Find out more about our latest publications

Research Papers 24-05 Feb. 19, 2024

- Research Topic Macrofinance

- Page 137

This study empirically examines whether this low inflationary trend can be attributed to structural changes in the economy, such as globalisation and demographic change, along with the stability of long-term inflation expectations due to successful inflation management by central banks.

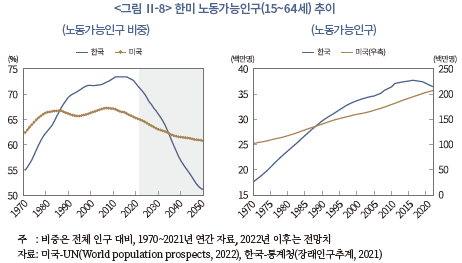

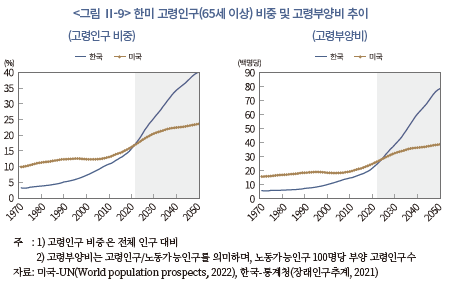

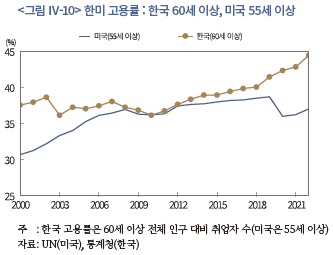

Before presenting the results of the analysis, we summarise the trends of globalisation and demographic changes in Korea and the United States from 1980 to 2020, the period of analysis. First, the world economy, including the Korean economy, entered the hyper-globalisation era in the 1990s, with significant progress of globalization. The U.S.-Korea globalisation entered the slowbalization phase around 2008 (U.S.) and 2013 (Korea), respectively. Next, this paper examines the demographic structure, focusing on the proportion of the working-age population (15~64 years old) and the elderly population (65+ years old) to the total population. The working-age population ratio in both countries has generally been on the rise since 1980, but it began to decline in the United States in 2008-2009 and in Korea in 2012-2013. In particular, the decline in the working-age population in Korea has been sharper than in the United States. As a result, the proportion of elderly people is increasing in both countries, but the proportion of elderly people in Korea is rising steeper than the United States.

The impact of these globalisation and demographic changes on the low inflation rate in Korea and the United States is as follows. First, our analysis shows that globalisation has played an important role in the flattening of the US-Korea Phillips curve. This result is observed for both headline and core inflation. In the case of the United States, where we were able to examine the role of long-term inflation expectations, the stabilization of inflation expectations also contributed to the decline in the cyclical sensitivity of inflation.

In our empirical analysis, globalisation is also found to have played a key role in the downward stabilisation of US and Korean trend inflation. After a large decline during the hyperglobalisation period, trend inflation in the two countries remained stable until the pandemic, suggesting that the decline in trend inflation during the hyperglobalisation period was largely driven by globalisation. This can be understood as a result of cost-efficiency improvements and increased competition among firms due to globalisation, as discussed in the existing literature. The impact of globalisation on trend inflation has been significantly lower in the US and Korea since around 2008 (US) and 2013 (Korea), respectively, reflecting the fact that globalisation in each country entered a plateau around the same time. In the United States, the stabilization of central bank-managed inflation expectations also contributed to the decline in trend inflation, with the impact mainly concentrated in the early to mid-1980s.

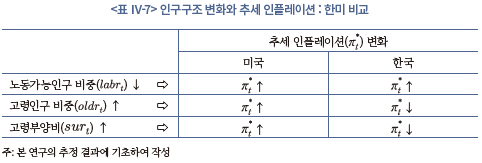

Second, differences were observed in the impact of demographic change on trend inflation between the two countries. First, in both countries, trend inflation rose as the share of the working-age population declined. This can be understood as a decrease in labour supply in the economy leading to higher inflation. On the other hand, for the elderly population share, trend inflation increased as the share increased in the US, but decreased in Korea. In the US, the elderly population can be attributed to their role as net consumers, consuming more than they produce. The elderly in Korea have been steadily increasing their participation in productive activities, and their spending power is much lower, so they have not been able to act as an inflationary force, unlike in the US.

The impact of demographics on trend inflation changed significantly when the baby boomers began to retire in each country (around 2008 in the US and 2013 in Korea). In both countries, the impact of demographic change on trend inflation was statistically significant, but economically limited compared to globalisation. In both countries, the impact of globalisation on trend inflation has largely outweighed the demographic effect.

However, in both countries, the impact of demographics on trend inflation has increased significantly as the baby boomers have begun to enter the elderly population. In the U.S., the share of the elderly population has been rising since before 2008, which has contributed to higher inflation, while the share of the working-age population has been declining since 2008, which has added upward pressure on inflation. As a result, after 2008, the impact of demographics on trend inflation exceeded the effect of globalisation and became a significant inflationary factor.

In Korea, the proportion of the elderly population has steadily increased since 1980, which has acted as a downward pressure on inflation. In addition, the share of the working-age population ended its upward trend around 2013 and entered a downward trend, turning it from a depressant to an inflationary factor. Until 2020, the period of empirical analysis in this study, the downward pressure on inflation due to the increase in the share of the elderly population was higher than the upward pressure on inflation due to the decrease in the share of the working-age population. However, using Statistics Korea's future population projections, it is estimated that from 2025 onwards, the upward pressure on trend inflation from the declining share of the working-age population will outweigh the downward pressure on trend inflation from the increasing share of the elderly population. This suggests that Korea's demographics are likely to be a structural driver of inflation in the future.

Along with a possible retreat from globalisation in the future, both Korea and the US are expected to experience a demographic transition in which the share of the working-age population declines and the share of the elderly increases for a considerable period of time. Applying the results of this study's empirical analysis to these economic structural changes, it is assessed that the low inflation rate that has remained stable in both Korea and the U.S. is likely to end and inflation volatility is likely to increase structurally. The steepening of the Phillips curve as a result of globalisation is likely to restore the cyclical sensitivity of inflation, which could lead to a structural increase in inflation volatility. We also expect trend inflation to rise as globalisation recedes.

코로나 팬데믹과 러시아-우크라이나 전쟁으로 주요국에서 물가상승세가 크게 확대된 가운데 지난 40년간 유지되어 온 저물가 시대가 종료될 것인가에 대해 관심과 우려가 커지고 있다. 1980년대 이후 계속된 저물가 기조는 일부 부작용을 동반하였으나 경제주체 및 금융시장에 다양한 효익을 제공하였다. 물가 기조에 변화가 발생할 경우 글로벌 경제 및 금융시장에 어려움이 크게 가중될 것이다.

인플레이션의 구조적 변화 가능성이 제기되는 이유는 저물가 기조와 연관되었을 것으로 추정되는 글로벌 경제구조에 변화가 감지되기 때문이다. 미중 무역 분쟁이 심화 중인 가운데 팬데믹과 러시아-우크라이나 전쟁으로 그동안 글로벌 경제의 효율성 제고에 기여한 세계화가 후퇴할 가능성이 크게 확대되었다. 여기에 Goodhart & Pradhan(2020a)이 강조한 것처럼 한국과 미국을 포함한 다수 국가는 이미 2010년을 전후한 시점부터 노동가능인구(생산가능인구) 비중이 감소하고 고령인구 비중이 증가하는 인구구조 변화를 겪는 중이다.

이와 같은 세계화 후퇴 가능성 및 인구구조 변화로 저물가 기조에 변화가 발생할 것인가에 대해 논란이 가중되고 있다. 일각에서는 세계화가 후퇴하고 고령화가 심화되면 저물가 시대가 마무리될 것이라는 의견을 개진 중인 반면, 이러한 우려가 과장되었다는 반론도 만만치 않다.1) 첫 번째 의견에서는 각국 중앙은행의 긴축에 힘입어 금번 인플레이션이 안정될 수 있을 것이나, 장기적 관점에서는 과거와 같은 저물가 기조로 복귀하지 못할 것으로 파악한다. 이와 달리, 두 번째 관점은 중앙은행의 성공적 물가 관리가 이루어지면 기조적 물가에 큰 변화가 없을 것이라는 긍정론으로 볼 수 있다.

흥미롭게 이처럼 상반된 시각은 세계화 및 인구구조와 같은 경제구조변수가 인플레이션의 구조적 동학(structural dynamics)에 미치는 영향에 대한 학계의 논란을 반영한다. 예를 들어, 본 연구 Ⅲ장에서 살펴보는 바와 같이 지난 20년 동안 학자들 간에 세계화가 인플레이션의 구조적 특징에 영향을 미칠 수 있는가에 대해 논쟁이 진행되어 왔다.

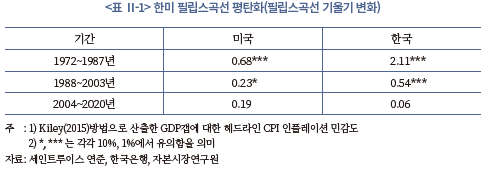

이에 본 연구는 세계화 및 인구구조를 중심으로 경제구조변수가 한국과 미국의 저물가 기조에 미친 영향을 분석하고, 향후 물가 기조에 변화가 발생할 수 있는지 평가하고자 한다. 본 연구에서는 1980년대 이후 지속된 저물가 기조를 필립스곡선 평탄화 및 추세 인플레이션 하향 안정의 두 가지 관점에서 살펴본다. 필립스곡선은 인플레이션과 경기여건 간 관계를 포착하므로 필립스곡선 평탄화는 인플레이션의 국내 경기에 대한 민감도가 둔화되었음을 의미한다. 추세 인플레이션의 하향 안정은 기조적 물가상승률, 즉 인플레이션의 장기 추세가 낮아졌음을 의미한다. 1980년대부터 코로나 팬데믹 이전까지 한미 인플레이션은 추세 인플레이션이 하향 안정화된 가운데, 필립스곡선 평탄화로 인플레이션의 경기순환적 특성이 약화되며 저물가 기조가 안정적으로 유지되었다.

만약 세계화 및 인구구조가 과거 저물가 기조에 미친 영향이 크지 않았다면, 세계화가 후퇴하고 노동가능인구 감소 등의 인구구조 변화가 심화되더라도 물가 기조에 유의미한 변화가 발생하지 않을 가능성이 큰 것으로 판단할 수 있다. 반면, 경제구조변수가 저물가에 기여했다면 중앙은행의 노력에도 저물가 시대가 마감될 가능성이 존재한다.

본 연구의 구성은 다음과 같다. 우선 Ⅱ장에서 필립스곡선 평탄화 및 추세 인플레이션 하향 안정 관점에서 1980년대 이후 한미 인플레이션의 특징을 살펴보고, 본 고에서 초점을 맞추는 경제구조변수인 세계화와 인구구조 추이를 알아본다. Ⅲ장에서는 세계화 및 인구구조가 인플레이션의 구조적 특징에 미친 영향을 다룬 기존문헌을 고찰한다. Ⅳ장은 본 연구의 실증분석을 다루며, 실증분석 결과를 토대로 향후 한미 인플레이션의 구조 변화 가능성을 평가해본다. 결론 및 시사점은 Ⅴ장에서 제시한다.

본 보고서는 명목금리의 추세적 변동을 살펴보고자 하는 두 편의 연구 중 제2편이다. 제1편에서는 인플레이션의 구조적 특징과 함께 추세금리를 결정하는 핵심 요소인 실질중립금리의 방향성에 대해 살펴본다. 경제구조 변화에 따른 추세금리의 변화 가능성은 제1편에서 종합하여 논의한다.

Ⅱ. 한미 인플레이션의 구조적 특징 및 경제구조변화

본 장에서는 1980년대 이후 한미 인플레이션의 구조적 특징을 살펴보고, 세계화 및 인구구조 측면에서 양국의 경제구조변화를 알아본다. 본 연구의 분석 대상인 양국 인플레이션의 구조적 특징은 저물가 기조로 압축할 수 있는데, 아래에서는 저물가 기조를 구성하는 인플레이션의 특징적 행태를 필립스곡선 평탄화와 추세 인플레이션 하락 관점에서 살펴본다. 경제구조변화는 다양한 요인을 고려할 수 있으나, 본 연구에서는 세계화와 인구구조 변화에 초점을 맞추고자 한다.

1. 1980년대 이후 한미 인플레이션의 구조적 특징

1980년대 이후 한국과 미국을 포함한 글로벌 인플레이션의 핵심적인 특징으로 필립스곡선의 평탄화와 추세 인플레이션의 하향 안정을 들 수 있다. 우선 주요 선진국을 중심으로 1980년대 중반부터 필립스곡선의 평탄화가 진행되었다(Borio & Filardo, 2007; Blanchard et al., 2015; BIS, 2017; Jorda et al., 2019a 등). 필립스곡선 평탄화는 인플레이션과 국내(domestic) 경기여건(유휴생산력: GDP갭 및 실업률갭) 간 관계가 약화되었음을 의미한다.2) 예를 들어, 필립스곡선이 평탄화될수록 국내 고용여건이 견조(tight)해져도 인플레이션 압력요인으로 작용하는 강도가 약해지는 효과가 발생한다. <표 II-1>에는 Kiley(2015)의 방법을 이용하여 산출된 한국과 미국의 필립스곡선 기울기3)가 나타나 있는데, 양국 모두 1980년대 이후부터 필립스곡선이 꾸준히 평탄화되었음을 알 수 있다.4)

필립스곡선 평탄화가 저물가 기조에 미친 영향은 다음과 같은 관점에서 이해할 수 있다. 1970년대와 같이 인플레이션이 국내 경기여건에 민감하게 반응하며 변동성이 커진다면 경제주체의 기대인플레이션이 안정되기 어려우며, 기대인플레이션이 안정되지 않으면 장기(long-term) 인플레이션, 즉 추세 인플레이션 또한 안정되기 힘들다.5) 이런 관점에서 필립스곡선 평탄화는 아래 논의될 추세 인플레이션 안정과 함께 1990년대 중반 이후 미국 등 주요국이 골디락스 경제(goldilocks economy)를 유지할 수 있었던 주요 토대로 지목되고 있다(Gordon & Stock, 1998). 한편, 필립스곡선 평탄화가 일시적인 현상에 그치지 않고 추세적으로 진행되었고, 여러 국가에서 관찰된다는 점은 구조적인 글로벌 공통요인이 동 현상의 원인으로 작용했을 가능성을 시사한다.

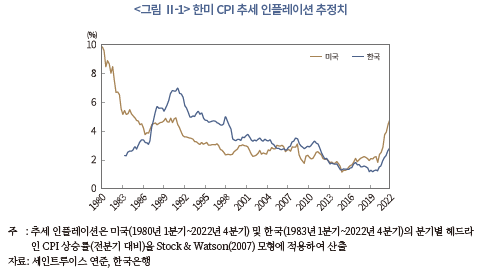

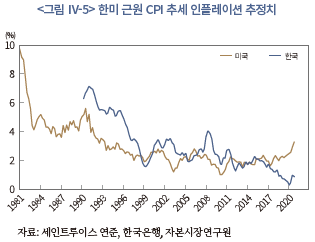

필립스곡선 평탄화와 함께 지난 40년간 글로벌 인플레이션의 또 다른 특징으로 추세 인플레이션의 하향 안정을 들 수 있다. 추세 인플레이션은 연구자에 따라 다양한 관점에서 정의되는데, 본 연구에서는 경제 전체의 수요뿐만 아니라 공급능력을 감안한 균형 물가상승률로 순환적(일시적) 요인을 배제한 물가상승률의 장기 추세를 추세 인플레이션으로 정의한다.6) <그림 Ⅱ-1>에는 1980년 이후 한미 양국의 헤드라인 CPI(Consumer Price Index) 추세 인플레이션 추정치가 나타나 있다.7)

<그림 Ⅱ-1>에 나타난 1980년대 이후 미국 추세 인플레이션의 변화를 살펴보면 다음과 같다. 미국 추세 인플레이션은 1980년대 초중반에 급격한 하락세를 나타냈다. 이후 1990년대 초반부터 2000년대 초반까지 장기간에 걸쳐 점진적으로 하락한 후 안정세를 유지하였다. 팬데믹 이전까지 연준의 물가목표치인 2% 내외에서 유지된 미국 추세 인플레이션은 팬데믹 이후 상승세로 전환하였다.8) 이와 같은 추세 인플레이션 하향 안정화는 미국뿐만 아니라 주요 선진국에서 공통으로 관찰되는 현상이다(Garnier et al., 2015). 다음으로 한국 추세 인플레이션의 경우 1980년대에는 상승세를 나타냈으나, 1990년대부터는 미국과 유사한 변화를 보였다. Kamber & Wong(2020) 및 Lane(2020) 등에 따르면 우리나라뿐만 아니라 다수 이머징 국가에서도 1990년대부터 추세 인플레이션이 하락세를 보인 것으로 추정되었다. 필립스곡선 평탄화와 마찬가지로 추세 인플레이션의 하향 안정화가 글로벌한 현상이라는 점을 감안하면 동 현상 역시 경제구조변화를 원인으로 생각해볼 수 있다.

옐런 전 연준 총재가 지적한 바와 같이 실제 인플레이션은 추세 인플레이션과 일시적 요인에 의해 발생하는 인플레이션갭(실제 인플레이션-추세 인플레이션)으로 분해할 수 있다(Yellen, 2015).9) 이상의 논의를 종합하면 팬데믹 이전 한미 인플레이션은 추세 인플레이션이 하향 안정화된 가운데, 필립스곡선 평탄화로 인플레이션의 경기순환적 특성이 약화되며 저물가 기조가 안정적으로 유지된 것으로 이해할 수 있다.

2. 경제구조변화 : 세계화 및 인구구조 변화

본 연구에서는 인플레이션의 구조적 특징, 즉 필립스곡선 평탄화 및 추세 인플레이션의 하향 안정에 영향을 미쳤을 것으로 추정되는 경제구조변수로 세계화와 인구구조 변화를 고려한다.10) 아래에서는 1980년대 이후 한국과 미국의 세계화 및 인구구조 변화를 살펴보고, 향후 추이를 평가해본다.

가. 한미 세계화 추이 및 전망

1) 현황

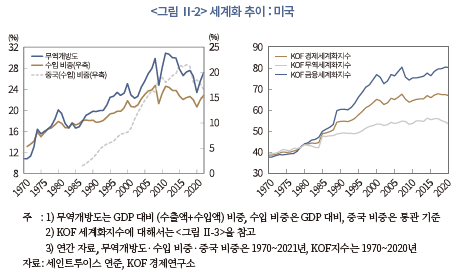

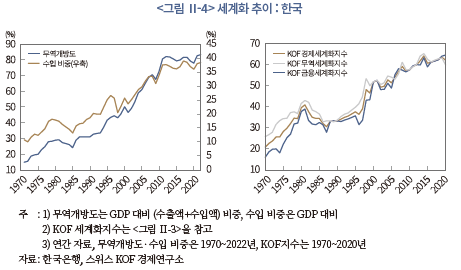

<그림 Ⅱ-2>는 전통적인 세계화 측정 변수인 무역개방도와 Gygli et al.(2019)이 고안한 KOF 세계화지수를 통해 살펴본 미국의 세계화 추이가 나타나 있다. KOF 세계화지수는 본 연구의 실증분석에서 사용되므로 여기서 설명한다. 세계화와 인플레이션의 관계를 살펴보는 데 있어 핵심 이슈 중 하나가 세계화의 측정에 있다. 다수 기존연구들은 무역 통계 및 글로벌 가치사슬(Global Value Chain: GVC)과 관련된 정량화된 지표(hard data)로 세계화를 측정한다. 하지만 세계화는 복합적‧다면적 특징을 가지므로 무역 통계만으로 파악하는 데 한계가 있다(Grabner et al., 2018; Hukkinen & Viren, 2022). 이에 최근에는 세계화의 다양한 특성이 반영된 KOF 세계화지수를 사용하는 연구들이 증가하는 추세이다.11) KOF 세계화지수는 경제세계화지수, 사회세계화지수 및 정치세계화지수로 구분되는데, 본 연구에서는 경제세계화지수를 사용한다. KOF 세계화지수는 정량적 무역 통계에 기초한 ‘실제상(de facto) 세계화지수’ 및 제도 등을 반영한 ‘제도적(de jure) 세계화지수’로 구성된다. 본 고에서 사용한 KOF 경제세계화지수는 무역 및 금융 세계화를 측정하는데, 지수의 구성은 <그림 Ⅱ-3>과 같다. KOF 세계화지수는 1970년부터 연별로 제공되며, 가장 최근(보고서 작성 시점 기준) 지수는 2020년까지 이용 가능하다.

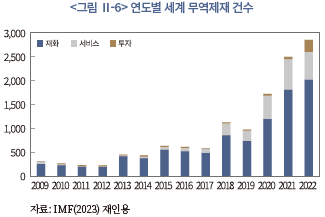

기존문헌에 따르면 세계화는 1970년대부터 진전이 있었으나, 1990년대 들어 본격화되며 초세계화(hyper-globalization) 국면에 진입한 것으로 지적된다(Attinasi & Balatti, 2021 등).12) 초세계화에는 자유무역주의의 뒷받침 아래 중국, 인도 및 구소련 국가의 세계 경제 편입이 중요한 역할을 하였는데, 특히 중국은 WTO에 가입한 2001년 이전부터 주요국과의 교역이 증가하며 세계화 진전에 크게 기여한 것으로 평가된다(Branstetter & Lardy, 2006; Subramanian & Kessler, 2013,; Ascari & Fosso, 2021 등). 2000년대 중반까지 초세계화가 지속되었으나, 2008년 글로벌 금융위기 이후에는 세계화가 정체 국면(slowbalization)에 진입한 것으로 평가된다(Irwin, 2020; IMF, 2023 등). 세계화 정체에는 다양한 요인이 작용한 것으로 파악되고 있는데, GVC 확장세 둔화(Attinasi & Balatti, 2021) 및 지정학적 긴장 등으로 인한 자유무역주의 퇴보(IMF, 2023) 등이 주요 원인으로 언급된다.

미국의 시기별 세계화 추이는 <그림 Ⅱ-2>를 통해서 확인할 수 있는데, 무역개방도 및 KOF 세계화지수를 통해 1990년대 초반 이후 세계화에 큰 진전이 있었음을 알 수 있다. 다만, 글로벌 금융위기 이후 세계화의 경우 무역통계상으로는 상당 부분 후퇴한 것으로 볼 수 있으나, KOF 세계화지수를 보면 정체 국면에 진입한 것으로 평가할 수 있다. Hukkinen & Viren(2022) 등은 이와 같은 이유에서 무역 통계를 사용한 세계화 측정에 한계가 있음을 지적한 바 있다. 한국의 세계화 추이는 <그림 Ⅱ-4>에 나타나 있는데, 미국과 마찬가지로 1990년대 들어 세계화가 급격히 진전되었으나, 미국과 달리 글로벌 금융위기 이후에도 세계화가 꾸준히 진전된 것을 알 수 있다. 다만, KOF 세계화지수를 기준으로 한국의 세계화는 2013년경부터 정체 국면에 진입한 것으로 파악된다.

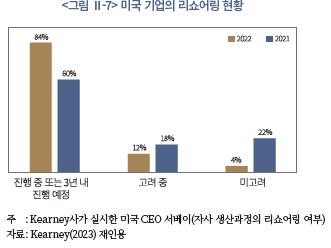

팬데믹과 러시아-우크라이나 전쟁으로 탈세계화 본격화 가능성에 대해 다양한 의견이 제기되고 있다. 일각에서는 중간재를 포함한 세계교역량이 2021년 이후 팬데믹 이전 추세로 복귀했다는 점을 근거로 탈세계화 또는 세계화 후퇴 위험이 과대평가되고 있다는 견해를 제시하였다(FT, 2022. 5. 26; Di Sano et al., 2023 등).13) 향후 전체적인 세계화 양태에는 상당한 불확실성이 존재하나, 본 연구의 초점인 세계화가 인플레이션에 미칠 수 있는 영향 측면에서는 아래 기술된 이유에서 과거에 비해 세계화로 인한 효익이 유의미하게 감소할 가능성이 높은 것으로 판단된다.

