Find out more about our latest publications

Challenges for Climate Finance towards Carbon Neutrality

Issue Papers 23-08 Mar. 13, 2023

- Research Topic Financial Services Industry

- Page 23

This report explores strategies for developing climate finance to achieve carbon neutrality. Even the most effective policies cannot inspire confidence and concrete actions without adequate financial support. Several international organizations estimate that the additional demand for climate finance will increase by $2 trillion to $5 trillion annually, potentially multiplying two to six times by 2050. Korea's projected demand for climate finance is expected to reach KRW 62 trillion annually and KRW 1,848 trillion cumulatively by 2050, potentially resulting in a significant shortage in this field.

International organizations predict that approximately 70% of total climate finance will come from the private sector. They also advocate for improvements in addressing certain structural factors contributing to market failures, including externalities in greenhouse gas emissions, maturity mismatches due to the long-term nature of climate investments, information asymmetry, and the resulting valuation challenges. To address these challenges, the most crucial step is the further development of blended finance. Blended finance entails the collaboration of the public and private sectors in sharing governance, returns, and investment risks, aiming to attract substantial liquidity from the private sector. This is suitable for climate finance that is characterized by externality, maturity mismatches, and information asymmetry. This is suitable for climate finance that is characterized by externality, maturity mismatches, and information asymmetry.

There is a need to reshape the current emissions trading market. The emissions trading market determines carbon prices, the core piece of information in assessing economic feasibility of climate investment. Balanced development between the carbon trading market and the voluntary carbon market (VCM) is essential, as it has the potential to enhance liquidity and improve price discovery efficiency. Lowering the emissions cap in line with nationally determined contributions (NDCs) appears necessary. The resulting market imbalance can be alleviated through measures such as redesigning market stabilization mechanisms, expanding participant diversity, and embracing carbon credit futures. Furthermore, increased transparency in the VCM could enhance the ecosystem within the emissions trading market.

Finally, it is advisable to mandate emissions disclosure to bridge the regulatory gap between Korea and developed countries. The mandated disclosure should encompass scope 3 emissions and expand the role of financial institutions responsible for managing emissions financed on the path to carbon neutrality.

International organizations predict that approximately 70% of total climate finance will come from the private sector. They also advocate for improvements in addressing certain structural factors contributing to market failures, including externalities in greenhouse gas emissions, maturity mismatches due to the long-term nature of climate investments, information asymmetry, and the resulting valuation challenges. To address these challenges, the most crucial step is the further development of blended finance. Blended finance entails the collaboration of the public and private sectors in sharing governance, returns, and investment risks, aiming to attract substantial liquidity from the private sector. This is suitable for climate finance that is characterized by externality, maturity mismatches, and information asymmetry. This is suitable for climate finance that is characterized by externality, maturity mismatches, and information asymmetry.

There is a need to reshape the current emissions trading market. The emissions trading market determines carbon prices, the core piece of information in assessing economic feasibility of climate investment. Balanced development between the carbon trading market and the voluntary carbon market (VCM) is essential, as it has the potential to enhance liquidity and improve price discovery efficiency. Lowering the emissions cap in line with nationally determined contributions (NDCs) appears necessary. The resulting market imbalance can be alleviated through measures such as redesigning market stabilization mechanisms, expanding participant diversity, and embracing carbon credit futures. Furthermore, increased transparency in the VCM could enhance the ecosystem within the emissions trading market.

Finally, it is advisable to mandate emissions disclosure to bridge the regulatory gap between Korea and developed countries. The mandated disclosure should encompass scope 3 emissions and expand the role of financial institutions responsible for managing emissions financed on the path to carbon neutrality.

Ⅰ. 서론

본 보고서는 2050 넷제로 달성을 위한 기후금융의 활성화 방안을 연구한다. 아무리 좋은 정책도 재원이 뒷받침되지 않으면 정책 신뢰와 실행을 담보할 수 없다. 파리협정 합의문도 탄소중립의 선언만큼이나 이행을 담보할 재원(기후금융)의 중요성을 강조하고 있다. 그럼에도 대규모 기후투자의 재원을 조달할 금융시스템 측면의 준비가 부족하다는 것이 국제기구의 일반적인 평가이다. 이에 본 보고서는 향후 30년간의 기후투자 필요 규모와 기후금융 부족(gap) 원인을 살펴보고, 기후금융 확충을 위해서는 금융부문이 어떤 준비와 대응을 해야 하는지 연구한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서 기후금융의 개념을 정의하고, Ⅲ장에서는 향후 30년간 탄소중립을 위해 필요한 기후투자 규모와 현재의 기후금융 공급 현황에 대한 분석을 통해 기후금융 부족의 발생 원인을 살펴본다. 마지막으로 Ⅳ장에서는 기후금융 부족 완화를 위한 금융부문의 주요 과제를 연구한다. 이를 위해 본 고는 기후금융의 외부성과 공공 기후금융의 조달제약 등을 고려할 때 민관협력금융(blended finance)체제의 구축이 필요하다는 점, 그리고 기후투자의 경제성 평가를 위해서는 배출권 가치를 결정하는 배출권시장의 발전이 동반되어야 한다는 점을 설명한다. 마지막으로, 정보비대칭 완화를 위한 탄소공시 의무화 규제에 대해 살펴볼 것이다.

Ⅱ. 기후금융의 개념과 현황

1. 기후금융의 개념과 범위

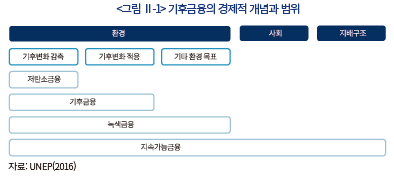

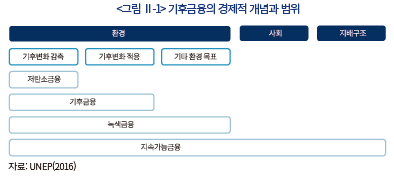

기존 문헌에서는 녹색금융(green finance), 기후금융(climate finance), 저탄소금융(low-carbon finance), 지속가능금융(sustainable finance) 등을 구분 없이 사용하고 있지만, 기후금융 연구를 위해서는 분류체계 정리가 선행될 필요가 있다. UNEP(2016)는 단순화 위험을 무릅쓰고 네 용어의 개념을 구분하고 있다. 네 용어 모두 환경, 사회, 지배구조를 비재무 리스크요인으로 인식하고 있지만, 어떤 범주를 보다 직접적으로 강조하느냐에 따라 용어의 선택이 달라져야 한다. 지속가능금융은 환경, 사회, 지배구조를 균형적으로 고려하는 금융이며, 환경을 강조하는 녹색금융, 기후금융, 저탄소금융과 구별된다.

기후금융은 환경금융 중에서도 온난화와 관련된 온실가스 배출의 저감 목적을 위한 금융으로 좁게 정의된다. UN 기후변화협약 기후금융연구반(United Nations Framework Convention on Climate Change Standing Committee on Finance: UNFCCC SCF)는 기후금융을 다시 감축금융(mitigation finance)과 적응금융(adaptation finance)으로 세분하고 있다. 저탄소금융으로 불리기도 하는 감축금융은 온실가스 배출의 감축(reducing), 회피(avoiding), 흡수(sinks), 저장(reservoirs) 목적의 금융이다. 적응금융은 기후변화로부터 생태계 충격(vulnerability) 완화를 위한 복원(resilience) 목적의 금융이다. 마지막으로 녹색금융은 기후금융보다 광의의 개념으로 온실가스 저감은 물론 물, 오염 등 환경 전반을 위한 조달을 지칭하는 개념이다.

이 같은 개념 구분에도 불구하고 기후금융, 녹색금융, 지속가능금융, 저탄소금융은 상호 보완적임에 유의할 필요가 있다. 후술하는 그린 택소노미(green taxonomy)는 녹색금융에 대한 경제적 정의를 넘어 규제적, 법적 정의가 무엇인지를 제도화한 것인데, 지속가능금융, 기후금융, 녹색금융 모두에 대해 사회적 요건까지 최소한 만족하도록 하는 최소요건(mimimum safeguard)을 요구하고 있다. 세부적인 목적은 후술하는 그린 택소노미에서 확인된다.

2. 기후금융의 법적 개념: 그린 택소노미

앞서의 기후금융 정의가 기능과 대상에 따른 경제적 정의라면, 그린 택소노미는 기후금융에 대한 규제적 법적 정의에 해당한다. 경제활동, 투자 대상 자산 및 프로젝트 성격 등의 세부 요건이 기후금융의 규제적 정의에 부합하는지 실무적으로 판단하는 녹색분류체계가 그린 택소노미이다. 규제적 정의를 별도로 도입한 목적은 그린워싱(green washing) 방지를 통해 금융자본이 실질적으로 환경목표를 달성하는 데 사용될 수 있도록 하기 위함이다. 그린 택소노미는 2021년 유럽에서 도입한 후 여러 나라에서 도입하고 있으며 우리나라도 2021년에 도입하였다.

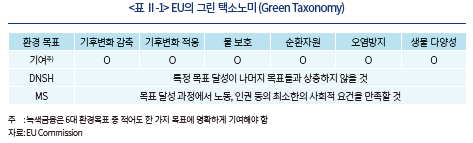

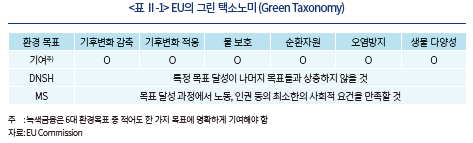

그린 택소노미에 부합하여 녹색금융으로 분류되기 위해서는 우선 기후변화 감축, 기후변화 적응, 물, 순환경제, 오염, 생물다양성 6개 분야 환경목표에 부합해야 한다. 또한 6개 환경목표에 부합하더라도, 투자프로젝트는 추가로 두 가지 요건을 충족해야 한다. 바로 DNSH(Do No Significant Harm)과 MS(Minimum Social Safeguard) 요건이다. DNSH는 하나의 환경목표 추구 과정에서 나머지 5개 환경목표의 가치를 훼손하는 상충이 발생하지 않아야 한다는 요건이다. MS는 투자프로젝트가 노동, 인권 등 사회적 규범에 대해 최소한의 요건을 충족해야 한다는 조건이다.1) 결국 그린 택소노미는 좁은 의미의 녹색금융도 넓은 의미의 지속가능금융 요건을 갖추어야 외부자금조달이 가능하다는 의미이다.

3. 기후금융의 현황

가. 글로벌 기후금융 현황

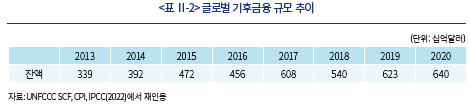

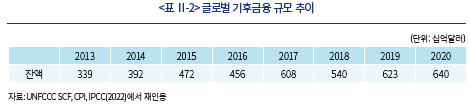

글로벌 기후금융 통계는 UNFCCC SCF, 국제에너지기구(International Energy Agency: IEA), 기후정책이니셔티브(Climate Policy Initiatives: CPI) 등에서 집계하고 있다. IPCC(2022)에 따르면 글로벌 기후금융은 UNFCCC SCF 기준으로 2013년 3,390억달러에서 매년 증가하여 2020년 6,400억달러로, 연평균 9.5%씩 성장한 것으로 집계되었다.

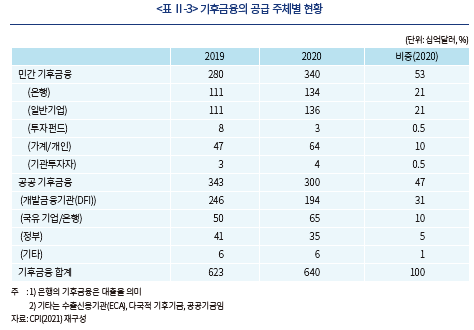

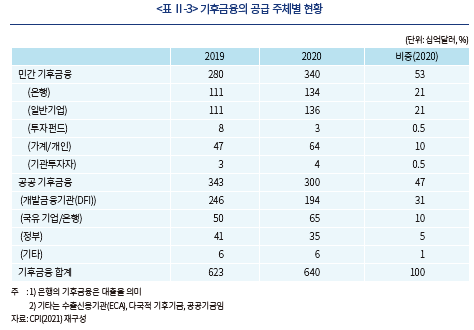

공급 주체는 그간 공공 기후금융 중심으로 이루어졌으나 파리협정 이후 민간 기후금융이 빠르게 늘고 있다. 2020년 기후금융 공급액 6,400억달러 중에서 민간 기후금융은 3,400억달러로 전체의 53%를 차지했다. 감축투자의 당사자인 일반기업이 녹색채권 등을 통해 전체 기후금융의 21%를 조성하며 주된 역할을 하였고, 신용을 공여하는 민간 은행도 전체의 21%를 공급하며 민간 기후금융을 주도하고 있다. 기후금융을 가장 많이 공급하는 금융기관은 공공 개발금융기관(Development Finance Institution: DFI)으로 전체 기후금융의 30%를 공급했다. 자본시장 관련 기관들의 역할은 아직 미미하다. 그간 정보비대칭성과 가치평가 어려움, 기업가치 제고의 불확실성 등으로 자본시장 조달이 부진했으나, 파리협정 이후 기관투자자의 초장기 녹색채권 수요 증대, 상쇄배출권 등 프로젝트 배출권시장의 기회 확대, 위험과 수익차등 분배를 통한 민관협력 기후금융의 확대 가능성 등으로 자본시장의 역할은 빠르게 확대될 것으로 전망된다.

