Find out more about our latest publications

Interest Rate Reversals between Home and Abroad: Impact on Capital Outflows and Financing Costs of Foreign Capital, and Implications

Issue Papers 23-24 Nov. 17, 2023

- Research Topic Macrofinance

- Page 24

This article delves into the recent interest rate reversal between Korea and the US, analyzing its characteristics and potential implications. It also explores the impact of this rate reversal on the possibility of capital outflows and the associated cost of financing foreign capital.

A historical analysis of capital outflows during periods of rate reversals since the 2000s reveals that such rate reversals have not led to significant capital outflows. Regression estimates indicate a minimal impact on bond fund flows, with some influence on stock investment funds. The observed phenomenon is more closely linked to external uncertainties arising from US rate hikes and a shift in risk preferences than to rate reversals between home and abroad. The result highlights that rate reversals have a limited impact on the outflows of domestic and foreign securities investment funds.

However, persistent rate reversals drive up the costs of financing foreign capital and foreign exchange hedging for foreign investments, which requires caution. When residents issue Korean Paper (foreign currency-denominated bonds in Korea), rising coupon rates of issuing bonds are leading to mounting interest payment burdens. It is also noteworthy that most domestic investment institutions pursue an FX hedging strategy when investing in foreign bonds, which contributes to increased FX hedging costs and diminished investment returns.

The implications drawn from this article are as follows. First, efforts should be put into reinforcing economic fundamentals and maintaining external soundness to safeguard the resilience of the Korean economy against prolonged rate reversals coupled with global external shocks. Second, economic agents are encouraged to establish effective systems and strategies for financing foreign capital to prepare for the rise in borrowing costs. To this end, it is also crucial to diversify foreign capital financing instruments and manage foreign currency liquidity. Lastly, domestic investors should develop systematic FX hedging policies that align with the characteristics of individual investment institutions or funds, rather than adopting routine FX hedging practices when investing in foreign securities.

A historical analysis of capital outflows during periods of rate reversals since the 2000s reveals that such rate reversals have not led to significant capital outflows. Regression estimates indicate a minimal impact on bond fund flows, with some influence on stock investment funds. The observed phenomenon is more closely linked to external uncertainties arising from US rate hikes and a shift in risk preferences than to rate reversals between home and abroad. The result highlights that rate reversals have a limited impact on the outflows of domestic and foreign securities investment funds.

However, persistent rate reversals drive up the costs of financing foreign capital and foreign exchange hedging for foreign investments, which requires caution. When residents issue Korean Paper (foreign currency-denominated bonds in Korea), rising coupon rates of issuing bonds are leading to mounting interest payment burdens. It is also noteworthy that most domestic investment institutions pursue an FX hedging strategy when investing in foreign bonds, which contributes to increased FX hedging costs and diminished investment returns.

The implications drawn from this article are as follows. First, efforts should be put into reinforcing economic fundamentals and maintaining external soundness to safeguard the resilience of the Korean economy against prolonged rate reversals coupled with global external shocks. Second, economic agents are encouraged to establish effective systems and strategies for financing foreign capital to prepare for the rise in borrowing costs. To this end, it is also crucial to diversify foreign capital financing instruments and manage foreign currency liquidity. Lastly, domestic investors should develop systematic FX hedging policies that align with the characteristics of individual investment institutions or funds, rather than adopting routine FX hedging practices when investing in foreign securities.

Ⅰ. 검토배경

지난해 이후 미국 연준의 초긴축적 통화정책으로 가파른 금리인상이 이어지면서 국내금리보다 미국금리가 더 높은 수준을 보이는 내외금리차1)의 역전 현상이 나타나고 있다. 2000년대 이후 지금까지 네 차례 내외금리차의 역전 현상이 있었으나 금리차의 역전폭에 있어 최근의 경우가 가장 크다. 또한 미국은 고용시장 등 견조한 경제상황을 바탕으로 연준이 2023년 말까지 추가적인 금리인상 가능성을 예고하고 있는데 반해 우리나라는 물가나 성장률 전망 등 경제 여건이 기준금리의 인상을 어렵게 하고 있는 상황이다. 따라서 향후 내외금리차의 역전폭은 지금보다 더 확대되고 기간도 과거의 경우보다 훨씬 오래 지속될 가능성이 있다.

우리나라에서 한미간 내외금리차의 역전 현상은 외국인 투자자금의 해외 유출 가능성을 크게 하면서 대외건전성 악화에 대한 우려를 낳고 있다. 미국 금리의 상승은 미달러화 자산에 대한 투자수익률 상승 기대로 국제자본이 신흥국에서 이탈하여 미국 또는 미달러화 표시자산으로 이동하는 요인으로 작용하기 때문이다. 또한 내외금리차의 역전 현상이 지속될 경우 우리 경제주체들의 외자조달비용이 상승하여 과거와 같은 저리의 외자조달이 어려워질 뿐만 아니라 거주자의 해외투자시 환위험의 회피를 위한 환헤지 전략의 수립에도 영향을 줄 수 있다는 점을 간과해서는 안 될 것으로 생각된다.

이런 점을 배경으로 본 보고서의 내용은 다음과 같이 구성하였다. II장에서 2000년대 이후부터 최근까지 우리나라의 내외금리차 역전 현상이 나타난 시기별로 특징을 비교해 보고 향후 금리차 역전 현상의 지속가능성에 대해 살펴보았다. III장에서는 금리차 역전에 따른 자본유출 가능성을 분석해 보았다. 특히 과거 금리 역전 기간중 자본유출입이 실제 발생하였는지를 거주자와 비거주자, 그리고 주식 및 채권 투자자금으로 세분하여 분석한 후 우리나라에서 내외금리차 역전이 자본유출입에 미치는 영향을 계량적으로 추정하였다. IV장에서는 금리 역전 현상이 외화채권 발행시 외자조달비용에 미치는 영향을 살펴본 후 거주자의 해외투자시 환헤지비용에 미치는 영향을 실제 사례와 함께 분석하였다. V장에서는 시사점을 제시하였다.

Ⅱ. 한미 금리차 역전 시기별 특징 및 전망

1. 금리차 역전 시기별 비교

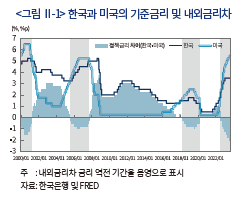

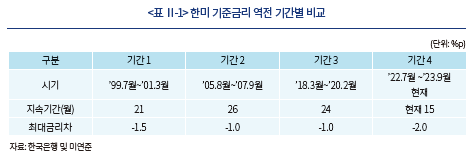

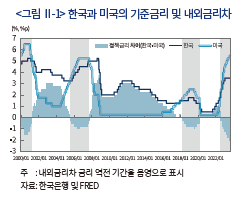

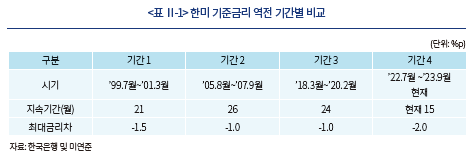

과거 우리나라에서 한미 금리차의 역전 현상이 나타난 것은 <그림 Ⅱ-1> 및 <표 Ⅱ-1>에서 보는 바와 같이 2000년 전후(’99.7월~’01.3월), 글로벌 금융위기 직전(’05.8월~’07.9월), 코로나19 위기 발생 직전(’18.3월~’20.2월) 및 최근 미국의 초긴축정책 기간(’22.7월 이후 현재) 등 네 차례로 파악된다.

최근의 경우를 보면 미연준의 기준금리인 연방기금금리 목표치(상단 기준)가 현재 5.5%에 달하고 있는데 반해 우리나라의 기준금리는 3.5%에 그쳐 기준금리로 볼 때 내외금리차가 2.0%p 수준으로 역전된 상황이다. 이는 과거 내외금리차 역전폭이 1.5%p로 가장 컸던 2000년경보다 더 큰 폭이다. 한편, 내외금리차 역전 현상의 지속기간에 있어서는 글로벌 금융위기 이전과 코로나19 위기 발생 직전이 각각 26개월과 24개월로 가장 긴 것으로 나타났으나 이 시기 동안 금리차 역전폭은 최대 1.0%p 수준이었다. 이와 비교하여 최근의 금리역전 현상은 금년 9월 현재 15개월째 지속되고 있으며, 큰 폭의 내외금리차 역전 정도가 언제까지 지속될지 예단하기 어려운 상황이다.

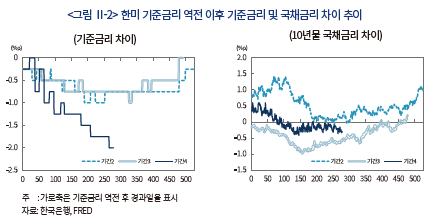

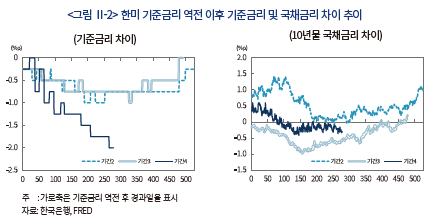

한편 최근(기간 4) 한미간 장기금리(국채 10년물 기준)의 경우에는 <그림 Ⅱ-2>에 나타난 바와 같이 금리 역전폭이 기준금리의 경우보다 다소 작은 것으로 나타난다. 즉, 최근의 장기금리차 역전 현상은 한미간 기준금리가 역전된 이후에도 한동안 나타나지 않다가 약 6개월 이후부터 나타났으며 장기금리차 역전폭은 0.2~0.4%p 범위에 그쳤다. 그 주된 이유는 미국의 장기국채 금리가 연준의 기준금리 대비 매우 낮은 수준을 보이는 데 따른 것으로, 이는 누적된 양적완화 정책 등으로 인해 미국 국채의 기간프리미엄이 낮은 수준을 유지하면서 장기국채 금리의 상승을 제한하는 요인으로 작용하고 있는데 주로 기인(백인석(2023))하는 것으로 판단된다.2)

2. 금리차 역전 현상의 지속가능성

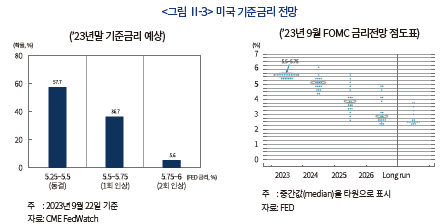

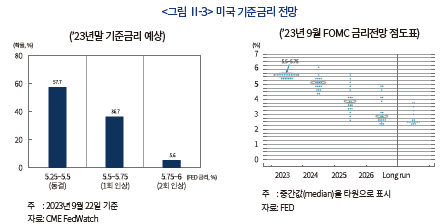

최근의 내외금리차 역전 현상이 얼마나 지속될 것인지는 미국과 우리나라의 경제성장이나 물가 등 경제상황에 좌우될 것으로 보인다. 최근 미국의 연방기금 금리선물 자료(CME FedWatch, 2023년 9월 22일 기준)3)에 따르면 2023년 12월말 미국 기준금리(상단)가 현재 5.5%가 유지될 가능성이 57.7%로 가장 높으나 연내 1회 이상 인상될 확률도 42.3%에 달해 연내 적어도 한차례 추가 인상 가능성도 있는 것으로 보인다. 또한 미연준의 9월 FOMC 점도표를 보더라도, 2025년까지 현재 국내 기준금리 수준인 3.5%보다 높을 것으로 전망되고 있다.

반면 우리나라의 국내 물가(소비자물가)는 금년 8월중 3.4%를 기록하여 중기 물가목표(2%)를 여전히 벗어난 상황이나 경제성장률이 금년중 1% 중반대4) 정도에 그칠 것으로 전망되어 실물경제의 가시적인 회복이 지연되고 있는 상황이다. 따라서 미국 기준금리의 인상 가능성에도 불구하고 국내 기준금리는 현재의 3.5%에서 인상될 가능성이 그리 크지 않은 것으로 보이므로5) 당분간 내외금리차의 역전현 상은 지속될 것으로 보인다.

