Find out more about our latest publications

Assessing the likelihood of a structural shift in interest rates (I): Economic structural change and the real neutral interest rate

Research Papers 24-04 Feb. 19, 2024

- Research Topic Macrofinance

- Page 61

Following the spread of COVID-19 and the steep rise in inflation, along with central banks in major countries raising interest rates, there is uncertainty about the future interest rate trend. There are contrasting views on whether we will return to the low-interest rates seen after the global financial crisis or if the long-standing trend of declining interest rates since the 1980s will be halted, resulting in a prolonged period of high interest rates. In this context, this report aims to provide the directional outlook for trend nominal interest rate fluctuations based on anticipated structural changes, such as demographic shifts, deglobalization, and productivity improvements.

Firstly, it has been statistically demonstrated that long-term government bond yields in South Korea and the United States maintain a stable relationship with the real neutral rate and trend inflation. Consequently, the factors influencing interest rates have been analyzed by distinguishing between the real neutral rate and trend inflation, leading to the creation of two research reports. This report, as the first part, primarily analyzes the impact of economic structural changes on the real neutral rate, summarizes and incorporates the outlook for trend inflation to be addressed in the second part, presenting the directional changes in trend interest rates and deriving policy implications.

To analyze the impact of economic structural variables such as demographic changes, productivity shifts, and national debt on the real neutral rate, forecasts for long-term real neutral rates in South Korea and the United States were estimated using UN population estimates, OECD productivity forecasts, and the National Assembly Budget Office's fiscal outlook. The analysis results suggest that the United States is expected to experience a rebound in the real neutral rate due to productivity improvements, while South Korea is forecasted to have a sustained plateau in the real neutral rate due to rapid population aging. Moreover, considering the results of the second part, which indicates a significant possibility of the end of the low inflation trend in South Korea and the U.S. due to future deglobalization and aging trends, it is concluded that global interest rates are likely to be stuck in a high-interest rate environment, and domestic interest rates are expected to find it challenging to return to the previous low-interest levels.

The directional trend of these interest rates poses challenges for fiscal policy in terms of the potential burden of interest costs due to expanding national debt and the possibility of fiscal expansion amid a household debt crisis. Regarding monetary policy, it raises challenges such as the central bank's dilemma in responding to supply shocks and the structural reversal of domestic and foreign interest rate differentials. Additionally, for the financial investment industry and pension funds, it suggests the need to consider changes in the relationship between asset yields and formulate new asset allocation strategies in response to market changes.

Firstly, it has been statistically demonstrated that long-term government bond yields in South Korea and the United States maintain a stable relationship with the real neutral rate and trend inflation. Consequently, the factors influencing interest rates have been analyzed by distinguishing between the real neutral rate and trend inflation, leading to the creation of two research reports. This report, as the first part, primarily analyzes the impact of economic structural changes on the real neutral rate, summarizes and incorporates the outlook for trend inflation to be addressed in the second part, presenting the directional changes in trend interest rates and deriving policy implications.

To analyze the impact of economic structural variables such as demographic changes, productivity shifts, and national debt on the real neutral rate, forecasts for long-term real neutral rates in South Korea and the United States were estimated using UN population estimates, OECD productivity forecasts, and the National Assembly Budget Office's fiscal outlook. The analysis results suggest that the United States is expected to experience a rebound in the real neutral rate due to productivity improvements, while South Korea is forecasted to have a sustained plateau in the real neutral rate due to rapid population aging. Moreover, considering the results of the second part, which indicates a significant possibility of the end of the low inflation trend in South Korea and the U.S. due to future deglobalization and aging trends, it is concluded that global interest rates are likely to be stuck in a high-interest rate environment, and domestic interest rates are expected to find it challenging to return to the previous low-interest levels.

The directional trend of these interest rates poses challenges for fiscal policy in terms of the potential burden of interest costs due to expanding national debt and the possibility of fiscal expansion amid a household debt crisis. Regarding monetary policy, it raises challenges such as the central bank's dilemma in responding to supply shocks and the structural reversal of domestic and foreign interest rate differentials. Additionally, for the financial investment industry and pension funds, it suggests the need to consider changes in the relationship between asset yields and formulate new asset allocation strategies in response to market changes.

Ⅰ. 논의의 배경

코로나19 감염확산 이후 가파른 인플레이션 상승에 대응하여 주요국 중앙은행들이 기준금리를 인상함에 따라 장기금리가 상승하고 있다. 이에 따라 향후 금리 기조에 대한 의문이 제기되는 가운데 글로벌 금융위기 이후와 같은 저금리로 복귀할 것인가 아니면 1980년대 이후 지속되어 온 금리 하락세가 중단되고 고금리가 상당 기간 고착화될 것인가에 대한 상반된 시각이 존재한다. 일각에서는 최근의 인플레이션 현상이 마무리되면 세계 경제가 코로나19 감염확산 이전의 장기 침체(secular stagnation)로 회귀할 것으로 예상하면서 최근의 금리 상승을 일시적 현상으로 판단한다. 특히 기대수명의 증가나 양극화 등으로 실질중립금리의 구조적 하락세가 지속될 것이라는 측면에서 저금리 기조로의 복귀 가능성을 제기한다(Blanchard, 2023). 반면 정부부채의 확대, 고령화에 따른 노동력 부족, 친환경 에너지 투자 수요 등으로 과거와 같은 낮은 수준의 실질금리 시대가 마무리되고 명목요인도 상승할 것으로 보여 금리가 장기 상승국면에 진입할 것이라는 예상 또한 존재한다(Goodhart & Pradhan, 2020; Schnabel, 2022; Blanchard & Summers, 2023).

글로벌 금융위기 이후 지속된 저금리가 자산가격의 상승과 함께 정부 및 민간의 부채 확대를 견인한 만큼 금리 기조에 대한 판단은 향후 국내외 거시금융 체제 전망에 대한 핵심적인 질문이다. 특히 팬데믹 이후 그동안 점진적으로 진행중이던 세계 경제의 구조적 변화가 표면화되는 동시에 가속화되면서 이러한 질문에 대한 관심이 더욱 커지고 있다. 주요 선진국들이 팬데믹 기간중 공통적으로 노동력 부족 문제를 겪으면서 인구구조의 변화에 대한 관심이 크게 확대되었다(Duval et al., 2022). 또한, 코로나19 감염확산 이전부터 이미 미중 무역분쟁으로 시작되었던 글로벌 경제의 진영간 대립이 최근 들어 더욱 격화됨에 따라 공급망이 이분화되는 등 탈세계화의 압력이 가중되고 있다(Cerdeiro et al., 2021; Javorcik et al., 2023). 다른 한편으로 글로벌 금융위기 이후 매우 부진했던 주요국의 생산성 추세가 최근 생성형 AI 도입이나 친환경 에너지 투자 확대 등에 힘입어 반등 가능성이 제기되고 있다(Goldman Sachs, 2023b; McKinsey & Company, 2023; Capital Economics, 2023). 이 밖에도 러시아‧우크라이나 전쟁 이후 국방비가 확대될 것으로 예상되는 데다 기후 변화 대응 과정에서 대규모 재정지출 수요가 발생하는 반면 주요국의 민주주의 위기로 재정건전성을 회복할 만한 정치적 리더쉽이 부재하다는 점은 국가부채 확대에 대한 우려를 키우고 있다(Arslanap & Eichengreen, 2023).

이러한 금리 기조의 방향성 문제에 대한 중요성에도 불구하고 블로그나 언론 기고, 연구자 간의 대담 등을 제외한 학술적 분석에 기반을 둔 선행연구는 아직까지 극히 제한적인 것이 사실이다. 특히 실질금리 및 물가 기조의 측면에서 상‧하방 요인이 공존하고 있는 가운데 대체로 기존 논의들이 실질중립금리(neutral rate of real interest)나 추세 물가만을 개별적으로 고려하므로 경제구조변화가 명목금리 기조에 미치는 영향을 종합적으로 평가한 연구 결과들이 거의 없는 상황이다. 본 보고서는 기존 연구의 이러한 한계점을 보완하고자 인구구조 변화, 탈세계화, 생산성 개선 등 향후 예상되는 구조변화에 따른 추세적 명목금리 변동의 방향성을 분석하는 것을 목표로 한다. 이를 위해 금리의 결정요인을 실질중립금리와 추세 인플레이션으로 구분하여 두 편의 연구보고서가 작성되었다. 제1편인 본 보고서는 경제구조변화에 따른 실질중립금리에 대한 영향을 주로 분석하는 한편, 제2편에서 다루는 추세 인플레이션에 대한 전망을 요약 반영하여 추세적 금리변동의 방향성을 제시하고 정책적 시사점을 도출하는 것을 목표로 하였다.

본 보고서의 구성 및 내용을 간략히 요약하면 다음과 같다. 우선 Ⅱ장에서는 실질중립금리 및 추세 인플레이션 추정치로부터 산출된 추세금리가 한미 양국의 장기 국채금리와 장기적으로 안정된 관계를 유지하고 있음을 통계적으로 실증하였다. 이를 통해 보고서의 제1편과 제2편에서 금리 기조를 실질중립금리와 추세 인플레이션으로 구분하여 분석하는 근거를 제시한다. Ⅲ장에서는 인구구조, 생산성 변화, 국가채무 등의 경제구조변수가 실질중립금리에 미칠 영향을 중첩세대모형(overlapping generation model)으로 분석하였다. 이를 위해 UN의 인구추계 전망, OECD의 생산성 전망, 국회 예산정책처의 재정전망 및 동일한 모형으로부터 추산된 미국의 실질중립금리 전망을 바탕으로 한국의 장기 실질중립금리 전망치를 제시하였다. 분석 결과 미국은 생산성 개선에 힘입어 실질중립금리가 반등할 것으로 예상되는 반면 한국은 가파른 인구 고령화로 실질중립금리가 장기적으로 횡보할 것으로 전망되었다.

금리 기조의 방향성 문제는 향후 거시안정화 정책의 정책여력(policy space)에 중대한 시사점을 가질 것으로 예상된다. 명목금리의 하한이 사실상 0% 수준이라고 한다면 장기 명목균형금리 수준은 통화정책의 여력을 결정짓는 한편 금리와 성장률간의 차이는 재정정책의 여력과 직결된다. 또한 고금리 기조가 고착화된다면 경제 규모에 비해 과도한 부채가 취약해지면서 금융안정에 대한 우려가 커질 수 있다. 이러한 경제정책에 대한 시사점과 별도로 글로벌 금융위기 이후 장기간의 저금리에 익숙해 있던 연기금 및 금융투자업계의 자산배분 전략에 대한 많은 변화가 필요할 것으로 판단된다. 이러한 정책 및 금융투자업계에 대한 시사점을 Ⅳ장에서 간략하게 정리하였다.

Ⅱ. 장기금리의 결정요인

본 장에서는 Ⅲ장에서 제시하는 실질중립금리와 제2편에서 추정되는 추세 인플레이션 추정치로부터 산출된 추세금리가 한미 양국의 장기 국채금리와 장기적으로 안정된 관계를 유지하고 있음을 제시한다. 이를 통해 전체 보고서에서 금리의 기조변화에 대해 실질중립금리와 추세 인플레이션3)으로 구분하여 살펴보는 것이 타당하다는 시사점을 제공한다.

1. 장기금리 결정요인에 대한 이론적 논의

본 고에서는 경제구조변수와 금리 기조간 관계를 고찰하는 것이 목적이므로 금리 변동중 추세 요인, 즉 추세금리를 분석대상으로 한다. 이를 위해 금리 변동을 추세 요인(trend factor)과 순환적 요인(cyclical factor)으로 다음과 같이 구분한다. 즉, 시점 에 만기가

에 만기가  인 금리를

인 금리를  라고 한다면

라고 한다면

이 되며  는 추세 요인,

는 추세 요인,  은 순환적 요인이다. 이때 순환적 요인은 주로 경기변동, 통화정책 및 금융 사이클 등에 의해 결정되는 금리 변동이다.

은 순환적 요인이다. 이때 순환적 요인은 주로 경기변동, 통화정책 및 금융 사이클 등에 의해 결정되는 금리 변동이다.

추세금리 는 Bauer & Rudebusch (2020), Brandt et al.(2021), Davis et al.(2021), Favero et al.(2023)에서와 마찬가지로 실질중립금리

는 Bauer & Rudebusch (2020), Brandt et al.(2021), Davis et al.(2021), Favero et al.(2023)에서와 마찬가지로 실질중립금리 및 추세물가

및 추세물가 에 의해 선형적으로 결정된다고 가정한다. 즉,

에 의해 선형적으로 결정된다고 가정한다. 즉,

이 되며 및

및  는 각각 만기가

는 각각 만기가  인 금리의 실질중립금리 및 추세 물가에 대한 민감도를 의미한다.

인 금리의 실질중립금리 및 추세 물가에 대한 민감도를 의미한다.

그렇다면 실제 관측 가능한 장기금리와의 관계로부터

이 성립되며 는 장기금리와 추세금리 간 회귀식의 안정적인 잔차항(stationary residual)이 된다. 한편 단기 명목금리

는 장기금리와 추세금리 간 회귀식의 안정적인 잔차항(stationary residual)이 된다. 한편 단기 명목금리  와 실질금리

와 실질금리  간의 관계를 나타내는 피셔 등식(Fisher equation)에 따르면

간의 관계를 나타내는 피셔 등식(Fisher equation)에 따르면  이 성립하며

이 성립하며  가 확률보행(random walk) 과정을 따를 경우 추세금리

가 확률보행(random walk) 과정을 따를 경우 추세금리  이라고 한다면 추세금리, 실질중립금리 및 추세 물가에 대해

이라고 한다면 추세금리, 실질중립금리 및 추세 물가에 대해  가 성립한다. 이러한 관계를 식(Ⅱ-1)에 적용하면

가 성립한다. 이러한 관계를 식(Ⅱ-1)에 적용하면

가 성립한다.

2. 장기금리와 거시경제적 요인과의 관계 분석

Bauer & Rudebusch(2020)는 코로나19 감염확산 이전까지의 미국 장기 국채금리의 지속성이 일반적인 거시경제적 추세에 기인하는 것인지 살펴보기 위해 공적분 회귀분석(cointegration regression)을 이용하여 장기금리가 중립금리 및 장기 기대 인플레이션을 통해 산출된 추세금리와 안정적 관계를 유지하고 있는지 여부를 검증한 바 있다. 본 절에서는 제1편에서 추정한 실질중립금리 및 제2편에서 사용되는 추세 물가 추정치를 통해 산출된 추세금리가 한미 양국의 장기금리와 안정적 관계를 유지하고 있는지 여부에 대해 1절에서 제시한 식(Ⅱ-1) 및 (Ⅱ-2)를 이용하여 실증적으로 검증한다. 해당 부분에서 자세히 설명되겠으나 실질중립금리는 Bielecki et al.(2020)의 중첩세대모형에서 자산시장 내 저축과 차입을 일치시키는 균형금리가 실질중립금리로 도출된다. 한편, 추세 인플레이션은 주요 선행연구에서 널리 활용되고 있는 Stock & Watson(2007)을 통해 추정하였다.

