Find out more about our latest publications

The Role of Reverse Mortgages in Private Pension Income

Issue Papers 23-11 Jun. 07, 2023

- Research Topic Asset Management/Pension

- Page 25

If the primary objective of public pension reform is financial stabilization, it naturally raises concerns about adequate retirement income. In practice, householders aged 60 or older, who are more likely to have already retired, often receive retirement benefits that are insufficient to serve as their primary source of income. This could lead to a serious decline in income even if a significant proportion of the elderly continues working in low-paying jobs in their late 60s. Conversely, they are less likely to see a decrease in the value of their illiquid assets, primarily consisting of real estate. As a result, most households may see their spending power decreasing rapidly, often leading to a decline in their overall standard of living. Those in their 50s are highly likely to face the same situation going forward as their asset portfolio is quite similar to that of householders aged 60 and over.

This report examined households led by those in their 50s and 60s as of 2020. We estimated their annual income, personal pension assets, net financial assets, and net housing assets when they turn the age of 60 right before the retirement, and analyzed whether each of the four types of assets is large enough to buy a plan that could replace 20% of their pre-retirement income. According to our analysis, only 0.2% to 0.4% of the examined households were able to attain a 20% income replacement rate through their personal pension assets. These findings held true even when the sources of income were expanded to include net financial assets. Nearly 94.3% of the households examined fell short of the 20% target when relying on their net financial assets, with an average income replacement level of only 3.5% to 4.1%. Nevertheless, a substantial improvement was observed when reverse mortgages on their own home were included. The households eligible for reverse mortgage could replace 16% to 18% of their income with their real estate assets, and the figure rose to around 20% if net financial assets were included. With reverse mortgage and net financial assets, the percentage of households that could achieve the 20% target jumped to 35% to 48%, depending on their income levels. Such high levels of income replacement are quite significant as those were achieved after housing and debt issues were settled.

Given the social value of housing pension, it is essential to implement further regulatory enhancements to attract a larger pool of prospective buyers. Additionally, it is important to assess whether an adequate number of accounts are available for public guarantees, especially as an increasing number of retirees may consider turning to reverse mortgages. Lastly, the present moment is an opportune time to devise additional strategies for establishing and promoting a private market for reverse mortgages, free from public guarantees.

This report examined households led by those in their 50s and 60s as of 2020. We estimated their annual income, personal pension assets, net financial assets, and net housing assets when they turn the age of 60 right before the retirement, and analyzed whether each of the four types of assets is large enough to buy a plan that could replace 20% of their pre-retirement income. According to our analysis, only 0.2% to 0.4% of the examined households were able to attain a 20% income replacement rate through their personal pension assets. These findings held true even when the sources of income were expanded to include net financial assets. Nearly 94.3% of the households examined fell short of the 20% target when relying on their net financial assets, with an average income replacement level of only 3.5% to 4.1%. Nevertheless, a substantial improvement was observed when reverse mortgages on their own home were included. The households eligible for reverse mortgage could replace 16% to 18% of their income with their real estate assets, and the figure rose to around 20% if net financial assets were included. With reverse mortgage and net financial assets, the percentage of households that could achieve the 20% target jumped to 35% to 48%, depending on their income levels. Such high levels of income replacement are quite significant as those were achieved after housing and debt issues were settled.

Given the social value of housing pension, it is essential to implement further regulatory enhancements to attract a larger pool of prospective buyers. Additionally, it is important to assess whether an adequate number of accounts are available for public guarantees, especially as an increasing number of retirees may consider turning to reverse mortgages. Lastly, the present moment is an opportune time to devise additional strategies for establishing and promoting a private market for reverse mortgages, free from public guarantees.

Ⅰ. 논의배경

OECD는 안정적인 노후생활을 위해 퇴직직전 소득 대비 약 70% 수준의 연금소득이 필요하다고 권유한다. 하지만 우리나라 퇴직자들은 국민연금과 퇴직연금을 합산해도 이 수준의 소득대체율을 확보하지 못하고 있다(강성호, 2017; 이태열 외, 2014). 더구나 최근 논의되고 있는 공적연금개혁의 일차적인 목표가 재정안정화에 있다면, 연금소득의 충분성에 대한 우려는 커질 수밖에 없다. 이에 따라 개인들이 사회생활 초반부터 국민연금과 퇴직연금 이외의 사적연금재원을 적립해 나가도록 유도하는 것이 중요한 과제 중 하나로 지적된다.1) 그러나 우리나라 가계의 자산은 비유동성 자산인 부동산에 쏠려있고(정화영, 2022), 그 과정에서 누적된 부채의 원리금상환 등으로 인해 금융자산을 충분히 적립할 여유가 없다. 사적연금재원 적립의 중요성은 누구나 잘 알고 있지만, 제한된 소득 여건하에서는 충분한 재원을 적립하기 쉽지 않다.

이 보고서에서는 50대 가구가2) 퇴직직전 시점에 사적연금으로 활용할 수 있는 재원의 적립규모를 추정하고, 이를 연금화할 경우의 소득대체율 수준을 알아본다.3) 50대 가구가 국민연금과 퇴직연금 이외의 재원으로 확보해야 하는 사적연금의 소득대체율을 20%라고 전제하고, 각각의 사적연금재원으로 이를 달성할 수 있는 가구가 얼마나 되는지 분석한다.4) 개인연금 및 순금융자산으로 소득대체율 20%에 해당하는 연금소득을 마련할 수 있는 가구를 식별한 후, 금융자산 적립액 전체를 활용해도 소득대체율 20%를 확보할 수 없는 가구의 경우 주택연금으로 이를 채울 수 있는지 분석한다.

이 보고서에서 50대 가구를 분석대상으로 한 이유는 다음과 같다. 첫째, 퇴직직전인 60세 시점의 소득, 개인연금 및 순금융자산 적립액과 보유주택 평가액을 추정해야 하는데, 이를 위해서는 가정이 필요하다. 추정기간이 길어질수록 가정의 적합성이 낮아지므로 30~40대를 분석대상에 포함하는 것은 무의미하다고 보았다. 둘째, 50대는 전체 인구에서 차지하는 비중이 높다. 따라서 이들의 안정적인 퇴직준비 여부는 향후 경제에 지대한 영향을 미칠 것이다. 셋째, 이미 주직업에서 퇴직했을 것으로 추정되는 60대와 달리 50대는 여전히 주직업에 종사하고 있을 가능성이 크다. 즉, 이들은 사적연금재원 적립의 중요성이 높은 연령층이다.

이 보고서에서는 조세재정연구원이 매년 조사해 발표하는「재정패널」자료를 이용하여 분석한다.5) 이 자료를 이용함으로써 다른 연구 대비 다음과 같은 차별화가 가능하다. 먼저, 이 자료에는 대표적인 가계패널 데이터인 통계청의 「가계금융복지조사」와 달리 조사대상 가구의 세제적격·세제비적격 개인연금 보유여부뿐만 아니라 보유금액도 명시적으로 조사되고 있다. 또한 패널 유지율이 상대적으로 높아서 분석대상 가구의 과거 데이터도 활용할 수 있다. 이는 퇴직직전 시점의 소득, 개인연금 및 순금융자산의 적립액을 추정하는데 있어서 개별가구의 과거경로를 활용할 수 있는 장점을 제공한다.

보고서의 구성은 다음과 같다. 2장에서는 퇴직 이후 가구의 소비와 소득구조를 살펴본다. 3장과 4장에서는 2020년 기준 50대 가구의 개인연금, 순금융자산, 순주택자산을 활용한 사적연금의 소득대체율을 추정하고, 분포의 특징을 분석한다. 5장에서는 분석의 정책적 함의를 논의한다.

Ⅱ. 퇴직가계의 소득 변화 및 연금 공백

본 장에서는 60대 이후 가구를 중심으로 퇴직가계의 소득 변화와 그에 따른 영향을 알아본다. 전술한 바와 같이 이 보고서에서는 분석을 위해 소득 및 소비, 자산 및 부채 등 사용한 모든 변수를 가구 기준으로 측정했다. 그리고 일부 변수의 포괄범위와 정의는 보고서의 목적에 부합하도록 원자료와 다르게 설정했다.6)

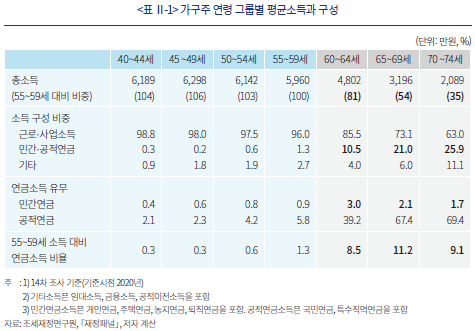

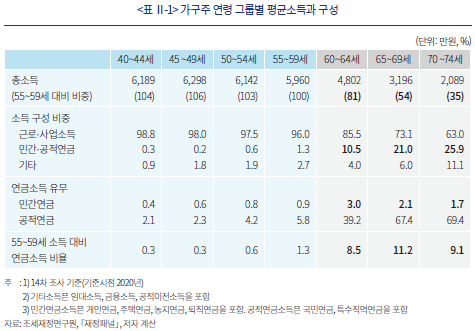

우리나라 가계의 평균소득은 가구주 연령 45~49세를 정점으로 떨어지기 시작한다. 60세를 넘어서면서 소득 하락이 본격화되기 시작하는데, 60~64세, 65~69세 연령대의 평균 총소득은 55~59세 연령대 평균 총소득 대비 각각 81%, 54%에 그친다. 총소득이 크게 떨어지는 가운데 60대까지는 근로 및 사업소득이 총소득에서 차지하는 비중이 높은 편이다. 고령에 접어들었음에도 불구하고, 노동시장에서 완전히 은퇴하지 못하고 근로와 사업을 계속하는 이유는 노후소득의 핵심을 차지해야 할 연금소득이 부족하기 때문이다. 민간연금과 공적연금을 합산해도 60대 총소득에서 차지하는 연금소득의 비중은 10~20% 수준에 불과하다. 60대 가구의 연금소득을 퇴직직전 연령대인 55~59세 연령대 가구의 총소득과 비교해보면 그 비율은 8~11% 내외에 그친다. 낮은 수준의 연금소득은 그나마 전적으로 공적연금으로부터 나온다. 민간연금소득이 발생하는 가구의 비중은 60~64세 연령대에서 3.0%, 65~69세에서 2.1%에 불과하다.

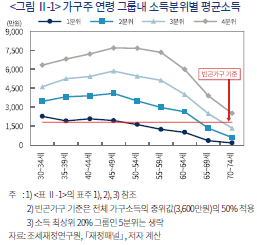

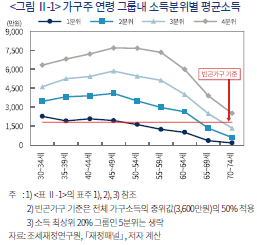

퇴직 후 총소득이 급격하게 줄어들어 경제적 어려움을 겪을 수 있는 계층은 소득 최상위 20%인 5분위 가구를 제외한 나머지 모든 소득 그룹이다. 소득 1분위 그룹의 평균 가구소득은 이미 50대부터 빈곤가구 기준 이하로 떨어진다. 소득 2분위~4분위 그룹에 속하는 가구의 평균소득도 65세 이후부터 차례로 이 기준 아래로 내려간다. 현재의 소득으로는 최상위 20% 가구를 제외한 나머지 대다수 가구가 노후에 기본생활 영위조차도 쉽지 않다는 의미이다.

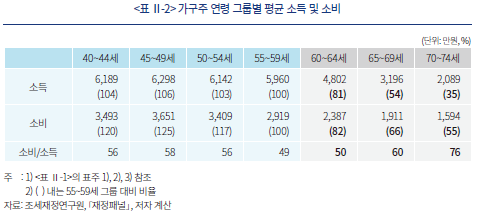

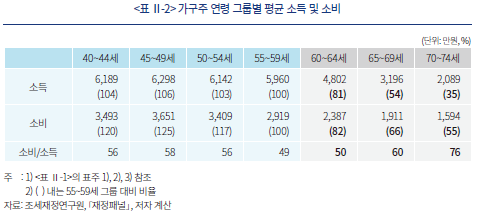

소득의 하락은 소비의 하락을 동반한다. 소비는 60세를 넘어서기 시작하면 55~59세 연령대 가구 소비의 82% 수준으로 떨어진다. 이 비율은 5년 단위로 더 크게 떨어져, 70~74세에는 55%에 그친다. 다만, 소비는 소득 대비 하락 폭이 작다. 소비에는 더 이상 줄이기 힘든 필수소비가 포함되기 때문이다. 소득 대비 소비의 비율은 60세부터 올라가기 시작하는데, 이는 소비규모가 커지기 때문이 아니라 소득의 하락 폭이 더 커서 나타나는 현상이다. 결국 많은 가계가 퇴직 이후 시간이 지나면서 소득이 크게 떨어지면, 필수소비를 제외한 대부분의 소비를 줄임으로써 삶의 질 하락을 피하기 어려운 구조라 볼 수 있겠다.

