OPINION

2024 Mar/05

Digital Transformation in Foreign Exchange Trading: Effects and Implications

Mar. 05, 2024

PDF

- Summary

- The ongoing digitalization in the global FX market has led to improvements in trading speed and convenience and cost savings, while bringing about a structural shift toward expanding the role of dealer-to-customer transactions. This shift holds following implications for Korea, where the digitalization of FX transactions remains in its early stages. First, domestic banks in Korea should recognize the need for digitalizing FX dealer-to-customer transactions to secure a stable customer base. Non-banking financial institutions should also focus on achieving digital competitiveness in FX trading and brokerage businesses, alongside the development of various FX business operations. Second, the traditional distinction between interbank and dealer-to-customer transactions is gradually blurring, underscoring the need for regulatory and infrastructure improvements to facilitate swift, convenient, and low-cost FX transactions and trading for multiple liquidity providers and customers. Lastly, Korea should enable non-residents to electronically offer quotes based on spot exchange rates to their global clients. This could serve as a catalyst for attracting offshore non-deliverable forward (NDF) traders into its domestic spot exchange market and fostering the digitalization of dealer-to-customer transactions in the FX market.

In an open economy like Korea, heavily reliant on the external sector, the foreign exchange market (FX market) plays a crucial role. Cross-border transactions involving goods, services, and various capital and financial instruments are inevitably carried out through the FX market. Exchange rates that are determined in this process have a significant impact on Korea’s macroeconomic conditions and financial stability. In this respect, it is essential to enhance the underlying infrastructure of the FX market to accommodate the demand for a range of FX transactions and reduce exchange rate volatility.

Over the past two decades, the global FX market has undergone rapid digitalization, propelled by advancements in computational technology. This has led to significant developments in the FX market structure, such as improved price efficiency and increased liquidity, primarily in dealer-to-customer transactions. On the other hand, the Seoul Foreign Exchange Market (Seoul FX Market) lags behind in both quantitative and qualitative advancements. To address these issues, the Korean government approved the digitalization of dealer-to-customer transactions in 2021 and is planning to improve its FX market infrastructure as part of the interbank market opening initiative scheduled for the latter half of 2024. Against this backdrop, this article delves into the digital evolution and structural changes in the global FX market and discusses their implications for the Korean FX market.

Advancing digitalization in foreign exchange transactions

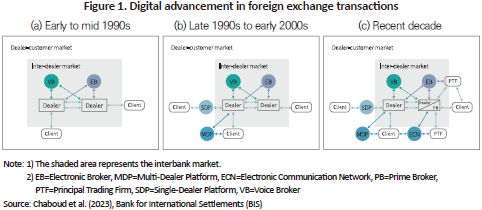

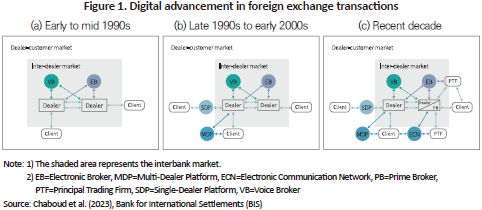

Until the early 1990s, in most cases, transactions among bank dealers (interbank market) and between customers such as banks and companies (dealer-to-customer market) were conducted manually, with orders placed via phone calls or fax. In the early to mid-1990s, however, FX transactions among dealers, including broker-mediated ones, began to transition to electronic trading, starting with the interbank market. Major FX brokers like Reuters and EBS launched electronic trading services, which eventually displaced voice brokers engaged in phone-based transactions from the market, albeit with some exceptions (Figure 1 (a)). This transition was driven by significant improvements in transaction speed and convenience facilitated by electronic services for order placement and execution. Nonetheless, banks continued to rely on voice brokers for conducting dealer-to-customer transactions.

From the late 1990s to the early 2000s (Figure 1 (b)), electronic trading services expanded into the dealer-to-customer market. Major global banks introduced a Single-Dealer Platform (SDP) for dealer-to-customer transactions using their own proprietary electronic technology.1) For example, Deutsche Bank began to electronically provide price information obtained from interbank brokers to customers through its electronic quoting system in 1996. In the early 2000s, a Multi-Dealer Platform (MDP)2) emerged, where upon a specific customer’s Request For Quote (RFQ), price and quantity information of multiple banks are integrated to enable the execution of orders at the most favorable conditions. This process has given rise to electronic brokers (aggregators) who deliver price information collected from banks to customers, and their role is now played by telecommunication companies as well as major banks.

