Find out more about our latest publications

Outsourced Chief Investment Officer Market: Growth Potential and Need for Full Discretion

Issue Papers 22-22 Nov. 08, 2022

- Research Topic Asset Management/Pension

- Page 20

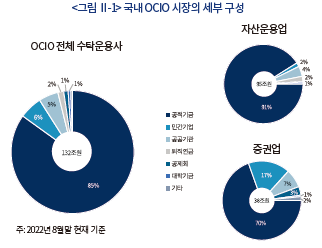

Korea’s Outsourced Chief Investment Officer (OCIO) market has grown on the back of public funds and is now diversifying its client base into private companies and foundations. As a way to enter the oligopolistic OCIO market, some financial services firms have tried to open up a new niche market, leading to such diversification. This article has estimated the accurate market size based on data provided by OCIO service providers. As a result, Korea’s OCIO market is projected at KRW 132 trillion as of end-August 2022. In the OCIO market, 85% of assets under management are still concentrated in public funds (KRW 112 trillion) but the proportion of private companies and public organizations has increased noticeably to 6% and 5%, respectively. The segmented OCIO market defined as a target market is expected to continue expanding into public institutions including public enterprises, rather than into private companies or mutual aid associations. What gains the most attention is the segmented OCIO market for retirement pension funds, which has particularly prompted securities firms to advance into the OCIO sector. But the market still amounts to no more than KRW 2 trillion. In this respect, institutional reform is required to encourage DB contributions to flow into the OCIO market.

Despite this quantitative growth, Korea’s OCIO scheme (K-OCIO) has structural limitations in that its role is confined to the execution of funds, which inhibits the OCIO model from providing a comprehensive asset management solution to OCIO service users. This can be attributable to the partial discretion scheme adopted by the K-OCIO. The full discretion model should be widely adopted to fully serve the OCIO’s goal of using external experts and stimulate healthy competition between trustees. To this end, this article recommends the use of the referent portfolio, selected by the Seoul National University Development Fund. The reference portfolio scheme, extensively used by Korea’s National Pension Fund and foreign public pension funds, is an effective tool to implement the full discretion OCIO model aimed at entrusting independent financial institutions with the top-level strategic decision-making process including the Strategic Asset Allocation (SAA). Full discretion can be implemented based on a trustor’s confidence in a trustee’s investment capability. It is notable that the OCIO scheme designed for supervision, instead of management, would end up delivering low operational efficiency.

Despite this quantitative growth, Korea’s OCIO scheme (K-OCIO) has structural limitations in that its role is confined to the execution of funds, which inhibits the OCIO model from providing a comprehensive asset management solution to OCIO service users. This can be attributable to the partial discretion scheme adopted by the K-OCIO. The full discretion model should be widely adopted to fully serve the OCIO’s goal of using external experts and stimulate healthy competition between trustees. To this end, this article recommends the use of the referent portfolio, selected by the Seoul National University Development Fund. The reference portfolio scheme, extensively used by Korea’s National Pension Fund and foreign public pension funds, is an effective tool to implement the full discretion OCIO model aimed at entrusting independent financial institutions with the top-level strategic decision-making process including the Strategic Asset Allocation (SAA). Full discretion can be implemented based on a trustor’s confidence in a trustee’s investment capability. It is notable that the OCIO scheme designed for supervision, instead of management, would end up delivering low operational efficiency.

Ⅰ. 서론

OCIO(Outsourced Chief Investment Officer)는 외부의 자산운용자(asset manager)가 자산보유자(asset owner)의 자금을 위탁받아 자산운용 업무의 전부 또는 일부를 대행해주는 전략적 일임위탁을 의미한다. 기존의 전통적 위탁방식에 비하여 자산운용에 수반되는 일련의 의사결정 과정에서 보다 상위의 전략적 의사결정 단계를 일부 또는 전부 포괄한다는 특징이 있다. 자산의 위탁운용에서 전략적 의사결정을 외부의 금융기관에 위임한다는 것은 매우 큰 의미를 갖는다. 널리 알려진 바와 같이, 운용성과의 대부분은 종목선택(stock selection) 같은 자금의 집행이 아닌 전략적자산배분(Strategic Asset Allocation)을 포함한 상위 전략적 의사결정에 의존하기 때문이다. 이는 내부의 운용 역량이 부족하여 자금의 운용을 외부 전문가에 위탁하는 OCIO 체계가 효율적으로 작동하기 위해서는 수탁자인 금융회사의 자산운용 역량과 전문성이 집중되는 핵심 업무가 상위 전략적 의사결정을 포괄하여야 함을 의미한다.

Chief Investment Officer(2021)에 의하면 OCIO 제도로 자금을 위탁하는 전체 위탁자의 절반이 OCIO 도입의 주된 사유로 ‘내부 자원의 한계’를 꼽고 있다.1) 선진국에 비해 개인이나 기관의 금융자산 운용 경험이 부족한 우리의 경우 내부 운용 역량이 절대적으로 부족한 상황에서 대규모의 자금을 운용해야 하는 자산보유자, 즉 OCIO 시장의 잠재수요는 매우 클 것으로 사료된다. 외부의 전문성을 활용하여 금융자산을 운용함에 있어 가장 효율적인 위탁운용 방식이 OCIO 체계라 할 수 있다. 이를 바탕으로 미국을 비롯한 금융 선진국의 OCIO 시장은 지속적인 성장세를 시현하고 있다.2) 이러한 시장수요는 국내 OCIO 시장 역시 해외와 유사한 성장세가 실현되기를 기대하는 근거임과 동시에 국내 자산운용시장에서 OCIO 제도가 활성화될 필요성이라 할 수 있다.

앞서 OCIO 제도를 수요로 하는 잠재시장 규모가 크다고 언급하였으나, 단순 짐작만으로 금융기관이 OCIO 시장에 참여하기는 어렵다. 특히 시장에 신규 진입하려는 금융회사는 조직을 신설하고 전문인력을 영입하는 등 상당한 규모의 투자를 선행하여야 하기 때문이다. 시장에 신규 진입하는 금융회사의 입장에서 이러한 경영 판단에 이르기 위해서는 OCIO 시장 전체뿐만 아니라 회사가 목표로 하는 세부시장에 대한 정확한 현황 파악과 정교한 시장 전망이 필요하다. 여기에서 세부시장은 신규 진입자의 목표시장 개념으로, 공적기금을 포함하여 전체 OCIO 시장을 구성하는 위탁자 유형을 의미한다.

하지만 국내에는 아직 이러한 시장정보를 제공하는 공신력 있는 기관이나 언론이 부재한 상황이다. 시장에 신규 진입하는 금융회사로서는 공적기금 외의 대안적 세부시장 확보가 필수적이다. 공적기금 OCIO 시장은 신규 진입이 거의 불가능할 정도로 이미 고착된 시장으로 인식되기 때문이다. 세부시장에 관한 관심은 특히 최근 시장 진입을 적극적으로 추진하고 있는 증권업 부문이 크다. 증권업의 OCIO 시장 진출 배경에는 퇴직연금제도가 있으나, 지금까지 퇴직연금 적립금의 실질적인 OCIO 시장 유입은 미미한 상황이다. 대안적 수요 주체로 공제회나 대학기금 등이 거론되며, 최근에는 민간기업이나 공기업 같은 공공기관 자금의 OCIO 수요가 확대되고 있는 것으로 관측된다. 이러한 관점에서, 본 연구에서는 국내 OCIO 시장을 6개의 세부시장으로 유형화하여 시장 규모 및 투자자 구성을 파악하고 이로부터 개별 세부시장의 향후 확대 가능성을 살펴보고자 한다.3)

OCIO 시장의 외형적 성장에도 불구하고 시장의 질적인 측면에서는 여러 심각한 문제점이 노정되고 있다. 남재우(2019)는 국내 OCIO 시장 활성화를 위한 개선과제로 비합리적인 수수료 체계 정상화, 과도한 전담운용체계 지양, 장기적이고 전략적인 제휴 관계 강화 등을 제시하였으나 지금까지 실질적인 제도 개선은 이루어지지 않고 있는 것으로 평가된다. 이로 인하여 국내 OCIO 시장은 대형 금융회사 중심의 과점 체계가 굳어지고 건전한 경쟁 구도가 실종된, 이른바 시장의 레드오션화에 대한 우려까지 대두되는 상황이다. 본고에서는 그동안 학계 및 업계를 중심으로 시장의 많은 문제점이 제기되었음에도 좀처럼 개선되지 않는 근본 원인으로 OCIO에게 위임되는 재량(discretion)의 부족을 제기하고, 최근 논의되고 있는 기준포트폴리오(reference portfolio)를 활용하여 OCIO의 운용 재량을 적극적으로 확대하는 방안을 제시하고자 한다.

Ⅱ. 국내 OCIO 세부시장

1. 시장 구성 및 현황

기관 대 기관의 사적계약을 기반으로 하는 일임시장의 특성상 정확한 OCIO 시장 규모를 추정하기는 매우 어렵다. 현황 파악이 정확지 않으니 이에 기반한 향후 시장 전망 역시 모호할 수밖에 없다. 국내 OCIO 시장에 관한 기존 학술연구 또는 언론 보도 등을 보면 100조원 규모의 시장 현황과 향후 1,000조원 규모로 확대될 수 있다는 시장 잠재력이 언급되고 있으나, 이에 대한 구체적인 조사 자료나 논리적 근거는 제시되지 않는다. 본고에서는 보다 정확한 시장 현황과 의미 있는 시장 전망을 위하여 시장의 공급자인 OCIO 운용사의 수탁고를 기준으로 시장조사를 실시하였다. 전체 OCIO 시장과 세부시장의 현재 운용규모와 자금의 성격을 가늠하기 위한 시장조사로서, OCIO 제도에 대한 금융기관의 인식, 시장 참여 목적, 시장에 대한 평가, 향후 전망 같은 일반적인 설문조사 성격의 서베이 문항은 포함하지 않았다. 구체적인 조사 내용은 현재 운용중인 OCIO 수탁규모와 자금의 성격에 따른 세부시장 분류, 세부시장 유형별 위탁기관의 특성 등이다. 동일 위탁자의 단일 자금이라 하더라도 세부시장 유형이 혼합되어 있는 경우 재분류하였다.4)

자산운용사와 증권사를 구분하여 별도의 리그로 선정하는 것이 일반적인 시장 상황임을 감안하여 각각의 업권에서 OCIO 시장에 참여하고 있는 대표적 금융기관을 6개씩 선정하여, 총 12개의 금융회사에 대한 OCIO 수탁규모를 조사하였다.5) 국내 OCIO 시장의 과점 양상을 감안할 때 상위 12개 금융회사의 수탁규모는 전체 OCIO 시장을 대부분 포괄할 수 있을 것으로 사료된다. OCIO 세부시장은 국내 시장 현황을 반영하여 대표적 시장참여자인 공적기금 외에 민간기업, 공공기관, 퇴직연금, 공제회, 대학기금의 6개 유형으로 정의하였다.6) 민간기업의 OCIO 수요 자금은 비교적 중장기로 운용되는 사업대기성자금 또는 사내유보금 등이다. 퇴직연금은 확정급여형(DB) 적립금이며, 최근 유행하고 있는 OCIO 공모펀드에 대한 퇴직연금 투자는 제외하였다. 퇴직연금 또는 대학기금 등에서 실제 운용이 아닌 투자자문만을 요구하는 경우도 OCIO 시장 규모 추산에서 제외하였다.

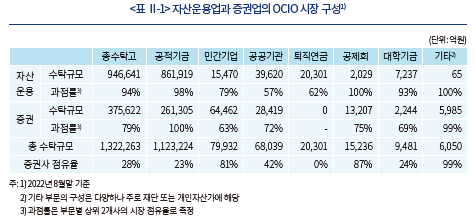

시장조사 결과, 2022년 8월말 현재 국내 OCIO 시장의 운용규모는 132.2조원으로 추산되었다. 알려진 바와 같이 공적기금이 112.3조원 규모로 전체 OCIO 시장의 85%를 차지하고 있으며, 민간기업을 포함한 다른 세부시장도 19.9조원 규모의 OCIO 시장을 형성하고 있음을 확인할 수 있다. 특히 OCIO 시장 진출이 상대적으로 느렸던 증권업의 경우 공적기금 외의 수탁 규모가 30%에 이르러, 그 비중이 9%에 불과한 자산운용업과 대조를 이룬다. 이는 신규진입이 거의 불가능한 대형 공적기금 OCIO 시장에서 탈피하여 경쟁력 있는 분야의 틈새시장을 개척하기 위한 증권업의 노력 결과로 해석된다. 전체 OCIO 시장에서 증권업의 수탁 규모는 37.6조원으로, 시장 점유율은 28%까지 확대되었다. 자산운용업과 증권업의 역할과 업무 범위가 분리된 우리 금융시장의 특성상 OCIO 위탁운용의 수탁사로 자산운용회사와 증권회사 중 어느 곳이 경쟁력 있느냐에 대한 논란이 있으나, 이에 대한 자산소유자의 선택은 아직은 유보적이다.7) OCIO 위탁운용이 직접적인 펀드의 운용이 아니라 자산배분 개념의 재간접펀드(fund of funds)임을 감안하면, 랩(wrap)의 형태로 일임위탁을 실행하는 증권회사의 OCIO 운용 역량이 자산운용회사보다 미흡하다고 주장할 근거는 없기 때문이다.8)

앞서 언급한 바와 같이 국내 OCIO 시장은 신규진입이 거의 불가능한 과점 양상을 보인다. 상위 2개 사의 시장 점유율로 측정한 과점률은 자산운용업의 경우 총 수탁고 기준 94%에 이른다. 이는 전체 시장의 85%를 차지하는 공적기금 부문에서 상위 2개 사의 과점률이 98% 달하기 때문이다. 이에 비하여 시장의 후발주자인 증권업의 과점률은 79% 수준으로 상대적으로 양호한 편이다. 이는 증권업의 시장 점유율이 높은 민간기업 부문에서 상위 2개 사의 과점률이 63% 수준으로 비교적 낮기 때문이다. 증권사의 기업금융 등에 의한 기존 네트워크를 기반으로 하는 민간기업 부문은 OCIO 시장에 새롭게 진입하려는 금융기관에 유효한 운용실적(track record)을 구축할 기회를 제공한다는 측면에서 긍정적이나, 이를 주요 사업 방향으로 설정하기에는 지속적인 성장 가능성이 크지 않다는 문제점이 지적된다. 증권업의 OCIO 시장 진출에 있어 가장 큰 이슈는 퇴직연금 시장이다. 자산운용업에 비해 증권업이 경쟁우위를 갖는 세부시장임에도 불구하고 퇴직연금 OCIO 시장에서 증권업의 시장 점유율은 아직 전무하며, 그 원인은 일임위탁을 허용하지 않는 퇴직연금 적립금의 운용 규제이다.

