Find out more about our latest publications

Reduced Interest Rate Sensitivity in the US Economy and its Implications

Issue Papers 23-22 Oct. 31, 2023

- Research Topic Macrofinance

- Page 21

Amid a surge in interest rates from the second half of 2022, major forecasting institutions initially presented a grim outlook for the US economic growth rate for 2023. However, as the US economy showed a more resilient growth trend than expected, these growth forecasts have been gradually revised upward. Previous studies have highlighted that structural economic changes, including financial innovation, regulatory relaxation, improvements in the monetary policy response framework, and globalization have contributed to the insensitivity of the US economy to interest rate changes. On the other hand, this article draws attention to a significant weakening of the impact of interest rates among monetary policy transmission channels during the current rate hike.

In this context, this article examines factors behind the change in long-term US Treasury yields during the recent rate hike period (March 2022 to July 2023) and decomposes these factors into monetary policy forecasts and the term premium for long-term Treasury bond holdings. Unlike previous rate hike periods, the rise in Treasury yields is solely attributed to monetary policy expectations, while the term premium has remained almost unchanged. Utilizing a dynamic stochastic general equilibrium (DSGE) model, this article analyzes the cause of the unusually low level of term premiums. It has been estimated to decline by nearly 100 basis points as of the end of 2022, primarily driven by large-scale Treasury bond holdings resulting from the US Fed’s quantitative easing. It is also noteworthy that as the mortgage, which comprises two-thirds of US household debt, primarily involves long-term fixed rates, the debt service burden of US households has remained at pre-Covid 19 levels, despite a sharp increase in the benchmark rate. In addition, the expansion of the aging Baby Boom generation with lower debt exposure has contributed to weakening the interest rate path.

As the correlation between the US real economy and interest rates is reduced, the uncertainty in estimating the neutral real interest rate, a reference rate for monetary policy, has increased. Accordingly, this inevitably necessitates improvised monetary policies for an extended period and makes it challenging to determine the appropriate level of tightening, possibly heightening uncertainty regarding the future growth trajectory. It should also be noted that the long-term US Treasury bond yields are expected to be greatly swayed by the term premium, rather than expectations for monetary policy. If a steep rise in term premium, as observed in September 2023, triggers Treasury yields hikes, it could lead to simultaneous increases in Korean government bond yields and intensify exchange rate volatility.

In this context, this article examines factors behind the change in long-term US Treasury yields during the recent rate hike period (March 2022 to July 2023) and decomposes these factors into monetary policy forecasts and the term premium for long-term Treasury bond holdings. Unlike previous rate hike periods, the rise in Treasury yields is solely attributed to monetary policy expectations, while the term premium has remained almost unchanged. Utilizing a dynamic stochastic general equilibrium (DSGE) model, this article analyzes the cause of the unusually low level of term premiums. It has been estimated to decline by nearly 100 basis points as of the end of 2022, primarily driven by large-scale Treasury bond holdings resulting from the US Fed’s quantitative easing. It is also noteworthy that as the mortgage, which comprises two-thirds of US household debt, primarily involves long-term fixed rates, the debt service burden of US households has remained at pre-Covid 19 levels, despite a sharp increase in the benchmark rate. In addition, the expansion of the aging Baby Boom generation with lower debt exposure has contributed to weakening the interest rate path.

As the correlation between the US real economy and interest rates is reduced, the uncertainty in estimating the neutral real interest rate, a reference rate for monetary policy, has increased. Accordingly, this inevitably necessitates improvised monetary policies for an extended period and makes it challenging to determine the appropriate level of tightening, possibly heightening uncertainty regarding the future growth trajectory. It should also be noted that the long-term US Treasury bond yields are expected to be greatly swayed by the term premium, rather than expectations for monetary policy. If a steep rise in term premium, as observed in September 2023, triggers Treasury yields hikes, it could lead to simultaneous increases in Korean government bond yields and intensify exchange rate volatility.

Ⅰ. 금리 인상에도 불구하고 견조한 미국 경제

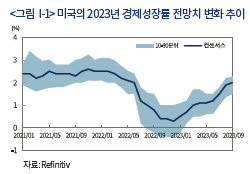

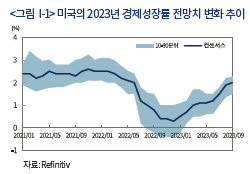

2022년 하반기 이후 미국의 가파른 물가상승세에 대응하여 기준금리가 큰 폭으로 인상되면서 경기둔화 우려가 커지기 시작했다. 이에 따라 주요 예측기관들은 당초 2023년 중 미국의 경제성장률이 크게 하락할 것으로 예측하였다. <그림 Ⅰ-1>은 미국의 2023년 경제성장률 전망치가 2021년 초부터 최근까지 시점별로 어떻게 변했는지를 보여준다. <그림 Ⅰ-1>에 따르면 2022년 7월 이후 컨센서스 전망치가 급락하였으며 특히 연말에는 2023년 중 마이너스 성장 가능성을 예측했던 기관들이 적지 않았음을 알 수 있다. 그러나 이후 미국 경기가 양호한 고용 및 민간소비를 중심으로 예상보다 견조한 성장 흐름을 나타내면서 성장 전망치가 점차 상향 조정되었다. IMF 또한 예외가 아니어서 2023년 성장률 전망치를 2022년 10월에는 1.0%로 전망했다가 2023년 1월 1.4%, 4월 1.6%, 7월 1.8%, 10월 2.1%로 계속해서 상향 조정하였다. 성장률 전망치가 비교적 조기에 조정된 것과 달리 12개월 후 경기침체 발생확률(Reuters 설문)은 상대적으로 더디게 반응하여 7월까지 50%를 유지하였으나 7월 FOMC 기자간담회에서 포웰(Powell) 연준 의장이 2023년 중 경기침체 가능성을 배제한다고 밝힌 이후 큰 폭으로 하락하여 최근(2023년 9월)에는 30%까지 하락한 상황이다.

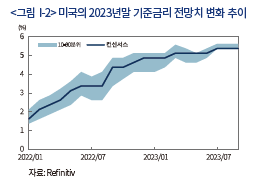

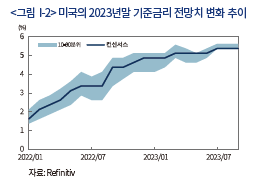

당초 미국 경제에 대한 부정적 시각이 우세했던 이유는 1980년대 이후 가장 높은 수준의 인플레이션과 이에 대응하기 위한 미 연준의 가파른 금리인상 때문이다. 즉, 급격한 금리인상으로 고용 및 민간소비가 악화되고 투자가 줄어들면서 수요가 둔화될 것이라는 예측에 근거한다. 흥미로운 점은 2023년 말 미국의 기준금리 수준에 대한 각 시점별 전망치를 나타내고 있는 <그림 Ⅰ-2>를 살펴보면 경기침체를 예측하던 지난해 말과 최근의 통화정책 경로에 대한 예측치의 차이는 50bp 정도로 크게 다르지 않다는 것이다.

미국 경제의 이러한 수수께끼 같은 상황을 이해하기 위해 본고는 미국 경제가 금리 변화에 구조적으로 둔감해졌으며 특히 최근 들어 양적완화 및 주택금융의 장기 고정금리화 등으로 통화정책의 파급경로가 크게 약화된 점에 주목한다. 이를 위해 먼저 Ⅱ장에서는 금리 민감도 하락 및 통화정책의 유효성 감소와 관련된 주요 선행연구 결과를 제시한다. 통화정책의 유효성 감소에 대해 다양한 원인이 제기되는 만큼 어느 하나가 주된 원인이라고 확신할 수는 없겠으나 Ⅲ장에서는 금번 금리인상기에 미국의 장기국채가 안정화되고 미국의 비금융 경제주체들의 고정금리 대출 확대로 통화정책의 전달경로가 약화되었을 가능성에 대해 분석한다. Ⅳ장에서는 이러한 분석 결과들을 바탕으로 한 통화정책 및 금융시장에 대한 시사점으로 마무리한다.

Ⅱ. 미국 경제의 금리 민감도 하락에 대한 선행연구

미국에서 1990년대 이후 실물경제의 금리 민감도가 하락하면서 통화정책의 유효성이 의문시됨에 따라 금리 민감도 하락원인에 대한 다양한 원인들이 제기되었다. 아래에서는 금융규제 완화, 통화정책 대응체계의 개선, 미국 경제의 구조 변화를 중심으로 기존 선행연구 결과들을 정리한다.

1. 금융규제 완화

우선, 미국에서 1980년대 이후 금융규제가 완화되고 초장기 고정금리 대출 도입과 같은 금융혁신 등으로 저신용 가계 및 기업 차주에 대한 신용제약이 완화되면서 금리와 실물경제 간 관계가 저하되었을 수 있다. 1930년대 대공황기 은행 간 예금경쟁을 규제하기 위해 도입된 은행 예금금리에 대한 상한 규제(regulation Q)는 1980년대 단계적으로 철폐되기 전까지 기준금리 인상이 실물경제에 미치는 영향을 증폭시키는 역할을 했다(Dynan et al., 2005). 즉, 금리상한제 하에서는 금리 상승기에 시장금리가 예금금리 상한을 웃돌게 될 경우 예금이 MMF 등으로 이탈(disintermediation)하게 됨에 따라 금융기관들의 대출 여력이 축소되면서 신용공급이 위축되었다. 금리상한제 철폐 이후 비록 금리상승기에 은행을 통한 조달비용이 상승하였으나 신용공급이 크게 축소되지는 않았기 때문에 금리인상의 실물긴축 효과가 이전에 비해 줄어들었다.

2. 통화정책 대응체계 개선

경기 변동에 대한 이해가 확대되면서 통화정책 대응체계가 개선된 점 또한 금리 민감도 하락에 기여했다는 지적들이 존재한다(Clarida et al., 2000; Boivin & Giannoni, 2006; Boivin et al., 2011; Coibion & Gorodnichenko, 2011). 1960~1970년대와 달리 볼커(Volcker) 의장 이후 미 연준의 인플레이션에 대한 적극적 대처 및 물가안정목표제의 성공적 운영 등으로 중앙은행에 대한 신뢰가 높아져 인플레이션에 대한 경제주체들의 기대가 안정되었다. Reifschneider et al.(1999)에 따르면 통화정책의 단기적 효과가 주로 경제주체들의 미래 통화정책이나 경기전망 및 인플레이션의 기대 변화를 통해 실물경제에 영향을 미치는 것으로 나타난 가운데, Boivin et al.(2011)의 실증분석에 의하면 과거와 달리 최근에는 기준금리 인상 충격에 대해 기대 인플레이션이 거의 변하지 않는 것으로 나타났다. 한편 기준금리 외에도 양적완화나 사전적 지침(forward guidance)과 같은 통화정책 수단이 확대된 점 또한 기준금리의 영향력 변화에 기여했을 것으로 판단된다. Crawley et al.(2022)에 따르면 양적완화 또는 양적긴축 등을 통해 2.5조달러의 연준 보유자산이 변동하는 것이 대체로 기준금리 50bp 변동에 상응한다고 보고하고 있다.

