Find out more about our latest publications

Introduction of E-money and Payment Institution in Korea: Issues and Challenges

Issue Papers 23-20 Oct. 25, 2023

- Research Topic Financial Services Industry

- Page 29

The discussion of introducing the E-money and Payment Institution (EMPI) has been revisited in Korea, sparking debates of pros and cons, while the issues raised so far have not been sufficiently resolved. Banks raise concerns that such an introduction may allow industrial conglomerates to enter the banking industry without a legal banking license, potentially weaken the principle of same conduct, same risk and same regulation, and pose threats to the stability of the payment settlement and financial system. On the other hand, fintech firms and credit card companies advocate for the positive impacts of introducing EMPI, foreseeing enhanced competition in money transfer services, greater competition in financial services, cost reduction in financial transactions, and increased benefits for financial consumers.

Interestingly, these issues are rooted in four primary factors that mostly have been overlooked. First, although an EMPI is distinct from a bank, it could be argued to be similar to a bank depending on the ways of providing financial services. Second, payment default risk arises because real-time money transfers are processed through deferred net settlement (DNS) and for this reason direct or indirect participation in the retail payment system in Korea is allowed only through collective decision-making of banks. Third, anticipated money movement can create a conflict of interests between EMPIs and banks. Lastly, it is uncertain whether the positive impacts claimed by fintech firms and credit card companies would materialize through the introduction of EMPI.

When looking at cases in the UK, EU, Singapore, and the US that have introduced schemes akin to the EMPI, the issues raised in Korea have not been reported. These jurisdictions do not classify or regard them as a bank. In addition, even non-banking financial institutions can directly participate in their own retail payment system or indirectly participate by making a private agreement or contract with a bank without concerns about payment stability. It is also hard to find any reports suggesting significant money movement and enhanced competition in financial services. However, as incidents of failure to manage customer funds or abuse of money laundering occur, there is a trend to improve and strengthen related regulations to protect customer funds and expand financial inclusion.

In conclusion, it may be a priority to resolve concerns about payment stability before introducing the EMPI whose positive effects are not certain. This involves adopting a real-time gross settlement system as soon as possible and improving unique features of the existing participation in the retail payment system. To introduce the EMPI first, it should revise relevant regulations such as limits on third-party operation of financial services so that positive effects can actually be realized, and strengthen related regulations to prevent problems such as potential digital run and reverse discrimination against depositors.

Interestingly, these issues are rooted in four primary factors that mostly have been overlooked. First, although an EMPI is distinct from a bank, it could be argued to be similar to a bank depending on the ways of providing financial services. Second, payment default risk arises because real-time money transfers are processed through deferred net settlement (DNS) and for this reason direct or indirect participation in the retail payment system in Korea is allowed only through collective decision-making of banks. Third, anticipated money movement can create a conflict of interests between EMPIs and banks. Lastly, it is uncertain whether the positive impacts claimed by fintech firms and credit card companies would materialize through the introduction of EMPI.

When looking at cases in the UK, EU, Singapore, and the US that have introduced schemes akin to the EMPI, the issues raised in Korea have not been reported. These jurisdictions do not classify or regard them as a bank. In addition, even non-banking financial institutions can directly participate in their own retail payment system or indirectly participate by making a private agreement or contract with a bank without concerns about payment stability. It is also hard to find any reports suggesting significant money movement and enhanced competition in financial services. However, as incidents of failure to manage customer funds or abuse of money laundering occur, there is a trend to improve and strengthen related regulations to protect customer funds and expand financial inclusion.

In conclusion, it may be a priority to resolve concerns about payment stability before introducing the EMPI whose positive effects are not certain. This involves adopting a real-time gross settlement system as soon as possible and improving unique features of the existing participation in the retail payment system. To introduce the EMPI first, it should revise relevant regulations such as limits on third-party operation of financial services so that positive effects can actually be realized, and strengthen related regulations to prevent problems such as potential digital run and reverse discrimination against depositors.

Ⅰ. 서론

2023년 초부터 6월말까지 금융당국과 금융업계는 다시 종합지급결제업 도입을 논의하였다(금융위원회ㆍ금융감독원, 2023.7.5). 2022년 8월에 전자금융거래법 개정 지연으로 종합지급결제업 도입 계획을 철회한 바 있었으나, 대형 은행의 과점을 해소하고 금융서비스 경쟁을 촉진하기 위한 방안 중 하나로 종합지급결제업 도입의 필요성이 재차 제기되었기 때문이다(금융위원회, 2023.3.30).

핀테크업계와 신용카드업계는 지급계좌(payment account)를 개설하는 방식으로 자금이체업을 영위하는 종합지급결제업이 도입될 경우 은행이 거의 독점하고 있는 자금이체업 경쟁을 촉진할 뿐 아니라 하나의 금융플랫폼이 되어 다양한 금융서비스를 연계하여 제공할 경우 금융서비스 경쟁도 촉진할 수 있다고 주장한다.반면에 은행 등은 종합지급결제업이 도입될 경우 산업자본의 은행업 우회진출, 동일기능-동일리스크-동일규제 원칙 약화, 지급결제와 금융 안정성 위협을 우려하고 있다. 이 때문에 종합지급결제업을 반드시 도입해야 하는가에 대해 의문을 제기하고 있다.

그러나 종합지급결제업 도입과 관련하여 그간의 논의를 따져보면 각자의 이해에 따라 찬반의견만을 일방적으로 주장할 뿐 여러 쟁점들을 야기하는 근본적 원인을 제대로 짚지 못하고 있다. 특히 은행과 같이 예금을 재원으로 자금중개 또는 신용창출 기능을 수행하지 않음에도 종합지급결제업이 은행업과 같다고 주장하거나, 우리나라의 독특한 지급결제제도가 지급결제 안정성을 스스로 저해하고 있다는 점을 간과하고 있다. 더구나 종합지급결제업 도입에 따른 긍정적 효과가 실질적으로 나타날 수 있다는 확신도 주지 못하고 있다.

한편 종합지급결제업과 유사한 제도를 도입한 주요국의 사례를 살펴보면 지급결제 분야의 핀테크 혁신을 장려하고 금융포용을 확대하는 데 더 큰 의의를 두고 있다. 종합지급결제업 도입이 은행 과점을 해소하거나 금융서비스 경쟁을 촉진했다는 보고는 발견되지 않는다. 최근에는 고객자금 보호와 금융포용 확대를 강화하기 위해 종합지급결제업 관련 규제를 보완하고 강화하는 추세다.

이러한 배경을 바탕으로 본 보고서에서는 종합지급결제업 도입과 관련된 쟁점을 부정적 입장과 긍정적 입장으로 구분하여 정리하고, 각 쟁점이 근본적으로 발생하는 원인을 분석하였다. 또한 종합지급결제업과 유사한 제도를 도입한 영국ㆍEU, 싱가포르, 미국의 경험과 교훈을 국내에서 제기된 쟁점에 초점을 맞춰 조사하고 정리하였다. 마지막으로 이를 토대로 종합지급결제업 도입과 관련된 정책적 시사점을 결론으로 제시하였다.

Ⅱ. 종합지급결제업 도입 방안

본 장에서는 종합지급결제업 도입과 관련한 쟁점을 살펴보기에 앞서 2023년 6월 현재 금융당국이 금융업계와 논의하고 있는 내용을 중심으로 종합지급결제업 도입 방안을 정리하였다(금융위원회, 2019.2.26; 금융위원회, 2020.7.27; 이용준, 2022; 금융위원회, 2023.3.30).

1. 종합지급결제업 정의와 진입요건

종합지급결제업은 금융당국이 자금이체업자를 종합지급결제사업자로 지정할 경우 자금이체, 대금결제, 결제대행 등 종합지급결제사업자가 영위할 수 있는 전자금융업 일체를 일컫는다.1) 특히 종합지급결제사업자로 지정되면 예외적으로 은행과 유사하게 지급계좌 개설을 통해 자금이체업을 영위할 수 있다. 이는 일반 자금이체업뿐 아니라 지급지시전달업과 가장 크게 구별되는 특징이기도 하다.2)

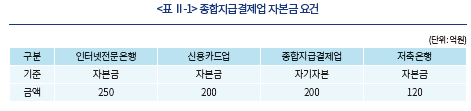

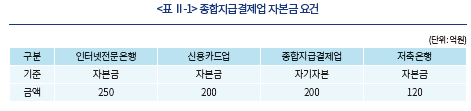

일반 자금이체업자가 종합지급결제사업자로 지정받기 위해서는 자기자본이 200억원 이상이어야 한다.3) 이는 인터넷전문은행의 최소자본금 요건인 250억원보다 낮고 신용카드사의 최소자본금 요건과 동일한 금액이다.4) 한편 자본금이 아닌 자기자본으로 진입요건을 설정한 점에서 종합지급결제사업자의 진입요건은 신용카드사뿐 아니라 저축은행의 최소자본금 요건보다 낮다.

한편 종합지급결제업 도입을 위해 전자금융거래법이 개정될 경우 자금이체업이 허가제로 운영될 예정이다. 이 점에서 종합지급결제사업자 지정대상은 매우 제한적일 수 있다. 현재까지는 간편송금과 간편결제 서비스를 제공하는 일부 전자금융업자와 겸영전자금융업자로서 신용카드사가 종합지급결제사업자 지정대상으로 논의되고 있다.

2. 지급결제시스템 참가방식

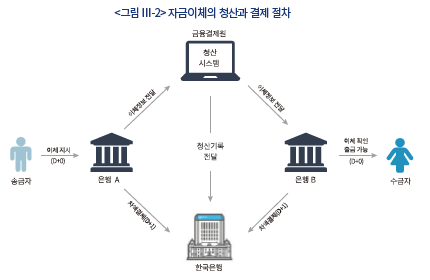

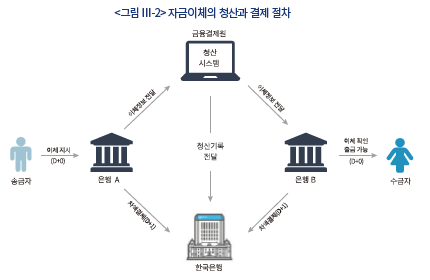

자금이체는 지급수단에 의한 지급결제와 동일하게 자금이체를 지시하고 확인하는 지급(payment), 송금자 금융회사와 수금자 금융회사 간 자금이체 지시에 따른 채권ㆍ채무 금액을 확인하고 계산하는 청산(clearing), 송금자 금융회사와 수금자 금융회사가 자금을 주고 받음으로써 자금이체에 따른 채권ㆍ채무 관계를 해소하는 결제(settlement)의 절차를 거쳐 완결된다(한국은행, 2023). 이를 위해 금융회사 간 청산과 결제를 지원하는 청산시스템과 결제시스템이 필요하며, 우리나라의 경우 금융결제원의 청산시스템인 소액결제망이 청산을, 한국은행의 결제시스템인 금융결제망(BOK-Wire+)이 결제를 수행한다.5)

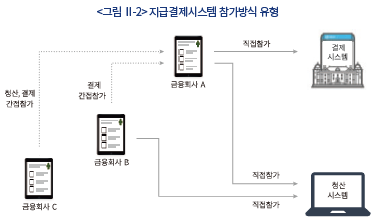

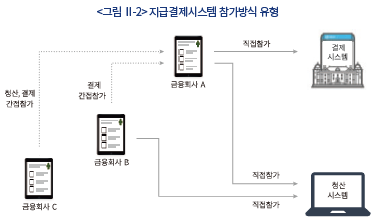

지급결제시스템 참가방식은 <그림 Ⅱ-2>에서 살펴볼 수 있듯이 결제시스템 직접참가 여부에 따라 직접참가와 간접참가로 구분된다. 일반적으로 결제시스템에 직접참가할 경우 청산시스템에도 직접참가할 수 있기 때문이다. 이에 따라 청산시스템에 직접참가하더라도 결제시스템에 간접참가하면 간접참가로 분류된다. 참고로 청산시스템 또는 결제시스템 간접참가는 직접참가 금융회사와 대행계약을 체결하는 경우를 일컫는다.

종합지급결제사업자가 지급계좌 개설을 통해 자금이체업을 영위하기 위해서는 최소한 금융결제원의 소액결제망에 직접 또는 간접참가할 수 있어야 한다. 이를 위해 전자금융거래법 개정안에서는 금융위원회가 한국은행과 협의하여 개방되어야 하는 청산시스템을 지정할 수 있는 권한을 규정하고 있다. 이는 금융당국에서도 종합지급결제사업자의 결제시스템 직접참가는 정책적으로 고려하지 않는다는 것을 의미한다.

한편 현재 소액결제시스템에 직접참가할 수 있는 금융회사는 「한국은행법」 제11조와 금융통화위원회의 「지급결제제도 운영ㆍ관리규정」에 따라 「은행법」에 따른 은행과 「금융지주회사법」에 따른 은행지주회사로 제한되어 있다. 또한 한국은행은 2020년 6월에 한국은행에 지급준비금 예치의무가 없는 비은행 금융회사의 직접참가를 원천적으로 배제하는 소액결제시스템의 직접참가 기준을 제시한 바 있다(한국은행, 2020.6.4).6)

소액결제시스템의 간접참가도 청산시스템인 소액결제망의 직접참가만 허용하고 있다. 이 경우에도 은행의 집단적 의사결정과 승인이 있어야 한다.7) 개별 은행과의 사적 계약을 통한 간접참가는 원천적으로 배제하고 있다. 이에 따라 2023년 6월말 현재 소액결제시스템 간접참가(금융결제원의 소액결제망 직접참가) 비은행 금융회사는 6개 서민금융기관, 26개 금융투자회사, 우체국뿐이다.8) 참고로 소액결제망에 직접참가한 비은행 금융회사는 자금이체에 따른 결제를 위해 직접참가 은행과 대행계약을 체결하여 결제시스템인 금융결제망에 간접참가한다.

한편 종합지급결제사업자가 소액결제시스템에 직접 또는 간접참가할 수 없더라도 오픈뱅킹공동망시스템에 가입하여 자금이체업을 영위할 수 있다.9) 이 경우 고객은 자신을 대신하여 종합지급결제사업자가 추심이체와 지급이체를 지시할 수 있도록 소액결제시스템에 직접 또는 간접참가한 다른 금융회사의 계좌를 연계해야 한다. 이 경우 종합지급결제업과 일반 자금이체업의 차이는 사라지게 된다.

3. 고객자금 보호와 건전성 규제

종합지급결제사업자는 자금이체업자와 동일하게 고객자금 전액을 고유재산과 분리하여 은행 등 금융회사(이하 관리기관)에 예치ㆍ신탁하는 방식으로 별도관리(safeguarding)해야 한다. 또한 고객자금에 대해 제3자의 상계ㆍ압류가 금지되고, 제3자에게 청구권을 양도하거나 담보로 제공할 수 없으며, 파산선고 등의 사유가 발생한 때에는 고객자금 전액을 우선 지급해야 한다.

관리기관은 종합지급결제사업자로부터 예치ㆍ신탁받은 고객자금이 고객의 재산임을 표시해야 하고, 고객자금의 안정적 운용을 해할 우려가 없는 은행 예금, 국채, 금융회사의 지급보증이 있는 채무증권 등으로 운용해야 한다. 또한 종합지급결제사업자가 파산선고 등의 이유로 고객자금 전액을 우선 지급하지 못할 경우 관리기관이 대신하여 고객자금을 우선변제해야 한다. 관리기관이 파산선고 등의 사유가 발생한 때에는 종합지급결제사업자에게 고객자금을 반환해야 한다.

종합지급결제사업자는 고객자금에 대한 이자지급이 금지되고, 고객자금을 재원으로 하는 신용공여(대출) 행위도 금지된다. 또한 종합지급결제사업자의 겸영업무와 부수업무는 엄격하게 제한된다. 외국환업무, 후불결제, 마이데이터, 금융상품판매대리ㆍ중개업 등이 허용되는 방향으로 논의되었으나 확정된 것은 없다.