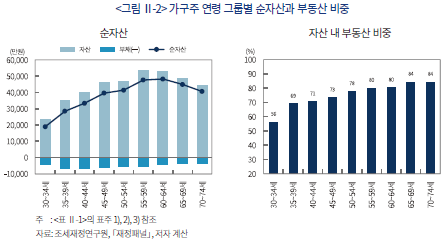

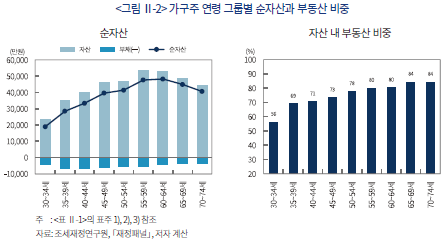

가계 소득은 60대 이후 큰 폭으로 떨어지지만, 순자산의 하락 폭은 크지 않다. 60~64세 그룹의 순자산은 55~59세 연령대의 순자산에 비해 오히려 늘어난다. 이후 연령이 올라감에 따라 순자산이 조금씩 줄어들긴 하지만, 74세까지는 평균적으로 크게 감소하지 않는다. 문제는 이들이 보유하고 있는 자산의 대부분이 비유동성 자산인 부동산이라는 점이다. 부동산이 가구 자산에서 차지하는 비중은 65~74세 연령대에서 84%까지 높아진다.

이상의 분석을 통해 60대 이후 가구의 소득, 소비 활동을 다음과 같이 정리해 볼 수 있다. 주직업에서 퇴직한 가구는 소득 하락의 충격을 줄이기 위해 소득이 낮더라도 근로와 사업을 계속한다. 이들이 퇴직후에도 근로와 사업을 지속하는 이유 중 하나는 연금소득이 부족하기 때문이다. 60대 중후반을 넘어서서 소득이 더 크게 줄어들면, 소비를 큰 폭으로 줄인다. 부족한 소득은 규모가 크지 않은 금융자산을 처분해 충당한다. 삶의 질이 떨어지지만, 주택보유는 포기하지 않는다.7)

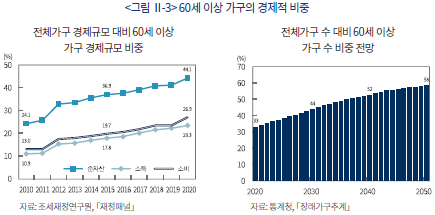

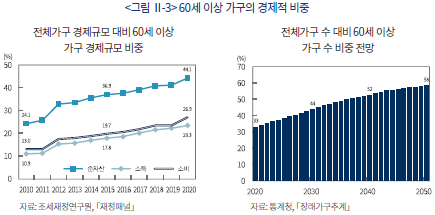

주택보유에 대한 높은 선호로 현재 대부분 연령대에서 자산구성의 부동산 쏠림이 발견된다. 자산구성에 극적인 변화가 나타나거나, 비유동성 자산의 유동화가 진전되지 않는다면, 전술한 60대 이후 가구의 소득, 소비 활동 패턴이 현재의 50대 세대에서도 이어질 가능성이 크다. 전체 인구에서 차지하는 퇴직 세대의 경제적 비중은 갈수록 커질 것으로 전망된다. 따라서, 현재의 50대 세대가 퇴직 후에도 비유동성 자산을 보유한 채, 소득 부족으로 소비를 줄이면 이들의 삶의 질 저하와 경제 전체의 비효율성 문제가 더 심화될 것이다.

Ⅲ. 퇴직직전 가계의 금융자산 적립과 사적연금소득8)

본 장에서는 2020년 기준 50대(가구주 연령 50~60세) 가구가 퇴직직전인 60세에 도달할 시점에서의 소득, 개인연금 및 순금융자산 적립액 등 주요변수를 추정한다.9) 이어서 적립된 개인연금 및 순금융자산을 통해 확보할 수 있는 연간 연금소득의 소득대체율을 개별가구 단위로 추정하고, 그 분포를 분석한다.

1. 분석 방법

추정을 위해 두 가지 중요한 가정을 전제한다. 첫째, 저축은 소득에 의해 결정된다. 둘째, 소득, 개인연금 및 순금융자산 적립액 등 주요변수는 동일한 소득군의 앞선 세대 증가 패턴을 따른다. 개략적인 추정방법은 다음과 같다. 먼저 재정패널 조사가구에 대하여 각 연령별로 소득분위를 다섯 개로 구분한 후, 각 1세 단위로 분위별 소득, 개인연금 및 순금융자산 적립액의 평균을 계산한다. 다음으로 각 연령 소득그룹별로 해당 변수의 최근 10년 평균 증가율을 산출한다. 마지막으로 2020년 기준 50~60세 가구를 각 연령별 소득분위로 구분한 후, 앞에서 산출한 해당 그룹 평균 증가율을 적용하여 60세 도달시 변수값을 추정한다.10)

이렇게 추정한 60세 시점의 개인연금 및 순금융자산 적립액으로 확정기간 연금을 구입하는데, 매년 동일한 현재가치의 연금을 수급하는 것으로 가정한다. 기대수명을 85세로 가정해 수급기간을 25년으로 설정하였으며, 연금자산 운용수익률과 할인율은 동일한 2.5%를 적용하였다.11) 소득대체율은 추정된 연간연금소득을 퇴직직전인 60세 시점의 연간소득으로 나눈 값으로 정의한다. 소득대체율 해석상의 왜곡을 피하기 위해 소득기준으로는 개별가구소득과 중위가구소득을 동시에 고려하였다.12)

2. 개인연금의 소득대체율

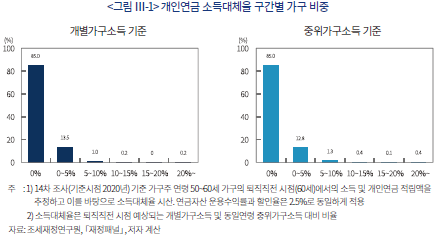

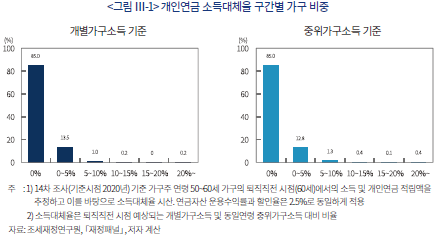

위와 같은 과정을 통해 추정한 결과는 다음과 같다. 우선, 개인연금의 소득대체율이 가계 전반에 걸쳐 매우 낮았다. 개인연금 소득대체율 구간별 가구 비중을 보면, 분석대상 가구의 85%가 개인연금을 보유하지 않아서 연금소득이 없었다. 개인연금을 보유한 가구도 대부분 소득대체율 5% 미만이었다. 개인연금 미보유가구와 소득대체율 5% 미만 가구가 전체 분석대상의 98%에 달한다. 개인연금으로 소득대체율 20% 이상을 달성할 수 있는 가구는 소득기준에 따라 전체의 0.2~0.4% 수준에 그쳤다.

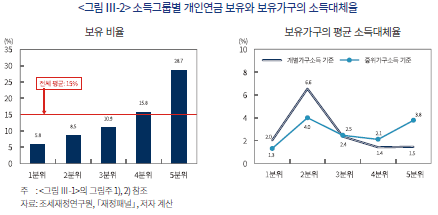

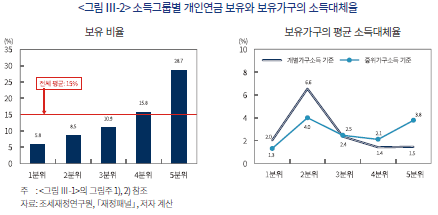

<그림 Ⅲ-2>에 따르면, 소득이 높은 그룹일수록 개인연금을 보유한 가구 비중이 높았다. 다만 평균적인 보유 비율인 15%에 비해 유의미할 정도로 보유가구 비중이 높아지는 소득그룹은 최상위 가구인 5분위 가구밖에 없었다. 이 그룹에서의 개인연금 보유가구 비중은 약 29% 수준이다. 전술한 바와 같이 개인연금 보유가구의 소득대체율이 매우 낮은 수준이었는데, 고소득 그룹에서도 큰 차이가 없었다. 개인연금을 보유한 5분위 소득그룹의 평균 소득대체율은 개별가구소득 기준으로는 1.5%, 중위가구소득 기준으로는 3.8%에 그쳤다.

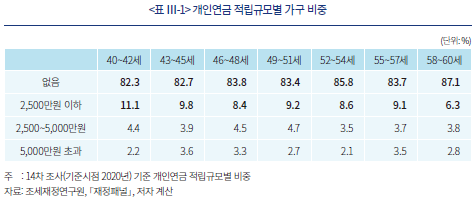

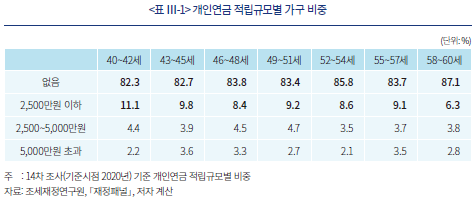

이와 같이 개인연금 소득대체율이 거의 무의미한 수준에 불과한 것은 가계 전반에 걸쳐 개인연금 가입률이 낮고, 적립금액도 크지 않은데 기인한다. <표 Ⅲ-1>은 2020년 기준 가구주 연령 그룹에 따라 개인연금 미보유율과 보유가구의 적립규모 분포를 보여준다. 40~60세 가구 전반에 걸쳐 개인연금 미보유가구 비중이 80%를 상회하는 가운데 60세에 가까워지면 미보유 비중이 더 올라간다. 보유가구 중에서도 2천5백만원 이하 적립 가구가 거의 전연령대에서 절반을 넘는다. 이러한 결과들을 통해 볼 때 퇴직직전 가계가 개인연금을 활용해 창출해낼 수 있는 현금흐름은 매우 제한적인 수준임을 확인할 수 있다.

3. 순금융자산의 소득대체율

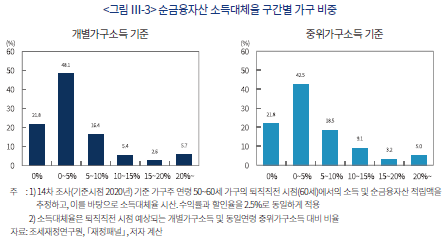

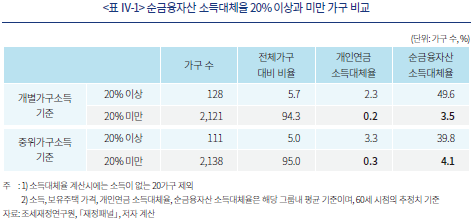

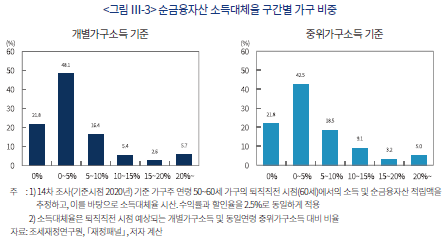

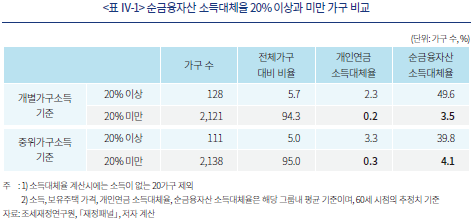

그렇다면 사적연금소득 재원의 범위를 개인연금을 포함한 금융자산으로 확장하면 소득대체율이 올라갈 수 있을까? <그림 Ⅲ-3>에는 순금융자산 소득대체율 구간별 가구 비중이 정리되어 있다. 순금융자산 소득대체율은 개인연금 대비 가계 전반에 걸쳐 다소 올라간다. 그러나 여전히 대부분 가계의 소득대체율이 20%에 미치지 못한다. 소득대체율이 20%를 상회하는 가구 비중은 소득기준에 따라 5.7%, 5.0%에 그쳤다. 순금융자산은 자산으로부터 부채를 차감한 금액이기 때문에 적립액이 없는 가구도 22%나 된다. 이에 따라 순금융자산 소득대체율이 5% 미만인 가구의 비중이 60%를 넘는다.

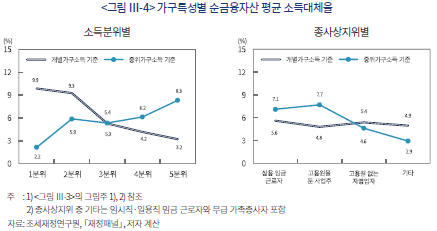

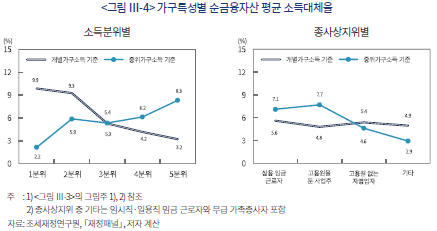

가구특성별로 나누어 분석해도 큰 흐름에는 변화가 없다. <그림 Ⅲ-4>에 의하면 소득이 높은 그룹일수록 대체로 중위가구소득 기준 평균 소득대체율이 높게 나타난다.13) 종사상지위별로는 상용 임금 근로자와 고용원을 둔 사업주 그룹의 순금융자산 소득대체율이 상대적으로 높았다. 그러나 각 그룹 전반에 걸쳐 소득대체율이 20%를 크게 밑돈다.

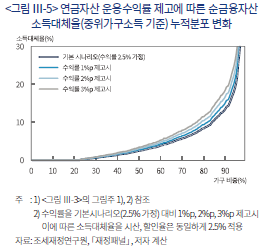

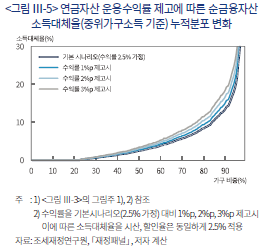

한편, 60세 시점까지 적립된 순금융자산으로 연금을 구입할 때 연금자산 운용수익률을 제고하더라도 가계 전반에 걸쳐 소득대체율이 높아지는 정도는 제한적인 수준에 그친다. <그림 Ⅲ-5>는 기본 시나리오(수익률 2.5% 가정) 대비 연금자산 운용수익률이 1%p, 2%p, 3%p 제고되는 경우의 소득대체율 누적분포 변화를 나타낸다. 연금자산 운용수익률이 5.5%까지 높아지더라도 소득대체율이 20%를 넘어서는 가구의 비중은 8% 내외에 그친다. 연금수급 기간인 25년간 매년 5.5% 수준의 수익률을 꾸준히 올리기도 어려울 뿐만 아니라, 그 효과도 미미한 것이다. 이는 전술한 바와 같이 주택보유 욕구로 인해 금융자산의 적립규모가 부족한데다, 부채 차감으로 연금 재원규모가 적은 데 기인한다.