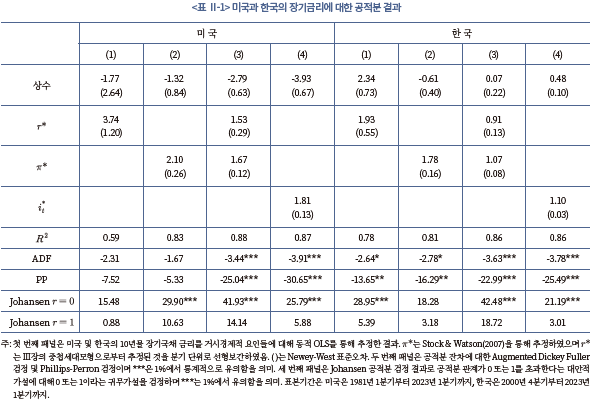

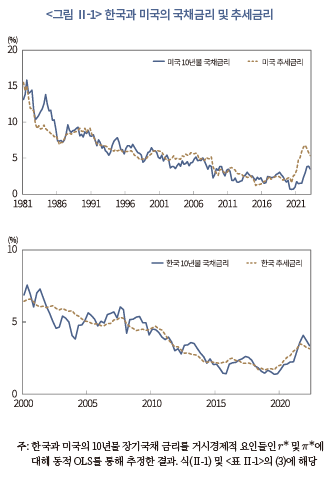

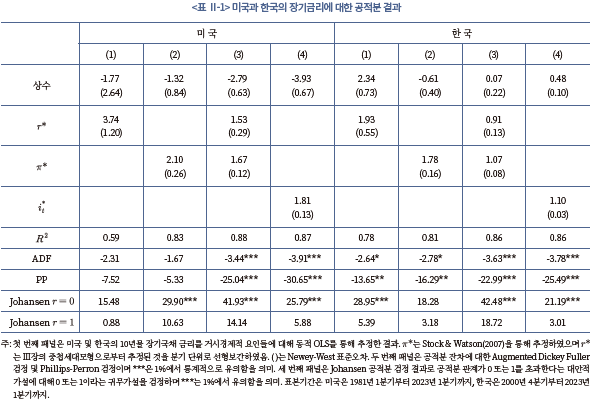

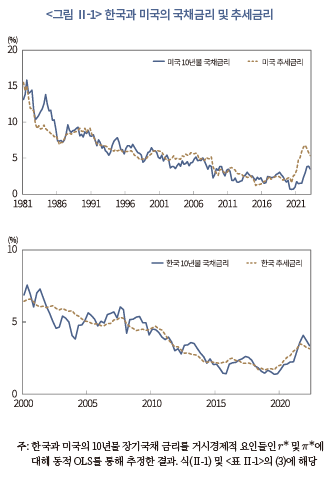

<표 Ⅱ-1>은 미국과 한국의 10년물 장기 국채금리에 대해 Stock & Watson(1993)의 동태적 최소자승법(Dynamic Ordinary Least Squares)을 통해 추정한 결과를 제시하고 있다. 우선 미국의 결과를 먼저 살펴보면 첫 번째 및 두 번째 회귀식은 각각 실질중립금리와 추세 인플레이션이 개별적으로 포함되어 있다. 회귀식의 잔차항에 대한 Augmented Dickey Fuller(ADF) 검정 및 Phillips-Perron(PP) 검정 결과 단위근(unit root)이라는 귀무가설이 기각되지 않는다. 추가적으로 Johansen 검정 결과를 살펴보면 장기 국채금리와 추세 인플레이션에 대해 공적분 관계가 없다는 귀무가설이 기각되지 않는다. 세 번째 회귀식은 실질중립금리와 추세 물가를 모두 포함하여 추정한 결과로 실질중립금리와 추세 인플레이션을 개별적으로 고려할 때에 비해 R2가 커진 것으로 나타났다. 잔차항에 대한 ADF 검정 및 PP 검정 결과 통계적으로 유의하게 안정적인 시계열로 나타났으며 Johansen 검정 결과 역시 장기 금리와 추세금리 간 공적분 관계를 뒷받침한다. 한편, 세 번째 회귀식에서 실질중립금리와 추세 인플레이션의 계수가 유사하게 추정된 가운데 를 이용한 네 번째 회귀분석 결과에서도 공적분 증거가 강한 것으로 나타나 10년물 장기 국채금리의 추세 성분을 완전히 포착할 수 있는 것으로 나타났다. 이러한 결과는 한국 국채금리를 바탕으로 추정 결과에서도 동일하게 확인된다. 실질중립금리 및 추세 인플레이션을 개별적으로 고려했을 때에 비해 두 거시경제적 요인을 모두 고려했을 때 모형의 설명력이 개선될 뿐만 아니라 공적분 관계에 대한 통계적 증거가 더욱 명확한 것으로 나타났다.

를 이용한 네 번째 회귀분석 결과에서도 공적분 증거가 강한 것으로 나타나 10년물 장기 국채금리의 추세 성분을 완전히 포착할 수 있는 것으로 나타났다. 이러한 결과는 한국 국채금리를 바탕으로 추정 결과에서도 동일하게 확인된다. 실질중립금리 및 추세 인플레이션을 개별적으로 고려했을 때에 비해 두 거시경제적 요인을 모두 고려했을 때 모형의 설명력이 개선될 뿐만 아니라 공적분 관계에 대한 통계적 증거가 더욱 명확한 것으로 나타났다.

종합적으로 이러한 점은 경제기초여건 변화에 따른 실질금리 및 인플레이션의 장기 추세가 국채금리의 추세적 움직임을 잘 설명할 뿐만 아니라 미래의 금리 변화를 예측할 때 모두 유용함을 시사한다. <그림 Ⅱ-1>은 식(Ⅱ-1)을 통해 추정한 추세금리와 실제 10년물 국채금리를 비교하고 있으며 <표 Ⅱ-1>에서 확인된 양자간의 안정적 관계를 제시하고 있다.

Ⅲ. 중첩세대모형 분석을 통한 실질중립금리 장기 전망

1. 실질중립금리의 개념 및 선행연구

가. 개념

실질중립금리는 중장기 시계에서 경기를 부양하거나 긴축시키지 않으면서 잠재 GDP 및 안정적인 물가상승률에 부합하는 실질금리를 의미한다(Blinder, 1999; IMF, 2023). 이러한 정의에 따르면 실질금리가 실질중립금리를 상회하게 될 경우 중장기적으로 인플레이션이 안정적 수준을 유지하지 못하고 하락하게 되며 반대인 경우 인플레이션이 상승하게 된다. 따라서 실질중립금리는 중앙은행이 조절하는 정책금리의 긴축 여부를 판단하는 준거 금리(reference rate)로 기능한다. 즉, 실질정책금리가 실질중립금리를 상회하면 통화정책이 긴축적인 상태로 평가할 수 있다. 이에 따라 테일러 준칙(Taylor rule)을 비롯한 다양한 통화 준칙에서 실질중립금리는 준칙 금리를 산정하는 데 핵심적인 역할을 하며 최근 들어 통화정책 커뮤니케이션 과정에서도 빈번하게 언급된다.

실질중립금리는 Wicksell(1936) 및 Keynes(1936)에 의해 상품가격이나 고용사정에 중립적인 금리로 처음 언급된 이후 장기간 큰 관심을 얻지 못했으나, 통화정책의 주요 수단이 통화량에서 금리로 전환되고 장기간 변화 없이 안정적4)인 것으로 생각되었던 중립금리가 글로벌 금융위기 이후 하락한 것으로 인식되면서 주요국의 통화정책 체계에 적극적으로 편입되었다(Yellen, 2017). 특히 준구조 모형을 통해 실질중립금리가 1990년대 이후 하락하였음을 보고한 Laubach & Williams(2003) 이후 실질중립금리에 관한 연구는 중립금리의 하락세에 대한 거시적 동인, 국제적 공행성, 매크로 레버리지 등 금융안정에 대한 명시적 고려, 기존 방법론의 불완전성에 따른 대안적 추정방법 등 다방면으로 활발하게 전개되었다.

나. 주요국의 실질중립금리 하락세에 대한 선행연구

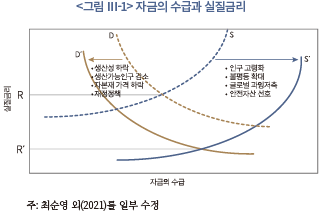

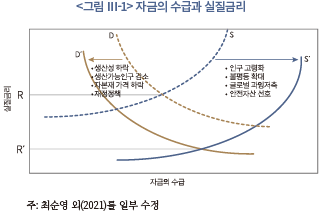

실질중립금리의 하락 원인에 대해 선행연구들이 다양한 설명을 제공하고 있는 가운데 <그림 Ⅲ-1>은 자금의 수요와 공급 측면에서 기존 설명들을 정리해 보았다. 우선, 생산성 혹은 잠재성장률이 하락하면 자본의 한계생산이 하락하여 투자 수요가 감소하게 되므로 자금의 수요곡선이 왼쪽으로 이동하게 되어 실질중립금리가 하락하게 된다(Laubach & Williams, 2003; Pescatori & Turunen, 2016; Holston et al., 2017; Sichel & Wang, 2017; Wynne & Zhang, 2018; Cesa-Bianchi et al., 2022). 또한, 주요 선진국 인구의 고령화로 생산가능인구가 감소함에 따라 일인당 자본장비율이 높아지고 자본의 한계생산이 저하되면서 자금 수요가 감소한다(Ikeda & Saito, 2014; Carvalho et al., 2016; Bielecki et al., 2020). 뿐만 아니라 세계화의 진전 등으로 자본재 가격이 하락한 점 또한 자금의 수요가 감소하게 된 원인으로 지적된다(Lian et al., 2020). 이러한 자금 수요의 축소 요인과 반대로 재정적자는 자금 수요를 확대시켜 실질금리를 상승시키는 요인으로 작용한다(Laubach, 2009; Rachel & Summers, 2019; Ferreira & Shousha, 2022)

한편, 자금의 공급 측면에서는 고령층 및 고소득층의 증가, 신흥국의 경상수지 확대 등 국내외 다양한 부문에서의 초과 저축이 실질중립금리 하락을 초래한 것으로 지적된다. 우선, 금융자산이 고령층에 편중된 가운데 기대수명이 확대되면서 고령층의 초과저축이 크게 확대되어 생산가능인구 축소에 따른 저축 감소효과를 상쇄해 경제 전체의 자금 공급 요인으로 작용한다(Carvalho et al., 2016; Bielecki et al., 2020). 또한 고소득층이 저소득층에 비해 한계소비성향이 낮은 만큼 불평등5)이 확대될수록 저축률이 상승하게 되며 실질금리는 하락하게 된다(Borio et al., 2017; Glick, 2019; Mian et al., 2021; Platzer & Peruffo, 2022). 뿐만 아니라 동아시아 신흥국들의 경상수지 흑자로부터 발생한 글로벌 과잉저축이 미국 등 선진국에 투자되면서 장기 국채금리가 하향 안정화되는 경로도 존재한다(Bernanke, 2005; Warnock & Warnock, 2009). 이 밖에도, 금융위기에 대한 경험 등으로 위험회피 성향이 강화됨에 따라 안전하고 유동성이 높은 자산에 대한 선호가 확대되면서 국채 등 무위험 자산으로의 자금 공급이 늘어나는 경로 또한 존재한다(Del Negro et al., 2017; Gourinchas et al., 2022). 종합적으로 자금의 수요 감소 및 공급 확대가 결합하여 실질중립금리가 점차 하락하였으며 이에 따라 코로나19 감염확산 이전까지 경제 구조나 대규모 정책 변화가 없으면 실질중립금리의 하락세가 계속되거나 낮은 수준이 지속될 것으로 예상되었다(Rachel & Smith, 2017).

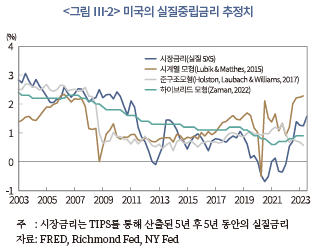

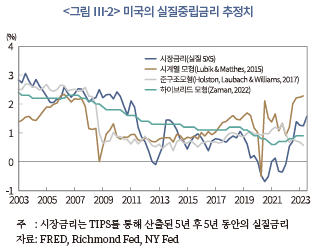

실질중립금리가 실제로 관측 가능하지 않아 경제 모형을 통해 추정해야 하므로 실질중립금리에 대한 다양한 추정치가 존재하는 가운데 <그림 Ⅲ-2>에서 나타나듯 물가연동채권에 반영된 시장금리나 Lubik & Matthes(2015) 등 일부 추정치는 팬데믹 이후 상승세를 나타냄에 따라 향후 방향성에 대한 관심이 지속되고 있다. 일각에서는 실질중립금리 하락세를 유발한 구조적 요인들이 코로나19 감염확산이나 팬데믹 이후의 인플레이션에 의해 되돌릴 수 없는 만큼 팬데믹 이전의 낮은 수준으로 복귀할 것이라고 주장한다(Bailey, 2022; Blanchard, 2023; IMF, 2023; Williams, 2023). 반면 다른 한편에서는 그간 실질중립금리 하락을 유도한 요인들의 영향이 정점에 도달했을 가능성이 제기되는 한편 정부부채의 확대, 생산성 제고에 의한 실질중립금리의 상방위험을 제기하는 시각 또한 존재한다(Luzzetti et al., 2022; Goldman Sachs, 2023a).

다. 한국의 실질중립금리에 대한 선행연구

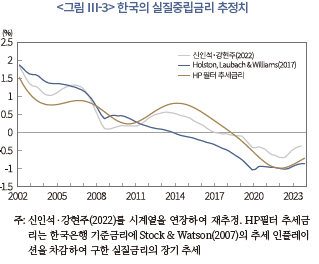

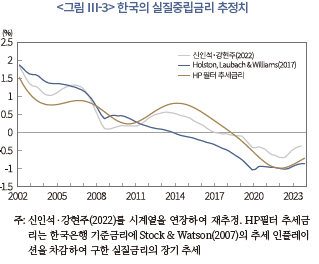

한국은 1990년대 이후 잠재성장률이 지속적으로 하락하였으며 <그림 Ⅲ-3>에서 나타난 바와 같이 실질중립금리의 하락세 또한 계속되고 있다. 미국을 비롯한 주요국의 실질중립금리의 하락세를 설명하는 거시적 동인들이 동일하게 한국의 실질중립금리 하락에 기여했을 가능성이 큰 것으로 판단된다. 그러나 오형석(2014) 등 국내를 대상으로 한 기존 연구들이 Laubach & Williams(2003)의 준구조 모형을 일부 변형하여 국내 데이터로 추정한 연구가 많은 반면, 잠재성장률 하락 외에 고령화나 불평등, 정부부채 확대 효과 등을 고려한 연구는 매우 제한적인 상황이다.6) 예외적으로 김민수‧박양수(2013) 및 Zhang et al.(2021)은 소규모 개방경제적 특성을 반영하였으며 Rafiq(2021) 및 오형석‧최지욱(2023)은 가계부채 확대에 따른 금융안정을 고려하는 등의 형태로 기존 모형을 확장하였다. 또한, 김명현‧권오익(2020) 및 강현주(2022)는 인구 고령화의 실질금리에 대한 효과를 분석하였다. 그러나 인구구조, 생산성 및 정부부채 등의 변화를 종합적으로 고려한 연구는 물론이고 이러한 구조변화를 고려하여 실질금리의 장기 추세를 전망한 연구는 극히 드문 상황이다.

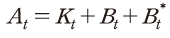

2. 중첩세대모형을 통한 한국과 미국의 중립금리 전망

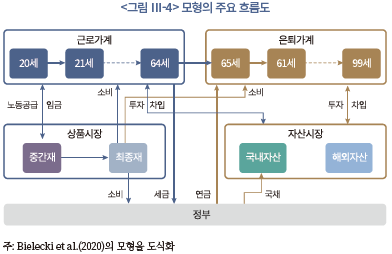

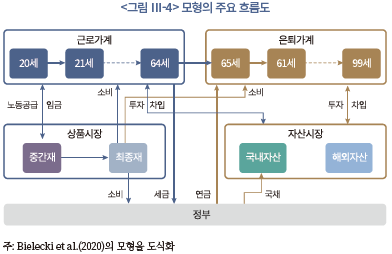

본 장에서는 Bielecki et al.(2020)의 생애주기(life-cycle) 모형을 바탕으로 한국 및 미국의 인구구조, 생산성 및 정부 재정 등의 데이터를 잘 반영할 수 있도록 모형내 모수 값들이 선택(calibration)되도록 하였다. <그림 Ⅲ-4>는 모형내 참여하는 경제 주체들과 상품 및 자산 시장간 흐름도를 제시하고 있다. 한편, 분석의 편의를 위해 대규모 경제인 미국은 폐쇄경제로, 한국은 국제금융시장에 접근 가능한 개방경제로 모형화되며 개방경제에서는 국내 금리가 외생적인 글로벌 금리에 의해 영향을 받게 된다. 또한 아래에서 일인당 기준으로 표현되는 변수는 소문자를, 집계 변수에 대해서는 대문자로 표현된다.

가. 모형의 주요 구조

1) 가계

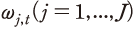

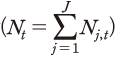

가계는 경제활동을 시작하는 20세에 세상에 진입하여 99세까지 살 수 있는 것으로 가정한다. 특정 연도 t에 연령이 j로 동일한 동기집단(cohort)의 크기를 로 지칭하기로 한다. 이에 따라 모형내 인구는 20세

로 지칭하기로 한다. 이에 따라 모형내 인구는 20세 부터 99세

부터 99세 까지 총 80개의 코호트로 구성되며 전체 인구

까지 총 80개의 코호트로 구성되며 전체 인구  는 개별 코호트의 합

는 개별 코호트의 합 과 같다. 모형내 인구구조의 변천 과정은 가장 나이가 어린 20세 코호트의 규모 변화

과 같다. 모형내 인구구조의 변천 과정은 가장 나이가 어린 20세 코호트의 규모 변화  와 함께 시간 및 연령에 따라 각 코호트가 직면한 사망 위험

와 함께 시간 및 연령에 따라 각 코호트가 직면한 사망 위험  에 의해 좌우된다.

에 의해 좌우된다.

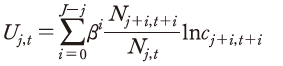

한편, 연령이 j인 코호트는 다음의 효용함수를 극대화한다고 가정하자.

여기서 는 주관적 할인율(subjective discount rate)을,

는 주관적 할인율(subjective discount rate)을,  은 최소 i년 이상 생존확률을 나타낸다.

은 최소 i년 이상 생존확률을 나타낸다.

