Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Generative AI-driven Productivity Innovation and the Financial Services Industry’s Responses

Publication date Sep. 19, 2023

Summary

Amid heated discussions on generative AI-based innovation for productivity, the financial services industry is also examining how the use of generative AI can help increase profitability and reduce operational cost. Generative AI differs qualitatively from previous technological innovations in that it serves as a tool to assist human cognitive functions. In the past, new technologies such as automated machines raised production efficiency by replacing low-skilled workers, while generative AI has been primarily used to improve the skill level of professional and high-paying occupations. Such a difference highlights the need for organizational restructuring as a part of the longer-term strategy of the financial sector since the industry typically involves a higher portion of professionals performing analytical tasks.

Compared to advanced economies, there seems to be room for Korea’s financial services industry to enhance IT capabilities. Korea has a relatively small share of employees in the financial sector with AI skills than global front runners in the field, such as the U.S. and India. Furthermore, Korea’s financial investment firms represent a small proportion of IT-related human resources and budget compared to global leading firms. Thus, it is important to raise awareness of new technologies such as generative AI and expand investment in intangible assets such as research capabilities across the entire industry. Throughout the process, managerial support with a long-term strategy and effective communication between subject matter experts and AI technicians are key factors in successfully realizing AI-driven innovation.

Compared to advanced economies, there seems to be room for Korea’s financial services industry to enhance IT capabilities. Korea has a relatively small share of employees in the financial sector with AI skills than global front runners in the field, such as the U.S. and India. Furthermore, Korea’s financial investment firms represent a small proportion of IT-related human resources and budget compared to global leading firms. Thus, it is important to raise awareness of new technologies such as generative AI and expand investment in intangible assets such as research capabilities across the entire industry. Throughout the process, managerial support with a long-term strategy and effective communication between subject matter experts and AI technicians are key factors in successfully realizing AI-driven innovation.

Since earlier this year, ongoing discussions on Large Language Models (LLMs), including ChatGPT, have not only raised interest and curiosity in the new technology, but also led to expectations for generative AI-based innovation for productivity. According to the recently published NBER report, customer support staff assisted by generative AI experienced an average 14% increase in work efficiency (Brynjolfsson et. al., 2023). In addition, McKinsey & Company predicts that generative AI will create value worth around $2.6 trillion to $4.4 trillion across 60 industries analyzed by its recent research report (McKinsey Global Institute, 2023). Such findings would facilitate the use of generative AI in a wide range of industry sectors.

In addition to research findings, the possibility of improving productivity through advanced AI is accepted proactively at the working level. As shown in Figure 1, large-scale investments have been constantly made in AI technology that serves as a driving force for innovation. In particular, the size of investment in finance-related AI technology can match the relevant investment in health care and cyber security sectors, and is larger than the investment in automation and marketing. The finding suggests that the prospect of AI technology is well recognized at the practice level and that relevant research and investment have been accelerated to gain the upper hand in the competition for productivity innovation.

It seems difficult to ignore the promise of AI-driven productivity innovation, even for the most conventional areas of the financial services industry. This article analyzes the initial results of generative-AI-based productivity enhancement and provides implications for IT capacity of the Korean financial services industry.

Changes in work environment that generative AI will bring (and has brought)

Generative AI-driven innovation should be distinguished from previous labor productivity improvement by technological changes because AI, unlike technological invention of the past, is built to support human cognitive functions. Eloundou et. al. (2023) find that around 80% of the US workforce could have at least 10% of their tasks performed by LLMs such as ChatGPT. Furthermore, some occupations could see a larger portion of their tasks affected by AI. The interesting part is that those occupations are classified as high-paying jobs. Such a finding is consistent with the recent study where LLMs are most effective in assisting with programming, writing, research, etc. (Baily et. al., 2023). In this respect, generative AI-based innovation is expected to differ qualitatively from the replacement of low-skilled workers caused by the introduction of (automated) machines.