종합지급결제사업자는 재무상태, 지급능력, 위험관리 등에 대하여 다른 전자금융업자보다 높은 수준의 건전성 규제도 받는다. 아직 종합지급결제사업자에 대한 건전성 경영지도기준이 구체적으로 제시되지 않았다. 그러나 종합지급결제업이 도입될 경우 현재 간편송금 서비스를 제공하는 전자금융업자보다 높은 수준의 건전성 경영지도기준이 적용될 것으로 예상된다.

현재 간편송금 서비스를 제공하는 전자금융업자는 최소자본금 요건을 항상 충족해야 하고, 자기자본이 0을 초과해야 하며, 고객자금 대비 자기자본비율도 20% 이상이어야 한다. 유동성 비율도 50% 이상이어야 한다. 다만 다른 전자금융업자와 달리 총자산 대비 투자위험성이 낮은 자산의 비율을 10% 이상 유지해야 하는 자산건전성(지급능력) 규제는 면제받고 있다.

Ⅲ. 종합지급결제업 도입 쟁점

본 장에서는 종합지급결제업 도입과 관련한 쟁점을 부정적 입장과 긍정적 입장을 구분하여 정리하고, 각 쟁점이 발생한 근본적 원인을 종합지급결제업의 은행업 여부, 독특한 지급결제제도 특징, 머니무브에 따른 이해 충돌, 긍정적 효과의 불확실성으로 제시하고 각각에 대해 분석하였다.

1. 부정적 입장

은행 등은 종합지급결제사업자에게 일상적인 지급결제 활동에 사용할 수 있는 계좌를 개설할 수 있는 권한을 부여할 경우 종합지급결제사업자가 은행과 다를 바가 없다고 주장한다. 이에 따라 산업자본의 은행업 우회진출, 동일기능-동일리스크-동일규제 약화, 지급결제와 금융 안정성 위협 등을 종합지급결제업 도입에 대한 부정적 입장으로 제시하고 있다.

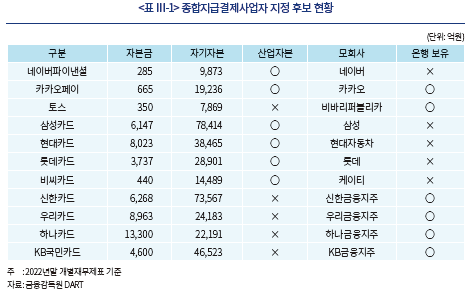

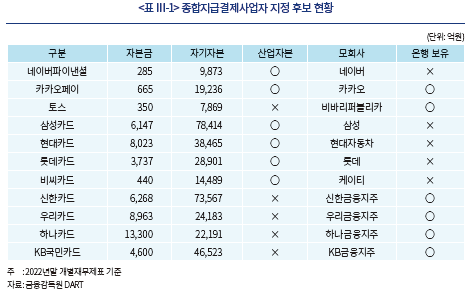

현재까지 종합지급결제사업자 지정대상으로 논의되고 있는 전자금융업자와 신용카드사 중에는 <표 Ⅲ-1>에 살펴볼 수 있듯이 은행계 신용카드사와 토스를 제외한 나머지의 경우 모회사가 산업자본에 속한다.10) 이에 따라 은행 등에서는 종합지급결제업 도입이 산업자본의 은행업 우회진출을 허용하는 것과 같다고 주장한다. 더 나아가 산업자본의 은행지분 소유를 엄격하게 제한하는 은산분리 규제가 유명무실해질 것이라고 우려한다.11)

이처럼 종합지급결제사업자가 사실상 은행업을 영위하는 것이라면 동일기능-동일리스크-동일규제 원칙에 입각하여 은행과 유사한 기준으로 규제를 받는 것이 마땅하다(한국은행, 2020.6.24) 그러나 학계 등에서는 종합지급결제사업자에 대한 건전성 규제가 은행에 대한 건전성 규제에 크게 못 미칠 뿐 아니라 종합지급결제사업자가 금융회사 지배구조 규제와 금융소비자 보호 규제를 직접적으로 적용받지 않는다고 지적한다(양기진, 2021).

이뿐 아니라 은행 등은 비은행 금융회사가 종합지급결제사업자로 지정될 경우 지급결제와 금융 안정성을 위협할 수 있다고 주장한다. 비정상적인 대규모 자금인출로 종합지급결제사업자의 지급불능 사태가 언제든지 쉽게 발생할 수 있기 때문이다. 특히 실리콘밸리은행(Silicon Valley Bank) 사례처럼 디지털런(digital run)이 일어날 수 있다고 우려한다(이성복, 2023a).

2. 긍정적 입장

핀테크업계와 신용카드사들은 청산시스템 직접참가, 자금이체 비용절감, 계좌기반 서비스 강화 등을 이유로 종합지급결제업 도입을 희망한다(한국핀테크산업협회, 2023.3.29; 여신금융협회, 2023.3.24). 이에 따라 자금이체업의 경쟁 강화, 금융서비스 경쟁의 촉진, 금융거래비용 절감, 금융소비자 편익 증대 등을 종합지급결제업 도입에 대한 긍정적 입장으로 제시하고 있다.

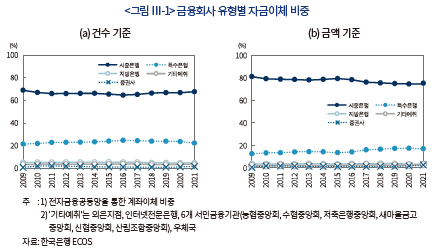

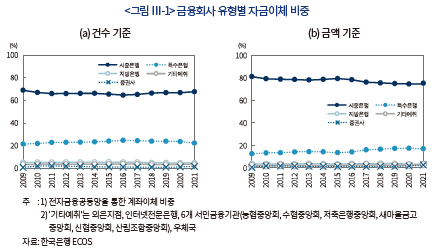

핀테크업계와 신용카드사들은 <그림 Ⅲ-1>에서 살펴볼 수 있듯이 은행이 자금이체업을 거의 독점하고 있는 상황에서 종합지급결제업이 도입될 경우 금융소비자 선택권이 확대되어 자금이체업의 경쟁을 촉진할 수 있다는 입장이다. 특히 간편송금처럼 은행보다 더 간단하고 편리하게 접근할 수 있는 자금이체 서비스를 제공할 것이기 때문에 유의미한 시장구조의 변화를 가져올 수 있다고 주장한다.

핀테크업계와 신용카드사들은 종합지급결제사업자로서 청산시스템에 직접참가하게 되면 자금이체 비용을 대폭 절감할 수 있고, 이를 재원으로 금융소비자에게 리워드ㆍ포인트 등 다양한 편익을 제공할 계획이라고 밝히고 있다.12) 또한 직접 개설한 계좌를 활용할 경우 은행의 계좌에 의존해야 하는 상황보다 기존에 제공하지 못한 지급결제 서비스를 새롭게 제공할 수 있고 다양한 금융서비스를 손쉽게 연계할 수 있다는 입장이다.13)

이에 따라 핀테크업계와 신용카드사들은 종합지급결제업 도입이 금융서비스 경쟁을 촉진할 수 있다고 주장한다. 금융소비자의 자금이동 경로가 은행의 계좌 중심에서 종합지급결제사업자의 계좌 중심으로 전환될수록 금융서비스 경쟁은 더 촉진될 것이고, 궁극적으로 금융서비스 질이 향상되고 금융소비자 편익이 제고될 것이라는 입장이다.

3. 쟁점 원인

종합지급결제업 도입에 대한 부정적 입장과 긍정적 입장을 종합적으로 정리해보면, 각 쟁점은 근본적으로 종합지급결제업의 은행업 여부, 독특한 지급결제시스템 참가 방식과 자금이체 처리의 제도적 특징, 머니무브에 따른 이해 충돌, 긍정적 효과의 불확실성에서 비롯된다.

가. 종합지급결제업의 은행업 여부

은행의 업무범위는 예ㆍ적금의 수신업무, 자금의 여신업무, 지급결제업무로 규정되어 있다.14) 이를 근거로 종합지급결제사업자가 다음과 같은 이유로 은행업을 영위한다고 주장한다(양기진, 2021). 첫째, 지급계좌 개설을 통해 고객자금을 수취하는 것은 은행의 수신업무와 같다. 둘째, 후불결제는 은행의 여신업무에 해당된다. 셋째, 자금이체업은 은행의 고유업무 중 하나인 지급결제업무에 해당된다.

특히 종합지급결제사업자가 지급계좌를 개설해 수취한 고객자금은 은행의 예금과 유사하게 원금이 보장되는 소비임치의 계약적 성질을 갖는다는 점에서 종합지급결제사업자의 고객자금 수취가 은행의 예금 수신과 동일하다고 볼 수 있다(고동원, 2018).15) 종합지급결제사업자는 일반 자금이체업자와 다르게 지급계좌를 개설해 고객자금을 직접 수취할 수 있고, 고객은 언제든지 자신의 지급계좌에서 자금의 이체나 출금을 요청할 수 있기 때문이다.

그러나 은행법에 따르면 “은행업”은 예ㆍ적금으로 수취한 고객자금을 재원으로 대출하는 업으로 정의되어 있다.16) 이는 종합지급결제사업자가 은행처럼 예금을 재원으로 자금중개(financial intermediation)의 역할을 수행하느냐에 따라 은행업 해당 여부가 결정되어야 함을 뜻한다(황순주, 2022).17) 그렇다면 종합지급결제사업자가 은행업을 영위한다고 볼 수 없다. 종합지급결제사업자는 은행처럼 고객자금을 재원으로 대출할 수 없기 때문이다. 따라서 종합지급결제사업자가 지급계좌를 개설해 고객자금을 수취하고 자금이체를 포함한 지급결제업무를 취급한다고 해서 은행업을 영위한다고 볼 수 없다(고동원, 2018).18)

더구나 종합지급결제사업자의 고객자금 수취도 네 가지 측면에서 은행의 예금 수신과 다르다. 첫째, 은행은 수신한 예금을 고유재산과 합산하여 관리하나, 종합지급결제사업자는 고객자금 전부를 고유재산과 분리하여 별도관리해야 한다. 둘째, 은행은 수시입출금이 가능한 요구불예금이더라도 이자를 지급하나, 종합지급결제사업자는 고객자금에 대해 이자지급이 금지되어 있다. 셋째, 은행의 예금은 일정 비율만큼 중앙은행에 지급준비금으로 예치해야 하나, 종합지급결제사업자의 고객자금은 지급준비금을 예치하지 않는다. 넷째, 종합지급결제사업자의 고객자금은 은행의 예금과 달리 예금보호대상에 포함되지 않는다.

특히 상기 차이점들 중 지급준비금 예치의무의 차이가 종합지급결제업이 은행업과 본질적으로 같지 않다는 점을 뒷받침해준다(박기영ㆍ김수현, 2017). 부분지준이론(Theory of Fractional Reserve)에 따르면 은행은 예금의 일정 비율을 중앙은행에 예치함으로써 시스템적으로 신용을 창출하는 기능을 수행하지만, 종합지급결제사업자는 은행처럼 신용을 창출하는 기능을 수행하지 않기 때문이다.

한편 종합지급결제사업자가 고유재산으로 대출하더라도 금융소비자는 자금의 출처와 상관없이 은행처럼 자금중개의 역할을 수행한다고 인식할 수 있다. 또한 종합지급결제사업자가 지급결제 실적에 비례하여 금전적 혜택을 제공한다면 은행의 예금처럼 이자를 지급하는 것과 같고, 은행의 예금 수신과 다를 바가 없다고 주장될 수 있다. 이 점에서 종합지급결제사업자의 사업 양태 등에 따라 종합지급결제사업자가 은행업을 영위한다는 주장이 계속 제기될 수 있다.19)

나. 독특한 지급결제제도 특징

전자금융업자나 신용카드사가 종합지급결제업 도입을 희망하는 가장 근본적인 이유는 지급결제시스템에 참가할 수 있고, 은행에게 지급하는 자금이체 비용을 대폭 절감할 수 있다고 기대하기 때문이다.20) 그러나 우리나라의 독특한 지급결제시스템 참가방식으로 인해 종합지급결제업 도입 여부와 상관없이 전자금융업자나 신용카드사가 지급결제시스템 직접 또는 간접참가하기 어려운 구조다.

우선 비은행 금융회사의 지급결제시스템 직접참가는 앞서 살펴본 바와 같이 한국은행법을 개정하지 않는 한 원천적으로 불가능하다. 지급결제시스템 간접참가도 청산시스템 직접참가만 가능하고, 은행의 집단적 의사결정과 승인이 있어야 한다. 사실 한국은행과 금융결제원은 2015년부터 비은행 금융회사의 지급결제시스템 간접참가(청산시스템 직접참가)가 언제든지 가능하다는 입장을 밝혀 왔다. 하지만 현재까지 지급결제시스템에 간접참가한 전자금융업자나 비은행 금융회사는 전무하다. 2019년 12월 금융당국의 주도로 오픈뱅킹공동망시스템을 개설하여 전자금융업자에게 은행의 펌뱅킹 서비스를 전면 개방한 것이 유일한 변화다.21)

은행 등이 지급결제시스템을 전자금융업자를 비롯한 비은행 금융회사에 개방하지 않는 근본적인 이유는 우리나라가 독특하게 실시간 자금이체를 실시간총액결제(Real-Time Gross Settlement: RTGS) 방식이 아닌 이연차액결제(Deferred Netting Settlement: DNS) 방식으로 처리하는 데 있다. <그림 Ⅲ-2>에서 살펴볼 수 있듯이 자금이체 청산은 금융결제원의 청산시스템을 통해 실시간(D+0)으로 처리되나, 자금이체 결제는 한국은행의 금융공동망을 통해 익일(D+1)에 처리되기 때문이다(한국은행, 2023).22)

실시간 자금이체를 이연차액결제 방식으로 처리할 경우 지급결제시스템 직접참가 금융회사는 최종적으로 이체자금이 결제되기 전까지 결제불이행 리스크를 부담해야 한다.23) 이 때문에 한국은행은 지급결제와 금융 안정성을 이유로 전자금융업자를 비롯한 비은행 금융회사의 지급결제시스템 직접 또는 간접참가를 제한하고 있고, 개별 은행과의 사적 계약을 통한 간접참가도 원천적으로 배제하고 있다(한국은행, 2020.6.24).

이와 같은 독특한 지급결제제도는 은행을 통해 자금이체를 이용하는 금융소비자에게 편의를 제공하는데 기여했다고 평가할 수 있다. 그러나 은행들이 결제불이행 리스크를 스스로 야기하는 독특한 지급결제제도를 채택하고, 지급결제 안정성을 이유로 비은행 금융회사에게 지급결제시스템을 개방하지 않음으로써 여러 쟁점과 논란을 유발하고 있는 것도 사실이다.

다. 머니무브에 따른 이해 충돌

은행 등이 종합지급결제업 도입을 반대하고, 전자금융업자와 신용카드사가 희망하는 이유는 종합지급결제업 도입으로 급격한 머니무브(money move)가 일어날 것을 우려하기 때문이다. 고객의 유휴자금(idle money)이 은행에서 종합지급결제사업자로 이동할수록 은행은 저렴한 자금조달 수단을 상실하는 반면, 종합지급결제사업자는 고객자금으로부터 새로운 수익원을 확보할 수 있기 때문이다.24)

우선 고객의 유휴자금이 이탈하는 만큼 은행의 자금조달 비용은 증가할 수밖에 없다. 은행은 대개 요구불예금에 대해 이자를 거의 지급하지 않기 때문이다. 물론 은행은 종합지급결제사업자의 고객자금을 예치ㆍ신탁받거나 자금이체 대행기관의 역할을 수행할 경우 종합지급결제사업자로부터 수수료 수익을 얻을 수 있다. 그럼에도 불구하고 은행은 고객자금이 대규모로 이탈할 경우 은행의 수익성이 저하될 것을 우려하고 있다.25)

이와 달리 종합지급결제사업자는 고객의 유휴자금을 유치하고 은행에 신탁할 경우 새로운 수익을 얻게 된다. 고객자금에 대해 이자지급이 금지되기 때문에 신탁수익은 종합지급결제사업자가 독차지한다. 물론 종합지급결제사업자가 고객자금을 유치하기 위해 고객에게 지급결제 실적에 비례하여 금전적 혜택을 제공할 경우 비용이 발생할 수 있다. 그렇다고 하더라도 종합지급결제사업자는 고객의 유휴자금을 더 많이 유치할수록 더 많은 수익을 얻을 수 있다.

