Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Risks of Spot Cryptocurrency ETFs

Publication date May. 14, 2024

Summary

There is a growing demand for the introduction of spot cryptocurrency ETFs in Korea. Despite high expectations for benefits of spot ETFs, it is crucial to closely assess their risks. The launch of spot cryptocurrency ETFs can not only magnify existing risks inherent in underlying assets but also pose additional risks. The existing risks are well-known issues in cryptocurrencies: inefficient allocation of resources, price risks, deposit volatility, and susceptibility to external factors. The additional risks involve perception distortion, increased channels for transmitting financial instability, capital outflows, and policy dilemmas.

Although there is optimism for the innovative potential of cryptocurrencies, they need to demonstrate their practical utility. Furthermore, it seems to take considerable time for each country to establish market regulations. Considering these circumstances, it is advisable to discuss the launch of spot ETFs in Korea only after thoroughly assessing precedents of major countries and weighing their up- and down-sides.

Although there is optimism for the innovative potential of cryptocurrencies, they need to demonstrate their practical utility. Furthermore, it seems to take considerable time for each country to establish market regulations. Considering these circumstances, it is advisable to discuss the launch of spot ETFs in Korea only after thoroughly assessing precedents of major countries and weighing their up- and down-sides.

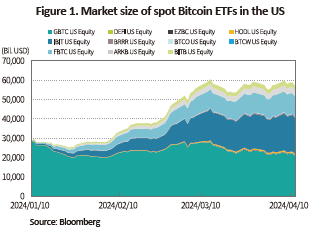

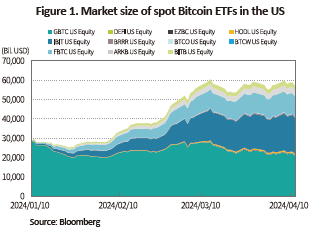

After gaining approval from the Securities and Exchange Commission (SEC) in January 2024, a total of 11 spot Bitcoin ETFs were simultaneously listed in the US. As a result, the market size (net assets) of spot Bitcoin ETFs in the US immediately surpassed that of Canada, the previous leader. The subsequent fund influx prompted the price of Bitcoin, their underlying asset, to soar to over $70,000.

The world’s first spot Bitcoin ETFs debuted in Canada in February 2021. As of the end of March 2024, spot Bitcoin ETFs are listed in seven countries worldwide including the US, Germany, Brazil, and three British Overseas Territories (Bermuda, Guernsey, and Jersey).1) The US dominates the global spot Bitcoin market, accounting for 80% or more of the market share, with Grayscale’s ETFs (GBTC US Equity in Figure 1) holding the largest share within the US.

Following the listing of spot Bitcoin ETFs in the US, there is a growing demand in Korea to approve the domestic issuance and brokerage of spot cryptocurrency2) ETFs. This stance is rooted in the belief that Korea should align with global trends in spot cryptocurrency ETFs, given their potential to bring about positive effects such as enhanced infrastructure, greater market accessibility, and new investment opportunities. However, there exists ongoing criticism towards cryptocurrencies and spot cryptocurrency ETFs regarding their social utility.3) This critical view stems from concerns that the issuance of spot ETFs, which lack intrinsic value and net societal benefits, could amplify financial and economic risks through various channels.

In terms of market capitalization, the global cryptocurrency market is equivalent to around 6% of the S&P 500 market as of March 2024, indicating that its market size is yet to be substantial compared to the traditional financial market. However, it does not rule out the possibility that related markets, such as the EFT market, fuel the expansion of the cryptocurrency market and associated risks materialize. Notably, the introduction of spot crypto ETFs may exacerbate risks inherent in underlying assets (cryptocurrencies) while posing additional risks. This article delves into the financial and economic risks associated with spot crypto ETFs in these two aspects.