본 고 Ⅲ장에 정리된 바와 같이 세계화는 비용효율성 및 경쟁 심화 경로를 통해 저물가 기조에 기여해 왔다. 그런데 <그림 Ⅱ-5>가 보여주는 것처럼 세계화는 글로벌 가치사슬의 고도화와 이에 따른 국가별 분업 심화를 반영하므로 세계화로 인한 경제 효율성 증가에는 안정성 및 복원력 감소가 동반된다. 안정성과 복원력이 뒷받침되지 않을 경우 효율성을 추구하는데 한계가 존재한다. 이와 같은 이유에서 1990년대 이후 초세계화는 기술혁신과 함께 WTO 설립 등을 통한 제도적인 뒷받침이 핵심 동인으로 평가된다(World Bank, 2020).

아래에서는 연령대(age cohort)별 인구 비중을 통해 한미 인구구조 변화 추이를 살펴본다. <그림 Ⅱ-8>은 전체 인구 중 노동가능인구(15~64세)의 비중 및 노동가능인구 수를 보여준다. 양국 노동가능인구 변화 중 가장 특징적인 점은 미국은 2007~2008년, 한국은 2012~2014년부터 노동가능인구 비중이 기조적인 하락세에 접어들었다는 점이다.16) 이는 각국에서 동 시기부터 베이비 붐 세대가 고령인구(65세 이상)에 편입되기 시작했기 때문이다. 양국의 노동가능인구 비중이 감소세에 접어든 점은 공통된 현상이나, 속도에는 큰 차이가 있다. 미국은 노동가능인구 비중 감소세가 완만하여 2050년에 61% 수준에 달할 것으로 예상되는 반면, 한국은 감소세가 급격하여 2050년에는 51% 수준까지 낮아질 것으로 전망되고 있다. 특히, 한국은 2017년부터 노동가능인구의 절대 수치가 감소하고 있다.

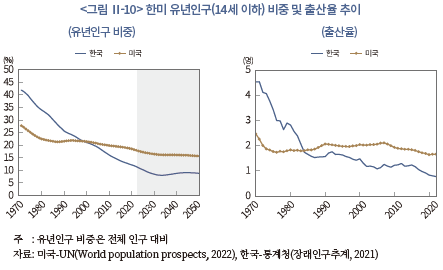

노동가능인구 변화는 유년인구(14세 이하) 변화 및 출산율과도 연관되는데, <그림 Ⅱ-10>에서 확인할 수 있듯이 미국은 2008년 이후 출산율이 소폭의 감소세를 보이고 있으나 대체로 안정세를 유지하고 있어 유년인구 비율이 점진적으로 낮아지고 있다. 반면 한국은 출산율이 꾸준히 하락하고 있으며, 특히 2020년부터는 하락 속도가 가팔라져 1명을 하회하고 있다.

지난 40년간 유지된 저물가 기조에는 다양한 원인이 있을 수 있겠으나, 본 연구에서는 세계화와 인구구조 변화가 인플레이션의 구조적 특징에 미친 영향을 살펴보고자 한다. 세계화는 국가 간 재화 및 서비스, 금융 및 노동시장 통합을 통해 글로벌 경제에 구조적인 변화를 초래한 핵심 변수이다. 이에 따라 인플레이션의 구조적 변화를 유발한 요인으로 세계화가 유력한 후보로 고려되어왔다. 인구구조 변화는 글로벌 공통요인이라기보다 국가별 고유요인으로 볼 수 있으나, 선진국을 중심으로 주요국이 공통으로 경험하고 있는 고령화 등은 추세 인플레이션에 영향을 미치는 중요 요인으로 파악되어왔다(Goodhart & Pradhan, 2020a, 2020b, 2020c 등).

한편 본 장에서 살펴보는 바와 같이 인플레이션 동학(dynamics)의 구조적 특징을 다루는 다수 기존문헌에서는 1980년대 이후의 인플레이션 변화가 통화정책과 긴밀히 연관된 것으로 평가한다. 국가마다 차이는 있으나, 1990년대들어 주요국 중앙은행이 물가목표제를 도입하는 등17) 중앙은행의 적극적인 물가 관리와 이로 인한 장기 기대인플레이션 안정이 추세 인플레이션 하락 및 필립스곡선 평탄화의 핵심 원인이라는 견해가 다수 존재한다. 이에 본 장에서는 인플레이션의 구조적 변화에 기여한 요인으로 세계화 및 인구구조 변화와 통화정책을 함께 살펴본다.

향후 세계화 후퇴 가능성이 존재하고 고령화의 가속화가 예상되는 만큼, 과거 저물가 기조에 경제구조변수가 어떤 영향을 미쳤는지가 향후 인플레이션 기조 전환 여부를 결정할 것이다. 만약 저물가 기조가 경제구조변수가 아닌 성공적 통화정책의 산물이라면 세계화가 후퇴하더라도 저물가 기조가 유지될 가능성이 크다. 이런 가운데 경제구조변수와 저물가 기조의 관계에 대해 상반된 견해가 제시되어 온 만큼 기존논의를 체계적으로 살펴볼 필요가 있다.

1. 세계화와 인플레이션

1990년대 중국과 인도 등이 글로벌 경제에 편입되면서 세계화가 가속화(Freeman, 2007; Carney, 2015)된 이후, 세계화가 글로벌 저물가 기조에 기여했을 것이라는 추론(Rogoff, 2004; Greenspan, 2005; Fisher, 2006 등)이 꾸준히 제기되어 왔다. 하지만 이러한 인식과 달리 세계화와 인플레이션 간 관계에 대해 지난 20년간 많은 연구가 진행되었음에도 세계화가 인플레이션 동학에 구조적인 변화를 유발했는지에 대해 학계의 견해차가 크다(Borio, 2017a; Hukkinen & Viren, 2022 등). 세계화와 인플레이션의 관계에 대한 기존문헌은 긍정론과 부정론이 공존한다. 세계화가 저물가 기조에 기여한 것으로 파악하는 연구가 작지 않으나, 인플레이션은 화폐적 현상(monetary phenomenon)이므로 세계화가 일시적으로는 인플레이션에 영향을 미칠 수 있지만, 중장기 인플레이션은 궁극적으로 통화정책에 의해 결정(통제)된다는 견해도 다수이다.18) 본 절에서는 이러한 논란을 염두에 두고 세계화와 인플레이션의 관계를 다룬 선행연구를 살펴본다.

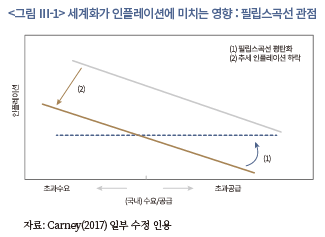

본 연구에서는 Ⅱ장에서 살펴본 필립스곡선 평탄화와 추세 인플레이션 하락 경로 관점에서 세계화와 인플레이션의 관계를 다룬 기존논의를 살펴본다. 이와 같은 경로는 <그림 Ⅲ-1>과 같이 도식화할 수 있다. 실선이 세계화를 고려하지 않은 필립스곡선으로, 재화 및 노동에 대한 국내 수요와 공급에 따라 인플레이션이 변화한다. 하지만 세계화로 인해 인플레이션이 글로벌 요인의 영향을 받을 경우 인플레이션의 국내 경기여건에 대한 민감도가 낮아질 수 있으며, 그 결과 필립스곡선이 평탄화된다. 다음으로 세계화가 추세 인플레이션의 하락을 촉발할 경우, 평균 인플레이션 수준에 영구적 변화가 발생하므로 그림과 같이 필립스곡선이 아래로 이동한다.19) 대다수 기존연구에서는 세계화가 인플레이션에 미치는 영향을 이상과 같이 필립스곡선 평탄화 및 추세 인플레이션 하락 관점에서 논의한다.20)21) 아래에서는 기존연구에 기초하여 사전적‧이론적으로 기대할 수 있는 세계화와 인플레이션 간 관계(필립스곡선 평탄화 및 추세 인플레이션 하락)에 대해 살펴보고, 실증연구 결과를 알아본다.

세계화로 국가 간 재화‧서비스, 자본 및 노동시장이 통합됨에 따라 국내(domestic) 인플레이션 결정에 글로벌 요인이 영향을 미칠 개연성이 존재하며, 이로 인해 인플레이션의 국내 경기여건에 민감도가 낮아졌을 것으로 추정할 수 있다(Rogoff, 2004 등). 하지만 아래에서 살펴보는 바와 같이 세계화가 필립스곡선 평탄화에 미친 영향은 사전적‧이론적 관점에서 방향성이 모호한 측면이 있으며, 실증문헌 또한 상반된 결과를 보고하고 있다.

우선 세계화가 필립스곡선 평탄화를 유발할 수 있는 사전 경로를 살펴본다. 세계화가 인플레이션과 국내 경기여건 간 관계 약화를 초래할 수 있는 대표적 원인으로 생산요소의 대체성(substitutability) 증가를 고려할 수 있다. 기존연구에 따르면 국내외 생산요소 간 대체성 증가에는 글로벌 가치사슬(GVC) 발전이 크게 기여한 것으로 평가된다(Yellen, 2006; Auer et al., 2017; Auer et al., 2019 등). 1990년대 들어 무역장벽 축소, 기술발전 및 해외직접투자 등에 힘입어 기업의 GVC 참여가 확대된 결과, 생산의 전 과정이 비용효율성에 기초해 분절화(fragmentation)되었다. GVC 발전으로 기업은 자국의 경제여건(유휴생산력)에 따라 생산요소의 가격이 상승하면 생산 과정을 저비용국가로 이전하거나 수입을 통해 국내 생산요소를 대체할 수 있다. 이와 같은 경로를 통해 기업 비용의 국내 경제여건에 대한 의존도가 감소하게 되며,22) 결과적으로 국내 경기여건 및 인플레이션 간 관계가 약화될 수 있다.

국내외 생산요소 간 대체성 증가는 고용시장에도 영향을 미쳤는데, 세계화 및 GVC 확대로 글로벌 생산 과정에 저임금 국가 노동력의 참여가 증가하였다(ECB, 2021a). 또한 저숙련(low-skilled) 업종을 중심으로 국내외 노동자 간 경쟁이 심화되었는데, 이와 같은 글로벌 노동시장 통합이 노동협상력 약화에도 영향을 미친 것으로 파악된다(Carney, 2017; Borio, 2021).23) Lombardi et al.(2023)의 이론적 분석에서는 이와 같은 노동협상력 저하로 국내 고용시장 여건이 인플레이션에 미치는 영향이 낮아질 수 있는 것으로 나타났다.

세계화는 이상에서 살펴본 지속적인 양(+)의 공급 충격과 함께, 기업의 가격‧임금 결정 행태(price‧wage setting behavior)에 영향을 미침으로써 필립스곡선의 기울기에 구조적인 변화를 가져올 수 있다. 세계화에 따른 기업의 가격 결정 행태 변화는 이론적 관점에서 세계화가 필립스곡선 기울기에 미치는 영향을 고찰할 수 있다는 점에서 중요성이 높다고 볼 수 있다. 기존연구에서 고려된 동 경로는 크게 경쟁 심화에 따른 전략적 상호보완성(strategic complementarity) 확대 및 시장구조 집중화(concentration) 경로로 구분할 수 있다. 상호보완성(Sbordone, 2007; Benigno & Faia, 2016; Amiti et al., 2019; Heise et al., 2022)은 해외 기업과의 경쟁에 직면한 국내 기업이 가격을 결정할 때 해외 기업의 행태를 반영하는 정도를 의미한다. Amiti et al.(2019)의 이론적 분석에 따르면 국내 기업은 자사 제품의 가격을 결정할 때, 자사의 한계비용과 함께 해외 경쟁 기업의 가격 책정을 반영하게 된다. 따라서 국내 기업은 국내 경기여건에 따라 비용이 상승하더라도 이를 충분히 가격에 반영하지 못하게 되며, 이로 인해 필립스곡선 평탄화가 발생할 수 있다.24) 반면, 경쟁 심화로 마크업(markup)이 감소할 경우25) 기업의 해외 경쟁기업 가격정책에 대한 민감도가 하락할 수 있으며, 국내 경제여건에 따른 자사의 비용변화를 보다 적극적으로 가격에 반영할 유인을 가지게 되어 필립스곡선이 가팔라질 수 있다(Sbordone, 2007).26)

한편 세계화로 경쟁이 심화되면 생산성이 높은 기업 위주로 시장구조가 재편되며 시장집중화가 심화될 수 있다(Autor et al., 2020). 기존문헌에 따르면 이와 같은 시장구조 집중화는 필립스곡선 기울기에 양방향의 영향을 미칠 수 있다(ECB, 2021a).27) 시장지배력이 높아진 기업은 자사의 지배력을 이용해 비용 변화를 적극적으로 가격에 반영할 유인을 가지는 한편(Obstfeld, 2020), 시장지배력을 유지하기 위해 전략적으로 경기변동에 따른 비용 상승을 가격에 반영(pass-through)하지 않을 유인이 있다(Guilloux-Nefussi, 2020).

이상에서 살펴본 바와 같이 세계화가 필립스곡선 기울기에 미칠 수 있는 영향은 방향성이 모호하며, 결과적으로 실증적 이슈라는 점에 연구자 간 합의가 형성되어 있다(Gaiotti, 2010; Borio, 2017a; ECB, 2021a 등). 아래에서는 세계화와 필립스곡선 기울기 간 관계를 분석한 주요 실증연구 결과를 살펴본다. 이하에 정리되는 것처럼 세계화가 필립스곡선 평탄화를 유발했는지에 대해 상반된 결과가 보고되고 있으며, 이로 인해 기존연구에서 아직 합의가 도출되지 않은 상태이다.28)

세계화와 필립스곡선 평탄화에 대한 실증연구는 주로 국내 유휴생산력을 포함하는 단일경제 축약형(reduced-form) 필립스곡선에 세계화 변수를 추가(글로벌 필립스곡선)하여, 세계화가 국내 인플레이션에 미친 영향을 분석한다. 이 분야의 초기문헌에서는 글로벌 요인의 영향을 파악하기 위해 국내 유휴생산력(국내갭)에 대응한 개념으로 해외 유휴생산력(해외갭 또는 글로벌갭)29)을 도입하고, 국내갭과 글로벌갭의 국내 인플레이션 결정에 대한 상대적 영향을 비교하였다.30) 다음 장의 본 고 실증분석에서는 글로벌갭을 세계화 변수로 채택하지 않지만,31) 동 변수는 세계화와 국내 인플레이션의 관계에 대한 논쟁, 즉 인플레이션 세계화 가설을 촉발하였다는 점에서 중요성이 있다. 이에 아래에서 주요 연구의 결과를 살펴본다.

해외 유휴생산력이 미국 인플레이션에 미친 영향을 분석한 대표적인 연구로 Tootell(1998), Gamber & Hung(2001) 및 Wynne & Kersting(2007) 등을 들 수 있다. Tootell(1998)의 연구에서는 해외갭이 미국 인플레이션(1973~1996년)에 유의한 영향을 미치지 않은 것으로 나타난 반면, Gamber & Hung(2001) 및 Wynne & Kersting(2007)에서는 해외 유휴생산력이 1990년대 미국 인플레이션 결정에 중요한 역할을 한 것으로 분석되었다. Borio & Filardo(2007)는 1980년부터 2005년까지 주요 17개국 인플레이션(CPI)에 대한 자국갭 및 해외갭의 역할을 분석하였는데, 1993년 이후 국내갭의 역할이 감소한 반면(필립스곡선 평탄화), 해외갭의 중요성은 증가한 것으로 나타났다. Borio & Filardo(2007)의 분석은 다수 선진국을 대상으로 글로벌갭이 필립스곡선 평탄화를 유발했다는 경험적 증거를 제시했다는 점에서 중요성이 큰 연구로 평가된다. 하지만 Ball(2006), Calza(2009) 및 Ihrig et al.(2010) 등은 Borio & Filardo(2007)의 실증적 근거가 강건성 및 일반화 측면에서 한계가 있다는 연구 결과를 발표하였다. Calza(2009)는 유로지역 국가의 경우, 해외갭의 역할이 유의하지 않은 것으로 보고하였으며, Ball(2006) 및 Ihrig et al.(2010)은 Borio & Filardo(2007)에서 글로벌갭의 산출방법 및 대상 국가를 일부 변경하거나, 기대인플레이션(대용치)을 인플레이션 설명변수로 추가할 경우 글로벌갭의 영향력이 크게 낮아지는 결과를 보고하였다.

위 논쟁 이후에 이루어진 연구 중에는 Bianchi & Civelli(2015), Ahmad & Civelli(2016), Jasova et al.(2018), Forbes(2019a, 2019b),32) Kohlscheen & Moessner(2022) 등이 다양한 국가 및 기간을 대상으로 글로벌갭이 필립스곡선 평탄화를 설명하는 데 중요한 역할을 한 것으로 평가하였다. 반면, Gnan & Valderrama(2006), Milani(2012), Mikolajun & Lodge(2016), ECB(2021a) 등에서는 글로벌갭이 필립스곡선 평탄화에 미친 영향이 유의하지 않거나, 통계적으로는 유의하더라도 실질적인 영향이 제한적인 것으로 분석되었다. 이처럼 글로벌갭이 필립스곡선 평탄화를 유발했는지에 대해 연구자 간에 합의가 이루어지지 않았으며, 아직 논쟁이 진행 중이다(ECB, 2021a).

글로벌갭의 유효성에 대한 실증 논란과 별개로 글로벌갭이 필립스곡선 평탄화 즉, 국내 인플레이션의 국내 경제여건에 대한 민감도를 낮출 수 있는 경로를 이해할 필요가 있다. Auer et al.(2017)은 GVC 참여가 글로벌갭이 필립스곡선 평탄화를 유발한 핵심 원인이라는 결과를 보고하였는데, GVC 확대로 국내외 생산요소 간 대체성이 증가하여 인플레이션의 대외 경제여건(글로벌갭)에 대한 민감도가 증가한 것으로 나타났다.33) Bianch & Civelli(2015) 및 Ahmad & Civelli(2016)는 각각 무역개방도 및 무역‧금융개방도 확대로 글로벌갭의 영향이 증가한 것으로 분석하였다.34)

한편, 글로벌갭 이외의 경로를 통해 세계화가 필립스곡선 기울기에 미친 영향에 대한 연구도 다양하게 진행되었다. 주요 연구의 결과를 살펴보면 다음과 같다. IMF(2006)의 분석(1960~1984년, 8개 선진국)에 따르면 필립스곡선의 국내 GDP갭에 대한 민감도 하락에는 무역개방도 확대에 따른 경쟁 효과(마크업 감소) 및 생산요소 대체성 증가가 핵심적인 역할을 담당한 것으로 나타났다. Pain et al.(2008)은 수입물가(수입 경쟁)를 통해 세계화가 필립스곡선 평탄화를 유발한 것으로 보고하였다. Ari et al.(2023)이 유럽 24개 선진국의 17개 산업 인플레이션을 분석한 결과 무역개방도가 필립스곡선 평탄화에 유의한 음(-)의 영향을 미친 것으로 나타났다.

Kohlscheen & Moessner(2022)의 분석(OECD 35개국 CPI인플레이션, 1985~2018년)에서는 KOF 세계화지수로 측정한 세계화 진전이 필립스곡선 평탄화에 유의한 영향을 미치는 것으로 나타났다. Friedrich & Selcuk(2022)도 세계화(KOF 세계화지수)가 18개 선진국 산업별 물가(1970~2009년)상승률의 국내 유휴생산력에 대한 민감도에 유의한 음의 영향을 미치는 것으로 보고하였다.35) 한편 Ascari & Fosso(2021)는 글로벌 공급 충격요인이 미국 필립스곡선의 평탄화를 유발한 것으로 보고하였다. Heise et al.(2022)이 1997년부터 2017년 기간의 미국 제조업 물가상승률을 분석한 결과, 수입 경쟁 및 시장집중도 확대로 임금에 대한 물가상승률 민감도가 하락한 것으로 확인하였다.

Badinger(2009)는 1985년부터 2004년까지 전 세계 91개국 인플레이션(CPI)을 분석한 결과, 이상의 결과와 상반되게 무역개방도 및 금융개방도로 측정한 세계화가 필립스곡선 기울기를 가파르게 만들었다는 결과를 보고하였다. Temple(2002), Daniels et al.(2005), Mody & Ohnsorge(2007) 등에 따르면 무역개방도가 필립스곡선 평탄화에 영향을 주지 못하는 것으로 나타났다. Eijffinger & Qian(2016) 분석에서는 무역개방도가 필립스곡선에 통계적으로 유의한 영향을 미치지만, 국가별로 방향이 상이한 것으로 확인되었다.36) Gaiotti(2010)가 1988년부터 2005년까지 2,000개 이탈리아 기업의 제품 가격상승률과 저임금 국가로부터의 수입 간 관계를 분석한 결과, 수입 경쟁이 개별 기업의 가격상승률과 국내갭 간 관계에 영향을 미쳤는지에 대해 일관된 결과를 확인할 수 없는 것으로 판단하였다.

이상과 같이 세계화와 필립스곡선 기울기 간 관계에 대해 상반된 결과가 혼재한 가운데, 통화정책이 필립스곡선 평탄화를 초래한 핵심 요인이라는 견해도 다수 존재한다. Williams(2006), Yellen(2006), Bernanke(2007) 및 Mishkin(2009) 등은 통화정책 신뢰로 인한 기대인플레이션 안정을 필립스곡선 평탄화의 원인으로 지목하였다. 경기여건에 따라 인플레이션이 일시적으로 상승하더라도 중앙은행의 물가 관리에 대한 신뢰가 형성된다면 장기 기대인플레이션이 안정(anchor)될 것이고, 기대인플레이션이 상승하지 않으면 가격 및 임금이 경기여건에 덜 민감해질 것이라는 점이 근거이다. Daniels et al.(2005)은 통화정책 독립성을 필립스곡선에 포함하면 무역개방도와 필립스곡선 기울기 간 관계가 약해지는 것으로 확인하였다. Ihrig et al.(2010), Mikolajun & Lodge(2016) 및 Bems et al.(2018)37) 등에서는 장기 기대인플레이션 안정이 글로벌갭보다 필립스곡선 평탄화에 중요한 역할을 한 것으로 분석되었다.

통화정책이 국내 경기여건과 인플레이션의 연계성을 약화시켰다는 논의는 세계화 환경을 고려하지 않은 폐쇄경제 인플레이션 연구 분야에서 보다 심도 있게 논의되었다. 대표적으로 Coibin & Gorodnichenko(2015), Jorda et al.(2019a), Jorda et al.(2019b), Barnichon & Mesters(2021), Hazell et al.(2022) 등은 중앙은행의 적극적 물가 관리로 인한 기대인플레이션 안정을 필립스곡선 평탄화를 유발한 중요 요인으로 제시하였다.38) 다만, Del Negro et al.(2020)의 분석에 따르면 필립스곡선 평탄화의 주요 원인이 통화정책보다 구조적 요인에 의한 공급곡선 평탄화에 있는 것으로 나타났다. 동 연구는 세계화(GVC 확대, 경쟁 증가 등)를 유력한 후보로 추정하였다. 이상 본 절에서 살펴본 바와 같이 필립스곡선 평탄화에 대한 세계화 및 통화정책(기대인플레이션 안정)의 역할에 대해 다양하고 상반된 결과가 보고되고 있는 만큼 변수 간 인과성을 단정하기 어려운 것으로 이해할 수 있다.

나. 세계화와 추세 인플레이션 하락

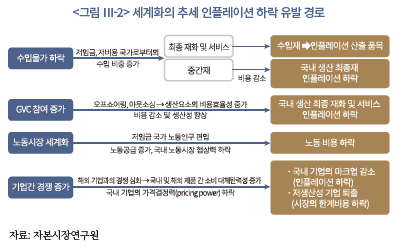

세계화는 아래 <그림 Ⅲ-2>에 정리된 바와 같이 재화‧서비스‧노동시장에서 발생하는 정(+)의 공급 충격 및 기업 간 경쟁 심화 경로를 통해 인플레이션 하락을 유발할 수 있다(Borio, 2017a; Carney, 2017; Ascari & Fosso, 2021; Attinasi & Balatti, 2021; ECB, 2021a 등). 중요한 점은 세계화가 점진적이고 추세적으로 진행되는 만큼 세계화가 유발한 공급 충격 및 경쟁 심화 또한 일시적이지 않고 지속적인 특징을 가진다는 데 있다. 결과적으로 세계화가 추세 인플레이션 하락요인으로 작용할 가능성이 있다.