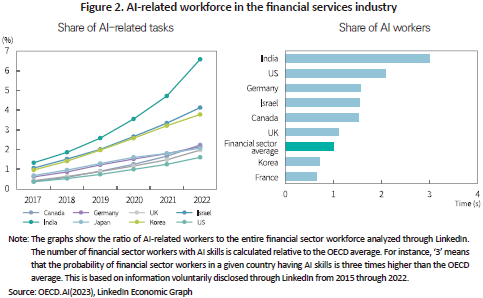

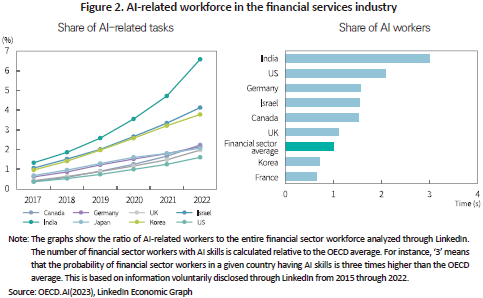

As the financial services industry traditionally involves a high proportion of analytical tasks, it is likely to benefit more from generative AI assistance compared to other industries. This is not just a possibility but also leads to changes in the nature of work and skills possessed by the financial sector workforce. Figure 2 illustrates the current state of employees equipped with AI skills in the financial services industry. As shown in the graph on the left, the utilization of AI by the financial sector continues to rise in various countries, implying that the demand for human resources with AI skills has been on a steady rise for several years. Unlike the current state on the demand side, there is a divergence in the supply of related workforce between countries. The graph on the right illustrates the proportion of employees with AI knowledge or skills among those engaging in the financial sector. With the average of OECD countries equal to one, the probability of a financial worker having AI skills is three times higher in India and two times higher in the U.S. On the other hand, the probability is about 0.7 times in Korea, falling below the OECD average.1)

Known use cases suggest that AI can change traditional business patterns and boost productivity in the financial services industry. Morgan Stanley has already encouraged more than 16,000 employees to actively utilize machine learning technology to assist customers with asset management and investment advisory since 2017. In addition, the company has recently adopted ChatGPT to accelerate efforts to further improve the productivity of investment advisory services (Son, March 14, 2023). CFA Institute (2021) presents examples where asset managers and investment advisors improved profitability through AI-based market and price analysis models in the European and Asian markets.

Korean financial sector’s IT capacity compared to advanced economies, and relevant implications

Korea’s financial services industry should embrace the new trend and discover future growth engines. To this end, it is important to examine whether the foundation for financial and human resources investment is sufficient to initiate AI-based innovation.

First of all, Korea’s IT capabilities, gauged by statistics of the financial investment industry, seem to fall short of those of global leading companies. Figure 3 shows the IT workforce and related total budget in Korea’s financial investment industry. By the number of workers, the ratio of IT employees to total workforce is 5% or less in the financial investment sector except in 2021. This figure is low, considering that 20% of JP Morgan’s entire employees were IT personnel in 2017.2) Although the aggregate IT budget amount has kept increasing since 2017, the ratio of IT budget to the total budget remains at up to 12%. The figure suggests that Korea relatively falls short of the global standard, given the aggressive investment in IT infrastructure by leading global financial institutions.3)

It is worth considering how investment is concentrated in AI-related startups to assess driving forces for innovation. According to the recent report on national AI capacity published regularly by the OECD, Korea only ranks eighth globally in terms of aggregate VC investment in AI.4) If we focus on the finance and insurance sectors, its ranking falls to ninth place.

Table 1 shows each country’s aggregate VC investment in AI relative to that of the US. No single country can match the US in terms of aggregate AI investment. If the scope is limited to the financial sector, however, some interesting facts come to light. For instance, the UK that ranks second in terms of the sum of VC investments only accounts for around 5.5% of US investment based on the aggregate AI investment made by entire industries, but within the scope of finance and insurance, the UK puts more than 16% of US investment into AI-related startups. On the other hand, Korea’s absolute AI investment amount is only 0.7% of US investment across all industries, which is even lowered to 0.6% if the scope is confined to the finance and insurance sectors.