Expansion of existing cryptocurrency risks

If the launch of spot crypto ETFs is approved in Korea, this is expected to stimulate both demand and supply sides, leading to a surge in cryptocurrency investments. On the demand side, potential investors who are not currently engaged with cryptocurrency trading platforms are likely to enter the market through ETFs. Once these ETFs are introduced, entry barriers could be lowered through the mobile trading system (MTS) or home trading system (HTS), thereby broadening the investor base. By investor profile, there were 14.03 million shareholders of listed companies as of the end of 2023 (distinct individuals) in the stock market, and 6.06 million investors (individuals) in the cryptocurrency market as of the first half of 2023. Given the extensive investor base in the stock market, it is reasonable to expect that there is a significant number of stock investors who can access the cryptocurrency market, using stock accounts, albeit with differences in counting standards.4) On the supply side, financial institutions such as asset management companies are anticipated to rush to issue and promote ETF products to bolster their revenue streams. Amid the increasing interest in cryptocurrencies, the ETF market itself has been substantially growing in Korea. These favorable conditions are likely to incentivize the issuance of spot crypto ETFs, potentially expanding the cryptocurrency market.

The expansion of the cryptocurrency market can magnify existing risks inherent in underlying assets, including inefficient resource allocation, price risks, deposit volatility, and susceptibility to external factors. First, inefficient resource allocation implies that the inflow of funds into the cryptocurrency market may merely transfer savings to non-productive sectors. Funds raised by firms from issuing securities such as stocks or corporate bonds can be directed towards capital investment and research and development, bolstering the real economy, including employment and growth. However, cryptocurrencies’ economic benefits, derived from mining or initial coin offerings (ICOs), have been constantly criticized for their obscure or limited contribution to the economy.5) If the technological advancements facilitated by cryptocurrency infrastructure fail to live up to optimistic expectations, resource allocation to the crypto sector will be significantly inefficient, compared to new technologies such as artificial intelligence (AI), robotics, and renewable energy. Furthermore, an empirical analysis by Lee et al. (2019) suggests that a rise in Bitcoin prices reduces retail investors’ net purchase of KOSPI stocks. This crowding-out effect may impede financing of firms, which requires caution.

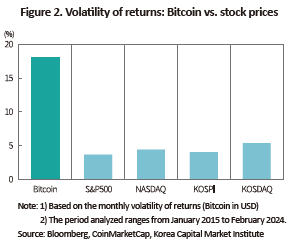

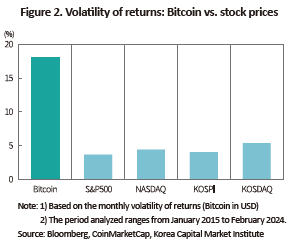

Second, price risk refers to the high volatility in cryptocurrency prices, which arises from pricing independent of cryptocurrencies' intrinsic value. Bindseil et al. (2022) argue that Bitcoin lacks intrinsic value, while Bill Gates6) and Greenspan (2023) suggest that cryptocurrency prices are sustained solely by expectations for price increases, regardless of their actual utility. When asset prices are not linked to fundamentals, their movements have randomness. In such cases, even small liquidity fluctuations can generate significant impacts (Gabaix & Koijen, 2022). As shown in Figure 2, the volatility of Bitcoin prices is immensely higher than that of traditional financial assets (approximately 5 times and 4.5 times that of S&P 500 and KOSPI, respectively), underscoring significant price risks.

Deposit volatility may be amplified as funds for cryptocurrency investments are deposited into and withdrawn from bank accounts. Although the key slogan for the cryptocurrency market is decentralization, the flow of its funds is inalienable to the banking system in practice, primarily hinging on centralized platforms linked to bank accounts. Consequently, the high volatility in the cryptocurrency market may contribute to increased volatility in deposit balances. This suggests that during booms, idle or leveraged funds for cryptocurrency investments are transferred, resulting in greater deposit inflows. However, during busts, investment funds may be curtailed or diverted to other assets, leading to decreased deposit inflows or even net outflows. The resultant expansion of deposit volatility can present challenges for banks in managing liquidity. It is noteworthy that major regulatory authorities in the US had warned about the risk of deposit outflows stemming from crypto market distress before the failure of small to medium banks in March 2023.7) Silvergate Bank indeed faced such a crisis and ceased operations.