2. 세부시장 성장 가능성

세부시장 별 현황 자료를 바탕으로 목표시장으로서의 성장 가능성을 가늠하기 위하여 개별 시장의 특성을 살펴보았다. 공적기금 외의 세부시장에서 가장 큰 비중을 보이는 분야가 민간기업 부문이라는 사실은 무척 흥미롭다. 8조원 규모로 추정되는 민간기업의 OCIO 수탁 자금은 대부분 상장기업이 보유하고 있는 사내현금유보금이다.9) 특히 후발주자인 증권업은 기존의 기업금융으로 확보된 네트워크를 기반으로 민간기업 OCIO 시장에서 81%의 점유율을 보인다. 이는 국내 OCIO 시장을 연구하는 해외 기관에서도 관심이 많은 부분으로, 상장기업이 이익을 배당이나 재투자로 배분하지 않고 전문 투자자의 도움을 받아 다른 기업에 지분투자하는 구조가 상식적이지 않기 때문이다. 최근 글로벌 금융위기 등을 거치면서 기업의 사내유보금 축적의 필요성이 증가함에 따라 1년 이상 중장기로 운용해야 할 자금이 크게 증가한 부분이 OCIO 위탁 확대의 직접적인 원인으로 파악된다. 특히 중장기로 상당한 규모의 사내유보금을 축적한 다음 3~5년 단위로 대규모 기업인수나 합병(M&A)을 추진하는 게임산업 등에서 이러한 OCIO 수요가 큰 것으로 알려져 있다. 하지만 민간기업의 이러한 OCIO 수요가 지금처럼 계속해서 유지될지 아니면 확대 또는 축소될지를 가늠하기는 매우 어렵다. 민간기업을 OCIO 시장의 장기적이고 안정적인 수요 주체로 보기는 어렵다는 의미이다.

공적기금을 제외한 OCIO 시장의 두 번째 수요 주체는 공기업 등의 공공기관으로 조사되었다. 약 7조원의 수탁규모로 전체 시장의 5%를 차지하고 있다. 최근 공기업 부채 축소와 같이 정부 정책의 영향이 큰 공공기관의 특성상 이 부문이 향후 OCIO 시장에서 의미 있는 수요 주체로 자리매김할 수 있을지를 예단하기는 어려우나, 민간기업 부문에 비해서는 지속성이나 가능성 측면에서 긍정적으로 평가된다. 최근 사모펀드 사태를 계기로 공기업의 여유자금 운용에 관한 기획재정부의 관리 지침(가이드라인)이 제시되는 등, 상당한 규모의 공기업 내부자금 운용에 있어 OCIO 위탁운용에 대한 잠재적 수요가 클 것으로 예상되기 때문이다. 최근 강원랜드의 여유자금 운용 방식이 파편화된 부분위임(partial discretion)에서 전체 운용자금에 대한 전담 OCIO 체계로 전환하여 새롭게 수탁사를 선정한 사례 역시 공공기관 OCIO 시장의 확대 가능성으로 평가된다. 한편 협동조합이나 새마을금고, 예금보험공사 같은 금융기관의 운용자금 역시 OCIO 시장의 잠재수요로 확대될 수 있다는 측면에서 공공기관 OCIO 시장의 지속적인 성장 가능성을 기대할 수 있다.

공제회 및 대학기금의 OCIO 시장 참여는 아직 미미한 수준이며, 앞으로도 자금 유입 규모는 매우 제한적일 것으로 사료된다. 현재 이 부문의 OCIO 수탁규모는 각각 1.5조원 및 0.9조원 수준으로 2% 미만의 시장 비중이다. 대표적 대학기금인 서울대발전기금이 본고에서 제안하는 기준포트폴리오 방식의 OCIO 위탁체계를 최초 도입하는 등 시장 발전에 상징적인 의미는 있으나, 관련법의 운용 제약으로 인하여 금융상품으로 운용 가능한 대학기금의 전체 규모는 5조원에도 미치지 못하는 것으로 파악된다. 공제회 자금의 경우 일정 규모 이상의 대형 공제회는 기관 내부에 별도의 운용 조직을 갖추고 있어 완전위임 형식의 OCIO 위탁은 현실적이지 않다. 또한 회원들에게 매년 지급해야 하는 높은 약정 이율 등으로 인하여 공제회 자금은 일종의 절대수익형 헤지펀드처럼 운용되고 있어 OCIO 운용사 입장에서는 부담스러운 운용조건이 된다. 내부 운용 역량이 충분하지 않은 중소형 공제회의 경우 과거 무리한 직접운용 또는 전통적 위탁운용에 의한 부실 자산이 지적되고 있어 향후 OCIO 시장으로 자금 유입이 확대될 가능성이 있다. 이에 대한 기대로 기 조성된 민간연기금투자풀을 통하여 중소형 공제회 자금의 집합운용이 활성화될 수 있다.

마지막으로 논의할 OCIO 시장의 핵심 수요 주체는 퇴직연금이다. 증권업이 OCIO 사업을 확대하는 배경에는 퇴직연금의 성장이 있음은 주지의 사실이다. 하지만 <표 Ⅱ-1>에서와 같이 DB형 퇴직연금 적립금의 OCIO 운용 규모는 2조원 수준이며, 모두 자산운용업의 수탁고로 증권업의 시장 참여는 전무한 실정이다. 작년 말 기준 퇴직연금 DB 적립금 규모는 171.5조원으로, 이 중 1.2%의 자금이 OCIO 시장으로 유입된 것으로 추산된다. DB형 퇴직연금에서 적립금운용위원회 설치 및 투자정책서(IPS) 작성이 의무화됨에 따라 대형 사업장을 중심으로 OCIO 위탁운용에 대한 수요가 빠르게 증가할 것으로 기대된다. 하지만 DB 적립금의 원활한 OCIO 시장 유입을 위해서는 퇴직연금의 운용 규제 완화가 선행되어야 한다. 아직까지 퇴직연금의 운용 수단으로 일임위탁은 허용되지 않고 있다. 따라서 현재 OCIO 시장으로 유입된 2조원 규모의 DB 적립금은 모두 사모펀드로 설정되어 있다. 기업의 경우 사모단독펀드의 설정이 허용되지 않기 때문에 대형 사업장이 단독으로 OCIO 위탁을 추진하기는 어려운 상황이다. 이는 퇴직연금시장에 상대적 강점을 갖는 증권업의 DB 적립금 수탁이 전무한 이유이다. 일정 수준의 투자자 보호 장치가 필수불가결한 DC형에 비해 DB형 적립금의 운용은 일종의 기관투자자에 해당하며, 기관투자자의 운용에 개인투자자와 동일한 수준의 투자자 보호 장치를 부과하는 것은 불합리하다. 운용 규제의 판단 기준은 퇴직연금사업자인 금융회사의 유불리가 아니라 가입자인 근로자의 이익 여부이다. DB형 퇴직연금의 운용 수단으로 일임위탁이 허용될 필요가 있다.

한편 DB형 퇴직연금의 적립금 규모 자체는 OCIO 시장이 기대하는 만큼 그렇게 크게 증가하지 않을 수 있다. 향후 퇴직금을 퇴직연금으로 강제 전환하는 제도일원화가 추진되더라도 신규로 DB형 퇴직연금을 도입하는 사업장은 많지 않을 것으로 전망되기 때문이다.10) 따라서 DB형 퇴직연금의 증가세는 신규 사업장의 추가 가입을 배제하고 기존 DB형 사업장에 대해 퇴직연금 기여율(8.3%)과 임금성장률(5%)만을 고려하여 추산하는 것이 합리적일 것이다. 이러한 가정하에서 퇴직연금 시장이 성숙기에 이르기까지 DB형 퇴직연금의 적립 규모를 추산해보면 최대 400조원을 넘지 않을 것으로 예상된다. 적립금운용위원회 설치 및 IPS 작성 의무화 같은 DB형 퇴직연금의 제도 개선에 힘입어 시장 유입률이 50%까지 상승한다고 가정하더라도 DB형 퇴직연금에서 OCIO 시장이 기대할 수 있는 최대 수탁규모는 200조원 미만이다. 퇴직연금 시장 확대만을 이유로 OCIO 시장이 1,000조원 규모까지 성장할 수 있다는 주장은 논리적 근거가 희박하다는 의미이다.

DC형 퇴직연금에서 OCIO 시장의 수요 주체로 기대할 수 있는 분야는 기금형 지배구조를 통한 DC 적립금의 집합운용이다. 해외에서는 DC형 퇴직연금의 구조적 문제점을 보완하기 위하여 다양한 형태의 혼합형(hybrid) DC 제도가 실행되고 있다. 최근 도입된 중소기업퇴직연금기금은 집합운용DC(Collective DC, 이하 CDC)로서 혼합형 DC 제도의 일환이라 할 수 있다. DC형임에도 불구하고 개별 근로자에게 운용지시권이 부여되지 않으며, 기금형 지배구조의 수탁법인으로 지정된 근로복지공단이 근로자의 DC 적립금을 집합(pooling)하여 운용한다. 자산운용의 경험과 역량이 부족한 근로복지공단은 CDC의 적립금 운용을 위하여 OCIO 제도를 선택하였다. 근로복지공단의 기존 퇴직연금 가입자를 중소기업퇴직연금기금으로 강제 이전하지 않음으로 인해 초기 수탁규모는 미미하나, 4년 내에 10조원 이상의 기금으로 확대될 것으로 공단은 추산하고 있다. 중소기업퇴직연금기금의 성공적 운용이 퇴직연금제도에서 갖는 의미는 지대하다. 복지제도의 일환인 퇴직연금의 사각지대 문제를 가장 효율적이고 바람직한 방향으로 해소할 수 있는 제도적 장치가 중소기업퇴직연금기금이기 때문이다. 제도 일원화와 더불어 CDC 적립금에 대한 OCIO 운용이 성공적으로 이루어진다면 중소기업퇴직연금기금은 규모와 역할 측면에서 향후 국민연금기금과 비교되는 위상을 가질 수 있다.

3. 시장의 수요 측면

공적기금을 제외한 OCIO 시장의 모든 수요 주체는 매우 비공개적이다. 예를 들면 상장기업 OCIO 위탁의 경우 투자 재원인 사내유보금에 대한 부정적 시각이 큰 상황에서 운용 규모뿐만 아니라 OCIO 위탁의 사실조차 외부로 공개되기를 꺼리기 때문이다. 별도의 공시 의무가 없는 공제회나 퇴직연금 등도 대부분 OCIO 위탁 규모를 외부로 공개하지 않는다. 따라서 공적기금 중심으로 OCIO 시장의 수요 측면을 살펴본다. OCIO 운용 체계의 효시라 할 수 있는 공적연기금투자풀을 비롯하여 다수의 공적기금이 OCIO 방식으로 자금을 운용하고 있다. 그 중에서 10조원 이상의 대형 OCIO는 기획재정부의 공적연기금투자풀과 국토교통부의 주택도시기금, 그리고 고용노동부의 고용 및 산재기금이 대표적이다. 대학기금 및 공제회 등 민간 성격의 자금을 통합하여 운용하기 위해 만들어진 민간투자풀은 도입 당시 계획되었던 관련 법령의 미비 등으로 인하여 2조원 이하의 운용규모가 지속되고 있다. 기금 규모가 5조원을 상회할 것으로 예상됨에 따라 본격적으로 OCIO 체계를 도입하려던 방사선폐기물기금은 연기금투자풀과 단독 OCIO를 병행하는 체계를 당분간 유지할 것으로 알려져 있다.

공적기금의 OCIO 위탁 현황을 살펴보면 이전부터 지적되던 불합리한 보수 수준과 과도한 전담체계 같은 문제들이 해소되기보다는 오히려 심화하는 양상이다. OCIO 위탁체계 측면에서 운용규모 10조원 이상의 대형 공적기금은 복수 주간운용사라는 특징을 보인다. 공적연기금투자풀은 2개의 자산운용회사를 복수 주간운용사로 활용하고 있으며, 주택도시기금과 고용산재기금은 자산운용회사와 증권회사를 각각 하나씩 선정하고 있다. 전체 운용자금을 모두 위탁하는 경우 위탁자와 수탁자의 전략적 제휴 관계가 강조된다는 측면에서, 단일 위탁자에 대한 복수의 OCIO 관계는 글로벌 트렌드에 부합하지 않는다는 지적이 제기될 수 있다. 특히 국내 공적기금의 복수 OCIO 체계는 기금의 전략적 판단이 요구되는 보완적 관계가 아닌 단순 성과 비교를 위한 경쟁관계로 설정되어 있어, OCIO 위탁운용의 비효율성이 제기될 수 있는 부분이다.

보완적 관계의 복수 OCIO는 운용 자산 및 운용 전략 측면에서 차별성을 강조하여 유형별로 최적의 OCIO 운용사를 활용하기 위한 목적이다. 예를 들면 대체자산과 전통자산에 대한 별도의 OCIO 운용사를 선정하는 방식이다. 이 경우 최적의 보완 관계를 설정하고 복수의 운용사를 전략적으로 관리하기 위해서는 기금 내부의 전문성이 일정 수준 확보되어야 한다. 국내 대형 공적기금의 복수 OCIO 체계는 운용성과 및 기금에 대한 서비스 측면에서 상호 경쟁을 유도하기 위한 목적으로 알려져 있다. 하지만 OCIO의 역할이 자금의 집행에 한정되어 있는 부분위임체계에서 복수 OCIO의 상호 경쟁을 유도할 수 있는 합리적인 평가체계를 구축하기는 매우 어렵다. 동등 분할 성격의 경쟁적 OCIO 관계가 효율적으로 작동하려면 완전위임체계가 보다 유리하다고 할 수 있다. 제한된 역할의 부분위임체계에서는 지속적으로 유의미한 성과 차이를 실현할 수 있는 운용상의 여지가 없기 때문이다. 이러한 주장에 대한 보다 자세한 설명과 논리적 근거는 이어지는 3장 위탁운용체계 개편을 참조하기 바란다.