3. 경제구조의 변화

세계화의 진전에 따른 글로벌 공급망 확대 등 공급부문의 구조변화 또한 금리 민감도 하락을 촉진하였을 것으로 보인다(Gamber & Hung, 2001; Forbes, 2019). 미국 기업의 다국적화로 생산 공정 중 상당 부분이 해외에서 이뤄지는 한편 아마존(Amazon)을 비롯한 인터넷 유통혁신 등으로 미국의 통화정책 변화가 생산비용에 미치는 영향이 축소된 반면 글로벌 요인들이 미국 물가에 미치는 영향은 크게 확대되었다. 특히 교역 확대로 자본재의 가격이 하락하면서 설비투자에 필요한 자금 수요가 줄어든 점 또한 금리 민감도 하락에 기여했을 수 있다(Sajedi & Thwaites, 2016; Lian et al., 2020).

기술혁신에 따른 기업의 자금조달 구조 변화가 통화정책이 기업 투자에 미치는 영향도를 낮췄을 가능성도 존재한다. 기술진보로 무형자산(intangible asset)의 중요성이 증가함에 따라 기업의 투자에도 변화가 발생할 수 있는데, 실제로 Corrado & Hulten(2010)에 따르면 미국의 경우 2000년을 전후한 시점부터 무형자산 투자가 유형자산을 상회하기 시작하였다. Döttling & Ratnovski(2023)가 미국 기업을 분석한 결과 기업의 무형자산 비중이 높을수록 금리에 대한 투자 민감도가 하락하는 것으로 나타났다. 이는 해당 기업의 자금조달에서 금리에 민감한 부채(debt financing)보다 자기자본(equity financing)의 중요성이 높다는 측면에서 이해할 수 있다. 동 연구에서는 무형자산의 중요성이 높은 혁신기업일수록 주가의 금리 민감도가 낮은 것으로 분석되었다.

Ⅲ. 금번 기준금리 인상기 금리경로의 약화

기존 선행연구에서 제시된 금리 민감도 하락 원인 중 어떠한 원인이 금번 금리인상기에 중요한 역할을 하였는지 명확히 알 수는 없으나, 본 장에서는 통화정책의 전통적 파급경로 중 금리경로가 제약된 점에 주목하여 분석하고자 한다. 즉, 중앙은행이 기준금리를 상향 조정하면 단기 시장금리와 함께 장기 시장금리 및 은행의 대출금리가 상승하여 가계소비와 기업대출을 줄여 생산을 위축시키는 역할을 한다. 그러나 금번 금리인상기에서는 기준금리 인상에도 불구하고 미국의 장기 시장금리는 과거에 비해 상승폭이 낮을 뿐만 아니라 민간대출에서 고정금리 비중 확대로 민간에 전가되는 금리 부담이 제한적인 점이 영향을 미친 것으로 판단된다.

1. 기간 프리미엄의 하향 안정에 따른 장기금리 상승 제한

금번 금리인상기 동안 미국의 국채금리는 2022년 2월 평균 1.97%에서 2023년 7월 3.82%로 상승하였다. 즉, 미국의 기준금리가 5.25%p 인상되는 동안 국채금리 상승폭은 1.85%p에 그쳤다. 금번 기준금리 인상기의 미국 국채금리 변화는 과거 인상기와 비교해도 이례적이다. <그림 Ⅲ-1> 에서 1982년 이후 미국의 금리인상기를 살펴보면, 대체로 국채금리가 최종 기준금리와 유사한 수준까지 상승하였다는 점을 확인할 수 있다. 이에 반해 금번에는 국채금리 고점(2021년 8월 21일 4.34%)이 최종 기준금리(2023년 7월 5.50%, 작성 시점 기준)를 크게 하회하였다. 이러한 결과는 통화정책 측면에서 장기금리의 기준금리 인상에 대한 민감도가 과거에 비해 크게 낮아졌으며 궁극적으로 중앙은행이 기준금리 인상을 통해 의도한 만큼의 통화긴축 효과가 나타나지 않을 수 있음을 시사한다.

금번 금리인상기에 관찰된 미국 장기국채 금리 추이의 특성을 살펴보기 위해 국채 금리를 미래 기준금리에 대한 예상치와 기간 프리미엄의 합으로 분해하여 살펴본다. 전자를 위험조정금리(risk-neutral yields)라 부르는데, 국채금리 중 기준금리 인상 효과가 반영된 부분으로 이해할 수 있다. 기간 프리미엄(term premium)은 채권의 리스크 프리미엄(위험보상 금리)으로 다양한 요인에 의해 결정되는데, 투자자가 인지하는 국채금리 상승위험(금리 변동성)이 증가할수록 커진다. 대체로 금리상승위험은 통화정책, 인플레이션 및 실물경제에 의해 결정되므로, 동 요인들의 불확실성이 높을수록 기간 프리미엄이 확대된다. 글로벌 안전자산 선호 현상 및 채권에 대한 수요와 공급 요인도 기간 프리미엄에 영향을 미치는데, 특히 미국의 경우 양적완화가 기간 프리미엄의 구조적 하락세에 영향을 미친 것으로 알려져 있다(Bernanke, 2015).

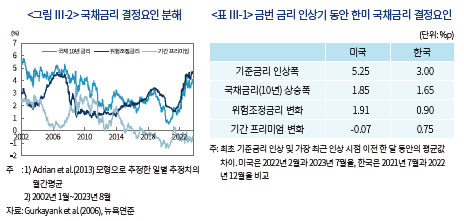

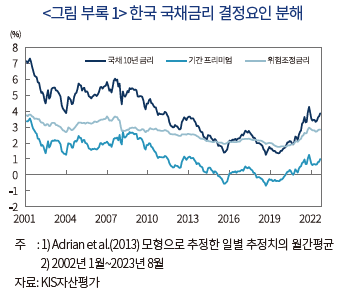

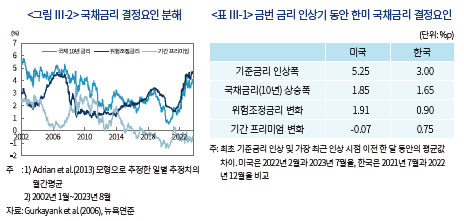

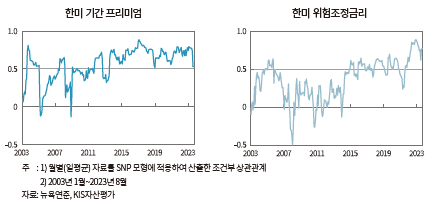

<그림 Ⅲ-2>에는 Adrian et al.(2013)에 제시된 방법을 사용하여 10년 만기 국채금리를 통화정책에 대한 기대(위험조정금리)1) 및 기간 프리미엄으로 분해한 결과가 나타나 있다.2) 다음으로 <표 Ⅲ-1>에는 위에서 언급된 방법을 통해 산출된 금번 기준금리 인상기 동안의 국채금리 결정요인 변화가 정리되어 있다. 분석 결과 미국의 국채금리 상승은 기간 프리미엄이 소폭 하락한 가운데 전적으로 기준금리 인상에 따른 위험조정금리에 의해 유발되었음을 알 수 있다. <그림 Ⅲ-2>에서 확인할 수 있듯이 2020년 이후 최근까지 미국의 기간 프리미엄은 1970년대 이후 가장 낮은 수준에 머물러있다. 금번 기준금리 인상기 동안의 높은 인플레이션 및 통화정책 불확실성을 고려할 때, 미국 기간 프리미엄이 이처럼 낮은 수준에서 유지된 것은 매우 이례적인 현상이다.

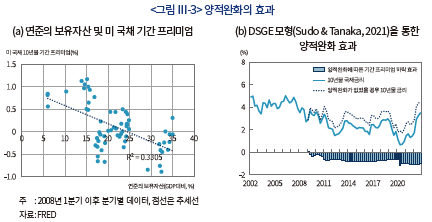

이처럼 최근 미국 기간 프리미엄이 이례적으로 낮은 수준을 유지하고 있는 원인에 대해서는 아직 면밀한 검토가 이루어지지 않은 상태로 파악된다. 다만 동일하게 Adrian et al.(2013)의 방법론으로 한국의 국채금리 변화를 분해했을 때 한국의 기간 프리미엄은 금번 금리인상기 중에 유의한 상승세를 보임에 따라 기간 프리미엄의 국채금리 상승 기여율이 절반 수준으로 나타났다. 이러한 점을 감안할 때, 미국 기간 프리미엄의 행태는 미국 고유 요인에 기인하는 것으로 판단해 볼 수 있다. 이와 관련하여 여러 요인이 지적될 수 있겠으나 누적된 양적완화의 효과가 유력한 원인으로 추정된다.

