Find out more about our latest publications

Analysis of the effects of short selling restriction

Research Papers 23-05 Aug. 25, 2023

- Research Topic Capital Markets

- Page 70

During the COVID-19 pandemic that began in 2020, the short selling regulations in the Korean stock market has undergone many changes. As there are still many controversies regarding the short selling regulations, it is very meaningful to investigate how the short selling regulations affects the stock market, and it can provide important implications for the future regulatory directions. This report reviews major changes in the short selling regulations during the COVID-19 pandemic, and conducts empirical analyses on the effects of the changes in the short selling regulations on the price efficiency, market liquidity, and return volatility.

In March of 2020 when the market plunged by rapid spread of COVID-19, short selling for all listed shares was banned in Korean stock market. Though market makers were exempted from the ban, even market makers minimized short selling activities. As the stock market rebounded and market sentiments was stabilized, in May of 2021 the short selling ban was lifted for constituents of KOSPI200 and KOSDAQ150. The short selling would not be allowed for non-constituents shares until the regulator amend the regulation policy for the short selling.

Empirical results are consistent with theoretical prediction and previous empirical analysis on short selling ban in general. First, price efficiency decreases, the return volatility and the frequency of extreme returns increase, and liquidity decreases after short selling ban. Particularly, volatility of positive returns and the frequency of extreme positive returns increases remarkably, which implies that short selling ban might fail to eliminate overvaluation. However, interestingly, while short selling ban expels institutional investors and raises the proportion of retail investors who are limit order traders, quoted spread decreases.

Second, return volatility and the frequency of extreme returns decrease and turnover increases after the partial lift of short selling ban. Results for price efficiency vary with efficiency measures and quoted spread is widened due to the decrease of retail investors after the partial lift of the ban. Because short selling activity is lower in the post-ban period than in the pre-ban period, the results of the lift of the ban might not be as strong as those of the ban.

Our results in Korea stock market reconfirm the adverse effect of short selling ban shown in the previous empirical and theoretical studies. Short selling ban might deteriorate price efficiency, increase return volatility, and reduce liquidity. To design the regulation of short selling, the regulator has to consider the role of short selling in the market and the possible negative impact of short selling ban on the market efficiency. It is desirable to design step-wise regulation and to prohibit illegal activity than to call a market-wide ban on short selling.

In March of 2020 when the market plunged by rapid spread of COVID-19, short selling for all listed shares was banned in Korean stock market. Though market makers were exempted from the ban, even market makers minimized short selling activities. As the stock market rebounded and market sentiments was stabilized, in May of 2021 the short selling ban was lifted for constituents of KOSPI200 and KOSDAQ150. The short selling would not be allowed for non-constituents shares until the regulator amend the regulation policy for the short selling.

Empirical results are consistent with theoretical prediction and previous empirical analysis on short selling ban in general. First, price efficiency decreases, the return volatility and the frequency of extreme returns increase, and liquidity decreases after short selling ban. Particularly, volatility of positive returns and the frequency of extreme positive returns increases remarkably, which implies that short selling ban might fail to eliminate overvaluation. However, interestingly, while short selling ban expels institutional investors and raises the proportion of retail investors who are limit order traders, quoted spread decreases.

Second, return volatility and the frequency of extreme returns decrease and turnover increases after the partial lift of short selling ban. Results for price efficiency vary with efficiency measures and quoted spread is widened due to the decrease of retail investors after the partial lift of the ban. Because short selling activity is lower in the post-ban period than in the pre-ban period, the results of the lift of the ban might not be as strong as those of the ban.

Our results in Korea stock market reconfirm the adverse effect of short selling ban shown in the previous empirical and theoretical studies. Short selling ban might deteriorate price efficiency, increase return volatility, and reduce liquidity. To design the regulation of short selling, the regulator has to consider the role of short selling in the market and the possible negative impact of short selling ban on the market efficiency. It is desirable to design step-wise regulation and to prohibit illegal activity than to call a market-wide ban on short selling.

Ⅰ. 연구의 배경 및 목적

국내 주식시장에서 공매도 제도만큼 많은 논란을 야기하는 제도는 드물다고 평가할 수 있다. 공매도에 대한 견해는 크게 가격효율성을 제고하고 버블형성을 억제한다는 긍정적인 평가와 주가하락을 초래하고 불공정거래에 악용될 위험성이 크다는 부정적인 인식으로 대별된다. 전자는 학계와 업계의 대체적인 견해인 반면 상당수의 개인투자자들은 후자의 의견을 지지하고 있다. 이러한 견해의 차이는 공매도 제도의 필요성에 대해서 상충적인 입장으로 연결되며, 오랜 기간 의견의 격차가 좁혀지지 않은 채로 소모적인 논쟁을 이어가고 있는 것으로 보인다.

공매도 제도를 유지하느냐 또는 폐지하느냐를 논의하기 위해서는 실제로 공매도의 경제적 기능이 관찰되느냐의 여부를 확인할 필요가 있다. 공매도 제도의 순기능이 실제로 관찰되지 않는다면 제도 존속의 당위성은 떨어질 것이다. 반면 공매도의 경제적 기능이 확인된다면 제도 폐지 여부는 신중하게 판단할 필요가 있을 것이다. 이론적인 관점에서 공매도 제도는 중요한 경제적 기능을 갖는 것으로 평가된다. 공매도는 기업에 관한 부정적인 정보가 주가에 반영되는 중요한 경로이며, 특히 정보반영 속도를 증가시킴으로써 가격에 대한 시장의 신뢰를 유지시키는 역할을 하는 것으로 설명된다.

현실에 있어서 이러한 이론적 예측이 실제로 작동하는지 여부는 실증분석을 통해 판단할 문제다. 따라서 본 보고서는 주식시장에서 얻을 수 있는 거래자료와 계량적 분석모형을 활용하여 공매도 제도의 경제적 기능이 관찰되는지를 검증하고자 한다. 국내 주식시장에서 공매도 규제는 꾸준히 강화되는 추세를 보여왔다. 특히 2020년 발생한 코로나19 팬데믹 이후 주목할만한 공매도 규제변화가 관찰되는데, 이는 공매도의 경제적 기능을 검증하고 규제효과를 분석하는 데 있어 중요한 기회를 제공하고 있다. 2020년 3월 코로나19가 글로벌 팬데믹으로 확산됨에 따라 우리나라를 포함한 주요국 증시는 기록적인 주가폭락을 경험하였다. 주식시장의 과도한 폭락을 억제하고 투자자들을 안정시키기 위하여 정부는 국내 상장주식에 대한 공매도를 전면금지하는 조치를 단행하였다. 공매도 전면금지는 이후 2021년 5월 2일까지 이어졌고, 동년 5월 3일부터 KOSPI200 및 KOSDAQ150 구성종목에 대해 부분적으로 공매도가 재개되었다. 본 보고서는 이러한 공매도 규제상의 변화를 활용하여 공매도의 기능 및 규제효과를 분석할 것이다.

규제변화 시점을 기준으로 그 전후를 비교하는 것은 경제학적 실증분석에서 광범위하게 활용되는 분석방법이다. 규제변화의 시점에 주목하는 이유는 공매도 전면금지 조치가 실행되기 전과 실행된 이후 투자자들의 거래행태 및 가격반응에 체계적인 차이가 발생할 수 있기 때문이다. 공매도가 부분재개된 시점에서도 유사한 형태의 분석을 시도할 수 있다. 이 경우 공매도가 재개된 종목과 여전히 금지된 종목간에 투자자의 거래행태와 가격반응이 달라질 수 있다. 따라서 본 보고서는 2020년 3월 공매도가 전면금지된 시점과 2021년 5월 공매도가 부분재개된 시점을 전후로 공매도의 경제적 기능에 변화가 관찰되는지를 추정하여 규제효과를 평가하고자 한다.

공매도 규제효과 분석을 위한 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 공매도 규제효과에 대한 국내외 선행연구 결과들을 종합해 비교한다. 공매도의 가격발견기능, 유동성 효과, 주가변동성에 미치는 영향 등에 대한 국내외 연구결과를 비교해서 정리할 것이다. Ⅲ장에서는 국내 상장주식시장에서의 공매도 거래활동에 대한 분석을 실시한다. 코로나19 팬데믹 이전 및 이후의 기간에서 관찰되는 중요한 공매도 관련 제도변화를 점검하고, 각각의 기간에 대해 시장별, 투자자그룹별 공매도 거래활동이 어떻게 변화하고 있는지를 파악할 것이다. Ⅳ장에서는 공매도 규제효과에 대한 계량적 분석을 실시한다. 계량분석을 위한 기본모형의 설정, 변수의 구성, 실증분석 결과 등이 제시된다. 마지막으로 Ⅴ장에서는 실증분석 결과를 정리하고 시사점을 도출한다.

Ⅱ. 공매도가 주식시장에 미치는 영향

공매도 제도가 주식시장에 미치는 영향에 대한 학술적인 연구는 다양한 방식으로 진행되어 왔으며, 많은 선행연구가 존재한다. 주로 공매도의 정보효과, 공매도가 가격발견 효율성, 시장유동성, 주가수익률 특성에 미치는 영향, 공매도 규제 전후의 초과수익률 등에 분석의 초점을 맞추고 있다.

공매도 규제에 대한 실증분석은 많은 경우 공매도 규제수준이 변경된 이후 가격발견 효율성, 시장유동성, 주가수익률 특성 등에 변화가 있는지 계량적으로 분석하는 접근법을 채택하고 있다. 이는 규제효과를 분석하는 통상적인 방식이다.

1. 공매도와 가격발견기능

공매도의 가격발견 기능에 관한 연구는 공매도에 관한 실증분석에서 가장 활발하게 연구가 진행되어온 영역이라 평가할 수 있다. 공매도에는 대차비용과 같은 추가적인 비용이 수반되므로 공매도 거래자는 정보거래자(informed trader)일 가능성이 높고, 공매도는 부정적인 기업정보가 주가에 반영되는 가장 중요한 채널 중의 하나이다. 따라서 공매도가 제한될 경우 부정적인 정보반영의 지연으로 인해 주식시장의 가격효율성이 하락할 것으로 예상한다.

해외의 실증분석 결과는 대체로 공매도 거래자들이 정보거래자임을 보고하고 있다. Dechow et al.(2001)은 펀더멘탈/주가 비율을 이용하여 공매도 거래자들의 특성을 분석할 결과, 공매도 거래자들은 주로 해당 비율이 낮은 주식을 공매도하고 있음을 발견하였다. 이는 공매도 거래자들이 주가가 고평가되었을 가능성이 높은 주식에 집중한다는 것을 의미한다. Desai et al.(2002)은 미국의 NASDAQ시장에서 공매도잔고가 높은 종목이 음의 초과수익률을 보이며 상장폐지 가능성이 높음을 보고하였다. 이를 바탕으로 공매도잔고가 정보효과가 있다고 해석하였다. Christophe et al.(2004)은 영업이익이 시장의 예상치를 하회하고 주가가 하락한 기업의 경우, 공매도 거래자들이 영업이익 발표 이전에 이미 공매도 거래를 증가시키고 있음을 확인하였다. 이를 통해 공매도 거래자가 정보거래자일 가능성이 높다고 지적하였다. Diether et al.(2009)은 미국 NYSE와 NASDAQ에서 공매도 비중이 각각 24%와 31%에 이르는 가운데 공매도 거래자들이 주가의 단기 과잉반응을 활용하여 유의한 수익률을 거두고 있음을 보고하였다. Boehmer et al.(2020)도 미국 NYSE 상장기업을 대상으로 한 분석에서 공매도 거래자가 정보거래자라는 결론을 내리고 있다.

공매도 거래자가 정보거래자일 가능성이 높다면 공매도의 제한은 정보거래자들의 참여를 위축시켜 가격효율성을 하락시킬 가능성을 높이게 된다. 공매도의 제한이 가격효율성을 저하시키고 있음을 보고하는 실증분석 결과는 국내외에서 광범위하게 확인된다. Bris et al.(2007)은 긍정적인 정보와 부정적인 정보가 주가에 반영되는 효율성을 비교한 결과 공매도 규제가 강한 국가에서 부정적인 정보가 주가에 반영되는 속도가 더 느림을 발견하였다. Beber & Pagano(2013)는 30여개 국가를 대상으로 2008년 글로벌 금융위기 전후의 가격효율성 변화를 분석하여 공매도 규제가 시장의 가격효율성을 저하시켰음을 발견하였다. 글로벌 금융위기로 주가가 급락하자 많은 국가에서 공매도를 일시적으로 금지하는 규제를 실행하였는데, 공매도 금지기간 동안 주식수익률과 과거의 시장수익률간의 상관관계가 더 강해지는 현상이, 특히 시장수익률이 음(-)인 경우에 뚜렷하게 나타났음을 보고하였다. Saffi & Sigurdsson(2011)은 26개국 주식시장을 분석하여 공매도에 대한 제약이 많은 국가일수록 가격효율성이 낮음을 발견하였다. 또한 공매도에 대한 제약을 완화하여도 주가변동성이 커지거나 극단적인 음(-)의 수익률이 나타나지 않음을 보고하였다. Boehmer & Wu(2013)의 실증분석 결과도 공매도 거래가 활발할 때 가격발견기능이 강화된다는 논리를 지지하고 있다. 이들은 NYSE 상장종목에 대한 분석을 통해 공매도 거래가 증가할 때 일중거래의 정보효율성이 증가함을 발견하였으며, 월간 및 연간 단위의 분석에서도 이러한 결과가 여전히 유효함을 보고하였다.

공매도 허용 종목을 지정하고 있는 홍콩 주식시장은 공매도의 영향을 분석하는데 유용한 환경을 제공하는데, Chang et al.(2007)과 Chen & Rhee(2010)의 분석결과도 공매도가 정보효율성을 강화하는 역할을 수행하고 있음을 보고하고 있다. Chang et al.(2007)은 공매도가 허용된 종목과 금지된 종목을 비교분석하여 공매도 제한이 주가의 과대평가를 유발한다는 결과를 보고하였으며, Chen & Rhee(2010)은 공매도 가능 종목에서 새로운 정보에 대해 가격조정이 더 신속하게 이루어짐을 발견하였다. 한편, 공매도 도입을 위한 중국의 파일럿(pilot) 프로그램을 연구한 Chang et al.(2014)은 공매도 거래의 허용이 가격효율성을 증가시켰음을 보고하였다. 공매도 거래가 시작되는 종목들은 평균적으로 가격이 하락, 즉 고평가가 해소되는 한편, 가격효율성은 증가하고 주가변동성은 하락한 것으로 관찰되었다.

국내 선행연구도 존재한다. Jung et al.(2013)은 한국 주식시장에서 개인투자자들의 공매도 거래참여가 시장의 가격효율성을 증가시킴을 보고하였다. 개인투자자들의 공매도 거래가 가능해진 종목에서 주가의 움직임이 랜덤워크(random walk)에 더 가까워짐을 발견하였다. Kim et al.(2016)은 2008년 글로벌 금융위기시에 실시된 국내 공매도 금지조치의 효과를 분석하여 가격효율성이 저하되었음을 보고하였다.

2. 공매도와 시장유동성

공매도에 의한 매도수요와 차입한 주식의 상환을 위한 매수수요는 추가적인 유동성을 창출한다. 또한 정보거래의 증가로 가격 불확실성이 감소하면서 호가스프레드가 줄어드는 효과도 기대할 수 있다. 반면 정보거래의 증가는 역선택위험을 증가시켜 호가스프레드가 확대될 가능성도 존재한다.

공매도 제한에 따른 유동성 축소는 대부분의 실증분석에서 일관된 결과를 보이고 있다. Marsh & Payne(2012)은 2008년~2009년에 시행된 영국 주식시장의 금융주 공매도 금지조치가 시장의 유동성을 뚜렷하게 위축시켰고, 이로 인해 공매도 금지가 시장의 안정화를 가져온 것이 아니라 시장의 질적 특성을 악화시키는 결과를 초래하였음을 주장하였다. Beber & Pagano(2013)는 국가간 주식거래 비교를 통해 공매도에 대한 규제강화는 시장유동성을 하락시키고 호가스프레드를 확대시킨다는 결과를 보고하였다.

Jung et al.(2013)은 한국 주식시장 개인투자자의 공매도거래를 분석하여 공매도가 시장의 유동성을 증가시키고 호가스프레드를 감소시킨다는 결과를 보고하였다. Wang & Lee(2015)도 한국 주식시장의 외국인 투자자 공매도 행태를 분석하여 매수주문이 증가할 때 외국인 투자자의 공매도도 같이 증가하는 현상을 확인하고, 공매도가 유동성을 증가시키는 효과를 가진 것으로 해석하였다. 최혁ㆍ이효정(2012), Kim et al.(2016), 황세운(2017), 이관휘 등(2021) 등은 2008년 글로벌 금융위기 이후에 실시되었던 공매도 전면금지로 인해 시장 전체의 유동성이 저하되었음을 보고하고 있다.

3. 공매도와 주가수익률 특성

공매도가 제한될 경우 긍정적인 정보의 반영에는 영향이 없는 반면 부정적인 정보의 반영은 느려지거나 일부만 반영되는 결과를 초래할 수 있다. 이 경우 주가 고평가에 대한 조정이 충분히 일어나지 않아 주가수익률 분포의 왜도(skewness)가 증가할 수 있을 것이다. 또한 부정적인 정보의 반영이 느려지면서 주가에 반영되지 않은 정보가 축적된다면 갑작스럽게 정보반영이 이루어지는 상황이 발생할 가능성이 증가한다. 이 경우 주가의 변동성은 증가할 수 있으며 주가급락의 빈도도 높아질 수 있다.

공매도와 주가수익률 특성의 관계에 대한 실증분석 결과를 살펴보면 공매도가 제한될수록 주가분포의 왜도가 증가한다는 결과가 많고 변동성에 관해서는 혼재된 결과가 보고되고 있다. Bris et al.(2007)은 46개국 주식시장에 대한 횡단면 및 시계열 정보 분석을 통해 공매도가 금지된 국가에서 시장수익률의 왜도가 크다는 결과를 보고하였다. Chang et al.(2007)과 Blau & Whitby(2016)도 공매도가 주가수익률의 왜도를 감소시킨다는 결과를 제시하였다. 변동성과 관련하여, Saffi & Sigurdsson(2011)은 26개국에 대한 분석에서 공매도 제한을 완화한다고 해서 주가변동성이 증가하거나 극단적인 음의 수익률 발생빈도가 증가하지 않는다는 분석을 내놓은 반면, Chang et al.(2007)은 홍콩시장 분석에서 공매도의 허용은 주가수익률 변동성을 증가시킨다는 결과를, Chang et al.(2014)은 중국시장 분석에서 공매도의 허용이 주가수익률 변동성을 하락시킨다를 결과를 보고하고 있다.

국내 주식시장에 대한 분석에서는 공매도가 수익률의 변동성에 영향을 주지 않거나 감소시킨다는 결과가 다수인 것으로 확인된다. Jung et al.(2013)은 국내 주식시장에서 개인투자자들의 공매도 거래가 수익률 왜도와 주가변동성에 영향을 미치지 않았다는 결론을 도출하였고, Wang & Lee(2015)도 외국인 투자자의 공매도 거래가 주가변동성에 통계적으로 유의적인 영향을 미치지 않음을 보고하였다. Kim et al.(2016)은 2008년 글로벌 금융위기시의 공매도 금지조치로 인해 오히려 주가변동성이 증가하였다는 결과를 제시하였다. Wang & Lee(2015)는 한국 주식시장에서 외국인 투자자들은 역모멘텀 방식의 공매도 거래전략을 주로 활용하고 있으며, 주가변동성에 영향을 주지 않는다는 결과를 제시하였다. 가장 최근의 연구인 이관휘 등(2021)은 코로나19 팬데믹 이후의 공매도 전면금지 조치가 주가하락을 방어하거나, 변동성을 줄인다는 증거를 찾을 수 없음을 보고했다. 아울러 공매도 과열종목 지정제도의 효과에 대한 분석을 통해 과열종목으로 지정된 이후 주가하락이 멈춘다는 증거를 찾을 수 없다는 결론을 도출하였다. 반면, 최용준ㆍ김철중(2014)은 국내 주식시장에서 변동성이 낮은 시기에는 공매도 거래와 주가변동성에 유의한 영향을 미치지 않으나 변동성이 높은 시기에는 공매도 거래가 주가변동성을 확대시킨다는 결과를 보고하고 있다. 황세운(2017)은 2011년 실시된 공매도 전면금지 기간동안 주가변동성이 줄어들었다는 결과를 도출하였다. 이밖에 참고할만한 연구로, 이영섭ㆍ한상범(2015)은 가격하락 국면에서 약탈적인 공매도거래가 증가하지 않으며 비공매도 거래가 공매도 거래에 비해 더 공격적이라는 결과를 도출하였다.

Ⅲ. 국내 공매도 규제변화 및 시장현황

1. 코로나19 팬데믹 전후의 공매도 규제변화

국내 주식시장에서 공매도 규제는 지속적으로 강화되어 왔다고 평가할 수 있다. 공매도에 대한 규제는 ‘자본시장과 금융투자업에 관한 법률(이하 자본시장법)’에 의해 이루어지고 있다. 자본시장법은 공매도를 소유하지 아니한 상장증권의 매도나 차입한 증권으로 결제하고자 하는 매도를 의미한다고 정의한다.1) 국내에서 무차입공매도는 원칙적으로 금지되고 차입공매도만 허용되는데, 결제이행의 위험이 없는 경우에 대해서는 무차입공매도로 간주하지 않는 예외규정을 두고 있다.2) 한편 공매도가 위기상황에서 가격하락을 부추길 수 있다는 지적에 따라 자본시장법은 금융위원회가 증권시장의 안정성 및 공정한 가격형성을 저해할 우려가 있는 경우에 차입공매도를 제한할 수 있도록 규정하고 있다.3)

공매도에 대한 규제구조를 살펴보면 과도한 주가하락을 방지하고 시장의 안정성을 유지하기 위한 시장안정화 조치, 공매도 거래 관련 정보의 공시에 관한 규제, 그리고 공매도 관련 불법행위에 관한 처벌로 구분할 수 있다. 2020년 3월에 발생한 코로나19 팬데믹 사태 이전의 공매도 규제는 주로 시장안정화 및 정보공시 강화에 초점을 맞추었다고 평가할 수 있다. 가장 대표적인 공매도 관련 시장안정화 조치로는 위기상황에서의 전면적인 공매도 거래금지 조치가 있다. 공매도 거래가 본격화된 2000년대 이후 국내 상장주식시장에서 공매도 거래가 전면금지된 사례는 세 차례이다. 그 첫 번째는 2008년 발생한 글로벌 금융위기 과정에서 실시되었다. 2008년 9월 리먼브라더스의 파산으로 인해 금융위기가 촉발되자 금융당국은 시장의 투매에 따른 폭락세를 진정시키고 거래를 안정화하기 위하여 2008년 10월 1일 공매도 거래를 전면금지하였다. 이후 시장의 안정세가 뚜렷해지면서 전면금지 시행 약 8개월만인 2009년 5월 31일 공매도 거래를 재개하였다. 두 번째 공매도 금지조치는 유럽 재정위기가 발생하여 시장이 급락하였던 2011년 8월 10일 시행되었다. 유럽 재정위기는 이전의 글로벌 금융위기에 비하여 충격이 상대적으로 작았고 시장이 빠르게 안정세를 찾으면서 공매도 금지조치는 약 3개월 후인 2011년 11월 9일 해제되었다. 세 번째 공매도 금지조치는 코로나19 팬데믹으로 인해 시장이 급락세를 보였던 2020년 3월 16일에 시행되었다. 해당 공매도 금지조치는 이전의 금지조치들에 비해 상대적으로 오랜 기간 유지되었는데, 약 14개월 동안 공매도 거래가 전면금지 되었고 2021년 5월 3일 일부 종목에 대해 공매도 거래가 재개되었다.4) 공매도 거래가 허용된 종목은 KOSPI200지수 및 KOSDAQ150지수를 구성하는 350개 종목이며, 나머지 종목에 대해서는 2022년 11월 현재까지 공매도거래가 금지되어 있다.

글로벌 금융위기나 코로나19 팬데믹과 같은 위기상황에서 시장의 공포감이 극에 달할 경우 필요 이상의 주가하락이 나타날 수 있으며 공매도는 그러한 주가하락을 부추길 가능성이 있다. 따라서 위기상황에서 공매도 금지는 시장을 안정화하는 역할을 기대할 수 있다는 것이 공매도 금지조치의 논리다. 그러나 공매도가 주가하락을 유발한 요인이 아니므로 공매도 금지로 시장의 하락세를 막기는 어렵다는 비판적 견해가 학계를 중심으로 꾸준히 제기되고 있다. 특히 코로나19 팬데믹 시기의 국내 공매도 전면금지 조치는 금융시장 상황이 정상적인 상태로 회복되었음에도 불구하고 전면해제되지 않고 부분적으로만 해제되어 정상적인 시장기능의 작동에 부담이 된다는 지적이 많은 상황이다.

