Find out more about our latest publications

Reforming Korea’s Multi-Pillar Pension system for Increasing Income Replacement Rates

Issue Papers 22-15 Aug. 16, 2022

- Research Topic Asset Management/Pension

- Page 23

This article aims to explore the pension scheme reform to achieve a higher income replacement ratio. As Korea’s combined income replacement ratio ranges from 57% (DC plans) to 61% (DB plans), reform for post-retirement income security should be directed toward achieving higher replacement ratios to ensure a post-retirement life with reasonable living standards. However, given the predicted depletion of pension assets, the public pension reform should focus on how to achieve stability of replacement ratios between generations (financial sustainability). Furthermore, it is necessary to overhaul private pension plans that could help raise income replacement ratios by boosting returns without additional premium payment in order to increase the contribution level within the multi-pillar pension scheme.

Even if the return is maximized through the reform of fund management, the pension fund depletion could be postponed by two to five years at most since the National Pension fund is drying up at a rapid pace. This necessitates an increase in the contribution to achieve financial sustainability. Notably, advanced management of pension assets could reduce the contribution burden significantly, considering that it is expected to generate additional profits that could be translated into 12 to 20 years’ worth of contribution income. In this respect, what is needed is social consensus for raising the contribution level. To this end, how to share the burden of fund deficit should be established and the contribution that the government and the national pension fund could make as trustees through the fund management reform should be reflected in actuarial valuation before the long-term contribution rate is determined.

If private plans—highly inefficient in asset management, compared to the public pension contributions—are overhauled, it is likely to drive up the income replacement ratio without any additional costs. If Korea enhances its pension scheme to the level of advanced economies by introducing fund-type retirement plans, the replacement ratio could climb by up to 5%p to 11%p, approaching the internationally recommended combined replacement ratio of 66% to 68%. Therefore, further discussions of pension reform should center around a multi-pillar approach encompassing public and private pension plans to devise an optimal policy mix for adequate post-retirement income security and the public pension’s financial sustainability.

Even if the return is maximized through the reform of fund management, the pension fund depletion could be postponed by two to five years at most since the National Pension fund is drying up at a rapid pace. This necessitates an increase in the contribution to achieve financial sustainability. Notably, advanced management of pension assets could reduce the contribution burden significantly, considering that it is expected to generate additional profits that could be translated into 12 to 20 years’ worth of contribution income. In this respect, what is needed is social consensus for raising the contribution level. To this end, how to share the burden of fund deficit should be established and the contribution that the government and the national pension fund could make as trustees through the fund management reform should be reflected in actuarial valuation before the long-term contribution rate is determined.

If private plans—highly inefficient in asset management, compared to the public pension contributions—are overhauled, it is likely to drive up the income replacement ratio without any additional costs. If Korea enhances its pension scheme to the level of advanced economies by introducing fund-type retirement plans, the replacement ratio could climb by up to 5%p to 11%p, approaching the internationally recommended combined replacement ratio of 66% to 68%. Therefore, further discussions of pension reform should center around a multi-pillar approach encompassing public and private pension plans to devise an optimal policy mix for adequate post-retirement income security and the public pension’s financial sustainability.

Ⅰ. 통합소득대체율로 본 다층연금의 개혁 방향

1. 연구 목적

본 보고서는 연금 소득대체율 상향을 위한 연금개혁 방향을 연구한다. 연금개혁의 관점과 범위, 방향은 다양한 스펙트럼을 가질 수 있는데, 본 보고서가 소득대체율을 중심에 두고 연구하는 것은 무엇보다 연금제도의 존재 목적이 노후소득의 보장에 있기 때문이다. 급여 적정성을 충족하지 못하는 연금제도는 재정안정이 확보되더라도 노후소득보장제도로서 의미는 퇴색된다.

아울러, 본 보고서는 급여 적정성과 재정 지속가능성 문제를 개별연금이 아닌 다층연금의 관점에서 연구한다. 우리나라는 1988년 국민연금 도입 이후 2001년에 본격적인 세제적격 개인연금, 2005년에 퇴직연금을 각각 도입하면서 국제기구가 제시한 ‘다층연금제도(multi-pillar pension system)’ 속에서 적정성과 지속가능성 간 정책조합을 유기적으로 시도할 수 있는 제도의 틀을 진작부터 운영하고 있다(World Bank, 1994; ILO, 2005). 국제기구가 다층연금제도를 미래의 노후소득보장제도 대안으로 제시한 것은 공적연금이 재정안정을 위한 제도개혁을 추진하는 과정에서 희생될 수 있는 노후소득의 적정성 문제를 사적연금과의 역할 분담을 통해 확보하기 위한 것이라고 할 수 있다. 이 같은 국제기구의 다층연금제도 메시지는 공적연금은 기금고갈, 사적연금은 심각한 운용 비효율 상태에 놓인 우리나라의 연금개혁 논의의 출발점이 될 수 있다고 판단된다.

이에 본 보고서에서는 다층연금의 통합소득대체율 추정을 통해 노후소득 수준의 적정성을 판단하고, 소득대체율 상향을 위한 공적연금과 사적연금의 역할 분담, 소득대체율의 세대간 안정을 위한 공적연금의 재정안정 강화 방안, 사적연금의 소득대체율 제고를 위한 운용체제 혁신 방안 등 소득대체율 상향을 위한 세부적인 정책 방향에 대해 검토한다.

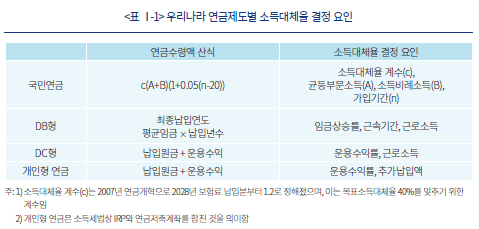

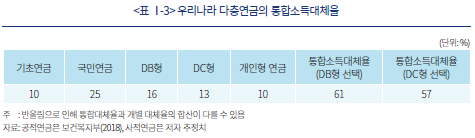

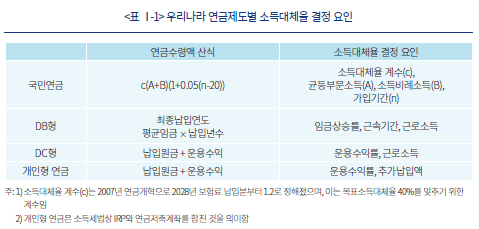

2. 통합소득대체율의 추정

다층연금제도 아래서 노후소득의 적정성은 통합소득대체율을 통해 판단할 수 있다. 국민연금, 퇴직연금, 개인연금 각각의 소득대체율을 합산한 통합소득대체율로 노후소득의 적정성으로 판단해야 한다. 기존의 일부 문헌들에서도 공적연금과 퇴직연금, 개인연금 각각의 소득대체율 실증에 초점을 맞춰 온 기존 연구 흐름을 넘어, 공적연금과 사적연금의 소득대체율을 통합적으로 판단하려는 움직임이 있었다.1) 선행 연구를 바탕으로 본 보고서는 <표 Ⅰ-1>과 같은 구성으로 연금별 소득대체율과 통합소득대체율을 측정하기로 한다. 선행 연구와 달리 본 고는 퇴직연금의 경우 DB형과 DC형을 구분하여 소득대체율을 측정한다. DB형의 경우 임금상승률과 근속연수가 소득대체율 결정 요인이기 때문에 적립금운용수익률이 소득대체율을 결정하는 DC형과 동일하게 취급할 수 없다. DB형 적립금의 운용수익률은 소득대체율과는 무관한 대신 재정건전성(기업의 확정급여채무)에 영향을 미친다. 그리고 여기서 개인형 연금은 퇴직연금의 IRP와 개인연금인 연금저축계좌를 포함하는 넓은 의미의 개인연금이다. 개인형 연금은 가입자의 가처분소득으로부터 자발적인 추가납입을 통해 노후자산을 형성하는 연금을 의미한다. 다시 말해, 추가납입(기여금)만이 소득대체율 측정에 포함되며 DB형과 DC형으로부터 이전한 퇴직소득은 개인형 연금의 소득대체율로 계산하지 않는다. 마지막으로 국민연금의 경우 소득대체율은 정부가 소득대체율 계수(c)를 정책적으로 결정한다. 국민연금 운용수익률은 소득대체율에 영향을 미치지 않으며, 연금재정의 건전성(소득대체율의 세대간 지속가능성)에만 영향을 미친다. 이처럼 소득대체율의 결정변수는 연금 성격에 따라 달라지기 때문에 노후소득의 적정성은 다층연금 전체로 판단해야 하면서도 정책수단은 연금별로 달라져야 한다.

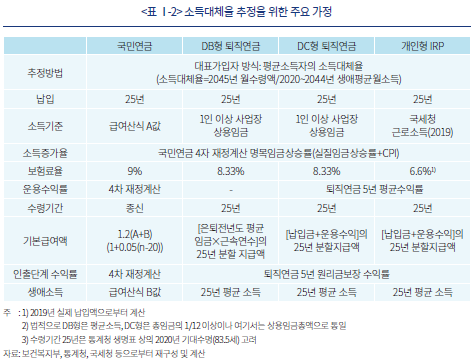

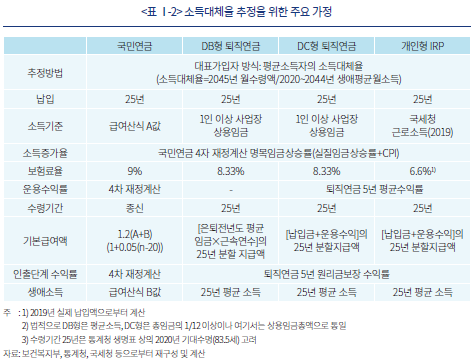

<표 Ⅰ-2>는 통합소득대체율 측정을 위한 구체적인 방법론과 변수들에 대한 가정들을 보여준다. 소득대체율 추정은 국민연금과 퇴직연금, 개인형 연금을 모두 가입한 대표가입자(평균소득가입자) 방식을 택한다. 보다 풍부한 논의를 위해서는 소득계층별로 대표가입자를 가정하고 소득계층별 소득대체율을 추정함이 바람직하나, 본 보고서가 소득분배까지 논의를 확대하는 데는 어려움이 있어 평균소득 가입자(대표가입자)로 분석을 한정한다. 보험료 납입기간은 25년으로 가정했다. 25년은 국민연금 4차 재정계산 당시 2088년 연금 수령자를 대상으로 추정한 국민연금의 평균가입기간(26.8년)을 참고한 것이며, 대졸 근로자의 평균적인 근속기간을 고려하였다.2) 국민연금과 퇴직연금 보험료율은 법정 보험료율이며, 개인형 연금의 보험료율(추가납입액/소득)은 2019년 국세청 통계로부터 계산하였다. 소득 및 보험료 증가율은 4차 재정계산의 명목임금상승률을 공통적으로 적용했으며, 사적연금 수령기간은 2020년 생명표 상의 기대수명을 고려하여 25년을 가정했다. 25년 납입하여 25년 수령하는 구조이다. 급여액의 경우 국민연금은 자체 기본연금액 산식을 따르며 DB형 퇴직연금은 최종임금에 근속연수를 곱한 금액, DC형과 개인형 연금은 납입원금과 운용수익을 합한 금액이 된다. 마지막으로 소득대체율 산식의 분모를 구성하는 은퇴 직전 소득은 공통적으로 생애평균소득 개념을 적용하였으며, 세부적으로 국민연금은 급여산식의 B값, 사적연금은 근로기간(납입기간) 평균소득으로 정의했다.

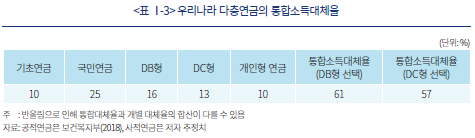

<표 Ⅰ-3>은 연금별 소득대체율과 통합소득대체율을 계산한 결과표이다. 국민연금 소득대체율은 4차 재정계산 이후 250만원 평균소득자의 25년 납입을 가정한 정부 추정치를 그대로 사용했으며, 기초연금도 정부 추정치를 사용했다(보건복지부, 2018). 사적연금은 본 보고서가 국민연금처럼 대표가입자방식으로 4차 재정계산의 주요 경제변수의 가정을 그대로 사용하여 추정한 것이다. 다만, DC형 퇴직연금과 개인형 연금의 운용수익률은 현행 퇴직연금제도의 원리금보장 중심 연금운용 실태를 소득대체율에 그대로 반영하기 위하여 퇴직연금의 과거 5년 평균수익률을 가정하여 계산하였다.