III. 내외금리차 역전이 자본유출입에 미치는 영향

1. 내외금리차 역전 시기별 자본유출입 추이

한미간 내외금리차의 변동은 국경간 증권 투자자금의 유출입 등 국제자본이동에 영향을 준다. 이는 금리의 변화가 주가 및 채권가격의 변동은 물론 투자통화의 환율변동으로 투자수익률에 영향을 주기 때문이다. 예를 들어 최근과 같은 미국 금리의 상승은 미달러화채권 수익률6)의 상승과 함께 미달러화의 강세로 환차익을 발생시키므로 국제자본이 신흥국으로부터 유출되어 미국내 또는 미달러화표시 자산으로 이동하는 요인이 된다.

반면 주식 투자자금의 경우에는 미국금리 상승시 예상주가수익률이 채권과는 반대의 영향이 나타날 수 있으나 그 영향은 명확하지 않은 것으로 평가되고 있다. 다만, 미국금리 상승시 달러화의 강세로 미국 주식이나 달러화표시 채권 투자에서 모두 환차익이 발생하므로 미국으로의 자본유입을 증가시키는 요인으로 작용한다.

본고에서는 자본유출의 성격 및 범위에 대해 거주자와 비거주자를 모두 포함하여 분석하였다. 이는 내외금리차 역전으로 자본유출이 발생하는 경우 해당국의 주가하락과 환율상승(자국통화 약세)이 나타나면서 금융시장 변동성이 커질 우려가 있기 때문인데 이는 비단 국내에 투자하고 있는 외국인 증권 투자자금뿐만 아니라 거주자의 해외증권 투자자금 유출입 경우에도 외환시장 수급에 마찬가지의 영향을 초래하기 때문이다. 아래에서는 2000년대 이후 우리나라 증권 투자자금의 유출입에 대해 외국인투자자의 국내투자와 거주자의 해외투자로 구분하여 실제 내외금리차 역전 기간동안 자본유출입이 어떤 모습을 보였는지를 살펴보았다.

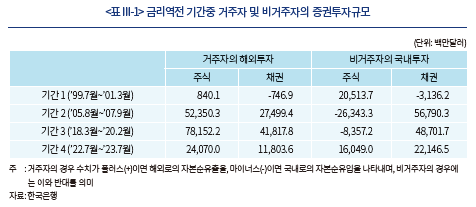

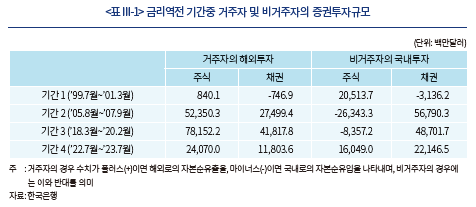

<표 III-1>에 나타난 바와 같이 2000년대 이후 국내 거주자의 해외증권 투자는 주식과 채권에서 모두 꾸준히 증가하는 모습을 보였다. 이는 우리나라의 대규모 경상수지 흑자에 따라 풍부한 외화유동성과 인구구조 고령화로 투자수익률 제고를 위한 해외투자 필요성이 커진 데 주로 기인한다. 또한 비거주자의 국내증권 투자 유출입의 경우에도 주식과 채권에서 모두 내외금리차와는 큰 상관이 없는 것으로 보인다. 즉, 글로벌 금융위기 직전(기간 2)과 코로나19 위기 발생 직전(기간3)의 경우 외국인의 주식 투자자금은 큰 폭의 순유출을 기록하였으나 이는 글로벌 금융위기 직전 대외불확실성의 고조와 미중 무역갈등 등 내외금리차와 상관없는 글로벌 요인에 기인하는 것으로 보인다. 또한 이 두 기간중에도 국내채권에 대한 외국인투자는 크게 증가하는 모습을 보여 외국인의 전체 국내증권 투자자금은 순유입을 보였다. 내외금리차의 역전폭이 가장 큰 최근(기간 4)의 경우에도 외국인투자자의 투자자금이 국내주식 및 국내채권에 모두 견조하게 순유입되어 내외금리차 역전에 큰 영향을 받고 있지 않는 것으로 나타났다. 이러한 결과는 우리나라에서 내외금리차가 역전될 경우 자본유출이 일어날 것이라는 통상적인 우려가 실제에 있어 발생하지 않았음을 시사한다.

2. 내외금리차에 따른 자본유출입 영향 분석

여기서는 내외금리차와 우리나라의 증권 투자자금 유출입 간의 관계에 대해 계량적으로 분석하였다. 이에 관한 선행연구에서는 대체로 내외금리차가 외국인의 국내채권 투자자금 유출입에 영향을 주는 요인 중 하나이나7) 대규모 자금 유출에 미치는 직접적인 영향은 불확실한 것으로 나타났다. 한국은행(2017)은 과거 대규모 자금유출의 결정요인으로 내외금리차 역전보다 글로벌 금융시장의 불확실성이나 국내 경제 및 금융시장 상황이 더 중요하다고 제시하였다. 다만, 윤영진ㆍ박종욱(2019)은 내외금리차의 역전이 장기간 이어질 경우에는 자금유출입에 지속적인 영향이 나타날 수도 있음을 주장하였다.8)

신흥국을 대상으로 분석한 연구(Ahmed & Zlate(2014), Ahmed(2017), Avdjiev et al.(2020), Koepke(2019))도 자금유출입은 내외금리차와 함께 글로벌 위험회피도, 경제성장률, 경제펀더멘털 등에 주로 영향을 받는 것으로 분석되었다.9) 아울러 Hoek et al.(2021)은 미국의 경제성장 호조에 따른 미국금리 상승의 경우 신흥국 경제에 미치는 부정적인 영향은 제한적이지만, 인플레이션 등 통화정책 전환으로 발생하는 미국금리 상승은 신흥국 경제에 충격을 줄 수 있으며, 거시경제 취약성이 큰 국가가 미국금리 상승의 영향을 더 크게 받는다는 분석 결과를 제시하였다.10)

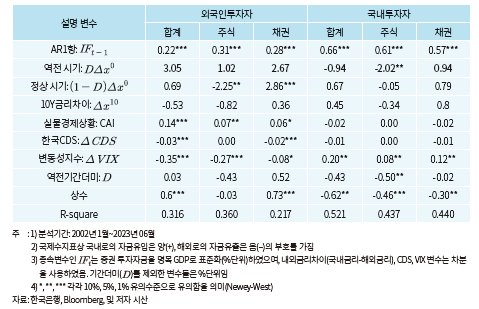

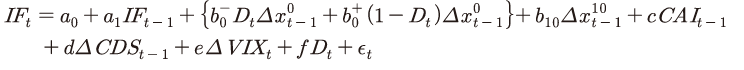

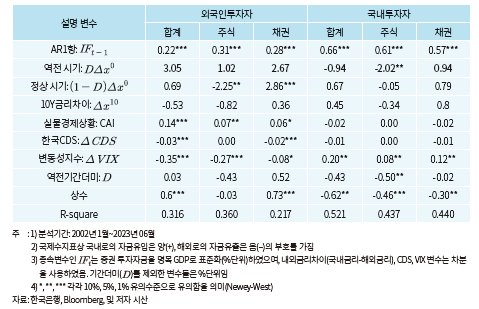

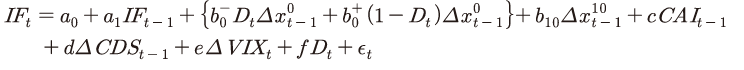

본 보고서에서는 우리나라 국제수지표상 외국인의 국내증권 투자 및 거주자의 해외증권 투자자금흐름 을 주식과 채권으로 구분하여 각각 종속변수로 설정하고 내외금리차를 포함한 다양한 설명변수를 이용하여 국내외 증권 투자자금유출입 결정요인을 회귀분석하였다. 분석기간은 2002년 2월~2023년 6월이며, 월간 데이터를 사용하였다.

을 주식과 채권으로 구분하여 각각 종속변수로 설정하고 내외금리차를 포함한 다양한 설명변수를 이용하여 국내외 증권 투자자금유출입 결정요인을 회귀분석하였다. 분석기간은 2002년 2월~2023년 6월이며, 월간 데이터를 사용하였다.

종속변수인 산출시 월별로 투자자금의 순(net)흐름을 국내 명목 GDP로 표준화하였다.11) 내외금리차를 나타내는 변수로는 한미 기준금리 차이(

산출시 월별로 투자자금의 순(net)흐름을 국내 명목 GDP로 표준화하였다.11) 내외금리차를 나타내는 변수로는 한미 기준금리 차이( ) 및 10년 국채금리 차이(

) 및 10년 국채금리 차이( )를 각각 사용하였다.12) 그 밖의 설명변수로는 국내 실물경제 상황, 국내 금융안정성 및 글로벌 불확실성 등을 반영하기 위해 경제활동지수(CAI)13), 한국 CDS프리미엄(5년물), 변동성지수(VIX)를 사용하였다.14) 또한, 내외금리차 역전 시기의 자금 흐름을 살펴보기 위해 기존연구에서 포함하지 않은 변수로 역전 기간 더미변수를 감안하였는데, 한미 정책금리차 역전

)를 각각 사용하였다.12) 그 밖의 설명변수로는 국내 실물경제 상황, 국내 금융안정성 및 글로벌 불확실성 등을 반영하기 위해 경제활동지수(CAI)13), 한국 CDS프리미엄(5년물), 변동성지수(VIX)를 사용하였다.14) 또한, 내외금리차 역전 시기의 자금 흐름을 살펴보기 위해 기존연구에서 포함하지 않은 변수로 역전 기간 더미변수를 감안하였는데, 한미 정책금리차 역전 기간을 1, 나머지 기간은 0으로 설정한 기간더미변수

기간을 1, 나머지 기간은 0으로 설정한 기간더미변수 를 설명변수에 추가하였다. 내외금리차이 및 CDS와 VIX는 1차 차분하여 사용하였으며15), 내생성을 완화하기 위해 국내요인과 직접 관련된 변수들은 시차항을 사용하였다.

를 설명변수에 추가하였다. 내외금리차이 및 CDS와 VIX는 1차 차분하여 사용하였으며15), 내생성을 완화하기 위해 국내요인과 직접 관련된 변수들은 시차항을 사용하였다.

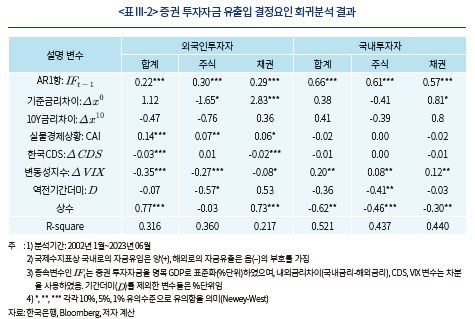

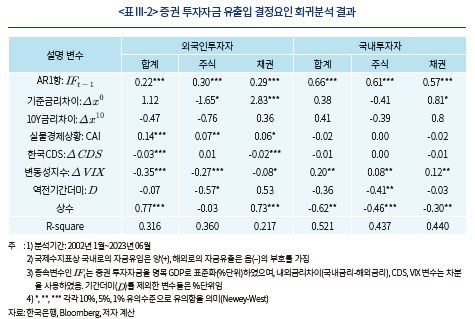

<표 III-2>는 <식 III-1> 회귀분석에 대한 추정 결과를 보여준다. 우선 외국인의 국내증권 투자에 있어 한미간 기준금리 차이 확대는 외국인 채권 투자자금의 순유입을 발생시키는 반면 주식 투자자금은 순유출시키는 요인인 것으로 분석되었으며 장기금리차의 경우에는 외국인의 증권 투자자금의 유출입에 유의한 영향을 주지 않는 것으로 나타났다. 그 밖의 설명변수중 국내 경제활동지수, VIX 및 CDS프리미엄 등 경제펀더멘털이나 대내외 위험지표들의 계수들도 예상 부호와 일치하였으며 통계적 유의성도 대체로 높은 것으로 확인되었다. 또한 한미 기준금리 역전 시기의 기간더미변수는 외국인의 채권 투자자금에는 통계적 유의성이 없는 것으로 나타나 내외금리차의 역전 현상 자체가 추가적인 자금유출입의 주요한 요인으로 작용하지는 않음을 시사하는 것으로 보인다. 다만, 주식의 경우에는 자금유출 요인으로 어느 정도 통계적 유의성이 있는 것으로 나타났다.16)

및

및  의 계수에 대해 구체적으로 해석해 보면 다음과 같다. 예를 들어 금리 역전 기간 중 외국인의 국내채권 투자자금에 대해 보면, 역전폭이 0.25%p 확대

의 계수에 대해 구체적으로 해석해 보면 다음과 같다. 예를 들어 금리 역전 기간 중 외국인의 국내채권 투자자금에 대해 보면, 역전폭이 0.25%p 확대 되면 외국인의 채권 투자자금은 명목 GDP의 0.7%(약 1.3조원) 감소함을17) 나타내는데,

되면 외국인의 채권 투자자금은 명목 GDP의 0.7%(약 1.3조원) 감소함을17) 나타내는데,  의 계수를 보면 역전 기간에 월평균 0.53%18) 추가 자금 유입 효과가 있다. 전 기간 평균인 +0.73%(상수)도 같이 감안한다면, 채권자금 유출이 우려될 수준은 아니라고 볼 수 있다.