코로나19 팬데믹 이전에 도입되었던 중요한 공매도 관련 규제로는 공매도 잔고 공시의무 부과제도와 공매도 과열종목 지정제도를 들 수 있다. 공매도 잔고 공시의무 부과제도는 주식시장에서 공매도 거래가 어떠한 투자자에 의해 이루어지고 있는지를 파악하기 위하여 도입되었다.5) 동 제도는 2016년 6월 30일 도입되었는데, 대규모 공매도 투자자에 대해 공매도 잔고비율에 따라 잔고공시 또는 신고의무를 부과하고 있다.6) 자본시장법과 시행령에 따르면 상장주식 총수대비 공매도 순잔고비율이 0.01% 이상인 경우 잔고 보고의무가 부과되며, 그 비율이 0.5% 이상인 경우 잔고 및 매도자에 관한 사항을 공시해야 한다.7) 공매도 거래활동 및 잔고에 관한 정보를 시장에 투명하게 공개하기 위한 규제로 이해할 수 있다.

공매도 과열종목 지정제도는 비정상적으로 공매도가 급증하고 가격이 급락한 종목을 매 거래일 장종료 후 공매도 과열종목으로 지정하고 다음 매매거래일 하루 동안 공매도 거래를 제한하는 제도로, 2017년 3월 27일 도입되었다.8) 공매도 과열종목 지정제도는 자본시장법 및 시행령이 아니라 한국거래소 유가증권시장 업무규정 및 시행세칙, 한국거래소 코스닥시장 업무규정 및 시행세칙에 근거한다. 전거래일 종가 대비 주가하락률, 해당 거래일의 공매도 거래비중, 직전 40거래일 평균대비 공매도 비중 등에 관한 기준을 만족하는 경우 다음 거래일에 해당 종목에 대한 공매도가 금지된다.9) 이후 공매도 과열종목 지정기준은 2022년 7월 과열종목 지정제도가 시장충격에 보다 민감하게 반응할 수 있도록 요건이 완화되어 더 많은 종목이 공매도 과열종목으로 지정될 수 있도록 한국거래소 규정이 개정되었다.10) 신설된 규정에 따르면 공매도 비중이 30% 이상이면 주가하락률(3% 이상), 공매도 거래대금 증가율(2배 이상)이 다소 낮더라도 공매도 과열종목으로 지정된다. 또한 공매도 과열종목으로 지정되어 공매도가 금지된 날에 주가하락률이 5% 이상일 경우 공매도 금지기간이 다음 거래일까지 자동으로 연장된다.

코로나19 팬데믹 이후 나타난 공매도 관련 규제변화로는 공매도 관련 불법행위에 대한 처벌강화, 유상증자 기간 중 해당 주식을 공매도한 자의 증자참여 제한, 대차계약내역 보관의무 부과 및 대차거래 모니터링 강화, 개인투자자의 공매도 참여환경 개선 등이 있다. 이 중에서 가장 주목할만한 규제변화는 공매도 관련 불법행위에 대한 처벌강화라고 할 수 있을 것이다. 이전까지 무차입공매도와 같은 공매도 관련 불법행위에 대해서 과태료만 부과할 수 있었기 때문에 공매도 관련 불법행위를 억제하는 효과가 미약하다는 지적이 계속되었다. 금융감독원의 통계에 따르면 2010년부터 2022년 4월까지 공매도 관련 불법행위로 과태료 또는 주의 조치를 받은 건수는 127건(과태료 71건, 주의 56건)에 이른다. 127건 중 외국인에 대한 처분이 119건, 94%의 비중을 차지하고 있어 공매도 관련 불법행위는 주로 외국인에 의해 이루어지는 것으로 파악된다. 외국인들의 공매도 거래 참여비중이 높다는 점을 감안하더라도 불법행위 비중이 매우 높음을 알 수 있다.

국회는 2020년 12월 자본시장법 개정을 통하여 공매도 관련 불법행위에 대해 형사처벌 및 과징금부과를 도입하였다. 형사처벌은 1년 이상의 유기징역 또는 이익 또는 회피한 손실액의 3배 이상 5배 이하의 벌금을 부과하는 것을 주된 내용으로 한다.11) 과징금은 위법한 공매도 주문금액의 범위 내에서 부과된다.12) 과징금 및 형사처벌의 도입 이후 실제로 처벌받은 사례가 아직까지 나오지 않았기 때문에 처벌기준 강화에 대한 개인투자자들의 인식은 아직 미흡한 편이지만, 고의적인 불법공매도 시도를 사전에 억제하는 효과가 있을 것으로 예상된다. 또한 착오나 실수 등으로 인한 위반이 발생하지 않도록 주의를 촉구하는 예방효과도 있을 것으로 기대된다. 금융당국은 지속적으로 불법공매도에 대한 적발 및 처벌을 강화할 방침을 밝히고 있다. 공매도 연계 불공정거래 기획조사를 강화하고, 무차입 공매도에 대한 신속한 조사를 위하여 한국거래소 시장감시위원회, 금융감독원 등이 불법공매도 모니터링 정보를 실시간으로 공유하는 체계를 구축하였다. 불법 공매도에 대한 적발 및 처벌활동이 강화되는 추세는 이어질 것으로 전망된다.

공매도 투자자는 대차계약 내역을 5년간 보관해야 하는 의무도 부과된다.13) 공매도를 실행하기 위해서는 대차계약 체결이 필수적인데, 대차계약 체결과 관련된 정보투명성을 강화하기 위한 조치라고 평가할 수 있다. 추가적으로 공매도 목적의 대차거래에 대한 모니터링 체계도 강화하였다. 금융당국은 금융투자업규정의 개정을 통해 공매도 목적 대차 후 90일 경과 시 금융당국에 보고의무를 부과하였다. 또한 공매도 잔고 대량보유 보고 내용에 상세 대차정보(당일 시작ㆍ마감 대차잔고)를 포함하는 규정도 마련하였다. 대차계약의 투명성이 제고되면 금융당국이 대차계약 일시와 매도주문 시기를 비교함으로써 불법행위를 보다 용이하게 적발해 낼 수 있을 것이다. 공매도와 대차거래간의 완결성을 높이기 위해 향후 대차거래를 전산거래로 의무화할 가능성이 있다는 점에서 정보보관의무의 부과 및 대차거래 모니터링 강화는 그 예비단계의 성격을 가진다고 볼 수 있다.

유상증자 기간 중 해당 주식을 공매도한 자의 유상증자 참여를 제한하는 규제도 코로나19 팬데믹 이후에 만들어졌다. 유상증자 계획을 발표한 주권상장법인의 주식을 공매도하여 공모가격을 떨어뜨린 후, 유상증자에서 낮은 가격에 신주를 배정받아 차입주식의 상환에 활용하는 차익거래가 나타나면서 투자자와 발행기업에 피해를 준다는 지적이 반복적으로 제기된 데 따른 것이다. 유상증자 계획이 공시된 이후 해당기업의 주식을 주식시장에서 공매도한 경우에는 유상증자 참여가 제한되며, 이를 위반할 경우 과징금이 부과된다.14)

2. 코로나19 팬데믹 전후의 공매도 현황

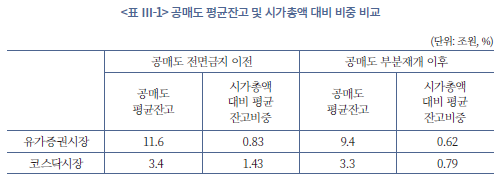

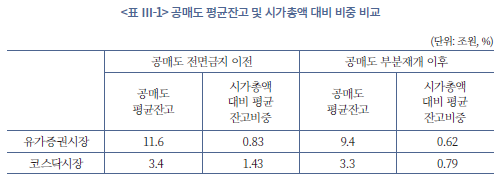

본 절에서는 국내 주식시장의 공매도 규제조치 전후의 주식시장 공매도 거래현황을 검토한다. 먼저 코로나19 팬데믹으로 공매도가 전면금지되기 직전 약 14개월(2019년 1월 2일~2020년 3월 13일)간 유가증권시장의 공매도 평균잔고는 11.6조원으로, 전체 시가총액 대비 평균비중은 0.83%이다. 코스닥시장의 경우 공매도 평균잔고는 3.4조원, 코스닥시장 시가총액 대비 1.43%이다. 코스닥시장의 공매도 평균잔고는 유가증권시장에 비해 절대 규모는 작으나 시가총액 대비 공매도 잔고비중은 높게 나타난다.

시가총액대비 공매도 잔고비중은 공매도 금지 이후 완만하게 감소하고, 부분재개 이후 빠르게 증가하는 추세를 보여준다. 2021년 5월 공매도 부분재개 이후 약 1년간의 평균잔고는 공매도 금지 이전 기간과 비슷한 수준으로 높아졌으나, 시가총액 대비 공매도 잔고비중은 공매도 금지 이전 기간에 비하여 크게 낮아졌다. 공매도 부분재개 이후 약 12개월(2021년 5월 3일~2022년 5월 11일) 동안의 유가증권시장 공매도 평균잔고는 9.4조원, 시가총액 대비 평균 잔고비중은 0.62%로 나타난다. 공매도 금지 이전 기간과 비교할 때 공매도 평균잔고는 2.2조원 감소했고, 시가총액 대비 평균 잔고비중은 0.21%p 하락하였다. 코스닥시장의 경우 공매도 평균잔고는 3.3조원, 시가총액 대비 잔고비중은 0.79%로 나타난다. 공매도 금지 이전과 비교하면 평균잔고는 0.1조원 감소했고, 시가총액 대비 평균 잔고비중은 0.64%p 하락하였다.

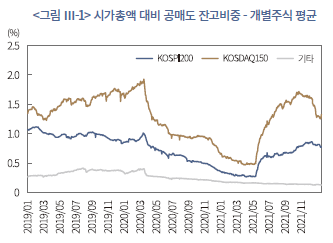

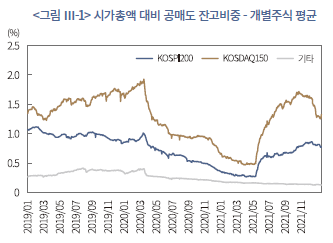

<그림 Ⅲ-1>은 공매도 잔고비중의 변화 추이를 KOSPI200 편입종목, KOSDAQ150 편입종목, 비편입종목으로 구분하여 제시하고 있다. KOSDAQ150 편입종목과 KOSPI200 편입종목의 잔고 변화 추세는 유사하나 KOSDAQ150 편입종목의 잔고비중이 전체 기간에 대해 가장 높게 나타난다. KOSDAQ150 종목의 공매도 잔고비중은 전면금지 이전 기간 2%에 육박하는 수준까지 높아졌지만 전면금지 이후에는 지속적으로 감소하여 부분재개 직전에는 0.5% 수준까지 하락하였다. KOSPI200 종목의 경우 전면금지 직전 1% 수준인 것으로 나타났으며, 이후 지속적으로 하락하여 부분재개 직전에는 0.3% 수준까지 떨어졌다. KOSPI200 종목 및 KOSDAQ150 종목의 공매도 잔고비중은 시장전체에 비해 높게 나타나는데, 이는 공매도가 주로 시가총액이 큰 대형종목에 집중되고 있음을 보여준다. KOSDAQ150 종목의 공매도 잔고비중이 KOSPI200 종목보다 높게 유지되고 있다는 것은 가치평가 수준에 대한 투자자의 견해차가 KOSDAQ150 종목에 대해 상대적으로 더 크다는 것을 의미한다. 공매도 부분재개 이후 KOSDAQ150 종목의 공매도 잔고비중이 KOSPI200 종목에 비해 훨씬 빠른 속도로 증가했다는 점도 동일한 관점에서 이해할 수 있다.

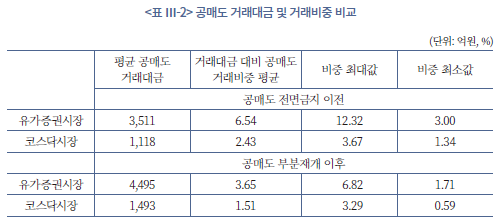

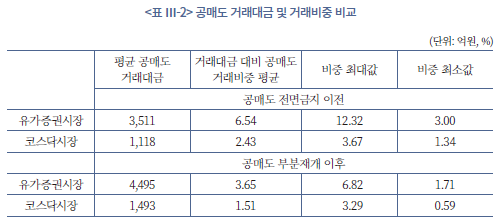

공매도 잔고비중과 더불어 공매도 거래현황 파악에 가장 널리 이용되는 지표는 총거래대금 대비 공매도 거래대금의 비중이다. <표 Ⅲ–2>는 공매도 전면금지 이전 기간과 부분재개 이후 기간에 대해 평균 공매도 거래대금과 공매도 거래비중의 변화를 제시하고 있다.

공매도 전면금지 이전 기간(2019년 1월 2일~2020년 3월 13일) 유가증권시장과 코스닥시장의 일평균 공매도 거래대금은 각각 3,511억원, 1,118억원이고, 공매도 거래대금이 전체 주식거래대금에서 차지하는 비중은 각각 6.54%와 2.43%이다. 주요 선진국 주식시장의 공매도 거래비중이 20~50%임을 고려할 때 국내 주식시장의 공매도 거래비중은 상당히 낮은 수준이다.15)

공매도 부분재개 이후 유가증권시장과 코스닥시장의 일평균 공매도 거래대금은 각각 4,495억원, 1,493억원으로 팬데믹 이전의 기간에 비해 증가하였다. 그러나 공매도 거래비중은 각각 3.65%와 1.51%로 팬데믹 이전에 비해 낮은 수준이다. 절대적인 공매도 거래대금은 증가하였지만, 공매도가 일부 종목에 대해서만 재개된데다 팬데믹 이후 개인투자자의 급격한 유입으로 주식 거래대금이 크게 증가한 영향으로 보인다.

한편 공매도 전면금지 기간에도 소량의 공매도 거래가 관찰되는데, 이는 시장조성자에 대해 공매도를 예외적으로 허용했기 때문이다. 다만 공매도 금지 이전에 시장조성자의 공매도가 전체 공매도의 23%, 전체 거래대금의 1.07%를 차지하였다는 점을 감안하면 공매도 전면금지 이후 시장조성자 역시 공매도를 최대한 회피한 것으로 보인다.16)

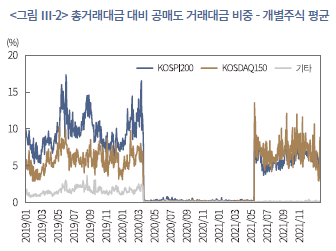

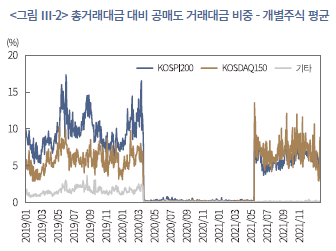

<그림 Ⅲ-2>는 공매도 거래비중 변화 추이를 KOSPI200 편입종목, KOSDAQ150 편입종목, 비편입종목으로 구분하여 제시하고 있다. 공매도 금지 이전 일평균 공매도 거래비중은 KOSPI200 편입종목 9.56%, KOSDAQ150 편입종목 5.76%, 비편입종목 1.54%로 KOSPI200 편입종목에서 공매도 거래가 가장 활발한 것으로 나타난다. 공매도가 주로 KOSPI200 및 KOSDAQ150 편입종목에 집중되고 있음을 확인할 수 있다. 공매도 부분재개 이후에는 KOSPI200 편입종목 5.98%, KOSDAQ150 편입종목 6.94%로 KOSDAQ150 편입종목에 대한 공매도 거래비중이 더 높게 나타난다. KOSPI200의 경우 공매도 금지 이전에 비해 거래비중이 줄어든 반면, KOSDAQ150의 경우 거래비중이 오히려 증가했다. 공매도 재개 이후 KOSDAQ150에 대한 공매도 잔고와 공매도 비중이 동시에 상승한 것은 공매도 전면금지 기간동안 KOSPI200지수보다 KOSDAQ150지수의 상승이 더 강하게 나타난 것과 관련이 있을 것으로 추정된다. 코스닥시장에서 고평가가 나타나고 있다는 판단에 따라 공매도 거래가 증가했을 가능성이 있다.

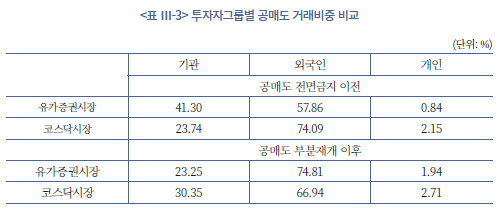

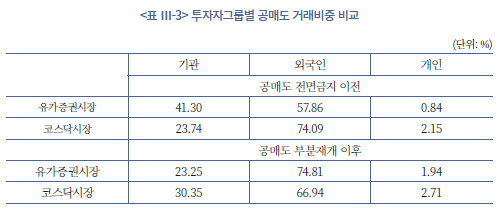

<표 Ⅲ–3>은 공매도 전면금지 이전 및 부분재개 이후의 투자자유형별 공매도 거래비중을 제시하고 있다. 공매도 부분재개 이후 외국인 투자자의 공매도 거래비중은 증가했으며, 개인투자자들의 공매도 참여도 증가한 것으로 관찰된다.

유가증권시장의 경우 금지 이전에 비해 부분재개 이후 외국인투자자의 공매도 비중은 큰 폭으로 증가했다. 반면 기관투자자의 공매도 비중은 부분재개 이후 큰 폭으로 감소했다. 개인투자자의 비중은 0.84%에서 1.94%로 두 배 이상 증가하였다. 코스닥시장의 경우 외국인투자자의 비중은 74.09%에서 66.94%로 오히려 감소했고, 기관투자자의 비중은 23.74%에서 30.35%로 증가했다. 유가증권시장과는 대조적인 결과다. 개인투자자들의 비중은 2.15%에서 2.71%로 증가하였다.

Ⅳ. 공매도 규제효과에 대한 계량적 분석

본 장에서는 공매도 금지 조치와 부분재개 조치의 영향을 실증적으로 분석한다. 먼저 선행연구의 논의를 바탕으로 공매도 규제변화가 가격효율성, 유동성, 수익률 특성에 미친 영향을 분석한다. 이어서 공매도 규제변화에 대한 초과수익률 반응과 그 결정요인을 분석한다.

1. 가격효율성, 유동성, 수익률 특성에 대한 영향 분석

가. 분석척도

공매도 금지 및 부분재개가 가격효율성에 미치는 영향을 파악하기 위한 가격효율성 척도로 자기상관계수(autocorrelation), 교차자기상관계수(cross- autocorrelation), 분산비율(variance ratio) 등 세 가지 척도를 이용한다.

자기상관계수(|AC|)는 개별주식의 일간수익률을 이용하여 계산하며 절대값을 기준으로 분석한다. 가격이 효율적이라면 수익률은 랜덤워크(random walk)를 따르게 되며 자기상관계수는 0이 된다. 따라서 자기상관계수의 절대값이 작을수록 가격효율성이 높은 것으로 평가한다. 아울러, 시장모형(market model)의 잔차를 이용하여 계산한 자기상관계수(|ACi|)를 추가적인 지표로 이용한다. 개별주식 수익률에 포함된 시장정보를 제거함으로써 개별주식에 대한 고유정보가 가격에 반영되는 정도를 측정한다.

교차자기상관계수(|XAC|)은 개별주식의 수익률과 전일의 시장수익률의 상관계수로 정의하며 절대값을 기준으로 분석한다. 교차자기상관계수의 절대값이 클수록 시장정보가 개별주식 가격에 늦게 반영된다는 것을 의미한다. 공매도가 제한될 경우 부정적 시장정보의 반영속도가 느려질 것이므로 시장수익률이 음(-)인 경우의 교차자기상관계수가 커질 것으로 예상된다. 따라서 시장수익률이 양(+)인 경우(|XAC+|)와 음(-)인 경우(|XAC-|)를 나누어 각각의 교차자기상관계수를 산출한다(Bris, Goetzmann, Zhu, 2007; Saffi & Sigurdsson, 2011).

분산비율(VR)은 주간수익률의 분산( )과 일간수익률의 분산(

)과 일간수익률의 분산( )을 이용하여

)을 이용하여

로 계산한다. 주가수익률이 랜덤워크를 따른다면 분산비율이 0이 되며, 가격이 효율적인 것으로 평가한다(Lo & MacKinlay, 1988).

로 계산한다. 주가수익률이 랜덤워크를 따른다면 분산비율이 0이 되며, 가격이 효율적인 것으로 평가한다(Lo & MacKinlay, 1988).

유동성 척도로는 호가스프레드(quoted spread), Amihud 비유동성(illiquidity) 척도, 거래회전율 등 세 가지를 이용한다. 호가스프레드(SPRD)는 최우선 매도호가와 최우선 매수호가의 차이를 의미한다. 호가스프레드가 클수록 주식의 경제적 기대가치와 체결가격의 차이가 크고 이는 높은 거래비용을 의미한다. 호가스프레드의 실제 관측치를 확보하지 못하였으므로 대신 Corwin & Schultz(2012)의 방법에 따른 추정치를 계산하여 이용한다. 이 추정치는 가격 대비 호가스프레드의 비율로 계산된다.

Amihud(2002) 비유동성 척도(ILLQD)는 일간수익률(%)의 절대값을 일간거래대금(원)으로 나눈 뒤 108을 곱하여 계산한다. 이는 단위금액의 거래가 수익률에 미치는 영향의 크기로, 시장충격비용(market impact costs)으로 간주할 수 있으며 유동성이 풍부할수록 비유동성 척도는 작은 값을 갖는다.

거래회전율(TURN)은 일간 거래대금을 시가총액으로 나누어 계산한다. 거래회전율이 높을수록 거래체결 확률이 높아지며 일반적으로 호가스프레드와 시장충격비용이 낮다. 다만, 거래회전율은 수익률의 불확실성 또는 투자자간 의견불일치 수준과 밀접한 연관성을 갖는 것으로 알려져 있으므로 유동성 척도로써 불완전한 측면이 있음을 감안할 필요가 있다.

마지막으로, 수익률 분포의 특성은 변동성, 왜도(skewness), 첨도(kurtosis), 극단적 수익률 발생비율 등을 이용하여 분석한다. 변동성(VLT), 왜도(SKW), 첨도(KRT)는 일간수익률을 이용하여 계산한다. 변동성의 경우, 공매도 금지가 수익률에 비대칭적으로 영향을 주었을 가능성이 있으므로, 추가적으로 수익률이 양(+)인 경우(VLT+)와 음(-)인 경우(VLT-)로 나누어 산출한다. 극단수익률 발생비율은 분석기간의 일간수익률 평균값을 기준으로 일간수익률이 표준편차의 2배를 상회하는 관측치의 비율(XTR+)과 하회하는 관측치의 비율(XTR-)을 각각 계산한다. 공매도가 금지될 경우 주가의 급등 혹은 고평가가 효과적으로 조정되지 않게 되므로 VLT+와 XTR+가 증가할 것으로 예상할 수 있다. 반면 공매도가 주가의 급락을 유발하는 원인이라는 공매도 규제 논리에 따르면 공매도 금지 이후 VLT-와 XTR-가 감소할 것으로 예상할 수 있다.

나. 분석개요

실증분석은 공매도 금지 전후에 대한 분석과 부분재개 전후에 대한 분석으로 구분하여 진행한다. 공매도 금지 전후에 대한 분석은 공매도 금지일(2020년 3월 16일) 기준으로 -125일부터 -6일까지 120일(거래일 기준)의 ‘금지 이전’ 기간과 +5일부터 +124일까지 120일의 ‘금지 이후’ 기간을 비교한다. 동일한 방식으로, 공매도 부분재개 전후에 대한 분석은 공매도 부분재개일(2021년 5월 3일) 기준으로 -125일부터 -6일까지 120일의 ‘재개 이전’ 기간과 +5일부터 +124일까지 120일의 ‘재개 이후’ 기간을 비교한다. 공매도 금지 전후 10일과 부분재개 전후 10일은 각 조치에 따라 분석대상 지표의 특성이 전환되는 시기로 간주하여 분석에서 제외한다.