추가 연금제도 개선 없이 현재3) 상태를 유지할 경우 통합소득대체율은 DB형 퇴직연금을 선택한 가입자는 61%, DC형을 선택한 가입자는 57%로 나타났다. 이는 우리나라 평균적인 가입자가 기대수명까지 생존할 경우 근로기간 평균소득의 57%에서 61% 정도를 연금소득으로 받을 수 있다는 의미이다. 물론 공적연금(기초연금+국민연금)에 해당하는 평균소득의 35%는 종신으로 수령할 수 있다. 사적연금(퇴직연금+개인형 연금)의 대체율은 26%(DB형 선택)와 23%(DC형 선택)로 나타났다. 퇴직연금 소득대체율의 경우 임금상승률이 적립금운용수익률보다 높아 DB형이 DC형보다 3%p 높게 나타났음을 확인할 수 있다.

연금개혁 방향과 관련하여 중요하게 확인할 부분은 통합소득대체율 57%에서 61%가 은퇴 이전의 생활 수준을 은퇴 이후에도 후퇴없이 누리기에 적정한 수준인가 하는 점이다. 국제기구 권고나 기존 문헌연구들로 보면 적정 수준보다 낮다는 것을 확인할 수 있다. 다음으로 가입자 커버리지가 가장 넓은 보편 연금이라 할 수 있는 공적연금의 대체율(합계 35%)이 적정한가도 중요하게 확인할 부분이다. 그리고 마지막으로 통합소득대체율이 적정수준보다 낮다면 다층연금체제에서 어떤 연금제도를 통해 소득대체율을 상향하는 것이 가입자와 국민경제 측면에서 가장 효율적일까 하는 정책적 물음을 가지고 연금개혁의 방향을 고려하는 것이다.

둘째, 적정 소득대체율의 지속가능성이다. 적정 소득대체율은 어느 세대의 문제가 아니라 여러 세대에 걸쳐 지속가능해야 한다. 이와 관련한 핵심 이슈는 국민연금의 재정고갈이다. 국민연금기금의 2050년대 중후반 고갈 우려는 소득대체율의 세대간 안정성이 확보되지 못했음을 의미하며, 소득대체율 상향보다 재정안정성 확보를 위한 안정화 방안 마련이 우선적인 연금개혁 어젠다가 될 수밖에 없음을 시사한다. 다만, 재정안정을 위해 현재의 목표소득대체율 40%를 더 낮출 것인가가 쟁점이 되고 있으나, 보건복지부가 추정한 실질 소득대체율 35%(국민연금 25%, 기초연금 10%)는 세계은행(2005)이 제시한 40%나 ILO(2005)가 30년 납입 기준으로 제시한 45%에는 미치지 못한다는 점을 고려할 필요가 있다. 더구나, 2021년 54만원의 국민연금 평균 수령액은 기초생활수급자의 생계비 수준이라는 점도 고려될 필요가 있다. 이런 점에서 소득대체율을 낮추는 ‘덜 받는’ 국민연금 개혁은 소득보장을 위한 다른 대안이나 보완책이 제시되지 않을 경우 사회적 합의가 쉽지 않을 것이다.

셋째, 소득대체율 상향은 사적연금 개혁을 통해 가장 비용효율적으로 달성될 수 있다. 이는 통합소득대체율 추정으로부터 자연스러운 귀결일 뿐만 아니라 1994년 세계은행의 다층연금제도로의 전환 제안 이후 ILO 등의 국제기구들과 연금 선진국이 추진하고 있는 연금개혁의 주요 방향과도 부합한다. 사적연금의 소득대체율은 앞서 살펴본 대로 운용수익률의 함수이고, 운용수익률 개선은 운용제도를 통해 가능하다. 우리나라는 사적연금 보험료율 대비 소득대체율로 볼 때 적립금 운용효율의 상향 여지가 클 것으로 판단된다. 사적연금의 보험료율은 퇴직급여분 8.33%에 추가납입분(6.6%)을 합치면 약 15%에 근접하지만, 운용수익률은 원리금보장수익률 수준에 머물러 있다. 선진국 수준으로 운용 효율개선을 위한 제도개혁이 이루어질 경우 현재의 소득대체율(DB형 16%, DC형 13%, 개인형 연금 10%)은 크게 상향될 수 있을 것으로 판단된다.

Ⅱ. 국민연금 소득대체율 안정화 방안

이 절에서는 국민연금 소득대체율을 현행 40%로 유지한다는 전제 아래 재정건전성 강화 방안에 대하여 검토한다. 사실 재정 건전화의 궁극적 목적이 공적연금의 적정 소득대체율을 현세대뿐만 아니라 다음 세대까지 안정적으로 유지하는 데 있기 때문에 재정건전화 방안 역시 소득대체율 적정화 방안의 한 부분이라고 볼 수 있다.

1. 재정안정화 비용의 분담원칙과 우선순위

국민연금 재정안정에는 막대한 비용부담이 발생하기 때문에 국민연금 개혁의 성패는 누가 어떻게 비용을 분담할 것인가에 대한 객관적이고 논리적이며 투명한 원칙과 우선순위를 설정하고 합의하는 것이 가장 중요하다고 판단된다. 4차 재정계산 이후 보험료-급여 조정안이 여럿 제시되었지만, 사회적 합의에 이르지 못한 것은 보험료든 급여든 부담의 주체를 가입자(그것이 기업이든 근로자든)에게만 집중되는 방안이었기 때문으로 판단된다. 그런데 국민연금의 이해당사자는 가입자 하나뿐이 아니다. 개혁방안의 공론화와 사회적 합의의 달성 가능성으로 본다면, 재정안정과 관련된 모든 이해당사자가 비용을 합리적으로 분담하는 방향으로 개혁방안을 마련할 필요가 있을 것이다. 이런 점에서 감사원(2020)이 4차 재정계산에서 정부와 기금이 부담해야 할 사항이 누락되어 재정추계에 오차가 생긴 부분에 대해 지적한 점은 주목할 필요가 있다.

비용부담의 원칙과 우선순위를 정하는 데 있어 본 고는 수탁자산관리의 일반원칙인 수탁자책임(fiduciary duty) 원칙이 비용분담 원칙과 우선순위를 정할 때 유용한 준거가 될 수 있다고 본다. 법적으로 정부와 국민연금공단은 가입자인 국민이 부담하는 보험료를 관리ㆍ운용하는 수탁자이다. 수탁자로서 신인의무에 따라 기금을 관리할 책무가 있다. 기금고갈의 원인 중에서 외생적 변수를 제외하면, 크게 수탁자가 기금의 관리와 운용에 최선을 다하지 않아서 기금고갈이 발생한 부분도 있을 수 있으며, 정책적으로 정한 소득대체율 또는 수익비 아래서는 현재의 보험료율이 수지상등을 위한 장기균형 보험료율보다 낮아서 발생할 수도 있다. 이때 논리적으로 본다면 보험료율 인상 정도를 결정하는 장기균형 보험료율은 수탁자가 가입자를 위해 적립금을 최선으로 관리ㆍ운용하는 것을 전제로 도출될 수 있다. 이것은 실무적으로 정부와 국민연금공단이 운용제도 혁신을 통해 선진국의 연기금 수준으로 기금운용수익을 극대화한 후에 필요보험료율과 보험료율 인상 수준이 결정되는 것이 타당하다는 의미이다. 운용제도 혁신의 기금안정 효과를 고려하지 않고 현 기금운용제도를 전제로 보험료율 인상을 결정한다는 것은 정부와 국민연금공단이 수탁자로서 부담해야 할 비용을 부담하지 않는 것과 다르지 않다.

현실적으로는 세계 최고 수준의 저출산ㆍ고령화로 2050년 이후 연금급여 지출이 급증함에 따라 연금고갈은 확정적으로 예상되고 있고, 최선의 관리ㆍ운용 노력이 따르더라도 최종단계에서 가입자의 보험료율 인상은 불가피할 것이다. 그러나, 보험료율 인상을 결정할 때 정부의 기금운용수익 제고 정책의 기금안정 효과를 미리 고려한 경우와 그렇지 않은 경우는 분명히 보험료율의 인상 폭에 영향을 미칠 뿐만 아니라, 연금개혁안에 대한 사회적 합의 도출 가능성에도 영향을 미칠 것으로 판단된다. 신인의무 관점에서 보면 보험료율 인상은 기금 자체와 정부가 운용제도 개선 노력을 통해 기금재정을 확충하는 것을 전제로 최후에 고려해야 하는 잔여적인 정책변수인 것이다.

다음으로 보험료율 인상에 앞서 정부가 비용을 발생시키는 공공정책(크레딧정책 등)과 법으로 정한 국민연금공단의 관리운영비용 등에 대하여 보다 적극적으로 비용을 부담하여 가입자의 보험료율 인상 부담을 최소화하는 것 역시 수탁자책무에 해당한다. 가입자의 이해를 해치면서 다른 목적으로 기금을 활용하는 것은 신인의무와 충돌하기 때문이다. 결국, 논리적으로 볼 때 국민연금 재정안정을 위한 비용부담의 우선순위는 기금 자체, 정부, 가입자가 되어야 할 것으로 보인다. 이하에서는 각각에 대해 자세히 검토하기로 한다.

2. 기금 자체의 노력: 운용제도 혁신

정부와 국민연금공단의 국민 노후자산을 관리하는 수탁자로서의 책무와 연금 선진국의 운영 경험으로 볼 때 기금 재정안정을 위한 최우선 정책은 기금의 관리ㆍ운용 비효율을 혁신하는데 두어야 한다. 가입자 생애주기로 볼 때 60년 이상 장기부채의 지급능력(재정안정)을 확보하기 위해서는 지배구조, 정책, 실행조직 등 연금자산의 장기운용 능력을 강화하는 것이 핵심적으로 중요할 것이다. 해외 공적연기금의 경험을 보면 기금운용체제의 효율성은 수지균형(insurance equation)을 위한 재정목표 기반 자산배분정책과 운용지배구조에 크게 영향을 받는 것으로 보인다.

가. 재정목표 기반 자산배분정책

해외 공적연금들이 고령화 등 인구역전에 따른 재정위기 탈출을 위해 마련한 연금개혁의 핵심의제에는 재정목표 명확화, 재정목표 기반의 재정안정화정책이 포함되어 있다. <표 Ⅱ-1>을 보면 글로벌 5대 공적연기금은 우리나라 국민연금을 제외하면 명확한 재정목표를 두고 장기부채와 자산의 장기적 수지균형정책을 마련하고 있다. 세계 최대 공적연금인 일본 GPIF는 100년 후 적립배율(funded ratio) 1을 유지하는 보험료정책, 운용수익(자산배분)정책, 급여정책을 추구한다. 그 일환으로 지금은 물가상승률+1.7%의 목표수익률에 부합하도록 기금자산을 운용하고 있다. 글로벌 3대 연금 네덜란드 ABP(APG)는 네덜란드 퇴직연금 공통 재정목표(적립률 104% 이상 유지) 아래서5) 적립률(funding ratio) 구간에 따라 급여 삭감, 급여 인상(인덱세이션) 등 재정안정화정책을 연계하고 있으며, 명시적인 목표수익률 대신 정책적 적립률(policy funding ratio) 110% 달성에 부합하는 자산배분정책을 추구하고 있다. 미국 캘퍼스 역시 3년마다 연금계리를 통해 재정을 재평가하고 요구수익률(assumed return)을 업데이트하고 있으며, 글로벌 5대 연금 CPPIB 또한 적립배율을 재정목표로 삼고 물가상승률+4%의 명시적 목표수익률을 두고 있다. CPPIB 재정목표 역시 재정안정정책과 연계되어 있으나, 네덜란드 ABP가 급여 조정에 초점이 맞춰진 것과 달리, CPPIB는 보험료율 상한(9.9%)을 두고, 그 범위 내에서 재정안정을 위한 보험료-자산배분-급여 간의 정책조합을 추구한다는 점에서 차이가 있다. 글로벌 5대 연기금 중에서 예외가 국민연금이다. 명시적인 재정목표가 부재하며 재정안정화공식도 존재하지 않는다. 그러다 보니 장기적인 재정안정을 위해 기금운용부문이 어떤 목표를 통해 어느 정도 기여해야 하는지에 대한 논의도 없으며, 장기적인 자산배분전략에 대한 비전도 없다. 국민연금의 재정안정정책이 재정목표의 설정에서부터 출발하여야 하는 이유이다.