이처럼 종합지급결제업 도입으로 상당한 수준의 머니무브가 일어날 경우 은행과 종합지급결제사업자의 이해가 충돌될 수밖에 없다. 이 때문에 종합지급결제업이 은행업에 해당되지 않는다고 판단되고 지급결제와 금융 안정성에 우려가 해소되더라도 종합지급결제업 도입에 대한 찬반의견은 머니무브의 가능성만으로도 첨예하게 갈릴 수 있다.

라. 긍정적 효과의 불확실성

전자금융업자나 신용카드사는 종합지급결제업이 도입될 경우 자금이체업의 경쟁 강화, 금융서비스 경쟁 촉진, 금융거래비용 절감, 금융소비자 편익 증대 등의 긍정적 효과가 나타날 것이라고 주장한다. 그러나 이러한 긍정적 효과가 실제 나타날지는 확실하지 않다. 특히 은행과 직접적 경쟁관계에 있는 인터넷전문은행의 신규진입 효과를 고려할 때 더욱 그렇다.

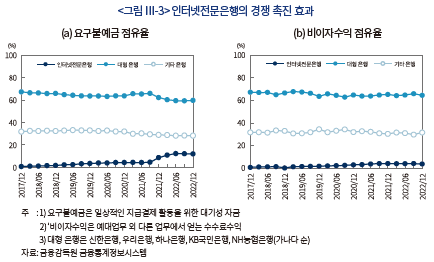

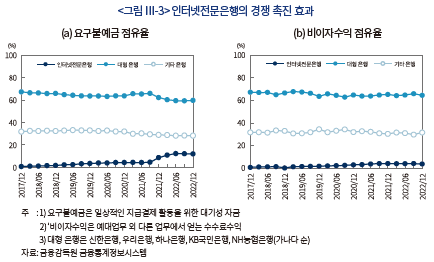

인터넷전문은행을 처음 도입했을 때도 상당한 경쟁 촉진 효과를 기대하였다. 그러나 인터넷전문은행이 2017년부터 신규로 3개사가 진입하였음에도 대형 은행의 과점이 크게 해소되지는 않았다(금융위원회, 2022.12.9).26) 특히 <그림 Ⅲ-3>에서 살펴볼 수 있듯이 자금이체뿐 아니라 금융서비스 경쟁이 크게 촉진되었다는 뚜렷한 증거는 발견되지 않는다.27)

물론 종합지급결제업 도입으로 전자금융업자나 신용카드사가 주장하는 긍정적 효과가 나타날 가능성을 완전히 배제할 수 없다. 그러나 현행 금융규제 하에서 종합지급결제사업자는 영국의 레볼루트(Revolut)처럼 하나의 금융플랫폼이 되어 다양한 금융서비스를 연계하여 은행과 같은 서비스를 제공하기도 쉽지 않다(이성복, 2021). 예를 들어, 금융회사 업무위탁 규제가 해외 수준만큼 대폭 완화되지 않는 한 현재 카카오페이, 토스 등 전자금융업자의 금융플랫폼이 제공하는 수준 이상을 기대하기 어렵다.

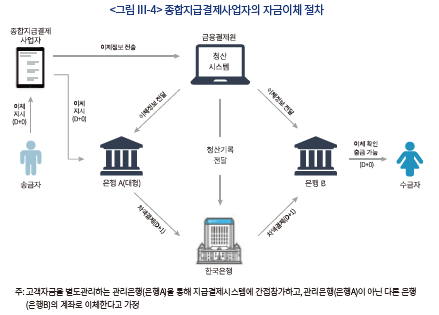

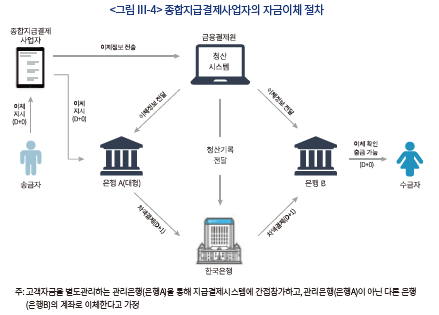

한편 일각에서는 은행에서 종합지급결제사업자로의 머니무브 규모가 커질수록 종합지급결제업 도입에 따른 경쟁 촉진의 효과가 크게 나타날 것이라고 주장한다. 그러나 이마저도 은행과 종합지급결제사업자 간의 수익 재배분만 일어날 가능성이 크고 금융소비자 후생을 향상하지 못한다면 사회 후생을 향상하지 못할 것으로 예상된다.28) 오히려 <그림 Ⅲ-4>에서 살펴볼 수 있듯이 자금이동 경로와 자금이체 절차가 이전보다 더 복잡해짐에 따라 자금이체와 관련하여 사회 전체가 부담하는 비용이 편익보다 더 커질 가능성도 존재한다.29)

Ⅳ. 주요국의 도입 경험과 교훈

그동안 종합지급결제업 도입을 논의할 때 영국ㆍEU의 전자화폐기관(E-money Institution: EMI), 싱가포르의 주요지급기관(Major Payment Institution: Major PI) 제도가 주로 소개되었다(금융위원회, 2020.7.27; 서정호, 2020; 황순주, 2022). 그러나 종합지급결제업 도입과 관련된 쟁점을 고려할 때 미국의 자금이체업자(money transmitter) 제도도 살펴볼 필요가 있다. 이에 따라 본 장에서는 영국ㆍEU, 싱가포르, 미국의 관련 제도의 도입 경험과 교훈을 종합지급결제업 도입과 관련된 쟁점에 초점을 맞춰 살펴보았다.

1. 주요국의 관련 제도

2021년 바젤위원회(BIS)의 지급시장인프라위원회(CPMI) 조사에 따르면, 조사대상 75개 국가 중에서 60개 국가에서 종합지급결제업과 유사한 제도를 도입한 것으로 파악된다(Ehrentraud et al., 2021). 이중 영국과 EU의 경우 2007년과 2015년에 지급서비스지침(Payment Services Directive)을 각각 제ㆍ개정하고 2009년에 전자화폐지침(E-money Directive)을 개정함으로써 지금의 전자화폐기관 제도로 발전하였고, 싱가포르의 경우 2019년에 지급서비스법(Payment Services Act)을 제정하여 지급결제기관 제도를 도입하였다.30) 미국의 경우 아주 오래 전부터 각 주의 관련 법에 따라 자금이체업자 제도가 운영되고 있다.31)

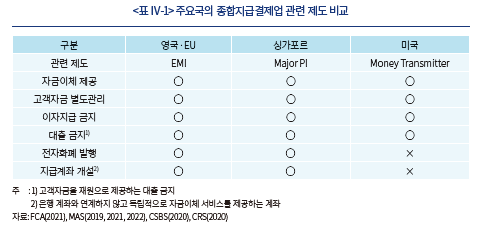

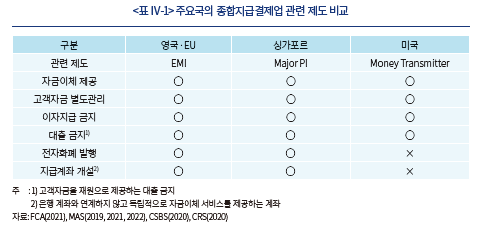

영국ㆍEU, 싱가포르, 미국의 종합지급결제업 관련 제도를 비교해 보면 <표 Ⅳ-1>에 나타난 바와 같다. 예금을 수신할 수 없고, 고객자금에 대해 이자를 지급할 수 없으며, 고객자금을 별도관리해야 한다. 또한 고객자금을 재원으로 대출을 제공할 수 없다.

한편 지급결제시스템 참가, 자금이체 처리, 고객자금 수취 방식에 따라 지급계좌 개설과 전자화폐 발행 여부가 다르다. 영국ㆍEU와 싱가포르의 경우 지급결제시스템에 직접참가할 수 있고 간접참가하더라도 지급계좌를 개설할 수 있다.32) 미국의 경우 제휴 은행을 통해 손쉽게 지급결제시스템을 이용할 수 있기 때문에 기본적으로 은행 계좌에 연계된 계정만을 개설한다.33) 또한 영국ㆍEU와 싱가포르의 경우 전자화폐를 발행하는 방식으로 고객자금을 수취하나, 미국의 경우 액면 그대로 고객자금을 수취한다.34)

2. 지급결제시스템 참가방식

영국ㆍEU, 싱가포르, 미국의 경우 종합지급결제업 관련 제도를 도입하는 과정에서 지급결제 안정성 위협에 대한 우려가 쟁점으로 제기되지 않았다. 이보다는 핀테크에 의한 지급결제 혁신을 촉진하기 위해 종합지급결제업 관련 사업자에게 지급결제시스템을 개방해야 한다는 필요성이 더 중요하게 논의되었다(서정호ㆍ김자봉, 2019). 가장 큰 이유는 이들 국가에서는 결제불이행 위험을 최소화하는 지급결제제도를 도입하거나 운영하고 있고, 비은행 금융회사는 은행의 집단적 의사결정이 아닌 개별 은행과의 사적 대행서비스 계약으로 지급결제시스템에 간접참가할 수 있기 때문이다.

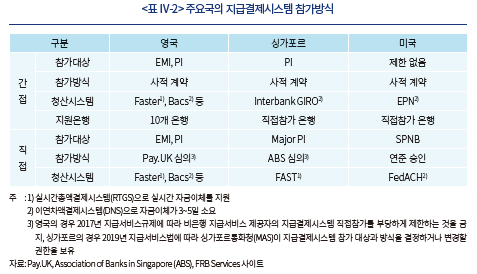

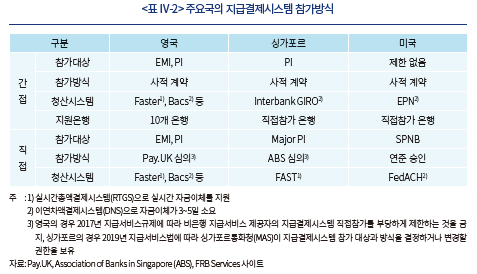

이에 따라 <표 Ⅳ-2>에서 살펴볼 수 있듯이 영국의 경우 2017년 7월에 전자화폐기관을 비롯한 비은행 지급서비스 제공자에게 영란은행 결제계좌(settlement account) 개설과 지급결제시스템 직접참가를 허용하였다(BOE, 2017.7.19). 싱가포르의 경우도 2018년 9월에 주요지급기관의 지급결제시스템 직접참가를 허용하였다(MAS, 2020.11.30). 한편 미국의 경우 2017년 3월에 도입된 특별목적은행(Special Purpose National Bank: SPNB)만 연준의 지급결제시스템에 직접참가할 수 있도록 제한하였다(OCC, 2016, 2017).35)36)

2023년 5월말 현재 영국의 경우 8개 전자화폐기관이 Faster 지급결제시스템에, 싱가포르의 경우 5개 주요지급기관이 FAST 지급결제시스템에 직접참가한 상태다. 미국의 경우 특별목적은행으로 인가받은 사례가 전무하여 FedACH에 직접참가한 사례도 없다.37) 나머지 종합지급결제업 관련 사업자는 지급결제시스템 직접참가 은행과의 사적 계약을 통해 지급결제시스템에 간접참가하는 것으로 파악된다.

3. 주요국의 도입 교훈

영국ㆍEU, 싱가포르, 미국뿐 아니라 종합지급결제업 관련 제도를 도입한 국가들은 공통적으로 자금이체업을 은행만 영위할 수 있는 고유업무로 보지 않는다. 예를 들어, EU의 지급결제지침(PSD) 제1조에서 지급결제서비스를 제공할 수 있는 기관을 신용기관(Credit Institution), 전자화폐기관(EMI), 지급결제기관(PI)으로 규정하고 있다. 특히 전자화폐기관처럼 지급계좌 개설을 통해 자금이체업을 영위한다고 해도 은행으로 보지 않는다.

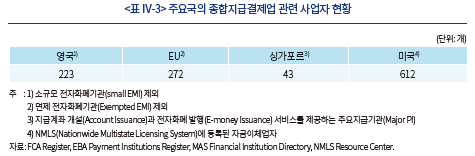

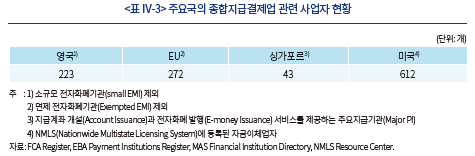

영국ㆍEU, 싱가포르, 미국의 종합지급결제업 관련 사업자 수는 <표 Ⅳ-3>에 나타난 바와 같이 적지 않다. 2023년 5월말 기준 영국과 EU의 경우 각각 223개와 272개 전자화폐기관이, 싱가포르의 경우 43개 주요지급기관이 영업 중이다. 미국의 경우 2023년 5월말 기준 612개 자금이체업자가 2개 이상 주에서 영업 중이다. 이는 현재 우리나라에서 제기된 쟁점들이 이들 국가에서는 크게 문제되지 않았다는 것을 간접적으로 시사한다.

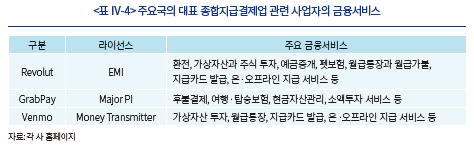

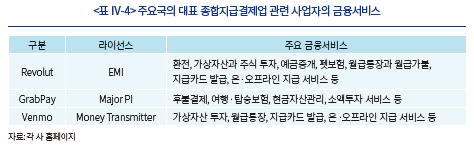

성공적인 종합지급결제업 관련 사업자로는 영국의 Revolut, 싱가포르의 GrabPay, 미국의 Venmo가 가장 잘 알려져 있다. 이들 모두 금융플랫폼에 기반하여 자금이체 서비스를 제공하고 있고, <표 Ⅳ-4>에서 살펴볼 수 있듯이 각 국가의 제도적 특성과 자체의 사업적 전략에 따라 다양한 금융서비스를 직접 또는 기존 금융회사와 제휴하여 제공하고 있다. 이는 우리나라와 달리 자회사 설립 또는 제3자와의 업무위탁 제휴를 통해 다양한 금융서비스를 제공할 수 있는 제도적 기반이 뒷받침하고 있기 때문이다(조성훈, 2020).

영국, 싱가포르, 미국에서 종합지급결제업 관련 사업자에 대한 수요는 다소 다르다. 영국의 경우 2020년 기준 성인의 4%만이 전자화폐기관의 지급계좌를, 싱가포르의 경우 2022년 기준 총인구의 약 70%가 주요지급기관의 지급계좌를 보유하고 있는 것으로 파악된다(FCA, 2021; Mordor Intelligence, 2023). 미국의 경우 성인의 약 20%(Zelle를 포함할 경우 약 40%)가 자금이체업자의 자금이체 서비스를 이용하는 것으로 조사된다(Consumer Reports, 2023).38)

한편 이들 국가에서 종합지급결제업 관련 제도의 도입으로 은행의 요구불예금이 유의미하게 감소하였거나 금융서비스 경쟁이 촉진되었다는 보고는 발견되지 않는다. 주요지급기관의 지급계좌 보유 비중이 높은 싱가포르에서조차 은행과의 경쟁 촉진 등과 같은 논의를 찾아보기 쉽지 않다. 이보다는 고객자금 보호와 금융포용 확대와 관련된 논의가 더 활발하게 이루어지고 있다.