공매도 금지 전후 분석에서, 모든 종목에 대해 공매도가 금지되었기 때문에 금지 전후의 비교만으로는 공매도 금지의 영향을 공매도 금지와 무관한 시장전체의 시계열적 변화와 분리하기 어렵다. 따라서 공매도 금지의 영향이 클 것으로 예상되는 종목과 그렇지 않은 종목으로 표본을 분류하여 공매도 금지 전후의 변화를 상호 비교하는 방법을 이용한다.17)

첫 번째 분류기준은 공매도 거래비중이다. 공매도 금지 이전에 공매도 거래가 많았던 주식이 공매도 거래가 적었던 주식에 비해 공매도 금지의 영향이 클 것으로 예상할 수 있다. 다만 공매도가 적었던 종목의 경우, 주식의 차입이 어렵기 때문인지 공매도 수요가 작았기 때문인지 구분되지 않는다. 주식의 차입이 어렵기 때문이라면 공매도 금지의 영향이 작을 것이나 공매도 수요가 작았기 때문이라면 공매도 금지의 영향에서 자유로울 수 없다. 이러한 점을 고려하여 공매도의 용이성을 두 번째 분류기준으로 이용한다. 공매도의 용이성은, 주식대여와 공매도가 주로 외국인투자자 및 기관투자자에 의해 이루어진다는 점에 착안하여 외국인투자자 및 기관투자자 거래비중을 활용한다.18) 19)

공매도 부분재개 전후 분석에서는 공매도 재개종목과 공매도가 재개되지 않은 종목의 재개 전후 변화를 상호 비교한다. 공매도 재개종목은 KOSPI200 및 KOSDAQ150 편입종목이다.

분석을 위한 공매도 자료와 주가자료는 DataGuide로부터, 파생상품 관련자료는 한국거래소로부터 확보하였다. 분석대상은 SPAC을 제외한 유가증권시장과 코스닥시장의 상장기업 보통주로, 공매도 금지 전후 분석에 1,967개 기업, 공매도 부분재개 분석에 2,049개 종목이 포함된다.

다. 공매도 금지 전후 실증분석

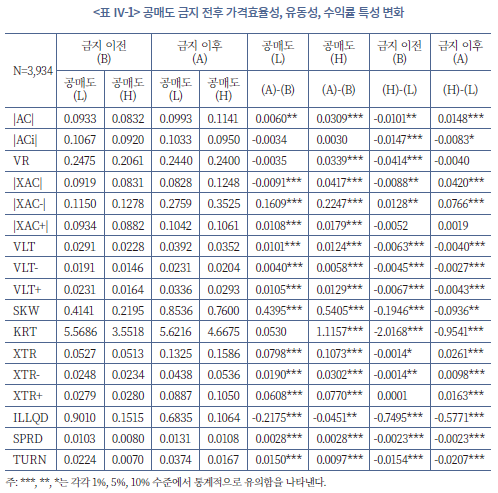

공매도 금지 조치가 가격효율성, 유동성, 수익률 특성에 미친 영향을 차례로 검토해보자. <표 Ⅳ-1>은 주요 분석변수의 공매도 금지 전후 변화를 거래비중 상위 20% 종목(공매도(H))과 나머지 하위 80% 종목(공매도(L))으로 나누어 제시하고, 금지 전후의 차이와 그룹간 차이의 통계적 유의성을 검토하고 있다.

공매도 금지 이전, 공매도(H) 그룹은 공매도(L) 그룹에 비해 전반적으로 가격효율성이 높고, 변동성이 작으며, 유동성이 높은 것으로 나타난다. 이 그룹에 KOSPI200 및 KOSDAQ150 지수에 편입된 종목과 시가총액 대형주가 많이 포함되어 있는 것과 연관된 결과로 보인다. 공매도 금지 이후, 공매도(H) 그룹의 가격효율성은 저하되고 변동성은 증가하여 공매도(L) 그룹과의 격차가 줄어들거나 역전되는 것으로 확인된다. 공매도 금지조치가 공매도(H) 그룹에 상대적으로 큰 영향을 미친 것으로 평가할 수 있다. 한편 유동성 지표에서는 공매도(H) 그룹과 공매도(L) 그룹 사이에 차별적인 변화가 관찰되지 않는다. 이러한 결과는 공매도 용이성을 기준으로 종목으로 구분하여 분석하는 경우에도 대체로 유사하다.

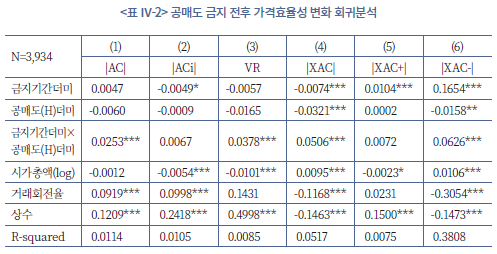

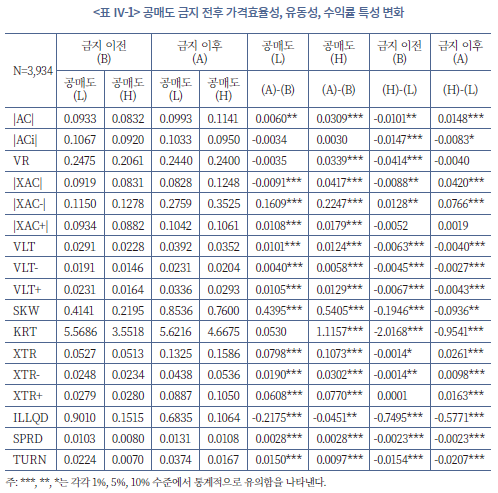

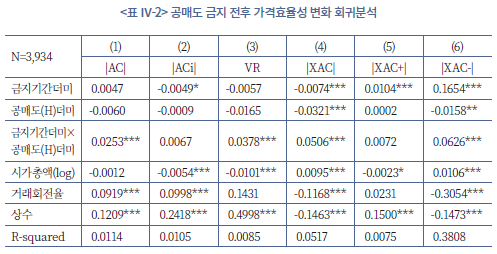

<표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>는 가격효율성, 수익률분포, 유동성 관련 척도를 종속변수로 다중회귀분석을 시행한 결과를 보여준다. 공매도 금지기간 더미변수, 공매도 거래비중 상위 20% 종목에 대한 더미변수, 두 변수의 교차(interaction)변수, 기타 통제변수가 독립변수로 포함되며, 기타 통제변수로는 기업규모, 수익률 변동성, 거래회전율을 포함한다.

먼저 <표 Ⅳ-2>에 따르면 종속변수가 자기상관계수(|AC|), 분산비율(VR), 교차자기상관계수(|XAC|)인 경우 교차변수의 계수가 통계적으로 유의한 양(+)의 값을 갖는 것으로 나타난다. 즉 공매도 금지 이후, 공매도 거래비중이 높았던 주식의 가격효율성이 상대적으로 악화되었다는 것을 의미한다. 특히, 시장수익률이 음(-)인 경우 교차자기상관계수(|XAC-|)의 계수가 유의한 양(+)의 값으로, 공매도 금지 이후 하락장에서 가격발견기능이 저하되는 현상을 확인할 수 있다. 한편 종속변수가 초과수익률 자기상관계수(|ACi|), 시장수익률이 양(+)인 경우의 교차자기상관계수(|XAC+|)인 경우 교차변수의 계수가 양(+)의 값으로 추정되었으나 통계적으로 유의하지 않았다.

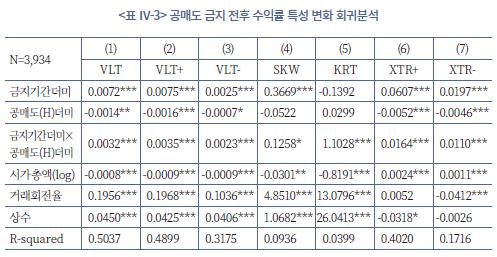

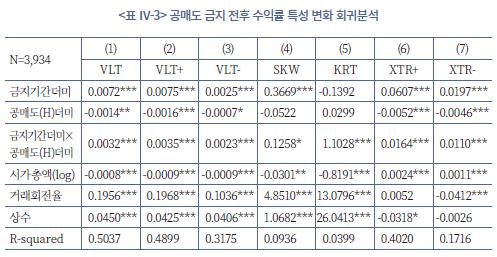

<표 Ⅳ-3>에서는 공매도 금지 이후 수익률 분포 특성의 변화에 대해 분석하고 있는데, 공매도 거래비중이 높았던 종목은 공매도 금지 이후 다른 종목에 비해 변동성, 왜도, 첨도, 극단적 수익률 발생빈도가 모두 증가하는 것으로 나타난다. 특히, 수익률이 양(+)인 경우의 변동성(VLT+)과 극단적 양(+)의 수익률 발생빈도(XTR+)에서 증가폭이 크게 나타나 공매도 제한이 주가의 과대평가를 효과적으로 제어하지 못하고 있음을 시사한다. 다시 말해, 공매도 거래는 주가의 급격한 상승이 나타났을 때 실행되어 주가를 안정화시키는 역할을 수행해 왔음을 방증하는 결과다. 또한 공매도 금지 이후, 수익률이 음(-)인 경우의 변동성(VLT-)과 극단적 음(-)의 수익률 발생빈도(XTR-)가 동시에 증가하는데 이는 공매도 금지를 통해 주가의 급락 가능성이 줄어들 것이라는 공매도 규제 논리와는 배치되는 결과다.

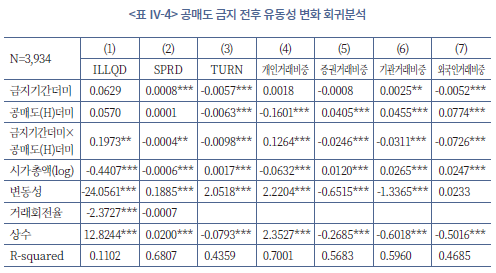

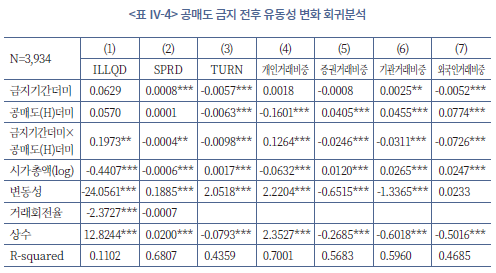

<표 Ⅳ-4>의 유동성 변화에 대한 분석은 일관된 결과가 확인되지 않는다. 공매도 거래비중이 높았던 종목은 공매도 금지 이후 비유동성 척도가 증가하고 거래회전율이 하락하나, 대조적으로 호가스프레드는 감소하는 것으로 나타난다. 공매도 거래가 금지되면서 유동성이 하락하였으나, 동시에 지정가 주문(limit order)의 비중이 높은 개인투자자의 참여가 늘어나면서 호가스프레드가 감소한 것으로 추정된다. <표 Ⅳ-4>의 (4)는 개인투자자 거래비중(=(개인투자자 매수대금+매도대금)/(거래대금×2))을 종속변수로 분석한 결과인데, 공매도 거래비중이 높았던 주식은 공매도 금지 이후 개인투자자의 거래비중이 12.64% 증가한 것을 확인할 수 있다. 반면, (5), (6), (7)의 결과에 따르면 증권사, 기관, 외국인의 거래비중은 모두 감소한 것으로 나타난다.

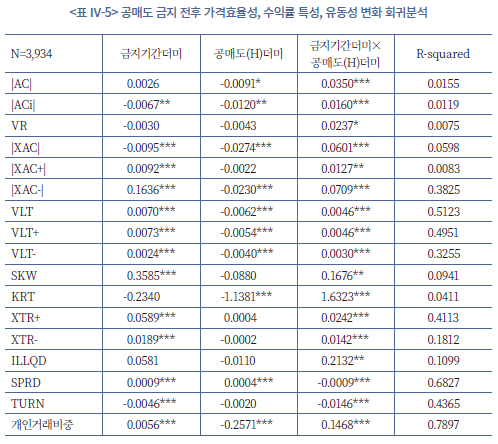

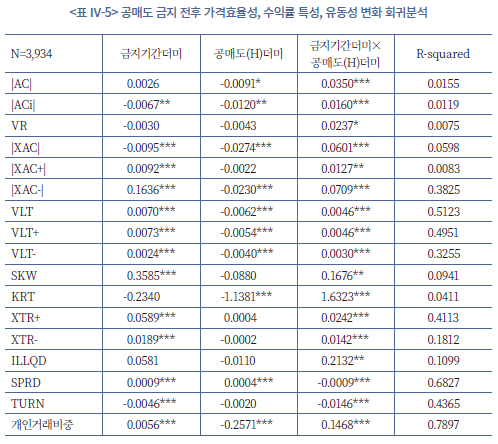

<표 Ⅳ-5>는 공매도 금지 이전 기간의 공매도 거래비중 대신 공매도 용이성(외국인 및 기관투자자 거래비중)을 기준으로 종목을 분류하여 공매도 금지의 영향을 분석한 결과이다. <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>와 동일한 분석이며, 공매도 금지기간 더미, 공매도 용이성 상위 20% 종목 더미, 두 변수의 교차변수에 대한 추정결과만을 제시하고 있다. 분석결과는 <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>와 질적으로 차이가 없다.

개별주식에 대해 매도포지션을 구축할 수 있는 대안적 수단이 존재한다면 공매도 금지의 부정적 효과가 완화될 수 있을 것이다. Danielsen et al.(2009), Beber & Pagano(2013), Gagnon(2018), Jiang et al.(2022) 등은 개별주식 선물과 옵션이 공매도의 대안으로 활용되고 있으며 현물시장의 가격효율성과 시장품질(market quality)에 긍정적인 영향을 미칠 수 있음을 실증적으로 보여주고 있다. 반면, Battalio & Schultz(2011)와 Grundy et al.(2012)는 공매도가 금지되는 경우 공매도의 대안으로써 개별주식 옵션의 역할은 제한적이라는 결론을 내리고 있다. 공매도 금지로 시장조성자의 헤지거래와 현물-옵션 차익거래가 어렵기 때문에 오히려 옵션시장이 위축되는 결과가 나타난다는 것이다. 게다가 옵션은 수익구조가 비선형이기 때문에 공매도와 동일한 포지션을 구축하는 데 있어 선물에 비해 더 많은 거래비용이 소요되는 문제도 있다.

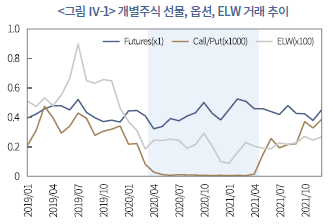

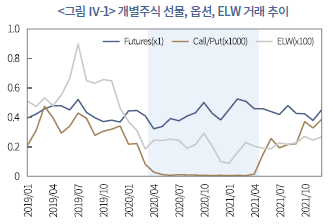

<그림 Ⅳ-1>은 공매도 금지 및 부분재개 전후의 개별주식 선물, 개별주식 옵션, 개별주식 ELW(Equity Linked Warrant)의 거래추이를 보여준다. 그래프가 표시하는 값은 각 상품유형별 거래대금을 해당 상품 기초자산의 거래대금으로 나눈 값이다.20)

개별주식 옵션의 경우 공매도 금지와 함께 거래가 거의 이루어지지 않은 것으로 나타난다. 유동성이 풍부하지 않은 가운데 시장조성자의 역할이 축소되면서 나타난 결과로 추정된다. 개별주식 ELW의 경우에도 공매도 금지기간 동안 거래대금은 기초자산 거래대금 대비 0.20% 수준에 불과하다. 개별주식 옵션과 ELW가 공매도의 대안적 수단으로 활용되었을 가능성은 부족해 보인다.

개별주식 선물 역시 공매도 금지기간 동안 거래활동이 증가하는 특징을 보이지는 않는다. 그러나 거래대금이 기초자산 거래대금의 40%를 상회하고 공매도 주요 주체인 외국인의 거래비중이 공매도 금지기간 동안 증가했다는 사실21)로 볼 때, 공매도의 대안적인 수단으로 활용되었을 가능성을 배제할 수 없다. 따라서, 개별주식 선물이 거래되는 종목의 경우 공매도 금지의 부정적 영향이 완화되는지 추가적으로 분석해 보도록 한다. 개별주식 선물 거래여부에 대한 더미변수를 구성하고, 공매도 금지기간 더미변수, 공매도 비중 상위 또는 공매도 용이성 상위 더미변수와의 교차변수를 산출하여 다중회귀분석을 시행한다.

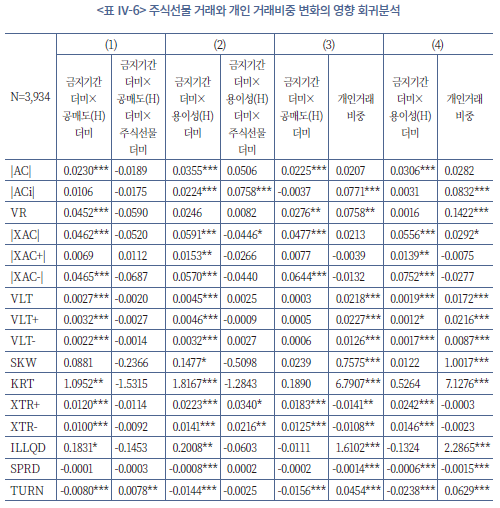

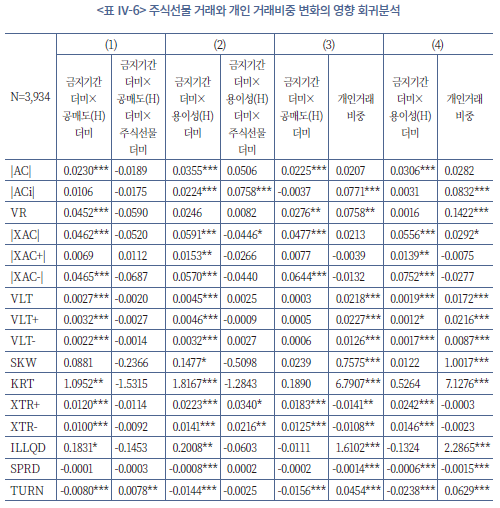

<표 Ⅳ-6>의 (1)과 (2)에 각각 공매도 비중 상위 더미변수와 공매도 용이성 상위 더미변수를 이용한 분석결과가 제시되어 있다. 교차변수에 대한 결과만 제시하며 기타 변수에 대한 추정결과는 생략한다. (1)에서 공매도 금지 더미변수, 공매도 비중 상위 더미변수, 주식선물 더미변수의 교차변수의 계수는 종속변수가 거래회전율인 경우에만 통계적으로 유의한 양(+)의 결과가 나타났다. (2)에서는 종속변수가 자기상관계수, 교차자기상관계수, 극단수익률 발생빈도인 경우 통계적 유의성이 확인되나 공매도 금지의 부정적 효과를 상쇄시키는 결과는 교차자기상관계수에서만 관찰된다. 요약하자면 매도 포지션을 구축할 수 있는 대안적 수단의 존재가 공매도 금지의 부정적 영향을 상쇄하는 효과는 뚜렷하지 않다.

두 번째 추가분석은 공매도 금지로 인한 개인투자자 거래비중 증가가 미치는 영향이다. <표 Ⅳ-4>와 <표 Ⅳ-5>에서 확인한 바와 같이, 공매도 비중이 크거나 공매도가 용이한 종목에서 공매도 금지 이후 개인투자자 비중이 크게 늘었다. 개인투자자는 무정보거래자(uninformed trader) 또는 잡음거래자(noise trader)로 간주할 수 있기 때문에 개인투자자의 비중 증가는 가격효율성을 저해하고 변동성을 증가시킬 가능성이 있다(Subrahmanyam, 1991; Han, Tang, Yang, 2016). 반면, 개인투자자 비중이 증가할수록 역선택(adverse selection) 위험이 낮아지면서 유동성이 증가할 수 있다(Glosten & Milgrom, 1985; Berkman & Koch, 2008). 공매도 금지가 가격효율성, 수익률분포, 유동성에 미친 영향은 공매도 금지로 인한 기관투자자 혹은 정보거래자의 감소, 개인투자자 혹은 무정보거래자의 증가에서 비롯된 결과일 수 있다.

<표 Ⅳ-6>의 (3)은 <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>의 분석에 개인투자자 거래비중을 독립변수로 추가하여 분석한 결과이고, (4)는 <표 Ⅳ-5>의 분석에 개인투자자 거래비중을 독립변수로 추가하여 분석한 결과이다. <표 Ⅳ-2>~<표 Ⅳ-5>의 결과와 비교할 때, 공매도 금지기간 더미변수와 공매도 비중 또는 용이성 상위 더미변수의 교차변수의 유의성이 감소한 대신 개인투자자 거래비중의 계수가 통계적으로 유의한 경우가 다수 관찰된다. 특히, 공매도 금지 이후 변동성의 증가, 왜도, 첨도의 증가, 비유동성의 증가는 개인투자자 거래비중 증가와 관련된 결과일 가능성이 높다는 사실을 보여준다.

라. 공매도 부분재개 전후 실증분석

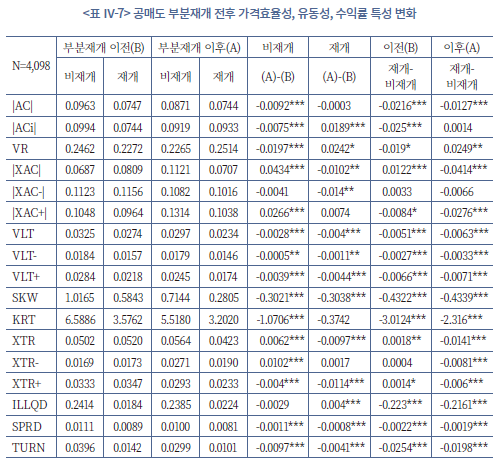

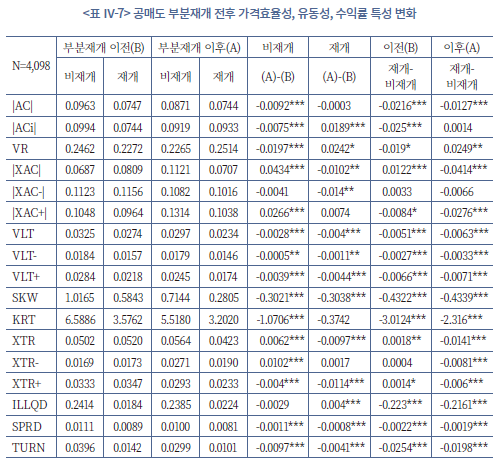

<표 Ⅳ-7>은 주요 분석변수의 공매도 부분재개 전후 변화를 공매도 재개종목(KOSPI200 및 KOSDAQ150 편입종목)과 비재개종목(KOSPI200 및 KOSDAQ150 비편입종목)으로 나누어 제시하고, 재개 전후의 차이와 그룹간 차이의 통계적 유의성을 검토하고 있다. 공매도 금지 전후에 관찰된 결과와 대칭적 관점에서, 공매도 재개 이후 가격효율성과 유동성이 개선되고 변동성이 감소하는지 확인한다. 가격효율성 지표의 경우 혼재된 결과를 보여주고 있다. 공매도 재개 이후 KOSPI200 및 KOSDAQ150 편입종목의 교차자기상관계수는 상대적으로 감소한 반면 초과수익률 자기상관계수와 분산비율은 오히려 상대적으로 증가한 것으로 나타난다. 변동성, 호가스프레드, 거래회전율의 경우 재개종목과 비재개종목 모두 감소한 것으로 나타나며, 극단적 수익률 발생빈도는 재개종목에서 상대적으로 크게 감소한 것으로 확인된다.

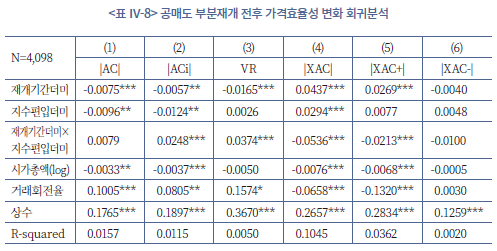

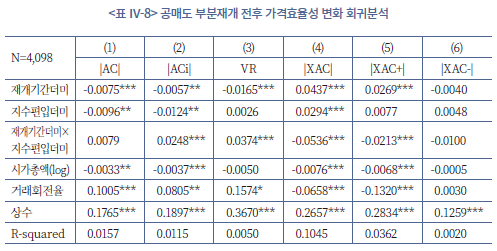

<표 Ⅳ-8>부터 <표 Ⅳ-10>은 공매도 부분재개 이후 공매도 재개종목과 비재개종목의 가격효율성, 수익률분포, 유동성 변화를 다중회귀분석으로 검토하고 있다. 분석결과는 <표 Ⅳ-7>의 결과와 대체로 유사하다. 먼저 <표 Ⅳ-8>의 가격효율성 지표의 경우, 공매도 재개종목은 초과수익률 자기상관계수와 분산비율이 공매도 재개 이후 오히려 증가한 것으로 나타난다. 반면 교차자기상관계수는 감소하는 것으로 나타나는데 시장수익률이 음(-)인 경우가 아닌 양(+)인 경우의 교차자기상관계수가 감소한 것으로 나타난다. 이러한 결과는 예상과 다른 결과로 그 이유를 명확히 파악하기 어렵다.