Ⅲ. OCIO 위탁운용체계 개편

1. 위탁체계 개편의 필요성

국내 OCIO 제도의 연혁은 짧지 않다. 공적연기금투자풀이 조성된 지 21년이며, 단일 위탁자에 대한 OCIO 제도의 효시로 주택도시기금을 꼽는다고 하더라도 18년의 이력이다. 연차로만 보면 성숙 단계의 시장이다. 하지만 국내 OCIO 시장의 현 상태는 ‘건전한 경쟁 구도 부재로 레드오션화된 과점 시장’으로 요약된다. 운용 역량과 이에 따른 성과의 경쟁이 아닌 보수 및 투입 인력 같은 외형적 경쟁만 가시적이다. 독점적 전담인력은 30명을 상회하는데 운용보수율은 3bp를 하회하는 비정상적 시장 상황이 지속 또는 강화되고 있다. 이는 기존 수탁사 또는 대형 금융회사에 절대적으로 유리한 상황으로, 이에 따라 최근 OCIO 운용사 선정에서 기존 운용사의 단일 지원으로 유효 경쟁이 이루어지지 않는 사례가 늘고 있다. 현재의 OCIO 위탁체계는 시장의 레드오션화를 가속화 할 수밖에 없는 구조이다.

그동안 시장 활성화를 위하여 학계와 업계를 중심으로 다양한 개선 방안이 논의되고 제안되었으나, 이에 대한 의사결정 주체인 위탁자의 적극적인 개선 의지는 보이지 않는다. 원가 수준에도 미치지 못하는 운용보수율의 정상화와 이를 완화할 수 있는 성과보수체계 도입, 득보다 실이 많은 전담운용체계의 지양, 장기적이고 전략적인 동반자 관계 구축 등이 대표적이다. 본질적으로 이는 정부 또는 공공기관이라 할 수 있는 공적기금 위주로 구성된 국내 OCIO 시장의 수요요인에 기인한다. 따라서 민간을 포함한 보다 다양한 성격의 자산보유자가 시장에 참여함으로써 시장이 양적으로나 질적으로 보다 두터워진다면 이러한 문제들은 점차 완화될 것으로 사료된다. 앞 장의 시장 현황 분석 결과를 보면 비록 더디기는 하나 이러한 방향으로 시장 수요가 확대되고 있음을 확인할 수 있다.

시장 수요를 다변화하기 위한 노력과 함께 기존의 전통적 위탁방식에 비해 OCIO 제도가 갖는 차별적 경쟁력을 유인할 수 있는 위탁운용체계의 구조적인 개편이 필요한 시점이다. 전술한 바와 같이, OCIO 제도의 경쟁력은 종합적이고 전략적인 투자 솔루션의 제공이다. 이러한 OCIO 위탁운용의 특성이 극대화되기 위해서는 전략적 의사결정의 상당 부분이 OCIO에게 위임되어야 한다. 지금처럼 OCIO에게 전술적 집행의 역할만 부과되는 상황에서는 아무리 전문성이 높은 운용사라 하더라도 종합적인 투자 솔루션을 제공하는 것 자체가 구조적으로 불가능하기 때문이다. 현행 체계에서는 이러한 문제를 운용이 아닌 자문 서비스라는 이름으로 보완하고 있다. 종합적 투자 솔루션을 제공하기 위한 운용전략과 투자 수단이 직접적으로 운용에 적용되는 것이 아니라 자문의 형식으로 제안만 되는 것이다. 하지만 자산운용에 수반되는 일련의 투자 의사결정에 있어 그 역할이 명시적으로 부과되지 않고 그 결과에 대한 책임(또는 보상) 또한 담보되지 않는 자문 서비스는 양과 질 모두에서 형식적일 수밖에 없다. 권한위임(mandate)에 명시되지 않은 업무는 평가받지 않으며, 수탁사인 금융회사는 결과에 대해 평가받지 않는 업무 영역에 양질의 내부 자원을 적극적으로 배분할 유인이 없기 때문이다.

2. 완전위임체계 확대

OCIO 위탁체계는 위임되는 재량의 범위에 따라 부분위임(partial discretion)과 완전위임(full discretion)으로 구분된다.11) 부분위임의 경우 하위운용사 선정 및 관리를 통한 포트폴리오 구축 권한만 OCIO에게 위임되는데 비하여, 완전위임체계에서는 정책적 판단을 제외한 대부분의 전략적 의사결정이 OCIO의 역할과 책임으로 설정될 수 있다. 일반적인 자산운용 프로세스는 정책적 의사결정 – 전략적 의사결정 – 포트폴리오 구축 – 성과평가의 네 단계로 이루어진다.12) 정책적 의사결정은 자금의 조성 목적을 감안하여 운용의 큰 방향을 결정하는 것이다. 사업 계획이나 재정추계 또는 ALM에 기반하여 투자정책서(IPS)를 작성하는 것이 주요 내용이다. 전략적 의사결정은 자금의 중장기 운용방향을 설정하는 것으로, 전략적자산배분 활동이 대표적이라 할 수 있다. 여기에서 전략적자산배분 활동이란 단순히 주어진 자산군(asset class)에 자산 비중을 할당하는 것만이 아니라. 자산군 분류 및 벤치마크의 설정을 통한 시장에 대한 탐색을 모두 포괄한다. 포트폴리오 구축 단계는 재간접펀드기구인 OCIO의 경우 하위운용사를 통해 자금을 배분하고 관리하는 과정이다. 이러한 자산운용 프로세스 하에서 OCIO 위탁운용의 부분위임과 완전위임의 차이는 전략적 의사결정에 대한 권한의 위임 여부로 이해할 수 있다.

앞서 언급한 바와 같이, 기존의 전통적 위탁운용에 비해 OCIO 제도가 갖는 차별적 경쟁력은 운용 역량이 부족한 위탁자에게 전략적 의사결정을 포함하여 종합적인 운용 솔루션을 제공할 수 있다는 점이다. 하지만 국내 OCIO 대부분이 관례적으로 채택하고 있는 제한된 역할의 부분위임체계에서는 이러한 경쟁력 있는 서비스를 제공할 수 있는 운용상의 여지가 없다. 부분위임체계에서 OCIO의 역할은 벤치마크 대비 초과수익 창출로 한정된다. 전술한 바와 같이 시장수익

창출로 한정된다. 전술한 바와 같이 시장수익 에 비해 초과수익은 크기도 작을뿐더러 통계적으로 유의미하지도 않다. 위험관리 측면에서도 금융위기와 같은 위기 상황에서 하방위험(downside risk)을 제어하는데 있어서 부분위임체계의 OCIO가 대응할 수 있는 운용전략이나 투자 수단은 매우 제한적이다. OCIO 제도에서 위탁자가 요구하는 수익률 제고와 위험관리 강화는 전략적자산배분을 포함한 상위 전략적 의사결정 단계에서 대부분 확정되기 때문이다. 부분위임체계에서 시장수익 또는 체계적위험에 관련된 OCIO의 역할 및 권한은 모두 자문의 영역이다. 하지만 자문이 운용을 대체할 수는 없다. 해외 OCIO 시장이 초기 투자자문으로 시작하여 OCIO 운용으로 진화한 배경이다. 성과에 미치는 자문 서비스의 기여도를 객관적으로 평가하고 그 결과를 수탁사 관리 및 성과보수에 반영하는 것 또한 매우 어렵다. 이는 결과적으로 수탁운용사 선정 및 관리체계를 왜곡시키고 시장의 건전한 경쟁구도를 저해하게 된다.

에 비해 초과수익은 크기도 작을뿐더러 통계적으로 유의미하지도 않다. 위험관리 측면에서도 금융위기와 같은 위기 상황에서 하방위험(downside risk)을 제어하는데 있어서 부분위임체계의 OCIO가 대응할 수 있는 운용전략이나 투자 수단은 매우 제한적이다. OCIO 제도에서 위탁자가 요구하는 수익률 제고와 위험관리 강화는 전략적자산배분을 포함한 상위 전략적 의사결정 단계에서 대부분 확정되기 때문이다. 부분위임체계에서 시장수익 또는 체계적위험에 관련된 OCIO의 역할 및 권한은 모두 자문의 영역이다. 하지만 자문이 운용을 대체할 수는 없다. 해외 OCIO 시장이 초기 투자자문으로 시작하여 OCIO 운용으로 진화한 배경이다. 성과에 미치는 자문 서비스의 기여도를 객관적으로 평가하고 그 결과를 수탁사 관리 및 성과보수에 반영하는 것 또한 매우 어렵다. 이는 결과적으로 수탁운용사 선정 및 관리체계를 왜곡시키고 시장의 건전한 경쟁구도를 저해하게 된다.

이에 비하여 완전위임체계에서는 전략적자산배분을 통한 시장수익과 체계적위험의 결정이 OCIO의 역할과 책임으로 설정된다. OCIO는 운용목표(mission)를 가장 효과적으로 달성할 수 있는 전략자산군(strategic asset class)을 설정하고, 이에 대한 밴치마크를 설정하여 투자가능시장을 정의하고, 주어진 위험제약 하에서 최종적으로 자산군 간 최적 배분 비중을 결정하는 일련의 전략적자산배분 활동을 수행하게 된다. 이렇게 작성된 전략적자산배분 하에서 실제 포트폴리오를 구축하고 관리하는 것도 모두 OCIO의 역할이다. OCIO는 초과수익만이 아니라 시장수익을 포함한 총수익성과와 체계적위험을 포함한 총위험으로 평가받게 된다. OCIO가 자신의 권한으로 실행한 모든 의사결정의 결과와 성과는 단계별로 분해되어 평가된다. 운용성과의 평가(evaluation)에서 수익과 위험의 요인분해(attribution analysis)를 의미한다. 이때 평가의 기준은 처음 전략적자산배분 단계에서 자산군 설정의 방향을 제시했던 운용목표이다. 이는 자금의 위탁자가 설정하여 OCIO에게 부과하는 것으로, 결국 효율적인 완전위임체계의 설계는 운용목표를 어떻게 명확하게 설정하고 이를 OCIO에게 효과적으로 강제하느냐가 관건이다.

완전위임체계의 의의는 OCIO 위탁방식의 제도 경쟁력을 확보하고 OCIO 운용사 간 경쟁구도를 강화하여 최종적으로 시장 수요자의 제도 만족도를 높이는 것이다. 완전위임에서 OCIO에게 요구하는 운용역량과 전문성은 부분위임의 그것과는 매우 다르다. 부분위임 OCIO에 요구되는 전문성은 하위운용사를 선정하고 자금을 배분하는 관리역량인 반면에 완전위임에서는 분산된 글로벌 포트폴리오를 구축할 수 있는 운용역량, 즉 자산배분 역량이 강조된다. 완전위임에서는 OCIO 운용사 간의 운용성과 차이가 지금보다 크게 확대될 수 있으며, 이 경우 동종유형(peer group) 비교평가가 실질적인 의미를 가질 수 있다. 완전위임체계에서는 OCIO의 운용역량과 전문성에 대한 합리적이고 객관적인 비교가 가능하기 때문이다. 앞서 2장 3절에서 동등 분할의 복수 OCIO 체계의 경우 완전위임이 제도 목적을 달성하는데 보다 효율적이라는 주장은 이에 근거한다.

자금의 위탁자 입장에서 완전위임 OCIO를 선택하는 것이 부담스러울 수 있다. 공적기금의 경우 관련 법이나 운용 규정의 개정이 필요한 부분이기도 하다. 하지만 공적기금 외의 세부시장 참여자는 제도 도입에 비교적 유연할 수 있을 것으로 사료된다. 서울대발전기금이 그 대표적 사례이다. 위임의 범위가 확대되면 그에 상응하여 OCIO 위탁 보수도 증가할 개연성이 크므로 이 역시 기존 위탁자 입장에서는 부담스러운 부분이다. 하지만 위탁 보수의 적정성은 모든 비용이 차감된 고객 수익률(client return) 개념으로 평가하는 경우 그 판단이 달라질 수 있다. Chief Investment Officer(2021) 서베이의 OCIO 도입 목적에서 비용 절감은 가장 낮은 순위임을 상기할 필요가 있다. 근본적으로는 전략적자산배분을 포함하여 자산운용의 큰 방향을 외부에 맡겼을 때 운용의 결과가 위탁자가 감내할 수 있는 범위를 벗어날 가능성에 대한 우려가 가장 클 것이다. 이를 통제하기 위한 제도적 장치가 다음 절에서 설명하는 기준포트폴리오 체계이다.

3. 기준포트폴리오 활용

완전위임체계는 외부 전문가인 OCIO의 역할 또는 위임의 범위를 적극적으로 확대하는 위탁 방식이다. 완전위임 OCIO의 업무 범위는 정책적 의사결정을 제외한 모든 자산운용 프로세스를 포괄할 수 있다. 하지만 전략적자산배분을 포함하여 상위 전략적 의사결정을 OCIO에게 위임하는 것은 현실적으로 매우 어려운 과제이다. 전략적자산배분에 의한 목표비중과 벤치마크로 만들어지는 가상의 포트폴리오를 전략적자산배분포트폴리오(이하 SAA 포트폴리오)라 한다. 일반적인 다단계 자산배분체계에서 SAA 포트폴리오는 주인(principal)의 포트폴리오로 해석된다. 하위 자산배분을 포함한 모든 운용 활동의 기준이 되는 포트폴리오로서, SAA 포트폴리오의 적절성은 성과평가의 대상이 아니며 배분 결과에 대해서는 아무도 책임지지 않는 것이 일반적이다. 하지만 전략적자산배분을 OCIO에게 위임하는 것은 대리인(agent)에게 운용의 장기적 방향을 결정할 권한을 주는 것으로, 이 경우 장기적 관점에서 자산운용의 결과가 주인이 원하는 방향으로 가지 않는 심각한 위험을 초래할 수도 있다. 따라서 적극적 권한 위임을 통해 대리인(agent)이 수행하게 되는 전략적자산배분은 그 효율성과 적정성이 반드시 사후적으로 측정되고 평가되어야 한다. 이를 기술적으로 구현하는 방안이 기준포트폴리오라 할 수 있다.

대리인에게 전략적자산배분을 포함한 전략적 의사결정을 위임하기 위해서는 자산운용에 대한 주인의 장기적 방향성이 대리인에게 명확하게 전달되어야 한다. 이는 주로 위험성향(risk appetite)의 관점에서 기준포트폴리오의 형식으로 제시된다. 이러한 방향성 및 허용범위 내에서 대리인이 전략적자산배분 활동을 수행토록 하는 위탁운용 체계가 설계되어야 한다. 이러한 위탁체계에서는 대리인의 전략적자산배분 활동으로부터 결과된 전체 운용성과에서 전략적자산배분의 효율성과 적절성이 분리되어 측정되고 평가되는 것이 중요하며, 이러한 평가의 기준으로 기준포트폴리오가 활용될 수 있다.

