Find out more about our latest publications

A Decade of Comprehensive Financial Investment Business Entities in Korea: Evaluation and Development Strategies to Become "Korean IBs"

Issue Papers 23-14 Aug. 07, 2023

- Research Topic Financial Services Industry

- Page 23

A decade has passed since South Korea introduced its ‘comprehensive financial investment business entity (CFIBE, hereinafter)’ framework in May 2013. On this significant milestone, this paper evaluates how Korean CFIBEs have developed their businesses in alignment with policy objectives and proposes development strategies to gain a competitive edge over global investment banks.

Among other aspects, this study examines how Korean CFIBEs have performed in relation to the four policy objectives outlined at the outset: Expansion, profitability and business differentiation, corporate financing expansion, and risk capital provision. For the past decade, Korean CFIBEs achieved quantitative growth in expansion and profitability, with their equity capital and net revenues rising 148% and 650%, respectively. Their qualitative performance is somewhat disappointing, with 70% to 80% of their revenues still derived from brokerage and principal investment, showing no indications of business diversification. Their quantitative performance is outstanding as their credit provision increased twentyfold over the past decade. However, Korean CFIBEs are ranked between 20th and 30th, and 60th and 70th in Asian ECM/DCM and M&A, respectively, showing their weaker capacities in corporate finance compared to global peers. Furthermore, they fell short of meeting expectations as providers of risk capital since a significant portion of their corporate loans were tied to SPC and real estate assets, with only a modest amount of capital invested in equity in innovative venture firms.

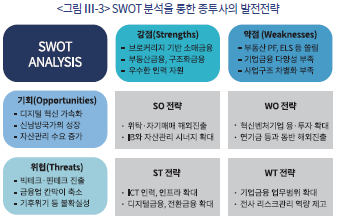

The second part of this report proposes development strategies for CFIBEs based on a comparative analysis of the business strategies of Korean CFIBEs and global IBs. A SWOT analysis suggested that CFIBEs have an edge in retail and structured financing, while disproportionately concentrating on ELS, DLS, and debt guarantees to real estate PF. This shows that they lack in diversity in corporate financing services while falling short of business differentiation. Their external opportunities include accelerated digitalization, growth in new southern countries, and increased demand for wealth management. Conversely, they are confronting threats, including increased competition from players entering bigtech and fintech sectors, the blurring of boundaries in financial services, growing political and economic uncertainties, and the climate crisis.

On the path toward becoming Korean IBs, CFIBEs should fully leverage their technological strength in ICT for expanding their presence abroad in brokerage and principal investment. Based on Korea's business development company scheme and M&A activities, they need to strengthen their corporate financing capacity, and join hands with pension funds and sovereign wealth funds. As part of their preemptive measures to future changes in the financial services industry, it is advisable for Korean CFIBEs to recruit additional ICT staff, increase investments in infrastructure, and concentrate their resources and capabilities on digital finance and transition finance. Additionally, in the long run, further efforts are needed to enable CFIBEs to participate in payment and settlement services for corporations. Furthermore, CFIBEs should make efforts to enhance their risk management capabilities by enhancing their remuneration schemes and internal controls.

Among other aspects, this study examines how Korean CFIBEs have performed in relation to the four policy objectives outlined at the outset: Expansion, profitability and business differentiation, corporate financing expansion, and risk capital provision. For the past decade, Korean CFIBEs achieved quantitative growth in expansion and profitability, with their equity capital and net revenues rising 148% and 650%, respectively. Their qualitative performance is somewhat disappointing, with 70% to 80% of their revenues still derived from brokerage and principal investment, showing no indications of business diversification. Their quantitative performance is outstanding as their credit provision increased twentyfold over the past decade. However, Korean CFIBEs are ranked between 20th and 30th, and 60th and 70th in Asian ECM/DCM and M&A, respectively, showing their weaker capacities in corporate finance compared to global peers. Furthermore, they fell short of meeting expectations as providers of risk capital since a significant portion of their corporate loans were tied to SPC and real estate assets, with only a modest amount of capital invested in equity in innovative venture firms.

The second part of this report proposes development strategies for CFIBEs based on a comparative analysis of the business strategies of Korean CFIBEs and global IBs. A SWOT analysis suggested that CFIBEs have an edge in retail and structured financing, while disproportionately concentrating on ELS, DLS, and debt guarantees to real estate PF. This shows that they lack in diversity in corporate financing services while falling short of business differentiation. Their external opportunities include accelerated digitalization, growth in new southern countries, and increased demand for wealth management. Conversely, they are confronting threats, including increased competition from players entering bigtech and fintech sectors, the blurring of boundaries in financial services, growing political and economic uncertainties, and the climate crisis.

On the path toward becoming Korean IBs, CFIBEs should fully leverage their technological strength in ICT for expanding their presence abroad in brokerage and principal investment. Based on Korea's business development company scheme and M&A activities, they need to strengthen their corporate financing capacity, and join hands with pension funds and sovereign wealth funds. As part of their preemptive measures to future changes in the financial services industry, it is advisable for Korean CFIBEs to recruit additional ICT staff, increase investments in infrastructure, and concentrate their resources and capabilities on digital finance and transition finance. Additionally, in the long run, further efforts are needed to enable CFIBEs to participate in payment and settlement services for corporations. Furthermore, CFIBEs should make efforts to enhance their risk management capabilities by enhancing their remuneration schemes and internal controls.

Ⅰ. 서론

2023년 6월 현재 종합금융투자사업자(이하 종투사) 제도를 도입한 지 10년이 지났다. 2013년 5월 금융당국은 혁신 중소기업의 창업과 성장을 지원하고 기업의 해외 프로젝트 수행 시 종합적인 금융서비스를 제공하는 것을 목표로 국내 대형 증권사를 투자은행(Investment Bank: IB)으로 육성하는 방안을 발표했다.1) 이에, 금융위원회는 2013년 10월 3조원 이상의 자기자본을 보유하고, 내부통제기준 구비 조건을 갖춘 주요 대형 증권회사를 종투사로 지정하고, 해당 종투사로 하여금 기업 신용공여와 헤지펀드 전담중개 업무(Prime Brokerage Service: PBS)를 허용했다.

그러나 2013년 10월 종투사 제도가 시행되었음에도 종투사의 모험자본 공급이 부족하고, 증권회사의 영업구조가 여전히 위탁매매 중심으로 이루어지는 등 증권업의 활력이 제고되지 못하였다는 인식이 많았다.2) 2014년 기준 국내 증권회사 영업수익의 51%를 위탁매매 부문이 차지하고 있었고, 투자은행 부문은 전체 수익의 10%에 불과했다. 또한 2015년 기준 국내 종투사의 자기자본은 3~6조원 수준으로 일본 노무라그룹(28.1조원), 중국 중신증권(25.6조원), 말레이시아 CIMB(11.7조원)에 비해 현저히 작아 국내 종투사들이 종합 기업금융 서비스를 제공하기에 역량이 부족했다.

이에, 금융당국은 2016년 8월 혁신기업에 대한 모험자본 공급을 확대하고, 투자은행 중심의 종합 기업금융 서비스를 확대하는 것을 목표로 초대형 투자은행 육성방안을 발표했다. 또한 글로벌 IB들의 사업구조를 벤치마크하여 국내 증권업의 대형화를 유도하고 해외진출을 장려하기 위해 자기자본을 키울수록 유망한 투자은행 사업기회를 제공하는 인센티브를 제시했다. 구체적으로 자기자본 4조원 이상의 종투사에게 발행어음 업무를 허용하고 자기자본 8조원 이상의 종투사에게 종합투자계좌(Investment Management Account: IMA) 업무를 허용했다. 당시 금융당국은 고객에게 수신한 자금을 기초로 기업에 대한 자금공급을 원활히 수행하기 위해 발행어음과 IMA로 조달한 자금은 레버리지 비율 규제 적용 대상에서 제외하는 인센티브를 제시하였다.

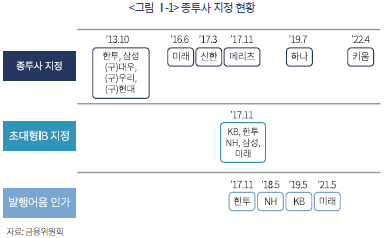

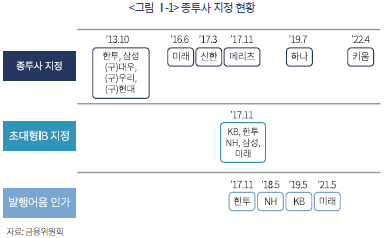

2023년 6월 현재 총 9개 대형 증권회사가 금융당국으로부터 종투사로 지정받아 기업 신용공여 등의 업무를 수행하고 있으며, 이 중 4개 종투사는 초대형 IB로 허가받아 발행어음 업무를 수행하고 있다. 종투사 지정 현황을 살펴보면(이하 <그림 Ⅰ-1> 참조), 2013년 10월 KB증권((구)현대증권), NH투자증권((구)우리투자증권), 미래에셋증권((구)대우증권), 삼성증권, 한국투자증권 등 5개 회사가 종투사로 지정받았으며 이후 (구)미래에셋증권3), 신한증권, 메리츠증권, 하나증권, 키움증권이 추가로 종투사로 지정받아 현재 9개 대형 증권회사가 종투사로서 기업 신용공여와 PBS 업무를 수행하고 있다. 2017년 11월에는 KB증권, NH투자증권, 미래에셋증권, 삼성증권, 한국투자증권이 초대형 IB로 지정받았으며 이중 삼성증권을 제외한 4개 증권회사가 발행어음 인가를 순차적으로 받아 발행어음 업무를 수행하고 있다. 2023년 6월 현재 IMA 업무를 수행하고 있는 초대형 IB는 존재하지 않는다.

종투사 제도를 도입한 지 10년이 지났으나 그간 한국 종투사들이 제도 도입 취지에 맞게 사업구조를 운영하고 발전시켜왔는지를 평가하고 심도 있게 분석한 연구는 많지 않다.4) 2013년 10월 종투사 지정 이후 자기자본 3조원 이상의 대형 증권회사를 중심으로 자기자본과 영업이익이 비교적 큰 폭으로 성장하는 등 양적 성과를 보여주었으나, 모험자본과 종합 기업금융 서비스보다는 부동산 PF, ELSㆍDLS 등 단기 성과를 추구하는 사업 중심으로 확장해온 점에서 질적 성과는 부족하다는 평가가 많다. 또한 해외진출 측면에서 종투사들이 글로벌 IB들과 견줄만한 경쟁력을 갖추었다고 평가하기에는 부족한 부분이 많다. 신정부가 금융투자산업을 중심으로 글로벌 경쟁력 강화 방안을 모색하는 가운데, 지난 10년간 국내 종투사의 발전사를 다각도로 평가 및 분석하고, 한국형 IB의 글로벌 경쟁력 제고를 위해 중장기 비전과 전략 제시가 절실히 필요한 시점이다.

이에, 본 연구에서는 지난 10년간 국내 종투사들이 수행해왔던 사업전략이 종투사 도입 취지에 맞게 운영되고 발전되어왔는지를 평가하고 국내 종투사의 발전 과제를 제시하고자 한다. 우선 Ⅱ장에서 과거 10년간 종투사의 재무적 성과를 분석하고 종투사 제도 도입 취지에 맞게 발전해왔는지를 평가한다. Ⅲ장에서는 국내 종투사와 글로벌 IB의 사업전략을 비교ㆍ분석하고 이를 통해 국내 종투사의 발전전략을 도출한다. Ⅳ장에서는 요약 및 정책 시사점을 제시한다.

Ⅱ. 종투사 10년의 재무적 성과에 대한 평가

본 장에서는 2013년 종투사 제도 도입 당시 목표로 했던 대형화, 수익성 및 차별적 사업구조, 종합 기업금융 서비스 확대, 모험자본 공급 등 재무적 측면에서의 성과를 평가한다.

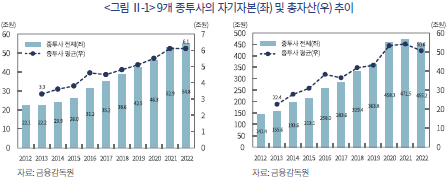

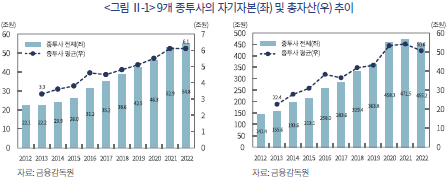

1. 대형화

2013년과 2016년 금융당국은 국내 증권업이 글로벌 IB들과 견줄만한 자본 규모로 성장하기를 기대하며 종투사 및 초대형 투자은행 육성 제도를 발표했다. 초대형 투자은행 육성 방안에서는 종투사 자기자본 규모를 3조원, 4조원, 8조원으로 구분하여 일정 자기자본 규모에 도달시 발행어음(4조원 이상 가능), IMA(8조원 이상 가능) 업무를 허용했다. 또한 금융당국은 종투사 수신자금에 대한 레버리지비율 규제 적용을 배제하고, 신(新)NCR 제도 하에서 신용위험액 부과 수준을 경감하는 등 종투사 대형화를 유도하는 정책을 발표했다. 이러한 대형화 유도 정책에 힘입어 국내 9개 종투사의 자기자본 규모는 2012년말 22.1조원에서 2022년말 54.8조원으로 148% 증가했으며 동기간 총자산은 141조원에서 455조원으로 222% 증가했다(<그림 Ⅱ-1> 참조).5) 동기간 국내 중소형 증권사의 자기자본 규모는 12.9조원에서 22.5조원으로 73% 증가하고 중소형 증권사의 자산 규모는 76.3조원에서 128.7조원으로 69% 증가에 그치는 등 종투사 증가율의 절반에 불과하다. 무엇보다 JP모건, 골드만삭스, 모건스탠리, 노무라그룹 등 글로벌 IB들의 최근 10년간 자기자본 증가율이 0~50% 내외에 불과한 것을 고려하면 국내 종투사의 자기자본 증가율은 매우 높다. 즉, 대형화 관점에서 국내 종투사는 우수한 양적 성과를 시현한 것으로 평가할 수 있다.

