OPINION

2023 Jun/13

Changes in Corporate Debt Structure in Response to Rising Interest Rates

Jun. 13, 2023

PDF

- Summary

- Amid rising market interest rates and changes in the funding market environment, the financing structure of listed companies has become diversified. As the yield of corporate bond issuance has shot up due to the increase in real interest rates, listed companies are increasing their reliance on financing alternatives while curtailing corporate bond issuance.

Although the financing structure of listed companies has become more flexible in response to the rise in interest rates, the financing cost for listed companies climbed in 2022 on a YoY basis. However, as rate hikes primarily affect newly raised funds, the increase in financing costs for listed companies is smaller than the rise in real interest rates. Furthermore, the difference in financing structure and credit ratings has made the increase in financing costs vary by market and company size. Meanwhile, corporate financial soundness has been undermined by a higher financing cost and lower profitability resulting from the economic slowdown. If interest rates keep rising further, listed companies may have to cope with higher interest expenses and worsening financial conditions, due to an additional interest burden from rollover.

Fortunately, interest rates have recently stabilized, easing concerns about a spike in corporate credit risk posed by rising interest rates. Considering lingering inflationary pressures and risk factors lurking in the money market, however, it seems hard to expect corporate financing conditions to show signs of drastic improvement. Accordingly, efforts should be exerted to proactively respond to the potential risks in the funding market, keep corporate financing costs down, and enhance corporate fundamentals.

In the aftermath of the Covid-19 pandemic, global supply chain disruptions and the Russia-Ukraine war have caused a price hike in resources, resulting in global inflation. In response, central banks around the world that maintained a loose monetary policy have launched an all-out attack on inflation by hiking the benchmark rate. This has led to a surge in market interest rates. In Korea, the risk of a default on real estate project financing (PF) loans, fueled by the Legoland crisis, and potential insolvency of US and European banks have put the money market into instability.

Rising market interest rates and changes in the funding market landscape are also affecting the corporate financing structure. In addition to the increase in interest rates, it is noteworthy that Korea Electric Power Corporation (KEPCO) has rapidly expanded the issuance of KEPCO bonds to service its growing debt, magnifying the supply and demand imbalance in the credit bond market. As a result, this has aggravated bond-based financing conditions for companies and financial institutions and corporate financing strategies are changing accordingly.

Against this backdrop, this article examines how rising interest rates have changed the debt financing structure for companies (listed on the KOSPI and KOSDAQ) and have affected the financial structure. Additionally, major risk factors in the money market will be analyzed.

The rise in interest rates driven by inflationary pressure

The global supply chain shock triggered by the Covid-19 crisis and the food and energy supply shortage fueled by the Russia-Ukraine war have put inflationary pressure on the global economy. The global inflation forecast by the OECD for the second quarter of 2023 reaches 6.7%, which has slowed down slightly from the end of the previous year but remains high compared to the past.

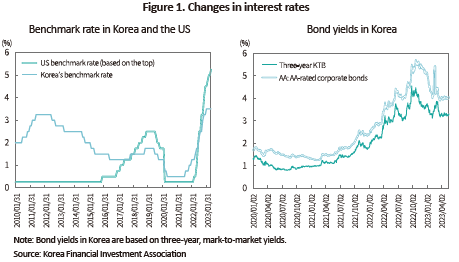

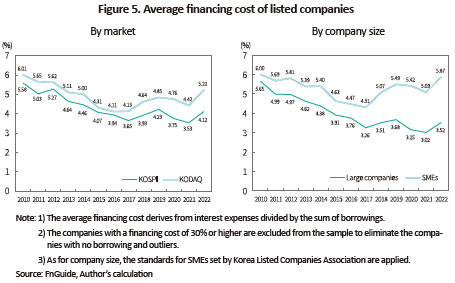

Central banks around the globe are sharply raising interest rates to curb inflation. The US has rapidly driven up the benchmark rate, which ranged from 0.0% to 0.25% as of end-February 2022, to 5.0% to 5.25% as of end-May 2023. Korea has kept pushing up the benchmark rate which stood at 0.5% as of end-July 2021 to 3.5%. Amid rapid rate hikes by the US, however, the gap in the benchmark rate between Korea and the US has widened to 1.75%p, hitting a historic high.