세계화가 인플레이션 수준에 가장 직접적으로 영향을 미치는 경로는 최종재 및 중간재 수입물가 하락이다. 최종재의 수입물가 하락은 최종재가 국내 인플레이션 산출 품목에 포함되는 만큼 인플레이션 하락을 유발한다. 한편, 국내에서 생산되는 최종재의 투입요소(중간재) 수입물가 하락은 국내 생산이 수입 중간재에 의존하는 만큼 국내 인플레이션 하락요인으로 작용할 수 있다. 일부 연구에서는 세계화가 국내 인플레이션에 미치는 영향이 경로와 관계없이 수입물가에 반영된다는 의견을 제시하였으나, 세계화가 아래 제시되는 GVC 및 경쟁 경로 등을 통해 국내 인플레이션에 영향을 미칠 수 있기 때문에 수입물가에만 초점을 맞춘 세계화 효과 분석에 한계가 있다는 의견이 지배적이다(Forbes, 2019a, 2019b).

이론적 측면에서는 세계화가 기업 간 경쟁 심화 경로를 통해 국내 인플레이션에 미치는 영향에 관심이 집중되었다. 동 분야의 이론적 논의를 간략히 정리하면 다음과 같다. 국내 기업은 세계화로 해외 기업과의 경쟁에 직면하면서 자사의 시장점유율을 유지하기 위해 적정(desired) 마크업을 축소할 유인이 발생한다(Guerrieri et al., 2010).40) 뉴케인지언 필립스곡선(New Keynesian Phillips Curve: NKPC) 이론에 따르면 마크업이 축소될수록 기업의 가격결정력(pricing power)이 낮아짐과 동시에 한계비용의 가격 전이 정도가 낮아지므로 제품가격 상승률(인플레이션)이 낮아진다. 세계화로 인한 기업 간 경쟁 심화는 마크업 축소와 함께 효율성이 낮은 기업의 퇴출을 유발할 수 있다. 결과적으로 세계화는 생산성 향상(한계비용 감소) 경로를 통해 인플레이션의 구조적 하락요인으로 작용할 수 있다(Melitz, 2003; Chen et al., 2004; Melitz & Ottaviano, 2008). 이상에서 살펴본 연구들은 세계화가 기업의 가격‧임금 결정 행태에 변화를 일으켜 추세 인플레이션 하락을 유발할 수 있는 경로를 이론적으로 규명했다는 점에서 의미가 있다.

하지만 이상의 근거에도 불구하고 추세 인플레이션은 궁극적으로 통화정책에 의해 결정된다는 견해가 우세하다. 중앙은행이 정해진 목표 물가수준(nominal anchor)을 달성하고자 하면, 통화정책에 의해 세계화가 인플레이션에 미치는 영향이 상쇄(offset)될 수 있기 때문이다(Ball, 2006; IMF, 2006; Yellen, 2006, 2015; Bernanke, 2007 등). 이와 같은 이유에서 IMF(2006)는 세계화가 중앙은행의 물가목표치 변화에 영향을 미치는 만큼만 추세 인플레이션 하락을 유도할 수 있는 것으로 파악한다. 앞에서 살펴본 세계화 연구들 중 상당수도 통화정책이 추세 인플레이션을 결정하는 중요 요인이라는 점을 부인하지 않으며, 다만 세계화가 통화정책과 별도로 추세 인플레이션 결정에 보완적으로 기여할 수 있다는 견해로 이해할 수 있다(Borio, 2017a, 2017b; Carney, 2017; Ascari & Fosso, 2021 등). 이와 같은 논쟁을 고려할 때, 세계화가 1980년대 이후 추세 인플레이션 하락에 미친 영향은 사전적으로 단정하기 어려운 측면이 있는 것으로 볼 수 있다.

아래에서는 세계화와 추세 인플레이션( 및 인플레이션 수준) 간 관계에 대한 실증문헌 결과를 살펴본다. 세계화가 추세 인플레이션에 미친 영향을 실증분석한 기존연구는 크게 특정 경로에 초점을 맞추고 그 효과를 분석한 연구와 경로와 관계없이 세계화가 추세 인플레이션 하락에 미친 영향을 실증적으로 살펴본 연구로 구분할 수 있다. 아래에서는 주요 연구 결과를 정리한다.

우선 저임금 국가로부터의 수입 효과를 살펴본 연구결과를 정리하면 다음과 같다. Auer & Fischer(2010) 및 Auer et al.(2013)은 각각 저임금 국가로부터의 수입 증가가 미국(1997~2006년) 및 유럽(1995~2008년) 제조업 물가상승률에 미친 영향을 분석했다. 동 연구들에 따르면 저임금 국가로부터 수입이 증가할수록 제조업 물가상승률이 낮은 것으로 나타났으며, 전체 인플레이션의 장기적 하락세가 발생할 수 있는 것으로 분석되었다. Amiti et al.(2020)에 따르면 중국의 WTO 가입으로 미국 제조업 물가가 유의미하게 하락한 것으로 나타났는데, 특히 관세 및 무역자유화에 대한 불확실성 완화가 중요한 역할을 담당한 것으로 분석되었다. Pain et al.(2008)은 저임금 국가로부터의 수입 증가가 OECD 및 비OECD 국가의 인플레이션(CPI) 하락(1995~2005년)에 기여한 것으로 보고하였다. Badinger(2009)가 1985년부터 2004년까지 전 세계 91개국 인플레이션(CPI)을 대상으로 분석한 결과 무역개방도 및 금융개방도가 인플레이션 하락을 유발한 것으로 나타났다.41)

반면, Kamin et al.(2006)은 중국으로부터의 수입 증가가 미국 물가(1993~2002년)에 통계적으로는 유의하게 음의 영향을 미치나, 경제적으로는 미미한 수준에 그친다는 결과를 보고하였다. Cote & de Resende(2008) 또한 중국 수입이 18개 OECD 국가 인플레이션(1984~2006년)에 유의한 음의 영향을 갖지만 크기가 제한적인 것으로 확인하였다. IMF(2006) 분석(1960~1984년)에 따르면 선진국의 경우, 수입물가 하락으로 인한 국내 인플레이션 하락 효과가 대략 2년 내외까지만 유지되는 것으로 나타났다.

이처럼 수입의존도( 및 무역개방도)가 인플레이션 수준에 미친 영향에 대해 상이한 실증분석 결과가 혼재한 가운데, Auer et al.(2017)은 단순 무역통계보다 GVC 참여도가 세계화를 파악하는데 유용한 지표임을 지적하였다. Andrews et al.(2018)은 22개 OECD 국가(1995~2014년)를 대상으로 한 분석에서 GVC 참여도가 높을수록 제조업 생산자물가상승률이 하락함을 확인하였다. de Soyres & Franco(2019)는 1970년부터 2017년까지 126개국의 연간 CPI 인플레이션과 GVC 참여도 간 관계를 분석하였다. 동 연구에 따르면 GVC 참여도 증가가 분석 대상 국가들의 인플레이션 동조화를 유발하였으며, 인플레이션 수준의 지속적 하락에 기여한 것으로 나타났다.

세계화에 따른 기업 간 경쟁 심화와 인플레이션의 관계를 실증분석한 연구 결과는 다음과 같다. 앞에서 살펴본 이론적 연구(Melitz, 2003; Chen et al., 2004; Melitz & Ottaviano, 2008; Guerrieri et al., 2010)에 따르면, 경쟁 심화는 기업의 마크업 하락 및 생산성 향상을 통해 인플레이션 하락을 유도할 수 있다. Chen et al.(2004, 2009)이 1988~2000년 EU 제조업 물가를 분석한 결과, 경쟁 심화가 주로 생산성 향상 경로를 통해 인플레이션 하락에 기여한 것으로 나타났다.42) Chen et al.(2004, 2009)이 1989~1999년 EU 제조업 물가를 이용하여 Melitz & Ottaviano(2008) 모형을 추정한 결과, 마크업 감소 및 생산성 향상 경로가 모두 확인되었다. 동 연구에서 경쟁 심화가 인플레이션 하락에 미치는 장기효과(long-run effect)도 통계적으로 유의한 것으로 분석되었으나, 강도는 제한적으로 것으로 나타났다. 반면, Guerrieri et al.(2010)에서는 경쟁 심화로 인한 기업의 마크업 감소가 1990년대 미국 재화 인플레이션 하락 폭(4%p 수준)의 절반 이상을 설명하는 것으로 분석되었다.

다음으로 특정 경로에 제한하지 않고 축약형 필립스곡선을 통해 세계화가 인플레이션 수준 변화에 미친 영향을 실증적으로 분석한 기존연구 결과를 살펴본다. Forbes(2019a, 2019b)는 43개국(31개 선진국‧12개 이머징 국가, 1996년 1분기~2017년 4분기)의 다양한 인플레이션(CPI, 근원CPI, 임금) 수준에 세계화(GVC 등)가 미친 영향을 분석하였다. 동 연구에 따르면 GVC가 인플레이션 하락에 영향을 미치지만, 인플레이션 유형 및 기간에 따라 유의성이 일관되지 않은 것으로 나타났다.43) Kohlscheen & Moessner(2022) 및 Ari et al.(2023)의 분석에서도 세계화(각각 KOF지수 및 무역개방도)가 인플레이션(각각 전분기 대비 CPI상승률 및 제조업 인플레이션) 수준에 유의한 영향을 미치지 않는 것으로 나타났다.44) 반면, Friedrich & Selcuk(2022)은 세계화(KOF 세계화지수)가 필립스곡선(18개 선진국의 산업별 물가, 1970~2009년)의 하향 이동을 유의하게 설명하는 것으로 확인하였다. 여기서 주목할 점은 위에 언급된 Forbes(2019a, 2019b), Kohlscheen & Moessner(2022), Friedrich & Selcuk(2022) 및 Ari et al.(2023)이 공통으로 세계화와 필립스곡선 평탄화 사이에 유의한 음의 관계를 보고하였다는 점이다.

아래에서는 계량모형을 통해 추세 인플레이션을 추정하고, 세계화가 산출된 추세 인플레이션에 미친 영향을 분석한 연구결과를 살펴본다. 동 연구들은 세계화가 추세 인플레이션의 하락을 유발하는 경로를 식별하지는 않았지만, 실증분석을 통해 세계화가 추세 인플레이션 추정치에 미치는 영향을 직접 살펴봤다는 점에서 본 연구와 관련도가 높다. Forbes(2019b)는 43개국(1990년 1분기~2017년 4분기) 인플레이션을 추세요인(추세 인플레이션)과 순환요인(CPI-추세 인플레이션)으로 분해하고, 세계화(글로벌갭, GVC)가 각 요인에 미치는 영향을 분석하였다.45) 동 연구에 따르면 세계화가 인플레이션의 순환요인에는 유의한 영향을 미쳤으나, 추세요인에 대한 설명력은 유의하지 않은 것으로 분석되었다.46) Kamber & Wong(2020)은 28개국(7개 선진국‧21개 이머징 국가, 1980년 1분기~2018년 1분기) CPI를 추세요인과 순환요인으로 분해하고 글로벌 충격이 각 요인에 미치는 영향을 분석하였다.47) 동 연구에서는 글로벌 충격이 이머징 국가의 추세 인플레이션에는 유의한 영향을 미치는 반면, 선진국 인플레이션의 추세요인에 대해서는 설명력이 낮은 것으로 분석되었다. 다만, 동 연구에서는 글로벌 충격이 주로 상품(commodity)가격에 의해 결정되어 세계화의 구조적 특징을 분석에 포함하지 않았다는 한계가 있다.

Attinasi & Balatti(2021) 및 ECB(2021a)는 6개 선진국48)(1996년 1분기~2018년 1분기)의 근원 인플레이션을 재화(goods) 및 서비스 물가로 구분하고, 세계화(무역개방도, GVC 참여도, KOF 정보세계화지수)49)가 각 추세 인플레이션50)에 미친 영향을 분석하였다. 분석 결과, 세계화가 재화 추세 인플레이션에는 유의한 음의 영향을 미쳤으나, 서비스 추세 인플레이션에는 예상과 달리 양의 영향을 미쳤다. 이처럼 재화 및 서비스 추세 인플레이션이 세계화와 반대 방향의 관계를 가짐에 따라 전체 근원 추세 인플레이션에는 그 효과가 상쇄되는 것으로 나타났다. 결과적으로 동 연구에서는 세계화가 전체 근원 추세 인플레이션에 통계적으로 유의한 음의 영향을 갖는 것으로 나타났으나, 그 효과가 제한적이며 경제적으로 유의미하지 않은 수준으로 확인되었다.51)

이상에서 살펴본 Forbes(2019a, 2019b), Attinasi & Balatti(2021), ECB(2021a) 및 Koester et al.(2021) 등에서는 공통으로 세계화보다 장기 기대인플레이션이 추세 인플레이션 결정에 중요한 역할을 담당하는 것으로 확인되었다. 동 연구들의 결과를 종합하면, 세계화는 추세 인플레이션보다 순환적 인플레이션에 영향을 미치며, 추세 인플레이션에 대해서는 기대인플레이션의 영향이 더 큰 것으로 파악할 수 있다. 세계화는 추세 인플레이션에 통계적으로는 유의한 영향을 미치는 경우도 있으나, 경제적으로는 유의미하지 않은 것으로 나타났다.

한편, Ascari & Fosso(2021)는 미국의 추세 인플레이션(CPI) 결정요인을 통화정책요인(장기 기대인플레이션) 및 글로벌 공급요인(international cost-pressure factor)으로 구분하여 추정한 결과, 글로벌 요인이 통화정책요인과 별개로 추세 인플레이션 형성에 중요한 역할을 담당하는 것으로 나타났다. 동 연구에서는 1990년대 중반부터 2011년까지 추정된 추세 인플레이션이 연준의 목표치인 2%를 지속적으로 하회하였는데, 같은 기간 장기 기대인플레이션은 연준의 물가목표치 부근에서 안정적으로 유지되었다. 통화정책에 의해 형성된 추세 인플레이션과 달리 글로벌 공급요인에 의해 생성된 추세 인플레이션은 1% 내외에서 형성된 것으로 나타났다. 결과적으로 1990년대 중반부터 2011년까지 미국 CPI 추세 인플레이션은 통화정책보다 글로벌 공급요인의 영향을 더 많은 받은 것으로 파악하였다.52)

지금까지 살펴본 다양한 논의에도 불구하고, 앞서 언급된 바와 같이 장기(long-run) 인플레이션은 궁극적으로 통화정책이 결정한다는 의견이 다수이다. Yellen(2015)은 통화정책의 성공적 물가 관리로 장기 기대인플레이션이 안정되면 일시적인 인플레이션 충격이 발생하더라도 경제주체의 가격 결정에 반영되지 않기 때문에 추세적인 인플레이션으로 연결되지 않는다는 점을 강조하였다. 유사한 맥락에서 Carney(2017) 및 ECB(2021a) 등은 세계화가 특정 섹테의 추세 인플레이션에 영향을 미치더라도 통화정책으로 여타 섹터의 인플레이션을 조정할 수 있는 만큼 세계화와 같은 구조변수가 전체 인플레이션 추세에 영향을 미치기 어렵다는 견해를 제시하였다. 유사한 맥락에서 Ball(2006) 및 Bernanke(2007) 등은 통화정책 효과 파급에 시간이 소요되는 만큼 세계화가 단기적으로는 인플레이션에 영향을 미칠 수 있는 것으로 평가하였다.

통화정책이 추세(장기) 인플레이션에 미친 영향을 살펴본 기존연구 결과를 간략히 정리하면 같다. Carlstrom & Fuerst(2009)에 따르면 통화정책 독립성이 1998년부터 2000년까지 26개 선진국(한국 포함) 인플레이션 하락의 2/3를 설명하는 것으로 분석되었다. 한편, Williams(2006)는 1980년대 중반 이후의 미국 저물가 기조는 기대인플레이션 안정에서 비롯된 것으로 평가하였다. Coibin & Gorodnichenko(2015) 및 Jorda et al.(2019a)은 미국 인플레이션 결정요인 중 기대인플레이션의 역할이 점차 증가하였으며, 특히 글로벌 금융위기 이후의 인플레이션 변화에는 기대인플레이션이 지배적인 역할을 한 것으로 분석하였다. Kamber et al.(2020)의 분석에서는 1996년부터 2018년까지 47개 선진국 및 이머징 국가의 인플레이션 수준 변화에 기대인플레이션의 역할이 큰 것으로 나타났다.

본 절에서 살펴본 추세 인플레이션과 세계화의 관계를 분석한 연구들에서도 기대인플레이션은 세계화 변수보다 일관되게 추세 인플레이션에 유의하게 양(+)의 영향을 미친 것으로 나타났다(Forbes, 2019a, 2019b; Attinasi & Balatti, 2021; Koester et al., 2021; Kohlscheen & Moessner, 2022). Kamber & Wong(2020) 및 Cote & de Resende(2008)는 간접적으로 추세 인플레이션 결정에 세계화보다 통화정책의 역할이 중요함을 강조하였다.

다. 세계화와 섹터별(재화 및 서비스) 인플레이션

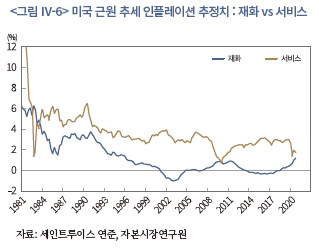

세계화와 인플레이션의 구조적 특징을 살펴봄에 있어 흥미로운 이슈는 세계화가 필립스곡선 평탄화 및 추세 인플레이션 하락에 미친 영향이 재화 및 서비스 인플레이션 간에 차이가 있다는 점이다. 앞에서 언급된 것처럼 Attinasi & Balatti(2021) 및 ECB(2021a)에 따르면 6개 선진국 인플레이션의 경우 세계화로 인한 추세 인플레이션 하락 효과가 재화 물가에 집중된다. Eo et al.(2023)이 미국 근원 재화 및 서비스 추세 인플레이션(1959년 1분기~2021년 4분기, Core PCE)을 추정한 결과, 1990년대 중반 이후 재화 추세 인플레이션이 0% 내외의 좁은 범위에서 변동한 반면, 서비스 추세 인플레이션은 3% 이상에서 형성되었다.53) 이로부터 Eo et al.(2023)은 전체 추세 인플레이션 변동이 서비스 추세 인플레이션에 의해 결정된다는 견해를 제시하였다. 앞에서 살펴본 Guerrieri et al.(2010) 및 Auer et al.(2013) 등 또한 재화 물가에 초점을 맞추어 세계화로 인한 장기 인플레이션 하락 효과를 분석하였다. 이상의 결과는 서비스보다 재화가 국제적으로 거래가 용이하다는 점이 주요 원인으로 파악된다.

세계화가 필립스곡선 기울기에 미치는 영향 또한 재화 및 서비스 물가 간에 차이가 관찰된다. Peach et al.(2013)이 미국 근원 재화 및 서비스 물가(2005년 1분기~2012년 4분기) 필립스곡선을 추정한 결과, 서비스 인플레이션은 장기 기대인플레이션 및 국내 유휴생산력(실업률갭)의 영향을 많이 받는 반면, 재화 인플레이션은 단기 기대인플레이션 및 수입 물가에 민감하게 반응하는 것으로 나타났다. Abdih et al.(2016)의 미국 근원 인플레이션(1996년 1분기~2015년 4분기) 분석에서도 서비스 인플레이션에 대해서는 대내요인(장기 기대인플레이션 및 실업률갭)의 영향이 크며, 재화 인플레이션의 경우 대외요인(환율 및 글로벌 원자재 가격)이 주요 결정요인으로 확인되었다. 이상의 내용은 <그림 Ⅲ-3>과 같이 정리할 수 있다.

인구구조 변화는 세계화와 함께 저물가 기조의 주요 원인으로 고려된다. 특히, 2008년 글로벌 금융위기 이후 세계화가 정체 국면에 진입한 반면 고령화(노동가능인구 비중 감소‧고령인구 비중 증가)는 가속화됨에 따라 2000년대 중반 이후의 기조적 저물가 원인으로 인구구조 변화가 지목되고 있다(Bobeica et al., 2017). 고령화와 인플레이션 간 관계에 대한 기존연구는 실증분석을 중심으로 수행되어 왔는데, 대부분의 연구가 인구구조 변화가 중장기 인플레이션 수준에 미치는 영향에 초점을 맞추고 있다. 본 고에서 살펴본 바에 따르면 인구구조가 필립스곡선 평탄화를 유발했는지에 대해서는 인과관계가 논의되지 않은 것으로 파악된다. 이에 본 절에서는 인구구조가 인플레이션 하락에 미친 영향을 다룬 연구를 살펴본다.54)

본 절에 정리된 바와 같이, 분석 국가 및 시기에 따라 선행연구별로 인구구조 변화와 인플레이션 간 관계에 대해 상이한 결과를 보고 중인 가운데, 인구구조가 인플레이션에 영향을 미치는 경로도 아직 명확하게 규명되지 않은 상태이다(Koester et al, 2021). 동 분야의 연구는 크게 고령화가 인플레이션 상승을 유발한다는 견해와 추세적인 인플레이션 하락요인이라는 주장으로 양분할 수 있다. 아래에서는 우선 생애주기(life-cycle) 가설에 입각해 인구구조가 인플레이션에 미칠 수 있는 영향을 살펴본다.

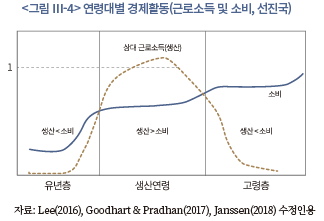

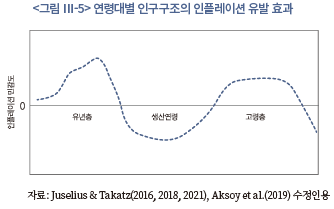

Goodhart & Pradhan(2017, 2020a, 2020b, 2020c, 이하 Goodhart & Pradhan), Juselius & Takatz(2016, 2018, 2021, 이하 Juselius & Takatz) 및 Aksoy et al.(2019) 등은 생애주기 이론에 기초해 연령대별 인구구조(age structure)가 인플레이션에 미치는 영향이 다를 수 있다는 견해와 실증분석 결과를 제시하였다. 동 연구들은 고령층 비중 등 특정 변수로 제한하지 않고 전체 인구구조가 인플레이션에 미칠 수 있는 영향을 종합적으로 파악할 수 있는 시각을 제공하였다는 점에서 의미가 있다. 동 연구들의 견해는 <그림 Ⅲ-4> 및 <그림 Ⅲ-5>로 요약할 수 있다.55)

<그림 Ⅲ-4>는 연령대별 소비와 생산의 크기를 보여주는데, 생애주기 이론에 따르면 유년층과 고령층은 생산활동에 비해 소비 규모가 큰 순소비집단(net consumer)으로 볼 수 있다. 반면, 노동가능인구는 은퇴 후를 대비하여 생산에 비해 소비를 적게 하는 순저축집단(net saver)이다. 필립스곡선 관점에서 인플레이션은 경제내 총수요가 총공급보다 클 때 상승압력이 발생하는 것으로 이해할 수 있으므로, 각 인구 코호트(cohort)가 인플레이션에 미치는 영향은 <그림 Ⅲ-5>와 같이 도출된다.

Aksoy et al.(2019)은 1970년부터 2014년까지 21개 OECD 국가의 전체 인구 대비 유년층(20세 미만), 생산연령층(20~60세) 및 고령층(60세 초과) 비율이 연도별 인플레이션에 미친 영향을 분석하였는데, 연령대별 비율이 <그림 Ⅲ-5>와 동일한 방향으로56) 인플레이션에 유의한 영향을 미친 것으로 나타났다.57) 다음으로 Juselius & Takatz는 22개 OECD 선진국의 인구 코호트별 비중이 인플레이션에 미친 영향을 다양한 기간(1870~2016년)에 대해 분석하였다. Juselius & Takatz는 인구구조를 5세 단위의 총 17개 코호트로 구분하여 영향을 조사하였다. 연령층별 비중의 연도별 인플레이션에 대한 영향은 대략적으로 <그림 Ⅲ-5>에 나타난 바와 같은데, 고령층 중 80세 이상 비중은 인플레이션 하락을 유발하는 것으로 나타났다. 또한 Juselius & Takatz에 따르면 이와 같은 인구구조의 영향은 추세 인플레이션(5년 및 25년 물가상승률)에 대해서도 거의 동일하게 확인되었다. 미국의 경우, 베이비 붐 세대의 인구 코호트 이동이 추세 인플레이션의 상당 부분을 설명하는 것으로 나타났다. 베이비 붐 세대는 1955~1975년(유년층)에 추세 인플레이션을 6%p 가량 상승시키는 역할을 하였으며, 1975~1990년(노동가능인구 편입)에는 5%p 정도 낮추는 효과를 보인 것으로 분석되었다.