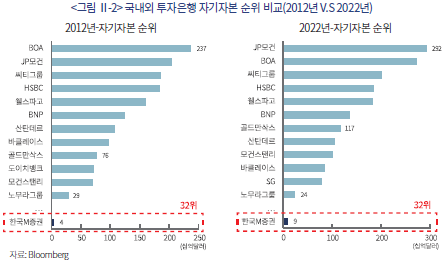

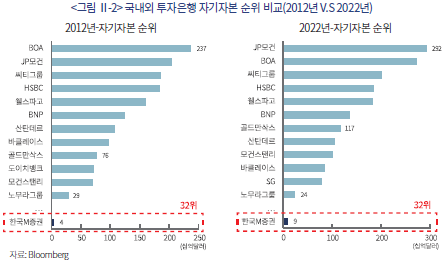

국내 종투사의 자기자본 증가율은 높지만, 자기자본의 절대 수준 측면에서는 글로벌 IB들과 비교해 여전히 낮은 순위를 기록하고 있다. 2022년말 기준 국내외 IB들을 자기자본 순위로 나열해보면 한국에서 자기자본 규모가 가장 높은 M증권의 자기자본 순위는 전세계 32위에 불과하다(<그림 Ⅱ-2> 참조). 2012년말 국내 증권사 중에서 가장 큰 증권사의 글로벌 순위가 32위였던 것과 비교하면 국내 대형 증권사의 자기자본 순위는 변함이 없다. 특히 아시아 국가 중에서 한국 증권사의 자기자본 순위는 경쟁 국가들과 비교해서 다소 낮다. 일본 대형 증권사 중에서 노무라증권, 다이와증권, 라쿠덴그룹의 자기자본 규모가 국내 종투사 자기자본 규모를 상회하며, 중국에서는 중신증권, 해통증권, 화타이증권 등 6개 이상의 증권사가 국내 종투사 자기자본 규모를 상회한다. 말레이시아 CIMB그룹, 대만 유안타그룹의 자기자본 규모도 국내 종투사의 규모를 상회하는 가운데 아시아 및 글로벌 사업을 확대하고 있다. 이상을 종합하면 국내 종투사의 자기자본 규모는 최근 10년간 비교적 빠른 속도로 증가했으나, 글로벌 IB들과 비교하면 자기자본 규모가 크지 않다. 따라서 국내 종투사가 글로벌 IB들과의 경쟁에서 우위를 가지려면 대형화는 지속해서 추진할 필요가 있다.

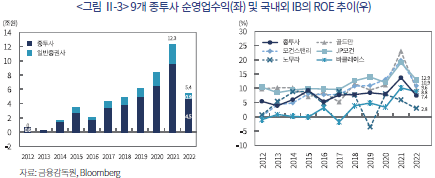

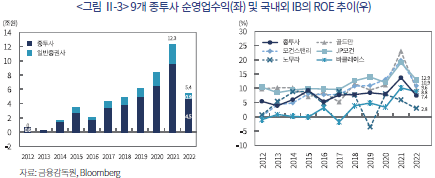

2. 수익성 및 사업차별화

종투사의 대형화를 유도하려면 증권사간 M&A와 유상증자만으로는 한계가 있고, 수익성 개선이 뒷받침되어야 한다. 이에, 금융당국은 초대형 투자은행 육성 방안에서 위탁매매 수익 의존도를 낮추고 사업 다변화를 통해 종투사의 수익성 개선을 도모하고자 했다. 금융당국의 정책 지원에 힘입어 지난 10년간 국내 종투사의 순영업수익은 큰 폭으로 증가했다. 9개 종투사의 2012년 순영업수익은 0.6조원에서 2022년 4.5조원으로 약 650% 증가했다(이하 <그림 Ⅱ-3> 참조). 2012~2022년 동안 종투사가 거둔 순영업수익은 38.5조원으로 증권업 전체 순영업이익(48.5조원)의 80%를 차지한 것을 고려하면 지난 10년간 종투사들이 한국 증권업의 수익성 향상을 견인해왔다고 말할 수 있다. 국내 종투사의 ROE는 2012년 5%대 초반에 불과했으나, 2021년 12.7%로 2배 이상 증가했으며, 2022년에는 금리 인상과 경기 둔화 등의 영향으로 다소 하락해 7.4%를 기록했다. 2022년 기준 국내 종투사의 ROE(7.4%)는 JP모건(12.9%), 모건스탠리(10.9%), 골드만삭스(9.6%), 바클레이스(8.8%)에 비해 소폭 낮고 노무라그룹(2.8%)에 비해 다소 높은 것으로 관찰되는 등 지난 10년간 수익성 측면에서 견조한 성과를 보여주었다.

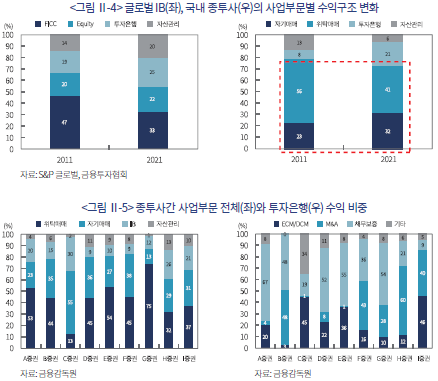

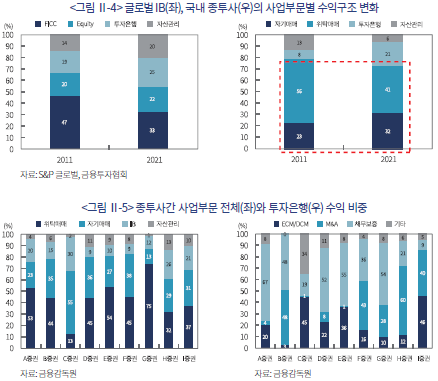

국내 종투사의 순영업수익은 큰 폭으로 증가했으나 수익구조 측면에서 특정 사업부문의 의존도가 높고, 종투사간 사업 차별화가 부족한 문제를 가지고 있다. <그림 Ⅱ-4>에서 볼 수 있듯이, 2021년 종투사의 위탁매매 수익 비중은 전체 영업수익의 41%로 제일 큰 비중을 차지하고 있고6), 자기매매 수익 비중이 32%로 두 번째로 높은 비중을 차지하고 있다. 최근 10년간 종투사의 위탁매매 수익 기여도가 감소했으나, 종투사 제도 도입 취지와 관련이 낮은 위탁매매와 자기매매 부문 수익 기여도가 전체의 70~80%를 차지하는 것은 바람직하지 못하다. 종투사의 투자은행 부문 수익 기여도가 증가한 것은 긍정적이나 투자은행 부문 수익의 상당수는 부동산 PF 채무보증 수수료와 관련되어 있어 종투사 제도 도입 취지에 부합한다고 보기는 어렵다. 그뿐 아니라 9개 종투사간 사업부문별 수익구조에서 큰 차이를 보여주지 못하고 있다. <그림 Ⅱ-5>는 지난 10년간 종투사간 사업부문별 수익 비중을 보여주고 있는데, 일부 종투사가 위탁매매 부문에서 낮은 수익 기여도를 보이고 있으나 대부분 종투사는 수익의 70~80%를 위탁매매와 자기매매 부문에 의존하고 있다. 한편 종투사간 투자은행 부문 수익 비중을 살펴보면 일부 종투사는 채무보증 수익 의존도가 낮고, ECM/DCM 및 M&A 수익 비중이 높은 것으로 관찰되는 등 투자은행 부문에서는 종투사간 차별화가 일부 관찰된다.

글로벌 IB들의 수익 비중을 살펴보면 지난 10년간 FICC(Fixed Income, Currency, Commodity) 수익 기여도가 47%에서 33%로 큰 폭 감소한 대신 투자은행, 자산관리 부문의 수익 기여도가 증가하는 등 수익구조가 다변화되었다.7) 예를 들어 골드만삭스는 M&A 주관ㆍ자문 업무에 강점을 가지며 투자은행 부문에서 높은 수익성을 거두고 있고, 모건스탠리는 E-Trade, Eaton-Vance 인수 및 생애주기 맞춤형 포트폴리오 서비스 제공을 통해 자산관리 부문에서 높은 수익성을 거두고 있다. 바클레이스는 투자은행과 소매금융의 시너지를 통해 여신부문에서 강점을 보이고 있으며, UBS는 고액 자산관리 및 투자은행 부문의 경쟁력을 바탕으로 해외진출을 적극적으로 추진해 해외점포에서 높은 이익을 거두고 있다.

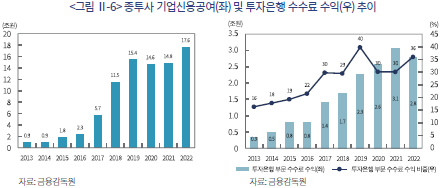

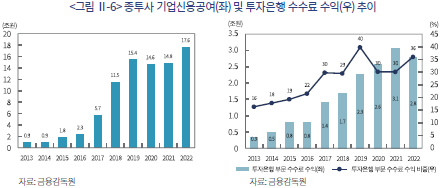

3. 종합 기업금융 서비스

종투사 제도 도입 당시 금융당국은 기업 신용공여, 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자, 해외 M&A 자문ㆍ주선, M&A 인수자금 공급, 기업에 대한 외국환서비스 및 현금성 자산 관리 등 다양한 종합 기업금융 서비스를 기대했다. 이와 같은 종합 기업금융 서비스가 활성화될 수 있도록 금융당국은 발행어음 업무를 허용하고 레버리지비율 규제 적용에 인센티브를 부여했으며, 기업 신용공여에 대한 순자본비율(NCR) 위험값을 100%에서 1.6~32%로 크게 완화해주었다.8) 정부의 정책 지원에 힘입어 종투사의 기업 신용공여 규모는 2013년말 0.9조원에서 2022년말 17.9조원으로 약 20배 증가했다(이하 <그림 Ⅱ-6> 참조).9) 종투사들의 투자은행 부문 수수료 수익도 큰 폭으로 증가했다. 2013년말 종투사의 투자은행 부문 수수료 수익은 3천 3백억원에 불과했으나 2022년말 2.8조원으로 약 9배 증가했다. 전체 수수료 수익 중에서 투자은행 부문 수수료 수익 기여도 역시 2013년말 16%에서 2022년말 36%로 20%p 증가하는 등 투자은행 부문 수익 증가가 종투사 영업수익 증가에 상당한 기여를 하였다.

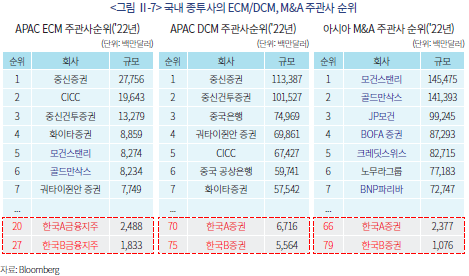

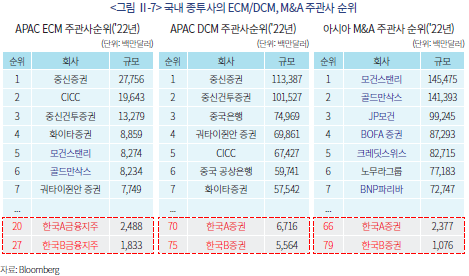

종투사의 기업금융 서비스 규모가 양적으로 성장했음에도 불구하고 질적 측면에서는 기업금융 서비스의 경쟁력이 다소 미흡하다. 우선 APAC 지역에서 ECM(Equity Capital Market) 주관사 중 국내 종투사의 순위는 20위권으로 ECM 주관사의 상위권은 중국계 증권회사 및 미국계 투자은행이 상위권을 차지하고 있다(이하 <그림 Ⅱ-7> 참조). 2022년 기준 중신증권, 중국국제금융공사(CICC)의 ECM 주관 규모는 각각 280억달러와 200억달러로 국내 상위권 종투사에 비해 10배 이상 크다. APAC 및 아시아 지역에서 DCM(Debt Capital Market)과 M&A 주관사 중에서 국내 종투사의 순위는 60~70위권으로 중국계 투자은행과 글로벌 투자은행에 비해 훨씬 뒤처진다. ECM 및 DCM 부문에서 중국계 투자은행이 상위권을 차지한 것은 중국 기업의 주식 및 채권 발행규모가 상대적으로 큰 가운데 국내 종투사 중국ㆍ홍콩 현지법인의 경쟁력이 다소 낮은 데서 그 원인을 찾을 수 있다. 아시아 지역 M&A 부문에 있어서는 미국계와 유럽계 투자은행이 상위권을 차지하고 있는데, 이는 국내 종투사가 글로벌 IB들과 비교하여 아시아 주요기업의 기업분석 능력에 있어 다소 열위에 있고, 자본력과 자금조달 비용 측면에서도 경쟁력이 부족한 데서 원인을 찾을 수 있다.

