Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Regulatory Shift in Asset-backed Securities: Impact and Outlook

Publication date Jan. 02, 2024

Summary

Korea’s asset-based securities (ABS) market is divided into the registered and non-registered ABS markets, each exhibiting some differences in the regulatory system and market structure. The registered ABS market is constrained by strict regulatory procedures and has limitations in introducing innovative securitization structures and new assets for securitization. The non-registered ABS market has attempted to adopt ABS with various structures but struggles with low market transparency.

In response, the Korean government has amended the Asset-backed Securitization Act and will put the amendment into force in January 2024, aiming for enhancing transparency in the ABS market and promoting the introduction of diverse securitization structures. This amendment includes measures to expand the scope of originators, allow for the introduction of new securitization structures such as the multi-seller structure and clarify the concept of ABS, in an effort to invigorate the ABS market. On the other hand, it also adopts stricter regulations related to ABS, including enhancing disclosure of issuance details for registered and non-registered ABS and introducing the risk retention system for originators.

These regulatory improvements are expected to have positive effects, such as the relaxed eligibility for originators, the securitization of a range of assets, and the introduction of new securitization structures. Additionally, the overall transparency of the ABS market is likely to improve, thereby contributing to the healthy development of the market. In the meantime, the risk retention regulation is anticipated to have a limited impact on the market, due to its relatively flexible approach. For the benefits of these improvements to be effectively realized, market participants should strive to boost the ABS market by issuing ABS based on various underlying assets and to enhance transparency for the development of the ABS market.

In response, the Korean government has amended the Asset-backed Securitization Act and will put the amendment into force in January 2024, aiming for enhancing transparency in the ABS market and promoting the introduction of diverse securitization structures. This amendment includes measures to expand the scope of originators, allow for the introduction of new securitization structures such as the multi-seller structure and clarify the concept of ABS, in an effort to invigorate the ABS market. On the other hand, it also adopts stricter regulations related to ABS, including enhancing disclosure of issuance details for registered and non-registered ABS and introducing the risk retention system for originators.

These regulatory improvements are expected to have positive effects, such as the relaxed eligibility for originators, the securitization of a range of assets, and the introduction of new securitization structures. Additionally, the overall transparency of the ABS market is likely to improve, thereby contributing to the healthy development of the market. In the meantime, the risk retention regulation is anticipated to have a limited impact on the market, due to its relatively flexible approach. For the benefits of these improvements to be effectively realized, market participants should strive to boost the ABS market by issuing ABS based on various underlying assets and to enhance transparency for the development of the ABS market.

In Korea, the asset-backed securities market was introduced through the enactment of the Asset-backed Securitization Act (the “Act”) in 1998. Since the inception, asset-backed securities (ABS) have played a role in promptly disposing of non-performing bonds, providing financing paths for companies and financial institutions to raise funds by leveraging their asset holdings, and stimulating the housing finance market through mortgage-backed securities (MBS). However, the Act failed to adequately accommodate the market demand for various securitization structures, due to its strict requirements for originators, financial supervisory authorities’ approval procedures for securitization plans, and the prohibition of continuous issuance. Consequently, non-registered ABS not governed by the Act were introduced, taking up a large share of the registered ABS market.1)

In response, the Korean government revised the Act in August 2023, and the amended Act is set to take effect starting from January next year. The amendment aims at expanding the scope of originators, regulating risk retention by originators, and enhancing information disclosure at the time of ABS issuance. The revised Act is expected to partially transform how the ABS market is structured.

Against this backdrop, this article delves into the structure and features of the recent ABS market, examines specific matters of the amended Act, and assesses the impact of regulatory changes on the ABS market.

Characteristics of the recent ABS market

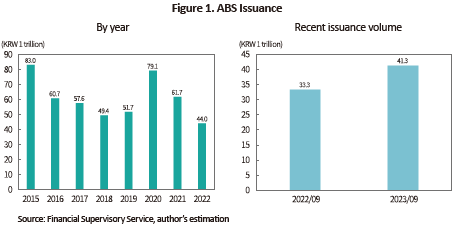

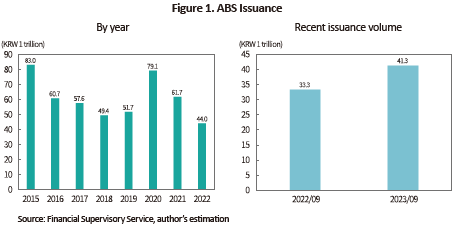

Registered ABS are primarily based on standardized assets such as mortgages, consumer financing, and account receivables. The issuance volume of ABS registered as of September 2023 amounts to KRW 41.3 trillion, representing a 24.0% increase on a YoY basis. The latest surge in ABS issuance can be attributed to the growth of MBS issuance.

