OPINION

2023 Jul/25

A Thought on Interest Rate Reversals between Korea and the US, and the Implications

Jul. 25, 2023

PDF

- Summary

- The US Fed's steep rate hike has sparked a rate reversal between Korea and the US. The rate reversal–the largest one compared to the past–is expected to persist for a considerable period of time going forward. Accordingly, concerns have been raised about possible capital outflows from Korea. However, the data on equity and debt portfolio flows by residents and non-residents during past rounds of rate reversal in Korea suggest that a rate reversal is unlikely to be a direct cause to capital outflows. However, rate reversals–if they continue further–could increase in the cost of financing foreign capital, which requires preparation. Specifically, costs may arise when residents attempt to hedge exchange risk from their outward portfolio investment by raising foreign capital in the FX swap market, a scenario that did not occur in the past. This needs considering as part of an FX hedging strategy.

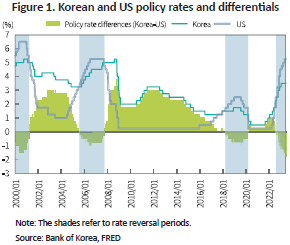

Recently, the US Fed has raised its policy rate steeply for curbing inflation, which led to a rate reversal where Korea's interest rate becomes lower than the US rate. Rate reversals did occur in the past only temporarily, but the recent reversal led to the largest differential between Korean and US interest rates. The trend of reversal between two countries is expected to persist for a considerable period of time because it is hard for Korea to raise its policy rate under the current economic conditions such as inflation and growth prospects while the US Fed is hinting one or two additional rate hikes this year.

The recent rate reversal between Korea and the US has constantly raised concerns about a possibility of capital outflows from Korea. If this phenomenon continues over a substantial period, the cost residents pay for raising foreign capital could rise further, which inevitably leads to a change in their financing behavior. This article analyzed capital flows by dividing them into equity and debt investment and by residents and non-residents during the periods of rate reversals from the 2000s to the present. Moreover, this article tried to explore the impact of rate reversals on the cost of financing foreign capital for economic entities including the financial investment industry that has demand for raising foreign capital, and briefly touched upon the implications related to this matter.

The largest rate reversal ever

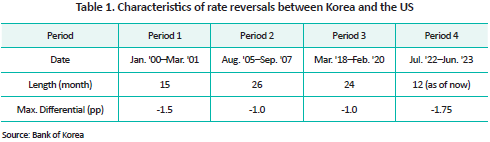

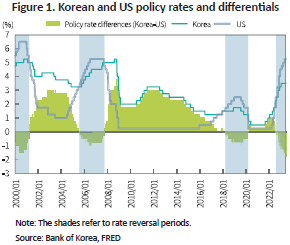

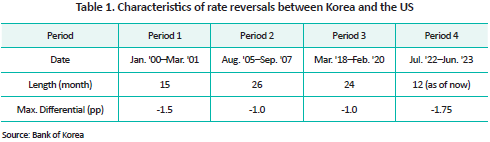

Currently, the federal funds rate–the US Fed's policy rate–reached 5.25% (upper limit) while Korea's policy rate stayed around 3.5%. Between the 2000s and the present, Korea observed four interest rate reversals–Korean won interest rates lower than US dollar interest rates–as illustrated in Table 1 and Figure 1: The early 2000s; right before the global financial crisis; right before the Covid-19 crisis; and during the Fed's recent ultra-tight policy. The longest rate reversals occurred prior to the global financial crisis (period 2) and before the Covid-19 crisis (period 3) for 26 months and 24 months, respectively. But the differentials of both reversals were less than 1.0%. By contrast, the most recent rate reversal has lasted for 12 months so far, but the size is unprecedentedly high at 1.75%.

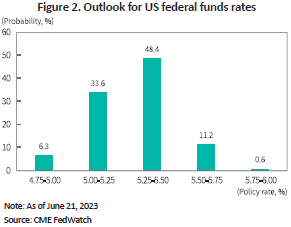

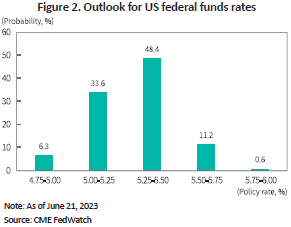

There is also a great interest in how long the recent rate reversal will persist. According to Fed fund futures data by CME FedWatch as of June 21, 2023, there is a 94% probability of the US policy rate (upper limit) rising above 5.25% at the end of this year. In the case of Korea, however, domestic inflation is gradually stabilizing downward with the growth outlook likely to remain in the mid-1% range this year, raising concerns about a possible downturn in the real economy. Hence, it appears that expectations for a policy rate cut are greater than the possibility that Korea follows the Fed's footsteps to raise its rate. This means that the recent rate reversal could persist further for an extended duration.