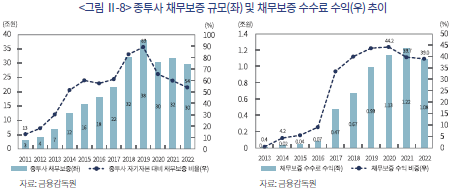

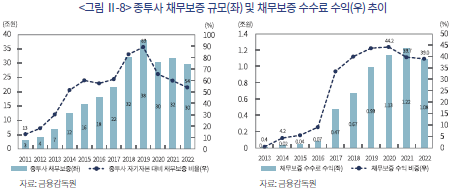

종투사 제도 도입 취지와 달리, 국내 종투사의 투자은행 부문 수수료 수익 중에서 부동산 PF 채무보증 관련 수수료 수익 의존도가 높은 점도 국내 종투사의 질적 역량이 부족한 것을 시사한다. 국내 종투사들은 건전성 규제가 완화된 것을 활용해 오히려 부동산 PF 채무보증 사업을 크게 늘려왔다. 과거 10년간 저금리와 부동산 경기 호조에 힘입어 2013년말 9개 종투사의 채무보증 수수료 수익은 최근 10년간 약 700배 이상(14억원(’12년)→1.1조원(’22년)) 증가했다(이하 <그림 Ⅱ-8> 참조). 해당 기간 투자은행 부문 수수료 수익 중에서 채무보증 수수료 수익이 차지하는 비중 역시 0.4%에서 39.0%로 약 100배 증가했다. 9개 종투사 대부분이 채무보증 사업 비중을 크게 늘리는 등 투자은행 부문에 있어서 종투사들끼리 사업 차별화가 관찰되지 않는 점도 국내 종투사의 질적 역량이 다소 미흡한 것을 시사한다. 2022년 기준 9개 종투사의 투자은행 부문 수수료 수익을 ECM/DCM, M&A, 채무보증 부문으로 분류하면 ECM/DCM, M&A 관련 수수료 수익 비중은 9개 종투사별로 0~50% 내외로 관찰되는 등 비교적 큰 편차를 가지고 있다. 반면 9개 종투사들의 채무보증 수수료 수익은 대부분 20~60%를 차지하는 등 채무보증 사업의 쏠림현상이 관찰된다. 9개 종투사들이 금융당국의 종투사 제도 도입 취지와 달리 ECM/DCM 인수, 주선 및 M&A 주선, 자문 사업보다 부동산 PF 채무보증 사업에 집중한 이유 중 하나로 부동산 PF 채무보증이 위험 대비 높은 기대수익을 가져다 준 것을 꼽을 수 있다.10)

4. 모험자본 공급

종투사 및 초대형IB 제도 도입 당시 금융당국은 종투사들이 기업금융 서비스를 확대하는 과정에 있어서 모험자본을 많이 공급함으로써 기업의 혁신성장에 마중물이 되는 것을 희망했다. 모험자본을 사전적으로 정의하는 것은 쉽지 않은 가운데, 타인자본보다 자기자본으로 기업금융을 지원할수록, 기업금융 조달방식이 채권보다는 주식에 가까울수록, 기업금융에 대한 투자 기간이 길수록, 재무구조가 우수한 대기업보다는 설립 연한이 짧은 중소기업과 벤처기업에게 기업금융을 제공할수록 모험자본에 가까운 것으로 말할 수 있다. 예를 들어 종투사들이 발행어음으로 조달한 자금으로 혁신중소기업에 대한 지분투자를 수행하고 우량 대기업보다는 중소ㆍ중견기업에게 대출을 확대하며, 짧은 만기의 우량담보 중심의 대출보다 만기가 긴 대출이나 무형자산을 담보로 대출을 수행할수록 종투사 및 초대형IB의 제도 취지에 부합한다고 볼 수 있다. 또한 ELS/DLS, RP매도, CP 및 ABCP 발행 등 만기가 짧은 차입부채를 늘리고 실질만기가 긴 부동산 관련 자산이나 부동산 수익증권을 보유하는 것은 모험자본 공급과는 거리가 먼 것으로 해석할 수 있다.

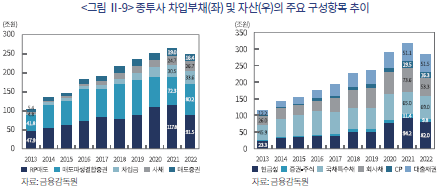

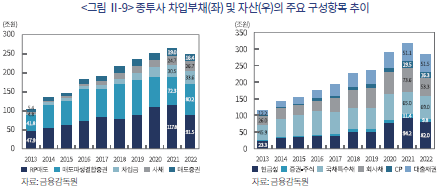

아쉽게도 국내 종투사들은 과거에 만기가 짧은 ELS/DLS, RP매도 등을 통해 차입부채를 늘리고 단기로 조달한 자금을 장기 채권이나 부동산 관련 수익증권을 보유하는 경향이 많았다. 2022년 기준 9개 종투사의 차입부채 규모는 약 252조원을 기록하고 있는 가운데, 이중 약 70%를 RP매도(91.5조원), 매도파생결합증권(80.2조원)이 차지하고 있다(이하 <그림 Ⅱ-9> 참조). RP매도와 매도파생결합증권의 경우 실질만기는 각각 1~7일, 3~6개월 이내인데, 만기가 짧은 차입부채 규모가 클수록 만기가 긴 자산과 고위험 자산을 보유하기 어렵다. 실제 9개 종투사의 자산구성 추이를 살펴보면, 2022년말 기준 현금성 자산 보유 규모가 82조원으로 자산 중 가장 큰 비중을 차지하고 있으며 모험자본 공급과 관련이 있는 주식 보유 규모는 9.8조원으로 전체 종투사 자산 규모 중 2.1%에 불과하다.

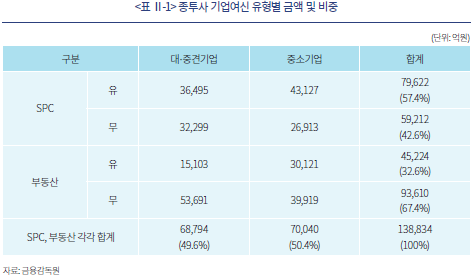

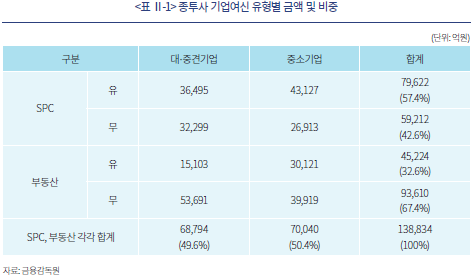

종투사 제도 및 초대형IB 제도 도입 이후 종투사들이 기업금융 규모를 큰 폭으로 늘렸으나, 기업금융의 세부 유형을 살펴보면 모험자본 공급과는 다소 거리가 먼 특징들이 관찰된다. <표 Ⅱ-1>에서 볼 수 있듯이, 2021년 상반기 기준 종투사 기업여신 중 57.4%는 특수목적회사(Special Purpose Company: SPC)를 통해 공급되었고, 종투사 기업여신 중 32.6%는 부동산 관련 자산으로 확인되었다. 이때 종투사의 SPC를 통해 수행된 기업금융 중 상당수는 부동산 담보 대출로 추정할 수 있다. 종투사가 부동산 PF 채무보증 사업을 확대하기 위해 SPC를 통해 PF-ABCP, PF-전단채 등 유동화증권 차환 발행을 수행해왔기 때문이다.11) 한편 기업 유형에 따라 기업금융 규모를 살펴보면, 모험자본과 관련이 높은 중소기업 기업금융 규모는 50%에 불과하다. 특히 부동산과 관련이 없는 기업금융 규모는 9.4조원인데 이중 중소기업 기업금융 규모는 4조원으로 42%에 불과하다. 반면 부동산과 관련된 기업금융 규모는 4.5조원인데, 이중 중소기업 기업금융 규모가 3조원으로 중소기업에게 제공된 기업금융 중 상당수는 모험자본과 관련이 낮은 부동산 담보 대출로 추정할 수 있다.

5. 시사점

2013년 종투사 제도 도입 당시 목표로 했던 대형화, 수익성 및 사업차별화, 기업금융 서비스 확대, 모험자본 공급 등 재무적 성과는 양적 측면에서 성과를 거둔 것으로 평가할 수 있다. 지난 10년간 종투사가 양적 성장을 실현한 데에는 발행어음이 허용되어 조달 비용이 낮아지고 NCR 위험값과 레버리지비율 산식이 개선되는 등 금융당국이 다양한 정책 지원을 제시한 것이 큰 영향을 미쳤다. 또한 글로벌 저금리 환경이 지속되고 기업금융과 부동산 경기가 호조세를 보인 점도 종투사의 양적 성장에 긍정적 영향을 미친 것으로 예상할 수 있다.

국내 종투사가 양적 성장에 집중하며 발전해옴에 따라 질적 성과 측면에서는 미흡한 점들이 관찰된다. 우선 종투사 순영업수익이 큰 폭으로 증가했으나 수익의 상당 부분을 ELSㆍDLS 발행 및 부동산 PF 채무보증 사업에 의존해왔으며 종투사간 사업 차별화가 다소 부족했다. 종투사의 기업금융 측면에 있어서도 부족한 점이 다수 관찰된다. 2013년 종투사 제도 도입 당시 금융당국은 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자, M&A 자문ㆍ주선, 인수자금 공급, 기업에 대한 외국환서비스 등 다양한 종합 기업금융 서비스를 기대했으나, 기업금융의 상당수는 부동산 관련 대출로 수행되었고 혁신 벤처ㆍ중소기업보다는 우량 대기업과 중견기업 중심으로 기업금융 서비스가 제공되었다.

즉, 지난 10년간 종투사 제도를 정량적 측면에서 평가하면 금융당국이 종투사에 기대했던 사업 차별화 및 모험자본 공급 확대의 목표는 달성했다고 보기 어렵다. 오히려 금융당국이 건전성 제도에 혜택을 준 것을 활용해 국내 종투사들이 단기 고수익을 기대할 수 있는 ELSㆍDLS 발행과 부동산 PF 사업에 집중한 것은 종투사 10년 발전사의 가장 큰 한계점으로 꼽을 수 있다.

Ⅲ. 글로벌 IB와 사업전략 비교를 통한 발전전략 제시

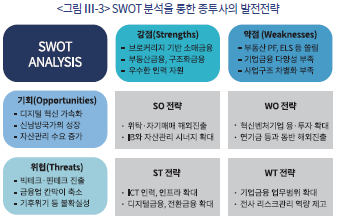

본 장에서는 국내 종투사 제도 도입 당시 벤치마크했던 글로벌 IB들과의 사업전략을 비교ㆍ분석하여 종투사의 발전전략을 모색하고자 한다. 구체적으로 글로벌 IB들의 사업전략을 살펴보고 국내 종투사에 대한 S(Strength)ㆍW(Weakness)ㆍO(Opportunity)ㆍT(Threat) 분석을 통해 종투사의 발전 방향을 제시하고자 한다.

1. 글로벌 IB의 사업전략 개요

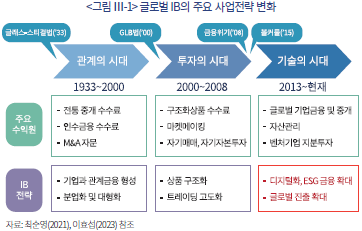

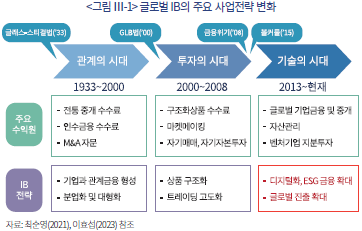

글로벌 IB들은 글로벌 금융위기 이후 도입된 볼커룰(Volcker Rule) 등의 영향으로 자기매매와 구조화상품 헤지트레이딩 업무 비중을 축소하고, 자산관리와 기업금융 서비스를 확대했다.12) 최근 글로벌 IB들은 과거 주요 수익원이었던 증권 인수ㆍ주선 업무를 다시 확대하고 글로벌 진출을 통해 M&A 주선ㆍ자문, 인수금융 업무 등을 늘리고 있다(이하 <그림 Ⅲ-1> 참조). 2020년초 발생한 코로나19를 계기로 글로벌 IB들은 디지털 전환에 적극적으로 대응하고 있으며, 기후 위기에 선제적으로 대응하기 위해 ESG 연계 금융서비스를 확대하고 있다. 선진국을 중심으로 잠재성장률이 하락하자, 미국계와 유럽계 IB들은 생산가능인구가 증가하고 기술혁신이 가속화되는 아시아 신흥국을 중심으로 글로벌 진출을 확대하고 있다. 글로벌 IB들과 달리, 국내 종투사들은 1990년대의 증권업 수익모델과 차별화 없이 위탁매매와 자기매매 위주로 사업을 수행해왔으며, 2013년 종투사 제도 도입 이후 건전성 규제가 다소 완화된 것을 이용하여 늘어난 잉여 자본을 ELSㆍDLS 발행 및 부동산 PF를 늘리는 데 활용해왔다.