다만 퇴직시점까지의 기간이 상대적으로 긴 50대 초반 가구의 경우, 순금융자산의 적립규모를 본 보고서의 기본 가정보다 높은 수준으로 올릴 수 있다면 소득대체율이 다소 개선될 수 있을 것이다. 그러나 이 역시 현실적으로 실현 가능성이 매우 낮을 것으로 판단된다. 소득이 크게 증가하거나, 금융자산 위주로 자산구성을 변경하거나, 금융자산 수익률을 대폭 올릴 경우 등을 생각해 볼 수 있는데 그 가능성은 크지 않다.

Ⅳ. 주택연금 활용을 통한 사적연금소득 보완

3장에서는 개인연금을 포함한 금융자산 적립금으로 충분한 소득대체율을 확보할 수 있는 가계가 극히 일부에 불과하다는 사실을 보았다. 4장에서는 순금융자산 적립액을 통해 퇴직직전 소득 대비 20% 수준의 연금소득을 확보하지 못한 가구가 주택연금을 활용할 때 충당할 수 있는 추가적인 연금소득 수준을 알아본다.

1. 주택연금 개요 및 현황

주택연금은 가입자가 보유주택을 매각하지 않고 거주하면서, 이를 담보로 연금을 제공받는 것을 의미한다. 우리나라의 주택연금은 한국주택금융공사가 공적인 보증을 제공하는 방식이 대부분이다. 공사가 저당권을 설정하면 주택연금을 취급하는 금융기관은 채무자인 가입자에게 연금 형태의 대출을 공급한다. 이 과정에서 공사는 금융기관에게 보증을 제공한다. 즉, 한국주택금융공사가 주택가격의 하락 위험을 부담한다. 물론 보증 보험료는 가입자들이 납부한다. 만약 주택가격이 예상보다 더 높게 상승해 정산 시점에 주택평가 가치가 남아있으면, 가입자들이 이를 돌려받는다. 즉, 주택가격 상방 변동성에 따른 혜택은 가입자들이 확보한다. 또한 금융기관이 파산하더라도 한국주택금융공사가 연금을 지급한다. 이처럼 공적인 보증이 제공됨에 따라 가입 대상자를 제한하고 있다. 만55세 이상, 공시가격 9억원 이하(시가 12억원 이하)의 주택을 소유한 자와 그 배우자가 가입대상자이며, 대상주택에 거주하고 있어야 한다. 다주택자도 보유주택의 공시가격 총액이 9억원 이하일 경우 가입이 가능하다. 가입자들은 연금의 지급방식(종신, 확정 등), 지급기간, 지급유형(정액형, 증가형 등)을 다양하게 선택할 수 있다.14)

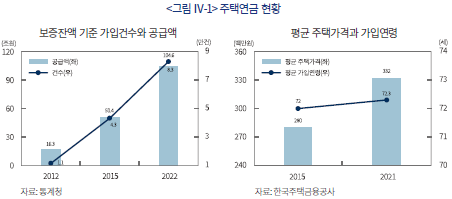

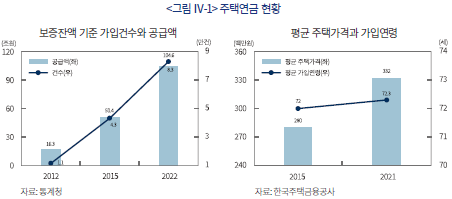

우리나라의 주택연금은 지난 2007년에 첫 출시되었으며, 출시 이후 가입건수와 보증금액이 꾸준히 늘어나고 있다. 2012년 이후 10년간 가입건수는 7.3배, 보증금액은 6.4배 늘어났다. 2021년을 기준으로 할 때 담보주택의 평균가격은 3억 3,200만원이며, 가입자 평균연령은 72.3세이다. 가입자는 늘어나고 있으나 주택은 여전히 노후소득의 보편적인 수단으로 활용되지 못하고 있다. 2022년 보증잔액 기준 주택연금 가입건수는 8.3만건이다. 2020년 기준 가구주 연령 55세 이상이 약 935만 가구임을 고려해 볼 때 55세 이상 전체 가구의 주택연금 가입률은 약 0.89%에 불과하다.15) 가입자의 담보주택 평균가격이 3억원을 약간 넘는데, 이는 주택연금 가입이 가능한 주택가격 상한선에 훨씬 미치지 못한다. 55세가 넘으면 주택연금 가입이 가능함에도 불구하고, 가입할 당시의 평균 연령이 70세가 넘는다는 통계는 퇴직 후 상당한 시간이 흘러야 주택연금에 가입한다는 사실을 보여준다. 주택연금의 경제적·재무적 가치가 우수하다는 다수의 연구결과에 비추어 볼 때 현재의 주택연금 활용도는 매우 미미하다.16)

2. 주택연금의 소득대체율

여기에서는 순금융자산을 통해 20%의 소득대체율을 확보하지 못한 50~60세 가구가 보유주택을 유동화할 경우 추가 연금을 얼마나 확보할 수 있는지 추정하고, 그 결과를 분석한다. 이를 위해 분석대상인 50대 가구 중 2020년 기준 주택보유가구를 분류하고, 해당 주택의 순주택자산을 계산하였다.17) 그리고 2020년 기준 50대 가구가 보유한 순주택자산의 평가액은 60세 시점까지 과거 주택가격 상승률만큼 오르는 것으로 가정하였다. 과거 주택가격 상승률은 2011~2020년 중 한국부동산원의 주택매매가격지수 평균 증가율을 적용하였다.

이어서 순금융자산으로 소득대체율 20%를 채우지 못한 가구를 식별한다. 가구주 연령 50~60세 전체 분석대상은 2,249가구인데, 이들 중 94.3%에 해당하는 2,121가구의 순금융자산 소득대체율이 20% 미만이었다. 이들의 개인연금 및 순금융자산 소득대체율은 평균 0.2%, 3.5%에 불과하였다. 이는 거의 노후소득으로 기능하지 못하는 수준이다. 반면 순금융자산 소득대체율이 20%를 초과하는 5.7%의 가구는 평균 49% 이상의 소득대체율을 확보하였다(<표 Ⅳ-1>).

순금융자산 소득대체율 20% 미만 가구 중 무주택가구, 보유주택 합산 평가액 12억원 초과 가구를 제외한 가구가 주택연금 가입대상이 된다. 그리고 이들 중 부채의 영향으로 인해 순주택자산이 0이거나 음수인 경우를 제외한 가구가 최종적으로 주택연금 수령가능 가구가 된다. 앞에서 추정한 50대 분석대상 가구의 60세 시점 순주택자산 평가액이 주택연금 계산을 위한 재원이다.18)

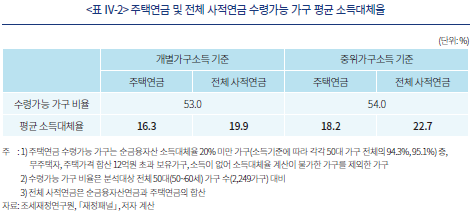

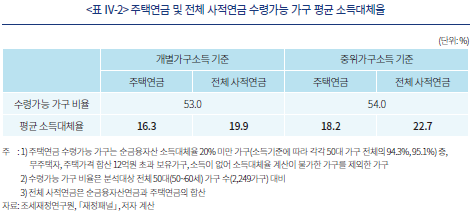

추정치의 기본통계는 주택자산의 연금소득 창출 수준이 낮지 않음을 보여준다. <표 Ⅳ-2>에 따르면, 주택연금 수령가능 가구 전체의 평균 소득대체율은 소득기준에 따라 16.3%에서 18.2% 수준에 이른다. 이들의 순금융자산 연금을 합산해 사적연금 전체의 소득대체율을 계산하면, 그 수치는 19.9~22.7%에 달한다. 주택연금 수령가능 가구 전체의 평균적인 수준으로 놓고 볼 때 보고서 서두에 전제로 했던 ‘국민연금 및 퇴직연금을 제외한 사적연금소득으로 소득대체율 20% 확보’가 가능한 수준이다. 이는 주택연금 가입자들이 평생 주거불안이 없는 상태에서 확보할 수 있는 연금소득이기 때문에 그 의미가 적지 않다.19) 여기에 더해 그동안 수많은 문제제기가 있었던 주택관련 부채를 모두 정산한 상태에서의 연금소득이라는 점에서 그 의의는 한층 크다고 하겠다.

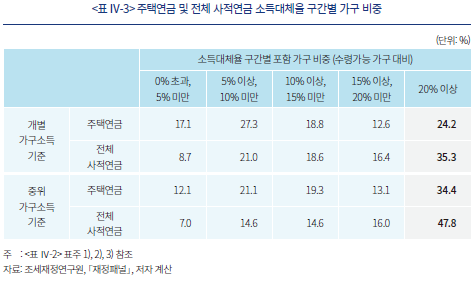

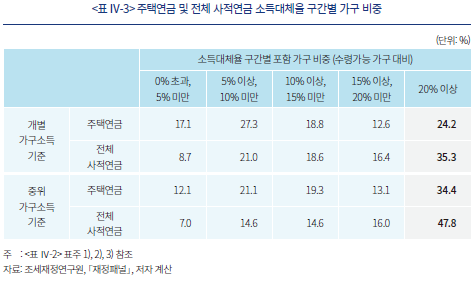

다만, 주택연금으로 확보할 수 있는 소득대체율의 수준은 가구간 편차가 불가피하게 발생한다. <표 Ⅳ-3>에는 주택연금과 전체 사적연금 수령가능 가구의 소득대체율 구간별 구성비가 정리되어 있다. 주택연금 수령가능 가구 중 약 44%의 소득대체율은 여전히 10%에 미치지 못한다. 그럼에도 불구하고, 상당수의 가구가 주택연금을 통해 20% 이상의 소득대체율을 확보할 수 있는 것으로 나타났다. 주택연금 수령가능자 중 약 24%가 20% 이상의 소득대체율을 확보할 수 있으며, 여기에 순금융자산연금을 합할 경우 주택연금 수령가능 가구 중 약 35%가 20% 이상의 소득대체율을 확보할 수 있다. 소득기준을 중위가구소득으로 바꿀 경우 이 수치는 거의 50%에 육박한다.

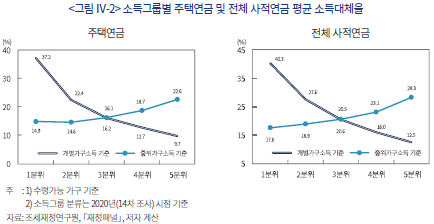

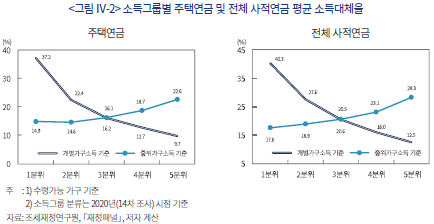

소득그룹별 주택연금 소득대체율을 보면, 전 소득그룹에서 소득대체율이 고르게 상승함을 확인할 수 있다. <그림 Ⅳ-2>에 따르면, 최저소득층인 1분위 가구의 경우 소득대체율이 개별가구소득 기준 37.2%, 중위가구소득 기준 14.9% 수준이다. 앞서 3장에서 소득 1분위 가구의 순금융자산 소득대체율이 개별가구소득 기준 9.9%, 중위가구소득 기준 2.2%이었음을 고려해 볼 때 비약적으로 상승했다. 순금융자산 소득대체율 대비 주택연금 소득대체율의 상승 폭은 소득이 낮을수록 컸다. 주택연금에 순금융자산연금을 합산한 전체 사적연금 소득대체율도 유사한 양상을 보였다.

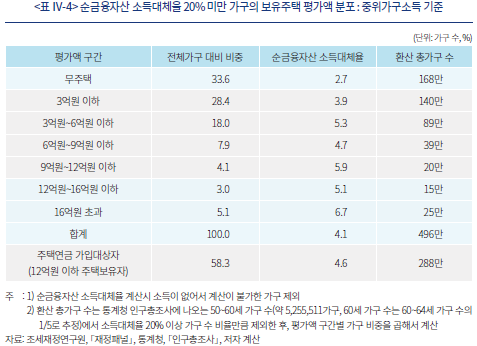

지금까지 순금융자산으로 소득대체율 20%를 채우지 못한 가구가 보유주택으로 연금을 확보하면 의미 있는 수준까지 소득대체율을 올릴 수 있음을 보았다. 이들의 보유주택 평가액 구간별 분포를 이용해 실제 50대 가구 전체에서 주택연금에 가입해 연금소득을 확보할 수 있는 가구가 얼마나 되는지 추정해 볼 수 있다.