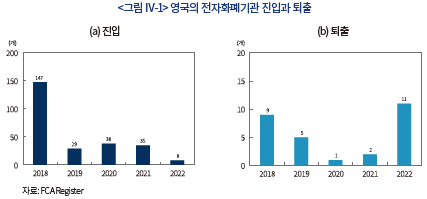

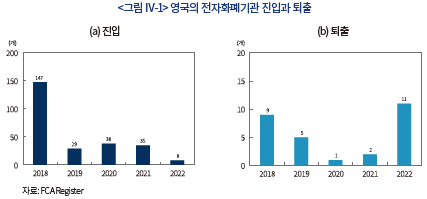

예를 들어, 영국의 경우 <그림 Ⅳ-1>에서 살펴볼 수 있듯이 폐업 또는 파산하는 전자화폐기관이 증가하고 일부 전자화폐기관이 고객자금을 별도관리하지 않거나 고객자금 반환에 실패하는 사례가 발생하자 고객자금 보호 강화를 위해 고객자금 관리, 유동성 리스크 관리, 파산정리 절차와 관련된 규제를 보완하고 강화하였다(FCA, 2020, 2021, 2023; HM Treasury, 2020).39)

미국의 경우 은행들이 자금세탁의 경로로 이용된다고 의심되는 자금이체업자의 고객자금 관리계좌를 동결(de-risking)하는 사례가 증가하자 금융포용 확대를 위해 자금이체업자가 자금세탁 경로로 악용되는 것을 방지하고 은행들이 자금이체업자의 고객자금 관리계좌를 일방적으로 동결하는 것을 최소화하는 방안을 마련하고 있다(GAO, 2019; CRS, 2020; DOT, 2023).40)

Ⅴ. 결론

지금까지 살펴본 바에 따르면 우리나라에서 종합지급결제업을 시급하게 도입할 필요성은 크지 않다.41) 종합지급결제업 도입에 따른 긍정적 효과가 불확실한 가운데 지급결제 안정성을 우려하면서까지 종합지급결제업을 도입할 명분이 충분하지 않기 때문이다. 그러나 종합지급결제업 도입 자체를 우려할 이유도 크지 않다. 종합지급결제업이 은행처럼 예금을 재원으로 자금중개 또는 신용창출 기능을 수행하는 것이 아니기 때문이다. 이 점에서 은행 등에서 주장하는 것처럼 산업자본의 은행업 우회진출과 동일기능-동일리스크-동일규제 약화는 우려할 사안이 아니다. 더구나 지급결제 안정성에 대한 우려도 우리나라의 독특한 지급결제제도에서 비롯된 것이므로 지급결제제도를 개선할 경우 충분히 해소될 수 있다.

따라서 종합지급결제업을 도입하기에 앞서 지급결제 안정성에 대한 우려를 불식하는 것이 우선일 수 있다. 이를 위해 현재 이연차액결제 방식으로 처리하는 실시간 자금이체를 실시간총액결제 방식으로 처리할 수 있도록 지급결제시스템을 개선할 필요가 있다.42) 또한 종합지급결제사업자를 비롯한 비은행 금융회사의 지급결제시스템 참가방식도 개선해야 한다. 특히 미국이나 영국에서처럼 비은행 금융회사가 은행의 집단적 의사결정이 아닌 사적 계약으로 지급결제시스템에 간접참가할 수 있도록 허용해야 한다.

종합지급결제업을 먼저 도입하고자 한다면 다음의 두 가지 과제를 선결해야 한다. 우선 종합지급결제사업자가 하나의 금융플랫폼이 되어 다양한 금융서비스를 직접 또는 연계하여 제공할 수 있는 제도적 기반을 마련해야 한다. 그렇지 않고 종합지급결제업만을 도입할 경우 종합지급결제업 도입에 따른 긍적적 효과는 나타나기 어렵고, 종합지급결제사업자에게 고객자금에 대한 수익권을 부여하는 결과만을 초래할 수 있다.

다음으로 디지털런 발생과 전이, 예금자 역차별 등과 같은 문제가 발생하지 않도록 관련 제도도 사전에 보완하고 강화해야 한다.43)44)45) 종합지급결제사업자의 고객자금 평가금액이 신탁운용의 결과로 고객자금 예치금액보다 현저하게 낮아질 경우 실리콘밸리뱅크의 사례처럼 대규모의 디지털런이 발생할 수 있기 때문이다. 이를 위해 영국의 경험을 토대로 고객자금 관리, 유동성 리스크 관리, 파산정리 절차 관련 규제를 우리나라 금융법 체계에 맞게 정비해야 한다.

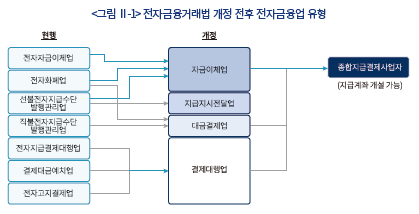

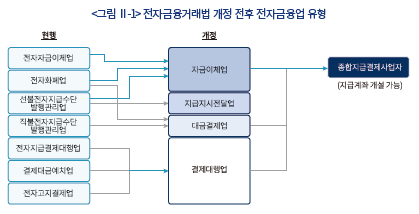

1) 종합지급결제업 도입을 위해 전자금융거래법이 개정될 경우 전자금융업은 <그림 Ⅱ-1>에서와 같이 간소화될 예정이다.

2) 일반 자금이체업자는 은행의 수시입출금 계좌에 연계된 계정만 개설할 수 있고, 지급지시전달업자는 계좌나 계정 없이 고객의 자금이체 지시만 고객의 은행에 전달할 수 있다.

3) 전자금융거래법 개정안에 따르면 자금이체업자의 최소자본금 요건은 고객예탁금과 분기별 자금이체 금액이 각각 30억원 이하이면 5억원, 각각 30억원 이상이고 100억원 이하이면 10억원, 각각 100억원 초과이면 20억원이다.

4) 여신전금융업법 제5조 제1항에 따라 신용카드사가 신용카드업만을 영위하거나 이와 함께 다른 여신전금융업의 하나를 영위하려는 경우 최소자본금 요건이 200억원이다.

5) 본 보고서에서는 금융결제원의 소액결제망과 한국은행의 금융결제망을 통틀어 지급결제시스템 또는 소액결제시스템이라고 지칭하기로 한다. 금융결제원의 소액결제망(청산시스템)은 CD공동망, 타행환공동망, 지방은행공동망, 자금관리서비스(CMS)공동망, 직불카드공동망, 전자금융공동망 등으로 구성되어 있다.

6) 소액결제시스템에 직접참가하기 위해서는 자금이체업무 수행의 법적 근거가 있고, 한국은행법에 따른 지급준비금 예치의무가 있는 금융회사로서 한국은행이 일시부족자금대출을 통해 결제유동성을 공급할 수 있어야 하며, 금융감독원과 공동검사를 실시할 수 있어야 하며, 차액결제리스크 관리능력을 보유한 것으로 판단되어야 한다.

7) 소액결제망에 직접참가하기 위해서는 금융결제원의 특별참가기관이 되어야 하고, 금융결제원의 특별참가기관이 되기 위해서는 금융결제원의 정관에 따라 은행으로 구성된 사원총회의 승인을 얻어야 한다.

8) 6개 서민금융기관으로는 농협중앙회, 수협중앙회, 저축은행중앙회, 새마을금고중앙회, 신협중앙회, 산림조합중앙회가 해당된다.

9) 오픈뱅킹공동망시스템은 전자금융업자가 은행과 개별적으로 펌뱅킹(firm banking)을 제휴하지 않고도 고객의 은행 계좌의 잔액, 거래내역 등을 조회하고 입금과 출금을 지시할 수 있는 청산시스템이다.

10) 네이버파이낸셜, 카카오페이, 삼성카드, 현대카드, 롯데카드, 비씨카드가 각각 비금융산업에 주력하고 있는 상호출자제한기업집단에 소속되어 있고, 카카오페이, 토스, 신한카드, 우리카드, 하나카드, KB국민카드의 모회사가 은행을 자회사로 보유하고 있다(공정거래위원회, 2022.4.27).

11) 현재 전자금융거래법 개정안에 제시된 종합지급결제사업자 지정요건에는 은산분리 규제와 같은 산업자본의 지분소유 제한이나 금융주력자 요건이 포함되어 있지 않다.

12) 신용카드사들은 여신전문금융업법을 개정해서라도 계좌를 개설할 수 있는 권한을 부여받고 싶어 한다. 이를 통해 청산시스템에 직접참가하게 되면 자금이체 비용을 대폭 절감할 수 있을 것으로 기대한다(여신금융협회, 2023.3.24).

13) 간편송금ㆍ간편결제는 은행의 계좌에 연계하지 않아도 되고, 급여이체ㆍ대금납부ㆍ외국환 등 일상적인 지급결제 서비스도 직접 제공할 수 있다. 이외에도 지급결제와 연계하여 혁신적인 금융서비스를 선보일 수 있다.

14) 은행법 제27조 제2항에 따라 은행업무의 범위는 예ㆍ적금의 수입 또는 유가증권, 그 밖의 채무증서의 발행, 자금의 대출 또는 어음의 할인, 내국환ㆍ외국환으로 규정되어 있다. 여기서 내국환ㆍ외국환업무는 지급결제업무로 볼 수 있다(고동원, 2018).

15) 예금은 우리나라 금융관계법에서 명확하게 정의되어 있지 않다. 유일하게 유사수신행위법 제2조와 제3조에서 다른 법령에 따른 인ㆍ허가를 받지 아니하고 불특정 다수인으로부터 장래에 원금의 전액 또는 이를 초과하는 금액을 지급할 것을 약정하고 예금ㆍ적금ㆍ부금ㆍ예탁금 등의 명목으로 금전을 받는 행위를 금지한다고 규정하고 있다.

16) 은행법 제2조에 따라 “은행업”은 ‘예금을 받거나 유가증권 또는 그 밖의 채무증서를 발행하여 불특정 다수인으로부터 채무를 부담함으로써 조달한 자금을 대출하는 것을 업(業)으로 하는 것’으로 정의되어 있다.

17) 황순주(2022)는 기존 문헌을 토대로 원래 은행은 편리한 지급결제 서비스의 필요성에 의해 출현하였으나, 자금중개 서비스가 은행의 본질적 역할이 되었다고 설명한다.

18) 고동원(2018)은 은행법에 따라 지급결제업무는 은행이 영위할 수 있는 업무 중 하나일 뿐 은행의 고유업무가 아니라고 설명한다.

19) 네이버파이낸셜이 미래에셋증권과 제휴하여 2020년 6월에 출시한 네이버통장이 은행의 예금통장으로 오인될 수 있다는 이유로 금융당국에서 위법 여부를 검토한 사례가 있다(조선비즈, 2020.6.17).

20) 전자금융업자는 2019년 12월 오픈뱅킹공동망시스템이 개설된 후 건당 자금이체 수수료를 종전의 1/10의 수준인 40~50원으로 인하된 적이 있으나 여전히 은행보다 높은 수준의 자금이체 비용을 부담하고 있다(금융위원회, 2019.6.20). 신용카드사는 금융결제원의 사원총회 승인 없이는 오픈뱅킹공동망시스템에 참여할 수 없어 종전과 동일하게 건당 400~500원의 자금이체 수수료를 부담하고 있다(한국은행, 2021.1.25).

21) 오픈뱅킹공동망시스템의 이용기관은 은행, 전자금융업자, 전자금융보조업자 등으로 제한되어 있다(금융위원회, 2019.6.20; 한국은행, 2021.1.25).

22) 이체자금이 송금자 은행에서 수금자 은행으로 최종적으로 결제(settlement)되지 않았어도 수금자 은행이 수금자에게 이체자금을 실시간으로 이용하거나 출금할 수 있도록 1일 신용을 제공한다.

23) 한국은행은 결제불이행 리스크를 최소화하기 위해 일차적으로 지급결제시스템 직접 또는 간접참가를 제한하고, 지급결제시스템 참가 금융회사에 대해서는 순이체한도, 차액결제대행한도(간접참가만), 담보 납입 등을 통해 결제불이행 리스크를 사전적으로 관리한다.

24) 종합지급결제사업자는 고객자금을 은행 등에 예치ㆍ신탁하여 별도관리해야 하기 때문에 머니무브는 표면적으로 일어날 뿐 실질적으로는 일어나지 않는다.

25) 황순주(2022)는 고객의 유휴자금 또는 결제성 예금이 1% 감소할 경우 은행의 순이자마진(net interest margin)이 1분기 후에 0.27% 감소하고 이후 개선되지 않는다고 보고한다.

26) 금융위원회 산하의 금융산업경쟁도평가위원회는 2022년 은행업의 경쟁도가 2018년과 비교할 때 악화되었다고 평가한다. 또한 이는 인터넷전문은행이 아직 규모가 작아 대형 시중은행에 유의미한 경쟁자로서 영향을 주지 못하였기 때문이라고 설명한다.

27) 2021년 9월 이후 인터넷전문은행의 요구불예금 점유율이 크게 증가한 것도 자금이체를 포함한 지급결제 서비스에 대한 수요가 증가했기 때문이 아니다. 2021년 6월에 은행업 본인가를 받고 9월에 출범한 토스뱅크가 요구불예금에 대해 높은 이자를 지급하는 파킹통장 서비스를 출시하고, 다른 인터넷전문은행도 유사한 파킹통장 서비스를 제공하기 시작한 데 기인한다.

28) 금융소비자 후생을 자금잉여자와 자금부족자로 구분하여 살펴볼 경우 자금잉여자의 편익은 유휴자금의 경제적 효용 증가로 증대될 수 있으나, 자금부족자의 비용은 은행의 자금조달 비용 상승으로 대출금리가 인상될 경우 더 커질 수 있다.

29) Chiu & Wong(2014)도 이론모형 분석을 통해 종합지급결제업 관련 제도의 도입이 사회 후생을 반드시 향상시키지 않을 수 있다고 보고한다.

30) 영국의 경우 2011년 전자화폐규제(Electronic Money Regulation 2011)와 2017년 지급서비스규제(Payment Services Regulation 2017)를 적용받는다.

31) 미국의 비은행 자금이체 서비스는 서부개척시대인 1870년대에 출현하였고, 1900년대 초부터 뉴저지(New Jersey) 주를 시작으로 각 주에서 제도화하였다(CSBS, 2020).

32) 영국의 경우 2015년 지급계좌규제(Payment Accounts Regulation 2015)에 따라 전자화폐기관이 개설한 계정이 일상적인 지급 거래(day-to-day payment transactions)를 지원한다고 판단되는 다음의 네 가지 요건을 충족한 경우에만 지급계좌로 인정한다(FCA, 2016). 첫째, 계좌에 자금을 예치할 수 있어야 한다. 둘째, 계좌에서 현금을 인출할 수 있어야 한다. 셋째, 제3자에게 이체 또는 결제를 지시할 수 있어야 한다. 넷째, 제3자로부터 이체 또는 결제를 수납할 수 있어야 한다.

33) 은행 계좌가 없는 경우 제휴 은행이 발급하는 직불카드와 연계되는 계정이 발급된다. 해당 계정은 자금이체업자를 통해서만 잔액을 조회할 수 있다.

34) 영국ㆍEU와 싱가포르의 경우 고객자금이 전자화폐 부채로 회계처리되나, 미국의 경우 미지급금(payable) 부채로 회계처리된다.

35) 미국의 청산시스템(Automated Clearing House: ACH)은 연준의 FedACH와 민간의 EPN(Electronic Payments Network)으로 구성되어 있다(한국은행, 2020).