In line with the rise in the benchmark rate, the real interest rate soared rapidly. In Korea, the yield on the three-year Korea Treasury Bond (KTB), which stood at 1.067% as of the first quarter of 2021, climbed to 3.725% by the end of 2022. Although the upward trend of KTB yields has slowed down owing to the sluggish economy and the possibility of falling interest rates in the second half of this year, the latest1) KTB yield has posted 3.307%, which is still higher than in the past. Corporate bond yields also showed a sharp increase in 2022. Affected by a rise in the benchmark rate, the supply and demand imbalance in credit bonds and escalating credit risk, the AA-rated corporate bond yield that was 1.473% as of end-first quarter of 2021 spiked to 5.134% as of end-2022, which recently declined to 4.050%.

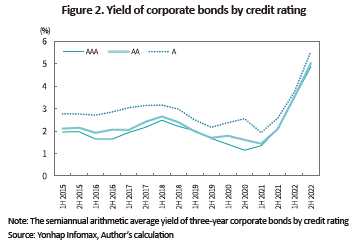

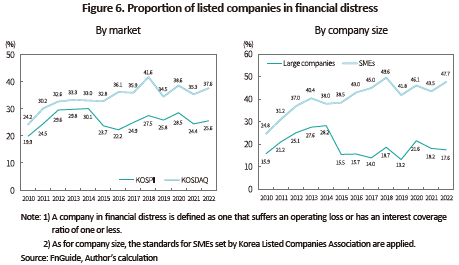

The increase in real interest rates has driven up the yield of corporate bonds. As shown in Figure 2, the yield of corporate bonds2) shot up to 5.07% in the second half of 2022 from 1.69% in the first half of 2021.

By credit rating, the yield of corporate bonds of all ratings has recently skyrocketed. The AAA-rated corporate bond yield has been directly influenced by the increase in the KEPCO bond issuance. The greater supply of KEPCO bonds has expanded the supply of highly rated credit bonds, thereby pushing up the yield of AAA-rated corporate bonds. As for A-rated corporate bonds, the credit crunch caused by the Legoland scandal had an impact on their yields. In the second half of 2022 when investors became more sensitive to the overall credit risk, the Legoland crisis occurred, resulting in a shortfall in estimated demand for A-rated corporate bonds and an increase in financing costs. As a result, some companies changed their financing strategy by delaying the bond issuance and expanding short-term borrowing, while other companies with the A rating pushed ahead with bond issuance, despite higher credit spreads compared to the first half of 2022.

As such, it is found that aside from benchmark rate hikes after the second half of 2021, the Legoland scandal, financial strains in the US and European banking sector, and changes in the supply and demand of credit bonds have had compounding effects on the yield of corporate bonds.

Changes in corporate debt financing structure in response to rising interest rates

In the face of rate hikes, companies are recently seeking a strategic shift in corporate debt financing by looking for alternative financing methods and expanding short-term financing. In this regard, this article intends to analyze the financial statements of listed companies to explore how the corporate debt financing structure has changed in response to the rise in interest rates.

