Find out more about our latest publications

Effect of Mandatory Auditing of Internal Control over Financial Reporting on Preventing Fraud in the Korean Capital Market

Research Papers 24-03 Feb. 05, 2024

- Research Topic Capital Markets

- Page 80

- No other publications.

- No other publications.

Since 2019, Korea has strengthened the external verification of the effectiveness of internal control systems following the amendments to the External Audit Act. To be more exact, the verification level of the internal control over financial reporting(hereafter, ICFR) was raised from 'review' to 'audit' for listed companies with total assets of more than 2 trillion KRW. Despite the effort, there have been several large-scale embezzlement cases where the internal control system has been overrode at firms and government agencies, such as Osstem Implants and Woori Bank. Based on these events, it seems necessary to examine the effect of mandating an audit of ICFR. Furthermore, we intend to gain a comprehensive understanding of the regulation and how it should be pursued.

This study aims to investigate the effect of the mandatory audit of ICFR, introduced in 2019, in deterring the likelihood of corporate fraud, especially regarding embezzlement and breach of trust. In addition, this report intends to identify improvement measures for the effective operation of the advanced internal control system. We thereby evaluate the effectiveness of the current system and provide policy implications supported by empirical evidence.

First, we compare Korea's intensified internal control system with those of the United States and Japan and find that Korea's internal control system is the most stringent in terms of procedural rigor. However, among the significant weaknesses of the internal accounting control system, a high proportion of cases fell under the category of "insufficient funds," indicating the need for improvement of the effectiveness of ICFR.

Next, we examine the trend of embezzlement and breach of trust before and after the mandatory audit of ICFR using the staggered difference-in-differences model. We find that the incidence of embezzlement and breach of trust in the overall capital market has been declining since 2019, and the decline has been more pronounced among companies with total assets of more than 2 trillion KRW, which were initially subject to the mandatory audit of ICFR. This suggests that the regulatory reformation that reinforced the assurance level of the ICFR from 'review' to 'audit' may have the impact of enhancing the effectiveness of the internal control system and deterring the occurrence of fraud.

Based on the empirical results, this study suggests several policy implications for a more effective internal control system. First, it is necessary to further refine and quantify the sentencing guidelines for large-scale embezzlement cases to deter employees' motivation to commit violations. Next, it is necessary to grant tax benefits to ease the cost burden of designing and implementing the ICFR for a limited period. Furthermore, the incentives for executives and employees to actively contribute to the effective operation of the ICFR and to whistle-blowing need to be expanded.

This study aims to investigate the effect of the mandatory audit of ICFR, introduced in 2019, in deterring the likelihood of corporate fraud, especially regarding embezzlement and breach of trust. In addition, this report intends to identify improvement measures for the effective operation of the advanced internal control system. We thereby evaluate the effectiveness of the current system and provide policy implications supported by empirical evidence.

First, we compare Korea's intensified internal control system with those of the United States and Japan and find that Korea's internal control system is the most stringent in terms of procedural rigor. However, among the significant weaknesses of the internal accounting control system, a high proportion of cases fell under the category of "insufficient funds," indicating the need for improvement of the effectiveness of ICFR.

Next, we examine the trend of embezzlement and breach of trust before and after the mandatory audit of ICFR using the staggered difference-in-differences model. We find that the incidence of embezzlement and breach of trust in the overall capital market has been declining since 2019, and the decline has been more pronounced among companies with total assets of more than 2 trillion KRW, which were initially subject to the mandatory audit of ICFR. This suggests that the regulatory reformation that reinforced the assurance level of the ICFR from 'review' to 'audit' may have the impact of enhancing the effectiveness of the internal control system and deterring the occurrence of fraud.

Based on the empirical results, this study suggests several policy implications for a more effective internal control system. First, it is necessary to further refine and quantify the sentencing guidelines for large-scale embezzlement cases to deter employees' motivation to commit violations. Next, it is necessary to grant tax benefits to ease the cost burden of designing and implementing the ICFR for a limited period. Furthermore, the incentives for executives and employees to actively contribute to the effective operation of the ICFR and to whistle-blowing need to be expanded.

Ⅰ. 서론

「주식회사 등의 외부감사에 관한 법률」(이하 ‘외감법’)의 개정 및 시행에 따라 2019년부터 자산총액 기준 2조원 이상 유가증권 및 코스닥시장 상장법인의 개별재무제표상 내부회계관리제도에 대한 인증수준이 ‘검토’에서 ‘감사’로 상향되었다.1) 내부회계관리제도의 인증수준 상향을 통한 내부통제제도의 고도화 노력에도 불구하고 2021년부터 민간기업 및 관공서 등에서 일련의 횡령 사건이 잇따라 발생하고 있다. 예를 들어, 2021년 발생한 오스템임플란트 직원의 2,215억원 횡령 사태는 민간기업의 내부통제제도가 효과적으로 작동하지 않고 있다는 점을 보여주고 있으며, 2022년 발생한 우리은행 직원의 600억원 횡령 사태는 고도화된 내부통제를 요구하는 금융기관에서조차 내부통제제도가 그 기능을 제대로 하지 못한다는 점에서 충격을 안겨준 바 있다. 실제로 2011년 2만 7,882건이었던 개인 및 기업의 횡령 범죄 발생 건수는 2020년 기준 6만 539건으로 10여 년 만에 117% 증가하였으며, 이는 같은 기간 전체 주요 경제범죄 발생 건수 증가율(약 50%)에 비해 2배 이상 높은 수준이다.2) 특히 금융기관에서 2017년부터 2021년 8월까지 발생한 횡령으로 인한 사고 금액은 약 1,540억원에 이르는 것으로 나타났다.3)

이러한 기업 내 횡령 사고는 비단 해당 기업뿐만 아니라 사회 전체적으로 막대한 비용을 초래한다는 점에서, 이를 예방‧억제하기 위한 이해당사자의 노력과 함께 정책적 방안 마련이 긴요한 문제라 할 수 있다. 우선, 기업은 현금 및 자산의 상실과 횡령 사고의 사후 수습으로 인한 업무 비효율화, 기업의 평판 및 신뢰도 하락, 자본비용의 상승 등 상당한 수준의 경제적 비용을 부담한다. 본 보고서의 분석에 따르면, 최초 횡령 사건 발생 시 자본시장에서 평균 7%대의 시가총액이 감소하며, 횡령 금액이 자산총액의 10%를 초과하는 대규모 횡령 사건의 경우 시가총액 감소분이 평균 16%에 육박하는 것으로 나타났다. 관련 선행연구 역시 횡령 사건과 같은 재산범죄 비율이 높을 경우 기업의 자기자본비용과 타인자본비용 모두 증가함을 실증한 바 있다(Brushwood et al., 2016).

기업을 둘러싼 여러 이해관계자 역시 상당한 사회적 비용을 부담한다. 소액주주의 경우 주주가치 하락으로 인해 직접적인 재산 손실을 경험하며(Dyck et al., 2023), 감사인 역시 내부통제 위험이 큰 횡령기업에 대해 감사위험에 상응하는 높은 보수를 청구한다(Lee & Ha, 2021). 횡령 범죄에 가담한 임‧직원에 대하여 행정‧사법적 제재를 부과하는 과정에서도 직‧간접적인 사회적 비용이 발생하며, 규제기관 역시 횡령 사건 증가에 따른 감독업무 부담이 가중되고 행정력을 낭비하게 되는 결과를 초래한다. 총체적으로 국가 전체의 회계 신뢰도 저하와 투명성 하락으로 이어져 글로벌 자금시장에서의 평판 손실을 고스란히 부담하게 된다.4)

내부회계관리제도의 인증수준 강화에도 불구하고 최근의 대규모 자금 횡령 사건이 발생한 원인은 여러 가지가 있겠으나, 내부회계관리제도가 그 목적에 맞게 실효적으로 운영되고 있는지에 대해 검토해 볼 필요성이 크다고 하겠다.5) 물론, 내부회계관리제도는 외부 공시 재무제표의 신뢰성을 확보하기 위해 설계‧운영하는 제도로서6) 재무보고 목적의 내부통제제도 확립에 초점을 맞추고 있는 만큼, 운영 혹은 법규 준수 측면의 내부통제를 완전히 관장하지 못하는 본질적 한계를 지닌다(내부회계관리제도 설계 및 운영 개념체계 문단 8~9). 그러나 자산의 편취‧남용‧부패 등 횡령 및 배임 부정에 대한 기업의 취약점은 재무제표의 중요 왜곡표시 위험과 밀접한 관련성을 갖기 때문에 내부회계관리제도는 전사적 내부통제와도 깊게 연관되어 있으며, 엄연히 현행 내부회계관리제도는 자산의 보호와 부정 방지 프로그램을 포함하고 있기도 하다(내부회계관리제도 설계 및 운영 개념체계 문단 12). 즉, 내부회계관리제도가 실효적으로 운영된다면 임직원의 횡령‧배임 행위를 적절히 통제할 수 있어야 한다. 따라서, 최근의 인증수준 강화가 기업의 횡령‧배임에 실질적으로 어떠한 영향을 미쳤는지 살펴보는 것은 제도의 효과성 평가와 관련하여 중요한 과제라 볼 수 있다.

특히, 최근의 내부회계관리제도 인증수준 상향과 관련하여 기업 측에서는 그 효과성에 비해 시스템 구축 및 운영에 따른 인적/금전적 비용 부담이 과도하다는 점을 주장하고 있으며, 내부회계관리제도의 실효성에 대한 논의는 여전히 진행 중에 있다.

이와 같은 논의 배경을 바탕으로, 본 연구보고서는 한국을 포함한 미국 및 일본 등 주요국의 내부회계관리제도 운영 실태를 살펴보고, 국내기업을 대상으로 1) 순차적 이중차분 모형을 활용하여 최근 이루어진 내부회계관리제도 인증수준 상향이 기업의 횡령‧배임 건수 및 금액에 어떠한 영향을 주는지, 2) 또한, 기업의 회계정보품질에는 어떠한 영향을 주는지, 그리고 3) 감사인의 감사보수 및 시간과는 어떠한 관계가 있는지 등을 실증적으로 분석하였다. 최종적으로 실효적인 내부통제제도 구축 및 내부회계관리제도 운영을 위해 형량 현실화, 세제상 혜택, 제재 감경 방안, 내부고발 유인책 확대 등 효과적인 내부회계관리제도의 설계 및 운영을 위한 다양한 개선안을 제시하였다.

주요 실증분석 결과는 다음과 같다. 첫째, 내부회계관리제도의 인증수준을 ‘검토’에서 ‘감사’로 상향한 2019년 이후 자본시장 전반의 횡령‧배임 건수는 추세적으로 하락 전환하였으며, 이러한 추이의 변화는 내부회계관리제도 감사를 의무화한 처치 집단에 의해 유도됨을 확인하였다. 즉, 내부회계관리제도의 인증수준 상향은 기업의 내부통제를 고도화하여 부정의 발생을 억제하는 효과가 있을 가능성이 높다는 점을 시사한다. 둘째, 내부회계관리제도 감사의무화에 따른 감사보수 및 감사시간과의 관련성을 검증한 결과, 감사의무화 대상 기업의 감사인은 감사의무화 비대상 기업 감사인 대비 높은 감사보수를 지출하고 더 많은 감사시간을 투입하여 결과적으로 감사인의 임률에는 영향이 없는 것으로 나타났다. 이는 내부회계관리제도 감사의무화 기업에 대해 제도의 이행부담 증가와 동시에 외부감사인의 적발 통제가 강화되었음을 시사하며, 그러한 상황에서 관측된 횡령‧배임에 대한 예방효과는 실제 효과 대비 과소 추정되었을 가능성을 내포한다고 할 것이다. 마지막으로, 내부회계관리제도의 인증수준 상향은 재무제표 감사품질의 대용치인 재량적 발생액과는 유의한 관련성이 없었으나, 회계불투명성을 대리하는 재량적 발생액 절댓값의 3개년 합산 측정치와는 유의한 음(-)의 관련성이 있음을 확인할 수 있었다. 이는 보다 장기적인 관점에서 내부회계관리제도의 감사의무화가 재무보고의 품질 개선과 연계될 가능성을 의미한다고 할 것이다.

내부회계관리제도의 감사의무화가 횡령‧배임의 예방에 효과가 있다는실증분석 결과를 바탕으로, 본 연구는 보다 효과적인 내부회계관리제도의 운영을 위해 아래와 같은 제도적 개선방안을 제시하고자 한다. 첫째, 임직원의 위반 동기 억제를 위한 형량 현실화가 필요할 것으로 판단한다. 횡령 범죄에 대한 법정형 자체는 미국과 영국 등 해외 주요국의 수준에 비해 결코 낮지 않으나, 고액의 횡령 사건에 대한 양형 기준이 세분화‧계량화되어 있지 않은 측면이 있다. 미국의 입법례 등을 참조하여 양형 기준을 보다 세분화하고 계량화하여 금전 범죄의 비례적 제재 원칙을 실현할 필요성이 존재하며, 횡령 재산에 대한 신속한 몰수 및 추징을 위해 추징집행력을 높이는 방안의 마련 역시 요구된다.

둘째, 내부회계관리제도의 실효적 구축 및 운영을 위해 내부회계관리제도 관련 투자에 대한 세제혜택 부여를 고려해 볼 수 있다. 실제 기업 담당자들은 ‘인력 및 예산 제약’을 내부회계관리제도 구축의 어려움 중 하나로 꼽고 있으며, 특히 중소기업의 경우 내부회계관리제도 구축에 적지 않은 비용을 수반하는 것으로 나타났다. 따라서, 효율적인 내부회계관리제도의 조기 정착을 위해 한시적인 세제혜택을 부여할 필요성이 존재할 것으로 판단한다.

셋째, 내부회계관리제도를 실효적으로 운영하는 경우 제재 경감 등의 유인책을 강화하는 방안이 필요하다. 내부회계관리제도가 무력화하는 경우 경영진에게 관련 감독책임을 무겁게 적용하되, 내부통제의 충실한 설계와 운영을 입증하는 경우 인적‧금전적 제재를 경감하여 경영진 스스로 내부회계관리제도의 실효적 운영에 확고한 의지(tone at the top)를 가질 수 있도록 유인을 제고하여야 한다.

마지막으로, 미국의 사례를 참고하여 내부고발과 이에 따른 포상제도를 확대할 필요가 있다. 현행 외감법 시행령에서 정한 신고자 포상금의 최대한도액 20억원은 부정의 규모에 따라 내부고발 유인을 비례적으로 강화하지 못하는 한계점이 존재한다. 우선, 다른 국내법과의 정합성을 고려하여 포상금 상한액을 상향 조정하고 장기적으로는 투자자보호기금 설립을 통해 회계부정에 대한 과징금을 내부고발 포상금의 재원으로 활용함으로써 내부고발 유인을 극대화할 필요가 있다.

본 연구보고서의 시사점은 다음과 같다. 우선, 내부회계관리제도의 인증수준 상향이 기업의 횡령‧배임에 미치는 영향을 직접적으로 규명한다는 점에서 의의가 있다고 할 것이다. 기존 선행연구에서는 주로 내부회계관리제도의 인증수준 상향과 재무보고품질 간의 관계에 대해 분석한 반면(Nagy, 2010; Bhaskar et al., 2019; 김태중 외, 2021; 구본승‧안성희, 2021), 본 연구는 순차적 이중차분 모형을 활용하여 최근의 주된 관심사인 횡령‧배임에 미치는 영향에 대해 분석하였다. 이를 통해 내부회계관리제도 감사의무화의 효과에 대한 기존 문헌의 논의를 확장하고 있다.

또한 최근 논의되고 있는 新외감법 도입의 정책적 효과를 심층적으로 평가하는 데 유용한 결과를 제시한다. 2018년 주기적 감사인 지정제, 표준감사시간제, 내부회계관리제도 감사 등의 외감법 개정안이 도입된 지 5년이 경과하였고, 이에 따라 제도의 정책적 효과에 대해 다양한 찬반 논의가 이루어지고 있다. 기업 측은 내부회계관리제도가 실효성의 충분한 검증 없이 도입된바 회계정보의 질적 향상이라는 본래 목적과 달리 문서화를 위한 제도로 변질되었음을 주장한다. 더불어 실질적 효과 대비 비용이 과도하다는 점을 들어 새로이 도입된 제도의 비용-편익 측면에서 의문을 품고 있다. 반면 회계법인에서는 내부회계관리제도 감사를 의무화한 2019년 이후 횡령‧배임의 발생빈도가 감소하였으며, 결국 인증수준 상향이 내부통제를 강화하여 부정을 예방하는 데 효익이 있음을 주장하고 있다.7) 본 연구보고서는 新외감법 중 내부회계관리제도 인증수준 강화에 초점을 맞추고, 내부회계관리제도의 감사의무화가 기업의 횡령‧배임 방지에 긍정적으로 작용한다는 실증적 증거를 제시하여 新외감법의 정책적 효과에 대한 논의를 개진하는 데 학문적 공헌이 있다. 이를 통해 기업 측의 우려와는 달리 내부회계관리제도 감사의무화의 기대효과가 크다는 점을 강조하고자 하였다.

마지막으로, 보다 효과적인 내부회계관리제도의 운영을 위한 다양한 정책적 제안을 제시하였다. 비록 본 연구의 발견이 내부회계관리제도의 인증수준 상향에 따른 횡령 및 배임 억제효과를 제시하고 있기는 하나, 이론적으로 내부회계관리제도가 횡령 등의 부정을 완벽히 통제한다고 볼 수는 없다. 따라서, 내부회계관리제도의 효과적 운영을 위한 다양한 정책적 제안 역시 실증분석과는 별개로 논의되어야 할 필요가 있다. 이러한 측면에서 내부회계관리제도에 대한 외부감사인의 감사의무화에도 불구하고 실효성 있는 내부회계관리제도의 운영을 위해서는 경영진이 내부회계관리제도 운영에 대한 확고한 의지(tone at the top)를 가질 필요가 있다. 이러한 점에 초점을 맞추어 본 연구보고서에서 제안한 형량 현실화, 제도 구축에 대한 한시적 세제혜택, 유인부합적 제재 경감, 내부고발 포상제도 확대 등의 방안은 내부회계관리제도의 감사의무화 이외에도 제도 운영의 실효성 제고를 위한 논의에 폭넓게 기여할 것이다.

본 보고서의 구성은 다음과 같다. 이어지는 Ⅱ장에서는 최근 발생하고 있는 일련의 횡령 및 배임 사건의 발생 현황을 살펴보고, 내부통제제도가 무력화되는 원인에 대해 분석한다. Ⅲ장에서는 미국‧일본 등의 내부회계관리제도 현황을 살펴봄으로써, 국내의 내부회계관리제도의 현주소에 대해 다시 한번 돌이켜보고자 한다. Ⅳ장에서는 순차적 이중차분 모형을 통해 내부회계관리제도의 감사의무화가 기업의 횡령‧배임에 미치는 영향에 대해 실증적 증거를 제시한다. Ⅴ장에서는 내부회계관리제도의 실효적 운영을 위한 다양한 개선방안을 제시하며, Ⅵ장에서는 결론을 맺고 정책적 시사점에 대해 논의한다.

Ⅱ. 횡령‧배임 사건 발생 현황 및 내부통제제도상 시사점

1. 횡령 사건의 발생원인과 중대성

최근 발생한 주요 횡령 사건의 발생원인으로는 자산가격 급등에 의한 투기적 성향의 횡령 동기 발현을 주요 요인으로 생각해 볼 수 있다. 특히 2022년 각국 중앙은행이 긴축적 통화정책 기조로 선회하기 이전까지 장기간에 걸쳐 초저금리 기조가 지속되었고, 신종 코로나바이러스감염증 사태에 대응하기 위해 정부가 유동성 공급을 확대하면서 주택가격 뿐만 아니라, 주식 및 가상자산 등 위험자산의 가격이 급등하였다. 이에 임직원의 주식투자 손실보전 등 투기목적의 횡령 동기가 발현하여 실제 횡령 사건 등으로 이어졌을 가능성이 존재한다. 그러나 보다 근본적으로 범죄의 동기가 발현하더라도 그 실현이 불가능하도록 시스템을 구축했어야 함에도 불구하고, 경영진 스스로 통제 절차를 무력화하는 등 실효적 운영에 대한 인식과 의지가 부족하여 횡령 사태가 발생한 측면을 빼놓을 수 없을 것이다.

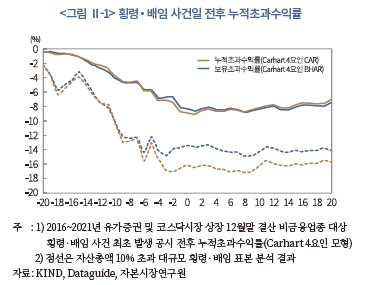

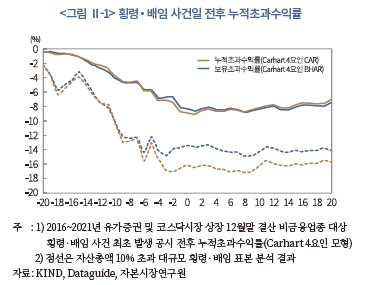

최근 발생한 일련의 횡령 사건의 특징 중 하나는 투기 및 은닉수단의 다양화로 범죄의 적발 이후에도 횡령금의 환수 불확실성이 높다는 점이다. 투기적 수요에 의한 횡령 이후 고위험 자산에 무분별한 투자를 감행해 막대한 손실을 기록하거나, 추적이 어려운 디지털 자산(예: 비트코인)을 은닉 수단으로 활용하는 등 범죄의 적발 이후 피해복구 과정에서 횡령액 환수에 대한 불확실성이 점차 커지는 상황이다. 또한 회사의 신뢰도 하락에 따른 기업가치 훼손이 심각하게 발생한다는 특징이 있다. 상장사의 경우 횡령 피해로 인한 직접적 손실뿐만 아니라, 평판 저하로 단기에 회복이 어려운 수준의 주가 하락을 경험하여 다수 이해관계자의 물질적‧정신적 손해를 야기할 수 있다. 실제 2016년부터 2021년까지 유가증권 및 코스닥시장 상장사들의 횡령 사건을 분석한 결과 최초 횡령 사건 발생일 기준 약 -7.08%의 평균 누적초과수익률이 관측되었으며, 자산총액의 10%를 초과하는 횡령의 경우 평균 누적초과수익률이 무려 –16.30%에 달하는 것으로 나타났다(<그림 Ⅱ-1> 참조).

이에 아래에서는 최근 발생한 오스템임플란트‧계양전기‧우리은행 등 주요 횡령 사건에 대해 간략히 살펴보고, 각 사건별로 내부통제제도상의 미비점에 대해 논의하여 내부통제제도가 무력화된 원인에 대해 논의하고자 한다.

2. 주요 횡령 사건 검토 및 내부통제제도상 시사점

오스템임플란트 횡령 사건은 2021년 회사 직원이 자본금의 108.18%에 달하는 2,215억원의 거액을 횡령한 사건이다. 담당직원이 자금집행, 승인 및 기록 전반에 관여하고 있었으며, 잔고증명서를 위조하는 방법 등을 통해 회사의 현금을 지속적으로 횡령하였다. 횡령한 금액은 주식‧부동산‧금괴 등 개인적인 거래에 사용되었으며, 거액의 주식투자 손실이 발생하여 결산 전 회사로 재입금에 실패하면서 횡령 사실이 발각되었다.

2022년 발각된 계양전기의 횡령 사건은 회사의 재무팀 직원이 약 245억원(자기자본의 12.7%)을 횡령하여 불법도박 및 가상화폐 투자 등에 사용한 사건이다. 횡령을 위해 거래처로의 지급 대금을 대리 수령하거나 매출채권의 장부를 조작하는 등 내부통제를 무력화하는 방안을 사용하였으나, 외부감사인의 채권채무조회서 조회과정에서 발각되었다.