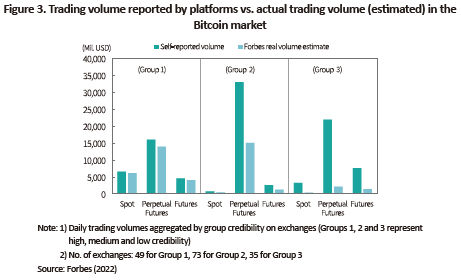

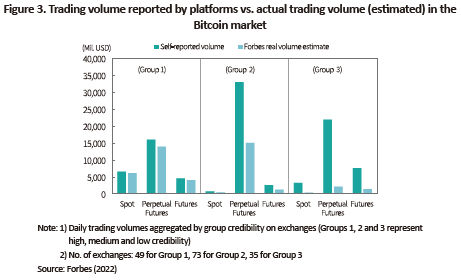

Lastly, vulnerability to external factors underscores the susceptibility of cryptocurrency prices in Korea to fluctuations driven by overseas market conditions, potentially spreading external shocks to the domestic market. In other words, unrest in global cryptocurrency markets, stemming from Bitcoin and Ethereum, can have a direct impact on cryptocurrency prices in Korea. Of particular concern is the difference in the pace of regulatory framework and security establishment among countries, which raises concerns that market disruptions in countries with regulatory loopholes could directly affect the Korean cryptocurrency market. Notably, in the global Bitcoin market, 51% of self-reported trading volume constitutes wash trading or data manipulation (Forbes, 2022), highlighting substantial regulatory gaps in many jurisdictions. Figure 3 illustrates a comparison between self-reported trading volumes by platforms and actual ones estimated by Forbes (2022), grouped by platform credibility (groups 1, 2, and 3 represent high, medium, and low credibility, respectively). Out of a total of 157 platforms, the self-reported volumes on 108 platforms exceed double the actual (estimated) volumes.

Additional risk

It is worth noting that the introduction of spot crypto ETFs may not only exacerbate existing risks inherent in cryptocurrencies but also pose additional financial and economic risks. These risks could involve perception distortion, increased channels for transmitting financial instability, capital outflows, and policy dilemmas. Perception distortion may give rise to significant misunderstandings regarding the risks and value of cryptocurrencies. As spot ETFs are approved, the public would recognize cryptocurrencies as a well-established investment instrument, which is regulated by financial authorities. Moreover, stakeholders like Cathie Wood from ARK Investment Management have described Bitcoin investment as a flight to safety or quality,8) raising concerns that such commercial narratives could be easily accepted and disseminated across the Korean market, following the launch of spot ETFs.

The expansion of channels for transmitting financial instability indicates an addition of nodes through which turmoil in the cryptocurrency market can spread to the financial system. This is a separate issue from potential run risks faced by banks heavily reliant on crypto investors’ deposits. Initially, distress stemming from a sharp decline in cryptocurrencies can impact financial institutions that have invested in cryptocurrency ETFs. If severe shocks lead to a market crunch, it could have a ripple effect via liquidity providers (LPs). For instance, a plunge in cryptocurrency prices may trigger a surge in ETF redemptions and the sell-off of spot cryptocurrencies, potentially causing further declines in cryptocurrency prices. Throughout this process, the failure of LPs to hedge effectively could result in market panic or substantial losses and liquidity shortages for LPs. Cryptocurrencies are deemed to entail high price volatility, which could hinder LPs’ hedging efforts.9) Therefore, it is crucial to be aware of this potential risk.

Capital outflows may occur if spot cryptocurrencies are sourced in large volumes from overseas in the wake of the issuance of spot crypto ETFs. This scenario could materialize in the event where legislative revisions allow domestic financial institutions to procure cryptocurrencies from global markets. The issuance of spot ETFs tied to Bitcoin or other global cryptocurrencies would likely prompt discussions about the need for sourcing spot cryptocurrencies from overseas to secure underlying assets. Thus, it is necessary to acknowledge the potential that the scenario mentioned above could become a reality. As widely recognized, Bitcoin typically carries a price premium10) of around 7-8% in Korea due to the domestic supply shortfall. Domestic financial institutions would be incentivized to source cryptocurrencies from overseas markets not only to address insufficient spot reserves but also to achieve cost savings. Hence, it is difficult to overlook the risk of capital outflows associated with this scenario.