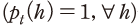

가계는 특정 나이 까지 일하다가 은퇴하며 은퇴 이후에는 연금소득

까지 일하다가 은퇴하며 은퇴 이후에는 연금소득  을 받는다. 연금제도 참여는 의무 사항이므로 모든 근로자는 노동 소득에 대해 세율

을 받는다. 연금제도 참여는 의무 사항이므로 모든 근로자는 노동 소득에 대해 세율  를 곱한 금액을 근로소득세 및 사회보장 기여금으로 납부한다. 가계는 국내 자본에 대한 청구권, 국내 정부 부채 및 (개방경제의 경우) 외국에서 발행한 자산을 거래하여 소비를 평탄화할 수 있다. 다만 모형이 결정론적 환경(perfect foresight)을 가정하고 있으므로 개별 가계의 관점에서 볼 때 이러한 모든 자산은 완벽한 대체재이므로 동일한 실질 이자율 을 지불한다. 코호트별 자산 보유량

를 곱한 금액을 근로소득세 및 사회보장 기여금으로 납부한다. 가계는 국내 자본에 대한 청구권, 국내 정부 부채 및 (개방경제의 경우) 외국에서 발행한 자산을 거래하여 소비를 평탄화할 수 있다. 다만 모형이 결정론적 환경(perfect foresight)을 가정하고 있으므로 개별 가계의 관점에서 볼 때 이러한 모든 자산은 완벽한 대체재이므로 동일한 실질 이자율 을 지불한다. 코호트별 자산 보유량  가 모든 연령

가 모든 연령  에서 음수가 아닌 것으로 제한하지 않으므로 다른 코호트 간 차입은 허용된다. 또한 가계는 중간재 생산자로부터 일시금 및 연령별 배당금

에서 음수가 아닌 것으로 제한하지 않으므로 다른 코호트 간 차입은 허용된다. 또한 가계는 중간재 생산자로부터 일시금 및 연령별 배당금  을 받는다. 대부분의 가계는 최대 연령에 도달하기 전에 사망하기 때문에 유산

을 받는다. 대부분의 가계는 최대 연령에 도달하기 전에 사망하기 때문에 유산 을 남기게 되며 해당 유산은 모든 생존 가계에 균등하게 재분배된다.

을 남기게 되며 해당 유산은 모든 생존 가계에 균등하게 재분배된다.

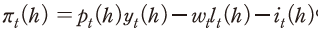

연령이 j인 가계의 예산제약은 다음과 같다.

여기서  는 은퇴연령 도달 여부에 대한 지시함수(indicator)이며

는 은퇴연령 도달 여부에 대한 지시함수(indicator)이며  는 연령별 노동생산성을,

는 연령별 노동생산성을,  는 실질임금을 의미하며 다음 절에서 좀더 상세히 설명하기로 한다.

는 실질임금을 의미하며 다음 절에서 좀더 상세히 설명하기로 한다.

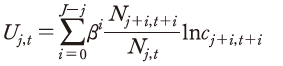

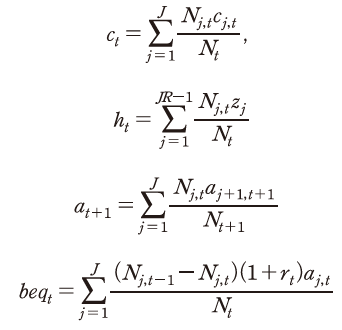

모든 생존 가구에 대해 일인당 소비, 노동, 자산 및 유산 규모를 일인당으로 표현하면 다음과 같다.

2) 기업

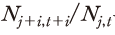

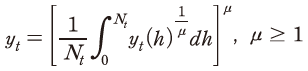

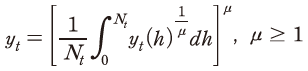

모형내에는 최종재를 생산하는 완전경쟁기업들과 중간재를 생산하는 독점적 경쟁기업(h로 구분)들이 존재한다. 각각의 기업 수는 인구구조 변화와 맞물려 인구 규모 와 연동되어 있다. 먼저, 완전경쟁기업들은 중간재

와 연동되어 있다. 먼저, 완전경쟁기업들은 중간재  를 구입하여 동질적인 최종재

를 구입하여 동질적인 최종재  를 다음과 같은 CES(Constant Elasticity of Substitution) 기술에 따라 생산한다고 가정한다.

를 다음과 같은 CES(Constant Elasticity of Substitution) 기술에 따라 생산한다고 가정한다.

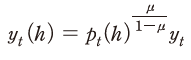

중간재 생산자 h가 자신의 생산품에 책정하는 (전체 물가대비) 상대 가격을  라고 한다면 이윤 극대화 조건으로부터 중간재에 대한 수요가 다음과 같이 도출된다.

라고 한다면 이윤 극대화 조건으로부터 중간재에 대한 수요가 다음과 같이 도출된다.

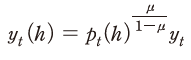

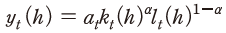

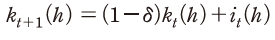

먼저, 중간재 생산자 h는 자본  과 노동

과 노동  을 이용하여 다음과 같은 Cobb-Douglas 생산함수에 따라 차별화된 재화를 생산한다.

을 이용하여 다음과 같은 Cobb-Douglas 생산함수에 따라 차별화된 재화를 생산한다.

여기서  는 총요소 생산성(total factor productivity)이다. 또한 자본

는 총요소 생산성(total factor productivity)이다. 또한 자본  는 다음과 같은 투자 과정에 의해 축적된다.

는 다음과 같은 투자 과정에 의해 축적된다.

중간재 기업의 이윤은  이 되며 앞에서 도출된 중간재에 대한 수요 곡선을 제약 조건으로 하여 이윤 극대화를 한다. 이윤은 노동소득에 비례하여 각 가계에 배분되는 것으로 가정한다.

이 되며 앞에서 도출된 중간재에 대한 수요 곡선을 제약 조건으로 하여 이윤 극대화를 한다. 이윤은 노동소득에 비례하여 각 가계에 배분되는 것으로 가정한다.

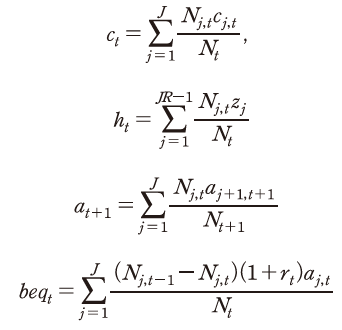

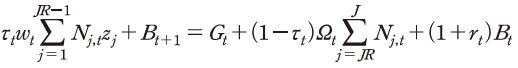

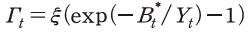

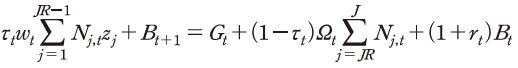

3) 정부 부문

정부는 시장에서 재화를 만큼 구매하고 연금 시스템을 관리한다. 또한, 가계의 노동 소득에 비례하여 부과되는 세금과 공공 부채

만큼 구매하고 연금 시스템을 관리한다. 또한, 가계의 노동 소득에 비례하여 부과되는 세금과 공공 부채  를 발행하여 지출을 조달한다. 다음은 정부의 예산 제약식이다.

를 발행하여 지출을 조달한다. 다음은 정부의 예산 제약식이다.

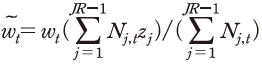

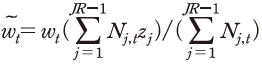

한편 은퇴 가구당 연금  은 소득대체율

은 소득대체율  와 경제 전체 평균 임금

와 경제 전체 평균 임금  의 곱으로 결정되며 경제 전체 평균 임금

의 곱으로 결정되며 경제 전체 평균 임금  은 다음과 같다.

은 다음과 같다.

정부 부채, 정부 소비 및 연금의 소득대체율 경로가 외생적으로 결정되고 세율  7)가 정부 예산 제약을 만족하도록 내생적으로 조정된다고 가정한다.

7)가 정부 예산 제약을 만족하도록 내생적으로 조정된다고 가정한다.

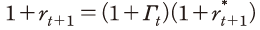

4) 대외 부문

한국과 같은 소규모 개방경제에서는 국제금융시장에 접근하여 해외 자산을 축적하거나 차입할 수 있는 것으로 가정한다. 다만 국가간 자본흐름에 현실적 제한을 두기 위해 국제 금융거래에서 차입 또는 대출 단위당 의 비용이 발생한다고 가정한다. 이에 따라 이자율 평형조건(interest rate parity condition)은 다음과 같다.

의 비용이 발생한다고 가정한다. 이에 따라 이자율 평형조건(interest rate parity condition)은 다음과 같다.

는 국내 경제의 관점에서 외생적인 글로벌 이자율이다. 한편, 국가간 자본흐름에서 발생하는 단위당 비용

는 국내 경제의 관점에서 외생적인 글로벌 이자율이다. 한편, 국가간 자본흐름에서 발생하는 단위당 비용  은 해당 국가의 대외부채에 따라 달라진다고 가정한다.

은 해당 국가의 대외부채에 따라 달라진다고 가정한다.

은 양의 값을 갖는 것으로 가정하며

은 양의 값을 갖는 것으로 가정하며  는 GDP 대비 순 대외자산을 의미한다. 반면, 폐쇄경제에서는 자본이동이 발생하지 않으므로

는 GDP 대비 순 대외자산을 의미한다. 반면, 폐쇄경제에서는 자본이동이 발생하지 않으므로  과

과  는 0으로 설정된다.

는 0으로 설정된다.

5) 시장 청산 조건

이 모형은 표준적인 청산 조건을 따른다. 모든 중간재 생산자는 동일하기 때문에 균형 상태에서 동일한 가격 을 부과하게 된다. 이에 따라 개별 중간재 생산의 집계가 단순화되어 총생산함수가 다음과 같이 도출된다.

을 부과하게 된다. 이에 따라 개별 중간재 생산의 집계가 단순화되어 총생산함수가 다음과 같이 도출된다.

한편, 자산시장 청산 조건은

이 되며 자산시장에서의 저축과 차입을 일치시키는 균형금리가 본 고에서 관심을 갖는 실질중립금리가 된다.

나. 모수 선택 및 외생변수

모형 경제는 몇 가지 외생변수들에 의해 작동된다. 첫째로 인구구조는 연령별 노동생산성, 모형 인구에 처음으로 진입하는 20세 인구의 증가율 및 연령별 사망률에 의존한다. 둘째로 경제 전체의 총요소 생산성에 좌우된다. 셋째로 정부의 국가채무 및 재정지출과 연관된다.

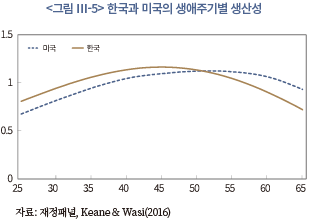

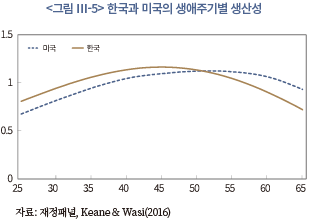

1) 인구구조

한국 및 미국 가계의 연령별 노동 생산성 는 가구주의 시간당 임금 데이터를 바탕으로 한다. 한국의 경우 김재칠‧정화영(2023)과 같이 재정패널 데이터를 바탕으로 계산되었으며, 미국에 대해서는 Bielecki et al.(2020)에서 사용된 Keane & Wasi(2016)의 데이터를 이용했으며 모두 HP필터를 통해 평활화하였다. <그림 Ⅲ-5>를 살펴보면 한국과 미국의 생산성은 20세부터 꾸준히 상승하다가 정점 이후 퇴직전까지 하락하는 형태의 분포를 갖고 있으며 정점에 이르는 시기가 한국이 미국보다 다소 이르다는 것을 제외하면 대체로 유사한 모습을 나타내고 있다. 법정 퇴직연령과 실효 퇴직연령8) 간의 차이가 있음을 감안하여 한국과 미국 모두 퇴직 연령은 65세로 설정하였다.

는 가구주의 시간당 임금 데이터를 바탕으로 한다. 한국의 경우 김재칠‧정화영(2023)과 같이 재정패널 데이터를 바탕으로 계산되었으며, 미국에 대해서는 Bielecki et al.(2020)에서 사용된 Keane & Wasi(2016)의 데이터를 이용했으며 모두 HP필터를 통해 평활화하였다. <그림 Ⅲ-5>를 살펴보면 한국과 미국의 생산성은 20세부터 꾸준히 상승하다가 정점 이후 퇴직전까지 하락하는 형태의 분포를 갖고 있으며 정점에 이르는 시기가 한국이 미국보다 다소 이르다는 것을 제외하면 대체로 유사한 모습을 나타내고 있다. 법정 퇴직연령과 실효 퇴직연령8) 간의 차이가 있음을 감안하여 한국과 미국 모두 퇴직 연령은 65세로 설정하였다.

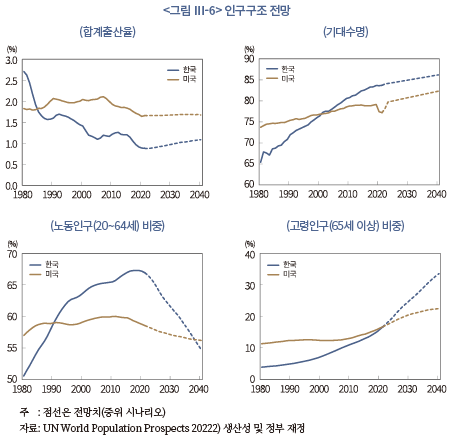

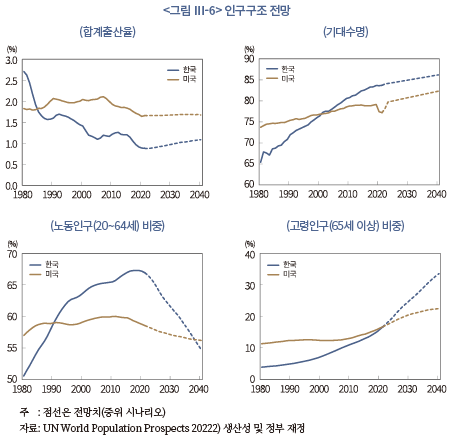

인구 통계 시나리오는 연령별 사망률과 20세 코호트 규모에 대한 1950~2021년까지의 과거 데이터와 2022~2100년까지 UN 세계 인구 전망(World Population Prospects 2022)의 중위 시나리오를 기반으로 한다. <그림 Ⅲ-6>은 한국과 미국에 대한 UN의 인구 전망을 제시하고 있다. 베이비붐 세대의 대규모 은퇴와 더불어 기대수명의 상승 및 출산율 하락으로 고령인구가 가파르게 늘어나는 가운데 노동인구 비중은 크게 줄어들 전망이다.

2) 생산성 및 정부 재정

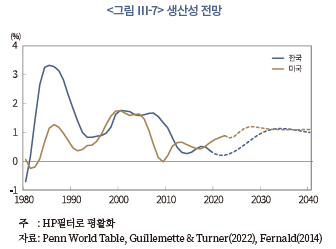

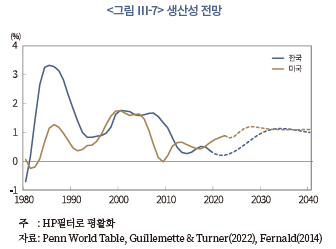

총요소 생산성은 한국의 경우 Penn World Table로부터 1954년부터 2019년까지의 데이터를, 미국은 샌프란시스코 연준의 Fernald(2014)로부터 1948년부터 2022년까지의 데이터를 사용하였다.9) 한국의 장기 전망치는 OECD의 연구 결과인 Guillemette & Turner(2021)를 바탕으로 하였으며 김지연‧정규철‧허진욱(2022)과 마찬가지로 2010~2019년중의 낮은 수준(0.5%)에서 장기적으로 1.0% 수준까지 회복될 것으로 예상한다(<그림 Ⅲ-7> 참조)10). 미국의 경우에는 의회예산처(CBO: Congressional Budget Office)가 2023년 6월에 발표한 예산 및 경제전망(Budget and Economic Outlook and Updates) 결과를 사용하였다. 미국 또한 2010~2019년중 평균 0.8%에서 장기적으로 1.1% 수준으로 상승할 것으로 전망되었다.

장기 생산성에 대한 낙관적인 기대는 다음의 몇 가지 주장에 주로 기인한다. 우선 Brynjolfsson et al.(2021)에 따르면 새로운 범용 기술의 이점을 최대한 활용하려면 보완 자본에 대한 막대한 투자가 필요하며 보완 자본에 대한 투자가 무형자산의 형태일 경우 측정이 어려울 뿐만 아니라 국민계정에서 투자가 아닌 비용으로 계상될 수 있어 기술 도입 초기에 생산성이 부진한 것으로 나타난다. 이후 점차 투자가 결실을 맺으면서 생산성이 큰 폭으로 반등(productivity J-curve)하게 된다고 주장한다. 이러한 견해는 <그림 Ⅲ-7>에서 나타나듯 생산성이 장기 시계에서 평균 회귀적인 특성을 갖는 점과도 잘 부합한다. 또한, Syverson(2023)은 글로벌 금융위기 이후 한동안 부진했던 경기 역동성이 최근 들어 주요국에서 반등 조짐을 나타내고 있음을 지적한다. 한편, 최근 들어 생성형 AI의 도입 및 친환경 에너지 기술에 대한 투자 확대 등에 따른 생산성 개선 기대감도 커지고 있다. 특히 Jones(2023)는 장기 경제성장이 혁신적 아이디어에 크게 의존하는 데 AI가 이러한 아이디어 탐색에 기여할 수 있음을 지적한다. AI의 도입 결과 Goldman Sachs(2023b)는 미국 등 주요 선진국의 연간 노동생산성을 10년에 걸쳐 1.5%p씩 상승시켜 전체 GDP를 7%까지 상승시킬 수 있다고 예상한다. 또한 Capital Economics(2023)는 AI가 장기 경제성장에 긍정적인 영향을 미칠 대표적인 국가로 미국과 한국을 꼽고 있다. 특히 OECD(2021) 및 Goldman Sachs(2022)는 기술의 최첨단 국가인 미국이 생산성 개선 움직임을 주도하는 가운데 한국은 미국의 생산성 추세에 빠르게 수렴할 것이라고 예상하고 있으며 <그림 Ⅲ-7>은 미국과 시차를 두고 한국의 생산성이 회복되는 전망을 반영하고 있다. 한편, 본 장에서는 실질금리의 장기추세 변화에 관심이 있으므로 HP(Hodrick & Prescott) 필터를 통해 총요소 생산성의 순환적 요소들을 제거하였다.