의 계수를 보면 역전 기간에 월평균 0.53%18) 추가 자금 유입 효과가 있다. 전 기간 평균인 +0.73%(상수)도 같이 감안한다면, 채권자금 유출이 우려될 수준은 아니라고 볼 수 있다.

한편 내국인의 해외증권 투자자금의 유출입에 있어서는 기준금리 차이의 확대시 해외채권 투자가 다소 위축되는 것으로 보이나 통계적 유의성은 그리 높지 않은 것으로 나타났다. 그러나 글로벌 불확실성(VIX)은 거주자의 해외 주식 및 채권투자를 모두 감소시키는 것으로 나타났으며 통계적 유의성도 비교적 높은 것으로 나타났다. 또한 금리 역전 시기의 기간더미변수는 거주자의 해외주식 투자를 증가시키는 요인으로 나타났는데 이는 내외금리차 역전시 해외경기에 대한 낙관적 기대로 해외채권에 대한 투자수요가 일부 해외주식으로 전환된 데 따른 것으로 생각된다.

요약하자면, 한미간 내외금리차의 역전은 외국인의 국내주식 투자자금 유출과 거주자의 해외주식 투자를 확대시키는 요인으로 분석된 반면 대내외 채권 투자자금에는 별다른 영향이 나타나지 않았다. 외국인의 국내채권 투자자금 유출입이 내외금리차 역전 자체에 큰 영향을 받지 않는 주된 이유로는 각국 중앙은행이나 공적자금 등 장기 투자자금 비중이 높다는 점(유복근(2018), 배영수ㆍ한재준(2022))과 글로벌 투자자금의 선진국 및 신흥국 포트폴리오 비중이 대체로 금리변동에 민감하게 반응하지 않는 특성 등에 기인하는 것으로 생각된다. 반면 주식 투자자금 유출입은 미국 금리상승에 따른 글로벌 불확실성과 위험선호 변화에 큰 영향을 받음에 따라 금리역전에 유의한 영향을 받는 것으로 보인다. 따라서 우리나라 전체적으로 내외금리차 역전이 대내외 증권 투자자금의 유출 가능성이나 대외건전성 악화를 초래하지는 않는 것으로 판단된다. 거주자 해외증권 투자의 경우에도 내외금리차 역전보다는 글로벌 불확실성 확대가 거주자의 해외 주식 및 채권투자를 위축시키는 주된 요인으로 분석되었다.

Ⅳ. 금리차 역전의 외자조달비용에 대한 영향

1. 외화채권 발행에 따른 비용 증가

해외금리에 비해 원화가 고금리이던 시절에는 외화채권 발행이나 해외은행 차입금 등을 통한 저리외자를 조달하여 우리 경제주체들의 자본조달비용을 낮추는 긍정적 측면이 있었다. 그러나 내외금리차 역전이 상당기간 지속될 것으로 보이는 현 시점에서는 외자조달비용이 전반적으로 상승하므로 외자조달 행태에 변화가 불가피할 것으로 보인다. 아래에서는 국내 거주자의 외화표시 채권(한국물 KP) 발행과 관련된 영향을 중심으로 살펴보았다.

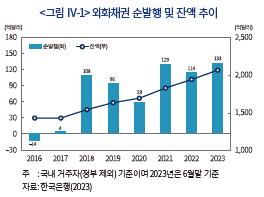

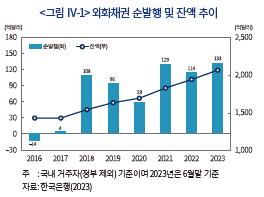

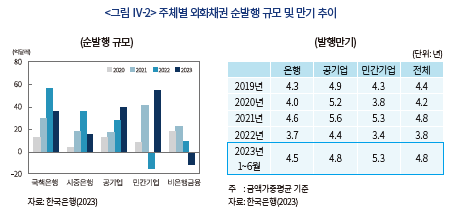

우리나라 거주자가 발행한 외화채권은 우리나라의 주요 외화조달 수단의 하나로서 순발행시 외채 증가요인이 된다. 우리나라에서는 국책은행을 포함한 은행이나 공기업, 민간기업 및 비은행금융기관 등 다양한 주체가 외화채권 발행에 참여하고 있다. <그림 Ⅳ-1>에 나타난 바와 같이 2023년 상반기중 외화채권의 순발행(신규발행액-만기상환액) 규모는 133억달러에 달하여 2022년 연중 순발행액 114억달러를 상회하였다. 그 결과 금년 6월말 현재 외화채권 잔액은 2천억달러를 넘어섰다.

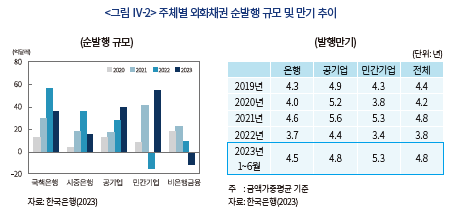

<그림 Ⅳ-2>에서 보는 바와 같이 금년 상반기중 외화채권 순발행이 크게 증가한 것은 민간기업과 공기업을 중심으로 해외 직접투자자금 조달 및 운영자금 마련을 위한 채권발행 규모가 크게 증가한 데 주로 기인한다. 또한 최근 외화채권 발행의 주요 특징의 하나로 발행만기가 장기화된 점을 들 수 있다. 전체 발행기관의 경우 발행만기(금액가중평균 기준)가 2022년중의 3.8년에서 금년 상반기중에는 4.8년으로 늘어났으며 특히 기업의 경우 해외직접투자 규모가 늘어나면서 장기외자조달을 위해 같은 기간중 3.4년에서 5.3년으로 가장 크게 늘어났다.

이러한 상황에서 최근의 내외금리차 역전 현상은 외화채권 이자상환비용에도 영향을 주고 있다. 국내금리에 비해 해외금리가 더 높은 수준을 보일 경우 발행자의 입장에서 외화채권 발행을 통한 저리외자의 획득이 어려워질 뿐만 아니라 발행금리의 상승으로 이자상환 부담이 가중되며, 이러한 점들은 우리나라 대외건전성에도 악영향을 줄 수 있다.

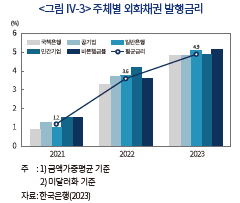

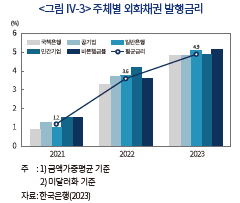

<그림 Ⅳ-3>에 제시된 실제 외환채권 발행금리를 보면 2021년의 1.2%에서 2022년과 2023년 상반기중에는 각각 3.6%, 4.9%로 가파르게 상승하였다. 이는 발행시 벤치마크 금리라 할 수 있는 미국채(10년물) 금리가 2022년중 평균 2.9%에서 금년 상반기중 3.6%로 상승한 데 크게 기인한다. 그 밖에 발행금리에 영향을 주는 가산금리는 2023년 상반기중 전년 대비 상당폭 하락하였으나 여전히 높은 수준을 보여 과거 수준으로 회귀하기는 어려울 것으로 전망되고 있다.19) 또한 과거 발행물량의 만기도래에 따른 차환시에도 신규 발행금리가 더 높아짐에 따라 이자지급 비용의 상승을 초래하게 된다. 한국은행 자료에 따르면 금년 하반기 만기도래 물량의 평균 발행금리는 대략 3% 정도로 신규 발행금리의 상승으로 차환발행시 이자비용 상승이 초래될 것으로 보인다. 이러한 외화채권 발행금리의 상승은 향후 미연준의 기준금리가 더 오르거나 양적완화의 축소로 미연준의 국채매입이 감소하는 경우 내외금리차 역전20) 현상을 더욱 심화시켜 상당기간 지속될 가능성이 있을 것으로 보인다.

2. 해외증권 투자시 환헤지비용 상승

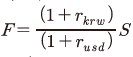

우리나라의 연기금이나 기관투자자 등 거주자의 해외증권 투자가 지속적으로 늘어나고 있는 가운데 환위험을 회피하기 위해 환헤지를 하는 경우가 많다. 이러한 환헤지 과정에서 내외금리차의 역전 현상은 환헤지비용의 상승을 초래한다. 즉 이들은 해외증권 투자를 위한 외자의 조달과 환위험 회피를 동시에 하기 위해 외환스왑시장(FX swap)에서 외자를 조달(현물환 매입+선물환 매도)하는 경우가 일반적이다. 이 경우 자본조달비용이라 할 수 있는 스왑포인트(선물환율-현물환율)가 이론값인 내외금리차에 따라 음(-)의 값을 갖게 됨으로써21) 내외금리차 역전폭 만큼 외자조달에 따른 비용이 발생한다. 이는 통상적으로 원화금리가 해외금리보다 높아 양(+)의 스왑포인트로 인해 외환스왑시장에서 환헤지를 동반한 해외투자를 하면서 내외금리차 만큼의 이득을 획득하였던 것과 반대의 상황이다.22)

가. 주요 기금의 환헤지 정책 현황

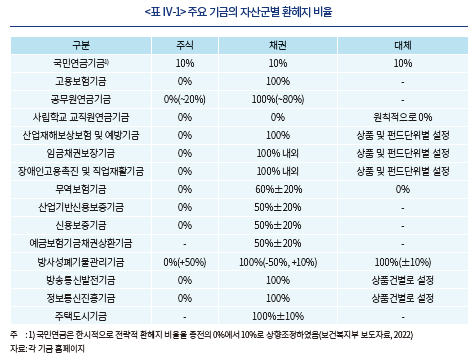

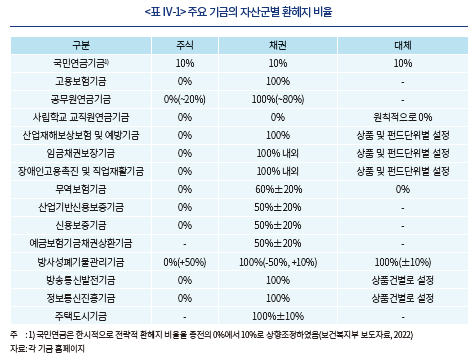

<표 Ⅳ-1>은 우리나라 주요 연기금들의 환헤지 정책을 정리한 표이다. 국민연금23)이나 사학연금 등 일부 대형기금을 제외하고 대부분 해외채권 투자시 환헤지 정책을 사용하고 있다. 그 밖의 공무원연금이나 산업재해보상기금 등 대부분의 연기금들은 해외채권 투자시 완전 헤지 정책을 고수하거나 적어도 50% 이상의 부분 헤지 정책을 사용하고 있다. 이 경우 환헤지를 위한 비용이 내외금리차 역전분만큼 소요되어 기금자산의 운용수익률을 하락시키는 요인이 되고 있다.