이상에서 살펴본 Goodhart & Pradhan, Juselius & Takatz 및 Aksoy et al.(2019) 등의 연구는 인구구조가 인플레이션에 미칠 수 있는 영향을 종합적으로 살펴볼 수 있는 유용한 수단이다. 동 연구들은 인구 코호트별로 인플레이션에 미치는 영향이 상이한 가운데, 고령화로 노동가능인구가 감소하고 고령인구가 증가하여 장기적으로 인플레이션 상승압력이 증가할 것이라는 견해를 제기하였다. 하지만 고령화 속도‧정도 및 사회안전망 구축 정도 등의 차이에 따라 고령층을 중심으로 <그림 Ⅲ-4>에 나타난 생산과 소비 행태가 다를 수 있는 만큼 인플레이션에 대한 영향도 다르게 나타날 가능성이 있다. 또한 고령화 정도가 심할 경우 고령화가 전체 경제의 생산 및 소비에 영향을 미칠 가능성도 있다. 고령화가 인플레이션의 추세적 하락을 유발한다는 연구들은 대체로 이런 관점에서 파악할 수 있다. 아래에서는 고령화를 구조적인 저물가 요인으로 파악하는 기존연구를 살펴본다.

고령화는 장기적으로 잠재성장률 하락을 유발하며, 이에 따라 가계 소득에 영구적인 음(-)의 충격이 발생할 수 있다. Shirakawa(2012)는 일본의 경우 이러한 거시경제 여건 변화에 대한 기대가 경제주체의 소비 활동에 영향을 미쳐 성장률의 추세적 하락세가 실현되기 전에 수요가 감소하였으며, 그 결과로 디플레이션이 발생했다는 견해를 제기하였다. Braun & Ikeda(2022)는 고령화로 향후 주요 선진국에서 저성장, 저금리(실질금리) 및 저물가로 대변되는 장기침체(secular stagnation) 현상이 지속될 수 있음을 지적하였다. 동 연구에 따르면 이론적으로 고령화가 심화될수록 경제 내에서 저축 및 국채 등과 같은 유동자산에 대한 수요가 부동산 및 내구재 등과 같은 비유동자산에 대한 수요를 상회하게 되며, 이로부터 기조적인 저물가 압력이 발생할 수 있다.58) 다만, Shirakawa(2012) 및 Braun & Ikeda(2022)의 논의가 고령화 정도가 여타 국가에 비해 매우 심화된 일본 사례에 기초한다는 점에 유의할 필요가 있다.59)

한편 Yoon et al.(2014)이 1960년부터 2013년까지 OECD 30개국의 인구구조와 인플레이션 간 관계를 분석한 결과, 고령층(65세 이상) 비율이 증가할수록 인플레이션이 낮아지는 것으로 나타났다. Gajewski(2015)의 분석(1970~2013년, OECD 34개국)에서는 고령부양 비율(15~64세 또는 20~64세 인구 대비 65세 이상 인구 비율)이 인플레이션에 음의 영향을 미치는 것으로 나타났다.60) Broniatowska(2019)의 분석(1971~2015년, OECD 32개국)에서도 고령부양 비율(15~64세 인구 대비 65세 이상 인구 비율)이 디플레이션 요인으로 확인되었다. 결과적으로 Yoon et al.(2014), Gajewski(2015) 및 Broniatowska(2019) 등은 고령화를 구조적인 인플레이션 하락요인으로 파악하였다. 동 연구들은 대체로 고령화로 인한 경제내 총수요 감소가 물가하락을 유발할 수 있다는 견해를 제시하였다. 흥미로운 점은 Gajewski(2015) 및 Broniatowska(2019)에서 유년부양 비율이 증가할수록 인플레이션이 높아지는 것으로 나타났는데, 이는 앞서 살펴본 Juselius & Takatz 및 Aksoy et al.(2019) 등의 결과와 일치한다. Juselius & Takatz는 고령화로 인한 디플레이션 효과가 주로 85세 이상 초고령층에 의해 유발된다는 견해를 제시하였다.

이상에서 살펴본 Goodhart & Pradhan, Juselius & Takatz 및 Aksoy et al.(2019)과 Yoon et al.(2014), Gajewski(2015) 및 Broniatowska(2019) 등에서 도출된 결과를 대략적으로 정리하면 다음과 같다. 대체로 유년층 및 노동가능연령층은 대부분의 연구에서 공통으로 인플레이션 상승요인으로 나타났다. 하지만 연구별로 고령층이 인플레이션에 미치는 영향의 부호가 반대 방향으로 분석되어 고령화가 인플레이션에 미치는 영향이 상이한 것으로 나타났다.

기존연구에서는 인구구조 변화가 임금 경로를 통해 인플레이션에 미치는 영향에 대해서도 상반된 의견이 제시된다. Goodhart & Pradhan은 고령화로 경제내 노동 공급이 축소됨에 따라 임금이 상승하여 인플레이션이 상승할 수 있다는 견해를 제시한 반면, Mojon & Ragot(2019)은 고령화로 임금 인플레이션이 낮아졌다는 실증분석 결과를 제시하였다. Mojon & Ragot(2019)의 1996년부터 2016년까지 19개 OECD 국가를 대상으로 한 분석에서는 55~64세 노동가능인구의 노동참여율이 증가하여 임금 인플레이션 압력이 낮아진 것으로 나타났다. 동 연령층은 기대수명 증가 및 연금개혁 등으로 노동참여율이 꾸준히 증가하였는데, Mojon & Ragot(2019)은 이들이 은퇴를 미룸으로써 일종의 양의 노동 공급 충격이 발생한 것으로 파악하였다.

한편 Lis et al.(2020) 및 Bodnar & Nerlich(2022) 등은 인구 코호트별 소비 행태의 차이가 고령화와 인플레이션 간 관계에 중요한 역할을 담당할 수 있다는 견해를 제시하였다. 고령층 소비는 타 연령층과 비교해 의료 및 장기요양 서비스 등에 집중되는데, 동 서비스 품목은 규제의 영향을 많이 받는다. 결과적으로 고령층 비중이 증가할수록 자동차 등 내구재 소비가 감소하고 수요탄력성이 낮은 품목에 대한 소비가 증가하므로 전체적으로 인플레이션이 낮아질 수 있다.61)

앞 절에서 살펴본 세계화와 인플레이션 간 관계에서 궁극적으로 통화정책이 추세 인플레이션을 결정한다는 견해를 살펴본 바 있다. 고령화의 경우 세계화와 달리 실질경제여건에 영향을 미친다는 데 합의가 이루어진 만큼, 고령화와 통화정책 간 상호작용이 인플레이션 결정에 중요한 역할을 할 수 있다는 의견이 지배적이다(Bobeica et al., 2017; Lis et al., 2020; Koester et al., 2021). 본 연구의 제1편에서 논의된 바와 같이 고령화는 실질중립금리의 추세적 하락을 유발하는 중요 요인이다. 만약 통화정책이 고령화로 인해 낮아진 실질중립금리 수준을 기준금리 결정에 충분히 반영(internalize)하지 못할 경우 긴축의 강도가 중앙은행이 의도하는 수준보다 높아질 수 있으며, 결과적으로 물가하락 압력이 상존하는 효과(deflationary bias)가 발생할 수 있다. 특히, 기준금리가 실효하한에 근접한 경우에는 통화정책이 고령화로 인한 실질중립금리 하락 효과를 반영하는데 어려움이 가중되어 고령화가 구조적인 인플레이션 하락요인으로 작용하게 된다.

Lis et al.(2020)은 중앙은행이 고령화로 인한 실질중립금리 하락을 충분히 반영하지 못할 경우 유로지역의 추세 인플레이션이 2030년에 0.5% 수준까지 하락할 수 있다는 분석 결과를 제시하였다. Bobeica et al.(2017)은 1975년부터 2016년까지 유로지역, 미국, 독일의 노동가능인구 비중 증가율(고령화 대리변수)과 (근원)인플레이션 간에 정의 관계가 존재함을 발견하였는데, 동 효과가 통화정책(기준금리)에 의해 일부 완화되는 것으로 나타났다. 결과적으로 동 연구의 결과를 고령화 관점에서 해석하면, 고령화는 인플레이션의 하락을 유발하는데, 만약 통화정책이 고령화의 실물 경제에 대한 영향을 충분히 반영하지 못한다면 의도치 않게 긴축 강도가 높아질 수 있음을 의미한다. 그 결과 디스인플레이션의 강도도 더 커지게 될 것이다.

Ⅳ. 실증분석

본 연구의 제1편에서 논의된 바와 같이 인플레이션의 구조적 특징은 실질중립금리와 함께 금리의 장기 추세를 결정하는 핵심 요인이다. 본 장에서는 세계화 및 인구구조 변화가 인플레이션의 구조적 특징에 미친 영향을 실증분석한다. 특히, 한미 비교를 통해 인플레이션의 결정요인에 차이가 존재하는지 확인한다. 다음으로 세계화 후퇴 및 인구구조 변화 추세(노동가능인구 감소 및 고령인구 증가)를 감안하여 향후 한미 인플레이션의 기조 변화 가능성을 평가해본다.

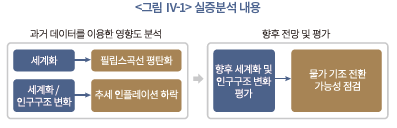

1. 분석 내용

본 연구에서는 한미 인플레이션의 구조적 특징을 필립스곡선 기울기(국내 경제여건에 대한 인플레이션의 민감도) 및 추세 인플레이션으로 구분하고, 세계화 및 인구구조 변화가 한미 필립스곡선 평탄화 및 추세 인플레이션 하락에 기여했는지 실증분석한다. Ⅲ장에서 살펴본 기존연구에 기초하여 필립스곡선 평탄화 유발 요인은 세계화만 고려하고자 하며, 추세 인플레이션 하락요인으로는 세계화와 인구구조 변화를 모두 고려한다. 과거 데이터 분석을 통해 도출된 세계화 및 인구구조 변화와 저물가 기조 간 관계를 토대로 세계화 후퇴 가능성 및 인구구조 변화가 한미 인플레이션 기조 변화에 미칠 영향을 평가해본다.

본 연구의 추세 인플레이션 분석은 Ⅲ장에서 살펴본 대다수 기존연구와 달리 세계화 및 인구구조의 상대적 중요성을 파악하기 위해 동 변수들을 동시에 실증모형에 포함한다. 다만, 변수들의 특성으로 인해 세계화 및 인구구조 변화를 함께 고려하는데 어려움이 있다. 이에 본 연구에서는 가능한 범위 내에서 분석을 실시하였으며, 이로 인해 한미 간에 모형의 일관성이 충분히 확보되지 못하는 한계가 있음을 미리 밝힌다. 본 장의 분석 내용은 아래 <그림 Ⅳ-1>과 같이 요약된다.

가. 분석 방법

본 연구에서는 아래 식(1)과 같이 세계화 효과를 고려한 축약형 필립스곡선을 통해 세계화가 필립스곡선 평탄화에 미친 영향을 분석한다.

기존연구에서는 크게 두 가지 방법을 통해 세계화가 인플레이션의 국내 유휴생산력에 대한 민감도 하락에 미친 영향을 분석한다. Borio & Filardo(2007) 및 Ihirg et al.(2010) 등은 식(1)에서 교차항

한편 식(1)에서 세계화가 필립스곡선 평탄화에 미친 영향은 교차항을 통해 반영되므로

나. 변수 및 자료

본 고에서는 1970년부터 2020년까지 한미 연간 인플레이션을 앞서 언급한 기본모형에 적용하여 세계화 효과를 분석하였다. 변수별 상세한 정의는 <부록 1>에 정리하였다. <부록 1>에 기술된 바와 같이 한미 간에 분석 대상 인플레이션에 차이가 있다. 먼저 한미 공통으로 헤드라인 CPI 인플레이션을 분석하였다. 미국의 경우 근원 CPI와 함께 근원 CPI의 하위 요소인 근원 재화(core goods) 및 근원 서비스(core services) 인플레이션을 추가로 분석하였다. 이를 통해 세계화가 근원 재화 및 서비스 인플레이션에 미치는 영향에 차이가 있는가를 살펴보았다. 한국 근원 CPI는 1990년부터 발표되어 충분한 표본 수 확보에 어려움이 있어 분석에 포함하지 않았다.65) 한국의 기대인플레이션은 표본기간 중 일부에만 시계열이 존재하기 때문에 분석에서 제외하였다. 다음으로 한미 세계화

다. 추정 결과

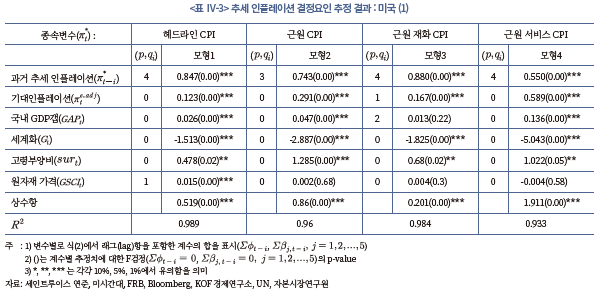

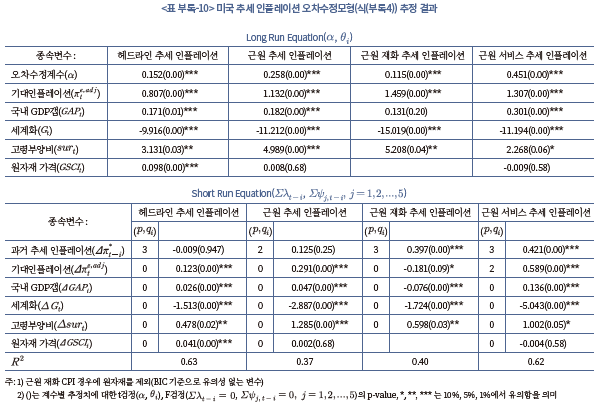

1) 미국

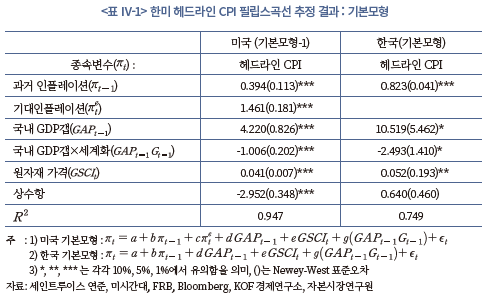

아래에서는 우선 헤드라인 인플레이션에 대한 결과를 살펴보고, 다음으로 근원 CPI 및 근원 재화‧서비스 인플레이션 결과를 정리한다. <표 Ⅳ-1>에는 미국 헤드라인 CPI에 대한 필립스곡선 기본모형의 추정 결과가 정리되어 있다. 우선 다수 기존연구와 마찬가지로 과거 인플레이션, 기대인플레이션 및 GDP갭 모두 인플레이션에 유의한 영향을 미치는 것으로 확인되었다. 아울러, 헤드라인 CPI이므로 글로벌 원자재 가격의 영향도 유의하다. 본 고의 초점인 세계화 및 GDP갭 교차항

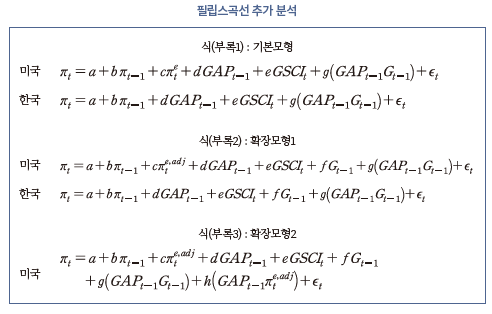

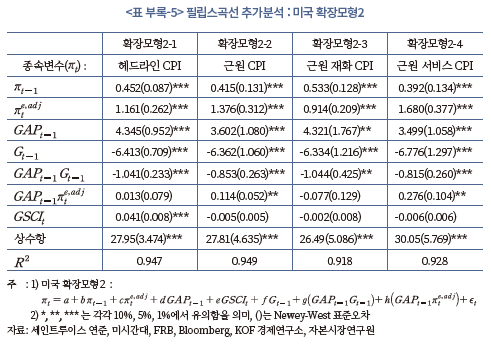

<부록 2>에 정리된 미국 확장모형의 추정 결과를 <표 Ⅳ-1>의 기본모형 결과와 비교하면 다음과 같다. 첫째, 세계화가 필립스곡선 평탄화에 미친 영향은 세계화를 별도의 독립변수로 포함해도 여전히 유효하다. <표 부록-4>의 확장모형1-1을 살펴보면 세계화 및 GDP갭 교차항

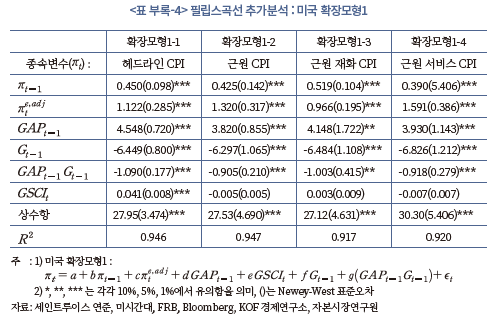

다음으로 <표 부록-5>에는 (조정) 기대인플레이션과 GDP갭의 교차항

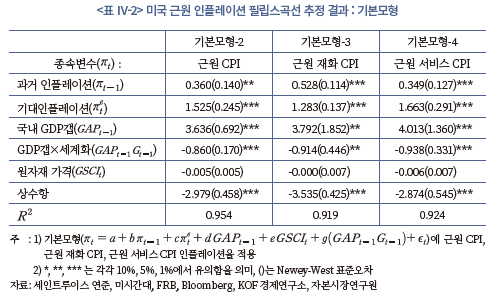

다음으로 근원 재화 인플레이션 및 근원 서비스 인플레이션 필립스곡선 추정 결과를 비교해본다. <표 Ⅳ-2>의 기본모형-3, <표 부록-4>의 확장모형1-3과 <표 부록-5>의 확장모형2-3은 근원 재화 인플레이션 추정 결과를 보여주며, <표 Ⅳ-2>의 기본모형-4, <표 부록-4>의 확장모형1-4와 <표 부록-5>의 확장모형2-4는 근원 서비스 인플레이션 추정 결과를 나타낸다.

근원 재화 및 근원 서비스 인플레이션의 특성 간 차이를 살펴보면 다음과 같다. 첫째, 분석 기간 중 평균적인 관계를 기준으로 볼 때, 근원 서비스 인플레이션이 근원 재화 인플레이션보다 기대인플레이션의 영향을 많이 받는 것으로 나타났는데,71) 동 결과는 Peach et al.(2013) 및 Abdih et al.(2016)에 부합한다. 둘째, 근원 재화 및 근원 서비스 인플레이션 모두 세계화가 진전될수록 인플레이션이 하락하는 것으로 확인되었다. 세계화의 인플레이션 수준에 대한 영향은 근원 재화 및 서비스 인플레이션에서 계수 추정치의 크기 및 유의성이 비슷한 것으로 나타났다.72) 셋째, 본 절의 초점인 세계화가 근원 재화 및 서비스 인플레이션 필립스곡선 평탄화에 미친 영향을 살펴보면, 근원 재화 및 서비스 인플레이션 모두 세계화가 진전되면서 국내 GDP갭에 대한 민감도가 낮아지는 것으로 나타났다.73) 흥미롭게도 서비스 인플레이션의 경우 필립스곡선 평탄화에 세계화뿐만 아니라 기대인플레이션 안정이 중요한 역할을 담당한 반면, 재화 인플레이션은 기대인플레이션의 영향이 유의하지 않았다.74)

앞의 <표 Ⅳ-1>에는 한국 헤드라인 CPI 인플레이션 필립스곡선 기본모형의 추정 결과가 나타나 있다. 우선 미국과 유사하게 과거 인플레이션, GDP갭 및 원자재 가격이 인플레이션에 영향을 미치는 것으로 나타났다. 세계화와 GDP갭 교차항

3) 추가분석 : 세계화로 인한 필립스곡선 평탄화 효과

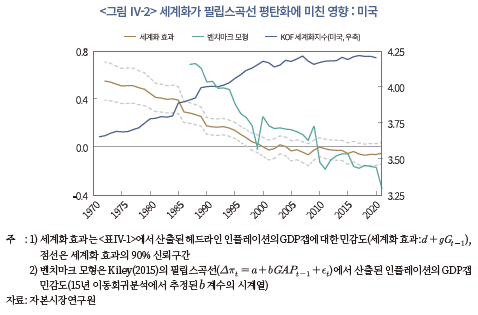

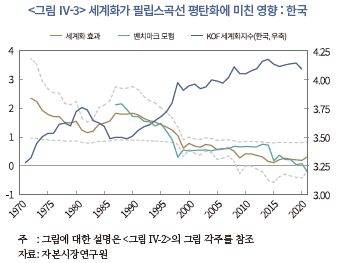

앞의 분석을 통해 세계화가 필립스곡선 평탄화에 유의한 영향을 미쳤는지를 알아보았다. 아래에서는 앞선 추정 결과를 이용하여 세계화로 인한 필립스곡선 평탄화 정도를 도식화하여 살펴본다. <그림 Ⅳ-2>와 <그림 Ⅳ-3>은 <표 Ⅳ-1>의 한미 CPI 필립스곡선 기본모형 추정 결과로부터 산출된 국내 GDP갭에 대한 인플레이션의 민감도

<그림 Ⅳ-2>와 <그림 Ⅳ-3>에서 한미 모두 세계화 진전에 따라 필립스곡선 기울기가 평탄화되어 왔음을 알 수 있다. 아울러, 본 연구에서 추정된 세계화 효과

본 절의 논의를 통해 한미 모두 인플레이션의 국내 경기 민감도 둔화에 세계화가 중요한 역할을 한 것으로 파악할 수 있다. 동 결과는 향후 세계화가 후퇴할 경우 한미 공통으로 경기와 물가 간 관계가 강화될 수 있음을 시사한다는 측면에서 주목할 필요가 있는 것으로 판단된다.

가. 분석 방법

본 절에서는 세계화와 인구구조 변화가 한미 추세 인플레이션의 하향 안정화에 미친 영향을 분석한다. 아래에서는 분석 대상인 양국의 추세 인플레이션 추정에 대해 설명하고, 추세 인플레이션 결정요인 분석 방법을 정리한다.

1) 추세 인플레이션 추정

우선 양국의 분석 대상 인플레이션을 설명한다. 한국의 경우 헤드라인 CPI 인플레이션 및 근원 CPI 인플레이션의 추세 인플레이션을 분석한다. 미국은 헤드라인 및 근원 CPI 인플레이션과 함께, 근원 재화 및 근원 서비스 CPI의 추세 인플레이션 결정요인을 살펴본다.78) 이를 통해 세계화가 추세 인플레이션에 미친 영향이 섹터별로 상이한지 알아본다.