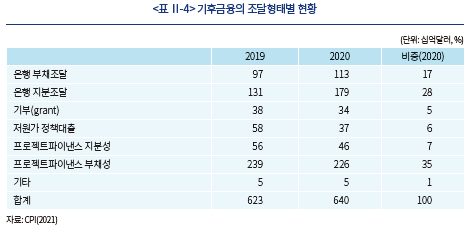

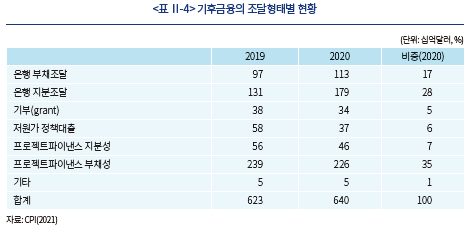

CPI(2021)는 기후금융을 크게 기부, 부채, 주식으로 분류한다. 기부(grants)는 현금, 현물 출연 등이며, 주식은 기업 혹은 금융기관이 고유계정을 통해 수행하는 직접 지분 출자와 프로젝트파이낸스 지분성 투자(project-level equity), 부채는 기업과 금융기관이 고유계정을 통해 수행하는 채권과 대출, 그리고 프로젝트파이낸스 부채성 투자(project-level debt)를 포함한다. 그리고 부채는 시장금리 이하로 대출이 이루어지는 정책성 부채(low-cost debt)와 시장금리로 대출이 이루어지는 시장성 부채(market-rate debt)로 구분된다. 2020년 지분 조달은 전체 기후금융의 35%, 부채 조달은 전체 기후금융의 58%로 나타났다. 지분 조달은 금융기관과 기업으로부터의 직접 지분투자가 대부분이었으며, 부채 조달은 주로 프로젝트파이낸스에 대한 시장성 대출이 대부분이었다.

조달목적은 감축금융이 대부분을 차지하고 있다. 2020년 전체 6,400억달러의 90%인 5,760억달러가 감축금융 목적으로 조달되었고 적응금융은 490억달러로 나타났다. 감축금융은 온실가스의 감축, 회피, 저장, 활용을 위한 기후금융을 의미한다. 감축금융은 특히 에너지전환과 수송부문으로 집중되고 있으며 전체 감축금융의 90%가 두 부문에 집중되어 있다. 적응금융은 기후변화에 따른 생태계 충격, 재난 위험을 최소화하기 위한 예방과 대응 금융을 의미한다.

나. 국내 기후금융 현황

우리나라의 기후금융은 선진국과 달리 공공 기후금융 중심이며, 정부 예산 중심의 공공 기후금융이 특징이다. 특히, 2021년말 2050 탄소중립과 2030년 40% 감축 로드맵을 발표함에 따라 2022년 기후금융 예산은 증가했다. 2022년을 2050 탄소중립 이행을 위한 원년으로 삼고, 2021년 기후금융 예산 7.3조원 대비 70% 증가한 11.9조원의 예산을 책정했다. 예산 규모뿐만 아니라 탄소중립기본법을 통해 공공 기후금융 재원인 기후대응기금을 2022년에 조성한 것도 주목할만한 일이다. 11.9조원의 예산은 기후대응기금 2.5조원과 기후대응기금 이외에 정부 일반예산 9.4조원으로 구성되어 있다.

한편 민간 기후금융에 관한 행정통계는 아직까지 존재하지 않는다. 녹색금융 또는 ESG 금융 등의 이름으로 여러 기관에서 집계하고 있으나, 기후금융 통계만 별도로 집계는 되지 않고 있다. ESG 금융 통계는 금융기관이 제출한 자료를 바탕으로 집계한 KOSIF & LEE(2021)가 비교적 체계적이다. 여기에서는 ESG 금융을 대출, 투자, 채권, 상품으로 나눠 집계하고 있다. ESG 금융 중에서 녹색금융, 그리고 녹색금융 중에서 온실가스 감축에 관련된 기후금융이 얼마인지는 추정이 어렵다. 다만, 기후금융을 포함하고 있을 것으로 추정되는 녹색대출 28조원과 녹색채권 발행액 3조원을 합친 31조원 중 일부가 민간 기후금융에 해당할 것으로 보인다.

Ⅲ. 탄소중립 투자와 기후금융의 발전 필요성

Ⅱ장에서 확인한 2020년 전세계 기후금융 6,400억달러는 지구 온도 상승 1.5도 제한을 목표로 2021년 COP26를 전후하여 각국이 새로 제출한 2030년 목표배출량(Nationally Determined Contribution: NDC)과 2050 넷제로 선언 이전의 기후투자 규모를 반영한다. 2050년 넷제로 선언으로 향후 30년간 필요한 기후투자와 기후금융 규모는 이보다 크게 늘어날 것임은 자명하다. 이 장에서는 2050년 넷제로를 반영한 글로벌 기후투자 규모 추정에 대한 국제기구의 선행 연구를 살펴보고, 우리나라 탄소가격의 장기전망치를 이용하여 우리나라의 기후투자 규모를 추정한다. 이를 통해 넷제로 기후투자 재원 조달을 위해서는 민관협력금융 등 기후금융 부족 해소를 위한 기후금융 공급체계의 구축이 필요함을 지적할 것이다.

1. 탄소중립 투자 수요 추정: 선행 연구

글로벌 기후투자 수요와 기후금융 규모 추정은 기후변화 아젠다를 주도하는 UN(UNFCCC와 IPCC)과 기후변화 대응을 위한 전세계 중앙은행 네트워크(The Network of Central Banks and Supervisors for Greening the Financial System: NGFS) 등에서 주로 이루어지고 있다. 기후투자는 특성상 기존의 경제분석 틀로는 한계가 있으며, 경제, 에너지, 기후변화에 관한 통합모델(Intergrated Assessment Model: IAM)의 구축을 통해 추정이 가능한데, 아직 표준화된 방법론이나 장기추정 시나리오가 존재하지 않아 추정치마다 편차가 큰 것이 현실이다.

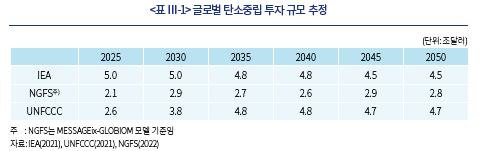

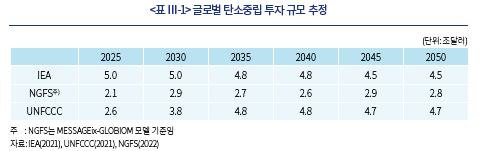

UN은 UNFCCC와 기후변화협약 실행보고서를 발간하는 IPCC 두 조직에서 글로벌 기후투자 규모를 추정하고 있다. UNFCCC는 2021년 11월 ‘넷제로 기후금융 로드맵’(Net Zero Financing Roadmaps)을 발표했다. 여기에 따르면 2050년까지 탄소중립 투자 규모는 지속적으로 증가하게 되는데, 2016~2020년 0.9조달러, 2021~2025년 2.6조달러, 2026~2030년 3.8조달러, 2031~2040년 4.8조달러, 2041~2050년 연간 4.7조달러를 전망하고 있다. 요약하면, 2030년까지는 연간 3조달러 내외, 2030년부터 2050년까지는 연간 4.7조달러를 매년 온실가스 감축을 위한 투자 비용으로 지출해야 한다는 것이다. 누적기준으로는 탄소중립를 위해 2050년까지 약 127조달러의 기후투자가 필요한 것으로 추정되었다. 부문별로는 발전부문 비중이 가장 높고 수송과 건물 부문 비중이 뒤를 이었으며, 산업부문은 연간 0.3~0.4조달러로 나타났다.

IEA(2021)는 NZE(Net Zero Emissions by 2050) 달성을 위해 에너지부문에서 2020년까지 매년 2조달러(2019년 USD 기준)의 투자가 필요하고, 2030년까지 매년 5조달러가 필요한 것으로 추정하고 있다. 기간별로는 2031~2040년 연간 4.8조달러, 2041년 이후 연간 4.5조달러로 추정되었다. 총 누적투자규모는 2050년까지 140조달러로 추정되었다. 이는 2030년까지 글로벌 GDP의 4.5%에 해당하며, 2050년까지는 글로벌 GDP의 2.5%에 해당하는 규모이다. 한편 기후변화 대응을 위한 중앙은행과 감독기구 네트워크인 NGFS는 2050년까지 2020년(6,210억달러) 대비 매년 두 배 이상 늘어나야 할 것으로 추정하였다. 5년 단위 연간 필요투자 규모는 2025년 1.4조달러, 2030년 1.7조달러, 2035년 1.5조달러, 2040년 1.5조달러, 2050년 1.7조달러로 추정하고 있다.

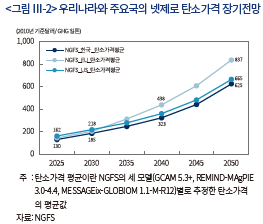

세 국제기구의 투자 전망치를 비교해 보면 IEA와 IEA의 기본모델을 바탕으로 추정한 UNFCCC의 투자 전망치가 대체로 유사한 수준에서 전망되고 있는 반면, NGFS 전망치는 두 기관보다는 낮은 수준에서 전망되고 있다. 이같은 전망의 차이는 모델의 방법론과 가정, 넷제로 달성에 필요한 탄소가격 전망의 차이에 기인하는 것으로 판단된다.2)

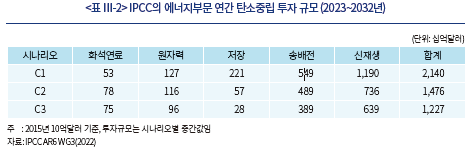

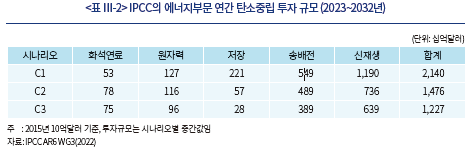

IPCC 또한 2022년 4월 6차 보고서 제3 실무그룹보고서(AR6 WGⅢ)에서 투자와 기후금융 챕터를 새로 추가하고, 탄소중립 기후투자 규모를 공개했다. UNFCCC와 달리 시나리오별 추정치를 발표하였다. 시나리오 1(C1)은 2100년에 1.5℃ 목표를 50% 확률로 큰 폭의 오버슈팅(overshooting) 없이 달성하는 경우이며, 시나리오 2(C2)는 1.5℃ 목표를 50% 확률로 달성하나, 2050년 전에 1.5℃ 이상으로 일시적 오버슈팅이 발생하는 경우이다. 시나리오 3(C3)은 67% 확률로 2℃ 이내 목표 달성에 성공하는 경우이다. 추정 결과, 넷제로를 어떤 시나리오에 이루느냐에 따라 기후금융 필요액이 차이가 났다. 이행 강도가 가장 높은 시나리오 1의 경우 2032년까지 매년 2.1조달러 투자가 필요했으며 C2는 1.5조달러, C3는 1.2조달러의 필요투자가 추정되었다. 경제규모와 비교하면 필요투자액은 2030년까지 글로벌 GDP의 3~6% 사이로 추정하고 있다.

우리나라도 최근 탄소중립 투자 규모를 추정하는 연구가 발표되고 있다. 대표적인 연구가 김승완(2022)과 김용건(2022)이다. 김승완(2022)은 탄소중립 추진을 위한 에너지부문의 전환비용을 연료비+설비투자비-잔존가치로 정의하고 비용최소화모델을 설정하여 추정했다. 추정 결과, 2030년까지 NDC 40% 감축 달성을 위해 필요한 에너지 전환비용은 2021년 현재가치(4.5% 할인율) 기준 333조원으로 추정되었다. 그리고 2050년까지 넷제로 누적투자 비용은 887조원에서 1,005조원으로 추정되었다. 김용건(2022)은 경제에 대한 연산가능일반균형모형(Computable General Equilibrium: CGE)과 전력공급최적화모형(power expansion model)을 이용하여 투자수요를 추정하였다. 다만, 탄소가격은 모형 내에서 추정하지 않고, IEA(2021)의 선진국 2050년 전망치 톤당 250달러를 가정한 경우(CP 시나리오)와 탄소가격이 그 두 배인 500달러가 될 경우(CP2) 시나리오 아래서 투자수요를 추정하였다. 추정 결과, 탄소가격이 500달러로 급등하지 않는 한 연간 30조원 내외가 될 것으로 추정되었고, 2040년부터는 연간 100조원에서 150조원 사이의 신규투자가 필요한 것으로 추정되었다.