한편, 해외증권 투자와 직간접적으로 관련되어 있는 은행, 증권사, 보험사 등 기관투자자들은 각 업권별 건전성규제비율24)의 산정시 대부분 환위험이 반영되므로 해외투자자산에 대해 환헤지 정책을 운영하고 있다. 자산운용사의 경우에는 해외투자펀드를 설정하면서 기관투자자나 개인고객의 투자목적에 따라 환헤지 정책을 정하는데, 환노출형 펀드와 환헤지형 펀드로 구분하여 운용하고 있다.25) 환헤지 거래 방법으로는 통상 단기(1년 이내) 헤지수단인 외환스왑(FX swap)과 중장기 헤지수단인 통화스왑(Cross Currency swap) 등 통화파생상품을 이용한다.26)

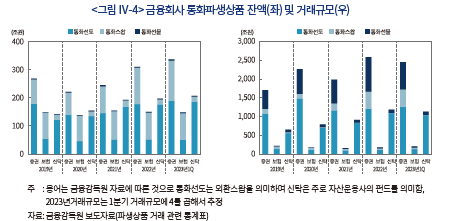

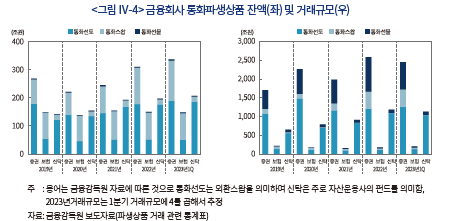

<그림 Ⅳ-4>는 주요 금융사들의 최근 통화파생상품 거래 및 잔액 추이를 나타낸다.27) 보험사의 경우 주로 장기물인 통화스왑을 이용하는 경우가 많은 반면 자산운용사 펀드의 경우에는 1년 이하의 외환스왑을 롤오버하는 방식으로 환헤지를 하는 경우가 많다. 내외금리차가 역전된 2022년 이후를 보면 환헤지를 위한 거래 규모 및 잔액이 소폭 증가한 것으로 나타나 내외금리차 역전에도 불구하고 기존의 환헤지 정책에 큰 변화는 없는 것으로 보인다. 이는 이들 기관의 환헤지비용이 최근 전반적으로 상승하고 특히 중장기 해외자산에 대해 단기로 롤오버하는 경우 환헤지비용이 더욱 상승하면서 최초 투자시점 대비 수익률의 하락 요인으로 작용하였을 것으로 보인다.

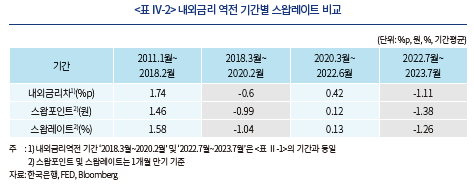

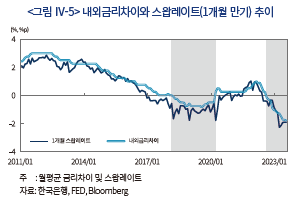

나. 환헤지에 따른 비용 분석 예시

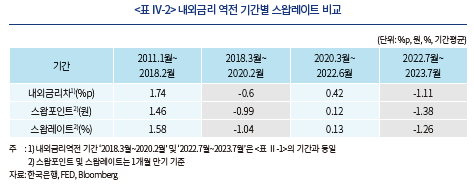

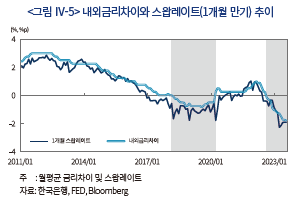

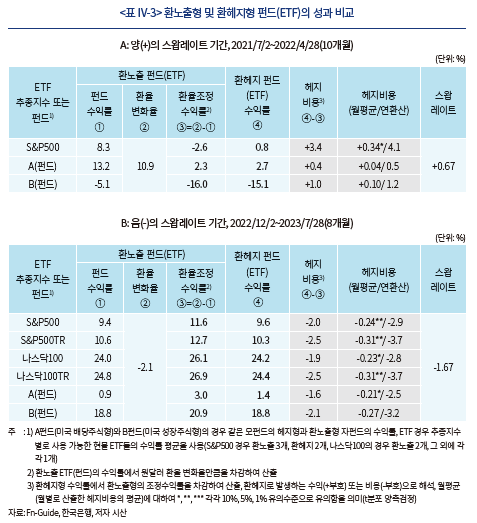

여기서는 해외주식형 ETF의 실제 자료를 이용하여 내외금리차 역전에 따른 스왑레이트28) 변화 및 환헤지비용에 대한 영향을 분석하였다. <표 Ⅳ-2> 및 <그림 Ⅳ-5>는 글로벌 금융위기 이후 최근까지 내외금리차 및 스왑레이트(1개월 만기) 추이를 나타낸다. 최근의 내외금리차 역전으로 실제 외환스왑시장에서의 스왑포인트 및 스왑레이트가 일정 시차를 보이기는 하나 이론값에 따라 음(-)으로 전환되었다.29) 즉, 2011.1월~2018.2월 기간에는 내외금리차(기간평균)가 1.74%, 스왑레이트가 1.58%로 양(+)의 값을 보인 반면, 내외금리차 역전 기간(음영 구간)인 2018.3월~2020.2월과 2022.7월~2023.7월 기간에는 스왑레이트가 각각 –1.04%와 –1.26%로 음(-)의 값을 기록하였다.

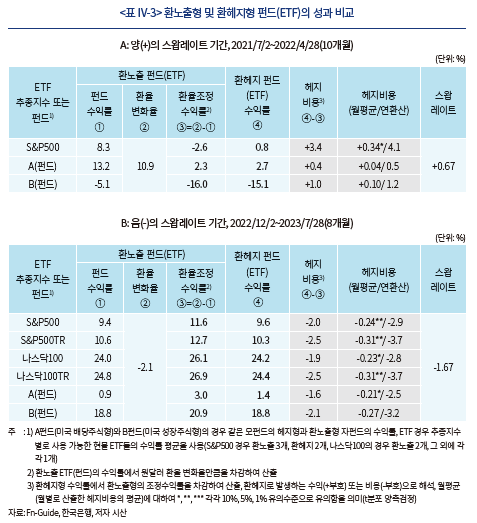

다음으로 스왑레이트가 양(+)인 기간과 음(–)인 기간을 구분하여 환헤지 과정에서 발생하는 손익 효과를 비교해 보았다. 종류가 다른 환노출형 펀드와 환헤지형 펀드의 성과를 비교하는 한계를 최소화하기 위해 추종지수(벤치마크) 추적오차가 작은 해외 주식형 ETF를 사용하였다.30) 구체적으로 S&P500 또는 나스닥100 지수를 추종하는 ETF들을 환노출형과 환헤지형으로 구분하여 기간수익률을 비교하였다. 아울러 해외증권 투자펀드 중 환노출형(UH)과 환헤지형(H)이 동시에 존재하는 사례(펀드 A, 펀드 B)도 비교하였다. 환노출형 펀드(또는 ETF)에 대해서는 환율변동 효과를 제외하기 위해 펀드(또는 ETF)수익률에서 원달러 환율 변화율을 차감한 환율조정수익률을 산출하고 이를 대응되는 환헤지형 펀드의 수익률에서 차감하여 환헤지비용을 추정하였다. 환헤지의 목적상 환헤지형 펀드의 수익률은 환노출형 펀드의 환율변동 효과를 제외한 환율조정수익률과 동일해야 하나 내외금리차에 따른 스왑레이트에 연동하여 환헤지비용이 영향을 받으므로 두 수익률이 일치하지 않는 경우가 발생한다.

이에 관한 결과는 <표 Ⅳ-3>에 제시되었다. 먼저 스왑레이트가 양(+)인 2021년 7월~2022년 4월까지 기간31)을 살펴보자(<표 Ⅳ-3>의 A). 이 기간 동안 원달러 환율이 10.9% 상승한 데 따른 환율상승 효과로 인해 환노출형 펀드의 수익률이 환헤지형의 수익률보다 높다. 예를 들어 S&P500지수 추종 환노출 ETF의 경우 펀드 수익률은 8.3%를 기록하였으나 환율상승 효과 10.9%를 차감한 환율조정수익률은 –2.6%를 기록하였다. 같은 기간 동안 환헤지형 ETF의 수익률은 0.8%로 환노출형 ETF의 환율조정수익률(-2.6%)보다 3.4% 더 크다. 이 차이는 스왑포인트가 양(+)의 값을 나타냄에 따라 환헤지 과정에서 내외금리차 만큼의 이익이 발생한 결과로 볼 수 있다. 마찬가지로 A펀드와 B펀드의 경우에도 환헤지형의 수익률이 환노출형의 환율조정수익률보다 각각 0.4%, 1.0% 더 큰 것으로 나타났는데 이는 양의 스왑레이트(기간 평균 0.67%)로 인한 효과라 할 수 있다.

반면, 스왑레이트가 음(-)인 2022년 12월~2023년 7월까지 기간32) 동안에는 반대의 결과가 나타난다(<표 Ⅳ-3>의 B). 즉, 이 기간중 S&P500지수 추종 환노출 ETF 수익률은 9.4%로 원달러 환율 변화율 –2.1%를 차감한 환율조정수익률은 11.6%이다. 반면 같은 기간중 환헤지형 ETF의 수익률은 9.6%로 환노출형 ETF의 환율조정수익률(11.6%)보다 2%나 더 작다. 나스닥100 추종 ETF 등 그 밖의 다른 펀드들의 경우에도 마찬가지로 같은 기간중 환노출형 펀드들의 환율조정수익률보다 환헤지형 펀드의 수익률이 더 작다. 이는 내외금리차 역전에 따른 음의 스왑레이트(기간평균 –1.67%)로 인해 환헤지 과정에서 비용이 발생한 결과라고 할 수 있다. 따라서 환헤지 전략 수립시 내외금리차의 역전 상황이 지속될 경우 발생하게 되는 추가적인 비용을 고려할 필요가 있다.

Ⅴ. 요약 및 시사점

2022년 이후 최근까지 이어지고 있는 내외금리차 역전 현상은 과거에 비해 그 폭이 가장 클 뿐만 아니라 기간 측면에서도 향후 오랜기간 지속될 가능성이 있다. 이런 점에서 본고에서는 최근 한미간 내외금리차 역전 현상의 특징과 전망을 살펴본 후 내외금리차 역전이 우리나라의 자본유출입 가능성 및 자본조달비용 등 대외건전성에 미치는 영향을 분석하였다.

2000년대 이후 우리나라에서 한미간 내외금리차가 역전된 시기별로 거주자와 비거주자의 주식 및 채권 투자자금 각각에 대해 자금유출입 추이를 살펴본 결과 내외금리차 역전에 따른 자본유출은 없었던 것으로 나타났다. 또한 우리나라 대내외 증권 투자자금의 유출입 결정요인에 관한 회귀추정 결과에서도 내외금리차 역전보다는 경제펀더멘털이나 대내외 불확실성에 기인한 위험지표 등이 더 중요한 것으로 확인되었다. 따라서 우리나라 전체적으로 내외금리차 역전이 대내외 증권투자자금의 유출 가능성이나 대외건전성 악화를 초래하지는 않는 것으로 판단된다.

