the entry of an ETF that utilizes various investment strategies. In the US and Europe, in addition to transparency-based active ETFs like those in Korea, non-transparent or semi-transparent ETFs that can delay the disclosure of asset portfolios are also permitted. Given these circumstances, the regulation for portfolio disclosure should be relieved to create a competitive ETF market environment. Furthermore, the correlation coefficient with underlying indices may be an essential requirement for stable returns and diversified investment. If the correlation coefficient criteria are too strict, however, active ETFs would end up being constrained by initial benchmark indices and fund managers could not use their own discretion. The US Securities and Exchange Commission (SEC) has no separate regulations but only requires active ETFs to clarify their intended correlation coefficient in the ETF prospectus. In this respect, it is worth considering alleviating active ETFs delisting criteria regarding the correlation coefficient.

Such reform designed for relaxed transparency requirements presupposes accurate evaluation of active ETFs’ asset holdings and measures to prevent the abuse of non-transparent information. As non-transparent or semi-transparent ETFs rarely disclose portfolio assets daily, it is of great importance to guarantee that market prices accurately reflect the value of underlying assets. For this reason, asset management companies should archive active ETF data including daily or intra-day price spreads or net asset value and conduct periodic disclosure. If necessary, the exchange and regulatory authorities should build a monitoring system for such data. In the case of ETFs whose portfolio assets are not disclosed, an internal control system should be put in place to prevent the abuse of such confidential information.

In the long run, it is necessary to facilitate a platform that allows for effective comparison of various ETFs, and investors should acquire knowledge to get a better understanding of investment vehicles through continuous learning. In the past when the types of products were simple and limited, it was sufficient to make an investment only by holding broad-market index ETFs. Currently, however, numerous ETFs are now being launched and they attempt to generate alpha by employing various kinds of strategies. Unlike mutual funds, ETFs are the investment vehicle directly selected by investors, regardless of sales channels. Therefore, it is necessary to provide a variety of education and research so that investors can understand the strengths and weaknesses of ETFs.

The ultimate goal of active ETFs is to outperform benchmark index returns. Some predict that active ETFs, still being in the early stage, will replace mutual funds in Korea. But this depends above all on managers’ ability to generate alpha. Considering that the slowdown in domestic mutual funds is primarily attributable to poor investment performance, improving the capability of fund managers is the most important factor. In this regard, investors also need to focus more on the long-term performance of active ETFs rather than short-term returns.

1) This is based on the end of 2022 data excluding ETFs managed as derivatives.

2) Interactive Investor, 2018. 1. 24, There are now 70 times more stock market indices than listed stocks in the world.

3) Aggregate cumulative returns are calculated as the weighted average net asset value of ETFs. Even if active ETFs investing in overseas stocks and ETFs without any benchmark return data are added, the total cumulative return pattern is qualitatively similar.

4) The benchmark-weighted index is calculated by taking average of the benchmark returns of ETFs and weighting them by net asset values of ETFs.

References

Easley, D., Michayluk, D., O’Hara, M., Putinins., T.J., 2021, The Active World of Passive Investing. Review of Finance 25(5).

An active ETF is a type of exchange-traded fund that aims to achieve alpha compared to benchmark, rather than utilizing a typical passive management strategy. Korea’s ETF market has seen steady growth in active ETFs. A total of 66 active ETFs were newly listed on the exchange last year and their number increased to more than 100 as of the end of 2022 from less than 20 two years ago (Figure 1). Since the scope of active ETFs was extended to equity-type products in July 2020, the launch of active equity ETFs has gained momentum. More recently, various active ETFs have emerged, such as products that manage global assets, a mix of stocks and bonds (ex. TDF), and REITs. With a wide range of listed active ETFs and the expansion of the ETF market, alpha-seeking investors are likely to move into the ETF market.

As illustrated in Figure 1 and Figure 2, the rise of active equity ETFs has been outstanding in terms of the number of products, despite being in the early stage. Figure 2 reveals that active ETFs amount to KRW 12.4 trillion in net assets as of the end of 2022, of which active bond ETFs represent around KRW 11 trillion. In the total bond ETF market, active products constitute nearly half of the total bond ETFs. On the other hand, active equity ETFs are responsible for only 2% of total equity ETFs, a tiny share compared to passive equity ETFs. This can be attributable to macroeconomic factors including a smaller selection of bond ETFs and a decline in risky asset prices. It should also be noted that passive equity ETFs account for a greater share relative to their active counterparts. The net asset value of active ETFs averages KRW 25.7 billion while passive ETFs reach KRW 123.5 billion in net assets, suggesting that passive ETFs outpace active ones in terms of individual fund size.1) But the AUM of active ETFs—still in the infancy—is likely to grow further depending on future returns, partly because an ETF is a preferred investment vehicle in Korea.

As the role of ETFs as an indirect investment vehicle for domestic households becomes increasingly important amid the slump of general mutual funds and the continued growth of ETFs, it is now necessary to discuss the stable establishment of active ETFs.

Potential for growth of active ETFs in Korea

Compared with a passive ETF tracking a specific index, the biggest advantage of an active ETF is that it can pursue relatively aggressive management strategies. Despite some limitations in asset management under the current regulatory framework, active ETFs can deliver excess returns above a benchmark by selecting a specific investment strategy and portfolio constituents. As they are listed on the exchange unlike mutual funds, active ETFs are easily traded on the exchange and entail no sales commissions, and the price risk that arises from fund redemption periods can be minimized. An active ETF is an indirect investment vehicle that can gain excess returns at a cost lower than that charged by mutual funds, as long as it delivers considerable performance.