마찬가지로 2022년 우리은행 횡령 사건이 발생하였다. 기업개선부 직원이 약 614억원을 횡령하였으며, 이는 2010년 이란의 가전업체 엔텍합이 대우일렉트로닉스 인수 우선협상대상자가 되며 지급한 금액이었다. 횡령 금액은 주로 파생상품에 투자한 후 손실을 본 것으로 나타났으며, 자금이 철저하게 통제되는 대형은행에서 발생한 횡령 사건으로 충격을 주었다. 주요 원인으로는 순환보직의 미실시, 실물계좌 미확인 등 내부통제제도의 취약점 때문인 것으로 파악된다.

이상의 최근 발생한 일련의 주요 횡령 사건을 살펴보면, 전반적으로 내부통제제도의 무력화에서 그 원인을 찾을 수 있다. 2018년 新외감법의 개정으로 인해 내부회계관리제도의 인증강화 등 회계 관련 규제가 지속적으로 강화되는 시기에 횡령 사건이 연속하여 발생하면서 현행 내부회계관리제도의 규제의 방향성에 대한 재논의가 필요하다는 의견이 대두되고 있다. 본 연구에서는 엄밀한 실증분석 모형을 바탕으로 내부회계관리제도의 인증수준 강화가 기업의 횡령‧배임과 어떠한 관계가 있는지 직접적으로 살펴봄으로써, 최근의 횡령 사건 발생과 내부회계관리제도 개혁에 대한 논의에 기여하고자 한다.

Ⅲ. 국내외 내부회계관리제도 인증 현황

1. 국내의 내부회계관리제도 현황

가. 내부회계관리제도 도입 연혁

국내의 내부회계관리제도는 1997년 IMF 외환위기를 계기로, 회계투명성 개선을 위한 회계제도 개혁방안으로 도입되었다. 이후 2001년 기업 구조조정촉진법에 포함되었다가 2003년 미국의 Sarbanes-Oxley Act(이하 SOX법)를 참고하여 외감법으로 내부회계관리제도에 관한 규정이 이관되어 영구적으로 법제화된 바 있다. 특히, 외감법으로 이관되면서 내부회계관리제도에 대한 인증수준은 외부감사인이 대표이사의 운영실태보고서에 대하여 ‘검토의견’을 제시하도록 하여 최초로 외부감사인의 의견 표명을 요구한 바 있다(외감법 제2조의3).

선행연구에서는 지속적으로 경영진이 자체 점검‧작성한 운영실태보고서를 외부감사인이 ‘검토’하는 절차의 내재적 한계를 지적한 바 있다. 신현걸(2007)은 기업회계기준의 위배로 비적정 감사의견을 받은 기업일지라도 내부회계관리제도 검토 단계에서 회계처리와 관련한 중요한 취약점의 발견이 어렵다는 점을 주장하였다. 이성욱 외(2010)는 감사인이 취약점을 발견하여 관련 검토의견을 표명한 경우에도 경영진이 이를 즉각 시정하지 않아 차기의 횡령 발생 빈도가 높게 관측된다는 점을 확인하였다. 또한 전반적인 재무보고품질 개선효과 역시 불확실하거나 제한적 상황에서만 관측가능하다는 다수의 선행연구 역시 존재한다(최종서‧공경태, 2012; 최준혁‧허익구, 2016).

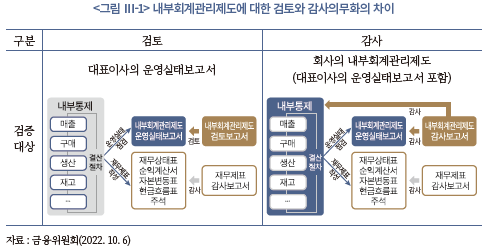

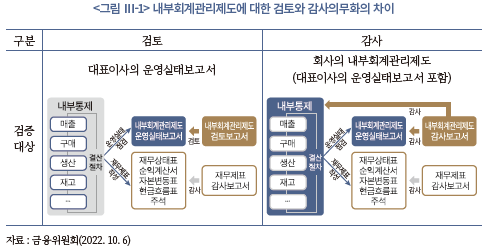

이에 2017년 10월에 이루어진 新외감법의 개정에 따라 내부회계관리제도에 대해 외부감사인의 의견 표명을 강화하는 개정안이 공포되었다. 이 개정안에 따라 자산총액 2조원 이상 유가증권시장 및 코스닥시장 상장법인을 대상으로 2019년부터 내부회계관리제도에 대한 외부감사인의 감사의견 표명 제도가 시행되었으며, 외부감사인의 의견 표명은 자산규모에 따라 순차적으로 도입되었다.8) 과거 검토의견 표명에 비해 보다 강화된 방식으로 기존의 대표이사의 운영실태보고서에 대한 검토의견의 표명이 아닌 기업의 내부회계관리제도 자체에 대한 인증을 목적으로 적극적 확신을 부여하는 방향으로 개정이 이루어졌다. 이러한 개정은 크게 1) 외부감사인의 검증대상이 기존의 경영진이 자체 점검‧작성한 운영실태보고서에서 경영활동 전반(예: 구매‧생산‧매출 등)의 실질적인 내부통제 설계와 운영으로 확대되었다는 점과 2) 외부감사인의 검증절차가 기존의 업무 담당자와의 질의응답에서 주요 통제활동의 직접 관찰 및 재수행으로 고도화되었다는 특징이 있다. 이러한 新외감법의 개정에 따라 내부회계관리제도 설계 및 운영 개념체계(내부회계관리제도 개념체계)와 내부회계관리제도 평가 및 보고 모범규준(내부회계관리제도 모범규준)이 2018년과 2021년에 개정 및 공표되었다. 아래 <그림 Ⅲ-1>에서는 내부회계관리제도에 대한 검토의견 표명과 감사의무화의 차이에 대해 요약하였다.

한편, 중소기업의 경우 내부회계관리제도의 감사 도입으로 인해 감사보수가 증가하고 이에 따라 수익성이 상대적으로 열악한 소규모 기업의 회계부담이 가중될 우려가 존재한다.9) 한국거래소의 내부회계관리제도운영위원회에서도 자산규모 1천억원을 기준으로 내부회계관리제도 운영능력에 유의미한 차이가 있다는 점을 제시한 바 있다.10) 이에 금융위원회에서는 중소기업의 경우, 내부회계관리제도 인증수준 상향의 이행비용이 편익을 초과한다는 의견을 고려하여 자산총액 1천억원 미만 소규모 상장사의 경우 내부회계관리제도의 외부감사를 면제하고 인증수준을 현행 검토로 유지하는 방안을 발표한 바 있다.11)12)

나. 현행 내부회계관리제도 평가 및 감사체계

국내의 내부회계관리제도 평가 및 감사체계는 크게 3단계로 구성되어 있다. 먼저, 대표자 및 내부회계관리자의 운영실태 평가가 이루어진다(외감법 제8조 제4항). 대표자 및 내부회계관리자는 회사의 내부회계제도 운영실태 점검결과, 취약점 및 시정조치 계획‧결과 등을 내부회계관리제도 운영실태보고서에 포함하여 보고하여야 한다. 이 점검절차에는 내부회계관리제도의 설계와 운영, 상시‧정기 점검체계, 효과성 점검 등의 객관적 지표 등을 포함하여야 하며, 내부회계관리제도에 대한 최종의견을 제시하여야 한다.

다음으로, 회사의 감사 혹은 감사위원회의 내부회계관리제도 평가가 이루어진다(외감법 제8조 제5항). 감사 혹은 감사위원회는 내부회계관리제도를 평가함에 있어 경영진의 부당한 개입이 없는지 확인하여야 하며, 내부회계관리규정의 실질적 운영 및 운영실태 보고의 기준과 절차 준수 여부 등을 평가하여 매년 주주총회 1주일 전 이사회에 대면보고하여야 한다.

마지막 절차는 외부감사인의 감사의견 표명이다(외감법 제8조 제6항 및 제7항). 외부감사인은 회사가 보고한 내부회계관리제도 운영실태보고서를 포함한 내부회계관리제도 전반에 대해 직접적 검증의 방식으로 인증절차를 수행하고 이에 대하여 감사의견을 제시하여야 한다.

이러한 3단계의 평가 및 감사체계는 후술하는 미국, 일본 등의 내부회계관리제도 평가 및 감사체계에 비해 보다 강화된 체계로 볼 수 있으며, 효과적으로 운영된다면 내부통제제도의 무력화를 어느 정도 예방할 수 있을 것으로 기대된다(김영태, 1995; 배한수‧권성국, 2015; 최성호‧김문태, 2017).

다. 내부회계관리제도 감사 및 검토의견 현황

내부회계관리제도에 대한 감사의견 표명 혹은 검토의견 제시가 이루어지는 경우, 내부회계관리제도를 효과적으로 설계하지 못한 기업에 대해 비적정의견이 나타날 수 있다. 본 절에서는 내부회계관리제도상 비적정의견을 받은 기업의 중요한 취약점의 사유 및 비중에 대해 살펴보고자 한다.

국내의 내부회계관리제도 비적정의견 기업의 비중은 후술하는 미국의 경우에 비해 상대적으로 낮은 것으로 파악된다. 2005년 내부회계관리제도에 대한 검토의견 표명상 비적정의견 기업의 비중은 3.6%였으나, 2014년 기준 0.9%까지 낮아진 바 있다. 또한 2019년 자산규모 2조원 이상 기업을 대상으로 내부회계관리제도에 대한 감사의견 표명이 도입되었음에도 불구하고 감사의견상 비적정기업은 2.5%로 미국의 내부회계관리제도에 대한 감사의견 도입 첫해(2004년)의 16.2%에 비해 지나치게 낮은 것으로 파악된다(삼정KPMG, 2022). 더욱이 2020년 자산규모 5천억원 이상 상장기업으로 감사대상이 확대되었음에도 불구하고, 비적정의견 기업의 비중은 오히려 1.4%로 감소한 바 있다.

2020년 기준 내부회계관리제도상 중요한 취약점의 사유 및 그에 따른 비중을 살펴보면 내부회계관리제도 자체의 구축과 운영 부실로 인한 ‘범위제한’(18.3%)과 특수관계자와의 자금거래에 대한 통제 미비 등으로 인한 ‘자금 통제 미비’(12.4%) 사례가 많다. ‘범위 제한’이란 외감법이 정한 내부회계관리제도 미구축, 내부회계관리제도 운영실태 평가 미수행이나 평가보고서 미제출, 감사에서 요구하는 증빙이나 자료가 불충분했거나 부적절하게 제공되는 경우를 의미한다. ‘자금 통제 미비’의 경우 자금 대여나 지급거래가 정해진 절차에 따른 적정성 검토 없이 이루어지는 경우를 말하며, 비경상적이고 이례적인 자금거래가 집행되는 과정에서 이사회 등의 승인절차 없이 불투명한 방식으로 처리되는 경우를 포함한다. 특히, 최근 발생한 일련의 횡령 사건이 불투명한 자금거래 집행에서 이루어진 것을 감안하면 ‘자금 통제 미비’가 중요한 취약점 사유로서 높은 비중을 차지한다는 것은 주목할 만하다.

라. 내부회계관리제도 감사의무화 관련 선행연구 검토

현재까지의 내부회계관리제도 감사의무화 관련 선행연구는 주로 이익조정 등 회계정보품질 측면에서 접근하고 있다. 윤회 외(2022)는 2019년 내부회계관리제도에 대한 감사도입으로 인해 일부 기업에서 이익조정 억제 효과가 있으나, 전반적으로는 유의한 영향을 미치지 않는다는 점을 주장하였다. 비슷한 맥락에서 김태중 외(2021) 역시 내부회계관리제도 감사의무화가 재무제표 상의 감사품질에 별다른 영향을 미치지 않는다는 점을 확인하였다. 이와는 달리 구본승‧안성희(2021)는 내부회계관리제도 전담인력이 있고, 전담인력 내 공인회계사 등 전문가가 존재하는 경우 재무보고품질에 유의한 향상 효과가 있다는 점을 주장하였다. 이는 비단 내부회계관리제도의 감사의무화 뿐만 아니라 내부회계관리제도를 운영하는 조직의 적격성과 객관성이 중요한 요소라는 점을 보여준다고 할 것이다.

반면, 강민지‧배성호(2022)는 외부감사인의 감사노력 측면에서 내부회계관리제도 감사의무화에 따라 감사보수와 감사시간이 유의미하게 증가한다는 점을 제시하였다. 해당 연구는 회사가 아닌 감사인 측면에서의 효익과 비용을 분석하였다는 측면에서 의의가 있다.

비록 직접적으로 내부회계관리제도의 감사의무화를 다루지는 않았지만, 선행연구에서는 내부통제활동이 기업의 횡령·배임과 관련이 있다는 점을 제시하고 있다. 김영태(1995)는 임직원의 부정을 효율적으로 발견하고 방지하기 위핸 내부감사인을 비롯한 내부통제제도의 역할에 대해 논의하고 있으며, 배한수‧권성국(2015)은 내부회계관리제도 담당인력의 특성이 기업 내 자산횡령 발생에 미치는 영향에 대해 실증적으로 분석하였다. 또한 최성호‧김문태(2017)는 내부회계관리제도의 효율적 운영에 따라 경영진의 특권적 소비행태에 해당하는 접대비 지출이 어떻게 달라지는지 실증적으로 분석하여 내부회계관리제도가 임직원의 부당행위 및 위법과 어떠한 관계가 있는지 조명하였다.

본 연구에서는 기존의 연구와 달리 내부회계관리제도의 감사의무화가 기업의 횡령‧배임에 영향을 미치는지를 직접적 검증의 방식으로 분석하여 기존의 연구를 확장하고, 내부회계관리제도의 감사의무화가 지닌 효익에 대한 논의에 기여하고자 한다.

2. 주요국의 내부회계관리제도 현황

가. 미국의 내부회계관리제도 현황 및 관련 선행연구

미국의 경우, 2000년대 초 발생한 Enron, Worldcom 등 일련의 회계부정 사태에 따라 기업의 회계정보 및 내부통제제도의 신뢰성에 대해 심각한 우려가 제기되었다. 이에 미국 연방의회에서는 2002년 SOX법을 제정하고, 2004년 11월 15일 이후 종료되는 사업연도부터 내부회계관리제도에 이를 적용하고 있다. SOX법 중 내부회계관리제도와 직접적으로 관련된 규정은 Section 302, 404(a) 및 404(b)를 들 수 있다. Section 302(재무보고에 대한 책임)에서는 경영진(CEO 및 CFO)에 대해 재무보고 목적 내부통제를 포함하여 재무제표의 적정한 작성에 책임을 부여하고 있다. Section 404(a)는 그 책임을 보다 구체화한 규정으로 상장회사의 경영진이 재무보고 내부통제의 유효성을 평가하고, 그 결과를 내부통제보고서 등의 형태로 사업보고서 등에 첨부하여 보고하여야 하는 의무를 규정하고 있다. Section 404(b)는 회사가 작성한 내부통제보고서 등에 대하여 외부감사인이 감사의견을 표명하도록 규정하고 있는데, 이는 재무제표에 대한 회계감사와는 별도로 이루어진다.

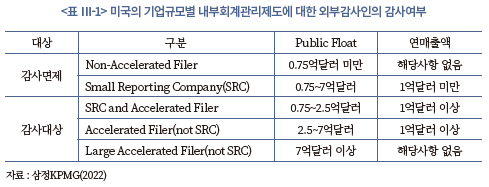

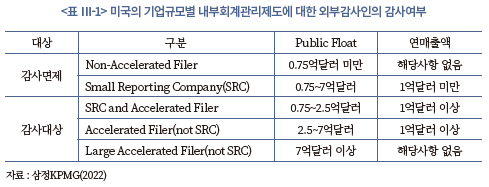

내부회계관리제도에 대한 외부감사인의 감사는 2004년 도입되었으나, 이행비용과 감사에 따른 편익에 따라 감사대상과 그 면제범위에 대해 지속적인 제도상의 변화가 일어나고 있다. 특별히 미국 증권거래위원회(Securities and Exchange Commission: SEC)에서는 기업규모별로 내부회계관리제도에 대한 외부감사인의 감사의무를 달리 규정하고 있다. <표 Ⅲ-1>에서는 미국의 기업규모별 내부회계관리제도에 대한 외부감사인의 감사여부를 도식화하였다.

먼저, 시가총액에 준하는 개념인 유통주식(Public Float)을 기준으로 0.75억달러 미만의 Non-Accelerated Filer의 경우 Section 404(b)에 따른 내부회계관리제도의 감사의무가 면제되고 있으며, 유통주식이 0.75억달러를 초과하더라도 7억달러에 미달하고, 연 매출액이 1억달러에 미치지 못하는 소규모보고기업(Smaller reporting company)의 경우에도 2020년 4월 이루어진 개정으로 Section 404(b)에 대한 감사의무를 면제받고 있다. 이상의 내부회계관리제도 관련 규정을 살펴볼 때, 미국의 내부회계관리제도는 크게 경영진의 평가보고서(Section 404(a))와 외부감사인의 감사의견 표명(Section 404(b))이라는 2단계 구조를 바탕으로 이루어져 있음을 알 수 있다.

2004년 내부회계관리제도에 대한 외부감사인의 감사의견 표명제도가 도입된 이래, 매년 약 6% 정도의 기업이 내부회계관리제도 관련 비적정의견을 받고 있는 것으로 나타났다(삼정KPMG, 2022). 다만, 2020년 소규모보고기업에 대한 감사면제가 도입되면서 3,064개의 상대적으로 규모가 작은 기업이 내부회계관리제도에 대한 외부감사대상에서 제외되었고, 이에 따라 비적정의견을 받은 기업의 비중이 4.6%로 크게 감소하였다. 2020년 기준 내부회계관리제도 비적정의견의 주요 사유로는 ‘당기 감사과정에서의 재무제표 수정’(22.8%)과 ‘회계인력 및 전문성 부족’(19.1%) 등인 것으로 나타났다. 반면, 중요한 취약점 사유 중 ‘자금 통제 미비’는 1건(0.3%)에 불과해 미국의 내부회계관리제도는 한국에 비해 상대적으로 자금 관련 내부통제에 잘 대응하고 있는 것으로 보인다.

내부회계관리제도에 대한 외부감사인의 감사의견 표명과는 별개로, 미국은 내부회계관리제도의 효과적 운영을 위한 정책적 인센티브를 제공하고 있다. 특히, 합리적으로 내부통제 절차 및 시스템을 갖추었음에도 직원의 위법행위를 방지할 수 없었던 경우에 감독자 책임에 대한 예외요건을 적용하여 책임에 대한 면책이 가능하다 (예: 증권거래법 15(b)(4)(E)). 이러한 면책요건에 의거하여 민사상 제재금의 감면이 가능한 구조이며, 이는 비단 내부회계관리제도의 설계 외에도 효과적 운영을 위한 인센티브를 제공하고 있는 미국의 내부회계관리제도의 특징 중 하나라고 할 것이다.

뿐만 아니라, 미국은 내부고발에 대한 포상금 제도를 통해 내부회계관리제도의 효과적 운영을 유도하고 있다. 회계부정에 대한 과징금의 10~30%를 포상금으로 지급하는 미국의 내부고발 포상금 지급제도는 내부고발자에게 다양한 유인책을 제공할 뿐만 아니라, 경영진 역시 내부회계관리제도의 효과적 설계에 많은 관심을 갖도록 유도하고 있다. 이러한 강력한 포상금 제도의 시행은 회계부정의 발생가능성을 낮추는 것으로 나타나고 있다

(Berger & Lee 2022).

미국의 내부회계관리제도 관련 선행연구는 크게 내부회계관리제도 감사의무화에 따라 중요한 취약점을 보고하는 기업의 특성, 내부회계관리제도상 중요한 취약점이 보고된 기업의 추후 의사결정, 소규모기업을 대상으로 내부회계관리제도 감사 면제를 도입한 효과에 대한 연구를 찾아볼 수 있다. 다만, 내부회계관리제도가 실제 기업의 횡령‧배임을 방지하는 효과가 있는지에 대한 연구는 상대적으로 부족한 실정이다.

내부회계관리제도상 중요한 취약점을 보고하는 기업은 평균적으로 규모가 작고, 당기순손실을 기록하는 경우가 많은 것으로 나타났다 (Ashbaugh-Skaife et al., 2007; Doyle et al., 2007). 또한 가족기업의 경우 내부회계관리제도상 중요한 취약점을 보고할 가능성이 높으며, 이는 가족기업에 대한 외부 모니터링이 취약하기 때문인 것으로 나타났다(Bardhan et al., 2015). 한편, 감사위원회의 높은 회의 빈도는 내부회계 관리제도상 중요한 취약점의 사후 적발 가능성을 높이는 한편, 감사위원회상 회계‧재무 전문성은 실효적인 관리‧감독 활동으로 취약요인을 사전에 보완 및 예방한다는 연구가 존재한다(Krishnan & Visvanathan 2007; Hoitash et al., 2009).

본 연구와 비교적 관련이 있는 연구는 Donelson et al.(2017)의 연구이다. 이 연구에서는 내부회계관리제도상 중요한 취약점을 보고한 기업의 경우 미래 횡령 사건이 발생할 가능성이 높다는 점을 제시하여, 내부회계관리제도를 적절히 운영하는 것이 횡령‧배임의 예방에 효과적인 방법이라는 점을 주장하였다. 그 외에도 내부회계관리제도가 취약한 기업의 경우, 재무보고품질이 낮고(Dolye et al., 2007; Ashbaugh et al., 2008), 재무제표를 재작성할 가능성이 높다는 연구도 존재한다(Myllymaki, 2014). 비단 재무보고 측면 외에도, 내부회계관리제도상 중요한 취약점을 보고한 기업은 모니터링이 약화되어 비효율적 투자를 할 가능성이 높고(Cheng et al., 2013), 자기자본비용 및 타인자본비용 모두 증가하는 것으로 나타나고 있다(El-Mahdy & Park, 2014; Gao & Jia, 2017).

한편, 소규모기업을 대상으로 한 이행비용 부담 관련 연구에서는 내부회계관리제도에 대한 외부감사에 따라 소규모기업의 경우 과도한 이행부담이 발생하여 이를 회피하기 위해 자진상장폐지를 결정할 가능성이 높다고 주장한다(Cutler, 2006). 또한, 소규모기업의 경우 내부회계관리제도의 감사가 감사보수의 급격한 상승을 불러오고(Eldridge & Kealey, 2005; Krishnan et al., 2020), 자본시장 역시 소규모기업의 내부회계관리제도 감사의무화에 대해 부정적으로 반응하는 것으로 나타났다(Chhaochharia & Grinstein, 2007).

이상의 연구를 종합하면, 내부회계관리제도에 대한 감사의무화는 기업의 내부통제제도상 중요한 취약점 발견에 유의미한 역할을 하는 것으로 보이나, 소규모기업의 과도한 이행비용 역시 충분히 고려해야 하는 것으로 나타났다.

나. 일본의 내부회계관리제도 현황 및 선행연구

일본의 내부회계관리제도 역시 1990년대와 2000년대 발생한 다양한 회계부정 및 횡령 사건을 계기로 본격적으로 제도화가 이루어졌다. 특히, 2005년 화장품 회사인 가네보(Kanebo)의 분식회계 결산이 발각되고, 2006년 라이브도어(Livedoor)의 회계부정 사건이 발생하면서 내부회계관리제도를 법제화해야 한다는 움직임이 구체적으로 논의되었다. 일본의 내부회계관리제도 관련 법적기준은 회사법과 금융상품거래법에 이원화되어 규정되어 있다는 특징이 있다.