그러나 큰 폭의 내외금리차 역전 현상의 지속은 우리 경제주체들의 자본조달비용의 상승과 해외투자시 환헤지비용의 상승을 초래하고 있다는 점을 간과해서는 안될 것으로 보인다. 거주자의 한국물 외화채권 발생시 발행금리 상승으로 인한 이자상환비용이 늘어나고 있고, 대부분의 국내 투자기관들이 해외채권 투자시 환헤지 전략을 추구하면서 내외금리차 역전에 따른 환헤지비용 증가와 투자수익률 하락 요인이 되고 있음에 유의할 필요가 있다.

본고의 시사점은 다음과 같다. 첫째, 현 시점에서 내외금리차 역전 현상으로 인한 우리나라의 자본유출 가능성은 크지 않은 것으로 보이므로 우리 경제주체들은 막연한 우려를 가질 필요는 없을 것으로 생각된다. 그러나 큰 폭의 내외금리차 역전이 장기간 지속되는 상황에서 예상치 못한 중대한 글로벌 외부충격이 가세하는 경우에는 우리 경제의 위기대응력과 회복력이 더욱 취약해 질 수밖에 없다는 점에 유념하여 경제체질 강화와 대외신인도 유지에 배가의 노력을 기울일 필요가 있다.

둘째, 각 경제주체별로 외자조달비용 상승에 대비한 외화조달체계 및 전략을 마련하는 것도 중요할 것으로 생각된다. 우리나라의 주요 외자조달 수단의 하나인 외화채권 발행시 국제금리 동향이나 전망에 대한 세심한 주의를 통해 발행 시기 및 조건 등을 최적화함으로써 외화조달비용을 최소화할 필요가 있다. 아울러 외자조달 수단을 다변화하고 외화유동성 관리에도 노력해 나가야 할 것으로 보인다.

셋째, 우리나라의 경상수지 흑자를 배경으로 지속적인 증가세를 보이고 있는 거주자의 해외증권 투자와 관련하여 국내 연기금 및 기관투자자들의 환헤지 정책에 대한 재검토가 필요할 것으로 생각된다. 해외자산에 대해 완전 또는 부분 헤지를 추구하는 과정에서 내외금리차 역전에 따른 외자조달비용 상승과 추가적인 환헤지비용이 지속적으로 발생할 수 있다는 점에 유념할 필요가 있다. 따라서 국내 투자기관이나 개별 기금들은 환헤지 전략 수립시 지금까지와 같이 관성적으로 환헤지를 추구하기보다는 외환(currency)을 하나의 투자 수익원으로 인식하고 각 기금의 특성을 고려한 체계적인 환헤지 전략을 수립하는 데 노력할 필요가 있다.

1) 본고에서 ‘내외금리차’는 ‘한국금리-미국금리’를 의미한다.

2) 보고서 작성 시기인 9월 기준이며, 10월 중 기간프리미엄이 상승하면서 미국 장기국채의 금리도 상승하여 한미간 10년물 국채금리의 역전폭은 0.7%p까지 확대되었다.

3) 보고서 작성 시기로 점도표가 발표된 9월 FOMC 주간의 금요일이다.

4) 주요 기관별 GDP 성장률(%) 전망(기관/전망시기/2023년/2024년): 한국은행/’23년 8월/1.4/2.2, KDI/’23년 8월/1.5/2.3, IMF/’23년 10월/1.4/2.2

5) Bloomberg에서 제공(2023년 9월 12일 기준)하고 있는 해외 주요 투자은행들의 한국 기준금리 전망 중간값은 2023년 4분기와 2024년 4분기 각각 3.5%와 2.75%이다.

6) 채권을 매입하여 만기까지 보유했을 경우의 수익률(매입시점의 YTM)을 의미한다.

7) 외국인 채권 투자자금 흐름의 경우 내외금리차 외에 차익거래 유인(내외금리차-스왑레이트)을 설명변수로 사용하며(유복근(2018), 배영수ㆍ한재준(2022)), 중앙은행이나 공적자금 유입 등의 이유로 금융위기 이후 외국인 채권 투자자금에 대한 금리 민감도가 감소하였다는 결과들이 보고된다.

8) 충격반응 분석 및 자기회귀시차분포(ARDL) 모형에서 시차변수를 다르게 설정한 분석을 통해 정책금리 변화의 영향이 오래 지속되어 계속적으로 자본유출입에 영향을 끼칠 수 있음을 제시하였다.

9) 금융위기 이후 금리차이에 대한 민감도가 높아졌다는 결과도 있지만, 시기별로 다르고, 다양한 여건들이 신흥국의 자금유출입에 영향을 끼친다.

10) 통화정책 변화에 따른 실증분석은 국채 10년 금리를 이용하였다. Ahmed et al.(2022)은 이론모형을 통해 미국 통화정책 변화의 영향을 보았으며, 마찬가지로 통화정책 변화 원인과 개별 국가의 펀더멘털(부채 및 인플레이션 기대 관리)이나 취약성이 중요함을 보였다.

11) Ahmed & Zlate(2014)는 증권 투자자금 흐름을 명목 GDP로 표준화해서 사용하였다. 본고는 코로나19 시기나 금융위기 전후에 발생한 명목 GDP의 변동 효과를 제외하기 위해 명목 GDP의 추세를 산출(HP 필터 이용)하고 선형보간을 통해서 분기 자료를 월별 자료로 전환하였다. 투자자금 원화 환산시 월별 평균 환율을 사용하였다. 국내 기준으로 자금유출입을 보기 위해 외국인 투자자금의 경우 + 부호가 국내로 자금 유입을 의미하고, 내국인 투자자금의 경우 –가 해외투자로 자금이 유출되는 경우를 의미한다. 는 %단위이다.

는 %단위이다.

12) 기준금리와 장기국채금리의 차이를 각각 포함한 것은 특히 최근 두 변수간의 상이한 움직임을 감안한 것이며, 두 변수(차분 사용) 간 상관관계는 분석 기간 중 0.09이다.

13) CAI(Current Activity Index)는 골드만삭스에서 제공하는 지수로 전월 대비 경제활동(각종 경제지표를 사용) 증가율을 연율화한 자료이다.

14) 한국은행(2017) 및 윤영진ㆍ박종욱(2019)을 참고하였다.

15) 시계열의 안정성(stationarity)을 감안하였다. ADF 테스트를 적용하면, 종속변수들은 안정적이지만, 은 불안정적인 I(1) 프로세스이다. CDS와 VIX는 전 구간에서 안정적이라고 할 수 있지만 분석 기간에 따라서 I(1)이 되기도 한다.

은 불안정적인 I(1) 프로세스이다. CDS와 VIX는 전 구간에서 안정적이라고 할 수 있지만 분석 기간에 따라서 I(1)이 되기도 한다.

16) 부록에 교차항 을 이용하여 내외금리차 역전 기간

을 이용하여 내외금리차 역전 기간 과 나머지 기간

과 나머지 기간 을 구분하여

을 구분하여  의 계수를 추정한 결과표를 추가하였다. 외국인 투자자금에 대한 역전 시기의 계수들은 유의성이 사라진다. 따라서 역전 기간 중

의 계수를 추정한 결과표를 추가하였다. 외국인 투자자금에 대한 역전 시기의 계수들은 유의성이 사라진다. 따라서 역전 기간 중  의 계수 및 상수항이 중요하다고 볼 수 있다.

의 계수 및 상수항이 중요하다고 볼 수 있다.

17) 의 계수로 <표 III-2>의 2.83을 사용했는데, <부록 표>에서 외국인 채권자금에 대한 역전 기간 중

의 계수로 <표 III-2>의 2.83을 사용했는데, <부록 표>에서 외국인 채권자금에 대한 역전 기간 중  의 계수는 2.67로 더 작으며 유의성이 떨어진다.

의 계수는 2.67로 더 작으며 유의성이 떨어진다.

18) 다만, 더미변수의 계수 0.53이 유의하지는 않다. 유의한 상수항을 같이 볼 필요가 있다.

19) 국제금융센터(2023. 7. 19) 참조

20) 기준금리와 함께 시장금리(10년 국채금리)의 역전을 의미한다.

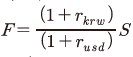

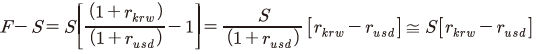

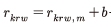

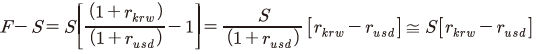

21) 현물환율 S, 국내금리 , 미국 금리

, 미국 금리 일 때, 선도환율

일 때, 선도환율  이며(Covered Interest Rate Parity), 선도환율과 현물환율의 차이인 스왑포인트는

이며(Covered Interest Rate Parity), 선도환율과 현물환율의 차이인 스왑포인트는  이다. 이 식에서 원화 금리

이다. 이 식에서 원화 금리  는 음의 베이시스(b, 원화 신용위험, 달러 유동성 등이 반영)가 포함되어 시장원화 금리

는 음의 베이시스(b, 원화 신용위험, 달러 유동성 등이 반영)가 포함되어 시장원화 금리  보다 낮게 형성된다. 따라서 시장금리상 원화금리가 미국 금리보다 더 높더라도 (정도가 크지 않으면) 스왑포인트는 음수가 될 수 있으며, 시장금리가 역전된 시기에는 스왑포인트가 음수가 된다.

보다 낮게 형성된다. 따라서 시장금리상 원화금리가 미국 금리보다 더 높더라도 (정도가 크지 않으면) 스왑포인트는 음수가 될 수 있으며, 시장금리가 역전된 시기에는 스왑포인트가 음수가 된다.

22) 현물환율(S)로 해외자산을 매입하고 선도환율(F)로 환헤지(선물환 매도) 계약을 하게 되면, 스왑포인트(F-S)만큼 추가 손익이 발생하며 이는 내외금리차의 영향을 받는다.

23) 전략적 환헤지 비율이 0%에서 한시적으로 10%까지 상향(보건복지부 보도자료(2022))되었으며, 전술적 환헤지 범위 5%까지 고려하면 현재 가능한 최대 환헤지 비율은 15%이다.

24) 이에 관해서는 신지급여력제도 해설서(보험사), 은행업감독업무시행세칙, 증권업 감독규정을 참고하면 된다.

25) 환헤지형은 환노출형의 외환평가손익을 헤지하기 위한 펀드로 볼 수 있다.

26) 일부는 장내 통화선물을 일시적인 수단으로 이용하기도 한다.

27) 은행의 경우 보유 해외자산의 환헤지 목적 보다는 타 금융사의 환헤지 거래의 상대방이 되거나 해외투자 외에 자금조달 목적으로 또는 다양한 거래(수출업체 통화선도 등)를 하기 떄문에 은행 포지션은 그래프와 논의에서 제외하였다.

28) 스왑레이트((F-S)/S)는 스왑포인트(F-S)를 환율(S)로 나누어 연율화(%)한 값으로 해외자산의 환헤지시 수익률과 직접적으로 연계되는 지표이다.

29) 스왑레이트가 이론값인 내외금리차의 변동 부호와 시기적으로 정확히 일치하지 않는 것은 외환스왑시장의 수급요인, 원화의 신용위험, 대외불확실성에 따른 리스크 요인 등이 복합적으로 영향을 주는 데 따른 것이다.

30) 해외선물이 아닌 현물을 운용하는 ETF들은 2020년 들어서 본격적으로 출시되기 시작하였다. 따라서 비교 분석 기간을 2021년 이후로 설정하였다.

31) 비교 가능한 펀드들이 존재하는 2020년 이후를 대상으로 1개월 만기 월평균 스왑레이트가 0.4% 이상인 기간을 선택하였다(수익률은 말일 직전 영업일 기준으로 계산).

32) 1개월 만기 월평균 스왑레이트가 -0.4% 이하인 기간을 선택하였고 2022년 12월부터 비교 가능한 ETF들이 다수 출시됨을 감안하였다(수익률은 말일 직전 영업일 기준으로 계산).

참고문헌

국제금융센터, 2023. 7. 19, ’23년 하반기 한국계 외화채권 발행시장 전망, Issue Analysis.