나. 운용지배구조의 전문성과 독립성

연금운용에서 지배구조 중요성에 대해서는 재론의 여지가 없다. 어떤 운용지배구조를 갖고 있는가에 따라 장기수익률을 결정하는 목표수익률과 전략적 자산배분이 달라지기 때문이다. 매년 국민연금공단이 발표하는 장기수익률 요인 분해를 보면 운용수익률의 99% 내외가 기금운용위원회가 결정하는 전략적 자산배분에서 비롯되었다. <표 Ⅱ-1>은 국민연금 지배구조 개편과 관련한 쟁점인 운용부문의 독립법인화와 기금운용위원회 구성에 대한 글로벌 5대 연금의 현황을 보여준다. 글로벌 5대 연기금의 운용지배구조를 보면 일률적이지는 않다. 일본 GPIF나 네덜란드 APG, 캐나다 CPPIB는 투자무분의 독립법인들이다. 공적연금(보험료 징수, 기금 운용, 급여 지급)에서 기금운용부문만 분리 혹은 위탁받아 운용하는 독립법인이 존재한다는 점이다. 이것의 장점은 전문성과 독립성을 중심에 두고 지배구조를 운영할 수 있다는 점이며, 운용 효율성 관점에서 가장 바람직한 모습이다. 물론 캘퍼스처럼 본체 내에서 기금운용의 전문성을 추구하는 경우도 있다는 점에서 지배구조 효율성은 하나의 정답만 존재하는 것은 아니다. 그렇지만 독립법인화와 관련한 중요한 포인트는 현재 국민연금의 기금운용이 독립성과 전문성을 바탕으로 이루어지는가, 그리고 향후 재정안정을 위한 운용수익률 제고 노력이 현재의 지배구조 아래서도 실현가능할 수 있는가에 대한 판단에 달려있다고 볼 수 있다. 먼저 독립성과 전문성 측면에서의 우려는 오랫동안 국민연금 운용제도 혁신과 관련하여 재정목표 설정의 시급성 주장이 제기되어 왔지만, 재정목표 기반 목표수익률 설정의 책임이 있는 국민연금 운용지배구조는 여기에 대해 진전된 모습을 보이지 못하고 있다는 점이다. 독립 공사화 여부 및 위원회 구성에서 전문성 강화 여부와 재정목표 기반 목표수익률 설정 가능성 여부는 밀접히 관련되어 있다고 판단된다.

3. 정부의 기금재정 기여 방안

수탁자로서 정부는 국민연금기금을 공공복지 정책수단으로 활용하고 있으며, 공적연금서비스 제공 대가로 소득세 수입이 발생하고 있다. 공공정책 집행과정에서 발생하는 비용은 기금 재정의 악화 요인이 될 수 있으므로 적정한 수준에서 부담할 필요가 있다. 여기서는 법으로 이미 정부가 부담하기로 한 비용을 명확하게 부담하는 것과 국민연금서비스의 대가로 수취한 소득세 수입을 기금재정에 환입하는 방안에 대해 살펴보기로 한다.

가. 국민연금 소득세 납부액의 기금 환입

2021년 기준 연금소득세 대상이 되는 국민연금 노령연금 수급자는 482만명, 노령연금 지급액은 25조원으로 나타났다. 노령연금 수급자 중에서 종합소득세 혹은 연금소득세 과세 대상이 되는 수령자는 소득세(종합소득세 혹은 연금소득세)를 납부해야 한다. 노령연금에 대한 소득세 납부는 2002년부터 국민연금 근로자 부담 보험료에 대하여 전액소득공제를 하는 대신 연금을 수령할 때 소득세를 부과하는 연금세제 개편에 따른 것이다. 국민연금 소득세 납부액은 다른 일반 조세 수입처럼 일반회계로 전입되고 있는데, 국민연금의 재정이 빠르게 고갈되는 상황을 고려할 때 이 조세수입을 기금 재정안정에 활용하는 방안을 검토해 볼 필요가 있다. 사실 이 같은 방안은 기금고갈 선진국에서 활용이 되고 있다는 점에서 새로운 것은 아니다. 미국은 부과방식 사회보장기금의 고갈이 예상되면서 1983년 제도개혁을 통해 고소득자가 받는 급여에 대해 부과하는 소득세 수입을 사회보장기금(OASDI)으로 환입하는 제도를 도입하였다. 목적은 기금재정을 확충하고 고소득층에 돌아가는 고급여에 대해 누진적 소득세를 부과하여 그 재원을 다시 기금으로 환입함으로써 기금의 계층간 형평성을 높이는 것이었다. 현재 그 규모가 연간 기금수입의 4% 정도를 차지한다. 소득세의 기금재정 환입은 정부가 연금제도의 최종적인 관리ㆍ운용 수탁자로서 기금고갈의 책임을 분담한다는 긍정적인 메시지도 담고 있어 연금개혁의 사회적 합의 도출에 긍정적일 수 있다고 판단된다.

우리나라는 아직 국민연금 수급자가 약 480만명에 불과하여 지금 당장의 소득세 수입은 많지 않을 것이다. 그렇지만 앞으로는 다르다. 기대수명 증가와 베이비부머 은퇴로 국민연금 수급자가 2030년 620만명, 2040년 1,000만명, 2050년 1,400만명 등으로 급속히 늘어난다. 대상자 추계가 다른 소득 여부에 따라 크게 달라져 추정이 쉽지는 않지만, 가령, 노령연금 수령자가 독신이고 연금소득 외에 다른 소득은 없는 단순 상황을 가정하면 어느 정도 추정이 가능하다. 이 경우 연금소득세는 노령연금이 연간 770만원 이상인 경우 발생하는데(김동엽, 2020), 대상자는 2021년 약 115만명으로 추정된다. 전체 노령연금 수령자 수(482만명) 기준으로는 전체의 24%가 부과대상이다. 금액기준으로 보면 월수령액 70만원 이상이 대상인데, 70만원 이상 수령자의 수령액은 전체 노령연금 지급액의 50% 정도이다. 2021년 25조원의 노령연금 지급액 중에서 약 50%인 12조원 정도가 연금소득세 부과 대상이 되며, 가장 보수적으로 최저소득세율 6%를 적용하면 연금소득세수는 7,000억원이다. 7,000억원은 국민연금공단의 1년 관리운영비에 해당한다. 앞으로 노령연금 수급자가 급증하는 2030년대 이후에는 그 규모 또한 급증할 것이며, 특히 소득상한을 상향할 경우 고소득자의 고급여에 따른 세수는 더 늘어날 것이다. 정부가 기금 재정안정 수단으로 연금개혁과정에서 고려해볼 만한 것으로 판단된다.

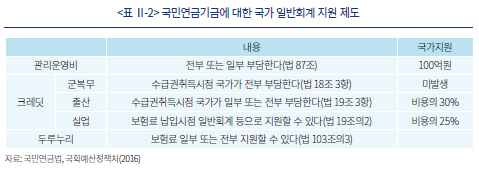

나. 크레딧제도 비용과 관리운영비 부담

국민연금은 가입자 보험료로 조성되는 보험성 기금이지만, 정부의 공공정책 수단으로 국민연금제도가 활용되고 있기 때문에 정부는 공공정책 집행 과정에서 발생한 국민연금기금 지출에 대해서는 예산으로 해당 지출을 부담하는 근거를 두고 있다. 크레딧(credit)제도, 관리운영비, 두루누리사업 등이 대표적이다.

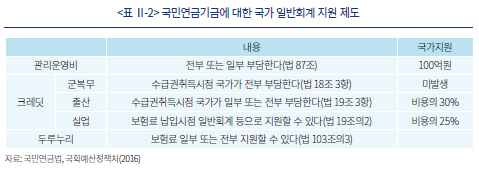

크레딧제도란 일정 요건(군복무, 출산, 실업)으로 인해 보험료를 불가피하게 납부하지 못하더라도 납부한 것으로 간주하여 사회보험의 가입기간으로 인정해주어 연금급여에 불이익이 없도록 하는 제도이다. 문제는 이때 비용(보험료 납부 간주)을 누군가는 부담해야 하는데, 크레딧제도는 사회보험에 사회부조적 성격을 가미하는 대표적인 공공정책에 해당하기 때문에 그 비용은 국가가 부담하는 것이 원칙이다. 그럼에도 <표 Ⅱ-2>에서 보듯이 군복무 크레딧의 경우만 국가가 의무 전액 부담을 하고, 출산은 일부 또는 전부 부담, 그리고 실업 크레딧은 일부 부담 가능성만 언급하고 있다.

그러나 국민연금의 기금고갈 시점이 저출산ㆍ고령화로 앞당겨지고, 고갈 이후 순수부과방식 전환 보험료 부담이 급등하는 상황에서 국가가 공공정책으로 도입한 사회부조 성격의 크레딧비용을 일반 가입자가 부담하는 것은 논리적으로도 부담능력 면에서도 바람직하지 않다. 따라서 크레딧 관련 비용은 전액 국가의 일반회계로 부담하도록 향후 연금개혁 논의에서 검토하는 것이 보험료 인상을 동반하는 연금개혁의 국민적 수용성을 높이기 위해서 필요하다. 또한 크레딧비용의 국가 부담시점을 노령연금수급권을 취득한 시점으로 두는 것도 효율성 면에서 바람직하지 않다. 보험료 발생 시점에서 크레딧 국가 예산을 집행할 수 있도록 제도 개선이 이루어진다면 기금 재정의 안정에 기여함은 물론이고, 높은 운용수익률로 기금재정에 기여할 수 있을 것이다.

한편 국민연금기금의 관리운영비에 대한 국가의 예산 지원을 늘릴 필요가 있다. 참고로 2021년 국민연금기금의 인건비 등 관리운영비는 7,383억원(보험료수입의 1.3%)에 이르고 있으나, 정부 일반예산은 100억원 지원에 그치고 있다. 기금고갈에 따른 가입자 부담이 증가하는 상황을 고려할 때, 그리고 후술하겠지만 국민연금서비스를 제공한 대가로 매년 징구하는 국민연금소득세 수입 규모와 비교할 때, 정부의 관리운영비 지원 수준은 매우 미미한 것으로 보이며, 관리운영비의 일부를 정부가 부담한다는 국민연금법 제38조의 취지를 무색하게 하고 있다. 관리운영비의 상당 비율을 일반회계에서 부담하여 국민연금기금 고갈의 부담을 국가도 분담하는 방안을 검토할 필요가 있다.

Ⅲ. 사적연금의 소득대체율 상향 방안

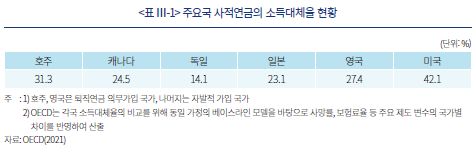

1. 사적연금의 운용 비효율: 국내외 소득대체율 비교

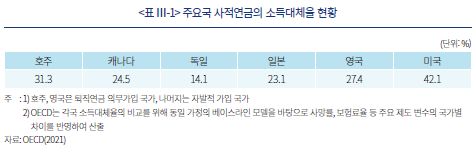

앞서 언급했듯이 우리나라 국민들의 평균적인 노후소득보장은 사적연금의 소득대체율 향상을 통하여 강화되는 것이 국가적으로 가장 효율적일 수 있다. 이는 거꾸로 현재 사적연금의 소득대체율이 개선 가능성 면에서 여력이 가장 크다는 것으로 그만큼 비효율적으로 관리ㆍ운용되고 있음을 시사한다. <표 Ⅲ-1>은 주요 사적연금 운영 국가들의 사적연금 소득대체율을 나타낸다. 사적연금이 가장 발달하고 효율적으로 운용되고 있는 미국 퇴직연금의 소득대체율은 42.1%를 기록하고 있다. 퇴직연금이 의무화된 호주와 영국도 각각 31.3%와 27.4%를 나타내고 있다. 앞서 우리나라 퇴직연금의 소득대체율은 DB형+개인형 26%, DC형+개인형 23%를 나타내고 있다. 미국, 호주와 같은 퇴직연금 선진국 수준으로 제도가 운영될 경우 소득대체율이 상향될 수 있음을 보여준다. 여기에 기여율을 감안하면 개선 여지는 더 큰 것으로 보인다. 한국은 개인형 연금 기여율(6.6%)까지 고려하면 사적연금 기여율은 14.9%인 반면 가령 호주의 기여율은 9.5% 수준이다. 우리나라 사적연금은 기여율은 높은데 소득대체율은 낮은 경우에 해당한다. 결국, 가입자의 추가 비용부담 없이 제도 운영의 효율성 개선을 통한 소득대체율의 향상 가능성이 매우 높은 경우에 해당한다.

2. 운용제도 개선의 효과: 미국 401(k)와 비교

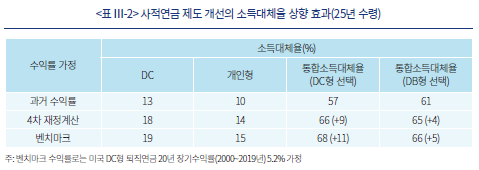

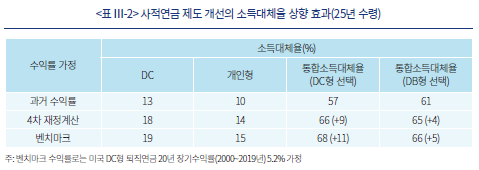

<표 Ⅲ-2>는 우리나라 사적연금 기금운용제도가 국민연금이나 선진국의 퇴직연금 수준으로 효율적으로 운영될 경우의 소득대체율 상향효과를 시뮬레이션한 결과이다. 여기서 제도 개선의 대리변수는 장기 운용수익률이 국민연금의 4차 재정계산에서 가정한 투자수익률을 실현하는 경우, 그리고 미국 DC형 퇴직연금이 지난 20년간 실현한 투자수익률을 실현하는 경우로 두었으며, 기본 시나리오(제도 개선이 없어 퇴직연금 과거 5년 평균수익률을 미래에도 실현하는 경우)와 소득대체율을 비교하였다.