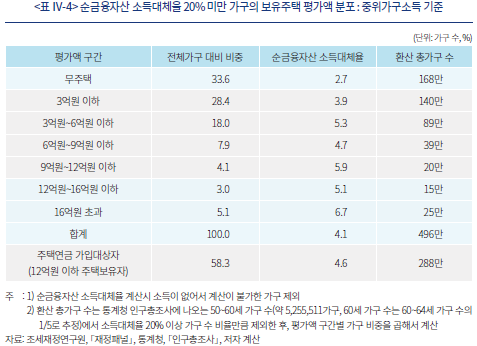

2020년 통계청 인구총조사 결과에 따르면, 50~60세 연령대의 총가구 수는 약 526만 가구이다. 이들 중 순금융자산으로 소득대체율 20% 이상을 확보할 수 있는 가구를 제외한 약 496만 가구가 순금융자산이 부족한 가구로 추정된다. 이들 중 무주택 가구와 12억원 초과 주택 보유가구(합계 208만 가구)를 제외한 288만 가구가 주택연금에 가입해 노후소득을 확보할 수 있는 잠재적 수요층이다. 이는 50~60세 전체 가구의 약 54.8%에 해당한다.

순금융자산 소득대체율 20% 미만 가구 중 33.6%인 무주택 가구는 금융자산과 주택 등 사적으로 보유한 자산으로 연금소득을 만들기 어려운 계층이다. 이들의 노후소득 마련은 공적연금 및 퇴직연금, 가족으로부터의 이전소득, 기타 사회복지 등으로 접근해야 풀 수 있는 문제인 것으로 보인다. 순금융자산으로 소득대체율 20%를 채울 수 없는 가구 중 8.1%가 평가액 12억원 초과 주택을 보유하고 있다. 이들은 현재 가입대상자 기준으로는 주택연금에 가입할 수 없다. 이들은 고가 주택을 보유하고 있음에도 불구하고 순금융자산 소득대체율이 평균 5.1~6.7%에 불과하였다. 여기에 해당하는 가구를 실제 총가구 수로 환산하면 약 40만 가구에 이른다. 이는 충분한 자산을 보유하고 있음에도 불구하고, 유동성 자산이 부족해 삶의 질이 떨어질 수 있는 가구가 많다는 의미이다. 여기에 속하는 가구는 현금흐름이 막혀 생활이 곤란한 상황이 오면, 보유주택을 매각해 주택가격이 더 저렴한 지역으로 이전하거나, 주택을 임차하는 방식으로 문제를 해결할 가능성이 크다. 이는 향후 주택시장 자체에도 큰 영향을 미칠 변수가 될 것이다.

Ⅴ. 결론 및 정책적 함의

주택은 우리나라 가계 자산의 대부분을 차지한다. 그 반대급부로 대부분의 가계는 노후소득으로 활용할 수 있는 유동성 재원이 부족하다. 60대 이상 가구가 미미한 연금소득으로 삶의 질 저하 문제에 직면한 가운데, 현재의 50대 가구 역시 동일한 문제에 노출될 가능성이 크다. 2020년 기준 50~60세 가구가 60세 시점에 확보할 수 있는 개인연금 소득대체율은 연금소득으로 기능하기 어려울 정도로 낮았다. 순금융자산으로 재원을 확대해도 연금소득 부족 문제가 해결되기 어려웠다. 분석대상 가구의 94.3%가 순금융자산을 통해 소득대체율 20%를 채울 수 없었다. 이들의 순금융자산 소득대체율은 평균 3.5~4.1%에 그쳤다. 그러나 이들이 보유주택을 통해 주택연금을 수령한다면 소득대체율을 상당 폭 올릴 수 있는 것으로 나타났다. 주택연금 수령가능 가구가 주택연금을 통해 확보할 수 있는 평균 소득대체율은 16~18% 수준이었으며, 순금융자산연금을 더하면 그 수치는 20% 내외에 이르렀다. 주택연금과 순금융자산연금을 합해 소득대체율 20%를 넘길 수 있는 가구의 비중도 소득기준에 따라 35~48%에 달했다. 주택담보대출, 임대보증금 부채 등 모든 부채를 정산하고, 동시에 주거안정을 확보하면서 마련할 수 있는 이 정도 수준의 소득대체율은 그 가치가 매우 크다고 판단된다.

분석의 정책적 함의를 논의하면서 보고서를 마무리한다. 주택연금 가입을 통해 퇴직자들이 노후 연금소득을 보완하는 것은 퇴직자 및 사회적 후생증대에 크게 보탬이 될 것으로 보인다. 따라서 많은 퇴직자들이 가입할 수 있도록 상품 매력도를 더 키우고, 가입자 증대에 대비해야 할 것이다. 주택연금제도는 급여수령 방식 다양화, 가입요건 완화, 연금수급권 강화 등 접근성과 안정성을 높이기 위해 지속적으로 개선되고 있다. 그러나 변동금리 상품만 제공되어 수요자인 가입자들이 금리위험에 노출되어 있으므로 고정금리 상품의 도입도 검토할 필요가 있다. 주택연금의 월급여 수준에 대한 불만족은 주거가치가 동시에 제공된다는 사실을 가입자들이 간과하기 때문일 수도 있다. 따라서 주택연금의 주거가치에 대한 잠재 수요자들의 이해도를 높일 방안도 찾아야 할 것으로 본다. 또한 한국주택금융공사가 주택가격 하락시 발생할 대위변제손실에 대비하기 위해 조성한 주택담보노후연금보증 계정 규모의 충분성도 검토해 볼 필요가 있다.20) 임박한 퇴직인구의 급증을 고려해 볼 때 주택연금 가입자 수는 늘어날 수밖에 없기 때문에 계정의 충분성도 이를 고려해 판단해야 할 것이다. 이 계정의 재원은 가입자들이 납입하는 보증료, 정부 출연금 등인데, 공사는 이를 잘 관리해야 하는 책임으로 인해 가입자 혜택에 초점을 맞춘 제도개선에 소극적이라는 의견도 있다(김성아 외, 2021).

다음으로, 공적보증이 제공되지 않는 민간주택연금시장의 활성화 방안을 찾아봐야 한다. 최근 한국주택금융공사법 개정안이 국회 정무위원회에서 의결됨에 따라 조만간 주택연금 가입이 가능한 주택 공시가격이 9억원에서 12억원(시가 약 16억원)으로 상향될 것으로 보인다. 평가액 16억원 초과 주택을 보유한 가구 중에서도 많은 이들의 유동성 자산이 부족했는데, 이들이 보유한 주택의 유동화시장도 필요하다. 물론 고가주택 보유자일수록 주택담보부 연금에 대한 거부감이 더 클 것으로 보여 시장이 활성화될 수 있을지는 불투명하다. 그럼에도 불구하고, 영국, 호주 등 공적보증이 없이도 민간 주택연금시장이 커가고 있는 사례들이 있는 만큼(전성주 외, 2015), 우리나라도 시장 확대 방안을 찾아봐야 할 것이다. 물론 초기에는 정부의 정책적 지원과 역할이 필요하다. 즉, 민간 주택연금시장이라고 하더라도 공공부문과 민간부문의 협력이 불가피하다. 예를 들어 정부 보증하에 주택연금 대출채권을 유동화시킬 수 있다면, 은행을 포함한 민간 금융기관의 적극적인 시장 참여가 가능할 수 있다. 그리고 미래 주택가격 상승의 혜택을 가입자와 금융기관이 나눌 수 있다면, 주택연금 대출 공급자 측면의 유인체계가 될 것이다. 민간 주택연금시장의 구축 및 활성화는 고가주택 보유자를 위해서만 필요한 것은 아니다. 공적보증이 제공되는 현재의 주택연금제도는 가입자가 증가하고 주택가격 하락 위험이 커질수록 정부에 큰 부담을 안길 것이다. 따라서 정부의 부담이 그나마 적은 민간 주택연금시장에서 그 부담을 점진적으로 흡수해줘야 한다.

마지막으로, 금융자산이 노후소득원으로 기능하도록 하기 위해서는 20~30대의 젊은 세대부터 오랫동안 금융자산을 적립하도록 유도해야 한다. 가계가 50대에 진입해 퇴직을 앞두면, 자산구성에 변화를 주기도 어렵고 소득도 하락하기 시작해 금융자산 추가 적립이 어렵다. 금융자산의 적립규모가 많지 않은 상태에서 50대 연령에 진입하면, 수익률 제고를 통한 적립규모 증대효과 역시 크지 않을 것이다. 현재의 20~30대 가구가 연금저축계좌, ISA계좌, IRP계좌 등 세제혜택을 제공하는 계좌에 오랫동안 저축 및 투자해 과세이연 및 장기복리효과를 누리면, 퇴직시점에 상당한 금융자산을 적립할 수 있을 것으로 본다. 따라서 금융자산 적립을 유도하기 위한 정책은 20~30대의 젊은 연령층에 초점을 맞추는 것이 효과를 극대화하는 방향일 것이다.

1) 퇴직금과 퇴직연금 등 퇴직급여는 적립에 강제성이 있는 자산이므로 준공적연금으로 분류할 수 있다. 이 보고서에서는 사적연금소득을 국민·퇴직연금 이외의 재원 중 개인연금(세제적격, 세제비적격), 광의의 금융자산, 주택자산으로 만들 수 있는 연금소득으로 정의한다.

2) 이 보고서에서는 편의상 퇴직시점을 법정정년 직후인 만61세로 정의한다. 따라서 50대 가구는 가구주 연령이 50~60세 범위에 있는 가구임을 밝혀둔다.

3) 이 보고서에서 소득대체율은 개인의 소득대체율이 아니라 가구 단위 소득대체율이다. 이는 자산 조사가 가구 단위로 이루어지고 있음을 고려한 것이다. 만약 가구주가 퇴직하기 전에 소득이 있는 미분가 가구원이 있다면, 퇴직직전 시점의 소득이 과다추정될 수 있다.

4) OECD(2021)는 평균임금을 받는 우리나라 근로자가 38년간 국민연금에 가입하면 31.2%의 소득대체율을 확보할 수 있는 것으로 추정했다. 퇴직연금의 경우 30년간 가입한 근로자가 확보할 수 있는 소득대체율이 15%를 넘기 어려운 것으로 추정된다(홍원구, 2018). 일반적으로 제시되는 최소 소득대체율 60% 및 OECD의 권고 소득대체율 70%를 기준으로 볼 때 우리나라 근로자들은 퇴직직전 소득 대비 14~24%의 추가 연금소득이 필요하다.

5) 1~14차「재정패널」의 조사시점은 2008년~2021년이며, 통계 기준시점은 2007년~2020년이다. 이 보고서에서는 소득 및 소비, 자산 및 부채, 가구특성 등 필요한 모든 변수의 계산을 위해 전체 패널의 가구 기준 데이터와 가구원 기준 데이터를 모두 사용했다. 참고로 14차 패널에서 조사한 가구 수는 8,798가구이며, 가구원 수는 22,500명이다.

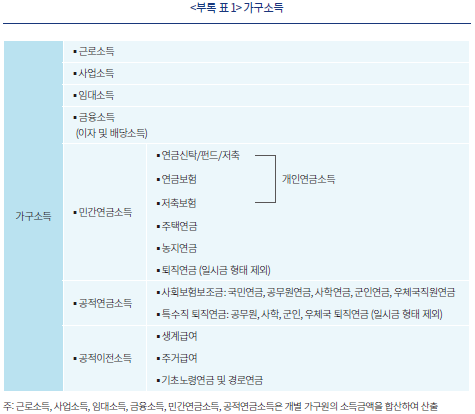

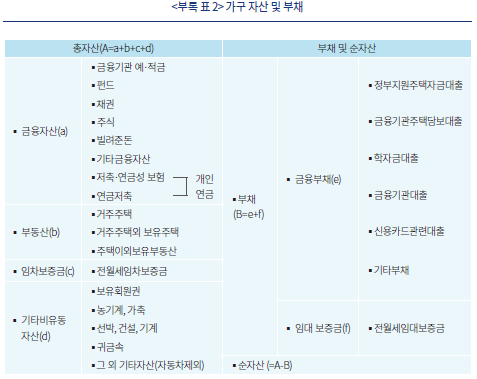

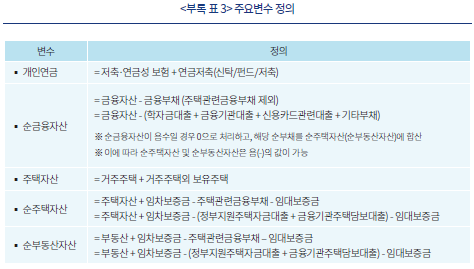

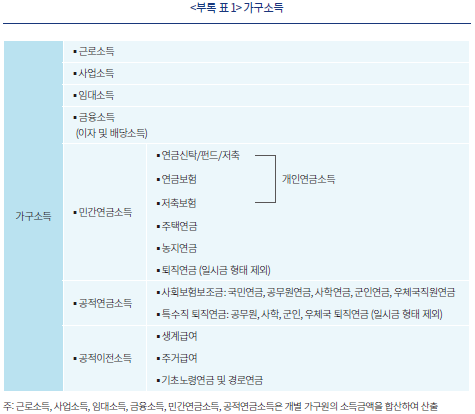

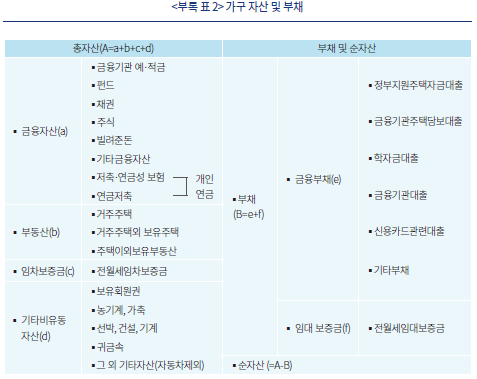

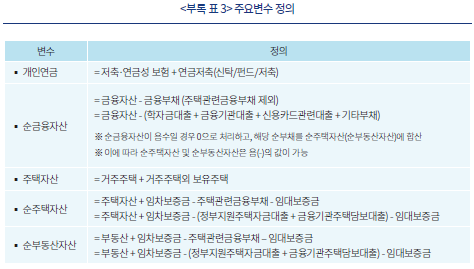

6) 소득에는 정기적 현금흐름에 해당하는 항목(근로·사업소득, 임대소득, 금융소득, 민간·공적연금소득, 공적이전소득)만을 포함하였으며, 가상자산과 자동차는 자산에서 제외하였다. 모든 항목에 대해 응답한 가구만을 분석대상에 포함하였다. 기타 각 변수의 포괄범위 및 주요변수 정의는 <부록 1>에 상세하게 정리하였다.