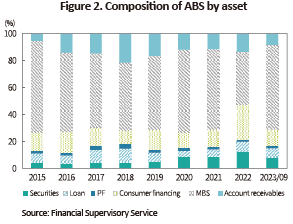

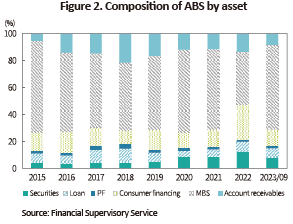

By asset type, MBS take up the largest share of the total ABS issuance, albeit with some variations, which are followed by consumer financing such as credit card receivables and installment financing. Credit card companies and installment financing companies tap into a certain size of consumer financing assets to raise funds annually. Some large corporations including mobile carriers also utilize account receivables as underlying assets for the financing purpose. As such, ABS not only serve as a fundraising means for housing finance but also allow companies and financial institutions to raise funds by leveraging asset holdings.

Non-registered ABS refer to ABCP and ABSTB, of which issuance is not regulated by the Act. The issuance of such securities has gained momentum as they can be conveniently issued without undergoing the registration procedures mandated by regulatory authorities. Most non-registered ABS are issued in the form of short-term securities with a limited maturity. For this reason, their outstanding balance provides more valuable information than the issuance volume.

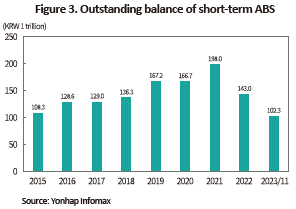

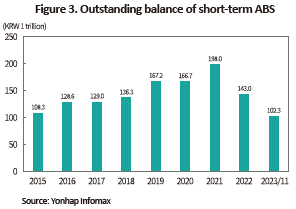

For short-term ABS, the outstanding balance showed a continuous increase until 2021 before taking a nosedive in 2022. As of the end of November 2023, the outstanding balance of short-term ABS, including ABCP and ABSTB, amounts to KRW 102.3 trillion, a 28.4% decrease from the end of the previous year. The sharp decline in the outstanding balance of non-registered ABS primarily stems from a plunge in PF (project finance) ABS, which account for a significant share in the non-registered ABS market, driven by the Legoland crisis, rising interest rates and a slowdown in the real estate market.

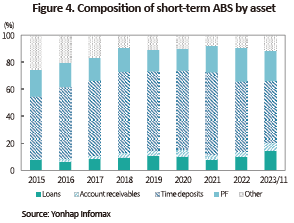

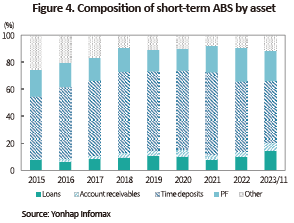

The analysis of the asset composition in short-term ABS reveals that time deposits represent the highest proportion, followed by PF. The strong presence of time deposits in short-term ABS can be explained by their role as an investment instrument for short-term products like MMFs. Meanwhile, the share of PF in the total outstanding balance of short-term ABS has dropped slightly to 23.0% at the end of November 2023 from 25.3% at the end of 2022. This minor decrease in the proportion of PF ABS is attributed to a substantial decline in the issuance of new PF ABS and the refinancing of existing PF, owing to high interest rates, the increase in construction costs and the sluggish real estate market.

One of the key characteristics of the registered ABS market is that ABS, which are designed for financing based on asset holdings of large corporations and financial institutions, dominate the market. Due to qualifications for originators, the utilization of ABS for fundraising is limited to specific companies and financial institutions. Furthermore, the introduction of new securitization structures or innovative securitized assets is scarcely observed in the registered ABS market, given the stringent regulatory procedures in place.