36) 미국의 특별목적은행은 예금을 수취할 수 없고 지급결제 또는 대출 업무만 취급할 수 있는 은행인가 제도다. 한편 연준이 운영하는 지급결제시스템에 참가하려면 연준의 별도 승인을 얻어야 한다.

37) 원래 특별목적은행 인가를 받으려고 계획했던 Varo Money와 SoFi는 각각 2020년 7월과 2022년 1월에 풀뱅킹(full-banking) 국립은행(national bank) 인가를 받았고, Sqaure는 2020년 3월에 산업대출은행(ILC) 인가를 받았다.

38) Zelle는 Bank of America, JPMorgan Chase, Wells Fargo을 비롯한 미국 전역의 1,700개 이상의 은행과 신용조합이 제공하는 디지털 플랫폼 기반의 자금이체 서비스다.

39) 2018년부터 2022년 중반까지 파산한 6개 비은행 지급서비스 사업자(전자화폐기관 포함) 중 1개 사업자만이 고객자금을 반환하는데 성공하였다(HM Treasury, 2020).

40) GAO(2019)에 따르면 자금이체업자의 고객자금 관리계좌를 보유하고 있다고 응답한 91개 은행 중 69개 은행이 2014년부터 2016년까지 해당 계좌를 해지하거나 거래를 제한하였다고, 이중 18개 은행은 총 1,098개 계좌를 해지하였다고 응답하였다.

41) 증권사의 법인 자금이체업무 허용과 관련된 논의는 종합지급결제업 도입 논의와 비슷한 측면도 있으나 본질적으로 다르다. 이에 대한 구체적 논의는 이성복(2023b)을 참고한다.

42) 한국은행은 2028년까지 실시간총액결제시스템을 구축하는 방안을 추진하고 있다(한국은행, 2023; 머니투데이, 2023.4.27). 따라서 지급결제 안정성을 위해 종합지급결제업 도입 여부를 실시간총액결제시스템이 구축된 이후에 논의하는 것이 바람직할 수 있다.

43) 은행에서 비정상적인 지급불능 사태가 발생할 경우 한국은행법에 따라 한국은행이 최종대부자 역할을 수행할 수 있고, 예금자보호법에 따라 예금 지급정지가 조치되며, 예금보호한도 내에서 고객자금이 보호된다. 이와 달리 현재 전자금융거래법 개정안에서는 종합지급결제사업자의 경우 이와 같은 안전장치가 마련되어 있지 않다.

44) 대규모의 고객자금 인출이 발생할 경우 관리기관인 은행으로 디지털런 위험이 전이될 수 있다. 특히 종합지급결제사업자가 고객자금을 계열 인터넷전문은행에 예치ㆍ신탁한 경우 디지털런 위험은 더 빠르게 전이되고 증폭될 수 있다.

45) 관리기관인 은행에서 「예금자보호법」에 따른 파산선고 등 보험사고(제2종)가 발생한 경우 예금등(금전신탁 포함)은 예금보호한도 내에서 보호되나 종합지급결제사업자의 고객자금은 전액 반환되어 보호된다. 이에 따라 예금자 역차별 이슈가 제기될 수 있다. 한편 은행에서 예금 지급정지 보험사고(제1종)가 발생한 경우 종합지급결제사업자의 고객자금에 대해 반환 의무가 발생하지 않는다.

참고문헌

고동원, 2018, 은행의 업무 범위에 관한 법적 연구, 은행법연구 11-2, 22-71.

공정거래위원회, 2022. 4. 27, 2022년도 공시대상기업집단 76개 지정, 보도자료.

금융위원회, 2019. 2. 26, 개방형 금융결제망[오픈뱅킹] 구축, 핀테크 성장을 촉진하고 생활금융을 혁신하겠습니다, 보도자료.

금융위원회, 2019. 6. 20, 오픈뱅킹 진행 현황 및 향후 일정, 보도자료.

금융위원회, 2020. 7. 27, 「디지털금융 종합혁신방안」 발표, 보도자료.

금융위원회, 2022. 12. 9, 제2기 금융산업 경쟁도평가위원회 운영결과 및 향후계획 - 은행업·신용카드업·신용정보업 평가결과 발표 -, 보도자료.

금융위원회, 2023. 3. 30, 제2차 은행권 경영ㆍ영업 관행ㆍ제도 개선 TF 논의 결과, 보도자료.

금융위원회ㆍ금융감독원, 2023. 7. 5, 은행권 경영ㆍ영업 관행ㆍ제도 개선 방안, 보도자료 별첨.

머니투데이, 2023. 4. 27, ‘한국판 SVB 사태’ 막아라…한은, 실시간총액결제 도입 속도낸다.

박기영ㆍ김수현, 2017, 은행의 신용창출 기능에 대한 소고, 『금융안정연구』 18(1), 77-111.

서정호, 2020, 종합지급결제업 도입과 향후 과제, 금융연구원 『금융브리프』 29(23).

서정호ㆍ김자봉, 2019, 최근 핀테크의 지급결제시장 참여 확대와 시사점, 금융연구원 『KIF VIP 리포트』 2019-06.

양기진, 2021, 전자금융거래법 개정(안)의 종합지급결제사업자 관련 쟁점 분석, 『법과 기업 연구』 11(2), 153-181.

여신금융협회, 2023. 3. 24, 카드사 지급결제 계좌 허용 관련 업계의견.

이성복, 2021, 『핀테크에 의한 금융혁신 양상과 시사점』, 자본시장연구원 연구보고서 2021-03.

이성복, 2023a, 실리콘밸리은행의 파산 원인과 교훈, 디지털경제금융연구원 『DEFI』 제2호, 34-37.

이성복, 2023b, 증권사의 법인 지급결제 허용 관련 쟁점과 과제, 자본시장연구원 『자본시장포커스』 2023-19호.

이용준, 2022, 전자금융거래법 일부개정법률안(김병욱의원 대표발의, 의안번호 제2113137호) 검토보고, 정무위원회.

조선비즈, 2020. 6. 17, ‘네이버통장’ 냈다가 ‘명칭 논란’ 휩싸인 네이버... 금융당국, 규제카드 ‘만지작’.

조성훈, 2020, 『금융투자회사 아웃소싱 관리 해외사례』, 자본시장연구원 이슈보고서 20-1.

최규선ㆍ이지영, 2018, 『유럽연합의 PSD2 시행이 금융권에 미치는 영향 분석』, 금융결제원 금융결제연구소.

한국은행, 2020, 『주요국 지급결제시스템 및 관련 법규 체계』, 지급결제 조사자료 제2020-3호.

한국은행, 2020. 6. 24. 「소액결제시스템 참가제도 개선」 관련 Q&A, 보도참고자료.

한국은행, 2020. 6. 4, 소액결제시스템 참가제도 개선, 보도참고자료.

한국은행, 2021. 1. 25, 금융결제원 운영 지급결제시스템 정기평가 결과, 보도자료.

한국은행, 2023, 『2022년도 지급결제보고서』.

한국핀테크산업협회, 2023. 3 .29, 종합지급결제업 도입을 통한 경쟁 촉진과 소비자 편익 증대.

황나영, 2020, 『싱가포르 종합지급결제업 현황과 시사점』, 우리금융경영연구소 Fintech Trend.

황순주, 2022, 『디지털 지급결제 시장의 개방이 금융소비자에게 미치는 영향과 정책과제』, KDI 연구보고서 2022-02.

Bank of England (BOE), 2017. 7. 19, Bank of England extends direct access to RTGS accounts to non-bank Payment Service Providers, News Release.

Chiu, J., Wong, T-N., 2014, E-Money: Efficiency, Stability and Optimal Policy, Bank of Canada Working Paper 2014-16.

Conference of State Bank Supervisors (CSBS), 2020, Reengineering Nonbank Supervision - Chapter Four: Overview of Money Services Business.

Congress Research Service (CRS), 2020, Telegraphs, Steamships, and Virtual Currency: An Analysis of Money Transmitter Regulation, CRS Report R46486.

Consumer Reports, 2023, Peer-to-Peer Payment Services.

Department of Treasure (DOT), 2023, The Department of the Treasury’s De-risking Strategy.

Ehrentraud, J, Prenio, J, Boar, C, Janfils, M, Lawson, A, 2021, Fintech and payments: regulating digital payment services and e-money, Bank for International Settlements (BIS) FSI Insights.

Financial Conduct Authority (FCA), 2016, Finalised guidance: Definition of a ‘payment account’, FG16/6 – Payment Accounts Regulations 2015.

Financial Conduct Authority (FCA), 2020, Coronavirus and safeguarding customers’ funds: Additional guidance for payment and e-money firms. Finalised guidance.

Financial Conduct Authority (FCA), 2021, Financial Lives 2020 Survey: The impact of coronavirus.

Financial Conduct Authority (FCA), 2021, Payment Services and Electronic Money – Our Approach (version 5).

Financial Conduct Authority (FCA), 2023, Portfolio Letter: FCA priorities for payment firms.

GAO, 2019, Examiners Need More Information on How to Assess Banks’ Compliance Controls for Money Transmitter Accounts.

HM Treasury, 2020, Insolvency Changes for Payment and Electronic Money Institutions.

Monetary Authority of Singapore (MAS), 2019, Guidelines on Licensing for Payment Service Providers.

Monetary Authority of Singapore (MAS), 2020. 11. 30, Non-Bank Financial Institutions to have Access to FAST and PayNow, Media Releases.

Monetary Authority of Singapore (MAS), 2021, Infographic on the Payment Services Act 2019.

Monetary Authority of Singapore (MAS), 2022, FAQs - Payment Services Act 2019.

Mordor Intelligence, 2023, Singapore Payments Market Size & Share Analysis.

Nationwide Mortgage Licensing System (NMLS), 2023, 2022 NMLS Money Service Businesses Report.

Office of the Comptroller of the Currency (OCC), 2016, Exploring Special Purpose National Bank Charters for Fintech Companies.

Office of the Comptroller of the Currency (OCC), 2017, Special Purpose National Bank Charters for Financial Technology Companies.

2023년 초부터 6월말까지 금융당국과 금융업계는 다시 종합지급결제업 도입을 논의하였다(금융위원회ㆍ금융감독원, 2023.7.5). 2022년 8월에 전자금융거래법 개정 지연으로 종합지급결제업 도입 계획을 철회한 바 있었으나, 대형 은행의 과점을 해소하고 금융서비스 경쟁을 촉진하기 위한 방안 중 하나로 종합지급결제업 도입의 필요성이 재차 제기되었기 때문이다(금융위원회, 2023.3.30).

핀테크업계와 신용카드업계는 지급계좌(payment account)를 개설하는 방식으로 자금이체업을 영위하는 종합지급결제업이 도입될 경우 은행이 거의 독점하고 있는 자금이체업 경쟁을 촉진할 뿐 아니라 하나의 금융플랫폼이 되어 다양한 금융서비스를 연계하여 제공할 경우 금융서비스 경쟁도 촉진할 수 있다고 주장한다.반면에 은행 등은 종합지급결제업이 도입될 경우 산업자본의 은행업 우회진출, 동일기능-동일리스크-동일규제 원칙 약화, 지급결제와 금융 안정성 위협을 우려하고 있다. 이 때문에 종합지급결제업을 반드시 도입해야 하는가에 대해 의문을 제기하고 있다.

그러나 종합지급결제업 도입과 관련하여 그간의 논의를 따져보면 각자의 이해에 따라 찬반의견만을 일방적으로 주장할 뿐 여러 쟁점들을 야기하는 근본적 원인을 제대로 짚지 못하고 있다. 특히 은행과 같이 예금을 재원으로 자금중개 또는 신용창출 기능을 수행하지 않음에도 종합지급결제업이 은행업과 같다고 주장하거나, 우리나라의 독특한 지급결제제도가 지급결제 안정성을 스스로 저해하고 있다는 점을 간과하고 있다. 더구나 종합지급결제업 도입에 따른 긍정적 효과가 실질적으로 나타날 수 있다는 확신도 주지 못하고 있다.

한편 종합지급결제업과 유사한 제도를 도입한 주요국의 사례를 살펴보면 지급결제 분야의 핀테크 혁신을 장려하고 금융포용을 확대하는 데 더 큰 의의를 두고 있다. 종합지급결제업 도입이 은행 과점을 해소하거나 금융서비스 경쟁을 촉진했다는 보고는 발견되지 않는다. 최근에는 고객자금 보호와 금융포용 확대를 강화하기 위해 종합지급결제업 관련 규제를 보완하고 강화하는 추세다.

이러한 배경을 바탕으로 본 보고서에서는 종합지급결제업 도입과 관련된 쟁점을 부정적 입장과 긍정적 입장으로 구분하여 정리하고, 각 쟁점이 근본적으로 발생하는 원인을 분석하였다. 또한 종합지급결제업과 유사한 제도를 도입한 영국ㆍEU, 싱가포르, 미국의 경험과 교훈을 국내에서 제기된 쟁점에 초점을 맞춰 조사하고 정리하였다. 마지막으로 이를 토대로 종합지급결제업 도입과 관련된 정책적 시사점을 결론으로 제시하였다.

Ⅱ. 종합지급결제업 도입 방안

본 장에서는 종합지급결제업 도입과 관련한 쟁점을 살펴보기에 앞서 2023년 6월 현재 금융당국이 금융업계와 논의하고 있는 내용을 중심으로 종합지급결제업 도입 방안을 정리하였다(금융위원회, 2019.2.26; 금융위원회, 2020.7.27; 이용준, 2022; 금융위원회, 2023.3.30).

1. 종합지급결제업 정의와 진입요건

종합지급결제업은 금융당국이 자금이체업자를 종합지급결제사업자로 지정할 경우 자금이체, 대금결제, 결제대행 등 종합지급결제사업자가 영위할 수 있는 전자금융업 일체를 일컫는다.1) 특히 종합지급결제사업자로 지정되면 예외적으로 은행과 유사하게 지급계좌 개설을 통해 자금이체업을 영위할 수 있다. 이는 일반 자금이체업뿐 아니라 지급지시전달업과 가장 크게 구별되는 특징이기도 하다.2)

2. 지급결제시스템 참가방식

자금이체는 지급수단에 의한 지급결제와 동일하게 자금이체를 지시하고 확인하는 지급(payment), 송금자 금융회사와 수금자 금융회사 간 자금이체 지시에 따른 채권ㆍ채무 금액을 확인하고 계산하는 청산(clearing), 송금자 금융회사와 수금자 금융회사가 자금을 주고 받음으로써 자금이체에 따른 채권ㆍ채무 관계를 해소하는 결제(settlement)의 절차를 거쳐 완결된다(한국은행, 2023). 이를 위해 금융회사 간 청산과 결제를 지원하는 청산시스템과 결제시스템이 필요하며, 우리나라의 경우 금융결제원의 청산시스템인 소액결제망이 청산을, 한국은행의 결제시스템인 금융결제망(BOK-Wire+)이 결제를 수행한다.5)

지급결제시스템 참가방식은 <그림 Ⅱ-2>에서 살펴볼 수 있듯이 결제시스템 직접참가 여부에 따라 직접참가와 간접참가로 구분된다. 일반적으로 결제시스템에 직접참가할 경우 청산시스템에도 직접참가할 수 있기 때문이다. 이에 따라 청산시스템에 직접참가하더라도 결제시스템에 간접참가하면 간접참가로 분류된다. 참고로 청산시스템 또는 결제시스템 간접참가는 직접참가 금융회사와 대행계약을 체결하는 경우를 일컫는다.