최근 자산운용체계의 개편을 검토하고 있는 국민연금기금은 기준포트폴리오를 ‘장기투자의 기준으로써 위탁 자산의 위험성향을 표방하는 단순 저비용 패시브 포트폴리오’로 정의하고 있다.13) 여기에서 위험성향은 위험선호도(risk preference)나 위험감내도(risk tolerance), 또는 목표위험(target risk) 등으로 다양하게 표현된다. 통상적으로 기준포트폴리오는 위험자산과 안전자산의 단순한 조합으로 위탁자의 위험성향을 표방한다. 기준포트폴리오는 자금의 성격 또는 조성 목적, 투자 신념(investment belief)과 같이 문장으로 기술되는 추상적 개념과 구체적인 수치로 설정되는 전략적자산배분의 가교 역할이라 할 수 있다. 즉, 사전적으로는 추상적 개념을 기술적 활동으로 전달하는 커뮤니케이션 수단이며, 사후적으로는 전략적자산배분의 효율성 및 적절성을 평가하는 기준이 된다. 따라서 전략적자산배분 권한을 OCIO에게 위임하는 경우 기준포트폴리오는 자금의 위탁자가 OCIO를 효과적으로 관리하기 위한 통제 장치로 이해할 수 있다.

기준포트폴리오를 활용하는 대표적 사례로 캐나다 국민연금(Canada Pension Plan: CPP)의 전담운용기관인 CPPI(CPP Investment)의 통합포트폴리오접근법(Total Portfolio Approach: TPA)이 유명하다. 기준포트폴리오 도입의 목적과 성격은 기관마다 상이하나 최근 국민연금기금도 이를 벤치마킹하여 기준포트폴리오를 통한 자산배분 고도화를 도모하고 있다.14) 기준포트폴리오 제도의 벤치마킹 대상이 주로 연기금인 이유로 기준포트폴리오가 부채가 정의되는 ALM 체계에서만 작동하는 방식으로 그 설정과 운영이 매우 어려운 운용 방법론으로 생각하는 경향이 있으나, 기준포트폴리오의 개념 자체는 대단히 단순하고 명확하다. 부채가 있는 연기금의 경우에는 설정된 기준포트폴리오가 기금이 지향하는 평균적인 위험의 표방이라는 의미를 갖기 위해서는 반드시 ALM 체계로부터 유도되어야 하는 어려움이 있을 뿐이다. 부채가 없는 국부펀드나 대학기금 등에서는 보다 단순한 방식으로 기준포트폴리오가 설정되고 운영될 수 있다.

그 대표적 사례가 국내 OCIO 시장에서 기준포트폴리오 방식으로 자금을 위탁하고 있는 서울대발전기금이다. 서울대발전기금은 2019년부터 전체 대학기금의 일부15)를 기준포트폴리오 방식의 완전위임 OCIO로 위탁하고 있다. 물론 완전위임체계에서도 권한 위임의 범위와 운용상 제약조건 등은 위임조건에 따라 얼마든지 달라질 수 있다. 구체적인 내용은 외부로 공개되지 않으나 기금이 안전자산과 위험자산16)의 단순 비중으로 구성된 기준포트폴리오를 제시하고 OCIO 운용사17)는 이를 장기적으로 추종하도록 전략적자산배분에 의한 SAA 포트폴리오 및 실제 포트폴리오의 구축 및 관리 업무를 수행하게 된다. 여기에 실물자산이 아닌 상장지수펀드(ETF)를 활용한 EMP(ETF Managed Portfolio) 구조로 다양한 자산군의 글로벌 포트폴리오를 구축한다는 제약조건이 부과되며, 부족한 운용보수 수준을 보완하고 완전위임체계에 대한 OCIO 운용사의 최선의 노력과 전문성을 유인하기 위하여 성과보수체계를 도입하였다. 3년의 운용기간이 경과한 현재, 국내에서는 처음 시도된 위탁운용체계임에도 불구하고 안정된 포트폴리오와 양호한 수익성과를 시현하고 있는 것으로 알려져 있다.

국내에 기준포트폴리오 방식의 완전위탁 OCIO 시장이 확산되기 위해서는 구체적인 실행 체계의 많은 부분이 논의되고 합의되어야 한다. 대표적으로 전략적자산배분을 포함한 OCIO의 실제 운용 결과가 기준포트폴리오를 얼마나 충실히 반영하고 있는지를 사후적으로 평가하는 것이 단기실적 위주의 현행 성과평가체계에서는 쉽지 않은 과제이다. 위탁자의 장기적인 위험성향을 표방하는 기준포트폴리오에 연간 단위의 단기성과를 일치시키도록 강요하는 성과평가는 운용의 왜곡을 가져올 수 있기 때문이다. OCIO가 설정하는 SAA 포트폴리오의 적절성은 최소 3년 이상의 장기수익률로 기준포트폴리오 추종 여부를 평가하고18), 실제 포트폴리오의 실현수익률은 OCIO가 설정한 SAA 포트폴리오에 대비하여 평가하는 2단계 성과평가체계를 강구해 볼 수 있다.

작년부터 본격적으로 시행되고 있는 공적연기금투자풀의 완전위탁형 OCIO19) 제도 역시 중소 기금의 모든 전략적 의사결정을 기금이 아닌 투자풀이 수행한다는 측면에서 완전위임체계의 일환으로 볼 수 있다. 다만 이러한 의사결정을 외부 전문가인 주간운용사가 아닌 투자풀운영위원회가 대신하고 있다는 점에서 본고에서 제안하는 기준포트폴리오 방식의 완전위임체계와는 차이가 있다. 이러한 위탁 구조가 제대로 작동하기 위해서는 투자풀운영위원회의 운용 역량과 전문성 확충이 전제되어야 한다. 하지만 현실적으로는 전략적 의사결정의 상당 부분이 주간운용사에 의해 이루어지고 위원회는 이를 형식적으로 승인하는 구조가 될 수밖에 없다. 주간운용사 입장에서는 실질적으로는 운용의 일환이지만 형식적으로는 자문 영역이 된다. 앞서 언급한 바와 같이, 전략적 의사결정에 대한 자문의 효율성은 높지 않다. 완전위탁형 OCIO에서도 본고에서 제안하는 기준포트폴리오 방식을 검토해 볼 수 있을 것으로 사료된다.

Ⅳ. 결론 및 시사점

본 연구에서는 OCIO 시장의 공급 주체인 수탁 금융회사를 대상으로 전체 OCIO 시장 및 세부시장 규모를 조사하였다. 조사 결과, 2022년 8월말 현재 국내 OCIO 시장은 132조원 규모로 추정된다. 전체 시장의 85%가 공적기금이며, 시장에 신규 진입하려는 후발주자가 목표로 하는 공적기금 외의 세부시장은 15% 비중인 20조원 규모로 추정되었다. 세부시장의 성장 가능성을 가늠해보면 민간기업보다는 공기업 등의 공공기관의 성장 잠재력이 크고 지속적일 것으로 판단된다. 증권업을 포함하여 후발주자로 시장에 신규 진입하는 금융회사가 기대하는 가장 주요한 세부시장은 퇴직연금이다. DB 적립금을 중심으로 하는 퇴직연금 자금이 OCIO 시장으로 원활히 유입되기 위해서는 적립금 운용 수단에 대한 열거주의식 운용규제가 완화되어야 한다.

자산운용사 또는 증권사 같은 금융기관이 OCIO 제도를 성장 가능성 있는 사업모형으로 설정하고 회사 차원의 인력과 자원을 지속적으로 투입하기 위해서는 이른바 목표 시장에 대한 명확한 정의와 체계적 분석이 필수적이다. 막연한 감이나 낙관적 기대만으로 사업위험을 감수할 수는 없기 때문이다. 마케팅 분야의 시장조사 및 분석 도구를 활용하여 정확한 시장 현황과 잠재적 목표시장의 규모가 주기적으로 파악될 필요가 있다. 민간 컨설팅 회사가 제공하는 이러한 시장조사는 국내 OCIO 시장이 지속적으로 성장하기 위한 일종의 시장 인프라이다. 수탁기관의 설문조사를 통해 국내 OCIO 시장의 규모를 파악하고 잠재적 목표시장으로서의 세부시장 별 특성을 살펴본 본 연구는 이러한 시장 인프라로서의 의의가 있다.

레드오션화에 대한 우려와 시장에서 제기되는 여러 문제점을 해결하기 위한 근본적인 개선책은 OCIO의 의사결정 범위 또는 위임되는 역할을 확대하는 것이다. 투자 실행의 역할만으로는 기존의 전통적 위탁방식과 차별되는 OCIO 본연의 경쟁력을 시현할 수 없기 때문이다. 전략적자산배분(SAA)을 포함한 상위 의사결정 단계로 위임의 범위를 확대하는 위탁체계를 완전위임 OCIO라 한다. 국내 OCIO 시장의 수요자가 관례적으로 채택하고 있는 부분위임이 갖는 운용의 비효율성과 이로 인한 시장 왜곡을 완화하기 위하여 완전위임체계의 확대를 주장한다. 완전위임이 요구하는 OCIO의 적극적인 역할 확대를 제도적으로 구현하는 방법론이 기준포트폴리오 체계이다. 기준포트폴리오 체계는 자금의 위탁자가 자신의 평균적인 위험성향을 표방하는 기준포트폴리오를 설정하여 수탁자에게 제시하고, OCIO는 이를 바탕으로 전략적자산배분을 포함한 모든 전략적 의사결정을 수행하는 위탁체계로 이해할 수 있다.

OCIO 제도가 국내에 처음 도입된 지 20년을 넘고 있다. 외부 전문가를 활용하는 위탁운용의 경험이 많지 않으며 자산운용에 대한 투자 신뢰가 높지 않은 우리 금융 환경에서 초기 OCIO 제도는 자금의 수탁자에 대한 불신을 전제로 설계되었다고 볼 수 있다. 정부 기관이라 할 수 있는 공적기금이 거대 자금을 민간 운용사에 위탁하는 과정에서 수탁 금융기관에 대한 신뢰 부족은 짧은 선정 및 평가 주기와 낮은 보수체계, 과도한 전담운용 같이 수탁자의 도덕적 해이를 방지하기 위한 제도적 장치를 요구하였다. 하지만 이러한 수탁사 관리체계는 ‘전략적이고 총괄적인 일임위탁’이라는 OCIO 제도 본연의 경쟁우위와 부합하지 않는다. 이는 20년의 세월이 흐른 현재까지 OCIO의 운용 효율성을 저하시키는 장애요인으로 남아 있다. 본고에서 제안하는 기준포트폴리오 방식의 완전위임체계는 수탁자인 금융회사에 대한 위탁자의 신뢰를 전제로 한다. 불신을 전제로 설계된 위탁체계의 운용 효율성은 낮을 수밖에 없음을 유념하여야 한다.

1) 최근 4년 동안 당 기관이 매년 조사하고 있는 OCIO 서베이에 의하면, 50%의 위탁자가 OCIO 도입 사유로 ‘내부 자원의 한계’를 꼽고 있으며, 그 뒤를 이어 ‘위험관리’, ‘추가적인 수탁자 감시’, ‘빠른 의사결정’, ‘수익률 제고’ 등의 사유가 각각 38%, 32%, 26%, 21% 순이다. ‘비용 절감’을 이유로 OCIO를 도입한 경우는 17%에 불과하다.(중복응답)

2) Cerulli Associates(2018)은 2014년 이후 향후 10년 동안 미국의 완전위임 OCIO 시장의 성장세가 연평균 9.2%에 이를 것으로 추산하고 있다.

3) 이러한 잠재시장 또는 유형별 목표시장에 대한 세밀한 시장 전망은 민간 컨설팅 회사의 사업 영역이다. 해외에서는 본고에서도 인용하고 있는 Chief Investment Officer 또는 Cerulli Associates 등이 그 역할을 수행하는 것으로 관측되나 국내는 아직 이런 시장조사가 시행되지 않고 있다. 본고에서는 세부시장 유형별 수탁 규모를 대략적으로 추산하고, 향후 정치한 시장 전망을 위해 고려해야 할 시장 특성을 제시하고자 한다.

4) 예를 들면 민간연기금투자풀의 단일 OCIO 수탁고를 세부시장 유형 분류에 따라 대학기금과 공제회, 공공기관 등으로 재분류하였다.

5) 조사 대상 자산운용회사는 미래에셋자산운용, 삼성자산운용, 신한자산운용, 한국투자신탁운용, 한화자산운용, KB자산운용이며, 증권회사는 미래에셋대우증권, 삼성증권, 신한금융투자증권, 한국투자증권, KB증권, NH투자증권이다. (회사명 순서)

6) 세부시장 유형은 신규 시장 참여자의 목표시장 관점으로 분류하였다. 해외의 경우, 예를 들면 OCIO Survey는 자금의 유형을 확정급여형(DB), 401k(DC), 대학 및 재단, 건강보험, 기타 등으로 분류하고 있다.

7) 대형 공적기금의 경우 복수 주간운용사 체계를 통해 자산운용회사와 증권회사를 별도 리그로 선정하는 경우가 일반적이나 최근 들어 이러한 업권 구분 없이 단수 또는 복수의 OCIO 운용사를 선정하는 경우가 확대되는 추세이다.

8) 이는 대형 공적기금의 OCIO 운용사 선정에 앞서 매번 실행되는 관련 연구용역에서도 반복적으로 확인되고 있는 사안이다.

9) 사업대기성 자금으로 유동성 관리가 목적인 3개월 미만의 단기 현금성 자금도 OCIO의 운용 자산에 포함되어 있기는 하나, 대부분 주식 및 채권에 투자되는 1년 이상의 중장기 운용자산 성격으로 파악된다.

10) 300인 이상 대형 사업장의 퇴직연금 도입률은 이미 90%를 상회하고 있으며, 중소 규모 사업장의 경우 DB형 퇴직연금에 대한 사용자의 부담이 커서 퇴직연금제도로 전환하더라도 대부분 DC형 퇴직연금만 제공할 것으로 예상된다.