다음으로, 글로벌 IB들은 글로벌 금융위기 이후 겸업화가 진행되었으나 국내 종투사들은 전업주의에 기반해 증권업 업무를 수행하고 있다(이하 <그림 Ⅲ-2> 참조). 국내 종투사들은 글로벌 IB들과 달리 은행, 보험회사, 여전회사가 개별 금융업법의 라이센스를 받아 수행하는 업무에 참여하지 못하고 있다. 예를 들어, 글로벌 IB들은 은행지주회사의 자회사나 유니버설뱅크로 변모하여 소매금융, 법인지급결제, 펀드 및 가상자산 수탁, 배출권 위탁매매 등을 큰 제약 없이 수행하고 있으나 국내 종투사들은 소매금융, 법인지급결제 등을 수행하지 못하고 있다. 한국 금융업법 체계는 전업주의를 고수하고 있어, 증권회사가 은행, 보험회사가 수행하는 본질적 업무에 참여를 희망하는 경우 엄격한 진입 규제와 건전성 규제를 적용하고 있기 때문이다. 또한 국내 종투사들은 법규 미정비 등으로 인해 가상자산 중개 및 수탁, 배출권 위탁매매 등의 업무를 수행하지 못하고 있다.13)

2. 국내 종투사에 대한 SWOT 분석

국내 종투사들은 글로벌 IB들과 비교하여 위탁매매 경쟁력이 높아 상대적으로 소매금융에 강점(Strength)이 있으며, 부동산 PF 및 ELSㆍDLS 헤지 매매를 확대하는 과정에서 부동산금융과 구조화금융에도 강점이 있다. 한국 자본시장은 개인투자자 비중이 높고 변동성이 커서 주식과 파생상품 위탁매매와 자기매매 비중이 높았기 때문이다. 코로나19 이후 금융산업의 디지털화가 가속화되는 가운데, 국내 종투사들은 과거 퀀트 분야 등에 상당한 인적, 물적 투자를 수행해온 까닭에 우수한 인력을 보유한 점도 국내 종투사의 강점으로 꼽을 수 있다.

반면 지난 10년간 종투사는 위험 대비 이익을 내기 쉬운 부동산 PF 채무보증과 ELS 등에 집중하며 기업금융 서비스의 다양성이 부족한 문제(Weakness)를 가지고 있다. 예를 들어 2013년 종투사 제도 도입 당시 금융당국이 기대했던 ECMㆍDCM, M&A 자문, 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자 등의 역량은 글로벌 IB와 비교하여 부족하다. 또한 글로벌 IB들과 다르게 ECM, DCM, M&A 자문 및 인수금융, 벤처기업 투자 등 특정 사업 분야에 차별성을 가지고 있는 종투사가 많지 않으며, 종투사간 사업구조의 쏠림이 관찰된 점도 단점으로 꼽을 수 있다.

다음으로 국내 종투사의 기회(Opportunity) 요인은 디지털 혁신이 가속화되고 개인과 기업의 자산축적 증가로 자산관리 수요가 증가하는 데서 찾을 수 있다. 코로나19 이후 비대면 자산관리 서비스 수요가 증가한 가운데, 우수한 ICT 기술력을 보유할수록 디지털화에 선제적으로 대응할 수 있기 때문이다. 세계화가 가속화되면서 중국, 인도, 베트남, 인도네시아 등 신남방국가가 빠르게 성장하고 있는 점도 국내 종투사에는 기회 요인이 될 수 있다. 경제성장률이 빠르게 증가하고 있는 신흥국은 자본시장의 발전 가능성이 크기 때문이다.

국내 종투사는 기회 요인 못지않게 외부 위협(Threat)도 큰 상황이다. 혁신 ICT 기술에 기반한 빅테크와 핀테크들이 브로커리지, 자산관리 등 증권업에 빠르게 진출하고 있다. 겸업주의가 확대되는 가운데 국내 은행은 비이자수익 증대를 위해 자산관리 서비스 확대를 추진하고 있다. 글로벌 정치경제 불확실성이 커졌고, 기후 위기가 현실로 다가오는 점도 국내 종투사에 위협 요인이 될 수 있다. 국가 온실가스 감축 목표가 강화됨에 따라 기업들은 탄소 가격 변동 위험에 크게 노출되었는데, 기업의 탄소 감축 지원을 위해 배출권 위탁 및 중개, 녹색 채권 발행 등 전환금융에 대한 수요가 빠르게 증가하고 있기 때문이다.

3. 국내 종투사의 발전전략

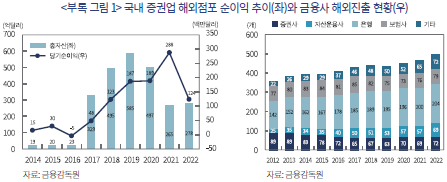

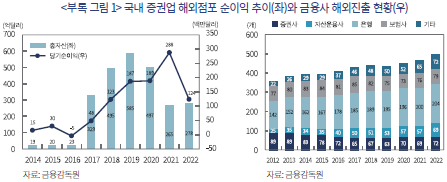

첫째, 한국 종투사의 강점을 기반으로 하여, 새로운 성장 기회를 확보하기 위해 SㆍO 전략을 제시하고자 한다(이하 <그림 Ⅲ-3> 참조). 우선 국내 종투사의 우수한 위탁매매 및 자기매매 업무 역량과 ICT 인력을 활용하여 성장 가능성이 큰 아시아 국가들에 적극적으로 진출하는 것이 필요하다. 2013년 종투사 제도 도입 당시 금융당국은 국내 종투사가 아시아 신흥국 등 해외에 적극적으로 진출하여 국내 종투사가 글로벌 IB들과의 경쟁에서 우위를 차지하기를 기대했으나, 국내 종투사의 해외 진출 성과는 기대에 미치지 못했다. 실제 국내 종투사의 해외진출 규모가 다소 증가했으나, 글로벌 IB들과 비교하면 해외진출 수익 기여도가 여전히 낮고(이하 <부록 그림 1> 참조)14), 국내 은행업, 자산운용업, 여신전문업 등과 비교해도 해외진출 증가 속도가 느리다.15) 따라서 종투사가 보유한 위탁매매와 자기매매 역량과 관련 ICT 인프라 자원을 활용하여 인도, 베트남, 인도네시아 등 신남방국가 자본시장에 국내 종투사들이 적극적으로 진출하는 노력이 필요하다. 더불어 저성장ㆍ고령화 영향으로 자산관리 부문의 성장세가 높을 것으로 예상되는 만큼 기업금융과 자산관리 부문의 시너지를 확대하는 노력이 필요하다.

둘째, 국내 종투사의 약점을 보완하고 기회를 모색하기 위해 WㆍO 전략을 제시한다. 앞선 절에서 살펴보았듯이 국내 종투사들은 혁신 벤처기업에 대한 모험자본 공급이 부족하고, 기업구조조정 시장에서 참여가 부진했다. 따라서 기업성장집합투자기구(BDC) 제도 도입 등을 통해 혁신 벤처기업에 대한 지분투자 및 벤처대출 역량을 강화하고 기업 생애주기 후기에 M&A 시장과 자본시장 중심 기업구조조정 활성화를 통해 국내 종투사들의 M&A 자문ㆍ인수금융 역량을 강화하는 노력이 필요하다.16) 더불어 한국 경제가 저성장 기조에 있어 국내 기업금융 수요는 한계가 있을 수 있으므로, 국내 종투사들이 연기금ㆍ국부펀드와 동반 해외 진출을 통해 매력적인 해외 기업금융 딜(Deal) 주선ㆍ중개에 참여하는 기회를 확대할 필요가 있다.

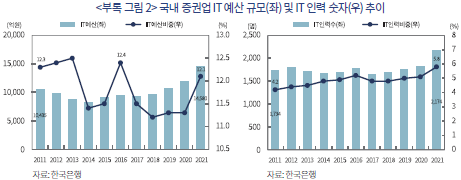

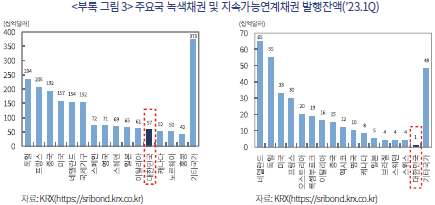

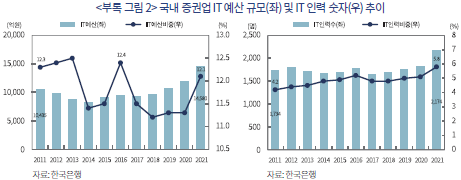

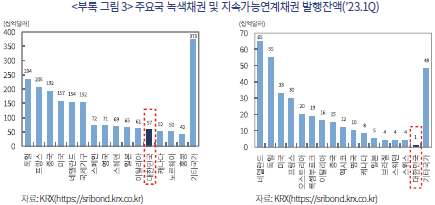

셋째, 국내 종투사의 강점을 기반으로 외부 위협에 대응하기 위해 SㆍT 전략을 제시한다. 빅테크와 핀테크의 진출 위협에 대응하고 우수한 소매금융 및 구조화금융 역량을 발휘하려면 국내 종투사들은 ICT 인력 채용을 늘리고 ICT 인프라 투자도 더욱 확대해야 한다. 골드만삭스, JP모건 등 글로벌 IB들은 디지털회사로의 변모를 추구하며 대규모 ICT 인력 채용과 인프라 투자를 수행하는 반면, 국내 종투사의 디지털화 대응은 매우 부족하다. 실제 종투사의 IT예산이 차지하는 비중은 12.3%(’11년)에서 12.1%(’21년)로 소폭 줄었으며, 종투사 전체 인력 중에서 IT 인력 비중은 5.8%로 글로벌 IB들과 비교해서 다소 낮다(이하 <부록 그림 2> 참조). 또한 미래 디지털화 가속화 및 기후변화 위기에 대응하기 위해 토큰증권 사업에 적극적으로 진출하고, 녹색채권ㆍ지속가능연계채권의 발행 확대 및 배출권 거래시장에서 위탁매매ㆍ자기매매 등의 참여를 확대할 필요가 있다. 실제 유럽과 북미의 주요 국가에 속한 기업들은 녹색채권, 지속가능연계채권들을 상당 규모로 발행하고 있지만(이하 <부록 그림 3> 참조), 국내 기업들은 상대적으로 녹색채권, 지속가능연계채권의 발행 규모가 매우 낮은 가운데 종투사들의 역할도 다소 부진한 것으로 알려져 있다.

넷째, 종투사의 약점을 보완하고 외부 위협에 대응하기 위해 WㆍO 전략을 제시한다. 무엇보다 국내 종투사들이 기업금융 서비스가 협소한 문제를 해결하기 위해 기업금융 업무범위를 확대하는 노력이 필요하다. 이를 위해 기업금융 역량 강화에 필수적인 법인지급결제 업무를 중장기적으로 허용하여 국내 종투사들이 국내외 기업들과 관계금융을 원활하게 형성하도록 도와줄 필요가 있다. 다음으로 국내 종투사가 고위험 사업구조에 집중했던 문제를 해소하고 글로벌 IB들과의 경쟁에서 우위를 가지려면 성과급 체계 및 내부통제 개선 등을 통해 전사적 위험관리 역량을 강화하는 노력이 선행되어야 할 것이다.

Ⅳ. 요약 및 시사점

종투사 제도를 도입한 지 10년이 지난 시점에 국내 종투사의 성과를 평가한 결과, 글로벌 IB들과 비교하여 종투사의 자기자본 및 총자산 규모가 빠르게 증가하고 순영업수익도 괄목할 수준으로 증가하는 등 재무적 성과 측면에서 양적 성과를 달성하였다. 반면 국내 종투사들이 부동산 PF 채무보증, ELSㆍDLS 사업 등 단기에 고수익을 기대하는 고위험 사업에 집중함에 따라 질적 성과는 다소 미흡한 것으로 평가되었다. 이에, 2013년 종투사 제도 도입 당시 목표로 했던 사업 차별화, 기업금융 서비스 확대, 모험자본 공급, 글로벌화 등 측면에서 더 큰 노력이 필요하다.

국내 종투사와 글로벌 IB들의 사업전략을 비교ㆍ분석한 결과, 국내 종투사는 위탁매매와 소매금융 부문에서 강점을 가지나, 기업금융 서비스의 다양성 및 종투사간 사업 차별화 측면에서는 글로벌 IB들과 비교하여 부족한 점이 많은 것으로 판단된다. 국내 종투사의 외부 기회 요인으로는 디지털 혁신 가속화, 신남방국가의 성장, 자산관리 수요의 증가를 꼽을 수 있으며 외부 위협 요인으로는 빅테크ㆍ핀테크의 증권업 진출 확대, 금융업 칸막이 축소, 정치경제 불확실성 및 기후 위기 증대 등을 고려할 수 있다.

종투사 제도 도입 당시 ‘글로벌 투자은행으로 성장하는 것’을 가장 큰 목표로 세웠던 만큼 한국형 IB로서 국내 종투사를 발전시키려면 국내 종투사의 강점을 기반으로 해외진출을 적극적으로 추진할 필요가 있다. 구체적으로 신남방국가의 위탁매매와 자기매매 분야에 진출하여 현지 소매 고객 니즈에 맞는 ICT 기반 증권매매 솔루션 제공을 확대할 필요가 있다. 또한 국내 종투사들이 투자은행 부문에서 경쟁력 우위를 가지기 위해 기업금융 역량을 강화하는 노력이 요구된다. BDC 제도 도입 등을 통해 혁신 벤처기업에 대한 융ㆍ투자를 확대하고 M&A 활성화를 통해 국내 종투사들의 M&A 자문ㆍ인수금융 역량을 높이는 것이 필요하다. 또한 국내 종투사들이 글로벌 경쟁력을 높이기 위해 종투사 해외법인에 대한 NCR 위험값 산식을 합리적으로 개선하고17), 연기금ㆍ국부펀드가 해외투자를 확대하는 과정에서 국내 종투사들이 중개 및 우량 딜(Deal) 주관 업무에 참여할 수 있는 유인책을 제시할 필요가 있다.18)

국내 종투사들이 빅테크ㆍ핀테크 진출 등 외부 위협에 선제적으로 대응하기 위해 전 사업 부문에서 ICT 인력 채용과 인프라 투자를 확대할 필요가 있으며, 토큰증권, 녹색채권ㆍ지속가능연계채권 발행 등 디지털금융 및 전환금융 부문에도 신사업 확대를 검토할 필요가 있다. 또한 국내 종투사들이 가진 문제점을 극복하고 글로벌 IB들과의 경쟁에서 우위를 가지려면, 국내 종투사들이 기업들과 관계금융을 원활하게 형성할 수 있도록 법인지급결제 업무를 허용하고, 성과급 체계 및 내부통제 개선 등을 통해 전사적 위험관리 역량을 강화하는 노력이 선행되어야 할 것이다.