추세 인플레이션은 관측되지 않으므로 모형을 통해 추정해야 한다. 추세 인플레이션은 다양한 방법으로 추정이 가능한데, 본 고에서는 보편적으로 활용되는 계량모형을 통해 추정한다. 양국의 헤드라인 CPI 추세 인플레이션 추정치는 Ⅱ장의 <그림 Ⅱ-1>에 제시된 바와 같다. 근원 추세 인플레이션 추정을 제시하기 전에 미국 근원 재화 및 근원 서비스 추세 인플레이션 추정방법을 설명한다. 본 고에서는 Eo et al.(2023)이 고안한 두 섹터 비관측요인(Two-Sector Unobserved Components Stochastic Volatility: UCSV)모형을 사용하여 미국 근원 재화 및 근원 서비스 추세 인플레이션을 추정한다. 동 모형은 Stock & Watson(2007)의 단일 섹터 비관측요인모형을 두 섹터(재화 및 서비스)로 확장한 것이다.79) 이와 같이 하위 섹터 인플레이션에 두 섹터 UCSV모형을 적용하므로 전체 근원 추세 인플레이션은 Stock & Watson(2007)의 단일 섹터 UCSV모형을 통해 추정한다. 헤드라인 인플레이션 또한 Ⅱ장의 <그림 Ⅱ-1>에 기술된 것처럼 근원 인플레이션과 동일하게 Stock & Watson(2007)을 적용하여 산출하였다. Stock & Watson(2007)은 추세 인플레이션 추정에 널리 활용되어온 모형이다.80) 헤드라인 및 근원 등 모든 추세 인플레이션은 분기별 전분기 대비 인플레이션을 각 모형에 적용하여 산출하였다.

2) 추세 인플레이션 결정요인 분석 방법

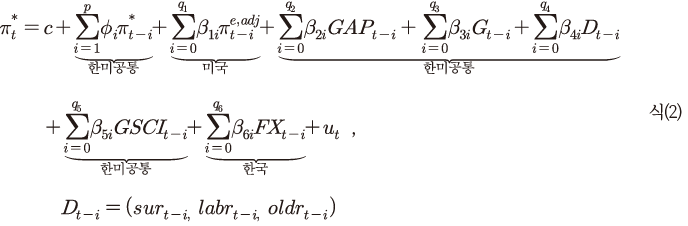

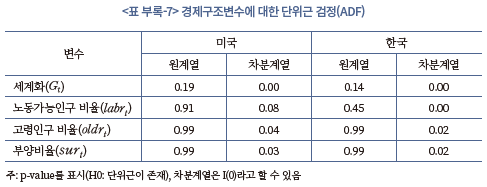

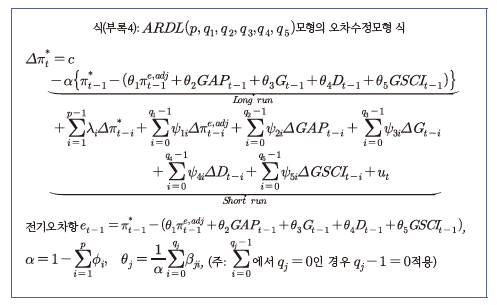

아래에서는 세계화 및 인구구조 변화가 추세 인플레이션에 미치는 영향의 분석 방법을 설명한다. 본 연구와 같이 종속변수 및 독립변수 중 일부가 비정상성(non-stationarity)을 갖는 경우 가성관계(spurious relationship)가 존재할 수 있으므로 회귀분석을 적용할 때 주의가 필요하다. 앞서 기술한 것처럼 본 고에서는 종속변수인 추세 인플레이션을 Stock & Watson(2007)을 적용하여 추정하는데, 동 방법은 기본적으로 추세 인플레이션을 임의보행과정(random walk process)으로 모형화한다. 또한 <부록 3>에 정리된 바와 같이 세계화 및 인구구조 등의 독립변수가 비정상성을 갖는다.81) 이에 본 고에서는 아래 식(2)와 같이 자기회귀시차분포(Autoregressive Distributed Lag Model: ARDL) 모형을 구성하여 추세 인플레이션 결정요인을 분석한다. ARDL은 변수 간에 비정상성 수준(order of non-stationarity)이 다른 경우에 적용할 수 있는 방법이다.82) 동 회귀식의 유효성은 식(2)에서 유도되는 오차수정모형(Error Correction Model: ECM)을 통해 검정할 수 있다. 본 고에서는 Pesaran et al.(2001)의 한계검정법(bounds test)을 적용하였으며, 검정 결과 및 장단기 균형관계식 추정 결과는 <부록 3>에 정리하였다. Attinasi & Balatti(2021) 및 ECB(2021a) 등도 본 고와 유사하게 ARDL 방법을 적용하여 추세 인플레이션 결정요인을 분석한 바 있다.83) 다만, 식(2)는 종속변수가 관찰되는 인플레이션이 아니기 때문에 식(1)과 달리 필립스곡선으로 파악할 수 없다는 점에 주의할 필요가 있다. 따라서 앞 절의 필립스곡선 분석과 달리 변수 간 교차항은 고려하지 않는다.

나. 변수 및 자료

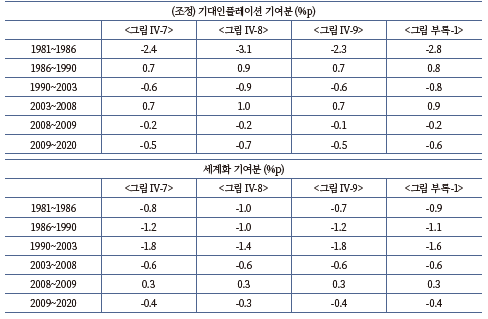

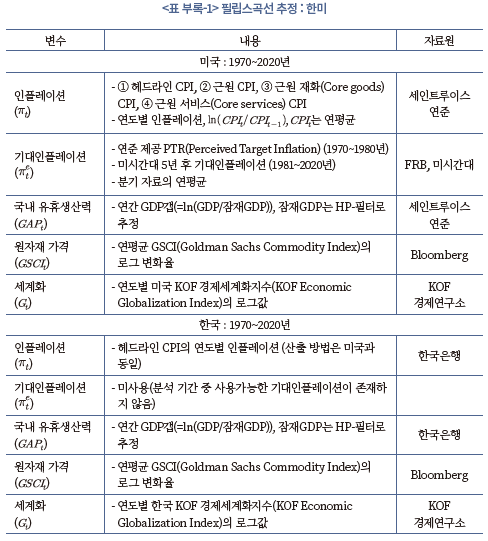

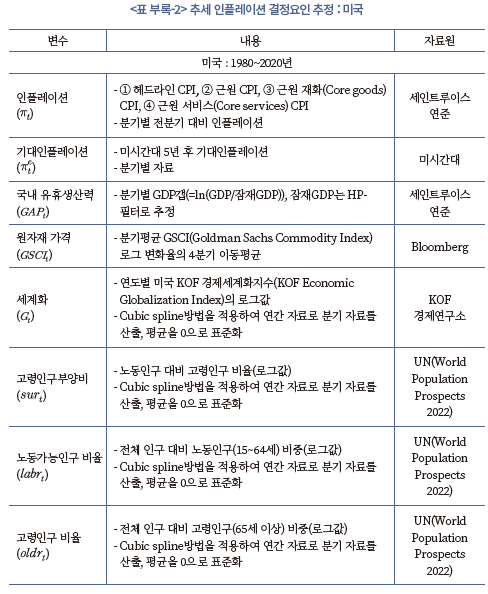

본 절에서는 미국의 경우 1980년 1분기~2020년 4분기, 한국은 1990년 1분기~2020년 4분기까지의 자료를 이용하여 세계화 및 인구구조 변화가 각국의 추세 인플레이션에 미친 영향을 분석하였다. 변수별 상세한 정의는 <표 부록-2>와 <표 부록-3>에 정리하였다. 여기서는 주요 내용만 언급한다.

표본기간과 관련해서 한국은 근원 인플레이션이 1990년부터 발표되었다. 양국의 분석 기간은 본 연구의 분석 목표인 헤드라인 및 근원 추세 인플레이션의 하향 안정화시기를 모두 포함한다. 주요 변수별 정의는 다음과 같다. 세계화

추세 인플레이션이 분기별 인플레이션으로부터 추정된 만큼 결정요인 후보 변수도 분기별 자료를 이용하였다. <부록 1>에 정리된 것처럼 여타 변수는 원자료가 분기별로 이용가능하나, KOF 세계화지수 및 인구구조 변수는 연간으로만 제공된다. 이에 본 고에서는 cubic spline방법을 이용하여 연간 KOF 세계화지수 및 인구구조 자료를 분기별 데이터로 변환하였다. 이와 같은 변수 변환은 Ⅲ장에서 살펴본 기존연구에서도 자주 사용되는 방법이다.85)

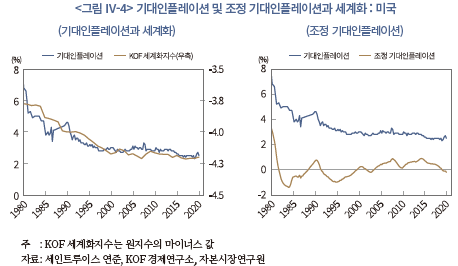

Ⅲ장에서 살펴본 바와 같이 기존문헌에서 추세 인플레이션 결정요인으로 경제구조변수(세계화 및 인구구조) 및 통화정책의 중요성(기대인플레이션)에 대해 의견이 크게 엇갈린다. 따라서 동 변수들을 추세 인플레이션 결정요인으로 가급적 동시에 고려해 상대적 중요성을 비교해볼 필요가 있다. 그런데 아래 <그림 Ⅳ-4>에 나타난 바와 같이 본 고의 분석 기간 중 미국 기대인플레이션과 미국 KOF 세계화지수 간에 매우 높은 상관관계(-0.86)가 존재하여 이를 교정할 필요가 있다.86) Albagli et al.(2022) 등의 기존문헌에 따르면 세계화가 기대인플레이션 결정에 영향을 미칠 수 있다.87) 따라서 본 연구의 ARDL 모형에서 세계화가 추세 인플레이션에 미치는 영향의 일부가 ‘세계화 → 기대인플레이션 → 추세 인플레이션’ 경로를 통해 반영될 가능성이 있다.88) 이에 본 연구에서는 세계화가 추세 인플레이션에 미친 영향을 정확하게 평가하기 위해 기대인플레이션 중 세계화에 의해 설명되는 부분을 분리하고 나머지 기대인플레이션을 분석에 사용하였다. 동 기대인플레이션을 ‘조정 기대인플레이션’으로 지칭하기로 한다.89)

이하 본 절의 내용에서 별도의 언급이 없는 경우 기대인플레이션은 조정 기대인플레이션을 의미한다. 다만, 한국의 경우 애초에 가용한 기대인플레이션이 존재하지 않으므로 미국과 같은 이슈가 발생하지 않는다. <그림 Ⅳ-4>는 미국 기대인플레이션과 조정 기대인플레이션을 보여준다.90) 조정 기대인플레이션은 1980년대 초반에 크게 하락하였고, 1990년을 전후하여 상승 후 하락하였다. 또한 2000년대 이후에는 좁은 범위에서 안정세를 유지하였다. 이와 같은 특징은 대체로 기존연구에서 언급되는 시기별 기대인플레이션의 변화에 부합한다(Goodfriend, 2002; Rapach & Wohar, 2005).

1) 근원 추세 인플레이션

<그림 Ⅳ-5>는 한국과 미국의 근원 CPI 추세 인플레이션 추정치를 보여준다. <그림 Ⅱ-1>에 제시된 헤드라인 CPI 추세 인플레이션과 비교해보면 일부 차이는 있으나, 대체로 시기별로 유사한 특징을 보여준다. 다만, 한국의 경우, 근원 추세 인플레이션이 2013~2014년 무렵부터 지속적인 하락세를 보였다는 점에서 헤드라인 추세 인플레이션과 차이가 있다.

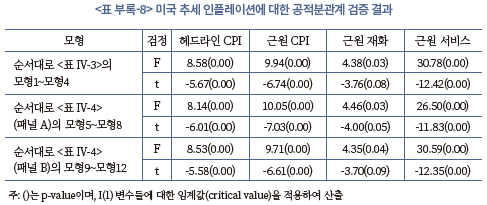

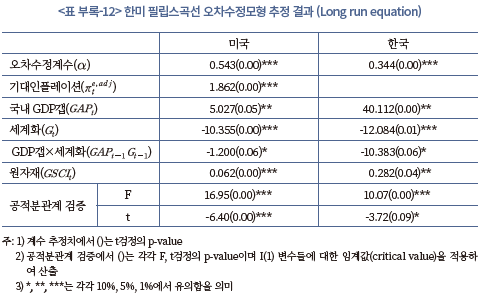

아래 <표 Ⅳ-3> 및 <표 Ⅳ-4>에는 식(2)에 기술된 미국의 유형별 추세 인플레이션 결정요인에 대한 추정 결과가 나타나 있다. <표 Ⅳ-3> 및 <표 Ⅳ-4>는 다른 변수는 동일한 가운데 인구구조 변수에 차이가 있다. <표 Ⅳ-3>은 인구구조 변수로 고령부양비

먼저, 다양한 모형에서 헤드라인 및 근원 추세 인플레이션은 (조정) 기대인플레이션

<표 Ⅳ-3> 및 <표 Ⅳ-4>에서 세계화가 헤드라인 및 근원 추세 인플레이션에 유의한 음(-)의 영향을 미친 것으로 추정되었다.93) 동 결과는 본 연구와 유사한 방법론을 채택한 Forbes(2019b)와는 차이가 있으나, Attinasi & Balatti(2021), ECB(2021a) 결과와 일맥상통한다.94) 다만, 동 연구들은 분석 대상 국가 및 시기 등에서 본 연구와 차이가 있으므로 결과를 직접 비교할 수 없음에 유의할 필요가 있다.95)96)

다음으로 <표 Ⅳ-3>이 보여주듯 고령부양비(노동가능인구 대비 고령인구 비율,

세계화 및 인구구조는 재화 추세 인플레이션과 서비스 추세 인플레이션에도 유의한 영향을 미치는 것으로 나타났다. <표 Ⅳ-3>에서 재화 및 서비스 추세 인플레이션 모두 세계화

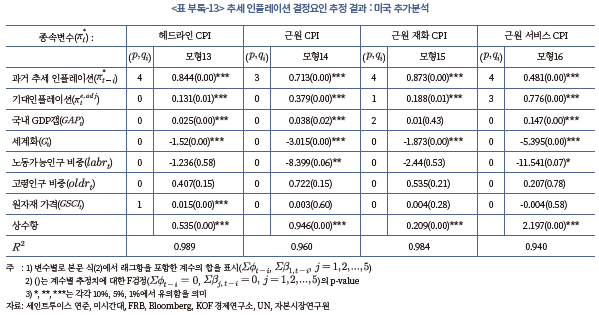

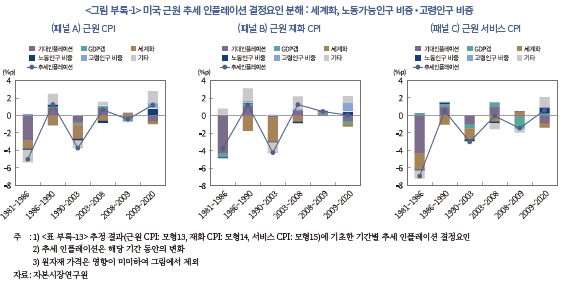

참고로 <부록 4>의 <표 부록-13>에는 인구구조 변수로 노동가능인구 비중 및 고령인구 비중을 동시에 고려한 모형의 추정 결과가 제시되어 있다. 결과를 간략히 정리하면, <표 Ⅳ-4>와 달리 모든 모형에서 고령인구 비중의 유의성이 낮았으며, 노동가능인구 비중은 근원 CPI(모형14) 및 근원 서비스(모형16)에 대해서만 유의한 음의 영향을 미친 것으로 나타났다.99)

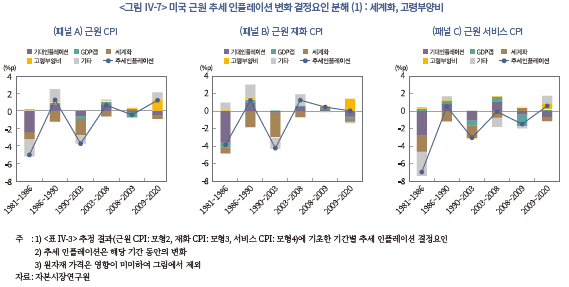

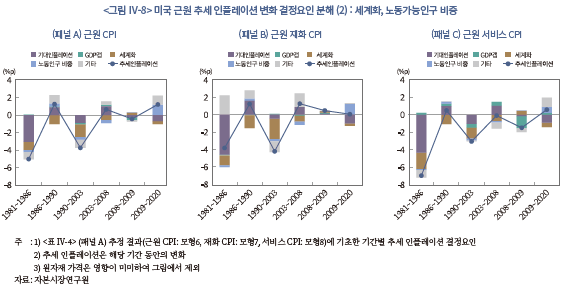

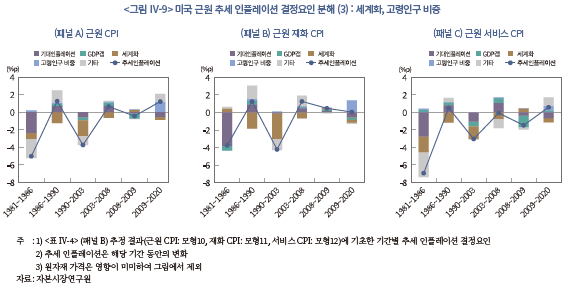

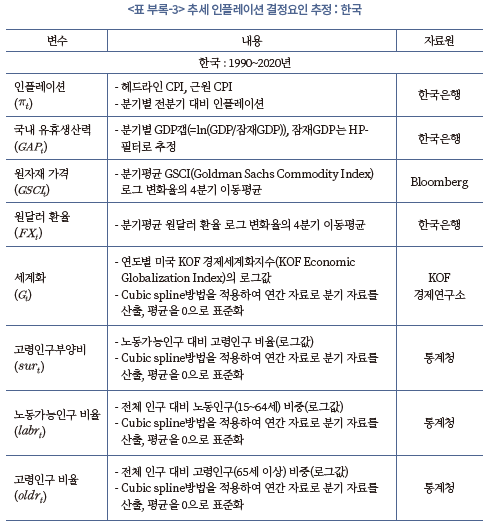

아래 <그림 Ⅳ-7>은 <표 Ⅳ-3>의 모형2, 모형3 및 모형4의 추정치를 사용하여 (전체) 근원, 근원 재화 및 근원 서비스 추세 인플레이션의 시기별 결정요인을 보여준다. 동일한 방법으로, <그림 Ⅳ-8> 및 <그림 Ⅳ-9>는 각각 <표 Ⅳ-4>의 (패널 A) 및 (패널 B) 추정 결과에 기초한 유형별 근원 추세 인플레이션 결정요인 분해 결과를 나타낸다. 각 그림에 적용된 기간 구분은 다음과 같은 점을 고려하여 선정하였다. 첫째, 기존문헌에서 1980년대 중반까지의 미국 인플레이션 하락이 통화긴축의 효과라는 지적(Calza, 2009; Ahmed & Civelli, 2016 등)이 꾸준히 제기된 만큼, 이를 알아보기 위해 1981~1986년을 동일 구간으로 선정하였다. 둘째, Ⅱ장에서 언급된 것처럼 1990년대부터 초세계화가 본격화된 점을 고려하여 1990~2003년까지를 같은 기간으로 구분했다. 2003년의 경우 다소 자의적인 측면이 있으나, <그림 Ⅳ-5>에서 1990년부터 시작된 근원 추세 인플레이션 하락세가 2003년까지 이어진 점을 고려하였다. 셋째, Ⅱ장에서 알아본 바와 같이 미국은 2008년 글로벌 금융위기를 전후하여 세계화 및 인구구조에 중요한 변화가 발생하였으므로 별도 기간으로 선정하여 살펴보았다. 이상에 기초해 주요 결과를 살펴보면 아래와 같다.

먼저 세계화 효과를 알아본다. 앞서 논의된 것처럼 세계화가 추세 인플레이션에 미친 영향을 살펴보는데 있어 중요 이슈 중 하나는 기대인플레이션 안정과 세계화 효과의 상대적 중요성에 있다. <그림 Ⅳ-7>~<그림 Ⅳ-9>의 (패널 A)를 비교해보자. 각 그림은 세계화를 포함한 여타 변수는 동일한 가운데 인구구조 변수에만 차이가 있다. 우선 1980년대 중반까지의 기간(1981~1986년)에 발생한 추세 인플레이션 하락에는 기대인플레이션 안정이 가장 중요한 역할을 하였다. 기대인플레이션은 1990년대 초반 이후 초세계화 기간(1990~2003년)의 추세 인플레이션 하락에도 일부 기여하였으나, 세계화와 비교해 역할이 작은 것으로 확인되었다. 아울러 기대인플레이션은 시기별로 추세물가의 상승 또는 하락을 촉발한 만큼 일방적인 추세 인플레이션 하락요인으로 작용하지는 않은 것으로 볼 수 있다.

반면, 세계화는 글로벌 금융위기 당시의 일시적 세계화 후퇴 시기(2008~2009년)를 제외한 모든 기간에 걸쳐 추세 인플레이션 하락을 유발하였다. 특히, 1990~2003년에 추세 인플레이션이 큰 폭으로 하락한 것은 대부분이 세계화의 기여로 나타났다. 각 그림을 통해 알 수 있듯이 세계화는 본 고에서 고려한 모든 변수 중 1980년대 이후의 추세 인플레이션 하향 안정화를 이끈 핵심 동인으로 확인되었다.102) 다만, 세계화가 추세 인플레이션에 미친 영향은 2008년부터 현저히 감소하였는데, 이는 미국의 경우 동 시기부터 전반적으로 세계화가 정체된 데 따른 결과로 파악할 수 있다.

다음으로 인구구조가 기간별 (전체) 근원 추세 인플레이션 변화에 미친 영향을 살펴본다. <그림 Ⅳ-7> (패널 A)는 고령부양비 효과를 보여주며, <그림 Ⅳ-8> (패널 A) 및 <그림 Ⅳ-9> (패널 A)는 각각 노동가능인구 비중 및 고령인구 비중의 기여분을 나타낸다. 각 그림에서 알 수 있듯이 미국에서 인구구조가 추세 인플레이션에 미치는 영향은 2008년경을 기점으로 크기 측면에서 큰 차이가 있다.

우선 <그림 Ⅳ-7> (패널 A)를 보면, 2008년 이전에는 고령부양비가 추세 인플레이션 상승을 유발했으나 크기가 매우 작은 것으로 나타났다. 노동가능인구 비중과 고령인구 비중으로 세분화하여 살펴봐도 유사한 경향을 확인할 수 있다. <그림 Ⅳ-8> (패널 A)에서 노동가능인구 비중의 경우 1986~1990년 기간을 제외하면 대체로 추세물가 하락요인으로 작용하였으나, 기여도가 크지 않다.103) 다음으로 <그림 Ⅳ-9> (패널 A)가 보여주듯 고령인구 비중은 대체로 약한 인플레이션 상승요인으로 볼 수 있다. 이는 분석 기간 중 일부시기를 제외하고 미국 고령인구 비중이 꾸준하게 증가했기 때문이다.

이상과 같이 미국의 경우 인구구조가 2008년경까지는 추세 인플레이션에 미친 영향이 세계화와 비교해 현저히 작았으나, 2008년 이후에는 강력한 인플레이션 상승요인으로 자리 잡은 것으로 나타났다. 이는 본 고 Ⅱ장의 <그림 Ⅱ-7>과 <그림 Ⅱ-8>에 나타났듯 글로벌 금융위기를 전후한 시점부터 베이비 붐 세대의 은퇴가 시작되며 노동가능인구 비중이 하락세로 전환하였고, 그 결과 고령인구 비중( 및 고령부양비)의 증가세가 가팔라진 데 원인이 있는 것으로 이해할 수 있다. 이러한 결과는 Goodhart & Pradhan의 주장을 뒷받침하는 근거로 고려할 수 있다. 2008년 이후 세계화가 정체되며 추세 인플레이션에 미친 영향이 감소한 가운데, 인구구조가 추세 인플레이션 상승을 유발하기 시작했다는 점은 향후 세계화 후퇴가 심화될 경우 추세 인플레이션이 유의미하게 상승할 수 있음을 시사한다는 점에서 중요성이 큰 것으로 판단된다.