회사법에서는 미국의 제도를 토대로 하여 회사업무의 효과성과 효율성 제고, 재무보고의 신뢰성 제고, 사업활동에 관한 법령준수, 그리고 회사 자산의 보전을 목적으로 하여 모든 회사에 대해 내부통제제도 구축을 의무화하고 있다. 이러한 회사법상 내부통제제도 관련 규정의 특징은 추상적이던 이사의 선관주의 의무에 포함된 내부통제제도의 구축의무를 법적 항목으로 규정한 것이라 할 수 있다(이효경, 2008). 다만, 이러한 구축의무를 소홀히 하더라도 임직원 및 회사에 대한 금전적 제재를 부과하는 규정은 미비한 것으로 알려져 있다(이효경, 2017).

금융상품거래법에서는 보다 구체적으로 재무보고 목적 내부통제에 대한 경영자의 평가와 감사인의 감사규정을 마련하고 있다. 소위 J-SOX법이라고 불리우는 이 규정은 상장기업의 재무보고 신뢰 제고를 목표로 하여 재무보고 중심의 내부통제보고서 제출의무를 규정하고 있다. 한편, 이러한 내부통제보고서는 외부회계감사인의 감사를 받아야 하는 것으로 규정되어 있는데(금융상품거래법 제193조의2 제2항), 미국의 내부회계관리제도에서 규정하고 있는 회계감사인의 감사와는 상당한 차이가 존재한다.

첫째, 회사의 재무보고 목적 내부통제에 대하여 직접적인 보고의무 및 감사의견을 요구하는 미국의 규정과는 달리, 회사의 내부통제보고서를 기반으로 회계감사인의 감사증명을 첨부하는 간접적인 형태를 취하고 있다. 회계감사인은 경영자가 제시한 내부통제보고서가 적정한지 여부에 대해서만 감사의견을 제시하도록 되어 있다. 이러한 점을 미루어볼 때, 한국과 미국의 내부회계관리제도에 비해 상당히 완화된 수준의 검증을 요구하는 것으로 해석할 수 있다.

일본의 내부통제제도 관련 선행연구에서는 내부통제제도 평가 및 감사의 도입과 관련하여 혼재된 결과를 제시하고 있다. 일부 연구에서는 기업이 재무보고 목적의 내부통제상 중요한 취약점을 공시한 경우 부정적인 초과수익률을 야기한다고 주장하는 반면(Nishizaki et al., 2014), 대부분의 선행연구에서는 중요한 취약점 공시에도 불구하고 유의미한 주가반응을 찾아볼 수 없었다고 해석하고 있다(Yazawa, 2010; Kawanish & Takeda, 2011).

종합하면, 일본의 내부통제 관련 제도는 직접적 검증방식의 감사가 아닌 간접적 방식의 감사의견 표명을 채택하고 있는데, 이러한 점이 투자자들의 반응과 관련하여 일관되지 않은 실증결과를 제시한 요인으로 보인다. 특히, 내부통제제도 관련 인증제도가 기업에게 이행부담으로 작용하는 점을 고려한 제도 설계로 재무보고품질 측면에서 유의미한 개선 효과를 달성하지 못한 것으로 판단된다.

다. 소결

이상의 국내 및 미국과 일본의 현행 내부회계관리제도 평가 및 감사체계를 종합하면, 한국의 내부회계관리제도 평가 및 감사체계는 크게 3단계로 구성되며, 이는 형식적 이행 요건 측면에서 미국이나 일본 등 해외 주요국과 비교하더라도 충실한 체계로 평가할 수 있다.

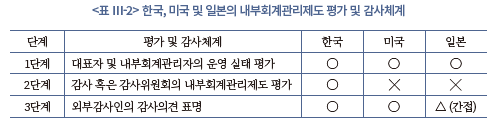

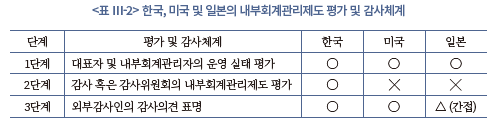

<표 Ⅲ-2>에서 살펴볼 수 있는 것과 같이, 한국은 대표자 및 내부회계관리자의 운영실태 평가(1단계), 감사 혹은 감사위원회의 내부회계관리제도 평가(2단계) 및 외부감사인의 감사의견 표명(3단계)으로 내부회계관리제도에 대한 평가 및 감사체계를 유지하고 있다. 반면 미국의 경우, 감사 혹은 감사위원회의 내부회계관리제도 평가(2단계)가 생략된 구조이며, 일본의 경우에는 3단계에 해당하는 외부감사인의 감사의견 표명마저 직접적 검증의 방식이 아닌 간접적 검증에 해당하는 구조를 지니고 있다.

이러한 충실한 평가 및 감사체계에도 불구하고 내부회계관리제도상 중요한 취약점의 사유 중 특수관계자와의 자금거래에 대한 통제 미비 등으로 인한 ‘자금 통제 미비’ 사례가 많다는 점은 그 제도가 효과적으로 운영되고 있는지에 대한 논의가 필요하다고 할 것이다. 따라서, 본 연구보고서는 현행 내부회계관리제도가 기업의 횡령 및 배임을 효과적으로 예방하고 있는지 보다 엄밀한 실증분석 모형을 통해 추가적으로 확인해보고자 한다.

Ⅳ. 내부회계관리제도 감사의 횡령‧배임 예방효과

1. 논의배경

전술한 Ⅲ장의 논의 내용을 종합하면, 현행 우리나라의 내부회계관리제도는 평가 및 감사체계상 절차적 엄격성을 대폭 강화한 제도에 해당한다. 그럼에도 실제 운영 측면에 있어서는 Ⅱ장에서 살펴보았듯 기초적인 자금 통제부터 미비점이 발견되는 등 제도의 효과성에 대한 심층적인 검토가 필요한 상황으로 볼 수 있다. 특히, 내부회계관리제도의 인증수준 상향이 내부통제 고도화에 도움이 되는지는 기업‧회계업계 간 상당한 견해차를 보이는 가운데, 제도 무용론을 촉발한 일련의 횡령 사건에 대해 내부회계관리제도 감사의무화의 효과가 유의적이지 않다는 최근 학계의 연구 결과로 제도 개혁의 적정성에 관한 논란이 확산하는 양상이다.13)

이에 본 장에서는 내부통제 강화를 목표로 한 제도 개혁이 본래의 취지 달성에 유용한지 세부적인 검증을 수행하고자 한다. 구체적으로 2절에서 내부회계관리제도 감사의무화 이후 횡령‧배임 사건의 추이를 점검하여 최근 연이어 발생한 대규모 자금 부정 사례들이 상장기업 전반의 특성을 대표하는 현상인지를 점검한다. 3절에서는 보다 엄밀한 검증을 수행하기 위해 횡령‧배임에 관한 제도 개혁의 영향을 실증 분석하는 통계적 모형을 설정하며, 관련 모형을 토대로 4절에서 내부회계관리제도의 감사의무화 효과를 검증한다. 특히, 일련의 논란이 제도의 본질적 한계로 인해 촉발한 것인지, 형식적 운영에 기인한 영향이 큰지 실증근거에 기반한 평가를 수행하여 최근 불거진 제도의 실효성 논란에 대한 시사점을 도출하고 후속 논의를 위한 기초자료를 제공한다.

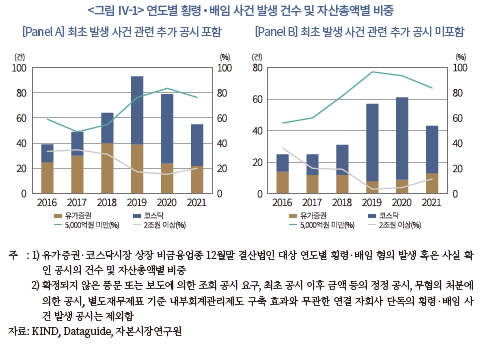

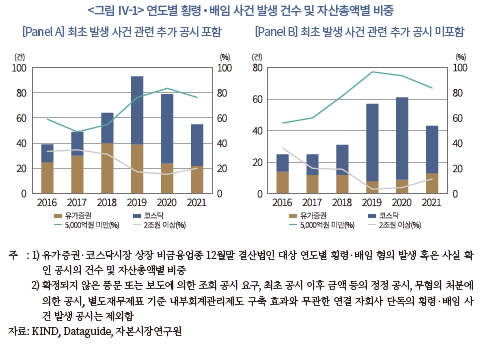

2. 횡령‧배임 발생 추이

본 절에서는 유가증권 및 코스닥시장 상장기업을 대상으로 시장 전반의 횡령‧배임 사건 발생 추이를 살펴본다. 내부회계관리제도의 감사는 2019년 자산총액 2조원 이상 기업부터 의무화하여 2020년 자산총액 5천억원 이상 기업으로 확대 적용하였는데 <그림 Ⅳ-1>에서 연도별 횡령‧배임 공시 추이를 살펴본 결과, 내부회계관리제도의 감사를 순차적으로 의무화한 2019년부터 횡령‧배임 건수의 추세적인 감소가 확인된다.14) 구체적으로 Panel A를 살펴보면, 2019년 93건과 비교하여 2020년에는 79건으로 횡령‧배임 건수가 약 15.1% 감소하였으며, 2021년에는 55건으로 2020년 대비 약 30.4% 감소한 것으로 나타났다.

특히, 2019년도부터 최초 의무화 대상에 해당하는 자산총액 2조원 이상 상장기업에서 그 하락 추이가 두드러진 것으로 확인된다. 전체 횡령‧배임 발생 건수에서 자산총액 2조원 이상의 기업이 차지하는 비중은 2019년도를 기점으로 47% 감소한 반면, 표본 기간 내 감사의무화 대상에 포함되지 않은 자산총액 5천억원 미만의 기업이 차지하는 비중은 45% 증가한 것으로 확인된다. 한편, 횡령‧배임은 최초 사건 적발 이후 관련 부정의 전모를 확인하는 과정에서 그 규모가 증가하는 범죄적 특성이 있는데, 이 경우 정정 공시의 형태로 추가 공시가 이루어지는바, 이를 포함한 추이를 Panel B에서 살펴본 결과 역시 질적으로 유사함이 확인된다. 자산총액 2조원 이상 기업 비중은 73% 감소한 가운데, 자산총액 5천억원 미만 기업 비중은 41% 증가하는 것으로 나타났다.

이상 내부회계관리제도 감사의무화 대상 기업을 중심으로 횡령‧배임의 감소 추이가 확연하게 나타난 결과는 최근 연이어 발생하고 있는 대규모 자금 부정 사례에도 불구하고, 이를 상장기업 전반에 팽배한 현상으로 확대해석하는 것에 상당한 주의가 필요함을 시사한다. 개별적인 내부통제 실패 사안의 중대성과는 별론으로 제도 전반의 실효성에 대한 평가 측면에서는 오히려 내부회계관리제도의 인증수준 상향이 기업의 내부통제를 고도화하여 부정의 발생을 억제하는 효과가 있을 가능성도 존재한다.

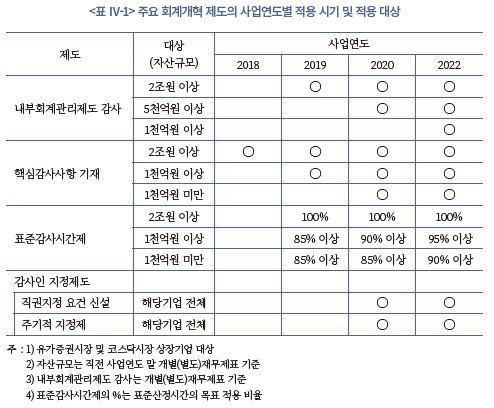

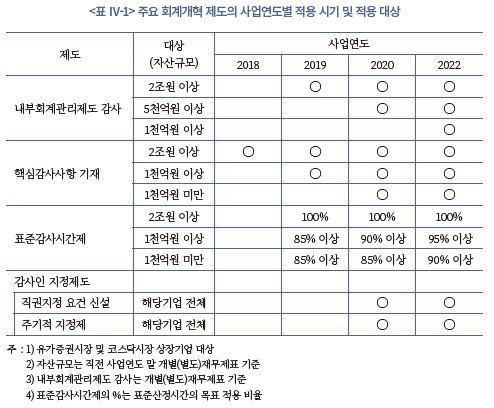

단, 2018년 新외감법의 시행 이후 회계투명성을 높이기 위한 다수의 제도가 유사한 시기에 집중적으로 시행됨에 따라(<표 Ⅳ-1> 참조), 기업별 횡령‧배임의 발생 및 적발 추이에는 다양한 제도들이 동시에 영향을 미치고 있을 가능성을 배제하기 어렵다. 이를 고려한 연구모형에 기초하여 내부회계관리제도 감사 효과에 관한 보다 정교한 실증분석이 필요할 것이다.

3. 연구설계

본 절에서는 내부회계관리제도의 감사의무화 효과에 관하여 명확한 결론을 도출하기 위해 회귀분석 모형을 설정한다. 내부회계관리제도 감사는 제도의 단계적 도입으로 처치 시기와 처치 집단이 복수가 되는 특성이 있으며, 다수의 회계 개혁 제도가 유사한 시기에 집중적으로 도입된바 관련 제도적 영향에 반응하는 여러 기업 특성 요인과 시기적 특성 요인을 통제한 연구설계가 필요할 것으로 판단한다. 특히, 2020년부터 외부감사인의 직권지정 요건을 확대 적용하고 주기적 지정제를 시행함에 따라 외부감사인에 의한 부정의 적발 통제가 강화되었을 가능성이 높다. 이는 내부회계관리제도의 부정 방지 효과를 실증하는 측면에서 보수적인 방향으로 결과의 편의를 유발할 가능성이 크나, 횡령‧배임의 발생 및 적발 추이에 영향을 미칠 수 있는 여타 제도적 영향을 충실히 고려한 접근 방법이 중요할 것이다.

가. 순차적 이중차분 회귀분석 모형

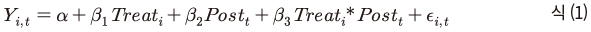

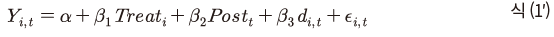

통상적으로 처치 시기 및 처치 집단이 단순한 경우에는 아래 식 (1)과 같이 단순형 이중차분(difference-in-differences) 모형을 활용한 처치효과 분석이 가능하다. 단일 시점에 제도를 시행하면서, 제도의 적용 대상이 단일 집단일 때, 이 처치 집단(Treat=1)의 처치 이후(Post=1) 효과를 포착하는 것이다.

이 처치 집단(Treat=1)의 처치 이후(Post=1) 효과를 포착하는 것이다.

식 (1)에서 핵심 처치변수  를

를  로 정의하자.

로 정의하자.  는

는  과 이 동시에 성립할 때만 1을 취하고, 나머지 경우에는 0을 취하는 더미변수이다. 이 경우 식 (1)은 아래 식 (1′)과 같이 다시 쓸 수 있다.

과 이 동시에 성립할 때만 1을 취하고, 나머지 경우에는 0을 취하는 더미변수이다. 이 경우 식 (1)은 아래 식 (1′)과 같이 다시 쓸 수 있다.

식 (1′)에서도 여전히 처치효과는  이다.

이다.

제도의 순차적 시행에 따라 제도 시행 시기와 적용 대상 집단이 다기간‧다집단으로 확장하는 때에는 아래 식 (2)와 같이 기업‧연도의 이원고정효과(two-way fixed effects)를 고려하여 일반화한(generalized) 형태의 순차적 이중차분(staggered difference-in-differences) 회귀분석 모형이 적합하다(Roberts & Whited, 2013; Breuer & deHaan, 2023). 식 (2)는 식 (1′)을 다기간‧다집단으로 확장한 모형으로 이해할 수 있다.

식 (2)에서  는 기업 고정효과,

는 기업 고정효과,  는 연도 고정효과를 표시한다. 식 (2)와 같은 고정효과 패널모형에서 기업‧연도 내 변동(within variation)은 각각 기업 고정효과 및 연도 고정효과가 흡수하므로 식 (1′)의 절편

는 연도 고정효과를 표시한다. 식 (2)와 같은 고정효과 패널모형에서 기업‧연도 내 변동(within variation)은 각각 기업 고정효과 및 연도 고정효과가 흡수하므로 식 (1′)의 절편 , 처치집단

, 처치집단 , 처치 이후

, 처치 이후 를 의미하는 단독항은 생략되며,

를 의미하는 단독항은 생략되며,  이 여전히 처치효과를 포착한다.

이 여전히 처치효과를 포착한다.

내부회계관리제도 감사는 단계적 의무화 일정에 따라 2019년 자산총액 2조원 이상 기업부터 우선 적용하고, 2020년 자산총액 5천억원 이상 기업으로 확대 적용하였으므로, 다기간‧다집단을 대상으로 제도 시행 효과를 포착하는 순차적 이중차분 회귀분석 모형을 활용할 이점이 크다. 첫째, 전통적 이중차분 모형을 활용할 경우 제도의 우선 적용 대상과 후속 적용 대상을 별도의 하위 표본으로 구분하여야 함에 따라 통계적 검정력이 약화하는데, 순차적 이중차분 모형은 전체 표본을 활용하므로 검정력 약화의 가능성이 작다. 둘째, 순차적 이중차분 모형은 고정효과 패널모형 특성상 기업 혹은 연도 내에 일정하게 작용하는 생략변수(correlated omitted variables) 문제를 통제하는 데 효과적이다. 유사한 시기 여러 제도의 집중적 시행으로 인한 영향을 가능한 한 통제함으로써 기업 내 변동에 한정한 처치효과의 해석이 가능한 이점이 있다.

이에 본 보고서에서는 아래 식 (3)의 순차적 이중차분 회귀분석 모형을 기반으로 내부회계관리제도 인증수준의 상향이 기업의 횡령‧배임에 어떠한 변화를 가져왔는지를 검증하고자 한다.

여기서 Y는 종속변수로, 1) 횡령‧배임 여부의 더미변수(횡령배임), 또는 2) 횡령‧배임 금액에 해당한다.  는 제도 시행 효과를 포착하는 처치변수로서, 기업

는 제도 시행 효과를 포착하는 처치변수로서, 기업  가 연도

가 연도  에 감사 수준의 내부회계관리제도 인증을 받으면 1, 그렇지 않으면 0의 값을 부여한다.

에 감사 수준의 내부회계관리제도 인증을 받으면 1, 그렇지 않으면 0의 값을 부여한다.  는 시간 변동 변수이므로, 동일한 기업 가 연도에 따라 내부회계관리제도의 인증수준이 상향될 수도, 그렇지 않을 수도 있는 점을 반영한다.

는 시간 변동 변수이므로, 동일한 기업 가 연도에 따라 내부회계관리제도의 인증수준이 상향될 수도, 그렇지 않을 수도 있는 점을 반영한다.

통제변수 벡터로는(Ctrl) 횡령‧배임의 영향 요인으로 알려진 다양한 요소를 포함하고자 횡령‧배임에 관한 임직원의 기회 및 합리화 요인(Summers & Sweeney, 1998; Choo & Tan, 2007)을 대리하는 당좌비율, 총자산수익률, 영업현금흐름수익률, 매출액성장률, 수익률변동성, 총발생액 변수 등을 고려하였으며, 외부 통제 특성(Ettredge et al., 2008)을 대리하는 변수로 log(총자산), log(감사보수), log(감사시간), 대형회계법인, 감사의견비적정, 초도감사 여부 등을 포함하였다. 새로운 내부회계관리제도가 기업의 횡령‧배임 사건의 발생(횡령배임) 및 금액(횡령배임금액)을 감소시켰다면, 의 계수값

의 계수값  은 유의미한 음(-)의 값을 가질 것으로 예상한다.

은 유의미한 음(-)의 값을 가질 것으로 예상한다.

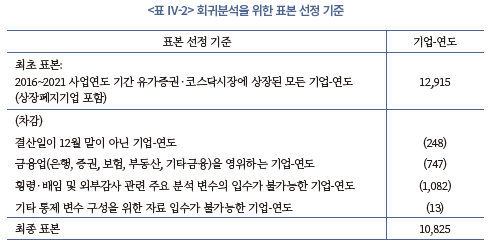

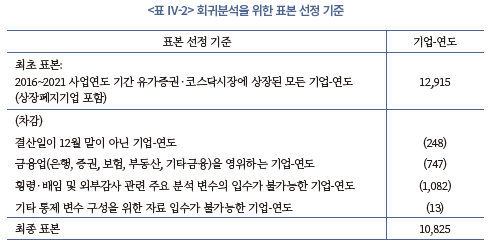

나. 표본 선정

본 연구의 표본은 2016년부터 2021년 회계연도 기간 한국거래소의 유가증권 및 코스닥시장에 상장된 비금융 기업을 대상으로 구성한다. 표본 기간은 내부회계관리제도 감사의무화 대상 기업이 의무화 연도 1~2년 전부터 관련 제도의 고도화 작업에 착수하고 이를 통해 내부통제 환경을 개선할 가능성을 고려하여 2016년을 표본의 시작 연도로 설정하였다. 분석 대상 기업은 제도적 영향 요인의 시기별 이질성을 완화하고 선행연구와의 비교가능성을 고려하여 12월말 결산 기업으로 한정하였다. TS-2000, DataGuide 등 활용 데이터베이스상 재무정보의 누락으로 주요 변수의 구성이 불가능한 기업-연도를 제외하였다. 횡령‧배임 및 외부감사 관련 주요 분석 변수의 구성이 가능한 표본은 10,838 기업-연도에 해당하며, 기타 통제 변수 구성이 가능한 최종 표본 수는 10,825 기업-연도에 해당한다(<표 Ⅳ-2> 참조).

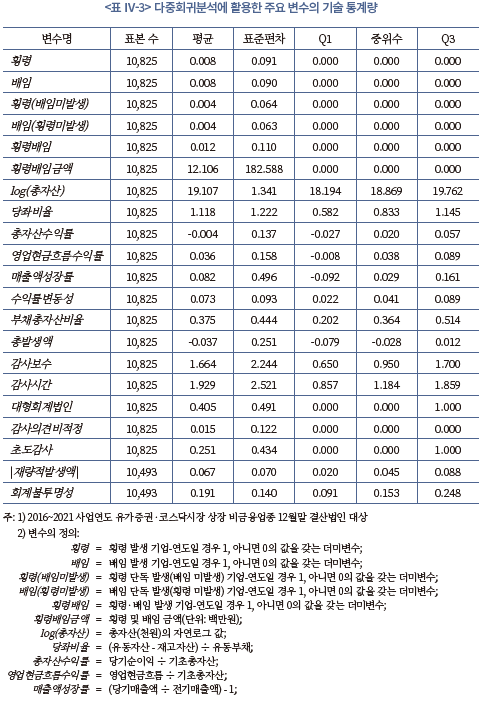

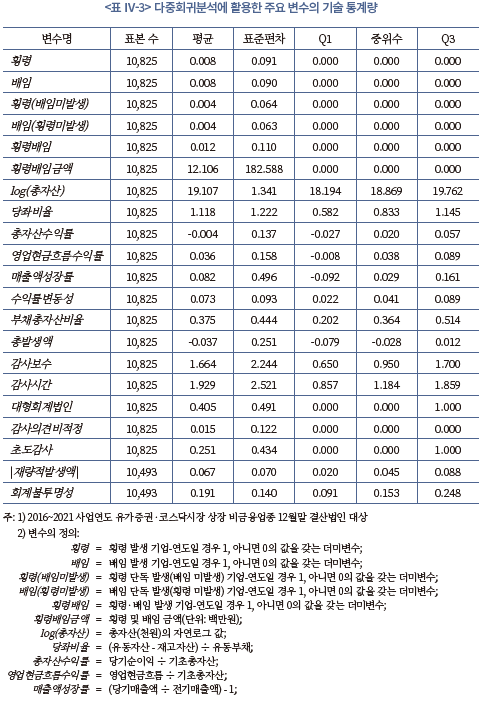

다. 기초통계량

최종 선정 표본을 토대로 다중회귀분석에 활용할 주요 변수의 기술통계량은 <표 Ⅳ-3>에서 제시한다. 전체 표본에서 횡령‧배임 사건이 차지하는 비중(횡령배임)은 0.012로 표본 내 133개의 기업-연도가 횡령‧배임 사건에 연루되어 업무상 횡령과 배임은 매우 극단적인 상황에서 발생하는 것으로 파악된다. 이중, 횡령만 단독으로 발생한 기업-연도는 44개, 배임만 단독으로 발생한 기업-연도는 43개, 횡령 및 배임이 동시에 발생한 기업-연도는 46개로 확인되어, 업무상 횡령은 독단적으로 발생하기보다 배임과 연관되어 발생하는 경향을 보여 경영진 수준에서의 내부통제 무력화 가능성이 예상된다. 극단값으로 인한 편의의 발생 가능성을 완화하고자 연속형 변수는 상‧하위 1% 수준에서 윈저화(winsorization)하였다.