7) 우리나라의 근로인구 평균소득 대비 65세 이상 노령자의 평균소득 비율은 OECD 국가 중 하위권에 속한다(OECD, 2021). 또한 우리나라 노령자들의 소득 중 공적연금소득, 공적이전소득, 퇴직연금소득의 비중은 25.9%로 OECD 평균인 55.7%보다 크게 낮다. 반면 근로소득 및 사업소득의 비중은 52%로 OECD 평균(25.1%)의 두 배가 넘는다. 미국 및 유럽에서도 주택자산이 가계자산의 대부분을 차지하지만 우리나라보다는 그 비중이 낮다. 2019년 기준 가계자산에서 차지하는 주택자산 비중은 유로지역의 경우 평균 57%, 미국의 경우 28% 수준이다(ECB, 2020; U.S. Census Bureau, 2022).

8) 원자료에서는 개인연금, 주택연금, 농지연금, 퇴직연금에서 나오는 소득을 민간연금소득으로 정의하는데, 이 보고서에서는 자산 항목의 개인연금, 금융자산, 주택자산으로부터 발생하는 연금소득을 사적연금소득으로 정의한다.

9) 14차 패널 기준 50대(50~60세)는 총 2,249가구이다. 보고서의 핵심변수인 개인연금은 저축 및 연금성보험과 연금저축(신탁/펀드/저축)을 합한 것이다. 순금융자산은 금융자산 총액(개인연금 포함)에서 금융부채를 뺀 것이다. 다만, 주택관련 부채(주택담보대출, 전월세임대보증금)는 금융자산에서 차감하지 않고 주택자산에서 차감한다.

10) 60세 시점에서의 주요변수 추정방법에 대한 자세한 설명은 <부록 2>로 넘긴다.

11) 수익률과 할인율이 동일하면, 연간연금소득은 적립재원을 수급기간으로 나눈 값과 같다.

12) 일반적으로 개별가구의 소득을 기준으로 한 연금의 소득대체율은 고소득 그룹에서 낮고, 저소득 그룹에서 높다. 이는 해석을 왜곡시킬 수 있어서 보완이 필요하다. 예를 들어 60세 시점 가구소득 2천만원인 가구가 61세부터 매년 4백만원의 연금을 수령하는 경우 개별가구소득 대비 연금 소득대체율은 20%이지만, 60세 가구 중 중위소득이 4천만원이라면, 중위가구소득 대비 소득대체율은 10%에 그친다.

13) 반면 개별가구소득 기준 평균 소득대체율은 고소득 분위일수록 낮아진다. 이는 고소득 분위 가구의 퇴직직전 소득이 여타 소득그룹에 비해 높아서 나타나는 현상이다.

14) 주택연금제도에 대한 기본적인 개요는 한국주택금융공사 홈페이지에 설명되어 있다. 노후소득재원으로서의 주택연금의 의미, 주택연금제도의 연혁, 법적 근거, 제도의 구성, 현황 등 자세한 내용은 김성아 외(2021), 강성호(2017) 등의 연구를 참조할 수 있다.

15) 통계청,「인구총조사」, 2020.

16) 김성아 외(2021)는 주택연금 가입 제약요인으로 월지급금 예상액에 대한 부정적 평가, 주택가격 상승에 대한 기대, 주택보유 의지, 상속동기 등을 지적했다. 기타 주택연금의 경제적 가치에 대해서는 강성호(2017), 함상문·고성수(2013) 등을 참고하기 바란다.

17) 주택연금 가입대상자 여부는 신청자의 보유주택 합산 평가액으로 결정된다. 그러나 수령 연금액수는 임대보증금 채무액, 해당 주택을 담보로 받은 금융부채액 등의 부채를 보유주택 합산 평가액에서 뺀 상태, 즉 순주택자산으로부터 산출된다. 따라서 본 4장에서 사적연금소득의 재원은 순주택자산이다. 이는 주택자산(거주주택, 거주주택외 보유주택)에 임차보증금 자산을 더하고, 주택관련 금융부채와 임대보증금 부채를 뺀 것이다. 3장에서 정의한 순금융자산이 음(-)의 값을 갖는 가구의 경우 순금융자산을 0으로 처리하고, 남은 부채를 주택자산에서 차감하였다. 따라서 순주택자산이 0 이하인 가구가 있다.

18) 주택연금의 경우에도 61세부터 85세까지 확정연금을 25년간 수령하는 것으로 가정하였다. 순주택자산으로 수령할 수 있는 연간 연금급여는 주택금융공사의 예상연금조회 프로그램을 활용해 산출하였다. 주택연금의 소득대체율은 3장에서와 마찬가지로 순주택자산으로 확보할 수 있는 연간 연금소득을 퇴직직전의 총소득으로 나눈 값으로 정의한다.

19) 최경진·임병권(2020)은 연금액수와 주거안정 가치를 모두 고려할 경우 주택연금 가입이 주택 매각 후 주거를 임대로 해결하면서 연금을 구입하는 경우보다 유리함을 보였다. 강성호(2017)는 2015년 기준 60세 가구가 주택연금에 가입할 경우 27.4%의 소득대체율을 확보할 수 있는 것으로 추정했다.

20) 이 계정은 주택금융신용보증기금 내에 설치되어 있으며, 이 기금의 관리자가 한국주택금융공사이다.

참고문헌

강성호, 2017, 국민·퇴직·개인·주택연금 소득대체율 추정과 노후소득보장체계 충당방안, 『예산정책연구』 6(2), 20-53.

김성아·이태진·최준영, 2021, 『주택연금의 노후 빈곤 완화 효과』, 한국보건사회연구원 연구보고서(수시) 2021-01.

이태열·강성호·김유미, 2014, 『공·사 사회안전망의 효율적인 역할 제고 방안』, 보험연구원 정책·경영보고서.

전성주·박선영·김유미, 2015, 『노후소득보장을 위한 주택연금 활성화 방안』, 보험연구원 조사자료집 2015-5.

정화영, 2022, 『부동산가격 상승이 가계의 자산·부채에 미치는 영향과 시사점』, 자본시장연구원 이슈보고서 22-27.

최경진·임병권, 2020, 자가주택을 활용한 노후소득 마련 비교분석, 『Financial Planning Review』 13(1), 1-28.

함상문·고성수, 2013, 『고령화시대에 대비한 역모기지 활용에 관한 연구』, 한국금융연구원 KIF Working Paper 2013-02.

홍원구, 2018, 퇴직연금의 소득대체율과 적립금, 자본시장연구원 『자본시장포커스』 2018-24호.

ECB, 2020, Household Wealth and Consumption in the Euro Area, Economic Bulletin 1/2020, 46-61.

OECD, 2021, Pensions at Glance 2021.

U.S. Census Bureau, 2022, The Wealth of Households 2020.

조세재정연구원 www.kipf.re.kr

통계청 kostat.go.kr

한국부동산원 www.reb.or.kr

한국주택금융공사 www.hf.go.kr

<부록 1> 각 변수의 포괄범위 및 주요변수 정의

OECD는 안정적인 노후생활을 위해 퇴직직전 소득 대비 약 70% 수준의 연금소득이 필요하다고 권유한다. 하지만 우리나라 퇴직자들은 국민연금과 퇴직연금을 합산해도 이 수준의 소득대체율을 확보하지 못하고 있다(강성호, 2017; 이태열 외, 2014). 더구나 최근 논의되고 있는 공적연금개혁의 일차적인 목표가 재정안정화에 있다면, 연금소득의 충분성에 대한 우려는 커질 수밖에 없다. 이에 따라 개인들이 사회생활 초반부터 국민연금과 퇴직연금 이외의 사적연금재원을 적립해 나가도록 유도하는 것이 중요한 과제 중 하나로 지적된다.1) 그러나 우리나라 가계의 자산은 비유동성 자산인 부동산에 쏠려있고(정화영, 2022), 그 과정에서 누적된 부채의 원리금상환 등으로 인해 금융자산을 충분히 적립할 여유가 없다. 사적연금재원 적립의 중요성은 누구나 잘 알고 있지만, 제한된 소득 여건하에서는 충분한 재원을 적립하기 쉽지 않다.

이 보고서에서는 50대 가구가2) 퇴직직전 시점에 사적연금으로 활용할 수 있는 재원의 적립규모를 추정하고, 이를 연금화할 경우의 소득대체율 수준을 알아본다.3) 50대 가구가 국민연금과 퇴직연금 이외의 재원으로 확보해야 하는 사적연금의 소득대체율을 20%라고 전제하고, 각각의 사적연금재원으로 이를 달성할 수 있는 가구가 얼마나 되는지 분석한다.4) 개인연금 및 순금융자산으로 소득대체율 20%에 해당하는 연금소득을 마련할 수 있는 가구를 식별한 후, 금융자산 적립액 전체를 활용해도 소득대체율 20%를 확보할 수 없는 가구의 경우 주택연금으로 이를 채울 수 있는지 분석한다.

이 보고서에서 50대 가구를 분석대상으로 한 이유는 다음과 같다. 첫째, 퇴직직전인 60세 시점의 소득, 개인연금 및 순금융자산 적립액과 보유주택 평가액을 추정해야 하는데, 이를 위해서는 가정이 필요하다. 추정기간이 길어질수록 가정의 적합성이 낮아지므로 30~40대를 분석대상에 포함하는 것은 무의미하다고 보았다. 둘째, 50대는 전체 인구에서 차지하는 비중이 높다. 따라서 이들의 안정적인 퇴직준비 여부는 향후 경제에 지대한 영향을 미칠 것이다. 셋째, 이미 주직업에서 퇴직했을 것으로 추정되는 60대와 달리 50대는 여전히 주직업에 종사하고 있을 가능성이 크다. 즉, 이들은 사적연금재원 적립의 중요성이 높은 연령층이다.

이 보고서에서는 조세재정연구원이 매년 조사해 발표하는「재정패널」자료를 이용하여 분석한다.5) 이 자료를 이용함으로써 다른 연구 대비 다음과 같은 차별화가 가능하다. 먼저, 이 자료에는 대표적인 가계패널 데이터인 통계청의 「가계금융복지조사」와 달리 조사대상 가구의 세제적격·세제비적격 개인연금 보유여부뿐만 아니라 보유금액도 명시적으로 조사되고 있다. 또한 패널 유지율이 상대적으로 높아서 분석대상 가구의 과거 데이터도 활용할 수 있다. 이는 퇴직직전 시점의 소득, 개인연금 및 순금융자산의 적립액을 추정하는데 있어서 개별가구의 과거경로를 활용할 수 있는 장점을 제공한다.

보고서의 구성은 다음과 같다. 2장에서는 퇴직 이후 가구의 소비와 소득구조를 살펴본다. 3장과 4장에서는 2020년 기준 50대 가구의 개인연금, 순금융자산, 순주택자산을 활용한 사적연금의 소득대체율을 추정하고, 분포의 특징을 분석한다. 5장에서는 분석의 정책적 함의를 논의한다.

Ⅱ. 퇴직가계의 소득 변화 및 연금 공백

본 장에서는 60대 이후 가구를 중심으로 퇴직가계의 소득 변화와 그에 따른 영향을 알아본다. 전술한 바와 같이 이 보고서에서는 분석을 위해 소득 및 소비, 자산 및 부채 등 사용한 모든 변수를 가구 기준으로 측정했다. 그리고 일부 변수의 포괄범위와 정의는 보고서의 목적에 부합하도록 원자료와 다르게 설정했다.6)

우리나라 가계의 평균소득은 가구주 연령 45~49세를 정점으로 떨어지기 시작한다. 60세를 넘어서면서 소득 하락이 본격화되기 시작하는데, 60~64세, 65~69세 연령대의 평균 총소득은 55~59세 연령대 평균 총소득 대비 각각 81%, 54%에 그친다. 총소득이 크게 떨어지는 가운데 60대까지는 근로 및 사업소득이 총소득에서 차지하는 비중이 높은 편이다. 고령에 접어들었음에도 불구하고, 노동시장에서 완전히 은퇴하지 못하고 근로와 사업을 계속하는 이유는 노후소득의 핵심을 차지해야 할 연금소득이 부족하기 때문이다. 민간연금과 공적연금을 합산해도 60대 총소득에서 차지하는 연금소득의 비중은 10~20% 수준에 불과하다. 60대 가구의 연금소득을 퇴직직전 연령대인 55~59세 연령대 가구의 총소득과 비교해보면 그 비율은 8~11% 내외에 그친다. 낮은 수준의 연금소득은 그나마 전적으로 공적연금으로부터 나온다. 민간연금소득이 발생하는 가구의 비중은 60~64세 연령대에서 3.0%, 65~69세에서 2.1%에 불과하다.