1) 금융위원회(2013. 5. 7) 참조

2) 금융위원회(2016. 8. 2) 참조

3) 2016년 9월 27일 금융위원회는 미래에셋증권과 (구)대우증권의 합병을 승인했다.

4) 2009년 2월부터 시행된 『자본시장과 금융투자업에 관한 법률』 이후 한국 증권업의 변화 양상에 대한 내용은 조성훈(2019) 연구를 참조하기 바란다.

5) 종투사 1사당 평균 자기자본은 2013년 3.3조원에서 2022년 6.1조원으로 84.8% 증가했으며, 종투사 1사당 평균 자산은 동기간 22.4조원(’13년)에서 50.6조원(’22년)으로 126% 증가했다.

6) 국내 종투사의 위탁매매 수익 비중이 높은 것은 한국 주식시장과 장내파생상품시장의 거래 회전율이 주요국 대비 높은데서 그 원인을 찾을 수 있다.

7) S&P 글로벌은 골드만삭스, 모건스탠리, JP모건, 씨티그룹, 뱅크오브아메리카, 바클레이스, BNP 파리바, 크레딧스위스, 도이치뱅크, HBSC, SG, UBS 등 미국계 5개사와 유럽계 7개사를 대상으로 사업부문별 영업수익을 평균하여 수익 기여도 추이를 발표한다. 이때 국내 종투사와 해외 IB간 사업부문의 구별이 정확히 같지는 않으나, 투자은행과 자산관리 부문의 성격은 유사성이 높다고 볼 수 있다. 한편 국내 자기매매 부분과 글로벌 IB의 FICC수익 부문은 금융상품 헤지 트레이딩 비중이 높다는 점에서 유사성이 크다고 할 수 있다.

8) 금융위원회(2016. 8. 2) 참조

9) 금융당국의 정책 지원 외에도 지난 10년간 저금리 환경이 지속되고 기업금융 수요가 증가한 점도 종투사의 기업 신용공여 규모 증가에 긍정적 영향을 미친 것으로 예상할 수 있다.

10) 9개 종투사가 부동산 PF 채무보증 수행 시 NCR 위험값이 채무보증 규모의 18%만큼 반영되지만, 채무보증 수행에 따른 수수료 수익은 최대 채무보증 규모의 10%를 기대할 수 있는 등 ECM/DCM, M&A 관련 사업보다 위험조정 기대수익이 훨씬 큰 것으로 알려져 있다. 증권업 부동산 PF 채무보증 관련한 위험 및 기대수익 등에 관한 자세한 사항은 장근혁ㆍ이석훈ㆍ이효섭(2022)를 참조하기 바란다.

11) 장근혁ㆍ이석훈ㆍ이효섭(2023) 참조

12) 글로벌 금융위기 이후 글로벌 IB들의 변화 양상은 최순영(2021)을 참고하기 바란다.

13) 가상자산 중개ㆍ수탁과 배출권 위탁매매에 대해서는 법제화가 진행 중으로 2023년 현재 국내 종투사가 해당 업무를 수행할 수 없다.

14) 2021년 기준 국내 종투사의 해외점포 수익 비중은 전체 수익의 4~5% 내외에 불과하나, 동기간 주요 글로벌 IB들의 해외점포 수익 비중은 글로벌 IB들의 연결기준 순이익의 40~50% 내외로 한국 종투사의 10배를 기록하고 있다.

15) 국내 종투사의 해외진출도가 타 업권에 비해 낮은 이유는 국내 금융회사가 아시아 국가로 해외 진출을 추진한 가운데, 중국ㆍ인도ㆍ베트남ㆍ인도네시아 등 신남방국가는 과거 은행업 중심으로 발전해왔기 때문에 자본시장에 대한 수요가 낮은 데서 그 이유를 찾을 수 있다.

16) 국내 종투사 및 증권사의 모험자본 공급 확대 방안 관련해서는 박용린ㆍ노산하ㆍ이상호(2021) 및 박용린(2022) 연구를 참고하기 바란다.

17) 금융위원회(2023. 7. 19)에 따르면 2023년 10월부터 종투사 해외법인이 기업 신용공여를 할 때 국내법인과 달리 위험값을 100% 부과했던 것을 신용등급에 따라 차등화된 위험값(1.6~32%)을 부과하는 것으로 규제가 완화될 전망이다. 또한 국내 종투사가 해외 대체투자상품 인수ㆍ중개시 셀다운 유예기간(위험액을 100% 차감하지 않는 기간)을 현행 1개월에서 3개월로 확대하여 해외 대체투자상품 인수ㆍ중개 역량을 지원할 필요가 있다.

18) 해외주식ㆍ해외채권 중개 경험이 풍부한 국내 종투사에게 브로커리지 증권사 선정 시 가점을 부여하고, 해외 대체투자 딜(Deal) 주선 또는 M&A 자문 경험이 있는 국내 종투사에게 국민연금기금ㆍ한국투자공사 등이 딜(Deal) 주선과 M&A 자문 기회를 제공하는 방안을 검토할 수 있다.

참고문헌

금융감독원, 2023. 5. 4, 2022년 국내 증권회사 해외점포 영업실적, 보도자료.

금융위원회, 2013. 5. 7, 증권사 영업활력 제고 방안, 보도자료.

금융위원회, 2016. 8. 2, 초대형 투자은행 육성을 위한 종합금융투자사업자 제도 개선방안, 보도자료.

금융위원회, 2023. 7. 19, 9.1일부터 CFD(차액결제거래) 투자자 보호장치가 대폭 강화됩니다, 보도자료.

박용린ㆍ노산하ㆍ이상호, 2021, 『기업부문 배분효율성 제고를 위한 자본시장의 역할』, 자본시장연구원 연구총서 21-02.

박용린, 2022, 『기업성장집합투자기구의 특징과 해외사례의 시사점』, 자본시장연구원 이슈보고서 22-10.

이효섭, 2023, 해외 IB의 발전전략 및 한국형 IB의 과제, 금융투자협회ㆍ자본시장연구원 공동 제1차 릴레이세미나(2023. 3. 14).

장근혁ㆍ이석훈ㆍ이효섭, 2023, 『국내 증권업 부동산PF 위험요인과 대응방안』, 자본시장연구원 이슈보고서 23-10.

최순영, 2021, 『글로벌 금융위기 이후 주요 투자은행의 변모』, 자본시장연구원 연구보고서 21-04.

최희남, 2023, 글로벌 영역 확대 방안, 금융투자협회ㆍ자본시장연구원 공동 제2차 릴레이세미나(2023. 4. 17).

2023년 6월 현재 종합금융투자사업자(이하 종투사) 제도를 도입한 지 10년이 지났다. 2013년 5월 금융당국은 혁신 중소기업의 창업과 성장을 지원하고 기업의 해외 프로젝트 수행 시 종합적인 금융서비스를 제공하는 것을 목표로 국내 대형 증권사를 투자은행(Investment Bank: IB)으로 육성하는 방안을 발표했다.1) 이에, 금융위원회는 2013년 10월 3조원 이상의 자기자본을 보유하고, 내부통제기준 구비 조건을 갖춘 주요 대형 증권회사를 종투사로 지정하고, 해당 종투사로 하여금 기업 신용공여와 헤지펀드 전담중개 업무(Prime Brokerage Service: PBS)를 허용했다.

그러나 2013년 10월 종투사 제도가 시행되었음에도 종투사의 모험자본 공급이 부족하고, 증권회사의 영업구조가 여전히 위탁매매 중심으로 이루어지는 등 증권업의 활력이 제고되지 못하였다는 인식이 많았다.2) 2014년 기준 국내 증권회사 영업수익의 51%를 위탁매매 부문이 차지하고 있었고, 투자은행 부문은 전체 수익의 10%에 불과했다. 또한 2015년 기준 국내 종투사의 자기자본은 3~6조원 수준으로 일본 노무라그룹(28.1조원), 중국 중신증권(25.6조원), 말레이시아 CIMB(11.7조원)에 비해 현저히 작아 국내 종투사들이 종합 기업금융 서비스를 제공하기에 역량이 부족했다.

이에, 금융당국은 2016년 8월 혁신기업에 대한 모험자본 공급을 확대하고, 투자은행 중심의 종합 기업금융 서비스를 확대하는 것을 목표로 초대형 투자은행 육성방안을 발표했다. 또한 글로벌 IB들의 사업구조를 벤치마크하여 국내 증권업의 대형화를 유도하고 해외진출을 장려하기 위해 자기자본을 키울수록 유망한 투자은행 사업기회를 제공하는 인센티브를 제시했다. 구체적으로 자기자본 4조원 이상의 종투사에게 발행어음 업무를 허용하고 자기자본 8조원 이상의 종투사에게 종합투자계좌(Investment Management Account: IMA) 업무를 허용했다. 당시 금융당국은 고객에게 수신한 자금을 기초로 기업에 대한 자금공급을 원활히 수행하기 위해 발행어음과 IMA로 조달한 자금은 레버리지 비율 규제 적용 대상에서 제외하는 인센티브를 제시하였다.

2023년 6월 현재 총 9개 대형 증권회사가 금융당국으로부터 종투사로 지정받아 기업 신용공여 등의 업무를 수행하고 있으며, 이 중 4개 종투사는 초대형 IB로 허가받아 발행어음 업무를 수행하고 있다. 종투사 지정 현황을 살펴보면(이하 <그림 Ⅰ-1> 참조), 2013년 10월 KB증권((구)현대증권), NH투자증권((구)우리투자증권), 미래에셋증권((구)대우증권), 삼성증권, 한국투자증권 등 5개 회사가 종투사로 지정받았으며 이후 (구)미래에셋증권3), 신한증권, 메리츠증권, 하나증권, 키움증권이 추가로 종투사로 지정받아 현재 9개 대형 증권회사가 종투사로서 기업 신용공여와 PBS 업무를 수행하고 있다. 2017년 11월에는 KB증권, NH투자증권, 미래에셋증권, 삼성증권, 한국투자증권이 초대형 IB로 지정받았으며 이중 삼성증권을 제외한 4개 증권회사가 발행어음 인가를 순차적으로 받아 발행어음 업무를 수행하고 있다. 2023년 6월 현재 IMA 업무를 수행하고 있는 초대형 IB는 존재하지 않는다.

종투사 제도를 도입한 지 10년이 지났으나 그간 한국 종투사들이 제도 도입 취지에 맞게 사업구조를 운영하고 발전시켜왔는지를 평가하고 심도 있게 분석한 연구는 많지 않다.4) 2013년 10월 종투사 지정 이후 자기자본 3조원 이상의 대형 증권회사를 중심으로 자기자본과 영업이익이 비교적 큰 폭으로 성장하는 등 양적 성과를 보여주었으나, 모험자본과 종합 기업금융 서비스보다는 부동산 PF, ELSㆍDLS 등 단기 성과를 추구하는 사업 중심으로 확장해온 점에서 질적 성과는 부족하다는 평가가 많다. 또한 해외진출 측면에서 종투사들이 글로벌 IB들과 견줄만한 경쟁력을 갖추었다고 평가하기에는 부족한 부분이 많다. 신정부가 금융투자산업을 중심으로 글로벌 경쟁력 강화 방안을 모색하는 가운데, 지난 10년간 국내 종투사의 발전사를 다각도로 평가 및 분석하고, 한국형 IB의 글로벌 경쟁력 제고를 위해 중장기 비전과 전략 제시가 절실히 필요한 시점이다.

이에, 본 연구에서는 지난 10년간 국내 종투사들이 수행해왔던 사업전략이 종투사 도입 취지에 맞게 운영되고 발전되어왔는지를 평가하고 국내 종투사의 발전 과제를 제시하고자 한다. 우선 Ⅱ장에서 과거 10년간 종투사의 재무적 성과를 분석하고 종투사 제도 도입 취지에 맞게 발전해왔는지를 평가한다. Ⅲ장에서는 국내 종투사와 글로벌 IB의 사업전략을 비교ㆍ분석하고 이를 통해 국내 종투사의 발전전략을 도출한다. Ⅳ장에서는 요약 및 정책 시사점을 제시한다.

Ⅱ. 종투사 10년의 재무적 성과에 대한 평가

본 장에서는 2013년 종투사 제도 도입 당시 목표로 했던 대형화, 수익성 및 차별적 사업구조, 종합 기업금융 서비스 확대, 모험자본 공급 등 재무적 측면에서의 성과를 평가한다.