4. 실증분석 결과

가. 횡령 통제

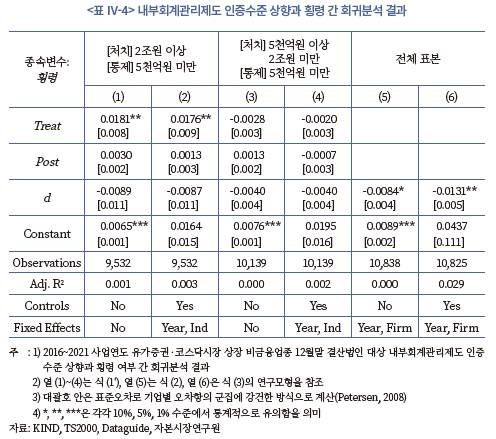

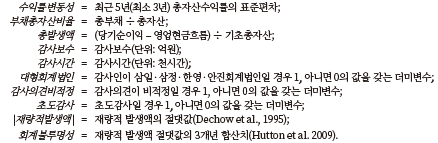

내부회계관리제도 감사의무화와 횡령 발생 공시 여부 간 다중회귀분석을 수행한 결과는 <표 Ⅳ-4>와 같다. 열 (1)과 열 (2)는 조기 처치 집단에 해당하는 자산총액 2조원 이상 기업의 처치효과를, 열 (3)과 열 (4)는 후속 처치 집단에 해당하는 자산총액 5천억원 이상 2조원 미만 기업의 처치효과를 별도의 하위 표본을 구성하여 살펴본 전통적 이중차분 모형 결과에 해당하며, 이는 기존 연구와의 비교 목적으로 수행한 분석 결과이다. 전술하였듯, 내부회계관리제도 감사는 2019년 자산총액 2조원 이상 기업부터 우선 적용하고 2020년 자산총액 5천억원 이상 기업으로 확대 적용하였으며, 제도 시행 시기를 전후로 회계투명성을 높이기 위한 다수의 제도가 집중적으로 시행된 실증분석 환경을 고려할 때, 기업‧연도의 이원고정효과를 고려하여 일반화한 형태의 순차적 이중차분 회귀분석 모형을 활용할 필요가 있다. 이에 열 (5)와 열 (6)에서 관련 결과를 제시한다.

분석 결과, 내부회계관리제도 감사의무화는 모형 설정(model specification)과 무관하게 횡령 발생과 음(-)의 관련성이 확인된다. 구체적으로 자산총액 2조원(5천억원) 이상 기업의 경우 인증수준을 검토에서 감사로 상향한 이후 평균적으로 횡령 발생이 0.89%p(0.4%p) 감소한 것으로 나타났다(<표 Ⅳ-4> 열 (1) 및 열 (3) 참조). 다만, 전통적 이중차분 모형을 활용한 것으로 추정되는 기존 학계의 분석 결과15)와 일관되게 통계적 유의성은 확인할 수 없었다(10% 유의수준).

단, 전체 표본을 대상으로 순차적 이중차분 모형을 활용한 결과에서는 인증수준 상향 시 횡령 발생이 0.84%p 감소한 것으로 나타나 조기‧후속 처치 집단의 평균 처치효과와 일관된 계수값을 보이는 가운데(<표 Ⅳ-4> 열 (5) 참조), 통계적 유의성 또한 확인할 수 있었다(10% 유의수준, 표준오차: 0.004). 특히, 횡령에 관한 임직원의 기회 유인과 합리화 유인, 외부감사인의 감사위험 대응 수준 등 관련 특성 요인을 추가 통제한 열 (6)의 결과에서도 횡령 억제 효과의 통계적 유의성이 유지됨을 확인하였다(5% 유의수준, 표준오차: 0.005). 모형 설정에 따라 통계적 유의성이 다르게 나타나는 이유는 표본 크기에 따른 검정력 차이의 영향으로 보인다.

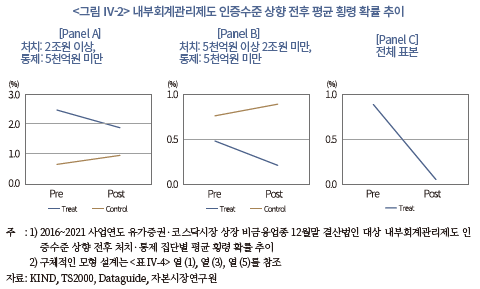

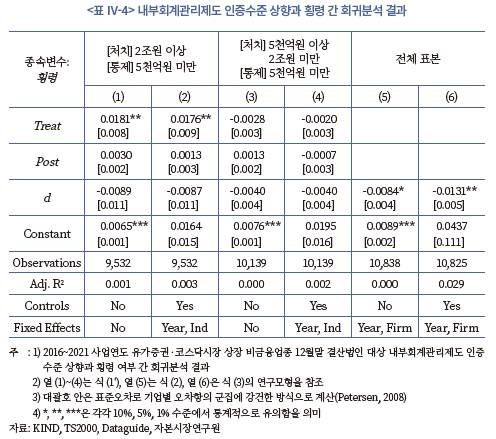

한편, 횡령 통제 효과의 경제적 규모를 가늠하고자 <그림 Ⅳ-2>에서 평균 횡령 확률 추이를 살펴본 결과, 자산총액 2조원(5천억원) 이상 기업은 감사의무화 이전 2.5%(0.5%) 수준에서 의무화 이후 1.9%(0.2%) 수준으로 횡령 발생 확률이 24%(56%) 감소한 것으로 나타나 경제적으로도 유의미한 억제 효과가 확인된다.

나. 배임 통제

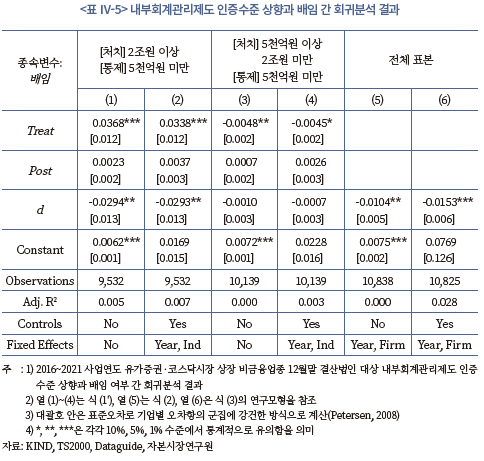

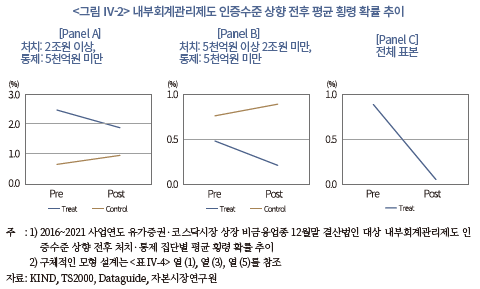

내부회계관리제도 감사의무화와 배임 발생 공시 여부 간 다중회귀분석을 수행한 결과는 <표 Ⅳ-5>와 같다. 분석 결과, 전술한 횡령 분석 결과와 유사하게 내부회계관리제도 감사의무화는 모형 설정(model specification)과 무관하게 배임 발생과 음(-)의 관련성이 확인된다. 구체적으로 자산총액 2조원(5천억원) 이상 기업의 경우 인증수준을 검토에서 감사로 상향한 이후 평균적으로 배임 발생이 2.94%p(0.1%p) 감소한 것으로 나타났다(<표 Ⅳ-5> 열 (1) 및 열 (3) 참조). 다만, 통계적 유의성은 자산총액 2조원 이상 기업에서만 확인할 수 있었다(5% 유의수준, 표준오차: 0.013).

전체 표본을 대상으로 순차적 이중차분 모형을 활용한 결과에서는 인증수준 상향 시 배임 발생이 1.04%p 감소한 것으로 나타나 조기‧후속 처치 집단의 평균 처치효과와 일관된 계수값을 보이는 가운데(<표 Ⅳ-5> 열 (5) 참조), 자산총액 2조원 이상의 조기 처치 집단과 유사한 수준에서 통계적 유의성 또한 확인되었다(5% 유의수준, 표준오차: 0.005). 횡령‧배임에 관한 기업 특성 요인을 추가 통제한 열 (6)의 결과에서도 배임 억제 효과의 통계적 유의성이 유지됨을 확인하였다(1% 유의수준, 표준오차: 0.006).

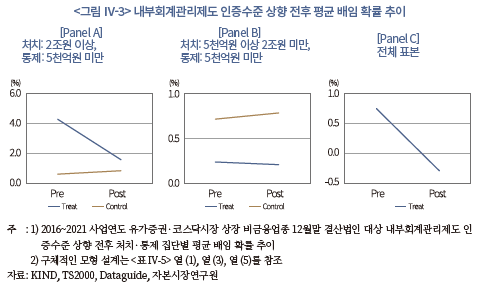

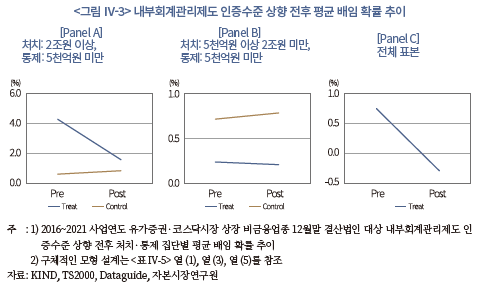

한편, 배임 통제 효과의 경제적 규모를 가늠하고자 <그림 Ⅳ-3>에서 평균 배임 확률 추이를 살펴본 결과, 자산총액 2조원(5천억원) 이상 기업은 감사의무화 이전 4.3%(0.2%) 수준에서 의무화 이후 1.6%(0.2%) 수준으로 배임 발생 확률이 63%(13%) 감소한 것으로 나타났다. 전반적으로 자산총액 2조원 이상 집단을 중심으로 통계적‧경제적으로 유의미한 배임 억제 효과가 관측된다.

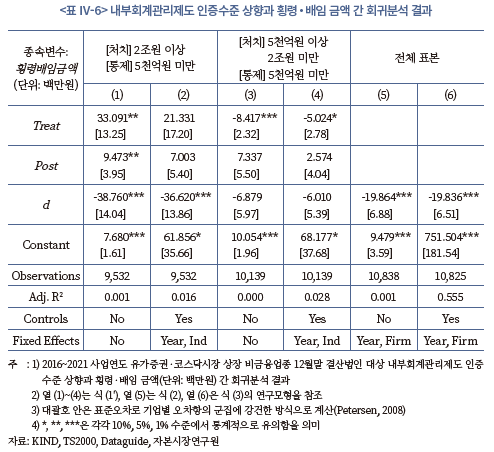

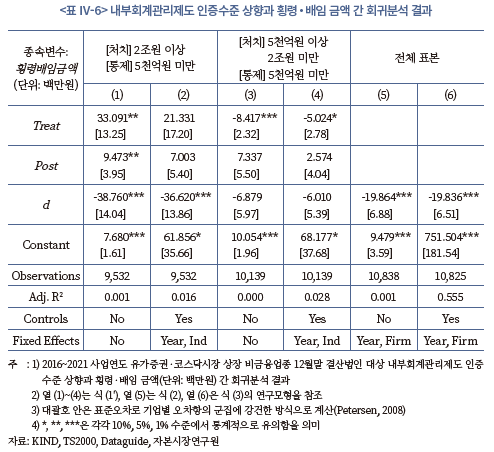

다. 횡령‧배임 금액 통제

<표 Ⅳ-6>에서는 내부회계관리제도 감사의무화와 횡령‧배임 금액 간 다중회귀분석을 수행한 결과를 제시한다. 이는 내부회계관리제도의 고도화가 부정 규모에 대한 통제 효과가 있는지를 살펴보기 위한 분석에 해당한다.16) 분석 결과, 내부회계관리제도 감사의무화는 횡령‧배임 금액과도 일관된 음(-)의 관련성이 확인된다. 구체적으로 자산총액 2조원(5천억원) 이상 기업의 경우 인증수준을 검토에서 감사로 상향한 이후 평균적으로 횡령‧배임 규모가 3,876만원(688만원) 감소한 것으로 나타났다(<표 Ⅳ-6> 열 (1) 및 열 (3) 참조). 다만, 통계적 유의성은 자산총액 2조원 이상 기업에서만 확인할 수 있었다(1% 유의수준, 표준오차: 14.035).

전체 표본을 대상으로 순차적 이중차분 모형을 활용한 결과에서는 횡령‧배임 규모가 1,986만원 감소한 것으로 나타나 조기‧후속 처치 집단의 평균 처치효과와 일관된 계수값을 보이는 가운데(<표 Ⅳ-6> 열 (5) 참조), 자산총액 2조원 이상의 조기 처치 집단과 유사한 수준에서 통계적 유의성 또한 확인되었다(1% 유의수준, 표준오차: 6.880). 횡령‧배임에 관한 기업 특성 요인을 추가 통제한 열 (6)의 결과에서도 부정 규모의 억제 효과가 통계적으로 유의함을 확인하였다(1% 유의수준, 표준오차: 6.512).

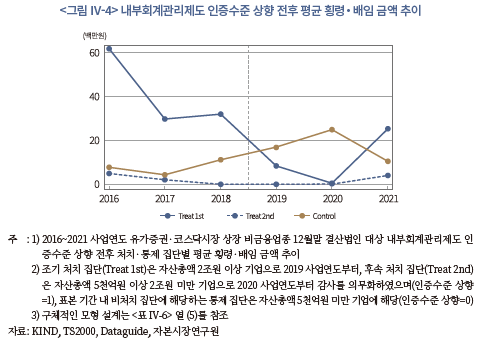

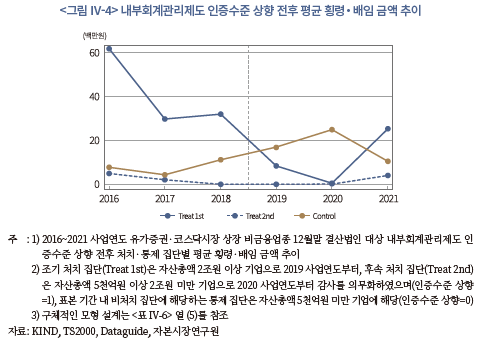

한편, <그림 Ⅳ-4>에서 평균 횡령‧배임 금액 추이를 살펴본 결과, 자산총액 2조원 이상 최초 처치 집단의 횡령‧배임 금액이 2019년 제도 시행을 전후로 확연한 감소 추세임이 확인된다. 2020년부터 감사를 의무화한 5천억원 이상 후속 처치 집단의 경우에도 횡령‧배임 금액이 하향 안정화 추세를 보인다. 단, 비처치 집단의 경우 횡령‧배임 금액이 증가 추세인 것으로 나타났다. 이는 자산 가격의 급등으로 임직원의 횡령 동기 발현이 증가한 시기적 특성 및 新외감법 시행에 따른 외부 적발 통제의 강화 등이 작용한 결과로 예상할 수 있으며, 내부회계관리제도의 감사의무화 효과가 실제보다 과소 추정될 가능성을 시사한다.

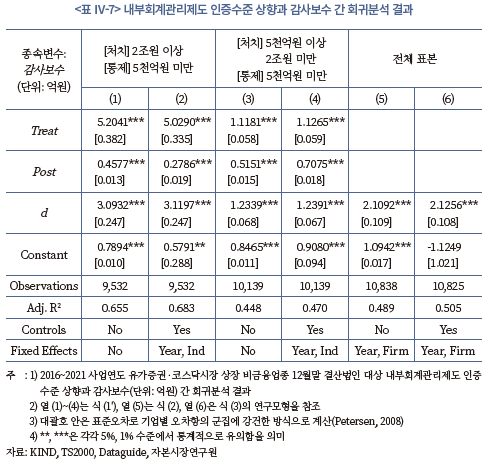

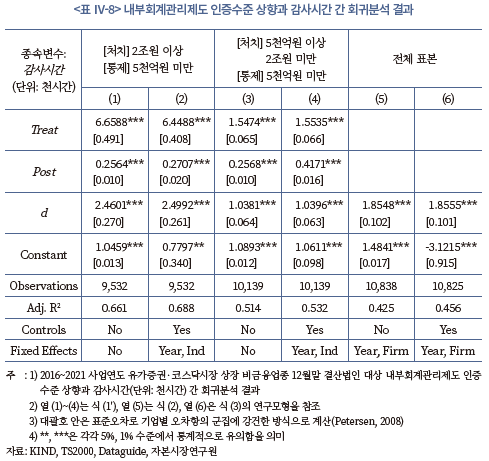

라. 감사보수‧시간‧임률 영향

본 절에서는 내부회계관리제도의 감사의무화로 인한 기업의 이행부담 요인을 점검하기 위해 감사보수, 감사시간 및 시간당감사보수로 측정한 임률에 대하여 각각 다중회귀분석을 수행한 결과를 제시한다.

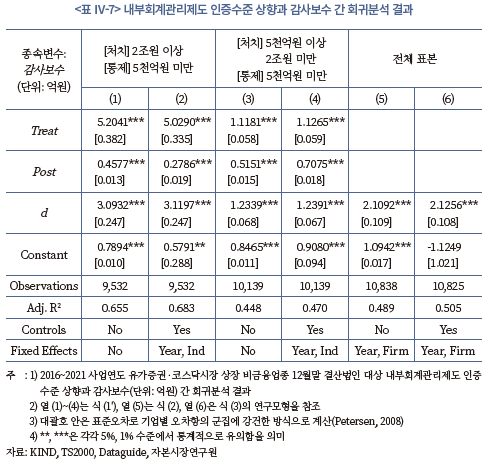

<표 Ⅳ-7> 열 (5)에서 내부회계관리제도 감사의무화와 감사보수 간의 관련성을 분석한 결과, 내부회계관리제도의 인증수준을 검토에서 감사로 상향하는 경우 평균적으로 감사보수가 2.1억원 상승한 것으로 나타났다(1% 유의수준, 표준오차: 0.109). 표본기간 내 비처치 집단에 해당하는 자산총액 5천억원 미만 기업의 감사보수가 61% 상승하는 동안 자산총액 5천억원 이상 2조원 미만 기업의 감사보수는 89% 상승한 것으로 확인되는 만큼 내부회계관리제도 감사의무화는 유의적인 감사보수 상승 요인으로 파악된다.

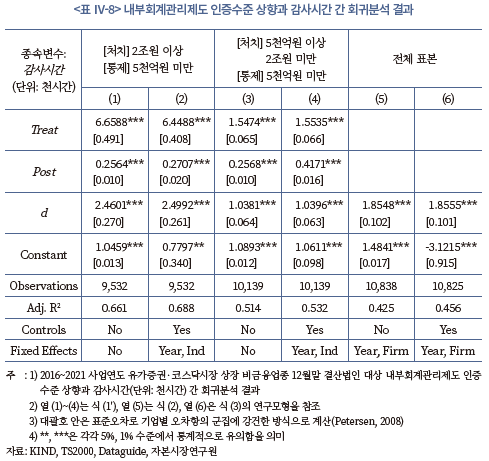

물론, <표 Ⅳ-8> 열 (5)에서 나타나듯 외부감사인의 감사 투입 시간 역시 함께 증가하였으며, 인증수준 상향에 따른 평균 감사시간 증가분은 1,855시간으로 파악된다(1% 유의수준, 표준오차: 0.102). 단, 자산총액 2조원 이상 기업의 감사시간이 평균 35% 상승한 것으로 확인되는데, 이는 공교롭게도 내부회계관리제도 감사시간에 대한 표준 가산율을 적용 첫해 30%에서 매해 5%씩 증가하도록 설정한 표준감사시간제 권고안과 매우 유사한 수치이다. 2022년 표준감사시간제 개정안에서는 해당 가산율 조항을 삭제하였으나, 표준감사시간제가 기계적으로 적용되고 있을 가능성에 대해서는 면밀한 검토가 필요할 것으로 보인다.

지면상 보고를 생략하였으나, 내부회계관리제도 감사의무화와 시간당감사보수로 측정한 임률 간의 관련성은 불분명한 것으로 나타났다. 新외감법 도입 이후 전반적인 시기상 임률 상승효과는 관측되며, 구체적으로 2019년(2020년) 이후 시간당 1.5만원(1.9만원) 수준의 유의미한 임률 상승이 나타났으나(1% 유의수준), 내부회계관리제도 인증수준 상향에 의한 효과는 극히 제한적인 것으로 확인되었다.

마. 강건성 분석

본 절에서는 상술한 실증분석 결과의 강건성을 확인하기 위해 다양한 추가분석을 수행하였으며, 지면상 보고는 생략하였다.

첫째, 내부회계관리제도 감사의무화가 기업의 재무보고품질에는 어떠한 영향을 미치는지 추가 분석하였다. 내부회계관리제도의 인증수준 상향이 임직원의 횡령‧배임을 예방할 만큼 내부통제를 고도화한다면, 재무보고의 품질 개선으로도 이어질 가능성이 존재한다. 이를 검증하기 위해 재량적 발생액의 절댓값(|재량적발생액|)과 재량적 발생액의 절댓값의 3개년 합산 측정치(회계불투명성)를 재무보고품질의 대용치로 삼고 추가적인 분석을 진행하였다. 먼저, 재무제표의 감사품질을 대용하는 재량적 발생액의 절댓값(|재량적발생액|) 측면에서는 유의한 관련성을 확인하지 못하였는데, 이는 내부회계관리제도 감사의무화와 재무제표 감사품질 개선 간 유의한 관련성을 확인하지 못한 김태중 외(2021)와 일관된다. 반면, 회계불투명성을 대용하는 재량적 발생액 절댓값의 3개년 합산 측정치(회계불투명성)와는 5% 수준에서 유의한 음(-)의 관련성이 나타나 보다 장기적 관점에서 재무보고의 품질 개선과 연계될 가능성을 살펴볼 필요가 있을 것으로 판단한다.