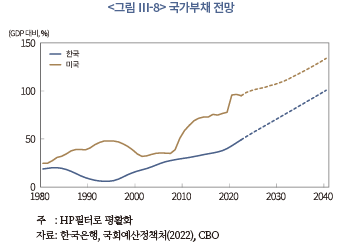

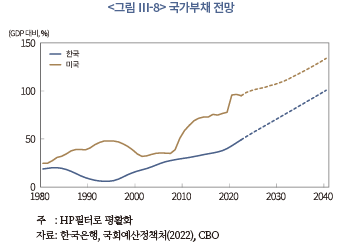

모형내 또 다른 주요 외생적 원동력은 재정 부문 및 연금 시스템과 관련된다. 한국의 정부 지출 및 부채에 관한 과거 통계는 한국은행 ECOS로부터 입수하였으며 향후 전망은 국회예산정책처(2022)의 장기 재정전망을 바탕으로 하였다. 국회예산정책처(2022)의 시나리오111)에 따르면 2040년 국가채무비율이 GDP 대비 100.8%가 될 것으로 예상된다. 미국의 경우 과거 통계는 FRED(Federal Reserve Economic Data)에서, 장기 전망은 의회예산처 전망치를 사용하였다. 총요소 생산성과 마찬가지로 HP 필터를 사용하여 경기 순환에 따른 공공부채의 변동 요인을 제거하였다. 한편, 연금의 소득대체율은 OECD(2021)를 바탕으로 한국과 미국은 각각 2020년 기준치인 31.2% 및 39.2%로 전 기간에 걸쳐 고정된 것으로 가정한다.

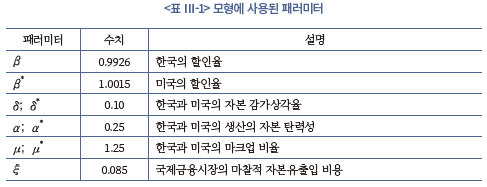

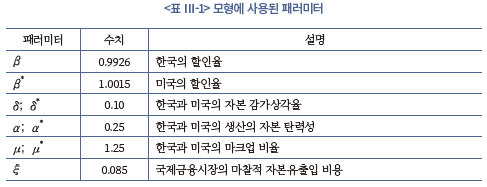

3) 구조적 패러미터

여타 구조적 패러미터 값은 선행연구에서 사용되는 표준적인 수치를 차용하거나 한국과 미국의 주요 거시경제 비율과 일치하도록 설정되었다. 구체적인 수치는 <표 Ⅲ-1>에 정리되어 있다. 우선 할인계수는 1999~2022년중 한국과 미국의 평균 실질금리 수준인 1.6% 및 2.5%와 일치하도록 선택된다. 생산에 사용되는 자본은 연평균 10%로 감가상각(depreciation)된다고 가정하였으며 생산의 자본 탄력성은 0.25로, 제품의 마크업 비율은 1.25로 설정하며 한미 양국이 모두 동일하다고 가정한다. 마지막으로 개방경제 모형에서 해외차입에 따른 마찰적 비용 파라미터는 한국의 순해외차입 수준이 1999~2013년중 평균인 GDP 대비 –10% 수준을 기준으로 하여 설정하였다.

다. 추정 결과

모형은 외생변수가 장기전망치를 따른다고 가정하고 비확률적인 시뮬레이션(deterministic simulation)으로 계산되었다. 폐쇄경제로 가정된 미국에 대해 먼저 계산하여 미국의 실질중립금리 장기 전망치를 도출하고 소규모 개방경제인 한국에 대해서는 미국 전망치를 글로벌 금리의 전제치로 활용하여 계산한다. 전망의 최종 시계는 2040년으로 설정하였다.

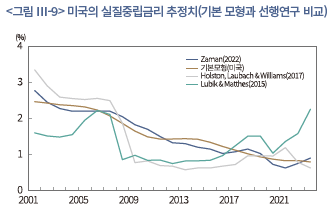

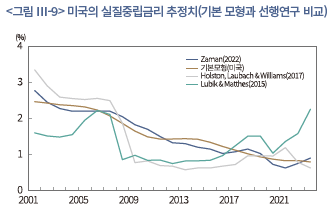

우선 2000년대 이후 2023년까지 미국의 실질중립금리를 살펴보면 <그림 Ⅲ-9>에서 나타난 바와 같이 2000년대 초반 2% 중반에서 2023년에는 0.8%로 하락한 것으로 나타났다. 기본모형을 통한 추정치는 실질금리에 대한 데이터 없이 인구구조, 생산성 및 국가부채 등의 외생적 데이터를 바탕으로 모형을 통해 시산(calibration)한 결과임에도 불구하고 실질금리 데이터를 바탕으로 한 Holston et al.(2017)의 추정치와 비슷한 추세를 보이고 있으며 준구조 모형에 서베이 결과를 추가하여 산출한 Zaman(2022)의 추정치와는 추세뿐만 아니라 수준 또한 매우 유사한 모습을 나타내고 있다.

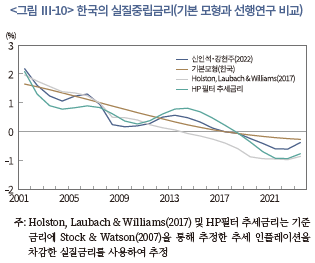

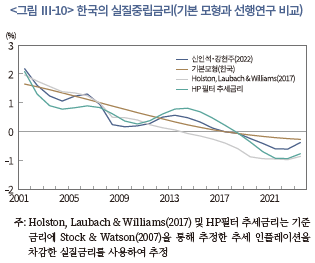

이러한 점은 한국의 경우에도 마찬가지다. <그림 Ⅲ-10>을 보면 기본 모형을 통해 추정한 한국의 실질중립금리는 2000년대 초반 1.7%에서 2023년 –0.3%까지 하락한 것으로 나타났다. 이러한 수치는 Holston et al.(2017)의 준구조 모형에 실물경기와 고용간 관계를 나타내는 오쿤의 법칙(Okun’s law), 테일러 준칙 및 피셔등식을 포함한 신인석‧강현주(2022)의 추정치의 추세와 매우 유사하며, 기본 모형이 HP필터를 이용한 추세 데이터를 사용한 만큼 신인석‧강현주(2022)의 추정치의 장기 추세에 잘 부합하는 것으로 나타났다. 한미 양국의 실질중립금리의 과거 추세에 대한 이러한 결과는 기본 모형이 실질금리에 관련된 동인들을 적절히 반영하고 있음을 보여준다.

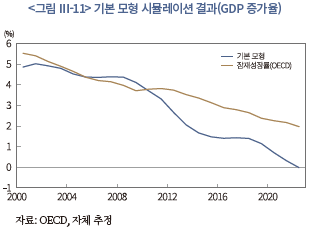

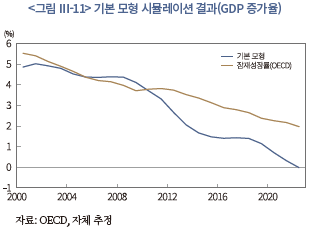

한편, <그림 Ⅲ-11>은 OECD가 추정한 잠재GDP 성장률 수치와 모형의 추정치를 비교하고 있다. 당연하게도 모형과 데이터 수치 간 일부 차이가 존재하나 2000년대 이후 GDP 성장률의 하락추세를 모형이 잘 포착해 낼뿐만 아니라 코로나 19 감염확산 이전 시기의 경우 수준 자체도 대체로 유사한 것으로 나타났다. 이에 따라 모형에서 명시적으로 대외 교역을 고려하고 있지 않음에도 불구하고 장기 시계에서 실물변수의 추세적 움직임을 비교적 잘 설명하는 것으로 평가할 수 있다.

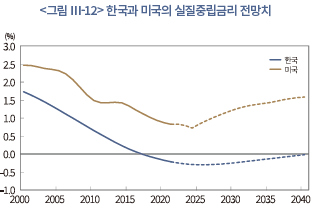

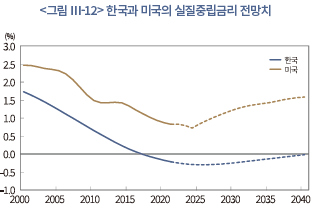

<그림 Ⅲ-12>는 한국과 미국의 2040년까지 실질중립금리 전망치를 제시하고 있다. 각국의 실질중립금리는 2020년대 중반까지 동반 하락할 것으로 예상되나 이후의 추이는 크게 달라질 것으로 예상된다. 미국의 실질중립금리는 가파르게 반등하여 2023년부터 2040년까지 0.75%p 상승하는 반면 한국의 실질중립금리는 동 기간중 0.25%p 상승에 불과하여 사실상 0% 수준에서 횡보하는 것으로 나타났다. 미국과 한국이 대체로 유사한 생산성 개선 및 국가채무 확대 경로를 나타낼 것으로 전망되는 점을 감안하면 결국 가파른 인구구조의 고령화가 한국과 미국간 상이한 금리경로의 원인이 됨을 알 수 있다.

라. 전망의 위험요인에 대한 논의

실질중립금리의 전망치는 모형내 주요 동인들에 대한 외생적 가정에 크게 의존하는 만큼 인구구조, 생산성 등 주요 동인들의 전망치에 대한 상‧하방 위험요인들이 실질중립금리의 전망의 불확실성을 유발하는 원인들이 된다. 아래에서는 몇 가지 요인들에 대해 간략히 열거한다.

우선, 모형내 주요 동인들 중 상‧하방 불확실성이 가장 큰 것은 생산성에 대한 전망이다. 앞에서는 OECD 및 CBO의 생산성 반등 전망에 기반하여 생산성의 J-커브 효과 및 AI 도입 등의 개선 요인을 중심으로 설명했으나 다양한 하방 위험들 또한 상존한다. 기존의 글로벌 공급망 체계에서는 기업들이 공급망 체계에 참여하여 생산성 증대 및 지식확산 효과를 누렸으나 글로벌 경제가 진영화되면서 중국의 독자적인 반도체 개발 사례와 같이 국가별 중복 투자가 발생하고 효율적 분업체계가 붕괴됨에 따라 생산성 향상이 지체될 수 있다(Cerdeiro et al., 2021). 또한 모형에서는 인구구조와 생산성을 독립적으로 고려하고 있으나 최근 인구구조 변화에 대한 선행연구들은 고령화로 생산성 또는 혁신 활동이 둔화된다는 점을 지적하고 있다(Lisack et al., 2021; Lee & Shin, 2021; Aksoy et al., 2019). 뿐만 아니라 장기 경제성장을 위해 앞에서 언급한 것처럼 혁신적인 아이디어가 필요하나 이미 쉽게 획득 가능한 기술발전이 대부분 이루어진 만큼 점점 더 생산성 개선이 용이하지 않으며 동일한 성장을 위해 더 많은 연구개발 투자가 필요하다는 점이 지적된다(Jones, 2023)12).

둘째로, 기본 모형에서 정부는 국민연금의 역할을 겸하고 있는데 정부채무나 지출과 별도로 국민연금의 개혁 또한 실질중립금리에 영향을 미칠 수 있다. 2023년 10월 기준 논의 중인 국민연금 개혁안에 따르면 재정건전성 확보를 위해 지급개시연령 및 소득대체율을 상향 조정하는 방안이 여러 대안들과 함께 검토되고 있다(보건복지부, 2023.10.30). 이러한 방안에 따라 지급개시연령이 높아지는 경우 모형에서는 은퇴연령이 높아짐을 의미하며 가계가 생산 활동에 장기간 종사하면서 은퇴기간이 단축됨에 따라 은퇴 이전에 축적해야 하는 민간 저축 규모가 줄어들어 실질중립금리가 기본 추정치에 비해 상승하게 된다. 만약 소득대체율 또한 높아진다면 마찬가지로 은퇴 이후의 소득이 늘어나게 되므로 은퇴 이전에 필요한 저축 규모를 줄여 실질중립금리가 추가적인 상승압력을 받게 된다.

셋째로, 인구구조는 매우 점진적으로 변하는 속성상 생산성 및 정부부채에 비해 불확실성이 적으나 이민 확대에 따라 변화 가능성이 존재한다. 모형에서는 20세 이상의 인구를 대상으로 하므로 2023년 기준의 출산율 변화 여부는 모형의 결과에 영향을 미치지 않겠으나 국내 노동력 부족 상황을 타개하기 위해 저임금 국가로부터 축적된 자산이 거의 없는 20세의 노동력이 신규 유입된다면 실질중립금리가 상승하게 된다. 다만, 신규 노동력의 유입이 기본 시나리오 하에서 예상되는 실질중립금리의 경로에 영향을 주는 데는 상당한 시간이 소요될 것이다. 또한, 본질적으로 가파른 인구 고령화가 중국을 포함한 동아시아 국가들의 공통적 문제인 만큼 GDP 및 실질중립금리를 유의미하게 상향 조정시킬 만한 인구의 외부 유입 가능성은 크지 않은 것으로 판단된다(강현주, 2022).

Ⅳ. 금리 기조에 대한 평가 및 시사점

본 장에서는 보고서의 제2편에서 다뤄지는 경제구조변화와 인플레이션의 연구 결과를 간략히 요약하고 Ⅲ장의 실질중립금리에 대한 전망 결과를 종합하여 향후 추세금리에 대한 방향성을 제시한다. 또한, 이러한 추세금리의 장기 흐름에 대한 전망을 바탕으로 정책적 시사점을 간략히 서술한다.

1. 경제구조변화와 인플레이션13)

제2편에서는 세계화 및 인구구조를 중심으로 경제구조변수가 한국과 미국의 저물가 기조에 미친 영향을 분석하고, 향후 물가 기조에 변화가 발생할 수 있는지를 평가한다. 이를 위해 1980년대 이후 지속된 저물가 기조를 필립스곡선 평탄화 및 추세 인플레이션의 하향 안정이라는 두 가지 관점에서 살펴본다. 필립스곡선의 평탄화는 인플레이션의 국내 경기에 대한 민감도 하락을 의미하며, 추세 인플레이션의 하향 안정은 인플레이션의 장기 추세가 낮아졌음을 의미한다. 한국과 미국에서 1980년대부터 코로나 감염확산 이전까지 추세 인플레이션이 하향 안정화된 가운데, 필립스곡선 평탄화로 인플레이션의 경기순환적 특성이 약화되며 저물가 기조가 안정적으로 유지되었는데 제2편의 연구는 이러한 저물가 기조가 세계화 및 인구구조 변화에 기인한 것인지를 실증적으로 살펴본다.

분석 결과 세계화 및 인구구조변화가 한국과 미국의 저물가 기조에 미친 영향은 다음과 같다. 첫째, 세계화는 한국과 미국의 필립스곡선 평탄화에 기여하였으며 추세 인플레이션의 하향 안정에도 핵심적인 역할을 한 것으로 확인되었다. 한국과 미국의 추세 인플레이션은 1990년대 냉전 체제의 붕괴 이후 초세계화(hyper-globalization) 기간 동안에 큰 폭으로 하락한 후 팬데믹 이전까지 안정세를 유지하였는데, 초세계화 시기에 발생한 추세 인플레이션의 하락은 대부분 세계화로부터 유발된 것으로 추정되었다. 이는 기존문헌에서 논의된 바와 같이 세계화 진전으로 비용 효율성이 향상되고 기업간 경쟁이 심화된 결과로 파악할 수 있다. 다만, 한국과 미국에서 세계화가 추세인플레이션에 미친 영향이 각각 2008년경(미국) 및 2013년경(한국)부터 현저히 낮아졌는데, 이는 각국의 세계화가 동 시기부터 정체국면에 진입한 점이 반영된 결과이다

둘째, 한국과 미국에서 인구구조 변화가 추세 인플레이션에 미친 영향을 살펴보면 선행 연구 결과들과 마찬가지로 한국과 미국에서 공통적으로 노동가능인구 비중이 감소할수록 추세 인플레이션이 상승하였다. 반면 고령인구 비중이 증가할 경우 미국에서는 추세 인플레이션이 상승하였으나 한국에서는 하락하는 것으로 나타났다. 미국에서는 고령인구가 생산보다 소비가 많은 순소비(net consumer) 집단인 반면 한국의 고령층은 생산 활동 참여가 꾸준히 증가하였으며, 소비 여력이 현저히 낮은 탓에 미국과 달리 인플레이션 상승요인으로 작용하지 못한 것으로 추정된다. 이에 따라 미국에서는 베이비 붐 세대의 은퇴가 본격화된 2008년 이후 인구구조가 유의미한 물가상승요인으로 작용한 반면 한국에서는 2020년까지 고령인구 비중 증가로 인한 인플레이션 하락 압력이 노동가능인구 비중 감소로 인한 인플레이션 상승 압력보다 큰 것으로 나타났다. 다만, 통계청의 장래인구 추계치를 적용하여 살펴본 결과, 2025년부터 노동가능인구 비중 감소로 인한 인플레이션 상승 효과가 고령인구 비중 증가에 따른 하락 효과를 상회하는 것으로 추정되어 향후 한국에서도 인구구조가 구조적인 인플레이션 상승요인으로 작용할 것으로 전망된다.