As Korea becomes increasingly aware of such a problem, there is a growing call for boosting IT competencies to improve the global competitiveness of the financial services industry. In a seminar held earlier this year on how to reinforce the competitiveness of the financial investment industry, the lower proportion of IT investment by Korea’s securities firms compared to global IBs was pointed out as an obstacle to digital competitiveness improvement.5) Furthermore, the need for greater investment in digital technology was mentioned by seminar participants as a way of increasing profitability in Korea’s asset management market.6)

Implications for development strategy of the financial services industry

In this section, I discuss the implications of generative AI-driven innovation on the long-term growth strategy of Korea’s financial sector. From a macroeconomic perspective, aggressive investments are essential for swiftly introducing and adapting to new technology. In particular, it is necessary to reassess the value of intangible assets such as research capabilities and accumulate them proactively. Brynjolfsson et. al. (2021) state that the utility of fundamental technology, such as generative AI tools, could be maximized only after making preemptive investments so as to understand and utilize such technology. Thus, the potential contribution of generative AI can be underestimated in the initial stage of technology introduction (such as the present). Their findings emphasize the need for raising awareness of fundamental technology, given that Korea’s financial sector falls short of its counterparts in terms of IT investment and resource utilization.

From a microeconomic perspective, it is worth examining whether the existing organizational structure and collaboration system can appropriately respond to generative AI-driven productivity innovation. By analyzing the résumé data of employees hired by U.S.-listed firms, Babina et. al. (2023) find that firms with a higher share of highly-educated workers with STEM (Science, Technology, Engineering, athematics) degrees are more active in investing in AI and such AI investments serve as a spur to a significant increase in the share of highly-educated workers and a flattening of hierarchical structure. This study suggests that a competent workforce and organizational restructuring are a prerequisite for the introduction of AI-based innovative technologies.

After securing human resources, it follows a gradual adaptation process to apply AI-based innovative technologies to legacy business practices. CFA Institute (2021) divides the process of introducing AI to various operating branches of the financial industry into three stages: (1) technical understanding, (2) effective publicity campaign of best practices, and (3) widespread application of new technology. They also emphasize management support based on a firm strategy and constant communication between financial professionals and AI experts, two factors that can be commonly found in former best practices. Building upon these factors, it is necessary to step up efforts to reassess organizational structures and business process in the financial services industry and create a work environment where new technologies can be flexibly accepted.

In response to productivity competition initiated by the development of generative AI tools, it seems many financial market participants are seeking a shift in their existing business practices and organizational structures. Interestingly, successful cases of AI application in the financial services industry differ from technological innovation in the past in that practical experience and newly-developed digital technology, two orthogonal elements, have complementarily underpinned AI-based innovation. This suggests the importance of establishing a long-term development strategy for the financial sector based on effective communication and cooperation between workers with practical experience and AI skills.

1) In the calculation, some bias may come into play as the statistics cited above were obtained from LinkedIn, a service that is relatively underused in Korea compared to other countries. Among financial sector workers in Korea, for instance, those working for global partners are more likely to use LinkeIn than those engaging in the IT industry.

2) Lee, J.E. (2020)

3) Brittany (2018)

4) Statistics and rankings cited in this section exclude China’s data.

5) Lee, H.S., 2023, Presentation material for the seminar on how to reinforce global competitiveness of the financial investment industry.

6) Lee. H.S., 2023, Presentation material for the seminar on recent changes in economic conditions and measures to improve returns and reliability in the asset management industry.

References

Babina, T., Fedyk, A., He, A. X., Hodson, J., 2023, Firm investments in artificial intelligence technologies and changes in workforce composition, NBER Working Paper No. 31325.