둘째, 횡령만 단독으로 발생한 때(즉, 횡령(배임미발생)=1)에도 내부회계관리제도 감사의무화의 부정 방지 효과를 확인하였다. 내부회계관리제도는 개념상 운영 범위가 재무보고 목적의 내부통제에 국한되어 횡령 범죄를 직접적으로 통제하는 데에는 본질적 한계가 존재한다는 지적이 있다.17) 그러나 횡령만 독립적으로 발생한 경우에도 감사를 의무화한 기업-연도에서 횡령 금액의 증분적인 감소 효과가 유의미하게 관측되었다(10% 유의수준, 표준오차: 2.02). 이러한 결과는 비록 내부회계관리제도의 운영 목적이 재무보고의 신뢰성 제고를 위한 내부통제 고도화에 한정될지라도, 재무보고상 중요한 왜곡표시 위험과 연관된 자산의 편취‧남용‧부패 등 횡령 및 배임 부정에 대한 기업의 취약점 통제와 실질적으로 밀접한 관련성이 있음을 시사한다. 또한, 내부회계관리제도 모범규준에서 자산의 보호 및 부정 방지 프로그램의 설계와 운영을 명시적으로 요구하는 것과 일관된 결과로 볼 수 있다.

셋째, 성향점수에 따라 1:1 대응표본을 구성한 분석을 수행하였다. 횡령‧배임 발생 기업과 그렇지 않은 기업 간에는 경제적 기초여건(fundamental) 측면에서 현저한 차이를 보이는바, 자산규모, 수익성, 성장성, 재무건전성, 감사의견, 재무보고품질 등 기업 단위에서의 특성 차이를 제거한 후 주요 분석을 재수행하였으며 본질적으로 동일한 결과를 확인하였다.

넷째, 新외감법 도입 이후 외부감사인의 적발 통제를 강화하는 다양한 제도들이 시행되었으며, 이러한 실증분석 환경에서 관측된 내부회계관리제도 감사의무화의 횡령‧배임에 대한 예방효과는 실제 효과 대비 과소 추정될 가능성을 내포한다. 이와 같은 편의 가능성을 완화하고자, 외부감사인이 재무제표의 기말 감사 과정에서 적발하였을 가능성이 큰 매년 1~3월에 공시된 횡령‧배임 사건을 표본에서 제외한 후 모든 분석을 재수행하였으나, 분석 결과가 시사하는 바는 본질적으로 동일하였다.

바. 소결

이상의 결과가 시사하는 바는 내부회계관리제도의 인증수준을 검토에서 감사로 상향한 2019년 이후 자본시장 전반의 횡령‧배임 건수가 추세적으로 하락 전환함과 동시에, 이러한 추이의 변화가 내부회계관리제도의 감사를 의무화한 기업집단에 의해 유도되었다는 점이다. 그간 다수의 선행연구는 이론적 측면에서 실질적인 내부통제 위험을 확인‧평가하기 위한 감사 수준의 인증제도 필요성을 강조해 왔으며(신현걸, 2007; 이성욱 외, 2010; 이재은, 2019), 제도의 시행 특성을 고려한 모형 설정 시 실증적으로도 관련 논의의 타당성이 확인된다.

전반적으로 내부회계관리제도 인증수준 상향은 기업의 내부통제를 고도화하며 횡령‧배임의 규모 측면에서 더욱 강건한 억제 효과를 확인할 수 있었다. 물론, 횡령‧배임의 예방효과에 대한 통계적 유의성은 모형 설정에 따라 다르게 나타났으나, 이는 표본 크기에 따른 검정력 차이의 영향으로 파악된다.

즉, 최근 내부회계관리제도와 관련한 일련의 논란을 촉발한 대규모 횡령 사건 등은 제도의 본질적 한계로 인한 영향보다는 형식적 운영에 기인한 영향이 큰 것으로 판단된다. 아울러, 내부회계관리제도의 구축과 운영, 감사의 이행 과정에서 기업의 비용 부담이 급증한 점 역시 부정하기 어려운 만큼 관련 요인을 종합적으로 고려하여 내부회계관리제도의 실효적 운영 유인을 제고하기 위한 정책적 개선안을 도출할 필요가 있다.

Ⅴ. 내부회계관리제도 실효성 개선방안

상술하였듯이, 내부회계관리제도의 인증수준 상향에 따라 자본시장 전반의 횡령·배임 억제에 영향을 미친다는 실증분석 결과는 내부회계관리제도가 효과적으로 운영된다면 자본시장 전반에 긍정적 영향을 미칠 수 있다는 점을 보여준다고 할 것이다. 그럼에도 불구하고, 내부회계관리제도의 구축에 드는 비용, 내부회계관리제도의 운영에 따른 인력부담 등은 기업 입장에서 내부회계관리제도의 효과성에 대한 의문을 제기하고 있다. 다만, 내부회계관리제도의 실효성이 실증분석의 결과로 확인된 상황에서, 실효적 운영을 확대하기 위한 유인부합적 제도를 적절히 설계한다면 제도의 효과성을 담보하면서도 기업의 비용 부담도 덜 수 있는 방안이 될 것이다. 이에 아래에서는 내부회계관리제도의 실효적 운영을 위한 정책적 개선방안을 제시하고자 한다.

1. 위반동기 억제를 위한 형량 현실화

가. 국내의 횡령‧배임 범죄의 법정형 및 양형기준

한국의 경우, 횡령‧배임죄에 대하여 형법 제356조에 기초하여 업무상 자기가 보관하는 타인의 재물에 대하여 그 임무에 위반하는 행위를 한 경우 10년 이하의 징역 또는 3천만원 이하의 벌금에 처하도록 규정하고 있다. 또한 「특정경제범죄가중처벌 등에 관한 법률」 제3조에 의하여 범죄로 인한 이득액이 5억원 이상일 경우 3년 이상의 유기징역에 처할 수 있다. 이러한 법정형은 양형위원회의 횡령‧배임죄에 관한 양형기준에 의거 부당이득의 금액별로 감경되거나 가중되는 구조를 지니고 있다.

이러한 횡령‧배임 범죄의 법정형 및 양형기준에 대하여 시민사회 및 언론을 중심으로 현행 형법상 횡령죄의 법정형이 양형기준 등으로 인해 지나치게 낮게 적용된다는 비판이 지속적으로 제기되고 있는 실정이다.18)19)20) 특히 상장사의 횡령 및 배임 범죄는 회사의 신뢰도 하락으로 인한 주가폭락을 야기하고, 이로 인해 상당수 주주의 재산적 피해를 일으키므로 합리적 형량 수준에 대해 사회적인 재논의‧수렴 과정이 필요할 것으로 보인다(김혜정‧기광도, 2015).

나. 해외 주요국의 횡령‧배임에 대한 형량 분석

미국의 경우 연방법 제666조에서 일반적인 횡령 행위를 다루고 있다.21) 또한 델라웨어주에서는 형법 제3708조에 의거, 횡령 행위에 대해 절도죄에 상응하여 처벌함을 규정하고 있으며, 횡령한 재산의 가치와 피해자에 따라 그 처벌이 가중된다. 캘리포니아주에서는 형법 제503조에 따라 신임관계에 있는 재산을 관리하던 자가 자신의 이익을 위해 기망하여 그 재산을 사용하거나 의도적으로 탈취한 경우 절도죄의 한 유형으로 횡령 행위를 처벌하며, 피해금액에 따라 중범죄와 경범죄로 나누어 형량이 달리 적용된다. 양형과 관련하여 범죄자의 범죄 등급 수준을 수직축으로, 과거 범죄 전력 수준을 수평축으로 하여 교차 지점의 양형을 간주 양형으로 하는 방식을 채택하고 있는데, 위반행위로 인한 타인의 손실액 및 피해자의 수(재정위협의 심각도)에 따라 양형단계를 가중하는 방식으로 이루어져 있다.

영국의 경우에는 횡령과 관련한 독자적인 법규정은 없고, 자신에게 속하지 않은 재산을 탈취한다는 점에서 절도죄(7년 이하의 징역형)를 적용하며, 횡령 행위를 위해 자신의 위치를 남용하거나 사취한 경우에는 사기죄(10년 이하의 징역형)를 적용하도록 되어 있다. 양형기준은 개별 범죄유형별로 서술식으로 구성되어 있는데, 절도죄의 경우 책임을 3단계(높음, 중간, 낮음)로 단계화하고, 그 피해 액수에 따라 등급화한 후 이 둘을 조합하여 양형구간을 정한다.

다. 외국 입법례와의 비교 및 형량 현실화를 위한 제안

횡령‧배임죄와 관련하여 미국 및 영국의 입법례와 비교해볼 때, 한국의 횡령죄 법정형은 10년 이하의 징역으로 규정되어 있어 기본 법정형 자체는 외국 입법례와 유사한 것으로 판단된다.22) 양형기준 역시 동일한 피해액을 기준으로 비교해볼 때, 미국이나 영국에 비해 낮은 수준은 아닌 것으로 보인다. 예를 들어, 피해액이 300억원일 경우 한국은 5년 이상 8년 이하의 징역형, 영국 역시 5년 이상 8년 이하의 징역형이 적용되며, 미국 연방법의 경우에만 10년 1개월 이상 12년 7개월 이하의 징역형이 적용되고 있다. 이처럼 우리나라의 경우 횡령 범죄에 대한 기본 법정형 및 양형기준 자체는 외국 입법례와 유사하다고 할 것이다. 또한 범죄이득액이 50억원 이상일 경우 특정경제가중처벌법상 무기징역에 처할 수 있을 정도로 가중처벌 요소도 강한 환경에 해당한다.

다만, 입법규정과 달리 형량 현실화를 위해 먼저 고액의 횡령 사건에 대한 양형기준을 세분화할 것이 요구된다. 특정경제가중처벌법 적용을 감안하면, 선고할 수 있는 최대 법정형 자체는 미국이나 영국에 비해 결코 낮지 않으나, 고액의 횡령 사건에 대해 양형기준이 세분화‧계량화되어 있지 않다는 한계가 존재한다. 이러한 한계를 반영하듯 최근 오스템임플란트 횡령 사건의 당사자인 前재무팀장에 대한 1심 판결에서도 “양형기준에 따르면 횡령‧배임액이 300억원 이상인 경우 기본 구간은 5~8년, 가중 구간은 권고형으로 정하고 있으나 해당 범행은 법률 규정과 양형기준을 무색하게 할 만큼 거액”임을 강조하며 35년형을 선고한 바 있다(2022고합37). 이처럼 거액의 횡령범죄에 대해 적절한 처분을 할 수 있도록 미국과 영국의 입법례 등을 참고하여 양형기준을 보다 세분화하여 계량화할 필요성이 존재한다.

2. 내부회계관리제도 관련 투자에 대한 세제혜택 부여

내부회계관리제도의 외부감사가 의무화됨에 따라 기업입장에서는 내부회계관리제도의 설계 및 구축에 따른 추가적인 비용부담이 발생한다. 최근 삼일회계법인이 기업 담당자를 대상으로 한 설문조사 결과에 따르면 응답자의 78%가 ‘인력 및 예산 제약’을 내부회계관리제도 구축에 있어 가장 큰 어려움으로 꼽고 있다(삼일회계법인, 2021). 기업의 내부회계관리제도 구축에는 평균적으로 3~5억원 가량의 비용이 소요되는 것으로 파악되며, 구축 이후 유지‧보수를 위해 평균적으로 연간 5천만원~1억원 정도가 소요될 것으로 추정된다.23)

따라서, 기업이 내부회계관리제도를 구축함에 있어 일시적으로 많은 비용이 소요되는 점을 고려하여 한시적인 세제혜택을 부여할 필요성이 존재한다. 선행연구에 따르면 효율적인 내부회계관리제도의 구축은 기업의 회계 및 세무투명성과도 직결되는 바, 세제혜택의 부여는 정부의 세수 확보 및 징세비용 감소에도 긍정적인 영향을 끼칠 수 있을 것으로 보인다(Bauer, 2015). 특별히, 내부회계관리제도 구축에 어려움을 겪는 중소기업의 경우에는 보다 높은 세제혜택을 부여하여 중소기업의 내부회계관리제도 구축을 조기에 정착시킬 필요성이 존재한다. 보다 구체적으로 내부회계관리제도를 자체적으로 설계 및 구축하는 경우에는 소요되는 비용을 손금에 산입하고 이를 준비금으로 처리하도록 할 수 있다.

비슷한 맥락에서 내부회계관리제도의 구축에 소요되는 외부컨설팅 비용에 대하여 일정액을 법인세 납부세액에서 공제하는 세액공제 제도의 도입도 고려해 봄직하다. 내부회계관리제도는 회계법인의 주도 하에 구축이 이루어지는 경우가 많기 때문에, 기업이 내부회계관리제도의 구축에 소요되는 외부컨설팅 비용에 대하여 일정비율을 세액공제의 항목으로 산출세액에서 직접 공제하는 방식을 채택할 수 있다. 이는 기업이 직접 내부회계관리제도를 구축하는 경우의 세제혜택과 형평성을 유지하는 차원에서 고려하여야 할 것이다. 현행 조세특례제한법에서도 ESG 관련 임직원 교육 및 경영수준 진단‧컨설팅 비용에 대한 세액공제(조세특례제한법 제10조 및 동법 시행령 제9조)를 도입하는 등 다양한 방식으로 외부컨설팅 비용에 대하여 세액공제가 가능하도록 하고 있으므로, 이러한 사례를 참고하여 법제화할 수 있을 것이다.

3. 내부회계관리제도의 실효적 운영에 대한 유인책 강화

가. 현행 내부회계관리제도 관련 과징금 구조

현행 내부회계관리제도와 관련하여 과징금 혹은 과태료의 부과는 이사의 주의의무를 포함해 여러 법 및 관련 제규정에 명문화되어 있다. 특히 외감법에서는 사업보고서의 작성의무 위반 및 허위기재 등에 대해 10년 이하의 징역 또는 위반행위로 얻은 이익 혹은 회피한 손실액의 2배 이상 5배 이하의 벌금을 부과하고 있다(외감법 제39조 제1항). 뿐만 아니라 감사인이 회사와 제3자에 대한 손해배상책임 발생시 당해 회사의 이사 및 감사도 책임이 있는 경우에는 감사인‧이사‧감사에게 민사상 연대손해배상책임이 발생한다(외감법 제31조 제4항).

나. 미국의 내부통제 운영에 따른 유인책

미국의 경우, 합리적으로 내부통제 절차 및 시스템을 갖춘 경우 감독자 책임에 대해 면책이 가능한 규정을 두고 있다. 금융회사의 경우 증권거래법상 면책요건을 법령에서 명시하여 감독자 책임에 대해 명확히 규정하고 있다(증권거래법 15(b)(4)(E)). 만약 직원의 위법행위를 방지하거나 실무적으로 이를 적발할 것으로 기대할 수 있는 합리적인 절차나 시스템을 마련하고, 그러한 절차와 시스템을 준수하지 않는다는 합리적인 의구심이 없는 상황에서 감독자가 자신에게 부여된 절차와 시스템을 적절히 이행하는 경우 민사상 제재금의 감면이 가능하다(이효섭 외, 2022).

다. 경영진이 내부통제의 충실한 설계와 실효적 운영을 입증하는 경우 제재를 경감하는 조항 명문화

한국의 경우에는 소규모회사 혹은 내부통제상의 부실 등을 자진신고하는 경우에 한하여 제재에 대한 경감이 가능하다. 다만, 손실규모가 크거나 사회적으로 이슈가 되는 사건에 대해서는 경감규정의 적용을 엄격히 적용하고 있다. 따라서, 미국의 사례를 참고하여 내부통제제도를 충실히 마련하는 경우 내부통제 부실에 대한 제재를 경감하는 조항을 명문화하는 것이 필요하다. 이를 통해 기업 스스로 내부통제제도의 실효성 강화에 인적‧물적 자원을 배분할 경제적 유인을 제공할 수 있다.

특히 합리적 면책조건에 대해 보다 구체적으로 명문화하여 제재경감조항이 오용되지 않도록 주의해야 할 것이다. 합리적인 면책조건으로는 다음과 같은 조건을 생각해 볼 수 있다. 먼저, 경영진 책임 하에 내부통제제도 설계 및 운영이 효과적으로 이루어지고 있는지 파악하고, 내부통제제도를 설치한 이후라도 정기적으로 내부통제제도의 효과성에 대하여 평가하고 이를 문서화하여야 한다. 또한 전체 임직원을 대상으로 내부통제제도의 중요성에 대해 교육하고 내부회계담당부서의 경우 외부교육 실시 등 추가적인 교육환경을 마련해야 한다. 마지막으로 내부통제보고서 작성 단계부터 감사위원회가 적극적으로 개입하여 형식적 절차에 그치지 않도록 관리 및 감독한다면 내부통제의 실효적 운영에 대한 유인책을 제공할 수 있을 것이다.

라. 내부회계관리제도 무력화에 대한 감독책임을 무겁게 적용하여 경영진이 확고한 의지(tone at the top)를 가질 유인을 강화

현행 법규정에 따르면, 내부회계관리제도 무력화에 따른 책임이 담당 임직원과 감사 및 감사위원으로 제한되어 있다.24) 내부회계관리제도의 무력화에 대한 감독책임을 무겁게 적용하기 위해 내부회계관리제도의 실효적 운영과 관련된 책임을 경영진에게 확장할 필요가 있다. 최근 대법원 판례는 담합행위에 대한 이사의 감시의무 위반을 인정함에 있어 내부통제제도의 충실한 설계와 실효적 운영 여부를 판단기준으로 삼은 바 있다(황현영, 2021; 대법원 2021. 11. 11. 선고 2017다222368 판결). 또한 사외이사의 경우에도 이사의 감시의무 위반에서 예외 대상이 아님을 판시하여 이사의 감시의무를 확장하는 추세인 것으로 보인다(대법원 2022. 5. 12. 선고 2021다279347 판결). 이상의 판례를 참고하여 내부회계관리제도의 실효적 운영에 대한 책임을 최고경영자(CEO)를 포함한 경영진으로 확장하는 것을 검토해 볼 필요가 있다.

보다 구체적으로, 대법원 판례상 실효적 내부통제 요건을 참고하여 대표이사가 1) 내부통제제도의 충실한 구축 노력을 하지 않았거나 2) 내부통제제도를 구축하였더라도 이를 이용한 회사 운영의 감시감독을 외면한 결과 ‘위법하다고 의심할만한 사유’를 발견하지 못하였다면 감시의무를 위반한 것으로 보아 이를 대표이사의 중과실로 처리하는 방안이 가능할 것이다.

4. 내부고발에 대한 포상금 등 유인책 확대

가. 내부고발에 대한 현행 유인책

2005년 이후 외감법 개정을 통해 기업의 회계정보의 부정행위에 대하여 내부고발을 한 신고자에게 포상금을 지급할 수 있도록 하고 있다. 회계부정에 대한 내부고발을 활성화함으로써 부정의 발생을 방지하고 회계투명성을 제고하기 위한 목적인데, 2017년 외감법 시행령 개정을 통해 신고포상금 한도를 기존의 1억원에서 10억원으로 인상한 바 있다

(외감법 시행령 제15조의2 제1항). 더불어 최근 금융위원회가 고시한 ‘회계 부정행위 신고 및 포상 등에 관한 규정 일부개정안’에 따르면 포상금 한도 금액을 자산총액 5천억원 이상인 회사 기준 20억원까지 늘어난 것으로 판단된다. 이와 같은 법정한도와는 별개로 2019년부터 2021년까지 회계부정 신고에 대한 1인당 평균지급금액은 5,396만원25)으로 상대적으로 낮은데, 이는 낮은 건별 포상금 한도와 다양한 차감율 등 복잡한 포상금 산정방식에 기인하는 것으로 보인다.

나. 미국의 내부고발 포상금 지급제도

미국은 회계부정에 대한 내부고발로 회사에 과징금이 부과되는 경우 과징금의 10~30%를 비례적으로 내부고발자에게 포상금으로 지급하도록 하고 있다. 특히 2012년부터 시행된 Dodd-Frank Act에 내부고발제보제도 강화조항을 법제화하여 내부고발자에게 다양한 유인책을 제공하고 있다. 미국 SEC의 연례보고서에 따르면, 미국 내부고발자 포상금 기준 상위 10명에게 지급된 금액은 최대 1억달러 이상에 달하며, 이는 금전 보상의 비례성을 확대한 것으로 볼 수 있다.26)

선행연구에 따르면 이처럼 강력한 포상금 제도의 시행으로 회계부정의 발생가능성이 줄어드는 효과가 확인되었다(Berger & Lee 2022). Berger & Lee(2022)에 따르면 Dodd-Frank Act 상 내부고발 프로그램의 시행으로 회계부정의 발생가능성이 12~22% 감소한 것으로 평가된다.

마지막으로 미국 SEC의 내부고발 프로그램은 신원을 철저히 보장하고 있으며, 이는 과거 메릴린치의 회계부정을 폭로해 거액의 포상금을 받은 3명이 현재도 메릴린치에서 그대로 근무 중이라는 사실에서 그 익명성을 가늠해볼 수 있다.

다. 내부고발에 대한 유인책 확대 방안

최근 금융위원회의 개정안으로 포상금 한도액이 10억원(자산규모 5천억원 이상 기업의 경우 20억원)으로 상향되었으나, 부정의 규모에 따라 내부고발 유인을 비례적으로 강화하지 못하는 한계점이 존재한다. 반면, 국내 다른 법률에서는 포상금의 상한이 외감법의 기준보다 상당히 높은 수준이다. 예를 들어, 자본시장법을 위반한 행위에 대한 포상금 한도는 20억원이며(자본시장법 시행령 제384조 제8항), 국세청의 조세탈루 공익신고자에 대한 포상액은 40억원 한도에서 납부액의 5~20%를 포상하는 비례성 포상제도를 도입하고 있다. 공정거래법 위반의 경우 포상금 한도가 30억원에 달하며, 실제 2021년 상반기 7개 제강사 고철구매 담합 건의 신고자는 17억 5,597만원의 포상금을 받은 것으로 알려져 있다.27) 따라서 회계부정에 대한 내부고발의 유인 확대를 위해 현행 외감법상 포상금 상한을 다른 국내법과 균형을 맞추어 상향하는 것이 필요하다.

더불어 보다 비례성 있는 포상금 지급을 위해 과징금‧포상금의 연계제도 역시 고려해볼 수 있다. 현행 내부고발의 포상금 재원은 금융위원회와 금융감독원의 예산으로, 재원 조달 방식상 내부고발 유인을 효과적으로 제고할 만큼 충분한 포상금을 지급하기에는 한계가 있다. 미국의 경우 회계부정을 포함한 증권법 위반사항에 대하여 신고자 포상금 제도를 운용함에 있어 SEC가 부과한 과징금을 재원으로 하여 포상금에 대한 지급 결정이 가능하다.28) 우리나라도 자본시장법과 외감법에 의한 과징금 부과가 증가하고 있어, 과징금을 재원으로 포상금을 지급할 경우 부정 규모에 비례한 보상이 가능하며 궁극적으로 내부고발 유인을 확대할 수 있을 것으로 예상된다. 보다 구체적으로 별도의 기금을 설립하고, 금융위원회가 이를 운영하며, 과징금을 포상금의 재원으로 활용하도록 하는 방안을 고려할 수 있다.

Ⅵ. 결론 및 정책적 시사점

2018년 新외감법의 도입으로 일정 규모 이상 국내 유가증권‧코스닥시장 상장기업은 내부회계관리제도에 대한 감사가 의무화되었다. 제도 도입 후 5년여가 흐른 현재, 내부회계관리제도의 감사의무화에 따른 비용‧효익에 대한 논란은 지속되고 있지만 실증결과에 기반한 논의는 재무보고품질에 관한 논의에 그치고 있다. 특히, 2021년 이후 일어난 대규모 횡령 사태를 계기로 내부회계관리제도가 내부통제제도로서 갖는 효과성에 대해 의문이 제기되면서 제도의 실효성에 대한 실제적인 평가가 필요한 상황이다.