결론적으로 향후 세계화 후퇴 및 인구 고령화 추세를 감안할 때 한국과 미국에서 그동안 안정적으로 유지되어온 저물가 기조가 종료될 가능성이 큰 것으로 평가된다. 세계화 후퇴로 필립스곡선이 가팔라져 인플레이션의 경기 민감도가 복원되면서 인플레이션의 변동성이 과거보다 구조적으로 확대되는 가운데 탈세계화 및 노동인구 부족 문제가 추세 인플레이션 상승세를 유도할 것으로 전망된다.

2. 추세금리의 방향성 평가 및 정책적 시사점

Ⅲ장의 실질중립금리에 대한 분석과 제Ⅱ편의 추세 인플레이션에 대한 논의를 종합해 보면 추세금리는 한국과 미국 모두 과거 글로벌 금융위기 이후 코로나19 감염확산 이전과 같은 저금리 수준으로 복귀하기는 어려울 전망이다. 향후 미국 경제가 생산성을 회복하는 가운데 주요 선진국의 국가부채가 확대됨에 따라 실질중립금리가 상승하는 동시에, 세계화가 후퇴하고 인구 고령화가 가속화됨에 따라 추세 인플레이션이 상승할 것으로 예상되는 만큼 글로벌 금리는 고금리 기조가 고착화될 수 있다. 한국은 가파른 인구 고령화로 실질중립금리가 낮은 수준에서 횡보할 것으로 예상되나, 노동가능인구의 부족 등에 따른 추세 인플레이션 상승 압력이 금리 기조를 좌우할 것으로 예상된다.

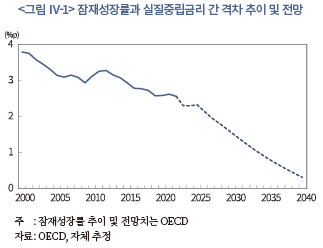

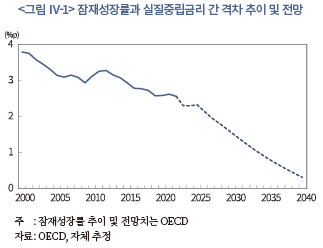

이러한 금리 기조의 방향성은 정부와 중앙은행의 통화 및 재정정책, 부채관리를 위한 거시건전성 정책뿐만 아니라 금융기관 및 연금기금 등의 장기 자산배분 등 다양한 부문에 중요한 시사점을 가진다. 우선, 재정정책과 관련하여 Ⅲ장에서 제시한 바와 같이 국가채무가 가파르게 늘어날 것으로 예상되는 가운데 금리가 높게 유지됨에 따라 정부의 이자비용 부담이 증가하면서 국가채무 증가가 당초 예상보다 확대되는 악순환에 빠질 수 있다. 특히 장기 실질중립금리가 0% 수준에서 횡보할 것으로 예상되는 가운데 2040~2050년중 잠재성장률 또한 유사한 수준으로 하락할 것으로 전망됨에 따라 <그림 Ⅳ-1>에서 나타난 바와 같이 실질금리와 성장률간 격차(r-g differential) 축소에 따른 정부부채의 장기 지속가능성에 대한 의문이 제기될 수 있다.14) 또한, 부채관리와 관련하여 주요국에 비해 월등히 높은 수준인 가계부채가 고금리에 부실화될 수 있으며, 이에 따라 유사시 취약가계에 대한 채무조정이나 부채탕금 등을 통해 일정 부분 국가채무로 전환될 가능성을 고려하면 안정적인 재정운용의 필요성이 더욱 커진다.

한편, 인구 고령화에 따른 낮은 실질중립금리와 추세 인플레이션 상승 가능성은 추세적으로 경제성장률이 하향 조정되는 가운데 물가상승률은 상승하는 장기 스태그플레이션(secular stagflation)의 가능성을 시사하므로 정교한 통화정책적 대응이 요구된다. 우선, 제2편의 연구결과가 시사하는 바와 같이 장기적 시계에서 세계화의 후퇴 및 인구구조 변화 등 공급요인으로 추세 인플레이션이 상승하는 상황에서 통화정책이 인플레이션의 구조적 동인 변화를 충분히 반영하지 못하고 기존의 낮은 추세 인플레이션에 근거한 인플레이션 목표를 고수하는 경우 의도하지 않은 긴축 효과가 발생할 수 있다. 따라서 중앙은행은 경제구조변화가 유발할 수 있는 인플레이션의 구조적 변화 가능성을 면밀히 평가하고 불확실성에 대비할 필요가 있다.15) 반면, 공급충격의 영향을 단지 지켜보는 식으로 방관하게 될 경우 세계화 후퇴 등으로 인플레이션과 국내 경기간 관계가 점차 강화되는 가운데 기대 인플레이션의 불안정성이 확대될 수 있다. 공급충격에 따른 이러한 딜레마적인 상황은 중앙은행의 물가안정 책무 수행을 더욱 어렵게 만들 것으로 판단된다.16) 한편, 국내 통화정책 결정을 어렵게 만들 또다른 요인은 내외금리차가 구조적으로 장기화될 수 있다는 점이다. 본 편의 Ⅲ장에서 분석한 바와 같이 한국과 미국의 실질중립금리는 그 역전폭이 향후 점차 심화될 것으로 예상된다. 이에 따라 환율이나 자본유출 등에 대한 우려로 선진국 중앙은행의 정책 결정에 의해 자율성이 일정 부분 제약되는 어려움이 발생할 수 있다.

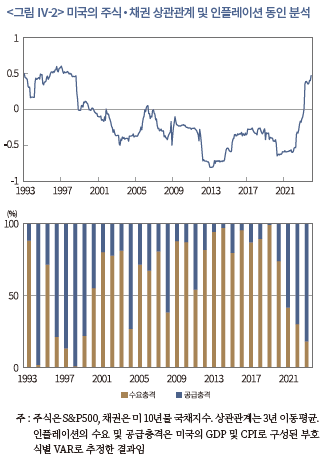

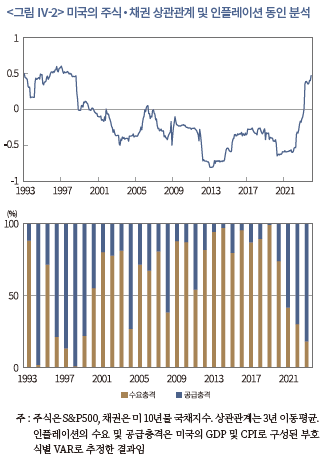

끝으로 금융시장과 관련하여 금리는 주식, 채권 등 금융자산의 장기 현금흐름에 대한 할인율로서 금융자산의 가격을 결정하는 핵심 요인이므로 자산가격 및 자산배분 전략에 직접적인 영향을 미친다. <그림 Ⅳ-2>에서 나타난 바와 2000년대 이후 주식과 채권 수익률이 음(-)의 상관관계를 유지함에 따라 분산투자 전략이 장기간 효율적 위험관리와 높은 수익률을 제공했다. 그러나 2022년부터 주식과 채권 수익률의 상관관계가 양(+)으로 전환되었다. 이러한 주식과 채권의 상관관계 변화는 인플레이션의 동인과 밀접하게 연관되어 있다(백인석‧장근혁, 2022). 즉, 금리인하나 재정확대 등 수요충격으로 인플레이션이 발생할 경우 GDP가 상승하는 동시에 물가 또한 상승하게 되므로 실물경기와 밀접한 관련이 있는 주가가 상승하는 반면 인플레이션으로 채권 가격은 하락하게 된다. 반면, 원자재 가격 상승과 같은 공급충격이 발생한 경우 GDP가 하락하는 반면 물가는 상승하므로 주가와 채권이 동반 하락하게 된다. 향후 인플레이션 변동이 탈세계화, 인구 고령화 또는 생산성 변화와 같은 공급 요인에 의해 주도된다면 주식과 채권 수익률의 양(+)의 상관관계가 장기화될 수 있음을 의미한다. 이와 같이 주식과 채권 가격이 같은 방향으로 움직이게 될 경우 주식과 채권으로 나누어 분산투자하는 전통적 자산배분 전략의 한계가 부각될 수 있다. 일례로 2022년에는 주식과 채권이 동시에 큰 폭으로 하락함에 따라 전통적인 분산투자 기법인 주식 60%와 채권 40%로 구성된 ‘60/40 포트폴리오’가 부진한 성과를 나타내기도 했다. 인플레이션의 장기화 가능성을 바탕으로 글로벌 자산운용업계 또한 ‘60/40 포트폴리오’에 기반한 전통적 분산투자의 장기 성과에 대해 부정적으로 예상(BlackRock, 2023)하고 있는 만큼, 금리 기조의 전환 가능성을 염두에 두고 시장 상황에 능동적으로 대응할 수 있도록 대안적 자산배분 전략에 대한 금융투자업계 및 기관투자가들의 관심이 확대되어야 할 것으로 판단된다.

1) 자본시장연구원 연구보고서 24-04.

2) 자본시장연구원 연구보고서 24-05.

3) 실질중립금리는 중장기 시계에서 경기를 부양하거나 긴축시키지 않으면서 잠재 GDP 및 안정적인 물가상승률에 부합하는 실질금리를 의미한다. 추세 인플레이션은 경제 전체의 수요뿐만 아니라 공급 능력을 감안한 물가상승률 수준으로 순환적(일시적) 요인을 배제한 물가상승률의 장기 추세에 해당된다. 실질중립금리 및 추세 인플레이션에 대한 자세한 설명은 각각 제1편의 Ⅲ장 및 제2편의 Ⅱ장에서 다룬다.

4) 테일러 준칙이 처음 등장하는 Taylor(1993)에서는 실질중립금리에 대한 연구가 본격화되기 이전인 만큼 실질중립금리의 시변성을 무시한 채 2%로 고정된 것으로 간주한다.

5) 불평등 확대가 장기적으로 경제성장에 부정적인 만큼 총수요를 위축시켜 자금의 수요가 감소하는 경로 또한 존재한다(Berg & Ostry, 2017; Auclert & Rognlie, 2018)

6) Laubach & Williams(2003) 및 Holston et al.(2017)의 준구조 모형은 실물경제(GDP)와 실질금리간 관계를 나타내는 IS 곡선, 인플레이션과 실물경제간 관계를 나타내는 필립스 곡선과 더불어 잠재성장률 및 기타 요인에 의해 실질중립금리가 설명된다는 관계식으로 구성되어 있어 잠재성장률의 하락이 실질중립금리의 변동을 대부분 설명하며 기타 요인의 변동에 대해서는 구조적 원인이 무엇인지 알 수 없는 한계가 존재한다.

7) 모형내에서 정부가 연금의 역할을 겸하고 있으므로 근로소득세와 연금보험료가 결합된 개념이다.

8) OECD(2021)에 따르면 2020년 기준 한국과 미국의 실효 퇴직연령은 각각 65.7세 및 64.9세이다.

9) 미국의 총요소 생산성 데이터의 경우 Fernald(2014)와 Penn World Tables(PWT) 데이터의 차이는 크지 않으며, 특히 모형에서 HP필터를 통한 추세치를 사용하기 때문에 그 차이는 더욱 줄어든다. 다만 Fernald(2014)의 데이터는 미국의 총요소 생산성과 관련된 선행 연구에서 널리 활용되고 있을 뿐만 아니라 PWT에 비해 시계열이 더 길다는 장점 때문에 사용되었다.

10) Goldman Sachs(2022) 또한 김지연‧정규철‧허진욱(2022)과 비슷한 장기 경제성장률 전망치(2040년대 각각 0.8% 및 0.7%)를 제시하고 있는데 생산요소별 세부 전망 내역을 알 수 없으나 장기 전망의 차이가 불확실성이 적은 노동이나 자본투입보다는 생산성 증가율에 주로 기인한다는 점을 감안하면 생산성 증가율에 대해 유사한 전망을 하고 있는 것으로 추측할 수 있다.

11) 동 시나리오에서는 재량지출이「2021~2025년 국가재정운용계획」과 동일하다고 가정하는 한편 2026~2030년중에는 장기수렴수준(GDP 대비 12.8%)으로 서서히 조정되었다가 2031년 이후에는 장기수렴수준이 유지된다고 가정한다.

12) 무어의 법칙(Moore’s law)에 따라 반도체의 연산 능력이 지속적으로 개선되어 왔으나 반도체의 미세공정이 한자리 수 나노미터(㎚)까지 진행됨에 따라 한계에 봉착한 것이 대표적인 사례라고 할 수 있다.

13) 본 절의 내용은 보고서의 제2편 『금리 기조의 구조적 전환 가능성 평가 (Ⅱ): 경제구조변화와 인플레이션』의 주요 내용을 요약한 것으로 자세한 분석은 해당 편을 참고하기 바란다.

14) 성장률이 실질금리를 상회할 경우 추가 재정적자가 없다면 국가채무비율(=국가채무/GDP)이 점차 축소되어 정부부채의 안정성이 자동적으로 개선될 수 있으나 격차가 축소되거나 오히려 실질금리가 성장률을 상회할 경우 이러한 효과를 기대할 수 없다.

15) 다만 여기에서는 장기적 시계에서 인플레이션의 추세적 변화 가능성을 언급하고 있는 만큼 최근 주요국 중앙은행들이 인플레이션을 목표 수준(2%)으로 안정시키기 위해 긴축 기조를 지속하고 있는 점과 배치되지 않는다.

16) Beaudry et al.(2023)에 따르면 중앙은행이 공급충격에 따른 인플레이션 상승에 대해 일정 임계수준에 도달할 때까지 용인했다가 임계점에 도달한 순간 긴축기조로 즉각 전환하는 것이 최적 전략이나, 2022년 연준의 정책실기 사례를 보면 현실에서 적용하기가 간단치 않음을 알 수 있다.

참고문헌

강현주, 2022, 『인구구조 변화가 장기 거시경제 추세에 미치는 영향』, 자본시장연구원 이슈보고서 22-26.

국회예산정책처, 2022, 『2022-2070년 NABO 장기 재정전망』.

김명현‧권오익, 2020, 인구 고령화가 실질 금리에 미치는 영향, 『경제분석』 26(1), 133-166.

김민수‧박양수, 2013, 소규모 개방경제의 특성을 고려한 중립적 실질금리 추정 및 변동요인 분석, 『경제분석』19(4), 47-86.

김재칠‧정화영, 2023, 『가계의 사적연금소득과 주택연금의 역할』, 자본시장연구원 이슈보고서 23-11.

김지연‧정규철‧허진욱, 2022, 장기경제성장률 전망과 시사점, KDI 2022 하반기 경제전망.

백인석‧장근혁, 2022, 인플레이션과 자산수익률간 관계: 인플레이션 헤지 관점』, 자본시장연구원 이슈보고서 22-25.

보건복지부, 2023.10.30., 『제5차 국민연금 종합운영계획(안)』, 보도자료.

신인석‧강현주, 2022, 한국 통화정책의 최근 기조 평가 및 쟁점, 『한국경제연구』14(4), 25-55.

오형석, 2014, 칼만필터를 이용한 우리나라의 중립금리 추정,『금융연구』28(1), 1-26.

오형석‧최지욱, 2023, 가계신용갭을 반영한 실질중립금리 추정 및 시사점, 『한국경제연구』15(4), 1-37.

최순영, 김종민, 장근혁, 강현주, 2021, 『저금리 시대 전망 및 금융투자업 대응전략』, 자본시장연구원 연구총서 21-04.

Aksoy, Y., Basso, H.S., Smith, R.P., Grasl, T., 2019, Demographic structure and macroeconomic trends, American Economic Journal: Macroeconomics 11(1), 193-222.

Arslanalp, S., Eichengreen, B., 2023, Living with High Public Debt, Jackson Hole Symposium, August 29.

Auclert, A., Rognlie, M., 2018, Inequality and Aggregate Demand, NBER working paper No.24280.

Bailey, A., 2022, The economic landscape: Structural change, global R* and the missing-investment puzzle, speech at the Official Monetary and Financial Institutions Forum.

Bauer, M., Rudebusch, 2020, Interest Rates under Falling Stars, American Economic Review 110(5), 1316-1354.

Beaudry, P., Lahiri, A., Carter, T.J., 2023, The Central Bank’s Dilemma: Look Through Supply Shocks or Control Inflation Expectations? NBER working paper No.31741.

Berg, A., Ostry, J.D., 2017, Inequality and Unsustainable Growth: Two Sides of the Same Coin? IMF Economic Review 65(4), 792-815.

Bernanke, S.B., 2005, The global saving glut and the U.S. current account deficit, speech at the Sandridge Lecture, Virginia Association of Economists.

Bielecki, M., Brzoza-Brezezina, M., Kolasa, M., 2020, Demographics and the natural interest rate in the euro area, European Economic Review 129, 103535.

BlackRock, 2023, New regime, new portfolio approach, Weekly Commentary, April 17.

Blanchard, O., 2023, Secular stagnation is not over, Peterson Institute for International Economics Realtime Economics, 24 January.