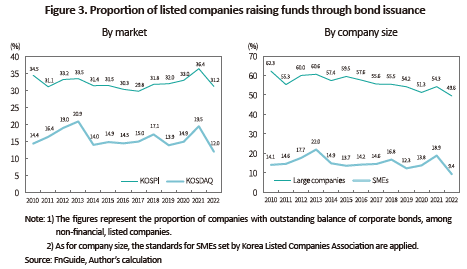

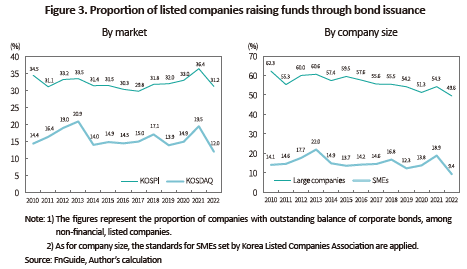

Among listed companies, those that raised funds through bond issuance represented 18.5% in 2022, a significant drop from 25.4% on a YoY basis. By market, companies that issued corporate bonds for financing, out of KOSPI-listed companies, accounted for 31.2% in 2022, representing a drastic fall from 36.4% of the previous year, while the proportion of such companies also declined from 19.5% to 18.5% in the KOSDAQ market. The declining proportion of companies raising funds through bond issuance can be primarily attributable to growing uncertainty over the corporate bond market. Rising interest rates have required higher financing costs, and greater issuance of KEPCO bonds and the Legoland shock have put strains on the corporate market. Under these circumstances, companies have considered financing alternatives that could replace the issuance of corporate bonds, including issuing short-term financing securities such as CP or short-term electronic bonds or relying on financial institutions for borrowing.

In an analysis of the companies raising funds through bond issuance by company size, large companies and SMEs took up 49.6% and 9.4% in 2022, respectively, suggesting that the gap between them has widened further. This implies that the corporate bond market structure centered around large companies with excellent credit ratings has been solidified.

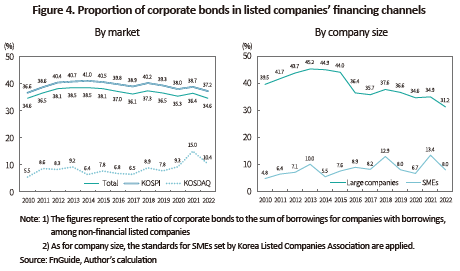

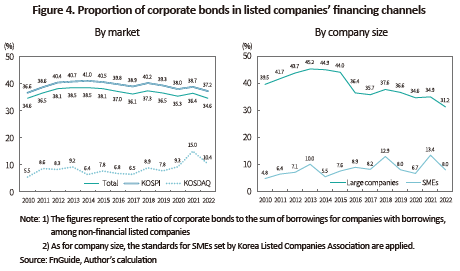

As the corporate bond market has become tight, the share of corporate bonds in listed companies’ borrowings has been on the decline. Out of the total amount of borrowings, the share of corporate bonds slid to 34.6% in 2022 from 36.4% in 2021. By market, a larger drop in the share of corporate bonds was observed in the KOSDAQ market than in the KOSPI market. By company size, SMEs experienced a bigger decrease in the share of corporate bonds than large companies. This suggests that the effects of tight corporate bond market conditions vary by market and company size. In a tight corporate bond market, investors become reluctant to purchase corporate bonds issued by companies that are small in size or have lower credit ratings. This flight to quality phenomenon has contributed to a plunge in financing through corporate bonds for KOSDAQ-listed companies and SMEs.

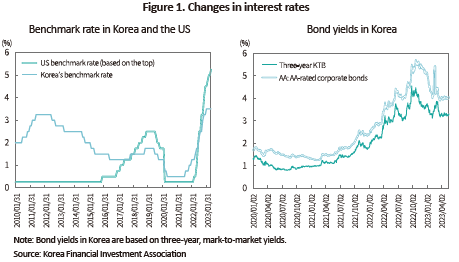

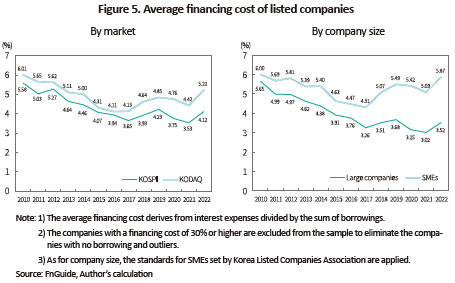

The shift in financing structure and rising interest rates are driving up financing costs. Financing costs for listed companies jumped from 4.11% in 2021 to 4.84% in 2022 on the back of rate hikes. By year, the average financing cost showed a downward trend until 2017, but kept rising between 2018 and 2019, and climbed again in 2022 after experiencing a YoY fall in 2021. As such, financing costs for corporate debts is swayed by changes in real interest rates and corporate borrowing structure.