본 연구보고서에서는 이러한 논의에 기여하기 위해 2019년부터 도입된 내부회계관리제도의 감사의무화가 기업의 가장 근원적인 내부통제에 해당하는 횡령‧배임을 실질적으로 예방하는 효과가 있는지 검증하고자 하였다. 이를 위해, 먼저 국내 및 미국과 일본 등 해외 주요국의 내부회계관리제도 운영 현황 및 감사체계를 검토하고 비교분석을 통해 국내 내부회계관리제도의 절차적 엄격성을 확인하였다.

다음으로 2019년부터 단계적으로 확대한 내부회계관리제도의 감사의무화 조치가 기업의 횡령‧배임 건수 및 금액에 미치는 영향에 대해 살펴보았다. 순차적 이중차분 회귀분석 모형을 활용한 분석 결과, 내부회계관리제도의 감사의무화는 기업의 횡령‧배임 건수 및 금액과 일관된 음(-)의 관련성을 보였다. 이는 최근의 대규모 횡령 사태로 인한 여러 논란에도 불구하고 내부회계관리제도 감사의무화가 횡령‧배임의 예방과 관련하여 유의적인 효과가 있음을 시사한다. 또한, 내부회계관리제도의 인증수준 상향은 선행연구에서 활용한 재무보고품질의 대용치인 재량적 발생액과는 유의한 관련성이 나타나지 않았으나, 회계불투명성에 해당하는 재량적 발생액 절댓값의 3개년 합산 측정치와는 유의한 음(-)의 관련성을 보였다. 이는 보다 장기적인 관점에서 내부회계관리제도의 인증수준 상향이 갖는 효과를 후속적으로 살펴볼 필요성을 제기한다.

상술한 결과는 최근 논의되고 있는 新외감법 도입의 정책적 효과를 이해하는 데 크게 공헌할 것으로 보인다. 특히 내부회계관리제도의 감사의무화가 기업의 횡령‧배임을 예방‧억제하는 효과가 있음을 실증한 결과는 최근 벌어지고 있는 일련의 횡령 사태에 대해 내부회계관리제도의 역할이 무용하지 않음을 시사한다. 이러한 점은 정책당국이 추후 내부회계관리제도의 감사의무화에 대한 재검토 및 개정을 논의하는 데 중요한 참고 자료로 활용할 수 있다.

끝으로, 향후 보다 실효성 있는 내부회계관리제도의 운영을 위해서는 횡령‧배임 등 위반 동기를 원천적으로 억제하기 위한 형량의 현실화가 필요할 것으로 판단한다. 내부통제가 무력화되는 경우 경영진의 감독책임은 엄정히 판단하되, 내부회계관리제도의 충실한 설계‧운영이 입증되는 때에는 제재 수준을 경감하여 실효적 운영에 관한 유인부합적 제도를 마련할 필요가 있다. 내부회계관리제도 구축에 대한 한시적 세제혜택 등 기업의 이행 부담을 완화하는 방안 역시 적극적인 검토가 필요하다.

다만, 본 연구에서 제시하고 있는 정책적 시사점은 국내의 자본시장 및 세제 관련 법률의 개정이 필요한 사항으로서 즉시 시행될 수 없다는 한계점이 존재할 것으로 보인다. 예를 들어, 세제혜택을 부여하기 위해서는 세수확보 등과 관련한 재정안정성의 측면 역시 고려되어야 할 것으로 보인다. 또한, 한국의 금융당국이 수사권 및 기소권 등에서 미국 증권거래위원회와 비교할 때 상당히 제한적인 권한을 행사할 수 있고, 회계부정과 관련된 과징금이 국고에 귀속된다는 점을 고려할 때 과징금 및 내부고발에 따른 포상금에 대한 정책적 제안 역시 한계점과 함께 고려되어야 할 것이다. 이상의 한계점에도 불구하고 본 연구는 내부회계관리제도의 인증수준 상향에 대한 실증분석과 더불어 정책적 제안을 제시함으로써, 앞으로의 내부회계관리제도 효과성 개선과 관련한 논의에 크게 기여할 수 있을 것으로 기대한다.

1) 자산총액 기준 2조원 이상 주권상장법인의 연결기준 내부회계관리제도 감사의무화는 신종 코로나바이러스감염증 사태로 기존의 2022년 시행에서 2023년 시행으로 연기되었다. 내부회계관리제도의 순차적 감사의무화 대상은 Ⅲ장에 상세히 서술하였다.

2) 통계청 국가통계포털

3) 금융감독원 금융사고현황

4) 실제로 스위스 국제경영개발대학원(International Institute for Management Development) 회계투명성 순위에서 우리나라의 순위는 2021년 37위에서 2022년 53위로 16계단 하락하였다. 주기적 감사인 지정제 등 新외감법의 도입에도 불구하고 회계투명성 순위가 하락하였다는 점은 시사하는 바가 크다고 할 것이다.

5) Mansor & Abdullahi(2015)에 따르면, 횡령 사고의 주요 원인 중 하나는 자산가격 급등으로 인해 횡령의 동기가 발현되기 때문이다. 2022년 이전 유동성 공급 확대로 인해 주택가격 뿐만 아니라, 주식 및 가상자산 등 위험자산의 가격이 급등한 반면 2022년 이후 이루어진 일련의 긴축적 통화정책 기조로 개인투자자들의 손실이 급증하였고, 이를 보전하기 위한 일탈 동기의 발생 역시 최근 횡령 사건의 주요 원인 중 하나라고 할 것이다.

6) 내부통제제도란 회사의 3가지 경영목적 달성을 위한 업무수행 정책 및 절차로서, 그 3가지 목적은 업무수행에 자원을 효과적이고 효율적으로 사용하기 위한 운영 목적(operations), 신뢰성 높은 내‧외부 보고를 위한 재무정보 및 비재무정보의 작성을 위한 보고 목적(reporting), 그리고 기업활동이 관련 법규 및 감독 규정을 준수하도록 하기 위한 법규 준수 목적(compliances)으로 구분된다.

7) 한국회계학회(2023. 2. 10)

8) 연결재무제표 기준 내부회계관리제도에 대한 외부감사인의 감사의견 표명 역시 자산총액 2조원 이상 주권상장법인을 대상으로 2022년부터 시행될 예정이었으나, 신종 코로나바이러스감염증 사태로 인하여 2023년부터 도입되었다.

9) 소규모 상장사의 경우 거래규모가 작고 사업구조가 단순한만큼 재무제표 감사를 통해서도 회계오류 및 부정을 적발할 수 있다는 의견이 지속적으로 제기되었다.

10) 내부회계관리제도운영위원회(2020)

11) 금융위원회(2022. 10. 6)

12) 미국의 경우에도 유통주식(Public float) 기준 0.75억달러 미만 혹은 유통주식(Public float) 0.75~7억달러이면서, 총매출액 1억달러 이하 기업의 경우 내부회계관리제도에 대한 외부감사를 면제하고 있다.

13) 아시아경제(2023. 4. 14)

14) 실질적인 횡령‧배임 사건만을 집계하기 위하여, 확정되지 않은 풍문 혹은 보도에 의한 횡령‧배임 사실의 조회 공시 요구는 제외하였으며, 최종적으로 무혐의 처분이 확정된 경우도 집계 대상에서 제외하였다. 아울러, 별도재무제표 기준 내부회계관리제도 구축 효과를 살펴보기 위해 연결 자회사 단독으로 발생한 횡령‧배임 사건 역시 제외하였다.

15) 한국회계학회(2023. 2. 10)

16) 다만, 상당수 사건은 횡령‧배임이 동시에 발생함에 따라 횡령 금액과 배임 금액의 구분공시가 이루어지지 않고 있다. 이에 본 연구에서는 횡령금액과 배임금액을 각각 구분하여 분석할 수 없다는 한계가 존재한다.

17) 아시아경제(2023. 4. 14)

18) 한국경제(2022. 7. 9)

19) 파이낸셜뉴스(2023. 1. 4)

20) 경제정의실천연합(2006. 4. 27)

21) 조직, 주, 지방 또는 인디언 부족 정부 또는 그 기관의 대리인이 횡령, 도둑질, 사기로 취득 또는 기타 권한 없이 고의로 정당한 소유자가 아닌 다른 사람의 사용으로 전환하거나 의도적으로 5000달러 이상의 재산을 오용한 경우 10년 이하의 징역에 처함(연방법 제666조(1)(a)).

22) 미국 연방법은 10년 이하의 징역을 규정하고 있으며, 영국법 역시 7년 이하의 징역 또는 10년 이하의 구금을 규정하고 있다.

23) 더벨(2022. 1. 21)

24) 외부감사 및 회계 등에 관한 규정 시행세칙에 의한 심사‧감리결과 조치 양정기준 [별표 1] Ⅲ.2.가.2

25) 금융감독원(2022. 3. 17)

26) SEC(2021)

27) 공정거래위원회(2021. 6. 23)

28) 1934 Securities Act §21F(g)

참고문헌

강민지‧배성호, 2022, 내부회계관리제도 감사가 외부감사인의 감사노력에 미치는 영향, 『국제회계연구』104, 217-245.

경제정의실천연합, 2006. 4. 27., 반복되는 재벌 비리, 솜방망이 처벌로는 안된다.

공정거래위원회, 2021. 6. 23, 역대 최대 신고포상금 지급, 보도자료.

구본승‧안성희, 2021, 내부회계관리제도에 대한 감사와 인력‧전담조직‧교육에의 투자가 이익조정에 미치는 영향,『세무회계연구』70, 51-76.

금융감독원, 2022. 3. 18, ‘21년도 회계부정신고 포상금 지급현황 및 제도 운영방향, 보도자료.

금융위원회, 2022. 10. 6, 중소기업 회계부담 합리화 방안, 보도자료.

김영태, 1995, 사원부정의 발생원인과 방지방법의 중요성에 대한 내부감사인판단에 관한 연구: AHP,『회계학연구』20(4), 1-20.

김태중‧유용근‧이상혁, 2021, 내부회계관리제도 감사가 재무제표 감사품질에 미치는 영향,『회계저널』30(6), 141-167.

김혜정‧기광도, 2015, 횡령‧ 배임죄 양형기준제도의 준수현황 및 개선방안,『형사정책연구』26(1), 55-84.

내부회계관리제도운영위원회, 2018,『내부회계관리제도 설계 및 운영 개념체계』.

내부회계관리제도운영위원회, 2020,『중소기업 내부회계관리제도 적용방안 연구』.

내부회계관리제도운영위원회, 2021,『내부회계관리제도 설계 및 운영 개념체계』.

더벨, 2022. 1. 21, 오스템임플란트 사태를 바라보는 중소기업의 불안감.

배한수‧권선국, 2015, 내부회계관리제도 담당인력의 특성과 기업지배구조가 자산횡령에 미치는 영향,『경영학연구』44(6), 1759-1783

삼일회계법인, 2021,『내부회계관리제도 미래전략 – 내부통제 고도화와 연결 실행 전략 Volume 2.0』.

삼정KPMG, 2022,『韓美 내부회계관리제도 비교와 시사점』.

신현걸, 2007, 내부회계관리제도 검토보고 현황 분석,『회계저널』16(1), 107-128.

아시아경제, 2023. 4. 14, [빛바랜 회계개혁]④강화된 내부회계관리제도로도 횡령 못막아.

윤회‧김응길‧노희천, 2022, 내부회계관리제도 감사가 이익조정에 미치는 영향: 내부회계담당 인력의 역할,『세무와 회계저널』23(2), 125-152.

이성욱‧김유찬‧정태섭, 2010, 내부회계관리제도의 취약점과 이사회 특성이 자산횡령에 미치는 효과,『회계저널』19(5), 89-123.

이재은, 2019, 횡령위험과 내부회계관리제도 취약성이 감사시간, 보수에 미친 영향,『회계‧세무와 감사 연구』61(2), 67-120.

이효경, 2008, 일본의 감사제도에 대한 최근 동향,『기업법연구』22(1), 61-86.

이효경, 2017, 일본의 내부통제제도 및 사례에 관한 검토,『선진상사법률연구』79, 39-77.

이효섭‧이석훈‧안수현, 2022,『주요국 내부통제 제도 현황 및 한국 내부통제 제도 개선 방향』, 자본시장연구원 연구보고서 22-01.

최성호‧김문태, 2017, 내부회계관리제도가 접대비 통제에 미치는 영향,『회계저널』26(3), 105-139.

최종서‧공경태, 2012, 내부회계관리제도의 도입 이후 발생액 질의 추세적 변화,『회계‧세무와 감사 연구』54(2), 299-341.

최준혁‧허익구, 2016, 내부회계관리제도 도입의 이익조정 억제 효과에 대한 재검토,『국제회계연구』70, 129-168.

파이낸셜뉴스, 2023. 1. 4, 300억 이상 횡령‧배임에 징역 5~8년 권고…양형기준 높여야.

한국경제, 2022. 7. 9, 300억 빼돌려도 3000억 빼돌려도 징역 5년…'솜방망이' 횡령 처벌.

한국회계학회, 2023. 2. 10, 회계개혁제도 평가 및 개선방안 심포지엄.

황현영, 2021, 이사의 감시의무와 내부통제시스템에 관한 연구-대법원 2021. 11. 11. 선고 2017 다 222368 판결,『법조』70(6), 448-472.

Ashbaugh-Skaife, H., Collins, D.W., Kinney Jr, W.R., 2007, The discovery and reporting of internal control deficiencies prior to SOX-mandated audits, Journal of Accounting and Economics 44(1-2), 166-192.

Bardhan, I., Lin, S., Wu, S.L., 2015, The quality of internal control over financial reporting in family firms, Accounting Horizons 29(1), 41-60.

Bauer, A.M., 2016, Tax avoidance and the implications of weak internal controls, Contemporary Accounting Research 33(2), 449-486.

Berger, P.G., Lee, H., 2022, Did the Dodd–Frank whistleblower provision deter accounting fraud? Journal of Accounting Research 60(4), 1337-1378.

Bhaskar, L.S., Schroeder, J.H., Shepardson, M.L., 2019, Integration of internal control and financial statement audits: Are two audits better than one? The Accounting Review 94(2), 53-81.

Breuer, M., deHaan, E., 2023, Using and interpreting fixed effects models, SSRN working paper.

Brushwood, J., Dhaliwal, D., Fairhurst, D., Serfling, M., 2016, Property crime, earnings variability, and the cost of capital, Journal of Corporate Finance 40, 142-173.

Cheng, M., Dhaliwal, D., Zhang, Y., 2013, Does investment efficiency improve after the disclosure of material weaknesses in internal control over financial reporting? Journal of Accounting and Economics 56(1), 1-18.

Chhaochharia, V., Grinstein, Y., 2007, Corporate governance and firm value: The impact of the 2002 governance rules, Journal of Finance 62(4), 1789-1825.

Choi, J.H., Choi, S., Hogan, C.E., Lee, J., 2013, The effect of human resource investment in internal control on the disclosure of internal control weaknesses, Auditing: A Journal of Practice & Theory 32(4), 169-199.

Choo, F., Tan, K., 2007, An “American Dream” theory of corporate executive Fraud, Accounting Forum 31(2), 203-215.

Cutler, M.G., 2006, Sarbanes-Oxley: Section 404 and the death of the small public company, bepress Legal Series, 1254.

Dechow, P.M., Sloan, R.G., Sweeney, A.P., 1995, Detecting earnings management, The Accounting Review 70(2), 193-225.

Donelson, D.C., Ege, M.S., McInnis, J.M., 2017, Internal control weaknesses and financial reporting fraud, Auditing: A Journal of Practice & Theory 36(3), 45-69.

Doyle, J., Ge, W., McVay, S., 2007, Determinants of weaknesses in internal control over financial reporting, Journal of Accounting and Economics 44(1-2), 193-223.

Dyck, A., Morse, A., Zingales, L., 2023, How pervasive is corporate fraud? Review of Accounting Studies, 1-34.

Eldridge, S.W., Kealey, B.T., 2005, SOX costs: Auditor attestation under Section 404, SSRN working paper.

El-Mahdy, D.F., Park, M.S., 2014, Internal control quality and information asymmetry in the secondary loan market, Review of Quantitative Finance and Accounting 43, 683-720.

Ettredge, M.L., Sun, L., Lee, P., Anandarajan, A.A., 2008, Is earnings fraud associated with high deferred tax and/or book minus tax levels? Auditing: A Journal of Practice & Theory 27(1), 1-33.

Gao, X., Jia, Y., 2017, The role of internal control in the equity issue market: Evidence from seasoned equity offerings, Journal of Accounting, Auditing & Finance 32(3), 303-328.

Hoitash, U., Hoitash, R., Bedard, J.C., 2009, Corporate governance and internal control over financial reporting: A comparison of regulatory regimes, The Accounting Review 84(3), 839-867.

Hutton, A.P., Marcus, A.J., Tehranian, H., 2009, Opaque financial reports, R2, and crash risk, Journal of Financial Economics 94(1), 67-86.

Kawanishi, H., Takeda, F., 2011, Market reactions to the disclosure of internal control weaknesses under the Japanese Sarbanes-Oxley Act of 2006, The Stock Market: Crisis, Recovery, and Emerging Economies, Nova Science Publishers: NY.

Krishnan, G.V., Visvanathan, G., 2007, Reporting internal control deficiencies in the post‐Sarbanes‐Oxley era: the role of auditors and corporate governance, International Journal of Auditing 11(2), 73-90.

Krishnan, J., Krishnan, J., Liang, S., 2020, Internal control and financial reporting quality of small firms: A comparative analysis of regulatory regimes, Review of Accounting and Finance 19(2), 221-246.

Lee, E.Y., Ha, W., 2021, Auditors’ response to corporate fraud: evidence from audit fees and auditor turnover, Managerial Auditing Journal 36(3), 405-436.

Mansor, N., Abdullahi, R., 2015, Fraud triangle theory and fraud diamond theory. Understanding the convergent and divergent for future research, International Journal of Academic Research in Accounting, Finance and Management Science 1(4), 38-45.

Myllymäki, E.R., 2014, The persistence in the association between Section 404 material weaknesses and financial reporting quality, Auditing: A Journal of Practice & Theory 33(1), 93-116.

Nagy, A.L., 2010, Section 404 compliance and financial reporting quality, Accounting Horizons 24(3), 441-454.

Nishizaki, R., Takano, Y., Takeda, F., 2014, Information content of internal control weaknesses: The evidence from Japan, The International Journal of Accounting 49(1), 1-26.

Petersen, M.A., 2008, Estimating standard errors in finance panel data sets: Comparing approaches, The Review of financial studies 22(1), 435-480.

Roberts, M.R., Whited, T.M., 2013, Endogeneity in empirical corporate finance1, Handbook of the Economics of Finance 2(A), 493-572, Elsevier.

Securities and Exchange Commission., 2021, 2021 Annual Report to Congress: Whistleblower Program.

Summers, S.L., Sweeney, J.T., 1998, Fraudulently misstated financial statements and insider trading: An empirical analysis, The Accounting Review 73(1), 131-146.

Yazawa, K., 2010, Why don’t Japanese companies disclose internal control weakness?: Evidence from J-SOX mandated audits, Aoyama Gakuin University 32, 2-11.

「주식회사 등의 외부감사에 관한 법률」(이하 ‘외감법’)의 개정 및 시행에 따라 2019년부터 자산총액 기준 2조원 이상 유가증권 및 코스닥시장 상장법인의 개별재무제표상 내부회계관리제도에 대한 인증수준이 ‘검토’에서 ‘감사’로 상향되었다.1) 내부회계관리제도의 인증수준 상향을 통한 내부통제제도의 고도화 노력에도 불구하고 2021년부터 민간기업 및 관공서 등에서 일련의 횡령 사건이 잇따라 발생하고 있다. 예를 들어, 2021년 발생한 오스템임플란트 직원의 2,215억원 횡령 사태는 민간기업의 내부통제제도가 효과적으로 작동하지 않고 있다는 점을 보여주고 있으며, 2022년 발생한 우리은행 직원의 600억원 횡령 사태는 고도화된 내부통제를 요구하는 금융기관에서조차 내부통제제도가 그 기능을 제대로 하지 못한다는 점에서 충격을 안겨준 바 있다. 실제로 2011년 2만 7,882건이었던 개인 및 기업의 횡령 범죄 발생 건수는 2020년 기준 6만 539건으로 10여 년 만에 117% 증가하였으며, 이는 같은 기간 전체 주요 경제범죄 발생 건수 증가율(약 50%)에 비해 2배 이상 높은 수준이다.2) 특히 금융기관에서 2017년부터 2021년 8월까지 발생한 횡령으로 인한 사고 금액은 약 1,540억원에 이르는 것으로 나타났다.3)

이러한 기업 내 횡령 사고는 비단 해당 기업뿐만 아니라 사회 전체적으로 막대한 비용을 초래한다는 점에서, 이를 예방‧억제하기 위한 이해당사자의 노력과 함께 정책적 방안 마련이 긴요한 문제라 할 수 있다. 우선, 기업은 현금 및 자산의 상실과 횡령 사고의 사후 수습으로 인한 업무 비효율화, 기업의 평판 및 신뢰도 하락, 자본비용의 상승 등 상당한 수준의 경제적 비용을 부담한다. 본 보고서의 분석에 따르면, 최초 횡령 사건 발생 시 자본시장에서 평균 7%대의 시가총액이 감소하며, 횡령 금액이 자산총액의 10%를 초과하는 대규모 횡령 사건의 경우 시가총액 감소분이 평균 16%에 육박하는 것으로 나타났다. 관련 선행연구 역시 횡령 사건과 같은 재산범죄 비율이 높을 경우 기업의 자기자본비용과 타인자본비용 모두 증가함을 실증한 바 있다(Brushwood et al., 2016).

기업을 둘러싼 여러 이해관계자 역시 상당한 사회적 비용을 부담한다. 소액주주의 경우 주주가치 하락으로 인해 직접적인 재산 손실을 경험하며(Dyck et al., 2023), 감사인 역시 내부통제 위험이 큰 횡령기업에 대해 감사위험에 상응하는 높은 보수를 청구한다(Lee & Ha, 2021). 횡령 범죄에 가담한 임‧직원에 대하여 행정‧사법적 제재를 부과하는 과정에서도 직‧간접적인 사회적 비용이 발생하며, 규제기관 역시 횡령 사건 증가에 따른 감독업무 부담이 가중되고 행정력을 낭비하게 되는 결과를 초래한다. 총체적으로 국가 전체의 회계 신뢰도 저하와 투명성 하락으로 이어져 글로벌 자금시장에서의 평판 손실을 고스란히 부담하게 된다.4)

내부회계관리제도의 인증수준 강화에도 불구하고 최근의 대규모 자금 횡령 사건이 발생한 원인은 여러 가지가 있겠으나, 내부회계관리제도가 그 목적에 맞게 실효적으로 운영되고 있는지에 대해 검토해 볼 필요성이 크다고 하겠다.5) 물론, 내부회계관리제도는 외부 공시 재무제표의 신뢰성을 확보하기 위해 설계‧운영하는 제도로서6) 재무보고 목적의 내부통제제도 확립에 초점을 맞추고 있는 만큼, 운영 혹은 법규 준수 측면의 내부통제를 완전히 관장하지 못하는 본질적 한계를 지닌다(내부회계관리제도 설계 및 운영 개념체계 문단 8~9). 그러나 자산의 편취‧남용‧부패 등 횡령 및 배임 부정에 대한 기업의 취약점은 재무제표의 중요 왜곡표시 위험과 밀접한 관련성을 갖기 때문에 내부회계관리제도는 전사적 내부통제와도 깊게 연관되어 있으며, 엄연히 현행 내부회계관리제도는 자산의 보호와 부정 방지 프로그램을 포함하고 있기도 하다(내부회계관리제도 설계 및 운영 개념체계 문단 12). 즉, 내부회계관리제도가 실효적으로 운영된다면 임직원의 횡령‧배임 행위를 적절히 통제할 수 있어야 한다. 따라서, 최근의 인증수준 강화가 기업의 횡령‧배임에 실질적으로 어떠한 영향을 미쳤는지 살펴보는 것은 제도의 효과성 평가와 관련하여 중요한 과제라 볼 수 있다.