In recent years, the structure of the global FX market has become remarkably complex and diverse. As illustrated in Figure 1 (c), Electronic Communication Networks (ECNs) have emerged, largely replacing the roles of global banks and FX brokers. ECNs gather the most favorable price and quantity information tailored to multiple needs and provide it to retail investors as well as non-banking financial institutions and Principal Trading Firms (PTFs). In Particular, PTFs have become significant FX traders, employing a algorithmic trading system3) to function not only as FX customers but also as liquidity providers. This shift is facilitated by the Prime Brokerage (PB) system where a bank enhances customer creditworthiness by allowing customers to use the bank’s name in their FX transactions. On top of that, FX brokerage functions have rapidly evolved, with the emergence of retail electronic brokers targeting retail investors engaged in FX investment, further complicating and diversifying the structure of the FX market.

Meanwhile, the Seoul FX Market is considered to be in the early stages of development shown in Figure 1 (b). Digital trading services were launched in the interbank market in October 2002 when domestic FX brokers4) provided their computer infrastructure to bank dealers. However, the digitalization of FX deal-to-customer transactions began only about two years ago, in December 2021, when the foreign exchange authorities permitted banks to handle their dealer-to-customer transactions electronically. Currently, it is known that only a few domestic banks use real-time interbank market price information to electronically process dealer-to-customer transactions. This implies that when it comes to digitalization of dealer-to-customer transactions, the Seoul FX Market lags behind its global counterpart by nearly 20 years.

Impact of digital transition and subsequent structural changes in the market

Amid the ongoing digitalization of global FX transactions, the global FX market is experiencing positive changes including greater market efficiency and increased liquidity as well as structural changes such as the development of the dealer-to-customer market. Key effects and structural changes can be summarized as follows.

First, the digitalization of FX transactions has increasingly permeated dealer-to-customer transactions, significantly enhancing customer convenience and reducing costs. Major clients such as companies and hedge funds now have access to real-time price information electronically provided by banks, without the need for price inquiries via phone calls, and execute FX transactions swiftly at optimal prices. Previously, banks determined spreads based on client creditworthiness, but now clients have greater control over pricing. Although banks have witnessed a slight decline in profitability due to intensified competition in dealer-to-customer transactions, the utilization of system dealers has enabled them to electronically provide customized quotes based on creditworthiness and automatically conduct tasks such as exchange position management, order placement, and order execution, traditionally handled by back-office operations at banks. The FX trading system established through system dealers has resulted in cost savings, enabling investment in customer management and the development of new services.

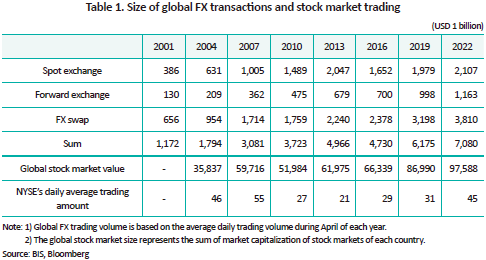

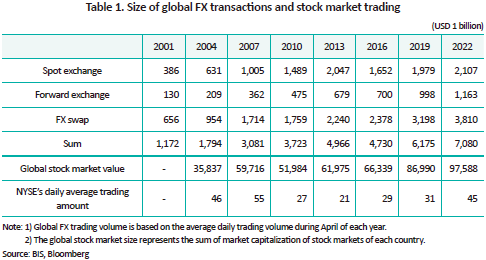

Second, the improved market efficiency resulting from advanced digitalization of FX transactions has significantly boosted market liquidity. According to the survey conducted by the Bank for International Settlements (BIS) every three years, the daily average of global FX trading volume amounted to $7.1 trillion in 2022, with spot exchange transactions reaching $2.1 trillion. These figures represent a 6-fold and 5.5-fold increase from the 2001 daily average, respectively, indicating balanced growth across most types of FX transactions. It is noteworthy that during the same period, the global stock market capitalization increased nearly three times, whereas the daily average trading volume of the New York Stock Exchange (NYSE), the largest in terms of market capitalization, showed little change. This suggests that the liquidity increase in the FX market attributable to digitalized dealer-to-customer transactions has outpaced that of the stock market.5)