운용수익률이 소득대체율에 영향을 미치는 DC형과 개인형의 경우 국민연금이 벤치마크일 때 소득대체율은 각각 5%p, 4%p, 401(k)가 벤치마크일 때 소득대체율은 각각 6%p, 5%p 상향하는 효과가 예측되었다. 그 결과, DC형을 선택한 가입자의 통합소득대체율은 국민연금이 벤치마크인 경우 66%, 401(k)가 벤치마크인 경우 68%로 추정되었다. 이는 우리나라 사적연금의 운용제도를 개선할 경우, 다층연금 전체의 통합대체율이 국제기구가 권고하는 70%에 근접할 수 있음을 시사한다. DB형을 선택한 가입자는 운영제도 개선이 DB형 가입자의 소득대체율에는 영향을 미치지 않으나, IRP 추가납입 등 개인형 사적연금의 수익률 개선으로 인하여 통합소득대체율이 각각 65%와 66%로 상향되는 것으로 추정되었다.

다만, 기금형 제도 도입이 국민연금이나 미국 401(k)의 높은 수익률을 설명하는 유일한 제도 변수는 아니라는 점에서 동 시뮬레이션 결과는 제도 개선으로 기대할 수 있는 소득대체율 상향의 최대치일 수 있다는 점에서 해석상의 주의는 필요하다.

3. 사적연금 소득대체율 상향을 위한 과제

그렇다면 미국의 401(k) 연금이나 우리나라 국민연금 수준으로 국내 사적연금의 운용제도를 개선할 경우 구체적으로 어떤 방향과 내용으로 제도 개선이 이루어져야 하는가. 퇴직연금 적립금운용제도와 관련하여 2021년 이후 디폴트옵션제도, 중소기업퇴직연금기금제도, 적립금운용위원회제도 등 운용효율을 높이기 위한 제도 개선이 이루어진 토대 위에, 추가적으로 고려되어야 할 사적연금 개혁 방향은 다음과 같다.

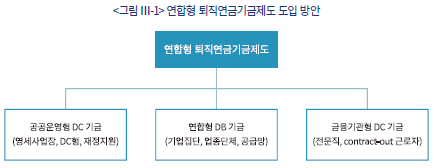

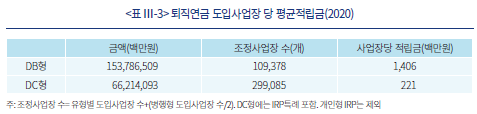

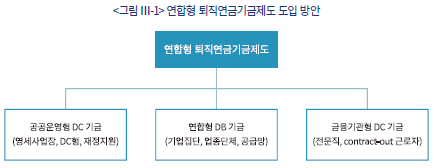

가. 연합형 퇴직연금기금제도 도입

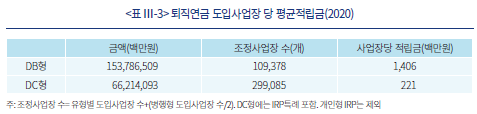

퇴직연금 적립금 운용제도 개선의 요체는 전문가의 조력을 통해 자산배분의 전문성을 높이고 다양한 자산군으로의 제약 없는 분산투자와 비용효율이 가능하도록 적립금 규모를 확충하는 것이다. 그런데 우리나라의 계약형 제도는 최근 디폴트옵션, 적립금운용위원회 등을 도입하여 자산배분 전문성을 강화하는 시도를 하고 있지만, 기금형 제도에 필적할 수는 없으며, 규모 면에서도 <표 Ⅲ-3>에서 확인하듯이 계약형 제도의 일대일 계약 속성상 규모의 경제 확보에 어려움이 있는 등 적립금의 운용 효율성으로 보면 연합형 퇴직연금제도가 궁극적인 제도개혁의 종착점이 될 수밖에 없다.

나. 연금세제혜택의 개인형 연금계좌 환입

우리나라는 국민연금 보험료 9%, 퇴직연금 8.3%, 개인형 추가납입 6.6% 등 보험료의 총합이 23.9%에 달해 강제저축률이 낮지 않다. 노후소득 안정을 위한 기여율의 인상이 현실적으로 매우 어려울 수 있다. 그런데 연금세제인 EET 제도 아래서 국민연금은 보험료에 대해 전액 소득공제, 사적연금은 추가납입에 대한 세액공제를 통해 연말정산 과정에서 가처분소득으로 환급을 해주는데, 환급해주는 해당 세제혜택금액을 연금계좌로 환입하여 노후자산으로 적립하는 방안을 생각할 수 있다. 물론 이 방안은 소비 가능 가처분소득(현재 소득)을 줄이는 대신 연금계좌 적립금(미래소득)을 늘리는 방식이기 때문에 가입자 측면의 순효과는 기대할 수 없다. 대신 이는 기여금의 명시적 인상 없이 다층연금 전체의 노후적립금 수준을 높이며 소득대체율을 높이는 노후소득 보장 측면의 효과는 있다. 다만, 국민연금의 경우 소득공제환급액을 국민연금기금으로 환입하는 것은 소득대체율 인상 없이 보험료율을 인상하는 효과가 있어 가입자들이 수용하기 어려울 것이다. 때문에 국민연금의 소득공제액과 사적연금의 세액공제는 모두 사적연금계좌인 IRP로 환급되는 것이 합리적일 것이다.

<표 Ⅲ-4>는 사적연금의 추가납입 세액공제를 연금계좌로 환입할 경우의 개인형 연금의 소득대체율 개선 효과를 보여준다. 2019년 기준 307만명의 세액공제 대상자의 평균 세액공제액은 36.4만원이었다. 이것을 연금계좌로 환입하여 적립 운용한다고 가정했을 때 소득대체율은, 제도 개선 없이 현재 퇴직연금 수익률이 미래에도 실현될 경우 1.5%p, 4차 재정계산 수준으로 운용제도가 개선될 경우 2.0%p, 그리고 미국 401(k) 수준으로 개선되었을 경우 2.2%p 높아지는 것으로 추정되었다.

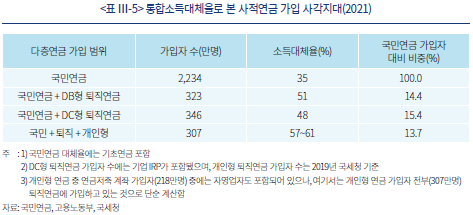

다. 가입 사각지대의 해소

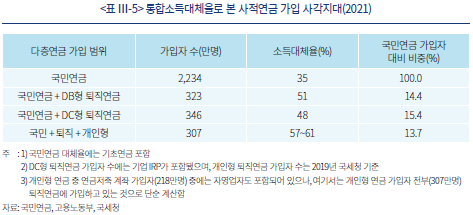

소득대체율 상향을 위한 가장 현실적 과제는 사각지대의 해소이다. 본 보고서는 국민연금과 퇴직연금, 그리고 개인형 연금을 모두 포함한 대표가입자를 가정하였으나, 현실은 국민연금만 가입한 국민이 대다수이기 때문에 다층연금과 통합소득대체율 개선 논의가 설득력을 갖기 위해서는 사적연금의 사각지대 해소가 급선무이다. <표 Ⅲ-5>를 보면 의무가입인 국민연금 가입자의 약 70%는 국민연금에만 가입되어 있고 사적연금을 가지고 있지 않은 것으로 나타났다. 이는 우리나라 국민의 2/3 이상의 연금 소득대체율은 35%라는 의미로 해석될 수 있다. 퇴직연금을 가진 국민연금 가입자 기준으로 약 30%(DB+DC)에 불과하며, 약 30%의 가입자들은 48%에서 51%의 소득대체율을 누릴 수 있다. 그리고 국민연금과 퇴직연금, 그리고 개인형 연금을 모두 가입한 국민은 국민연금 가입자 기준으로 13.7%에 불과했으며, 이들만이 다층연금 전체의 통합소득대체율 57%에서 61%를 누릴 수 있는 것으로 나타났다. 결국, 사적 연금가입 사각지대를 해소하는 것이 연금 소득대체율 제고를 위한 가장 현실적인 과제임을 확인할 수 있다.

1) 퇴직연금의 소득대체율 추정은 박은주ㆍ박희진(2015), 성주호(2019) 등이 있으며, 공적연금과 사적연금 통합소득대체율 추정은 임병인ㆍ강성호(2005), 강성호(2011), 한정림ㆍ박주완(2014) 등에 의해 시도되었다.

2) 2018년 제4차 국민연금 장기재정추계(보건복지부, 2018)에 따르면 2088년 신규 수급자의 평균 가입기간은 26.8년, 소득대체율은 24.3%로 전망되었다. 그리고 퇴직연금 설문조사에 따르면 대졸 가입자의 경우 30세에 가입하여 55세(54세 실제 정년퇴직)에 퇴직하는 경우가 많았다.

3) 2020년 소득 및 기여금 통계와 2018년 국민연금 4차 재정계산 당시의 경제변수로 가정한다.

4) 안종범ㆍ전승훈(2005), 석상훈(2010)은 소비함수 추정을 통해 우리나라 적정소득대체율을 각각 66.5%, 84%로 추정하였다.

5) 6년 연속 적립률 90% 미만시 급여 삭감, 6년 연속 90% 이상 104% 이하면 재정정상화플랜 마련, 110% 미만이면 급여의 indexation 금지, 110% 이상 130% 미만이면 부분적 indexation 허용, 130% 이상이면 indexation 허용 등의 정책을 펴고 있다(ABP 홈페이지).

6) 국민연금기금 전략적 자산배분의 수익기여도는 2021년 99.6%, 2020년 89.7%, 2019년 95.8%이다(국민연금기금운용위원회, 2022).

7) 2055년 수급자는 1,595만명에 이르러 가입자 수를 능가하게 된다(4차 재정계산).

참고문헌

감사원, 2020, 『감사보고서: 국민연금 관리 실태』.

강동수ㆍ김종훈ㆍ허재준ㆍ송홍선, 2014, 사적연금 활성화 방안, KDI, 노동연구원, 자본시장연구원 공동 학술연구용역, 기획재정부.

강성호, 2011, 생애기간을 고려한 공ㆍ사적연금소득 추정, 『보험학회지』 88(4), 51-87.

국민연금기금운용위원회, 2022, 『2021년도 국민연금 기금운용 성과평가안』.

국민연금연구원, 2016, 재정목표 및 재정지표의 국제비교 연구, 조사보고서.

국민연금연구원, 2021, 『국민노후보장패널 8차 부가조사』.

국회예산정책처, 2016, 국민연금 크레딧 예산의 문제점과 개선과제, 『NABO 경제동향 & 이슈』 48(10).

김동엽, 2020, 『세금을 알아야 연금이 보인다』, 미래에셋은퇴연구소.

박은주ㆍ박희진, 2015, 『퇴직연금 소득대체율 연구』, 고용노동부, 근로복지공단.

박태영, 2010, 『공적연금기금의 투자정책 및 자산배분전략 국제비교』, 국민연금연구원.

보건복지부, 2018, 『제4차 국민연금 재정계산을 바탕으로 한 국민연금 종합운영계획』.

석상훈, 2010, 패널자료로 추정한 소득대체율 분석, 『보건사회연구』 30(2), 5-38.

성주호, 2019, 퇴직연금 목표소득대체율 설정 및 실현전략, 퇴직연금 공동 세미나, 고용노동부, 근로복지공단.

송홍선, 2019, 다층연금시대의 국민연금 제도개혁 방향, 자본시장연구원 『자본시장포커스』 2019-23호.

송홍선, 2019, 『수익률 제고를 위한 퇴직연금 자산운용체계 개선 방향』, 자본시장연구원 이슈보고서 19-10.

송홍선, 2021, 『DC형 퇴직연금의 노후안전망 역할 강화 연구』, 자본시장연구원 연구보고서 22-03.

안종범ㆍ전승훈, 2005, 은퇴자가구의 적정소득대체율, 『한국경제연구』 15, 5-34.

임병인ㆍ강성호, 2005, 국민ㆍ퇴직ㆍ개인연금의 소득계층별 노후소득보장효과. 『보험개발연구』 16(3), 89-121.

정해식ㆍ이다마ㆍ이병재ㆍ한겨레, 2020, 『노후소득보장제도 개혁 담론 분석』, 보건사회연구원.

한정림ㆍ박주완, 2014, 『우리나라 다층노후소득보장체계의 연금소득 추정』, 국민연금연구원.

한정림, 2018, OASDI 노령연금 수급자의 소득대체율: 평가방법에 따른 의미와 비교, 국민연금연구원 『연금포럼』 봄호.

EU, 2021, The 2021 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in the EU.

ILO, 2005, Economic Security for a Better World.