특히, 최근의 내부회계관리제도 인증수준 상향과 관련하여 기업 측에서는 그 효과성에 비해 시스템 구축 및 운영에 따른 인적/금전적 비용 부담이 과도하다는 점을 주장하고 있으며, 내부회계관리제도의 실효성에 대한 논의는 여전히 진행 중에 있다.

이와 같은 논의 배경을 바탕으로, 본 연구보고서는 한국을 포함한 미국 및 일본 등 주요국의 내부회계관리제도 운영 실태를 살펴보고, 국내기업을 대상으로 1) 순차적 이중차분 모형을 활용하여 최근 이루어진 내부회계관리제도 인증수준 상향이 기업의 횡령‧배임 건수 및 금액에 어떠한 영향을 주는지, 2) 또한, 기업의 회계정보품질에는 어떠한 영향을 주는지, 그리고 3) 감사인의 감사보수 및 시간과는 어떠한 관계가 있는지 등을 실증적으로 분석하였다. 최종적으로 실효적인 내부통제제도 구축 및 내부회계관리제도 운영을 위해 형량 현실화, 세제상 혜택, 제재 감경 방안, 내부고발 유인책 확대 등 효과적인 내부회계관리제도의 설계 및 운영을 위한 다양한 개선안을 제시하였다.

주요 실증분석 결과는 다음과 같다. 첫째, 내부회계관리제도의 인증수준을 ‘검토’에서 ‘감사’로 상향한 2019년 이후 자본시장 전반의 횡령‧배임 건수는 추세적으로 하락 전환하였으며, 이러한 추이의 변화는 내부회계관리제도 감사를 의무화한 처치 집단에 의해 유도됨을 확인하였다. 즉, 내부회계관리제도의 인증수준 상향은 기업의 내부통제를 고도화하여 부정의 발생을 억제하는 효과가 있을 가능성이 높다는 점을 시사한다. 둘째, 내부회계관리제도 감사의무화에 따른 감사보수 및 감사시간과의 관련성을 검증한 결과, 감사의무화 대상 기업의 감사인은 감사의무화 비대상 기업 감사인 대비 높은 감사보수를 지출하고 더 많은 감사시간을 투입하여 결과적으로 감사인의 임률에는 영향이 없는 것으로 나타났다. 이는 내부회계관리제도 감사의무화 기업에 대해 제도의 이행부담 증가와 동시에 외부감사인의 적발 통제가 강화되었음을 시사하며, 그러한 상황에서 관측된 횡령‧배임에 대한 예방효과는 실제 효과 대비 과소 추정되었을 가능성을 내포한다고 할 것이다. 마지막으로, 내부회계관리제도의 인증수준 상향은 재무제표 감사품질의 대용치인 재량적 발생액과는 유의한 관련성이 없었으나, 회계불투명성을 대리하는 재량적 발생액 절댓값의 3개년 합산 측정치와는 유의한 음(-)의 관련성이 있음을 확인할 수 있었다. 이는 보다 장기적인 관점에서 내부회계관리제도의 감사의무화가 재무보고의 품질 개선과 연계될 가능성을 의미한다고 할 것이다.

내부회계관리제도의 감사의무화가 횡령‧배임의 예방에 효과가 있다는실증분석 결과를 바탕으로, 본 연구는 보다 효과적인 내부회계관리제도의 운영을 위해 아래와 같은 제도적 개선방안을 제시하고자 한다. 첫째, 임직원의 위반 동기 억제를 위한 형량 현실화가 필요할 것으로 판단한다. 횡령 범죄에 대한 법정형 자체는 미국과 영국 등 해외 주요국의 수준에 비해 결코 낮지 않으나, 고액의 횡령 사건에 대한 양형 기준이 세분화‧계량화되어 있지 않은 측면이 있다. 미국의 입법례 등을 참조하여 양형 기준을 보다 세분화하고 계량화하여 금전 범죄의 비례적 제재 원칙을 실현할 필요성이 존재하며, 횡령 재산에 대한 신속한 몰수 및 추징을 위해 추징집행력을 높이는 방안의 마련 역시 요구된다.

둘째, 내부회계관리제도의 실효적 구축 및 운영을 위해 내부회계관리제도 관련 투자에 대한 세제혜택 부여를 고려해 볼 수 있다. 실제 기업 담당자들은 ‘인력 및 예산 제약’을 내부회계관리제도 구축의 어려움 중 하나로 꼽고 있으며, 특히 중소기업의 경우 내부회계관리제도 구축에 적지 않은 비용을 수반하는 것으로 나타났다. 따라서, 효율적인 내부회계관리제도의 조기 정착을 위해 한시적인 세제혜택을 부여할 필요성이 존재할 것으로 판단한다.

셋째, 내부회계관리제도를 실효적으로 운영하는 경우 제재 경감 등의 유인책을 강화하는 방안이 필요하다. 내부회계관리제도가 무력화하는 경우 경영진에게 관련 감독책임을 무겁게 적용하되, 내부통제의 충실한 설계와 운영을 입증하는 경우 인적‧금전적 제재를 경감하여 경영진 스스로 내부회계관리제도의 실효적 운영에 확고한 의지(tone at the top)를 가질 수 있도록 유인을 제고하여야 한다.

마지막으로, 미국의 사례를 참고하여 내부고발과 이에 따른 포상제도를 확대할 필요가 있다. 현행 외감법 시행령에서 정한 신고자 포상금의 최대한도액 20억원은 부정의 규모에 따라 내부고발 유인을 비례적으로 강화하지 못하는 한계점이 존재한다. 우선, 다른 국내법과의 정합성을 고려하여 포상금 상한액을 상향 조정하고 장기적으로는 투자자보호기금 설립을 통해 회계부정에 대한 과징금을 내부고발 포상금의 재원으로 활용함으로써 내부고발 유인을 극대화할 필요가 있다.

본 연구보고서의 시사점은 다음과 같다. 우선, 내부회계관리제도의 인증수준 상향이 기업의 횡령‧배임에 미치는 영향을 직접적으로 규명한다는 점에서 의의가 있다고 할 것이다. 기존 선행연구에서는 주로 내부회계관리제도의 인증수준 상향과 재무보고품질 간의 관계에 대해 분석한 반면(Nagy, 2010; Bhaskar et al., 2019; 김태중 외, 2021; 구본승‧안성희, 2021), 본 연구는 순차적 이중차분 모형을 활용하여 최근의 주된 관심사인 횡령‧배임에 미치는 영향에 대해 분석하였다. 이를 통해 내부회계관리제도 감사의무화의 효과에 대한 기존 문헌의 논의를 확장하고 있다.

또한 최근 논의되고 있는 新외감법 도입의 정책적 효과를 심층적으로 평가하는 데 유용한 결과를 제시한다. 2018년 주기적 감사인 지정제, 표준감사시간제, 내부회계관리제도 감사 등의 외감법 개정안이 도입된 지 5년이 경과하였고, 이에 따라 제도의 정책적 효과에 대해 다양한 찬반 논의가 이루어지고 있다. 기업 측은 내부회계관리제도가 실효성의 충분한 검증 없이 도입된바 회계정보의 질적 향상이라는 본래 목적과 달리 문서화를 위한 제도로 변질되었음을 주장한다. 더불어 실질적 효과 대비 비용이 과도하다는 점을 들어 새로이 도입된 제도의 비용-편익 측면에서 의문을 품고 있다. 반면 회계법인에서는 내부회계관리제도 감사를 의무화한 2019년 이후 횡령‧배임의 발생빈도가 감소하였으며, 결국 인증수준 상향이 내부통제를 강화하여 부정을 예방하는 데 효익이 있음을 주장하고 있다.7) 본 연구보고서는 新외감법 중 내부회계관리제도 인증수준 강화에 초점을 맞추고, 내부회계관리제도의 감사의무화가 기업의 횡령‧배임 방지에 긍정적으로 작용한다는 실증적 증거를 제시하여 新외감법의 정책적 효과에 대한 논의를 개진하는 데 학문적 공헌이 있다. 이를 통해 기업 측의 우려와는 달리 내부회계관리제도 감사의무화의 기대효과가 크다는 점을 강조하고자 하였다.

마지막으로, 보다 효과적인 내부회계관리제도의 운영을 위한 다양한 정책적 제안을 제시하였다. 비록 본 연구의 발견이 내부회계관리제도의 인증수준 상향에 따른 횡령 및 배임 억제효과를 제시하고 있기는 하나, 이론적으로 내부회계관리제도가 횡령 등의 부정을 완벽히 통제한다고 볼 수는 없다. 따라서, 내부회계관리제도의 효과적 운영을 위한 다양한 정책적 제안 역시 실증분석과는 별개로 논의되어야 할 필요가 있다. 이러한 측면에서 내부회계관리제도에 대한 외부감사인의 감사의무화에도 불구하고 실효성 있는 내부회계관리제도의 운영을 위해서는 경영진이 내부회계관리제도 운영에 대한 확고한 의지(tone at the top)를 가질 필요가 있다. 이러한 점에 초점을 맞추어 본 연구보고서에서 제안한 형량 현실화, 제도 구축에 대한 한시적 세제혜택, 유인부합적 제재 경감, 내부고발 포상제도 확대 등의 방안은 내부회계관리제도의 감사의무화 이외에도 제도 운영의 실효성 제고를 위한 논의에 폭넓게 기여할 것이다.

본 보고서의 구성은 다음과 같다. 이어지는 Ⅱ장에서는 최근 발생하고 있는 일련의 횡령 및 배임 사건의 발생 현황을 살펴보고, 내부통제제도가 무력화되는 원인에 대해 분석한다. Ⅲ장에서는 미국‧일본 등의 내부회계관리제도 현황을 살펴봄으로써, 국내의 내부회계관리제도의 현주소에 대해 다시 한번 돌이켜보고자 한다. Ⅳ장에서는 순차적 이중차분 모형을 통해 내부회계관리제도의 감사의무화가 기업의 횡령‧배임에 미치는 영향에 대해 실증적 증거를 제시한다. Ⅴ장에서는 내부회계관리제도의 실효적 운영을 위한 다양한 개선방안을 제시하며, Ⅵ장에서는 결론을 맺고 정책적 시사점에 대해 논의한다.

Ⅱ. 횡령‧배임 사건 발생 현황 및 내부통제제도상 시사점

1. 횡령 사건의 발생원인과 중대성

최근 발생한 주요 횡령 사건의 발생원인으로는 자산가격 급등에 의한 투기적 성향의 횡령 동기 발현을 주요 요인으로 생각해 볼 수 있다. 특히 2022년 각국 중앙은행이 긴축적 통화정책 기조로 선회하기 이전까지 장기간에 걸쳐 초저금리 기조가 지속되었고, 신종 코로나바이러스감염증 사태에 대응하기 위해 정부가 유동성 공급을 확대하면서 주택가격 뿐만 아니라, 주식 및 가상자산 등 위험자산의 가격이 급등하였다. 이에 임직원의 주식투자 손실보전 등 투기목적의 횡령 동기가 발현하여 실제 횡령 사건 등으로 이어졌을 가능성이 존재한다. 그러나 보다 근본적으로 범죄의 동기가 발현하더라도 그 실현이 불가능하도록 시스템을 구축했어야 함에도 불구하고, 경영진 스스로 통제 절차를 무력화하는 등 실효적 운영에 대한 인식과 의지가 부족하여 횡령 사태가 발생한 측면을 빼놓을 수 없을 것이다.

최근 발생한 일련의 횡령 사건의 특징 중 하나는 투기 및 은닉수단의 다양화로 범죄의 적발 이후에도 횡령금의 환수 불확실성이 높다는 점이다. 투기적 수요에 의한 횡령 이후 고위험 자산에 무분별한 투자를 감행해 막대한 손실을 기록하거나, 추적이 어려운 디지털 자산(예: 비트코인)을 은닉 수단으로 활용하는 등 범죄의 적발 이후 피해복구 과정에서 횡령액 환수에 대한 불확실성이 점차 커지는 상황이다. 또한 회사의 신뢰도 하락에 따른 기업가치 훼손이 심각하게 발생한다는 특징이 있다. 상장사의 경우 횡령 피해로 인한 직접적 손실뿐만 아니라, 평판 저하로 단기에 회복이 어려운 수준의 주가 하락을 경험하여 다수 이해관계자의 물질적‧정신적 손해를 야기할 수 있다. 실제 2016년부터 2021년까지 유가증권 및 코스닥시장 상장사들의 횡령 사건을 분석한 결과 최초 횡령 사건 발생일 기준 약 -7.08%의 평균 누적초과수익률이 관측되었으며, 자산총액의 10%를 초과하는 횡령의 경우 평균 누적초과수익률이 무려 –16.30%에 달하는 것으로 나타났다(<그림 Ⅱ-1> 참조).

2. 주요 횡령 사건 검토 및 내부통제제도상 시사점

오스템임플란트 횡령 사건은 2021년 회사 직원이 자본금의 108.18%에 달하는 2,215억원의 거액을 횡령한 사건이다. 담당직원이 자금집행, 승인 및 기록 전반에 관여하고 있었으며, 잔고증명서를 위조하는 방법 등을 통해 회사의 현금을 지속적으로 횡령하였다. 횡령한 금액은 주식‧부동산‧금괴 등 개인적인 거래에 사용되었으며, 거액의 주식투자 손실이 발생하여 결산 전 회사로 재입금에 실패하면서 횡령 사실이 발각되었다.

2022년 발각된 계양전기의 횡령 사건은 회사의 재무팀 직원이 약 245억원(자기자본의 12.7%)을 횡령하여 불법도박 및 가상화폐 투자 등에 사용한 사건이다. 횡령을 위해 거래처로의 지급 대금을 대리 수령하거나 매출채권의 장부를 조작하는 등 내부통제를 무력화하는 방안을 사용하였으나, 외부감사인의 채권채무조회서 조회과정에서 발각되었다.

마찬가지로 2022년 우리은행 횡령 사건이 발생하였다. 기업개선부 직원이 약 614억원을 횡령하였으며, 이는 2010년 이란의 가전업체 엔텍합이 대우일렉트로닉스 인수 우선협상대상자가 되며 지급한 금액이었다. 횡령 금액은 주로 파생상품에 투자한 후 손실을 본 것으로 나타났으며, 자금이 철저하게 통제되는 대형은행에서 발생한 횡령 사건으로 충격을 주었다. 주요 원인으로는 순환보직의 미실시, 실물계좌 미확인 등 내부통제제도의 취약점 때문인 것으로 파악된다.

이상의 최근 발생한 일련의 주요 횡령 사건을 살펴보면, 전반적으로 내부통제제도의 무력화에서 그 원인을 찾을 수 있다. 2018년 新외감법의 개정으로 인해 내부회계관리제도의 인증강화 등 회계 관련 규제가 지속적으로 강화되는 시기에 횡령 사건이 연속하여 발생하면서 현행 내부회계관리제도의 규제의 방향성에 대한 재논의가 필요하다는 의견이 대두되고 있다. 본 연구에서는 엄밀한 실증분석 모형을 바탕으로 내부회계관리제도의 인증수준 강화가 기업의 횡령‧배임과 어떠한 관계가 있는지 직접적으로 살펴봄으로써, 최근의 횡령 사건 발생과 내부회계관리제도 개혁에 대한 논의에 기여하고자 한다.

Ⅲ. 국내외 내부회계관리제도 인증 현황

1. 국내의 내부회계관리제도 현황

가. 내부회계관리제도 도입 연혁

국내의 내부회계관리제도는 1997년 IMF 외환위기를 계기로, 회계투명성 개선을 위한 회계제도 개혁방안으로 도입되었다. 이후 2001년 기업 구조조정촉진법에 포함되었다가 2003년 미국의 Sarbanes-Oxley Act(이하 SOX법)를 참고하여 외감법으로 내부회계관리제도에 관한 규정이 이관되어 영구적으로 법제화된 바 있다. 특히, 외감법으로 이관되면서 내부회계관리제도에 대한 인증수준은 외부감사인이 대표이사의 운영실태보고서에 대하여 ‘검토의견’을 제시하도록 하여 최초로 외부감사인의 의견 표명을 요구한 바 있다(외감법 제2조의3).

선행연구에서는 지속적으로 경영진이 자체 점검‧작성한 운영실태보고서를 외부감사인이 ‘검토’하는 절차의 내재적 한계를 지적한 바 있다. 신현걸(2007)은 기업회계기준의 위배로 비적정 감사의견을 받은 기업일지라도 내부회계관리제도 검토 단계에서 회계처리와 관련한 중요한 취약점의 발견이 어렵다는 점을 주장하였다. 이성욱 외(2010)는 감사인이 취약점을 발견하여 관련 검토의견을 표명한 경우에도 경영진이 이를 즉각 시정하지 않아 차기의 횡령 발생 빈도가 높게 관측된다는 점을 확인하였다. 또한 전반적인 재무보고품질 개선효과 역시 불확실하거나 제한적 상황에서만 관측가능하다는 다수의 선행연구 역시 존재한다(최종서‧공경태, 2012; 최준혁‧허익구, 2016).

이에 2017년 10월에 이루어진 新외감법의 개정에 따라 내부회계관리제도에 대해 외부감사인의 의견 표명을 강화하는 개정안이 공포되었다. 이 개정안에 따라 자산총액 2조원 이상 유가증권시장 및 코스닥시장 상장법인을 대상으로 2019년부터 내부회계관리제도에 대한 외부감사인의 감사의견 표명 제도가 시행되었으며, 외부감사인의 의견 표명은 자산규모에 따라 순차적으로 도입되었다.8) 과거 검토의견 표명에 비해 보다 강화된 방식으로 기존의 대표이사의 운영실태보고서에 대한 검토의견의 표명이 아닌 기업의 내부회계관리제도 자체에 대한 인증을 목적으로 적극적 확신을 부여하는 방향으로 개정이 이루어졌다. 이러한 개정은 크게 1) 외부감사인의 검증대상이 기존의 경영진이 자체 점검‧작성한 운영실태보고서에서 경영활동 전반(예: 구매‧생산‧매출 등)의 실질적인 내부통제 설계와 운영으로 확대되었다는 점과 2) 외부감사인의 검증절차가 기존의 업무 담당자와의 질의응답에서 주요 통제활동의 직접 관찰 및 재수행으로 고도화되었다는 특징이 있다. 이러한 新외감법의 개정에 따라 내부회계관리제도 설계 및 운영 개념체계(내부회계관리제도 개념체계)와 내부회계관리제도 평가 및 보고 모범규준(내부회계관리제도 모범규준)이 2018년과 2021년에 개정 및 공표되었다. 아래 <그림 Ⅲ-1>에서는 내부회계관리제도에 대한 검토의견 표명과 감사의무화의 차이에 대해 요약하였다.

나. 현행 내부회계관리제도 평가 및 감사체계

국내의 내부회계관리제도 평가 및 감사체계는 크게 3단계로 구성되어 있다. 먼저, 대표자 및 내부회계관리자의 운영실태 평가가 이루어진다(외감법 제8조 제4항). 대표자 및 내부회계관리자는 회사의 내부회계제도 운영실태 점검결과, 취약점 및 시정조치 계획‧결과 등을 내부회계관리제도 운영실태보고서에 포함하여 보고하여야 한다. 이 점검절차에는 내부회계관리제도의 설계와 운영, 상시‧정기 점검체계, 효과성 점검 등의 객관적 지표 등을 포함하여야 하며, 내부회계관리제도에 대한 최종의견을 제시하여야 한다.

다음으로, 회사의 감사 혹은 감사위원회의 내부회계관리제도 평가가 이루어진다(외감법 제8조 제5항). 감사 혹은 감사위원회는 내부회계관리제도를 평가함에 있어 경영진의 부당한 개입이 없는지 확인하여야 하며, 내부회계관리규정의 실질적 운영 및 운영실태 보고의 기준과 절차 준수 여부 등을 평가하여 매년 주주총회 1주일 전 이사회에 대면보고하여야 한다.

마지막 절차는 외부감사인의 감사의견 표명이다(외감법 제8조 제6항 및 제7항). 외부감사인은 회사가 보고한 내부회계관리제도 운영실태보고서를 포함한 내부회계관리제도 전반에 대해 직접적 검증의 방식으로 인증절차를 수행하고 이에 대하여 감사의견을 제시하여야 한다.

이러한 3단계의 평가 및 감사체계는 후술하는 미국, 일본 등의 내부회계관리제도 평가 및 감사체계에 비해 보다 강화된 체계로 볼 수 있으며, 효과적으로 운영된다면 내부통제제도의 무력화를 어느 정도 예방할 수 있을 것으로 기대된다(김영태, 1995; 배한수‧권성국, 2015; 최성호‧김문태, 2017).

다. 내부회계관리제도 감사 및 검토의견 현황

내부회계관리제도에 대한 감사의견 표명 혹은 검토의견 제시가 이루어지는 경우, 내부회계관리제도를 효과적으로 설계하지 못한 기업에 대해 비적정의견이 나타날 수 있다. 본 절에서는 내부회계관리제도상 비적정의견을 받은 기업의 중요한 취약점의 사유 및 비중에 대해 살펴보고자 한다.

국내의 내부회계관리제도 비적정의견 기업의 비중은 후술하는 미국의 경우에 비해 상대적으로 낮은 것으로 파악된다. 2005년 내부회계관리제도에 대한 검토의견 표명상 비적정의견 기업의 비중은 3.6%였으나, 2014년 기준 0.9%까지 낮아진 바 있다. 또한 2019년 자산규모 2조원 이상 기업을 대상으로 내부회계관리제도에 대한 감사의견 표명이 도입되었음에도 불구하고 감사의견상 비적정기업은 2.5%로 미국의 내부회계관리제도에 대한 감사의견 도입 첫해(2004년)의 16.2%에 비해 지나치게 낮은 것으로 파악된다(삼정KPMG, 2022). 더욱이 2020년 자산규모 5천억원 이상 상장기업으로 감사대상이 확대되었음에도 불구하고, 비적정의견 기업의 비중은 오히려 1.4%로 감소한 바 있다.

2020년 기준 내부회계관리제도상 중요한 취약점의 사유 및 그에 따른 비중을 살펴보면 내부회계관리제도 자체의 구축과 운영 부실로 인한 ‘범위제한’(18.3%)과 특수관계자와의 자금거래에 대한 통제 미비 등으로 인한 ‘자금 통제 미비’(12.4%) 사례가 많다. ‘범위 제한’이란 외감법이 정한 내부회계관리제도 미구축, 내부회계관리제도 운영실태 평가 미수행이나 평가보고서 미제출, 감사에서 요구하는 증빙이나 자료가 불충분했거나 부적절하게 제공되는 경우를 의미한다. ‘자금 통제 미비’의 경우 자금 대여나 지급거래가 정해진 절차에 따른 적정성 검토 없이 이루어지는 경우를 말하며, 비경상적이고 이례적인 자금거래가 집행되는 과정에서 이사회 등의 승인절차 없이 불투명한 방식으로 처리되는 경우를 포함한다. 특히, 최근 발생한 일련의 횡령 사건이 불투명한 자금거래 집행에서 이루어진 것을 감안하면 ‘자금 통제 미비’가 중요한 취약점 사유로서 높은 비중을 차지한다는 것은 주목할 만하다.