Baily, M. N., Brynjolfsson, E., Korinek, A., 2023. 5. 10, Machines of mind: The case for an AI-powered productivity boom, Brookings Commentary.

Brittany, W., 2018. 4. 26, Goldman Sachs – A technology company?

Brynjolfsson, E., Li, D., Raymond, L. R., 2023, Generative AI at work, NBER Working Paper No. 31161.

Brynjolfsson, E., Rock, D., Syverson, C., 2021, The productivity J-Curve: How intangibles complement general purpose technologies, American Economic Journal: Macroeconomics 13(1), 333-372.

CFA Institute, 2021, T-Shaped Teams: Organizing to Adopt AI and Big Data at Investment Firms.

Eloundou, T., Manning, S., Mishkin, P., Rock, D., 2023, GPTs are GPTs: An early look at the labor market impact potential of large language models, Working Paper.

McKinsey Global Institute, 2023. 6, The economic potential of generative AI: The next productivity frontier.

Son, H., 2023. 3. 14, Morgan Stanley is testing an OpenAI-powered chatbot for its 16,000 financial advisors, CNBC.

[Korean]

Bank of Korea’s Financial Informatization Promotion Council, 2022. 8, Status of financial informatization promotion.

Lee, J.E., 2020, Current state and implications of IT workforce in Korea’s financial sector, Capital Market Focus 2020-05.

Lee, H.S., May 30, 2023, Suggestions on the roles and tasks of asset managers in the financial services industry.

Lee, H.S., March 14, 2023, Development strategies of global IBs and challenges of Korean IBs.

OECD.AI https://oecd.ai/en/trends-and-data

Our World in Data https://ourworldindata.org/artificial-intelligence

In addition to research findings, the possibility of improving productivity through advanced AI is accepted proactively at the working level. As shown in Figure 1, large-scale investments have been constantly made in AI technology that serves as a driving force for innovation. In particular, the size of investment in finance-related AI technology can match the relevant investment in health care and cyber security sectors, and is larger than the investment in automation and marketing. The finding suggests that the prospect of AI technology is well recognized at the practice level and that relevant research and investment have been accelerated to gain the upper hand in the competition for productivity innovation.

It seems difficult to ignore the promise of AI-driven productivity innovation, even for the most conventional areas of the financial services industry. This article analyzes the initial results of generative-AI-based productivity enhancement and provides implications for IT capacity of the Korean financial services industry.

Changes in work environment that generative AI will bring (and has brought)

Generative AI-driven innovation should be distinguished from previous labor productivity improvement by technological changes because AI, unlike technological invention of the past, is built to support human cognitive functions. Eloundou et. al. (2023) find that around 80% of the US workforce could have at least 10% of their tasks performed by LLMs such as ChatGPT. Furthermore, some occupations could see a larger portion of their tasks affected by AI. The interesting part is that those occupations are classified as high-paying jobs. Such a finding is consistent with the recent study where LLMs are most effective in assisting with programming, writing, research, etc. (Baily et. al., 2023). In this respect, generative AI-based innovation is expected to differ qualitatively from the replacement of low-skilled workers caused by the introduction of (automated) machines.

As the financial services industry traditionally involves a high proportion of analytical tasks, it is likely to benefit more from generative AI assistance compared to other industries. This is not just a possibility but also leads to changes in the nature of work and skills possessed by the financial sector workforce. Figure 2 illustrates the current state of employees equipped with AI skills in the financial services industry. As shown in the graph on the left, the utilization of AI by the financial sector continues to rise in various countries, implying that the demand for human resources with AI skills has been on a steady rise for several years. Unlike the current state on the demand side, there is a divergence in the supply of related workforce between countries. The graph on the right illustrates the proportion of employees with AI knowledge or skills among those engaging in the financial sector. With the average of OECD countries equal to one, the probability of a financial worker having AI skills is three times higher in India and two times higher in the U.S. On the other hand, the probability is about 0.7 times in Korea, falling below the OECD average.1)