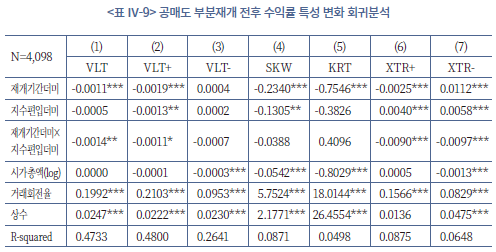

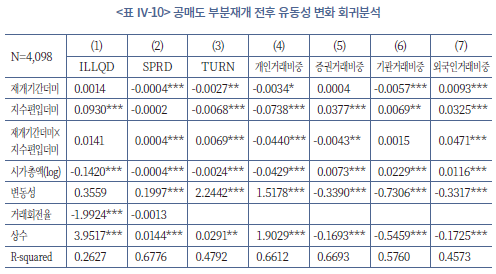

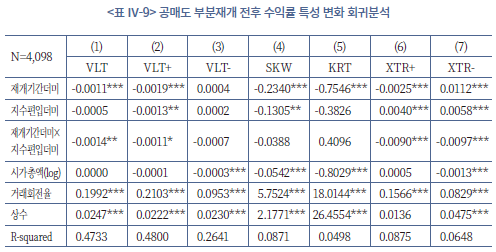

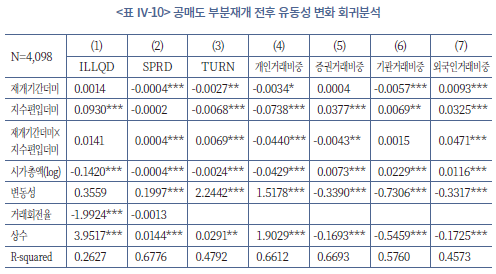

<표 Ⅳ-9>의 수익률 특성에 대한 분석결과에서는 공매도 재개 이후 변동성 감소와 극단적 수익률 발생빈도 감소가 확인된다. 수익률의 왜도와 첨도에는 유의한 변화가 확인되지 않는다. 마지막 <표 Ⅳ-10>의 유동성 지표에 대한 분석에서는 공매도 부분재개 이후 재개종목에서 거래회전율이 증가하는 동시에 호가스프레드도 증가하는 것으로 나타난다. 거래회전율 증가는 공매도 거래의 재개와, 호가스프레드 감소는 개인투자자의 비중이 감소하는 것과 연관된 결과로 추정된다. 공매도 재개에 따른 개인투자자의 거래비중 감소는 <표 Ⅳ-10>의 (4)에서 확인할 수 있다. 한편, (5), (6), (7)의 결과에 따르면 공매도 재개 이후 개인투자자 거래비중이 감소한 만큼 외국인투자자의 거래비중이 증가한 것으로 나타난다. 공매도 재개가 가격효율성에 미친 영향과 달리, 수익률 특성과 유동성에 미친 영향은 대체로 공매도 금지의 영향과 대칭적인 것으로 판단된다.

앞서 <표 Ⅳ-6>에서와 마찬가지 논리로, 공매도 재개로 긍정적인 변화가 나타났다면, 공매도의 대안적 수단이 존재하지 않는 종목에서 뚜렷하게 나타날 것이다. 또한 공매도 재개에 따른 긍정적 변화, 특히 변동성 및 극단적 수익률 발생빈도의 감소는 개인투자자의 거래비중 감소에 의한 결과일 가능성이 있다.

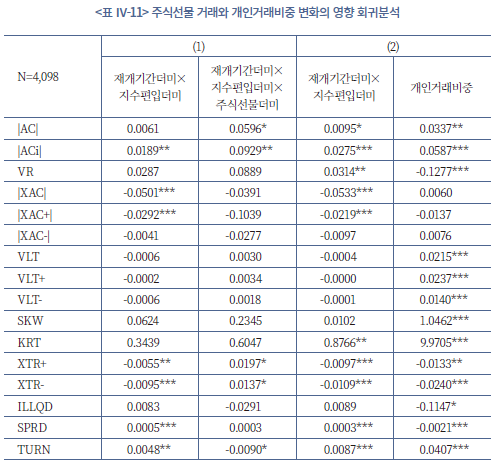

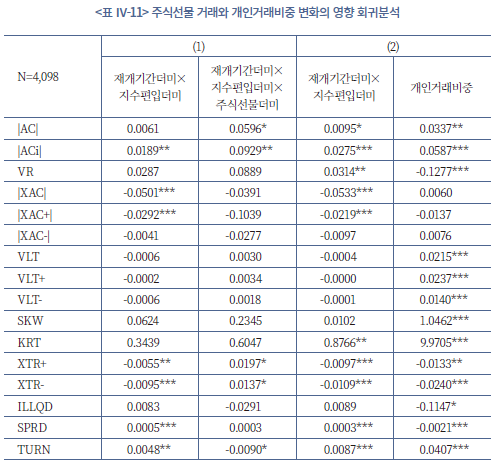

개별주식 선물의 거래 여부에 대한 더미변수를 추가적으로 활용한 <표 Ⅳ-11>의 (1)에 따르면 예상에 부합하는 결과가 일부 확인된다. 공매도 재개 이후 공매도 재개종목에서 극단적 수익률 발생빈도가 하락하는데, 개별주식 선물이 거래되는 경우 이 효과가 상쇄되는 것으로 나타난다. 또한 공매도 재개종목에서 나타나는 거래회전율 증가 효과도 개별주식 선물이 거래되는 종목에서는 그 효과가 상쇄되는 것을 확인할 수 있다.

한편, 앞서 <표 Ⅳ-8>의 가격효율성에 대한 분석에서 공매도 재개 이후 재개종목의 일부 가격효율성 지표(|ACi|와 VR)가 악화되는 결과가 확인되었다. 개별주식 선물 거래여부를 통제한 후 재개기간 더미와 지수편입 더미의 교차변수의 유의성이 하락하는 것으로 미루어 볼 때, 공매도 재개 이후 가격효율성의 악화는 개별주식 선물이 거래되는 종목에서 나타난 현상, 즉 공매도 재개에 의한 결과가 아닐 가능성이 있다.

<표 Ⅳ-11>의 (2)는 <표 Ⅳ-8>, <표 Ⅳ-9>, <표 Ⅳ-10>의 분석에서 개인투자자 거래비중을 독립변수로 추가한 분석이다. 종속변수가 변동성인 경우 공매도 재개기간 더미와 지수편입 더미의 교차변수의 계수의 유의성이 사라진다. 즉 공매도 재개 이후 재개종목의 변동성 감소는 개인투자자 거래비중 감소에 의해 나타난 결과임을 보여준다. 한편 개인투자자 거래비중의 계수는 대체로 직관에 부합하고 <표 Ⅳ-6>의 결과와도 유사하다.

마지막으로 분석결과의 강건성을 확보하기 위해 분석대상 주식의 시가총액을 통제한 분석을 시도하였다. 공매도 거래비중이 큰 종목, 공매도가 용이한 종목, 공매도가 재개된 종목 모두 대형주이기 때문에 전체 주식을 표본으로 이용한 분석결과는 공매도 금지 또는 부분재개에 의해 나타난 결과가 아니라 대형주와 중소형주의 특성 차이에 의해 나타난 결과일 가능성이 있기 때문이다.

공매도 금지 조치의 영향을 분석하는 경우, 공매도 거래비중 또는 공매도 용이성 상위 20% 주식의 시가총액 최소값을 하한선으로, 공매도 거래비중 또는 공매도 용이성 하위 80% 주식의 시가총액 최대값을 상한선으로 설정하고 시가총액이 이 범위 안에 포함되는 주식으로 표본을 제한하여 동일한 분석을 시행하였다. 공매도 부분재개 조치의 영향을 분석하는 경우에도 동일한 방법으로, 지수편입종목의 시가총액 최소값을 하한선으로, 지수비편입종목의 시가총액 최대값을 상한선으로 설정하고 시가총액이 이 범위 안에 포함되는 주식으로 표본을 제한하여 동일한 분석을 시행하였다. 공매도 금지 조치와 부분재개 조치에 대한 모든 분석에서 이상에서 보고한 결과와 유사한 결과가 확인된다. 다만 관심변수의 통계적 유의성은 소폭 하락한다.22)

한편, 공매도 금지 조치 전후에 대한 분석결과와 비교할 때 공매도 부분재개 조치 전후의 분석결과는 유의성이 다소 낮고 부분적으로 예상에 부합하지 않는 결과도 관찰된다. 그 원인으로 두 가지 가능성을 생각해 볼 수 있는데, 첫째, 공매도 금지에 따른 충격이 재개에 따른 충격보다 크기 때문일 수 있다. 공매도 거래비중 또는 용이성 상위종목의 공매도 금지 이전 공매도 거래비중은 지수편입종목의 공매도 재개 이후 공매도 거래비중에 비해 2배 이상 높은 것으로 확인된다. 따라서 공매도가 가격효율성, 변동성, 유동성에 영향을 미친다면 공매도 금지 조치에서 영향이 크게 나타날 가능성이 높다. 둘째, 시장조성자의 영향이다. 공매도 부분재개에도 불구하고 시장조성자의 공매도는 금지 이전 수준으로 회복되지 못했고 2021년 9월부터는 일부 시장조성자의 업무가 중단된 바 있다. 시장조성자가 가격효율성, 변동성, 유동성에 영향을 주는 요인이라면 공매도 재개조치의 긍정적 영향을 상쇄했을 가능성이 있다. 이에 대해서는 추가적인 연구가 요구된다.

2. 수익률에 대한 영향 분석

공매도 금지가 수익률에 미치는 영향에 대해서는 상반된 두 가지 시각이 존재한다. 전통적인 관점은, 공매도가 금지되면 부정적 견해를 갖는 투자자가 시장에서 사라지고 긍정적 견해를 갖는 투자자만 남게 되므로 주가의 과대평가가 일어날 수 있다는 주장이다(Miller, 1977). 따라서 공매도 금지는 양(+)의 초과수익률을 유발하며, 투자자 의견이 분산된 정도가 큰 주식에서 명확한 반응이 나타날 가능성이 높다. 반면, 공매도 금지로 인하여 유동성이 감소하고 가격효율성이 저하된다면 유동성 프리미엄과 가격불확실성 증가와 관련된 위험프리미엄이 증가하게 되어 오히려 주가가 하락한다는 견해도 존재한다(Bai et al., 2006; Nezafat et al., 2017). 이에 따르면 공매도 금지는 음(-)의 초과수익률을 유발하며 가격효율성 또는 유동성이 감소한 주식일수록 수익률 반응이 클 것으로 예상할 수 있다.

초과수익률 분석은 Carhart(1997)의 4요인 모형을 기초로 계산한 위험조정 초과수익률을 기준으로 한다. 4요인 모형은 시장요인, 기업규모, 장부가-시장가, 추세(momentum) 요인을 고려하는 모형으로 Fama & French(1992)의 3요인 모형에 추세요인을 추가한 모형이다.23) 시장수익률과 요인 포트폴리오 수익률에 대한 회귀계수 추정은 공매도 금지일 기준 -140일부터 -21일까지의 일간자료를 바탕으로 하며, 금융회사는 분석에서 제외한다.

분석을 위한 공매도 자료, 주가자료, 재무제표 자료는 DataGuide로부터 확보하였다. 분석대상은 SPAC을 제외한 유가증권시장과 코스닥시장의 상장기업 보통주로, 공매도 금지 전후 분석에 1,792개 기업, 공매도 부분재개 분석에 1,898개 종목이 포함된다.

가. 공매도 금지 전후 실증분석

초과수익률 반응은 공매도 금지의 기대영향 수준에 따라 주식을 분류하여 분석한다. 2장에서와 같이, 공매도 금지 이전 기간의 공매도 거래비중 또는 공매도 용이성(기관투자자 및 외국인 투자자 거래비중)에 따라 주식을 5개 그룹으로 분류한다.

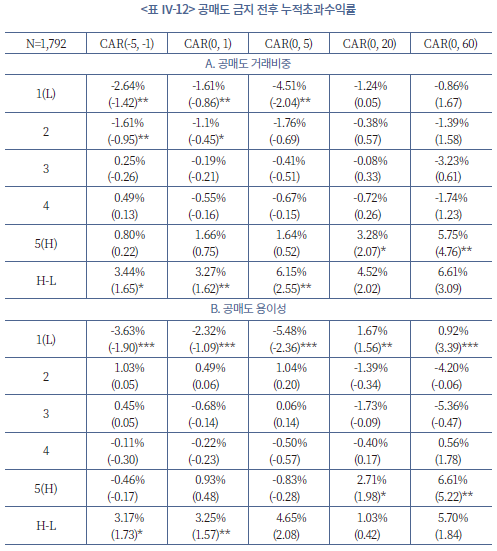

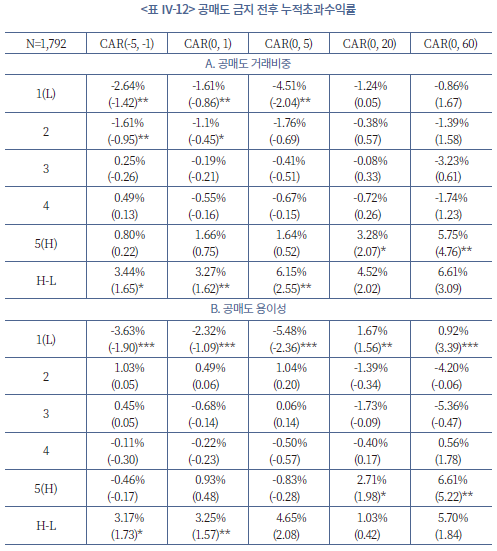

<표 Ⅳ-12>는 공매도 금지일 기준 -5일부터 +60일까지의 기간별 누적초과수익률을 주식 그룹별로 제시하고 있다. -4일(3월 10일)에 규제당국의 공매도 규제강화 조치가 최초로 이루어졌고, 공매도 금지 결정은 공매도 금지 직전 거래일(3월 13일)에 이루어졌음을 고려하여 -5일부터 분석 대상으로 설정한다.

공매도 금지조치는 모든 종목에 대해 동일 시점에 시행되었으므로 종목별 초과수익률 사이에 상관관계가 존재할 가능성이 높다. 또한 금지조치가 주가뿐만 아니라 주가변동성을 증폭시켰을 가능성(event-induced volatility)도 존재한다. 평균 초과수익률의 통계적 유의성 검정에서 초과수익률간 상관관계와 변동성 변화를 간과할 경우 표준편차가 과소평가되어 평균 초과수익률이 0이라는 귀무가설이 과대기각(over-rejection)되는 문제가 발생한다. 이러한 문제를 극복하기 위해 Kolari & Pynnönen(2010)이 제시한 검정통계량(ADJ-BMP)을 이용하여 통계적 유의성을 평가한다.

패널A는 공매도 금지 이전 공매도 거래비중에 따라 주식을 5개 그룹으로 나누어 기간별 누적초과수익률을 비교하고 있다. CAR(a, b)는 공매도 금지일(t=0)을 기준으로 a일부터 b일까지 일간수익률을 누적한 값이며, 괄호 안의 값은 통계적 유의성 평가를 위해 산출한 평균 표준화(scaled) 초과수익률이다.24) 공매도 거래비중이 가장 큰 그룹(H)의 경우 단기 수익률 반응은 크지 않고 20일 및 60일 누적초과수익률이 통계적으로 유의한 양(+)의 값을 갖는다. 반면 공매도 거래비중이 가장 작은 그룹(L)의 경우에는 유의한 음(-)의 단기 수익률 반응이 관찰된다.25) 그 결과, 공매도 거래비중이 가장 큰 그룹(H)과 가장 작은 그룹(L)의 초과수익률 차이는 공매도 금지 -5일부터 +5일까지 단기 구간에서 유의한 양(+)의 값으로 나타난다. 즉, 공매도 거래비중이 컸던 종목일수록 공매도 금지조치 전후 단기간 동안 상대적으로 높은 수익률을 시현한다. 공매도 용이성을 기준으로 종목을 구분한 패널B의 결과는 패널A의 결과와 대체로 유사하다.

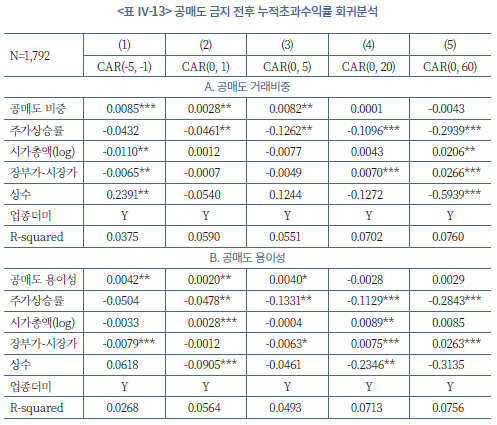

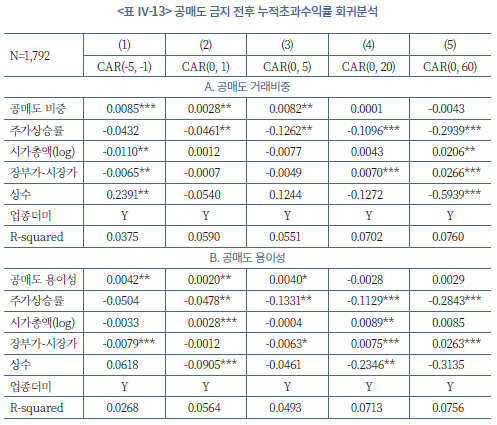

<표 Ⅳ-13>은 기간별 누적초과수익률을 종속변수로, 공매도 변수, 주가상승률, 시가총액, 장부가-시장가 비율, 업종더미를 독립변수로 이용한 다중회귀분석 결과이다. 공매도 변수는 공매도 거래비중(패널A), 공매도 용이성(기관투자자 및 외국인투자자 거래비중)(패널B)이며, 왜도가 높은 변수 특성의 영향을 줄이기 위해 공매도 금지 -70일부터 -11일까지의 평균값으로 10분위 순위값을 계산하여 이용한다.26) 주가상승률은 공매도 금지 -70일부터 -11일을 기준으로 계산하며, 시가총액은 로그값을 취하여 이용한다. 업종은 FnGuide의 10개 섹터를 기준으로 분류한다.

<표 Ⅳ-13>의 분석결과는 <표 Ⅳ-12>에서 확인한 결과와 대체로 일관된다. 공매도 금지 직전과 직후 (-5, +5)의 기간 사이에 단기적으로, 공매도 거래비중이 높은 주식일수록, 공매도가 용이한 주식일수록 초과수익률이 높게 나타난다.

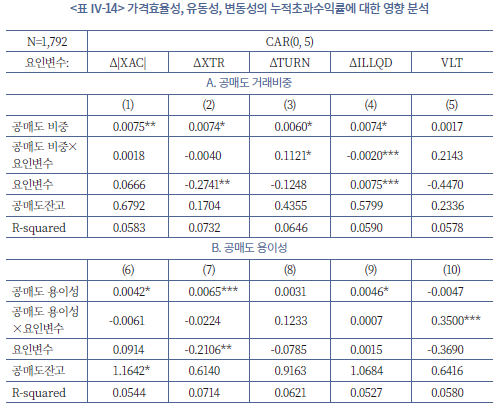

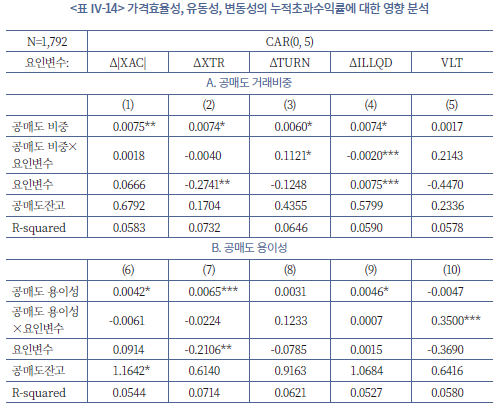

<표 Ⅳ-14>는 공매도 금지가 초과수익률에 영향을 미치는 경로를 파악하기 위한 분석이다. 앞서 언급한 바와 같이, 기업가치에 대한 투자자의 견해차가 클 경우 공매도 금지는 과대평가를 유발할 수 있으며, 공매도 금지에 따른 유동성과 가격효율성 저하가 요구수익률 상승으로 이어진다면 공매도 금지는 주가하락 요인으로 작용할 수 있다.

투자자의 견해차는 수익률 변동성을 대리변수로 이용하며, 가격효율성은 교차자기상관계수와 극단적 수익률 발생빈도를, 유동성은 거래회전율과 비유동성 지표를 이용한다. 이들 변수와 공매도 변수의 교차변수를 이용하여 교차효과를 파악해 보도록 한다. 추가로, 공매도 잔고가 클수록 공매도 금지 후 상환수요가 매수압력으로 작용할 수 있다는 점을 고려하여 공매도 잔고규모를 독립변수로 포함한다. 종속변수는 CAR(0, 5)를 이용한다.

A와 B는 각각 공매도 거래비중과 공매도 용이성을 기준으로 분석한 결과이다. 교차변수의 계수 추정결과를 보면, A와 B에서 일관되게 유의한 결과를 찾아보기는 어렵다. 다만, 통계적으로 유의한 일부 결과는 예상에 부합한다. 공매도 금지 후 거래회전율 감소, 비유동성 척도의 증가는 공매도 비중이 높았던 종목의 초과수익률을 감소시키는 요인으로 나타나며, 높은 변동성 수준은 공매도가 용이한 종목의 초과수익률을 증가시키는 요인으로 분석된다. 한편 공매도 잔고는 모든 경우 통계적 유의성이 제한적이다.

나. 공매도 부분재개 전후 실증분석

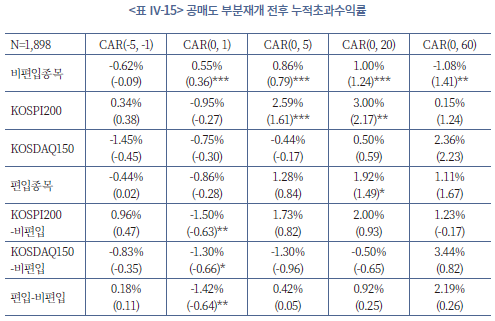

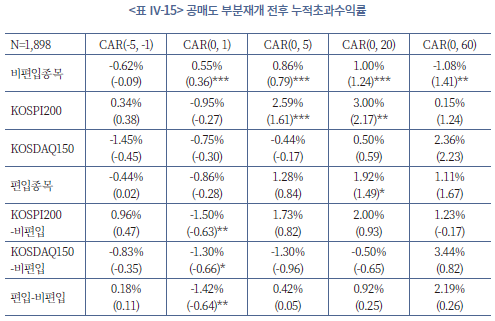

공매도 재개는 KOSPI200과 KOSDAQ150 편입종목에 대해서만 이루어졌으므로, 초과수익률 분석은 지수편입 종목과 비편입 종목을 비교하는 방식으로 진행한다. <표 Ⅳ-15>는 공매도 재개일 기준 -5일부터 +60일까지의 기간별 누적초과수익률을 제시하고 있다.

지수편입종목의 경우 CAR(0, 1)이 음(-)의 값이나 통계적으로 유의하지 않으며, CAR(0, 5), CAR(0, 20), CAR(0, 60)은 유의하지 않은 양(+)의 값으로 나타난다. 지수편입종목과 비지수편입종목 누적초과수익률과의 차이는 KOSPI200, KOSDAQ150 편입종목 모두에서 (0, 1) 구간에서만 통계적으로 유의한 음(-)의 값을 보여준다. 공매도 재개는 부정적으로 평가되고 있으며, 다만 공매도 금지와 유사하게 단기적인 수익률 반응을 일으키는 것으로 확인된다.