Meanwhile, it has been found that the increase in financing costs for listed companies is relatively smaller, compared to the rise in corporate bond yields. This can be explained by the fact that rising interest rates only affect newly raised funds as funds previously raised at lower interest rates have yet to reach maturity.

By market, the average financing cost of KOSDAQ-listed companies is higher than that of KOSPI-listed counterparts. By company size, SMEs saw a significant increase in financing costs, compared to large companies. During rate hike cycles, financing conditions for smaller companies with lower ratings tend to become worse.

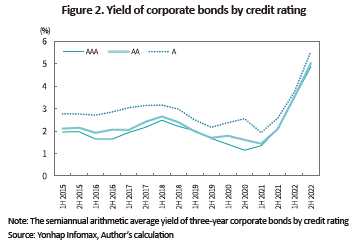

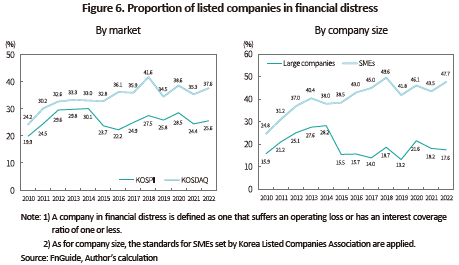

Amid aggravating corporate financing conditions and economic slowdown, a growing number of listed companies came under a worsening financial position in 2022. Among listed companies, those posting an operating loss or an interest coverage ratio of one or less accounted for 25.6% of KOSPI-listed companies and 37.6% of the KOSDAQ-listed ones in 2022. By company size, financial conditions for SMEs have deteriorated more severely than those for large companies. In 2022, 47.7% of the sample of SMEs suffered an operating loss or had an interest coverage ratio of one or less, while the share of large companies in financial distress showed a slight decrease on a YoY basis. As such, primary factors behind the worsening financial position seem to include a greater interest burden fueled by rising interest rates and deteriorating profitability stemming from the sluggish economy.

Risk factors and countermeasures

As mentioned above, the increase in the benchmark rate and the real interest rate has raised financing costs of listed companies and modified the corporate financing structure. As rate hikes predominantly affect newly raised funds, the increase in financing costs is smaller than the rise in real interest rates. In addition, the difference in financing structure and credit ratings has made a financing cost and its increase vary by market and company size. In the meantime, corporate financial soundness has been undermined by higher financing costs and lower profitability resulting from the economic slowdown. If interest rates keep rising further, listed companies may have to cope with higher interest expenses and worsening financial conditions, due to an additional interest burden from rollover.

Fortunately, interest rates have recently stabilized, easing concerns about a spike in corporate credit risk posed by interest rate hikes. Considering lingering inflationary pressures and risk factors in the money market, however, it seems hard to expect corporate financing conditions to show signs of drastic improvement. Accordingly, efforts should be exerted to proactively respond to potential risks in the funding market and enhance corporate financing structure.

If the spread of global financial unrest, such as the banking crisis originating from the US and Europe, triggers a financial crisis, this could serve as the biggest destabilizing factor in corporate financing. Although aggressive measures taken by the US and Europe have curbed the spread of the banking crisis, risk factors are lurking in the market, such as the insolvency of banks fueled by the decline in the value of commercial real estate, contraction of the lending market resulting from liquidity issues of some banks, and concerns over long-term economic recession. Such instability in the financial market may have an impact on the global economy as well as corporate financing, thereby intensifying volatility in the corporate funding market.

On top of that, higher interest rates may be kept up by inflationary pressures. Market participants anticipate interest rates to go down in the second half of this year, but such anticipation seems not to align with the policy direction pursued by central banks of the US and other economies. For this reason, it is difficult to rule out the possibility that the benchmark rate will remain at the current level or nudge up until inflationary pressures subside. Furthermore, the continuity of high interest rates is likely to affect corporate financing costs and structure and may increase the number of marginal firms and restructuring pressures.

Going forward, corporate finance stabilization policies should be established in response to changes in the conditions of the corporate funding market. What is first needed is the policy to revitalize corporate finance for SMEs with vulnerabilities in financing. The prerequisite for reviewing the funding policy is the evaluation of marginal firms and industries and the introduction of improvement measures.