2. 탄소가격을 이용한 국내 탄소중립 투자 추정

가. 방법론

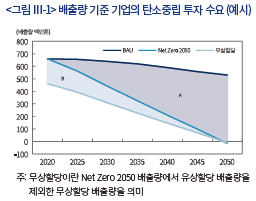

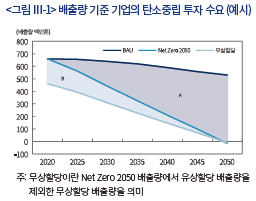

탄소중립 투자 규모는 균형방정식을 기후, 에너지, 경제부문을 연계한 복잡한 통합모델로부터 추정하는 것이 일반적인 방법론이나, 경제학적으로 보면 탄소중립 투자의 정의는 단순 명확하다. 탄소중립 감축활동이 제로일 때 자연배출량과 2050 탄소중립을 위해 요구되는 수준의 감축활동을 했을 때 배출량과의 차이의 화폐적 가치가 탄소중립 투자이다. 현실에서는 감축활동 없이 자연 성장할 때 자연배출량(Business As Usual: BAU)과 2050까지 목표배출량(NDC) 차이가 된다. 본 보고서는 앞서 선행연구와 달리, 이 정의에 부합하도록 앞의 산식처럼 방정식을 정의하고 탄소중립 투자 규모를 추정한다. 2050년까지 배출량 기준의 탄소중립 투자 규모는 <그림 Ⅲ-1>의 삼각형 면적 [A]를 계산하는 것과 같다. 다만, 추가로 고려할 사항은 감축 주체인 기업이 부담하는 배출권거래제 유상할당 비용 역시 기업이 감당해야할 감축비용이기 때문에, 이 부분을 추가해야 한다는 점이다. 유상할당은 허용배출량의 일정 부분을 유상으로 구입하는 제도로서 투자비용에 포함되어야 한다. 그림에서 삼각형 면적 [B]로 표시되어 있다. 우리나라는 배출권허용총량(CAP)의 10%를 유상으로 할당하고 있으나, 본 고에서는 30%까지 확대될 것으로 가정하고 추정하였다. 30% 가정은 정부가 2022년 11월 로드맵에서 수치 제시 없이 유상할당의 ‘단계적’ 확대를 언급한 점, EU ETS(Emissions Trading Systems)의 유상할당 비중이 57%인 점, 그리고 CAP 대폭 감축과 유상할당 대폭 확대 동시 추진 따른 산업계 수용성 등을 고려하여 저자가 주관적으로 판단한 수치이다.

나. 추정 결과

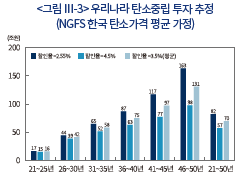

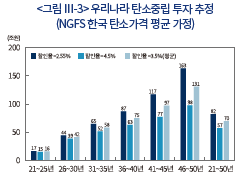

한국의 평균 탄소가격을 가정할 경우, 할인율을 기준으로 투자규모는 <그림 Ⅲ-3>과 같이 추정되었다. 사회적 할인율과 NGFS의 장기이자율의 평균 할인율(3.5%)를 기준으로 보면 2050년까지 누적 탄소중립 투자 수요는 2,097조원으로 나타났다. 할인율에 따라 1,722조원(4.5% 할인율)에서 2,471조원(2.55% 할인율)로 추정되었다. 2050년까지 전체 기간 연평균 투자액은 70조원이며 할인율에 따라 57조원에서 82조원으로 추정되었다. 기간별 평균 투자 수요는 2021~2125년 15~17조원, 2026~2030년 39~44조원, 2030년 이후에는 연간 최대투자 규모가 163조원까지 늘어났다. 2050년 GDP 대비 2.2~3.8%로 나타나 IPCC(2022)가 전세계 평균으로 전망한 3~6% 범위에 근사하는 것으로 나타났다.4)

3. 기후금융 부족(gap)과 민간 기후금융 필요성

가. 기후금융 부족과 민간 기후금융

2050년까지 글로벌 기준 연간 2~5조달러, 한국 기준 57~82조원의 탄소중립 투자 수요가 예상되지만, 2020년 글로벌 기후금융은 6,400억달러, 한국은 정부 예산 기준 11조원, 녹색금융 기준 31조원에 머물고 있다. 기후금융의 공급 능력이 단기간에 확충되기는 어려운 만큼 향후 상당한 기후금융 부족을 예상할 수 있다. 이 같은 기후금융 부족 문제를 일찍부터 연구하고 그 현황과 개선 방향을 제시한 기관은 UN이다. 특히, UNFCCC(2021)는 정부 재정제약으로 공공 기후금융만으로는 향후 30년간의 탄소중립 투자 수요를 충족할 수 없다고 지적하고, 전체 기후금융의 70%는 민간 기후금융시장을 통해 조달되는 것이 바람직하다는 견해를 제시하고 있다. 민간 기후금융이 탄소중립 성패를 좌우하는 핵심 요소가 될 것임을 시사한 것이다.

UNFCCC(2021)는 기후금융 조달에서 공공과 민간 비중을 3:7로 제시하고 2021~2125년 동안 조달해야 할 연간 2.6조달러의 기후금융의 세부 조달 방향에 대해 기술하고 있다. 공공 기후금융 전체가 매년 0.79조달러를 조달하고, 이중 국영기업(State-Owned Enterprises: SOEs)이 0.33조달러, 기타 공공부문이 0.46조달러를 조달할 것으로 전망했다. 전체의 70%를 조달해야 할 민간 기후금융의 경우 기업무문이 0.96조달러, 민간 금융기관이 0.46조달러를 조달할 것으로 전망됐다. 기관투자자와 민간펀드 등의 비중은 크지 않을 것으로 전망됐다.

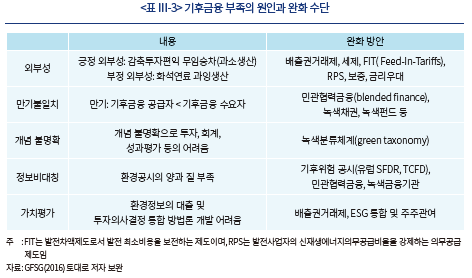

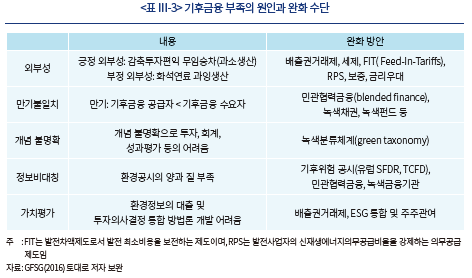

나. 민간 기후금융 부족 원인과 개선 수단

이처럼 기후금융 부족 해소를 위해서는 민간 금융의 참여가 불가피하나, 기후금융의 속성을 고려할 때 유인체계를 개선하지 않는 한, 민간 기후금융의 활성화에는 한계가 있다는 것이 일반적인 평가이다. 기후금융 부족을 체계적으로 분석한 G20 녹색금융 종합보고서(GFSG, 2016)는 기후금융을 시장원리에 맡겨두면 실패할 수밖에 없다고 진단한다. 기후금융의 실패(과소공급)는 구조적이고 근본적인 성격을 갖기 때문이라는 것이다. 가장 큰 원인은 외부성이다. 감축투자의 편익을 제3자가 댓가 없이 누리는 긍정적 외부성(positive externalities), 화석연료 과잉투자로 인한 기후변화 비용을 제 3자에게 전가하는 부정적 외부성(negative externalities) 모두 기후금융의 과소공급 원인이 된다. 이 같은 기후금융의 외부성을 체계적으로 내부화할 수 있어야 기후금융이 시장에 적정 공급될 수 있을 것이다. 이를 위해 보조금(subsidies), 세액공제(tax credit), 발전차액(feed-in-tariffs)제도, 배출권거래제, 신재생에너지의무화(Renewable Portfolio Standards: RPSs) 등 다양한 내부화 기제들이 기후금융시장에 도입되고 있다. 이 중에서 글로벌 솔루션으로 가장 주목받는 제도가 탄소배출권거래제라고 할 수 있다.

둘째, 기후금융 실패는 만기불일치(maturity mismatch)와 깊은 연관이 있다. 기본적으로 기후투자를 핵심 투자프로젝트, 가령, 탄소의 제거, 저장, 활용을 위한 기술개발,제철부문의 수소환원제철 R&D 투자, 수소경제로의 전환 등은 장기자금의 조달을 필요로 하는데, 민간 금융기관의 만기변환기능은 이를 충족하지 못하는 것이다. 이같은 만기불일치를 완화하기 위하여 국제기구에서 주목하는 방안들에는 민관협동금융, 녹색채권, 기관투자자의 녹색인프라펀드 등이 있다. 녹색채권의 경우 발행과 이행 관련 투명성 부족이 시장 발전의 주요 장애요인이었는데, 선진국을 중심으로 그린 택소노미가 빠르게 도입됨에 따라 녹색채권을 통해 만기불일치가 크게 개선될 것으로 보인다. 그러나 녹색채권은 만기불일치를 완화할 수 있는 하나의 금융수단에 불과하고, 기후금융의 만기불일치와 내재위험을 근본적으로 관리하기 위해서는 민관협력금융체제의 구축이 중요하다는 것이 국제기구의 평가이다. 초장기의 기후투자 위험을 민간 부문만으로 모두 흡수하기는 어려우며, 정부과 민간이 투자위험을 분담할 수 있어야 기후금융이 적정하게 공급될 수 있다는 것이다.

셋째, 정보비대칭성의 완화이다. 기후위험 정보비대칭성 완화의 일환으로 전세계적인 정책 공조가 이루어지고 있는 분야가 기후정보 공시의 의무화 로드맵이다. EU는 의무화된 지속가능금융공시(Sustainable Finance Disclosure Regulation: SFDR)규제를 이미 시행하고 있으며 미국 SEC도 상장기업에 대해 기후위험공시 의무화를 추진하고 있다. 우리나라도 2030년까지 ESG 공시를 의무화 하는 로드맵을 발표한 바 있다.

마지막으로 가치평가의 어려움이다. 기후금융에서 가치평가 어려움은 다 차원적이다. 우선 기후투자는 배출권 획득이기 목적이기 때문에 배출권시장에서 가치평가가 효율적으로 이루어져야하며, 이를 위해 글로벌 배출권시장은 할당시장과 유동시장의 미시구조 효율화에 박차를 가하고 있다. 기후금융 프로젝트의 가치평가 역시 어려운 과제인데, 이 역시 배출권시장과 밀접한 관련을 갖는다. 배출권가격이 효율적으로 결정되어야 기후투자프로젝트의 경제성이 제대로 평가되며 기후금융 공급을 유인할 수 있을 것이며, 나아가 감축활동을 수행하는 기업의 가치도 공정하게 평가될 수 있다.

이상의 논의를 바탕으로 Ⅳ장에서는 기후금융 활성화를 위해 핵심적으로 중요하다고 판단하는 세 가지 과제에 대해 살펴본다. 우선, 초장기의 기후투자 자금조달이 실패한 주요 요인인 만기불일치와 과도한 위험부담 문제를 완화하는 방안으로 국제기구에서 주목하고 있는 민관협력금융의 활성화에 대해 검토한다. 다음으로 기후투자와 기후금융의 실패가 기본적으로 온실가스에 대해 그동안 배출자부담원칙이 적용되지 못한 데 있는 만큼, 외부성 문제를 해소하고 기후투자의 가치평가 불확실 문제를 완화하는데 중요한 역할을 하는 배출권거래시장의 활성화 방안에 대해 검토한다. 마지막으로, TCFD(Task Force on Climate-related Financial Disclosures) 공시 의무화 방안을 살펴본다. 공시 의무화는 기후금융 실패의 주요 요인인 기후위험 관련 정보비대칭성 문제를 완화함으로써 기후금융이 시장친화적인 보상메커니즘에 의해 자율적으로 활성화하도록 하는 가장 중요한 시장인프라라고 할 수 있다.

Ⅳ. 기후금융 발전을 위한 금융부문 과제

1. 민관협력금융 확대

기후금융은 기후투자의 정보비대칭성과 만기불일치 문제로 수요곡선과 공급곡선이 만나지 못하는 시장실패(코너해) 문제가 발생할 수 있다. 시장실패의 교정은 조달방식 혁신을 통해 완화할 수 있는데, 대표적인 것이 민관협력금융 방식이다. 민관협력금융이란 문자 그대로 정부와 민간 금융부문이 감축투자프로젝트의 미래 성과(수익과 위험)를 분담함으로써 금융의 불확실성을 통제하는 조달방식이다. 사실 민관협력금융은 기후 분야가 아니더라도 그간 대규모 투자프로젝트에 활용되어 온 금융조달방식으로, 특히 지속가능발전목표(Sustainable Development Goals: SDGs)의 확산과 함께 개발금융기관의 정책금융방식으로 주목받아 왔다.

기후금융에 민관협력금융을 중요하게 도입한 케이스는 유럽의 InvestEU 프로그램이다.5) 유럽그린뉴딜(European Green Deal)에 2021~2030년 동안 필요한 기후투자 재원 1조유로 중에서 InvestEU 방식으로 2,790억유로를 조달할 계획을 세우고 있다. 민간 기후금융을 유인하기 위해 도입한 InvestEU 프로그램은 13개 EU 기금과 유럽전략투자기금(European Fund for Strategic Investments: EFSI)으로 구성되어 있다. 특징은 민간 자금을 유인을 위해 투자결정구조(지배구조, 조직)나 수익 및 위험 배분 등에서 공공 기후금융과 구별된다. InvestEU는 법인격이 있는 회사 조직은 아니며, 위원회 중심의 지배구조로 운영된다. 위원회 위원은 민간 투자회사 전문가, 유럽투자은행(European Investment Bank: EIB) 대표 등 투자 전문성을 가진 인사를 중심으로 구성된다.