Known use cases suggest that AI can change traditional business patterns and boost productivity in the financial services industry. Morgan Stanley has already encouraged more than 16,000 employees to actively utilize machine learning technology to assist customers with asset management and investment advisory since 2017. In addition, the company has recently adopted ChatGPT to accelerate efforts to further improve the productivity of investment advisory services (Son, March 14, 2023). CFA Institute (2021) presents examples where asset managers and investment advisors improved profitability through AI-based market and price analysis models in the European and Asian markets.

Korean financial sector’s IT capacity compared to advanced economies, and relevant implications

Korea’s financial services industry should embrace the new trend and discover future growth engines. To this end, it is important to examine whether the foundation for financial and human resources investment is sufficient to initiate AI-based innovation.

First of all, Korea’s IT capabilities, gauged by statistics of the financial investment industry, seem to fall short of those of global leading companies. Figure 3 shows the IT workforce and related total budget in Korea’s financial investment industry. By the number of workers, the ratio of IT employees to total workforce is 5% or less in the financial investment sector except in 2021. This figure is low, considering that 20% of JP Morgan’s entire employees were IT personnel in 2017.2) Although the aggregate IT budget amount has kept increasing since 2017, the ratio of IT budget to the total budget remains at up to 12%. The figure suggests that Korea relatively falls short of the global standard, given the aggressive investment in IT infrastructure by leading global financial institutions.3)

It is worth considering how investment is concentrated in AI-related startups to assess driving forces for innovation. According to the recent report on national AI capacity published regularly by the OECD, Korea only ranks eighth globally in terms of aggregate VC investment in AI.4) If we focus on the finance and insurance sectors, its ranking falls to ninth place.

Table 1 shows each country’s aggregate VC investment in AI relative to that of the US. No single country can match the US in terms of aggregate AI investment. If the scope is limited to the financial sector, however, some interesting facts come to light. For instance, the UK that ranks second in terms of the sum of VC investments only accounts for around 5.5% of US investment based on the aggregate AI investment made by entire industries, but within the scope of finance and insurance, the UK puts more than 16% of US investment into AI-related startups. On the other hand, Korea’s absolute AI investment amount is only 0.7% of US investment across all industries, which is even lowered to 0.6% if the scope is confined to the finance and insurance sectors.

As Korea becomes increasingly aware of such a problem, there is a growing call for boosting IT competencies to improve the global competitiveness of the financial services industry. In a seminar held earlier this year on how to reinforce the competitiveness of the financial investment industry, the lower proportion of IT investment by Korea’s securities firms compared to global IBs was pointed out as an obstacle to digital competitiveness improvement.5) Furthermore, the need for greater investment in digital technology was mentioned by seminar participants as a way of increasing profitability in Korea’s asset management market.6)

Implications for development strategy of the financial services industry

In this section, I discuss the implications of generative AI-driven innovation on the long-term growth strategy of Korea’s financial sector. From a macroeconomic perspective, aggressive investments are essential for swiftly introducing and adapting to new technology. In particular, it is necessary to reassess the value of intangible assets such as research capabilities and accumulate them proactively. Brynjolfsson et. al. (2021) state that the utility of fundamental technology, such as generative AI tools, could be maximized only after making preemptive investments so as to understand and utilize such technology. Thus, the potential contribution of generative AI can be underestimated in the initial stage of technology introduction (such as the present). Their findings emphasize the need for raising awareness of fundamental technology, given that Korea’s financial sector falls short of its counterparts in terms of IT investment and resource utilization.