The corporate sector should implement financing strategies that align with the changing market environment. In this respect, it should strive to improve the efficiency of financing by examining changes in interest rates and the funding market and aggressively revising financing strategies to reduce financing costs. Additionally, corporate fundamentals should be enhanced through improvement in productivity and profitability, which can lay the foundation for surviving the changes in the money market.

1) As of May 18, 2023

2) The average spot rate of unsecured corporate bonds by quarter

Rising market interest rates and changes in the funding market landscape are also affecting the corporate financing structure. In addition to the increase in interest rates, it is noteworthy that Korea Electric Power Corporation (KEPCO) has rapidly expanded the issuance of KEPCO bonds to service its growing debt, magnifying the supply and demand imbalance in the credit bond market. As a result, this has aggravated bond-based financing conditions for companies and financial institutions and corporate financing strategies are changing accordingly.

Against this backdrop, this article examines how rising interest rates have changed the debt financing structure for companies (listed on the KOSPI and KOSDAQ) and have affected the financial structure. Additionally, major risk factors in the money market will be analyzed.

The rise in interest rates driven by inflationary pressure

The global supply chain shock triggered by the Covid-19 crisis and the food and energy supply shortage fueled by the Russia-Ukraine war have put inflationary pressure on the global economy. The global inflation forecast by the OECD for the second quarter of 2023 reaches 6.7%, which has slowed down slightly from the end of the previous year but remains high compared to the past.

Central banks around the globe are sharply raising interest rates to curb inflation. The US has rapidly driven up the benchmark rate, which ranged from 0.0% to 0.25% as of end-February 2022, to 5.0% to 5.25% as of end-May 2023. Korea has kept pushing up the benchmark rate which stood at 0.5% as of end-July 2021 to 3.5%. Amid rapid rate hikes by the US, however, the gap in the benchmark rate between Korea and the US has widened to 1.75%p, hitting a historic high.

In line with the rise in the benchmark rate, the real interest rate soared rapidly. In Korea, the yield on the three-year Korea Treasury Bond (KTB), which stood at 1.067% as of the first quarter of 2021, climbed to 3.725% by the end of 2022. Although the upward trend of KTB yields has slowed down owing to the sluggish economy and the possibility of falling interest rates in the second half of this year, the latest1) KTB yield has posted 3.307%, which is still higher than in the past. Corporate bond yields also showed a sharp increase in 2022. Affected by a rise in the benchmark rate, the supply and demand imbalance in credit bonds and escalating credit risk, the AA-rated corporate bond yield that was 1.473% as of end-first quarter of 2021 spiked to 5.134% as of end-2022, which recently declined to 4.050%.

By credit rating, the yield of corporate bonds of all ratings has recently skyrocketed. The AAA-rated corporate bond yield has been directly influenced by the increase in the KEPCO bond issuance. The greater supply of KEPCO bonds has expanded the supply of highly rated credit bonds, thereby pushing up the yield of AAA-rated corporate bonds. As for A-rated corporate bonds, the credit crunch caused by the Legoland scandal had an impact on their yields. In the second half of 2022 when investors became more sensitive to the overall credit risk, the Legoland crisis occurred, resulting in a shortfall in estimated demand for A-rated corporate bonds and an increase in financing costs. As a result, some companies changed their financing strategy by delaying the bond issuance and expanding short-term borrowing, while other companies with the A rating pushed ahead with bond issuance, despite higher credit spreads compared to the first half of 2022.

As such, it is found that aside from benchmark rate hikes after the second half of 2021, the Legoland scandal, financial strains in the US and European banking sector, and changes in the supply and demand of credit bonds have had compounding effects on the yield of corporate bonds.

In the face of rate hikes, companies are recently seeking a strategic shift in corporate debt financing by looking for alternative financing methods and expanding short-term financing. In this regard, this article intends to analyze the financial statements of listed companies to explore how the corporate debt financing structure has changed in response to the rise in interest rates.