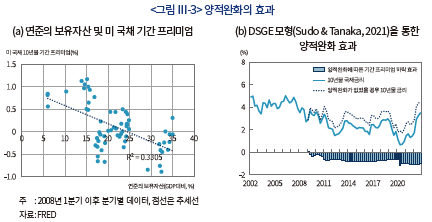

양적완화가 미 국채의 기간 프리미엄에 미친 영향을 살펴보기 위해 Sudo & Tanaka(2021)3)의 모형을 미국 데이터를 이용하여 추정하여 보았다. <그림 Ⅲ-3>에서 나타나듯 동 모형으로부터 양적완화를 통해 중앙은행이 보유한 국채 보유 잔액이 장기 국채 금리에 미치는 영향, 즉 잔액 효과(stock effect)를 추정한 결과 2022년말 기준 기간 프리미엄을 약 100bp 하락시킨 것으로 나타났다. 추정의 불확실성이 상당하나, 이러한 결과는 연준의 기존 연구 결과들과 유사한 것으로 보인다. 예를 들어 Bonis et al.(2017)은 2017년 말 연준의 국채 보유에 따른 10년물 기간 프리미엄 하락 효과를 85bp로 추정하였는데 Sudo & Tanaka(2021) 모형을 통한 해당 시점의 추정치(77bp)와 상당히 근접한 결과이다. 이러한 분석 결과를 고려하면 장단기 금리의 역전으로 앞서 지적한 바와 같이 국채 금리의 고점이 최종 기준금리를 크게 하회하는 원인이 연준의 대규모 자산 보유에서 비롯되는 것으로 해석할 수 있다. 또한 여기서는 미국의 양적완화에 의한 기간 프리미엄 하락 효과만을 고려하고 있으나, 코로나19 감염확산 기간에 유로지역, 일본 및 영국 등의 유동성 확대가 미국 국채 시장에 미쳤을 영향(spillback)을 감안하면 추가적인 장기금리 하락 압력이 존재했을 가능성이 크다. 마찬가지로 장단기 금리 역전이 경기침체가 임박했음을 나타내는 주요 예측 지표로 사용4)됐으나, 과거와 달리 장기금리가 양적완화의 영향으로 하향 안정화됨에 따라 왜곡된 신호를 제공하고 있을 가능성이 존재한다.

2. 고정금리 대출 비중 확대 및 인구 고령화에 따른 가계의 금리 민감도 하락

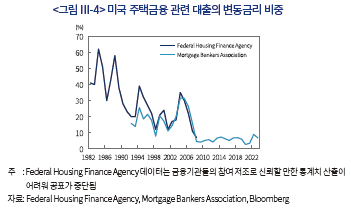

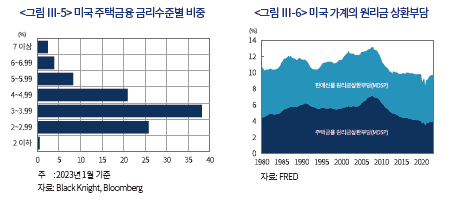

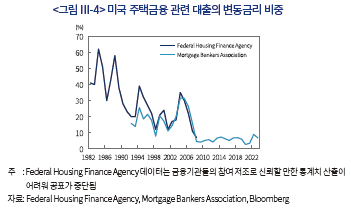

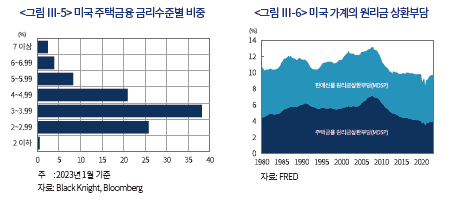

글로벌 금융위기 이후 미국의 가계부채가 축소된 데다 주택시장을 중심으로 고정금리 대출 비중이 높아 차입자의 이자 부담이 많이 늘어나지 않아 금리 인상의 영향이 더욱 약화되었을 수 있다. <그림 Ⅲ-4>는 미국 주택금융에서 변동금리 대출의 비중을 보여주고 있는데 1980년대 초반 50% 수준이던 대출금리 비중은 정부 보증기관들에 의한 주택금융의 증권화(securitization)에 힘입어 30년 고정금리 대출이 가장 보편적인 형태5)로 자리매김함에 따라 글로벌 금융위기 이후 최근까지 10%를 하회하고 있다. 2023년 1분기 기준 주택금융이 가계 및 비영리 법인의 전체 부채중 65.9%를 차지하는 가운데 전체 주택금융중 40% 이상이 초저금리 기간인 2021~2022년중에 실행됨에 따라 가계의 주택금융과 관련된 이자 부담은 크게 늘지 않은 것으로 나타났다(<그림 Ⅲ-5> 참조). <그림 Ⅲ-6>에 나타나듯 실제로 금리 인상에도 불구하고 가계의 가처분 소득 대비 원리금 상환부담은 2023년 1분기 기준 9.6%으로 급격한 금리인상에도 불구하고 코로나19 감염확산 직전인 2019년 당시(9.8%)보다 낮은 수준이다. 가계의 원리금 상환부담이 낮게 유지되고 있는 것은 주택금융 상환부담이 현재와 기준금리 수준이 같은 2007년 3분기의 절반 수준이기 때문이다.

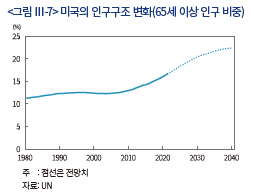

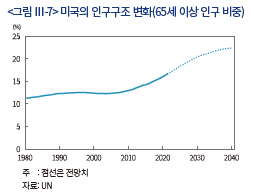

주택 대출의 고정금리 비중 확대와 더불어 인구 고령화 또한 민간 소비의 금리 민감도 하락에 영향을 줄 수 있다. 미국의 베이비붐 세대(1946~1964년생)의 은퇴가 2008년 글로벌 금융위기를 전후해서 본격화되면서 <그림 Ⅲ-7>에서 나타난 바와 같이 전체 인구에서 65세 이상 인구 비중이 빠르게 증가하고 있다. 미국의 고령층은 재정상태가 양호한 데다 주택구입 및 학자금 대출 등에 따른 부채에 대한 노출 정도가 다른 연령층에 비해 상대적으로 낮다. 이에 따라 뉴욕 연준의 소비자 지출 서베이(survey of consumer expenditures)에 따르면 전체 연령층의 소비 중 고령층 소비 비중이 2022년 22% 수준으로 1972년 이후 최고치를 기록하였다. 결과적으로 고령층 소비 비중이 증가하여 경제 전체 소비의 금리 민감도 하락에 기여했을 것으로 판단해 볼 수 있다.

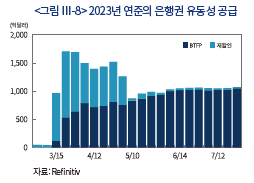

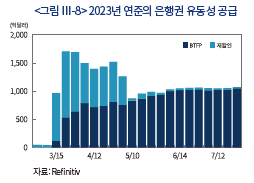

이러한 점들을 감안하면 연준의 기준금리 인상에 따른 금리위험은 가계와 같은 비금융 경제주체로부터 은행을 비롯한 금융 부문으로 이전된 것으로 볼 수 있다. 실제로 2023년 3월에 발생한 일부 지방 및 중소 은행들의 파산 사태는 금리 인상에 따른 은행이 보유한 국채 가격 및 은행 대출 가치의 하락이 주요 원인이었다. 다만 후속 처리 과정에서 나타나듯 금리 인상과 동시에 연준이 재할인창구 및 BTFP(Bank Term Funding Program) 등을 통한 적극적인 유동성 공급(<그림 Ⅲ-8> 참조)으로 미국의 은행권 불안이 점차 안정화되었다. 장기적으로 은행들의 대출기준 강화로 신용공급이 위축되고 기업들의 회사채 차환 과정에서 금리 부담이 심화되어 투자가 위축될 수는 있겠으나, 최소한 지금까지는 민간의 금리 부담을 제한하는 가운데 금리위험에 노출된 은행권을 연준이 유동성 공급을 통해 뒷받침하는 형태로 통화정책을 운용하고 있다.

Ⅳ. 미국 통화정책 및 국채금리에 대한 영향

1. 통화정책 및 성장경로의 불확실성

실물경제의 금리 민감도 하락에 따른 일차적 문제는 기준금리의 준거(reference) 역할을 하는 실질중립금리 추정의 불확실성 확대로 향후 중앙은행의 통화정책 경로에 대한 불확실성을 확대시킨다는 점이다. 실질중립금리란 실물경기를 자극하지도 위축시키지도 않는 균형 수준의 금리인 만큼 직접 관측할 수 없으며 모형을 통해 추정해야 한다. 따라서 실물경제와 금리의 관계가 미약해지면 실물경제 변수를 통해 관측할 수 없는 실질중립금리를 추정할 때 발생하는 불확실성이 더욱 커질 수밖에 없다(Fiorentini et al., 2018). 특히 금리 민감도 하락을 충분히 고려하지 못할 경우 실질중립금리 추정치가 매우 경기순행적(procyclical)일 수 있어 잘못된 통화정책 판단을 내릴 수 있다. 글로벌 금융위기 이후 코로나19 감염확산 이전까지 저금리에도 불구하고 통화정책이 경기를 부양하지 못하자 실질중립금리의 하락 및 제로금리 하한으로 통화정책이 충분히 완화적이지 못하기 때문이라는 주장이 보편적으로 받아들여졌다. 그러다가 최근 가파른 금리인상에도 불구하고 미국 경제가 견조한 흐름을 이어가자 일각에서는 실질중립금리가 상승하여 통화정책이 충분히 긴축적이지 못하기 때문이라는 주장이 제기되고 있다(Baker et al., 2023). 이러한 주장들은 통화정책의 유효성이 과거와 동일하다고 가정한 결과 글로벌 금융위기 이후 지속되는 실물경제와 금리간 관계 약화를 실질중립금리의 변화에 기인한 것으로 설명하고 있으나, 개념상 경제의 균형금리인 실질중립금리가 단기간에 급변6)한다는 주장은 받아들이기 힘들다. 실제로 학계와 중앙은행에서 널리 사용되는 Laubach & Williams(2003) 모형에 기반한 준구조 모형으로 미국의 실질중립금리를 추정할 때 표본기간을 두 구간(1961년 1분기~1990년 4분기 및 1991년 1분기~2023년 1분기)으로 구분하면 과거에 비해 실물경제와 실질금리간 관계를 반영하는 IS(Investment-Saving) 곡선의 기울기가 크게 평탄화(flattening)되었음을 확인할 수 있다(강현주, 2023).

이에 따라 균형 수준의 통화긴축 정도를 사전적으로 판단하기 어려워져 경제지표에 임기응변식으로 대응하는 통화정책 운영이 상당 기간 지속될 수 있다. 실제로 뉴욕 연준의 윌리암스(Williams) 총재는 과거 발표된 논문(Orphanides & Williams, 2002)을 통해 중립금리 수준의 불확실성이 클 경우 잘못 추정했을 가능성이 높은 중립금리 수준을 고려하기 보다는 인플레이션과 실물경제 변화에 대응하여 금리를 조정하는 방식(first-difference rule)7)이 바람직하다고 지적한 바 있다. 코로나19 감염확산 이후 경제전망의 불확실성과 함께 발표되는 경제지표가 상이한 시그널을 제공함에 따라 금리인상 지속 및 동결 여부에 대해 시장 참가자들은 물론 연준 내부에서조차 견해가 엇갈릴 수 있다.