11) 위탁자 입장에서 운용자산의 일부 또는 전부를 위탁하느냐로 부분위임과 완전위임을 구분하기도 하나, 본고에서와 같이 위임되는 재량의 범위로 구분하는 것이 일반적이다.

12) 위험관리 활동은 이 모든 과정에 포괄적으로 적용된다.

13) 박태영‧원상희(2017)

14) CPPI의 기준포트폴리오는 자산배분체계의 고도화보다는 자산군에 얽매이지 않는 적극적인 액티브운용을 위하여 기준포트폴리오 체계를 도입하였다. 즉, 특정 자산군에 대한 목표 비중을 설정하지 않고 모든 포트폴리오를 액티브 프로그램화하여 기준포트폴리오 대비 초과수익 창출을 목표로 한다. 이에 비하여 국민연금기금의 기준포트폴리오는 기존의 다단계 자산배분체계를 고도화하는 관점에서 추진되고 있으며, 실질적인 주요 대상은 대체투자 부문으로 한정되는 것으로 알려져 있다.

15) 초기 약정금액은 2,500억원 규모로 알려져 있다.

16) 일반적으로 위험자산은 글로벌 주식시장지수, 안전자산은 자국 채권시장지수를 활용한다. 이때 활용되는 시장지수는 일종의 기회비용 벤치마크(opportunity cost benchmark)의 개념으로 전략적 자산군에서 시장을 정의하기 위한 벤치마크지수와는 설정 목적이 다르다.

17) 2019년 제도 개편 이후 삼성자산운용이 OCIO 운용사로 선정되었다.

18) SAA 포트폴리오는 시장지수인 벤치마크로 구성된 가상의 포트폴리오이다. OCIO 위탁운용의 기간은 짧더라도 OCIO가 설정한 SAA 포트폴리오의 장기수익률은 산출 가능하며, 이러한 SAA 포트폴리오의 장기 수익성과가 기준포트폴리오가 표방하는 기대수익률과 위험성향을 충실히 지향하고 있는지를 평가할 수 있다.

19) 2021년부터 본격 시행되고 있는 공적연기금투자풀의 새로운 위탁체계로, 중소형 공적기금을 대상으로 기금의 전략적 의사결정을 모두 OCIO가 수행하는 일종의 완전위임체계이다. 하지만 다수의 수익자를 대상으로 자금을 집합하여 운용하는 투자풀의 특성상, 여기에서 OCIO는 외부 금융기관인 주간운용사가 아니라 기획재정부 산하의 위원회 조직인 연기금투자풀을 의미한다. 따라서 본고에서 제안하는 기준포트폴리오 방식이 아닌, 연기금투자풀의 위원회가 개별 기금의 위원회를 대신하여 모든 전략적 의사결정을 수행하는 방식이다.

참고문헌

남재우, 2019,『국내 OCIO 제도 정착을 위한 개선과제』, 자본시장연구원 이슈보고서 2019-5호.

박태영·원상희, 2017, 국민연금기금의 기준포트폴리오 설정 방안, 국민연금연구원, 『정책보고서』 2017-6호.

Cerulli Associates, 2018, OCIO at an Inflection Point: Strong Growth Ahead, but Institutions Are Demanding More.

Chief Investment Officer, 2021, 2021 Outsourced–Chief Investment Office Survey.

고용노동부 www.moel.go.kr

국토교통부 www.molit.go.kr

기획재정부 www.moef.go.kr

주택도시기금 nhuf.molit.go.kr

한국증권금융 www.ksfc.co.kr

Chief Investment Officer www.ai-cio.com

OCIO(Outsourced Chief Investment Officer)는 외부의 자산운용자(asset manager)가 자산보유자(asset owner)의 자금을 위탁받아 자산운용 업무의 전부 또는 일부를 대행해주는 전략적 일임위탁을 의미한다. 기존의 전통적 위탁방식에 비하여 자산운용에 수반되는 일련의 의사결정 과정에서 보다 상위의 전략적 의사결정 단계를 일부 또는 전부 포괄한다는 특징이 있다. 자산의 위탁운용에서 전략적 의사결정을 외부의 금융기관에 위임한다는 것은 매우 큰 의미를 갖는다. 널리 알려진 바와 같이, 운용성과의 대부분은 종목선택(stock selection) 같은 자금의 집행이 아닌 전략적자산배분(Strategic Asset Allocation)을 포함한 상위 전략적 의사결정에 의존하기 때문이다. 이는 내부의 운용 역량이 부족하여 자금의 운용을 외부 전문가에 위탁하는 OCIO 체계가 효율적으로 작동하기 위해서는 수탁자인 금융회사의 자산운용 역량과 전문성이 집중되는 핵심 업무가 상위 전략적 의사결정을 포괄하여야 함을 의미한다.

Chief Investment Officer(2021)에 의하면 OCIO 제도로 자금을 위탁하는 전체 위탁자의 절반이 OCIO 도입의 주된 사유로 ‘내부 자원의 한계’를 꼽고 있다.1) 선진국에 비해 개인이나 기관의 금융자산 운용 경험이 부족한 우리의 경우 내부 운용 역량이 절대적으로 부족한 상황에서 대규모의 자금을 운용해야 하는 자산보유자, 즉 OCIO 시장의 잠재수요는 매우 클 것으로 사료된다. 외부의 전문성을 활용하여 금융자산을 운용함에 있어 가장 효율적인 위탁운용 방식이 OCIO 체계라 할 수 있다. 이를 바탕으로 미국을 비롯한 금융 선진국의 OCIO 시장은 지속적인 성장세를 시현하고 있다.2) 이러한 시장수요는 국내 OCIO 시장 역시 해외와 유사한 성장세가 실현되기를 기대하는 근거임과 동시에 국내 자산운용시장에서 OCIO 제도가 활성화될 필요성이라 할 수 있다.

앞서 OCIO 제도를 수요로 하는 잠재시장 규모가 크다고 언급하였으나, 단순 짐작만으로 금융기관이 OCIO 시장에 참여하기는 어렵다. 특히 시장에 신규 진입하려는 금융회사는 조직을 신설하고 전문인력을 영입하는 등 상당한 규모의 투자를 선행하여야 하기 때문이다. 시장에 신규 진입하는 금융회사의 입장에서 이러한 경영 판단에 이르기 위해서는 OCIO 시장 전체뿐만 아니라 회사가 목표로 하는 세부시장에 대한 정확한 현황 파악과 정교한 시장 전망이 필요하다. 여기에서 세부시장은 신규 진입자의 목표시장 개념으로, 공적기금을 포함하여 전체 OCIO 시장을 구성하는 위탁자 유형을 의미한다.

하지만 국내에는 아직 이러한 시장정보를 제공하는 공신력 있는 기관이나 언론이 부재한 상황이다. 시장에 신규 진입하는 금융회사로서는 공적기금 외의 대안적 세부시장 확보가 필수적이다. 공적기금 OCIO 시장은 신규 진입이 거의 불가능할 정도로 이미 고착된 시장으로 인식되기 때문이다. 세부시장에 관한 관심은 특히 최근 시장 진입을 적극적으로 추진하고 있는 증권업 부문이 크다. 증권업의 OCIO 시장 진출 배경에는 퇴직연금제도가 있으나, 지금까지 퇴직연금 적립금의 실질적인 OCIO 시장 유입은 미미한 상황이다. 대안적 수요 주체로 공제회나 대학기금 등이 거론되며, 최근에는 민간기업이나 공기업 같은 공공기관 자금의 OCIO 수요가 확대되고 있는 것으로 관측된다. 이러한 관점에서, 본 연구에서는 국내 OCIO 시장을 6개의 세부시장으로 유형화하여 시장 규모 및 투자자 구성을 파악하고 이로부터 개별 세부시장의 향후 확대 가능성을 살펴보고자 한다.3)

OCIO 시장의 외형적 성장에도 불구하고 시장의 질적인 측면에서는 여러 심각한 문제점이 노정되고 있다. 남재우(2019)는 국내 OCIO 시장 활성화를 위한 개선과제로 비합리적인 수수료 체계 정상화, 과도한 전담운용체계 지양, 장기적이고 전략적인 제휴 관계 강화 등을 제시하였으나 지금까지 실질적인 제도 개선은 이루어지지 않고 있는 것으로 평가된다. 이로 인하여 국내 OCIO 시장은 대형 금융회사 중심의 과점 체계가 굳어지고 건전한 경쟁 구도가 실종된, 이른바 시장의 레드오션화에 대한 우려까지 대두되는 상황이다. 본고에서는 그동안 학계 및 업계를 중심으로 시장의 많은 문제점이 제기되었음에도 좀처럼 개선되지 않는 근본 원인으로 OCIO에게 위임되는 재량(discretion)의 부족을 제기하고, 최근 논의되고 있는 기준포트폴리오(reference portfolio)를 활용하여 OCIO의 운용 재량을 적극적으로 확대하는 방안을 제시하고자 한다.

Ⅱ. 국내 OCIO 세부시장

1. 시장 구성 및 현황

기관 대 기관의 사적계약을 기반으로 하는 일임시장의 특성상 정확한 OCIO 시장 규모를 추정하기는 매우 어렵다. 현황 파악이 정확지 않으니 이에 기반한 향후 시장 전망 역시 모호할 수밖에 없다. 국내 OCIO 시장에 관한 기존 학술연구 또는 언론 보도 등을 보면 100조원 규모의 시장 현황과 향후 1,000조원 규모로 확대될 수 있다는 시장 잠재력이 언급되고 있으나, 이에 대한 구체적인 조사 자료나 논리적 근거는 제시되지 않는다. 본고에서는 보다 정확한 시장 현황과 의미 있는 시장 전망을 위하여 시장의 공급자인 OCIO 운용사의 수탁고를 기준으로 시장조사를 실시하였다. 전체 OCIO 시장과 세부시장의 현재 운용규모와 자금의 성격을 가늠하기 위한 시장조사로서, OCIO 제도에 대한 금융기관의 인식, 시장 참여 목적, 시장에 대한 평가, 향후 전망 같은 일반적인 설문조사 성격의 서베이 문항은 포함하지 않았다. 구체적인 조사 내용은 현재 운용중인 OCIO 수탁규모와 자금의 성격에 따른 세부시장 분류, 세부시장 유형별 위탁기관의 특성 등이다. 동일 위탁자의 단일 자금이라 하더라도 세부시장 유형이 혼합되어 있는 경우 재분류하였다.4)

자산운용사와 증권사를 구분하여 별도의 리그로 선정하는 것이 일반적인 시장 상황임을 감안하여 각각의 업권에서 OCIO 시장에 참여하고 있는 대표적 금융기관을 6개씩 선정하여, 총 12개의 금융회사에 대한 OCIO 수탁규모를 조사하였다.5) 국내 OCIO 시장의 과점 양상을 감안할 때 상위 12개 금융회사의 수탁규모는 전체 OCIO 시장을 대부분 포괄할 수 있을 것으로 사료된다. OCIO 세부시장은 국내 시장 현황을 반영하여 대표적 시장참여자인 공적기금 외에 민간기업, 공공기관, 퇴직연금, 공제회, 대학기금의 6개 유형으로 정의하였다.6) 민간기업의 OCIO 수요 자금은 비교적 중장기로 운용되는 사업대기성자금 또는 사내유보금 등이다. 퇴직연금은 확정급여형(DB) 적립금이며, 최근 유행하고 있는 OCIO 공모펀드에 대한 퇴직연금 투자는 제외하였다. 퇴직연금 또는 대학기금 등에서 실제 운용이 아닌 투자자문만을 요구하는 경우도 OCIO 시장 규모 추산에서 제외하였다.

2. 세부시장 성장 가능성

세부시장 별 현황 자료를 바탕으로 목표시장으로서의 성장 가능성을 가늠하기 위하여 개별 시장의 특성을 살펴보았다. 공적기금 외의 세부시장에서 가장 큰 비중을 보이는 분야가 민간기업 부문이라는 사실은 무척 흥미롭다. 8조원 규모로 추정되는 민간기업의 OCIO 수탁 자금은 대부분 상장기업이 보유하고 있는 사내현금유보금이다.9) 특히 후발주자인 증권업은 기존의 기업금융으로 확보된 네트워크를 기반으로 민간기업 OCIO 시장에서 81%의 점유율을 보인다. 이는 국내 OCIO 시장을 연구하는 해외 기관에서도 관심이 많은 부분으로, 상장기업이 이익을 배당이나 재투자로 배분하지 않고 전문 투자자의 도움을 받아 다른 기업에 지분투자하는 구조가 상식적이지 않기 때문이다. 최근 글로벌 금융위기 등을 거치면서 기업의 사내유보금 축적의 필요성이 증가함에 따라 1년 이상 중장기로 운용해야 할 자금이 크게 증가한 부분이 OCIO 위탁 확대의 직접적인 원인으로 파악된다. 특히 중장기로 상당한 규모의 사내유보금을 축적한 다음 3~5년 단위로 대규모 기업인수나 합병(M&A)을 추진하는 게임산업 등에서 이러한 OCIO 수요가 큰 것으로 알려져 있다. 하지만 민간기업의 이러한 OCIO 수요가 지금처럼 계속해서 유지될지 아니면 확대 또는 축소될지를 가늠하기는 매우 어렵다. 민간기업을 OCIO 시장의 장기적이고 안정적인 수요 주체로 보기는 어렵다는 의미이다.

공적기금을 제외한 OCIO 시장의 두 번째 수요 주체는 공기업 등의 공공기관으로 조사되었다. 약 7조원의 수탁규모로 전체 시장의 5%를 차지하고 있다. 최근 공기업 부채 축소와 같이 정부 정책의 영향이 큰 공공기관의 특성상 이 부문이 향후 OCIO 시장에서 의미 있는 수요 주체로 자리매김할 수 있을지를 예단하기는 어려우나, 민간기업 부문에 비해서는 지속성이나 가능성 측면에서 긍정적으로 평가된다. 최근 사모펀드 사태를 계기로 공기업의 여유자금 운용에 관한 기획재정부의 관리 지침(가이드라인)이 제시되는 등, 상당한 규모의 공기업 내부자금 운용에 있어 OCIO 위탁운용에 대한 잠재적 수요가 클 것으로 예상되기 때문이다. 최근 강원랜드의 여유자금 운용 방식이 파편화된 부분위임(partial discretion)에서 전체 운용자금에 대한 전담 OCIO 체계로 전환하여 새롭게 수탁사를 선정한 사례 역시 공공기관 OCIO 시장의 확대 가능성으로 평가된다. 한편 협동조합이나 새마을금고, 예금보험공사 같은 금융기관의 운용자금 역시 OCIO 시장의 잠재수요로 확대될 수 있다는 측면에서 공공기관 OCIO 시장의 지속적인 성장 가능성을 기대할 수 있다.