1. 대형화

2013년과 2016년 금융당국은 국내 증권업이 글로벌 IB들과 견줄만한 자본 규모로 성장하기를 기대하며 종투사 및 초대형 투자은행 육성 제도를 발표했다. 초대형 투자은행 육성 방안에서는 종투사 자기자본 규모를 3조원, 4조원, 8조원으로 구분하여 일정 자기자본 규모에 도달시 발행어음(4조원 이상 가능), IMA(8조원 이상 가능) 업무를 허용했다. 또한 금융당국은 종투사 수신자금에 대한 레버리지비율 규제 적용을 배제하고, 신(新)NCR 제도 하에서 신용위험액 부과 수준을 경감하는 등 종투사 대형화를 유도하는 정책을 발표했다. 이러한 대형화 유도 정책에 힘입어 국내 9개 종투사의 자기자본 규모는 2012년말 22.1조원에서 2022년말 54.8조원으로 148% 증가했으며 동기간 총자산은 141조원에서 455조원으로 222% 증가했다(<그림 Ⅱ-1> 참조).5) 동기간 국내 중소형 증권사의 자기자본 규모는 12.9조원에서 22.5조원으로 73% 증가하고 중소형 증권사의 자산 규모는 76.3조원에서 128.7조원으로 69% 증가에 그치는 등 종투사 증가율의 절반에 불과하다. 무엇보다 JP모건, 골드만삭스, 모건스탠리, 노무라그룹 등 글로벌 IB들의 최근 10년간 자기자본 증가율이 0~50% 내외에 불과한 것을 고려하면 국내 종투사의 자기자본 증가율은 매우 높다. 즉, 대형화 관점에서 국내 종투사는 우수한 양적 성과를 시현한 것으로 평가할 수 있다.

국내 종투사의 자기자본 증가율은 높지만, 자기자본의 절대 수준 측면에서는 글로벌 IB들과 비교해 여전히 낮은 순위를 기록하고 있다. 2022년말 기준 국내외 IB들을 자기자본 순위로 나열해보면 한국에서 자기자본 규모가 가장 높은 M증권의 자기자본 순위는 전세계 32위에 불과하다(<그림 Ⅱ-2> 참조). 2012년말 국내 증권사 중에서 가장 큰 증권사의 글로벌 순위가 32위였던 것과 비교하면 국내 대형 증권사의 자기자본 순위는 변함이 없다. 특히 아시아 국가 중에서 한국 증권사의 자기자본 순위는 경쟁 국가들과 비교해서 다소 낮다. 일본 대형 증권사 중에서 노무라증권, 다이와증권, 라쿠덴그룹의 자기자본 규모가 국내 종투사 자기자본 규모를 상회하며, 중국에서는 중신증권, 해통증권, 화타이증권 등 6개 이상의 증권사가 국내 종투사 자기자본 규모를 상회한다. 말레이시아 CIMB그룹, 대만 유안타그룹의 자기자본 규모도 국내 종투사의 규모를 상회하는 가운데 아시아 및 글로벌 사업을 확대하고 있다. 이상을 종합하면 국내 종투사의 자기자본 규모는 최근 10년간 비교적 빠른 속도로 증가했으나, 글로벌 IB들과 비교하면 자기자본 규모가 크지 않다. 따라서 국내 종투사가 글로벌 IB들과의 경쟁에서 우위를 가지려면 대형화는 지속해서 추진할 필요가 있다.

2. 수익성 및 사업차별화

종투사의 대형화를 유도하려면 증권사간 M&A와 유상증자만으로는 한계가 있고, 수익성 개선이 뒷받침되어야 한다. 이에, 금융당국은 초대형 투자은행 육성 방안에서 위탁매매 수익 의존도를 낮추고 사업 다변화를 통해 종투사의 수익성 개선을 도모하고자 했다. 금융당국의 정책 지원에 힘입어 지난 10년간 국내 종투사의 순영업수익은 큰 폭으로 증가했다. 9개 종투사의 2012년 순영업수익은 0.6조원에서 2022년 4.5조원으로 약 650% 증가했다(이하 <그림 Ⅱ-3> 참조). 2012~2022년 동안 종투사가 거둔 순영업수익은 38.5조원으로 증권업 전체 순영업이익(48.5조원)의 80%를 차지한 것을 고려하면 지난 10년간 종투사들이 한국 증권업의 수익성 향상을 견인해왔다고 말할 수 있다. 국내 종투사의 ROE는 2012년 5%대 초반에 불과했으나, 2021년 12.7%로 2배 이상 증가했으며, 2022년에는 금리 인상과 경기 둔화 등의 영향으로 다소 하락해 7.4%를 기록했다. 2022년 기준 국내 종투사의 ROE(7.4%)는 JP모건(12.9%), 모건스탠리(10.9%), 골드만삭스(9.6%), 바클레이스(8.8%)에 비해 소폭 낮고 노무라그룹(2.8%)에 비해 다소 높은 것으로 관찰되는 등 지난 10년간 수익성 측면에서 견조한 성과를 보여주었다.

국내 종투사의 순영업수익은 큰 폭으로 증가했으나 수익구조 측면에서 특정 사업부문의 의존도가 높고, 종투사간 사업 차별화가 부족한 문제를 가지고 있다. <그림 Ⅱ-4>에서 볼 수 있듯이, 2021년 종투사의 위탁매매 수익 비중은 전체 영업수익의 41%로 제일 큰 비중을 차지하고 있고6), 자기매매 수익 비중이 32%로 두 번째로 높은 비중을 차지하고 있다. 최근 10년간 종투사의 위탁매매 수익 기여도가 감소했으나, 종투사 제도 도입 취지와 관련이 낮은 위탁매매와 자기매매 부문 수익 기여도가 전체의 70~80%를 차지하는 것은 바람직하지 못하다. 종투사의 투자은행 부문 수익 기여도가 증가한 것은 긍정적이나 투자은행 부문 수익의 상당수는 부동산 PF 채무보증 수수료와 관련되어 있어 종투사 제도 도입 취지에 부합한다고 보기는 어렵다. 그뿐 아니라 9개 종투사간 사업부문별 수익구조에서 큰 차이를 보여주지 못하고 있다. <그림 Ⅱ-5>는 지난 10년간 종투사간 사업부문별 수익 비중을 보여주고 있는데, 일부 종투사가 위탁매매 부문에서 낮은 수익 기여도를 보이고 있으나 대부분 종투사는 수익의 70~80%를 위탁매매와 자기매매 부문에 의존하고 있다. 한편 종투사간 투자은행 부문 수익 비중을 살펴보면 일부 종투사는 채무보증 수익 의존도가 낮고, ECM/DCM 및 M&A 수익 비중이 높은 것으로 관찰되는 등 투자은행 부문에서는 종투사간 차별화가 일부 관찰된다.

글로벌 IB들의 수익 비중을 살펴보면 지난 10년간 FICC(Fixed Income, Currency, Commodity) 수익 기여도가 47%에서 33%로 큰 폭 감소한 대신 투자은행, 자산관리 부문의 수익 기여도가 증가하는 등 수익구조가 다변화되었다.7) 예를 들어 골드만삭스는 M&A 주관ㆍ자문 업무에 강점을 가지며 투자은행 부문에서 높은 수익성을 거두고 있고, 모건스탠리는 E-Trade, Eaton-Vance 인수 및 생애주기 맞춤형 포트폴리오 서비스 제공을 통해 자산관리 부문에서 높은 수익성을 거두고 있다. 바클레이스는 투자은행과 소매금융의 시너지를 통해 여신부문에서 강점을 보이고 있으며, UBS는 고액 자산관리 및 투자은행 부문의 경쟁력을 바탕으로 해외진출을 적극적으로 추진해 해외점포에서 높은 이익을 거두고 있다.

3. 종합 기업금융 서비스

종투사 제도 도입 당시 금융당국은 기업 신용공여, 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자, 해외 M&A 자문ㆍ주선, M&A 인수자금 공급, 기업에 대한 외국환서비스 및 현금성 자산 관리 등 다양한 종합 기업금융 서비스를 기대했다. 이와 같은 종합 기업금융 서비스가 활성화될 수 있도록 금융당국은 발행어음 업무를 허용하고 레버리지비율 규제 적용에 인센티브를 부여했으며, 기업 신용공여에 대한 순자본비율(NCR) 위험값을 100%에서 1.6~32%로 크게 완화해주었다.8) 정부의 정책 지원에 힘입어 종투사의 기업 신용공여 규모는 2013년말 0.9조원에서 2022년말 17.9조원으로 약 20배 증가했다(이하 <그림 Ⅱ-6> 참조).9) 종투사들의 투자은행 부문 수수료 수익도 큰 폭으로 증가했다. 2013년말 종투사의 투자은행 부문 수수료 수익은 3천 3백억원에 불과했으나 2022년말 2.8조원으로 약 9배 증가했다. 전체 수수료 수익 중에서 투자은행 부문 수수료 수익 기여도 역시 2013년말 16%에서 2022년말 36%로 20%p 증가하는 등 투자은행 부문 수익 증가가 종투사 영업수익 증가에 상당한 기여를 하였다.

종투사의 기업금융 서비스 규모가 양적으로 성장했음에도 불구하고 질적 측면에서는 기업금융 서비스의 경쟁력이 다소 미흡하다. 우선 APAC 지역에서 ECM(Equity Capital Market) 주관사 중 국내 종투사의 순위는 20위권으로 ECM 주관사의 상위권은 중국계 증권회사 및 미국계 투자은행이 상위권을 차지하고 있다(이하 <그림 Ⅱ-7> 참조). 2022년 기준 중신증권, 중국국제금융공사(CICC)의 ECM 주관 규모는 각각 280억달러와 200억달러로 국내 상위권 종투사에 비해 10배 이상 크다. APAC 및 아시아 지역에서 DCM(Debt Capital Market)과 M&A 주관사 중에서 국내 종투사의 순위는 60~70위권으로 중국계 투자은행과 글로벌 투자은행에 비해 훨씬 뒤처진다. ECM 및 DCM 부문에서 중국계 투자은행이 상위권을 차지한 것은 중국 기업의 주식 및 채권 발행규모가 상대적으로 큰 가운데 국내 종투사 중국ㆍ홍콩 현지법인의 경쟁력이 다소 낮은 데서 그 원인을 찾을 수 있다. 아시아 지역 M&A 부문에 있어서는 미국계와 유럽계 투자은행이 상위권을 차지하고 있는데, 이는 국내 종투사가 글로벌 IB들과 비교하여 아시아 주요기업의 기업분석 능력에 있어 다소 열위에 있고, 자본력과 자금조달 비용 측면에서도 경쟁력이 부족한 데서 원인을 찾을 수 있다.

종투사 제도 도입 취지와 달리, 국내 종투사의 투자은행 부문 수수료 수익 중에서 부동산 PF 채무보증 관련 수수료 수익 의존도가 높은 점도 국내 종투사의 질적 역량이 부족한 것을 시사한다. 국내 종투사들은 건전성 규제가 완화된 것을 활용해 오히려 부동산 PF 채무보증 사업을 크게 늘려왔다. 과거 10년간 저금리와 부동산 경기 호조에 힘입어 2013년말 9개 종투사의 채무보증 수수료 수익은 최근 10년간 약 700배 이상(14억원(’12년)→1.1조원(’22년)) 증가했다(이하 <그림 Ⅱ-8> 참조). 해당 기간 투자은행 부문 수수료 수익 중에서 채무보증 수수료 수익이 차지하는 비중 역시 0.4%에서 39.0%로 약 100배 증가했다. 9개 종투사 대부분이 채무보증 사업 비중을 크게 늘리는 등 투자은행 부문에 있어서 종투사들끼리 사업 차별화가 관찰되지 않는 점도 국내 종투사의 질적 역량이 다소 미흡한 것을 시사한다. 2022년 기준 9개 종투사의 투자은행 부문 수수료 수익을 ECM/DCM, M&A, 채무보증 부문으로 분류하면 ECM/DCM, M&A 관련 수수료 수익 비중은 9개 종투사별로 0~50% 내외로 관찰되는 등 비교적 큰 편차를 가지고 있다. 반면 9개 종투사들의 채무보증 수수료 수익은 대부분 20~60%를 차지하는 등 채무보증 사업의 쏠림현상이 관찰된다. 9개 종투사들이 금융당국의 종투사 제도 도입 취지와 달리 ECM/DCM 인수, 주선 및 M&A 주선, 자문 사업보다 부동산 PF 채무보증 사업에 집중한 이유 중 하나로 부동산 PF 채무보증이 위험 대비 높은 기대수익을 가져다 준 것을 꼽을 수 있다.10)

4. 모험자본 공급

종투사 및 초대형IB 제도 도입 당시 금융당국은 종투사들이 기업금융 서비스를 확대하는 과정에 있어서 모험자본을 많이 공급함으로써 기업의 혁신성장에 마중물이 되는 것을 희망했다. 모험자본을 사전적으로 정의하는 것은 쉽지 않은 가운데, 타인자본보다 자기자본으로 기업금융을 지원할수록, 기업금융 조달방식이 채권보다는 주식에 가까울수록, 기업금융에 대한 투자 기간이 길수록, 재무구조가 우수한 대기업보다는 설립 연한이 짧은 중소기업과 벤처기업에게 기업금융을 제공할수록 모험자본에 가까운 것으로 말할 수 있다. 예를 들어 종투사들이 발행어음으로 조달한 자금으로 혁신중소기업에 대한 지분투자를 수행하고 우량 대기업보다는 중소ㆍ중견기업에게 대출을 확대하며, 짧은 만기의 우량담보 중심의 대출보다 만기가 긴 대출이나 무형자산을 담보로 대출을 수행할수록 종투사 및 초대형IB의 제도 취지에 부합한다고 볼 수 있다. 또한 ELS/DLS, RP매도, CP 및 ABCP 발행 등 만기가 짧은 차입부채를 늘리고 실질만기가 긴 부동산 관련 자산이나 부동산 수익증권을 보유하는 것은 모험자본 공급과는 거리가 먼 것으로 해석할 수 있다.