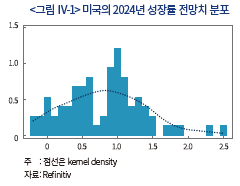

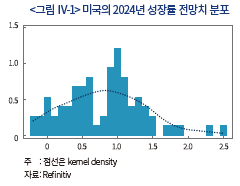

실물경제의 금리 민감도 하락에 따른 실질중립금리의 추정의 어려움은 적정한 긴축 정도에 대한 판단을 어렵게 하여 향후 성장경로에 대한 불확실성으로 이어지고 있다. 2023년 미국의 경제성장률 전망에 대해 전문적인 경제예측 기관들이 집단적으로 오류를 나타내었음을 Ⅰ장에서 언급한 바 있는데 이러한 문제는 2024년 성장률 전망에서 다시 재연되고 있다. <그림 Ⅳ-1>은 2023년 9월 기준 주요 예측기관들의 2024년 미국 성장률 전망치 분포를 나타내고 있다. 주요 대형 IB들 사이에서도 전망치가 0%에서 2%로 크게 상이하다.

2. 기간 프리미엄 정상화에 따른 국채금리 불안 가능성

앞으로는 미국 국채금리 결정요인 중 기간 프리미엄에 관심을 가질 필요가 있다. 실제로 미국 국채금리는 연준의 2023년 7월 금리인상 이후 변동성이 확대되는 가운데 상승세를 나타냈다. 10년물을 기준으로 7월 인상일 대비 8월 31일 국채금리, 기간 프리미엄 및 위험조정금리의 상승폭은 각각 0.22%p, 0.19%p 및 0.03%p로 확인되었다.8) 결과적으로 7월 인상 이후의 국채금리 상승은 통화정책 변경에 대한 기대가 안정된 가운데, 주로 기간 프리미엄 확대에 기인한 것으로 나타났다.

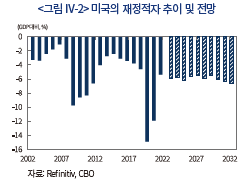

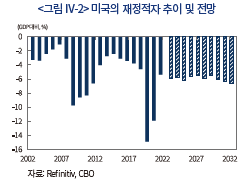

한편 연준은 6월 FOMC에서 기준금리를 동결한 데 이어 상당 기간 기준금리를 인하하지 않을 가능성을 제기하였다. 금융시장 참여자들의 향후 기준금리 변경에 대한 기대가 대체로 연준의 정책 방향에 부합하고 있다는 점을 고려하면9), 금리인하가 가시화되기까지는 국채금리 결정요인 중 기준금리의 영향이 낮아질 가능성이 있다. 이런 가운데 연준이 기준금리를 동결하고 있으나 양적 긴축(quantitative tightening)은 지속하고 있다. 또한 최근 미국의 신용등급 강등 사례에서 나타나듯 미국의 재정문제가 재차 두드러질 수 있다.10) 따라서 기준금리가 동결되더라도 양적 긴축 및 재정적자에 따른 국채발행 증가 등으로 인해 기간 프리미엄이 정상화될 수 있다. 7월 이후 가파른 상승에도 불구하고, <그림 Ⅲ-2>에서 확인할 수 있듯이 최근 미국 기간 프리미엄은 여전히 역사적으로 매우 낮은 수준에 머물고 있다. 이상의 점들을 종합할 때, 향후 기간 프리미엄이 국채금리의 상승을 유발(또는 하락을 제한)하는 요인으로 작용할 가능성이 있는 것으로 평가해볼 수 있다.

3. 우리나라 통화정책 및 국채금리에 대한 시사점

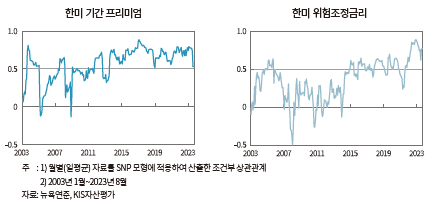

최근 우리나라 국채금리는 미국 국채금리의 영향을 받으며 강하게 동조화되고 있다. 조건부 상관관계(conditional correlation)11)를 통해 한미 국채금리 동조화를 살펴보면 우리나라 국채금리는 미국 금리와 동조화되는 가운데 특히 2022년 이후에는 동조화 강도가 현저히 높아졌다.12) 한미 국채금리 동조화 원인을 금리 결정요인 관점에서 양국 기간 프리미엄 및 위험조정금리 동조화로 나누어볼 수 있다. <그림 Ⅳ-3>에서 나타나듯 위험조정금리(통화정책에 대한 기대)의 동조화는 과거에는 높지 않았으나, 2022년 이후에는 한미 긴축의 영향으로 강화되었다가 2023년 2분기부터 양국의 정책기조가 엇갈리며 동조화가 약해지고 있다. 미국의 기준금리 인하가 가시화되기 전까지 위험조정금리 경로를 통한 한미 국채금리 동조화는 약해질 가능성이 높은 것으로 판단된다. 한미 국채금리 동조화는 주로 기간 프리미엄 경로를 통해 발생해왔다. 양국의 기간 프리미엄 동조화는 물가 불확실성 등과 같은 공통요인의 영향으로 나타날 수 있으나, 미국 기간 프리미엄이 우리나라 기간 프리미엄 결정요인으로 작용하여 동조화가 강해질 수 있다는 점에 주목할 필요가 있다. 이러한 점은 미국 국채금리가 기간 프리미엄 경로를 통해 우리나라 국채금리에 영향을 미칠 수 있음을 의미한다(오형석, 2020; 구병수, 2022). 따라서 미국 기간 프리미엄이 정상화될 경우 우리나라 국채금리의 중요 상승요인으로 작용하여 국내 통화정책의 유효성을 제한하는 결과를 가져올 수 있으므로 유의할 필요가 있다. 특히 한은이 기준금리를 동결하고 있는 상황에서 기간 프리미엄 경로를 통해 국채금리가 상승하면 의도하지 않은 긴축효과가 발생할 수 있다.

아울러, 중장기 국채금리에 대한 미국 기준금리 인상 영향력 감소가 역대 최고수준까지 확대된 한미 기준금리(및 기준금리에 연동되는 단기금리) 역전에도 기여한 것으로 판단된다. 물론 미국의 인플레이션 강도가 우리나라보다 높았다는 점을 한미 기준금리 역전의 주요 원인으로 꼽을 수 있을 것이다. 여기에, 동일한 긴축효과를 유발하기 위해 우리나라보다 미국의 기준금리 인상폭이 클 수 있다는 점 또한 기준금리 역전폭 심화에 영향을 미친 것으로 볼 수 있다. 기준금리 역전의 주요 원인이 미국에 있다는 점은 국내 통화정책 대응에 어려움이 가중될 수 있음을 의미한다. 잠재적인 환율 변동성 확대 위험에 대응할 수 있는 방안을 마련할 필요가 있다.

1) Adrian et al.(2013) 방법에서 위험조정금리는 채권의 만기까지 1개월 만기 선도금리의 평균로 산출된다. 따라서 현재 국채 수익률곡선(yield curve)에 내재된 향후 기준금리 경로를 반영한다.

2) Adrian et al.(2013)을 통한 국채금리 결정요인 추정은 <부록 1>을 참고하기 바란다.

3) 모형의 개요에 대해서는 <부록 2>를 참고하기 바란다.

4) 1955년부터 코로나19 감염확산 이전까지 모든 경기침체 이전에 장단기 금리 역전 현상이 발생했다(Bauer & Mertens, 2018). 이러한 점에 착안하여 뉴욕 연준과 클리블랜드 연준은 국채의 수익률 곡선 정보로부터 경기침체 확률을 구하는 모형을 운영 중이다

5) HMDA(Home Mortgage Disclosure Act)에 따르면 2021년 기준 전체 주택대출의 70%가 30년 고정금리 대출인 것으로 나타났다.

6) 예를 들어 뉴욕 연준의 DSGE 모형에 의한 실질중립금리 추정치는 2021년 1분기 –15.9%에서 2023년 1분기에 3.6%로 상승한 것으로 나타났다.

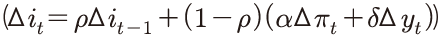

7) 중앙은행의 명목 정책금리 는 실질중립금리

는 실질중립금리 , 인플레이션 목표

, 인플레이션 목표  및 GDP갭(

및 GDP갭( )과 인플레이션 상황

)과 인플레이션 상황  을 감안한

을 감안한  와 같은 테일러 준칙(Taylor rule)을 따른다고 하면 기초경제 여건과 관련이 있는 실질중립금리

와 같은 테일러 준칙(Taylor rule)을 따른다고 하면 기초경제 여건과 관련이 있는 실질중립금리 와 인플레이션 목표

와 인플레이션 목표  및 잠재GDP

및 잠재GDP 는 단기에서 안정적

는 단기에서 안정적 이므로 비관측 변수들에 의존하지 않는 준칙

이므로 비관측 변수들에 의존하지 않는 준칙 을 도출할 수 있다.

을 도출할 수 있다.

8) 국채금리는 Adrian et al.(2013) 모형에 의해 추정된 10년물 국채금리를 의미하며, 실제 10년 만기 국채금리의 변화폭은 0.24%p이다. 10년물 국채금리 고점(8월 21일 4.34%)을 기준으로 보면, 국채금리, 기간 프리미엄 및 위험조정금리의 상승폭은 각각 0.45%p, 0.35%p 및 0.10%p이다.

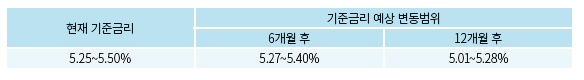

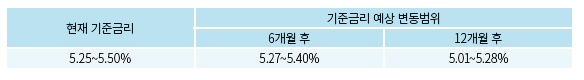

9) Adrian et al.(2013) 모형을 이용해 미국 국채 수익률곡선에 내재된 향후 기준금리 인상경로에 대한 기대를 추정할 수 있는데, 7월 금리인상 이후 미국 국채시장 참여자들은 내년 상반기 중 1회 정도의 금리인하를 예상 중인 것으로 분석되었다. 시장참여자들이 6개월 내 금리인하 가능성을 낮게 보고 있는 점은 상당 기간 기준금리 동결을 시사하고 있는 연준의 기조가 영향을 미친 결과로 해석할 수 있다. 7월 27일부터 8월 31일까지 Adrian et al.(2013) 모형을 통해 추정한 향후 6개월 및 12개월 후 기준금리에 대한 시장 예상치의 변동범위는 아래 표와 같다.