민관협력금융은 순수 민간 기후금융이나 공공 기후금융과 달리 시드머니로서 공공 기후금융, 조달승수(민간 기후금융/공공 기후금융), 투자 위험과 수익의 배분 방식 등을 결정하는 조달전략이 중요하다. InvestEU의 하위 펀드인 EFSI의 경우 EU 재정 1유로로 3배의 공공 기후금융(정부 재정 제외)을 매칭하고, 여기에 5배까지 민간 기후금융을 유인하도록 설계되어 있다. 최대 조달승수가 15배인 셈이다. 실제 조달승수는 그 한도 내에서 수익과 위험 분담 비율과 방식, 해당 기후투자프로젝트의 사전적인 성공확률 등에 따라 달라질 것이다. 정보비대칭성이나 투자기간 등으로 인해 시장실패 가능성이 높은 투자프로젝트의 경우 상대적으로 공공 기후금융 부문의 출자 비중이나 손실분담율을 높임으로써 민간 기후금융을 유인할 수 있을 것이다. 민간 금융 유인 방식은 손실을 분담하는 방법뿐만 아니라 초과수익을 이전하는 메커니즘 도입을 통해 이루어질 수도 있다. 가령, 해당 기후금융 투자프로젝트의 성과가 기준수익률을 초과달성할 경우 공공 금융에 귀속될 수익의 일부를 민간 금융으로 이전시키는 방식이다. EU의 경우 초과수익 이전방식보다 위험분담방식이 일반적으로 활용되고 있는 것으로 보인다. 결국, 민관협력금융은 시장실패 문제를 공공과 민간이 협력하여 완화하는 방식이기 때문에 지배구조나 투자성과 배분이 기존의 정책금융이나 민간 금융과는 다른 접근을 하는 금융조달체계라고 할 수 있다.

우리나라도 2020년 뉴딜펀드 정책을 통해 기후투자 분야에 민관협력금융을 적용한 바 있다. 정부 예산과 산업은행 정책금융이 공공 기후금융의 재원이 되고 여기에 민간 모험자본을 유인하는 구조였다. 별도의 지배구조가 구성되었고, 민간 모험자본을 유인할 수 있는 다양한 손실분담 및 초과수익배분 메커니즘을 설계하고 적용하기도 하였다. 우리나라도 기후금융 부문에 민관협력금융체제를 확대할 경험과 기반을 갖추고 있는 셈이다. 앞으로 과제는 뉴딜펀드 같은 민관협력금융 방식을 기후투자 전반으로 확대함으로써 탄소중립을 위한 투자 재원의 부족 없이 비용 효율적인 기후금융 조달체계를 구축하는 것이다.

이를 위해 현 단계에서 가장 시급한 과제는 정부의 탄소중립 예산의 집행 방식을 재검토하는 것이라고 판단된다. 앞서 살펴본 대로 우리나라 탄소중립 예산은 2022년 11.9조원으로 2021년 NDC 상향을 반영하여 전년 대비 60% 이상 대폭 증액됐다. 이제 집행 효율이 중요해졌으며, 기본 원칙은 예산 단위당 감축 효율의 극대화가 되어야 할 것이다. 이를 위해서는 우선, 관리 측면의 효율성을 개선할 필요가 있다. 현재 탄소중립 예산은 일반예산과 기후대응기금으로 이원화되어 있고, 일반예산은 통합적으로 관리되지 못하고 부처별로 관리되고 있다. 감축 효율은 경제 전체의 감축투자 우선순위 아래 통합관리 되도록 탄소중립 예산의 집행 거버넌스를 정비할 필요가 있다. 방향은 일반예산과 기후대응기금을 하나의 거버넌스로 일원화하고 전문성을 갖춘 민간 전문가의 참여를 확대하는 거버넌스가 바람직할 것이다. 다음으로 예산 지출의 효율성 측면이다. 우리나라 탄소중립 예산 지출에는 민관협력금융 개념이 약하다. 예산을 마중물로 하여 민간의 풍부한 유동성을 활용하는 예산 전략 없이는 탄소중립에 필요한 대규모 기후투자 재원 마련에 어려움이 있다는 점을 염두에 두고, 뉴딜펀드 경험을 토대로 민관협력금융의 모범사례를 만들어 갈 필요가 있다.

아울러, 공공 기후금융 재원의 지출우선순위는 시장실패 가능성이 큰 투자부문이며, 시장실패 가능성에 따라 민간 자금 유인을 위한 최적의 조달승수, 위험분담 비율과 방식 등을 결정함으로써 예산 지출의 효율성을 담보하여야 할 것이다.

2. 탄소시장 활성화

기후금융 발전에 탄소시장 발전이 중요한 이유는 탄소시장의 독특한 기능과 역할 때문이다. 무엇보다, 기후투자프로젝트의 경제성은 최종적으로 배출권 가치에 의해 결정되기 때문이며, 배출권의 가치평가(valuation) 기능을 수행하는 탄소시장은 기후금융에서 핵심적인 역할을 담당한다고 할 수 있다. 배출권 가치가 높을수록 기후금융 프로젝트의 기대수익률이 높아지기 때문에 기후금융 공급 여건은 개선된다. 재무적 이익(이자, 배당 등)에 관심이 있는 기후금융 공급자들이라도 배출권 가치가 프로젝트의 경제성(기대수익률)과 성공 가능성에 영향을 미치기 때문에 최종적으로는 탄소시장의 영향을 받는 구조이다. 또한 배출권시장은 배출권 자체가 기후금융의 재원(원천)으로 사용되기도 한다. 특히, 유상할당 재정수입은 공공 기후금융의 주요 조달원으로서 시장실패 가능성이 높은 투자프로젝트에 집중 투자되며, 관련 위험을 분담하는 역할을 한다. 정부부문이나 NGO에서도 비영리 배출권 투자프로젝트에서 발생한 배출권 수익을 다시 새로운 프로젝트의 재원으로 재투자하기도 한다. 마지막으로, 배출권시장은 기업이 적극적인 탄소경영으로 획득한 잉여배출권을 수익화하는 회수시장 기능을 수행하기도 하며, 한계감축비용이 높은 기업들에게는 부족 배출권 구입을 통해 비용 효율적인 감축을 가능하게 한다.

그렇다면 배출권시장 발전을 위해서는 어떤 제도적 정책적 방향성을 가져야 하는지 살펴보자. 우선, 규제시장인 ETS시장과 자발적 탄소시장(Voluntary Carbon Market: VCM)이 균형적으로 발전하는 탄소시장 생태계를 구축하는 것이 중요하다. 두 시장은 NDC 감축 목표와의 연계 정도, 시장 인프라 규제, 시장 투명성 등에서 분명히 구별되는 시장이나, 배출권의 가치평가, 회수 등의 면에서 상호보완성은 점점 커질 것으로 보이기 때문이다. 기업은 글로벌 환경공시의 의무화 추세로 인해 배출량 감축의 범위가 직접배출(Scope 1)이나 간접배출(Scope 2)을 넘어 공급망까지 포괄하는 기타간접배출(Scope 3)까지 감축해야 하는 상황이다. 이 점이 기업이 체감하는 과거 교토의정서체제와 지금의 파리협정체계의 가장 큰 차이점이라 할 수 있다. 이처럼 광의의 기업의 탄소경영 범위를 고려할 때 ETS시장 넘어 자발적 탄소시장을 통한 가치평가와 회수의 중요성은 점점 커질 것이다. 두 시장이 함께 발전하는 탄소시장 생태계가 필요한 이유이다.

두 번째, ETS시장을 파리협정과 탄소중립 달성 목표에 맞게 운영 패러다임을 전환하는 것이다. 탄소중립의 핵심 이행 수단인 ETS 허용배출총량(cap) 감축률을 NDC 감축률 상향에 맞춰 대폭 상향하고, 향후 NDC 정책 변화를 ETS시장이 신속하게 반영할 수 있도록 정책결정 거버넌스를 효율화할 필요가 있다. 그리고 배출량 감축 주체인 기업부문이 국가 NDC 달성에 적극 호응할 수 있도록 감축 인센티브를 획기적으로 ETS 할당제도에 반영할 필요가 있을 것이다. 특히, 감축률 상향으로 ETS시장의 수급불균형이 심화할 것에 대비하여 시장안정예비분(Market Stability Reserve: MSR)제도를 통해 정부가 직접 수량 조절을 주도하고, 이 과정에서 필요한 예비분은 기업이 조직경계 밖에서 수행하는 다양한 외부감축활동을 상쇄배출권으로 전환하여 확보하는 방안을 검토할 필요가 있다. 그 외에도 부족한 거래 활성화와 유동성 창출을 위해 배출권선물을 도입하고6), EU가 재정수입 용처를 혁신기금, 현대화기금, 사회기금 등으로 명확히 하여 재량을 최소화한 것처럼, 연간 1조원 이상 예상되는 유상할당 재정수입의 활용원칙을 명확화할 필요가 있다. 시장실패가 가장 심각하게 나타나는 초장기의 만기불일치 R&D 프로젝트, 생산공정 전환, CCUS 등으로 유상할당재원이 집중 환류할 수 있도록 현재의 기후안정기금의 사용 용도를 엄격히 운영할 필요가 있다. 필요에 따라서는 유럽의 혁신기금처럼 기후안정기금 내에 자펀드 투자 목적을 명확히 하여, 유상할당 재원이 민관협력금융의 재원으로 집중 활용되도록 유도할 필요가 있다.

셋째, 자발적 탄소시장 시장이 ETS의 보완시장으로 발전할 수 있도록 관련 인프라를 정비할 필요가 있다. 보완시장이 되기 위해서는 기후투자로부터 획득하는 배출권의 실재성과 측정의 객관성 등 전반적인 시장 투명성을 높이는 검증체계를 갖추는 것이 중요한 만큼, 관련 인프라에 대한 공익적 관점의 최소 기준과 점검이 필요해 보인다. 투명성 강화를 통해 시장 자율적으로 시장이 형성되는 기반이 마련된다면, ETS시장과 VCM시장은 할당제도에서의 차이가 있을 뿐이며 ETS시장과 함께 배출권의 가치평가와 회수 기능을 보완적으로 수행하는 시장으로 발전하게 될 것이다.

3. TCFD 공시 의무화

탄소시장을 통해 탄소가 비경제재에서 경제재로 변화하면서 기후리스크 정보에 대한 시장의 요구가 강하게 나타나고 있다. 기본적으로 자산시장에서 리스크는 곧 가치(프리미엄)이기 때문에 탄소 정보는 기후금융과 탄소시장의 효율적 작동을 위한 핵심 인프라라고 할 수 있다. 이런 점에서 TCFD 공시를 의무화하는 글로벌 흐름은 글로벌 탄소중립 관점에서 매우 바람직한 흐름이라고 할 수 있다.

공시 의무화에 가장 적극적인 곳은 EU이다. EU의 SFDR은 TCFD를 포괄하는 탄소 정보 의무화 제도로서, 투자상품을 제조하는 금융기관과 투자상품(펀드, 일임, 신탁계약)에 투자자산으로 편입된 모든 기업이 공시 의무화 대상이다. 탄소 정보 공개범위도 시행 시점에서는 직접배출(Scope 1)과 간접배출(Scope 2)로 한정했지만, 2023년 1월 1일부터는 공급망을 포함하는 기타간접배출(Scope 3) 정보까지 공개 범위에 포함하였다. 이는 원청기업이 하청기업의 온실가스배출량까지 관리해야 한다는 것을 의미한다. 또한 금융기관의 대출을 받은 차입기업과 자산포트폴리오에 포함된 피투자기업의 배출량(포트폴리오배출량)을 공개해야 한다. 사실 금융기관의 금융배출량financed emission) 정보를 공개한다는 것은 금융회사로 하여금 대출기업 또는 피투자기업의 온실가스 감축 활동을 감시(monitoring)하고 필요에 따라 컨설팅 또는 영향력을 행사하여 감축을 유도하라는 의미와 같다. 이는 기후변화 대응에 대한 주주관여(engagement)라고 볼 수 있으며, 기후변화 공시가 궁극적으로 금융기관에 대한 감독규제(기후위험을 반영한 자본규제, 스트레스테스트, 감축목표 규제 등)로 발전할 수 있음을 시사한다.

미국 또한 지난 3월 기후위험 신공시규제안(New Climate Disclosure Requirements)을 발표하면서, 공시 의무화를 적극 검토하고 있다. 신공시규제안은 상장기업과 비상장외국기업(foreign private issuers)이 대상이다. 그렇지만 이들의 배출량 정보공시 범위에 Scope 3 배출량을 포함하고 있어 비상장기업 역시 SEC 규제안에 간접적으로 영향을 받을 수밖에 없게 되었다. 금융기관 역시 마찬가지로 포트폴리오 배출량(financed emisson)을 공개하도록 되어 있다. 그 외 영국은 2022년 4월부터 TCFD 공시를 의무화하는 G20 회원국 중 최초 국가로서 1,300여개의 금융기관과 대기업이 대상이다. 그리고 뉴질랜드는 영국보다 앞서 TCFD 의무화를 도입한 첫 사례로 기록되고 있다. 자산 10억달러 이상 모든 은행, 운용자산 10억달러 이상 모든 자산운용회사, 연간 보험료수입 2.5억달러 이상이거나 운용자산 10억달러 이상의 보험회사, 그리고 뉴질랜드 거래소에 상장된 모든 주식 혹은 채권 발행회사, 운용자산 10억달러 이상의 연기금 등 대부분의 금융기관이 대상이다.