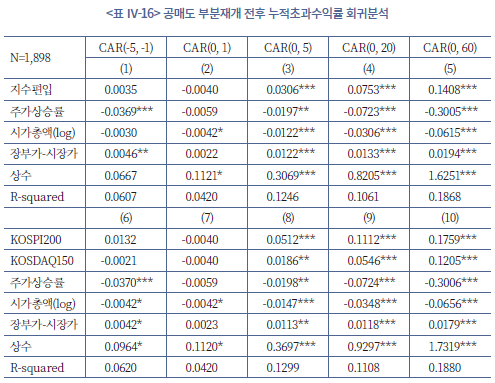

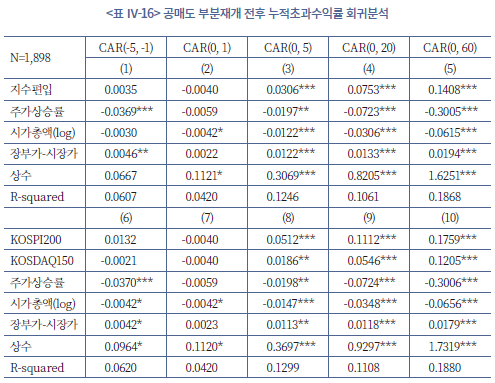

<표 Ⅳ-16>은 지수편입 더미변수와 가격상승률, 시가총액, 장부가-시장가 비율, 섹터 더미변수를 독립변수로 이용한 다중회귀분석 결과이다. <표 IV-15>의 결과와는 다소 차이를 보이는데, KOSPI200 지수편입 또는 KOSDAQ150 지수편입 더미변수의 계수는 공통적으로 종속변수가 CAR(0, 5), CAR(0, 20), CAR(0, 60)일 때 통계적으로 유의한 양(+)의 값으로 추정된다. 공매도 재개가 저평가를 유발하는 것이 아니라 공매도 재개 이후 초과수익률이 관찰된다.

만약 공매도 금지가 주가의 체계적인 과대평가를 일으켰다면, 공매도 재개를 통해 과대평가를 해소하는 효과를 기대할 수 있다. 이를 검토하기 위해 공매도 금지기간의 과대평가 수준을 종목별로 평가하고, 과대평가 수준이 높을수록 공매도 재개 전후 음(-)의 초과수익률이 관찰되는지 확인한다.

과대평가 수준의 평가는 엄철준(2018)의 가격오류 측정방법을 이용한다. 엄철준(2018)은 개별주식의 초과수익률(무위험이자율 기준)을 다른 모든 주식 각각의 초과수익률에 대해 회귀분석하여 절편을 산출하고, 산출된 절편의 횡단면 중간값을 과대평가의 척도로 이용하였다. 이를 통해 한국 주식시장에서 과대평가 수준이 높을수록 기대수익률이 하락함을 실증적으로 확인하였다. 과대평가 수준의 측정은 공매도 재개일 기준 -70일부터 -11일까지 60거래일 수익률 자료를 이용한다.

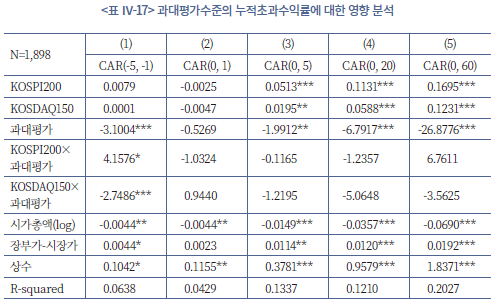

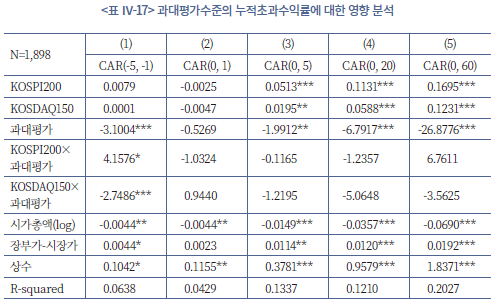

<표 Ⅳ-17>은 과대평가 변수와 지수편입 더미변수의 교차변수를 이용한 다중회귀분석 결과이다.27) 먼저 과대평가 변수의 계수는 유의한 음(-)의 값으로, 과대평가 수준이 높은 주식은 초과수익률이 하락하는 추세를 보인다. 지수편입 더미변수와 교차변수의 계수는 CAR(-5, -1)에서만 유의성이 관찰되는데, KOSDAQ150에서는 유의한 음(-)의 값으로 예상에 부합하는 결과가 나타나는 반면 KOSPI200에서는 유의한 양(+)의 값으로 상반된 결과가 나타난다. 공매도 재개가 과대평가를 해소하는 효과가 있다고 보기에는 유의성과 일관성이 부족한 결과로 판단된다.

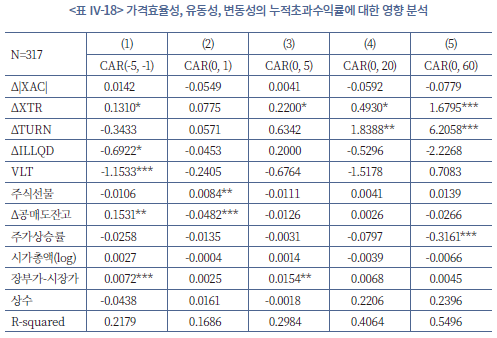

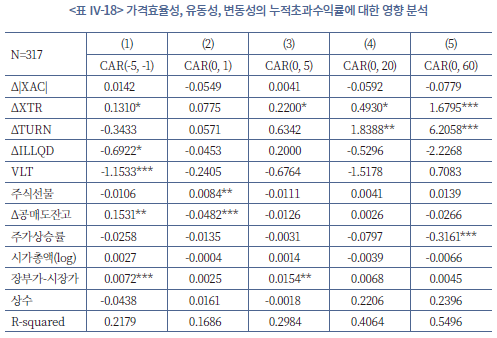

<표 Ⅳ-18>은 공매도 재개가 지수편입종목의 초과수익률에 영향을 미치는 경로에 대해 분석한다. <표 Ⅳ-14>의 분석과 유사하게, 공매도 재개 전후 가격효율성 및 유동성의 변화, 재개 이전의 변동성 수준, 파생상품 거래여부를 설명변수로 이용하며, 공매도 재개 후 공매도의 매도압력의 영향을 통제하기 위해 공매도 잔고변화를 설명변수로 포함한다.

가격효율성 변수 중 교차자기상관계수에서는 유의한 결과가 나타나지 않으며, 극단적 수익률 발생빈도에서는 계수가 양(+)의 값으로 예상과 상반된 결과가 관찰된다. 유동성 변수에서는, 거래회전율이 상승할수록, 비유동성 지표가 감소할수록 초과수익률이 유의하게 증가하는 결과가 일부 확인된다. 투자자의 견해차를 대리하는 수익률 변동성의 계수는 CAR(-5, -1)에서 유의한 음(-)의 값으로 추정된다. 공매도 재개를 앞두고 부정적 전망이 반영되어 수익률이 하락하는 것으로 해석할 수 있다. 공매도 잔고증가의 경우, 공매도 재개 후 단기적으로(CAR(0, 1)) 초과수익률에 부정적 영향을 주는 요인으로 확인된다.

Ⅴ. 결론

본 고는 코로나19 팬데믹 전후의 주요한 공매도 제도변화를 점검하고, 공매도 전면금지와 부분재개 조치가 주식시장에 미친 영향을 실증적으로 검토하였다.

공매도 규제효과에 대한 실증분석 결과는 공매도에 대한 이론적 예측이나 기존 실증연구결과와 대체로 일관성을 가진다고 평가할 수 있다. 특히 전면금지의 경우 부정적 영향이 명확하게 관찰된다. 공매도 전면금지 이후 가격효율성이 저하되고, 변동성과 극단수익률 발생빈도가 증가하며, 거래회전율은 하락하는 것으로 나타난다. 공매도 전면금지에 따른 부정적 영향은 정보거래자의 감소뿐만 아니라 개인투자자 비중 증가와도 연관된 것으로 추정된다. 이러한 부정적 영향에도 불구하고, 공매도 금지조치에 대해서는 단기적으로 양(+)의 초과수익률이 관찰된다. 한편 공매도 재개의 영향은 대체로 전면금지와 대칭적으로 나타나나 결과의 유의성과 일관성은 다소 하락한다. 공매도 재개에 대해서는 단기적으로 음(-)의 초과수익률이 관찰된다.

실증분석의 결과는 공매도 규제는 공매도의 경제적 역할을 충분히 고려해서 설계될 필요가 있음을 시사한다. 개인투자자들이 가지고 있는 부정적인 인식과 달리 공매도는 가격발견에 기여하고 유동성을 공급하는 역할을 수행한다. 공매도의 순기능을 부인하기 어렵다면 전면금지와 같은 극단적인 접근방식보다는 그 기능은 유지하되 부작용을 최소화시키는 방향으로 공매도 규제를 운용할 필요가 있을 것이다.

2021년 5월에 공매도가 부분재개된 이후에도 개인투자자들을 중심으로 공매도 전면금지에 대한 요구가 이어지고 있다. 공매도가 다시 전면금지될지 모른다는 제도적 불확실성은 공매도 거래자들의 거래유인을 저하시키는 요소로 작용할 수 있다. 시장조성자들의 공매도 거래가 축소되어 있는 것도 유사한 맥락이다. 공매도 전면금지 기간동안 예외적으로 허용되었던 공매도 거래에 대한 비난 여론에 시장조성자의 불공정거래에 대한 논란까지 겹치면서 여파는 공매도 재개 이후까지 이어지고 있다. 공매도가 부분재개되었음에도 공매도가 위축되고 공매도의 순기능 역시 제한되고 있는 것이다.

코로나19 팬데믹 위기상황에서 시장을 안정화시키기 위해 공매도를 금지한 조치는 시장의 공감대를 충분히 얻을 수 있는 정책적 판단으로 볼 수 있다. 공매도 관련 불법행위에 대한 처벌강화와 대차거래에 대한 정보관리 강화의무의 부여 등 역시 적절한 규제방향이라 평가할 수 있을 것이다. 그러나 주식시장이 위기상황에서 벗어났음에도 일부 종목에 대해서만 공매도를 재개하고 또한 규제적 불확실성이 공매도 재개의 효과를 반감시키는 상황은 바람직하다고 보기 어렵다.

공매도 관련 규정을 위반할 가능성 또는 공매도가 불공정 거래행위에 연루될 가능성을 부인할 수 없다. 그러나 공매도의 경제적 기능을 고려할 때 이를 이유로 공매도 전면금지와 같은 강력한 규제수단을 빈번하게 활용하는 것은 신중하게 접근할 필요가 있다. 해외의 많은 주식시장들이 코로나19 팬데믹 상황에서도 공매도에 대한 금지조치를 단행하지 않았던 것은 다수의 실증분석을 통해 공매도의 경제적 기능이 확인되고, 그러한 기능이 위기상황에서도 오히려 더 긴요할 수 있다는 판단에 따른 것이라고 볼 수 있다.

공매도 관련 규정위반과 불공정 거래행위에 대한 적발 및 처벌을 강화하고, 개인투자자들에 대한 접근성을 꾸준히 개선해가는 것은 향후 공매도 제도개선에 있어서 중요한 방향성이 될 수 있을 것이다. 불공정 거래행위에 대한 처벌기준은 이미 상당히 강화되었으니, 적발과 처벌이 실효적으로 이루어질 수 있도록 시장에 대한 모니터링을 지속적으로 강화해야 할 것이다. 주식 대차거래의 전산화를 촉진하고 궁극적으로는 대차거래 전용플랫폼에서의 계약체결을 의무화하는 방안을 마련할 필요성도 크다. 이는 무차입공매도를 차단하는 가장 중요한 기반이 될 수 있다. 금융회사의 공매도 및 대차거래에 관한 내부통제시스템을 개선하고 전산화 수준을 높임으로써 무차입공매도의 발생가능성을 최소화시키는 노력도 중요하다. 추가적으로 개인투자자들에 대한 대주거래 서비스 개선을 위해 대주풀(pool)을 확대하려는 노력과 대주거래조건을 합리적인 수준으로 개선해 나가는 노력도 중요한 의미를 가질 것이다. 공매도의 경제적 기능을 인정하면서 합리적인 시장구조 구축을 위한 제도적 환경정비를 통해 공매도에 대한 시장의 신뢰를 확보해 나가야 할 것이다.

1) 자본시장법 제180조(공매도의 제한) 제1항 제1호 및 제2호

2) 자본시장법 제180조(공매도의 제한) 제2항

3) 자본시장법 제180조(공매도의 제한) 제3항

4) 금융위원회(보도자료, 2021. 4. 29)

5) 금융위원회(보도자료, 2013. 11. 13)

6) 기존에 공매도 거래의 투명성을 강화하기 위한 국제적 논의를 수용하여 2012년 8월 대량 공매도 포지션 보고제도를 도입한 바 있다(금융위원회 보도자료, 2012. 3. 12). 그러나 공매도 잔고정보가 공개되지는 않았기 때문에 투기적 공매도를 억제하는 효과가 충분하지 않다는 지적이 있었다.

7) 자본시장법 제180조의2(순보유잔고의 보고) & 제180조의3(순보유잔고의 공시), 동법 시행령 제208조의2(순보유잔고의 보고) & 제208조의3(순보유잔고의 공시)

8) 금융위원회(보도자료, 2016. 11. 10)

9) 한국거래소 유가증권시장 업무규정 제17조(공매도호가의 제한), 유가증권시장 업무규정 시행세칙 제24조의3(차입공매도 호가의 제한), 한국거래소 코스닥시장 업무규정 제9조의2(공매도호가의 제한), 코스닥시장 업무규정 시행세칙 제8조의5(차입공매도 호가의 제한) 등

10) 금융위원회(보도자료 및 별첨자료, 2022. 7. 28)

11) 자본시장법 제443조(벌칙) 제1항 제10호

12) 자본시장법 제429조의3(위법한 공매도에 대한 과징금) 제1항

13) 자본시장법 제180조의5(차입공매도를 위한 대차거래정보 보관 등) 제1항

14) 자본시장법 제180조의4(공매도 거래자의 모집 또는 매출에 따른 주식 취득 제한)

15) 주식시장 공매도 거래비중은 일본 30~40%, 캐나다 20~30%, 홍콩 20~30%, 미국 40~50% 수준으로 추정된다.

16) 정부는 공매도 금지 조치 당시 시장조성자에 대해 공매도 금지 예외를 두었으나, 2020년 3월 18일부터 시장조성 의무시간, 의무수량, 호가스프레드 기준을 1/2로 완화함으로써 시장조성자 공매도의 최소화를 유도하였다. 아울러 2020년 12월 18일, 미니KOSPI200 선물 및 옵션 시장조성자의 공매도 금지, 일정 유동성 수준 도달시 시장조성종목 제외, 시장조성자에 대한 업틱룰 적용, 시장조성 제도운영 현황 및 거래내역에 대한 공시 확대 등의 제도개선 계획을 발표하였다.

17) 이를 Difference in Differences 방법이라 한다.

18) 공매도 용이성을 측정하는 가장 유용한 지표는 대차수수료라 할 수 있는데, 공개된 자료가 존재하지 않는다.

19) 공매도 거래비중과 공매도 용이성을 아우르는 기준으로 KOSPI200 및 KOSDAQ150 지수편입여부를 활용할 수 있다. 이 경우 분석결과는 공매도 거래비중 또는 공매도 용이성을 기준으로 활용한 결과와 질적으로 동일하다.

20) 스케일(scale) 차이를 고려하여, 주식옵션은 1000배, ELW는 100배 곱한 값으로 나타내고 있다.

21) 개별주식 선물에 대한 외국인 거래비중은 공매도 금지 이전(2019년 1월 2일~2020년 3월 13일) 44.2%, 공매도 금지 기간(2020년 3월 16일~2021년 4월 30일) 51.5%, 공매도 부분재개 이후(2021년 5월 3일~2021년 12월 30일) 47.5%로 나타난다.

22) 기업규모 등 기업 특성 차이가 결과에 미치는 영향을 통제하기 위해서는 공매도 거래비중 상위 종목, 공매도 용이성 상위 종목, 또는 지수편입 종목 각각에 대해 기업규모, 유동성, 변동성 등 특성이 유사한 종목을 매칭(matching)하여 표본을 구성하는 방법이 보다 적절할 수 있다. 그러나 유사성이 높은 기업을 매칭할 경우 분석에 필요한 충분한 표본을 구성할 수 없었으므로, 대안으로 시가총액의 범위를 제한하는 방식을 선택하였다.

23) 시장모형 또는 3요인 모형을 이용하더라도 분석결과에 질적인 차이는 크지 않다.

24) 이와 관련된 구체적인 내용은 Kolari & Pynnönen(2010)를 참조하기 바란다.

25) 공매도 금지조치 전후 공매도 비중이 작은 종목에서 음(-)의 초과수익률이 나타나는 것은 예상과는 다른 결과다. 이는 초과수익률 산출을 위한 4요인 모형에서 고려하지 못한 요인이 존재하거나 4요인 모형의 추정계수가 시계열적으로 변화하기 때문일 가능성이 있다.

26) 평균값을 기준으로 정렬하여 10개 그룹으로 나눈 뒤 하위 그룹부터 0에서 9까지의 값을 부여하는 식이다. 순위값 대신 로그변환 변수를 이용하여 분석하더라도 결과에 질적인 차이는 없다.

27) <표 IV-16>에서 독립변수로 포함한 가격상승률은 과대평가 수준과 상관관계가 높게 나타나 독립변수에서 제외하였다.

참고문헌

금융위원회, 2012. 3. 12, 대량 공매도 보고제도 도입, 보도자료.

금융위원회, 2013. 11. 13, 공매도 제도 개선방안, 보도자료.

금융위원회, 2016. 11. 10, 공매도 및 공시제도 개선방안, 보도자료.

금융위원회, 2022. 7. 28, 관계기관 합동 “불법공매도 적발ㆍ처벌 강화 및 공매도 관련 제도 보완방안” 발표, 보도자료.

금융위원회, 2022. 7. 28, 불법공매도 적발ㆍ처벌 강화 및 공매도 관련 제도 보완방안, 보도별첨자료.

이관휘ㆍ왕수봉ㆍ이종섭, 2021, 공매도의 시장영향 및 바람직한 규제방안, 아주대학교 산학협력단.

엄철준, 2018, 횡단면 주식가격오류와 고유변동성: 새로운 접근법, 『한국증권학회지』 47(3), 471-503.

이영섭ㆍ한상범, 2015, 한국 주식시장에서의 공매도와 가격반전 분석, 『한국파생상품학회지』 23(2), 265-287.

조성순ㆍ박순홍, 2014, 신용등급 변화와 공매도 거래, 『한국증권학회지』 43(3), 499-542.

최용준ㆍ김철중, 2014, 시장상황별 주식공매도가 변동성에 미치는 질적 특성에 관한 연구, 『기업경영연구』 53, 85-99.

최혁ㆍ이효정, 2012, 공매도 제한효과와 공매도 금지효과의 비교: 유동성과 정보성에 미치는 영향을 중심으로, 『재무연구』 25(2), 161-202.

황세운, 2017, 『공매도 규제효과 분석 및 정책적 시사점』, 연구보고서 17-06, 자본시장연구원.

Amihud, Y., 2002, Illiquidity and stock returns: cross-section and time-series effects, Journal of Financial Markets 5(1), 31-56.

Bai, Y., Chang, E.C., Wang, J., 2006, Asset prices under short-sale constraints, working paper.

Battalio, R., Schultz, P, 2011, Regulatory uncertainty and market liquidity: The 2008 short sale ban's impact on equity option markets, Journal of Finance 66(6), 2013-2053.

Beber, A., Pagano, M., 2013, Short-selling bans around the world: Evidence from the 2007-2009 crisis, Journal of Finance 68(1), 343-381.

Berkman, H., Koch, P.D., 2008, Noise trading and the price formation process, Journal of Empirical Finance 15(2), 232-250.

Blau, B.M., Whitby, R., 2016, Skewness, short interest, and the efficiency of stock prices, working paper.

Boehmer, E., Wu, J., 2013, Short selling and the price discovery process, Review of Financial Studies 26(2), 287-322.

Boehmer, E., Jones, C.M., Wu, J., Zhang, X., 2020, What do short sellers know? Review of Finance 24(6), 1203-1235.

Bris, A., Goetzmann, W.N., Zhu, N., 2007, Efficiency and the bear: Short sales and markets around the world, Journal of Finance 62(3), 1029-1079.

Carhart, M.M., 1997, On persistence in mutual fund performance, Journal of Finance 52(1), 57-82.

Chang, E.C., Cheng, J.W., Yu, Y., 2007, Short-sales constraints and price discovery: Evidence from the Hong Kong market, Journal of Finance 62(5), 2097-2121.

Chang, E.C., Luo, Y., Ren, J., 2014, Short-selling, margin-trading, and price efficiency: Evidence from the Chinese market, Journal of Banking & Finance 48, 411-424.

Chen, C.X., Rhee, S.G., 2010, Short sales and speed of price adjustment: Evidence from the Hong Kong stock market, Journal of Banking & Finance 34(2), 471-483.

Christophe, S.E., Ferri, M.G., Angel, J.J., 2004, Short-selling prior to earnings announcements, Journal of Finance 59(4), 1845-1875.

Corwin, S.A., Schultz, P., 2012, A simple way to estimate bid‐ask spreads from daily high and low prices, Journal of Finance 67(2), 719-760.

Danielsen, B.R., Van Ness, R.A., Warr, R.S., 2009, Single stock futures as a substitute for short sales: Evidence from microstructure data, Journal of Business Finance & Accounting 36(9‐10), 1273-1293.

Dechow, P.M., Hutton, A.P., Meulboek, L., Sloan, R.G., 2001, Short-sellers, fundamental analysis, and stock returns, Journal of Financial Economics 61, 77-106.

Desai, H., Ramesh, K., Thiagarajan, S.R., Balachandran, B.V., 2002, An investigation of the information role of short interest in the Nasdaq market, Journal of Finance 57, 2263-2287.

Diether, K.B., Lee, K.H., Werner, I.M., 2009, Short-sale strategies and return predictability, Review of Financial Studies 22(2), 575-607.

Fama, E.F., French, K.R., 1992, The cross‐section of expected stock returns, Journal of Finance 47(2), 427-465.

Gagnon, L., 2018, Short Sale constraints and single stock futures introductions, Financial Review 53(1), 5-50.

Glosten, L.R., Milgrom, P.R., 1985, Bid, ask and transaction prices in a specialist market with heterogeneously informed traders, Journal of Financial Economics 14(1), 71-100.

Grundy, B.D., Lim, B., Verwijmeren, P., 2012, Do option markets undo restrictions on short sales? Evidence from the 2008 short-sale ban, Journal of Financial Economics 106(2), 331-348.

Han, B., Tang, Y., Yang, L., 2016, Public information and uninformed trading: Implications for market liquidity and price efficiency, Journal of Economic Theory 163, 604-643.

Jiang, G.J., Shimizu, Y., Strong, C., 2022, Back to the futures: When short selling is banned, Journal of Financial Markets 61, Article 100735.

Jung, C.S., Kim, W., Lee, D.W., 2013, Short selling by individual investors: Destablizing or price discovering? Pacific-Basin Finance Journal 21(1), 1232-1248.

Kim, J., Kim, J.S., Yoo, S.S., 2016, Regulatory overkill? Short-sales ban in Korea, International Journal of Managerial Finance 12(5), 673-699.

Kolari, J.W., Pynnönen, S., 2010, Event study testing with cross-sectional correlation of abnormal returns, Review of Financial Studies 23(11), 3996-4025.

Lo, A.W., MacKinlay, A.C., 1988, Stock market prices do not follow random walks: Evidence from a simple specification test, Review of Financial Studies 1(1), 41-66.

Marsh, I.W., Payne, R., 2012, Banning short sales and market quality: The UK experience, Journal of Banking & Finance 36(7), 1975-1986.

Miller, E.M., 1977, Risk, uncertainty, and divergence of opinion, Journal of Finance 32(4), 1151-1168.

Nezafat, M., Schroder, M., Wang, Q., 2017, Short-sale constraints, information acquisition, and asset prices, Journal of Economic Theory 172, 273-312.

Saffi, P.A., Sigurdsson, K., 2011, Price efficiency and short selling, Review of Financial Studies 24(3), 821-852.

Subrahmanyam, A., 1991, Risk aversion, market liquidity, and price efficiency, Review of Financial Studies 4(3), 417-441.

Wang, S.F., Lee, K.H., 2015, Do foreign short-seller predict stock returns? Evidence from daily short-selling in Korean stock market, Pacific-Basin Finance Journal 32(1), 56-75.

국내 주식시장에서 공매도 제도만큼 많은 논란을 야기하는 제도는 드물다고 평가할 수 있다. 공매도에 대한 견해는 크게 가격효율성을 제고하고 버블형성을 억제한다는 긍정적인 평가와 주가하락을 초래하고 불공정거래에 악용될 위험성이 크다는 부정적인 인식으로 대별된다. 전자는 학계와 업계의 대체적인 견해인 반면 상당수의 개인투자자들은 후자의 의견을 지지하고 있다. 이러한 견해의 차이는 공매도 제도의 필요성에 대해서 상충적인 입장으로 연결되며, 오랜 기간 의견의 격차가 좁혀지지 않은 채로 소모적인 논쟁을 이어가고 있는 것으로 보인다.