Among listed companies, those that raised funds through bond issuance represented 18.5% in 2022, a significant drop from 25.4% on a YoY basis. By market, companies that issued corporate bonds for financing, out of KOSPI-listed companies, accounted for 31.2% in 2022, representing a drastic fall from 36.4% of the previous year, while the proportion of such companies also declined from 19.5% to 18.5% in the KOSDAQ market. The declining proportion of companies raising funds through bond issuance can be primarily attributable to growing uncertainty over the corporate bond market. Rising interest rates have required higher financing costs, and greater issuance of KEPCO bonds and the Legoland shock have put strains on the corporate market. Under these circumstances, companies have considered financing alternatives that could replace the issuance of corporate bonds, including issuing short-term financing securities such as CP or short-term electronic bonds or relying on financial institutions for borrowing.

In an analysis of the companies raising funds through bond issuance by company size, large companies and SMEs took up 49.6% and 9.4% in 2022, respectively, suggesting that the gap between them has widened further. This implies that the corporate bond market structure centered around large companies with excellent credit ratings has been solidified.

Meanwhile, it has been found that the increase in financing costs for listed companies is relatively smaller, compared to the rise in corporate bond yields. This can be explained by the fact that rising interest rates only affect newly raised funds as funds previously raised at lower interest rates have yet to reach maturity.

By market, the average financing cost of KOSDAQ-listed companies is higher than that of KOSPI-listed counterparts. By company size, SMEs saw a significant increase in financing costs, compared to large companies. During rate hike cycles, financing conditions for smaller companies with lower ratings tend to become worse.

As mentioned above, the increase in the benchmark rate and the real interest rate has raised financing costs of listed companies and modified the corporate financing structure. As rate hikes predominantly affect newly raised funds, the increase in financing costs is smaller than the rise in real interest rates. In addition, the difference in financing structure and credit ratings has made a financing cost and its increase vary by market and company size. In the meantime, corporate financial soundness has been undermined by higher financing costs and lower profitability resulting from the economic slowdown. If interest rates keep rising further, listed companies may have to cope with higher interest expenses and worsening financial conditions, due to an additional interest burden from rollover.

Fortunately, interest rates have recently stabilized, easing concerns about a spike in corporate credit risk posed by interest rate hikes. Considering lingering inflationary pressures and risk factors in the money market, however, it seems hard to expect corporate financing conditions to show signs of drastic improvement. Accordingly, efforts should be exerted to proactively respond to potential risks in the funding market and enhance corporate financing structure.

If the spread of global financial unrest, such as the banking crisis originating from the US and Europe, triggers a financial crisis, this could serve as the biggest destabilizing factor in corporate financing. Although aggressive measures taken by the US and Europe have curbed the spread of the banking crisis, risk factors are lurking in the market, such as the insolvency of banks fueled by the decline in the value of commercial real estate, contraction of the lending market resulting from liquidity issues of some banks, and concerns over long-term economic recession. Such instability in the financial market may have an impact on the global economy as well as corporate financing, thereby intensifying volatility in the corporate funding market.

On top of that, higher interest rates may be kept up by inflationary pressures. Market participants anticipate interest rates to go down in the second half of this year, but such anticipation seems not to align with the policy direction pursued by central banks of the US and other economies. For this reason, it is difficult to rule out the possibility that the benchmark rate will remain at the current level or nudge up until inflationary pressures subside. Furthermore, the continuity of high interest rates is likely to affect corporate financing costs and structure and may increase the number of marginal firms and restructuring pressures.

Going forward, corporate finance stabilization policies should be established in response to changes in the conditions of the corporate funding market. What is first needed is the policy to revitalize corporate finance for SMEs with vulnerabilities in financing. The prerequisite for reviewing the funding policy is the evaluation of marginal firms and industries and the introduction of improvement measures.

The corporate sector should implement financing strategies that align with the changing market environment. In this respect, it should strive to improve the efficiency of financing by examining changes in interest rates and the funding market and aggressively revising financing strategies to reduce financing costs. Additionally, corporate fundamentals should be enhanced through improvement in productivity and profitability, which can lay the foundation for surviving the changes in the money market.

1) As of May 18, 2023

2) The average spot rate of unsecured corporate bonds by quarter