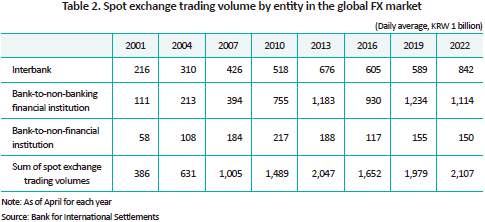

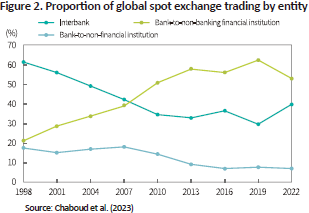

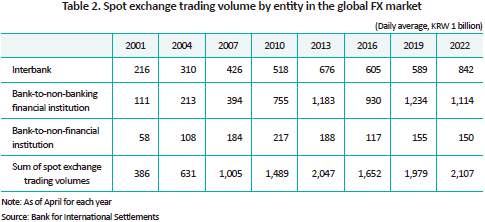

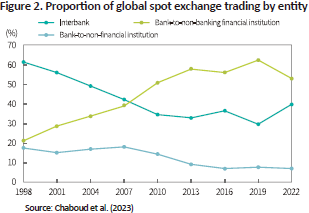

Third, the dealer-to-customer market has undergone remarkable improvement compared to the interbank market. In an examination of spot exchange transactions by entity, interbank transactions increased by 3.9 times during the specified period, while transactions between banks and non-banking financial institutions6) saw a whopping 10-fold increase.7) This trend is evident in Figure 2, which illustrates that spot exchange transactions between banks and non-banking financial institutions have overtaken interbank transaction volumes since 2010. The increased proportion of FX transactions by non-banking financial institutions can be attributed to the rising demand for FX trading involving entities such as global hedge funds and sovereign wealth funds. Additionally, major banks have expanded prime brokerage (PB) services and invested in the development of customer electronic trading platforms to enhance trading convenience for such financial institutions.8)

Fourth, amid these changes, the existing FX market structure, previously divided between banks and companies, is evolving into a multi-layered framework. Intensified competition in dealer-to-customer transactions and expanded customer bases have reduced the need for hot potato trading aimed at mitigating FX risk, resulting in a contraction in spot exchange trading. On the other hand, the size of the dealer-to-customer market has increased and customers have gained greater control over pricing, compared to the past. In particular, PTFs have seen an increase in trading volume and frequency and are even taking on the role of liquidity providers through PB services offered by global banks, indicating their growing present in the market. This suggests that the distinction between liquidity providers (LPs) and liquidity customers (LCs) in the traditional market structure has gradually become blurred.

Implications

The digitalization of FX trading in the dealer-to-customer market has yielded positive effects such as improvements in transaction speed and convenience and cost savings. Additionally, the role and importance of dealer-to-customer transactions are growing compared to interbank transactions. In particular, major companies and non-banking financial institutions have assumed the role of liquidity providers in addition to being FX customers, thus blurring the traditional distinction in the FX market. This global trend has significant implications for Korea, where the digitalization of the dealer-to-customer market remains in its early stages.

First, domestic banks in Korea have been conservative in adopting the digitalization in dealer-to-customer transactions. Given that this is an irreversible global trend, embracing digitalization could allow them to secure a stable customer base through swift and convenient transactions and cost savings. In this respect, banks should develop individual IT infrastructure and adopt advanced digitalization systems to prepare for potential weakening of their control over and intensified competition in dealer-to-customer transactions. They also need to put efforts into improving customer services. Notably, inflows and outflows of securities investment funds are expected to further increase in Korea. Therefore, non-banking financial institutions including domestic securities firms should proactively adapt to digitalization-led structural changes in the FX market by gaining a competitive advantage in FX trading and expanding and diversifying FX trading and brokerage businesses.

Second, the traditional FX market segmentation between interbank trading and dealer-to-customer trading has become gradually ambiguous, a trend that Korea should reflect in its legal framework. Rather than adhering to bank-centric approach embedded in FX-related regulations, there is a need to focus on facilitating the functions of the FX market to support external trading in an open economy system. To this end, it is essential to move away from the current distinction between FX banks and other institutions involved in FX transactions. Additionally, the FX market infrastructure and relevant legal framework should be improved to facilitate swift, convenient, and low-cost FX transactions and trading for various liquidity providers and customers.