다음으로 근원 재화 및 근원 서비스 추세 인플레이션을 살펴본다. <그림 Ⅳ-7>, <그림 Ⅳ-8> 및 <그림 Ⅳ-9>의 (패널 B)와 (패널 C)는 각각 근원 재화 및 근원 서비스 추세 인플레이션의 시기별 분해 결과를 보여준다. 우선 세계화의 역할과 관련해서 가장 눈에 띄는 점은 1990~2003년 기간에 세계화로 인한 재화 추세 인플레이션 하락 폭이 서비스 추세 인플레이션 하락분을 크게 상회한다는 점이다. 동 기간 세계화로 인한 추세 인플레이션 하락 폭은 재화 인플레이션이 서비스 인플레이션의 두 배를 넘었다. 각 그림의 (패널 B)에서 알 수 있듯이 1990~2003년 기간의 재화 추세 인플레이션 하락은 본 연구에서 식별되지 않은 기타요인을 제외하면 대부분이 세계화 효과로 추정되었다.104) 다만, 2003년 이후부터는 세계화의 영향이 재화 및 서비스 인플레이션에 대해 유사한 수준이다.

기대인플레이션의 경우 1990년 이후 대체로 서비스 인플레이션에 상대적으로 큰 영향을 미쳤으나, 재화 인플레이션에 대한 영향과 차이가 두드러지지 않는 것을 알 수 있다. 결과적으로 중앙은행의 물가 관리 노력은 재화 및 서비스 추세 인플레이션 안정에 유사한 영향을 미친 것으로 볼 수 있다. 이러한 결과는 앞 절의 분석에서 기대인플레이션이 필립스곡선 평탄화에 미친 영향이 서비스 인플레이션에서는 유의했으나 재화 인플레이션의 경우 유의하지 않은 결과와 대비된다. 즉, 기대인플레이션은 서비스 물가를 중심으로 인플레이션의 국내 경기 민감도 둔화를 유발한 반면, 재화 및 서비스 추세 인플레이션 안정에는 유사한 수준으로 기여한 것으로 요약할 수 있다. 한편, 국내 GDP갭이 추세 인플레이션에 미치는 영향은 재화물가 보다 서비스물가에서 확연히 큰 것으로 추정되었다. 이상에서 살펴본 세계화, 기대인플레이션 및 GDP갭의 재화 및 서비스 추세 인플레이션에 대한 영향은 인구구조 변수와 관계없이 거의 유사하다.

다음으로 인구구조가 재화 및 서비스 근원 인플레이션에 미친 영향을 비교해본다. 여기서는 인구구조가 추세 인플레이션에 본격적인 영향을 미친 2008년 이후를 살펴본다. <그림 Ⅳ-7>의 (패널 B)와 (패널 C)를 비교하면 재화 인플레이션이 서비스 인플레이션보다 고령부양비 증가에 더 민감하게 반응한 것을 알 수 있다. <그림 Ⅳ-9>의 (패널 B) 및 (패널 C)에서 알 수 있듯이 이는 주로 재화 인플레이션이 서비스 인플레이션보다 고령인구 비중 증가의 영향을 많이 받기 때문으로 파악된다.

본 고 <부록 4>의 <그림 부록-1>에는 세계화와 노동가능인구 비중 및 고령인구 비중을 함께 포함한 모형에서 도출된 분해 결과가 나타나 있다. 앞서 언급한 것처럼 동 모형은 고령인구 비중의 영향이 유의하지 않았다. 다만, <그림 부록-1>에서 한 가지 흥미로운 점은 인구구조가 본격적인 추세 인플레이션 상승을 유발한 2009~2020년 기간에 서비스 물가의 경우 고령인구 비중보다 노동가능인구 비중이 추세 인플레이션 상승에 큰 영향을 미친 반면, 재화 추세 인플레이션의 경우에는 반대로 노동가능인구 비중보다 고령인구 비중의 역할이 컸다는 데 있다.

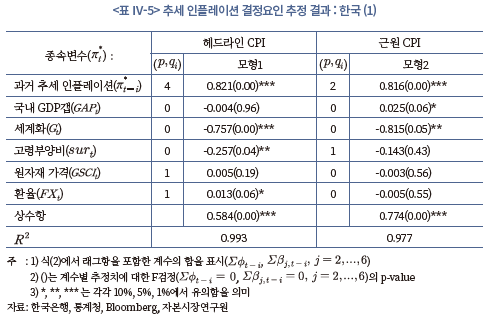

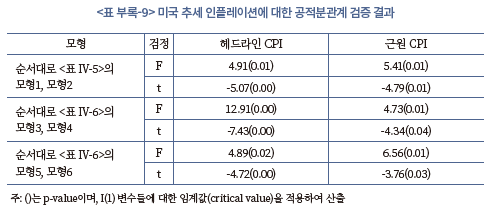

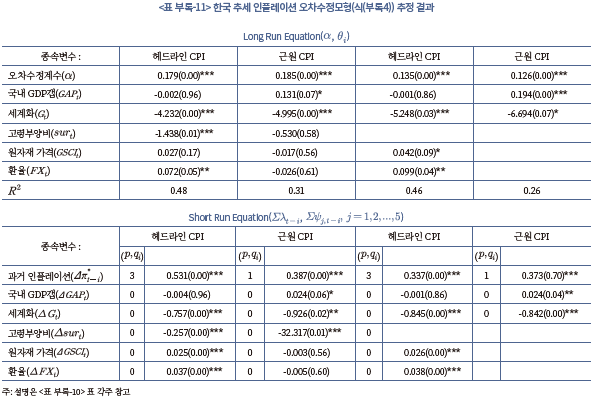

<표 Ⅳ-5>에는 한국 헤드라인 및 근원 CPI 추세 인플레이션 결정요인 추정 결과가 제시되어 있다. 전술한 바와 같이 한국은 자료의 제약으로 미국과 달리 기대인플레이션을 분석에 포함하지 못하였다.

다음으로, 고령부양비

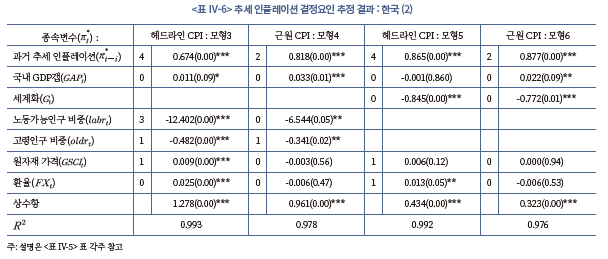

아래 <표 Ⅳ-6>에는 인구구조를 노동가능인구 비중

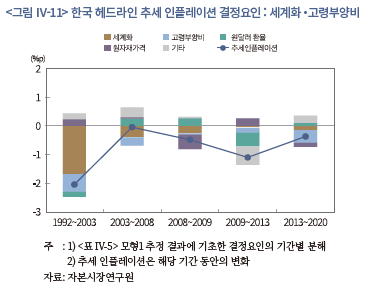

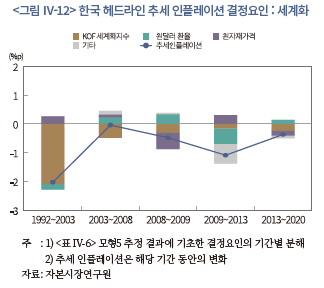

한국은 세계화가 전 기간에 걸쳐 추세 인플레이션 하락에 기여하였다. 특히 1992~2003년 추세 인플레이션 하락분(-2.0%p) 중 대부분이 세계화 효과(-1.7%p)에 기인한 것으로 나타났다. 한국은 미국과 달리 2008년 글로벌 금융위기 기간에도 세계화가 추세 인플레이션 상승을 유발하지 않았다. 이는 Ⅱ장에서 살펴본 것처럼 해당 기간에 미국은 세계화가 후퇴한 반면 한국은 확장세가 유지된 데 따른 차이로 이해할 수 있다. <그림 Ⅳ-12>는 인구구조 변수를 제외하고 세계화만 고려한 모형(<표 Ⅳ-6>의 모형5)의 분해결과를 보여주는데, <그림 Ⅳ-11>과 비교해보면 대체로 세계화가 인구구조 변수의 포함과 관계없이 유사한 수준으로 추세 인플레이션 하락에 기여한 것을 알 수 있다.

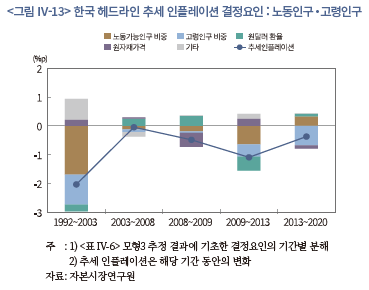

다음으로 <그림 Ⅳ-11>에서 고령부양비가 꾸준히 증가하면서 세계화보다 강도는 낮으나 인플레이션 하락요인으로 작용해왔음을 알 수 있다. 그런데 <표 Ⅳ-6>에서 알 수 있듯 한국은 미국과 달리 노동가능인구 비중과 고령인구 비중이 추세 인플레이션에 반대 방향의 영향을 미친다. 따라서 두 변수의 효과를 구분하여 분석할 필요가 있다. <그림 Ⅳ-13>은 노동가능인구 비중 및 고령인구 비중이 추세 인플레이션에 미친 영향을 분해한 결과를 보여준다. 2013년까지는 노동가능인구 비중 및 고령인구 비중이 동일하게 추세 인플레이션 하락요인으로 작용하였음을 알 수 있다. 이는 동 시기까지 노동가능인구 비중 및 고령인구 비중이 꾸준히 증가하였기 때문이다. 그러나 Ⅱ장에서 살펴본 바와 같이 한국은 2013년경을 기점으로 고령인구 비중은 증가세가 확대된 반면, 노동가능인구 비중은 감소세로 전환하였다. 이로 인해 <그림 Ⅳ-13>에서 2013~2020년에 고령인구 비중은 앞 시기와 마찬가지로 추세 인플레이션 하락을 유발하였으나, 노동가능인구는 비중이 감소함에 따라 추세 인플레이션 상승요인으로 전환하였다. 동 시기에 고령인구 비중 증가 효과가 노동가능인구 비중 감소 효과를 상회하여 두 효과를 합한 순효과(net effect)는 추세 인플레이션 하락으로 나타났다.

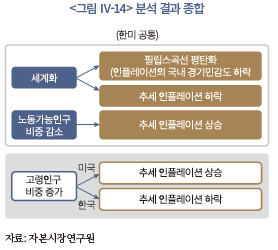

본 장에서는 지금까지의 분석에 기초하여 향후 한미 인플레이션의 기조 변화 가능성을 평가해본다. 앞 장에서 살펴본 세계화 및 인구구조 변화가 한미 필립스곡선 평탄화 및 추세 인플레이션 하락에 미친 영향을 정리하면 아래 <그림 Ⅳ-14>와 같다. 첫째, 한미 모두 세계화가 필립스곡선 평탄화에 유의미하게 기여하였다. 이는 세계화로 인플레이션의 국내 경기민감도가 낮아졌음을 의미하며, 인플레이션이 안정세를 유지해 온 중요 배경이 되었다. 둘째, 한미 공통으로 세계화가 추세 인플레이션 하향 안정에 크게 기여하였다. 초세계화 시기에 특히 두드려졌던 추세 인플레이션 하락 중 상당 부분은 세계화 효과로 추정되었다. 셋째, 한미 모두 노동인구 비중이 감소하고 고령인구 비중이 증가하는 인구구조 변화를 겪고 있는데, 한미간에 양 인구구조 요인이 추세 인플레이션에 미치는 영향에 차이가 있다. 노동가능인구 비중 감소는 한미 공통으로 구조적 인플레이션 상승요인이다. 반면, 고령인구 비중 증가는 미국의 경우 추세 인플레이션 상승요인이었으나, 한국에서는 인플레이션 하락요인으로 작용하였다.

본 장의 실증분석 결과를 이러한 경제구조변화와 연결하여 향후 인플레이션의 기조 변화 가능성을 살펴보면 다음과 같다. 미국은 세계화 후퇴, 노동인구 비중 감소 및 고령인구 비중 증가로 추세 인플레이션이 상승하는 가운데, 인플레이션의 국내 경기 민감도가 복원되며 물가 불확실성이 구조적으로 상승할 가능성이 있다.

한국의 경우 세계화 후퇴로 인한 인플레이션의 구조 변화는 미국과 동일하게 필립스곡선이 가팔라지는 가운데 추세 인플레이션이 상승할 것으로 전망할 수 있다. 반면, 한국은 인구구조 변화가 추세 인플레이션에 미치는 영향에 불확실성이 있다. 여기서는 향후 인구구조 변화에 따른 추세 인플레이션의 상승 또는 하락 가능성을 평가하기 위해 앞에서 추정된 모형에 인구구조 전망치(통계청)를 적용해보았다. 우선 고령부양비가 꾸준히 증가할 것으로 전망되는데, 앞의 추정에서 고령부양비가 추세 인플레이션을 하락시키는 것으로 나타났기 때문에 고령부양비를 인구구조 변수로 선정하면 향후에도 추세 인플레이션의 하락세가 지속되는 것으로 전망치가 산출된다.

그런데, 앞 절의 분석에서 한국은 2013년 이후에 노동인구와 고령인구가 추세 인플레이션에 반대 방향의 영향을 미치기 시작했음을 살펴본 바 있다. 이는 2013년 이후에 고령인구 비중이 상승하는 가운데, 노동가능인구 비중이 하락세로 전환하였기 때문임을 지적한 바 있다. 통계청 인구추계에 따르면 이와 같은 인구구조 변화는 향후에도 장기간 지속될 전망이다.

한국의 경우 이처럼 노동가능인구 비중 감소 및 고령인구 비중 증가가 예상되는 조건에서는 고령부양비를 통해 인구구조가 추세 인플레이션에 미치는 영향을 평가하는 것이 적정하지 않을 수 있다는 점(misleading)에 유의할 필요가 있다. 이를 직관적으로 살펴보면, 앞의 <표 Ⅳ-7>의 한국 결과에서 노동가능인구 비중이 하락하면 추세 인플레이션이 상승하는 반면, 고령인구 비중이 증가하면 추세 인플레이션이 하락하는 효과가 발생한다. 따라서 두 반대 방향 효과의 상대적인 크기에 따라 추세 인플레이션이 상승할 수도 있고 하락할 수도 있다. 그런데 이와 같은 조건(노동인구 비중 감소, 고령인구 비중 증가)에서는 고령부양비가 증가하므로, 동 변수를 기준으로 하면 추세 인플레이션이 항상 하락하는 효과가 발생한다.108)

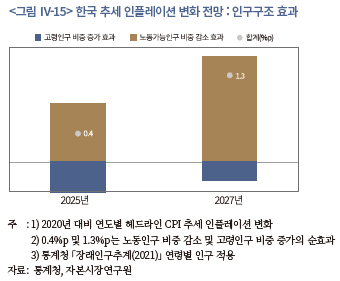

따라서 본 고에서는 고령부양비 대신 노동인구 비중 및 고령인구 비중을 통해 향후 인구구조 변화에 따른 한국 추세 인플레이션 변화를 평가한다. 구체적으로 <표 Ⅳ-6> 모형3(헤드라인 추세 인플레이션 결정요인식)의 추정치에 인구구조 전망치(통계청)를 적용해보았다. 아래 <그림 Ⅳ-15>는 2025년 및 2027년에 예상되는 노동인구 비중 감소 효과(인플레이션 상승)와 고령인구 비중 증가 효과(인플레이션 하락)를 보여준다.

<그림 Ⅳ-15>는 <표 Ⅳ-6> 모형3의 계수 추정치에 2027년까지의 인구전망치를 대입하여 얻은 결과이다. 분석에서 노동가능인구 비중 및 고령인구 비중은 2021년까지는 실제 자료를 사용하였으며, 이후에는 추계치를 적용하였다. GDP갭, 원자재 가격 및 원달러 환율은 2023년 2분기까지는 관측치를 적용하였으며, 2023년 3분기부터는 본 고 분석 기간(1990년 1분기~2020년 4분기)의 평균치를 사용하였다. 이와 같이 <그림 Ⅳ-15>의 추세 인플레이션 변화 전망치는 노동인구 비중 감소 및 고령인구 비중 증가 효과만 고려하여 산출되었다.

<그림 Ⅳ-15>의 추세 인플레이션 변화 전망치를 살펴보면, 당장 2025년에 노동인구 비중 감소로 인한 추세 인플레이션 상승 폭이 고령인구 비중 증가로 인한 추세 인플레이션 하락 폭을 상회할 것으로 전망된다. 2027년에는 차이가 더욱 확대되어 추세 인플레이션이 2020년 대비 1%p 넘게 상승할 수 있는 것으로 추정되었다. 2027년은 고령인구 비중 증가 속도가 최고치에 달하는 기간이다.109)

참고로 본 장의 분석 결과 중 세계화 측정에 대해 언급하고자 한다. 본 장의 결과는 <그림 Ⅱ-3>에서 살펴본 KOF 경제세계화지수를 세계화 변수로 선정하여 분석한 결과이다. 본 고에서 제시되지는 않았으나 세계화 변수로 KOF 무역세계화지수를 사용해도 대체로 유사한 결과가 도출되었다. 이는 분석 기간 중 양 변수가 유사한 행태를 보인 점에 기인하는 것으로 판단된다.

V. 결론 및 시사점

본 연구는 한미 금리의 기조 전환 가능성을 살펴보기 위해 경제구조변수가 인플레이션의 구조적 특징에 미친 영향을 분석하고, 경제구조변화로 인해 저물가 기조에 변화가 발생할 수 있는지 평가해 보았다. 본 연구의 제1편에서 살펴본 것처럼 한미 모두 저금리 고착화에 저물가 기조가 핵심적인 역할을 담당하였다. 따라서 저물가 기조가 종료될 경우 금리 기조에도 근본적인 변화가 발생할 가능성이 있다. 본 장에서는 본 고의 연구 결과를 정리하고 시사점을 논의한다.

본 고에서는 지난 40여 년간 관찰된 인플레이션의 구조적 특징, 즉 저물가 기조를 필립스곡선 평탄화 및 추세 인플레이션 하향 안정의 두 가지 관점에서 살펴보았다. 필립스곡선 평탄화는 인플레이션의 국내 경기에 대한 민감도가 둔화되었음을 나타내며, 추세 인플레이션의 하향 안정은 기조적 물가상승률, 즉 인플레이션의 장기 추세가 낮아졌음을 의미한다. 1980년대부터 코로나 팬데믹 이전까지 한미 인플레이션은 추세 인플레이션이 하향 안정화된 가운데, 필립스곡선 평탄화로 인플레이션의 경기순환적 특성이 약화되며 저물가 기조가 안정적으로 유지되어왔다.

본 연구는 이와 같은 인플레이션의 구조적 특징이 중앙은행의 성공적 물가 관리로 인한 장기 기대인플레이션 안정과 함께 세계화 및 인구구조 변화로 살펴본 경제의 구조적 변화에 기인한 것인지를 실증적으로 분석하였다. 본 고의 주요 분석 결과를 정리하면 다음과 같다.

첫째, 한미 모두 필립스곡선 평탄화에 세계화 진전이 중요한 역할을 한 것으로 확인되었다. 이러한 결과는 헤드라인 및 근원 인플레이션 모두에서 관찰되었다. 장기 기대인플레이션의 역할을 살펴볼 수 있었던 미국의 경우, 기대인플레이션 안정 또한 필립스곡선으로 포착된 인플레이션 동학에 중요한 역할을 하였다. 다만, 기대인플레이션이 인플레이션의 국내 경기 민감도 하락에 미친 영향은 근원 인플레이션에서 특히 강한 것으로 추정되었다. 이는 헤드라인 인플레이션의 경우 필립스곡선이 평탄화된 데에 기대인플레이션보다 세계화의 역할이 중요할 수 있음을 시사한다.110) 근원 인플레이션 중에는 재화 인플레이션에서 필립스곡선 평탄화에 세계화가 지배적인 역할을 하였으며, 근원 서비스 인플레이션의 경우에는 세계화와 기대인플레이션 모두 필립스곡선 평탄화에 기여하였다.

둘째, 세계화는 한미 추세 인플레이션의 하향 안정에도 크게 기여한 것으로 분석되었다. 양국의 추세 인플레이션은 1990년대를 중심으로 한 초세계화 기간에 큰 폭으로 하락한 후 팬데믹 이전까지 안정세를 유지하였는데, 초세계화 기간에 발생한 추세 인플레이션의 하락은 대부분 세계화로부터 유발된 것으로 추정되었다. 이는 기존문헌에서 논의된 바와 같이 세계화 진전으로 비용효율성이 향상되고 기업 간 경쟁이 심화된 결과로 파악할 수 있다. 세계화가 추세 인플레이션에 미친 영향은 미국은 2008년경, 한국은 2013년경부터 현저히 낮아졌는데, 이는 양국이 각 시기부터 세계화가 정체 국면에 진입하였기 때문이다. 선행연구에서 세계화 효과가 재화 인플레이션에 집중된 것으로 언급되어 왔는데, 본 고의 분석에서도 서비스보다 재화인플레이션이 세계화의 혜택을 많이 받은 것으로 나타났다. 다만, 서비스 추세 인플레이션 또한 강도 측면에서는 재화 추세 인플레이션에 미치지 못하나, 세계화 효과가 통계적‧경제적으로 유의미하였다.

본 고 분석에 따르면 중앙은행이 관리하는 기대인플레이션의 안정세 또한 추세 인플레이션 하락에 기여하였는데, 그 영향은 주로 1980년대 초중반에 집중된 것으로 확인되었다. 미국 분석을 토대로 할 때, 기대인플레이션은 재화 및 서비스 추세 인플레이션 모두에 영향을 미쳤다. 본 고의 결과는 세계화 효과에도 불구하고 기대인플레이션이 안정되지 않으면 추세 인플레이션 또한 안정될 수 없음을 의미한다.

다음으로 인구구조가 추세 인플레이션에 미친 영향에 대해 흥미로운 결과가 관찰되었다. 본 연구에서는 고령부양비(고령인구/노동가능인구), 전체 인구 대비 노동가능인구 및 고령인구 비중을 통해 인구구조의 역할을 살펴보았다. 고령부양비를 노동가능인구 및 고령인구로 나누어 분석함으로써 인구구조가 추세 인플레이션에 미치는 영향에 대한 이해도를 제고할 수 있었다.

한미 모두 노동가능인구 비중이 감소할수록 추세 인플레이션이 상승하였다. 이는 경제내 노동공급 감소가 물가상승을 유발한 탓으로 파악할 수 있다. 반면 고령인구 비중의 경우, 동 비중이 증가할수록 미국은 추세 인플레이션이 상승하였으나, 한국은 하락하였다. 이로 인해 미국은 고령부양비가 추세 인플레이션 상승을 유발한 반면, 한국은 하락요인으로 작용하였다. 미국은 고령인구가 생산보다 소비가 많은 순소비 집단으로서의 역할을 담당한 것으로 해석할 수 있다. 한국의 고령층은 생산 활동 참여가 꾸준히 증가하였으며, 소비여력이 현저히 낮은 탓에 미국과 달리 인플레이션 상승요인으로 작용하지 못한 것으로 추정된다.111)

인구구조가 추세 인플레이션에 미친 영향은 각국에서 베이비 붐 세대의 은퇴가 시작된 시기(미국 2008년경, 한국 2013년경)를 기준으로 구분할 필요가 있다. 한미 모두 동 시기부터 노동가능인구 비중이 빠르게 감소하고 고령인구 비중의 증가세가 확대되었다. 미국은 2008년 이전까지 인구구조가 추세 인플레이션에 미친 영향이 통계적으로는 유의하였으나, 경제적으로는 그 효과가 매우 제한되었다. 미국은 동 시기까지 세계화 영향이 인구구조 효과를 크게 상회하였다. 이는 인구구조가 추세 인플레이션에 미친 영향을 강조하는 기존문헌에 비춰볼 때 예상에서 다소 벗어난 것으로 이해될 수 있으나, 인구구조 변화가 인플레이션의 구조적 특징에 미친 영향이 세계화 진전(노동시장 세계화)과 맞물려 발생했을 수 있다는 Goodhart & Pradhan의 통찰에 부합하는 결과로 파악할 필요가 있다. 한국은 2013년 이전까지 노동가능인구 및 고령인구 비중이 모두 증가한 가운데, 고령인구 비중 증가 속도가 더 컸던 관계로 고령부양비가 증가하여 추세 인플레이션 하락을 유발하였다. 다만, 한국 또한 2013년까지 인구구조보다 세계화가 추세 인플레이션 하락에 더 크게 기여하였다.