OECD, 2021, Pension at a Glance.

World Bank, 1994, Averting the Old-Age Crisis: Policies to Protect Policies to Protect the Old and Promote Growth.

CPPIB www.cppinvestments.com

DOL www.dol.gov

Global SWF globalswf.com

GPIF www.gpif.go.jp

OECD www.oecd.org

1. 연구 목적

본 보고서는 연금 소득대체율 상향을 위한 연금개혁 방향을 연구한다. 연금개혁의 관점과 범위, 방향은 다양한 스펙트럼을 가질 수 있는데, 본 보고서가 소득대체율을 중심에 두고 연구하는 것은 무엇보다 연금제도의 존재 목적이 노후소득의 보장에 있기 때문이다. 급여 적정성을 충족하지 못하는 연금제도는 재정안정이 확보되더라도 노후소득보장제도로서 의미는 퇴색된다.

아울러, 본 보고서는 급여 적정성과 재정 지속가능성 문제를 개별연금이 아닌 다층연금의 관점에서 연구한다. 우리나라는 1988년 국민연금 도입 이후 2001년에 본격적인 세제적격 개인연금, 2005년에 퇴직연금을 각각 도입하면서 국제기구가 제시한 ‘다층연금제도(multi-pillar pension system)’ 속에서 적정성과 지속가능성 간 정책조합을 유기적으로 시도할 수 있는 제도의 틀을 진작부터 운영하고 있다(World Bank, 1994; ILO, 2005). 국제기구가 다층연금제도를 미래의 노후소득보장제도 대안으로 제시한 것은 공적연금이 재정안정을 위한 제도개혁을 추진하는 과정에서 희생될 수 있는 노후소득의 적정성 문제를 사적연금과의 역할 분담을 통해 확보하기 위한 것이라고 할 수 있다. 이 같은 국제기구의 다층연금제도 메시지는 공적연금은 기금고갈, 사적연금은 심각한 운용 비효율 상태에 놓인 우리나라의 연금개혁 논의의 출발점이 될 수 있다고 판단된다.

이에 본 보고서에서는 다층연금의 통합소득대체율 추정을 통해 노후소득 수준의 적정성을 판단하고, 소득대체율 상향을 위한 공적연금과 사적연금의 역할 분담, 소득대체율의 세대간 안정을 위한 공적연금의 재정안정 강화 방안, 사적연금의 소득대체율 제고를 위한 운용체제 혁신 방안 등 소득대체율 상향을 위한 세부적인 정책 방향에 대해 검토한다.

2. 통합소득대체율의 추정

다층연금제도 아래서 노후소득의 적정성은 통합소득대체율을 통해 판단할 수 있다. 국민연금, 퇴직연금, 개인연금 각각의 소득대체율을 합산한 통합소득대체율로 노후소득의 적정성으로 판단해야 한다. 기존의 일부 문헌들에서도 공적연금과 퇴직연금, 개인연금 각각의 소득대체율 실증에 초점을 맞춰 온 기존 연구 흐름을 넘어, 공적연금과 사적연금의 소득대체율을 통합적으로 판단하려는 움직임이 있었다.1) 선행 연구를 바탕으로 본 보고서는 <표 Ⅰ-1>과 같은 구성으로 연금별 소득대체율과 통합소득대체율을 측정하기로 한다. 선행 연구와 달리 본 고는 퇴직연금의 경우 DB형과 DC형을 구분하여 소득대체율을 측정한다. DB형의 경우 임금상승률과 근속연수가 소득대체율 결정 요인이기 때문에 적립금운용수익률이 소득대체율을 결정하는 DC형과 동일하게 취급할 수 없다. DB형 적립금의 운용수익률은 소득대체율과는 무관한 대신 재정건전성(기업의 확정급여채무)에 영향을 미친다. 그리고 여기서 개인형 연금은 퇴직연금의 IRP와 개인연금인 연금저축계좌를 포함하는 넓은 의미의 개인연금이다. 개인형 연금은 가입자의 가처분소득으로부터 자발적인 추가납입을 통해 노후자산을 형성하는 연금을 의미한다. 다시 말해, 추가납입(기여금)만이 소득대체율 측정에 포함되며 DB형과 DC형으로부터 이전한 퇴직소득은 개인형 연금의 소득대체율로 계산하지 않는다. 마지막으로 국민연금의 경우 소득대체율은 정부가 소득대체율 계수(c)를 정책적으로 결정한다. 국민연금 운용수익률은 소득대체율에 영향을 미치지 않으며, 연금재정의 건전성(소득대체율의 세대간 지속가능성)에만 영향을 미친다. 이처럼 소득대체율의 결정변수는 연금 성격에 따라 달라지기 때문에 노후소득의 적정성은 다층연금 전체로 판단해야 하면서도 정책수단은 연금별로 달라져야 한다.

<표 Ⅰ-2>는 통합소득대체율 측정을 위한 구체적인 방법론과 변수들에 대한 가정들을 보여준다. 소득대체율 추정은 국민연금과 퇴직연금, 개인형 연금을 모두 가입한 대표가입자(평균소득가입자) 방식을 택한다. 보다 풍부한 논의를 위해서는 소득계층별로 대표가입자를 가정하고 소득계층별 소득대체율을 추정함이 바람직하나, 본 보고서가 소득분배까지 논의를 확대하는 데는 어려움이 있어 평균소득 가입자(대표가입자)로 분석을 한정한다. 보험료 납입기간은 25년으로 가정했다. 25년은 국민연금 4차 재정계산 당시 2088년 연금 수령자를 대상으로 추정한 국민연금의 평균가입기간(26.8년)을 참고한 것이며, 대졸 근로자의 평균적인 근속기간을 고려하였다.2) 국민연금과 퇴직연금 보험료율은 법정 보험료율이며, 개인형 연금의 보험료율(추가납입액/소득)은 2019년 국세청 통계로부터 계산하였다. 소득 및 보험료 증가율은 4차 재정계산의 명목임금상승률을 공통적으로 적용했으며, 사적연금 수령기간은 2020년 생명표 상의 기대수명을 고려하여 25년을 가정했다. 25년 납입하여 25년 수령하는 구조이다. 급여액의 경우 국민연금은 자체 기본연금액 산식을 따르며 DB형 퇴직연금은 최종임금에 근속연수를 곱한 금액, DC형과 개인형 연금은 납입원금과 운용수익을 합한 금액이 된다. 마지막으로 소득대체율 산식의 분모를 구성하는 은퇴 직전 소득은 공통적으로 생애평균소득 개념을 적용하였으며, 세부적으로 국민연금은 급여산식의 B값, 사적연금은 근로기간(납입기간) 평균소득으로 정의했다.

<표 Ⅰ-3>은 연금별 소득대체율과 통합소득대체율을 계산한 결과표이다. 국민연금 소득대체율은 4차 재정계산 이후 250만원 평균소득자의 25년 납입을 가정한 정부 추정치를 그대로 사용했으며, 기초연금도 정부 추정치를 사용했다(보건복지부, 2018). 사적연금은 본 보고서가 국민연금처럼 대표가입자방식으로 4차 재정계산의 주요 경제변수의 가정을 그대로 사용하여 추정한 것이다. 다만, DC형 퇴직연금과 개인형 연금의 운용수익률은 현행 퇴직연금제도의 원리금보장 중심 연금운용 실태를 소득대체율에 그대로 반영하기 위하여 퇴직연금의 과거 5년 평균수익률을 가정하여 계산하였다.

추가 연금제도 개선 없이 현재3) 상태를 유지할 경우 통합소득대체율은 DB형 퇴직연금을 선택한 가입자는 61%, DC형을 선택한 가입자는 57%로 나타났다. 이는 우리나라 평균적인 가입자가 기대수명까지 생존할 경우 근로기간 평균소득의 57%에서 61% 정도를 연금소득으로 받을 수 있다는 의미이다. 물론 공적연금(기초연금+국민연금)에 해당하는 평균소득의 35%는 종신으로 수령할 수 있다. 사적연금(퇴직연금+개인형 연금)의 대체율은 26%(DB형 선택)와 23%(DC형 선택)로 나타났다. 퇴직연금 소득대체율의 경우 임금상승률이 적립금운용수익률보다 높아 DB형이 DC형보다 3%p 높게 나타났음을 확인할 수 있다.

연금개혁 방향과 관련하여 중요하게 확인할 부분은 통합소득대체율 57%에서 61%가 은퇴 이전의 생활 수준을 은퇴 이후에도 후퇴없이 누리기에 적정한 수준인가 하는 점이다. 국제기구 권고나 기존 문헌연구들로 보면 적정 수준보다 낮다는 것을 확인할 수 있다. 다음으로 가입자 커버리지가 가장 넓은 보편 연금이라 할 수 있는 공적연금의 대체율(합계 35%)이 적정한가도 중요하게 확인할 부분이다. 그리고 마지막으로 통합소득대체율이 적정수준보다 낮다면 다층연금체제에서 어떤 연금제도를 통해 소득대체율을 상향하는 것이 가입자와 국민경제 측면에서 가장 효율적일까 하는 정책적 물음을 가지고 연금개혁의 방향을 고려하는 것이다.

3. 다층연금의 개혁 방향

통합소득대체율 추정 결과로부터 본 고는 다음과 같은 다층연금 개혁 방향에 대해 검토한다. 먼저, 소득대체율 적정성 판단이다. 연금제도의 존재 의의는 노후소득 보장으로 은퇴 전후 후퇴 없는 생활수준을 유지하는 적정 소득을 제공하는 데 있다. 추정된 57%에서 61%의 통합소득대체율은 국제기구의 권고(70% 내외), 국내외 학술연구4)등에 비추어볼 때 적정수준보다 낮은 것으로 나타났다. 이는 다층연금의 소득대체율 상향이 초고령사회를 준비하는 우리나라 연금개혁의 기본방향으로 설정될 필요가 있음을 시사한다. 둘째, 적정 소득대체율의 지속가능성이다. 적정 소득대체율은 어느 세대의 문제가 아니라 여러 세대에 걸쳐 지속가능해야 한다. 이와 관련한 핵심 이슈는 국민연금의 재정고갈이다. 국민연금기금의 2050년대 중후반 고갈 우려는 소득대체율의 세대간 안정성이 확보되지 못했음을 의미하며, 소득대체율 상향보다 재정안정성 확보를 위한 안정화 방안 마련이 우선적인 연금개혁 어젠다가 될 수밖에 없음을 시사한다. 다만, 재정안정을 위해 현재의 목표소득대체율 40%를 더 낮출 것인가가 쟁점이 되고 있으나, 보건복지부가 추정한 실질 소득대체율 35%(국민연금 25%, 기초연금 10%)는 세계은행(2005)이 제시한 40%나 ILO(2005)가 30년 납입 기준으로 제시한 45%에는 미치지 못한다는 점을 고려할 필요가 있다. 더구나, 2021년 54만원의 국민연금 평균 수령액은 기초생활수급자의 생계비 수준이라는 점도 고려될 필요가 있다. 이런 점에서 소득대체율을 낮추는 ‘덜 받는’ 국민연금 개혁은 소득보장을 위한 다른 대안이나 보완책이 제시되지 않을 경우 사회적 합의가 쉽지 않을 것이다.

셋째, 소득대체율 상향은 사적연금 개혁을 통해 가장 비용효율적으로 달성될 수 있다. 이는 통합소득대체율 추정으로부터 자연스러운 귀결일 뿐만 아니라 1994년 세계은행의 다층연금제도로의 전환 제안 이후 ILO 등의 국제기구들과 연금 선진국이 추진하고 있는 연금개혁의 주요 방향과도 부합한다. 사적연금의 소득대체율은 앞서 살펴본 대로 운용수익률의 함수이고, 운용수익률 개선은 운용제도를 통해 가능하다. 우리나라는 사적연금 보험료율 대비 소득대체율로 볼 때 적립금 운용효율의 상향 여지가 클 것으로 판단된다. 사적연금의 보험료율은 퇴직급여분 8.33%에 추가납입분(6.6%)을 합치면 약 15%에 근접하지만, 운용수익률은 원리금보장수익률 수준에 머물러 있다. 선진국 수준으로 운용 효율개선을 위한 제도개혁이 이루어질 경우 현재의 소득대체율(DB형 16%, DC형 13%, 개인형 연금 10%)은 크게 상향될 수 있을 것으로 판단된다.

Ⅱ. 국민연금 소득대체율 안정화 방안

이 절에서는 국민연금 소득대체율을 현행 40%로 유지한다는 전제 아래 재정건전성 강화 방안에 대하여 검토한다. 사실 재정 건전화의 궁극적 목적이 공적연금의 적정 소득대체율을 현세대뿐만 아니라 다음 세대까지 안정적으로 유지하는 데 있기 때문에 재정건전화 방안 역시 소득대체율 적정화 방안의 한 부분이라고 볼 수 있다.