10) 콜럼비아 대학교의 미시킨(Mishkin) 교수는 2023년 8월 KCMI Global Issue에서 미국의 기간 프리미엄 상승을 촉발시킬 주요 요인으로 재정적자 누증 및 이를 규율하지 못하는 정치적 난맥상을 꼽은 바 있다.

11) Gallant & Nychka(1987) 및 Gallant & Tauchen(2017)의 SNP(semi-nonparametric) 방법을 이용하여 한미 국채금리, 기간 프리미엄 및 위험조정금리 간 조건부 상관관계를 추정하였다.

12) <부록 2>에는 조건부 상관관계(conditional correlation)를 통해 살펴본 한미 국채금리, 기간 프리미엄 및 위험조정금리 동조화 현상이 정리되어 있다. 2022년 1월부터 2023년 8월까지 한미 국채금리 상관관계는 0.82~0.92에서 변동 중이다.

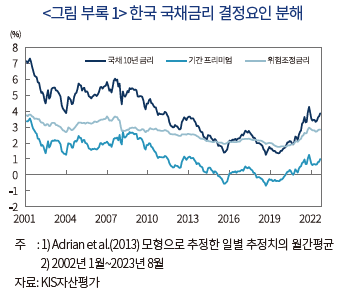

<부록 1> ACM 모형을 사용한 한미 국채금리 결정요인 추정

Adrian et al.(2013)의 이자율기간구조모형(ACM모형)은 1개월부터 120개월 만기의 일별 할인채 금리를 사용하여 추정한다. 미국의 할인채 금리는 1970년 1월 2일부터 2023년 8월 31일까지 연준이 Gurkayank et al.(2006)의 방법에 의해 도출하여 제공하는 데이터를 사용하였다. 다음으로 국내 할인채 금리는 2002년 1월 2일부터 2023년 8월 31일까지 KIS자산평가가 추정한 만기별 할인채 금리를 사용하였다. <그림 Ⅲ-2>에는 미국 10년 만기 국채금리의 추정결과가 나타나 있으며, 한국 10년물 국채금리 분해결과는 아래 <그림 부록 1>과 같다.

<부록 2> Sudo & Tanaka(2020) 모형을 통한 미국 양적완화의 장기국채 기간 프리미엄에 대한 영향 추정

Sudo & Tanaka(2020) 모형은 일본은행의 양적완화 효과를 기간중 채권 매입량에 따른 유량효과(flow effect)와 매입한 채권의 총량에 의한 잔액효과(stock effect)로 구분하여 추정하기 위해 개발된 모형으로 본고에서는 미 연준의 양적완화 효과를 추정하기 위해 미국 데이터를 사용하여 추정하였다. Sudo & Tanaka(2020) 모형은 국채 시장 투자자의 시장 분할 및 선호시장 가설을 바탕으로 장단기 국채의 불완전 대체성에 기반한 동태적 확률 일반균형(DSGE)으로 모형의 개괄적인 내용은 다음과 같다.

■ 수요: 가계는 장단기 채권을 모두 거래할 수 있으나 장기채권에 대한 거래 비용이 발생하는 무제한 가계와 장기채권만 거래할 수 있으나 거래비용은 없는 제한 가계로 구분

■ 공급: 기업 부문이 독점적 경쟁시장에서 생산되는 중간재와 완전 경쟁적인 최종재로 구분되며 중간재 생산기업은 노동과 자본을 이용해 중간재를 생산하며, 최종재 생산기업은 중간재를 변환하여 소비재 및 자본으로 전환

■ 정부 및 중앙은행: 정부는 국채를 공급하며 중앙은행은 테일러 준칙에 따라 금리를 설정하는 한편 장기국채를 매입. 장기국채 매입은 지난기의 국채 보유량과 중앙은행의 장기 국채보유 균형에 의존하는 것으로 가정

■ 외생 충격: 가계의 선호 및 노동 공급 충격, 기업의 가격 마크업 충격, 기술 충격, 투자에 대한 조정비용 충격, 통화정책 충격, 정부의 지출 충격 및 장기국채 공급 충격, 조세충격, 장기국채에 대한 거래비용 충격, 중앙은행의 양적완화 충격

모형은 2001년 4분기부터 2022년 4분기까지 미국의 GDP, CPI, 소비, 비주거용 투자, 실질임금, 취업자수, 기준금리, 10년물 국채금리, 연준의 실질 국채 보유액을 사용하였으며 베이지언 기법으로 추정되었다.

참고문헌

강현주, 2023, 미국 실물경제의 금리 민감도 하락 및 시사점, 자본시장연구원 『자본시장포커스』 2023-12호, 자본시장연구원.

구병수, 2022, 미국 인플레이션 국면별 기대인플레이션과 기간프리미엄이 국내 수익률곡선에 미치는 비대칭적 영향, 한국은행 『조사통계월보』 제76권 제7호, 3-27.

오형석, 2020, 우리나라 장기금리 기간프리미엄 분석 및 정책적 시사점, 『금융연구』 제34권 제4호, 27-59.

Adrian, T., Crump, R., Moench, E., 2013, Pricing term structure with linear regression, Journal of Financial Economics 110(1), 110-138.

Baker, K., Casey, L., Del Negro, M., Gleich, A., Nallamotu, R., 2023, The Post-Pandemic r*, Liberty Street Economics, August 9.

Bauer, M., Mertens, T.M., 2018, Economic Forecasts with the Yield Curve, FRBSF Economic Letters 2018-07.

Bernanke, B.S., 2016, Why are interest rates so low, part 4: Term premiums, available at https://www.brookings.edu.

Boivin, J., Kiley, M.T., Mishkin, F.S., 2011, How Has the Monetary Transmission Mechanism Evolved Over Time? Handbook of Monetary Economics 3a, 369-422.

Boivin, J., Giannoni, M.P., 2006, Has Monetary Policy Become More Effective? Review of Economics and Statistics 88(3), 445-462.

Bonis, B., Ihrig, J., Wei, M., 2017, The Effect of the Federal Reserve’s Securities Holdings on Long-term Interest Rates, FEDS Notes, April, 20.

Brand, C., Mazelis, F., 2019, Taylor-rule consistent estimates of the natural rate of interest, ECB working paper No.2257.

Clarida, R., Gali, J., Gertler, M., 2000, Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory, Quarterly Journal of Economics, 115(1), 147-180.

Corrado, C.,A, Hulten, C.R., (2010, How do you measure a “technological revolution”? American Economic Review 100(2), 99–104.

Crawley, E., Gagnon, E., Hebden, J., Trevino, J., 2022, Substitutability between Balance Sheet Reduction and Policy Rate Hikes: Some Illustrations and a Discussion, FEDS Notes, June 03.

Döttling, D., Ratnovski, L., 2023, Monetary policy and intangible investment, Journal of Monetary Economics 134, 53-72.

Dynan, K., Elmendorf, D., Sichel, D., 2005, Can Financial Innovation Help to Explain the Reduced Volatility of Economic Activity?, Journal of Monetary Economics 53(1), 123-150.

Fiorentini, G., Galesi, A., Perez-Quiros, G., Sentana, E., 2018, The rise and fall of the natural interest rate, CEPR Discussion Papers 13042.

Forbes, K., 2019, Has globalization changed the inflation process?, BIS working papers No.791.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica 55(2), 363-390.

Gallant, R.A., Tauchen, G., 2017, SNP: A program for nonparametric time series analysis, Manuscript, Duke University.

Gamber, E., Hung, J., 2001, Has the rise in globalization reduced U.S. inflation in the 1990s?, Economic Inquiry 39(1), 58-73.

Gurkaynak, R.S., Sack, B., Wright, J.H., 2006, The U.S. Treasury yield curve: 1961 to present, FRB Finance and Economics Discussion Series 2006-28.

Kish, R.J., 2022, The Dominance of the U.S. 30-Year Fixed Rate Residential Mortgage, Journal of Real Estate Practice and Education 24:1, 1-16.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lian, W., Novta, N., Pugacheva, E., Timmer Y., Topalova, P., 2020, The price of capital goods: a driver of investment under threat, IMF Economic Review 68, 509-549.

Sajedi, R., Thwaites, G., 2016, Why are real interest rates so low? The role of the relative price of investment goods, IMF Economic Review 64(4), 635-659.

Wall Street Journal (WSJ), 2023.10.8, The U.S. economy’s secret weapon: Seniors with money to spend.

Zhou, X., 2022, Existing Low-Rate Mortgages Blunt Impact of Recent Rate Surge, Dalls Fed Economics, December 27.

2022년 하반기 이후 미국의 가파른 물가상승세에 대응하여 기준금리가 큰 폭으로 인상되면서 경기둔화 우려가 커지기 시작했다. 이에 따라 주요 예측기관들은 당초 2023년 중 미국의 경제성장률이 크게 하락할 것으로 예측하였다. <그림 Ⅰ-1>은 미국의 2023년 경제성장률 전망치가 2021년 초부터 최근까지 시점별로 어떻게 변했는지를 보여준다. <그림 Ⅰ-1>에 따르면 2022년 7월 이후 컨센서스 전망치가 급락하였으며 특히 연말에는 2023년 중 마이너스 성장 가능성을 예측했던 기관들이 적지 않았음을 알 수 있다. 그러나 이후 미국 경기가 양호한 고용 및 민간소비를 중심으로 예상보다 견조한 성장 흐름을 나타내면서 성장 전망치가 점차 상향 조정되었다. IMF 또한 예외가 아니어서 2023년 성장률 전망치를 2022년 10월에는 1.0%로 전망했다가 2023년 1월 1.4%, 4월 1.6%, 7월 1.8%, 10월 2.1%로 계속해서 상향 조정하였다. 성장률 전망치가 비교적 조기에 조정된 것과 달리 12개월 후 경기침체 발생확률(Reuters 설문)은 상대적으로 더디게 반응하여 7월까지 50%를 유지하였으나 7월 FOMC 기자간담회에서 포웰(Powell) 연준 의장이 2023년 중 경기침체 가능성을 배제한다고 밝힌 이후 큰 폭으로 하락하여 최근(2023년 9월)에는 30%까지 하락한 상황이다.