공제회 및 대학기금의 OCIO 시장 참여는 아직 미미한 수준이며, 앞으로도 자금 유입 규모는 매우 제한적일 것으로 사료된다. 현재 이 부문의 OCIO 수탁규모는 각각 1.5조원 및 0.9조원 수준으로 2% 미만의 시장 비중이다. 대표적 대학기금인 서울대발전기금이 본고에서 제안하는 기준포트폴리오 방식의 OCIO 위탁체계를 최초 도입하는 등 시장 발전에 상징적인 의미는 있으나, 관련법의 운용 제약으로 인하여 금융상품으로 운용 가능한 대학기금의 전체 규모는 5조원에도 미치지 못하는 것으로 파악된다. 공제회 자금의 경우 일정 규모 이상의 대형 공제회는 기관 내부에 별도의 운용 조직을 갖추고 있어 완전위임 형식의 OCIO 위탁은 현실적이지 않다. 또한 회원들에게 매년 지급해야 하는 높은 약정 이율 등으로 인하여 공제회 자금은 일종의 절대수익형 헤지펀드처럼 운용되고 있어 OCIO 운용사 입장에서는 부담스러운 운용조건이 된다. 내부 운용 역량이 충분하지 않은 중소형 공제회의 경우 과거 무리한 직접운용 또는 전통적 위탁운용에 의한 부실 자산이 지적되고 있어 향후 OCIO 시장으로 자금 유입이 확대될 가능성이 있다. 이에 대한 기대로 기 조성된 민간연기금투자풀을 통하여 중소형 공제회 자금의 집합운용이 활성화될 수 있다.

마지막으로 논의할 OCIO 시장의 핵심 수요 주체는 퇴직연금이다. 증권업이 OCIO 사업을 확대하는 배경에는 퇴직연금의 성장이 있음은 주지의 사실이다. 하지만 <표 Ⅱ-1>에서와 같이 DB형 퇴직연금 적립금의 OCIO 운용 규모는 2조원 수준이며, 모두 자산운용업의 수탁고로 증권업의 시장 참여는 전무한 실정이다. 작년 말 기준 퇴직연금 DB 적립금 규모는 171.5조원으로, 이 중 1.2%의 자금이 OCIO 시장으로 유입된 것으로 추산된다. DB형 퇴직연금에서 적립금운용위원회 설치 및 투자정책서(IPS) 작성이 의무화됨에 따라 대형 사업장을 중심으로 OCIO 위탁운용에 대한 수요가 빠르게 증가할 것으로 기대된다. 하지만 DB 적립금의 원활한 OCIO 시장 유입을 위해서는 퇴직연금의 운용 규제 완화가 선행되어야 한다. 아직까지 퇴직연금의 운용 수단으로 일임위탁은 허용되지 않고 있다. 따라서 현재 OCIO 시장으로 유입된 2조원 규모의 DB 적립금은 모두 사모펀드로 설정되어 있다. 기업의 경우 사모단독펀드의 설정이 허용되지 않기 때문에 대형 사업장이 단독으로 OCIO 위탁을 추진하기는 어려운 상황이다. 이는 퇴직연금시장에 상대적 강점을 갖는 증권업의 DB 적립금 수탁이 전무한 이유이다. 일정 수준의 투자자 보호 장치가 필수불가결한 DC형에 비해 DB형 적립금의 운용은 일종의 기관투자자에 해당하며, 기관투자자의 운용에 개인투자자와 동일한 수준의 투자자 보호 장치를 부과하는 것은 불합리하다. 운용 규제의 판단 기준은 퇴직연금사업자인 금융회사의 유불리가 아니라 가입자인 근로자의 이익 여부이다. DB형 퇴직연금의 운용 수단으로 일임위탁이 허용될 필요가 있다.

한편 DB형 퇴직연금의 적립금 규모 자체는 OCIO 시장이 기대하는 만큼 그렇게 크게 증가하지 않을 수 있다. 향후 퇴직금을 퇴직연금으로 강제 전환하는 제도일원화가 추진되더라도 신규로 DB형 퇴직연금을 도입하는 사업장은 많지 않을 것으로 전망되기 때문이다.10) 따라서 DB형 퇴직연금의 증가세는 신규 사업장의 추가 가입을 배제하고 기존 DB형 사업장에 대해 퇴직연금 기여율(8.3%)과 임금성장률(5%)만을 고려하여 추산하는 것이 합리적일 것이다. 이러한 가정하에서 퇴직연금 시장이 성숙기에 이르기까지 DB형 퇴직연금의 적립 규모를 추산해보면 최대 400조원을 넘지 않을 것으로 예상된다. 적립금운용위원회 설치 및 IPS 작성 의무화 같은 DB형 퇴직연금의 제도 개선에 힘입어 시장 유입률이 50%까지 상승한다고 가정하더라도 DB형 퇴직연금에서 OCIO 시장이 기대할 수 있는 최대 수탁규모는 200조원 미만이다. 퇴직연금 시장 확대만을 이유로 OCIO 시장이 1,000조원 규모까지 성장할 수 있다는 주장은 논리적 근거가 희박하다는 의미이다.

DC형 퇴직연금에서 OCIO 시장의 수요 주체로 기대할 수 있는 분야는 기금형 지배구조를 통한 DC 적립금의 집합운용이다. 해외에서는 DC형 퇴직연금의 구조적 문제점을 보완하기 위하여 다양한 형태의 혼합형(hybrid) DC 제도가 실행되고 있다. 최근 도입된 중소기업퇴직연금기금은 집합운용DC(Collective DC, 이하 CDC)로서 혼합형 DC 제도의 일환이라 할 수 있다. DC형임에도 불구하고 개별 근로자에게 운용지시권이 부여되지 않으며, 기금형 지배구조의 수탁법인으로 지정된 근로복지공단이 근로자의 DC 적립금을 집합(pooling)하여 운용한다. 자산운용의 경험과 역량이 부족한 근로복지공단은 CDC의 적립금 운용을 위하여 OCIO 제도를 선택하였다. 근로복지공단의 기존 퇴직연금 가입자를 중소기업퇴직연금기금으로 강제 이전하지 않음으로 인해 초기 수탁규모는 미미하나, 4년 내에 10조원 이상의 기금으로 확대될 것으로 공단은 추산하고 있다. 중소기업퇴직연금기금의 성공적 운용이 퇴직연금제도에서 갖는 의미는 지대하다. 복지제도의 일환인 퇴직연금의 사각지대 문제를 가장 효율적이고 바람직한 방향으로 해소할 수 있는 제도적 장치가 중소기업퇴직연금기금이기 때문이다. 제도 일원화와 더불어 CDC 적립금에 대한 OCIO 운용이 성공적으로 이루어진다면 중소기업퇴직연금기금은 규모와 역할 측면에서 향후 국민연금기금과 비교되는 위상을 가질 수 있다.

3. 시장의 수요 측면

공적기금을 제외한 OCIO 시장의 모든 수요 주체는 매우 비공개적이다. 예를 들면 상장기업 OCIO 위탁의 경우 투자 재원인 사내유보금에 대한 부정적 시각이 큰 상황에서 운용 규모뿐만 아니라 OCIO 위탁의 사실조차 외부로 공개되기를 꺼리기 때문이다. 별도의 공시 의무가 없는 공제회나 퇴직연금 등도 대부분 OCIO 위탁 규모를 외부로 공개하지 않는다. 따라서 공적기금 중심으로 OCIO 시장의 수요 측면을 살펴본다. OCIO 운용 체계의 효시라 할 수 있는 공적연기금투자풀을 비롯하여 다수의 공적기금이 OCIO 방식으로 자금을 운용하고 있다. 그 중에서 10조원 이상의 대형 OCIO는 기획재정부의 공적연기금투자풀과 국토교통부의 주택도시기금, 그리고 고용노동부의 고용 및 산재기금이 대표적이다. 대학기금 및 공제회 등 민간 성격의 자금을 통합하여 운용하기 위해 만들어진 민간투자풀은 도입 당시 계획되었던 관련 법령의 미비 등으로 인하여 2조원 이하의 운용규모가 지속되고 있다. 기금 규모가 5조원을 상회할 것으로 예상됨에 따라 본격적으로 OCIO 체계를 도입하려던 방사선폐기물기금은 연기금투자풀과 단독 OCIO를 병행하는 체계를 당분간 유지할 것으로 알려져 있다.

공적기금의 OCIO 위탁 현황을 살펴보면 이전부터 지적되던 불합리한 보수 수준과 과도한 전담체계 같은 문제들이 해소되기보다는 오히려 심화하는 양상이다. OCIO 위탁체계 측면에서 운용규모 10조원 이상의 대형 공적기금은 복수 주간운용사라는 특징을 보인다. 공적연기금투자풀은 2개의 자산운용회사를 복수 주간운용사로 활용하고 있으며, 주택도시기금과 고용산재기금은 자산운용회사와 증권회사를 각각 하나씩 선정하고 있다. 전체 운용자금을 모두 위탁하는 경우 위탁자와 수탁자의 전략적 제휴 관계가 강조된다는 측면에서, 단일 위탁자에 대한 복수의 OCIO 관계는 글로벌 트렌드에 부합하지 않는다는 지적이 제기될 수 있다. 특히 국내 공적기금의 복수 OCIO 체계는 기금의 전략적 판단이 요구되는 보완적 관계가 아닌 단순 성과 비교를 위한 경쟁관계로 설정되어 있어, OCIO 위탁운용의 비효율성이 제기될 수 있는 부분이다.

보완적 관계의 복수 OCIO는 운용 자산 및 운용 전략 측면에서 차별성을 강조하여 유형별로 최적의 OCIO 운용사를 활용하기 위한 목적이다. 예를 들면 대체자산과 전통자산에 대한 별도의 OCIO 운용사를 선정하는 방식이다. 이 경우 최적의 보완 관계를 설정하고 복수의 운용사를 전략적으로 관리하기 위해서는 기금 내부의 전문성이 일정 수준 확보되어야 한다. 국내 대형 공적기금의 복수 OCIO 체계는 운용성과 및 기금에 대한 서비스 측면에서 상호 경쟁을 유도하기 위한 목적으로 알려져 있다. 하지만 OCIO의 역할이 자금의 집행에 한정되어 있는 부분위임체계에서 복수 OCIO의 상호 경쟁을 유도할 수 있는 합리적인 평가체계를 구축하기는 매우 어렵다. 동등 분할 성격의 경쟁적 OCIO 관계가 효율적으로 작동하려면 완전위임체계가 보다 유리하다고 할 수 있다. 제한된 역할의 부분위임체계에서는 지속적으로 유의미한 성과 차이를 실현할 수 있는 운용상의 여지가 없기 때문이다. 이러한 주장에 대한 보다 자세한 설명과 논리적 근거는 이어지는 3장 위탁운용체계 개편을 참조하기 바란다.

Ⅲ. OCIO 위탁운용체계 개편

1. 위탁체계 개편의 필요성

국내 OCIO 제도의 연혁은 짧지 않다. 공적연기금투자풀이 조성된 지 21년이며, 단일 위탁자에 대한 OCIO 제도의 효시로 주택도시기금을 꼽는다고 하더라도 18년의 이력이다. 연차로만 보면 성숙 단계의 시장이다. 하지만 국내 OCIO 시장의 현 상태는 ‘건전한 경쟁 구도 부재로 레드오션화된 과점 시장’으로 요약된다. 운용 역량과 이에 따른 성과의 경쟁이 아닌 보수 및 투입 인력 같은 외형적 경쟁만 가시적이다. 독점적 전담인력은 30명을 상회하는데 운용보수율은 3bp를 하회하는 비정상적 시장 상황이 지속 또는 강화되고 있다. 이는 기존 수탁사 또는 대형 금융회사에 절대적으로 유리한 상황으로, 이에 따라 최근 OCIO 운용사 선정에서 기존 운용사의 단일 지원으로 유효 경쟁이 이루어지지 않는 사례가 늘고 있다. 현재의 OCIO 위탁체계는 시장의 레드오션화를 가속화 할 수밖에 없는 구조이다.

그동안 시장 활성화를 위하여 학계와 업계를 중심으로 다양한 개선 방안이 논의되고 제안되었으나, 이에 대한 의사결정 주체인 위탁자의 적극적인 개선 의지는 보이지 않는다. 원가 수준에도 미치지 못하는 운용보수율의 정상화와 이를 완화할 수 있는 성과보수체계 도입, 득보다 실이 많은 전담운용체계의 지양, 장기적이고 전략적인 동반자 관계 구축 등이 대표적이다. 본질적으로 이는 정부 또는 공공기관이라 할 수 있는 공적기금 위주로 구성된 국내 OCIO 시장의 수요요인에 기인한다. 따라서 민간을 포함한 보다 다양한 성격의 자산보유자가 시장에 참여함으로써 시장이 양적으로나 질적으로 보다 두터워진다면 이러한 문제들은 점차 완화될 것으로 사료된다. 앞 장의 시장 현황 분석 결과를 보면 비록 더디기는 하나 이러한 방향으로 시장 수요가 확대되고 있음을 확인할 수 있다.

시장 수요를 다변화하기 위한 노력과 함께 기존의 전통적 위탁방식에 비해 OCIO 제도가 갖는 차별적 경쟁력을 유인할 수 있는 위탁운용체계의 구조적인 개편이 필요한 시점이다. 전술한 바와 같이, OCIO 제도의 경쟁력은 종합적이고 전략적인 투자 솔루션의 제공이다. 이러한 OCIO 위탁운용의 특성이 극대화되기 위해서는 전략적 의사결정의 상당 부분이 OCIO에게 위임되어야 한다. 지금처럼 OCIO에게 전술적 집행의 역할만 부과되는 상황에서는 아무리 전문성이 높은 운용사라 하더라도 종합적인 투자 솔루션을 제공하는 것 자체가 구조적으로 불가능하기 때문이다. 현행 체계에서는 이러한 문제를 운용이 아닌 자문 서비스라는 이름으로 보완하고 있다. 종합적 투자 솔루션을 제공하기 위한 운용전략과 투자 수단이 직접적으로 운용에 적용되는 것이 아니라 자문의 형식으로 제안만 되는 것이다. 하지만 자산운용에 수반되는 일련의 투자 의사결정에 있어 그 역할이 명시적으로 부과되지 않고 그 결과에 대한 책임(또는 보상) 또한 담보되지 않는 자문 서비스는 양과 질 모두에서 형식적일 수밖에 없다. 권한위임(mandate)에 명시되지 않은 업무는 평가받지 않으며, 수탁사인 금융회사는 결과에 대해 평가받지 않는 업무 영역에 양질의 내부 자원을 적극적으로 배분할 유인이 없기 때문이다.