공매도 제도를 유지하느냐 또는 폐지하느냐를 논의하기 위해서는 실제로 공매도의 경제적 기능이 관찰되느냐의 여부를 확인할 필요가 있다. 공매도 제도의 순기능이 실제로 관찰되지 않는다면 제도 존속의 당위성은 떨어질 것이다. 반면 공매도의 경제적 기능이 확인된다면 제도 폐지 여부는 신중하게 판단할 필요가 있을 것이다. 이론적인 관점에서 공매도 제도는 중요한 경제적 기능을 갖는 것으로 평가된다. 공매도는 기업에 관한 부정적인 정보가 주가에 반영되는 중요한 경로이며, 특히 정보반영 속도를 증가시킴으로써 가격에 대한 시장의 신뢰를 유지시키는 역할을 하는 것으로 설명된다.

현실에 있어서 이러한 이론적 예측이 실제로 작동하는지 여부는 실증분석을 통해 판단할 문제다. 따라서 본 보고서는 주식시장에서 얻을 수 있는 거래자료와 계량적 분석모형을 활용하여 공매도 제도의 경제적 기능이 관찰되는지를 검증하고자 한다. 국내 주식시장에서 공매도 규제는 꾸준히 강화되는 추세를 보여왔다. 특히 2020년 발생한 코로나19 팬데믹 이후 주목할만한 공매도 규제변화가 관찰되는데, 이는 공매도의 경제적 기능을 검증하고 규제효과를 분석하는 데 있어 중요한 기회를 제공하고 있다. 2020년 3월 코로나19가 글로벌 팬데믹으로 확산됨에 따라 우리나라를 포함한 주요국 증시는 기록적인 주가폭락을 경험하였다. 주식시장의 과도한 폭락을 억제하고 투자자들을 안정시키기 위하여 정부는 국내 상장주식에 대한 공매도를 전면금지하는 조치를 단행하였다. 공매도 전면금지는 이후 2021년 5월 2일까지 이어졌고, 동년 5월 3일부터 KOSPI200 및 KOSDAQ150 구성종목에 대해 부분적으로 공매도가 재개되었다. 본 보고서는 이러한 공매도 규제상의 변화를 활용하여 공매도의 기능 및 규제효과를 분석할 것이다.

규제변화 시점을 기준으로 그 전후를 비교하는 것은 경제학적 실증분석에서 광범위하게 활용되는 분석방법이다. 규제변화의 시점에 주목하는 이유는 공매도 전면금지 조치가 실행되기 전과 실행된 이후 투자자들의 거래행태 및 가격반응에 체계적인 차이가 발생할 수 있기 때문이다. 공매도가 부분재개된 시점에서도 유사한 형태의 분석을 시도할 수 있다. 이 경우 공매도가 재개된 종목과 여전히 금지된 종목간에 투자자의 거래행태와 가격반응이 달라질 수 있다. 따라서 본 보고서는 2020년 3월 공매도가 전면금지된 시점과 2021년 5월 공매도가 부분재개된 시점을 전후로 공매도의 경제적 기능에 변화가 관찰되는지를 추정하여 규제효과를 평가하고자 한다.

공매도 규제효과 분석을 위한 본 보고서의 구성은 다음과 같다. Ⅱ장에서는 공매도 규제효과에 대한 국내외 선행연구 결과들을 종합해 비교한다. 공매도의 가격발견기능, 유동성 효과, 주가변동성에 미치는 영향 등에 대한 국내외 연구결과를 비교해서 정리할 것이다. Ⅲ장에서는 국내 상장주식시장에서의 공매도 거래활동에 대한 분석을 실시한다. 코로나19 팬데믹 이전 및 이후의 기간에서 관찰되는 중요한 공매도 관련 제도변화를 점검하고, 각각의 기간에 대해 시장별, 투자자그룹별 공매도 거래활동이 어떻게 변화하고 있는지를 파악할 것이다. Ⅳ장에서는 공매도 규제효과에 대한 계량적 분석을 실시한다. 계량분석을 위한 기본모형의 설정, 변수의 구성, 실증분석 결과 등이 제시된다. 마지막으로 Ⅴ장에서는 실증분석 결과를 정리하고 시사점을 도출한다.

Ⅱ. 공매도가 주식시장에 미치는 영향

공매도 제도가 주식시장에 미치는 영향에 대한 학술적인 연구는 다양한 방식으로 진행되어 왔으며, 많은 선행연구가 존재한다. 주로 공매도의 정보효과, 공매도가 가격발견 효율성, 시장유동성, 주가수익률 특성에 미치는 영향, 공매도 규제 전후의 초과수익률 등에 분석의 초점을 맞추고 있다.

공매도 규제에 대한 실증분석은 많은 경우 공매도 규제수준이 변경된 이후 가격발견 효율성, 시장유동성, 주가수익률 특성 등에 변화가 있는지 계량적으로 분석하는 접근법을 채택하고 있다. 이는 규제효과를 분석하는 통상적인 방식이다.

1. 공매도와 가격발견기능

공매도의 가격발견 기능에 관한 연구는 공매도에 관한 실증분석에서 가장 활발하게 연구가 진행되어온 영역이라 평가할 수 있다. 공매도에는 대차비용과 같은 추가적인 비용이 수반되므로 공매도 거래자는 정보거래자(informed trader)일 가능성이 높고, 공매도는 부정적인 기업정보가 주가에 반영되는 가장 중요한 채널 중의 하나이다. 따라서 공매도가 제한될 경우 부정적인 정보반영의 지연으로 인해 주식시장의 가격효율성이 하락할 것으로 예상한다.

해외의 실증분석 결과는 대체로 공매도 거래자들이 정보거래자임을 보고하고 있다. Dechow et al.(2001)은 펀더멘탈/주가 비율을 이용하여 공매도 거래자들의 특성을 분석할 결과, 공매도 거래자들은 주로 해당 비율이 낮은 주식을 공매도하고 있음을 발견하였다. 이는 공매도 거래자들이 주가가 고평가되었을 가능성이 높은 주식에 집중한다는 것을 의미한다. Desai et al.(2002)은 미국의 NASDAQ시장에서 공매도잔고가 높은 종목이 음의 초과수익률을 보이며 상장폐지 가능성이 높음을 보고하였다. 이를 바탕으로 공매도잔고가 정보효과가 있다고 해석하였다. Christophe et al.(2004)은 영업이익이 시장의 예상치를 하회하고 주가가 하락한 기업의 경우, 공매도 거래자들이 영업이익 발표 이전에 이미 공매도 거래를 증가시키고 있음을 확인하였다. 이를 통해 공매도 거래자가 정보거래자일 가능성이 높다고 지적하였다. Diether et al.(2009)은 미국 NYSE와 NASDAQ에서 공매도 비중이 각각 24%와 31%에 이르는 가운데 공매도 거래자들이 주가의 단기 과잉반응을 활용하여 유의한 수익률을 거두고 있음을 보고하였다. Boehmer et al.(2020)도 미국 NYSE 상장기업을 대상으로 한 분석에서 공매도 거래자가 정보거래자라는 결론을 내리고 있다.

공매도 거래자가 정보거래자일 가능성이 높다면 공매도의 제한은 정보거래자들의 참여를 위축시켜 가격효율성을 하락시킬 가능성을 높이게 된다. 공매도의 제한이 가격효율성을 저하시키고 있음을 보고하는 실증분석 결과는 국내외에서 광범위하게 확인된다. Bris et al.(2007)은 긍정적인 정보와 부정적인 정보가 주가에 반영되는 효율성을 비교한 결과 공매도 규제가 강한 국가에서 부정적인 정보가 주가에 반영되는 속도가 더 느림을 발견하였다. Beber & Pagano(2013)는 30여개 국가를 대상으로 2008년 글로벌 금융위기 전후의 가격효율성 변화를 분석하여 공매도 규제가 시장의 가격효율성을 저하시켰음을 발견하였다. 글로벌 금융위기로 주가가 급락하자 많은 국가에서 공매도를 일시적으로 금지하는 규제를 실행하였는데, 공매도 금지기간 동안 주식수익률과 과거의 시장수익률간의 상관관계가 더 강해지는 현상이, 특히 시장수익률이 음(-)인 경우에 뚜렷하게 나타났음을 보고하였다. Saffi & Sigurdsson(2011)은 26개국 주식시장을 분석하여 공매도에 대한 제약이 많은 국가일수록 가격효율성이 낮음을 발견하였다. 또한 공매도에 대한 제약을 완화하여도 주가변동성이 커지거나 극단적인 음(-)의 수익률이 나타나지 않음을 보고하였다. Boehmer & Wu(2013)의 실증분석 결과도 공매도 거래가 활발할 때 가격발견기능이 강화된다는 논리를 지지하고 있다. 이들은 NYSE 상장종목에 대한 분석을 통해 공매도 거래가 증가할 때 일중거래의 정보효율성이 증가함을 발견하였으며, 월간 및 연간 단위의 분석에서도 이러한 결과가 여전히 유효함을 보고하였다.

공매도 허용 종목을 지정하고 있는 홍콩 주식시장은 공매도의 영향을 분석하는데 유용한 환경을 제공하는데, Chang et al.(2007)과 Chen & Rhee(2010)의 분석결과도 공매도가 정보효율성을 강화하는 역할을 수행하고 있음을 보고하고 있다. Chang et al.(2007)은 공매도가 허용된 종목과 금지된 종목을 비교분석하여 공매도 제한이 주가의 과대평가를 유발한다는 결과를 보고하였으며, Chen & Rhee(2010)은 공매도 가능 종목에서 새로운 정보에 대해 가격조정이 더 신속하게 이루어짐을 발견하였다. 한편, 공매도 도입을 위한 중국의 파일럿(pilot) 프로그램을 연구한 Chang et al.(2014)은 공매도 거래의 허용이 가격효율성을 증가시켰음을 보고하였다. 공매도 거래가 시작되는 종목들은 평균적으로 가격이 하락, 즉 고평가가 해소되는 한편, 가격효율성은 증가하고 주가변동성은 하락한 것으로 관찰되었다.

국내 선행연구도 존재한다. Jung et al.(2013)은 한국 주식시장에서 개인투자자들의 공매도 거래참여가 시장의 가격효율성을 증가시킴을 보고하였다. 개인투자자들의 공매도 거래가 가능해진 종목에서 주가의 움직임이 랜덤워크(random walk)에 더 가까워짐을 발견하였다. Kim et al.(2016)은 2008년 글로벌 금융위기시에 실시된 국내 공매도 금지조치의 효과를 분석하여 가격효율성이 저하되었음을 보고하였다.

2. 공매도와 시장유동성

공매도에 의한 매도수요와 차입한 주식의 상환을 위한 매수수요는 추가적인 유동성을 창출한다. 또한 정보거래의 증가로 가격 불확실성이 감소하면서 호가스프레드가 줄어드는 효과도 기대할 수 있다. 반면 정보거래의 증가는 역선택위험을 증가시켜 호가스프레드가 확대될 가능성도 존재한다.

공매도 제한에 따른 유동성 축소는 대부분의 실증분석에서 일관된 결과를 보이고 있다. Marsh & Payne(2012)은 2008년~2009년에 시행된 영국 주식시장의 금융주 공매도 금지조치가 시장의 유동성을 뚜렷하게 위축시켰고, 이로 인해 공매도 금지가 시장의 안정화를 가져온 것이 아니라 시장의 질적 특성을 악화시키는 결과를 초래하였음을 주장하였다. Beber & Pagano(2013)는 국가간 주식거래 비교를 통해 공매도에 대한 규제강화는 시장유동성을 하락시키고 호가스프레드를 확대시킨다는 결과를 보고하였다.

Jung et al.(2013)은 한국 주식시장 개인투자자의 공매도거래를 분석하여 공매도가 시장의 유동성을 증가시키고 호가스프레드를 감소시킨다는 결과를 보고하였다. Wang & Lee(2015)도 한국 주식시장의 외국인 투자자 공매도 행태를 분석하여 매수주문이 증가할 때 외국인 투자자의 공매도도 같이 증가하는 현상을 확인하고, 공매도가 유동성을 증가시키는 효과를 가진 것으로 해석하였다. 최혁ㆍ이효정(2012), Kim et al.(2016), 황세운(2017), 이관휘 등(2021) 등은 2008년 글로벌 금융위기 이후에 실시되었던 공매도 전면금지로 인해 시장 전체의 유동성이 저하되었음을 보고하고 있다.

3. 공매도와 주가수익률 특성

공매도가 제한될 경우 긍정적인 정보의 반영에는 영향이 없는 반면 부정적인 정보의 반영은 느려지거나 일부만 반영되는 결과를 초래할 수 있다. 이 경우 주가 고평가에 대한 조정이 충분히 일어나지 않아 주가수익률 분포의 왜도(skewness)가 증가할 수 있을 것이다. 또한 부정적인 정보의 반영이 느려지면서 주가에 반영되지 않은 정보가 축적된다면 갑작스럽게 정보반영이 이루어지는 상황이 발생할 가능성이 증가한다. 이 경우 주가의 변동성은 증가할 수 있으며 주가급락의 빈도도 높아질 수 있다.

공매도와 주가수익률 특성의 관계에 대한 실증분석 결과를 살펴보면 공매도가 제한될수록 주가분포의 왜도가 증가한다는 결과가 많고 변동성에 관해서는 혼재된 결과가 보고되고 있다. Bris et al.(2007)은 46개국 주식시장에 대한 횡단면 및 시계열 정보 분석을 통해 공매도가 금지된 국가에서 시장수익률의 왜도가 크다는 결과를 보고하였다. Chang et al.(2007)과 Blau & Whitby(2016)도 공매도가 주가수익률의 왜도를 감소시킨다는 결과를 제시하였다. 변동성과 관련하여, Saffi & Sigurdsson(2011)은 26개국에 대한 분석에서 공매도 제한을 완화한다고 해서 주가변동성이 증가하거나 극단적인 음의 수익률 발생빈도가 증가하지 않는다는 분석을 내놓은 반면, Chang et al.(2007)은 홍콩시장 분석에서 공매도의 허용은 주가수익률 변동성을 증가시킨다는 결과를, Chang et al.(2014)은 중국시장 분석에서 공매도의 허용이 주가수익률 변동성을 하락시킨다를 결과를 보고하고 있다.

국내 주식시장에 대한 분석에서는 공매도가 수익률의 변동성에 영향을 주지 않거나 감소시킨다는 결과가 다수인 것으로 확인된다. Jung et al.(2013)은 국내 주식시장에서 개인투자자들의 공매도 거래가 수익률 왜도와 주가변동성에 영향을 미치지 않았다는 결론을 도출하였고, Wang & Lee(2015)도 외국인 투자자의 공매도 거래가 주가변동성에 통계적으로 유의적인 영향을 미치지 않음을 보고하였다. Kim et al.(2016)은 2008년 글로벌 금융위기시의 공매도 금지조치로 인해 오히려 주가변동성이 증가하였다는 결과를 제시하였다. Wang & Lee(2015)는 한국 주식시장에서 외국인 투자자들은 역모멘텀 방식의 공매도 거래전략을 주로 활용하고 있으며, 주가변동성에 영향을 주지 않는다는 결과를 제시하였다. 가장 최근의 연구인 이관휘 등(2021)은 코로나19 팬데믹 이후의 공매도 전면금지 조치가 주가하락을 방어하거나, 변동성을 줄인다는 증거를 찾을 수 없음을 보고했다. 아울러 공매도 과열종목 지정제도의 효과에 대한 분석을 통해 과열종목으로 지정된 이후 주가하락이 멈춘다는 증거를 찾을 수 없다는 결론을 도출하였다. 반면, 최용준ㆍ김철중(2014)은 국내 주식시장에서 변동성이 낮은 시기에는 공매도 거래와 주가변동성에 유의한 영향을 미치지 않으나 변동성이 높은 시기에는 공매도 거래가 주가변동성을 확대시킨다는 결과를 보고하고 있다. 황세운(2017)은 2011년 실시된 공매도 전면금지 기간동안 주가변동성이 줄어들었다는 결과를 도출하였다. 이밖에 참고할만한 연구로, 이영섭ㆍ한상범(2015)은 가격하락 국면에서 약탈적인 공매도거래가 증가하지 않으며 비공매도 거래가 공매도 거래에 비해 더 공격적이라는 결과를 도출하였다.

Ⅲ. 국내 공매도 규제변화 및 시장현황

1. 코로나19 팬데믹 전후의 공매도 규제변화

국내 주식시장에서 공매도 규제는 지속적으로 강화되어 왔다고 평가할 수 있다. 공매도에 대한 규제는 ‘자본시장과 금융투자업에 관한 법률(이하 자본시장법)’에 의해 이루어지고 있다. 자본시장법은 공매도를 소유하지 아니한 상장증권의 매도나 차입한 증권으로 결제하고자 하는 매도를 의미한다고 정의한다.1) 국내에서 무차입공매도는 원칙적으로 금지되고 차입공매도만 허용되는데, 결제이행의 위험이 없는 경우에 대해서는 무차입공매도로 간주하지 않는 예외규정을 두고 있다.2) 한편 공매도가 위기상황에서 가격하락을 부추길 수 있다는 지적에 따라 자본시장법은 금융위원회가 증권시장의 안정성 및 공정한 가격형성을 저해할 우려가 있는 경우에 차입공매도를 제한할 수 있도록 규정하고 있다.3)

공매도에 대한 규제구조를 살펴보면 과도한 주가하락을 방지하고 시장의 안정성을 유지하기 위한 시장안정화 조치, 공매도 거래 관련 정보의 공시에 관한 규제, 그리고 공매도 관련 불법행위에 관한 처벌로 구분할 수 있다. 2020년 3월에 발생한 코로나19 팬데믹 사태 이전의 공매도 규제는 주로 시장안정화 및 정보공시 강화에 초점을 맞추었다고 평가할 수 있다. 가장 대표적인 공매도 관련 시장안정화 조치로는 위기상황에서의 전면적인 공매도 거래금지 조치가 있다. 공매도 거래가 본격화된 2000년대 이후 국내 상장주식시장에서 공매도 거래가 전면금지된 사례는 세 차례이다. 그 첫 번째는 2008년 발생한 글로벌 금융위기 과정에서 실시되었다. 2008년 9월 리먼브라더스의 파산으로 인해 금융위기가 촉발되자 금융당국은 시장의 투매에 따른 폭락세를 진정시키고 거래를 안정화하기 위하여 2008년 10월 1일 공매도 거래를 전면금지하였다. 이후 시장의 안정세가 뚜렷해지면서 전면금지 시행 약 8개월만인 2009년 5월 31일 공매도 거래를 재개하였다. 두 번째 공매도 금지조치는 유럽 재정위기가 발생하여 시장이 급락하였던 2011년 8월 10일 시행되었다. 유럽 재정위기는 이전의 글로벌 금융위기에 비하여 충격이 상대적으로 작았고 시장이 빠르게 안정세를 찾으면서 공매도 금지조치는 약 3개월 후인 2011년 11월 9일 해제되었다. 세 번째 공매도 금지조치는 코로나19 팬데믹으로 인해 시장이 급락세를 보였던 2020년 3월 16일에 시행되었다. 해당 공매도 금지조치는 이전의 금지조치들에 비해 상대적으로 오랜 기간 유지되었는데, 약 14개월 동안 공매도 거래가 전면금지 되었고 2021년 5월 3일 일부 종목에 대해 공매도 거래가 재개되었다.4) 공매도 거래가 허용된 종목은 KOSPI200지수 및 KOSDAQ150지수를 구성하는 350개 종목이며, 나머지 종목에 대해서는 2022년 11월 현재까지 공매도거래가 금지되어 있다.

글로벌 금융위기나 코로나19 팬데믹과 같은 위기상황에서 시장의 공포감이 극에 달할 경우 필요 이상의 주가하락이 나타날 수 있으며 공매도는 그러한 주가하락을 부추길 가능성이 있다. 따라서 위기상황에서 공매도 금지는 시장을 안정화하는 역할을 기대할 수 있다는 것이 공매도 금지조치의 논리다. 그러나 공매도가 주가하락을 유발한 요인이 아니므로 공매도 금지로 시장의 하락세를 막기는 어렵다는 비판적 견해가 학계를 중심으로 꾸준히 제기되고 있다. 특히 코로나19 팬데믹 시기의 국내 공매도 전면금지 조치는 금융시장 상황이 정상적인 상태로 회복되었음에도 불구하고 전면해제되지 않고 부분적으로만 해제되어 정상적인 시장기능의 작동에 부담이 된다는 지적이 많은 상황이다.

코로나19 팬데믹 이전에 도입되었던 중요한 공매도 관련 규제로는 공매도 잔고 공시의무 부과제도와 공매도 과열종목 지정제도를 들 수 있다. 공매도 잔고 공시의무 부과제도는 주식시장에서 공매도 거래가 어떠한 투자자에 의해 이루어지고 있는지를 파악하기 위하여 도입되었다.5) 동 제도는 2016년 6월 30일 도입되었는데, 대규모 공매도 투자자에 대해 공매도 잔고비율에 따라 잔고공시 또는 신고의무를 부과하고 있다.6) 자본시장법과 시행령에 따르면 상장주식 총수대비 공매도 순잔고비율이 0.01% 이상인 경우 잔고 보고의무가 부과되며, 그 비율이 0.5% 이상인 경우 잔고 및 매도자에 관한 사항을 공시해야 한다.7) 공매도 거래활동 및 잔고에 관한 정보를 시장에 투명하게 공개하기 위한 규제로 이해할 수 있다.

공매도 과열종목 지정제도는 비정상적으로 공매도가 급증하고 가격이 급락한 종목을 매 거래일 장종료 후 공매도 과열종목으로 지정하고 다음 매매거래일 하루 동안 공매도 거래를 제한하는 제도로, 2017년 3월 27일 도입되었다.8) 공매도 과열종목 지정제도는 자본시장법 및 시행령이 아니라 한국거래소 유가증권시장 업무규정 및 시행세칙, 한국거래소 코스닥시장 업무규정 및 시행세칙에 근거한다. 전거래일 종가 대비 주가하락률, 해당 거래일의 공매도 거래비중, 직전 40거래일 평균대비 공매도 비중 등에 관한 기준을 만족하는 경우 다음 거래일에 해당 종목에 대한 공매도가 금지된다.9) 이후 공매도 과열종목 지정기준은 2022년 7월 과열종목 지정제도가 시장충격에 보다 민감하게 반응할 수 있도록 요건이 완화되어 더 많은 종목이 공매도 과열종목으로 지정될 수 있도록 한국거래소 규정이 개정되었다.10) 신설된 규정에 따르면 공매도 비중이 30% 이상이면 주가하락률(3% 이상), 공매도 거래대금 증가율(2배 이상)이 다소 낮더라도 공매도 과열종목으로 지정된다. 또한 공매도 과열종목으로 지정되어 공매도가 금지된 날에 주가하락률이 5% 이상일 경우 공매도 금지기간이 다음 거래일까지 자동으로 연장된다.

코로나19 팬데믹 이후 나타난 공매도 관련 규제변화로는 공매도 관련 불법행위에 대한 처벌강화, 유상증자 기간 중 해당 주식을 공매도한 자의 증자참여 제한, 대차계약내역 보관의무 부과 및 대차거래 모니터링 강화, 개인투자자의 공매도 참여환경 개선 등이 있다. 이 중에서 가장 주목할만한 규제변화는 공매도 관련 불법행위에 대한 처벌강화라고 할 수 있을 것이다. 이전까지 무차입공매도와 같은 공매도 관련 불법행위에 대해서 과태료만 부과할 수 있었기 때문에 공매도 관련 불법행위를 억제하는 효과가 미약하다는 지적이 계속되었다. 금융감독원의 통계에 따르면 2010년부터 2022년 4월까지 공매도 관련 불법행위로 과태료 또는 주의 조치를 받은 건수는 127건(과태료 71건, 주의 56건)에 이른다. 127건 중 외국인에 대한 처분이 119건, 94%의 비중을 차지하고 있어 공매도 관련 불법행위는 주로 외국인에 의해 이루어지는 것으로 파악된다. 외국인들의 공매도 거래 참여비중이 높다는 점을 감안하더라도 불법행위 비중이 매우 높음을 알 수 있다.