Ⅱ. 미국 경제의 금리 민감도 하락에 대한 선행연구

미국에서 1990년대 이후 실물경제의 금리 민감도가 하락하면서 통화정책의 유효성이 의문시됨에 따라 금리 민감도 하락원인에 대한 다양한 원인들이 제기되었다. 아래에서는 금융규제 완화, 통화정책 대응체계의 개선, 미국 경제의 구조 변화를 중심으로 기존 선행연구 결과들을 정리한다.

1. 금융규제 완화

우선, 미국에서 1980년대 이후 금융규제가 완화되고 초장기 고정금리 대출 도입과 같은 금융혁신 등으로 저신용 가계 및 기업 차주에 대한 신용제약이 완화되면서 금리와 실물경제 간 관계가 저하되었을 수 있다. 1930년대 대공황기 은행 간 예금경쟁을 규제하기 위해 도입된 은행 예금금리에 대한 상한 규제(regulation Q)는 1980년대 단계적으로 철폐되기 전까지 기준금리 인상이 실물경제에 미치는 영향을 증폭시키는 역할을 했다(Dynan et al., 2005). 즉, 금리상한제 하에서는 금리 상승기에 시장금리가 예금금리 상한을 웃돌게 될 경우 예금이 MMF 등으로 이탈(disintermediation)하게 됨에 따라 금융기관들의 대출 여력이 축소되면서 신용공급이 위축되었다. 금리상한제 철폐 이후 비록 금리상승기에 은행을 통한 조달비용이 상승하였으나 신용공급이 크게 축소되지는 않았기 때문에 금리인상의 실물긴축 효과가 이전에 비해 줄어들었다.

2. 통화정책 대응체계 개선

경기 변동에 대한 이해가 확대되면서 통화정책 대응체계가 개선된 점 또한 금리 민감도 하락에 기여했다는 지적들이 존재한다(Clarida et al., 2000; Boivin & Giannoni, 2006; Boivin et al., 2011; Coibion & Gorodnichenko, 2011). 1960~1970년대와 달리 볼커(Volcker) 의장 이후 미 연준의 인플레이션에 대한 적극적 대처 및 물가안정목표제의 성공적 운영 등으로 중앙은행에 대한 신뢰가 높아져 인플레이션에 대한 경제주체들의 기대가 안정되었다. Reifschneider et al.(1999)에 따르면 통화정책의 단기적 효과가 주로 경제주체들의 미래 통화정책이나 경기전망 및 인플레이션의 기대 변화를 통해 실물경제에 영향을 미치는 것으로 나타난 가운데, Boivin et al.(2011)의 실증분석에 의하면 과거와 달리 최근에는 기준금리 인상 충격에 대해 기대 인플레이션이 거의 변하지 않는 것으로 나타났다. 한편 기준금리 외에도 양적완화나 사전적 지침(forward guidance)과 같은 통화정책 수단이 확대된 점 또한 기준금리의 영향력 변화에 기여했을 것으로 판단된다. Crawley et al.(2022)에 따르면 양적완화 또는 양적긴축 등을 통해 2.5조달러의 연준 보유자산이 변동하는 것이 대체로 기준금리 50bp 변동에 상응한다고 보고하고 있다.

세계화의 진전에 따른 글로벌 공급망 확대 등 공급부문의 구조변화 또한 금리 민감도 하락을 촉진하였을 것으로 보인다(Gamber & Hung, 2001; Forbes, 2019). 미국 기업의 다국적화로 생산 공정 중 상당 부분이 해외에서 이뤄지는 한편 아마존(Amazon)을 비롯한 인터넷 유통혁신 등으로 미국의 통화정책 변화가 생산비용에 미치는 영향이 축소된 반면 글로벌 요인들이 미국 물가에 미치는 영향은 크게 확대되었다. 특히 교역 확대로 자본재의 가격이 하락하면서 설비투자에 필요한 자금 수요가 줄어든 점 또한 금리 민감도 하락에 기여했을 수 있다(Sajedi & Thwaites, 2016; Lian et al., 2020).

기술혁신에 따른 기업의 자금조달 구조 변화가 통화정책이 기업 투자에 미치는 영향도를 낮췄을 가능성도 존재한다. 기술진보로 무형자산(intangible asset)의 중요성이 증가함에 따라 기업의 투자에도 변화가 발생할 수 있는데, 실제로 Corrado & Hulten(2010)에 따르면 미국의 경우 2000년을 전후한 시점부터 무형자산 투자가 유형자산을 상회하기 시작하였다. Döttling & Ratnovski(2023)가 미국 기업을 분석한 결과 기업의 무형자산 비중이 높을수록 금리에 대한 투자 민감도가 하락하는 것으로 나타났다. 이는 해당 기업의 자금조달에서 금리에 민감한 부채(debt financing)보다 자기자본(equity financing)의 중요성이 높다는 측면에서 이해할 수 있다. 동 연구에서는 무형자산의 중요성이 높은 혁신기업일수록 주가의 금리 민감도가 낮은 것으로 분석되었다.

Ⅲ. 금번 기준금리 인상기 금리경로의 약화

기존 선행연구에서 제시된 금리 민감도 하락 원인 중 어떠한 원인이 금번 금리인상기에 중요한 역할을 하였는지 명확히 알 수는 없으나, 본 장에서는 통화정책의 전통적 파급경로 중 금리경로가 제약된 점에 주목하여 분석하고자 한다. 즉, 중앙은행이 기준금리를 상향 조정하면 단기 시장금리와 함께 장기 시장금리 및 은행의 대출금리가 상승하여 가계소비와 기업대출을 줄여 생산을 위축시키는 역할을 한다. 그러나 금번 금리인상기에서는 기준금리 인상에도 불구하고 미국의 장기 시장금리는 과거에 비해 상승폭이 낮을 뿐만 아니라 민간대출에서 고정금리 비중 확대로 민간에 전가되는 금리 부담이 제한적인 점이 영향을 미친 것으로 판단된다.

1. 기간 프리미엄의 하향 안정에 따른 장기금리 상승 제한

금번 금리인상기 동안 미국의 국채금리는 2022년 2월 평균 1.97%에서 2023년 7월 3.82%로 상승하였다. 즉, 미국의 기준금리가 5.25%p 인상되는 동안 국채금리 상승폭은 1.85%p에 그쳤다. 금번 기준금리 인상기의 미국 국채금리 변화는 과거 인상기와 비교해도 이례적이다. <그림 Ⅲ-1> 에서 1982년 이후 미국의 금리인상기를 살펴보면, 대체로 국채금리가 최종 기준금리와 유사한 수준까지 상승하였다는 점을 확인할 수 있다. 이에 반해 금번에는 국채금리 고점(2021년 8월 21일 4.34%)이 최종 기준금리(2023년 7월 5.50%, 작성 시점 기준)를 크게 하회하였다. 이러한 결과는 통화정책 측면에서 장기금리의 기준금리 인상에 대한 민감도가 과거에 비해 크게 낮아졌으며 궁극적으로 중앙은행이 기준금리 인상을 통해 의도한 만큼의 통화긴축 효과가 나타나지 않을 수 있음을 시사한다.

<그림 Ⅲ-2>에는 Adrian et al.(2013)에 제시된 방법을 사용하여 10년 만기 국채금리를 통화정책에 대한 기대(위험조정금리)1) 및 기간 프리미엄으로 분해한 결과가 나타나 있다.2) 다음으로 <표 Ⅲ-1>에는 위에서 언급된 방법을 통해 산출된 금번 기준금리 인상기 동안의 국채금리 결정요인 변화가 정리되어 있다. 분석 결과 미국의 국채금리 상승은 기간 프리미엄이 소폭 하락한 가운데 전적으로 기준금리 인상에 따른 위험조정금리에 의해 유발되었음을 알 수 있다. <그림 Ⅲ-2>에서 확인할 수 있듯이 2020년 이후 최근까지 미국의 기간 프리미엄은 1970년대 이후 가장 낮은 수준에 머물러있다. 금번 기준금리 인상기 동안의 높은 인플레이션 및 통화정책 불확실성을 고려할 때, 미국 기간 프리미엄이 이처럼 낮은 수준에서 유지된 것은 매우 이례적인 현상이다.

양적완화가 미 국채의 기간 프리미엄에 미친 영향을 살펴보기 위해 Sudo & Tanaka(2021)3)의 모형을 미국 데이터를 이용하여 추정하여 보았다. <그림 Ⅲ-3>에서 나타나듯 동 모형으로부터 양적완화를 통해 중앙은행이 보유한 국채 보유 잔액이 장기 국채 금리에 미치는 영향, 즉 잔액 효과(stock effect)를 추정한 결과 2022년말 기준 기간 프리미엄을 약 100bp 하락시킨 것으로 나타났다. 추정의 불확실성이 상당하나, 이러한 결과는 연준의 기존 연구 결과들과 유사한 것으로 보인다. 예를 들어 Bonis et al.(2017)은 2017년 말 연준의 국채 보유에 따른 10년물 기간 프리미엄 하락 효과를 85bp로 추정하였는데 Sudo & Tanaka(2021) 모형을 통한 해당 시점의 추정치(77bp)와 상당히 근접한 결과이다. 이러한 분석 결과를 고려하면 장단기 금리의 역전으로 앞서 지적한 바와 같이 국채 금리의 고점이 최종 기준금리를 크게 하회하는 원인이 연준의 대규모 자산 보유에서 비롯되는 것으로 해석할 수 있다. 또한 여기서는 미국의 양적완화에 의한 기간 프리미엄 하락 효과만을 고려하고 있으나, 코로나19 감염확산 기간에 유로지역, 일본 및 영국 등의 유동성 확대가 미국 국채 시장에 미쳤을 영향(spillback)을 감안하면 추가적인 장기금리 하락 압력이 존재했을 가능성이 크다. 마찬가지로 장단기 금리 역전이 경기침체가 임박했음을 나타내는 주요 예측 지표로 사용4)됐으나, 과거와 달리 장기금리가 양적완화의 영향으로 하향 안정화됨에 따라 왜곡된 신호를 제공하고 있을 가능성이 존재한다.