From a microeconomic perspective, it is worth examining whether the existing organizational structure and collaboration system can appropriately respond to generative AI-driven productivity innovation. By analyzing the résumé data of employees hired by U.S.-listed firms, Babina et. al. (2023) find that firms with a higher share of highly-educated workers with STEM (Science, Technology, Engineering, athematics) degrees are more active in investing in AI and such AI investments serve as a spur to a significant increase in the share of highly-educated workers and a flattening of hierarchical structure. This study suggests that a competent workforce and organizational restructuring are a prerequisite for the introduction of AI-based innovative technologies.

After securing human resources, it follows a gradual adaptation process to apply AI-based innovative technologies to legacy business practices. CFA Institute (2021) divides the process of introducing AI to various operating branches of the financial industry into three stages: (1) technical understanding, (2) effective publicity campaign of best practices, and (3) widespread application of new technology. They also emphasize management support based on a firm strategy and constant communication between financial professionals and AI experts, two factors that can be commonly found in former best practices. Building upon these factors, it is necessary to step up efforts to reassess organizational structures and business process in the financial services industry and create a work environment where new technologies can be flexibly accepted.

In response to productivity competition initiated by the development of generative AI tools, it seems many financial market participants are seeking a shift in their existing business practices and organizational structures. Interestingly, successful cases of AI application in the financial services industry differ from technological innovation in the past in that practical experience and newly-developed digital technology, two orthogonal elements, have complementarily underpinned AI-based innovation. This suggests the importance of establishing a long-term development strategy for the financial sector based on effective communication and cooperation between workers with practical experience and AI skills.

1) In the calculation, some bias may come into play as the statistics cited above were obtained from LinkedIn, a service that is relatively underused in Korea compared to other countries. Among financial sector workers in Korea, for instance, those working for global partners are more likely to use LinkeIn than those engaging in the IT industry.

2) Lee, J.E. (2020)

3) Brittany (2018)

4) Statistics and rankings cited in this section exclude China’s data.

5) Lee, H.S., 2023, Presentation material for the seminar on how to reinforce global competitiveness of the financial investment industry.

6) Lee. H.S., 2023, Presentation material for the seminar on recent changes in economic conditions and measures to improve returns and reliability in the asset management industry.

References

Babina, T., Fedyk, A., He, A. X., Hodson, J., 2023, Firm investments in artificial intelligence technologies and changes in workforce composition, NBER Working Paper No. 31325.

Baily, M. N., Brynjolfsson, E., Korinek, A., 2023. 5. 10, Machines of mind: The case for an AI-powered productivity boom, Brookings Commentary.

Brittany, W., 2018. 4. 26, Goldman Sachs – A technology company?

Brynjolfsson, E., Li, D., Raymond, L. R., 2023, Generative AI at work, NBER Working Paper No. 31161.

Brynjolfsson, E., Rock, D., Syverson, C., 2021, The productivity J-Curve: How intangibles complement general purpose technologies, American Economic Journal: Macroeconomics 13(1), 333-372.

CFA Institute, 2021, T-Shaped Teams: Organizing to Adopt AI and Big Data at Investment Firms.

Eloundou, T., Manning, S., Mishkin, P., Rock, D., 2023, GPTs are GPTs: An early look at the labor market impact potential of large language models, Working Paper.

McKinsey Global Institute, 2023. 6, The economic potential of generative AI: The next productivity frontier.

Son, H., 2023. 3. 14, Morgan Stanley is testing an OpenAI-powered chatbot for its 16,000 financial advisors, CNBC.

[Korean]

Bank of Korea’s Financial Informatization Promotion Council, 2022. 8, Status of financial informatization promotion.

Lee, J.E., 2020, Current state and implications of IT workforce in Korea’s financial sector, Capital Market Focus 2020-05.

Lee, H.S., May 30, 2023, Suggestions on the roles and tasks of asset managers in the financial services industry.

Lee, H.S., March 14, 2023, Development strategies of global IBs and challenges of Korean IBs.

OECD.AI https://oecd.ai/en/trends-and-data

Our World in Data https://ourworldindata.org/artificial-intelligence