하지만 한미 모두 베이비 붐 세대의 고령인구 편입이 시작되면서 인구구조가 추세 인플레이션에 미친 영향이 크게 확대되었다. 미국은 1980년 이후 고령인구 비중이 일부 기간(1990년대 중후반)을 제외하고 꾸준히 증가하여 인플레이션 상승으로 작용해온 가운데, 2008년경을 기점으로 노동가능인구 비중이 감소세로 전환하며 인플레이션 상승압력이 추가되었다. 그 결과 2008년 이후에는 인구구조가 유의미한 물가상승요인으로 자리 잡았다.

한국은 1980년 이후 고령인구 비중이 꾸준히 상승하여 인플레이션 하락요인으로 작용해온 가운데, 2013년경을 기점으로 노동가능인구 비중이 하락세에 접어들며 인플레이션 상승요인으로 전환되었다. 본 고의 실증분석 기간인 2020년까지는 고령인구 비중 증가로 인한 인플레이션 하락압력이 노동가능인구 비중 감소로 인한 인플레이션 상승압력보다 높았다. 하지만 통계청 장래인구 추계치를 적용하여 살펴본 결과, 당장 2025년부터 노동가능인구 비중 감소로 인한 추세 인플레이션 상승효과가 고령인구 비중 증가가 유발하는 추세 인플레이션 하락 효과를 상회하는 것으로 추정되었다. 이는 한국 또한 향후 인구구조가 구조적인 인플레이션 상승요인으로 작용할 가능성이 있음을 시사한다.

인구구조의 추세 인플레이션에 대한 영향은 인구구조와 실질중립금리 간 관계 및 이에 대한 통화정책 대응 관점에서도 살펴볼 수 있다. 본 연구보고서 제1편에서 살펴본 바와 같이 고령화(노동인구 감소 및 고령인구 증가)가 진행될수록 실질중립금리가 하락하게 된다.112) 이와 같이 인구구조 변화로 실질중립금리가 하락하는 상황에서 중앙은행이 실질중립금리의 변동을 늦게 반영하여 지나치게 완화적이거나 긴축적인 통화정책이 유지될 경우 추세 인플레이션이 상승하거나 하락하는 결과가 나타날 수 있다.113)

본 고에서 살펴본 바와 같이 기존문헌에서는 세계화 및 인구구조가 인플레이션의 구조적 특징에 미친 영향에 대해 다양한 결과가 제시되어왔다. 본 연구가 한미 인플레이션만을 분석 대상으로 한정하였으며, 이론적 관점에서 경제구조변수와 인플레이션 간 인과관계를 분석하지 못하였다는 점 등을 고려할 때 확대 해석에 주의를 기울여야 하겠으나, 다음과 같은 시사점을 찾아볼 수 있다.

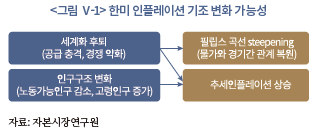

우선 40년간 저물가 기조를 이끈 핵심 동인이 소멸 중으로, 한미 모두 저물가 기조가 종료되고 물가 변동성이 구조적으로 확대될 가능성이 있다. 먼저 인구구조 측면에서 한미 모두 상당 기간 노동인구 비중이 감소하고 고령인구 비중이 증가하는 인구구조 변화를 겪을 것으로 전망된다. 다음으로 본격적인 탈세계화 진입 여부에는 상당한 논란이 있으나, 세계화 효과(효율성 및 경쟁 심화)가 작동하기 위한 핵심 전제조건인 자유무역주의 및 지정학적 안정성이 크게 훼손되고 있다. 이로 인해 보수적인 관점에서 판단해도 세계화는 상당 부분 후회할 가능성이 높은 것으로 평가할 수 있다.

이와 같은 경제구조변화에 본 고의 실증분석 결과를 적용해 보면, 세계화 후퇴로 필립스곡선이 가팔라지며 인플레이션의 경기 민감도가 복원될 가능성이 있다. 이 경우 인플레이션의 변동성이 과거보다 구조적으로 확대되는 결과가 나타날 수 있다. 또한 세계화 후퇴로 추세 인플레이션이 상승세를 보일 것으로 전망할 수 있다. 특히 동 효과는 지난 40년간 추세 인플레이션의 안정을 이끈 재화 추세 인플레이션에서 먼저 관찰될 수 있다. 서비스 추세 인플레이션 또한 그동안 세계화로 인한 효익이 있었던 만큼 세계화가 후퇴하면 과거보다 높은 수준으로 상승할 개연성이 있는 것으로 판단된다. 미국은 이미 글로벌 금융위기 이후부터 인구구조 변화(노동인구 비중 감소‧고령인구 비중 증가)가 추세 인플레이션 상승요인으로 자리잡았고, 한국도 현재와 같은 인구구조 변화 추세가 유지된다면 세계화 후퇴에 더해 구조적인 인플레이션 상승요인으로 고착될 가능성이 있다. 이상을 종합하여 향후 한미 인플레이션의 구조 변화 가능성을 도식화하면 아래 <그림 Ⅴ-1>과 같다.

본 고에서 살펴본 인플레이션의 구조적 변화 가능성은 한미 금리의 장기 추세 결정에 중요한 영향을 미칠 것으로 전망된다. 본 보고서 제1편에 따르면 추세 인플레이션과 함께 실질중립금리가 추세금리를 결정하는 핵심 요인이다. 동 연구에서 향후 미국의 실질중립금리는 점진적인 상승세가 예상되었으며, 한국은 횡보할 것으로 전망되었다. 따라서 추세 인플레이션이 상승할 경우 한미 모두 추세금리가 상승할 가능성이 큰 것으로 평가할 수 있다.

본 연구는 세계화 후퇴 및 인구구조 변화와 함께 인플레이션의 구조적 특징에 영향을 미칠 가능성이 있는 경제구조변수인 기후변화에 대해 살펴보지 않았다. 동 분야의 연구는 아직 초기 단계에 있으나, 기후변화가 인플레이션에 미칠 수 있는 영향에는 상당한 불확실성이 있는 것으로 파악되고 있다. 기후변화가 가속화 되고 있는 만큼 인플레이션에 대한 영향을 이해하기 위한 노력이 필요한 것으로 판단된다.114)

1) WSJ(2021. 12. 5)은 탈세계화로 비용 상승 충격이 발생하여 장기적인 인플레이션 상승으로 이어질 수 있다는 견해를 밝혔다. 반면, FT(2022. 5. 26)는 세계화가 저물가 기조에 기여한 바가 크지 않은 만큼 탈세계화로 인한 인플레이션의 기조적 상승위험이 과장된 것으로 평가하고, 세계화가 아닌 인구구조 변화가 인플레이션의 구조적 상승을 유발할 가능성이 높다는 의견을 제시하였다.

2) 뉴케인지언 필립스곡선 이론에서 필립스곡선 평탄화는 기업의 가격결정(price-setting)이 공급압력(한계비용)에 덜 민감해지는 현상을 의미한다(Del Negro et al., 2020).

3) 연간 헤드라인 CPI 인플레이션 변화![]() 를 전년도 GDP갭에 대해 회귀분석하여 얻어진 인플레이션의 국내 GDP갭에 대한 민감도 추정치를 의미한다. 즉, 필립스곡선 기울기 값이 y일 경우 이는 전년도 GDP 갭이 1%p 상승했을 때 금년 인플레이션이 y%p 상승한다는 것을 의미한다. 회귀식에서 연간 인플레이션

를 전년도 GDP갭에 대해 회귀분석하여 얻어진 인플레이션의 국내 GDP갭에 대한 민감도 추정치를 의미한다. 즉, 필립스곡선 기울기 값이 y일 경우 이는 전년도 GDP 갭이 1%p 상승했을 때 금년 인플레이션이 y%p 상승한다는 것을 의미한다. 회귀식에서 연간 인플레이션![]() 은

은 ![]() 로 정의되며,

로 정의되며, ![]() 는 연도별로 분기 물가지수의 평균치이다. 회귀분석은 <표 Ⅱ-1>에 기술된 기간별로 시행하였다. Powell(2018), Stock & Watson(2021) 및 Hazell et al.(2022)도 본 고와 유사한 방법을 통해 미국 필립스곡선 평탄화를 분석하였다.

는 연도별로 분기 물가지수의 평균치이다. 회귀분석은 <표 Ⅱ-1>에 기술된 기간별로 시행하였다. Powell(2018), Stock & Watson(2021) 및 Hazell et al.(2022)도 본 고와 유사한 방법을 통해 미국 필립스곡선 평탄화를 분석하였다.

4) 필립스곡선 평탄화를 다룬 기존문헌에 따르면 추정방법에 따라 다소 차이는 있으나, 선진국의 필립스곡선 기울기는 1960년대 이후 시기별로 증가 또는 감소하였으며, 1980년대 중반부터는 지속적으로 완만해진 것으로 파악된다.

다만, 코로나 팬데믹 이후에는 미국 등 주요국의 필립스곡선 기울기가 증가세로 전환하였다는 결과가 보고되고 있다(Hajdini, 2023; Hobijn et al., 2023).

5) 다음 장의 기존문헌 고찰에서 언급되는 바와 같이 기대인플레이션이 안정되지 않으면 일시적인 인플레이션 충격이 기업의 가격 결정에 영향을 미칠 수 있으며, 이 경우 일시적인 충격이 추세적인 인플레이션으로 연결될 수 있다.

6) 다만, 추세 인플레이션 정의 시 고려하는 순환적(일시적) 요인이 경기순환성을 의미하지는 않는다. 본 연구 Ⅲ장의 기존문헌 및 Ⅳ장의 실증분석에서 논의되는 바와 같이 추세 인플레이션은 GDP갭의 영향을 받는 것으로 파악된다.

7) 추세 인플레이션은 다양한 방법을 통해 추정할 수 있다. 본 연구에서는 계량적 모형을 통해 추세 인플레이션을 추정하고자 한다. Stock & Watson(2007)방법은 추세 인플레이션 산출에 많이 활용되는 대표적 모형이다.

8) 미국의 추세 인플레이션을 살펴본 대부분의 연구에서도 <그림 Ⅱ-1>과 유사한 특징이 관찰된 바 있다. Coglely & Sbordone(2008), Mertens(2016), Stock & Watson(2007, 2016), Ascari & Fosso(2021), Eo et al.(2023) 등을 참고하기 바란다.

9) 실제 인플레이션=추세 인플레이션+인플레이션갭(=실제 인플레이션–추세 인플레이션)의 관계가 성립함을 의미한다.

10) Goodhart & Pradhan(2020a, 2020b, 2020c), Lagarde(2022, 2023), Schnabel(2022) 및 Daly(2023) 등을 종합하면 향후 인플레이션의 구조적 동학에 변화를 유발할 것으로 기대되는 변수로 세계화 후퇴, 인구구조 변화 및 탈탄소화를 고려할 수 있다. 탈탄소화는 과거 데이터를 이용한 실증분석이 용이하지 않은 측면이 있으므로 본 연구에서는 분석에 포함하지 않기로 한다.

11) 다음 장(기존연구)에 정리된 바와 같이, Attinasi & Balatti(2021), ECB(2021a, 2021b), Koester et al.(2021), Kohlscheen & Moessner(2022) 및 Friedrich & Selcuk(2022) 등은 다양한 KOF 세계화지수를 사용하여 인플레이션과 세계화의 관계를 분석하였다.

12) 세계화 전반에 대한 내용은 매우 방대하므로 본 고에서는 1980년대 이후부터 코로나 팬데믹 이전까지의 진전 상황만 간략하게 언급한다. 세계화에 대한 상세한 내용은 James(2023)를 참고하기 바란다.

13) 본 고 <그림 Ⅱ-2>와 <그림 Ⅱ-4>에서 한미 모두 2022년에 무역개방도가 팬데믹 이전 수준을 회복하였다.

14) 미국의 대중국 수입 비중 변화는 <그림 Ⅱ-2>를 참고하기 바란다.

15) Goldberg & Reed(2023)에 따르면 미국은 프렌드쇼어링도 현실화 중인 것으로 평가된다. 2022년 기준, 미국 국민이 우호국(friend)으로 믿는 국가일수록 수입 비중(해당 국가로부터의 수입액/전체 미국 수입액)이 통계적으로 유의하게 증가하는 것으로 나타났다.

16) 미국은 노동가능인구 비중이 2007년에 67.23%로 정점을 기록하였으며, 한국은 2012년 및 2014년에 73.42%로 최고치를 기록하였다.

17) 미국과 한국은 각각 2012년 및 1998년에 물가안정목표제를 공식 도입하였다. 다만, 미국은 그린스펀 전 총재의 적극적 물가 관리에 힘입어 1990년대 중반에 저물가에 대한 신뢰가 확립된 것으로 평가된다(Goodfriend, 2002).

18) Ball(2006)은 세계화가 인플레이션 동학의 구조적 특징에 어떤 영향도 미치지 않았다는 견해를 제시하기도 하였다.

Koester et al.(2021)에 따르면 세계화가 물가에 미치는 영향이 영구적인 효과(permanent effect)가 될지는 통화정책이 결정한다.

19) Carney(2015, 2017) 및 Friedrich & Selcuk(2022) 등은 두 경로를 각각 필립스곡선 기울기(slope) 및 필립스곡선의 평행이동(position)으로 지칭하였다.

20) IMF(2006), Yellen(2006), Bernanke(2007), Borio(2017a, 2017b), Carney(2015, 2017), Forbes(2019a, 2019b), Attinasi & Balatti(2021), ECB(2021a), Koester et al.(2021) 등을 참고하기 바란다.

21) Bernanke(2007), Carney(2015, 2017) 등에 따르면 세계화는 필립스곡선 평탄화 및 추세 인플레이션 경로 외에 국내 생산여력에 영향을 미침으로써 국내 인플레이션에 영향을 미칠 수 있다. 즉, 국내 수요가 일정하더라도 국내 제품에 대한 해외 수요가 증가하면 해당 수출품목에 대한 국내 생산여력이 낮아지는 결과가 발생한다. 이 경우 국내 인플레이션은 <그림 Ⅲ-1>에서 회색실선을 따라 이동하게 된다. 다만, 이와 같은 수출 경로는 세계화가 국내 인플레이션의 구조적 특징에 미치는 영향으로 보기 힘든 측면이 있다. 이에 본 연구에서는 동 경로에 대해서 살펴보지 않기로 한다.

22) 이는 GVC 대상 국가 및 생산요소 수입국의 유휴생산능력이 국내 기업의 비용에 미치는 영향이 증가하게 됨을 의미한다(Ascari & Fosso, 2021).

23) 물론, 노동자의 협상력 저하에는 세계화 외에 다양한 구조적 요인이 영향을 미쳤다. 이에 대해서는 IMF(2006)을 참고하기 바란다.

24) Amiti et al.(2019)이 벨기에 제조업체를 대상으로 추정한 결과, 기업이 가격을 결정할 때 자사의 한계비용 및 해외 경쟁기업의 가격에 대한 민감도가 각각 0.6과 0.4로 나타났다. 해외 기업의 가격에 대한 민감도는 국내 기업이 대기업일수록 높아지는 것으로 나타났다.

25) 세계화로 경쟁이 심화되면 기업의 마크업이 구조적으로 감소할 수 있다. 이에 대해서는 다음 절(세계화와 추세 인플레이션)의 기존연구 고찰을 참고하기 바란다.

26) Sbordone(2007)의 모형에서도 Amiti et al.(2019)과 같이 전략적 상호보완성이 강화되는 결과가 나타나기도 한다.

결과적으로 Sbordone(2007) 모형에서는 세계화로 필립스곡선의 기울기가 증가하거나 감소할 수 있다. Carney(2015) 또한 세계화로 인한 기업의 가격 결정이 필립스곡선 기울기를 평탄하게 만들 수도 있는 동시에 가파르게 유도할 수 있는 양방향 경로가 가능하다는 직관을 제시한 바 있다.

27) 아래 문장은 ECB(2021a)에 정리된 내용을 수정하여 인용하였다.

28) 세계화와 필립스곡선 평탄화 간 관계에 대한 기존문헌은 방대하다. 본 연구에서 살펴본 기존연구 중에서는 세계화가 필립스곡선 평탄화를 유발했다는 연구로 Gamber & Hung(2001), IMF(2006), Pain et al.(2006), Borio & Filardo (2007), Razin & Binyamini(2007), Wynne & Kersting(2007), Bianchi & Civelli(2015), Ahmad & Civelli(2016), Auer et al.(2017), Jasova et al.(2018), Forbes(2019a, 2019b), Lombardi et al.(2020), Ascari & Fosso(2021), Friedrich & Selcuk(2022), Heise et al.(2022), Kohlscheen & Moessner(2022), Ari et al.(2023), Kochugovindan & Lawson(2023) 등이 있다. 반면 세계화가 필립스곡선 기울기에 통계적으로 유의한 영향을 미치지 않았거나, 통계적으로는 유의하더라도 경제적 효과가 크지 않다는 결과를 보고한 연구에는 Tootell(1998), Temple(2002), Daniels et al.(2005), Ball(2006), Calza(2009), Cecchetti & Debelle(2006), Gnan & Valderrama(2006), Mody & Ohnsorge(2007), Groen & Mumtaz(2008), Mishkin(2009), Castelnuovo(2010), Ihrig et al.(2010), Milani(2012), Mikolajun & Lodge(2016), Attinasi & Balatti(2021), ECB(2021a) 등이 있다.

29) 기존연구에서 해외 유휴생산력은 주로 분석 대상 국가의 주요 무역상대국 GDP갭에 다양한 방식의 가중치(무역비중, 수입비중, GDP비중 등)를 적용하여 산출된다. 때로는 교역상대국에 제한하지 않고, 전 세계의 GDP갭(글로벌갭)을 분석에 포함하기도 한다.

30) 세계화가 중장기 국내 인플레이션에 미치는 영향에 대해 회의적인 시각을 견지한 Bernanke(2007)는 글로벌갭이 세계화된 경제환경에서 전반적인 대외요인의 영향을 반영할 수 있다는 점에서 글로벌갭의 역할이 세계화와 국내 인플레이션 간 관계 중 유일하게 개연성이 있는 경로로 지적한 바 있다.

31) Bernanke(2007)가 언급한 것처럼 글로벌 유휴생산력은 측정에 어려움이 있다. 더욱이, Dreger et al.(2015)이 지적한 바와 같이 주요국의 경우 글로벌 경기변동과 국내 경기변동이 동조화되는 경향이 있어 국내갭과 글로벌갭의 독립적 식별에 어려움이 있다. 한국과 미국에 대해 다양한 방법의 글로벌갭을 적용할 때의 잠재적인 문제에 대해서는 장근혁‧백인석(2022)의 <부록 1>을 참고하기 바란다.

32) Forbes(2019a, 2019b)에서는 43개국(31개 선진국‧12개 이머징 국가, 1996년 1분기~2017년 4분기)의 다양한 인플레이션(CPI, 근원CPI, 임금)의 국내 경기여건에 대한 민감도 하락이 대부분 글로벌갭에 의해 유발된 것으로 분석되었다.

33) Andrews et al.(2018)에 따르면 GVC 참여가 확대되며 글로벌 생산자물가상승률이 하락한 가운데 국가 간 동조화도 심화된 것으로 분석되었다.

34) Ahmad & Civelli(2016)에 따르면 무역 및 금융개방도가 일정 수준(threshold)을 넘을 경우 국내 인플레이션이 국내 경제여건보다 글로벌갭에 의해 포착된 해외 경제여건의 영향을 더 많이 받는 것으로 나타났다.

35) IMF(2006), Pain et al.(2008), Kohlscheen & Moessner(2022) 등은 필립스곡선에서 각 세계화 변수와 국내 GDP갭의 교차항(interaction term, GDP갭×세계화)의 계수를 추정하여 세계화가 필립스곡선 평탄화에 미친 영향을 분석하였다. 동 연구들에서 교차항의 계수가 유의한 음의 값을 가지는 것으로 추정되었다. 반면, Auer et al.(2017) 및 Friedrich & Selcuk(2022) 등은 필립스곡선의 기울기를 먼저 추정하고, 동 기울기가 세계화 변수로 설명되는지 분석하였다. 동 연구들에서는 세계화 변수가 필립스곡선 기울기에 유의한 음의 영향을 미친 것으로 나타났다.

36) Eijffinger & Qian(2016)은 1977년부터 2007년까지 11개 OECD 국가 인플레이션을 분석하였다. 동 연구들은 국가별 필립스곡선에서 무역 및 금융 개방도와 국내갭의 교차항을 살펴보았다. 분석 국가 중 캐나다와 미국은 교차항 추정계수가 유의한 음의 값을 가져 필립스곡선 평탄화에 영향을 미친 것으로 나타났다. 반면 이탈리아는 교차항이 유의한 양의 값으로 분석되었다. 여타 국가는 계수가 유의하지 않은 것으로 나타났다(호주: -, 일본‧네덜란드‧영국: +).

37) Bems et al.(2018)이 2004년부터 2018년까지 18개 이머징 국가의 근원 인플레이션을 분석한 결과 장기 기대인플레이션 안정이 인플레이션의 순환적 변동(경기민감도)에 중요한 역할을 하는 것으로 나타났다. 반면, 글로벌갭의 영향은 미미한 것으로 확인되었다.

38) 예를 들어, Hazell et al.(2022)은 1990년부터 2000년까지 미국의 필립스곡선 평탄화가 대부분 장기 기대인플레이션이 안정에 기인하는 것으로 분석하였다.

39) Borio(2017b)에 따르면 전 세계 노동가능인구에서 선진국이 차지하는 비중이 1990년 41%에서 2015년에는 18%로 크게 감소하였다.

40) 인플레이션이 기업의 기대인플레이션 및 한계비용에 의해 결정되는 것으로 파악하는 Gali & Gertler(2000) 등의 전통적 단일국가 NKPC에서는 기업이 독점적 경쟁 및 고정된 대체소비탄력도에 직면하며, 마크업(제품 가격과 한계비용 비율)도 상수로 가정한다. Guerrieri et al.(2010) 등 개방경제 NKPC에서는 국내 기업과 해외 기업 간 경쟁을 이론에 도입하고, 기업이 소비자의 국내 및 해외 제품 간 대체탄력성 변화에 직면한 것으로 가정한다. 개방경제 NKPC 연구에 따르면 대체로 국내 기업 제품에 대한 수요 변화(소비탄력도)는 해외 제품과 국내 제품 간 상대가격의 영향을 받는다. 따라서 해외 기업이 제품가격을 낮추면 해외 기업과의 경쟁에 직면한 국내 기업은 시장점유율을 유지하기 위해 적정(desired) 마크업을 낮추게 되며, 결과적으로 국내 인플레이션이 하락하게 된다.

41) 다만, Cote & de Resende(2008)에 따르면 2000년 이후부터 중국 수입 효과가 증가하였으며, 핵심 경로는 국내 기업과의 경쟁 경로인 것으로 지적된다.

42) Chen et al.(2004, 2009)에 따르면 마크업 감소는 지속성이 낮은 것으로 분석되었다.

43) Forbes(2019a, 2019b)에 따르면, 예를 들어 GVC는 CPI 상승률에는 유의한 영향을 미쳤으나, 근원 CPI에 대해서는 설명력이 유의하지 않은 것으로 나타났다. 이로 인해 Forbes(2019b)는 세계화가 인플레이션 하향 추세를 설명하는데 한계가 있는 것으로 지적하였다. 한편, Forbes(2019b)의 축약형 필립스곡선에서 기대인플레이션은 비교적 일관되게 인플레이션 수준 변화를 설명하는 것으로 나타났다.

44) 다만, Kohlscheen & Moessner(2022)에서 인플레이션 측정 시기가 증가할 경우(2‧4‧6분기 물가상승률), 세계화 유의성이 증가하는 것으로 나타났다.

45) Forbes(2019b)는 Stock & Watson(2007) 및 Chan(2013)의 방법을 일부 수정한 ARUC(Autoregressive Unobserved Components) 모형을 이용하여 43개 국가의 추세 인플레이션을 추정하였다.

46) Forbes(2019b)는 추세 인플레이션 및 세계화 변수의 차분값을 실증분석(회귀분석)에 사용하였다.

47) Kamber & Wong(2020)은 다변량 BN(Beveridge and Nelson) 분해를 통해 추세 인플레이션을 추정하였다.