Rete reversals unlikely to spark capital outflows

Rate reversals between Korean and the US have an immediate impact on short- and long-term market rates, and thus affect global capital flows such as portfolio investment flows. This could be because a rate change directly affects investment returns via stock and bond price changes, and also has additional impact on investment returns via exchange gains and losses from changes in exchange rates.

For example, an increase in US interest rates could push up both yields on US dollar-denominated bonds, and expectations for strong dollar and exchange gains. As a result, international capital could move into US assets or dollar-denominated assets. This means a possibility of portfolio outflows from Korea towards the US. Although it is possible for returns on equity investment to show an opposite impact to interest rate changes, the impact is seen unclear. However, the impact from exchange rate fluctuations remains the same as that of bonds. Hence, even if a US rate hike places downward pressure on US equity prices, expectations for exchange gains from strong dollar could trigger a capital inflow to the US.

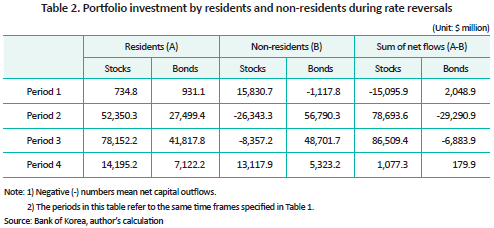

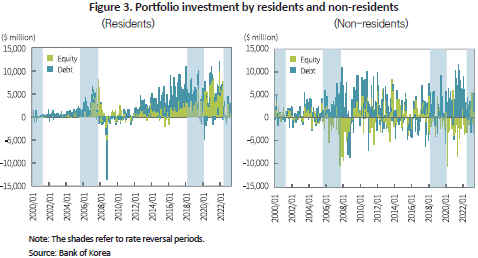

Under the context, it is worth noting the characteristics and scopes of capital outflows. Concerns arise with regard to a possible capital outflow resulting from rate reversals between home and abroad because capital outflows could depreciate stock and other asset prices and currency value, which may lead to higher financial market volatility. The problem is not limited to inward portfolio investment in Korea. It seems appropriate to apply this to Korean residents' outward portfolio flows that also have equivalent impact on the supply and demand in the FX market. Taking that into account, the below table analyzed capital flows during the period of rate reversals by dividing portfolio (stocks and bonds) outflows and inflows by domestic residents and non-residents since the 2000s.

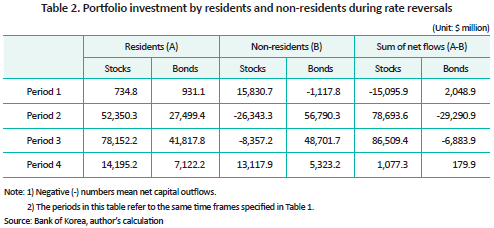

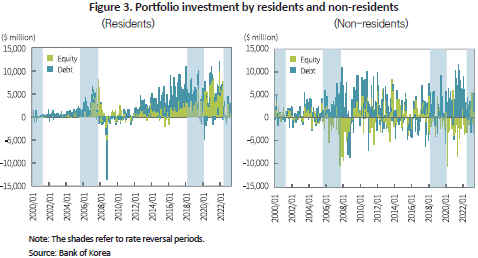

As shown in Table 2, outward portfolio investment by domestic residents has persistently grown regardless of rate reversals since the 2000s, reflecting Korea's large current account surplus. Non-residents' portfolio inflows and outflows were different in stocks and bonds, both of which were little affected by interest rate differences between home and abroad. This means that non-residents' stock portfolio recorded a large net outflow during the pre-crisis periods (period 2 and 3), but that had more likely stemmed from financial unrest prior to the global financial crisis and external uncertainties from US-China trade conflicts, rather than rate differences between home and abroad. During that period, portfolio investment in domestic bonds jumped significantly, leading to a net inflow into portfolio bond investment by non-residents. More recently during period 4, there was a gradual rise in outward and inward portfolio stock and bond investment by residents and non-residents. This again shows little impact from rate reversals.