퇴직 후 총소득이 급격하게 줄어들어 경제적 어려움을 겪을 수 있는 계층은 소득 최상위 20%인 5분위 가구를 제외한 나머지 모든 소득 그룹이다. 소득 1분위 그룹의 평균 가구소득은 이미 50대부터 빈곤가구 기준 이하로 떨어진다. 소득 2분위~4분위 그룹에 속하는 가구의 평균소득도 65세 이후부터 차례로 이 기준 아래로 내려간다. 현재의 소득으로는 최상위 20% 가구를 제외한 나머지 대다수 가구가 노후에 기본생활 영위조차도 쉽지 않다는 의미이다.

소득의 하락은 소비의 하락을 동반한다. 소비는 60세를 넘어서기 시작하면 55~59세 연령대 가구 소비의 82% 수준으로 떨어진다. 이 비율은 5년 단위로 더 크게 떨어져, 70~74세에는 55%에 그친다. 다만, 소비는 소득 대비 하락 폭이 작다. 소비에는 더 이상 줄이기 힘든 필수소비가 포함되기 때문이다. 소득 대비 소비의 비율은 60세부터 올라가기 시작하는데, 이는 소비규모가 커지기 때문이 아니라 소득의 하락 폭이 더 커서 나타나는 현상이다. 결국 많은 가계가 퇴직 이후 시간이 지나면서 소득이 크게 떨어지면, 필수소비를 제외한 대부분의 소비를 줄임으로써 삶의 질 하락을 피하기 어려운 구조라 볼 수 있겠다.

가계 소득은 60대 이후 큰 폭으로 떨어지지만, 순자산의 하락 폭은 크지 않다. 60~64세 그룹의 순자산은 55~59세 연령대의 순자산에 비해 오히려 늘어난다. 이후 연령이 올라감에 따라 순자산이 조금씩 줄어들긴 하지만, 74세까지는 평균적으로 크게 감소하지 않는다. 문제는 이들이 보유하고 있는 자산의 대부분이 비유동성 자산인 부동산이라는 점이다. 부동산이 가구 자산에서 차지하는 비중은 65~74세 연령대에서 84%까지 높아진다.

이상의 분석을 통해 60대 이후 가구의 소득, 소비 활동을 다음과 같이 정리해 볼 수 있다. 주직업에서 퇴직한 가구는 소득 하락의 충격을 줄이기 위해 소득이 낮더라도 근로와 사업을 계속한다. 이들이 퇴직후에도 근로와 사업을 지속하는 이유 중 하나는 연금소득이 부족하기 때문이다. 60대 중후반을 넘어서서 소득이 더 크게 줄어들면, 소비를 큰 폭으로 줄인다. 부족한 소득은 규모가 크지 않은 금융자산을 처분해 충당한다. 삶의 질이 떨어지지만, 주택보유는 포기하지 않는다.7)

주택보유에 대한 높은 선호로 현재 대부분 연령대에서 자산구성의 부동산 쏠림이 발견된다. 자산구성에 극적인 변화가 나타나거나, 비유동성 자산의 유동화가 진전되지 않는다면, 전술한 60대 이후 가구의 소득, 소비 활동 패턴이 현재의 50대 세대에서도 이어질 가능성이 크다. 전체 인구에서 차지하는 퇴직 세대의 경제적 비중은 갈수록 커질 것으로 전망된다. 따라서, 현재의 50대 세대가 퇴직 후에도 비유동성 자산을 보유한 채, 소득 부족으로 소비를 줄이면 이들의 삶의 질 저하와 경제 전체의 비효율성 문제가 더 심화될 것이다.

Ⅲ. 퇴직직전 가계의 금융자산 적립과 사적연금소득8)

본 장에서는 2020년 기준 50대(가구주 연령 50~60세) 가구가 퇴직직전인 60세에 도달할 시점에서의 소득, 개인연금 및 순금융자산 적립액 등 주요변수를 추정한다.9) 이어서 적립된 개인연금 및 순금융자산을 통해 확보할 수 있는 연간 연금소득의 소득대체율을 개별가구 단위로 추정하고, 그 분포를 분석한다.

1. 분석 방법

추정을 위해 두 가지 중요한 가정을 전제한다. 첫째, 저축은 소득에 의해 결정된다. 둘째, 소득, 개인연금 및 순금융자산 적립액 등 주요변수는 동일한 소득군의 앞선 세대 증가 패턴을 따른다. 개략적인 추정방법은 다음과 같다. 먼저 재정패널 조사가구에 대하여 각 연령별로 소득분위를 다섯 개로 구분한 후, 각 1세 단위로 분위별 소득, 개인연금 및 순금융자산 적립액의 평균을 계산한다. 다음으로 각 연령 소득그룹별로 해당 변수의 최근 10년 평균 증가율을 산출한다. 마지막으로 2020년 기준 50~60세 가구를 각 연령별 소득분위로 구분한 후, 앞에서 산출한 해당 그룹 평균 증가율을 적용하여 60세 도달시 변수값을 추정한다.10)

이렇게 추정한 60세 시점의 개인연금 및 순금융자산 적립액으로 확정기간 연금을 구입하는데, 매년 동일한 현재가치의 연금을 수급하는 것으로 가정한다. 기대수명을 85세로 가정해 수급기간을 25년으로 설정하였으며, 연금자산 운용수익률과 할인율은 동일한 2.5%를 적용하였다.11) 소득대체율은 추정된 연간연금소득을 퇴직직전인 60세 시점의 연간소득으로 나눈 값으로 정의한다. 소득대체율 해석상의 왜곡을 피하기 위해 소득기준으로는 개별가구소득과 중위가구소득을 동시에 고려하였다.12)

2. 개인연금의 소득대체율

위와 같은 과정을 통해 추정한 결과는 다음과 같다. 우선, 개인연금의 소득대체율이 가계 전반에 걸쳐 매우 낮았다. 개인연금 소득대체율 구간별 가구 비중을 보면, 분석대상 가구의 85%가 개인연금을 보유하지 않아서 연금소득이 없었다. 개인연금을 보유한 가구도 대부분 소득대체율 5% 미만이었다. 개인연금 미보유가구와 소득대체율 5% 미만 가구가 전체 분석대상의 98%에 달한다. 개인연금으로 소득대체율 20% 이상을 달성할 수 있는 가구는 소득기준에 따라 전체의 0.2~0.4% 수준에 그쳤다.

<그림 Ⅲ-2>에 따르면, 소득이 높은 그룹일수록 개인연금을 보유한 가구 비중이 높았다. 다만 평균적인 보유 비율인 15%에 비해 유의미할 정도로 보유가구 비중이 높아지는 소득그룹은 최상위 가구인 5분위 가구밖에 없었다. 이 그룹에서의 개인연금 보유가구 비중은 약 29% 수준이다. 전술한 바와 같이 개인연금 보유가구의 소득대체율이 매우 낮은 수준이었는데, 고소득 그룹에서도 큰 차이가 없었다. 개인연금을 보유한 5분위 소득그룹의 평균 소득대체율은 개별가구소득 기준으로는 1.5%, 중위가구소득 기준으로는 3.8%에 그쳤다.

이와 같이 개인연금 소득대체율이 거의 무의미한 수준에 불과한 것은 가계 전반에 걸쳐 개인연금 가입률이 낮고, 적립금액도 크지 않은데 기인한다. <표 Ⅲ-1>은 2020년 기준 가구주 연령 그룹에 따라 개인연금 미보유율과 보유가구의 적립규모 분포를 보여준다. 40~60세 가구 전반에 걸쳐 개인연금 미보유가구 비중이 80%를 상회하는 가운데 60세에 가까워지면 미보유 비중이 더 올라간다. 보유가구 중에서도 2천5백만원 이하 적립 가구가 거의 전연령대에서 절반을 넘는다. 이러한 결과들을 통해 볼 때 퇴직직전 가계가 개인연금을 활용해 창출해낼 수 있는 현금흐름은 매우 제한적인 수준임을 확인할 수 있다.

3. 순금융자산의 소득대체율

그렇다면 사적연금소득 재원의 범위를 개인연금을 포함한 금융자산으로 확장하면 소득대체율이 올라갈 수 있을까? <그림 Ⅲ-3>에는 순금융자산 소득대체율 구간별 가구 비중이 정리되어 있다. 순금융자산 소득대체율은 개인연금 대비 가계 전반에 걸쳐 다소 올라간다. 그러나 여전히 대부분 가계의 소득대체율이 20%에 미치지 못한다. 소득대체율이 20%를 상회하는 가구 비중은 소득기준에 따라 5.7%, 5.0%에 그쳤다. 순금융자산은 자산으로부터 부채를 차감한 금액이기 때문에 적립액이 없는 가구도 22%나 된다. 이에 따라 순금융자산 소득대체율이 5% 미만인 가구의 비중이 60%를 넘는다.

가구특성별로 나누어 분석해도 큰 흐름에는 변화가 없다. <그림 Ⅲ-4>에 의하면 소득이 높은 그룹일수록 대체로 중위가구소득 기준 평균 소득대체율이 높게 나타난다.13) 종사상지위별로는 상용 임금 근로자와 고용원을 둔 사업주 그룹의 순금융자산 소득대체율이 상대적으로 높았다. 그러나 각 그룹 전반에 걸쳐 소득대체율이 20%를 크게 밑돈다.

한편, 60세 시점까지 적립된 순금융자산으로 연금을 구입할 때 연금자산 운용수익률을 제고하더라도 가계 전반에 걸쳐 소득대체율이 높아지는 정도는 제한적인 수준에 그친다. <그림 Ⅲ-5>는 기본 시나리오(수익률 2.5% 가정) 대비 연금자산 운용수익률이 1%p, 2%p, 3%p 제고되는 경우의 소득대체율 누적분포 변화를 나타낸다. 연금자산 운용수익률이 5.5%까지 높아지더라도 소득대체율이 20%를 넘어서는 가구의 비중은 8% 내외에 그친다. 연금수급 기간인 25년간 매년 5.5% 수준의 수익률을 꾸준히 올리기도 어려울 뿐만 아니라, 그 효과도 미미한 것이다. 이는 전술한 바와 같이 주택보유 욕구로 인해 금융자산의 적립규모가 부족한데다, 부채 차감으로 연금 재원규모가 적은 데 기인한다.

다만 퇴직시점까지의 기간이 상대적으로 긴 50대 초반 가구의 경우, 순금융자산의 적립규모를 본 보고서의 기본 가정보다 높은 수준으로 올릴 수 있다면 소득대체율이 다소 개선될 수 있을 것이다. 그러나 이 역시 현실적으로 실현 가능성이 매우 낮을 것으로 판단된다. 소득이 크게 증가하거나, 금융자산 위주로 자산구성을 변경하거나, 금융자산 수익률을 대폭 올릴 경우 등을 생각해 볼 수 있는데 그 가능성은 크지 않다.

Ⅳ. 주택연금 활용을 통한 사적연금소득 보완

3장에서는 개인연금을 포함한 금융자산 적립금으로 충분한 소득대체율을 확보할 수 있는 가계가 극히 일부에 불과하다는 사실을 보았다. 4장에서는 순금융자산 적립액을 통해 퇴직직전 소득 대비 20% 수준의 연금소득을 확보하지 못한 가구가 주택연금을 활용할 때 충당할 수 있는 추가적인 연금소득 수준을 알아본다.

1. 주택연금 개요 및 현황

주택연금은 가입자가 보유주택을 매각하지 않고 거주하면서, 이를 담보로 연금을 제공받는 것을 의미한다. 우리나라의 주택연금은 한국주택금융공사가 공적인 보증을 제공하는 방식이 대부분이다. 공사가 저당권을 설정하면 주택연금을 취급하는 금융기관은 채무자인 가입자에게 연금 형태의 대출을 공급한다. 이 과정에서 공사는 금융기관에게 보증을 제공한다. 즉, 한국주택금융공사가 주택가격의 하락 위험을 부담한다. 물론 보증 보험료는 가입자들이 납부한다. 만약 주택가격이 예상보다 더 높게 상승해 정산 시점에 주택평가 가치가 남아있으면, 가입자들이 이를 돌려받는다. 즉, 주택가격 상방 변동성에 따른 혜택은 가입자들이 확보한다. 또한 금융기관이 파산하더라도 한국주택금융공사가 연금을 지급한다. 이처럼 공적인 보증이 제공됨에 따라 가입 대상자를 제한하고 있다. 만55세 이상, 공시가격 9억원 이하(시가 12억원 이하)의 주택을 소유한 자와 그 배우자가 가입대상자이며, 대상주택에 거주하고 있어야 한다. 다주택자도 보유주택의 공시가격 총액이 9억원 이하일 경우 가입이 가능하다. 가입자들은 연금의 지급방식(종신, 확정 등), 지급기간, 지급유형(정액형, 증가형 등)을 다양하게 선택할 수 있다.14)

우리나라의 주택연금은 지난 2007년에 첫 출시되었으며, 출시 이후 가입건수와 보증금액이 꾸준히 늘어나고 있다. 2012년 이후 10년간 가입건수는 7.3배, 보증금액은 6.4배 늘어났다. 2021년을 기준으로 할 때 담보주택의 평균가격은 3억 3,200만원이며, 가입자 평균연령은 72.3세이다. 가입자는 늘어나고 있으나 주택은 여전히 노후소득의 보편적인 수단으로 활용되지 못하고 있다. 2022년 보증잔액 기준 주택연금 가입건수는 8.3만건이다. 2020년 기준 가구주 연령 55세 이상이 약 935만 가구임을 고려해 볼 때 55세 이상 전체 가구의 주택연금 가입률은 약 0.89%에 불과하다.15) 가입자의 담보주택 평균가격이 3억원을 약간 넘는데, 이는 주택연금 가입이 가능한 주택가격 상한선에 훨씬 미치지 못한다. 55세가 넘으면 주택연금 가입이 가능함에도 불구하고, 가입할 당시의 평균 연령이 70세가 넘는다는 통계는 퇴직 후 상당한 시간이 흘러야 주택연금에 가입한다는 사실을 보여준다. 주택연금의 경제적·재무적 가치가 우수하다는 다수의 연구결과에 비추어 볼 때 현재의 주택연금 활용도는 매우 미미하다.16)

2. 주택연금의 소득대체율

여기에서는 순금융자산을 통해 20%의 소득대체율을 확보하지 못한 50~60세 가구가 보유주택을 유동화할 경우 추가 연금을 얼마나 확보할 수 있는지 추정하고, 그 결과를 분석한다. 이를 위해 분석대상인 50대 가구 중 2020년 기준 주택보유가구를 분류하고, 해당 주택의 순주택자산을 계산하였다.17) 그리고 2020년 기준 50대 가구가 보유한 순주택자산의 평가액은 60세 시점까지 과거 주택가격 상승률만큼 오르는 것으로 가정하였다. 과거 주택가격 상승률은 2011~2020년 중 한국부동산원의 주택매매가격지수 평균 증가율을 적용하였다.