Lastly, policy dilemmas arise when the potential market expansion resulting from the launch of spot ETFs impedes the efficient implementation of policies. If cryptocurrencies constitute a significant portion of economic agents’ investment portfolios, crucial regulations could not be timely implemented due to concerns about their negative effects on crypto prices. Additionally, it is worth considering that if financial institutions become insolvent due to cryptocurrency crises, it could necessitate policy support at high social costs.

Conclusion

Spot crypto ETFs can magnify the inherent risks of underlying assets and trigger additional risks. Despite optimism for the innovative potential, cryptocurrencies still need to demonstrate their practical utility. If cryptocurrencies fail to deliver significant technical advancements, the introduction of spot crypto ETFs may merely serve as an additional wealth redistribution instrument with substantial opportunity costs and limited social benefits. Furthermore, while the global crypto market is growing rapidly, it seems to take considerable time for each country to establish market regulations. Against this backdrop, it is advisable to discuss the launch of spot ETFs in Korea only after thoroughly assessing precedents of major countries and weighing their up- and down-sides.

1) The seven countries are the US, Canada, Germany, Brazil, Australia, Switzerland, and Liechtenstein. On April 15, Hong Kong approved the listing of spot Bitcoin and Ethereum ETFs.

2) In this article, cryptocurrencies refer to unbacked ones that do not have underlying assets such as real assets and securities, or reserves. Bitcoin, Ethereum, and Ripple fall into this category, whereas stablecoins and security tokens do not.

3) Some notable opposite views include Acemoglu (September 5, 2021), Bill Gates (2022), Greenspan (2023), ECB’s Bindseil & Schaaf (2024), and Park (2024).

4) Cryptocurrency investors are users who have completed customer verification requirements, and their number refers to the aggregate count of users on each trading platform. Therefore, this figure includes duplicates (cases where an individual holds accounts on multiple platforms).

5) For example, while cryptocurrency investors anticipate that Bitcoin can create economic value through blockchain technology, numerous researchers have expressed skepticism about this possibility. Catalini & Gans (2019) argued that blockchain would

incur more costs than benefits and thus, could not replace the current centralized systems, unless highly restrictive conditions are met. Abadi & Brunnermeier (2022) presented theoretical findings suggesting that blockchain tied to Bitcoin would not replace centralized ledger systems to a large extent. This view aligns with the ECB’s Bindseil et al. (2022), who assert that Bitcoin holds zero intrinsic value.

6) Wall Street Journal, June 15, 2022, Bill Gates says NFTs and crypto are ‘100%’ based on greater fool theory.

7) In January and February 2023, the US Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) issued a joint statement regarding such a risk.

8) https://www.bloomberg.com/news/videos/2023-08-07/cathie-wood-on-bitcoin-etf-tesla-and-china-market-video

9) Maeil Business Newspaper, November 8, 2023, A new era of Bitcoin ETFs? ‘their adoption is premature’…“difficult to gauge the adoption timing”.

10) It refers to the price difference derived from the conversion of overseas Bitcoin prices (in USD) into Korean won.

References

Abadi J., Brunnermeier, M., 2022, Blockchain economics, NBER Working Paper, 25407.

Acemoglu, D., 2021. 10. 5, The bitcoin fountainhead, Project Syndicate.

Bindseil, U., Papsdorf, P., Schaaf, J., 2022, The encrypted threat: Bitcoin’s social cost and regulatory responses, SUERF Policy Note Issue No 262.

Bindseil, U., Schaaf, J., 2024, ETF approval for bitcoin–the naked emperor’s newclothes, ECB Blog.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency, 2023.1.3, Joint statement on crypto-asset risks to banking organizations.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency, 2023.2.23, Joint statement on liquidity risks to banking organizations resulting from crypto-asset market vulnerabilities.

Catalini, C., Gans, J. S., 2020, Some simple economics of the blockchain, NBER Working Paper, 22952.

Forbes, 2022, More than Half of All Bitcoin Trades are Fake.

Gabaix, X., Koijen, R. S. J., 2022, In the search of the origins of financial fluctuations: The inelastic markets hypothesis, NBER Working Paper, 28967.

Greenspan, A. 2023, Year end Q&A, Advisors Capital Management.