Blanchard, O., Summers, L., 2023, Summers and Blanchard debate the future of interest rates, Peterson Institute for International Economics, 7 March.

Blinder, A.S., 1999, Central Banking in Theory and Practice, MIT Press.

Borio, C., Disyatat, P., Juselius, M., Rungcharoenkitkul, P., 2017, Why so low for so long? A long-term view of real interest rates, BIS working papers No.685.

Brandt, C., Goy, G., Lemke, W., 2021, Natural rate chimera and bond pricing reality, ECB working paper No.2612.

Brynjolfsson, E., Rock, D., Syverson, C., 2021, The Productivity J-Curve: How Intangibles Complement General Purpose Technologies, American Economic

Journal: Macroeconomics 13(1), 333-372.

Capital Economics, 2023, AI, Economies and Markets – How artificial intelligence will transform the global economy.

Carvalho, C., Ferrero, A., Nechio, F., 2016, Demographics and real interest rates: Inspecting the mechanism, European Economic Review 88, 208-256.

Cerdeiro, D.A., Eugster, J., Mano, R.C., Muir, D., Peiris, S.J., 2021, Sizing Up the Effects of Technological Decoupling, IMF working paper WP/21/69.

Cesa-Bianchi, A., Harrison, R., Sajedi, R., 2022, Decomposing the drivers of Global R*, Bank of England staff working paper No.990.

Davis, J., Fuenzalida, C., Taylor, A., 2021, The Natural Rate Puzzle: Global Macro Trends and the Market-Implied R*, NBER working paper 26560.

Del Negro, M., Giannoni, M.P., Giannone, D., Tambalotti, A., 2017, Safety, Liquidity and the Natural Rate of Interest, Brookings Papers on Economic Activity, Spring, 235-294.

Duval, R., Ji, L., Li, L., Oikonomou M., Pizzinelli, C., Shibata, I., Sozzi, A., Tavares, M.M., 2022, Labor Market Tightness in Advanced Economies, IMF Staff Discussion Notes 2022/001.

Favero, C., Melone, A., Tamoni, 2023, Monetary Policy and Bond Prices with Drifting Equilibrium Rates, Journal of Financial and Quantitative Analysis, 1-26.

Ferreira, T., Shousha, S., 2022, Determinants of Global Neutral Interest Rates, FRB working paper.

Fernald, J., 2014, A Quarterly, Utilization-Adjusted Series on Total Factor Productivity, Federal Reserve Bank of San Francisco working paper.

Glick, R., 2019, R* and the global economy, Federal Reserve Bank of San Francisco working paper 2019-18.

Goldman Sachs, 2022, The Path to 2075 – Slower Global Growth, But Convergence Remains Intact, Global Economics Paper, December 6.

Goldman Sachs, 2023a, What Have We Learned About the Neutral Rate? US Economic Analyst, June 5.

Goldman Sachs, 2023b, Generative AI: Hype, or truly transformative?, Top of Mind, Issue 120, July 5.

Goodhart, C., Pradhan, M., 2020, The great demographic reversal, Palgrave Macmillan.

Gourinchas, P., Rey, H., Sauzet, M., 2022, Global Real Rates: A Secular Approach, CEPR Discussion Paper DP16941.

Guillemette, Y., Turner, D., 2021, The Long Game: Fiscal Outlooks To 2060 Underline Need For Structural Reform, OECD Economic Policy Paper October 2021 No. 29.

Holston, K., Laubach, T., Williams, J., 2017, Measuring the Natural Rate of Interest: International Trends and Determinants, Journal of International Economics 108, S59-S75.

International Monetary Fund, 2023, The Natural Rate of Interest: Drivers and Implications for Policy in World Economic Outlook, 45-67, April.

Ikeda, D., Saito, M., 2014, The effects of demographic changes on the real interest rate, Japan and the World Economy 12, 37-48.

Javorcik, B.S., Kitzmuller, L., Schweiger, H., Yildirim, M.A., 2023, Economic costs of friend-shoring, European Bank for Reconstruction and Development working paper.

Jones, C., 2023, The Outlook for Long-Term Economic Growth, Jackson Hole Symposium, August 29.

Laubach, T., 2009, New evidence on the interest rate effects of budget deficits and debt, Journal of the European Economic Association 7(4), 856-885.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lee, H., Shin, K., 2021, Decomposing effects of population aging on economic growth in OECD countries, Asian Economic Papers 20(3), 138-159

Lian, W., Novta, N., Pugacheva, E., Timmer Y., Topalova, P., 2020, The price of capital goods: a driver of investment under threat, IMF Economic Review 68, 509-549.

Lisack, N., Sajedi, R., Thwaites, G., 2021, Population aging and the macroeconomy, International Journal of Central Banking 17(2), 43-80.

Lubik, T., Matthes, C., 2015, Time-Varying Parameter Vector Autoregressions: Specification, Estimation and an Application, Economic Quarterly 101(4), 323-352, Federal Reserve Bank of Richmond.

Luzzetti, M., Ryan, B., Weidner, J., Yang, A., 2022, (R-)Star gazing: Macro drivers suggest real neutral rate may have risen, SUERF Policy Brief No.472.

Keynes, J.M., 1936, The General Theory of Employment, Interest and Money, Palgrave Macmillan.

Keane, M.P., Wasi, N., 2016, Labour supply: the roles of human capital and the extensive margin, Economic Journal 592, 578-617.

McKinsey & Company, 2023, The economic potential of generative AI : The next productivity frontier, June.

Mian, A., Straub, L., Sufi, A., 2021, Indebted Demand, The Quarterly Journal of Economics 136(4), 2243-2307.

Organization for Economic Cooperation and Development, 2021, Pensions at a Glance 2021: OECD and G20 Indicators, OECD Publishing, Paris.

Pescatori, A., Turunen, J., 2016, Lower for Longer: Neutral Rate in the U.S., IMF Economic Review 64, 708-731.

Platzer, J., Peruffo, M., 2022, Secular Drivers of the Natural Rate of Interest in the United States: A Quantitative Evaluation, IMF working paper WP/22/30.

Rachel, L., Smith, T., 2017, Are low real interest rates here to stay? International Journal of Central Banking, September 1-42.

Rachel, L., Summers, L. H., 2019, On secular stagnation in the industrialized world, Brookings Papers on Economic Activity, Spring, 1-54.

Rafiq, S., 2021, What’s in the (R)-Stars for Korea? IMF working paper WP/21/93.

Sichel, D.E., Wang, J.C., 2017, The Equilibrium Real Policy Rate Through the Lens of Standard Growth Models, Federal Reserve Bank of Boston working paper.

Schnabel., I., 2022, Monetary Policy and the Great Volatility, Jackson Hole Economic Policy Symposium organised by the Federal Reserve Bank of Kansas City, 27 August.

Stock, J.H., Watson, M.H., 1993, A simple estimator of cointegrating vectors in higher order integrated systems, Econometrica 61(4), 783-820.

Stock, J.H., Watson, M.H., 2007, Why Has U.S. Inflation Become Harder to Forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Syverson, 2023, Structural Shifts in the Global Economy: Structural Constraints on Growth, Jackson Hole Symposium, August 29.

Taylor, J.B., 1993, Discretion versus policy rules in practice, Carnegie-Rochester Conference Series on Public Policy 39, 195-214.

Warnock, F.E., Warnock, V.C., 2009, International capital flows and U.S. interest rates, Journal of International Money and Finance 28(6), 903-919.

Wicksell, K., 1936, Interest and Prices, (Kahn, R.F., Trans.), Sentry Press, New York (Original work published 1898)

Williams, J., 2023, Measuring the Natural Rate of Interest: Past, Present and Future, Remarks at the Thomas Laubach Research Conference, May 19.

Wynne, M.A., Zhang, R., 2018, Measuring the world natural rate of interest, Economic Inquiry 56(1), 530-544.

Yellen, J., 2017, The Economic Outlook and the Conduct of Monetary Policy, Speech at the Stanford Institute for Economic Policy Research, Stanford University, January 19.

Zaman, S., 2022, A Unified Framework to Estimate Macroeconomic Stars, Federal Reserve Bank of Cleveland, Working Paper No. 21-23R

Zhang, R., Martinez-Garcia, E., Wynne, M., Grossman, V., 2021, Ties that bind: Estimating the natural rate of interest for small open economies, Journal of International Money and Finance 113, 102315.

코로나19 감염확산 이후 가파른 인플레이션 상승에 대응하여 주요국 중앙은행들이 기준금리를 인상함에 따라 장기금리가 상승하고 있다. 이에 따라 향후 금리 기조에 대한 의문이 제기되는 가운데 글로벌 금융위기 이후와 같은 저금리로 복귀할 것인가 아니면 1980년대 이후 지속되어 온 금리 하락세가 중단되고 고금리가 상당 기간 고착화될 것인가에 대한 상반된 시각이 존재한다. 일각에서는 최근의 인플레이션 현상이 마무리되면 세계 경제가 코로나19 감염확산 이전의 장기 침체(secular stagnation)로 회귀할 것으로 예상하면서 최근의 금리 상승을 일시적 현상으로 판단한다. 특히 기대수명의 증가나 양극화 등으로 실질중립금리의 구조적 하락세가 지속될 것이라는 측면에서 저금리 기조로의 복귀 가능성을 제기한다(Blanchard, 2023). 반면 정부부채의 확대, 고령화에 따른 노동력 부족, 친환경 에너지 투자 수요 등으로 과거와 같은 낮은 수준의 실질금리 시대가 마무리되고 명목요인도 상승할 것으로 보여 금리가 장기 상승국면에 진입할 것이라는 예상 또한 존재한다(Goodhart & Pradhan, 2020; Schnabel, 2022; Blanchard & Summers, 2023).

글로벌 금융위기 이후 지속된 저금리가 자산가격의 상승과 함께 정부 및 민간의 부채 확대를 견인한 만큼 금리 기조에 대한 판단은 향후 국내외 거시금융 체제 전망에 대한 핵심적인 질문이다. 특히 팬데믹 이후 그동안 점진적으로 진행중이던 세계 경제의 구조적 변화가 표면화되는 동시에 가속화되면서 이러한 질문에 대한 관심이 더욱 커지고 있다. 주요 선진국들이 팬데믹 기간중 공통적으로 노동력 부족 문제를 겪으면서 인구구조의 변화에 대한 관심이 크게 확대되었다(Duval et al., 2022). 또한, 코로나19 감염확산 이전부터 이미 미중 무역분쟁으로 시작되었던 글로벌 경제의 진영간 대립이 최근 들어 더욱 격화됨에 따라 공급망이 이분화되는 등 탈세계화의 압력이 가중되고 있다(Cerdeiro et al., 2021; Javorcik et al., 2023). 다른 한편으로 글로벌 금융위기 이후 매우 부진했던 주요국의 생산성 추세가 최근 생성형 AI 도입이나 친환경 에너지 투자 확대 등에 힘입어 반등 가능성이 제기되고 있다(Goldman Sachs, 2023b; McKinsey & Company, 2023; Capital Economics, 2023). 이 밖에도 러시아‧우크라이나 전쟁 이후 국방비가 확대될 것으로 예상되는 데다 기후 변화 대응 과정에서 대규모 재정지출 수요가 발생하는 반면 주요국의 민주주의 위기로 재정건전성을 회복할 만한 정치적 리더쉽이 부재하다는 점은 국가부채 확대에 대한 우려를 키우고 있다(Arslanap & Eichengreen, 2023).

이러한 금리 기조의 방향성 문제에 대한 중요성에도 불구하고 블로그나 언론 기고, 연구자 간의 대담 등을 제외한 학술적 분석에 기반을 둔 선행연구는 아직까지 극히 제한적인 것이 사실이다. 특히 실질금리 및 물가 기조의 측면에서 상‧하방 요인이 공존하고 있는 가운데 대체로 기존 논의들이 실질중립금리(neutral rate of real interest)나 추세 물가만을 개별적으로 고려하므로 경제구조변화가 명목금리 기조에 미치는 영향을 종합적으로 평가한 연구 결과들이 거의 없는 상황이다. 본 보고서는 기존 연구의 이러한 한계점을 보완하고자 인구구조 변화, 탈세계화, 생산성 개선 등 향후 예상되는 구조변화에 따른 추세적 명목금리 변동의 방향성을 분석하는 것을 목표로 한다. 이를 위해 금리의 결정요인을 실질중립금리와 추세 인플레이션으로 구분하여 두 편의 연구보고서가 작성되었다. 제1편인 본 보고서는 경제구조변화에 따른 실질중립금리에 대한 영향을 주로 분석하는 한편, 제2편에서 다루는 추세 인플레이션에 대한 전망을 요약 반영하여 추세적 금리변동의 방향성을 제시하고 정책적 시사점을 도출하는 것을 목표로 하였다.

본 보고서의 구성 및 내용을 간략히 요약하면 다음과 같다. 우선 Ⅱ장에서는 실질중립금리 및 추세 인플레이션 추정치로부터 산출된 추세금리가 한미 양국의 장기 국채금리와 장기적으로 안정된 관계를 유지하고 있음을 통계적으로 실증하였다. 이를 통해 보고서의 제1편과 제2편에서 금리 기조를 실질중립금리와 추세 인플레이션으로 구분하여 분석하는 근거를 제시한다. Ⅲ장에서는 인구구조, 생산성 변화, 국가채무 등의 경제구조변수가 실질중립금리에 미칠 영향을 중첩세대모형(overlapping generation model)으로 분석하였다. 이를 위해 UN의 인구추계 전망, OECD의 생산성 전망, 국회 예산정책처의 재정전망 및 동일한 모형으로부터 추산된 미국의 실질중립금리 전망을 바탕으로 한국의 장기 실질중립금리 전망치를 제시하였다. 분석 결과 미국은 생산성 개선에 힘입어 실질중립금리가 반등할 것으로 예상되는 반면 한국은 가파른 인구 고령화로 실질중립금리가 장기적으로 횡보할 것으로 전망되었다.

금리 기조의 방향성 문제는 향후 거시안정화 정책의 정책여력(policy space)에 중대한 시사점을 가질 것으로 예상된다. 명목금리의 하한이 사실상 0% 수준이라고 한다면 장기 명목균형금리 수준은 통화정책의 여력을 결정짓는 한편 금리와 성장률간의 차이는 재정정책의 여력과 직결된다. 또한 고금리 기조가 고착화된다면 경제 규모에 비해 과도한 부채가 취약해지면서 금융안정에 대한 우려가 커질 수 있다. 이러한 경제정책에 대한 시사점과 별도로 글로벌 금융위기 이후 장기간의 저금리에 익숙해 있던 연기금 및 금융투자업계의 자산배분 전략에 대한 많은 변화가 필요할 것으로 판단된다. 이러한 정책 및 금융투자업계에 대한 시사점을 Ⅳ장에서 간략하게 정리하였다.

Ⅱ. 장기금리의 결정요인

본 장에서는 Ⅲ장에서 제시하는 실질중립금리와 제2편에서 추정되는 추세 인플레이션 추정치로부터 산출된 추세금리가 한미 양국의 장기 국채금리와 장기적으로 안정된 관계를 유지하고 있음을 제시한다. 이를 통해 전체 보고서에서 금리의 기조변화에 대해 실질중립금리와 추세 인플레이션3)으로 구분하여 살펴보는 것이 타당하다는 시사점을 제공한다.

1. 장기금리 결정요인에 대한 이론적 논의

본 고에서는 경제구조변수와 금리 기조간 관계를 고찰하는 것이 목적이므로 금리 변동중 추세 요인, 즉 추세금리를 분석대상으로 한다. 이를 위해 금리 변동을 추세 요인(trend factor)과 순환적 요인(cyclical factor)으로 다음과 같이 구분한다. 즉, 시점

에 만기가

에 만기가  인 금리를

인 금리를 추세금리

이 되며

인 금리의 실질중립금리 및 추세 물가에 대한 민감도를 의미한다.

인 금리의 실질중립금리 및 추세 물가에 대한 민감도를 의미한다.그렇다면 실제 관측 가능한 장기금리와의 관계로부터

이 성립되며

2. 장기금리와 거시경제적 요인과의 관계 분석

Bauer & Rudebusch(2020)는 코로나19 감염확산 이전까지의 미국 장기 국채금리의 지속성이 일반적인 거시경제적 추세에 기인하는 것인지 살펴보기 위해 공적분 회귀분석(cointegration regression)을 이용하여 장기금리가 중립금리 및 장기 기대 인플레이션을 통해 산출된 추세금리와 안정적 관계를 유지하고 있는지 여부를 검증한 바 있다. 본 절에서는 제1편에서 추정한 실질중립금리 및 제2편에서 사용되는 추세 물가 추정치를 통해 산출된 추세금리가 한미 양국의 장기금리와 안정적 관계를 유지하고 있는지 여부에 대해 1절에서 제시한 식(Ⅱ-1) 및 (Ⅱ-2)를 이용하여 실증적으로 검증한다. 해당 부분에서 자세히 설명되겠으나 실질중립금리는 Bielecki et al.(2020)의 중첩세대모형에서 자산시장 내 저축과 차입을 일치시키는 균형금리가 실질중립금리로 도출된다. 한편, 추세 인플레이션은 주요 선행연구에서 널리 활용되고 있는 Stock & Watson(2007)을 통해 추정하였다.