The results suggest that the common perception of capital outflows in the event of rate reversal can be hardly observed in Korea. In other words, it appears that capital outflows–portfolio investment by residents and non-residents–are affected more by global uncertainties and the resulting changes in risk appetite and global liquidity as well as economic fundamentals in each country, than by interest rate differences between home and abroad.

Rising costs for raising foreign capital: The impacts and implications

Although a rate reversal between home and abroad is not highly likely to cause capital outflows, the interest rate difference is expected to remain quite high for a considerable period of time, which requires Korean economic entities to reconsider their behavior and costs for financing foreign capital. When Korea kept its interest rate quite high, raising foreign capital at a lower rate was positive as it lowered financing costs for domestic entities. However, under the current condition where the US dollar interest rate is higher than the Korean one, it is important to note that there is a general increase in the cost of financing foreign capital via issuing dollar-denominated bonds, borrowing from foreign banks, etc.

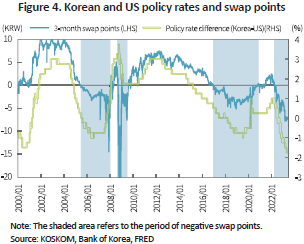

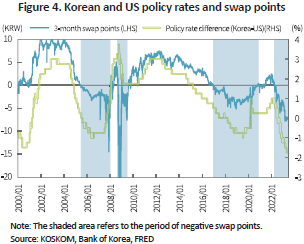

Also, as Korea has seen a persistent increase in outward portfolio investment by residents, it is advisable to bear in mind that the cost of financing foreign capital will further rise if pension funds and institutional investors try to hedge 100% of foreign currency exposure to mitigate exchange risk. If an institution finances foreign capital in an FX swap market for hedging exchange risk by buying spot and selling forward, the swap point–financing costs–will reflect the interest rate difference between home and abroad and turn negative, incurring additional costs that would amount as much as the size of rate reversal. This is exactly opposite to the past when Korean won interest rates were higher: At that time, financing foreign capital in the FX swap market led go gains as much as the size of the interest rate difference due to the positive swap point.

Accordingly, it is critical now than ever that Korean economic entities take careful note of the likelihood of the rate reversal lingering for an extended duration and come up with a coping strategy to deal with rising costs of raising foreign capital, rather than having irrational concerns. A caution is required to closely monitor interest rate trends and outlook when issuing foreign bonds for raising capital. Particularly important is a new exchange hedging strategy that takes into account the additional financing cost arising when domestic residents try to finance foreign capital in the FX swap market for hedging exchange risk involved in their outward portfolio investment.

The recent rate reversal between Korea and the US has constantly raised concerns about a possibility of capital outflows from Korea. If this phenomenon continues over a substantial period, the cost residents pay for raising foreign capital could rise further, which inevitably leads to a change in their financing behavior. This article analyzed capital flows by dividing them into equity and debt investment and by residents and non-residents during the periods of rate reversals from the 2000s to the present. Moreover, this article tried to explore the impact of rate reversals on the cost of financing foreign capital for economic entities including the financial investment industry that has demand for raising foreign capital, and briefly touched upon the implications related to this matter.

The largest rate reversal ever

Currently, the federal funds rate–the US Fed's policy rate–reached 5.25% (upper limit) while Korea's policy rate stayed around 3.5%. Between the 2000s and the present, Korea observed four interest rate reversals–Korean won interest rates lower than US dollar interest rates–as illustrated in Table 1 and Figure 1: The early 2000s; right before the global financial crisis; right before the Covid-19 crisis; and during the Fed's recent ultra-tight policy. The longest rate reversals occurred prior to the global financial crisis (period 2) and before the Covid-19 crisis (period 3) for 26 months and 24 months, respectively. But the differentials of both reversals were less than 1.0%. By contrast, the most recent rate reversal has lasted for 12 months so far, but the size is unprecedentedly high at 1.75%.

There is also a great interest in how long the recent rate reversal will persist. According to Fed fund futures data by CME FedWatch as of June 21, 2023, there is a 94% probability of the US policy rate (upper limit) rising above 5.25% at the end of this year. In the case of Korea, however, domestic inflation is gradually stabilizing downward with the growth outlook likely to remain in the mid-1% range this year, raising concerns about a possible downturn in the real economy. Hence, it appears that expectations for a policy rate cut are greater than the possibility that Korea follows the Fed's footsteps to raise its rate. This means that the recent rate reversal could persist further for an extended duration.