배영수ㆍ한재준, 2022, 내외금리차가 외국인 투자자의 국내 채권 투자 결정에 미치는 영향, 『한국경제의 분석』 28(3), 171-216.

백인석, 2023, 시장금리 측면에서 살펴본 한미 기준금리 인상 영향 비교 및 시사점, 자본시장연구원 『자본시장포커스』 2023-13호.

보건복지부, 2022. 12. 16, 2022년도 제6차 기금운용위원회 개최, 보도자료.

유복근, 2018, 글로벌 금융위기 전․후 외국인의 채권투자 결정요인 변화 분석: 한국의 사례, 『BOK 경제연구』 2018-18호.

윤영진ㆍ박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증 분석, 『경제학연구』 제 67집 제2호.

이승호, 2023, 한·미간 금리차 역전 현상 및 영향에 대한 소고, 자본시장연구원 『자본시장포커스』 2023-14호.

한국은행, 2017, 『미 연준 통화정책 정상화에 따른 자본유출 가능성』, 통화신용정책보고서, 2017년 4월.

한국은행, 2023, 최근 외화채권 동향 및 상환 여건 점검.

https://www.bok.or.kr/portal/bbs/B0000347/view.do?nttId=10078544&menuNo=201106&pageIndex=1

Ahmed, S., Andrei Z., 2014, Capital flows to emerging market economies: A brave new world? Journal of International Money and Finance 48, 221–248.

Ahmed, S., Ozge A., Albert Q., 2022, U.S. Monetary Policy Spillovers to Emerging Markets: Both Shocks and Vulnerabilities Matter, New York FED.

Ahmed, S., 2017, The Drivers of Capital Flows in Emerging Markets Post Global Financial Crisis, IMF working paper No. 17/52.

Avdjiev, S., Leonardo G., Linda S.G., Stefano S,, 2020, The Shifting Drivers of Global Liquidity, Journal of International Economics 125.

Hoek, Jasper, Steve K., Emre Y., 2021, Are Rising U.S. Interest Rates Destabilizing for Emerging Market Economies? FEDS Notes, June 23, 2021.

Koepke, R., 2019, What Drives Capital Flows to Emerging Markets? A Survey of the Empirical Literature, Journal of Economic Surveys 33, 516-540.

<부록 표> 증권 투자자금 유출입 결정요인 회귀분석 결과

(금리 역전 시기 구분 분석)

본문의 식(1)에서 기준금리 차이에 따라 인 시기를 구분하여

인 시기를 구분하여  의 민감도를 비교하기 위해

의 민감도를 비교하기 위해  와

와  를 설명변수로 사용하였음.

를 설명변수로 사용하였음.

는 한미 정책금리차 역전 시기

는 한미 정책금리차 역전 시기 중

중  의 계수(민감도)이고,

의 계수(민감도)이고,

는 정상 시기

는 정상 시기 중 의 계수(민감도)임.

중 의 계수(민감도)임.

본문 <표 III-2>의 와 달리 아래 표에서 역전 시기 중

와 달리 아래 표에서 역전 시기 중  의 민감도인

의 민감도인  는 국내투자자의 해외주식 투자자금 유출 경우만 유의함

는 국내투자자의 해외주식 투자자금 유출 경우만 유의함

지난해 이후 미국 연준의 초긴축적 통화정책으로 가파른 금리인상이 이어지면서 국내금리보다 미국금리가 더 높은 수준을 보이는 내외금리차1)의 역전 현상이 나타나고 있다. 2000년대 이후 지금까지 네 차례 내외금리차의 역전 현상이 있었으나 금리차의 역전폭에 있어 최근의 경우가 가장 크다. 또한 미국은 고용시장 등 견조한 경제상황을 바탕으로 연준이 2023년 말까지 추가적인 금리인상 가능성을 예고하고 있는데 반해 우리나라는 물가나 성장률 전망 등 경제 여건이 기준금리의 인상을 어렵게 하고 있는 상황이다. 따라서 향후 내외금리차의 역전폭은 지금보다 더 확대되고 기간도 과거의 경우보다 훨씬 오래 지속될 가능성이 있다.

우리나라에서 한미간 내외금리차의 역전 현상은 외국인 투자자금의 해외 유출 가능성을 크게 하면서 대외건전성 악화에 대한 우려를 낳고 있다. 미국 금리의 상승은 미달러화 자산에 대한 투자수익률 상승 기대로 국제자본이 신흥국에서 이탈하여 미국 또는 미달러화 표시자산으로 이동하는 요인으로 작용하기 때문이다. 또한 내외금리차의 역전 현상이 지속될 경우 우리 경제주체들의 외자조달비용이 상승하여 과거와 같은 저리의 외자조달이 어려워질 뿐만 아니라 거주자의 해외투자시 환위험의 회피를 위한 환헤지 전략의 수립에도 영향을 줄 수 있다는 점을 간과해서는 안 될 것으로 생각된다.

이런 점을 배경으로 본 보고서의 내용은 다음과 같이 구성하였다. II장에서 2000년대 이후부터 최근까지 우리나라의 내외금리차 역전 현상이 나타난 시기별로 특징을 비교해 보고 향후 금리차 역전 현상의 지속가능성에 대해 살펴보았다. III장에서는 금리차 역전에 따른 자본유출 가능성을 분석해 보았다. 특히 과거 금리 역전 기간중 자본유출입이 실제 발생하였는지를 거주자와 비거주자, 그리고 주식 및 채권 투자자금으로 세분하여 분석한 후 우리나라에서 내외금리차 역전이 자본유출입에 미치는 영향을 계량적으로 추정하였다. IV장에서는 금리 역전 현상이 외화채권 발행시 외자조달비용에 미치는 영향을 살펴본 후 거주자의 해외투자시 환헤지비용에 미치는 영향을 실제 사례와 함께 분석하였다. V장에서는 시사점을 제시하였다.

Ⅱ. 한미 금리차 역전 시기별 특징 및 전망

1. 금리차 역전 시기별 비교

과거 우리나라에서 한미 금리차의 역전 현상이 나타난 것은 <그림 Ⅱ-1> 및 <표 Ⅱ-1>에서 보는 바와 같이 2000년 전후(’99.7월~’01.3월), 글로벌 금융위기 직전(’05.8월~’07.9월), 코로나19 위기 발생 직전(’18.3월~’20.2월) 및 최근 미국의 초긴축정책 기간(’22.7월 이후 현재) 등 네 차례로 파악된다.

최근의 경우를 보면 미연준의 기준금리인 연방기금금리 목표치(상단 기준)가 현재 5.5%에 달하고 있는데 반해 우리나라의 기준금리는 3.5%에 그쳐 기준금리로 볼 때 내외금리차가 2.0%p 수준으로 역전된 상황이다. 이는 과거 내외금리차 역전폭이 1.5%p로 가장 컸던 2000년경보다 더 큰 폭이다. 한편, 내외금리차 역전 현상의 지속기간에 있어서는 글로벌 금융위기 이전과 코로나19 위기 발생 직전이 각각 26개월과 24개월로 가장 긴 것으로 나타났으나 이 시기 동안 금리차 역전폭은 최대 1.0%p 수준이었다. 이와 비교하여 최근의 금리역전 현상은 금년 9월 현재 15개월째 지속되고 있으며, 큰 폭의 내외금리차 역전 정도가 언제까지 지속될지 예단하기 어려운 상황이다.

최근의 내외금리차 역전 현상이 얼마나 지속될 것인지는 미국과 우리나라의 경제성장이나 물가 등 경제상황에 좌우될 것으로 보인다. 최근 미국의 연방기금 금리선물 자료(CME FedWatch, 2023년 9월 22일 기준)3)에 따르면 2023년 12월말 미국 기준금리(상단)가 현재 5.5%가 유지될 가능성이 57.7%로 가장 높으나 연내 1회 이상 인상될 확률도 42.3%에 달해 연내 적어도 한차례 추가 인상 가능성도 있는 것으로 보인다. 또한 미연준의 9월 FOMC 점도표를 보더라도, 2025년까지 현재 국내 기준금리 수준인 3.5%보다 높을 것으로 전망되고 있다.

III. 내외금리차 역전이 자본유출입에 미치는 영향

1. 내외금리차 역전 시기별 자본유출입 추이

한미간 내외금리차의 변동은 국경간 증권 투자자금의 유출입 등 국제자본이동에 영향을 준다. 이는 금리의 변화가 주가 및 채권가격의 변동은 물론 투자통화의 환율변동으로 투자수익률에 영향을 주기 때문이다. 예를 들어 최근과 같은 미국 금리의 상승은 미달러화채권 수익률6)의 상승과 함께 미달러화의 강세로 환차익을 발생시키므로 국제자본이 신흥국으로부터 유출되어 미국내 또는 미달러화표시 자산으로 이동하는 요인이 된다.

반면 주식 투자자금의 경우에는 미국금리 상승시 예상주가수익률이 채권과는 반대의 영향이 나타날 수 있으나 그 영향은 명확하지 않은 것으로 평가되고 있다. 다만, 미국금리 상승시 달러화의 강세로 미국 주식이나 달러화표시 채권 투자에서 모두 환차익이 발생하므로 미국으로의 자본유입을 증가시키는 요인으로 작용한다.

본고에서는 자본유출의 성격 및 범위에 대해 거주자와 비거주자를 모두 포함하여 분석하였다. 이는 내외금리차 역전으로 자본유출이 발생하는 경우 해당국의 주가하락과 환율상승(자국통화 약세)이 나타나면서 금융시장 변동성이 커질 우려가 있기 때문인데 이는 비단 국내에 투자하고 있는 외국인 증권 투자자금뿐만 아니라 거주자의 해외증권 투자자금 유출입 경우에도 외환시장 수급에 마찬가지의 영향을 초래하기 때문이다. 아래에서는 2000년대 이후 우리나라 증권 투자자금의 유출입에 대해 외국인투자자의 국내투자와 거주자의 해외투자로 구분하여 실제 내외금리차 역전 기간동안 자본유출입이 어떤 모습을 보였는지를 살펴보았다.

<표 III-1>에 나타난 바와 같이 2000년대 이후 국내 거주자의 해외증권 투자는 주식과 채권에서 모두 꾸준히 증가하는 모습을 보였다. 이는 우리나라의 대규모 경상수지 흑자에 따라 풍부한 외화유동성과 인구구조 고령화로 투자수익률 제고를 위한 해외투자 필요성이 커진 데 주로 기인한다. 또한 비거주자의 국내증권 투자 유출입의 경우에도 주식과 채권에서 모두 내외금리차와는 큰 상관이 없는 것으로 보인다. 즉, 글로벌 금융위기 직전(기간 2)과 코로나19 위기 발생 직전(기간3)의 경우 외국인의 주식 투자자금은 큰 폭의 순유출을 기록하였으나 이는 글로벌 금융위기 직전 대외불확실성의 고조와 미중 무역갈등 등 내외금리차와 상관없는 글로벌 요인에 기인하는 것으로 보인다. 또한 이 두 기간중에도 국내채권에 대한 외국인투자는 크게 증가하는 모습을 보여 외국인의 전체 국내증권 투자자금은 순유입을 보였다. 내외금리차의 역전폭이 가장 큰 최근(기간 4)의 경우에도 외국인투자자의 투자자금이 국내주식 및 국내채권에 모두 견조하게 순유입되어 내외금리차 역전에 큰 영향을 받고 있지 않는 것으로 나타났다. 이러한 결과는 우리나라에서 내외금리차가 역전될 경우 자본유출이 일어날 것이라는 통상적인 우려가 실제에 있어 발생하지 않았음을 시사한다.