[Korean]

Park, S.Y., January 1, 2024, Considerations on the launch of Bitcoin ETFs in Korea, JoongAng Ilbo.

Lee, K.W., Cho, S.J., Min, K.S. and Yang, C.W., 2019, Determinants of Bitcoin prices: Empirical analysis on the Korean market, Korean Journal of Financial Studies 48(4).

Following the listing of spot Bitcoin ETFs in the US, there is a growing demand in Korea to approve the domestic issuance and brokerage of spot cryptocurrency2) ETFs. This stance is rooted in the belief that Korea should align with global trends in spot cryptocurrency ETFs, given their potential to bring about positive effects such as enhanced infrastructure, greater market accessibility, and new investment opportunities. However, there exists ongoing criticism towards cryptocurrencies and spot cryptocurrency ETFs regarding their social utility.3) This critical view stems from concerns that the issuance of spot ETFs, which lack intrinsic value and net societal benefits, could amplify financial and economic risks through various channels.

In terms of market capitalization, the global cryptocurrency market is equivalent to around 6% of the S&P 500 market as of March 2024, indicating that its market size is yet to be substantial compared to the traditional financial market. However, it does not rule out the possibility that related markets, such as the EFT market, fuel the expansion of the cryptocurrency market and associated risks materialize. Notably, the introduction of spot crypto ETFs may exacerbate risks inherent in underlying assets (cryptocurrencies) while posing additional risks. This article delves into the financial and economic risks associated with spot crypto ETFs in these two aspects.

Expansion of existing cryptocurrency risks

If the launch of spot crypto ETFs is approved in Korea, this is expected to stimulate both demand and supply sides, leading to a surge in cryptocurrency investments. On the demand side, potential investors who are not currently engaged with cryptocurrency trading platforms are likely to enter the market through ETFs. Once these ETFs are introduced, entry barriers could be lowered through the mobile trading system (MTS) or home trading system (HTS), thereby broadening the investor base. By investor profile, there were 14.03 million shareholders of listed companies as of the end of 2023 (distinct individuals) in the stock market, and 6.06 million investors (individuals) in the cryptocurrency market as of the first half of 2023. Given the extensive investor base in the stock market, it is reasonable to expect that there is a significant number of stock investors who can access the cryptocurrency market, using stock accounts, albeit with differences in counting standards.4) On the supply side, financial institutions such as asset management companies are anticipated to rush to issue and promote ETF products to bolster their revenue streams. Amid the increasing interest in cryptocurrencies, the ETF market itself has been substantially growing in Korea. These favorable conditions are likely to incentivize the issuance of spot crypto ETFs, potentially expanding the cryptocurrency market.

The expansion of the cryptocurrency market can magnify existing risks inherent in underlying assets, including inefficient resource allocation, price risks, deposit volatility, and susceptibility to external factors. First, inefficient resource allocation implies that the inflow of funds into the cryptocurrency market may merely transfer savings to non-productive sectors. Funds raised by firms from issuing securities such as stocks or corporate bonds can be directed towards capital investment and research and development, bolstering the real economy, including employment and growth. However, cryptocurrencies’ economic benefits, derived from mining or initial coin offerings (ICOs), have been constantly criticized for their obscure or limited contribution to the economy.5) If the technological advancements facilitated by cryptocurrency infrastructure fail to live up to optimistic expectations, resource allocation to the crypto sector will be significantly inefficient, compared to new technologies such as artificial intelligence (AI), robotics, and renewable energy. Furthermore, an empirical analysis by Lee et al. (2019) suggests that a rise in Bitcoin prices reduces retail investors’ net purchase of KOSPI stocks. This crowding-out effect may impede financing of firms, which requires caution.

Second, price risk refers to the high volatility in cryptocurrency prices, which arises from pricing independent of cryptocurrencies' intrinsic value. Bindseil et al. (2022) argue that Bitcoin lacks intrinsic value, while Bill Gates6) and Greenspan (2023) suggest that cryptocurrency prices are sustained solely by expectations for price increases, regardless of their actual utility. When asset prices are not linked to fundamentals, their movements have randomness. In such cases, even small liquidity fluctuations can generate significant impacts (Gabaix & Koijen, 2022). As shown in Figure 2, the volatility of Bitcoin prices is immensely higher than that of traditional financial assets (approximately 5 times and 4.5 times that of S&P 500 and KOSPI, respectively), underscoring significant price risks.