Rete reversals unlikely to spark capital outflows

Rate reversals between Korean and the US have an immediate impact on short- and long-term market rates, and thus affect global capital flows such as portfolio investment flows. This could be because a rate change directly affects investment returns via stock and bond price changes, and also has additional impact on investment returns via exchange gains and losses from changes in exchange rates.

For example, an increase in US interest rates could push up both yields on US dollar-denominated bonds, and expectations for strong dollar and exchange gains. As a result, international capital could move into US assets or dollar-denominated assets. This means a possibility of portfolio outflows from Korea towards the US. Although it is possible for returns on equity investment to show an opposite impact to interest rate changes, the impact is seen unclear. However, the impact from exchange rate fluctuations remains the same as that of bonds. Hence, even if a US rate hike places downward pressure on US equity prices, expectations for exchange gains from strong dollar could trigger a capital inflow to the US.

Under the context, it is worth noting the characteristics and scopes of capital outflows. Concerns arise with regard to a possible capital outflow resulting from rate reversals between home and abroad because capital outflows could depreciate stock and other asset prices and currency value, which may lead to higher financial market volatility. The problem is not limited to inward portfolio investment in Korea. It seems appropriate to apply this to Korean residents' outward portfolio flows that also have equivalent impact on the supply and demand in the FX market. Taking that into account, the below table analyzed capital flows during the period of rate reversals by dividing portfolio (stocks and bonds) outflows and inflows by domestic residents and non-residents since the 2000s.

As shown in Table 2, outward portfolio investment by domestic residents has persistently grown regardless of rate reversals since the 2000s, reflecting Korea's large current account surplus. Non-residents' portfolio inflows and outflows were different in stocks and bonds, both of which were little affected by interest rate differences between home and abroad. This means that non-residents' stock portfolio recorded a large net outflow during the pre-crisis periods (period 2 and 3), but that had more likely stemmed from financial unrest prior to the global financial crisis and external uncertainties from US-China trade conflicts, rather than rate differences between home and abroad. During that period, portfolio investment in domestic bonds jumped significantly, leading to a net inflow into portfolio bond investment by non-residents. More recently during period 4, there was a gradual rise in outward and inward portfolio stock and bond investment by residents and non-residents. This again shows little impact from rate reversals.

The results suggest that the common perception of capital outflows in the event of rate reversal can be hardly observed in Korea. In other words, it appears that capital outflows–portfolio investment by residents and non-residents–are affected more by global uncertainties and the resulting changes in risk appetite and global liquidity as well as economic fundamentals in each country, than by interest rate differences between home and abroad.

Rising costs for raising foreign capital: The impacts and implications

Although a rate reversal between home and abroad is not highly likely to cause capital outflows, the interest rate difference is expected to remain quite high for a considerable period of time, which requires Korean economic entities to reconsider their behavior and costs for financing foreign capital. When Korea kept its interest rate quite high, raising foreign capital at a lower rate was positive as it lowered financing costs for domestic entities. However, under the current condition where the US dollar interest rate is higher than the Korean one, it is important to note that there is a general increase in the cost of financing foreign capital via issuing dollar-denominated bonds, borrowing from foreign banks, etc.

Also, as Korea has seen a persistent increase in outward portfolio investment by residents, it is advisable to bear in mind that the cost of financing foreign capital will further rise if pension funds and institutional investors try to hedge 100% of foreign currency exposure to mitigate exchange risk. If an institution finances foreign capital in an FX swap market for hedging exchange risk by buying spot and selling forward, the swap point–financing costs–will reflect the interest rate difference between home and abroad and turn negative, incurring additional costs that would amount as much as the size of rate reversal. This is exactly opposite to the past when Korean won interest rates were higher: At that time, financing foreign capital in the FX swap market led go gains as much as the size of the interest rate difference due to the positive swap point.

Accordingly, it is critical now than ever that Korean economic entities take careful note of the likelihood of the rate reversal lingering for an extended duration and come up with a coping strategy to deal with rising costs of raising foreign capital, rather than having irrational concerns. A caution is required to closely monitor interest rate trends and outlook when issuing foreign bonds for raising capital. Particularly important is a new exchange hedging strategy that takes into account the additional financing cost arising when domestic residents try to finance foreign capital in the FX swap market for hedging exchange risk involved in their outward portfolio investment.