국회는 2020년 12월 자본시장법 개정을 통하여 공매도 관련 불법행위에 대해 형사처벌 및 과징금부과를 도입하였다. 형사처벌은 1년 이상의 유기징역 또는 이익 또는 회피한 손실액의 3배 이상 5배 이하의 벌금을 부과하는 것을 주된 내용으로 한다.11) 과징금은 위법한 공매도 주문금액의 범위 내에서 부과된다.12) 과징금 및 형사처벌의 도입 이후 실제로 처벌받은 사례가 아직까지 나오지 않았기 때문에 처벌기준 강화에 대한 개인투자자들의 인식은 아직 미흡한 편이지만, 고의적인 불법공매도 시도를 사전에 억제하는 효과가 있을 것으로 예상된다. 또한 착오나 실수 등으로 인한 위반이 발생하지 않도록 주의를 촉구하는 예방효과도 있을 것으로 기대된다. 금융당국은 지속적으로 불법공매도에 대한 적발 및 처벌을 강화할 방침을 밝히고 있다. 공매도 연계 불공정거래 기획조사를 강화하고, 무차입 공매도에 대한 신속한 조사를 위하여 한국거래소 시장감시위원회, 금융감독원 등이 불법공매도 모니터링 정보를 실시간으로 공유하는 체계를 구축하였다. 불법 공매도에 대한 적발 및 처벌활동이 강화되는 추세는 이어질 것으로 전망된다.

공매도 투자자는 대차계약 내역을 5년간 보관해야 하는 의무도 부과된다.13) 공매도를 실행하기 위해서는 대차계약 체결이 필수적인데, 대차계약 체결과 관련된 정보투명성을 강화하기 위한 조치라고 평가할 수 있다. 추가적으로 공매도 목적의 대차거래에 대한 모니터링 체계도 강화하였다. 금융당국은 금융투자업규정의 개정을 통해 공매도 목적 대차 후 90일 경과 시 금융당국에 보고의무를 부과하였다. 또한 공매도 잔고 대량보유 보고 내용에 상세 대차정보(당일 시작ㆍ마감 대차잔고)를 포함하는 규정도 마련하였다. 대차계약의 투명성이 제고되면 금융당국이 대차계약 일시와 매도주문 시기를 비교함으로써 불법행위를 보다 용이하게 적발해 낼 수 있을 것이다. 공매도와 대차거래간의 완결성을 높이기 위해 향후 대차거래를 전산거래로 의무화할 가능성이 있다는 점에서 정보보관의무의 부과 및 대차거래 모니터링 강화는 그 예비단계의 성격을 가진다고 볼 수 있다.

유상증자 기간 중 해당 주식을 공매도한 자의 유상증자 참여를 제한하는 규제도 코로나19 팬데믹 이후에 만들어졌다. 유상증자 계획을 발표한 주권상장법인의 주식을 공매도하여 공모가격을 떨어뜨린 후, 유상증자에서 낮은 가격에 신주를 배정받아 차입주식의 상환에 활용하는 차익거래가 나타나면서 투자자와 발행기업에 피해를 준다는 지적이 반복적으로 제기된 데 따른 것이다. 유상증자 계획이 공시된 이후 해당기업의 주식을 주식시장에서 공매도한 경우에는 유상증자 참여가 제한되며, 이를 위반할 경우 과징금이 부과된다.14)

2. 코로나19 팬데믹 전후의 공매도 현황

본 절에서는 국내 주식시장의 공매도 규제조치 전후의 주식시장 공매도 거래현황을 검토한다. 먼저 코로나19 팬데믹으로 공매도가 전면금지되기 직전 약 14개월(2019년 1월 2일~2020년 3월 13일)간 유가증권시장의 공매도 평균잔고는 11.6조원으로, 전체 시가총액 대비 평균비중은 0.83%이다. 코스닥시장의 경우 공매도 평균잔고는 3.4조원, 코스닥시장 시가총액 대비 1.43%이다. 코스닥시장의 공매도 평균잔고는 유가증권시장에 비해 절대 규모는 작으나 시가총액 대비 공매도 잔고비중은 높게 나타난다.

시가총액대비 공매도 잔고비중은 공매도 금지 이후 완만하게 감소하고, 부분재개 이후 빠르게 증가하는 추세를 보여준다. 2021년 5월 공매도 부분재개 이후 약 1년간의 평균잔고는 공매도 금지 이전 기간과 비슷한 수준으로 높아졌으나, 시가총액 대비 공매도 잔고비중은 공매도 금지 이전 기간에 비하여 크게 낮아졌다. 공매도 부분재개 이후 약 12개월(2021년 5월 3일~2022년 5월 11일) 동안의 유가증권시장 공매도 평균잔고는 9.4조원, 시가총액 대비 평균 잔고비중은 0.62%로 나타난다. 공매도 금지 이전 기간과 비교할 때 공매도 평균잔고는 2.2조원 감소했고, 시가총액 대비 평균 잔고비중은 0.21%p 하락하였다. 코스닥시장의 경우 공매도 평균잔고는 3.3조원, 시가총액 대비 잔고비중은 0.79%로 나타난다. 공매도 금지 이전과 비교하면 평균잔고는 0.1조원 감소했고, 시가총액 대비 평균 잔고비중은 0.64%p 하락하였다.

공매도 전면금지 이전 기간(2019년 1월 2일~2020년 3월 13일) 유가증권시장과 코스닥시장의 일평균 공매도 거래대금은 각각 3,511억원, 1,118억원이고, 공매도 거래대금이 전체 주식거래대금에서 차지하는 비중은 각각 6.54%와 2.43%이다. 주요 선진국 주식시장의 공매도 거래비중이 20~50%임을 고려할 때 국내 주식시장의 공매도 거래비중은 상당히 낮은 수준이다.15)

공매도 부분재개 이후 유가증권시장과 코스닥시장의 일평균 공매도 거래대금은 각각 4,495억원, 1,493억원으로 팬데믹 이전의 기간에 비해 증가하였다. 그러나 공매도 거래비중은 각각 3.65%와 1.51%로 팬데믹 이전에 비해 낮은 수준이다. 절대적인 공매도 거래대금은 증가하였지만, 공매도가 일부 종목에 대해서만 재개된데다 팬데믹 이후 개인투자자의 급격한 유입으로 주식 거래대금이 크게 증가한 영향으로 보인다.

한편 공매도 전면금지 기간에도 소량의 공매도 거래가 관찰되는데, 이는 시장조성자에 대해 공매도를 예외적으로 허용했기 때문이다. 다만 공매도 금지 이전에 시장조성자의 공매도가 전체 공매도의 23%, 전체 거래대금의 1.07%를 차지하였다는 점을 감안하면 공매도 전면금지 이후 시장조성자 역시 공매도를 최대한 회피한 것으로 보인다.16)

유가증권시장의 경우 금지 이전에 비해 부분재개 이후 외국인투자자의 공매도 비중은 큰 폭으로 증가했다. 반면 기관투자자의 공매도 비중은 부분재개 이후 큰 폭으로 감소했다. 개인투자자의 비중은 0.84%에서 1.94%로 두 배 이상 증가하였다. 코스닥시장의 경우 외국인투자자의 비중은 74.09%에서 66.94%로 오히려 감소했고, 기관투자자의 비중은 23.74%에서 30.35%로 증가했다. 유가증권시장과는 대조적인 결과다. 개인투자자들의 비중은 2.15%에서 2.71%로 증가하였다.

Ⅳ. 공매도 규제효과에 대한 계량적 분석

본 장에서는 공매도 금지 조치와 부분재개 조치의 영향을 실증적으로 분석한다. 먼저 선행연구의 논의를 바탕으로 공매도 규제변화가 가격효율성, 유동성, 수익률 특성에 미친 영향을 분석한다. 이어서 공매도 규제변화에 대한 초과수익률 반응과 그 결정요인을 분석한다.

1. 가격효율성, 유동성, 수익률 특성에 대한 영향 분석

가. 분석척도

공매도 금지 및 부분재개가 가격효율성에 미치는 영향을 파악하기 위한 가격효율성 척도로 자기상관계수(autocorrelation), 교차자기상관계수(cross- autocorrelation), 분산비율(variance ratio) 등 세 가지 척도를 이용한다.

자기상관계수(|AC|)는 개별주식의 일간수익률을 이용하여 계산하며 절대값을 기준으로 분석한다. 가격이 효율적이라면 수익률은 랜덤워크(random walk)를 따르게 되며 자기상관계수는 0이 된다. 따라서 자기상관계수의 절대값이 작을수록 가격효율성이 높은 것으로 평가한다. 아울러, 시장모형(market model)의 잔차를 이용하여 계산한 자기상관계수(|ACi|)를 추가적인 지표로 이용한다. 개별주식 수익률에 포함된 시장정보를 제거함으로써 개별주식에 대한 고유정보가 가격에 반영되는 정도를 측정한다.

교차자기상관계수(|XAC|)은 개별주식의 수익률과 전일의 시장수익률의 상관계수로 정의하며 절대값을 기준으로 분석한다. 교차자기상관계수의 절대값이 클수록 시장정보가 개별주식 가격에 늦게 반영된다는 것을 의미한다. 공매도가 제한될 경우 부정적 시장정보의 반영속도가 느려질 것이므로 시장수익률이 음(-)인 경우의 교차자기상관계수가 커질 것으로 예상된다. 따라서 시장수익률이 양(+)인 경우(|XAC+|)와 음(-)인 경우(|XAC-|)를 나누어 각각의 교차자기상관계수를 산출한다(Bris, Goetzmann, Zhu, 2007; Saffi & Sigurdsson, 2011).

분산비율(VR)은 주간수익률의 분산(

유동성 척도로는 호가스프레드(quoted spread), Amihud 비유동성(illiquidity) 척도, 거래회전율 등 세 가지를 이용한다. 호가스프레드(SPRD)는 최우선 매도호가와 최우선 매수호가의 차이를 의미한다. 호가스프레드가 클수록 주식의 경제적 기대가치와 체결가격의 차이가 크고 이는 높은 거래비용을 의미한다. 호가스프레드의 실제 관측치를 확보하지 못하였으므로 대신 Corwin & Schultz(2012)의 방법에 따른 추정치를 계산하여 이용한다. 이 추정치는 가격 대비 호가스프레드의 비율로 계산된다.

Amihud(2002) 비유동성 척도(ILLQD)는 일간수익률(%)의 절대값을 일간거래대금(원)으로 나눈 뒤 108을 곱하여 계산한다. 이는 단위금액의 거래가 수익률에 미치는 영향의 크기로, 시장충격비용(market impact costs)으로 간주할 수 있으며 유동성이 풍부할수록 비유동성 척도는 작은 값을 갖는다.

거래회전율(TURN)은 일간 거래대금을 시가총액으로 나누어 계산한다. 거래회전율이 높을수록 거래체결 확률이 높아지며 일반적으로 호가스프레드와 시장충격비용이 낮다. 다만, 거래회전율은 수익률의 불확실성 또는 투자자간 의견불일치 수준과 밀접한 연관성을 갖는 것으로 알려져 있으므로 유동성 척도로써 불완전한 측면이 있음을 감안할 필요가 있다.

마지막으로, 수익률 분포의 특성은 변동성, 왜도(skewness), 첨도(kurtosis), 극단적 수익률 발생비율 등을 이용하여 분석한다. 변동성(VLT), 왜도(SKW), 첨도(KRT)는 일간수익률을 이용하여 계산한다. 변동성의 경우, 공매도 금지가 수익률에 비대칭적으로 영향을 주었을 가능성이 있으므로, 추가적으로 수익률이 양(+)인 경우(VLT+)와 음(-)인 경우(VLT-)로 나누어 산출한다. 극단수익률 발생비율은 분석기간의 일간수익률 평균값을 기준으로 일간수익률이 표준편차의 2배를 상회하는 관측치의 비율(XTR+)과 하회하는 관측치의 비율(XTR-)을 각각 계산한다. 공매도가 금지될 경우 주가의 급등 혹은 고평가가 효과적으로 조정되지 않게 되므로 VLT+와 XTR+가 증가할 것으로 예상할 수 있다. 반면 공매도가 주가의 급락을 유발하는 원인이라는 공매도 규제 논리에 따르면 공매도 금지 이후 VLT-와 XTR-가 감소할 것으로 예상할 수 있다.

나. 분석개요

실증분석은 공매도 금지 전후에 대한 분석과 부분재개 전후에 대한 분석으로 구분하여 진행한다. 공매도 금지 전후에 대한 분석은 공매도 금지일(2020년 3월 16일) 기준으로 -125일부터 -6일까지 120일(거래일 기준)의 ‘금지 이전’ 기간과 +5일부터 +124일까지 120일의 ‘금지 이후’ 기간을 비교한다. 동일한 방식으로, 공매도 부분재개 전후에 대한 분석은 공매도 부분재개일(2021년 5월 3일) 기준으로 -125일부터 -6일까지 120일의 ‘재개 이전’ 기간과 +5일부터 +124일까지 120일의 ‘재개 이후’ 기간을 비교한다. 공매도 금지 전후 10일과 부분재개 전후 10일은 각 조치에 따라 분석대상 지표의 특성이 전환되는 시기로 간주하여 분석에서 제외한다.

공매도 금지 전후 분석에서, 모든 종목에 대해 공매도가 금지되었기 때문에 금지 전후의 비교만으로는 공매도 금지의 영향을 공매도 금지와 무관한 시장전체의 시계열적 변화와 분리하기 어렵다. 따라서 공매도 금지의 영향이 클 것으로 예상되는 종목과 그렇지 않은 종목으로 표본을 분류하여 공매도 금지 전후의 변화를 상호 비교하는 방법을 이용한다.17)

첫 번째 분류기준은 공매도 거래비중이다. 공매도 금지 이전에 공매도 거래가 많았던 주식이 공매도 거래가 적었던 주식에 비해 공매도 금지의 영향이 클 것으로 예상할 수 있다. 다만 공매도가 적었던 종목의 경우, 주식의 차입이 어렵기 때문인지 공매도 수요가 작았기 때문인지 구분되지 않는다. 주식의 차입이 어렵기 때문이라면 공매도 금지의 영향이 작을 것이나 공매도 수요가 작았기 때문이라면 공매도 금지의 영향에서 자유로울 수 없다. 이러한 점을 고려하여 공매도의 용이성을 두 번째 분류기준으로 이용한다. 공매도의 용이성은, 주식대여와 공매도가 주로 외국인투자자 및 기관투자자에 의해 이루어진다는 점에 착안하여 외국인투자자 및 기관투자자 거래비중을 활용한다.18) 19)

공매도 부분재개 전후 분석에서는 공매도 재개종목과 공매도가 재개되지 않은 종목의 재개 전후 변화를 상호 비교한다. 공매도 재개종목은 KOSPI200 및 KOSDAQ150 편입종목이다.

분석을 위한 공매도 자료와 주가자료는 DataGuide로부터, 파생상품 관련자료는 한국거래소로부터 확보하였다. 분석대상은 SPAC을 제외한 유가증권시장과 코스닥시장의 상장기업 보통주로, 공매도 금지 전후 분석에 1,967개 기업, 공매도 부분재개 분석에 2,049개 종목이 포함된다.

다. 공매도 금지 전후 실증분석

공매도 금지 조치가 가격효율성, 유동성, 수익률 특성에 미친 영향을 차례로 검토해보자. <표 Ⅳ-1>은 주요 분석변수의 공매도 금지 전후 변화를 거래비중 상위 20% 종목(공매도(H))과 나머지 하위 80% 종목(공매도(L))으로 나누어 제시하고, 금지 전후의 차이와 그룹간 차이의 통계적 유의성을 검토하고 있다.

공매도 금지 이전, 공매도(H) 그룹은 공매도(L) 그룹에 비해 전반적으로 가격효율성이 높고, 변동성이 작으며, 유동성이 높은 것으로 나타난다. 이 그룹에 KOSPI200 및 KOSDAQ150 지수에 편입된 종목과 시가총액 대형주가 많이 포함되어 있는 것과 연관된 결과로 보인다. 공매도 금지 이후, 공매도(H) 그룹의 가격효율성은 저하되고 변동성은 증가하여 공매도(L) 그룹과의 격차가 줄어들거나 역전되는 것으로 확인된다. 공매도 금지조치가 공매도(H) 그룹에 상대적으로 큰 영향을 미친 것으로 평가할 수 있다. 한편 유동성 지표에서는 공매도(H) 그룹과 공매도(L) 그룹 사이에 차별적인 변화가 관찰되지 않는다. 이러한 결과는 공매도 용이성을 기준으로 종목으로 구분하여 분석하는 경우에도 대체로 유사하다.

<표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>는 가격효율성, 수익률분포, 유동성 관련 척도를 종속변수로 다중회귀분석을 시행한 결과를 보여준다. 공매도 금지기간 더미변수, 공매도 거래비중 상위 20% 종목에 대한 더미변수, 두 변수의 교차(interaction)변수, 기타 통제변수가 독립변수로 포함되며, 기타 통제변수로는 기업규모, 수익률 변동성, 거래회전율을 포함한다.

먼저 <표 Ⅳ-2>에 따르면 종속변수가 자기상관계수(|AC|), 분산비율(VR), 교차자기상관계수(|XAC|)인 경우 교차변수의 계수가 통계적으로 유의한 양(+)의 값을 갖는 것으로 나타난다. 즉 공매도 금지 이후, 공매도 거래비중이 높았던 주식의 가격효율성이 상대적으로 악화되었다는 것을 의미한다. 특히, 시장수익률이 음(-)인 경우 교차자기상관계수(|XAC-|)의 계수가 유의한 양(+)의 값으로, 공매도 금지 이후 하락장에서 가격발견기능이 저하되는 현상을 확인할 수 있다. 한편 종속변수가 초과수익률 자기상관계수(|ACi|), 시장수익률이 양(+)인 경우의 교차자기상관계수(|XAC+|)인 경우 교차변수의 계수가 양(+)의 값으로 추정되었으나 통계적으로 유의하지 않았다.

<표 Ⅳ-3>에서는 공매도 금지 이후 수익률 분포 특성의 변화에 대해 분석하고 있는데, 공매도 거래비중이 높았던 종목은 공매도 금지 이후 다른 종목에 비해 변동성, 왜도, 첨도, 극단적 수익률 발생빈도가 모두 증가하는 것으로 나타난다. 특히, 수익률이 양(+)인 경우의 변동성(VLT+)과 극단적 양(+)의 수익률 발생빈도(XTR+)에서 증가폭이 크게 나타나 공매도 제한이 주가의 과대평가를 효과적으로 제어하지 못하고 있음을 시사한다. 다시 말해, 공매도 거래는 주가의 급격한 상승이 나타났을 때 실행되어 주가를 안정화시키는 역할을 수행해 왔음을 방증하는 결과다. 또한 공매도 금지 이후, 수익률이 음(-)인 경우의 변동성(VLT-)과 극단적 음(-)의 수익률 발생빈도(XTR-)가 동시에 증가하는데 이는 공매도 금지를 통해 주가의 급락 가능성이 줄어들 것이라는 공매도 규제 논리와는 배치되는 결과다.

<표 Ⅳ-4>의 유동성 변화에 대한 분석은 일관된 결과가 확인되지 않는다. 공매도 거래비중이 높았던 종목은 공매도 금지 이후 비유동성 척도가 증가하고 거래회전율이 하락하나, 대조적으로 호가스프레드는 감소하는 것으로 나타난다. 공매도 거래가 금지되면서 유동성이 하락하였으나, 동시에 지정가 주문(limit order)의 비중이 높은 개인투자자의 참여가 늘어나면서 호가스프레드가 감소한 것으로 추정된다. <표 Ⅳ-4>의 (4)는 개인투자자 거래비중(=(개인투자자 매수대금+매도대금)/(거래대금×2))을 종속변수로 분석한 결과인데, 공매도 거래비중이 높았던 주식은 공매도 금지 이후 개인투자자의 거래비중이 12.64% 증가한 것을 확인할 수 있다. 반면, (5), (6), (7)의 결과에 따르면 증권사, 기관, 외국인의 거래비중은 모두 감소한 것으로 나타난다.

<표 Ⅳ-5>는 공매도 금지 이전 기간의 공매도 거래비중 대신 공매도 용이성(외국인 및 기관투자자 거래비중)을 기준으로 종목을 분류하여 공매도 금지의 영향을 분석한 결과이다. <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>와 동일한 분석이며, 공매도 금지기간 더미, 공매도 용이성 상위 20% 종목 더미, 두 변수의 교차변수에 대한 추정결과만을 제시하고 있다. 분석결과는 <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>와 질적으로 차이가 없다.

<그림 Ⅳ-1>은 공매도 금지 및 부분재개 전후의 개별주식 선물, 개별주식 옵션, 개별주식 ELW(Equity Linked Warrant)의 거래추이를 보여준다. 그래프가 표시하는 값은 각 상품유형별 거래대금을 해당 상품 기초자산의 거래대금으로 나눈 값이다.20)

개별주식 옵션의 경우 공매도 금지와 함께 거래가 거의 이루어지지 않은 것으로 나타난다. 유동성이 풍부하지 않은 가운데 시장조성자의 역할이 축소되면서 나타난 결과로 추정된다. 개별주식 ELW의 경우에도 공매도 금지기간 동안 거래대금은 기초자산 거래대금 대비 0.20% 수준에 불과하다. 개별주식 옵션과 ELW가 공매도의 대안적 수단으로 활용되었을 가능성은 부족해 보인다.

개별주식 선물 역시 공매도 금지기간 동안 거래활동이 증가하는 특징을 보이지는 않는다. 그러나 거래대금이 기초자산 거래대금의 40%를 상회하고 공매도 주요 주체인 외국인의 거래비중이 공매도 금지기간 동안 증가했다는 사실21)로 볼 때, 공매도의 대안적인 수단으로 활용되었을 가능성을 배제할 수 없다. 따라서, 개별주식 선물이 거래되는 종목의 경우 공매도 금지의 부정적 영향이 완화되는지 추가적으로 분석해 보도록 한다. 개별주식 선물 거래여부에 대한 더미변수를 구성하고, 공매도 금지기간 더미변수, 공매도 비중 상위 또는 공매도 용이성 상위 더미변수와의 교차변수를 산출하여 다중회귀분석을 시행한다.

두 번째 추가분석은 공매도 금지로 인한 개인투자자 거래비중 증가가 미치는 영향이다. <표 Ⅳ-4>와 <표 Ⅳ-5>에서 확인한 바와 같이, 공매도 비중이 크거나 공매도가 용이한 종목에서 공매도 금지 이후 개인투자자 비중이 크게 늘었다. 개인투자자는 무정보거래자(uninformed trader) 또는 잡음거래자(noise trader)로 간주할 수 있기 때문에 개인투자자의 비중 증가는 가격효율성을 저해하고 변동성을 증가시킬 가능성이 있다(Subrahmanyam, 1991; Han, Tang, Yang, 2016). 반면, 개인투자자 비중이 증가할수록 역선택(adverse selection) 위험이 낮아지면서 유동성이 증가할 수 있다(Glosten & Milgrom, 1985; Berkman & Koch, 2008). 공매도 금지가 가격효율성, 수익률분포, 유동성에 미친 영향은 공매도 금지로 인한 기관투자자 혹은 정보거래자의 감소, 개인투자자 혹은 무정보거래자의 증가에서 비롯된 결과일 수 있다.

<표 Ⅳ-6>의 (3)은 <표 Ⅳ-2>, <표 Ⅳ-3>, <표 Ⅳ-4>의 분석에 개인투자자 거래비중을 독립변수로 추가하여 분석한 결과이고, (4)는 <표 Ⅳ-5>의 분석에 개인투자자 거래비중을 독립변수로 추가하여 분석한 결과이다. <표 Ⅳ-2>~<표 Ⅳ-5>의 결과와 비교할 때, 공매도 금지기간 더미변수와 공매도 비중 또는 용이성 상위 더미변수의 교차변수의 유의성이 감소한 대신 개인투자자 거래비중의 계수가 통계적으로 유의한 경우가 다수 관찰된다. 특히, 공매도 금지 이후 변동성의 증가, 왜도, 첨도의 증가, 비유동성의 증가는 개인투자자 거래비중 증가와 관련된 결과일 가능성이 높다는 사실을 보여준다.

라. 공매도 부분재개 전후 실증분석

<표 Ⅳ-7>은 주요 분석변수의 공매도 부분재개 전후 변화를 공매도 재개종목(KOSPI200 및 KOSDAQ150 편입종목)과 비재개종목(KOSPI200 및 KOSDAQ150 비편입종목)으로 나누어 제시하고, 재개 전후의 차이와 그룹간 차이의 통계적 유의성을 검토하고 있다. 공매도 금지 전후에 관찰된 결과와 대칭적 관점에서, 공매도 재개 이후 가격효율성과 유동성이 개선되고 변동성이 감소하는지 확인한다. 가격효율성 지표의 경우 혼재된 결과를 보여주고 있다. 공매도 재개 이후 KOSPI200 및 KOSDAQ150 편입종목의 교차자기상관계수는 상대적으로 감소한 반면 초과수익률 자기상관계수와 분산비율은 오히려 상대적으로 증가한 것으로 나타난다. 변동성, 호가스프레드, 거래회전율의 경우 재개종목과 비재개종목 모두 감소한 것으로 나타나며, 극단적 수익률 발생빈도는 재개종목에서 상대적으로 크게 감소한 것으로 확인된다.