우리나라도 ESG 정보를 자율공시에서 의무공시로 전환하는 로드맵을 2022년에 제시한 바 있다. 지금은 ESG 정보공시가 자율공시인데, 2025년부터 자산 2조원 이상 상장기업을 대상으로 점진 의무화하여, 2030년에는 전체 코스피 상장회사로 의무화 범위를 확대할 계획이다. 그런데 앞서 글로벌 공시 의무화 규제와 비교할 때 우리나라의 공시 의무화 로드맵은 시간 일정만 제시했을 뿐, 배출량 범위나 적용 대상 등에 대해서는 구체성과 합리성을 보완할 필요가 있다. 무엇보다, 적용 대상을 일정규모 이상의 코스피 상장기업으로 한정하고 있는데, 투자자보호나 규제차익 해소를 위해 동일 요건의 코스닥 상장기업까지 포함하는 것이 바람직하다. 둘째, 공시 대상 배출량 범위는 기업의 준비와 대응에 매우 중요한 정보이므로 명확히 할 필요가 있다. 특히, 공급망을 포함하는 기타간접배출(Scope 3)이 의무화 범위에 포함되는지는 매우 중요한 정보이다. 직접배출(Scope 1), 간접배출(Scope 2)보다 기타간접배출(Scope 3) 배출량이 더 큰 기업들이 제조업의 경우 많이 발견되기 때문에 이것의 포함 여부에 따라 기업의 감축투자의 범위와 전략은 달라져야 한다. 경제 전체로는 중소기업의 온실가스 감축정책에도 중대한 영향을 미칠 수 있다.

마지막으로, 금융기관의 경우 상장 여부에 관계없이 의무화 대상에 포함할 필요가 있다. 금융기관은 금융배출량(financed emission) 관리를 통해 일반기업의 감축활동에 영향을 미칠 수 있는 위치에 있기 때문이다. 금융자원 배분을 통해 기업에 대한 통제권을 가지고 있어서 차입/피투자기업의 채권자 또는 주주로서 영향력을 행사할 수 있다. 금융기관의 이 같은 특수 역할을 고려하여 글로벌 탄소중립 규제 역시 금융기관에 대해 보다 엄중한 역할을 요구하고 있다. 탄소회계금융연합(Partnership for Carbon Accounting Financials: PCAF)이나 과학적 감축목표 이니셔티브(Science-based Target Initiative: SBTi) 등도 금융기관의 금융배출량을 별도로 측정하는 방법론을 개발하고, 모니터링과 관여(engagement) 전략에 대해 컨설팅을 하고 있다. 앞서 영국, 뉴질랜드 등에서 TCFD 공개 의무화를 금융기관으로 한정하여 적용한 것도 금융기관의 이 같은 역할이 중요하기 때문일 것이다.

1) EU가 MS 요건으로 열거하고 있는 국제규범으로는 the UN Guiding Principles on Business and Human Rights, the OECD Guidelines for Multinational Enterprises(MNEs): A legal international instrument on responsible business conduct (RBC), the ILO Core Labour Conventions on Fundamental Rights and Principles at Work the International Bill of Human Rights 등이다.

2) 국제기구간 넷제로 달성을 가정한 탄소가격 장기전망은 상당한 차이를 보인다. 가령, IEA는 선진국 기준으로 2030년 130달러, 2040년 205달러, 2050년 250달러, NGFS는 전세계 기준으로 2030년 115달러, 2040년 255달러, 2050년 451달러로 전망하고 있다.

3) BAU에 대한 학술 및 국가 차원의 추정치는 확인하기 어려움. 기존 문헌은 2018년 배출량(7.2억톤)을 BAU 대용치로 사용하고 있으나, 경제구조와 인구구조 미반영으로 과다 추정 가능성이 있는 바, 본 보고서는 NGFS 현 정책유지(current policy)시 배출량 경로를 BAU로 사용. 이때 BAU는 2020년 6.6억톤, 2030년 6.5억톤, 2040년 5.8억톤, 2050년 5.3억톤임

4) 참고로, BAU를 2018년 배출량으로 하고 한국의 평균 탄소가격을 이용한 경우는 2050년까지 누적 탄소중립 투자 수요는 평균 2,272조원, 1,852조원(4.5% 할인율)에서 2,692조원(2.55% 할인율)으로 나타났다. 또한 글로벌 탄소가격으로 국내 탄소가격이 수렴하는 경향을 가정하고 유럽과 미국의 탄소가격 시나리오를 한국 탄소가격 전망치의 대용치로 사용할 경우, 감축투자비용은 크게 증가한다. 유럽 탄소가격을 대용치로 사용할 경우 2050년까지 누적 투자규모는 2,200조원(4.5% 할인율)에서 3,200조원(2.55% 할인율) 사이, 미국 가격의 경우 1,900조원에서 2,700조원으로 증가한다.

5) InvestEU는 지속가능성장을 위한 투자프로그램으로 2021~2027년 동안 총 3,720억유로의 투자 재원 조성을 목적으로 마련되었으며, 민간 투자자금의 유인을 위해 유럽 내에 13개 EU 기금과 EFSI를 통합 관리하고 있다.

6) EU-ETS는 2021년 기준 거래의 87.1%가 배출권선물을 통해 이루어지며, 배출권 현물 거래비중은 5.6%에 불과하다(한국환경공단, 2022).

참고문헌

김승완, 2022, 『에너지부문 전환비용 추정』, 에너지경제연구원-환경연구원 공동심포지엄.

김용건, 2022, 『탄소가격정책의 환경경제적 파급효과 및 정책적 시사점』, 에너지경제연구원-환경연구원 공동심포지엄.

송홍선, 2021, 『2050 탄소중립과 배출권거래제의 활성화』, 자본시장연구원 이슈보고서 21-23.

송홍선, 2022, 『금융기관의 기후위험관리 동향과 과제』, S&P Global 세미나.

송홍선, 2022, 『기후금융과 배출권시장』, 지니포럼, 국가균형발전위원회.

송홍선·이인형, 2022, 『탄소중립·ESG 관련 투자 활성화 및 투자자보호 방안』, 금융위원회 학술연구용역.

한국환경공단, 2022, ETS Insight 2022-50.

CPI, 2021, The Global Landscape of Climate Finance.

EU, 2020, Taxonomy: Final report of the Technical Expert Group on Sustainable Finance, EU Technical Expert Group on Sustainable Finance.

European Commission, 2020. 1. 14, Green deal investment plan and just transition mechanism explained, Questions and Answers.

G20 Green Finance Study Group, 2016, G20 Green Finance Synthesis Report.

IEA, 2021, Net Zero by 2050 A Roadmap for the Global Energy Sector, Special Report 4th Revision.

IPCC, 2022, Summary for Policymakers, Working Group III Report, Sixth Assessment Report.

KOSIF & LEE, 2021,Sustainable Finance of Korea Stands at the Crossroads, Whitepaper on Korea ESG finance in 2020.

OECD, 2020, ESG Investing: Practices, Progress and Challenges.

UNEP, 2016, Definitions and concepts: Background note, Inquiry working paper 16/13.

UNFCCC, 2021, Net Zero Financing Roadmaps, UN Climate Change Conference UK2020.

본 보고서는 2050 넷제로 달성을 위한 기후금융의 활성화 방안을 연구한다. 아무리 좋은 정책도 재원이 뒷받침되지 않으면 정책 신뢰와 실행을 담보할 수 없다. 파리협정 합의문도 탄소중립의 선언만큼이나 이행을 담보할 재원(기후금융)의 중요성을 강조하고 있다. 그럼에도 대규모 기후투자의 재원을 조달할 금융시스템 측면의 준비가 부족하다는 것이 국제기구의 일반적인 평가이다. 이에 본 보고서는 향후 30년간의 기후투자 필요 규모와 기후금융 부족(gap) 원인을 살펴보고, 기후금융 확충을 위해서는 금융부문이 어떤 준비와 대응을 해야 하는지 연구한다.

본 보고서의 구성은 다음과 같다. Ⅱ장에서 기후금융의 개념을 정의하고, Ⅲ장에서는 향후 30년간 탄소중립을 위해 필요한 기후투자 규모와 현재의 기후금융 공급 현황에 대한 분석을 통해 기후금융 부족의 발생 원인을 살펴본다. 마지막으로 Ⅳ장에서는 기후금융 부족 완화를 위한 금융부문의 주요 과제를 연구한다. 이를 위해 본 고는 기후금융의 외부성과 공공 기후금융의 조달제약 등을 고려할 때 민관협력금융(blended finance)체제의 구축이 필요하다는 점, 그리고 기후투자의 경제성 평가를 위해서는 배출권 가치를 결정하는 배출권시장의 발전이 동반되어야 한다는 점을 설명한다. 마지막으로, 정보비대칭 완화를 위한 탄소공시 의무화 규제에 대해 살펴볼 것이다.

Ⅱ. 기후금융의 개념과 현황

1. 기후금융의 개념과 범위

기존 문헌에서는 녹색금융(green finance), 기후금융(climate finance), 저탄소금융(low-carbon finance), 지속가능금융(sustainable finance) 등을 구분 없이 사용하고 있지만, 기후금융 연구를 위해서는 분류체계 정리가 선행될 필요가 있다. UNEP(2016)는 단순화 위험을 무릅쓰고 네 용어의 개념을 구분하고 있다. 네 용어 모두 환경, 사회, 지배구조를 비재무 리스크요인으로 인식하고 있지만, 어떤 범주를 보다 직접적으로 강조하느냐에 따라 용어의 선택이 달라져야 한다. 지속가능금융은 환경, 사회, 지배구조를 균형적으로 고려하는 금융이며, 환경을 강조하는 녹색금융, 기후금융, 저탄소금융과 구별된다.

기후금융은 환경금융 중에서도 온난화와 관련된 온실가스 배출의 저감 목적을 위한 금융으로 좁게 정의된다. UN 기후변화협약 기후금융연구반(United Nations Framework Convention on Climate Change Standing Committee on Finance: UNFCCC SCF)는 기후금융을 다시 감축금융(mitigation finance)과 적응금융(adaptation finance)으로 세분하고 있다. 저탄소금융으로 불리기도 하는 감축금융은 온실가스 배출의 감축(reducing), 회피(avoiding), 흡수(sinks), 저장(reservoirs) 목적의 금융이다. 적응금융은 기후변화로부터 생태계 충격(vulnerability) 완화를 위한 복원(resilience) 목적의 금융이다. 마지막으로 녹색금융은 기후금융보다 광의의 개념으로 온실가스 저감은 물론 물, 오염 등 환경 전반을 위한 조달을 지칭하는 개념이다.

이 같은 개념 구분에도 불구하고 기후금융, 녹색금융, 지속가능금융, 저탄소금융은 상호 보완적임에 유의할 필요가 있다. 후술하는 그린 택소노미(green taxonomy)는 녹색금융에 대한 경제적 정의를 넘어 규제적, 법적 정의가 무엇인지를 제도화한 것인데, 지속가능금융, 기후금융, 녹색금융 모두에 대해 사회적 요건까지 최소한 만족하도록 하는 최소요건(mimimum safeguard)을 요구하고 있다. 세부적인 목적은 후술하는 그린 택소노미에서 확인된다.

앞서의 기후금융 정의가 기능과 대상에 따른 경제적 정의라면, 그린 택소노미는 기후금융에 대한 규제적 법적 정의에 해당한다. 경제활동, 투자 대상 자산 및 프로젝트 성격 등의 세부 요건이 기후금융의 규제적 정의에 부합하는지 실무적으로 판단하는 녹색분류체계가 그린 택소노미이다. 규제적 정의를 별도로 도입한 목적은 그린워싱(green washing) 방지를 통해 금융자본이 실질적으로 환경목표를 달성하는 데 사용될 수 있도록 하기 위함이다. 그린 택소노미는 2021년 유럽에서 도입한 후 여러 나라에서 도입하고 있으며 우리나라도 2021년에 도입하였다.

그린 택소노미에 부합하여 녹색금융으로 분류되기 위해서는 우선 기후변화 감축, 기후변화 적응, 물, 순환경제, 오염, 생물다양성 6개 분야 환경목표에 부합해야 한다. 또한 6개 환경목표에 부합하더라도, 투자프로젝트는 추가로 두 가지 요건을 충족해야 한다. 바로 DNSH(Do No Significant Harm)과 MS(Minimum Social Safeguard) 요건이다. DNSH는 하나의 환경목표 추구 과정에서 나머지 5개 환경목표의 가치를 훼손하는 상충이 발생하지 않아야 한다는 요건이다. MS는 투자프로젝트가 노동, 인권 등 사회적 규범에 대해 최소한의 요건을 충족해야 한다는 조건이다.1) 결국 그린 택소노미는 좁은 의미의 녹색금융도 넓은 의미의 지속가능금융 요건을 갖추어야 외부자금조달이 가능하다는 의미이다.

가. 글로벌 기후금융 현황

글로벌 기후금융 통계는 UNFCCC SCF, 국제에너지기구(International Energy Agency: IEA), 기후정책이니셔티브(Climate Policy Initiatives: CPI) 등에서 집계하고 있다. IPCC(2022)에 따르면 글로벌 기후금융은 UNFCCC SCF 기준으로 2013년 3,390억달러에서 매년 증가하여 2020년 6,400억달러로, 연평균 9.5%씩 성장한 것으로 집계되었다.

조달목적은 감축금융이 대부분을 차지하고 있다. 2020년 전체 6,400억달러의 90%인 5,760억달러가 감축금융 목적으로 조달되었고 적응금융은 490억달러로 나타났다. 감축금융은 온실가스의 감축, 회피, 저장, 활용을 위한 기후금융을 의미한다. 감축금융은 특히 에너지전환과 수송부문으로 집중되고 있으며 전체 감축금융의 90%가 두 부문에 집중되어 있다. 적응금융은 기후변화에 따른 생태계 충격, 재난 위험을 최소화하기 위한 예방과 대응 금융을 의미한다.