이어서 순금융자산으로 소득대체율 20%를 채우지 못한 가구를 식별한다. 가구주 연령 50~60세 전체 분석대상은 2,249가구인데, 이들 중 94.3%에 해당하는 2,121가구의 순금융자산 소득대체율이 20% 미만이었다. 이들의 개인연금 및 순금융자산 소득대체율은 평균 0.2%, 3.5%에 불과하였다. 이는 거의 노후소득으로 기능하지 못하는 수준이다. 반면 순금융자산 소득대체율이 20%를 초과하는 5.7%의 가구는 평균 49% 이상의 소득대체율을 확보하였다(<표 Ⅳ-1>).

순금융자산 소득대체율 20% 미만 가구 중 무주택가구, 보유주택 합산 평가액 12억원 초과 가구를 제외한 가구가 주택연금 가입대상이 된다. 그리고 이들 중 부채의 영향으로 인해 순주택자산이 0이거나 음수인 경우를 제외한 가구가 최종적으로 주택연금 수령가능 가구가 된다. 앞에서 추정한 50대 분석대상 가구의 60세 시점 순주택자산 평가액이 주택연금 계산을 위한 재원이다.18)

추정치의 기본통계는 주택자산의 연금소득 창출 수준이 낮지 않음을 보여준다. <표 Ⅳ-2>에 따르면, 주택연금 수령가능 가구 전체의 평균 소득대체율은 소득기준에 따라 16.3%에서 18.2% 수준에 이른다. 이들의 순금융자산 연금을 합산해 사적연금 전체의 소득대체율을 계산하면, 그 수치는 19.9~22.7%에 달한다. 주택연금 수령가능 가구 전체의 평균적인 수준으로 놓고 볼 때 보고서 서두에 전제로 했던 ‘국민연금 및 퇴직연금을 제외한 사적연금소득으로 소득대체율 20% 확보’가 가능한 수준이다. 이는 주택연금 가입자들이 평생 주거불안이 없는 상태에서 확보할 수 있는 연금소득이기 때문에 그 의미가 적지 않다.19) 여기에 더해 그동안 수많은 문제제기가 있었던 주택관련 부채를 모두 정산한 상태에서의 연금소득이라는 점에서 그 의의는 한층 크다고 하겠다.

다만, 주택연금으로 확보할 수 있는 소득대체율의 수준은 가구간 편차가 불가피하게 발생한다. <표 Ⅳ-3>에는 주택연금과 전체 사적연금 수령가능 가구의 소득대체율 구간별 구성비가 정리되어 있다. 주택연금 수령가능 가구 중 약 44%의 소득대체율은 여전히 10%에 미치지 못한다. 그럼에도 불구하고, 상당수의 가구가 주택연금을 통해 20% 이상의 소득대체율을 확보할 수 있는 것으로 나타났다. 주택연금 수령가능자 중 약 24%가 20% 이상의 소득대체율을 확보할 수 있으며, 여기에 순금융자산연금을 합할 경우 주택연금 수령가능 가구 중 약 35%가 20% 이상의 소득대체율을 확보할 수 있다. 소득기준을 중위가구소득으로 바꿀 경우 이 수치는 거의 50%에 육박한다.

소득그룹별 주택연금 소득대체율을 보면, 전 소득그룹에서 소득대체율이 고르게 상승함을 확인할 수 있다. <그림 Ⅳ-2>에 따르면, 최저소득층인 1분위 가구의 경우 소득대체율이 개별가구소득 기준 37.2%, 중위가구소득 기준 14.9% 수준이다. 앞서 3장에서 소득 1분위 가구의 순금융자산 소득대체율이 개별가구소득 기준 9.9%, 중위가구소득 기준 2.2%이었음을 고려해 볼 때 비약적으로 상승했다. 순금융자산 소득대체율 대비 주택연금 소득대체율의 상승 폭은 소득이 낮을수록 컸다. 주택연금에 순금융자산연금을 합산한 전체 사적연금 소득대체율도 유사한 양상을 보였다.

지금까지 순금융자산으로 소득대체율 20%를 채우지 못한 가구가 보유주택으로 연금을 확보하면 의미 있는 수준까지 소득대체율을 올릴 수 있음을 보았다. 이들의 보유주택 평가액 구간별 분포를 이용해 실제 50대 가구 전체에서 주택연금에 가입해 연금소득을 확보할 수 있는 가구가 얼마나 되는지 추정해 볼 수 있다.

2020년 통계청 인구총조사 결과에 따르면, 50~60세 연령대의 총가구 수는 약 526만 가구이다. 이들 중 순금융자산으로 소득대체율 20% 이상을 확보할 수 있는 가구를 제외한 약 496만 가구가 순금융자산이 부족한 가구로 추정된다. 이들 중 무주택 가구와 12억원 초과 주택 보유가구(합계 208만 가구)를 제외한 288만 가구가 주택연금에 가입해 노후소득을 확보할 수 있는 잠재적 수요층이다. 이는 50~60세 전체 가구의 약 54.8%에 해당한다.

순금융자산 소득대체율 20% 미만 가구 중 33.6%인 무주택 가구는 금융자산과 주택 등 사적으로 보유한 자산으로 연금소득을 만들기 어려운 계층이다. 이들의 노후소득 마련은 공적연금 및 퇴직연금, 가족으로부터의 이전소득, 기타 사회복지 등으로 접근해야 풀 수 있는 문제인 것으로 보인다. 순금융자산으로 소득대체율 20%를 채울 수 없는 가구 중 8.1%가 평가액 12억원 초과 주택을 보유하고 있다. 이들은 현재 가입대상자 기준으로는 주택연금에 가입할 수 없다. 이들은 고가 주택을 보유하고 있음에도 불구하고 순금융자산 소득대체율이 평균 5.1~6.7%에 불과하였다. 여기에 해당하는 가구를 실제 총가구 수로 환산하면 약 40만 가구에 이른다. 이는 충분한 자산을 보유하고 있음에도 불구하고, 유동성 자산이 부족해 삶의 질이 떨어질 수 있는 가구가 많다는 의미이다. 여기에 속하는 가구는 현금흐름이 막혀 생활이 곤란한 상황이 오면, 보유주택을 매각해 주택가격이 더 저렴한 지역으로 이전하거나, 주택을 임차하는 방식으로 문제를 해결할 가능성이 크다. 이는 향후 주택시장 자체에도 큰 영향을 미칠 변수가 될 것이다.

Ⅴ. 결론 및 정책적 함의

주택은 우리나라 가계 자산의 대부분을 차지한다. 그 반대급부로 대부분의 가계는 노후소득으로 활용할 수 있는 유동성 재원이 부족하다. 60대 이상 가구가 미미한 연금소득으로 삶의 질 저하 문제에 직면한 가운데, 현재의 50대 가구 역시 동일한 문제에 노출될 가능성이 크다. 2020년 기준 50~60세 가구가 60세 시점에 확보할 수 있는 개인연금 소득대체율은 연금소득으로 기능하기 어려울 정도로 낮았다. 순금융자산으로 재원을 확대해도 연금소득 부족 문제가 해결되기 어려웠다. 분석대상 가구의 94.3%가 순금융자산을 통해 소득대체율 20%를 채울 수 없었다. 이들의 순금융자산 소득대체율은 평균 3.5~4.1%에 그쳤다. 그러나 이들이 보유주택을 통해 주택연금을 수령한다면 소득대체율을 상당 폭 올릴 수 있는 것으로 나타났다. 주택연금 수령가능 가구가 주택연금을 통해 확보할 수 있는 평균 소득대체율은 16~18% 수준이었으며, 순금융자산연금을 더하면 그 수치는 20% 내외에 이르렀다. 주택연금과 순금융자산연금을 합해 소득대체율 20%를 넘길 수 있는 가구의 비중도 소득기준에 따라 35~48%에 달했다. 주택담보대출, 임대보증금 부채 등 모든 부채를 정산하고, 동시에 주거안정을 확보하면서 마련할 수 있는 이 정도 수준의 소득대체율은 그 가치가 매우 크다고 판단된다.

분석의 정책적 함의를 논의하면서 보고서를 마무리한다. 주택연금 가입을 통해 퇴직자들이 노후 연금소득을 보완하는 것은 퇴직자 및 사회적 후생증대에 크게 보탬이 될 것으로 보인다. 따라서 많은 퇴직자들이 가입할 수 있도록 상품 매력도를 더 키우고, 가입자 증대에 대비해야 할 것이다. 주택연금제도는 급여수령 방식 다양화, 가입요건 완화, 연금수급권 강화 등 접근성과 안정성을 높이기 위해 지속적으로 개선되고 있다. 그러나 변동금리 상품만 제공되어 수요자인 가입자들이 금리위험에 노출되어 있으므로 고정금리 상품의 도입도 검토할 필요가 있다. 주택연금의 월급여 수준에 대한 불만족은 주거가치가 동시에 제공된다는 사실을 가입자들이 간과하기 때문일 수도 있다. 따라서 주택연금의 주거가치에 대한 잠재 수요자들의 이해도를 높일 방안도 찾아야 할 것으로 본다. 또한 한국주택금융공사가 주택가격 하락시 발생할 대위변제손실에 대비하기 위해 조성한 주택담보노후연금보증 계정 규모의 충분성도 검토해 볼 필요가 있다.20) 임박한 퇴직인구의 급증을 고려해 볼 때 주택연금 가입자 수는 늘어날 수밖에 없기 때문에 계정의 충분성도 이를 고려해 판단해야 할 것이다. 이 계정의 재원은 가입자들이 납입하는 보증료, 정부 출연금 등인데, 공사는 이를 잘 관리해야 하는 책임으로 인해 가입자 혜택에 초점을 맞춘 제도개선에 소극적이라는 의견도 있다(김성아 외, 2021).

다음으로, 공적보증이 제공되지 않는 민간주택연금시장의 활성화 방안을 찾아봐야 한다. 최근 한국주택금융공사법 개정안이 국회 정무위원회에서 의결됨에 따라 조만간 주택연금 가입이 가능한 주택 공시가격이 9억원에서 12억원(시가 약 16억원)으로 상향될 것으로 보인다. 평가액 16억원 초과 주택을 보유한 가구 중에서도 많은 이들의 유동성 자산이 부족했는데, 이들이 보유한 주택의 유동화시장도 필요하다. 물론 고가주택 보유자일수록 주택담보부 연금에 대한 거부감이 더 클 것으로 보여 시장이 활성화될 수 있을지는 불투명하다. 그럼에도 불구하고, 영국, 호주 등 공적보증이 없이도 민간 주택연금시장이 커가고 있는 사례들이 있는 만큼(전성주 외, 2015), 우리나라도 시장 확대 방안을 찾아봐야 할 것이다. 물론 초기에는 정부의 정책적 지원과 역할이 필요하다. 즉, 민간 주택연금시장이라고 하더라도 공공부문과 민간부문의 협력이 불가피하다. 예를 들어 정부 보증하에 주택연금 대출채권을 유동화시킬 수 있다면, 은행을 포함한 민간 금융기관의 적극적인 시장 참여가 가능할 수 있다. 그리고 미래 주택가격 상승의 혜택을 가입자와 금융기관이 나눌 수 있다면, 주택연금 대출 공급자 측면의 유인체계가 될 것이다. 민간 주택연금시장의 구축 및 활성화는 고가주택 보유자를 위해서만 필요한 것은 아니다. 공적보증이 제공되는 현재의 주택연금제도는 가입자가 증가하고 주택가격 하락 위험이 커질수록 정부에 큰 부담을 안길 것이다. 따라서 정부의 부담이 그나마 적은 민간 주택연금시장에서 그 부담을 점진적으로 흡수해줘야 한다.

마지막으로, 금융자산이 노후소득원으로 기능하도록 하기 위해서는 20~30대의 젊은 세대부터 오랫동안 금융자산을 적립하도록 유도해야 한다. 가계가 50대에 진입해 퇴직을 앞두면, 자산구성에 변화를 주기도 어렵고 소득도 하락하기 시작해 금융자산 추가 적립이 어렵다. 금융자산의 적립규모가 많지 않은 상태에서 50대 연령에 진입하면, 수익률 제고를 통한 적립규모 증대효과 역시 크지 않을 것이다. 현재의 20~30대 가구가 연금저축계좌, ISA계좌, IRP계좌 등 세제혜택을 제공하는 계좌에 오랫동안 저축 및 투자해 과세이연 및 장기복리효과를 누리면, 퇴직시점에 상당한 금융자산을 적립할 수 있을 것으로 본다. 따라서 금융자산 적립을 유도하기 위한 정책은 20~30대의 젊은 연령층에 초점을 맞추는 것이 효과를 극대화하는 방향일 것이다.