여기서는 내외금리차와 우리나라의 증권 투자자금 유출입 간의 관계에 대해 계량적으로 분석하였다. 이에 관한 선행연구에서는 대체로 내외금리차가 외국인의 국내채권 투자자금 유출입에 영향을 주는 요인 중 하나이나7) 대규모 자금 유출에 미치는 직접적인 영향은 불확실한 것으로 나타났다. 한국은행(2017)은 과거 대규모 자금유출의 결정요인으로 내외금리차 역전보다 글로벌 금융시장의 불확실성이나 국내 경제 및 금융시장 상황이 더 중요하다고 제시하였다. 다만, 윤영진ㆍ박종욱(2019)은 내외금리차의 역전이 장기간 이어질 경우에는 자금유출입에 지속적인 영향이 나타날 수도 있음을 주장하였다.8)

신흥국을 대상으로 분석한 연구(Ahmed & Zlate(2014), Ahmed(2017), Avdjiev et al.(2020), Koepke(2019))도 자금유출입은 내외금리차와 함께 글로벌 위험회피도, 경제성장률, 경제펀더멘털 등에 주로 영향을 받는 것으로 분석되었다.9) 아울러 Hoek et al.(2021)은 미국의 경제성장 호조에 따른 미국금리 상승의 경우 신흥국 경제에 미치는 부정적인 영향은 제한적이지만, 인플레이션 등 통화정책 전환으로 발생하는 미국금리 상승은 신흥국 경제에 충격을 줄 수 있으며, 거시경제 취약성이 큰 국가가 미국금리 상승의 영향을 더 크게 받는다는 분석 결과를 제시하였다.10)

본 보고서에서는 우리나라 국제수지표상 외국인의 국내증권 투자 및 거주자의 해외증권 투자자금흐름

종속변수인

요약하자면, 한미간 내외금리차의 역전은 외국인의 국내주식 투자자금 유출과 거주자의 해외주식 투자를 확대시키는 요인으로 분석된 반면 대내외 채권 투자자금에는 별다른 영향이 나타나지 않았다. 외국인의 국내채권 투자자금 유출입이 내외금리차 역전 자체에 큰 영향을 받지 않는 주된 이유로는 각국 중앙은행이나 공적자금 등 장기 투자자금 비중이 높다는 점(유복근(2018), 배영수ㆍ한재준(2022))과 글로벌 투자자금의 선진국 및 신흥국 포트폴리오 비중이 대체로 금리변동에 민감하게 반응하지 않는 특성 등에 기인하는 것으로 생각된다. 반면 주식 투자자금 유출입은 미국 금리상승에 따른 글로벌 불확실성과 위험선호 변화에 큰 영향을 받음에 따라 금리역전에 유의한 영향을 받는 것으로 보인다. 따라서 우리나라 전체적으로 내외금리차 역전이 대내외 증권 투자자금의 유출 가능성이나 대외건전성 악화를 초래하지는 않는 것으로 판단된다. 거주자 해외증권 투자의 경우에도 내외금리차 역전보다는 글로벌 불확실성 확대가 거주자의 해외 주식 및 채권투자를 위축시키는 주된 요인으로 분석되었다.

Ⅳ. 금리차 역전의 외자조달비용에 대한 영향

1. 외화채권 발행에 따른 비용 증가

해외금리에 비해 원화가 고금리이던 시절에는 외화채권 발행이나 해외은행 차입금 등을 통한 저리외자를 조달하여 우리 경제주체들의 자본조달비용을 낮추는 긍정적 측면이 있었다. 그러나 내외금리차 역전이 상당기간 지속될 것으로 보이는 현 시점에서는 외자조달비용이 전반적으로 상승하므로 외자조달 행태에 변화가 불가피할 것으로 보인다. 아래에서는 국내 거주자의 외화표시 채권(한국물 KP) 발행과 관련된 영향을 중심으로 살펴보았다.

우리나라 거주자가 발행한 외화채권은 우리나라의 주요 외화조달 수단의 하나로서 순발행시 외채 증가요인이 된다. 우리나라에서는 국책은행을 포함한 은행이나 공기업, 민간기업 및 비은행금융기관 등 다양한 주체가 외화채권 발행에 참여하고 있다. <그림 Ⅳ-1>에 나타난 바와 같이 2023년 상반기중 외화채권의 순발행(신규발행액-만기상환액) 규모는 133억달러에 달하여 2022년 연중 순발행액 114억달러를 상회하였다. 그 결과 금년 6월말 현재 외화채권 잔액은 2천억달러를 넘어섰다.

<그림 Ⅳ-3>에 제시된 실제 외환채권 발행금리를 보면 2021년의 1.2%에서 2022년과 2023년 상반기중에는 각각 3.6%, 4.9%로 가파르게 상승하였다. 이는 발행시 벤치마크 금리라 할 수 있는 미국채(10년물) 금리가 2022년중 평균 2.9%에서 금년 상반기중 3.6%로 상승한 데 크게 기인한다. 그 밖에 발행금리에 영향을 주는 가산금리는 2023년 상반기중 전년 대비 상당폭 하락하였으나 여전히 높은 수준을 보여 과거 수준으로 회귀하기는 어려울 것으로 전망되고 있다.19) 또한 과거 발행물량의 만기도래에 따른 차환시에도 신규 발행금리가 더 높아짐에 따라 이자지급 비용의 상승을 초래하게 된다. 한국은행 자료에 따르면 금년 하반기 만기도래 물량의 평균 발행금리는 대략 3% 정도로 신규 발행금리의 상승으로 차환발행시 이자비용 상승이 초래될 것으로 보인다. 이러한 외화채권 발행금리의 상승은 향후 미연준의 기준금리가 더 오르거나 양적완화의 축소로 미연준의 국채매입이 감소하는 경우 내외금리차 역전20) 현상을 더욱 심화시켜 상당기간 지속될 가능성이 있을 것으로 보인다.

우리나라의 연기금이나 기관투자자 등 거주자의 해외증권 투자가 지속적으로 늘어나고 있는 가운데 환위험을 회피하기 위해 환헤지를 하는 경우가 많다. 이러한 환헤지 과정에서 내외금리차의 역전 현상은 환헤지비용의 상승을 초래한다. 즉 이들은 해외증권 투자를 위한 외자의 조달과 환위험 회피를 동시에 하기 위해 외환스왑시장(FX swap)에서 외자를 조달(현물환 매입+선물환 매도)하는 경우가 일반적이다. 이 경우 자본조달비용이라 할 수 있는 스왑포인트(선물환율-현물환율)가 이론값인 내외금리차에 따라 음(-)의 값을 갖게 됨으로써21) 내외금리차 역전폭 만큼 외자조달에 따른 비용이 발생한다. 이는 통상적으로 원화금리가 해외금리보다 높아 양(+)의 스왑포인트로 인해 외환스왑시장에서 환헤지를 동반한 해외투자를 하면서 내외금리차 만큼의 이득을 획득하였던 것과 반대의 상황이다.22)

가. 주요 기금의 환헤지 정책 현황

<표 Ⅳ-1>은 우리나라 주요 연기금들의 환헤지 정책을 정리한 표이다. 국민연금23)이나 사학연금 등 일부 대형기금을 제외하고 대부분 해외채권 투자시 환헤지 정책을 사용하고 있다. 그 밖의 공무원연금이나 산업재해보상기금 등 대부분의 연기금들은 해외채권 투자시 완전 헤지 정책을 고수하거나 적어도 50% 이상의 부분 헤지 정책을 사용하고 있다. 이 경우 환헤지를 위한 비용이 내외금리차 역전분만큼 소요되어 기금자산의 운용수익률을 하락시키는 요인이 되고 있다.

<그림 Ⅳ-4>는 주요 금융사들의 최근 통화파생상품 거래 및 잔액 추이를 나타낸다.27) 보험사의 경우 주로 장기물인 통화스왑을 이용하는 경우가 많은 반면 자산운용사 펀드의 경우에는 1년 이하의 외환스왑을 롤오버하는 방식으로 환헤지를 하는 경우가 많다. 내외금리차가 역전된 2022년 이후를 보면 환헤지를 위한 거래 규모 및 잔액이 소폭 증가한 것으로 나타나 내외금리차 역전에도 불구하고 기존의 환헤지 정책에 큰 변화는 없는 것으로 보인다. 이는 이들 기관의 환헤지비용이 최근 전반적으로 상승하고 특히 중장기 해외자산에 대해 단기로 롤오버하는 경우 환헤지비용이 더욱 상승하면서 최초 투자시점 대비 수익률의 하락 요인으로 작용하였을 것으로 보인다.

여기서는 해외주식형 ETF의 실제 자료를 이용하여 내외금리차 역전에 따른 스왑레이트28) 변화 및 환헤지비용에 대한 영향을 분석하였다. <표 Ⅳ-2> 및 <그림 Ⅳ-5>는 글로벌 금융위기 이후 최근까지 내외금리차 및 스왑레이트(1개월 만기) 추이를 나타낸다. 최근의 내외금리차 역전으로 실제 외환스왑시장에서의 스왑포인트 및 스왑레이트가 일정 시차를 보이기는 하나 이론값에 따라 음(-)으로 전환되었다.29) 즉, 2011.1월~2018.2월 기간에는 내외금리차(기간평균)가 1.74%, 스왑레이트가 1.58%로 양(+)의 값을 보인 반면, 내외금리차 역전 기간(음영 구간)인 2018.3월~2020.2월과 2022.7월~2023.7월 기간에는 스왑레이트가 각각 –1.04%와 –1.26%로 음(-)의 값을 기록하였다.

이에 관한 결과는 <표 Ⅳ-3>에 제시되었다. 먼저 스왑레이트가 양(+)인 2021년 7월~2022년 4월까지 기간31)을 살펴보자(<표 Ⅳ-3>의 A). 이 기간 동안 원달러 환율이 10.9% 상승한 데 따른 환율상승 효과로 인해 환노출형 펀드의 수익률이 환헤지형의 수익률보다 높다. 예를 들어 S&P500지수 추종 환노출 ETF의 경우 펀드 수익률은 8.3%를 기록하였으나 환율상승 효과 10.9%를 차감한 환율조정수익률은 –2.6%를 기록하였다. 같은 기간 동안 환헤지형 ETF의 수익률은 0.8%로 환노출형 ETF의 환율조정수익률(-2.6%)보다 3.4% 더 크다. 이 차이는 스왑포인트가 양(+)의 값을 나타냄에 따라 환헤지 과정에서 내외금리차 만큼의 이익이 발생한 결과로 볼 수 있다. 마찬가지로 A펀드와 B펀드의 경우에도 환헤지형의 수익률이 환노출형의 환율조정수익률보다 각각 0.4%, 1.0% 더 큰 것으로 나타났는데 이는 양의 스왑레이트(기간 평균 0.67%)로 인한 효과라 할 수 있다.

Ⅴ. 요약 및 시사점

2022년 이후 최근까지 이어지고 있는 내외금리차 역전 현상은 과거에 비해 그 폭이 가장 클 뿐만 아니라 기간 측면에서도 향후 오랜기간 지속될 가능성이 있다. 이런 점에서 본고에서는 최근 한미간 내외금리차 역전 현상의 특징과 전망을 살펴본 후 내외금리차 역전이 우리나라의 자본유출입 가능성 및 자본조달비용 등 대외건전성에 미치는 영향을 분석하였다.

2000년대 이후 우리나라에서 한미간 내외금리차가 역전된 시기별로 거주자와 비거주자의 주식 및 채권 투자자금 각각에 대해 자금유출입 추이를 살펴본 결과 내외금리차 역전에 따른 자본유출은 없었던 것으로 나타났다. 또한 우리나라 대내외 증권 투자자금의 유출입 결정요인에 관한 회귀추정 결과에서도 내외금리차 역전보다는 경제펀더멘털이나 대내외 불확실성에 기인한 위험지표 등이 더 중요한 것으로 확인되었다. 따라서 우리나라 전체적으로 내외금리차 역전이 대내외 증권투자자금의 유출 가능성이나 대외건전성 악화를 초래하지는 않는 것으로 판단된다.