1. 재정안정화 비용의 분담원칙과 우선순위

국민연금 재정안정에는 막대한 비용부담이 발생하기 때문에 국민연금 개혁의 성패는 누가 어떻게 비용을 분담할 것인가에 대한 객관적이고 논리적이며 투명한 원칙과 우선순위를 설정하고 합의하는 것이 가장 중요하다고 판단된다. 4차 재정계산 이후 보험료-급여 조정안이 여럿 제시되었지만, 사회적 합의에 이르지 못한 것은 보험료든 급여든 부담의 주체를 가입자(그것이 기업이든 근로자든)에게만 집중되는 방안이었기 때문으로 판단된다. 그런데 국민연금의 이해당사자는 가입자 하나뿐이 아니다. 개혁방안의 공론화와 사회적 합의의 달성 가능성으로 본다면, 재정안정과 관련된 모든 이해당사자가 비용을 합리적으로 분담하는 방향으로 개혁방안을 마련할 필요가 있을 것이다. 이런 점에서 감사원(2020)이 4차 재정계산에서 정부와 기금이 부담해야 할 사항이 누락되어 재정추계에 오차가 생긴 부분에 대해 지적한 점은 주목할 필요가 있다.

비용부담의 원칙과 우선순위를 정하는 데 있어 본 고는 수탁자산관리의 일반원칙인 수탁자책임(fiduciary duty) 원칙이 비용분담 원칙과 우선순위를 정할 때 유용한 준거가 될 수 있다고 본다. 법적으로 정부와 국민연금공단은 가입자인 국민이 부담하는 보험료를 관리ㆍ운용하는 수탁자이다. 수탁자로서 신인의무에 따라 기금을 관리할 책무가 있다. 기금고갈의 원인 중에서 외생적 변수를 제외하면, 크게 수탁자가 기금의 관리와 운용에 최선을 다하지 않아서 기금고갈이 발생한 부분도 있을 수 있으며, 정책적으로 정한 소득대체율 또는 수익비 아래서는 현재의 보험료율이 수지상등을 위한 장기균형 보험료율보다 낮아서 발생할 수도 있다. 이때 논리적으로 본다면 보험료율 인상 정도를 결정하는 장기균형 보험료율은 수탁자가 가입자를 위해 적립금을 최선으로 관리ㆍ운용하는 것을 전제로 도출될 수 있다. 이것은 실무적으로 정부와 국민연금공단이 운용제도 혁신을 통해 선진국의 연기금 수준으로 기금운용수익을 극대화한 후에 필요보험료율과 보험료율 인상 수준이 결정되는 것이 타당하다는 의미이다. 운용제도 혁신의 기금안정 효과를 고려하지 않고 현 기금운용제도를 전제로 보험료율 인상을 결정한다는 것은 정부와 국민연금공단이 수탁자로서 부담해야 할 비용을 부담하지 않는 것과 다르지 않다.

현실적으로는 세계 최고 수준의 저출산ㆍ고령화로 2050년 이후 연금급여 지출이 급증함에 따라 연금고갈은 확정적으로 예상되고 있고, 최선의 관리ㆍ운용 노력이 따르더라도 최종단계에서 가입자의 보험료율 인상은 불가피할 것이다. 그러나, 보험료율 인상을 결정할 때 정부의 기금운용수익 제고 정책의 기금안정 효과를 미리 고려한 경우와 그렇지 않은 경우는 분명히 보험료율의 인상 폭에 영향을 미칠 뿐만 아니라, 연금개혁안에 대한 사회적 합의 도출 가능성에도 영향을 미칠 것으로 판단된다. 신인의무 관점에서 보면 보험료율 인상은 기금 자체와 정부가 운용제도 개선 노력을 통해 기금재정을 확충하는 것을 전제로 최후에 고려해야 하는 잔여적인 정책변수인 것이다.

다음으로 보험료율 인상에 앞서 정부가 비용을 발생시키는 공공정책(크레딧정책 등)과 법으로 정한 국민연금공단의 관리운영비용 등에 대하여 보다 적극적으로 비용을 부담하여 가입자의 보험료율 인상 부담을 최소화하는 것 역시 수탁자책무에 해당한다. 가입자의 이해를 해치면서 다른 목적으로 기금을 활용하는 것은 신인의무와 충돌하기 때문이다. 결국, 논리적으로 볼 때 국민연금 재정안정을 위한 비용부담의 우선순위는 기금 자체, 정부, 가입자가 되어야 할 것으로 보인다. 이하에서는 각각에 대해 자세히 검토하기로 한다.

2. 기금 자체의 노력: 운용제도 혁신

정부와 국민연금공단의 국민 노후자산을 관리하는 수탁자로서의 책무와 연금 선진국의 운영 경험으로 볼 때 기금 재정안정을 위한 최우선 정책은 기금의 관리ㆍ운용 비효율을 혁신하는데 두어야 한다. 가입자 생애주기로 볼 때 60년 이상 장기부채의 지급능력(재정안정)을 확보하기 위해서는 지배구조, 정책, 실행조직 등 연금자산의 장기운용 능력을 강화하는 것이 핵심적으로 중요할 것이다. 해외 공적연기금의 경험을 보면 기금운용체제의 효율성은 수지균형(insurance equation)을 위한 재정목표 기반 자산배분정책과 운용지배구조에 크게 영향을 받는 것으로 보인다.

가. 재정목표 기반 자산배분정책

해외 공적연금들이 고령화 등 인구역전에 따른 재정위기 탈출을 위해 마련한 연금개혁의 핵심의제에는 재정목표 명확화, 재정목표 기반의 재정안정화정책이 포함되어 있다. <표 Ⅱ-1>을 보면 글로벌 5대 공적연기금은 우리나라 국민연금을 제외하면 명확한 재정목표를 두고 장기부채와 자산의 장기적 수지균형정책을 마련하고 있다. 세계 최대 공적연금인 일본 GPIF는 100년 후 적립배율(funded ratio) 1을 유지하는 보험료정책, 운용수익(자산배분)정책, 급여정책을 추구한다. 그 일환으로 지금은 물가상승률+1.7%의 목표수익률에 부합하도록 기금자산을 운용하고 있다. 글로벌 3대 연금 네덜란드 ABP(APG)는 네덜란드 퇴직연금 공통 재정목표(적립률 104% 이상 유지) 아래서5) 적립률(funding ratio) 구간에 따라 급여 삭감, 급여 인상(인덱세이션) 등 재정안정화정책을 연계하고 있으며, 명시적인 목표수익률 대신 정책적 적립률(policy funding ratio) 110% 달성에 부합하는 자산배분정책을 추구하고 있다. 미국 캘퍼스 역시 3년마다 연금계리를 통해 재정을 재평가하고 요구수익률(assumed return)을 업데이트하고 있으며, 글로벌 5대 연금 CPPIB 또한 적립배율을 재정목표로 삼고 물가상승률+4%의 명시적 목표수익률을 두고 있다. CPPIB 재정목표 역시 재정안정정책과 연계되어 있으나, 네덜란드 ABP가 급여 조정에 초점이 맞춰진 것과 달리, CPPIB는 보험료율 상한(9.9%)을 두고, 그 범위 내에서 재정안정을 위한 보험료-자산배분-급여 간의 정책조합을 추구한다는 점에서 차이가 있다. 글로벌 5대 연기금 중에서 예외가 국민연금이다. 명시적인 재정목표가 부재하며 재정안정화공식도 존재하지 않는다. 그러다 보니 장기적인 재정안정을 위해 기금운용부문이 어떤 목표를 통해 어느 정도 기여해야 하는지에 대한 논의도 없으며, 장기적인 자산배분전략에 대한 비전도 없다. 국민연금의 재정안정정책이 재정목표의 설정에서부터 출발하여야 하는 이유이다.

나. 운용지배구조의 전문성과 독립성

연금운용에서 지배구조 중요성에 대해서는 재론의 여지가 없다. 어떤 운용지배구조를 갖고 있는가에 따라 장기수익률을 결정하는 목표수익률과 전략적 자산배분이 달라지기 때문이다. 매년 국민연금공단이 발표하는 장기수익률 요인 분해를 보면 운용수익률의 99% 내외가 기금운용위원회가 결정하는 전략적 자산배분에서 비롯되었다. <표 Ⅱ-1>은 국민연금 지배구조 개편과 관련한 쟁점인 운용부문의 독립법인화와 기금운용위원회 구성에 대한 글로벌 5대 연금의 현황을 보여준다. 글로벌 5대 연기금의 운용지배구조를 보면 일률적이지는 않다. 일본 GPIF나 네덜란드 APG, 캐나다 CPPIB는 투자무분의 독립법인들이다. 공적연금(보험료 징수, 기금 운용, 급여 지급)에서 기금운용부문만 분리 혹은 위탁받아 운용하는 독립법인이 존재한다는 점이다. 이것의 장점은 전문성과 독립성을 중심에 두고 지배구조를 운영할 수 있다는 점이며, 운용 효율성 관점에서 가장 바람직한 모습이다. 물론 캘퍼스처럼 본체 내에서 기금운용의 전문성을 추구하는 경우도 있다는 점에서 지배구조 효율성은 하나의 정답만 존재하는 것은 아니다. 그렇지만 독립법인화와 관련한 중요한 포인트는 현재 국민연금의 기금운용이 독립성과 전문성을 바탕으로 이루어지는가, 그리고 향후 재정안정을 위한 운용수익률 제고 노력이 현재의 지배구조 아래서도 실현가능할 수 있는가에 대한 판단에 달려있다고 볼 수 있다. 먼저 독립성과 전문성 측면에서의 우려는 오랫동안 국민연금 운용제도 혁신과 관련하여 재정목표 설정의 시급성 주장이 제기되어 왔지만, 재정목표 기반 목표수익률 설정의 책임이 있는 국민연금 운용지배구조는 여기에 대해 진전된 모습을 보이지 못하고 있다는 점이다. 독립 공사화 여부 및 위원회 구성에서 전문성 강화 여부와 재정목표 기반 목표수익률 설정 가능성 여부는 밀접히 관련되어 있다고 판단된다.

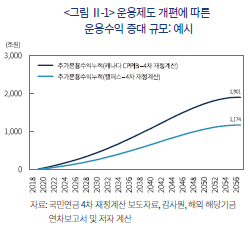

다. 운용제도 개편 효과: 해외 기금과의 간접 비교

운용제도 개편의 효과를 사전에 정량적으로 측정하는 데는 기본적으로 무리가 있으나, 기금 수익률 결정에서 목표수익률에 기반한 전략적 자산배분의 효과가 국민연금의 경우도 대체로 90% 내외로 추정되는 등6) 운용지배구조의 성과 기여도가 결정적인 점을 감안할 때, 선진국 연기금의 운용성과 역시 대부분이 효율적인 운용제도와 밀접한 관련이 있을 것으로 추론할 수 있다. 이에 본 보고서는 비록 과도한 단순화의 위험은 있지만, 국민연금이 장기수지균형을 달성하는 재정목표를 수립하고 운용지배구조의 개선이 이루어졌을 때 최대로 달성할 수 있는 수익률 개선 정도를 선진국의 운용수익률이라고 가정하고 시뮬레이션을 진행하기로 한다.

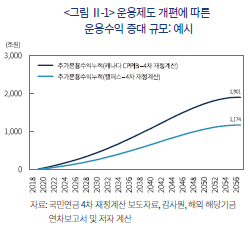

<그림 Ⅱ-1>은 글로벌 연기금의 운용수익률을 기금운용제도 개편의 대리변수로 두고, 벤치마크 연기금을 캐나다의 CPPIB와 미국의 캘퍼스로 할 때의 추가적인 운용수익 규모를 나타낸다. 두 기금은 모두 ALM 기반의 재정목표와 목표수익률을 설정하고, 그에 상응하는 장기 자산배분정책을 추구하고 있다. 캘퍼스는 과거 20년 장기수익률이 6.77%, 4년마다 조정하는 연금계리적 요구수익률이 2020년 기준 7.0%이며, CPPIB는 20년 장기수익률이 8.48%, 3년마다 조정하는 연금계리적 요구수익률은 명시적으로 언급하지 않으며 실질수익률 3.95%(base CPP 기준)로 발표하고 있다. 시뮬레이션은 장기수익률과 요구수익률 모두 사용할 수 있으나, 본 보고서에서 4차 재정계산에 기초하여 국민연금을 분석하였기 때문에 일관성을 위해 국민연금의 4차 재정계산 가정 수익률과 벤치마크 연기금의 요구수익률을 기초로 계산하는 것이 정합적으로 보인다. 다만, 캐나다의 경우 명목요구수익률 계산에 필요한 물가상승률에 대한 기준을 확인할 수 없어 20년 장기수익률을 사용하였다. 시뮬레이션 결과, 기금고갈 시점인 2057년까지 39년(2019~2057년) 동안, 국민연금이 CPPIB와 같은 운용수익률을 달성할 경우 추가로 얻는 운용수익의 누적금액은 1,900조원, 캘퍼스와 같은 운용수익률을 달성할 경우 추가적인 운용수익 누적금액은 1,174조원에 이를 것으로 추정되었다. 이 수치는 우리나라의 제도 개선 속도로 볼 때 비록 추가수익의 최대치일 가능성이 있지만, 기금고갈정책과 관련하여 매우 중요한 시사점을 준다. 기금운용의 효율성 제고 노력은 가입자의 추가적인 비용부담 없이 효율 개선만으로도 1,000조원에서 2,000조원의 기금을 확충할 수 있다는 사실을 알려주기 때문이다.