Lastly, vulnerability to external factors underscores the susceptibility of cryptocurrency prices in Korea to fluctuations driven by overseas market conditions, potentially spreading external shocks to the domestic market. In other words, unrest in global cryptocurrency markets, stemming from Bitcoin and Ethereum, can have a direct impact on cryptocurrency prices in Korea. Of particular concern is the difference in the pace of regulatory framework and security establishment among countries, which raises concerns that market disruptions in countries with regulatory loopholes could directly affect the Korean cryptocurrency market. Notably, in the global Bitcoin market, 51% of self-reported trading volume constitutes wash trading or data manipulation (Forbes, 2022), highlighting substantial regulatory gaps in many jurisdictions. Figure 3 illustrates a comparison between self-reported trading volumes by platforms and actual ones estimated by Forbes (2022), grouped by platform credibility (groups 1, 2, and 3 represent high, medium, and low credibility, respectively). Out of a total of 157 platforms, the self-reported volumes on 108 platforms exceed double the actual (estimated) volumes.

It is worth noting that the introduction of spot crypto ETFs may not only exacerbate existing risks inherent in cryptocurrencies but also pose additional financial and economic risks. These risks could involve perception distortion, increased channels for transmitting financial instability, capital outflows, and policy dilemmas. Perception distortion may give rise to significant misunderstandings regarding the risks and value of cryptocurrencies. As spot ETFs are approved, the public would recognize cryptocurrencies as a well-established investment instrument, which is regulated by financial authorities. Moreover, stakeholders like Cathie Wood from ARK Investment Management have described Bitcoin investment as a flight to safety or quality,8) raising concerns that such commercial narratives could be easily accepted and disseminated across the Korean market, following the launch of spot ETFs.

The expansion of channels for transmitting financial instability indicates an addition of nodes through which turmoil in the cryptocurrency market can spread to the financial system. This is a separate issue from potential run risks faced by banks heavily reliant on crypto investors’ deposits. Initially, distress stemming from a sharp decline in cryptocurrencies can impact financial institutions that have invested in cryptocurrency ETFs. If severe shocks lead to a market crunch, it could have a ripple effect via liquidity providers (LPs). For instance, a plunge in cryptocurrency prices may trigger a surge in ETF redemptions and the sell-off of spot cryptocurrencies, potentially causing further declines in cryptocurrency prices. Throughout this process, the failure of LPs to hedge effectively could result in market panic or substantial losses and liquidity shortages for LPs. Cryptocurrencies are deemed to entail high price volatility, which could hinder LPs’ hedging efforts.9) Therefore, it is crucial to be aware of this potential risk.

Capital outflows may occur if spot cryptocurrencies are sourced in large volumes from overseas in the wake of the issuance of spot crypto ETFs. This scenario could materialize in the event where legislative revisions allow domestic financial institutions to procure cryptocurrencies from global markets. The issuance of spot ETFs tied to Bitcoin or other global cryptocurrencies would likely prompt discussions about the need for sourcing spot cryptocurrencies from overseas to secure underlying assets. Thus, it is necessary to acknowledge the potential that the scenario mentioned above could become a reality. As widely recognized, Bitcoin typically carries a price premium10) of around 7-8% in Korea due to the domestic supply shortfall. Domestic financial institutions would be incentivized to source cryptocurrencies from overseas markets not only to address insufficient spot reserves but also to achieve cost savings. Hence, it is difficult to overlook the risk of capital outflows associated with this scenario.

Lastly, policy dilemmas arise when the potential market expansion resulting from the launch of spot ETFs impedes the efficient implementation of policies. If cryptocurrencies constitute a significant portion of economic agents’ investment portfolios, crucial regulations could not be timely implemented due to concerns about their negative effects on crypto prices. Additionally, it is worth considering that if financial institutions become insolvent due to cryptocurrency crises, it could necessitate policy support at high social costs.