<표 Ⅱ-1>은 미국과 한국의 10년물 장기 국채금리에 대해 Stock & Watson(1993)의 동태적 최소자승법(Dynamic Ordinary Least Squares)을 통해 추정한 결과를 제시하고 있다. 우선 미국의 결과를 먼저 살펴보면 첫 번째 및 두 번째 회귀식은 각각 실질중립금리와 추세 인플레이션이 개별적으로 포함되어 있다. 회귀식의 잔차항에 대한 Augmented Dickey Fuller(ADF) 검정 및 Phillips-Perron(PP) 검정 결과 단위근(unit root)이라는 귀무가설이 기각되지 않는다. 추가적으로 Johansen 검정 결과를 살펴보면 장기 국채금리와 추세 인플레이션에 대해 공적분 관계가 없다는 귀무가설이 기각되지 않는다. 세 번째 회귀식은 실질중립금리와 추세 물가를 모두 포함하여 추정한 결과로 실질중립금리와 추세 인플레이션을 개별적으로 고려할 때에 비해 R2가 커진 것으로 나타났다. 잔차항에 대한 ADF 검정 및 PP 검정 결과 통계적으로 유의하게 안정적인 시계열로 나타났으며 Johansen 검정 결과 역시 장기 금리와 추세금리 간 공적분 관계를 뒷받침한다. 한편, 세 번째 회귀식에서 실질중립금리와 추세 인플레이션의 계수가 유사하게 추정된 가운데

1. 실질중립금리의 개념 및 선행연구

가. 개념

실질중립금리는 중장기 시계에서 경기를 부양하거나 긴축시키지 않으면서 잠재 GDP 및 안정적인 물가상승률에 부합하는 실질금리를 의미한다(Blinder, 1999; IMF, 2023). 이러한 정의에 따르면 실질금리가 실질중립금리를 상회하게 될 경우 중장기적으로 인플레이션이 안정적 수준을 유지하지 못하고 하락하게 되며 반대인 경우 인플레이션이 상승하게 된다. 따라서 실질중립금리는 중앙은행이 조절하는 정책금리의 긴축 여부를 판단하는 준거 금리(reference rate)로 기능한다. 즉, 실질정책금리가 실질중립금리를 상회하면 통화정책이 긴축적인 상태로 평가할 수 있다. 이에 따라 테일러 준칙(Taylor rule)을 비롯한 다양한 통화 준칙에서 실질중립금리는 준칙 금리를 산정하는 데 핵심적인 역할을 하며 최근 들어 통화정책 커뮤니케이션 과정에서도 빈번하게 언급된다.

실질중립금리는 Wicksell(1936) 및 Keynes(1936)에 의해 상품가격이나 고용사정에 중립적인 금리로 처음 언급된 이후 장기간 큰 관심을 얻지 못했으나, 통화정책의 주요 수단이 통화량에서 금리로 전환되고 장기간 변화 없이 안정적4)인 것으로 생각되었던 중립금리가 글로벌 금융위기 이후 하락한 것으로 인식되면서 주요국의 통화정책 체계에 적극적으로 편입되었다(Yellen, 2017). 특히 준구조 모형을 통해 실질중립금리가 1990년대 이후 하락하였음을 보고한 Laubach & Williams(2003) 이후 실질중립금리에 관한 연구는 중립금리의 하락세에 대한 거시적 동인, 국제적 공행성, 매크로 레버리지 등 금융안정에 대한 명시적 고려, 기존 방법론의 불완전성에 따른 대안적 추정방법 등 다방면으로 활발하게 전개되었다.

나. 주요국의 실질중립금리 하락세에 대한 선행연구

실질중립금리의 하락 원인에 대해 선행연구들이 다양한 설명을 제공하고 있는 가운데 <그림 Ⅲ-1>은 자금의 수요와 공급 측면에서 기존 설명들을 정리해 보았다. 우선, 생산성 혹은 잠재성장률이 하락하면 자본의 한계생산이 하락하여 투자 수요가 감소하게 되므로 자금의 수요곡선이 왼쪽으로 이동하게 되어 실질중립금리가 하락하게 된다(Laubach & Williams, 2003; Pescatori & Turunen, 2016; Holston et al., 2017; Sichel & Wang, 2017; Wynne & Zhang, 2018; Cesa-Bianchi et al., 2022). 또한, 주요 선진국 인구의 고령화로 생산가능인구가 감소함에 따라 일인당 자본장비율이 높아지고 자본의 한계생산이 저하되면서 자금 수요가 감소한다(Ikeda & Saito, 2014; Carvalho et al., 2016; Bielecki et al., 2020). 뿐만 아니라 세계화의 진전 등으로 자본재 가격이 하락한 점 또한 자금의 수요가 감소하게 된 원인으로 지적된다(Lian et al., 2020). 이러한 자금 수요의 축소 요인과 반대로 재정적자는 자금 수요를 확대시켜 실질금리를 상승시키는 요인으로 작용한다(Laubach, 2009; Rachel & Summers, 2019; Ferreira & Shousha, 2022)

실질중립금리가 실제로 관측 가능하지 않아 경제 모형을 통해 추정해야 하므로 실질중립금리에 대한 다양한 추정치가 존재하는 가운데 <그림 Ⅲ-2>에서 나타나듯 물가연동채권에 반영된 시장금리나 Lubik & Matthes(2015) 등 일부 추정치는 팬데믹 이후 상승세를 나타냄에 따라 향후 방향성에 대한 관심이 지속되고 있다. 일각에서는 실질중립금리 하락세를 유발한 구조적 요인들이 코로나19 감염확산이나 팬데믹 이후의 인플레이션에 의해 되돌릴 수 없는 만큼 팬데믹 이전의 낮은 수준으로 복귀할 것이라고 주장한다(Bailey, 2022; Blanchard, 2023; IMF, 2023; Williams, 2023). 반면 다른 한편에서는 그간 실질중립금리 하락을 유도한 요인들의 영향이 정점에 도달했을 가능성이 제기되는 한편 정부부채의 확대, 생산성 제고에 의한 실질중립금리의 상방위험을 제기하는 시각 또한 존재한다(Luzzetti et al., 2022; Goldman Sachs, 2023a).

한국은 1990년대 이후 잠재성장률이 지속적으로 하락하였으며 <그림 Ⅲ-3>에서 나타난 바와 같이 실질중립금리의 하락세 또한 계속되고 있다. 미국을 비롯한 주요국의 실질중립금리의 하락세를 설명하는 거시적 동인들이 동일하게 한국의 실질중립금리 하락에 기여했을 가능성이 큰 것으로 판단된다. 그러나 오형석(2014) 등 국내를 대상으로 한 기존 연구들이 Laubach & Williams(2003)의 준구조 모형을 일부 변형하여 국내 데이터로 추정한 연구가 많은 반면, 잠재성장률 하락 외에 고령화나 불평등, 정부부채 확대 효과 등을 고려한 연구는 매우 제한적인 상황이다.6) 예외적으로 김민수‧박양수(2013) 및 Zhang et al.(2021)은 소규모 개방경제적 특성을 반영하였으며 Rafiq(2021) 및 오형석‧최지욱(2023)은 가계부채 확대에 따른 금융안정을 고려하는 등의 형태로 기존 모형을 확장하였다. 또한, 김명현‧권오익(2020) 및 강현주(2022)는 인구 고령화의 실질금리에 대한 효과를 분석하였다. 그러나 인구구조, 생산성 및 정부부채 등의 변화를 종합적으로 고려한 연구는 물론이고 이러한 구조변화를 고려하여 실질금리의 장기 추세를 전망한 연구는 극히 드문 상황이다.

본 장에서는 Bielecki et al.(2020)의 생애주기(life-cycle) 모형을 바탕으로 한국 및 미국의 인구구조, 생산성 및 정부 재정 등의 데이터를 잘 반영할 수 있도록 모형내 모수 값들이 선택(calibration)되도록 하였다. <그림 Ⅲ-4>는 모형내 참여하는 경제 주체들과 상품 및 자산 시장간 흐름도를 제시하고 있다. 한편, 분석의 편의를 위해 대규모 경제인 미국은 폐쇄경제로, 한국은 국제금융시장에 접근 가능한 개방경제로 모형화되며 개방경제에서는 국내 금리가 외생적인 글로벌 금리에 의해 영향을 받게 된다. 또한 아래에서 일인당 기준으로 표현되는 변수는 소문자를, 집계 변수에 대해서는 대문자로 표현된다.

1) 가계

가계는 경제활동을 시작하는 20세에 세상에 진입하여 99세까지 살 수 있는 것으로 가정한다. 특정 연도 t에 연령이 j로 동일한 동기집단(cohort)의 크기를

과 같다. 모형내 인구구조의 변천 과정은 가장 나이가 어린 20세 코호트의 규모 변화

과 같다. 모형내 인구구조의 변천 과정은 가장 나이가 어린 20세 코호트의 규모 변화 한편, 연령이 j인 코호트는 다음의 효용함수를 극대화한다고 가정하자.

여기서

가계는 특정 나이

연령이 j인 가계의 예산제약은 다음과 같다.

모든 생존 가구에 대해 일인당 소비, 노동, 자산 및 유산 규모를 일인당으로 표현하면 다음과 같다.

모형내에는 최종재를 생산하는 완전경쟁기업들과 중간재를 생산하는 독점적 경쟁기업(h로 구분)들이 존재한다. 각각의 기업 수는 인구구조 변화와 맞물려 인구 규모

3) 정부 부문

정부는 시장에서 재화를

4) 대외 부문

한국과 같은 소규모 개방경제에서는 국제금융시장에 접근하여 해외 자산을 축적하거나 차입할 수 있는 것으로 가정한다. 다만 국가간 자본흐름에 현실적 제한을 두기 위해 국제 금융거래에서 차입 또는 대출 단위당

5) 시장 청산 조건

이 모형은 표준적인 청산 조건을 따른다. 모든 중간재 생산자는 동일하기 때문에 균형 상태에서 동일한 가격

한편, 자산시장 청산 조건은

나. 모수 선택 및 외생변수

모형 경제는 몇 가지 외생변수들에 의해 작동된다. 첫째로 인구구조는 연령별 노동생산성, 모형 인구에 처음으로 진입하는 20세 인구의 증가율 및 연령별 사망률에 의존한다. 둘째로 경제 전체의 총요소 생산성에 좌우된다. 셋째로 정부의 국가채무 및 재정지출과 연관된다.

1) 인구구조

한국 및 미국 가계의 연령별 노동 생산성

총요소 생산성은 한국의 경우 Penn World Table로부터 1954년부터 2019년까지의 데이터를, 미국은 샌프란시스코 연준의 Fernald(2014)로부터 1948년부터 2022년까지의 데이터를 사용하였다.9) 한국의 장기 전망치는 OECD의 연구 결과인 Guillemette & Turner(2021)를 바탕으로 하였으며 김지연‧정규철‧허진욱(2022)과 마찬가지로 2010~2019년중의 낮은 수준(0.5%)에서 장기적으로 1.0% 수준까지 회복될 것으로 예상한다(<그림 Ⅲ-7> 참조)10). 미국의 경우에는 의회예산처(CBO: Congressional Budget Office)가 2023년 6월에 발표한 예산 및 경제전망(Budget and Economic Outlook and Updates) 결과를 사용하였다. 미국 또한 2010~2019년중 평균 0.8%에서 장기적으로 1.1% 수준으로 상승할 것으로 전망되었다.

장기 생산성에 대한 낙관적인 기대는 다음의 몇 가지 주장에 주로 기인한다. 우선 Brynjolfsson et al.(2021)에 따르면 새로운 범용 기술의 이점을 최대한 활용하려면 보완 자본에 대한 막대한 투자가 필요하며 보완 자본에 대한 투자가 무형자산의 형태일 경우 측정이 어려울 뿐만 아니라 국민계정에서 투자가 아닌 비용으로 계상될 수 있어 기술 도입 초기에 생산성이 부진한 것으로 나타난다. 이후 점차 투자가 결실을 맺으면서 생산성이 큰 폭으로 반등(productivity J-curve)하게 된다고 주장한다. 이러한 견해는 <그림 Ⅲ-7>에서 나타나듯 생산성이 장기 시계에서 평균 회귀적인 특성을 갖는 점과도 잘 부합한다. 또한, Syverson(2023)은 글로벌 금융위기 이후 한동안 부진했던 경기 역동성이 최근 들어 주요국에서 반등 조짐을 나타내고 있음을 지적한다. 한편, 최근 들어 생성형 AI의 도입 및 친환경 에너지 기술에 대한 투자 확대 등에 따른 생산성 개선 기대감도 커지고 있다. 특히 Jones(2023)는 장기 경제성장이 혁신적 아이디어에 크게 의존하는 데 AI가 이러한 아이디어 탐색에 기여할 수 있음을 지적한다. AI의 도입 결과 Goldman Sachs(2023b)는 미국 등 주요 선진국의 연간 노동생산성을 10년에 걸쳐 1.5%p씩 상승시켜 전체 GDP를 7%까지 상승시킬 수 있다고 예상한다. 또한 Capital Economics(2023)는 AI가 장기 경제성장에 긍정적인 영향을 미칠 대표적인 국가로 미국과 한국을 꼽고 있다. 특히 OECD(2021) 및 Goldman Sachs(2022)는 기술의 최첨단 국가인 미국이 생산성 개선 움직임을 주도하는 가운데 한국은 미국의 생산성 추세에 빠르게 수렴할 것이라고 예상하고 있으며 <그림 Ⅲ-7>은 미국과 시차를 두고 한국의 생산성이 회복되는 전망을 반영하고 있다. 한편, 본 장에서는 실질금리의 장기추세 변화에 관심이 있으므로 HP(Hodrick & Prescott) 필터를 통해 총요소 생산성의 순환적 요소들을 제거하였다.

여타 구조적 패러미터 값은 선행연구에서 사용되는 표준적인 수치를 차용하거나 한국과 미국의 주요 거시경제 비율과 일치하도록 설정되었다. 구체적인 수치는 <표 Ⅲ-1>에 정리되어 있다. 우선 할인계수는 1999~2022년중 한국과 미국의 평균 실질금리 수준인 1.6% 및 2.5%와 일치하도록 선택된다. 생산에 사용되는 자본은 연평균 10%로 감가상각(depreciation)된다고 가정하였으며 생산의 자본 탄력성은 0.25로, 제품의 마크업 비율은 1.25로 설정하며 한미 양국이 모두 동일하다고 가정한다. 마지막으로 개방경제 모형에서 해외차입에 따른 마찰적 비용 파라미터는 한국의 순해외차입 수준이 1999~2013년중 평균인 GDP 대비 –10% 수준을 기준으로 하여 설정하였다.

모형은 외생변수가 장기전망치를 따른다고 가정하고 비확률적인 시뮬레이션(deterministic simulation)으로 계산되었다. 폐쇄경제로 가정된 미국에 대해 먼저 계산하여 미국의 실질중립금리 장기 전망치를 도출하고 소규모 개방경제인 한국에 대해서는 미국 전망치를 글로벌 금리의 전제치로 활용하여 계산한다. 전망의 최종 시계는 2040년으로 설정하였다.

우선 2000년대 이후 2023년까지 미국의 실질중립금리를 살펴보면 <그림 Ⅲ-9>에서 나타난 바와 같이 2000년대 초반 2% 중반에서 2023년에는 0.8%로 하락한 것으로 나타났다. 기본모형을 통한 추정치는 실질금리에 대한 데이터 없이 인구구조, 생산성 및 국가부채 등의 외생적 데이터를 바탕으로 모형을 통해 시산(calibration)한 결과임에도 불구하고 실질금리 데이터를 바탕으로 한 Holston et al.(2017)의 추정치와 비슷한 추세를 보이고 있으며 준구조 모형에 서베이 결과를 추가하여 산출한 Zaman(2022)의 추정치와는 추세뿐만 아니라 수준 또한 매우 유사한 모습을 나타내고 있다.

실질중립금리의 전망치는 모형내 주요 동인들에 대한 외생적 가정에 크게 의존하는 만큼 인구구조, 생산성 등 주요 동인들의 전망치에 대한 상‧하방 위험요인들이 실질중립금리의 전망의 불확실성을 유발하는 원인들이 된다. 아래에서는 몇 가지 요인들에 대해 간략히 열거한다.

우선, 모형내 주요 동인들 중 상‧하방 불확실성이 가장 큰 것은 생산성에 대한 전망이다. 앞에서는 OECD 및 CBO의 생산성 반등 전망에 기반하여 생산성의 J-커브 효과 및 AI 도입 등의 개선 요인을 중심으로 설명했으나 다양한 하방 위험들 또한 상존한다. 기존의 글로벌 공급망 체계에서는 기업들이 공급망 체계에 참여하여 생산성 증대 및 지식확산 효과를 누렸으나 글로벌 경제가 진영화되면서 중국의 독자적인 반도체 개발 사례와 같이 국가별 중복 투자가 발생하고 효율적 분업체계가 붕괴됨에 따라 생산성 향상이 지체될 수 있다(Cerdeiro et al., 2021). 또한 모형에서는 인구구조와 생산성을 독립적으로 고려하고 있으나 최근 인구구조 변화에 대한 선행연구들은 고령화로 생산성 또는 혁신 활동이 둔화된다는 점을 지적하고 있다(Lisack et al., 2021; Lee & Shin, 2021; Aksoy et al., 2019). 뿐만 아니라 장기 경제성장을 위해 앞에서 언급한 것처럼 혁신적인 아이디어가 필요하나 이미 쉽게 획득 가능한 기술발전이 대부분 이루어진 만큼 점점 더 생산성 개선이 용이하지 않으며 동일한 성장을 위해 더 많은 연구개발 투자가 필요하다는 점이 지적된다(Jones, 2023)12).