Third, Korea’s foreign exchange authorities should capitalize on the opening of the interbank market to foreign relevant financial institutions (RFIs), scheduled for the latter half of this year, to improve the infrastructure of the Korean FX market. To ensure that the interbank market opening to foreign entities yields positive effects, it is crucial to enhance incentives for their participation in the Korean FX market. Currently, offshore traders primarily engage in digitalized KRW-denominated non-deliverable forward (NDF) trading. In this respect, what is needed is the establishment of market infrastructure that enables these traders—who have entered the Korean interbank market—to electronically provide quotes based on spot exchange rates determined domestically to global hedge funds and other major clients. This approach can create an opportunity to attract offshore NDF traders into the domestic spot exchange market, thus achieving market opening effects, while also advancing the digitalization of dealer-to-customer transactions in the Korean FX market.

1) Key electronic technologies include the API (Application Programming Interface), which electronically delivers real-time price information in the interbank market to customers, and the MMS (Market Making System) that refers to an internal system deals for banks.

2) Representative initial MDPs include Currenex, Hostpot FX, and Fxall.

3) Algorithmic trading refers to a trading method where computer programs automatically execute trades according to predetermined algorithms.

4) In the Seoul FX Market, KRW-USD spot exchange trading is handled by Seoul Money Brokerage Services and Korea Money Brokerage, which provide computer infrastructure for interbank trading to bank dealers.

5) The average daily spot exchange trading volume in Korea increased from KRW 5.32 billion in 2001 to KRW 23.13 billion in 2022.

6) Non-banking financial institutions include global hedge funds, mutual funds, public pension funds, and insurance companies.

7) Similar results were obtained from traditional FX transactions, including spot exchange, forward exchange, and currency swap transactions.

8) The survey by the BIS found that in terms of digitalization, dealer-to-customer transactions take up a greater proportion than interbank transactions, and by transaction type, spot exchange transactions showed the highest level of digitalization.

References

BIS, 2022, OTC Foreign Exchange Turnover in April 2022.

Chaboud, A., Rime, D., Sushko, V., 2023, The foreign exchange market, BIS Working Papers NO.1094.

Schrimpf, A., Sushko, V., 2019, FX trade execution: complex and highly fragmented, BIS Quarterly Review, December 2019.

Over the past two decades, the global FX market has undergone rapid digitalization, propelled by advancements in computational technology. This has led to significant developments in the FX market structure, such as improved price efficiency and increased liquidity, primarily in dealer-to-customer transactions. On the other hand, the Seoul Foreign Exchange Market (Seoul FX Market) lags behind in both quantitative and qualitative advancements. To address these issues, the Korean government approved the digitalization of dealer-to-customer transactions in 2021 and is planning to improve its FX market infrastructure as part of the interbank market opening initiative scheduled for the latter half of 2024. Against this backdrop, this article delves into the digital evolution and structural changes in the global FX market and discusses their implications for the Korean FX market.

Advancing digitalization in foreign exchange transactions

Until the early 1990s, in most cases, transactions among bank dealers (interbank market) and between customers such as banks and companies (dealer-to-customer market) were conducted manually, with orders placed via phone calls or fax. In the early to mid-1990s, however, FX transactions among dealers, including broker-mediated ones, began to transition to electronic trading, starting with the interbank market. Major FX brokers like Reuters and EBS launched electronic trading services, which eventually displaced voice brokers engaged in phone-based transactions from the market, albeit with some exceptions (Figure 1 (a)). This transition was driven by significant improvements in transaction speed and convenience facilitated by electronic services for order placement and execution. Nonetheless, banks continued to rely on voice brokers for conducting dealer-to-customer transactions.

From the late 1990s to the early 2000s (Figure 1 (b)), electronic trading services expanded into the dealer-to-customer market. Major global banks introduced a Single-Dealer Platform (SDP) for dealer-to-customer transactions using their own proprietary electronic technology.1) For example, Deutsche Bank began to electronically provide price information obtained from interbank brokers to customers through its electronic quoting system in 1996. In the early 2000s, a Multi-Dealer Platform (MDP)2) emerged, where upon a specific customer’s Request For Quote (RFQ), price and quantity information of multiple banks are integrated to enable the execution of orders at the most favorable conditions. This process has given rise to electronic brokers (aggregators) who deliver price information collected from banks to customers, and their role is now played by telecommunication companies as well as major banks.