Still, there are constraints on the growth of active ETFs. In addition to a number of active ETFs, a wide range of passive ETFs have been currently listed. As shown in Figure 3, there are more than 280 underlying indices for stock index ETFs in Korea as of the end of 2022 and if bonds and blend ETFs are added, the number of separate underlying indices is ever-growing, reaching as high as 373. Accordingly, passive ETFs are increasingly specialized into sector-based, smart-beta and thematic types. In an analysis of the US-listed ETFs, passive ETFs, depending on the design of their underlying index, have turned into actively managed investment vehicles that can generate alpha (Easley et al., 2021). According to the survey conducted by the Index Industry Association (IIA), there are more than 3.3 million stock indices globally, almost 70 times more than the number of listed stocks.2) This suggests that passive ETFs taking on the same role as active products are expected to steadily emerge going forward, which could restrain active ETFs from thriving further.

The benefits generally expected from ETF investing seem less noticeable in active ETFs. But one thing that can make up for all the limitations of active ETFs is high profitability. Figure 5 represents the aggregate cumulative returns of active ETFs listed in Korea that invest in Korean stocks.3) The weighted average return of each active ETF at each point in time is calculated from returns on active ETFs based on net asset value. The black solid line in Figure 5 exceeds KOSPI200 by +8.6% and the benchmarked-weighted index4) by +7.5%. This translates into annual cumulative returns between +3.3% and +3.7%, which is remarkable performance considering the operational constraints of domestic active ETFs. But it seems to take more time to predict long-term performance as most active ETFs have a short track record. Future improvements in regulations may lead to the emergence of products having different risk-return patterns. But above all, the key to invigorating active ETFs lies in excess performance and sustainability.

Future challenges

Boosting the growth of active ETFs has been considered a way of revitalizing the stagnant mutual fund market. However, given that active ETFs are quite different from passive ETFs, careful consideration is required and a feasible approach must be sought.

In the short run, there is a need to improve the regulatory framework for the operation of active ETFs, aiming for encouraging fund managers to voluntarily exert their competence. Under the current regulatory framework, active ETFs should maintain a correlation coefficient with underlying indices at 0.7 or higher and disclose the portfolio composition on a daily basis. While transparency is a critical factor in ETFs, daily disclosure can limit the entry of an ETF that utilizes various investment strategies. In the US and Europe, in addition to transparency-based active ETFs like those in Korea, non-transparent or semi-transparent ETFs that can delay the disclosure of asset portfolios are also permitted. Given these circumstances, the regulation for portfolio disclosure should be relieved to create a competitive ETF market environment. Furthermore, the correlation coefficient with underlying indices may be an essential requirement for stable returns and diversified investment. If the correlation coefficient criteria are too strict, however, active ETFs would end up being constrained by initial benchmark indices and fund managers could not use their own discretion. The US Securities and Exchange Commission (SEC) has no separate regulations but only requires active ETFs to clarify their intended correlation coefficient in the ETF prospectus. In this respect, it is worth considering alleviating active ETFs delisting criteria regarding the correlation coefficient.

Such reform designed for relaxed transparency requirements presupposes accurate evaluation of active ETFs’ asset holdings and measures to prevent the abuse of non-transparent information. As non-transparent or semi-transparent ETFs rarely disclose portfolio assets daily, it is of great importance to guarantee that market prices accurately reflect the value of underlying assets. For this reason, asset management companies should archive active ETF data including daily or intra-day price spreads or net asset value and conduct periodic disclosure. If necessary, the exchange and regulatory authorities should build a monitoring system for such data. In the case of ETFs whose portfolio assets are not disclosed, an internal control system should be put in place to prevent the abuse of such confidential information.

In the long run, it is necessary to facilitate a platform that allows for effective comparison of various ETFs, and investors should acquire knowledge to get a better understanding of investment vehicles through continuous learning. In the past when the types of products were simple and limited, it was sufficient to make an investment only by holding broad-market index ETFs. Currently, however, numerous ETFs are now being launched and they attempt to generate alpha by employing various kinds of strategies. Unlike mutual funds, ETFs are the investment vehicle directly selected by investors, regardless of sales channels. Therefore, it is necessary to provide a variety of education and research so that investors can understand the strengths and weaknesses of ETFs.

The ultimate goal of active ETFs is to outperform benchmark index returns. Some predict that active ETFs, still being in the early stage, will replace mutual funds in Korea. But this depends above all on managers’ ability to generate alpha. Considering that the slowdown in domestic mutual funds is primarily attributable to poor investment performance, improving the capability of fund managers is the most important factor. In this regard, investors also need to focus more on the long-term performance of active ETFs rather than short-term returns.

1) This is based on the end of 2022 data excluding ETFs managed as derivatives.

2) Interactive Investor, 2018. 1. 24, There are now 70 times more stock market indices than listed stocks in the world.

3) Aggregate cumulative returns are calculated as the weighted average net asset value of ETFs. Even if active ETFs investing in overseas stocks and ETFs without any benchmark return data are added, the total cumulative return pattern is qualitatively similar.

4) The benchmark-weighted index is calculated by taking average of the benchmark returns of ETFs and weighting them by net asset values of ETFs.

References

Easley, D., Michayluk, D., O’Hara, M., Putinins., T.J., 2021, The Active World of Passive Investing. Review of Finance 25(5).