한편 현재 소액결제시스템에 직접참가할 수 있는 금융회사는 「한국은행법」 제11조와 금융통화위원회의 「지급결제제도 운영ㆍ관리규정」에 따라 「은행법」에 따른 은행과 「금융지주회사법」에 따른 은행지주회사로 제한되어 있다. 또한 한국은행은 2020년 6월에 한국은행에 지급준비금 예치의무가 없는 비은행 금융회사의 직접참가를 원천적으로 배제하는 소액결제시스템의 직접참가 기준을 제시한 바 있다(한국은행, 2020.6.4).6)

소액결제시스템의 간접참가도 청산시스템인 소액결제망의 직접참가만 허용하고 있다. 이 경우에도 은행의 집단적 의사결정과 승인이 있어야 한다.7) 개별 은행과의 사적 계약을 통한 간접참가는 원천적으로 배제하고 있다. 이에 따라 2023년 6월말 현재 소액결제시스템 간접참가(금융결제원의 소액결제망 직접참가) 비은행 금융회사는 6개 서민금융기관, 26개 금융투자회사, 우체국뿐이다.8) 참고로 소액결제망에 직접참가한 비은행 금융회사는 자금이체에 따른 결제를 위해 직접참가 은행과 대행계약을 체결하여 결제시스템인 금융결제망에 간접참가한다.

한편 종합지급결제사업자가 소액결제시스템에 직접 또는 간접참가할 수 없더라도 오픈뱅킹공동망시스템에 가입하여 자금이체업을 영위할 수 있다.9) 이 경우 고객은 자신을 대신하여 종합지급결제사업자가 추심이체와 지급이체를 지시할 수 있도록 소액결제시스템에 직접 또는 간접참가한 다른 금융회사의 계좌를 연계해야 한다. 이 경우 종합지급결제업과 일반 자금이체업의 차이는 사라지게 된다.

3. 고객자금 보호와 건전성 규제

종합지급결제사업자는 자금이체업자와 동일하게 고객자금 전액을 고유재산과 분리하여 은행 등 금융회사(이하 관리기관)에 예치ㆍ신탁하는 방식으로 별도관리(safeguarding)해야 한다. 또한 고객자금에 대해 제3자의 상계ㆍ압류가 금지되고, 제3자에게 청구권을 양도하거나 담보로 제공할 수 없으며, 파산선고 등의 사유가 발생한 때에는 고객자금 전액을 우선 지급해야 한다.

관리기관은 종합지급결제사업자로부터 예치ㆍ신탁받은 고객자금이 고객의 재산임을 표시해야 하고, 고객자금의 안정적 운용을 해할 우려가 없는 은행 예금, 국채, 금융회사의 지급보증이 있는 채무증권 등으로 운용해야 한다. 또한 종합지급결제사업자가 파산선고 등의 이유로 고객자금 전액을 우선 지급하지 못할 경우 관리기관이 대신하여 고객자금을 우선변제해야 한다. 관리기관이 파산선고 등의 사유가 발생한 때에는 종합지급결제사업자에게 고객자금을 반환해야 한다.

종합지급결제사업자는 고객자금에 대한 이자지급이 금지되고, 고객자금을 재원으로 하는 신용공여(대출) 행위도 금지된다. 또한 종합지급결제사업자의 겸영업무와 부수업무는 엄격하게 제한된다. 외국환업무, 후불결제, 마이데이터, 금융상품판매대리ㆍ중개업 등이 허용되는 방향으로 논의되었으나 확정된 것은 없다.

종합지급결제사업자는 재무상태, 지급능력, 위험관리 등에 대하여 다른 전자금융업자보다 높은 수준의 건전성 규제도 받는다. 아직 종합지급결제사업자에 대한 건전성 경영지도기준이 구체적으로 제시되지 않았다. 그러나 종합지급결제업이 도입될 경우 현재 간편송금 서비스를 제공하는 전자금융업자보다 높은 수준의 건전성 경영지도기준이 적용될 것으로 예상된다.

현재 간편송금 서비스를 제공하는 전자금융업자는 최소자본금 요건을 항상 충족해야 하고, 자기자본이 0을 초과해야 하며, 고객자금 대비 자기자본비율도 20% 이상이어야 한다. 유동성 비율도 50% 이상이어야 한다. 다만 다른 전자금융업자와 달리 총자산 대비 투자위험성이 낮은 자산의 비율을 10% 이상 유지해야 하는 자산건전성(지급능력) 규제는 면제받고 있다.

Ⅲ. 종합지급결제업 도입 쟁점

본 장에서는 종합지급결제업 도입과 관련한 쟁점을 부정적 입장과 긍정적 입장을 구분하여 정리하고, 각 쟁점이 발생한 근본적 원인을 종합지급결제업의 은행업 여부, 독특한 지급결제제도 특징, 머니무브에 따른 이해 충돌, 긍정적 효과의 불확실성으로 제시하고 각각에 대해 분석하였다.

1. 부정적 입장

은행 등은 종합지급결제사업자에게 일상적인 지급결제 활동에 사용할 수 있는 계좌를 개설할 수 있는 권한을 부여할 경우 종합지급결제사업자가 은행과 다를 바가 없다고 주장한다. 이에 따라 산업자본의 은행업 우회진출, 동일기능-동일리스크-동일규제 약화, 지급결제와 금융 안정성 위협 등을 종합지급결제업 도입에 대한 부정적 입장으로 제시하고 있다.

현재까지 종합지급결제사업자 지정대상으로 논의되고 있는 전자금융업자와 신용카드사 중에는 <표 Ⅲ-1>에 살펴볼 수 있듯이 은행계 신용카드사와 토스를 제외한 나머지의 경우 모회사가 산업자본에 속한다.10) 이에 따라 은행 등에서는 종합지급결제업 도입이 산업자본의 은행업 우회진출을 허용하는 것과 같다고 주장한다. 더 나아가 산업자본의 은행지분 소유를 엄격하게 제한하는 은산분리 규제가 유명무실해질 것이라고 우려한다.11)

이뿐 아니라 은행 등은 비은행 금융회사가 종합지급결제사업자로 지정될 경우 지급결제와 금융 안정성을 위협할 수 있다고 주장한다. 비정상적인 대규모 자금인출로 종합지급결제사업자의 지급불능 사태가 언제든지 쉽게 발생할 수 있기 때문이다. 특히 실리콘밸리은행(Silicon Valley Bank) 사례처럼 디지털런(digital run)이 일어날 수 있다고 우려한다(이성복, 2023a).

2. 긍정적 입장

핀테크업계와 신용카드사들은 청산시스템 직접참가, 자금이체 비용절감, 계좌기반 서비스 강화 등을 이유로 종합지급결제업 도입을 희망한다(한국핀테크산업협회, 2023.3.29; 여신금융협회, 2023.3.24). 이에 따라 자금이체업의 경쟁 강화, 금융서비스 경쟁의 촉진, 금융거래비용 절감, 금융소비자 편익 증대 등을 종합지급결제업 도입에 대한 긍정적 입장으로 제시하고 있다.

핀테크업계와 신용카드사들은 <그림 Ⅲ-1>에서 살펴볼 수 있듯이 은행이 자금이체업을 거의 독점하고 있는 상황에서 종합지급결제업이 도입될 경우 금융소비자 선택권이 확대되어 자금이체업의 경쟁을 촉진할 수 있다는 입장이다. 특히 간편송금처럼 은행보다 더 간단하고 편리하게 접근할 수 있는 자금이체 서비스를 제공할 것이기 때문에 유의미한 시장구조의 변화를 가져올 수 있다고 주장한다.

이에 따라 핀테크업계와 신용카드사들은 종합지급결제업 도입이 금융서비스 경쟁을 촉진할 수 있다고 주장한다. 금융소비자의 자금이동 경로가 은행의 계좌 중심에서 종합지급결제사업자의 계좌 중심으로 전환될수록 금융서비스 경쟁은 더 촉진될 것이고, 궁극적으로 금융서비스 질이 향상되고 금융소비자 편익이 제고될 것이라는 입장이다.

3. 쟁점 원인

종합지급결제업 도입에 대한 부정적 입장과 긍정적 입장을 종합적으로 정리해보면, 각 쟁점은 근본적으로 종합지급결제업의 은행업 여부, 독특한 지급결제시스템 참가 방식과 자금이체 처리의 제도적 특징, 머니무브에 따른 이해 충돌, 긍정적 효과의 불확실성에서 비롯된다.

가. 종합지급결제업의 은행업 여부

은행의 업무범위는 예ㆍ적금의 수신업무, 자금의 여신업무, 지급결제업무로 규정되어 있다.14) 이를 근거로 종합지급결제사업자가 다음과 같은 이유로 은행업을 영위한다고 주장한다(양기진, 2021). 첫째, 지급계좌 개설을 통해 고객자금을 수취하는 것은 은행의 수신업무와 같다. 둘째, 후불결제는 은행의 여신업무에 해당된다. 셋째, 자금이체업은 은행의 고유업무 중 하나인 지급결제업무에 해당된다.

특히 종합지급결제사업자가 지급계좌를 개설해 수취한 고객자금은 은행의 예금과 유사하게 원금이 보장되는 소비임치의 계약적 성질을 갖는다는 점에서 종합지급결제사업자의 고객자금 수취가 은행의 예금 수신과 동일하다고 볼 수 있다(고동원, 2018).15) 종합지급결제사업자는 일반 자금이체업자와 다르게 지급계좌를 개설해 고객자금을 직접 수취할 수 있고, 고객은 언제든지 자신의 지급계좌에서 자금의 이체나 출금을 요청할 수 있기 때문이다.

그러나 은행법에 따르면 “은행업”은 예ㆍ적금으로 수취한 고객자금을 재원으로 대출하는 업으로 정의되어 있다.16) 이는 종합지급결제사업자가 은행처럼 예금을 재원으로 자금중개(financial intermediation)의 역할을 수행하느냐에 따라 은행업 해당 여부가 결정되어야 함을 뜻한다(황순주, 2022).17) 그렇다면 종합지급결제사업자가 은행업을 영위한다고 볼 수 없다. 종합지급결제사업자는 은행처럼 고객자금을 재원으로 대출할 수 없기 때문이다. 따라서 종합지급결제사업자가 지급계좌를 개설해 고객자금을 수취하고 자금이체를 포함한 지급결제업무를 취급한다고 해서 은행업을 영위한다고 볼 수 없다(고동원, 2018).18)

더구나 종합지급결제사업자의 고객자금 수취도 네 가지 측면에서 은행의 예금 수신과 다르다. 첫째, 은행은 수신한 예금을 고유재산과 합산하여 관리하나, 종합지급결제사업자는 고객자금 전부를 고유재산과 분리하여 별도관리해야 한다. 둘째, 은행은 수시입출금이 가능한 요구불예금이더라도 이자를 지급하나, 종합지급결제사업자는 고객자금에 대해 이자지급이 금지되어 있다. 셋째, 은행의 예금은 일정 비율만큼 중앙은행에 지급준비금으로 예치해야 하나, 종합지급결제사업자의 고객자금은 지급준비금을 예치하지 않는다. 넷째, 종합지급결제사업자의 고객자금은 은행의 예금과 달리 예금보호대상에 포함되지 않는다.

특히 상기 차이점들 중 지급준비금 예치의무의 차이가 종합지급결제업이 은행업과 본질적으로 같지 않다는 점을 뒷받침해준다(박기영ㆍ김수현, 2017). 부분지준이론(Theory of Fractional Reserve)에 따르면 은행은 예금의 일정 비율을 중앙은행에 예치함으로써 시스템적으로 신용을 창출하는 기능을 수행하지만, 종합지급결제사업자는 은행처럼 신용을 창출하는 기능을 수행하지 않기 때문이다.

한편 종합지급결제사업자가 고유재산으로 대출하더라도 금융소비자는 자금의 출처와 상관없이 은행처럼 자금중개의 역할을 수행한다고 인식할 수 있다. 또한 종합지급결제사업자가 지급결제 실적에 비례하여 금전적 혜택을 제공한다면 은행의 예금처럼 이자를 지급하는 것과 같고, 은행의 예금 수신과 다를 바가 없다고 주장될 수 있다. 이 점에서 종합지급결제사업자의 사업 양태 등에 따라 종합지급결제사업자가 은행업을 영위한다는 주장이 계속 제기될 수 있다.19)

나. 독특한 지급결제제도 특징

전자금융업자나 신용카드사가 종합지급결제업 도입을 희망하는 가장 근본적인 이유는 지급결제시스템에 참가할 수 있고, 은행에게 지급하는 자금이체 비용을 대폭 절감할 수 있다고 기대하기 때문이다.20) 그러나 우리나라의 독특한 지급결제시스템 참가방식으로 인해 종합지급결제업 도입 여부와 상관없이 전자금융업자나 신용카드사가 지급결제시스템 직접 또는 간접참가하기 어려운 구조다.

우선 비은행 금융회사의 지급결제시스템 직접참가는 앞서 살펴본 바와 같이 한국은행법을 개정하지 않는 한 원천적으로 불가능하다. 지급결제시스템 간접참가도 청산시스템 직접참가만 가능하고, 은행의 집단적 의사결정과 승인이 있어야 한다. 사실 한국은행과 금융결제원은 2015년부터 비은행 금융회사의 지급결제시스템 간접참가(청산시스템 직접참가)가 언제든지 가능하다는 입장을 밝혀 왔다. 하지만 현재까지 지급결제시스템에 간접참가한 전자금융업자나 비은행 금융회사는 전무하다. 2019년 12월 금융당국의 주도로 오픈뱅킹공동망시스템을 개설하여 전자금융업자에게 은행의 펌뱅킹 서비스를 전면 개방한 것이 유일한 변화다.21)

실시간 자금이체를 이연차액결제 방식으로 처리할 경우 지급결제시스템 직접참가 금융회사는 최종적으로 이체자금이 결제되기 전까지 결제불이행 리스크를 부담해야 한다.23) 이 때문에 한국은행은 지급결제와 금융 안정성을 이유로 전자금융업자를 비롯한 비은행 금융회사의 지급결제시스템 직접 또는 간접참가를 제한하고 있고, 개별 은행과의 사적 계약을 통한 간접참가도 원천적으로 배제하고 있다(한국은행, 2020.6.24).

이와 같은 독특한 지급결제제도는 은행을 통해 자금이체를 이용하는 금융소비자에게 편의를 제공하는데 기여했다고 평가할 수 있다. 그러나 은행들이 결제불이행 리스크를 스스로 야기하는 독특한 지급결제제도를 채택하고, 지급결제 안정성을 이유로 비은행 금융회사에게 지급결제시스템을 개방하지 않음으로써 여러 쟁점과 논란을 유발하고 있는 것도 사실이다.

다. 머니무브에 따른 이해 충돌

은행 등이 종합지급결제업 도입을 반대하고, 전자금융업자와 신용카드사가 희망하는 이유는 종합지급결제업 도입으로 급격한 머니무브(money move)가 일어날 것을 우려하기 때문이다. 고객의 유휴자금(idle money)이 은행에서 종합지급결제사업자로 이동할수록 은행은 저렴한 자금조달 수단을 상실하는 반면, 종합지급결제사업자는 고객자금으로부터 새로운 수익원을 확보할 수 있기 때문이다.24)

우선 고객의 유휴자금이 이탈하는 만큼 은행의 자금조달 비용은 증가할 수밖에 없다. 은행은 대개 요구불예금에 대해 이자를 거의 지급하지 않기 때문이다. 물론 은행은 종합지급결제사업자의 고객자금을 예치ㆍ신탁받거나 자금이체 대행기관의 역할을 수행할 경우 종합지급결제사업자로부터 수수료 수익을 얻을 수 있다. 그럼에도 불구하고 은행은 고객자금이 대규모로 이탈할 경우 은행의 수익성이 저하될 것을 우려하고 있다.25)

이와 달리 종합지급결제사업자는 고객의 유휴자금을 유치하고 은행에 신탁할 경우 새로운 수익을 얻게 된다. 고객자금에 대해 이자지급이 금지되기 때문에 신탁수익은 종합지급결제사업자가 독차지한다. 물론 종합지급결제사업자가 고객자금을 유치하기 위해 고객에게 지급결제 실적에 비례하여 금전적 혜택을 제공할 경우 비용이 발생할 수 있다. 그렇다고 하더라도 종합지급결제사업자는 고객의 유휴자금을 더 많이 유치할수록 더 많은 수익을 얻을 수 있다.