2. 완전위임체계 확대

OCIO 위탁체계는 위임되는 재량의 범위에 따라 부분위임(partial discretion)과 완전위임(full discretion)으로 구분된다.11) 부분위임의 경우 하위운용사 선정 및 관리를 통한 포트폴리오 구축 권한만 OCIO에게 위임되는데 비하여, 완전위임체계에서는 정책적 판단을 제외한 대부분의 전략적 의사결정이 OCIO의 역할과 책임으로 설정될 수 있다. 일반적인 자산운용 프로세스는 정책적 의사결정 – 전략적 의사결정 – 포트폴리오 구축 – 성과평가의 네 단계로 이루어진다.12) 정책적 의사결정은 자금의 조성 목적을 감안하여 운용의 큰 방향을 결정하는 것이다. 사업 계획이나 재정추계 또는 ALM에 기반하여 투자정책서(IPS)를 작성하는 것이 주요 내용이다. 전략적 의사결정은 자금의 중장기 운용방향을 설정하는 것으로, 전략적자산배분 활동이 대표적이라 할 수 있다. 여기에서 전략적자산배분 활동이란 단순히 주어진 자산군(asset class)에 자산 비중을 할당하는 것만이 아니라. 자산군 분류 및 벤치마크의 설정을 통한 시장에 대한 탐색을 모두 포괄한다. 포트폴리오 구축 단계는 재간접펀드기구인 OCIO의 경우 하위운용사를 통해 자금을 배분하고 관리하는 과정이다. 이러한 자산운용 프로세스 하에서 OCIO 위탁운용의 부분위임과 완전위임의 차이는 전략적 의사결정에 대한 권한의 위임 여부로 이해할 수 있다.

앞서 언급한 바와 같이, 기존의 전통적 위탁운용에 비해 OCIO 제도가 갖는 차별적 경쟁력은 운용 역량이 부족한 위탁자에게 전략적 의사결정을 포함하여 종합적인 운용 솔루션을 제공할 수 있다는 점이다. 하지만 국내 OCIO 대부분이 관례적으로 채택하고 있는 제한된 역할의 부분위임체계에서는 이러한 경쟁력 있는 서비스를 제공할 수 있는 운용상의 여지가 없다. 부분위임체계에서 OCIO의 역할은 벤치마크 대비 초과수익

창출로 한정된다. 전술한 바와 같이 시장수익

창출로 한정된다. 전술한 바와 같이 시장수익 에 비해 초과수익은 크기도 작을뿐더러 통계적으로 유의미하지도 않다. 위험관리 측면에서도 금융위기와 같은 위기 상황에서 하방위험(downside risk)을 제어하는데 있어서 부분위임체계의 OCIO가 대응할 수 있는 운용전략이나 투자 수단은 매우 제한적이다. OCIO 제도에서 위탁자가 요구하는 수익률 제고와 위험관리 강화는 전략적자산배분을 포함한 상위 전략적 의사결정 단계에서 대부분 확정되기 때문이다. 부분위임체계에서 시장수익 또는 체계적위험에 관련된 OCIO의 역할 및 권한은 모두 자문의 영역이다. 하지만 자문이 운용을 대체할 수는 없다. 해외 OCIO 시장이 초기 투자자문으로 시작하여 OCIO 운용으로 진화한 배경이다. 성과에 미치는 자문 서비스의 기여도를 객관적으로 평가하고 그 결과를 수탁사 관리 및 성과보수에 반영하는 것 또한 매우 어렵다. 이는 결과적으로 수탁운용사 선정 및 관리체계를 왜곡시키고 시장의 건전한 경쟁구도를 저해하게 된다.

에 비해 초과수익은 크기도 작을뿐더러 통계적으로 유의미하지도 않다. 위험관리 측면에서도 금융위기와 같은 위기 상황에서 하방위험(downside risk)을 제어하는데 있어서 부분위임체계의 OCIO가 대응할 수 있는 운용전략이나 투자 수단은 매우 제한적이다. OCIO 제도에서 위탁자가 요구하는 수익률 제고와 위험관리 강화는 전략적자산배분을 포함한 상위 전략적 의사결정 단계에서 대부분 확정되기 때문이다. 부분위임체계에서 시장수익 또는 체계적위험에 관련된 OCIO의 역할 및 권한은 모두 자문의 영역이다. 하지만 자문이 운용을 대체할 수는 없다. 해외 OCIO 시장이 초기 투자자문으로 시작하여 OCIO 운용으로 진화한 배경이다. 성과에 미치는 자문 서비스의 기여도를 객관적으로 평가하고 그 결과를 수탁사 관리 및 성과보수에 반영하는 것 또한 매우 어렵다. 이는 결과적으로 수탁운용사 선정 및 관리체계를 왜곡시키고 시장의 건전한 경쟁구도를 저해하게 된다.이에 비하여 완전위임체계에서는 전략적자산배분을 통한 시장수익과 체계적위험의 결정이 OCIO의 역할과 책임으로 설정된다. OCIO는 운용목표(mission)를 가장 효과적으로 달성할 수 있는 전략자산군(strategic asset class)을 설정하고, 이에 대한 밴치마크를 설정하여 투자가능시장을 정의하고, 주어진 위험제약 하에서 최종적으로 자산군 간 최적 배분 비중을 결정하는 일련의 전략적자산배분 활동을 수행하게 된다. 이렇게 작성된 전략적자산배분 하에서 실제 포트폴리오를 구축하고 관리하는 것도 모두 OCIO의 역할이다. OCIO는 초과수익만이 아니라 시장수익을 포함한 총수익성과와 체계적위험을 포함한 총위험으로 평가받게 된다. OCIO가 자신의 권한으로 실행한 모든 의사결정의 결과와 성과는 단계별로 분해되어 평가된다. 운용성과의 평가(evaluation)에서 수익과 위험의 요인분해(attribution analysis)를 의미한다. 이때 평가의 기준은 처음 전략적자산배분 단계에서 자산군 설정의 방향을 제시했던 운용목표이다. 이는 자금의 위탁자가 설정하여 OCIO에게 부과하는 것으로, 결국 효율적인 완전위임체계의 설계는 운용목표를 어떻게 명확하게 설정하고 이를 OCIO에게 효과적으로 강제하느냐가 관건이다.

완전위임체계의 의의는 OCIO 위탁방식의 제도 경쟁력을 확보하고 OCIO 운용사 간 경쟁구도를 강화하여 최종적으로 시장 수요자의 제도 만족도를 높이는 것이다. 완전위임에서 OCIO에게 요구하는 운용역량과 전문성은 부분위임의 그것과는 매우 다르다. 부분위임 OCIO에 요구되는 전문성은 하위운용사를 선정하고 자금을 배분하는 관리역량인 반면에 완전위임에서는 분산된 글로벌 포트폴리오를 구축할 수 있는 운용역량, 즉 자산배분 역량이 강조된다. 완전위임에서는 OCIO 운용사 간의 운용성과 차이가 지금보다 크게 확대될 수 있으며, 이 경우 동종유형(peer group) 비교평가가 실질적인 의미를 가질 수 있다. 완전위임체계에서는 OCIO의 운용역량과 전문성에 대한 합리적이고 객관적인 비교가 가능하기 때문이다. 앞서 2장 3절에서 동등 분할의 복수 OCIO 체계의 경우 완전위임이 제도 목적을 달성하는데 보다 효율적이라는 주장은 이에 근거한다.

자금의 위탁자 입장에서 완전위임 OCIO를 선택하는 것이 부담스러울 수 있다. 공적기금의 경우 관련 법이나 운용 규정의 개정이 필요한 부분이기도 하다. 하지만 공적기금 외의 세부시장 참여자는 제도 도입에 비교적 유연할 수 있을 것으로 사료된다. 서울대발전기금이 그 대표적 사례이다. 위임의 범위가 확대되면 그에 상응하여 OCIO 위탁 보수도 증가할 개연성이 크므로 이 역시 기존 위탁자 입장에서는 부담스러운 부분이다. 하지만 위탁 보수의 적정성은 모든 비용이 차감된 고객 수익률(client return) 개념으로 평가하는 경우 그 판단이 달라질 수 있다. Chief Investment Officer(2021) 서베이의 OCIO 도입 목적에서 비용 절감은 가장 낮은 순위임을 상기할 필요가 있다. 근본적으로는 전략적자산배분을 포함하여 자산운용의 큰 방향을 외부에 맡겼을 때 운용의 결과가 위탁자가 감내할 수 있는 범위를 벗어날 가능성에 대한 우려가 가장 클 것이다. 이를 통제하기 위한 제도적 장치가 다음 절에서 설명하는 기준포트폴리오 체계이다.

3. 기준포트폴리오 활용

완전위임체계는 외부 전문가인 OCIO의 역할 또는 위임의 범위를 적극적으로 확대하는 위탁 방식이다. 완전위임 OCIO의 업무 범위는 정책적 의사결정을 제외한 모든 자산운용 프로세스를 포괄할 수 있다. 하지만 전략적자산배분을 포함하여 상위 전략적 의사결정을 OCIO에게 위임하는 것은 현실적으로 매우 어려운 과제이다. 전략적자산배분에 의한 목표비중과 벤치마크로 만들어지는 가상의 포트폴리오를 전략적자산배분포트폴리오(이하 SAA 포트폴리오)라 한다. 일반적인 다단계 자산배분체계에서 SAA 포트폴리오는 주인(principal)의 포트폴리오로 해석된다. 하위 자산배분을 포함한 모든 운용 활동의 기준이 되는 포트폴리오로서, SAA 포트폴리오의 적절성은 성과평가의 대상이 아니며 배분 결과에 대해서는 아무도 책임지지 않는 것이 일반적이다. 하지만 전략적자산배분을 OCIO에게 위임하는 것은 대리인(agent)에게 운용의 장기적 방향을 결정할 권한을 주는 것으로, 이 경우 장기적 관점에서 자산운용의 결과가 주인이 원하는 방향으로 가지 않는 심각한 위험을 초래할 수도 있다. 따라서 적극적 권한 위임을 통해 대리인(agent)이 수행하게 되는 전략적자산배분은 그 효율성과 적정성이 반드시 사후적으로 측정되고 평가되어야 한다. 이를 기술적으로 구현하는 방안이 기준포트폴리오라 할 수 있다.

대리인에게 전략적자산배분을 포함한 전략적 의사결정을 위임하기 위해서는 자산운용에 대한 주인의 장기적 방향성이 대리인에게 명확하게 전달되어야 한다. 이는 주로 위험성향(risk appetite)의 관점에서 기준포트폴리오의 형식으로 제시된다. 이러한 방향성 및 허용범위 내에서 대리인이 전략적자산배분 활동을 수행토록 하는 위탁운용 체계가 설계되어야 한다. 이러한 위탁체계에서는 대리인의 전략적자산배분 활동으로부터 결과된 전체 운용성과에서 전략적자산배분의 효율성과 적절성이 분리되어 측정되고 평가되는 것이 중요하며, 이러한 평가의 기준으로 기준포트폴리오가 활용될 수 있다.

최근 자산운용체계의 개편을 검토하고 있는 국민연금기금은 기준포트폴리오를 ‘장기투자의 기준으로써 위탁 자산의 위험성향을 표방하는 단순 저비용 패시브 포트폴리오’로 정의하고 있다.13) 여기에서 위험성향은 위험선호도(risk preference)나 위험감내도(risk tolerance), 또는 목표위험(target risk) 등으로 다양하게 표현된다. 통상적으로 기준포트폴리오는 위험자산과 안전자산의 단순한 조합으로 위탁자의 위험성향을 표방한다. 기준포트폴리오는 자금의 성격 또는 조성 목적, 투자 신념(investment belief)과 같이 문장으로 기술되는 추상적 개념과 구체적인 수치로 설정되는 전략적자산배분의 가교 역할이라 할 수 있다. 즉, 사전적으로는 추상적 개념을 기술적 활동으로 전달하는 커뮤니케이션 수단이며, 사후적으로는 전략적자산배분의 효율성 및 적절성을 평가하는 기준이 된다. 따라서 전략적자산배분 권한을 OCIO에게 위임하는 경우 기준포트폴리오는 자금의 위탁자가 OCIO를 효과적으로 관리하기 위한 통제 장치로 이해할 수 있다.

기준포트폴리오를 활용하는 대표적 사례로 캐나다 국민연금(Canada Pension Plan: CPP)의 전담운용기관인 CPPI(CPP Investment)의 통합포트폴리오접근법(Total Portfolio Approach: TPA)이 유명하다. 기준포트폴리오 도입의 목적과 성격은 기관마다 상이하나 최근 국민연금기금도 이를 벤치마킹하여 기준포트폴리오를 통한 자산배분 고도화를 도모하고 있다.14) 기준포트폴리오 제도의 벤치마킹 대상이 주로 연기금인 이유로 기준포트폴리오가 부채가 정의되는 ALM 체계에서만 작동하는 방식으로 그 설정과 운영이 매우 어려운 운용 방법론으로 생각하는 경향이 있으나, 기준포트폴리오의 개념 자체는 대단히 단순하고 명확하다. 부채가 있는 연기금의 경우에는 설정된 기준포트폴리오가 기금이 지향하는 평균적인 위험의 표방이라는 의미를 갖기 위해서는 반드시 ALM 체계로부터 유도되어야 하는 어려움이 있을 뿐이다. 부채가 없는 국부펀드나 대학기금 등에서는 보다 단순한 방식으로 기준포트폴리오가 설정되고 운영될 수 있다.