In recent years, the structure of the global FX market has become remarkably complex and diverse. As illustrated in Figure 1 (c), Electronic Communication Networks (ECNs) have emerged, largely replacing the roles of global banks and FX brokers. ECNs gather the most favorable price and quantity information tailored to multiple needs and provide it to retail investors as well as non-banking financial institutions and Principal Trading Firms (PTFs). In Particular, PTFs have become significant FX traders, employing a algorithmic trading system3) to function not only as FX customers but also as liquidity providers. This shift is facilitated by the Prime Brokerage (PB) system where a bank enhances customer creditworthiness by allowing customers to use the bank’s name in their FX transactions. On top of that, FX brokerage functions have rapidly evolved, with the emergence of retail electronic brokers targeting retail investors engaged in FX investment, further complicating and diversifying the structure of the FX market.

Meanwhile, the Seoul FX Market is considered to be in the early stages of development shown in Figure 1 (b). Digital trading services were launched in the interbank market in October 2002 when domestic FX brokers4) provided their computer infrastructure to bank dealers. However, the digitalization of FX deal-to-customer transactions began only about two years ago, in December 2021, when the foreign exchange authorities permitted banks to handle their dealer-to-customer transactions electronically. Currently, it is known that only a few domestic banks use real-time interbank market price information to electronically process dealer-to-customer transactions. This implies that when it comes to digitalization of dealer-to-customer transactions, the Seoul FX Market lags behind its global counterpart by nearly 20 years.

Impact of digital transition and subsequent structural changes in the market

Amid the ongoing digitalization of global FX transactions, the global FX market is experiencing positive changes including greater market efficiency and increased liquidity as well as structural changes such as the development of the dealer-to-customer market. Key effects and structural changes can be summarized as follows.

First, the digitalization of FX transactions has increasingly permeated dealer-to-customer transactions, significantly enhancing customer convenience and reducing costs. Major clients such as companies and hedge funds now have access to real-time price information electronically provided by banks, without the need for price inquiries via phone calls, and execute FX transactions swiftly at optimal prices. Previously, banks determined spreads based on client creditworthiness, but now clients have greater control over pricing. Although banks have witnessed a slight decline in profitability due to intensified competition in dealer-to-customer transactions, the utilization of system dealers has enabled them to electronically provide customized quotes based on creditworthiness and automatically conduct tasks such as exchange position management, order placement, and order execution, traditionally handled by back-office operations at banks. The FX trading system established through system dealers has resulted in cost savings, enabling investment in customer management and the development of new services.

Second, the improved market efficiency resulting from advanced digitalization of FX transactions has significantly boosted market liquidity. According to the survey conducted by the Bank for International Settlements (BIS) every three years, the daily average of global FX trading volume amounted to $7.1 trillion in 2022, with spot exchange transactions reaching $2.1 trillion. These figures represent a 6-fold and 5.5-fold increase from the 2001 daily average, respectively, indicating balanced growth across most types of FX transactions. It is noteworthy that during the same period, the global stock market capitalization increased nearly three times, whereas the daily average trading volume of the New York Stock Exchange (NYSE), the largest in terms of market capitalization, showed little change. This suggests that the liquidity increase in the FX market attributable to digitalized dealer-to-customer transactions has outpaced that of the stock market.5)

Third, the dealer-to-customer market has undergone remarkable improvement compared to the interbank market. In an examination of spot exchange transactions by entity, interbank transactions increased by 3.9 times during the specified period, while transactions between banks and non-banking financial institutions6) saw a whopping 10-fold increase.7) This trend is evident in Figure 2, which illustrates that spot exchange transactions between banks and non-banking financial institutions have overtaken interbank transaction volumes since 2010. The increased proportion of FX transactions by non-banking financial institutions can be attributed to the rising demand for FX trading involving entities such as global hedge funds and sovereign wealth funds. Additionally, major banks have expanded prime brokerage (PB) services and invested in the development of customer electronic trading platforms to enhance trading convenience for such financial institutions.8)

Fourth, amid these changes, the existing FX market structure, previously divided between banks and companies, is evolving into a multi-layered framework. Intensified competition in dealer-to-customer transactions and expanded customer bases have reduced the need for hot potato trading aimed at mitigating FX risk, resulting in a contraction in spot exchange trading. On the other hand, the size of the dealer-to-customer market has increased and customers have gained greater control over pricing, compared to the past. In particular, PTFs have seen an increase in trading volume and frequency and are even taking on the role of liquidity providers through PB services offered by global banks, indicating their growing present in the market. This suggests that the distinction between liquidity providers (LPs) and liquidity customers (LCs) in the traditional market structure has gradually become blurred.