<표 Ⅳ-8>부터 <표 Ⅳ-10>은 공매도 부분재개 이후 공매도 재개종목과 비재개종목의 가격효율성, 수익률분포, 유동성 변화를 다중회귀분석으로 검토하고 있다. 분석결과는 <표 Ⅳ-7>의 결과와 대체로 유사하다. 먼저 <표 Ⅳ-8>의 가격효율성 지표의 경우, 공매도 재개종목은 초과수익률 자기상관계수와 분산비율이 공매도 재개 이후 오히려 증가한 것으로 나타난다. 반면 교차자기상관계수는 감소하는 것으로 나타나는데 시장수익률이 음(-)인 경우가 아닌 양(+)인 경우의 교차자기상관계수가 감소한 것으로 나타난다. 이러한 결과는 예상과 다른 결과로 그 이유를 명확히 파악하기 어렵다.

<표 Ⅳ-9>의 수익률 특성에 대한 분석결과에서는 공매도 재개 이후 변동성 감소와 극단적 수익률 발생빈도 감소가 확인된다. 수익률의 왜도와 첨도에는 유의한 변화가 확인되지 않는다. 마지막 <표 Ⅳ-10>의 유동성 지표에 대한 분석에서는 공매도 부분재개 이후 재개종목에서 거래회전율이 증가하는 동시에 호가스프레드도 증가하는 것으로 나타난다. 거래회전율 증가는 공매도 거래의 재개와, 호가스프레드 감소는 개인투자자의 비중이 감소하는 것과 연관된 결과로 추정된다. 공매도 재개에 따른 개인투자자의 거래비중 감소는 <표 Ⅳ-10>의 (4)에서 확인할 수 있다. 한편, (5), (6), (7)의 결과에 따르면 공매도 재개 이후 개인투자자 거래비중이 감소한 만큼 외국인투자자의 거래비중이 증가한 것으로 나타난다. 공매도 재개가 가격효율성에 미친 영향과 달리, 수익률 특성과 유동성에 미친 영향은 대체로 공매도 금지의 영향과 대칭적인 것으로 판단된다.

개별주식 선물의 거래 여부에 대한 더미변수를 추가적으로 활용한 <표 Ⅳ-11>의 (1)에 따르면 예상에 부합하는 결과가 일부 확인된다. 공매도 재개 이후 공매도 재개종목에서 극단적 수익률 발생빈도가 하락하는데, 개별주식 선물이 거래되는 경우 이 효과가 상쇄되는 것으로 나타난다. 또한 공매도 재개종목에서 나타나는 거래회전율 증가 효과도 개별주식 선물이 거래되는 종목에서는 그 효과가 상쇄되는 것을 확인할 수 있다.

한편, 앞서 <표 Ⅳ-8>의 가격효율성에 대한 분석에서 공매도 재개 이후 재개종목의 일부 가격효율성 지표(|ACi|와 VR)가 악화되는 결과가 확인되었다. 개별주식 선물 거래여부를 통제한 후 재개기간 더미와 지수편입 더미의 교차변수의 유의성이 하락하는 것으로 미루어 볼 때, 공매도 재개 이후 가격효율성의 악화는 개별주식 선물이 거래되는 종목에서 나타난 현상, 즉 공매도 재개에 의한 결과가 아닐 가능성이 있다.

<표 Ⅳ-11>의 (2)는 <표 Ⅳ-8>, <표 Ⅳ-9>, <표 Ⅳ-10>의 분석에서 개인투자자 거래비중을 독립변수로 추가한 분석이다. 종속변수가 변동성인 경우 공매도 재개기간 더미와 지수편입 더미의 교차변수의 계수의 유의성이 사라진다. 즉 공매도 재개 이후 재개종목의 변동성 감소는 개인투자자 거래비중 감소에 의해 나타난 결과임을 보여준다. 한편 개인투자자 거래비중의 계수는 대체로 직관에 부합하고 <표 Ⅳ-6>의 결과와도 유사하다.

공매도 금지 조치의 영향을 분석하는 경우, 공매도 거래비중 또는 공매도 용이성 상위 20% 주식의 시가총액 최소값을 하한선으로, 공매도 거래비중 또는 공매도 용이성 하위 80% 주식의 시가총액 최대값을 상한선으로 설정하고 시가총액이 이 범위 안에 포함되는 주식으로 표본을 제한하여 동일한 분석을 시행하였다. 공매도 부분재개 조치의 영향을 분석하는 경우에도 동일한 방법으로, 지수편입종목의 시가총액 최소값을 하한선으로, 지수비편입종목의 시가총액 최대값을 상한선으로 설정하고 시가총액이 이 범위 안에 포함되는 주식으로 표본을 제한하여 동일한 분석을 시행하였다. 공매도 금지 조치와 부분재개 조치에 대한 모든 분석에서 이상에서 보고한 결과와 유사한 결과가 확인된다. 다만 관심변수의 통계적 유의성은 소폭 하락한다.22)

한편, 공매도 금지 조치 전후에 대한 분석결과와 비교할 때 공매도 부분재개 조치 전후의 분석결과는 유의성이 다소 낮고 부분적으로 예상에 부합하지 않는 결과도 관찰된다. 그 원인으로 두 가지 가능성을 생각해 볼 수 있는데, 첫째, 공매도 금지에 따른 충격이 재개에 따른 충격보다 크기 때문일 수 있다. 공매도 거래비중 또는 용이성 상위종목의 공매도 금지 이전 공매도 거래비중은 지수편입종목의 공매도 재개 이후 공매도 거래비중에 비해 2배 이상 높은 것으로 확인된다. 따라서 공매도가 가격효율성, 변동성, 유동성에 영향을 미친다면 공매도 금지 조치에서 영향이 크게 나타날 가능성이 높다. 둘째, 시장조성자의 영향이다. 공매도 부분재개에도 불구하고 시장조성자의 공매도는 금지 이전 수준으로 회복되지 못했고 2021년 9월부터는 일부 시장조성자의 업무가 중단된 바 있다. 시장조성자가 가격효율성, 변동성, 유동성에 영향을 주는 요인이라면 공매도 재개조치의 긍정적 영향을 상쇄했을 가능성이 있다. 이에 대해서는 추가적인 연구가 요구된다.

2. 수익률에 대한 영향 분석

공매도 금지가 수익률에 미치는 영향에 대해서는 상반된 두 가지 시각이 존재한다. 전통적인 관점은, 공매도가 금지되면 부정적 견해를 갖는 투자자가 시장에서 사라지고 긍정적 견해를 갖는 투자자만 남게 되므로 주가의 과대평가가 일어날 수 있다는 주장이다(Miller, 1977). 따라서 공매도 금지는 양(+)의 초과수익률을 유발하며, 투자자 의견이 분산된 정도가 큰 주식에서 명확한 반응이 나타날 가능성이 높다. 반면, 공매도 금지로 인하여 유동성이 감소하고 가격효율성이 저하된다면 유동성 프리미엄과 가격불확실성 증가와 관련된 위험프리미엄이 증가하게 되어 오히려 주가가 하락한다는 견해도 존재한다(Bai et al., 2006; Nezafat et al., 2017). 이에 따르면 공매도 금지는 음(-)의 초과수익률을 유발하며 가격효율성 또는 유동성이 감소한 주식일수록 수익률 반응이 클 것으로 예상할 수 있다.

초과수익률 분석은 Carhart(1997)의 4요인 모형을 기초로 계산한 위험조정 초과수익률을 기준으로 한다. 4요인 모형은 시장요인, 기업규모, 장부가-시장가, 추세(momentum) 요인을 고려하는 모형으로 Fama & French(1992)의 3요인 모형에 추세요인을 추가한 모형이다.23) 시장수익률과 요인 포트폴리오 수익률에 대한 회귀계수 추정은 공매도 금지일 기준 -140일부터 -21일까지의 일간자료를 바탕으로 하며, 금융회사는 분석에서 제외한다.

분석을 위한 공매도 자료, 주가자료, 재무제표 자료는 DataGuide로부터 확보하였다. 분석대상은 SPAC을 제외한 유가증권시장과 코스닥시장의 상장기업 보통주로, 공매도 금지 전후 분석에 1,792개 기업, 공매도 부분재개 분석에 1,898개 종목이 포함된다.

가. 공매도 금지 전후 실증분석

초과수익률 반응은 공매도 금지의 기대영향 수준에 따라 주식을 분류하여 분석한다. 2장에서와 같이, 공매도 금지 이전 기간의 공매도 거래비중 또는 공매도 용이성(기관투자자 및 외국인 투자자 거래비중)에 따라 주식을 5개 그룹으로 분류한다.

<표 Ⅳ-12>는 공매도 금지일 기준 -5일부터 +60일까지의 기간별 누적초과수익률을 주식 그룹별로 제시하고 있다. -4일(3월 10일)에 규제당국의 공매도 규제강화 조치가 최초로 이루어졌고, 공매도 금지 결정은 공매도 금지 직전 거래일(3월 13일)에 이루어졌음을 고려하여 -5일부터 분석 대상으로 설정한다.

공매도 금지조치는 모든 종목에 대해 동일 시점에 시행되었으므로 종목별 초과수익률 사이에 상관관계가 존재할 가능성이 높다. 또한 금지조치가 주가뿐만 아니라 주가변동성을 증폭시켰을 가능성(event-induced volatility)도 존재한다. 평균 초과수익률의 통계적 유의성 검정에서 초과수익률간 상관관계와 변동성 변화를 간과할 경우 표준편차가 과소평가되어 평균 초과수익률이 0이라는 귀무가설이 과대기각(over-rejection)되는 문제가 발생한다. 이러한 문제를 극복하기 위해 Kolari & Pynnönen(2010)이 제시한 검정통계량(ADJ-BMP)을 이용하여 통계적 유의성을 평가한다.

패널A는 공매도 금지 이전 공매도 거래비중에 따라 주식을 5개 그룹으로 나누어 기간별 누적초과수익률을 비교하고 있다. CAR(a, b)는 공매도 금지일(t=0)을 기준으로 a일부터 b일까지 일간수익률을 누적한 값이며, 괄호 안의 값은 통계적 유의성 평가를 위해 산출한 평균 표준화(scaled) 초과수익률이다.24) 공매도 거래비중이 가장 큰 그룹(H)의 경우 단기 수익률 반응은 크지 않고 20일 및 60일 누적초과수익률이 통계적으로 유의한 양(+)의 값을 갖는다. 반면 공매도 거래비중이 가장 작은 그룹(L)의 경우에는 유의한 음(-)의 단기 수익률 반응이 관찰된다.25) 그 결과, 공매도 거래비중이 가장 큰 그룹(H)과 가장 작은 그룹(L)의 초과수익률 차이는 공매도 금지 -5일부터 +5일까지 단기 구간에서 유의한 양(+)의 값으로 나타난다. 즉, 공매도 거래비중이 컸던 종목일수록 공매도 금지조치 전후 단기간 동안 상대적으로 높은 수익률을 시현한다. 공매도 용이성을 기준으로 종목을 구분한 패널B의 결과는 패널A의 결과와 대체로 유사하다.

<표 Ⅳ-13>의 분석결과는 <표 Ⅳ-12>에서 확인한 결과와 대체로 일관된다. 공매도 금지 직전과 직후 (-5, +5)의 기간 사이에 단기적으로, 공매도 거래비중이 높은 주식일수록, 공매도가 용이한 주식일수록 초과수익률이 높게 나타난다.

<표 Ⅳ-14>는 공매도 금지가 초과수익률에 영향을 미치는 경로를 파악하기 위한 분석이다. 앞서 언급한 바와 같이, 기업가치에 대한 투자자의 견해차가 클 경우 공매도 금지는 과대평가를 유발할 수 있으며, 공매도 금지에 따른 유동성과 가격효율성 저하가 요구수익률 상승으로 이어진다면 공매도 금지는 주가하락 요인으로 작용할 수 있다.

투자자의 견해차는 수익률 변동성을 대리변수로 이용하며, 가격효율성은 교차자기상관계수와 극단적 수익률 발생빈도를, 유동성은 거래회전율과 비유동성 지표를 이용한다. 이들 변수와 공매도 변수의 교차변수를 이용하여 교차효과를 파악해 보도록 한다. 추가로, 공매도 잔고가 클수록 공매도 금지 후 상환수요가 매수압력으로 작용할 수 있다는 점을 고려하여 공매도 잔고규모를 독립변수로 포함한다. 종속변수는 CAR(0, 5)를 이용한다.

A와 B는 각각 공매도 거래비중과 공매도 용이성을 기준으로 분석한 결과이다. 교차변수의 계수 추정결과를 보면, A와 B에서 일관되게 유의한 결과를 찾아보기는 어렵다. 다만, 통계적으로 유의한 일부 결과는 예상에 부합한다. 공매도 금지 후 거래회전율 감소, 비유동성 척도의 증가는 공매도 비중이 높았던 종목의 초과수익률을 감소시키는 요인으로 나타나며, 높은 변동성 수준은 공매도가 용이한 종목의 초과수익률을 증가시키는 요인으로 분석된다. 한편 공매도 잔고는 모든 경우 통계적 유의성이 제한적이다.

나. 공매도 부분재개 전후 실증분석

공매도 재개는 KOSPI200과 KOSDAQ150 편입종목에 대해서만 이루어졌으므로, 초과수익률 분석은 지수편입 종목과 비편입 종목을 비교하는 방식으로 진행한다. <표 Ⅳ-15>는 공매도 재개일 기준 -5일부터 +60일까지의 기간별 누적초과수익률을 제시하고 있다.

지수편입종목의 경우 CAR(0, 1)이 음(-)의 값이나 통계적으로 유의하지 않으며, CAR(0, 5), CAR(0, 20), CAR(0, 60)은 유의하지 않은 양(+)의 값으로 나타난다. 지수편입종목과 비지수편입종목 누적초과수익률과의 차이는 KOSPI200, KOSDAQ150 편입종목 모두에서 (0, 1) 구간에서만 통계적으로 유의한 음(-)의 값을 보여준다. 공매도 재개는 부정적으로 평가되고 있으며, 다만 공매도 금지와 유사하게 단기적인 수익률 반응을 일으키는 것으로 확인된다.

<표 Ⅳ-16>은 지수편입 더미변수와 가격상승률, 시가총액, 장부가-시장가 비율, 섹터 더미변수를 독립변수로 이용한 다중회귀분석 결과이다. <표 IV-15>의 결과와는 다소 차이를 보이는데, KOSPI200 지수편입 또는 KOSDAQ150 지수편입 더미변수의 계수는 공통적으로 종속변수가 CAR(0, 5), CAR(0, 20), CAR(0, 60)일 때 통계적으로 유의한 양(+)의 값으로 추정된다. 공매도 재개가 저평가를 유발하는 것이 아니라 공매도 재개 이후 초과수익률이 관찰된다.

만약 공매도 금지가 주가의 체계적인 과대평가를 일으켰다면, 공매도 재개를 통해 과대평가를 해소하는 효과를 기대할 수 있다. 이를 검토하기 위해 공매도 금지기간의 과대평가 수준을 종목별로 평가하고, 과대평가 수준이 높을수록 공매도 재개 전후 음(-)의 초과수익률이 관찰되는지 확인한다.

과대평가 수준의 평가는 엄철준(2018)의 가격오류 측정방법을 이용한다. 엄철준(2018)은 개별주식의 초과수익률(무위험이자율 기준)을 다른 모든 주식 각각의 초과수익률에 대해 회귀분석하여 절편을 산출하고, 산출된 절편의 횡단면 중간값을 과대평가의 척도로 이용하였다. 이를 통해 한국 주식시장에서 과대평가 수준이 높을수록 기대수익률이 하락함을 실증적으로 확인하였다. 과대평가 수준의 측정은 공매도 재개일 기준 -70일부터 -11일까지 60거래일 수익률 자료를 이용한다.

<표 Ⅳ-17>은 과대평가 변수와 지수편입 더미변수의 교차변수를 이용한 다중회귀분석 결과이다.27) 먼저 과대평가 변수의 계수는 유의한 음(-)의 값으로, 과대평가 수준이 높은 주식은 초과수익률이 하락하는 추세를 보인다. 지수편입 더미변수와 교차변수의 계수는 CAR(-5, -1)에서만 유의성이 관찰되는데, KOSDAQ150에서는 유의한 음(-)의 값으로 예상에 부합하는 결과가 나타나는 반면 KOSPI200에서는 유의한 양(+)의 값으로 상반된 결과가 나타난다. 공매도 재개가 과대평가를 해소하는 효과가 있다고 보기에는 유의성과 일관성이 부족한 결과로 판단된다.

가격효율성 변수 중 교차자기상관계수에서는 유의한 결과가 나타나지 않으며, 극단적 수익률 발생빈도에서는 계수가 양(+)의 값으로 예상과 상반된 결과가 관찰된다. 유동성 변수에서는, 거래회전율이 상승할수록, 비유동성 지표가 감소할수록 초과수익률이 유의하게 증가하는 결과가 일부 확인된다. 투자자의 견해차를 대리하는 수익률 변동성의 계수는 CAR(-5, -1)에서 유의한 음(-)의 값으로 추정된다. 공매도 재개를 앞두고 부정적 전망이 반영되어 수익률이 하락하는 것으로 해석할 수 있다. 공매도 잔고증가의 경우, 공매도 재개 후 단기적으로(CAR(0, 1)) 초과수익률에 부정적 영향을 주는 요인으로 확인된다.

Ⅴ. 결론

본 고는 코로나19 팬데믹 전후의 주요한 공매도 제도변화를 점검하고, 공매도 전면금지와 부분재개 조치가 주식시장에 미친 영향을 실증적으로 검토하였다.

공매도 규제효과에 대한 실증분석 결과는 공매도에 대한 이론적 예측이나 기존 실증연구결과와 대체로 일관성을 가진다고 평가할 수 있다. 특히 전면금지의 경우 부정적 영향이 명확하게 관찰된다. 공매도 전면금지 이후 가격효율성이 저하되고, 변동성과 극단수익률 발생빈도가 증가하며, 거래회전율은 하락하는 것으로 나타난다. 공매도 전면금지에 따른 부정적 영향은 정보거래자의 감소뿐만 아니라 개인투자자 비중 증가와도 연관된 것으로 추정된다. 이러한 부정적 영향에도 불구하고, 공매도 금지조치에 대해서는 단기적으로 양(+)의 초과수익률이 관찰된다. 한편 공매도 재개의 영향은 대체로 전면금지와 대칭적으로 나타나나 결과의 유의성과 일관성은 다소 하락한다. 공매도 재개에 대해서는 단기적으로 음(-)의 초과수익률이 관찰된다.

실증분석의 결과는 공매도 규제는 공매도의 경제적 역할을 충분히 고려해서 설계될 필요가 있음을 시사한다. 개인투자자들이 가지고 있는 부정적인 인식과 달리 공매도는 가격발견에 기여하고 유동성을 공급하는 역할을 수행한다. 공매도의 순기능을 부인하기 어렵다면 전면금지와 같은 극단적인 접근방식보다는 그 기능은 유지하되 부작용을 최소화시키는 방향으로 공매도 규제를 운용할 필요가 있을 것이다.

2021년 5월에 공매도가 부분재개된 이후에도 개인투자자들을 중심으로 공매도 전면금지에 대한 요구가 이어지고 있다. 공매도가 다시 전면금지될지 모른다는 제도적 불확실성은 공매도 거래자들의 거래유인을 저하시키는 요소로 작용할 수 있다. 시장조성자들의 공매도 거래가 축소되어 있는 것도 유사한 맥락이다. 공매도 전면금지 기간동안 예외적으로 허용되었던 공매도 거래에 대한 비난 여론에 시장조성자의 불공정거래에 대한 논란까지 겹치면서 여파는 공매도 재개 이후까지 이어지고 있다. 공매도가 부분재개되었음에도 공매도가 위축되고 공매도의 순기능 역시 제한되고 있는 것이다.

코로나19 팬데믹 위기상황에서 시장을 안정화시키기 위해 공매도를 금지한 조치는 시장의 공감대를 충분히 얻을 수 있는 정책적 판단으로 볼 수 있다. 공매도 관련 불법행위에 대한 처벌강화와 대차거래에 대한 정보관리 강화의무의 부여 등 역시 적절한 규제방향이라 평가할 수 있을 것이다. 그러나 주식시장이 위기상황에서 벗어났음에도 일부 종목에 대해서만 공매도를 재개하고 또한 규제적 불확실성이 공매도 재개의 효과를 반감시키는 상황은 바람직하다고 보기 어렵다.

공매도 관련 규정을 위반할 가능성 또는 공매도가 불공정 거래행위에 연루될 가능성을 부인할 수 없다. 그러나 공매도의 경제적 기능을 고려할 때 이를 이유로 공매도 전면금지와 같은 강력한 규제수단을 빈번하게 활용하는 것은 신중하게 접근할 필요가 있다. 해외의 많은 주식시장들이 코로나19 팬데믹 상황에서도 공매도에 대한 금지조치를 단행하지 않았던 것은 다수의 실증분석을 통해 공매도의 경제적 기능이 확인되고, 그러한 기능이 위기상황에서도 오히려 더 긴요할 수 있다는 판단에 따른 것이라고 볼 수 있다.

공매도 관련 규정위반과 불공정 거래행위에 대한 적발 및 처벌을 강화하고, 개인투자자들에 대한 접근성을 꾸준히 개선해가는 것은 향후 공매도 제도개선에 있어서 중요한 방향성이 될 수 있을 것이다. 불공정 거래행위에 대한 처벌기준은 이미 상당히 강화되었으니, 적발과 처벌이 실효적으로 이루어질 수 있도록 시장에 대한 모니터링을 지속적으로 강화해야 할 것이다. 주식 대차거래의 전산화를 촉진하고 궁극적으로는 대차거래 전용플랫폼에서의 계약체결을 의무화하는 방안을 마련할 필요성도 크다. 이는 무차입공매도를 차단하는 가장 중요한 기반이 될 수 있다. 금융회사의 공매도 및 대차거래에 관한 내부통제시스템을 개선하고 전산화 수준을 높임으로써 무차입공매도의 발생가능성을 최소화시키는 노력도 중요하다. 추가적으로 개인투자자들에 대한 대주거래 서비스 개선을 위해 대주풀(pool)을 확대하려는 노력과 대주거래조건을 합리적인 수준으로 개선해 나가는 노력도 중요한 의미를 가질 것이다. 공매도의 경제적 기능을 인정하면서 합리적인 시장구조 구축을 위한 제도적 환경정비를 통해 공매도에 대한 시장의 신뢰를 확보해 나가야 할 것이다.

1) 자본시장법 제180조(공매도의 제한) 제1항 제1호 및 제2호

2) 자본시장법 제180조(공매도의 제한) 제2항

3) 자본시장법 제180조(공매도의 제한) 제3항

4) 금융위원회(보도자료, 2021. 4. 29)

5) 금융위원회(보도자료, 2013. 11. 13)

6) 기존에 공매도 거래의 투명성을 강화하기 위한 국제적 논의를 수용하여 2012년 8월 대량 공매도 포지션 보고제도를 도입한 바 있다(금융위원회 보도자료, 2012. 3. 12). 그러나 공매도 잔고정보가 공개되지는 않았기 때문에 투기적 공매도를 억제하는 효과가 충분하지 않다는 지적이 있었다.

7) 자본시장법 제180조의2(순보유잔고의 보고) & 제180조의3(순보유잔고의 공시), 동법 시행령 제208조의2(순보유잔고의 보고) & 제208조의3(순보유잔고의 공시)

8) 금융위원회(보도자료, 2016. 11. 10)

9) 한국거래소 유가증권시장 업무규정 제17조(공매도호가의 제한), 유가증권시장 업무규정 시행세칙 제24조의3(차입공매도 호가의 제한), 한국거래소 코스닥시장 업무규정 제9조의2(공매도호가의 제한), 코스닥시장 업무규정 시행세칙 제8조의5(차입공매도 호가의 제한) 등

10) 금융위원회(보도자료 및 별첨자료, 2022. 7. 28)

11) 자본시장법 제443조(벌칙) 제1항 제10호

12) 자본시장법 제429조의3(위법한 공매도에 대한 과징금) 제1항