글로벌 금융위기 이후 미국의 가계부채가 축소된 데다 주택시장을 중심으로 고정금리 대출 비중이 높아 차입자의 이자 부담이 많이 늘어나지 않아 금리 인상의 영향이 더욱 약화되었을 수 있다. <그림 Ⅲ-4>는 미국 주택금융에서 변동금리 대출의 비중을 보여주고 있는데 1980년대 초반 50% 수준이던 대출금리 비중은 정부 보증기관들에 의한 주택금융의 증권화(securitization)에 힘입어 30년 고정금리 대출이 가장 보편적인 형태5)로 자리매김함에 따라 글로벌 금융위기 이후 최근까지 10%를 하회하고 있다. 2023년 1분기 기준 주택금융이 가계 및 비영리 법인의 전체 부채중 65.9%를 차지하는 가운데 전체 주택금융중 40% 이상이 초저금리 기간인 2021~2022년중에 실행됨에 따라 가계의 주택금융과 관련된 이자 부담은 크게 늘지 않은 것으로 나타났다(<그림 Ⅲ-5> 참조). <그림 Ⅲ-6>에 나타나듯 실제로 금리 인상에도 불구하고 가계의 가처분 소득 대비 원리금 상환부담은 2023년 1분기 기준 9.6%으로 급격한 금리인상에도 불구하고 코로나19 감염확산 직전인 2019년 당시(9.8%)보다 낮은 수준이다. 가계의 원리금 상환부담이 낮게 유지되고 있는 것은 주택금융 상환부담이 현재와 기준금리 수준이 같은 2007년 3분기의 절반 수준이기 때문이다.

1. 통화정책 및 성장경로의 불확실성

실물경제의 금리 민감도 하락에 따른 일차적 문제는 기준금리의 준거(reference) 역할을 하는 실질중립금리 추정의 불확실성 확대로 향후 중앙은행의 통화정책 경로에 대한 불확실성을 확대시킨다는 점이다. 실질중립금리란 실물경기를 자극하지도 위축시키지도 않는 균형 수준의 금리인 만큼 직접 관측할 수 없으며 모형을 통해 추정해야 한다. 따라서 실물경제와 금리의 관계가 미약해지면 실물경제 변수를 통해 관측할 수 없는 실질중립금리를 추정할 때 발생하는 불확실성이 더욱 커질 수밖에 없다(Fiorentini et al., 2018). 특히 금리 민감도 하락을 충분히 고려하지 못할 경우 실질중립금리 추정치가 매우 경기순행적(procyclical)일 수 있어 잘못된 통화정책 판단을 내릴 수 있다. 글로벌 금융위기 이후 코로나19 감염확산 이전까지 저금리에도 불구하고 통화정책이 경기를 부양하지 못하자 실질중립금리의 하락 및 제로금리 하한으로 통화정책이 충분히 완화적이지 못하기 때문이라는 주장이 보편적으로 받아들여졌다. 그러다가 최근 가파른 금리인상에도 불구하고 미국 경제가 견조한 흐름을 이어가자 일각에서는 실질중립금리가 상승하여 통화정책이 충분히 긴축적이지 못하기 때문이라는 주장이 제기되고 있다(Baker et al., 2023). 이러한 주장들은 통화정책의 유효성이 과거와 동일하다고 가정한 결과 글로벌 금융위기 이후 지속되는 실물경제와 금리간 관계 약화를 실질중립금리의 변화에 기인한 것으로 설명하고 있으나, 개념상 경제의 균형금리인 실질중립금리가 단기간에 급변6)한다는 주장은 받아들이기 힘들다. 실제로 학계와 중앙은행에서 널리 사용되는 Laubach & Williams(2003) 모형에 기반한 준구조 모형으로 미국의 실질중립금리를 추정할 때 표본기간을 두 구간(1961년 1분기~1990년 4분기 및 1991년 1분기~2023년 1분기)으로 구분하면 과거에 비해 실물경제와 실질금리간 관계를 반영하는 IS(Investment-Saving) 곡선의 기울기가 크게 평탄화(flattening)되었음을 확인할 수 있다(강현주, 2023).

이에 따라 균형 수준의 통화긴축 정도를 사전적으로 판단하기 어려워져 경제지표에 임기응변식으로 대응하는 통화정책 운영이 상당 기간 지속될 수 있다. 실제로 뉴욕 연준의 윌리암스(Williams) 총재는 과거 발표된 논문(Orphanides & Williams, 2002)을 통해 중립금리 수준의 불확실성이 클 경우 잘못 추정했을 가능성이 높은 중립금리 수준을 고려하기 보다는 인플레이션과 실물경제 변화에 대응하여 금리를 조정하는 방식(first-difference rule)7)이 바람직하다고 지적한 바 있다. 코로나19 감염확산 이후 경제전망의 불확실성과 함께 발표되는 경제지표가 상이한 시그널을 제공함에 따라 금리인상 지속 및 동결 여부에 대해 시장 참가자들은 물론 연준 내부에서조차 견해가 엇갈릴 수 있다.

실물경제의 금리 민감도 하락에 따른 실질중립금리의 추정의 어려움은 적정한 긴축 정도에 대한 판단을 어렵게 하여 향후 성장경로에 대한 불확실성으로 이어지고 있다. 2023년 미국의 경제성장률 전망에 대해 전문적인 경제예측 기관들이 집단적으로 오류를 나타내었음을 Ⅰ장에서 언급한 바 있는데 이러한 문제는 2024년 성장률 전망에서 다시 재연되고 있다. <그림 Ⅳ-1>은 2023년 9월 기준 주요 예측기관들의 2024년 미국 성장률 전망치 분포를 나타내고 있다. 주요 대형 IB들 사이에서도 전망치가 0%에서 2%로 크게 상이하다.

앞으로는 미국 국채금리 결정요인 중 기간 프리미엄에 관심을 가질 필요가 있다. 실제로 미국 국채금리는 연준의 2023년 7월 금리인상 이후 변동성이 확대되는 가운데 상승세를 나타냈다. 10년물을 기준으로 7월 인상일 대비 8월 31일 국채금리, 기간 프리미엄 및 위험조정금리의 상승폭은 각각 0.22%p, 0.19%p 및 0.03%p로 확인되었다.8) 결과적으로 7월 인상 이후의 국채금리 상승은 통화정책 변경에 대한 기대가 안정된 가운데, 주로 기간 프리미엄 확대에 기인한 것으로 나타났다.

한편 연준은 6월 FOMC에서 기준금리를 동결한 데 이어 상당 기간 기준금리를 인하하지 않을 가능성을 제기하였다. 금융시장 참여자들의 향후 기준금리 변경에 대한 기대가 대체로 연준의 정책 방향에 부합하고 있다는 점을 고려하면9), 금리인하가 가시화되기까지는 국채금리 결정요인 중 기준금리의 영향이 낮아질 가능성이 있다. 이런 가운데 연준이 기준금리를 동결하고 있으나 양적 긴축(quantitative tightening)은 지속하고 있다. 또한 최근 미국의 신용등급 강등 사례에서 나타나듯 미국의 재정문제가 재차 두드러질 수 있다.10) 따라서 기준금리가 동결되더라도 양적 긴축 및 재정적자에 따른 국채발행 증가 등으로 인해 기간 프리미엄이 정상화될 수 있다. 7월 이후 가파른 상승에도 불구하고, <그림 Ⅲ-2>에서 확인할 수 있듯이 최근 미국 기간 프리미엄은 여전히 역사적으로 매우 낮은 수준에 머물고 있다. 이상의 점들을 종합할 때, 향후 기간 프리미엄이 국채금리의 상승을 유발(또는 하락을 제한)하는 요인으로 작용할 가능성이 있는 것으로 평가해볼 수 있다.

최근 우리나라 국채금리는 미국 국채금리의 영향을 받으며 강하게 동조화되고 있다. 조건부 상관관계(conditional correlation)11)를 통해 한미 국채금리 동조화를 살펴보면 우리나라 국채금리는 미국 금리와 동조화되는 가운데 특히 2022년 이후에는 동조화 강도가 현저히 높아졌다.12) 한미 국채금리 동조화 원인을 금리 결정요인 관점에서 양국 기간 프리미엄 및 위험조정금리 동조화로 나누어볼 수 있다. <그림 Ⅳ-3>에서 나타나듯 위험조정금리(통화정책에 대한 기대)의 동조화는 과거에는 높지 않았으나, 2022년 이후에는 한미 긴축의 영향으로 강화되었다가 2023년 2분기부터 양국의 정책기조가 엇갈리며 동조화가 약해지고 있다. 미국의 기준금리 인하가 가시화되기 전까지 위험조정금리 경로를 통한 한미 국채금리 동조화는 약해질 가능성이 높은 것으로 판단된다. 한미 국채금리 동조화는 주로 기간 프리미엄 경로를 통해 발생해왔다. 양국의 기간 프리미엄 동조화는 물가 불확실성 등과 같은 공통요인의 영향으로 나타날 수 있으나, 미국 기간 프리미엄이 우리나라 기간 프리미엄 결정요인으로 작용하여 동조화가 강해질 수 있다는 점에 주목할 필요가 있다. 이러한 점은 미국 국채금리가 기간 프리미엄 경로를 통해 우리나라 국채금리에 영향을 미칠 수 있음을 의미한다(오형석, 2020; 구병수, 2022). 따라서 미국 기간 프리미엄이 정상화될 경우 우리나라 국채금리의 중요 상승요인으로 작용하여 국내 통화정책의 유효성을 제한하는 결과를 가져올 수 있으므로 유의할 필요가 있다. 특히 한은이 기준금리를 동결하고 있는 상황에서 기간 프리미엄 경로를 통해 국채금리가 상승하면 의도하지 않은 긴축효과가 발생할 수 있다.

1) Adrian et al.(2013) 방법에서 위험조정금리는 채권의 만기까지 1개월 만기 선도금리의 평균로 산출된다. 따라서 현재 국채 수익률곡선(yield curve)에 내재된 향후 기준금리 경로를 반영한다.

2) Adrian et al.(2013)을 통한 국채금리 결정요인 추정은 <부록 1>을 참고하기 바란다.

3) 모형의 개요에 대해서는 <부록 2>를 참고하기 바란다.

4) 1955년부터 코로나19 감염확산 이전까지 모든 경기침체 이전에 장단기 금리 역전 현상이 발생했다(Bauer & Mertens, 2018). 이러한 점에 착안하여 뉴욕 연준과 클리블랜드 연준은 국채의 수익률 곡선 정보로부터 경기침체 확률을 구하는 모형을 운영 중이다

5) HMDA(Home Mortgage Disclosure Act)에 따르면 2021년 기준 전체 주택대출의 70%가 30년 고정금리 대출인 것으로 나타났다.