우리나라의 기후금융은 선진국과 달리 공공 기후금융 중심이며, 정부 예산 중심의 공공 기후금융이 특징이다. 특히, 2021년말 2050 탄소중립과 2030년 40% 감축 로드맵을 발표함에 따라 2022년 기후금융 예산은 증가했다. 2022년을 2050 탄소중립 이행을 위한 원년으로 삼고, 2021년 기후금융 예산 7.3조원 대비 70% 증가한 11.9조원의 예산을 책정했다. 예산 규모뿐만 아니라 탄소중립기본법을 통해 공공 기후금융 재원인 기후대응기금을 2022년에 조성한 것도 주목할만한 일이다. 11.9조원의 예산은 기후대응기금 2.5조원과 기후대응기금 이외에 정부 일반예산 9.4조원으로 구성되어 있다.

한편 민간 기후금융에 관한 행정통계는 아직까지 존재하지 않는다. 녹색금융 또는 ESG 금융 등의 이름으로 여러 기관에서 집계하고 있으나, 기후금융 통계만 별도로 집계는 되지 않고 있다. ESG 금융 통계는 금융기관이 제출한 자료를 바탕으로 집계한 KOSIF & LEE(2021)가 비교적 체계적이다. 여기에서는 ESG 금융을 대출, 투자, 채권, 상품으로 나눠 집계하고 있다. ESG 금융 중에서 녹색금융, 그리고 녹색금융 중에서 온실가스 감축에 관련된 기후금융이 얼마인지는 추정이 어렵다. 다만, 기후금융을 포함하고 있을 것으로 추정되는 녹색대출 28조원과 녹색채권 발행액 3조원을 합친 31조원 중 일부가 민간 기후금융에 해당할 것으로 보인다.

Ⅲ. 탄소중립 투자와 기후금융의 발전 필요성

Ⅱ장에서 확인한 2020년 전세계 기후금융 6,400억달러는 지구 온도 상승 1.5도 제한을 목표로 2021년 COP26를 전후하여 각국이 새로 제출한 2030년 목표배출량(Nationally Determined Contribution: NDC)과 2050 넷제로 선언 이전의 기후투자 규모를 반영한다. 2050년 넷제로 선언으로 향후 30년간 필요한 기후투자와 기후금융 규모는 이보다 크게 늘어날 것임은 자명하다. 이 장에서는 2050년 넷제로를 반영한 글로벌 기후투자 규모 추정에 대한 국제기구의 선행 연구를 살펴보고, 우리나라 탄소가격의 장기전망치를 이용하여 우리나라의 기후투자 규모를 추정한다. 이를 통해 넷제로 기후투자 재원 조달을 위해서는 민관협력금융 등 기후금융 부족 해소를 위한 기후금융 공급체계의 구축이 필요함을 지적할 것이다.

1. 탄소중립 투자 수요 추정: 선행 연구

글로벌 기후투자 수요와 기후금융 규모 추정은 기후변화 아젠다를 주도하는 UN(UNFCCC와 IPCC)과 기후변화 대응을 위한 전세계 중앙은행 네트워크(The Network of Central Banks and Supervisors for Greening the Financial System: NGFS) 등에서 주로 이루어지고 있다. 기후투자는 특성상 기존의 경제분석 틀로는 한계가 있으며, 경제, 에너지, 기후변화에 관한 통합모델(Intergrated Assessment Model: IAM)의 구축을 통해 추정이 가능한데, 아직 표준화된 방법론이나 장기추정 시나리오가 존재하지 않아 추정치마다 편차가 큰 것이 현실이다.

UN은 UNFCCC와 기후변화협약 실행보고서를 발간하는 IPCC 두 조직에서 글로벌 기후투자 규모를 추정하고 있다. UNFCCC는 2021년 11월 ‘넷제로 기후금융 로드맵’(Net Zero Financing Roadmaps)을 발표했다. 여기에 따르면 2050년까지 탄소중립 투자 규모는 지속적으로 증가하게 되는데, 2016~2020년 0.9조달러, 2021~2025년 2.6조달러, 2026~2030년 3.8조달러, 2031~2040년 4.8조달러, 2041~2050년 연간 4.7조달러를 전망하고 있다. 요약하면, 2030년까지는 연간 3조달러 내외, 2030년부터 2050년까지는 연간 4.7조달러를 매년 온실가스 감축을 위한 투자 비용으로 지출해야 한다는 것이다. 누적기준으로는 탄소중립를 위해 2050년까지 약 127조달러의 기후투자가 필요한 것으로 추정되었다. 부문별로는 발전부문 비중이 가장 높고 수송과 건물 부문 비중이 뒤를 이었으며, 산업부문은 연간 0.3~0.4조달러로 나타났다.

IEA(2021)는 NZE(Net Zero Emissions by 2050) 달성을 위해 에너지부문에서 2020년까지 매년 2조달러(2019년 USD 기준)의 투자가 필요하고, 2030년까지 매년 5조달러가 필요한 것으로 추정하고 있다. 기간별로는 2031~2040년 연간 4.8조달러, 2041년 이후 연간 4.5조달러로 추정되었다. 총 누적투자규모는 2050년까지 140조달러로 추정되었다. 이는 2030년까지 글로벌 GDP의 4.5%에 해당하며, 2050년까지는 글로벌 GDP의 2.5%에 해당하는 규모이다. 한편 기후변화 대응을 위한 중앙은행과 감독기구 네트워크인 NGFS는 2050년까지 2020년(6,210억달러) 대비 매년 두 배 이상 늘어나야 할 것으로 추정하였다. 5년 단위 연간 필요투자 규모는 2025년 1.4조달러, 2030년 1.7조달러, 2035년 1.5조달러, 2040년 1.5조달러, 2050년 1.7조달러로 추정하고 있다.

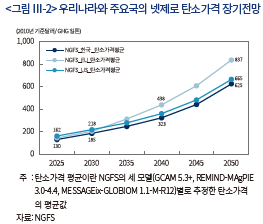

세 국제기구의 투자 전망치를 비교해 보면 IEA와 IEA의 기본모델을 바탕으로 추정한 UNFCCC의 투자 전망치가 대체로 유사한 수준에서 전망되고 있는 반면, NGFS 전망치는 두 기관보다는 낮은 수준에서 전망되고 있다. 이같은 전망의 차이는 모델의 방법론과 가정, 넷제로 달성에 필요한 탄소가격 전망의 차이에 기인하는 것으로 판단된다.2)

2. 탄소가격을 이용한 국내 탄소중립 투자 추정

가. 방법론

탄소중립 투자 규모는 균형방정식을 기후, 에너지, 경제부문을 연계한 복잡한 통합모델로부터 추정하는 것이 일반적인 방법론이나, 경제학적으로 보면 탄소중립 투자의 정의는 단순 명확하다. 탄소중립 감축활동이 제로일 때 자연배출량과 2050 탄소중립을 위해 요구되는 수준의 감축활동을 했을 때 배출량과의 차이의 화폐적 가치가 탄소중립 투자이다. 현실에서는 감축활동 없이 자연 성장할 때 자연배출량(Business As Usual: BAU)과 2050까지 목표배출량(NDC) 차이가 된다. 본 보고서는 앞서 선행연구와 달리, 이 정의에 부합하도록 앞의 산식처럼 방정식을 정의하고 탄소중립 투자 규모를 추정한다. 2050년까지 배출량 기준의 탄소중립 투자 규모는 <그림 Ⅲ-1>의 삼각형 면적 [A]를 계산하는 것과 같다. 다만, 추가로 고려할 사항은 감축 주체인 기업이 부담하는 배출권거래제 유상할당 비용 역시 기업이 감당해야할 감축비용이기 때문에, 이 부분을 추가해야 한다는 점이다. 유상할당은 허용배출량의 일정 부분을 유상으로 구입하는 제도로서 투자비용에 포함되어야 한다. 그림에서 삼각형 면적 [B]로 표시되어 있다. 우리나라는 배출권허용총량(CAP)의 10%를 유상으로 할당하고 있으나, 본 고에서는 30%까지 확대될 것으로 가정하고 추정하였다. 30% 가정은 정부가 2022년 11월 로드맵에서 수치 제시 없이 유상할당의 ‘단계적’ 확대를 언급한 점, EU ETS(Emissions Trading Systems)의 유상할당 비중이 57%인 점, 그리고 CAP 대폭 감축과 유상할당 대폭 확대 동시 추진 따른 산업계 수용성 등을 고려하여 저자가 주관적으로 판단한 수치이다.

감축투자액 = A+B =[탄소가격*(BAU배출량 – NDC목표)] + [탄소가격*유상할당 배출량]

투자 추정을 위해 본 고는 목표배출량은 2021년말 상향한 국가감축목표(2030년까지 2018년 배출량 40% 감축, 2050년에 탄소중립), 자연배출량은 NGFS의 현 정책유지 시나리오에서 산출한 배출량 경로를 사용하였다. 이는 탄소중립 선언 이전의 감축정책을 가정하고 거시경제와 인구구조, 산업구조 변화 등을 반영한 통합모델에서 산출한 값이다.3) 탄소가격은 국제기구가 추정한 가격 정보를 이용하였다. 국제기구의 탄소가격 전망치는 최적화모델인 통합모델(IAS)로부터 추정된 최적가격(optimal carbon price)이기 때문에 경제학적으로 균형가격에 해당하며 본 고의 추정 목적에 부합한다. 다만, 국제기구마다 다른 전망치의 추정오차를 고려하여 NGFS의 평균값(2050년 625달러)을 기본으로 사용하고, 중장기 탄소가격 수렴가능성을 고려하여 NGFS의 EU 탄소가격과 미국 탄소가격을 보조 정보로 사용하였다. 그리고 2050년까지 추정치는 할인율에 크게 의존하는 바, 여기서는 NGFS의 한국 장기금리 전망치(2.55%)와 김승완(2022)이 사용한 우리나라 사회적 할인율(4.5%) 두 가지를 사용하였으며 원화 환산을 위해 NGFS 기준에 따라 2010년 미국달러 환율(1,156원)을 사용하였다.

한국의 평균 탄소가격을 가정할 경우, 할인율을 기준으로 투자규모는 <그림 Ⅲ-3>과 같이 추정되었다. 사회적 할인율과 NGFS의 장기이자율의 평균 할인율(3.5%)를 기준으로 보면 2050년까지 누적 탄소중립 투자 수요는 2,097조원으로 나타났다. 할인율에 따라 1,722조원(4.5% 할인율)에서 2,471조원(2.55% 할인율)로 추정되었다. 2050년까지 전체 기간 연평균 투자액은 70조원이며 할인율에 따라 57조원에서 82조원으로 추정되었다. 기간별 평균 투자 수요는 2021~2125년 15~17조원, 2026~2030년 39~44조원, 2030년 이후에는 연간 최대투자 규모가 163조원까지 늘어났다. 2050년 GDP 대비 2.2~3.8%로 나타나 IPCC(2022)가 전세계 평균으로 전망한 3~6% 범위에 근사하는 것으로 나타났다.4)

가. 기후금융 부족과 민간 기후금융

2050년까지 글로벌 기준 연간 2~5조달러, 한국 기준 57~82조원의 탄소중립 투자 수요가 예상되지만, 2020년 글로벌 기후금융은 6,400억달러, 한국은 정부 예산 기준 11조원, 녹색금융 기준 31조원에 머물고 있다. 기후금융의 공급 능력이 단기간에 확충되기는 어려운 만큼 향후 상당한 기후금융 부족을 예상할 수 있다. 이 같은 기후금융 부족 문제를 일찍부터 연구하고 그 현황과 개선 방향을 제시한 기관은 UN이다. 특히, UNFCCC(2021)는 정부 재정제약으로 공공 기후금융만으로는 향후 30년간의 탄소중립 투자 수요를 충족할 수 없다고 지적하고, 전체 기후금융의 70%는 민간 기후금융시장을 통해 조달되는 것이 바람직하다는 견해를 제시하고 있다. 민간 기후금융이 탄소중립 성패를 좌우하는 핵심 요소가 될 것임을 시사한 것이다.

UNFCCC(2021)는 기후금융 조달에서 공공과 민간 비중을 3:7로 제시하고 2021~2125년 동안 조달해야 할 연간 2.6조달러의 기후금융의 세부 조달 방향에 대해 기술하고 있다. 공공 기후금융 전체가 매년 0.79조달러를 조달하고, 이중 국영기업(State-Owned Enterprises: SOEs)이 0.33조달러, 기타 공공부문이 0.46조달러를 조달할 것으로 전망했다. 전체의 70%를 조달해야 할 민간 기후금융의 경우 기업무문이 0.96조달러, 민간 금융기관이 0.46조달러를 조달할 것으로 전망됐다. 기관투자자와 민간펀드 등의 비중은 크지 않을 것으로 전망됐다.

나. 민간 기후금융 부족 원인과 개선 수단

이처럼 기후금융 부족 해소를 위해서는 민간 금융의 참여가 불가피하나, 기후금융의 속성을 고려할 때 유인체계를 개선하지 않는 한, 민간 기후금융의 활성화에는 한계가 있다는 것이 일반적인 평가이다. 기후금융 부족을 체계적으로 분석한 G20 녹색금융 종합보고서(GFSG, 2016)는 기후금융을 시장원리에 맡겨두면 실패할 수밖에 없다고 진단한다. 기후금융의 실패(과소공급)는 구조적이고 근본적인 성격을 갖기 때문이라는 것이다. 가장 큰 원인은 외부성이다. 감축투자의 편익을 제3자가 댓가 없이 누리는 긍정적 외부성(positive externalities), 화석연료 과잉투자로 인한 기후변화 비용을 제 3자에게 전가하는 부정적 외부성(negative externalities) 모두 기후금융의 과소공급 원인이 된다. 이 같은 기후금융의 외부성을 체계적으로 내부화할 수 있어야 기후금융이 시장에 적정 공급될 수 있을 것이다. 이를 위해 보조금(subsidies), 세액공제(tax credit), 발전차액(feed-in-tariffs)제도, 배출권거래제, 신재생에너지의무화(Renewable Portfolio Standards: RPSs) 등 다양한 내부화 기제들이 기후금융시장에 도입되고 있다. 이 중에서 글로벌 솔루션으로 가장 주목받는 제도가 탄소배출권거래제라고 할 수 있다.