Conclusion

Spot crypto ETFs can magnify the inherent risks of underlying assets and trigger additional risks. Despite optimism for the innovative potential, cryptocurrencies still need to demonstrate their practical utility. If cryptocurrencies fail to deliver significant technical advancements, the introduction of spot crypto ETFs may merely serve as an additional wealth redistribution instrument with substantial opportunity costs and limited social benefits. Furthermore, while the global crypto market is growing rapidly, it seems to take considerable time for each country to establish market regulations. Against this backdrop, it is advisable to discuss the launch of spot ETFs in Korea only after thoroughly assessing precedents of major countries and weighing their up- and down-sides.

1) The seven countries are the US, Canada, Germany, Brazil, Australia, Switzerland, and Liechtenstein. On April 15, Hong Kong approved the listing of spot Bitcoin and Ethereum ETFs.

2) In this article, cryptocurrencies refer to unbacked ones that do not have underlying assets such as real assets and securities, or reserves. Bitcoin, Ethereum, and Ripple fall into this category, whereas stablecoins and security tokens do not.

3) Some notable opposite views include Acemoglu (September 5, 2021), Bill Gates (2022), Greenspan (2023), ECB’s Bindseil & Schaaf (2024), and Park (2024).

4) Cryptocurrency investors are users who have completed customer verification requirements, and their number refers to the aggregate count of users on each trading platform. Therefore, this figure includes duplicates (cases where an individual holds accounts on multiple platforms).

5) For example, while cryptocurrency investors anticipate that Bitcoin can create economic value through blockchain technology, numerous researchers have expressed skepticism about this possibility. Catalini & Gans (2019) argued that blockchain would

incur more costs than benefits and thus, could not replace the current centralized systems, unless highly restrictive conditions are met. Abadi & Brunnermeier (2022) presented theoretical findings suggesting that blockchain tied to Bitcoin would not replace centralized ledger systems to a large extent. This view aligns with the ECB’s Bindseil et al. (2022), who assert that Bitcoin holds zero intrinsic value.

6) Wall Street Journal, June 15, 2022, Bill Gates says NFTs and crypto are ‘100%’ based on greater fool theory.

7) In January and February 2023, the US Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) issued a joint statement regarding such a risk.

8) https://www.bloomberg.com/news/videos/2023-08-07/cathie-wood-on-bitcoin-etf-tesla-and-china-market-video

9) Maeil Business Newspaper, November 8, 2023, A new era of Bitcoin ETFs? ‘their adoption is premature’…“difficult to gauge the adoption timing”.

10) It refers to the price difference derived from the conversion of overseas Bitcoin prices (in USD) into Korean won.

References

Abadi J., Brunnermeier, M., 2022, Blockchain economics, NBER Working Paper, 25407.

Acemoglu, D., 2021. 10. 5, The bitcoin fountainhead, Project Syndicate.

Bindseil, U., Papsdorf, P., Schaaf, J., 2022, The encrypted threat: Bitcoin’s social cost and regulatory responses, SUERF Policy Note Issue No 262.

Bindseil, U., Schaaf, J., 2024, ETF approval for bitcoin–the naked emperor’s newclothes, ECB Blog.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency, 2023.1.3, Joint statement on crypto-asset risks to banking organizations.

Board of Governors of the Federal Reserve System, Federal Deposit Insurance Corporation and Office of the Comptroller of the Currency, 2023.2.23, Joint statement on liquidity risks to banking organizations resulting from crypto-asset market vulnerabilities.

Catalini, C., Gans, J. S., 2020, Some simple economics of the blockchain, NBER Working Paper, 22952.

Forbes, 2022, More than Half of All Bitcoin Trades are Fake.

Gabaix, X., Koijen, R. S. J., 2022, In the search of the origins of financial fluctuations: The inelastic markets hypothesis, NBER Working Paper, 28967.

Greenspan, A. 2023, Year end Q&A, Advisors Capital Management.

[Korean]

Park, S.Y., January 1, 2024, Considerations on the launch of Bitcoin ETFs in Korea, JoongAng Ilbo.

Lee, K.W., Cho, S.J., Min, K.S. and Yang, C.W., 2019, Determinants of Bitcoin prices: Empirical analysis on the Korean market, Korean Journal of Financial Studies 48(4).