이처럼 종합지급결제업 도입으로 상당한 수준의 머니무브가 일어날 경우 은행과 종합지급결제사업자의 이해가 충돌될 수밖에 없다. 이 때문에 종합지급결제업이 은행업에 해당되지 않는다고 판단되고 지급결제와 금융 안정성에 우려가 해소되더라도 종합지급결제업 도입에 대한 찬반의견은 머니무브의 가능성만으로도 첨예하게 갈릴 수 있다.

라. 긍정적 효과의 불확실성

전자금융업자나 신용카드사는 종합지급결제업이 도입될 경우 자금이체업의 경쟁 강화, 금융서비스 경쟁 촉진, 금융거래비용 절감, 금융소비자 편익 증대 등의 긍정적 효과가 나타날 것이라고 주장한다. 그러나 이러한 긍정적 효과가 실제 나타날지는 확실하지 않다. 특히 은행과 직접적 경쟁관계에 있는 인터넷전문은행의 신규진입 효과를 고려할 때 더욱 그렇다.

인터넷전문은행을 처음 도입했을 때도 상당한 경쟁 촉진 효과를 기대하였다. 그러나 인터넷전문은행이 2017년부터 신규로 3개사가 진입하였음에도 대형 은행의 과점이 크게 해소되지는 않았다(금융위원회, 2022.12.9).26) 특히 <그림 Ⅲ-3>에서 살펴볼 수 있듯이 자금이체뿐 아니라 금융서비스 경쟁이 크게 촉진되었다는 뚜렷한 증거는 발견되지 않는다.27)

한편 일각에서는 은행에서 종합지급결제사업자로의 머니무브 규모가 커질수록 종합지급결제업 도입에 따른 경쟁 촉진의 효과가 크게 나타날 것이라고 주장한다. 그러나 이마저도 은행과 종합지급결제사업자 간의 수익 재배분만 일어날 가능성이 크고 금융소비자 후생을 향상하지 못한다면 사회 후생을 향상하지 못할 것으로 예상된다.28) 오히려 <그림 Ⅲ-4>에서 살펴볼 수 있듯이 자금이동 경로와 자금이체 절차가 이전보다 더 복잡해짐에 따라 자금이체와 관련하여 사회 전체가 부담하는 비용이 편익보다 더 커질 가능성도 존재한다.29)

그동안 종합지급결제업 도입을 논의할 때 영국ㆍEU의 전자화폐기관(E-money Institution: EMI), 싱가포르의 주요지급기관(Major Payment Institution: Major PI) 제도가 주로 소개되었다(금융위원회, 2020.7.27; 서정호, 2020; 황순주, 2022). 그러나 종합지급결제업 도입과 관련된 쟁점을 고려할 때 미국의 자금이체업자(money transmitter) 제도도 살펴볼 필요가 있다. 이에 따라 본 장에서는 영국ㆍEU, 싱가포르, 미국의 관련 제도의 도입 경험과 교훈을 종합지급결제업 도입과 관련된 쟁점에 초점을 맞춰 살펴보았다.

1. 주요국의 관련 제도

2021년 바젤위원회(BIS)의 지급시장인프라위원회(CPMI) 조사에 따르면, 조사대상 75개 국가 중에서 60개 국가에서 종합지급결제업과 유사한 제도를 도입한 것으로 파악된다(Ehrentraud et al., 2021). 이중 영국과 EU의 경우 2007년과 2015년에 지급서비스지침(Payment Services Directive)을 각각 제ㆍ개정하고 2009년에 전자화폐지침(E-money Directive)을 개정함으로써 지금의 전자화폐기관 제도로 발전하였고, 싱가포르의 경우 2019년에 지급서비스법(Payment Services Act)을 제정하여 지급결제기관 제도를 도입하였다.30) 미국의 경우 아주 오래 전부터 각 주의 관련 법에 따라 자금이체업자 제도가 운영되고 있다.31)

영국ㆍEU, 싱가포르, 미국의 종합지급결제업 관련 제도를 비교해 보면 <표 Ⅳ-1>에 나타난 바와 같다. 예금을 수신할 수 없고, 고객자금에 대해 이자를 지급할 수 없으며, 고객자금을 별도관리해야 한다. 또한 고객자금을 재원으로 대출을 제공할 수 없다.

2. 지급결제시스템 참가방식

영국ㆍEU, 싱가포르, 미국의 경우 종합지급결제업 관련 제도를 도입하는 과정에서 지급결제 안정성 위협에 대한 우려가 쟁점으로 제기되지 않았다. 이보다는 핀테크에 의한 지급결제 혁신을 촉진하기 위해 종합지급결제업 관련 사업자에게 지급결제시스템을 개방해야 한다는 필요성이 더 중요하게 논의되었다(서정호ㆍ김자봉, 2019). 가장 큰 이유는 이들 국가에서는 결제불이행 위험을 최소화하는 지급결제제도를 도입하거나 운영하고 있고, 비은행 금융회사는 은행의 집단적 의사결정이 아닌 개별 은행과의 사적 대행서비스 계약으로 지급결제시스템에 간접참가할 수 있기 때문이다.

이에 따라 <표 Ⅳ-2>에서 살펴볼 수 있듯이 영국의 경우 2017년 7월에 전자화폐기관을 비롯한 비은행 지급서비스 제공자에게 영란은행 결제계좌(settlement account) 개설과 지급결제시스템 직접참가를 허용하였다(BOE, 2017.7.19). 싱가포르의 경우도 2018년 9월에 주요지급기관의 지급결제시스템 직접참가를 허용하였다(MAS, 2020.11.30). 한편 미국의 경우 2017년 3월에 도입된 특별목적은행(Special Purpose National Bank: SPNB)만 연준의 지급결제시스템에 직접참가할 수 있도록 제한하였다(OCC, 2016, 2017).35)36)

3. 주요국의 도입 교훈

영국ㆍEU, 싱가포르, 미국뿐 아니라 종합지급결제업 관련 제도를 도입한 국가들은 공통적으로 자금이체업을 은행만 영위할 수 있는 고유업무로 보지 않는다. 예를 들어, EU의 지급결제지침(PSD) 제1조에서 지급결제서비스를 제공할 수 있는 기관을 신용기관(Credit Institution), 전자화폐기관(EMI), 지급결제기관(PI)으로 규정하고 있다. 특히 전자화폐기관처럼 지급계좌 개설을 통해 자금이체업을 영위한다고 해도 은행으로 보지 않는다.

영국ㆍEU, 싱가포르, 미국의 종합지급결제업 관련 사업자 수는 <표 Ⅳ-3>에 나타난 바와 같이 적지 않다. 2023년 5월말 기준 영국과 EU의 경우 각각 223개와 272개 전자화폐기관이, 싱가포르의 경우 43개 주요지급기관이 영업 중이다. 미국의 경우 2023년 5월말 기준 612개 자금이체업자가 2개 이상 주에서 영업 중이다. 이는 현재 우리나라에서 제기된 쟁점들이 이들 국가에서는 크게 문제되지 않았다는 것을 간접적으로 시사한다.

영국, 싱가포르, 미국에서 종합지급결제업 관련 사업자에 대한 수요는 다소 다르다. 영국의 경우 2020년 기준 성인의 4%만이 전자화폐기관의 지급계좌를, 싱가포르의 경우 2022년 기준 총인구의 약 70%가 주요지급기관의 지급계좌를 보유하고 있는 것으로 파악된다(FCA, 2021; Mordor Intelligence, 2023). 미국의 경우 성인의 약 20%(Zelle를 포함할 경우 약 40%)가 자금이체업자의 자금이체 서비스를 이용하는 것으로 조사된다(Consumer Reports, 2023).38)

예를 들어, 영국의 경우 <그림 Ⅳ-1>에서 살펴볼 수 있듯이 폐업 또는 파산하는 전자화폐기관이 증가하고 일부 전자화폐기관이 고객자금을 별도관리하지 않거나 고객자금 반환에 실패하는 사례가 발생하자 고객자금 보호 강화를 위해 고객자금 관리, 유동성 리스크 관리, 파산정리 절차와 관련된 규제를 보완하고 강화하였다(FCA, 2020, 2021, 2023; HM Treasury, 2020).39)

Ⅴ. 결론

지금까지 살펴본 바에 따르면 우리나라에서 종합지급결제업을 시급하게 도입할 필요성은 크지 않다.41) 종합지급결제업 도입에 따른 긍정적 효과가 불확실한 가운데 지급결제 안정성을 우려하면서까지 종합지급결제업을 도입할 명분이 충분하지 않기 때문이다. 그러나 종합지급결제업 도입 자체를 우려할 이유도 크지 않다. 종합지급결제업이 은행처럼 예금을 재원으로 자금중개 또는 신용창출 기능을 수행하는 것이 아니기 때문이다. 이 점에서 은행 등에서 주장하는 것처럼 산업자본의 은행업 우회진출과 동일기능-동일리스크-동일규제 약화는 우려할 사안이 아니다. 더구나 지급결제 안정성에 대한 우려도 우리나라의 독특한 지급결제제도에서 비롯된 것이므로 지급결제제도를 개선할 경우 충분히 해소될 수 있다.

따라서 종합지급결제업을 도입하기에 앞서 지급결제 안정성에 대한 우려를 불식하는 것이 우선일 수 있다. 이를 위해 현재 이연차액결제 방식으로 처리하는 실시간 자금이체를 실시간총액결제 방식으로 처리할 수 있도록 지급결제시스템을 개선할 필요가 있다.42) 또한 종합지급결제사업자를 비롯한 비은행 금융회사의 지급결제시스템 참가방식도 개선해야 한다. 특히 미국이나 영국에서처럼 비은행 금융회사가 은행의 집단적 의사결정이 아닌 사적 계약으로 지급결제시스템에 간접참가할 수 있도록 허용해야 한다.

종합지급결제업을 먼저 도입하고자 한다면 다음의 두 가지 과제를 선결해야 한다. 우선 종합지급결제사업자가 하나의 금융플랫폼이 되어 다양한 금융서비스를 직접 또는 연계하여 제공할 수 있는 제도적 기반을 마련해야 한다. 그렇지 않고 종합지급결제업만을 도입할 경우 종합지급결제업 도입에 따른 긍적적 효과는 나타나기 어렵고, 종합지급결제사업자에게 고객자금에 대한 수익권을 부여하는 결과만을 초래할 수 있다.

다음으로 디지털런 발생과 전이, 예금자 역차별 등과 같은 문제가 발생하지 않도록 관련 제도도 사전에 보완하고 강화해야 한다.43)44)45) 종합지급결제사업자의 고객자금 평가금액이 신탁운용의 결과로 고객자금 예치금액보다 현저하게 낮아질 경우 실리콘밸리뱅크의 사례처럼 대규모의 디지털런이 발생할 수 있기 때문이다. 이를 위해 영국의 경험을 토대로 고객자금 관리, 유동성 리스크 관리, 파산정리 절차 관련 규제를 우리나라 금융법 체계에 맞게 정비해야 한다.

1) 종합지급결제업 도입을 위해 전자금융거래법이 개정될 경우 전자금융업은 <그림 Ⅱ-1>에서와 같이 간소화될 예정이다.

2) 일반 자금이체업자는 은행의 수시입출금 계좌에 연계된 계정만 개설할 수 있고, 지급지시전달업자는 계좌나 계정 없이 고객의 자금이체 지시만 고객의 은행에 전달할 수 있다.

3) 전자금융거래법 개정안에 따르면 자금이체업자의 최소자본금 요건은 고객예탁금과 분기별 자금이체 금액이 각각 30억원 이하이면 5억원, 각각 30억원 이상이고 100억원 이하이면 10억원, 각각 100억원 초과이면 20억원이다.

4) 여신전금융업법 제5조 제1항에 따라 신용카드사가 신용카드업만을 영위하거나 이와 함께 다른 여신전금융업의 하나를 영위하려는 경우 최소자본금 요건이 200억원이다.

5) 본 보고서에서는 금융결제원의 소액결제망과 한국은행의 금융결제망을 통틀어 지급결제시스템 또는 소액결제시스템이라고 지칭하기로 한다. 금융결제원의 소액결제망(청산시스템)은 CD공동망, 타행환공동망, 지방은행공동망, 자금관리서비스(CMS)공동망, 직불카드공동망, 전자금융공동망 등으로 구성되어 있다.

6) 소액결제시스템에 직접참가하기 위해서는 자금이체업무 수행의 법적 근거가 있고, 한국은행법에 따른 지급준비금 예치의무가 있는 금융회사로서 한국은행이 일시부족자금대출을 통해 결제유동성을 공급할 수 있어야 하며, 금융감독원과 공동검사를 실시할 수 있어야 하며, 차액결제리스크 관리능력을 보유한 것으로 판단되어야 한다.

7) 소액결제망에 직접참가하기 위해서는 금융결제원의 특별참가기관이 되어야 하고, 금융결제원의 특별참가기관이 되기 위해서는 금융결제원의 정관에 따라 은행으로 구성된 사원총회의 승인을 얻어야 한다.

8) 6개 서민금융기관으로는 농협중앙회, 수협중앙회, 저축은행중앙회, 새마을금고중앙회, 신협중앙회, 산림조합중앙회가 해당된다.

9) 오픈뱅킹공동망시스템은 전자금융업자가 은행과 개별적으로 펌뱅킹(firm banking)을 제휴하지 않고도 고객의 은행 계좌의 잔액, 거래내역 등을 조회하고 입금과 출금을 지시할 수 있는 청산시스템이다.

10) 네이버파이낸셜, 카카오페이, 삼성카드, 현대카드, 롯데카드, 비씨카드가 각각 비금융산업에 주력하고 있는 상호출자제한기업집단에 소속되어 있고, 카카오페이, 토스, 신한카드, 우리카드, 하나카드, KB국민카드의 모회사가 은행을 자회사로 보유하고 있다(공정거래위원회, 2022.4.27).

11) 현재 전자금융거래법 개정안에 제시된 종합지급결제사업자 지정요건에는 은산분리 규제와 같은 산업자본의 지분소유 제한이나 금융주력자 요건이 포함되어 있지 않다.

12) 신용카드사들은 여신전문금융업법을 개정해서라도 계좌를 개설할 수 있는 권한을 부여받고 싶어 한다. 이를 통해 청산시스템에 직접참가하게 되면 자금이체 비용을 대폭 절감할 수 있을 것으로 기대한다(여신금융협회, 2023.3.24).

13) 간편송금ㆍ간편결제는 은행의 계좌에 연계하지 않아도 되고, 급여이체ㆍ대금납부ㆍ외국환 등 일상적인 지급결제 서비스도 직접 제공할 수 있다. 이외에도 지급결제와 연계하여 혁신적인 금융서비스를 선보일 수 있다.

14) 은행법 제27조 제2항에 따라 은행업무의 범위는 예ㆍ적금의 수입 또는 유가증권, 그 밖의 채무증서의 발행, 자금의 대출 또는 어음의 할인, 내국환ㆍ외국환으로 규정되어 있다. 여기서 내국환ㆍ외국환업무는 지급결제업무로 볼 수 있다(고동원, 2018).

15) 예금은 우리나라 금융관계법에서 명확하게 정의되어 있지 않다. 유일하게 유사수신행위법 제2조와 제3조에서 다른 법령에 따른 인ㆍ허가를 받지 아니하고 불특정 다수인으로부터 장래에 원금의 전액 또는 이를 초과하는 금액을 지급할 것을 약정하고 예금ㆍ적금ㆍ부금ㆍ예탁금 등의 명목으로 금전을 받는 행위를 금지한다고 규정하고 있다.