둘째, 기후금융 실패는 만기불일치(maturity mismatch)와 깊은 연관이 있다. 기본적으로 기후투자를 핵심 투자프로젝트, 가령, 탄소의 제거, 저장, 활용을 위한 기술개발,제철부문의 수소환원제철 R&D 투자, 수소경제로의 전환 등은 장기자금의 조달을 필요로 하는데, 민간 금융기관의 만기변환기능은 이를 충족하지 못하는 것이다. 이같은 만기불일치를 완화하기 위하여 국제기구에서 주목하는 방안들에는 민관협동금융, 녹색채권, 기관투자자의 녹색인프라펀드 등이 있다. 녹색채권의 경우 발행과 이행 관련 투명성 부족이 시장 발전의 주요 장애요인이었는데, 선진국을 중심으로 그린 택소노미가 빠르게 도입됨에 따라 녹색채권을 통해 만기불일치가 크게 개선될 것으로 보인다. 그러나 녹색채권은 만기불일치를 완화할 수 있는 하나의 금융수단에 불과하고, 기후금융의 만기불일치와 내재위험을 근본적으로 관리하기 위해서는 민관협력금융체제의 구축이 중요하다는 것이 국제기구의 평가이다. 초장기의 기후투자 위험을 민간 부문만으로 모두 흡수하기는 어려우며, 정부과 민간이 투자위험을 분담할 수 있어야 기후금융이 적정하게 공급될 수 있다는 것이다.

셋째, 정보비대칭성의 완화이다. 기후위험 정보비대칭성 완화의 일환으로 전세계적인 정책 공조가 이루어지고 있는 분야가 기후정보 공시의 의무화 로드맵이다. EU는 의무화된 지속가능금융공시(Sustainable Finance Disclosure Regulation: SFDR)규제를 이미 시행하고 있으며 미국 SEC도 상장기업에 대해 기후위험공시 의무화를 추진하고 있다. 우리나라도 2030년까지 ESG 공시를 의무화 하는 로드맵을 발표한 바 있다.

마지막으로 가치평가의 어려움이다. 기후금융에서 가치평가 어려움은 다 차원적이다. 우선 기후투자는 배출권 획득이기 목적이기 때문에 배출권시장에서 가치평가가 효율적으로 이루어져야하며, 이를 위해 글로벌 배출권시장은 할당시장과 유동시장의 미시구조 효율화에 박차를 가하고 있다. 기후금융 프로젝트의 가치평가 역시 어려운 과제인데, 이 역시 배출권시장과 밀접한 관련을 갖는다. 배출권가격이 효율적으로 결정되어야 기후투자프로젝트의 경제성이 제대로 평가되며 기후금융 공급을 유인할 수 있을 것이며, 나아가 감축활동을 수행하는 기업의 가치도 공정하게 평가될 수 있다.

이상의 논의를 바탕으로 Ⅳ장에서는 기후금융 활성화를 위해 핵심적으로 중요하다고 판단하는 세 가지 과제에 대해 살펴본다. 우선, 초장기의 기후투자 자금조달이 실패한 주요 요인인 만기불일치와 과도한 위험부담 문제를 완화하는 방안으로 국제기구에서 주목하고 있는 민관협력금융의 활성화에 대해 검토한다. 다음으로 기후투자와 기후금융의 실패가 기본적으로 온실가스에 대해 그동안 배출자부담원칙이 적용되지 못한 데 있는 만큼, 외부성 문제를 해소하고 기후투자의 가치평가 불확실 문제를 완화하는데 중요한 역할을 하는 배출권거래시장의 활성화 방안에 대해 검토한다. 마지막으로, TCFD(Task Force on Climate-related Financial Disclosures) 공시 의무화 방안을 살펴본다. 공시 의무화는 기후금융 실패의 주요 요인인 기후위험 관련 정보비대칭성 문제를 완화함으로써 기후금융이 시장친화적인 보상메커니즘에 의해 자율적으로 활성화하도록 하는 가장 중요한 시장인프라라고 할 수 있다.

1. 민관협력금융 확대

기후금융은 기후투자의 정보비대칭성과 만기불일치 문제로 수요곡선과 공급곡선이 만나지 못하는 시장실패(코너해) 문제가 발생할 수 있다. 시장실패의 교정은 조달방식 혁신을 통해 완화할 수 있는데, 대표적인 것이 민관협력금융 방식이다. 민관협력금융이란 문자 그대로 정부와 민간 금융부문이 감축투자프로젝트의 미래 성과(수익과 위험)를 분담함으로써 금융의 불확실성을 통제하는 조달방식이다. 사실 민관협력금융은 기후 분야가 아니더라도 그간 대규모 투자프로젝트에 활용되어 온 금융조달방식으로, 특히 지속가능발전목표(Sustainable Development Goals: SDGs)의 확산과 함께 개발금융기관의 정책금융방식으로 주목받아 왔다.

기후금융에 민관협력금융을 중요하게 도입한 케이스는 유럽의 InvestEU 프로그램이다.5) 유럽그린뉴딜(European Green Deal)에 2021~2030년 동안 필요한 기후투자 재원 1조유로 중에서 InvestEU 방식으로 2,790억유로를 조달할 계획을 세우고 있다. 민간 기후금융을 유인하기 위해 도입한 InvestEU 프로그램은 13개 EU 기금과 유럽전략투자기금(European Fund for Strategic Investments: EFSI)으로 구성되어 있다. 특징은 민간 자금을 유인을 위해 투자결정구조(지배구조, 조직)나 수익 및 위험 배분 등에서 공공 기후금융과 구별된다. InvestEU는 법인격이 있는 회사 조직은 아니며, 위원회 중심의 지배구조로 운영된다. 위원회 위원은 민간 투자회사 전문가, 유럽투자은행(European Investment Bank: EIB) 대표 등 투자 전문성을 가진 인사를 중심으로 구성된다.

민관협력금융은 순수 민간 기후금융이나 공공 기후금융과 달리 시드머니로서 공공 기후금융, 조달승수(민간 기후금융/공공 기후금융), 투자 위험과 수익의 배분 방식 등을 결정하는 조달전략이 중요하다. InvestEU의 하위 펀드인 EFSI의 경우 EU 재정 1유로로 3배의 공공 기후금융(정부 재정 제외)을 매칭하고, 여기에 5배까지 민간 기후금융을 유인하도록 설계되어 있다. 최대 조달승수가 15배인 셈이다. 실제 조달승수는 그 한도 내에서 수익과 위험 분담 비율과 방식, 해당 기후투자프로젝트의 사전적인 성공확률 등에 따라 달라질 것이다. 정보비대칭성이나 투자기간 등으로 인해 시장실패 가능성이 높은 투자프로젝트의 경우 상대적으로 공공 기후금융 부문의 출자 비중이나 손실분담율을 높임으로써 민간 기후금융을 유인할 수 있을 것이다. 민간 금융 유인 방식은 손실을 분담하는 방법뿐만 아니라 초과수익을 이전하는 메커니즘 도입을 통해 이루어질 수도 있다. 가령, 해당 기후금융 투자프로젝트의 성과가 기준수익률을 초과달성할 경우 공공 금융에 귀속될 수익의 일부를 민간 금융으로 이전시키는 방식이다. EU의 경우 초과수익 이전방식보다 위험분담방식이 일반적으로 활용되고 있는 것으로 보인다. 결국, 민관협력금융은 시장실패 문제를 공공과 민간이 협력하여 완화하는 방식이기 때문에 지배구조나 투자성과 배분이 기존의 정책금융이나 민간 금융과는 다른 접근을 하는 금융조달체계라고 할 수 있다.

우리나라도 2020년 뉴딜펀드 정책을 통해 기후투자 분야에 민관협력금융을 적용한 바 있다. 정부 예산과 산업은행 정책금융이 공공 기후금융의 재원이 되고 여기에 민간 모험자본을 유인하는 구조였다. 별도의 지배구조가 구성되었고, 민간 모험자본을 유인할 수 있는 다양한 손실분담 및 초과수익배분 메커니즘을 설계하고 적용하기도 하였다. 우리나라도 기후금융 부문에 민관협력금융체제를 확대할 경험과 기반을 갖추고 있는 셈이다. 앞으로 과제는 뉴딜펀드 같은 민관협력금융 방식을 기후투자 전반으로 확대함으로써 탄소중립을 위한 투자 재원의 부족 없이 비용 효율적인 기후금융 조달체계를 구축하는 것이다.

이를 위해 현 단계에서 가장 시급한 과제는 정부의 탄소중립 예산의 집행 방식을 재검토하는 것이라고 판단된다. 앞서 살펴본 대로 우리나라 탄소중립 예산은 2022년 11.9조원으로 2021년 NDC 상향을 반영하여 전년 대비 60% 이상 대폭 증액됐다. 이제 집행 효율이 중요해졌으며, 기본 원칙은 예산 단위당 감축 효율의 극대화가 되어야 할 것이다. 이를 위해서는 우선, 관리 측면의 효율성을 개선할 필요가 있다. 현재 탄소중립 예산은 일반예산과 기후대응기금으로 이원화되어 있고, 일반예산은 통합적으로 관리되지 못하고 부처별로 관리되고 있다. 감축 효율은 경제 전체의 감축투자 우선순위 아래 통합관리 되도록 탄소중립 예산의 집행 거버넌스를 정비할 필요가 있다. 방향은 일반예산과 기후대응기금을 하나의 거버넌스로 일원화하고 전문성을 갖춘 민간 전문가의 참여를 확대하는 거버넌스가 바람직할 것이다. 다음으로 예산 지출의 효율성 측면이다. 우리나라 탄소중립 예산 지출에는 민관협력금융 개념이 약하다. 예산을 마중물로 하여 민간의 풍부한 유동성을 활용하는 예산 전략 없이는 탄소중립에 필요한 대규모 기후투자 재원 마련에 어려움이 있다는 점을 염두에 두고, 뉴딜펀드 경험을 토대로 민관협력금융의 모범사례를 만들어 갈 필요가 있다.

아울러, 공공 기후금융 재원의 지출우선순위는 시장실패 가능성이 큰 투자부문이며, 시장실패 가능성에 따라 민간 자금 유인을 위한 최적의 조달승수, 위험분담 비율과 방식 등을 결정함으로써 예산 지출의 효율성을 담보하여야 할 것이다.

2. 탄소시장 활성화

기후금융 발전에 탄소시장 발전이 중요한 이유는 탄소시장의 독특한 기능과 역할 때문이다. 무엇보다, 기후투자프로젝트의 경제성은 최종적으로 배출권 가치에 의해 결정되기 때문이며, 배출권의 가치평가(valuation) 기능을 수행하는 탄소시장은 기후금융에서 핵심적인 역할을 담당한다고 할 수 있다. 배출권 가치가 높을수록 기후금융 프로젝트의 기대수익률이 높아지기 때문에 기후금융 공급 여건은 개선된다. 재무적 이익(이자, 배당 등)에 관심이 있는 기후금융 공급자들이라도 배출권 가치가 프로젝트의 경제성(기대수익률)과 성공 가능성에 영향을 미치기 때문에 최종적으로는 탄소시장의 영향을 받는 구조이다. 또한 배출권시장은 배출권 자체가 기후금융의 재원(원천)으로 사용되기도 한다. 특히, 유상할당 재정수입은 공공 기후금융의 주요 조달원으로서 시장실패 가능성이 높은 투자프로젝트에 집중 투자되며, 관련 위험을 분담하는 역할을 한다. 정부부문이나 NGO에서도 비영리 배출권 투자프로젝트에서 발생한 배출권 수익을 다시 새로운 프로젝트의 재원으로 재투자하기도 한다. 마지막으로, 배출권시장은 기업이 적극적인 탄소경영으로 획득한 잉여배출권을 수익화하는 회수시장 기능을 수행하기도 하며, 한계감축비용이 높은 기업들에게는 부족 배출권 구입을 통해 비용 효율적인 감축을 가능하게 한다.

그렇다면 배출권시장 발전을 위해서는 어떤 제도적 정책적 방향성을 가져야 하는지 살펴보자. 우선, 규제시장인 ETS시장과 자발적 탄소시장(Voluntary Carbon Market: VCM)이 균형적으로 발전하는 탄소시장 생태계를 구축하는 것이 중요하다. 두 시장은 NDC 감축 목표와의 연계 정도, 시장 인프라 규제, 시장 투명성 등에서 분명히 구별되는 시장이나, 배출권의 가치평가, 회수 등의 면에서 상호보완성은 점점 커질 것으로 보이기 때문이다. 기업은 글로벌 환경공시의 의무화 추세로 인해 배출량 감축의 범위가 직접배출(Scope 1)이나 간접배출(Scope 2)을 넘어 공급망까지 포괄하는 기타간접배출(Scope 3)까지 감축해야 하는 상황이다. 이 점이 기업이 체감하는 과거 교토의정서체제와 지금의 파리협정체계의 가장 큰 차이점이라 할 수 있다. 이처럼 광의의 기업의 탄소경영 범위를 고려할 때 ETS시장 넘어 자발적 탄소시장을 통한 가치평가와 회수의 중요성은 점점 커질 것이다. 두 시장이 함께 발전하는 탄소시장 생태계가 필요한 이유이다.