그 대표적 사례가 국내 OCIO 시장에서 기준포트폴리오 방식으로 자금을 위탁하고 있는 서울대발전기금이다. 서울대발전기금은 2019년부터 전체 대학기금의 일부15)를 기준포트폴리오 방식의 완전위임 OCIO로 위탁하고 있다. 물론 완전위임체계에서도 권한 위임의 범위와 운용상 제약조건 등은 위임조건에 따라 얼마든지 달라질 수 있다. 구체적인 내용은 외부로 공개되지 않으나 기금이 안전자산과 위험자산16)의 단순 비중으로 구성된 기준포트폴리오를 제시하고 OCIO 운용사17)는 이를 장기적으로 추종하도록 전략적자산배분에 의한 SAA 포트폴리오 및 실제 포트폴리오의 구축 및 관리 업무를 수행하게 된다. 여기에 실물자산이 아닌 상장지수펀드(ETF)를 활용한 EMP(ETF Managed Portfolio) 구조로 다양한 자산군의 글로벌 포트폴리오를 구축한다는 제약조건이 부과되며, 부족한 운용보수 수준을 보완하고 완전위임체계에 대한 OCIO 운용사의 최선의 노력과 전문성을 유인하기 위하여 성과보수체계를 도입하였다. 3년의 운용기간이 경과한 현재, 국내에서는 처음 시도된 위탁운용체계임에도 불구하고 안정된 포트폴리오와 양호한 수익성과를 시현하고 있는 것으로 알려져 있다.

국내에 기준포트폴리오 방식의 완전위탁 OCIO 시장이 확산되기 위해서는 구체적인 실행 체계의 많은 부분이 논의되고 합의되어야 한다. 대표적으로 전략적자산배분을 포함한 OCIO의 실제 운용 결과가 기준포트폴리오를 얼마나 충실히 반영하고 있는지를 사후적으로 평가하는 것이 단기실적 위주의 현행 성과평가체계에서는 쉽지 않은 과제이다. 위탁자의 장기적인 위험성향을 표방하는 기준포트폴리오에 연간 단위의 단기성과를 일치시키도록 강요하는 성과평가는 운용의 왜곡을 가져올 수 있기 때문이다. OCIO가 설정하는 SAA 포트폴리오의 적절성은 최소 3년 이상의 장기수익률로 기준포트폴리오 추종 여부를 평가하고18), 실제 포트폴리오의 실현수익률은 OCIO가 설정한 SAA 포트폴리오에 대비하여 평가하는 2단계 성과평가체계를 강구해 볼 수 있다.

작년부터 본격적으로 시행되고 있는 공적연기금투자풀의 완전위탁형 OCIO19) 제도 역시 중소 기금의 모든 전략적 의사결정을 기금이 아닌 투자풀이 수행한다는 측면에서 완전위임체계의 일환으로 볼 수 있다. 다만 이러한 의사결정을 외부 전문가인 주간운용사가 아닌 투자풀운영위원회가 대신하고 있다는 점에서 본고에서 제안하는 기준포트폴리오 방식의 완전위임체계와는 차이가 있다. 이러한 위탁 구조가 제대로 작동하기 위해서는 투자풀운영위원회의 운용 역량과 전문성 확충이 전제되어야 한다. 하지만 현실적으로는 전략적 의사결정의 상당 부분이 주간운용사에 의해 이루어지고 위원회는 이를 형식적으로 승인하는 구조가 될 수밖에 없다. 주간운용사 입장에서는 실질적으로는 운용의 일환이지만 형식적으로는 자문 영역이 된다. 앞서 언급한 바와 같이, 전략적 의사결정에 대한 자문의 효율성은 높지 않다. 완전위탁형 OCIO에서도 본고에서 제안하는 기준포트폴리오 방식을 검토해 볼 수 있을 것으로 사료된다.

Ⅳ. 결론 및 시사점

본 연구에서는 OCIO 시장의 공급 주체인 수탁 금융회사를 대상으로 전체 OCIO 시장 및 세부시장 규모를 조사하였다. 조사 결과, 2022년 8월말 현재 국내 OCIO 시장은 132조원 규모로 추정된다. 전체 시장의 85%가 공적기금이며, 시장에 신규 진입하려는 후발주자가 목표로 하는 공적기금 외의 세부시장은 15% 비중인 20조원 규모로 추정되었다. 세부시장의 성장 가능성을 가늠해보면 민간기업보다는 공기업 등의 공공기관의 성장 잠재력이 크고 지속적일 것으로 판단된다. 증권업을 포함하여 후발주자로 시장에 신규 진입하는 금융회사가 기대하는 가장 주요한 세부시장은 퇴직연금이다. DB 적립금을 중심으로 하는 퇴직연금 자금이 OCIO 시장으로 원활히 유입되기 위해서는 적립금 운용 수단에 대한 열거주의식 운용규제가 완화되어야 한다.

자산운용사 또는 증권사 같은 금융기관이 OCIO 제도를 성장 가능성 있는 사업모형으로 설정하고 회사 차원의 인력과 자원을 지속적으로 투입하기 위해서는 이른바 목표 시장에 대한 명확한 정의와 체계적 분석이 필수적이다. 막연한 감이나 낙관적 기대만으로 사업위험을 감수할 수는 없기 때문이다. 마케팅 분야의 시장조사 및 분석 도구를 활용하여 정확한 시장 현황과 잠재적 목표시장의 규모가 주기적으로 파악될 필요가 있다. 민간 컨설팅 회사가 제공하는 이러한 시장조사는 국내 OCIO 시장이 지속적으로 성장하기 위한 일종의 시장 인프라이다. 수탁기관의 설문조사를 통해 국내 OCIO 시장의 규모를 파악하고 잠재적 목표시장으로서의 세부시장 별 특성을 살펴본 본 연구는 이러한 시장 인프라로서의 의의가 있다.

레드오션화에 대한 우려와 시장에서 제기되는 여러 문제점을 해결하기 위한 근본적인 개선책은 OCIO의 의사결정 범위 또는 위임되는 역할을 확대하는 것이다. 투자 실행의 역할만으로는 기존의 전통적 위탁방식과 차별되는 OCIO 본연의 경쟁력을 시현할 수 없기 때문이다. 전략적자산배분(SAA)을 포함한 상위 의사결정 단계로 위임의 범위를 확대하는 위탁체계를 완전위임 OCIO라 한다. 국내 OCIO 시장의 수요자가 관례적으로 채택하고 있는 부분위임이 갖는 운용의 비효율성과 이로 인한 시장 왜곡을 완화하기 위하여 완전위임체계의 확대를 주장한다. 완전위임이 요구하는 OCIO의 적극적인 역할 확대를 제도적으로 구현하는 방법론이 기준포트폴리오 체계이다. 기준포트폴리오 체계는 자금의 위탁자가 자신의 평균적인 위험성향을 표방하는 기준포트폴리오를 설정하여 수탁자에게 제시하고, OCIO는 이를 바탕으로 전략적자산배분을 포함한 모든 전략적 의사결정을 수행하는 위탁체계로 이해할 수 있다.

OCIO 제도가 국내에 처음 도입된 지 20년을 넘고 있다. 외부 전문가를 활용하는 위탁운용의 경험이 많지 않으며 자산운용에 대한 투자 신뢰가 높지 않은 우리 금융 환경에서 초기 OCIO 제도는 자금의 수탁자에 대한 불신을 전제로 설계되었다고 볼 수 있다. 정부 기관이라 할 수 있는 공적기금이 거대 자금을 민간 운용사에 위탁하는 과정에서 수탁 금융기관에 대한 신뢰 부족은 짧은 선정 및 평가 주기와 낮은 보수체계, 과도한 전담운용 같이 수탁자의 도덕적 해이를 방지하기 위한 제도적 장치를 요구하였다. 하지만 이러한 수탁사 관리체계는 ‘전략적이고 총괄적인 일임위탁’이라는 OCIO 제도 본연의 경쟁우위와 부합하지 않는다. 이는 20년의 세월이 흐른 현재까지 OCIO의 운용 효율성을 저하시키는 장애요인으로 남아 있다. 본고에서 제안하는 기준포트폴리오 방식의 완전위임체계는 수탁자인 금융회사에 대한 위탁자의 신뢰를 전제로 한다. 불신을 전제로 설계된 위탁체계의 운용 효율성은 낮을 수밖에 없음을 유념하여야 한다.

1) 최근 4년 동안 당 기관이 매년 조사하고 있는 OCIO 서베이에 의하면, 50%의 위탁자가 OCIO 도입 사유로 ‘내부 자원의 한계’를 꼽고 있으며, 그 뒤를 이어 ‘위험관리’, ‘추가적인 수탁자 감시’, ‘빠른 의사결정’, ‘수익률 제고’ 등의 사유가 각각 38%, 32%, 26%, 21% 순이다. ‘비용 절감’을 이유로 OCIO를 도입한 경우는 17%에 불과하다.(중복응답)

2) Cerulli Associates(2018)은 2014년 이후 향후 10년 동안 미국의 완전위임 OCIO 시장의 성장세가 연평균 9.2%에 이를 것으로 추산하고 있다.

3) 이러한 잠재시장 또는 유형별 목표시장에 대한 세밀한 시장 전망은 민간 컨설팅 회사의 사업 영역이다. 해외에서는 본고에서도 인용하고 있는 Chief Investment Officer 또는 Cerulli Associates 등이 그 역할을 수행하는 것으로 관측되나 국내는 아직 이런 시장조사가 시행되지 않고 있다. 본고에서는 세부시장 유형별 수탁 규모를 대략적으로 추산하고, 향후 정치한 시장 전망을 위해 고려해야 할 시장 특성을 제시하고자 한다.

4) 예를 들면 민간연기금투자풀의 단일 OCIO 수탁고를 세부시장 유형 분류에 따라 대학기금과 공제회, 공공기관 등으로 재분류하였다.

5) 조사 대상 자산운용회사는 미래에셋자산운용, 삼성자산운용, 신한자산운용, 한국투자신탁운용, 한화자산운용, KB자산운용이며, 증권회사는 미래에셋대우증권, 삼성증권, 신한금융투자증권, 한국투자증권, KB증권, NH투자증권이다. (회사명 순서)

6) 세부시장 유형은 신규 시장 참여자의 목표시장 관점으로 분류하였다. 해외의 경우, 예를 들면 OCIO Survey는 자금의 유형을 확정급여형(DB), 401k(DC), 대학 및 재단, 건강보험, 기타 등으로 분류하고 있다.

7) 대형 공적기금의 경우 복수 주간운용사 체계를 통해 자산운용회사와 증권회사를 별도 리그로 선정하는 경우가 일반적이나 최근 들어 이러한 업권 구분 없이 단수 또는 복수의 OCIO 운용사를 선정하는 경우가 확대되는 추세이다.

8) 이는 대형 공적기금의 OCIO 운용사 선정에 앞서 매번 실행되는 관련 연구용역에서도 반복적으로 확인되고 있는 사안이다.

9) 사업대기성 자금으로 유동성 관리가 목적인 3개월 미만의 단기 현금성 자금도 OCIO의 운용 자산에 포함되어 있기는 하나, 대부분 주식 및 채권에 투자되는 1년 이상의 중장기 운용자산 성격으로 파악된다.

10) 300인 이상 대형 사업장의 퇴직연금 도입률은 이미 90%를 상회하고 있으며, 중소 규모 사업장의 경우 DB형 퇴직연금에 대한 사용자의 부담이 커서 퇴직연금제도로 전환하더라도 대부분 DC형 퇴직연금만 제공할 것으로 예상된다.

11) 위탁자 입장에서 운용자산의 일부 또는 전부를 위탁하느냐로 부분위임과 완전위임을 구분하기도 하나, 본고에서와 같이 위임되는 재량의 범위로 구분하는 것이 일반적이다.

12) 위험관리 활동은 이 모든 과정에 포괄적으로 적용된다.

13) 박태영‧원상희(2017)

14) CPPI의 기준포트폴리오는 자산배분체계의 고도화보다는 자산군에 얽매이지 않는 적극적인 액티브운용을 위하여 기준포트폴리오 체계를 도입하였다. 즉, 특정 자산군에 대한 목표 비중을 설정하지 않고 모든 포트폴리오를 액티브 프로그램화하여 기준포트폴리오 대비 초과수익 창출을 목표로 한다. 이에 비하여 국민연금기금의 기준포트폴리오는 기존의 다단계 자산배분체계를 고도화하는 관점에서 추진되고 있으며, 실질적인 주요 대상은 대체투자 부문으로 한정되는 것으로 알려져 있다.

15) 초기 약정금액은 2,500억원 규모로 알려져 있다.

16) 일반적으로 위험자산은 글로벌 주식시장지수, 안전자산은 자국 채권시장지수를 활용한다. 이때 활용되는 시장지수는 일종의 기회비용 벤치마크(opportunity cost benchmark)의 개념으로 전략적 자산군에서 시장을 정의하기 위한 벤치마크지수와는 설정 목적이 다르다.

17) 2019년 제도 개편 이후 삼성자산운용이 OCIO 운용사로 선정되었다.

18) SAA 포트폴리오는 시장지수인 벤치마크로 구성된 가상의 포트폴리오이다. OCIO 위탁운용의 기간은 짧더라도 OCIO가 설정한 SAA 포트폴리오의 장기수익률은 산출 가능하며, 이러한 SAA 포트폴리오의 장기 수익성과가 기준포트폴리오가 표방하는 기대수익률과 위험성향을 충실히 지향하고 있는지를 평가할 수 있다.

19) 2021년부터 본격 시행되고 있는 공적연기금투자풀의 새로운 위탁체계로, 중소형 공적기금을 대상으로 기금의 전략적 의사결정을 모두 OCIO가 수행하는 일종의 완전위임체계이다. 하지만 다수의 수익자를 대상으로 자금을 집합하여 운용하는 투자풀의 특성상, 여기에서 OCIO는 외부 금융기관인 주간운용사가 아니라 기획재정부 산하의 위원회 조직인 연기금투자풀을 의미한다. 따라서 본고에서 제안하는 기준포트폴리오 방식이 아닌, 연기금투자풀의 위원회가 개별 기금의 위원회를 대신하여 모든 전략적 의사결정을 수행하는 방식이다.

참고문헌

남재우, 2019,『국내 OCIO 제도 정착을 위한 개선과제』, 자본시장연구원 이슈보고서 2019-5호.

박태영·원상희, 2017, 국민연금기금의 기준포트폴리오 설정 방안, 국민연금연구원, 『정책보고서』 2017-6호.

Cerulli Associates, 2018, OCIO at an Inflection Point: Strong Growth Ahead, but Institutions Are Demanding More.

Chief Investment Officer, 2021, 2021 Outsourced–Chief Investment Office Survey.

고용노동부 www.moel.go.kr

국토교통부 www.molit.go.kr

기획재정부 www.moef.go.kr

주택도시기금 nhuf.molit.go.kr

한국증권금융 www.ksfc.co.kr

Chief Investment Officer www.ai-cio.com