1) 퇴직금과 퇴직연금 등 퇴직급여는 적립에 강제성이 있는 자산이므로 준공적연금으로 분류할 수 있다. 이 보고서에서는 사적연금소득을 국민·퇴직연금 이외의 재원 중 개인연금(세제적격, 세제비적격), 광의의 금융자산, 주택자산으로 만들 수 있는 연금소득으로 정의한다.

2) 이 보고서에서는 편의상 퇴직시점을 법정정년 직후인 만61세로 정의한다. 따라서 50대 가구는 가구주 연령이 50~60세 범위에 있는 가구임을 밝혀둔다.

3) 이 보고서에서 소득대체율은 개인의 소득대체율이 아니라 가구 단위 소득대체율이다. 이는 자산 조사가 가구 단위로 이루어지고 있음을 고려한 것이다. 만약 가구주가 퇴직하기 전에 소득이 있는 미분가 가구원이 있다면, 퇴직직전 시점의 소득이 과다추정될 수 있다.

4) OECD(2021)는 평균임금을 받는 우리나라 근로자가 38년간 국민연금에 가입하면 31.2%의 소득대체율을 확보할 수 있는 것으로 추정했다. 퇴직연금의 경우 30년간 가입한 근로자가 확보할 수 있는 소득대체율이 15%를 넘기 어려운 것으로 추정된다(홍원구, 2018). 일반적으로 제시되는 최소 소득대체율 60% 및 OECD의 권고 소득대체율 70%를 기준으로 볼 때 우리나라 근로자들은 퇴직직전 소득 대비 14~24%의 추가 연금소득이 필요하다.

5) 1~14차「재정패널」의 조사시점은 2008년~2021년이며, 통계 기준시점은 2007년~2020년이다. 이 보고서에서는 소득 및 소비, 자산 및 부채, 가구특성 등 필요한 모든 변수의 계산을 위해 전체 패널의 가구 기준 데이터와 가구원 기준 데이터를 모두 사용했다. 참고로 14차 패널에서 조사한 가구 수는 8,798가구이며, 가구원 수는 22,500명이다.

6) 소득에는 정기적 현금흐름에 해당하는 항목(근로·사업소득, 임대소득, 금융소득, 민간·공적연금소득, 공적이전소득)만을 포함하였으며, 가상자산과 자동차는 자산에서 제외하였다. 모든 항목에 대해 응답한 가구만을 분석대상에 포함하였다. 기타 각 변수의 포괄범위 및 주요변수 정의는 <부록 1>에 상세하게 정리하였다.

7) 우리나라의 근로인구 평균소득 대비 65세 이상 노령자의 평균소득 비율은 OECD 국가 중 하위권에 속한다(OECD, 2021). 또한 우리나라 노령자들의 소득 중 공적연금소득, 공적이전소득, 퇴직연금소득의 비중은 25.9%로 OECD 평균인 55.7%보다 크게 낮다. 반면 근로소득 및 사업소득의 비중은 52%로 OECD 평균(25.1%)의 두 배가 넘는다. 미국 및 유럽에서도 주택자산이 가계자산의 대부분을 차지하지만 우리나라보다는 그 비중이 낮다. 2019년 기준 가계자산에서 차지하는 주택자산 비중은 유로지역의 경우 평균 57%, 미국의 경우 28% 수준이다(ECB, 2020; U.S. Census Bureau, 2022).

8) 원자료에서는 개인연금, 주택연금, 농지연금, 퇴직연금에서 나오는 소득을 민간연금소득으로 정의하는데, 이 보고서에서는 자산 항목의 개인연금, 금융자산, 주택자산으로부터 발생하는 연금소득을 사적연금소득으로 정의한다.

9) 14차 패널 기준 50대(50~60세)는 총 2,249가구이다. 보고서의 핵심변수인 개인연금은 저축 및 연금성보험과 연금저축(신탁/펀드/저축)을 합한 것이다. 순금융자산은 금융자산 총액(개인연금 포함)에서 금융부채를 뺀 것이다. 다만, 주택관련 부채(주택담보대출, 전월세임대보증금)는 금융자산에서 차감하지 않고 주택자산에서 차감한다.

10) 60세 시점에서의 주요변수 추정방법에 대한 자세한 설명은 <부록 2>로 넘긴다.

11) 수익률과 할인율이 동일하면, 연간연금소득은 적립재원을 수급기간으로 나눈 값과 같다.

12) 일반적으로 개별가구의 소득을 기준으로 한 연금의 소득대체율은 고소득 그룹에서 낮고, 저소득 그룹에서 높다. 이는 해석을 왜곡시킬 수 있어서 보완이 필요하다. 예를 들어 60세 시점 가구소득 2천만원인 가구가 61세부터 매년 4백만원의 연금을 수령하는 경우 개별가구소득 대비 연금 소득대체율은 20%이지만, 60세 가구 중 중위소득이 4천만원이라면, 중위가구소득 대비 소득대체율은 10%에 그친다.

13) 반면 개별가구소득 기준 평균 소득대체율은 고소득 분위일수록 낮아진다. 이는 고소득 분위 가구의 퇴직직전 소득이 여타 소득그룹에 비해 높아서 나타나는 현상이다.

14) 주택연금제도에 대한 기본적인 개요는 한국주택금융공사 홈페이지에 설명되어 있다. 노후소득재원으로서의 주택연금의 의미, 주택연금제도의 연혁, 법적 근거, 제도의 구성, 현황 등 자세한 내용은 김성아 외(2021), 강성호(2017) 등의 연구를 참조할 수 있다.

15) 통계청,「인구총조사」, 2020.

16) 김성아 외(2021)는 주택연금 가입 제약요인으로 월지급금 예상액에 대한 부정적 평가, 주택가격 상승에 대한 기대, 주택보유 의지, 상속동기 등을 지적했다. 기타 주택연금의 경제적 가치에 대해서는 강성호(2017), 함상문·고성수(2013) 등을 참고하기 바란다.

17) 주택연금 가입대상자 여부는 신청자의 보유주택 합산 평가액으로 결정된다. 그러나 수령 연금액수는 임대보증금 채무액, 해당 주택을 담보로 받은 금융부채액 등의 부채를 보유주택 합산 평가액에서 뺀 상태, 즉 순주택자산으로부터 산출된다. 따라서 본 4장에서 사적연금소득의 재원은 순주택자산이다. 이는 주택자산(거주주택, 거주주택외 보유주택)에 임차보증금 자산을 더하고, 주택관련 금융부채와 임대보증금 부채를 뺀 것이다. 3장에서 정의한 순금융자산이 음(-)의 값을 갖는 가구의 경우 순금융자산을 0으로 처리하고, 남은 부채를 주택자산에서 차감하였다. 따라서 순주택자산이 0 이하인 가구가 있다.

18) 주택연금의 경우에도 61세부터 85세까지 확정연금을 25년간 수령하는 것으로 가정하였다. 순주택자산으로 수령할 수 있는 연간 연금급여는 주택금융공사의 예상연금조회 프로그램을 활용해 산출하였다. 주택연금의 소득대체율은 3장에서와 마찬가지로 순주택자산으로 확보할 수 있는 연간 연금소득을 퇴직직전의 총소득으로 나눈 값으로 정의한다.

19) 최경진·임병권(2020)은 연금액수와 주거안정 가치를 모두 고려할 경우 주택연금 가입이 주택 매각 후 주거를 임대로 해결하면서 연금을 구입하는 경우보다 유리함을 보였다. 강성호(2017)는 2015년 기준 60세 가구가 주택연금에 가입할 경우 27.4%의 소득대체율을 확보할 수 있는 것으로 추정했다.

20) 이 계정은 주택금융신용보증기금 내에 설치되어 있으며, 이 기금의 관리자가 한국주택금융공사이다.

참고문헌

강성호, 2017, 국민·퇴직·개인·주택연금 소득대체율 추정과 노후소득보장체계 충당방안, 『예산정책연구』 6(2), 20-53.

김성아·이태진·최준영, 2021, 『주택연금의 노후 빈곤 완화 효과』, 한국보건사회연구원 연구보고서(수시) 2021-01.

이태열·강성호·김유미, 2014, 『공·사 사회안전망의 효율적인 역할 제고 방안』, 보험연구원 정책·경영보고서.

전성주·박선영·김유미, 2015, 『노후소득보장을 위한 주택연금 활성화 방안』, 보험연구원 조사자료집 2015-5.

정화영, 2022, 『부동산가격 상승이 가계의 자산·부채에 미치는 영향과 시사점』, 자본시장연구원 이슈보고서 22-27.

최경진·임병권, 2020, 자가주택을 활용한 노후소득 마련 비교분석, 『Financial Planning Review』 13(1), 1-28.

함상문·고성수, 2013, 『고령화시대에 대비한 역모기지 활용에 관한 연구』, 한국금융연구원 KIF Working Paper 2013-02.

홍원구, 2018, 퇴직연금의 소득대체율과 적립금, 자본시장연구원 『자본시장포커스』 2018-24호.

ECB, 2020, Household Wealth and Consumption in the Euro Area, Economic Bulletin 1/2020, 46-61.

OECD, 2021, Pensions at Glance 2021.

U.S. Census Bureau, 2022, The Wealth of Households 2020.

조세재정연구원 www.kipf.re.kr

통계청 kostat.go.kr

한국부동산원 www.reb.or.kr

한국주택금융공사 www.hf.go.kr

<부록 1> 각 변수의 포괄범위 및 주요변수 정의

<부록 2> 퇴직직전 시점(60세)의 주요변수 추정방법

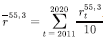

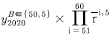

50~60세 가구의 60세 도달 시점에서의 주요변수(소득, 개인연금 및 순금융자산 적립액)는 다음과 같은 단계를 거쳐 추정한다.

① 재정패널 조사가구에 대하여 각 연령별로 소득분위를 5개로 구분한 후, 각 1세 단위로 소득그룹별 변수 평균을 계산

▪ 각 연령 단위(1세 단위)로 소득분위를 구분하는 경우 표본수가 크게 적어 분위별 경계값이 안정적이지 않은 모습을 보였는데, 이에 충분한 표본수를 확보하기 위해 각 연령 기준 ±1세를 포함한 3세 단위로 소득분위를 구분하여 분위별 경계값의 안정성을 확보

② 1세 단위 소득그룹별로 변수의 연간 증가율을 계산하고, 이를 바탕으로 최근 10년 평균 증가율을 산출

▪ 극단치를 제거하기 위해 연도별 증가율은 ±50%에서 윈저화(winsorize)

③ ②에서 산출한 평균 증가율을 적용하여 2020년 기준 50~60세 가구가 60세에 도달 시점에서의 변수값 추정

2020년 55세 소득 3분위 그룹의 가구 평균을 과 같이 표현하자. 2020년 55세 3분위 그룹의 평균 증가율은

과 같이 표현하자. 2020년 55세 3분위 그룹의 평균 증가율은  로 계산되며, 이를 바탕으로 해당 그룹의 최근 10년 평균 증가율

로 계산되며, 이를 바탕으로 해당 그룹의 최근 10년 평균 증가율  을 산출할 수 있다. 위에서 산출한 평균 증가율을 적용하여 60세 시점에서의 변수값을 추정한다 .

을 산출할 수 있다. 위에서 산출한 평균 증가율을 적용하여 60세 시점에서의 변수값을 추정한다 .

예를 들어 2020년 55세 소득 3분위 그룹에 속하는 가구 A의 변수값을 로 표현하면 동 가구의 60세 시점에서의 추정 변수값은

로 표현하면 동 가구의 60세 시점에서의 추정 변수값은  이다. 동일한 방식으로 2020년 50세 소득 5분위 그룹에 속하는 가구 B의 변수값을

이다. 동일한 방식으로 2020년 50세 소득 5분위 그룹에 속하는 가구 B의 변수값을  로 표현하면 60세 시점에서의 추정값은

로 표현하면 60세 시점에서의 추정값은  이다.

이다.

50~60세 가구의 60세 도달 시점에서의 주요변수(소득, 개인연금 및 순금융자산 적립액)는 다음과 같은 단계를 거쳐 추정한다.

① 재정패널 조사가구에 대하여 각 연령별로 소득분위를 5개로 구분한 후, 각 1세 단위로 소득그룹별 변수 평균을 계산

▪ 각 연령 단위(1세 단위)로 소득분위를 구분하는 경우 표본수가 크게 적어 분위별 경계값이 안정적이지 않은 모습을 보였는데, 이에 충분한 표본수를 확보하기 위해 각 연령 기준 ±1세를 포함한 3세 단위로 소득분위를 구분하여 분위별 경계값의 안정성을 확보

② 1세 단위 소득그룹별로 변수의 연간 증가율을 계산하고, 이를 바탕으로 최근 10년 평균 증가율을 산출

▪ 극단치를 제거하기 위해 연도별 증가율은 ±50%에서 윈저화(winsorize)

③ ②에서 산출한 평균 증가율을 적용하여 2020년 기준 50~60세 가구가 60세에 도달 시점에서의 변수값 추정

2020년 55세 소득 3분위 그룹의 가구 평균을

예를 들어 2020년 55세 소득 3분위 그룹에 속하는 가구 A의 변수값을