두 번째, ETS시장을 파리협정과 탄소중립 달성 목표에 맞게 운영 패러다임을 전환하는 것이다. 탄소중립의 핵심 이행 수단인 ETS 허용배출총량(cap) 감축률을 NDC 감축률 상향에 맞춰 대폭 상향하고, 향후 NDC 정책 변화를 ETS시장이 신속하게 반영할 수 있도록 정책결정 거버넌스를 효율화할 필요가 있다. 그리고 배출량 감축 주체인 기업부문이 국가 NDC 달성에 적극 호응할 수 있도록 감축 인센티브를 획기적으로 ETS 할당제도에 반영할 필요가 있을 것이다. 특히, 감축률 상향으로 ETS시장의 수급불균형이 심화할 것에 대비하여 시장안정예비분(Market Stability Reserve: MSR)제도를 통해 정부가 직접 수량 조절을 주도하고, 이 과정에서 필요한 예비분은 기업이 조직경계 밖에서 수행하는 다양한 외부감축활동을 상쇄배출권으로 전환하여 확보하는 방안을 검토할 필요가 있다. 그 외에도 부족한 거래 활성화와 유동성 창출을 위해 배출권선물을 도입하고6), EU가 재정수입 용처를 혁신기금, 현대화기금, 사회기금 등으로 명확히 하여 재량을 최소화한 것처럼, 연간 1조원 이상 예상되는 유상할당 재정수입의 활용원칙을 명확화할 필요가 있다. 시장실패가 가장 심각하게 나타나는 초장기의 만기불일치 R&D 프로젝트, 생산공정 전환, CCUS 등으로 유상할당재원이 집중 환류할 수 있도록 현재의 기후안정기금의 사용 용도를 엄격히 운영할 필요가 있다. 필요에 따라서는 유럽의 혁신기금처럼 기후안정기금 내에 자펀드 투자 목적을 명확히 하여, 유상할당 재원이 민관협력금융의 재원으로 집중 활용되도록 유도할 필요가 있다.

셋째, 자발적 탄소시장 시장이 ETS의 보완시장으로 발전할 수 있도록 관련 인프라를 정비할 필요가 있다. 보완시장이 되기 위해서는 기후투자로부터 획득하는 배출권의 실재성과 측정의 객관성 등 전반적인 시장 투명성을 높이는 검증체계를 갖추는 것이 중요한 만큼, 관련 인프라에 대한 공익적 관점의 최소 기준과 점검이 필요해 보인다. 투명성 강화를 통해 시장 자율적으로 시장이 형성되는 기반이 마련된다면, ETS시장과 VCM시장은 할당제도에서의 차이가 있을 뿐이며 ETS시장과 함께 배출권의 가치평가와 회수 기능을 보완적으로 수행하는 시장으로 발전하게 될 것이다.

3. TCFD 공시 의무화

탄소시장을 통해 탄소가 비경제재에서 경제재로 변화하면서 기후리스크 정보에 대한 시장의 요구가 강하게 나타나고 있다. 기본적으로 자산시장에서 리스크는 곧 가치(프리미엄)이기 때문에 탄소 정보는 기후금융과 탄소시장의 효율적 작동을 위한 핵심 인프라라고 할 수 있다. 이런 점에서 TCFD 공시를 의무화하는 글로벌 흐름은 글로벌 탄소중립 관점에서 매우 바람직한 흐름이라고 할 수 있다.

공시 의무화에 가장 적극적인 곳은 EU이다. EU의 SFDR은 TCFD를 포괄하는 탄소 정보 의무화 제도로서, 투자상품을 제조하는 금융기관과 투자상품(펀드, 일임, 신탁계약)에 투자자산으로 편입된 모든 기업이 공시 의무화 대상이다. 탄소 정보 공개범위도 시행 시점에서는 직접배출(Scope 1)과 간접배출(Scope 2)로 한정했지만, 2023년 1월 1일부터는 공급망을 포함하는 기타간접배출(Scope 3) 정보까지 공개 범위에 포함하였다. 이는 원청기업이 하청기업의 온실가스배출량까지 관리해야 한다는 것을 의미한다. 또한 금융기관의 대출을 받은 차입기업과 자산포트폴리오에 포함된 피투자기업의 배출량(포트폴리오배출량)을 공개해야 한다. 사실 금융기관의 금융배출량financed emission) 정보를 공개한다는 것은 금융회사로 하여금 대출기업 또는 피투자기업의 온실가스 감축 활동을 감시(monitoring)하고 필요에 따라 컨설팅 또는 영향력을 행사하여 감축을 유도하라는 의미와 같다. 이는 기후변화 대응에 대한 주주관여(engagement)라고 볼 수 있으며, 기후변화 공시가 궁극적으로 금융기관에 대한 감독규제(기후위험을 반영한 자본규제, 스트레스테스트, 감축목표 규제 등)로 발전할 수 있음을 시사한다.

미국 또한 지난 3월 기후위험 신공시규제안(New Climate Disclosure Requirements)을 발표하면서, 공시 의무화를 적극 검토하고 있다. 신공시규제안은 상장기업과 비상장외국기업(foreign private issuers)이 대상이다. 그렇지만 이들의 배출량 정보공시 범위에 Scope 3 배출량을 포함하고 있어 비상장기업 역시 SEC 규제안에 간접적으로 영향을 받을 수밖에 없게 되었다. 금융기관 역시 마찬가지로 포트폴리오 배출량(financed emisson)을 공개하도록 되어 있다. 그 외 영국은 2022년 4월부터 TCFD 공시를 의무화하는 G20 회원국 중 최초 국가로서 1,300여개의 금융기관과 대기업이 대상이다. 그리고 뉴질랜드는 영국보다 앞서 TCFD 의무화를 도입한 첫 사례로 기록되고 있다. 자산 10억달러 이상 모든 은행, 운용자산 10억달러 이상 모든 자산운용회사, 연간 보험료수입 2.5억달러 이상이거나 운용자산 10억달러 이상의 보험회사, 그리고 뉴질랜드 거래소에 상장된 모든 주식 혹은 채권 발행회사, 운용자산 10억달러 이상의 연기금 등 대부분의 금융기관이 대상이다.

우리나라도 ESG 정보를 자율공시에서 의무공시로 전환하는 로드맵을 2022년에 제시한 바 있다. 지금은 ESG 정보공시가 자율공시인데, 2025년부터 자산 2조원 이상 상장기업을 대상으로 점진 의무화하여, 2030년에는 전체 코스피 상장회사로 의무화 범위를 확대할 계획이다. 그런데 앞서 글로벌 공시 의무화 규제와 비교할 때 우리나라의 공시 의무화 로드맵은 시간 일정만 제시했을 뿐, 배출량 범위나 적용 대상 등에 대해서는 구체성과 합리성을 보완할 필요가 있다. 무엇보다, 적용 대상을 일정규모 이상의 코스피 상장기업으로 한정하고 있는데, 투자자보호나 규제차익 해소를 위해 동일 요건의 코스닥 상장기업까지 포함하는 것이 바람직하다. 둘째, 공시 대상 배출량 범위는 기업의 준비와 대응에 매우 중요한 정보이므로 명확히 할 필요가 있다. 특히, 공급망을 포함하는 기타간접배출(Scope 3)이 의무화 범위에 포함되는지는 매우 중요한 정보이다. 직접배출(Scope 1), 간접배출(Scope 2)보다 기타간접배출(Scope 3) 배출량이 더 큰 기업들이 제조업의 경우 많이 발견되기 때문에 이것의 포함 여부에 따라 기업의 감축투자의 범위와 전략은 달라져야 한다. 경제 전체로는 중소기업의 온실가스 감축정책에도 중대한 영향을 미칠 수 있다.

마지막으로, 금융기관의 경우 상장 여부에 관계없이 의무화 대상에 포함할 필요가 있다. 금융기관은 금융배출량(financed emission) 관리를 통해 일반기업의 감축활동에 영향을 미칠 수 있는 위치에 있기 때문이다. 금융자원 배분을 통해 기업에 대한 통제권을 가지고 있어서 차입/피투자기업의 채권자 또는 주주로서 영향력을 행사할 수 있다. 금융기관의 이 같은 특수 역할을 고려하여 글로벌 탄소중립 규제 역시 금융기관에 대해 보다 엄중한 역할을 요구하고 있다. 탄소회계금융연합(Partnership for Carbon Accounting Financials: PCAF)이나 과학적 감축목표 이니셔티브(Science-based Target Initiative: SBTi) 등도 금융기관의 금융배출량을 별도로 측정하는 방법론을 개발하고, 모니터링과 관여(engagement) 전략에 대해 컨설팅을 하고 있다. 앞서 영국, 뉴질랜드 등에서 TCFD 공개 의무화를 금융기관으로 한정하여 적용한 것도 금융기관의 이 같은 역할이 중요하기 때문일 것이다.

1) EU가 MS 요건으로 열거하고 있는 국제규범으로는 the UN Guiding Principles on Business and Human Rights, the OECD Guidelines for Multinational Enterprises(MNEs): A legal international instrument on responsible business conduct (RBC), the ILO Core Labour Conventions on Fundamental Rights and Principles at Work the International Bill of Human Rights 등이다.

2) 국제기구간 넷제로 달성을 가정한 탄소가격 장기전망은 상당한 차이를 보인다. 가령, IEA는 선진국 기준으로 2030년 130달러, 2040년 205달러, 2050년 250달러, NGFS는 전세계 기준으로 2030년 115달러, 2040년 255달러, 2050년 451달러로 전망하고 있다.

3) BAU에 대한 학술 및 국가 차원의 추정치는 확인하기 어려움. 기존 문헌은 2018년 배출량(7.2억톤)을 BAU 대용치로 사용하고 있으나, 경제구조와 인구구조 미반영으로 과다 추정 가능성이 있는 바, 본 보고서는 NGFS 현 정책유지(current policy)시 배출량 경로를 BAU로 사용. 이때 BAU는 2020년 6.6억톤, 2030년 6.5억톤, 2040년 5.8억톤, 2050년 5.3억톤임

4) 참고로, BAU를 2018년 배출량으로 하고 한국의 평균 탄소가격을 이용한 경우는 2050년까지 누적 탄소중립 투자 수요는 평균 2,272조원, 1,852조원(4.5% 할인율)에서 2,692조원(2.55% 할인율)으로 나타났다. 또한 글로벌 탄소가격으로 국내 탄소가격이 수렴하는 경향을 가정하고 유럽과 미국의 탄소가격 시나리오를 한국 탄소가격 전망치의 대용치로 사용할 경우, 감축투자비용은 크게 증가한다. 유럽 탄소가격을 대용치로 사용할 경우 2050년까지 누적 투자규모는 2,200조원(4.5% 할인율)에서 3,200조원(2.55% 할인율) 사이, 미국 가격의 경우 1,900조원에서 2,700조원으로 증가한다.

5) InvestEU는 지속가능성장을 위한 투자프로그램으로 2021~2027년 동안 총 3,720억유로의 투자 재원 조성을 목적으로 마련되었으며, 민간 투자자금의 유인을 위해 유럽 내에 13개 EU 기금과 EFSI를 통합 관리하고 있다.

6) EU-ETS는 2021년 기준 거래의 87.1%가 배출권선물을 통해 이루어지며, 배출권 현물 거래비중은 5.6%에 불과하다(한국환경공단, 2022).

참고문헌

김승완, 2022, 『에너지부문 전환비용 추정』, 에너지경제연구원-환경연구원 공동심포지엄.

김용건, 2022, 『탄소가격정책의 환경경제적 파급효과 및 정책적 시사점』, 에너지경제연구원-환경연구원 공동심포지엄.

송홍선, 2021, 『2050 탄소중립과 배출권거래제의 활성화』, 자본시장연구원 이슈보고서 21-23.

송홍선, 2022, 『금융기관의 기후위험관리 동향과 과제』, S&P Global 세미나.

송홍선, 2022, 『기후금융과 배출권시장』, 지니포럼, 국가균형발전위원회.

송홍선·이인형, 2022, 『탄소중립·ESG 관련 투자 활성화 및 투자자보호 방안』, 금융위원회 학술연구용역.

한국환경공단, 2022, ETS Insight 2022-50.

CPI, 2021, The Global Landscape of Climate Finance.

EU, 2020, Taxonomy: Final report of the Technical Expert Group on Sustainable Finance, EU Technical Expert Group on Sustainable Finance.

European Commission, 2020. 1. 14, Green deal investment plan and just transition mechanism explained, Questions and Answers.

G20 Green Finance Study Group, 2016, G20 Green Finance Synthesis Report.

IEA, 2021, Net Zero by 2050 A Roadmap for the Global Energy Sector, Special Report 4th Revision.

IPCC, 2022, Summary for Policymakers, Working Group III Report, Sixth Assessment Report.

KOSIF & LEE, 2021,Sustainable Finance of Korea Stands at the Crossroads, Whitepaper on Korea ESG finance in 2020.

OECD, 2020, ESG Investing: Practices, Progress and Challenges.

UNEP, 2016, Definitions and concepts: Background note, Inquiry working paper 16/13.

UNFCCC, 2021, Net Zero Financing Roadmaps, UN Climate Change Conference UK2020.