라. 내부회계관리제도 감사의무화 관련 선행연구 검토

현재까지의 내부회계관리제도 감사의무화 관련 선행연구는 주로 이익조정 등 회계정보품질 측면에서 접근하고 있다. 윤회 외(2022)는 2019년 내부회계관리제도에 대한 감사도입으로 인해 일부 기업에서 이익조정 억제 효과가 있으나, 전반적으로는 유의한 영향을 미치지 않는다는 점을 주장하였다. 비슷한 맥락에서 김태중 외(2021) 역시 내부회계관리제도 감사의무화가 재무제표 상의 감사품질에 별다른 영향을 미치지 않는다는 점을 확인하였다. 이와는 달리 구본승‧안성희(2021)는 내부회계관리제도 전담인력이 있고, 전담인력 내 공인회계사 등 전문가가 존재하는 경우 재무보고품질에 유의한 향상 효과가 있다는 점을 주장하였다. 이는 비단 내부회계관리제도의 감사의무화 뿐만 아니라 내부회계관리제도를 운영하는 조직의 적격성과 객관성이 중요한 요소라는 점을 보여준다고 할 것이다.

반면, 강민지‧배성호(2022)는 외부감사인의 감사노력 측면에서 내부회계관리제도 감사의무화에 따라 감사보수와 감사시간이 유의미하게 증가한다는 점을 제시하였다. 해당 연구는 회사가 아닌 감사인 측면에서의 효익과 비용을 분석하였다는 측면에서 의의가 있다.

비록 직접적으로 내부회계관리제도의 감사의무화를 다루지는 않았지만, 선행연구에서는 내부통제활동이 기업의 횡령·배임과 관련이 있다는 점을 제시하고 있다. 김영태(1995)는 임직원의 부정을 효율적으로 발견하고 방지하기 위핸 내부감사인을 비롯한 내부통제제도의 역할에 대해 논의하고 있으며, 배한수‧권성국(2015)은 내부회계관리제도 담당인력의 특성이 기업 내 자산횡령 발생에 미치는 영향에 대해 실증적으로 분석하였다. 또한 최성호‧김문태(2017)는 내부회계관리제도의 효율적 운영에 따라 경영진의 특권적 소비행태에 해당하는 접대비 지출이 어떻게 달라지는지 실증적으로 분석하여 내부회계관리제도가 임직원의 부당행위 및 위법과 어떠한 관계가 있는지 조명하였다.

본 연구에서는 기존의 연구와 달리 내부회계관리제도의 감사의무화가 기업의 횡령‧배임에 영향을 미치는지를 직접적 검증의 방식으로 분석하여 기존의 연구를 확장하고, 내부회계관리제도의 감사의무화가 지닌 효익에 대한 논의에 기여하고자 한다.

2. 주요국의 내부회계관리제도 현황

가. 미국의 내부회계관리제도 현황 및 관련 선행연구

미국의 경우, 2000년대 초 발생한 Enron, Worldcom 등 일련의 회계부정 사태에 따라 기업의 회계정보 및 내부통제제도의 신뢰성에 대해 심각한 우려가 제기되었다. 이에 미국 연방의회에서는 2002년 SOX법을 제정하고, 2004년 11월 15일 이후 종료되는 사업연도부터 내부회계관리제도에 이를 적용하고 있다. SOX법 중 내부회계관리제도와 직접적으로 관련된 규정은 Section 302, 404(a) 및 404(b)를 들 수 있다. Section 302(재무보고에 대한 책임)에서는 경영진(CEO 및 CFO)에 대해 재무보고 목적 내부통제를 포함하여 재무제표의 적정한 작성에 책임을 부여하고 있다. Section 404(a)는 그 책임을 보다 구체화한 규정으로 상장회사의 경영진이 재무보고 내부통제의 유효성을 평가하고, 그 결과를 내부통제보고서 등의 형태로 사업보고서 등에 첨부하여 보고하여야 하는 의무를 규정하고 있다. Section 404(b)는 회사가 작성한 내부통제보고서 등에 대하여 외부감사인이 감사의견을 표명하도록 규정하고 있는데, 이는 재무제표에 대한 회계감사와는 별도로 이루어진다.

내부회계관리제도에 대한 외부감사인의 감사는 2004년 도입되었으나, 이행비용과 감사에 따른 편익에 따라 감사대상과 그 면제범위에 대해 지속적인 제도상의 변화가 일어나고 있다. 특별히 미국 증권거래위원회(Securities and Exchange Commission: SEC)에서는 기업규모별로 내부회계관리제도에 대한 외부감사인의 감사의무를 달리 규정하고 있다. <표 Ⅲ-1>에서는 미국의 기업규모별 내부회계관리제도에 대한 외부감사인의 감사여부를 도식화하였다.

2004년 내부회계관리제도에 대한 외부감사인의 감사의견 표명제도가 도입된 이래, 매년 약 6% 정도의 기업이 내부회계관리제도 관련 비적정의견을 받고 있는 것으로 나타났다(삼정KPMG, 2022). 다만, 2020년 소규모보고기업에 대한 감사면제가 도입되면서 3,064개의 상대적으로 규모가 작은 기업이 내부회계관리제도에 대한 외부감사대상에서 제외되었고, 이에 따라 비적정의견을 받은 기업의 비중이 4.6%로 크게 감소하였다. 2020년 기준 내부회계관리제도 비적정의견의 주요 사유로는 ‘당기 감사과정에서의 재무제표 수정’(22.8%)과 ‘회계인력 및 전문성 부족’(19.1%) 등인 것으로 나타났다. 반면, 중요한 취약점 사유 중 ‘자금 통제 미비’는 1건(0.3%)에 불과해 미국의 내부회계관리제도는 한국에 비해 상대적으로 자금 관련 내부통제에 잘 대응하고 있는 것으로 보인다.

내부회계관리제도에 대한 외부감사인의 감사의견 표명과는 별개로, 미국은 내부회계관리제도의 효과적 운영을 위한 정책적 인센티브를 제공하고 있다. 특히, 합리적으로 내부통제 절차 및 시스템을 갖추었음에도 직원의 위법행위를 방지할 수 없었던 경우에 감독자 책임에 대한 예외요건을 적용하여 책임에 대한 면책이 가능하다 (예: 증권거래법 15(b)(4)(E)). 이러한 면책요건에 의거하여 민사상 제재금의 감면이 가능한 구조이며, 이는 비단 내부회계관리제도의 설계 외에도 효과적 운영을 위한 인센티브를 제공하고 있는 미국의 내부회계관리제도의 특징 중 하나라고 할 것이다.

뿐만 아니라, 미국은 내부고발에 대한 포상금 제도를 통해 내부회계관리제도의 효과적 운영을 유도하고 있다. 회계부정에 대한 과징금의 10~30%를 포상금으로 지급하는 미국의 내부고발 포상금 지급제도는 내부고발자에게 다양한 유인책을 제공할 뿐만 아니라, 경영진 역시 내부회계관리제도의 효과적 설계에 많은 관심을 갖도록 유도하고 있다. 이러한 강력한 포상금 제도의 시행은 회계부정의 발생가능성을 낮추는 것으로 나타나고 있다

(Berger & Lee 2022).

미국의 내부회계관리제도 관련 선행연구는 크게 내부회계관리제도 감사의무화에 따라 중요한 취약점을 보고하는 기업의 특성, 내부회계관리제도상 중요한 취약점이 보고된 기업의 추후 의사결정, 소규모기업을 대상으로 내부회계관리제도 감사 면제를 도입한 효과에 대한 연구를 찾아볼 수 있다. 다만, 내부회계관리제도가 실제 기업의 횡령‧배임을 방지하는 효과가 있는지에 대한 연구는 상대적으로 부족한 실정이다.

내부회계관리제도상 중요한 취약점을 보고하는 기업은 평균적으로 규모가 작고, 당기순손실을 기록하는 경우가 많은 것으로 나타났다 (Ashbaugh-Skaife et al., 2007; Doyle et al., 2007). 또한 가족기업의 경우 내부회계관리제도상 중요한 취약점을 보고할 가능성이 높으며, 이는 가족기업에 대한 외부 모니터링이 취약하기 때문인 것으로 나타났다(Bardhan et al., 2015). 한편, 감사위원회의 높은 회의 빈도는 내부회계 관리제도상 중요한 취약점의 사후 적발 가능성을 높이는 한편, 감사위원회상 회계‧재무 전문성은 실효적인 관리‧감독 활동으로 취약요인을 사전에 보완 및 예방한다는 연구가 존재한다(Krishnan & Visvanathan 2007; Hoitash et al., 2009).

본 연구와 비교적 관련이 있는 연구는 Donelson et al.(2017)의 연구이다. 이 연구에서는 내부회계관리제도상 중요한 취약점을 보고한 기업의 경우 미래 횡령 사건이 발생할 가능성이 높다는 점을 제시하여, 내부회계관리제도를 적절히 운영하는 것이 횡령‧배임의 예방에 효과적인 방법이라는 점을 주장하였다. 그 외에도 내부회계관리제도가 취약한 기업의 경우, 재무보고품질이 낮고(Dolye et al., 2007; Ashbaugh et al., 2008), 재무제표를 재작성할 가능성이 높다는 연구도 존재한다(Myllymaki, 2014). 비단 재무보고 측면 외에도, 내부회계관리제도상 중요한 취약점을 보고한 기업은 모니터링이 약화되어 비효율적 투자를 할 가능성이 높고(Cheng et al., 2013), 자기자본비용 및 타인자본비용 모두 증가하는 것으로 나타나고 있다(El-Mahdy & Park, 2014; Gao & Jia, 2017).

한편, 소규모기업을 대상으로 한 이행비용 부담 관련 연구에서는 내부회계관리제도에 대한 외부감사에 따라 소규모기업의 경우 과도한 이행부담이 발생하여 이를 회피하기 위해 자진상장폐지를 결정할 가능성이 높다고 주장한다(Cutler, 2006). 또한, 소규모기업의 경우 내부회계관리제도의 감사가 감사보수의 급격한 상승을 불러오고(Eldridge & Kealey, 2005; Krishnan et al., 2020), 자본시장 역시 소규모기업의 내부회계관리제도 감사의무화에 대해 부정적으로 반응하는 것으로 나타났다(Chhaochharia & Grinstein, 2007).

이상의 연구를 종합하면, 내부회계관리제도에 대한 감사의무화는 기업의 내부통제제도상 중요한 취약점 발견에 유의미한 역할을 하는 것으로 보이나, 소규모기업의 과도한 이행비용 역시 충분히 고려해야 하는 것으로 나타났다.

나. 일본의 내부회계관리제도 현황 및 선행연구

일본의 내부회계관리제도 역시 1990년대와 2000년대 발생한 다양한 회계부정 및 횡령 사건을 계기로 본격적으로 제도화가 이루어졌다. 특히, 2005년 화장품 회사인 가네보(Kanebo)의 분식회계 결산이 발각되고, 2006년 라이브도어(Livedoor)의 회계부정 사건이 발생하면서 내부회계관리제도를 법제화해야 한다는 움직임이 구체적으로 논의되었다. 일본의 내부회계관리제도 관련 법적기준은 회사법과 금융상품거래법에 이원화되어 규정되어 있다는 특징이 있다.

회사법에서는 미국의 제도를 토대로 하여 회사업무의 효과성과 효율성 제고, 재무보고의 신뢰성 제고, 사업활동에 관한 법령준수, 그리고 회사 자산의 보전을 목적으로 하여 모든 회사에 대해 내부통제제도 구축을 의무화하고 있다. 이러한 회사법상 내부통제제도 관련 규정의 특징은 추상적이던 이사의 선관주의 의무에 포함된 내부통제제도의 구축의무를 법적 항목으로 규정한 것이라 할 수 있다(이효경, 2008). 다만, 이러한 구축의무를 소홀히 하더라도 임직원 및 회사에 대한 금전적 제재를 부과하는 규정은 미비한 것으로 알려져 있다(이효경, 2017).

금융상품거래법에서는 보다 구체적으로 재무보고 목적 내부통제에 대한 경영자의 평가와 감사인의 감사규정을 마련하고 있다. 소위 J-SOX법이라고 불리우는 이 규정은 상장기업의 재무보고 신뢰 제고를 목표로 하여 재무보고 중심의 내부통제보고서 제출의무를 규정하고 있다. 한편, 이러한 내부통제보고서는 외부회계감사인의 감사를 받아야 하는 것으로 규정되어 있는데(금융상품거래법 제193조의2 제2항), 미국의 내부회계관리제도에서 규정하고 있는 회계감사인의 감사와는 상당한 차이가 존재한다.

첫째, 회사의 재무보고 목적 내부통제에 대하여 직접적인 보고의무 및 감사의견을 요구하는 미국의 규정과는 달리, 회사의 내부통제보고서를 기반으로 회계감사인의 감사증명을 첨부하는 간접적인 형태를 취하고 있다. 회계감사인은 경영자가 제시한 내부통제보고서가 적정한지 여부에 대해서만 감사의견을 제시하도록 되어 있다. 이러한 점을 미루어볼 때, 한국과 미국의 내부회계관리제도에 비해 상당히 완화된 수준의 검증을 요구하는 것으로 해석할 수 있다.

일본의 내부통제제도 관련 선행연구에서는 내부통제제도 평가 및 감사의 도입과 관련하여 혼재된 결과를 제시하고 있다. 일부 연구에서는 기업이 재무보고 목적의 내부통제상 중요한 취약점을 공시한 경우 부정적인 초과수익률을 야기한다고 주장하는 반면(Nishizaki et al., 2014), 대부분의 선행연구에서는 중요한 취약점 공시에도 불구하고 유의미한 주가반응을 찾아볼 수 없었다고 해석하고 있다(Yazawa, 2010; Kawanish & Takeda, 2011).

종합하면, 일본의 내부통제 관련 제도는 직접적 검증방식의 감사가 아닌 간접적 방식의 감사의견 표명을 채택하고 있는데, 이러한 점이 투자자들의 반응과 관련하여 일관되지 않은 실증결과를 제시한 요인으로 보인다. 특히, 내부통제제도 관련 인증제도가 기업에게 이행부담으로 작용하는 점을 고려한 제도 설계로 재무보고품질 측면에서 유의미한 개선 효과를 달성하지 못한 것으로 판단된다.

다. 소결

이상의 국내 및 미국과 일본의 현행 내부회계관리제도 평가 및 감사체계를 종합하면, 한국의 내부회계관리제도 평가 및 감사체계는 크게 3단계로 구성되며, 이는 형식적 이행 요건 측면에서 미국이나 일본 등 해외 주요국과 비교하더라도 충실한 체계로 평가할 수 있다.

<표 Ⅲ-2>에서 살펴볼 수 있는 것과 같이, 한국은 대표자 및 내부회계관리자의 운영실태 평가(1단계), 감사 혹은 감사위원회의 내부회계관리제도 평가(2단계) 및 외부감사인의 감사의견 표명(3단계)으로 내부회계관리제도에 대한 평가 및 감사체계를 유지하고 있다. 반면 미국의 경우, 감사 혹은 감사위원회의 내부회계관리제도 평가(2단계)가 생략된 구조이며, 일본의 경우에는 3단계에 해당하는 외부감사인의 감사의견 표명마저 직접적 검증의 방식이 아닌 간접적 검증에 해당하는 구조를 지니고 있다.

Ⅳ. 내부회계관리제도 감사의 횡령‧배임 예방효과

1. 논의배경

전술한 Ⅲ장의 논의 내용을 종합하면, 현행 우리나라의 내부회계관리제도는 평가 및 감사체계상 절차적 엄격성을 대폭 강화한 제도에 해당한다. 그럼에도 실제 운영 측면에 있어서는 Ⅱ장에서 살펴보았듯 기초적인 자금 통제부터 미비점이 발견되는 등 제도의 효과성에 대한 심층적인 검토가 필요한 상황으로 볼 수 있다. 특히, 내부회계관리제도의 인증수준 상향이 내부통제 고도화에 도움이 되는지는 기업‧회계업계 간 상당한 견해차를 보이는 가운데, 제도 무용론을 촉발한 일련의 횡령 사건에 대해 내부회계관리제도 감사의무화의 효과가 유의적이지 않다는 최근 학계의 연구 결과로 제도 개혁의 적정성에 관한 논란이 확산하는 양상이다.13)

이에 본 장에서는 내부통제 강화를 목표로 한 제도 개혁이 본래의 취지 달성에 유용한지 세부적인 검증을 수행하고자 한다. 구체적으로 2절에서 내부회계관리제도 감사의무화 이후 횡령‧배임 사건의 추이를 점검하여 최근 연이어 발생한 대규모 자금 부정 사례들이 상장기업 전반의 특성을 대표하는 현상인지를 점검한다. 3절에서는 보다 엄밀한 검증을 수행하기 위해 횡령‧배임에 관한 제도 개혁의 영향을 실증 분석하는 통계적 모형을 설정하며, 관련 모형을 토대로 4절에서 내부회계관리제도의 감사의무화 효과를 검증한다. 특히, 일련의 논란이 제도의 본질적 한계로 인해 촉발한 것인지, 형식적 운영에 기인한 영향이 큰지 실증근거에 기반한 평가를 수행하여 최근 불거진 제도의 실효성 논란에 대한 시사점을 도출하고 후속 논의를 위한 기초자료를 제공한다.

2. 횡령‧배임 발생 추이

본 절에서는 유가증권 및 코스닥시장 상장기업을 대상으로 시장 전반의 횡령‧배임 사건 발생 추이를 살펴본다. 내부회계관리제도의 감사는 2019년 자산총액 2조원 이상 기업부터 의무화하여 2020년 자산총액 5천억원 이상 기업으로 확대 적용하였는데 <그림 Ⅳ-1>에서 연도별 횡령‧배임 공시 추이를 살펴본 결과, 내부회계관리제도의 감사를 순차적으로 의무화한 2019년부터 횡령‧배임 건수의 추세적인 감소가 확인된다.14) 구체적으로 Panel A를 살펴보면, 2019년 93건과 비교하여 2020년에는 79건으로 횡령‧배임 건수가 약 15.1% 감소하였으며, 2021년에는 55건으로 2020년 대비 약 30.4% 감소한 것으로 나타났다.

특히, 2019년도부터 최초 의무화 대상에 해당하는 자산총액 2조원 이상 상장기업에서 그 하락 추이가 두드러진 것으로 확인된다. 전체 횡령‧배임 발생 건수에서 자산총액 2조원 이상의 기업이 차지하는 비중은 2019년도를 기점으로 47% 감소한 반면, 표본 기간 내 감사의무화 대상에 포함되지 않은 자산총액 5천억원 미만의 기업이 차지하는 비중은 45% 증가한 것으로 확인된다. 한편, 횡령‧배임은 최초 사건 적발 이후 관련 부정의 전모를 확인하는 과정에서 그 규모가 증가하는 범죄적 특성이 있는데, 이 경우 정정 공시의 형태로 추가 공시가 이루어지는바, 이를 포함한 추이를 Panel B에서 살펴본 결과 역시 질적으로 유사함이 확인된다. 자산총액 2조원 이상 기업 비중은 73% 감소한 가운데, 자산총액 5천억원 미만 기업 비중은 41% 증가하는 것으로 나타났다.

단, 2018년 新외감법의 시행 이후 회계투명성을 높이기 위한 다수의 제도가 유사한 시기에 집중적으로 시행됨에 따라(<표 Ⅳ-1> 참조), 기업별 횡령‧배임의 발생 및 적발 추이에는 다양한 제도들이 동시에 영향을 미치고 있을 가능성을 배제하기 어렵다. 이를 고려한 연구모형에 기초하여 내부회계관리제도 감사 효과에 관한 보다 정교한 실증분석이 필요할 것이다.

본 절에서는 내부회계관리제도의 감사의무화 효과에 관하여 명확한 결론을 도출하기 위해 회귀분석 모형을 설정한다. 내부회계관리제도 감사는 제도의 단계적 도입으로 처치 시기와 처치 집단이 복수가 되는 특성이 있으며, 다수의 회계 개혁 제도가 유사한 시기에 집중적으로 도입된바 관련 제도적 영향에 반응하는 여러 기업 특성 요인과 시기적 특성 요인을 통제한 연구설계가 필요할 것으로 판단한다. 특히, 2020년부터 외부감사인의 직권지정 요건을 확대 적용하고 주기적 지정제를 시행함에 따라 외부감사인에 의한 부정의 적발 통제가 강화되었을 가능성이 높다. 이는 내부회계관리제도의 부정 방지 효과를 실증하는 측면에서 보수적인 방향으로 결과의 편의를 유발할 가능성이 크나, 횡령‧배임의 발생 및 적발 추이에 영향을 미칠 수 있는 여타 제도적 영향을 충실히 고려한 접근 방법이 중요할 것이다.

가. 순차적 이중차분 회귀분석 모형

통상적으로 처치 시기 및 처치 집단이 단순한 경우에는 아래 식 (1)과 같이 단순형 이중차분(difference-in-differences) 모형을 활용한 처치효과 분석이 가능하다. 단일 시점에 제도를 시행하면서, 제도의 적용 대상이 단일 집단일 때,

제도의 순차적 시행에 따라 제도 시행 시기와 적용 대상 집단이 다기간‧다집단으로 확장하는 때에는 아래 식 (2)와 같이 기업‧연도의 이원고정효과(two-way fixed effects)를 고려하여 일반화한(generalized) 형태의 순차적 이중차분(staggered difference-in-differences) 회귀분석 모형이 적합하다(Roberts & Whited, 2013; Breuer & deHaan, 2023). 식 (2)는 식 (1′)을 다기간‧다집단으로 확장한 모형으로 이해할 수 있다.

내부회계관리제도 감사는 단계적 의무화 일정에 따라 2019년 자산총액 2조원 이상 기업부터 우선 적용하고, 2020년 자산총액 5천억원 이상 기업으로 확대 적용하였으므로, 다기간‧다집단을 대상으로 제도 시행 효과를 포착하는 순차적 이중차분 회귀분석 모형을 활용할 이점이 크다. 첫째, 전통적 이중차분 모형을 활용할 경우 제도의 우선 적용 대상과 후속 적용 대상을 별도의 하위 표본으로 구분하여야 함에 따라 통계적 검정력이 약화하는데, 순차적 이중차분 모형은 전체 표본을 활용하므로 검정력 약화의 가능성이 작다. 둘째, 순차적 이중차분 모형은 고정효과 패널모형 특성상 기업 혹은 연도 내에 일정하게 작용하는 생략변수(correlated omitted variables) 문제를 통제하는 데 효과적이다. 유사한 시기 여러 제도의 집중적 시행으로 인한 영향을 가능한 한 통제함으로써 기업 내 변동에 한정한 처치효과의 해석이 가능한 이점이 있다.

이에 본 보고서에서는 아래 식 (3)의 순차적 이중차분 회귀분석 모형을 기반으로 내부회계관리제도 인증수준의 상향이 기업의 횡령‧배임에 어떠한 변화를 가져왔는지를 검증하고자 한다.

통제변수 벡터로는(Ctrl) 횡령‧배임의 영향 요인으로 알려진 다양한 요소를 포함하고자 횡령‧배임에 관한 임직원의 기회 및 합리화 요인(Summers & Sweeney, 1998; Choo & Tan, 2007)을 대리하는 당좌비율, 총자산수익률, 영업현금흐름수익률, 매출액성장률, 수익률변동성, 총발생액 변수 등을 고려하였으며, 외부 통제 특성(Ettredge et al., 2008)을 대리하는 변수로 log(총자산), log(감사보수), log(감사시간), 대형회계법인, 감사의견비적정, 초도감사 여부 등을 포함하였다. 새로운 내부회계관리제도가 기업의 횡령‧배임 사건의 발생(횡령배임) 및 금액(횡령배임금액)을 감소시켰다면,