Implications

The digitalization of FX trading in the dealer-to-customer market has yielded positive effects such as improvements in transaction speed and convenience and cost savings. Additionally, the role and importance of dealer-to-customer transactions are growing compared to interbank transactions. In particular, major companies and non-banking financial institutions have assumed the role of liquidity providers in addition to being FX customers, thus blurring the traditional distinction in the FX market. This global trend has significant implications for Korea, where the digitalization of the dealer-to-customer market remains in its early stages.

First, domestic banks in Korea have been conservative in adopting the digitalization in dealer-to-customer transactions. Given that this is an irreversible global trend, embracing digitalization could allow them to secure a stable customer base through swift and convenient transactions and cost savings. In this respect, banks should develop individual IT infrastructure and adopt advanced digitalization systems to prepare for potential weakening of their control over and intensified competition in dealer-to-customer transactions. They also need to put efforts into improving customer services. Notably, inflows and outflows of securities investment funds are expected to further increase in Korea. Therefore, non-banking financial institutions including domestic securities firms should proactively adapt to digitalization-led structural changes in the FX market by gaining a competitive advantage in FX trading and expanding and diversifying FX trading and brokerage businesses.

Second, the traditional FX market segmentation between interbank trading and dealer-to-customer trading has become gradually ambiguous, a trend that Korea should reflect in its legal framework. Rather than adhering to bank-centric approach embedded in FX-related regulations, there is a need to focus on facilitating the functions of the FX market to support external trading in an open economy system. To this end, it is essential to move away from the current distinction between FX banks and other institutions involved in FX transactions. Additionally, the FX market infrastructure and relevant legal framework should be improved to facilitate swift, convenient, and low-cost FX transactions and trading for various liquidity providers and customers.

Third, Korea’s foreign exchange authorities should capitalize on the opening of the interbank market to foreign relevant financial institutions (RFIs), scheduled for the latter half of this year, to improve the infrastructure of the Korean FX market. To ensure that the interbank market opening to foreign entities yields positive effects, it is crucial to enhance incentives for their participation in the Korean FX market. Currently, offshore traders primarily engage in digitalized KRW-denominated non-deliverable forward (NDF) trading. In this respect, what is needed is the establishment of market infrastructure that enables these traders—who have entered the Korean interbank market—to electronically provide quotes based on spot exchange rates determined domestically to global hedge funds and other major clients. This approach can create an opportunity to attract offshore NDF traders into the domestic spot exchange market, thus achieving market opening effects, while also advancing the digitalization of dealer-to-customer transactions in the Korean FX market.

1) Key electronic technologies include the API (Application Programming Interface), which electronically delivers real-time price information in the interbank market to customers, and the MMS (Market Making System) that refers to an internal system deals for banks.

2) Representative initial MDPs include Currenex, Hostpot FX, and Fxall.

3) Algorithmic trading refers to a trading method where computer programs automatically execute trades according to predetermined algorithms.

4) In the Seoul FX Market, KRW-USD spot exchange trading is handled by Seoul Money Brokerage Services and Korea Money Brokerage, which provide computer infrastructure for interbank trading to bank dealers.

5) The average daily spot exchange trading volume in Korea increased from KRW 5.32 billion in 2001 to KRW 23.13 billion in 2022.

6) Non-banking financial institutions include global hedge funds, mutual funds, public pension funds, and insurance companies.

7) Similar results were obtained from traditional FX transactions, including spot exchange, forward exchange, and currency swap transactions.

8) The survey by the BIS found that in terms of digitalization, dealer-to-customer transactions take up a greater proportion than interbank transactions, and by transaction type, spot exchange transactions showed the highest level of digitalization.

References

BIS, 2022, OTC Foreign Exchange Turnover in April 2022.

Chaboud, A., Rime, D., Sushko, V., 2023, The foreign exchange market, BIS Working Papers NO.1094.

Schrimpf, A., Sushko, V., 2019, FX trade execution: complex and highly fragmented, BIS Quarterly Review, December 2019.