운용제도 개편의 효과를 사전에 정량적으로 측정하는 데는 기본적으로 무리가 있으나, 기금 수익률 결정에서 목표수익률에 기반한 전략적 자산배분의 효과가 국민연금의 경우도 대체로 90% 내외로 추정되는 등6) 운용지배구조의 성과 기여도가 결정적인 점을 감안할 때, 선진국 연기금의 운용성과 역시 대부분이 효율적인 운용제도와 밀접한 관련이 있을 것으로 추론할 수 있다. 이에 본 보고서는 비록 과도한 단순화의 위험은 있지만, 국민연금이 장기수지균형을 달성하는 재정목표를 수립하고 운용지배구조의 개선이 이루어졌을 때 최대로 달성할 수 있는 수익률 개선 정도를 선진국의 운용수익률이라고 가정하고 시뮬레이션을 진행하기로 한다.

그렇다면 1,000조원에서 2,000조원 정도의 기금확충은 재정안정과 관련하여 어느 정도 의미있는 수치일까? 고갈시점 이연효과를 보면 추정치 1,060조원에서 1,900조원은 4차 재정계산 기준으로 국민연금기금의 고갈 시기를 2년에서 5년 정도 늦추는 효과가 있을 것으로 추정된다. 고갈 시기 이연효과가 생각만큼 크지 않은 것으로 나타났다. 그 이유는 2050년대 이후 연금수령인구의 급증으로 급여지출 규모가 급증하기 때문이다. 한 해 급여지출 규모는 2057년 414조원, 2060년 483조원 등으로 급격히 늘어나기 때문에7) 추가 운용수익의 절대 금액이 크지만 이연효과는 크지 않게 된 것이다. 결국, 운용제도 개편 등 기금 재정을 안정시키기 위한 노력을 최대한으로 하더라도, 세계 최고속도의 저출산ㆍ고령화로 인한 인구구조 역전 효과로 인해 기금 고갈 자체를 막는 것은 불가능하다는 것을 알 수 있다.

그렇지만, 운용제도 개선에 따른 추가 운용수익은 가입자의 보험료 부담 경감 측면에서는 심대한 기여를 할 수 있다고 판단된다. 2021년 9% 보험료율로 기금의 보험료 수입이 53조원 발생했는데, 추가 운용수익 1,174조원에서 1,900조원의 현재가치(할인율 1.64%)는 각각 1,042조원, 643조원으로 가입자가 약 12년에서 20년 동안 부담하는 보험료에 해당하기 때문이다. 결국, 운용제도 개편은 기금고갈을 이연하는데는 한계가 있으나, 가입자들의 보험료 부담을 줄이는데는 분명한 역할을 할 것으로 예상된다. 3. 정부의 기금재정 기여 방안

수탁자로서 정부는 국민연금기금을 공공복지 정책수단으로 활용하고 있으며, 공적연금서비스 제공 대가로 소득세 수입이 발생하고 있다. 공공정책 집행과정에서 발생하는 비용은 기금 재정의 악화 요인이 될 수 있으므로 적정한 수준에서 부담할 필요가 있다. 여기서는 법으로 이미 정부가 부담하기로 한 비용을 명확하게 부담하는 것과 국민연금서비스의 대가로 수취한 소득세 수입을 기금재정에 환입하는 방안에 대해 살펴보기로 한다.

가. 국민연금 소득세 납부액의 기금 환입

2021년 기준 연금소득세 대상이 되는 국민연금 노령연금 수급자는 482만명, 노령연금 지급액은 25조원으로 나타났다. 노령연금 수급자 중에서 종합소득세 혹은 연금소득세 과세 대상이 되는 수령자는 소득세(종합소득세 혹은 연금소득세)를 납부해야 한다. 노령연금에 대한 소득세 납부는 2002년부터 국민연금 근로자 부담 보험료에 대하여 전액소득공제를 하는 대신 연금을 수령할 때 소득세를 부과하는 연금세제 개편에 따른 것이다. 국민연금 소득세 납부액은 다른 일반 조세 수입처럼 일반회계로 전입되고 있는데, 국민연금의 재정이 빠르게 고갈되는 상황을 고려할 때 이 조세수입을 기금 재정안정에 활용하는 방안을 검토해 볼 필요가 있다. 사실 이 같은 방안은 기금고갈 선진국에서 활용이 되고 있다는 점에서 새로운 것은 아니다. 미국은 부과방식 사회보장기금의 고갈이 예상되면서 1983년 제도개혁을 통해 고소득자가 받는 급여에 대해 부과하는 소득세 수입을 사회보장기금(OASDI)으로 환입하는 제도를 도입하였다. 목적은 기금재정을 확충하고 고소득층에 돌아가는 고급여에 대해 누진적 소득세를 부과하여 그 재원을 다시 기금으로 환입함으로써 기금의 계층간 형평성을 높이는 것이었다. 현재 그 규모가 연간 기금수입의 4% 정도를 차지한다. 소득세의 기금재정 환입은 정부가 연금제도의 최종적인 관리ㆍ운용 수탁자로서 기금고갈의 책임을 분담한다는 긍정적인 메시지도 담고 있어 연금개혁의 사회적 합의 도출에 긍정적일 수 있다고 판단된다.

우리나라는 아직 국민연금 수급자가 약 480만명에 불과하여 지금 당장의 소득세 수입은 많지 않을 것이다. 그렇지만 앞으로는 다르다. 기대수명 증가와 베이비부머 은퇴로 국민연금 수급자가 2030년 620만명, 2040년 1,000만명, 2050년 1,400만명 등으로 급속히 늘어난다. 대상자 추계가 다른 소득 여부에 따라 크게 달라져 추정이 쉽지는 않지만, 가령, 노령연금 수령자가 독신이고 연금소득 외에 다른 소득은 없는 단순 상황을 가정하면 어느 정도 추정이 가능하다. 이 경우 연금소득세는 노령연금이 연간 770만원 이상인 경우 발생하는데(김동엽, 2020), 대상자는 2021년 약 115만명으로 추정된다. 전체 노령연금 수령자 수(482만명) 기준으로는 전체의 24%가 부과대상이다. 금액기준으로 보면 월수령액 70만원 이상이 대상인데, 70만원 이상 수령자의 수령액은 전체 노령연금 지급액의 50% 정도이다. 2021년 25조원의 노령연금 지급액 중에서 약 50%인 12조원 정도가 연금소득세 부과 대상이 되며, 가장 보수적으로 최저소득세율 6%를 적용하면 연금소득세수는 7,000억원이다. 7,000억원은 국민연금공단의 1년 관리운영비에 해당한다. 앞으로 노령연금 수급자가 급증하는 2030년대 이후에는 그 규모 또한 급증할 것이며, 특히 소득상한을 상향할 경우 고소득자의 고급여에 따른 세수는 더 늘어날 것이다. 정부가 기금 재정안정 수단으로 연금개혁과정에서 고려해볼 만한 것으로 판단된다.

나. 크레딧제도 비용과 관리운영비 부담

국민연금은 가입자 보험료로 조성되는 보험성 기금이지만, 정부의 공공정책 수단으로 국민연금제도가 활용되고 있기 때문에 정부는 공공정책 집행 과정에서 발생한 국민연금기금 지출에 대해서는 예산으로 해당 지출을 부담하는 근거를 두고 있다. 크레딧(credit)제도, 관리운영비, 두루누리사업 등이 대표적이다.

크레딧제도란 일정 요건(군복무, 출산, 실업)으로 인해 보험료를 불가피하게 납부하지 못하더라도 납부한 것으로 간주하여 사회보험의 가입기간으로 인정해주어 연금급여에 불이익이 없도록 하는 제도이다. 문제는 이때 비용(보험료 납부 간주)을 누군가는 부담해야 하는데, 크레딧제도는 사회보험에 사회부조적 성격을 가미하는 대표적인 공공정책에 해당하기 때문에 그 비용은 국가가 부담하는 것이 원칙이다. 그럼에도 <표 Ⅱ-2>에서 보듯이 군복무 크레딧의 경우만 국가가 의무 전액 부담을 하고, 출산은 일부 또는 전부 부담, 그리고 실업 크레딧은 일부 부담 가능성만 언급하고 있다.

그러나 국민연금의 기금고갈 시점이 저출산ㆍ고령화로 앞당겨지고, 고갈 이후 순수부과방식 전환 보험료 부담이 급등하는 상황에서 국가가 공공정책으로 도입한 사회부조 성격의 크레딧비용을 일반 가입자가 부담하는 것은 논리적으로도 부담능력 면에서도 바람직하지 않다. 따라서 크레딧 관련 비용은 전액 국가의 일반회계로 부담하도록 향후 연금개혁 논의에서 검토하는 것이 보험료 인상을 동반하는 연금개혁의 국민적 수용성을 높이기 위해서 필요하다. 또한 크레딧비용의 국가 부담시점을 노령연금수급권을 취득한 시점으로 두는 것도 효율성 면에서 바람직하지 않다. 보험료 발생 시점에서 크레딧 국가 예산을 집행할 수 있도록 제도 개선이 이루어진다면 기금 재정의 안정에 기여함은 물론이고, 높은 운용수익률로 기금재정에 기여할 수 있을 것이다.

한편 국민연금기금의 관리운영비에 대한 국가의 예산 지원을 늘릴 필요가 있다. 참고로 2021년 국민연금기금의 인건비 등 관리운영비는 7,383억원(보험료수입의 1.3%)에 이르고 있으나, 정부 일반예산은 100억원 지원에 그치고 있다. 기금고갈에 따른 가입자 부담이 증가하는 상황을 고려할 때, 그리고 후술하겠지만 국민연금서비스를 제공한 대가로 매년 징구하는 국민연금소득세 수입 규모와 비교할 때, 정부의 관리운영비 지원 수준은 매우 미미한 것으로 보이며, 관리운영비의 일부를 정부가 부담한다는 국민연금법 제38조의 취지를 무색하게 하고 있다. 관리운영비의 상당 비율을 일반회계에서 부담하여 국민연금기금 고갈의 부담을 국가도 분담하는 방안을 검토할 필요가 있다.

Ⅲ. 사적연금의 소득대체율 상향 방안

1. 사적연금의 운용 비효율: 국내외 소득대체율 비교

앞서 언급했듯이 우리나라 국민들의 평균적인 노후소득보장은 사적연금의 소득대체율 향상을 통하여 강화되는 것이 국가적으로 가장 효율적일 수 있다. 이는 거꾸로 현재 사적연금의 소득대체율이 개선 가능성 면에서 여력이 가장 크다는 것으로 그만큼 비효율적으로 관리ㆍ운용되고 있음을 시사한다. <표 Ⅲ-1>은 주요 사적연금 운영 국가들의 사적연금 소득대체율을 나타낸다. 사적연금이 가장 발달하고 효율적으로 운용되고 있는 미국 퇴직연금의 소득대체율은 42.1%를 기록하고 있다. 퇴직연금이 의무화된 호주와 영국도 각각 31.3%와 27.4%를 나타내고 있다. 앞서 우리나라 퇴직연금의 소득대체율은 DB형+개인형 26%, DC형+개인형 23%를 나타내고 있다. 미국, 호주와 같은 퇴직연금 선진국 수준으로 제도가 운영될 경우 소득대체율이 상향될 수 있음을 보여준다. 여기에 기여율을 감안하면 개선 여지는 더 큰 것으로 보인다. 한국은 개인형 연금 기여율(6.6%)까지 고려하면 사적연금 기여율은 14.9%인 반면 가령 호주의 기여율은 9.5% 수준이다. 우리나라 사적연금은 기여율은 높은데 소득대체율은 낮은 경우에 해당한다. 결국, 가입자의 추가 비용부담 없이 제도 운영의 효율성 개선을 통한 소득대체율의 향상 가능성이 매우 높은 경우에 해당한다.

<표 Ⅲ-2>는 우리나라 사적연금 기금운용제도가 국민연금이나 선진국의 퇴직연금 수준으로 효율적으로 운영될 경우의 소득대체율 상향효과를 시뮬레이션한 결과이다. 여기서 제도 개선의 대리변수는 장기 운용수익률이 국민연금의 4차 재정계산에서 가정한 투자수익률을 실현하는 경우, 그리고 미국 DC형 퇴직연금이 지난 20년간 실현한 투자수익률을 실현하는 경우로 두었으며, 기본 시나리오(제도 개선이 없어 퇴직연금 과거 5년 평균수익률을 미래에도 실현하는 경우)와 소득대체율을 비교하였다.