On the other hand, the non-registered ABS market has seen the issuance of a range of ABS for various purposes, the introduction of new securitization structures, including credit derivatives, and the securitization of new underlying assets such as intellectual property rights. Investors have recently raised concerns about the growing dominance of PF ABS and sufficient information about such securities has been rarely disclosed. As a result, investor confidence in the non-registered ABS market has diminished, leading to a sharp decline in attempts to introduce new assets or securitization structures.

Key changes in the ABS regulation

The amendment to the Act primarily focuses on expanding the eligibility for originators, allowing the introduction of diverse securitization structures and easing regulations of registered ABS, including simplifying the registration process. In addition, measures have been taken to enhance risk management for the entire ABS including non-registered ABS.

Institutions listed in the Act and the Enforcement Decree of the said Act are defined as qualified originators. The amended Act expands the eligibility for originators to include the government, local governments and community financial institutions, in addition to the institutions listed. As for companies, asset holding eligibility was previously limited to companies with a high credit rating, which has been extended to include externally audited corporations over a certain size.

Other measures are also being prepared to facilitate the securitization of various assets. Under the amended Act, future claims and the rights of intangible property (including intellectual property), of which inclusion as traditional ABS was previously uncertain, are clearly defined as ABS. Particularly, these measures try to reduce legal uncertainties related to the securitization of intellectual property rights in an effort to facilitate the issuance of relevant securities. The amended Act also allows for a multi-seller securitization structure where multiple originators transfer receivables to issue ABS, and permits claims collection agencies to engage in asset management. Additionally, the amendment eases regulations, for example to permit discretionary registration for securitization not affecting investor protection.

Meanwhile, the amended Act also includes provisions to enhance information disclosure for non-registered ABS as well as registered ABS. For non-registered ABS, a system has been introduced to require the disclosure of securitization structures, including issuance details—type, total amount, and issuance conditions—and credit enhancement. Another system has been adopted for all types of ABS to be registered in the Korea Securities Depository’s ABS integrated information scheme, aiming to improve the transparency of ABS.

On top of that, the amended Act adopts a risk retention system where originators are required to retain 5% of the ABS issuance balance to address conflicts of interest related to asset securitization. In detail, the risk retention regulation is comprehensively applied to both registered and non-registered securitization. Vertical, horizontal and mixed methods are all permitted for mandatory risk retention. However, an exemption from mandatory risk retention has been in place for some ABS with low credit risk or a low possibility of conflicts of interest. Under the amended Act, the ABS exempt from mandatory risk retention are those for which the government, local governments, or public institutions guarantee the principal and interest payment. The Enforcement Decree of the Act exempts the ABS fully acquired by the government, local governments and public institutions from mandatory risk retention. In the asset securitization supervision regulation, P-CBOs, securitized time deposits, securitized terminal installment receivables, securitized bridge loans, securitized NPL bonds, and securitized corporate purchasing card payments are exempt from mandatory risk retention. Even with the introduction of the 5% risk retention regulation, the amended Act has taken a flexible approach by exempting ABS with a low possibility of conflicts of interest from mandatory risk retention.

Impact of changes in the ABS regulation

The regulatory improvement in ABS is expected to have diverse effects on the market. First, the relaxed eligibility for originators is anticipated to increase financing opportunities through securitization based on assets held by various companies. As companies ineligible for holding assets previously engaged in securitization by adopting a bridge loan structure, their investors faced limitations in understanding the substance of securitized assets. Relaxed requirements for asset holding seem to reduce circumvented securitization and assist companies in leveraging assets for fundraising.

The amendment requires future cash flows and intangible property rights to be specified as securitized assets, which is expected to boost ABS issuance. If intellectual property rights or copyrights, held by companies, are securitized, it could increase financing opportunities in respective industries. The introduction of a multi-seller structure can open the door to the securitization structure of pooling receivables held by several companies. Hence, regulatory improvements such as easing originator eligibility and increasing the scope of securitization assets are likely to facilitate corporate financing activities.

A stricter requirement for information disclosure of ABS including non-registered ABS is likely to enhance transparency across the ABS market. As for non-registered securitization, restraints on information provision regarding securitization structures and underlying assets have hindered market growth. With these regulatory improvements, the transparency of ABS including non-registered ABS is expected to increase. As a result, this would alleviate constraints on information acquisition by investors and enhance the soundness of the ABS market in the long run.