아쉽게도 국내 종투사들은 과거에 만기가 짧은 ELS/DLS, RP매도 등을 통해 차입부채를 늘리고 단기로 조달한 자금을 장기 채권이나 부동산 관련 수익증권을 보유하는 경향이 많았다. 2022년 기준 9개 종투사의 차입부채 규모는 약 252조원을 기록하고 있는 가운데, 이중 약 70%를 RP매도(91.5조원), 매도파생결합증권(80.2조원)이 차지하고 있다(이하 <그림 Ⅱ-9> 참조). RP매도와 매도파생결합증권의 경우 실질만기는 각각 1~7일, 3~6개월 이내인데, 만기가 짧은 차입부채 규모가 클수록 만기가 긴 자산과 고위험 자산을 보유하기 어렵다. 실제 9개 종투사의 자산구성 추이를 살펴보면, 2022년말 기준 현금성 자산 보유 규모가 82조원으로 자산 중 가장 큰 비중을 차지하고 있으며 모험자본 공급과 관련이 있는 주식 보유 규모는 9.8조원으로 전체 종투사 자산 규모 중 2.1%에 불과하다.

종투사 제도 및 초대형IB 제도 도입 이후 종투사들이 기업금융 규모를 큰 폭으로 늘렸으나, 기업금융의 세부 유형을 살펴보면 모험자본 공급과는 다소 거리가 먼 특징들이 관찰된다. <표 Ⅱ-1>에서 볼 수 있듯이, 2021년 상반기 기준 종투사 기업여신 중 57.4%는 특수목적회사(Special Purpose Company: SPC)를 통해 공급되었고, 종투사 기업여신 중 32.6%는 부동산 관련 자산으로 확인되었다. 이때 종투사의 SPC를 통해 수행된 기업금융 중 상당수는 부동산 담보 대출로 추정할 수 있다. 종투사가 부동산 PF 채무보증 사업을 확대하기 위해 SPC를 통해 PF-ABCP, PF-전단채 등 유동화증권 차환 발행을 수행해왔기 때문이다.11) 한편 기업 유형에 따라 기업금융 규모를 살펴보면, 모험자본과 관련이 높은 중소기업 기업금융 규모는 50%에 불과하다. 특히 부동산과 관련이 없는 기업금융 규모는 9.4조원인데 이중 중소기업 기업금융 규모는 4조원으로 42%에 불과하다. 반면 부동산과 관련된 기업금융 규모는 4.5조원인데, 이중 중소기업 기업금융 규모가 3조원으로 중소기업에게 제공된 기업금융 중 상당수는 모험자본과 관련이 낮은 부동산 담보 대출로 추정할 수 있다.

5. 시사점

2013년 종투사 제도 도입 당시 목표로 했던 대형화, 수익성 및 사업차별화, 기업금융 서비스 확대, 모험자본 공급 등 재무적 성과는 양적 측면에서 성과를 거둔 것으로 평가할 수 있다. 지난 10년간 종투사가 양적 성장을 실현한 데에는 발행어음이 허용되어 조달 비용이 낮아지고 NCR 위험값과 레버리지비율 산식이 개선되는 등 금융당국이 다양한 정책 지원을 제시한 것이 큰 영향을 미쳤다. 또한 글로벌 저금리 환경이 지속되고 기업금융과 부동산 경기가 호조세를 보인 점도 종투사의 양적 성장에 긍정적 영향을 미친 것으로 예상할 수 있다.

국내 종투사가 양적 성장에 집중하며 발전해옴에 따라 질적 성과 측면에서는 미흡한 점들이 관찰된다. 우선 종투사 순영업수익이 큰 폭으로 증가했으나 수익의 상당 부분을 ELSㆍDLS 발행 및 부동산 PF 채무보증 사업에 의존해왔으며 종투사간 사업 차별화가 다소 부족했다. 종투사의 기업금융 측면에 있어서도 부족한 점이 다수 관찰된다. 2013년 종투사 제도 도입 당시 금융당국은 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자, M&A 자문ㆍ주선, 인수자금 공급, 기업에 대한 외국환서비스 등 다양한 종합 기업금융 서비스를 기대했으나, 기업금융의 상당수는 부동산 관련 대출로 수행되었고 혁신 벤처ㆍ중소기업보다는 우량 대기업과 중견기업 중심으로 기업금융 서비스가 제공되었다.

즉, 지난 10년간 종투사 제도를 정량적 측면에서 평가하면 금융당국이 종투사에 기대했던 사업 차별화 및 모험자본 공급 확대의 목표는 달성했다고 보기 어렵다. 오히려 금융당국이 건전성 제도에 혜택을 준 것을 활용해 국내 종투사들이 단기 고수익을 기대할 수 있는 ELSㆍDLS 발행과 부동산 PF 사업에 집중한 것은 종투사 10년 발전사의 가장 큰 한계점으로 꼽을 수 있다.

Ⅲ. 글로벌 IB와 사업전략 비교를 통한 발전전략 제시

본 장에서는 국내 종투사 제도 도입 당시 벤치마크했던 글로벌 IB들과의 사업전략을 비교ㆍ분석하여 종투사의 발전전략을 모색하고자 한다. 구체적으로 글로벌 IB들의 사업전략을 살펴보고 국내 종투사에 대한 S(Strength)ㆍW(Weakness)ㆍO(Opportunity)ㆍT(Threat) 분석을 통해 종투사의 발전 방향을 제시하고자 한다.

1. 글로벌 IB의 사업전략 개요

글로벌 IB들은 글로벌 금융위기 이후 도입된 볼커룰(Volcker Rule) 등의 영향으로 자기매매와 구조화상품 헤지트레이딩 업무 비중을 축소하고, 자산관리와 기업금융 서비스를 확대했다.12) 최근 글로벌 IB들은 과거 주요 수익원이었던 증권 인수ㆍ주선 업무를 다시 확대하고 글로벌 진출을 통해 M&A 주선ㆍ자문, 인수금융 업무 등을 늘리고 있다(이하 <그림 Ⅲ-1> 참조). 2020년초 발생한 코로나19를 계기로 글로벌 IB들은 디지털 전환에 적극적으로 대응하고 있으며, 기후 위기에 선제적으로 대응하기 위해 ESG 연계 금융서비스를 확대하고 있다. 선진국을 중심으로 잠재성장률이 하락하자, 미국계와 유럽계 IB들은 생산가능인구가 증가하고 기술혁신이 가속화되는 아시아 신흥국을 중심으로 글로벌 진출을 확대하고 있다. 글로벌 IB들과 달리, 국내 종투사들은 1990년대의 증권업 수익모델과 차별화 없이 위탁매매와 자기매매 위주로 사업을 수행해왔으며, 2013년 종투사 제도 도입 이후 건전성 규제가 다소 완화된 것을 이용하여 늘어난 잉여 자본을 ELSㆍDLS 발행 및 부동산 PF를 늘리는 데 활용해왔다.

다음으로, 글로벌 IB들은 글로벌 금융위기 이후 겸업화가 진행되었으나 국내 종투사들은 전업주의에 기반해 증권업 업무를 수행하고 있다(이하 <그림 Ⅲ-2> 참조). 국내 종투사들은 글로벌 IB들과 달리 은행, 보험회사, 여전회사가 개별 금융업법의 라이센스를 받아 수행하는 업무에 참여하지 못하고 있다. 예를 들어, 글로벌 IB들은 은행지주회사의 자회사나 유니버설뱅크로 변모하여 소매금융, 법인지급결제, 펀드 및 가상자산 수탁, 배출권 위탁매매 등을 큰 제약 없이 수행하고 있으나 국내 종투사들은 소매금융, 법인지급결제 등을 수행하지 못하고 있다. 한국 금융업법 체계는 전업주의를 고수하고 있어, 증권회사가 은행, 보험회사가 수행하는 본질적 업무에 참여를 희망하는 경우 엄격한 진입 규제와 건전성 규제를 적용하고 있기 때문이다. 또한 국내 종투사들은 법규 미정비 등으로 인해 가상자산 중개 및 수탁, 배출권 위탁매매 등의 업무를 수행하지 못하고 있다.13)

2. 국내 종투사에 대한 SWOT 분석

국내 종투사들은 글로벌 IB들과 비교하여 위탁매매 경쟁력이 높아 상대적으로 소매금융에 강점(Strength)이 있으며, 부동산 PF 및 ELSㆍDLS 헤지 매매를 확대하는 과정에서 부동산금융과 구조화금융에도 강점이 있다. 한국 자본시장은 개인투자자 비중이 높고 변동성이 커서 주식과 파생상품 위탁매매와 자기매매 비중이 높았기 때문이다. 코로나19 이후 금융산업의 디지털화가 가속화되는 가운데, 국내 종투사들은 과거 퀀트 분야 등에 상당한 인적, 물적 투자를 수행해온 까닭에 우수한 인력을 보유한 점도 국내 종투사의 강점으로 꼽을 수 있다.

반면 지난 10년간 종투사는 위험 대비 이익을 내기 쉬운 부동산 PF 채무보증과 ELS 등에 집중하며 기업금융 서비스의 다양성이 부족한 문제(Weakness)를 가지고 있다. 예를 들어 2013년 종투사 제도 도입 당시 금융당국이 기대했던 ECMㆍDCM, M&A 자문, 혁신 중소기업에 대한 융ㆍ투자, 초대형 프로젝트에 대한 중ㆍ후순위 출자 등의 역량은 글로벌 IB와 비교하여 부족하다. 또한 글로벌 IB들과 다르게 ECM, DCM, M&A 자문 및 인수금융, 벤처기업 투자 등 특정 사업 분야에 차별성을 가지고 있는 종투사가 많지 않으며, 종투사간 사업구조의 쏠림이 관찰된 점도 단점으로 꼽을 수 있다.

다음으로 국내 종투사의 기회(Opportunity) 요인은 디지털 혁신이 가속화되고 개인과 기업의 자산축적 증가로 자산관리 수요가 증가하는 데서 찾을 수 있다. 코로나19 이후 비대면 자산관리 서비스 수요가 증가한 가운데, 우수한 ICT 기술력을 보유할수록 디지털화에 선제적으로 대응할 수 있기 때문이다. 세계화가 가속화되면서 중국, 인도, 베트남, 인도네시아 등 신남방국가가 빠르게 성장하고 있는 점도 국내 종투사에는 기회 요인이 될 수 있다. 경제성장률이 빠르게 증가하고 있는 신흥국은 자본시장의 발전 가능성이 크기 때문이다.

국내 종투사는 기회 요인 못지않게 외부 위협(Threat)도 큰 상황이다. 혁신 ICT 기술에 기반한 빅테크와 핀테크들이 브로커리지, 자산관리 등 증권업에 빠르게 진출하고 있다. 겸업주의가 확대되는 가운데 국내 은행은 비이자수익 증대를 위해 자산관리 서비스 확대를 추진하고 있다. 글로벌 정치경제 불확실성이 커졌고, 기후 위기가 현실로 다가오는 점도 국내 종투사에 위협 요인이 될 수 있다. 국가 온실가스 감축 목표가 강화됨에 따라 기업들은 탄소 가격 변동 위험에 크게 노출되었는데, 기업의 탄소 감축 지원을 위해 배출권 위탁 및 중개, 녹색 채권 발행 등 전환금융에 대한 수요가 빠르게 증가하고 있기 때문이다.

3. 국내 종투사의 발전전략

첫째, 한국 종투사의 강점을 기반으로 하여, 새로운 성장 기회를 확보하기 위해 SㆍO 전략을 제시하고자 한다(이하 <그림 Ⅲ-3> 참조). 우선 국내 종투사의 우수한 위탁매매 및 자기매매 업무 역량과 ICT 인력을 활용하여 성장 가능성이 큰 아시아 국가들에 적극적으로 진출하는 것이 필요하다. 2013년 종투사 제도 도입 당시 금융당국은 국내 종투사가 아시아 신흥국 등 해외에 적극적으로 진출하여 국내 종투사가 글로벌 IB들과의 경쟁에서 우위를 차지하기를 기대했으나, 국내 종투사의 해외 진출 성과는 기대에 미치지 못했다. 실제 국내 종투사의 해외진출 규모가 다소 증가했으나, 글로벌 IB들과 비교하면 해외진출 수익 기여도가 여전히 낮고(이하 <부록 그림 1> 참조)14), 국내 은행업, 자산운용업, 여신전문업 등과 비교해도 해외진출 증가 속도가 느리다.15) 따라서 종투사가 보유한 위탁매매와 자기매매 역량과 관련 ICT 인프라 자원을 활용하여 인도, 베트남, 인도네시아 등 신남방국가 자본시장에 국내 종투사들이 적극적으로 진출하는 노력이 필요하다. 더불어 저성장ㆍ고령화 영향으로 자산관리 부문의 성장세가 높을 것으로 예상되는 만큼 기업금융과 자산관리 부문의 시너지를 확대하는 노력이 필요하다.