그러나 큰 폭의 내외금리차 역전 현상의 지속은 우리 경제주체들의 자본조달비용의 상승과 해외투자시 환헤지비용의 상승을 초래하고 있다는 점을 간과해서는 안될 것으로 보인다. 거주자의 한국물 외화채권 발생시 발행금리 상승으로 인한 이자상환비용이 늘어나고 있고, 대부분의 국내 투자기관들이 해외채권 투자시 환헤지 전략을 추구하면서 내외금리차 역전에 따른 환헤지비용 증가와 투자수익률 하락 요인이 되고 있음에 유의할 필요가 있다.

본고의 시사점은 다음과 같다. 첫째, 현 시점에서 내외금리차 역전 현상으로 인한 우리나라의 자본유출 가능성은 크지 않은 것으로 보이므로 우리 경제주체들은 막연한 우려를 가질 필요는 없을 것으로 생각된다. 그러나 큰 폭의 내외금리차 역전이 장기간 지속되는 상황에서 예상치 못한 중대한 글로벌 외부충격이 가세하는 경우에는 우리 경제의 위기대응력과 회복력이 더욱 취약해 질 수밖에 없다는 점에 유념하여 경제체질 강화와 대외신인도 유지에 배가의 노력을 기울일 필요가 있다.

둘째, 각 경제주체별로 외자조달비용 상승에 대비한 외화조달체계 및 전략을 마련하는 것도 중요할 것으로 생각된다. 우리나라의 주요 외자조달 수단의 하나인 외화채권 발행시 국제금리 동향이나 전망에 대한 세심한 주의를 통해 발행 시기 및 조건 등을 최적화함으로써 외화조달비용을 최소화할 필요가 있다. 아울러 외자조달 수단을 다변화하고 외화유동성 관리에도 노력해 나가야 할 것으로 보인다.

셋째, 우리나라의 경상수지 흑자를 배경으로 지속적인 증가세를 보이고 있는 거주자의 해외증권 투자와 관련하여 국내 연기금 및 기관투자자들의 환헤지 정책에 대한 재검토가 필요할 것으로 생각된다. 해외자산에 대해 완전 또는 부분 헤지를 추구하는 과정에서 내외금리차 역전에 따른 외자조달비용 상승과 추가적인 환헤지비용이 지속적으로 발생할 수 있다는 점에 유념할 필요가 있다. 따라서 국내 투자기관이나 개별 기금들은 환헤지 전략 수립시 지금까지와 같이 관성적으로 환헤지를 추구하기보다는 외환(currency)을 하나의 투자 수익원으로 인식하고 각 기금의 특성을 고려한 체계적인 환헤지 전략을 수립하는 데 노력할 필요가 있다.

1) 본고에서 ‘내외금리차’는 ‘한국금리-미국금리’를 의미한다.

2) 보고서 작성 시기인 9월 기준이며, 10월 중 기간프리미엄이 상승하면서 미국 장기국채의 금리도 상승하여 한미간 10년물 국채금리의 역전폭은 0.7%p까지 확대되었다.

3) 보고서 작성 시기로 점도표가 발표된 9월 FOMC 주간의 금요일이다.

4) 주요 기관별 GDP 성장률(%) 전망(기관/전망시기/2023년/2024년): 한국은행/’23년 8월/1.4/2.2, KDI/’23년 8월/1.5/2.3, IMF/’23년 10월/1.4/2.2

5) Bloomberg에서 제공(2023년 9월 12일 기준)하고 있는 해외 주요 투자은행들의 한국 기준금리 전망 중간값은 2023년 4분기와 2024년 4분기 각각 3.5%와 2.75%이다.

6) 채권을 매입하여 만기까지 보유했을 경우의 수익률(매입시점의 YTM)을 의미한다.

7) 외국인 채권 투자자금 흐름의 경우 내외금리차 외에 차익거래 유인(내외금리차-스왑레이트)을 설명변수로 사용하며(유복근(2018), 배영수ㆍ한재준(2022)), 중앙은행이나 공적자금 유입 등의 이유로 금융위기 이후 외국인 채권 투자자금에 대한 금리 민감도가 감소하였다는 결과들이 보고된다.

8) 충격반응 분석 및 자기회귀시차분포(ARDL) 모형에서 시차변수를 다르게 설정한 분석을 통해 정책금리 변화의 영향이 오래 지속되어 계속적으로 자본유출입에 영향을 끼칠 수 있음을 제시하였다.

9) 금융위기 이후 금리차이에 대한 민감도가 높아졌다는 결과도 있지만, 시기별로 다르고, 다양한 여건들이 신흥국의 자금유출입에 영향을 끼친다.

10) 통화정책 변화에 따른 실증분석은 국채 10년 금리를 이용하였다. Ahmed et al.(2022)은 이론모형을 통해 미국 통화정책 변화의 영향을 보았으며, 마찬가지로 통화정책 변화 원인과 개별 국가의 펀더멘털(부채 및 인플레이션 기대 관리)이나 취약성이 중요함을 보였다.

11) Ahmed & Zlate(2014)는 증권 투자자금 흐름을 명목 GDP로 표준화해서 사용하였다. 본고는 코로나19 시기나 금융위기 전후에 발생한 명목 GDP의 변동 효과를 제외하기 위해 명목 GDP의 추세를 산출(HP 필터 이용)하고 선형보간을 통해서 분기 자료를 월별 자료로 전환하였다. 투자자금 원화 환산시 월별 평균 환율을 사용하였다. 국내 기준으로 자금유출입을 보기 위해 외국인 투자자금의 경우 + 부호가 국내로 자금 유입을 의미하고, 내국인 투자자금의 경우 –가 해외투자로 자금이 유출되는 경우를 의미한다.

12) 기준금리와 장기국채금리의 차이를 각각 포함한 것은 특히 최근 두 변수간의 상이한 움직임을 감안한 것이며, 두 변수(차분 사용) 간 상관관계는 분석 기간 중 0.09이다.

13) CAI(Current Activity Index)는 골드만삭스에서 제공하는 지수로 전월 대비 경제활동(각종 경제지표를 사용) 증가율을 연율화한 자료이다.

14) 한국은행(2017) 및 윤영진ㆍ박종욱(2019)을 참고하였다.

15) 시계열의 안정성(stationarity)을 감안하였다. ADF 테스트를 적용하면, 종속변수들은 안정적이지만,

16) 부록에 교차항

17)

18) 다만, 더미변수의 계수 0.53이 유의하지는 않다. 유의한 상수항을 같이 볼 필요가 있다.

19) 국제금융센터(2023. 7. 19) 참조

20) 기준금리와 함께 시장금리(10년 국채금리)의 역전을 의미한다.

21) 현물환율 S, 국내금리

이며(Covered Interest Rate Parity), 선도환율과 현물환율의 차이인 스왑포인트는

이며(Covered Interest Rate Parity), 선도환율과 현물환율의 차이인 스왑포인트는  이다. 이 식에서 원화 금리

이다. 이 식에서 원화 금리 22) 현물환율(S)로 해외자산을 매입하고 선도환율(F)로 환헤지(선물환 매도) 계약을 하게 되면, 스왑포인트(F-S)만큼 추가 손익이 발생하며 이는 내외금리차의 영향을 받는다.

23) 전략적 환헤지 비율이 0%에서 한시적으로 10%까지 상향(보건복지부 보도자료(2022))되었으며, 전술적 환헤지 범위 5%까지 고려하면 현재 가능한 최대 환헤지 비율은 15%이다.

24) 이에 관해서는 신지급여력제도 해설서(보험사), 은행업감독업무시행세칙, 증권업 감독규정을 참고하면 된다.

25) 환헤지형은 환노출형의 외환평가손익을 헤지하기 위한 펀드로 볼 수 있다.

26) 일부는 장내 통화선물을 일시적인 수단으로 이용하기도 한다.

27) 은행의 경우 보유 해외자산의 환헤지 목적 보다는 타 금융사의 환헤지 거래의 상대방이 되거나 해외투자 외에 자금조달 목적으로 또는 다양한 거래(수출업체 통화선도 등)를 하기 떄문에 은행 포지션은 그래프와 논의에서 제외하였다.

28) 스왑레이트((F-S)/S)는 스왑포인트(F-S)를 환율(S)로 나누어 연율화(%)한 값으로 해외자산의 환헤지시 수익률과 직접적으로 연계되는 지표이다.

29) 스왑레이트가 이론값인 내외금리차의 변동 부호와 시기적으로 정확히 일치하지 않는 것은 외환스왑시장의 수급요인, 원화의 신용위험, 대외불확실성에 따른 리스크 요인 등이 복합적으로 영향을 주는 데 따른 것이다.

30) 해외선물이 아닌 현물을 운용하는 ETF들은 2020년 들어서 본격적으로 출시되기 시작하였다. 따라서 비교 분석 기간을 2021년 이후로 설정하였다.

31) 비교 가능한 펀드들이 존재하는 2020년 이후를 대상으로 1개월 만기 월평균 스왑레이트가 0.4% 이상인 기간을 선택하였다(수익률은 말일 직전 영업일 기준으로 계산).

32) 1개월 만기 월평균 스왑레이트가 -0.4% 이하인 기간을 선택하였고 2022년 12월부터 비교 가능한 ETF들이 다수 출시됨을 감안하였다(수익률은 말일 직전 영업일 기준으로 계산).

참고문헌

국제금융센터, 2023. 7. 19, ’23년 하반기 한국계 외화채권 발행시장 전망, Issue Analysis.

배영수ㆍ한재준, 2022, 내외금리차가 외국인 투자자의 국내 채권 투자 결정에 미치는 영향, 『한국경제의 분석』 28(3), 171-216.

백인석, 2023, 시장금리 측면에서 살펴본 한미 기준금리 인상 영향 비교 및 시사점, 자본시장연구원 『자본시장포커스』 2023-13호.

보건복지부, 2022. 12. 16, 2022년도 제6차 기금운용위원회 개최, 보도자료.

유복근, 2018, 글로벌 금융위기 전․후 외국인의 채권투자 결정요인 변화 분석: 한국의 사례, 『BOK 경제연구』 2018-18호.

윤영진ㆍ박종욱, 2019, 내외금리차와 자본유출입: 이론 및 실증 분석, 『경제학연구』 제 67집 제2호.

이승호, 2023, 한·미간 금리차 역전 현상 및 영향에 대한 소고, 자본시장연구원 『자본시장포커스』 2023-14호.

한국은행, 2017, 『미 연준 통화정책 정상화에 따른 자본유출 가능성』, 통화신용정책보고서, 2017년 4월.

한국은행, 2023, 최근 외화채권 동향 및 상환 여건 점검.

https://www.bok.or.kr/portal/bbs/B0000347/view.do?nttId=10078544&menuNo=201106&pageIndex=1

Ahmed, S., Andrei Z., 2014, Capital flows to emerging market economies: A brave new world? Journal of International Money and Finance 48, 221–248.

Ahmed, S., Ozge A., Albert Q., 2022, U.S. Monetary Policy Spillovers to Emerging Markets: Both Shocks and Vulnerabilities Matter, New York FED.

Ahmed, S., 2017, The Drivers of Capital Flows in Emerging Markets Post Global Financial Crisis, IMF working paper No. 17/52.

Avdjiev, S., Leonardo G., Linda S.G., Stefano S,, 2020, The Shifting Drivers of Global Liquidity, Journal of International Economics 125.

Hoek, Jasper, Steve K., Emre Y., 2021, Are Rising U.S. Interest Rates Destabilizing for Emerging Market Economies? FEDS Notes, June 23, 2021.

Koepke, R., 2019, What Drives Capital Flows to Emerging Markets? A Survey of the Empirical Literature, Journal of Economic Surveys 33, 516-540.

<부록 표> 증권 투자자금 유출입 결정요인 회귀분석 결과

(금리 역전 시기 구분 분석)

본문의 식(1)에서 기준금리 차이에 따라

본문 <표 III-2>의