In the meantime, the introduction of the risk retention system for originators is anticipated to have a limited impact on the market. This system has been implemented to address conflicts of interest arising from the transfer of originators’ risk to the market. In the case where securitization primarily aims to leverage assets for financing, conflicts of interest are less likely to occur. In this respect, the US has introduced a system of exempting securitization structures with a low possibility of conflicts of interest from mandatory risk retention. As for securitization mainly designed for financing, Korea also provides an exemption from mandatory risk retention. Consequently, ABS frequently issued for financing purposes in Korea are highly likely to be excluded from the risk retention regulation.

The latest amendment to the Act aims to promote the securitization of various assets, ease the eligibility for originators, and improve transparency in the entire ABS market. For the benefits of these improvements to be realized, market participants should put efforts into issuing ABS based on various underlying assets and facilitating the issuance of ABS with various structures. In line with the regulatory reform, the ABS market is expected to evolve into a dynamic market that efficiently serves as a financing source for companies and financial institutions next year, propelled by proactive endeavors of market participants.

1) Securitized securities issued under the Asset-backed Securitization Act are defined as registered ABS (Asset-backed Securities, while ABCP (Asset-backed Commercial Paper) and ABSTB (Asset-backed Short Term Bond) not governed by the said Act are categorized as non-registered ABS.

In response, the Korean government revised the Act in August 2023, and the amended Act is set to take effect starting from January next year. The amendment aims at expanding the scope of originators, regulating risk retention by originators, and enhancing information disclosure at the time of ABS issuance. The revised Act is expected to partially transform how the ABS market is structured.

Against this backdrop, this article delves into the structure and features of the recent ABS market, examines specific matters of the amended Act, and assesses the impact of regulatory changes on the ABS market.

Characteristics of the recent ABS market

Registered ABS are primarily based on standardized assets such as mortgages, consumer financing, and account receivables. The issuance volume of ABS registered as of September 2023 amounts to KRW 41.3 trillion, representing a 24.0% increase on a YoY basis. The latest surge in ABS issuance can be attributed to the growth of MBS issuance.

For short-term ABS, the outstanding balance showed a continuous increase until 2021 before taking a nosedive in 2022. As of the end of November 2023, the outstanding balance of short-term ABS, including ABCP and ABSTB, amounts to KRW 102.3 trillion, a 28.4% decrease from the end of the previous year. The sharp decline in the outstanding balance of non-registered ABS primarily stems from a plunge in PF (project finance) ABS, which account for a significant share in the non-registered ABS market, driven by the Legoland crisis, rising interest rates and a slowdown in the real estate market.

On the other hand, the non-registered ABS market has seen the issuance of a range of ABS for various purposes, the introduction of new securitization structures, including credit derivatives, and the securitization of new underlying assets such as intellectual property rights. Investors have recently raised concerns about the growing dominance of PF ABS and sufficient information about such securities has been rarely disclosed. As a result, investor confidence in the non-registered ABS market has diminished, leading to a sharp decline in attempts to introduce new assets or securitization structures.

Key changes in the ABS regulation

The amendment to the Act primarily focuses on expanding the eligibility for originators, allowing the introduction of diverse securitization structures and easing regulations of registered ABS, including simplifying the registration process. In addition, measures have been taken to enhance risk management for the entire ABS including non-registered ABS.

Institutions listed in the Act and the Enforcement Decree of the said Act are defined as qualified originators. The amended Act expands the eligibility for originators to include the government, local governments and community financial institutions, in addition to the institutions listed. As for companies, asset holding eligibility was previously limited to companies with a high credit rating, which has been extended to include externally audited corporations over a certain size.

Other measures are also being prepared to facilitate the securitization of various assets. Under the amended Act, future claims and the rights of intangible property (including intellectual property), of which inclusion as traditional ABS was previously uncertain, are clearly defined as ABS. Particularly, these measures try to reduce legal uncertainties related to the securitization of intellectual property rights in an effort to facilitate the issuance of relevant securities. The amended Act also allows for a multi-seller securitization structure where multiple originators transfer receivables to issue ABS, and permits claims collection agencies to engage in asset management. Additionally, the amendment eases regulations, for example to permit discretionary registration for securitization not affecting investor protection.