16) 은행법 제2조에 따라 “은행업”은 ‘예금을 받거나 유가증권 또는 그 밖의 채무증서를 발행하여 불특정 다수인으로부터 채무를 부담함으로써 조달한 자금을 대출하는 것을 업(業)으로 하는 것’으로 정의되어 있다.

17) 황순주(2022)는 기존 문헌을 토대로 원래 은행은 편리한 지급결제 서비스의 필요성에 의해 출현하였으나, 자금중개 서비스가 은행의 본질적 역할이 되었다고 설명한다.

18) 고동원(2018)은 은행법에 따라 지급결제업무는 은행이 영위할 수 있는 업무 중 하나일 뿐 은행의 고유업무가 아니라고 설명한다.

19) 네이버파이낸셜이 미래에셋증권과 제휴하여 2020년 6월에 출시한 네이버통장이 은행의 예금통장으로 오인될 수 있다는 이유로 금융당국에서 위법 여부를 검토한 사례가 있다(조선비즈, 2020.6.17).

20) 전자금융업자는 2019년 12월 오픈뱅킹공동망시스템이 개설된 후 건당 자금이체 수수료를 종전의 1/10의 수준인 40~50원으로 인하된 적이 있으나 여전히 은행보다 높은 수준의 자금이체 비용을 부담하고 있다(금융위원회, 2019.6.20). 신용카드사는 금융결제원의 사원총회 승인 없이는 오픈뱅킹공동망시스템에 참여할 수 없어 종전과 동일하게 건당 400~500원의 자금이체 수수료를 부담하고 있다(한국은행, 2021.1.25).

21) 오픈뱅킹공동망시스템의 이용기관은 은행, 전자금융업자, 전자금융보조업자 등으로 제한되어 있다(금융위원회, 2019.6.20; 한국은행, 2021.1.25).

22) 이체자금이 송금자 은행에서 수금자 은행으로 최종적으로 결제(settlement)되지 않았어도 수금자 은행이 수금자에게 이체자금을 실시간으로 이용하거나 출금할 수 있도록 1일 신용을 제공한다.

23) 한국은행은 결제불이행 리스크를 최소화하기 위해 일차적으로 지급결제시스템 직접 또는 간접참가를 제한하고, 지급결제시스템 참가 금융회사에 대해서는 순이체한도, 차액결제대행한도(간접참가만), 담보 납입 등을 통해 결제불이행 리스크를 사전적으로 관리한다.

24) 종합지급결제사업자는 고객자금을 은행 등에 예치ㆍ신탁하여 별도관리해야 하기 때문에 머니무브는 표면적으로 일어날 뿐 실질적으로는 일어나지 않는다.

25) 황순주(2022)는 고객의 유휴자금 또는 결제성 예금이 1% 감소할 경우 은행의 순이자마진(net interest margin)이 1분기 후에 0.27% 감소하고 이후 개선되지 않는다고 보고한다.

26) 금융위원회 산하의 금융산업경쟁도평가위원회는 2022년 은행업의 경쟁도가 2018년과 비교할 때 악화되었다고 평가한다. 또한 이는 인터넷전문은행이 아직 규모가 작아 대형 시중은행에 유의미한 경쟁자로서 영향을 주지 못하였기 때문이라고 설명한다.

27) 2021년 9월 이후 인터넷전문은행의 요구불예금 점유율이 크게 증가한 것도 자금이체를 포함한 지급결제 서비스에 대한 수요가 증가했기 때문이 아니다. 2021년 6월에 은행업 본인가를 받고 9월에 출범한 토스뱅크가 요구불예금에 대해 높은 이자를 지급하는 파킹통장 서비스를 출시하고, 다른 인터넷전문은행도 유사한 파킹통장 서비스를 제공하기 시작한 데 기인한다.

28) 금융소비자 후생을 자금잉여자와 자금부족자로 구분하여 살펴볼 경우 자금잉여자의 편익은 유휴자금의 경제적 효용 증가로 증대될 수 있으나, 자금부족자의 비용은 은행의 자금조달 비용 상승으로 대출금리가 인상될 경우 더 커질 수 있다.

29) Chiu & Wong(2014)도 이론모형 분석을 통해 종합지급결제업 관련 제도의 도입이 사회 후생을 반드시 향상시키지 않을 수 있다고 보고한다.

30) 영국의 경우 2011년 전자화폐규제(Electronic Money Regulation 2011)와 2017년 지급서비스규제(Payment Services Regulation 2017)를 적용받는다.

31) 미국의 비은행 자금이체 서비스는 서부개척시대인 1870년대에 출현하였고, 1900년대 초부터 뉴저지(New Jersey) 주를 시작으로 각 주에서 제도화하였다(CSBS, 2020).

32) 영국의 경우 2015년 지급계좌규제(Payment Accounts Regulation 2015)에 따라 전자화폐기관이 개설한 계정이 일상적인 지급 거래(day-to-day payment transactions)를 지원한다고 판단되는 다음의 네 가지 요건을 충족한 경우에만 지급계좌로 인정한다(FCA, 2016). 첫째, 계좌에 자금을 예치할 수 있어야 한다. 둘째, 계좌에서 현금을 인출할 수 있어야 한다. 셋째, 제3자에게 이체 또는 결제를 지시할 수 있어야 한다. 넷째, 제3자로부터 이체 또는 결제를 수납할 수 있어야 한다.

33) 은행 계좌가 없는 경우 제휴 은행이 발급하는 직불카드와 연계되는 계정이 발급된다. 해당 계정은 자금이체업자를 통해서만 잔액을 조회할 수 있다.

34) 영국ㆍEU와 싱가포르의 경우 고객자금이 전자화폐 부채로 회계처리되나, 미국의 경우 미지급금(payable) 부채로 회계처리된다.

35) 미국의 청산시스템(Automated Clearing House: ACH)은 연준의 FedACH와 민간의 EPN(Electronic Payments Network)으로 구성되어 있다(한국은행, 2020).

36) 미국의 특별목적은행은 예금을 수취할 수 없고 지급결제 또는 대출 업무만 취급할 수 있는 은행인가 제도다. 한편 연준이 운영하는 지급결제시스템에 참가하려면 연준의 별도 승인을 얻어야 한다.

37) 원래 특별목적은행 인가를 받으려고 계획했던 Varo Money와 SoFi는 각각 2020년 7월과 2022년 1월에 풀뱅킹(full-banking) 국립은행(national bank) 인가를 받았고, Sqaure는 2020년 3월에 산업대출은행(ILC) 인가를 받았다.

38) Zelle는 Bank of America, JPMorgan Chase, Wells Fargo을 비롯한 미국 전역의 1,700개 이상의 은행과 신용조합이 제공하는 디지털 플랫폼 기반의 자금이체 서비스다.

39) 2018년부터 2022년 중반까지 파산한 6개 비은행 지급서비스 사업자(전자화폐기관 포함) 중 1개 사업자만이 고객자금을 반환하는데 성공하였다(HM Treasury, 2020).

40) GAO(2019)에 따르면 자금이체업자의 고객자금 관리계좌를 보유하고 있다고 응답한 91개 은행 중 69개 은행이 2014년부터 2016년까지 해당 계좌를 해지하거나 거래를 제한하였다고, 이중 18개 은행은 총 1,098개 계좌를 해지하였다고 응답하였다.

41) 증권사의 법인 자금이체업무 허용과 관련된 논의는 종합지급결제업 도입 논의와 비슷한 측면도 있으나 본질적으로 다르다. 이에 대한 구체적 논의는 이성복(2023b)을 참고한다.

42) 한국은행은 2028년까지 실시간총액결제시스템을 구축하는 방안을 추진하고 있다(한국은행, 2023; 머니투데이, 2023.4.27). 따라서 지급결제 안정성을 위해 종합지급결제업 도입 여부를 실시간총액결제시스템이 구축된 이후에 논의하는 것이 바람직할 수 있다.

43) 은행에서 비정상적인 지급불능 사태가 발생할 경우 한국은행법에 따라 한국은행이 최종대부자 역할을 수행할 수 있고, 예금자보호법에 따라 예금 지급정지가 조치되며, 예금보호한도 내에서 고객자금이 보호된다. 이와 달리 현재 전자금융거래법 개정안에서는 종합지급결제사업자의 경우 이와 같은 안전장치가 마련되어 있지 않다.

44) 대규모의 고객자금 인출이 발생할 경우 관리기관인 은행으로 디지털런 위험이 전이될 수 있다. 특히 종합지급결제사업자가 고객자금을 계열 인터넷전문은행에 예치ㆍ신탁한 경우 디지털런 위험은 더 빠르게 전이되고 증폭될 수 있다.

45) 관리기관인 은행에서 「예금자보호법」에 따른 파산선고 등 보험사고(제2종)가 발생한 경우 예금등(금전신탁 포함)은 예금보호한도 내에서 보호되나 종합지급결제사업자의 고객자금은 전액 반환되어 보호된다. 이에 따라 예금자 역차별 이슈가 제기될 수 있다. 한편 은행에서 예금 지급정지 보험사고(제1종)가 발생한 경우 종합지급결제사업자의 고객자금에 대해 반환 의무가 발생하지 않는다.

참고문헌

고동원, 2018, 은행의 업무 범위에 관한 법적 연구, 은행법연구 11-2, 22-71.

공정거래위원회, 2022. 4. 27, 2022년도 공시대상기업집단 76개 지정, 보도자료.

금융위원회, 2019. 2. 26, 개방형 금융결제망[오픈뱅킹] 구축, 핀테크 성장을 촉진하고 생활금융을 혁신하겠습니다, 보도자료.

금융위원회, 2019. 6. 20, 오픈뱅킹 진행 현황 및 향후 일정, 보도자료.

금융위원회, 2020. 7. 27, 「디지털금융 종합혁신방안」 발표, 보도자료.

금융위원회, 2022. 12. 9, 제2기 금융산업 경쟁도평가위원회 운영결과 및 향후계획 - 은행업·신용카드업·신용정보업 평가결과 발표 -, 보도자료.

금융위원회, 2023. 3. 30, 제2차 은행권 경영ㆍ영업 관행ㆍ제도 개선 TF 논의 결과, 보도자료.

금융위원회ㆍ금융감독원, 2023. 7. 5, 은행권 경영ㆍ영업 관행ㆍ제도 개선 방안, 보도자료 별첨.

머니투데이, 2023. 4. 27, ‘한국판 SVB 사태’ 막아라…한은, 실시간총액결제 도입 속도낸다.

박기영ㆍ김수현, 2017, 은행의 신용창출 기능에 대한 소고, 『금융안정연구』 18(1), 77-111.

서정호, 2020, 종합지급결제업 도입과 향후 과제, 금융연구원 『금융브리프』 29(23).

서정호ㆍ김자봉, 2019, 최근 핀테크의 지급결제시장 참여 확대와 시사점, 금융연구원 『KIF VIP 리포트』 2019-06.

양기진, 2021, 전자금융거래법 개정(안)의 종합지급결제사업자 관련 쟁점 분석, 『법과 기업 연구』 11(2), 153-181.

여신금융협회, 2023. 3. 24, 카드사 지급결제 계좌 허용 관련 업계의견.

이성복, 2021, 『핀테크에 의한 금융혁신 양상과 시사점』, 자본시장연구원 연구보고서 2021-03.

이성복, 2023a, 실리콘밸리은행의 파산 원인과 교훈, 디지털경제금융연구원 『DEFI』 제2호, 34-37.

이성복, 2023b, 증권사의 법인 지급결제 허용 관련 쟁점과 과제, 자본시장연구원 『자본시장포커스』 2023-19호.

이용준, 2022, 전자금융거래법 일부개정법률안(김병욱의원 대표발의, 의안번호 제2113137호) 검토보고, 정무위원회.

조선비즈, 2020. 6. 17, ‘네이버통장’ 냈다가 ‘명칭 논란’ 휩싸인 네이버... 금융당국, 규제카드 ‘만지작’.

조성훈, 2020, 『금융투자회사 아웃소싱 관리 해외사례』, 자본시장연구원 이슈보고서 20-1.

최규선ㆍ이지영, 2018, 『유럽연합의 PSD2 시행이 금융권에 미치는 영향 분석』, 금융결제원 금융결제연구소.

한국은행, 2020, 『주요국 지급결제시스템 및 관련 법규 체계』, 지급결제 조사자료 제2020-3호.

한국은행, 2020. 6. 24. 「소액결제시스템 참가제도 개선」 관련 Q&A, 보도참고자료.

한국은행, 2020. 6. 4, 소액결제시스템 참가제도 개선, 보도참고자료.

한국은행, 2021. 1. 25, 금융결제원 운영 지급결제시스템 정기평가 결과, 보도자료.

한국은행, 2023, 『2022년도 지급결제보고서』.

한국핀테크산업협회, 2023. 3 .29, 종합지급결제업 도입을 통한 경쟁 촉진과 소비자 편익 증대.

황나영, 2020, 『싱가포르 종합지급결제업 현황과 시사점』, 우리금융경영연구소 Fintech Trend.

황순주, 2022, 『디지털 지급결제 시장의 개방이 금융소비자에게 미치는 영향과 정책과제』, KDI 연구보고서 2022-02.

Bank of England (BOE), 2017. 7. 19, Bank of England extends direct access to RTGS accounts to non-bank Payment Service Providers, News Release.

Chiu, J., Wong, T-N., 2014, E-Money: Efficiency, Stability and Optimal Policy, Bank of Canada Working Paper 2014-16.

Conference of State Bank Supervisors (CSBS), 2020, Reengineering Nonbank Supervision - Chapter Four: Overview of Money Services Business.

Congress Research Service (CRS), 2020, Telegraphs, Steamships, and Virtual Currency: An Analysis of Money Transmitter Regulation, CRS Report R46486.

Consumer Reports, 2023, Peer-to-Peer Payment Services.

Department of Treasure (DOT), 2023, The Department of the Treasury’s De-risking Strategy.

Ehrentraud, J, Prenio, J, Boar, C, Janfils, M, Lawson, A, 2021, Fintech and payments: regulating digital payment services and e-money, Bank for International Settlements (BIS) FSI Insights.

Financial Conduct Authority (FCA), 2016, Finalised guidance: Definition of a ‘payment account’, FG16/6 – Payment Accounts Regulations 2015.

Financial Conduct Authority (FCA), 2020, Coronavirus and safeguarding customers’ funds: Additional guidance for payment and e-money firms. Finalised guidance.

Financial Conduct Authority (FCA), 2021, Financial Lives 2020 Survey: The impact of coronavirus.

Financial Conduct Authority (FCA), 2021, Payment Services and Electronic Money – Our Approach (version 5).

Financial Conduct Authority (FCA), 2023, Portfolio Letter: FCA priorities for payment firms.

GAO, 2019, Examiners Need More Information on How to Assess Banks’ Compliance Controls for Money Transmitter Accounts.

HM Treasury, 2020, Insolvency Changes for Payment and Electronic Money Institutions.

Monetary Authority of Singapore (MAS), 2019, Guidelines on Licensing for Payment Service Providers.

Monetary Authority of Singapore (MAS), 2020. 11. 30, Non-Bank Financial Institutions to have Access to FAST and PayNow, Media Releases.

Monetary Authority of Singapore (MAS), 2021, Infographic on the Payment Services Act 2019.

Monetary Authority of Singapore (MAS), 2022, FAQs - Payment Services Act 2019.

Mordor Intelligence, 2023, Singapore Payments Market Size & Share Analysis.

Nationwide Mortgage Licensing System (NMLS), 2023, 2022 NMLS Money Service Businesses Report.

Office of the Comptroller of the Currency (OCC), 2016, Exploring Special Purpose National Bank Charters for Fintech Companies.

Office of the Comptroller of the Currency (OCC), 2017, Special Purpose National Bank Charters for Financial Technology Companies.