6) 예를 들어 뉴욕 연준의 DSGE 모형에 의한 실질중립금리 추정치는 2021년 1분기 –15.9%에서 2023년 1분기에 3.6%로 상승한 것으로 나타났다.

7) 중앙은행의 명목 정책금리

는 실질중립금리

는 실질중립금리 , 인플레이션 목표

, 인플레이션 목표  및 GDP갭(

및 GDP갭( )과 인플레이션 상황

)과 인플레이션 상황  을 감안한

을 감안한  와 같은 테일러 준칙(Taylor rule)을 따른다고 하면 기초경제 여건과 관련이 있는 실질중립금리

와 같은 테일러 준칙(Taylor rule)을 따른다고 하면 기초경제 여건과 관련이 있는 실질중립금리 와 인플레이션 목표

와 인플레이션 목표  및 잠재GDP

및 잠재GDP 는 단기에서 안정적

는 단기에서 안정적 이므로 비관측 변수들에 의존하지 않는 준칙

이므로 비관측 변수들에 의존하지 않는 준칙 을 도출할 수 있다.

을 도출할 수 있다.8) 국채금리는 Adrian et al.(2013) 모형에 의해 추정된 10년물 국채금리를 의미하며, 실제 10년 만기 국채금리의 변화폭은 0.24%p이다. 10년물 국채금리 고점(8월 21일 4.34%)을 기준으로 보면, 국채금리, 기간 프리미엄 및 위험조정금리의 상승폭은 각각 0.45%p, 0.35%p 및 0.10%p이다.

9) Adrian et al.(2013) 모형을 이용해 미국 국채 수익률곡선에 내재된 향후 기준금리 인상경로에 대한 기대를 추정할 수 있는데, 7월 금리인상 이후 미국 국채시장 참여자들은 내년 상반기 중 1회 정도의 금리인하를 예상 중인 것으로 분석되었다. 시장참여자들이 6개월 내 금리인하 가능성을 낮게 보고 있는 점은 상당 기간 기준금리 동결을 시사하고 있는 연준의 기조가 영향을 미친 결과로 해석할 수 있다. 7월 27일부터 8월 31일까지 Adrian et al.(2013) 모형을 통해 추정한 향후 6개월 및 12개월 후 기준금리에 대한 시장 예상치의 변동범위는 아래 표와 같다.

10) 콜럼비아 대학교의 미시킨(Mishkin) 교수는 2023년 8월 KCMI Global Issue에서 미국의 기간 프리미엄 상승을 촉발시킬 주요 요인으로 재정적자 누증 및 이를 규율하지 못하는 정치적 난맥상을 꼽은 바 있다.

11) Gallant & Nychka(1987) 및 Gallant & Tauchen(2017)의 SNP(semi-nonparametric) 방법을 이용하여 한미 국채금리, 기간 프리미엄 및 위험조정금리 간 조건부 상관관계를 추정하였다.

12) <부록 2>에는 조건부 상관관계(conditional correlation)를 통해 살펴본 한미 국채금리, 기간 프리미엄 및 위험조정금리 동조화 현상이 정리되어 있다. 2022년 1월부터 2023년 8월까지 한미 국채금리 상관관계는 0.82~0.92에서 변동 중이다.

<부록 1> ACM 모형을 사용한 한미 국채금리 결정요인 추정

Adrian et al.(2013)의 이자율기간구조모형(ACM모형)은 1개월부터 120개월 만기의 일별 할인채 금리를 사용하여 추정한다. 미국의 할인채 금리는 1970년 1월 2일부터 2023년 8월 31일까지 연준이 Gurkayank et al.(2006)의 방법에 의해 도출하여 제공하는 데이터를 사용하였다. 다음으로 국내 할인채 금리는 2002년 1월 2일부터 2023년 8월 31일까지 KIS자산평가가 추정한 만기별 할인채 금리를 사용하였다. <그림 Ⅲ-2>에는 미국 10년 만기 국채금리의 추정결과가 나타나 있으며, 한국 10년물 국채금리 분해결과는 아래 <그림 부록 1>과 같다.

Sudo & Tanaka(2020) 모형은 일본은행의 양적완화 효과를 기간중 채권 매입량에 따른 유량효과(flow effect)와 매입한 채권의 총량에 의한 잔액효과(stock effect)로 구분하여 추정하기 위해 개발된 모형으로 본고에서는 미 연준의 양적완화 효과를 추정하기 위해 미국 데이터를 사용하여 추정하였다. Sudo & Tanaka(2020) 모형은 국채 시장 투자자의 시장 분할 및 선호시장 가설을 바탕으로 장단기 국채의 불완전 대체성에 기반한 동태적 확률 일반균형(DSGE)으로 모형의 개괄적인 내용은 다음과 같다.

■ 수요: 가계는 장단기 채권을 모두 거래할 수 있으나 장기채권에 대한 거래 비용이 발생하는 무제한 가계와 장기채권만 거래할 수 있으나 거래비용은 없는 제한 가계로 구분

■ 공급: 기업 부문이 독점적 경쟁시장에서 생산되는 중간재와 완전 경쟁적인 최종재로 구분되며 중간재 생산기업은 노동과 자본을 이용해 중간재를 생산하며, 최종재 생산기업은 중간재를 변환하여 소비재 및 자본으로 전환

■ 정부 및 중앙은행: 정부는 국채를 공급하며 중앙은행은 테일러 준칙에 따라 금리를 설정하는 한편 장기국채를 매입. 장기국채 매입은 지난기의 국채 보유량과 중앙은행의 장기 국채보유 균형에 의존하는 것으로 가정

■ 외생 충격: 가계의 선호 및 노동 공급 충격, 기업의 가격 마크업 충격, 기술 충격, 투자에 대한 조정비용 충격, 통화정책 충격, 정부의 지출 충격 및 장기국채 공급 충격, 조세충격, 장기국채에 대한 거래비용 충격, 중앙은행의 양적완화 충격

모형은 2001년 4분기부터 2022년 4분기까지 미국의 GDP, CPI, 소비, 비주거용 투자, 실질임금, 취업자수, 기준금리, 10년물 국채금리, 연준의 실질 국채 보유액을 사용하였으며 베이지언 기법으로 추정되었다.

참고문헌

강현주, 2023, 미국 실물경제의 금리 민감도 하락 및 시사점, 자본시장연구원 『자본시장포커스』 2023-12호, 자본시장연구원.

구병수, 2022, 미국 인플레이션 국면별 기대인플레이션과 기간프리미엄이 국내 수익률곡선에 미치는 비대칭적 영향, 한국은행 『조사통계월보』 제76권 제7호, 3-27.

오형석, 2020, 우리나라 장기금리 기간프리미엄 분석 및 정책적 시사점, 『금융연구』 제34권 제4호, 27-59.

Adrian, T., Crump, R., Moench, E., 2013, Pricing term structure with linear regression, Journal of Financial Economics 110(1), 110-138.

Baker, K., Casey, L., Del Negro, M., Gleich, A., Nallamotu, R., 2023, The Post-Pandemic r*, Liberty Street Economics, August 9.

Bauer, M., Mertens, T.M., 2018, Economic Forecasts with the Yield Curve, FRBSF Economic Letters 2018-07.

Bernanke, B.S., 2016, Why are interest rates so low, part 4: Term premiums, available at https://www.brookings.edu.

Boivin, J., Kiley, M.T., Mishkin, F.S., 2011, How Has the Monetary Transmission Mechanism Evolved Over Time? Handbook of Monetary Economics 3a, 369-422.

Boivin, J., Giannoni, M.P., 2006, Has Monetary Policy Become More Effective? Review of Economics and Statistics 88(3), 445-462.

Bonis, B., Ihrig, J., Wei, M., 2017, The Effect of the Federal Reserve’s Securities Holdings on Long-term Interest Rates, FEDS Notes, April, 20.

Brand, C., Mazelis, F., 2019, Taylor-rule consistent estimates of the natural rate of interest, ECB working paper No.2257.

Clarida, R., Gali, J., Gertler, M., 2000, Monetary Policy Rules and Macroeconomic Stability: Evidence and Some Theory, Quarterly Journal of Economics, 115(1), 147-180.

Corrado, C.,A, Hulten, C.R., (2010, How do you measure a “technological revolution”? American Economic Review 100(2), 99–104.

Crawley, E., Gagnon, E., Hebden, J., Trevino, J., 2022, Substitutability between Balance Sheet Reduction and Policy Rate Hikes: Some Illustrations and a Discussion, FEDS Notes, June 03.

Döttling, D., Ratnovski, L., 2023, Monetary policy and intangible investment, Journal of Monetary Economics 134, 53-72.

Dynan, K., Elmendorf, D., Sichel, D., 2005, Can Financial Innovation Help to Explain the Reduced Volatility of Economic Activity?, Journal of Monetary Economics 53(1), 123-150.

Fiorentini, G., Galesi, A., Perez-Quiros, G., Sentana, E., 2018, The rise and fall of the natural interest rate, CEPR Discussion Papers 13042.

Forbes, K., 2019, Has globalization changed the inflation process?, BIS working papers No.791.

Gallant, R.A., Nychka, D.W., 1987, Semi-nonparametric maximum likelihood estimation, Econometrica 55(2), 363-390.

Gallant, R.A., Tauchen, G., 2017, SNP: A program for nonparametric time series analysis, Manuscript, Duke University.

Gamber, E., Hung, J., 2001, Has the rise in globalization reduced U.S. inflation in the 1990s?, Economic Inquiry 39(1), 58-73.

Gurkaynak, R.S., Sack, B., Wright, J.H., 2006, The U.S. Treasury yield curve: 1961 to present, FRB Finance and Economics Discussion Series 2006-28.

Kish, R.J., 2022, The Dominance of the U.S. 30-Year Fixed Rate Residential Mortgage, Journal of Real Estate Practice and Education 24:1, 1-16.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lian, W., Novta, N., Pugacheva, E., Timmer Y., Topalova, P., 2020, The price of capital goods: a driver of investment under threat, IMF Economic Review 68, 509-549.

Sajedi, R., Thwaites, G., 2016, Why are real interest rates so low? The role of the relative price of investment goods, IMF Economic Review 64(4), 635-659.

Wall Street Journal (WSJ), 2023.10.8, The U.S. economy’s secret weapon: Seniors with money to spend.

Zhou, X., 2022, Existing Low-Rate Mortgages Blunt Impact of Recent Rate Surge, Dalls Fed Economics, December 27.