둘째, 국내 종투사의 약점을 보완하고 기회를 모색하기 위해 WㆍO 전략을 제시한다. 앞선 절에서 살펴보았듯이 국내 종투사들은 혁신 벤처기업에 대한 모험자본 공급이 부족하고, 기업구조조정 시장에서 참여가 부진했다. 따라서 기업성장집합투자기구(BDC) 제도 도입 등을 통해 혁신 벤처기업에 대한 지분투자 및 벤처대출 역량을 강화하고 기업 생애주기 후기에 M&A 시장과 자본시장 중심 기업구조조정 활성화를 통해 국내 종투사들의 M&A 자문ㆍ인수금융 역량을 강화하는 노력이 필요하다.16) 더불어 한국 경제가 저성장 기조에 있어 국내 기업금융 수요는 한계가 있을 수 있으므로, 국내 종투사들이 연기금ㆍ국부펀드와 동반 해외 진출을 통해 매력적인 해외 기업금융 딜(Deal) 주선ㆍ중개에 참여하는 기회를 확대할 필요가 있다.

셋째, 국내 종투사의 강점을 기반으로 외부 위협에 대응하기 위해 SㆍT 전략을 제시한다. 빅테크와 핀테크의 진출 위협에 대응하고 우수한 소매금융 및 구조화금융 역량을 발휘하려면 국내 종투사들은 ICT 인력 채용을 늘리고 ICT 인프라 투자도 더욱 확대해야 한다. 골드만삭스, JP모건 등 글로벌 IB들은 디지털회사로의 변모를 추구하며 대규모 ICT 인력 채용과 인프라 투자를 수행하는 반면, 국내 종투사의 디지털화 대응은 매우 부족하다. 실제 종투사의 IT예산이 차지하는 비중은 12.3%(’11년)에서 12.1%(’21년)로 소폭 줄었으며, 종투사 전체 인력 중에서 IT 인력 비중은 5.8%로 글로벌 IB들과 비교해서 다소 낮다(이하 <부록 그림 2> 참조). 또한 미래 디지털화 가속화 및 기후변화 위기에 대응하기 위해 토큰증권 사업에 적극적으로 진출하고, 녹색채권ㆍ지속가능연계채권의 발행 확대 및 배출권 거래시장에서 위탁매매ㆍ자기매매 등의 참여를 확대할 필요가 있다. 실제 유럽과 북미의 주요 국가에 속한 기업들은 녹색채권, 지속가능연계채권들을 상당 규모로 발행하고 있지만(이하 <부록 그림 3> 참조), 국내 기업들은 상대적으로 녹색채권, 지속가능연계채권의 발행 규모가 매우 낮은 가운데 종투사들의 역할도 다소 부진한 것으로 알려져 있다.

넷째, 종투사의 약점을 보완하고 외부 위협에 대응하기 위해 WㆍO 전략을 제시한다. 무엇보다 국내 종투사들이 기업금융 서비스가 협소한 문제를 해결하기 위해 기업금융 업무범위를 확대하는 노력이 필요하다. 이를 위해 기업금융 역량 강화에 필수적인 법인지급결제 업무를 중장기적으로 허용하여 국내 종투사들이 국내외 기업들과 관계금융을 원활하게 형성하도록 도와줄 필요가 있다. 다음으로 국내 종투사가 고위험 사업구조에 집중했던 문제를 해소하고 글로벌 IB들과의 경쟁에서 우위를 가지려면 성과급 체계 및 내부통제 개선 등을 통해 전사적 위험관리 역량을 강화하는 노력이 선행되어야 할 것이다.

Ⅳ. 요약 및 시사점

종투사 제도를 도입한 지 10년이 지난 시점에 국내 종투사의 성과를 평가한 결과, 글로벌 IB들과 비교하여 종투사의 자기자본 및 총자산 규모가 빠르게 증가하고 순영업수익도 괄목할 수준으로 증가하는 등 재무적 성과 측면에서 양적 성과를 달성하였다. 반면 국내 종투사들이 부동산 PF 채무보증, ELSㆍDLS 사업 등 단기에 고수익을 기대하는 고위험 사업에 집중함에 따라 질적 성과는 다소 미흡한 것으로 평가되었다. 이에, 2013년 종투사 제도 도입 당시 목표로 했던 사업 차별화, 기업금융 서비스 확대, 모험자본 공급, 글로벌화 등 측면에서 더 큰 노력이 필요하다.

국내 종투사와 글로벌 IB들의 사업전략을 비교ㆍ분석한 결과, 국내 종투사는 위탁매매와 소매금융 부문에서 강점을 가지나, 기업금융 서비스의 다양성 및 종투사간 사업 차별화 측면에서는 글로벌 IB들과 비교하여 부족한 점이 많은 것으로 판단된다. 국내 종투사의 외부 기회 요인으로는 디지털 혁신 가속화, 신남방국가의 성장, 자산관리 수요의 증가를 꼽을 수 있으며 외부 위협 요인으로는 빅테크ㆍ핀테크의 증권업 진출 확대, 금융업 칸막이 축소, 정치경제 불확실성 및 기후 위기 증대 등을 고려할 수 있다.

종투사 제도 도입 당시 ‘글로벌 투자은행으로 성장하는 것’을 가장 큰 목표로 세웠던 만큼 한국형 IB로서 국내 종투사를 발전시키려면 국내 종투사의 강점을 기반으로 해외진출을 적극적으로 추진할 필요가 있다. 구체적으로 신남방국가의 위탁매매와 자기매매 분야에 진출하여 현지 소매 고객 니즈에 맞는 ICT 기반 증권매매 솔루션 제공을 확대할 필요가 있다. 또한 국내 종투사들이 투자은행 부문에서 경쟁력 우위를 가지기 위해 기업금융 역량을 강화하는 노력이 요구된다. BDC 제도 도입 등을 통해 혁신 벤처기업에 대한 융ㆍ투자를 확대하고 M&A 활성화를 통해 국내 종투사들의 M&A 자문ㆍ인수금융 역량을 높이는 것이 필요하다. 또한 국내 종투사들이 글로벌 경쟁력을 높이기 위해 종투사 해외법인에 대한 NCR 위험값 산식을 합리적으로 개선하고17), 연기금ㆍ국부펀드가 해외투자를 확대하는 과정에서 국내 종투사들이 중개 및 우량 딜(Deal) 주관 업무에 참여할 수 있는 유인책을 제시할 필요가 있다.18)

국내 종투사들이 빅테크ㆍ핀테크 진출 등 외부 위협에 선제적으로 대응하기 위해 전 사업 부문에서 ICT 인력 채용과 인프라 투자를 확대할 필요가 있으며, 토큰증권, 녹색채권ㆍ지속가능연계채권 발행 등 디지털금융 및 전환금융 부문에도 신사업 확대를 검토할 필요가 있다. 또한 국내 종투사들이 가진 문제점을 극복하고 글로벌 IB들과의 경쟁에서 우위를 가지려면, 국내 종투사들이 기업들과 관계금융을 원활하게 형성할 수 있도록 법인지급결제 업무를 허용하고, 성과급 체계 및 내부통제 개선 등을 통해 전사적 위험관리 역량을 강화하는 노력이 선행되어야 할 것이다.

1) 금융위원회(2013. 5. 7) 참조

2) 금융위원회(2016. 8. 2) 참조

3) 2016년 9월 27일 금융위원회는 미래에셋증권과 (구)대우증권의 합병을 승인했다.

4) 2009년 2월부터 시행된 『자본시장과 금융투자업에 관한 법률』 이후 한국 증권업의 변화 양상에 대한 내용은 조성훈(2019) 연구를 참조하기 바란다.

5) 종투사 1사당 평균 자기자본은 2013년 3.3조원에서 2022년 6.1조원으로 84.8% 증가했으며, 종투사 1사당 평균 자산은 동기간 22.4조원(’13년)에서 50.6조원(’22년)으로 126% 증가했다.

6) 국내 종투사의 위탁매매 수익 비중이 높은 것은 한국 주식시장과 장내파생상품시장의 거래 회전율이 주요국 대비 높은데서 그 원인을 찾을 수 있다.

7) S&P 글로벌은 골드만삭스, 모건스탠리, JP모건, 씨티그룹, 뱅크오브아메리카, 바클레이스, BNP 파리바, 크레딧스위스, 도이치뱅크, HBSC, SG, UBS 등 미국계 5개사와 유럽계 7개사를 대상으로 사업부문별 영업수익을 평균하여 수익 기여도 추이를 발표한다. 이때 국내 종투사와 해외 IB간 사업부문의 구별이 정확히 같지는 않으나, 투자은행과 자산관리 부문의 성격은 유사성이 높다고 볼 수 있다. 한편 국내 자기매매 부분과 글로벌 IB의 FICC수익 부문은 금융상품 헤지 트레이딩 비중이 높다는 점에서 유사성이 크다고 할 수 있다.

8) 금융위원회(2016. 8. 2) 참조

9) 금융당국의 정책 지원 외에도 지난 10년간 저금리 환경이 지속되고 기업금융 수요가 증가한 점도 종투사의 기업 신용공여 규모 증가에 긍정적 영향을 미친 것으로 예상할 수 있다.

10) 9개 종투사가 부동산 PF 채무보증 수행 시 NCR 위험값이 채무보증 규모의 18%만큼 반영되지만, 채무보증 수행에 따른 수수료 수익은 최대 채무보증 규모의 10%를 기대할 수 있는 등 ECM/DCM, M&A 관련 사업보다 위험조정 기대수익이 훨씬 큰 것으로 알려져 있다. 증권업 부동산 PF 채무보증 관련한 위험 및 기대수익 등에 관한 자세한 사항은 장근혁ㆍ이석훈ㆍ이효섭(2022)를 참조하기 바란다.

11) 장근혁ㆍ이석훈ㆍ이효섭(2023) 참조

12) 글로벌 금융위기 이후 글로벌 IB들의 변화 양상은 최순영(2021)을 참고하기 바란다.

13) 가상자산 중개ㆍ수탁과 배출권 위탁매매에 대해서는 법제화가 진행 중으로 2023년 현재 국내 종투사가 해당 업무를 수행할 수 없다.

14) 2021년 기준 국내 종투사의 해외점포 수익 비중은 전체 수익의 4~5% 내외에 불과하나, 동기간 주요 글로벌 IB들의 해외점포 수익 비중은 글로벌 IB들의 연결기준 순이익의 40~50% 내외로 한국 종투사의 10배를 기록하고 있다.

15) 국내 종투사의 해외진출도가 타 업권에 비해 낮은 이유는 국내 금융회사가 아시아 국가로 해외 진출을 추진한 가운데, 중국ㆍ인도ㆍ베트남ㆍ인도네시아 등 신남방국가는 과거 은행업 중심으로 발전해왔기 때문에 자본시장에 대한 수요가 낮은 데서 그 이유를 찾을 수 있다.

16) 국내 종투사 및 증권사의 모험자본 공급 확대 방안 관련해서는 박용린ㆍ노산하ㆍ이상호(2021) 및 박용린(2022) 연구를 참고하기 바란다.

17) 금융위원회(2023. 7. 19)에 따르면 2023년 10월부터 종투사 해외법인이 기업 신용공여를 할 때 국내법인과 달리 위험값을 100% 부과했던 것을 신용등급에 따라 차등화된 위험값(1.6~32%)을 부과하는 것으로 규제가 완화될 전망이다. 또한 국내 종투사가 해외 대체투자상품 인수ㆍ중개시 셀다운 유예기간(위험액을 100% 차감하지 않는 기간)을 현행 1개월에서 3개월로 확대하여 해외 대체투자상품 인수ㆍ중개 역량을 지원할 필요가 있다.

18) 해외주식ㆍ해외채권 중개 경험이 풍부한 국내 종투사에게 브로커리지 증권사 선정 시 가점을 부여하고, 해외 대체투자 딜(Deal) 주선 또는 M&A 자문 경험이 있는 국내 종투사에게 국민연금기금ㆍ한국투자공사 등이 딜(Deal) 주선과 M&A 자문 기회를 제공하는 방안을 검토할 수 있다.

참고문헌

금융감독원, 2023. 5. 4, 2022년 국내 증권회사 해외점포 영업실적, 보도자료.

금융위원회, 2013. 5. 7, 증권사 영업활력 제고 방안, 보도자료.

금융위원회, 2016. 8. 2, 초대형 투자은행 육성을 위한 종합금융투자사업자 제도 개선방안, 보도자료.

금융위원회, 2023. 7. 19, 9.1일부터 CFD(차액결제거래) 투자자 보호장치가 대폭 강화됩니다, 보도자료.

박용린ㆍ노산하ㆍ이상호, 2021, 『기업부문 배분효율성 제고를 위한 자본시장의 역할』, 자본시장연구원 연구총서 21-02.

박용린, 2022, 『기업성장집합투자기구의 특징과 해외사례의 시사점』, 자본시장연구원 이슈보고서 22-10.

이효섭, 2023, 해외 IB의 발전전략 및 한국형 IB의 과제, 금융투자협회ㆍ자본시장연구원 공동 제1차 릴레이세미나(2023. 3. 14).

장근혁ㆍ이석훈ㆍ이효섭, 2023, 『국내 증권업 부동산PF 위험요인과 대응방안』, 자본시장연구원 이슈보고서 23-10.

최순영, 2021, 『글로벌 금융위기 이후 주요 투자은행의 변모』, 자본시장연구원 연구보고서 21-04.

최희남, 2023, 글로벌 영역 확대 방안, 금융투자협회ㆍ자본시장연구원 공동 제2차 릴레이세미나(2023. 4. 17).

<부록>