48) 호주, 캐나다, 유로지역, 일본, 영국, 미국

49) Attinasi & Balatti(2021), ECB(2021a) 및 Koester et al.(2021) 등은 세계화 변수로 통상적인 무역개방도 및 수입의존도를 사용하지 않고 KOF 세계화 지수를 사용하였다.

50) Attinasi & Balatti(2021)은 계량모형을 사용하지 않고 전년동기비 인플레이션의 12분기 평균을 추세 인플레이션 대용치로 사용하였다.

51) Attinasi & Balatti(2021) 및 ECB(2021a)는 세계화가 진전될수록 서비스 추세 인플레이션이 상승하는 원인을 모색하지는 않았으나, 기존연구들에서 포착된 세계화와 추세 인플레이션 간 관계가 유의미하지 않은 점에 대한 원인을 제시했다는 점에서 의미가 있다.

52) 1990년대 중반부터 2011년까지 글로벌 공급요인이 추세 인플레이션과 장기 기대인플레이션과의 괴리를 설명함을 의미한다. Ascari & Fosso(2021)는 동 기간의 글로벌 공급 충격이 주로 중국의 세계 경제 편입에 따른 GVC 활성화에 기인하는 것으로 지적하였다.

53) 이는 본 연구의 <그림 Ⅳ-6>에서도 확인할 수 있다.

54) 인구구조와 인플레이션 간 관계에 대한 선행연구 고찰은 강환구(2017) 및 안병권 외(2017)에도 잘 정리되어 있다.

55) <그림 Ⅲ-4> 및 <그림 Ⅲ-5>는 인용된 연구에 제시된 실증분석 결과를 대략적으로 나타낸 것이다. 구체적인 수준은 부정확하므로 정성적인 특성만 살펴보기 바란다.

56) Aksoy et al.(2019)에서 분석된 인구구조 코호트별 인플레이션에 대한 영향은 0.70(20세 미만), -0.75(20~60세), 0.05(60세 초과)로 추정되었다.

57) 강현주(2022)는 Aksoy et al.(2019)을 바탕으로 분석 대상 국가(OECD 21개국)를 일부 변경하고, 분석 기간을 확장(1980~2020년)하여 인구 코호트가 장기 인플레이션에 미치는 영향을 살펴보았다. 동 연구에서도 Aksoy et al.(2019)과 같이 유년층(0~19세) 및 고령층(65세 이상) 비율이 증가할수록 (연간) 인플레이션이 상승하였으며, 노동가능인구(20~60세) 비율은 인플레이션 하락요인으로 분석되었다.

58 Braun & Ikeda(2022)에서 유동자산에 대한 초과수요(liquid asset demand glut)는 전통적인 secular stagnation 이론의 과잉저축(savings glut) 현상으로 해석할 수 있다.

59) UN 통계에 따르면 일본은 1995년부터 노동가능인구(15세~64세)가 감소하기 시작하였다. 그 결과 일본의 고령인구부양비율(old-age dependency ratio)은 1985년에는 G7국가 중 가장 낮은 수준이었으나, 2005년에는 가장 높은 순위로 상승하였다(Braun & Ikeda, 2022).

60) Gajewski(2015)에서 유년부양 비율(15~64세 또는 20~64세 인구 대비 15세 이하 또는 20세 이하 인구 비율)이 증가할수록 인플레이션이 높아지는 것으로 나타났는데, 이는 앞서 살펴본 Juselius & Takatz 및 Aksoy et al.(2019) 등의 결과와 일치한다.

61) Lis et al.(2020) 및 Bodnar & Nerlich(2022)의 논의는 <그림 Ⅲ-4>에서 수요-공급 간 양적 차이 외에 소비 패턴 변화와 같은 요인들이 고려될 필요가 있음을 시사한다.

62) 식(1)과 같이 현재 인플레이션![]() 결정요인으로 인플레이션의 지속성(persistence)을 포착하는 과거 인플레이션

결정요인으로 인플레이션의 지속성(persistence)을 포착하는 과거 인플레이션![]() 및 향후 인플레이션에 대한 기대(기대인플레이션)를 동시에 포함하는 필립스곡선을 혼합형(hybrid) 필립스곡선으로 지칭한다. 과거 인플레이션만 고려하는 실증 필립스곡선은 backward-looking이 되며, 기대인플레이션만 포함하면 forward-looking 필립스곡선이 된다. 다만, 식(1)과 같은 축약형 필립스곡선은 구조모형(균형이론 모형)인 NKPC와 구분될 필요가 있다. 일정한 조건을 만족하면 NKPC 모형은 축약형 필립스곡선으로 나타낼 수 있으며, 통상 실증분석의 용이성 및 인플레이션 적합도 향상 측면에서 다양한 축약형 모형이 고려된다. 이런 관점에서 축약형 모형을 실증적(empirical) 필립스곡선으로 지칭하기도 한다. 자세한 내용은 Gali & Gertler(2000), Kuttner & Robinson(2008) 및 Forbes(2019a, 2019b) 등을 참고하기 바란다.

및 향후 인플레이션에 대한 기대(기대인플레이션)를 동시에 포함하는 필립스곡선을 혼합형(hybrid) 필립스곡선으로 지칭한다. 과거 인플레이션만 고려하는 실증 필립스곡선은 backward-looking이 되며, 기대인플레이션만 포함하면 forward-looking 필립스곡선이 된다. 다만, 식(1)과 같은 축약형 필립스곡선은 구조모형(균형이론 모형)인 NKPC와 구분될 필요가 있다. 일정한 조건을 만족하면 NKPC 모형은 축약형 필립스곡선으로 나타낼 수 있으며, 통상 실증분석의 용이성 및 인플레이션 적합도 향상 측면에서 다양한 축약형 모형이 고려된다. 이런 관점에서 축약형 모형을 실증적(empirical) 필립스곡선으로 지칭하기도 한다. 자세한 내용은 Gali & Gertler(2000), Kuttner & Robinson(2008) 및 Forbes(2019a, 2019b) 등을 참고하기 바란다.

63) 다만, 식(1)은 추세 인플레이션을 분석 대상으로 하지 않으므로 ![]() 계수를 통해 포착된 인플레이션 수준 변화를 장기적 관점의 추세 인플레이션 변화로 단정할 수 없다.

계수를 통해 포착된 인플레이션 수준 변화를 장기적 관점의 추세 인플레이션 변화로 단정할 수 없다.

64) 다음 절에 제시된 본 연구의 자료에서 기대인플레이션과 세계화 변수 간에 높은 음의 상관관계(-0.85)가 존재하여 이를 교정할 필요가 있다. <부록 2>의 기대인플레이션 및 세계화를 동시에 포함한 모형에서는 기대인플레이션 대신 ‘조정 기대인플레이션’을 사용하였다. 조정 기대인플레이션은 본 연구에서 실시하는 추세 인플레이션 결정요인 분석에서 매우 중요한 역할을 담당하므로 본 장 ‘3. 분석 결과 : 세계화 및 인구구조 변화와 추세 인플레이션’에서 기술하기로 한다.

65) 아울러, 한국은 미국과 달리 근원 재화 및 서비스 인플레이션이 별도로 집계되지 않으며, 공개된 자료를 통해서 근원 인플레이션을 재화 및 서비스 인플레이션으로 구분하여 산출할 수 없다.

66) 한미 필립스곡선 회귀식에서 세계화 변수가 비정상성(non-stationarity)을 가지는 것으로 확인되었다. 이 경우 다음 절(추세인플레이션 결정요인 분석)에 기술된 바와 같이 필립스곡선 회귀식에 가성관계(spurious)가 존재할 수 있다. 이에 자기회귀시차분포(Autoregressive Distributed Lag Model: ARDL) 모형을 통해 회귀식의 유효성을 검정하였다. 동 결과는 <부록 3>의 마지막에 제시되어 있다. ARDL 추정 및 결과 해석에 대해서는 다음 절(추세인플레이션 결정요인 분석) 및 <부록 3>을 참고하기 바란다.

67) ![]() 계수 추정치가 유의한 양의 값을 가지면 기대인플레이션이 낮을수록 인플레이션의 GDP갭에 대한 민감도가 낮아지는 효과가 발생한다.

계수 추정치가 유의한 양의 값을 가지면 기대인플레이션이 낮을수록 인플레이션의 GDP갭에 대한 민감도가 낮아지는 효과가 발생한다.

68) 다만, Ⅲ장에서 살펴본 기존연구들은 본 고 <부록 2>에 제시된 확장모형2-1을 검정하지 않았다. 아울러, 대부분의 기존연구는 여러 국가의 패널자료를 이용하였으며, 세계화 변수도 무역개방도 등 무역 통계를 사용했다는 점에서 본 고와 차이가 있다. 따라서 본 연구의 결과를 기존연구와 직접 비교하는 데에는 주의가 필요하다.

69) <표 Ⅳ-2> 및 <부록 2>에 제시된 추가 모형들에서 원자재 가격(GSCI)은 전체 근원 및 근원 재화‧서비스 인플레이션에 유의한 영향을 미치지 않는다. 이는 근원 인플레이션의 특성에 기인한 것으로 판단된다.

70) <표 부록-5> 확장모형2-2(근원 인플레이션)에서 (조정) 기대인플레이션과 GDP갭의 교차항![]() 계수가 유의한 양의 값으로 추정되었다. 반면, 확장모형2-1(헤드라인 인플레이션)의 교차항 계수는 부호는 양이나 유의하지 않았다.

계수가 유의한 양의 값으로 추정되었다. 반면, 확장모형2-1(헤드라인 인플레이션)의 교차항 계수는 부호는 양이나 유의하지 않았다.

71) <표 Ⅳ-2>에서 ![]() 계수 추정치가 재화 인플레이션은 1.283(기본모형-3), 서비스 인플레이션은 1.680(기본모형-4)이다. 유사하게 <표 부록-4>의 확장모형1-3 및 확장모형1-4, <표 부록-5>의 확장모형2-3 및 확장모형2-4의

계수 추정치가 재화 인플레이션은 1.283(기본모형-3), 서비스 인플레이션은 1.680(기본모형-4)이다. 유사하게 <표 부록-4>의 확장모형1-3 및 확장모형1-4, <표 부록-5>의 확장모형2-3 및 확장모형2-4의 ![]() 를 비교해도 기대인플레이션은 재화 인플레이션보다 서비스 인플레이션에 영향을 크게 미치는 것으로 나타났다.

를 비교해도 기대인플레이션은 재화 인플레이션보다 서비스 인플레이션에 영향을 크게 미치는 것으로 나타났다.

72) <표 부록-4>의 확장모형1-3 및 1-4, <표 부록-5>의 확장모형2-3 및 2-4의 ![]() 계수 추정치를 비교해보면 크기 및 유의성이 모두 유사한 것을 알 수 있다.

계수 추정치를 비교해보면 크기 및 유의성이 모두 유사한 것을 알 수 있다.

73) <표 Ⅳ-2>, <표 부록-4> 및 <표 부록-5>에서 ![]() 계수 추정치가 모두 유의한 음의 값을 가진다.

계수 추정치가 모두 유의한 음의 값을 가진다.

74) <표 부록-5>의 확장모형2-3 및 2-4에서 ![]() 계수 추정치

계수 추정치![]() 가 재화 인플레이션의 경우 유의하지 않은 음의 값으로 추정된 반면, 서비스 인플레이션은 유의한 양의 값으로 나타났다.

가 재화 인플레이션의 경우 유의하지 않은 음의 값으로 추정된 반면, 서비스 인플레이션은 유의한 양의 값으로 나타났다.

75) <표 부록-6>에서 ![]() 계수 추정치가 유의한 음의 값으로 추정되었다.

계수 추정치가 유의한 음의 값으로 추정되었다.

76) Ⅱ장에서 언급된 바와 같이 Kiley(2015) 방법은 연간 헤드라인 CPI 인플레이션 변화![]() 를 전년도 GDP갭에 대해 회귀분석하여 인플레이션의 국내 GDP갭에 대한 민감도를 추정한다. <그림 Ⅳ-2>와 <그림 Ⅳ-3>은 과거 15년 자료를 이용한 이동(rolling) 회귀분석

를 전년도 GDP갭에 대해 회귀분석하여 인플레이션의 국내 GDP갭에 대한 민감도를 추정한다. <그림 Ⅳ-2>와 <그림 Ⅳ-3>은 과거 15년 자료를 이용한 이동(rolling) 회귀분석![]() 에서 얻어진 계수 추정치의 시계열을 보여준다.

에서 얻어진 계수 추정치의 시계열을 보여준다.

77) 다만 벤치마크 모형은 비교 용도로만 고려하고자 한다.

78) 앞 절에서 언급된 것처럼 한국은 근원 인플레이션 중 재화 및 서비스 인플레이션이 별도로 집계되지 않으므로 미국과 같이 섹터별 추세 인플레이션을 분석할 수 없다.

79) Eo et al.(2023)의 두 섹터 UCSV모형은 섹터별 인플레이션 간 상관관계를 고려한다. 따라서 근원 재화 및 근원 서비스 인플레이션에 대해 각각 Stock & Watson(2007)의 단일 섹터 UCSV모형을 적용하여 추정한 추세 인플레이션과 차이가 있다.

80) Stock & Watson(2007) 추세 인플레이션은 여타 모형의 벤치마크로도 자주 사용된다. 이에 대해서는 Banbura & Bobeica(2020) 및 Forbes(2019b) 등을 참고하기 바란다.

81) 추세 인플레이션 결정요인으로 고려한 기타 요인은 정상시계열(I(0))로 확인되었다.

82) 즉, ARDL은 종속변수가 비정상시계열(I(1))이며, 독립변수에 정상시계열(I(0)) 및 비정상시계열(I(1))이 혼재해있는 일반적인 경우에 적용할 수 있는 방법이다(Kripfganz & Schneider, 2023).

83) Fiorenti et al.(2018) 및 Borio et al.(2022)은 ARDL방법을 적용하여 실질중립금리 결정요인을 실증분석하였다. ARDL 방법은 경제 및 재무 분야에서 광범위하게 사용된다. ARDL 방법의 소개 및 적용 사례에 대해서는 Kripfganz & Schneider(2023)를 참고하기 바란다.

84) 이 점에 대해서는 본 장의 ‘4. 한미 인플레이션 기조 변화 가능성 평가’에서 살펴본다.

85) Attinasi & Balatti(2021), Koester et al.(2021), Kohlscheen & Moessner(2022) 등도 다양한 방법을 통해 연간 KOF 세계화지수를 분기 데이터로 변환하여 분석에 사용하였다. Mikolajun & Lodge(2016), Jasova et al.(2018), Banbura & Bobeica(2020) 등은 연간 GDP갭 자료를 분기로 전환하였으며, Forbes(2019a, 2019b)는 연간 GVC 데이터를 분기로 변환하여 실증분석에 사용하였다.

86) 대부분의 기존연구는 다수 국가의 패널 자료를 이용하므로 본 고와 같이 기대인플레이션과 세계화 변수 간에 높은 상관관계가 존재하는지 단정할 수 없다.

87) NKPC 이론에서 기대인플레이션은 기업의 한계비용에 대한 기대를 반영하는 것으로 생각할 수 있다. Albagli et al.(2022)은 글로벌 공급망에서 획득할 수 있는 생산투입요소 가격 변화가 기업의 기대인플레이션 형성에 중요한 역할을 담당할 수 있다는 이론적‧실증적 근거를 제시하였다. Rogoff(2004) 및 Gnan & Valderrama(2006) 등은 세계화가 기대인플레이션의 추세적 하락에 영향을 미쳤을 수 있다는 추론을 제기하였다.

88) 바꿔 말하면 기대인플레이션이 추세 인플레이션에 미치는 영향 중 일부는 세계화 효과를 반영한 것으로 볼 수 있다.

89) 조정 기대인플레이션은 기대인플레이션을 KOF 세계화지수에 대해 회귀분석하여 산출된 잔차항이다.

90) 조정 기대인플레이션에 대해 ADF(Augmented Dickey Fuller)검정을 실시한 결과, 유의수준 1%에서 안정적(stationary)인 시계열로 확인되었다.

91) 미국의 재화 및 서비스 추세 인플레이션은 Eo et al.(2023), 선진 12개국의 재화 및 서비스 추세 인플레이션은 Attinasi & Balatti(2021) 및 Koester et al.(2021)을 참고할 수 있는데, <그림 Ⅳ-6>과 유사한 특징을 보여준다.

92) 모형1, 모형2, 모형5, 모형6, 모형9, 모형10의 ![]() 및

및 ![]() 계수 추정치가 모두 유의한 양의 값이다.

계수 추정치가 모두 유의한 양의 값이다.

93) 모형1, 모형2, 모형5, 모형6, 모형9, 모형10의 ![]() 계수 추정치가 모두 유의한 음의 값으로 추정되었다.

계수 추정치가 모두 유의한 음의 값으로 추정되었다.

94) Forbes(2019b)의 분석에서는 세계화 변수가 추세 인플레이션에 유의한 영향을 미치지 못하는 것으로 나타났다. Attinasi & Balatti(2021) 및 ECB(2021a)는 다양한 세계화 변수(무역개방도, GVC 참여도, KOF 정보세계화지수) 중 일부(무역개방도, GVC 참여도)가 추세 인플레이션에 유의한 음의 영향을 미친 것으로 확인되었다. 다만, Attinasi & Balatti(2021) 및 ECB(2021a)는 세계화가 추세 인플레이션에 미친 영향이 통계적으로는 유의하지만 경제적으로는 영향도가 제한적임을 지적하였다.

95) 본 고에서 결과를 제시하지는 않지만, 본 연구에서 조정 기대인플레이션 대신 기대인플레이션을 사용하면 세계화 효과의 유의성이 크게 낮아진다. 앞에서 기술된 것처럼 세계화가 기대인플레이션 형성에 영향을 미칠 경우, 기대인플레이션이 추세 인플레이션에 미치는 영향 중 일부는 세계화 효과로 파악할 필요가 있는 것으로 판단된다.

96) Ⅲ장에서 살펴본 바와 같이 Friedrich & Selcuk(2022)의 분석에서는 세계화(KOF 세계화지수)가 필립스곡선의 하향 이동(추세 인플레이션 하락)을 유의하게 설명하였다. 다만, 동 연구는 추세 인플레이션 결정요인으로 기대인플레이션을 포함하지 않았다.

97) 모형3, 모형4, 모형7, 모형8, 모형11, 모형12의 ![]() 계수 추정치가 모두 유의한 양의 값으로 추정되었다.

계수 추정치가 모두 유의한 양의 값으로 추정되었다.

98) 모형3, 모형4, 모형7, 모형8, 모형11, 모형12에서 ![]() 계수 추정치를 비교하면, 서비스 인플레이션은 모두 유의한 양의 값을 가진 반면, 재화 인플레이션은 유의하지 않았다.

계수 추정치를 비교하면, 서비스 인플레이션은 모두 유의한 양의 값을 가진 반면, 재화 인플레이션은 유의하지 않았다.

99) <표 Ⅳ-3>과 <표 부록-13>의 차이를 알아보면 다음과 같다. 본 연구의 변수 정의상![]() 이 성립한다. 따라서 <표 Ⅳ-3>은 <표 부록-13>에 제약

이 성립한다. 따라서 <표 Ⅳ-3>은 <표 부록-13>에 제약![]() 을 추가한 형태(restricted version)로 파악할 수 있다.

을 추가한 형태(restricted version)로 파악할 수 있다.

100) 역사적 분해방법의 세부적인 내용은 <부록 5>에 정리하였다.

101) 헤드라인 및 근원 추세 인플레이션 결정요인 분해에서 차이는 헤드라인의 경우 원자재 가격의 영향이 근원에 비해 다소 유의미하게 산출된다는 점이다. 근원 추세 인플레이션의 경우 원자재 가격의 영향이 매우 미미하다. 이 점을 제외하면 헤드라인 및 근원 추세 인플레이션 결정요인 분해에서 주목할 만한 차이가 확인되지 않았다.

102) 아래 표에 정리된 것처럼 기대인플레이션 및 세계화의 기간별 추세 인플레이션 변화에 대한 기여분은 다양한 모형 간에 유사한 수준으로 추정되었다.

103) 미국은 1986년부터 1996년까지 노동가능인구 비중이 감소하였으며, 동 기간 동안 추세 인플레이션 상승요인으로 작용하였다.

104) <그림 Ⅳ-7>, <그림 Ⅳ-8> 및 <그림 Ⅳ-9>의 (패널 B)에서 1990~2003년 중 추세 인플레이션의 전체 하락 폭 중 세계화 기여도가 각각 70%, 56% 및 70%로 나타났다.

105) 이러한 점은 대체로 일본 사례를 살펴본 Shirakawa(2012) 및 Braun & Ikeda(2022)의 결과와 일맥상통한다.

106) 다만, 본 고에서는 한국의 고령화가 구조적인 인플레이션 하락요인으로 작용한 원인에 대해 상세한 분석을 실시하지 않는다.

107) 가계금융복지조사 결과 2022년 기준 50대의 실질 보유 순자산액(중간값 기준)은 2012년 기준 50대보다 40.1%(1.9억 원→2.7억 원) 더 많은 것으로 나타났다.

108) 본문의 내용을 좀 더 상세히 설명하면 다음과 같다. 본 연구에서 인구구조 변수는 모두 원자료의 로그값이므로 아래 식이 성립한다.

![]()

(로그 고령부양비 = 로그 고령인구 비중 - 로그 노동가능인구 비중)

노동인구 비중 감소 및 고령인구 증가는 동일하게 고령부양비 상승을 의미한다. 그런데, 만약 노동인구 비중 감소는 추세 인플레이션 상승을 촉발(‘효과1’)하는 반면 고령인구 비중 증가가 추세 인플레이션 하락을 유발(‘효과2’)할 경우에는 두 가지의 상반된 효과를 단일변수인 고령부양비를 통해 측정하는데 한계가 있다. 고령부양비는 동일하게 상승하더라도, ‘효과1’ 및 ‘효과2’의 상대 크기에 따라 추세 인플레이션이 상승할 수도 있고 하락할 수도 있기 때문이다.

109) <그림 Ⅳ-15>의 추세 인플레이션 추정치는 인구구조 외 경제 여건이나 인구구조가 여타 경제 여건에 미치는 영향을 반영하지 못하므로 장기 시계의 추정치는 신뢰도가 높지 않지만, 2027년 이후에는 추세 인플레이션 상승 폭이 더 확대된다.

110) 한국은 자료의 제약으로 기대인플레이션이 필립스곡선 평탄화에 미친 영향을 세계화 효과와 비교하지 못하였다.

111) 아울러, 한국은 고령인구 비중 증가 속도가 매우 가파르다는 측면에서, 과거 일본 사례와 같이 고령화가 경제 전체의 소비 감소를 유발중일 가능성도 존재하는 것으로 파악된다.

112) 인구구조가 고령화되는 경우 생산가능인구 감소로 자금수요가 줄어드는 한편, 고령층의 초과저축으로 자금공급이 확대됨에 따라 실질중립금리가 하락하게 된다. 즉, 생산가능인구가 줄어들 경우 일인당 자본장비율이 높아져 자본의 한계생산이 저하됨에 따라 투자가 축소되어 자금 수요가 줄어든다. 또한, 생애주기모형에서 금융자산이 고령층에 편중된 가운데 고령층의 비중이 확대됨에 따라 고령층이 보유한 초과 저축이 경제 전체의 자금공급 요인으로 작용하게 된다.

113) 이와 같은 경로는 Lis et al.(2020) 및 Koester et al.(2021) 등에서 제시된 바 있다. 동 연구들에서는 중앙은행이 고령화로 인한 실질중립금리 변화를 통화정책에 충분히 반영하지 못하는 구체적인 이유는 제시하지 않았으나, 예를 들면 노동가능인구 감소로 실질임금이 상승하지만, 실업률은 낮게 유지되고, 이는 명목임금 및 기대인플레이션의 상승으로 연결되나, 가계/정부부채가 누적된 상황에서 이들의 이자상환부담을 고려하여 중앙은행이 충분한 수준의 금리인상을 하지 못할 가능성 등을 고려할 수 있다. 이 점을 지적해주신 익명의 심사자께 감사드린다.

114) 기후변화가 인플레이션에 미치는 영향에 대한 논의는 ECB(2021b), Schnabel(2022), Cevik & Jalles(2023) 등을 참고하기 바란다.