Meanwhile, the amended Act also includes provisions to enhance information disclosure for non-registered ABS as well as registered ABS. For non-registered ABS, a system has been introduced to require the disclosure of securitization structures, including issuance details—type, total amount, and issuance conditions—and credit enhancement. Another system has been adopted for all types of ABS to be registered in the Korea Securities Depository’s ABS integrated information scheme, aiming to improve the transparency of ABS.

On top of that, the amended Act adopts a risk retention system where originators are required to retain 5% of the ABS issuance balance to address conflicts of interest related to asset securitization. In detail, the risk retention regulation is comprehensively applied to both registered and non-registered securitization. Vertical, horizontal and mixed methods are all permitted for mandatory risk retention. However, an exemption from mandatory risk retention has been in place for some ABS with low credit risk or a low possibility of conflicts of interest. Under the amended Act, the ABS exempt from mandatory risk retention are those for which the government, local governments, or public institutions guarantee the principal and interest payment. The Enforcement Decree of the Act exempts the ABS fully acquired by the government, local governments and public institutions from mandatory risk retention. In the asset securitization supervision regulation, P-CBOs, securitized time deposits, securitized terminal installment receivables, securitized bridge loans, securitized NPL bonds, and securitized corporate purchasing card payments are exempt from mandatory risk retention. Even with the introduction of the 5% risk retention regulation, the amended Act has taken a flexible approach by exempting ABS with a low possibility of conflicts of interest from mandatory risk retention.

Impact of changes in the ABS regulation

The regulatory improvement in ABS is expected to have diverse effects on the market. First, the relaxed eligibility for originators is anticipated to increase financing opportunities through securitization based on assets held by various companies. As companies ineligible for holding assets previously engaged in securitization by adopting a bridge loan structure, their investors faced limitations in understanding the substance of securitized assets. Relaxed requirements for asset holding seem to reduce circumvented securitization and assist companies in leveraging assets for fundraising.

The amendment requires future cash flows and intangible property rights to be specified as securitized assets, which is expected to boost ABS issuance. If intellectual property rights or copyrights, held by companies, are securitized, it could increase financing opportunities in respective industries. The introduction of a multi-seller structure can open the door to the securitization structure of pooling receivables held by several companies. Hence, regulatory improvements such as easing originator eligibility and increasing the scope of securitization assets are likely to facilitate corporate financing activities.

A stricter requirement for information disclosure of ABS including non-registered ABS is likely to enhance transparency across the ABS market. As for non-registered securitization, restraints on information provision regarding securitization structures and underlying assets have hindered market growth. With these regulatory improvements, the transparency of ABS including non-registered ABS is expected to increase. As a result, this would alleviate constraints on information acquisition by investors and enhance the soundness of the ABS market in the long run.

In the meantime, the introduction of the risk retention system for originators is anticipated to have a limited impact on the market. This system has been implemented to address conflicts of interest arising from the transfer of originators’ risk to the market. In the case where securitization primarily aims to leverage assets for financing, conflicts of interest are less likely to occur. In this respect, the US has introduced a system of exempting securitization structures with a low possibility of conflicts of interest from mandatory risk retention. As for securitization mainly designed for financing, Korea also provides an exemption from mandatory risk retention. Consequently, ABS frequently issued for financing purposes in Korea are highly likely to be excluded from the risk retention regulation.

The latest amendment to the Act aims to promote the securitization of various assets, ease the eligibility for originators, and improve transparency in the entire ABS market. For the benefits of these improvements to be realized, market participants should put efforts into issuing ABS based on various underlying assets and facilitating the issuance of ABS with various structures. In line with the regulatory reform, the ABS market is expected to evolve into a dynamic market that efficiently serves as a financing source for companies and financial institutions next year, propelled by proactive endeavors of market participants.

1) Securitized securities issued under the Asset-backed Securitization Act are defined as registered ABS (Asset-backed Securities, while ABCP (Asset-backed Commercial Paper) and ABSTB (Asset-backed Short Term Bond) not governed by the said Act are categorized as non-registered ABS.