운용수익률이 소득대체율에 영향을 미치는 DC형과 개인형의 경우 국민연금이 벤치마크일 때 소득대체율은 각각 5%p, 4%p, 401(k)가 벤치마크일 때 소득대체율은 각각 6%p, 5%p 상향하는 효과가 예측되었다. 그 결과, DC형을 선택한 가입자의 통합소득대체율은 국민연금이 벤치마크인 경우 66%, 401(k)가 벤치마크인 경우 68%로 추정되었다. 이는 우리나라 사적연금의 운용제도를 개선할 경우, 다층연금 전체의 통합대체율이 국제기구가 권고하는 70%에 근접할 수 있음을 시사한다. DB형을 선택한 가입자는 운영제도 개선이 DB형 가입자의 소득대체율에는 영향을 미치지 않으나, IRP 추가납입 등 개인형 사적연금의 수익률 개선으로 인하여 통합소득대체율이 각각 65%와 66%로 상향되는 것으로 추정되었다.

다만, 기금형 제도 도입이 국민연금이나 미국 401(k)의 높은 수익률을 설명하는 유일한 제도 변수는 아니라는 점에서 동 시뮬레이션 결과는 제도 개선으로 기대할 수 있는 소득대체율 상향의 최대치일 수 있다는 점에서 해석상의 주의는 필요하다.

3. 사적연금 소득대체율 상향을 위한 과제

그렇다면 미국의 401(k) 연금이나 우리나라 국민연금 수준으로 국내 사적연금의 운용제도를 개선할 경우 구체적으로 어떤 방향과 내용으로 제도 개선이 이루어져야 하는가. 퇴직연금 적립금운용제도와 관련하여 2021년 이후 디폴트옵션제도, 중소기업퇴직연금기금제도, 적립금운용위원회제도 등 운용효율을 높이기 위한 제도 개선이 이루어진 토대 위에, 추가적으로 고려되어야 할 사적연금 개혁 방향은 다음과 같다.

가. 연합형 퇴직연금기금제도 도입

퇴직연금 적립금 운용제도 개선의 요체는 전문가의 조력을 통해 자산배분의 전문성을 높이고 다양한 자산군으로의 제약 없는 분산투자와 비용효율이 가능하도록 적립금 규모를 확충하는 것이다. 그런데 우리나라의 계약형 제도는 최근 디폴트옵션, 적립금운용위원회 등을 도입하여 자산배분 전문성을 강화하는 시도를 하고 있지만, 기금형 제도에 필적할 수는 없으며, 규모 면에서도 <표 Ⅲ-3>에서 확인하듯이 계약형 제도의 일대일 계약 속성상 규모의 경제 확보에 어려움이 있는 등 적립금의 운용 효율성으로 보면 연합형 퇴직연금제도가 궁극적인 제도개혁의 종착점이 될 수밖에 없다.

연합형 퇴직연금기금은 기금의 대형화(규모의 경제)와 전문가로 구성된 수탁자위원회를 통해 자산배분의 전문성을 제고하는 미국 등 연금 선진국의 퇴직연금 지배구조를 도입하는 것을 의미한다. 먼저, 공공운영형 기금은 공공기관이 영세사업장을 대상으로 재정지원 패키지와 함께 운용효율과 사각지대 해소를 동시에 염두에 두고 설립하는 것으로 작년에 도입한 중소기업퇴직연금기금이 그 역할을 할 예정이다. <그림 Ⅲ-1>에서 보듯이 앞으로 나머지 두 유형이 제도적으로 보완될 필요가 있는데, 하나는 2021년 171조원의 계약형 DB형 연금의 규모의 불경제 상황(<표 Ⅲ-3> 참조)을 규모의 경제가 가능하도록 연합형 기금을 조성하는 것이다. 적립금운용위원회 도입을 통해 자산배분 전문성 제고의 제도적 기틀은 마련하였으나, 규모의 불경제에 따른 자산배분 제약 문제는 남아 있다. 기업집단, 업종별 단체 등을 중심으로 연합이 가능할 수 있다. 다른 하나는 금융기관형 기금으로 영리형 기금인 대신에 전문직, 고소득자, 다른 기금 미가입자 등 투자성향이 구별되는 집단을 대상으로 맞춤형 서비스를 제공하는 기금으로 호주의 소매형과 유사하다.

나. 연금세제혜택의 개인형 연금계좌 환입

우리나라는 국민연금 보험료 9%, 퇴직연금 8.3%, 개인형 추가납입 6.6% 등 보험료의 총합이 23.9%에 달해 강제저축률이 낮지 않다. 노후소득 안정을 위한 기여율의 인상이 현실적으로 매우 어려울 수 있다. 그런데 연금세제인 EET 제도 아래서 국민연금은 보험료에 대해 전액 소득공제, 사적연금은 추가납입에 대한 세액공제를 통해 연말정산 과정에서 가처분소득으로 환급을 해주는데, 환급해주는 해당 세제혜택금액을 연금계좌로 환입하여 노후자산으로 적립하는 방안을 생각할 수 있다. 물론 이 방안은 소비 가능 가처분소득(현재 소득)을 줄이는 대신 연금계좌 적립금(미래소득)을 늘리는 방식이기 때문에 가입자 측면의 순효과는 기대할 수 없다. 대신 이는 기여금의 명시적 인상 없이 다층연금 전체의 노후적립금 수준을 높이며 소득대체율을 높이는 노후소득 보장 측면의 효과는 있다. 다만, 국민연금의 경우 소득공제환급액을 국민연금기금으로 환입하는 것은 소득대체율 인상 없이 보험료율을 인상하는 효과가 있어 가입자들이 수용하기 어려울 것이다. 때문에 국민연금의 소득공제액과 사적연금의 세액공제는 모두 사적연금계좌인 IRP로 환급되는 것이 합리적일 것이다.

<표 Ⅲ-4>는 사적연금의 추가납입 세액공제를 연금계좌로 환입할 경우의 개인형 연금의 소득대체율 개선 효과를 보여준다. 2019년 기준 307만명의 세액공제 대상자의 평균 세액공제액은 36.4만원이었다. 이것을 연금계좌로 환입하여 적립 운용한다고 가정했을 때 소득대체율은, 제도 개선 없이 현재 퇴직연금 수익률이 미래에도 실현될 경우 1.5%p, 4차 재정계산 수준으로 운용제도가 개선될 경우 2.0%p, 그리고 미국 401(k) 수준으로 개선되었을 경우 2.2%p 높아지는 것으로 추정되었다.

다. 가입 사각지대의 해소

소득대체율 상향을 위한 가장 현실적 과제는 사각지대의 해소이다. 본 보고서는 국민연금과 퇴직연금, 그리고 개인형 연금을 모두 포함한 대표가입자를 가정하였으나, 현실은 국민연금만 가입한 국민이 대다수이기 때문에 다층연금과 통합소득대체율 개선 논의가 설득력을 갖기 위해서는 사적연금의 사각지대 해소가 급선무이다. <표 Ⅲ-5>를 보면 의무가입인 국민연금 가입자의 약 70%는 국민연금에만 가입되어 있고 사적연금을 가지고 있지 않은 것으로 나타났다. 이는 우리나라 국민의 2/3 이상의 연금 소득대체율은 35%라는 의미로 해석될 수 있다. 퇴직연금을 가진 국민연금 가입자 기준으로 약 30%(DB+DC)에 불과하며, 약 30%의 가입자들은 48%에서 51%의 소득대체율을 누릴 수 있다. 그리고 국민연금과 퇴직연금, 그리고 개인형 연금을 모두 가입한 국민은 국민연금 가입자 기준으로 13.7%에 불과했으며, 이들만이 다층연금 전체의 통합소득대체율 57%에서 61%를 누릴 수 있는 것으로 나타났다. 결국, 사적 연금가입 사각지대를 해소하는 것이 연금 소득대체율 제고를 위한 가장 현실적인 과제임을 확인할 수 있다.

1) 퇴직연금의 소득대체율 추정은 박은주ㆍ박희진(2015), 성주호(2019) 등이 있으며, 공적연금과 사적연금 통합소득대체율 추정은 임병인ㆍ강성호(2005), 강성호(2011), 한정림ㆍ박주완(2014) 등에 의해 시도되었다.

2) 2018년 제4차 국민연금 장기재정추계(보건복지부, 2018)에 따르면 2088년 신규 수급자의 평균 가입기간은 26.8년, 소득대체율은 24.3%로 전망되었다. 그리고 퇴직연금 설문조사에 따르면 대졸 가입자의 경우 30세에 가입하여 55세(54세 실제 정년퇴직)에 퇴직하는 경우가 많았다.

3) 2020년 소득 및 기여금 통계와 2018년 국민연금 4차 재정계산 당시의 경제변수로 가정한다.

4) 안종범ㆍ전승훈(2005), 석상훈(2010)은 소비함수 추정을 통해 우리나라 적정소득대체율을 각각 66.5%, 84%로 추정하였다.

5) 6년 연속 적립률 90% 미만시 급여 삭감, 6년 연속 90% 이상 104% 이하면 재정정상화플랜 마련, 110% 미만이면 급여의 indexation 금지, 110% 이상 130% 미만이면 부분적 indexation 허용, 130% 이상이면 indexation 허용 등의 정책을 펴고 있다(ABP 홈페이지).

6) 국민연금기금 전략적 자산배분의 수익기여도는 2021년 99.6%, 2020년 89.7%, 2019년 95.8%이다(국민연금기금운용위원회, 2022).

7) 2055년 수급자는 1,595만명에 이르러 가입자 수를 능가하게 된다(4차 재정계산).

감사원, 2020, 『감사보고서: 국민연금 관리 실태』.

강동수ㆍ김종훈ㆍ허재준ㆍ송홍선, 2014, 사적연금 활성화 방안, KDI, 노동연구원, 자본시장연구원 공동 학술연구용역, 기획재정부.

강성호, 2011, 생애기간을 고려한 공ㆍ사적연금소득 추정, 『보험학회지』 88(4), 51-87.

국민연금기금운용위원회, 2022, 『2021년도 국민연금 기금운용 성과평가안』.

국민연금연구원, 2016, 재정목표 및 재정지표의 국제비교 연구, 조사보고서.

국민연금연구원, 2021, 『국민노후보장패널 8차 부가조사』.

국회예산정책처, 2016, 국민연금 크레딧 예산의 문제점과 개선과제, 『NABO 경제동향 & 이슈』 48(10).

김동엽, 2020, 『세금을 알아야 연금이 보인다』, 미래에셋은퇴연구소.

박은주ㆍ박희진, 2015, 『퇴직연금 소득대체율 연구』, 고용노동부, 근로복지공단.

박태영, 2010, 『공적연금기금의 투자정책 및 자산배분전략 국제비교』, 국민연금연구원.

보건복지부, 2018, 『제4차 국민연금 재정계산을 바탕으로 한 국민연금 종합운영계획』.

석상훈, 2010, 패널자료로 추정한 소득대체율 분석, 『보건사회연구』 30(2), 5-38.

성주호, 2019, 퇴직연금 목표소득대체율 설정 및 실현전략, 퇴직연금 공동 세미나, 고용노동부, 근로복지공단.

송홍선, 2019, 다층연금시대의 국민연금 제도개혁 방향, 자본시장연구원 『자본시장포커스』 2019-23호.

송홍선, 2019, 『수익률 제고를 위한 퇴직연금 자산운용체계 개선 방향』, 자본시장연구원 이슈보고서 19-10.

송홍선, 2021, 『DC형 퇴직연금의 노후안전망 역할 강화 연구』, 자본시장연구원 연구보고서 22-03.

안종범ㆍ전승훈, 2005, 은퇴자가구의 적정소득대체율, 『한국경제연구』 15, 5-34.

임병인ㆍ강성호, 2005, 국민ㆍ퇴직ㆍ개인연금의 소득계층별 노후소득보장효과. 『보험개발연구』 16(3), 89-121.

정해식ㆍ이다마ㆍ이병재ㆍ한겨레, 2020, 『노후소득보장제도 개혁 담론 분석』, 보건사회연구원.

한정림ㆍ박주완, 2014, 『우리나라 다층노후소득보장체계의 연금소득 추정』, 국민연금연구원.

한정림, 2018, OASDI 노령연금 수급자의 소득대체율: 평가방법에 따른 의미와 비교, 국민연금연구원 『연금포럼』 봄호.

EU, 2021, The 2021 Pension Adequacy Report: Current and Future Income Adequacy in Old Age in the EU.

ILO, 2005, Economic Security for a Better World.

OECD, 2021, Pension at a Glance.

World Bank, 1994, Averting the Old-Age Crisis: Policies to Protect Policies to Protect the Old and Promote Growth.

CPPIB www.cppinvestments.com

DOL www.dol.gov

Global SWF globalswf.com

GPIF www.gpif.go.jp

OECD www.oecd.org