둘째로, 기본 모형에서 정부는 국민연금의 역할을 겸하고 있는데 정부채무나 지출과 별도로 국민연금의 개혁 또한 실질중립금리에 영향을 미칠 수 있다. 2023년 10월 기준 논의 중인 국민연금 개혁안에 따르면 재정건전성 확보를 위해 지급개시연령 및 소득대체율을 상향 조정하는 방안이 여러 대안들과 함께 검토되고 있다(보건복지부, 2023.10.30). 이러한 방안에 따라 지급개시연령이 높아지는 경우 모형에서는 은퇴연령이 높아짐을 의미하며 가계가 생산 활동에 장기간 종사하면서 은퇴기간이 단축됨에 따라 은퇴 이전에 축적해야 하는 민간 저축 규모가 줄어들어 실질중립금리가 기본 추정치에 비해 상승하게 된다. 만약 소득대체율 또한 높아진다면 마찬가지로 은퇴 이후의 소득이 늘어나게 되므로 은퇴 이전에 필요한 저축 규모를 줄여 실질중립금리가 추가적인 상승압력을 받게 된다.

셋째로, 인구구조는 매우 점진적으로 변하는 속성상 생산성 및 정부부채에 비해 불확실성이 적으나 이민 확대에 따라 변화 가능성이 존재한다. 모형에서는 20세 이상의 인구를 대상으로 하므로 2023년 기준의 출산율 변화 여부는 모형의 결과에 영향을 미치지 않겠으나 국내 노동력 부족 상황을 타개하기 위해 저임금 국가로부터 축적된 자산이 거의 없는 20세의 노동력이 신규 유입된다면 실질중립금리가 상승하게 된다. 다만, 신규 노동력의 유입이 기본 시나리오 하에서 예상되는 실질중립금리의 경로에 영향을 주는 데는 상당한 시간이 소요될 것이다. 또한, 본질적으로 가파른 인구 고령화가 중국을 포함한 동아시아 국가들의 공통적 문제인 만큼 GDP 및 실질중립금리를 유의미하게 상향 조정시킬 만한 인구의 외부 유입 가능성은 크지 않은 것으로 판단된다(강현주, 2022).

Ⅳ. 금리 기조에 대한 평가 및 시사점

본 장에서는 보고서의 제2편에서 다뤄지는 경제구조변화와 인플레이션의 연구 결과를 간략히 요약하고 Ⅲ장의 실질중립금리에 대한 전망 결과를 종합하여 향후 추세금리에 대한 방향성을 제시한다. 또한, 이러한 추세금리의 장기 흐름에 대한 전망을 바탕으로 정책적 시사점을 간략히 서술한다.

1. 경제구조변화와 인플레이션13)

제2편에서는 세계화 및 인구구조를 중심으로 경제구조변수가 한국과 미국의 저물가 기조에 미친 영향을 분석하고, 향후 물가 기조에 변화가 발생할 수 있는지를 평가한다. 이를 위해 1980년대 이후 지속된 저물가 기조를 필립스곡선 평탄화 및 추세 인플레이션의 하향 안정이라는 두 가지 관점에서 살펴본다. 필립스곡선의 평탄화는 인플레이션의 국내 경기에 대한 민감도 하락을 의미하며, 추세 인플레이션의 하향 안정은 인플레이션의 장기 추세가 낮아졌음을 의미한다. 한국과 미국에서 1980년대부터 코로나 감염확산 이전까지 추세 인플레이션이 하향 안정화된 가운데, 필립스곡선 평탄화로 인플레이션의 경기순환적 특성이 약화되며 저물가 기조가 안정적으로 유지되었는데 제2편의 연구는 이러한 저물가 기조가 세계화 및 인구구조 변화에 기인한 것인지를 실증적으로 살펴본다.

분석 결과 세계화 및 인구구조변화가 한국과 미국의 저물가 기조에 미친 영향은 다음과 같다. 첫째, 세계화는 한국과 미국의 필립스곡선 평탄화에 기여하였으며 추세 인플레이션의 하향 안정에도 핵심적인 역할을 한 것으로 확인되었다. 한국과 미국의 추세 인플레이션은 1990년대 냉전 체제의 붕괴 이후 초세계화(hyper-globalization) 기간 동안에 큰 폭으로 하락한 후 팬데믹 이전까지 안정세를 유지하였는데, 초세계화 시기에 발생한 추세 인플레이션의 하락은 대부분 세계화로부터 유발된 것으로 추정되었다. 이는 기존문헌에서 논의된 바와 같이 세계화 진전으로 비용 효율성이 향상되고 기업간 경쟁이 심화된 결과로 파악할 수 있다. 다만, 한국과 미국에서 세계화가 추세인플레이션에 미친 영향이 각각 2008년경(미국) 및 2013년경(한국)부터 현저히 낮아졌는데, 이는 각국의 세계화가 동 시기부터 정체국면에 진입한 점이 반영된 결과이다

둘째, 한국과 미국에서 인구구조 변화가 추세 인플레이션에 미친 영향을 살펴보면 선행 연구 결과들과 마찬가지로 한국과 미국에서 공통적으로 노동가능인구 비중이 감소할수록 추세 인플레이션이 상승하였다. 반면 고령인구 비중이 증가할 경우 미국에서는 추세 인플레이션이 상승하였으나 한국에서는 하락하는 것으로 나타났다. 미국에서는 고령인구가 생산보다 소비가 많은 순소비(net consumer) 집단인 반면 한국의 고령층은 생산 활동 참여가 꾸준히 증가하였으며, 소비 여력이 현저히 낮은 탓에 미국과 달리 인플레이션 상승요인으로 작용하지 못한 것으로 추정된다. 이에 따라 미국에서는 베이비 붐 세대의 은퇴가 본격화된 2008년 이후 인구구조가 유의미한 물가상승요인으로 작용한 반면 한국에서는 2020년까지 고령인구 비중 증가로 인한 인플레이션 하락 압력이 노동가능인구 비중 감소로 인한 인플레이션 상승 압력보다 큰 것으로 나타났다. 다만, 통계청의 장래인구 추계치를 적용하여 살펴본 결과, 2025년부터 노동가능인구 비중 감소로 인한 인플레이션 상승 효과가 고령인구 비중 증가에 따른 하락 효과를 상회하는 것으로 추정되어 향후 한국에서도 인구구조가 구조적인 인플레이션 상승요인으로 작용할 것으로 전망된다.

결론적으로 향후 세계화 후퇴 및 인구 고령화 추세를 감안할 때 한국과 미국에서 그동안 안정적으로 유지되어온 저물가 기조가 종료될 가능성이 큰 것으로 평가된다. 세계화 후퇴로 필립스곡선이 가팔라져 인플레이션의 경기 민감도가 복원되면서 인플레이션의 변동성이 과거보다 구조적으로 확대되는 가운데 탈세계화 및 노동인구 부족 문제가 추세 인플레이션 상승세를 유도할 것으로 전망된다.

2. 추세금리의 방향성 평가 및 정책적 시사점

Ⅲ장의 실질중립금리에 대한 분석과 제Ⅱ편의 추세 인플레이션에 대한 논의를 종합해 보면 추세금리는 한국과 미국 모두 과거 글로벌 금융위기 이후 코로나19 감염확산 이전과 같은 저금리 수준으로 복귀하기는 어려울 전망이다. 향후 미국 경제가 생산성을 회복하는 가운데 주요 선진국의 국가부채가 확대됨에 따라 실질중립금리가 상승하는 동시에, 세계화가 후퇴하고 인구 고령화가 가속화됨에 따라 추세 인플레이션이 상승할 것으로 예상되는 만큼 글로벌 금리는 고금리 기조가 고착화될 수 있다. 한국은 가파른 인구 고령화로 실질중립금리가 낮은 수준에서 횡보할 것으로 예상되나, 노동가능인구의 부족 등에 따른 추세 인플레이션 상승 압력이 금리 기조를 좌우할 것으로 예상된다.

이러한 금리 기조의 방향성은 정부와 중앙은행의 통화 및 재정정책, 부채관리를 위한 거시건전성 정책뿐만 아니라 금융기관 및 연금기금 등의 장기 자산배분 등 다양한 부문에 중요한 시사점을 가진다. 우선, 재정정책과 관련하여 Ⅲ장에서 제시한 바와 같이 국가채무가 가파르게 늘어날 것으로 예상되는 가운데 금리가 높게 유지됨에 따라 정부의 이자비용 부담이 증가하면서 국가채무 증가가 당초 예상보다 확대되는 악순환에 빠질 수 있다. 특히 장기 실질중립금리가 0% 수준에서 횡보할 것으로 예상되는 가운데 2040~2050년중 잠재성장률 또한 유사한 수준으로 하락할 것으로 전망됨에 따라 <그림 Ⅳ-1>에서 나타난 바와 같이 실질금리와 성장률간 격차(r-g differential) 축소에 따른 정부부채의 장기 지속가능성에 대한 의문이 제기될 수 있다.14) 또한, 부채관리와 관련하여 주요국에 비해 월등히 높은 수준인 가계부채가 고금리에 부실화될 수 있으며, 이에 따라 유사시 취약가계에 대한 채무조정이나 부채탕금 등을 통해 일정 부분 국가채무로 전환될 가능성을 고려하면 안정적인 재정운용의 필요성이 더욱 커진다.

끝으로 금융시장과 관련하여 금리는 주식, 채권 등 금융자산의 장기 현금흐름에 대한 할인율로서 금융자산의 가격을 결정하는 핵심 요인이므로 자산가격 및 자산배분 전략에 직접적인 영향을 미친다. <그림 Ⅳ-2>에서 나타난 바와 2000년대 이후 주식과 채권 수익률이 음(-)의 상관관계를 유지함에 따라 분산투자 전략이 장기간 효율적 위험관리와 높은 수익률을 제공했다. 그러나 2022년부터 주식과 채권 수익률의 상관관계가 양(+)으로 전환되었다. 이러한 주식과 채권의 상관관계 변화는 인플레이션의 동인과 밀접하게 연관되어 있다(백인석‧장근혁, 2022). 즉, 금리인하나 재정확대 등 수요충격으로 인플레이션이 발생할 경우 GDP가 상승하는 동시에 물가 또한 상승하게 되므로 실물경기와 밀접한 관련이 있는 주가가 상승하는 반면 인플레이션으로 채권 가격은 하락하게 된다. 반면, 원자재 가격 상승과 같은 공급충격이 발생한 경우 GDP가 하락하는 반면 물가는 상승하므로 주가와 채권이 동반 하락하게 된다. 향후 인플레이션 변동이 탈세계화, 인구 고령화 또는 생산성 변화와 같은 공급 요인에 의해 주도된다면 주식과 채권 수익률의 양(+)의 상관관계가 장기화될 수 있음을 의미한다. 이와 같이 주식과 채권 가격이 같은 방향으로 움직이게 될 경우 주식과 채권으로 나누어 분산투자하는 전통적 자산배분 전략의 한계가 부각될 수 있다. 일례로 2022년에는 주식과 채권이 동시에 큰 폭으로 하락함에 따라 전통적인 분산투자 기법인 주식 60%와 채권 40%로 구성된 ‘60/40 포트폴리오’가 부진한 성과를 나타내기도 했다. 인플레이션의 장기화 가능성을 바탕으로 글로벌 자산운용업계 또한 ‘60/40 포트폴리오’에 기반한 전통적 분산투자의 장기 성과에 대해 부정적으로 예상(BlackRock, 2023)하고 있는 만큼, 금리 기조의 전환 가능성을 염두에 두고 시장 상황에 능동적으로 대응할 수 있도록 대안적 자산배분 전략에 대한 금융투자업계 및 기관투자가들의 관심이 확대되어야 할 것으로 판단된다.

1) 자본시장연구원 연구보고서 24-04.

2) 자본시장연구원 연구보고서 24-05.

3) 실질중립금리는 중장기 시계에서 경기를 부양하거나 긴축시키지 않으면서 잠재 GDP 및 안정적인 물가상승률에 부합하는 실질금리를 의미한다. 추세 인플레이션은 경제 전체의 수요뿐만 아니라 공급 능력을 감안한 물가상승률 수준으로 순환적(일시적) 요인을 배제한 물가상승률의 장기 추세에 해당된다. 실질중립금리 및 추세 인플레이션에 대한 자세한 설명은 각각 제1편의 Ⅲ장 및 제2편의 Ⅱ장에서 다룬다.

4) 테일러 준칙이 처음 등장하는 Taylor(1993)에서는 실질중립금리에 대한 연구가 본격화되기 이전인 만큼 실질중립금리의 시변성을 무시한 채 2%로 고정된 것으로 간주한다.

5) 불평등 확대가 장기적으로 경제성장에 부정적인 만큼 총수요를 위축시켜 자금의 수요가 감소하는 경로 또한 존재한다(Berg & Ostry, 2017; Auclert & Rognlie, 2018)

6) Laubach & Williams(2003) 및 Holston et al.(2017)의 준구조 모형은 실물경제(GDP)와 실질금리간 관계를 나타내는 IS 곡선, 인플레이션과 실물경제간 관계를 나타내는 필립스 곡선과 더불어 잠재성장률 및 기타 요인에 의해 실질중립금리가 설명된다는 관계식으로 구성되어 있어 잠재성장률의 하락이 실질중립금리의 변동을 대부분 설명하며 기타 요인의 변동에 대해서는 구조적 원인이 무엇인지 알 수 없는 한계가 존재한다.

7) 모형내에서 정부가 연금의 역할을 겸하고 있으므로 근로소득세와 연금보험료가 결합된 개념이다.

8) OECD(2021)에 따르면 2020년 기준 한국과 미국의 실효 퇴직연령은 각각 65.7세 및 64.9세이다.

9) 미국의 총요소 생산성 데이터의 경우 Fernald(2014)와 Penn World Tables(PWT) 데이터의 차이는 크지 않으며, 특히 모형에서 HP필터를 통한 추세치를 사용하기 때문에 그 차이는 더욱 줄어든다. 다만 Fernald(2014)의 데이터는 미국의 총요소 생산성과 관련된 선행 연구에서 널리 활용되고 있을 뿐만 아니라 PWT에 비해 시계열이 더 길다는 장점 때문에 사용되었다.

10) Goldman Sachs(2022) 또한 김지연‧정규철‧허진욱(2022)과 비슷한 장기 경제성장률 전망치(2040년대 각각 0.8% 및 0.7%)를 제시하고 있는데 생산요소별 세부 전망 내역을 알 수 없으나 장기 전망의 차이가 불확실성이 적은 노동이나 자본투입보다는 생산성 증가율에 주로 기인한다는 점을 감안하면 생산성 증가율에 대해 유사한 전망을 하고 있는 것으로 추측할 수 있다.

11) 동 시나리오에서는 재량지출이「2021~2025년 국가재정운용계획」과 동일하다고 가정하는 한편 2026~2030년중에는 장기수렴수준(GDP 대비 12.8%)으로 서서히 조정되었다가 2031년 이후에는 장기수렴수준이 유지된다고 가정한다.

12) 무어의 법칙(Moore’s law)에 따라 반도체의 연산 능력이 지속적으로 개선되어 왔으나 반도체의 미세공정이 한자리 수 나노미터(㎚)까지 진행됨에 따라 한계에 봉착한 것이 대표적인 사례라고 할 수 있다.

13) 본 절의 내용은 보고서의 제2편 『금리 기조의 구조적 전환 가능성 평가 (Ⅱ): 경제구조변화와 인플레이션』의 주요 내용을 요약한 것으로 자세한 분석은 해당 편을 참고하기 바란다.

14) 성장률이 실질금리를 상회할 경우 추가 재정적자가 없다면 국가채무비율(=국가채무/GDP)이 점차 축소되어 정부부채의 안정성이 자동적으로 개선될 수 있으나 격차가 축소되거나 오히려 실질금리가 성장률을 상회할 경우 이러한 효과를 기대할 수 없다.

15) 다만 여기에서는 장기적 시계에서 인플레이션의 추세적 변화 가능성을 언급하고 있는 만큼 최근 주요국 중앙은행들이 인플레이션을 목표 수준(2%)으로 안정시키기 위해 긴축 기조를 지속하고 있는 점과 배치되지 않는다.

16) Beaudry et al.(2023)에 따르면 중앙은행이 공급충격에 따른 인플레이션 상승에 대해 일정 임계수준에 도달할 때까지 용인했다가 임계점에 도달한 순간 긴축기조로 즉각 전환하는 것이 최적 전략이나, 2022년 연준의 정책실기 사례를 보면 현실에서 적용하기가 간단치 않음을 알 수 있다.

참고문헌

강현주, 2022, 『인구구조 변화가 장기 거시경제 추세에 미치는 영향』, 자본시장연구원 이슈보고서 22-26.

국회예산정책처, 2022, 『2022-2070년 NABO 장기 재정전망』.

김명현‧권오익, 2020, 인구 고령화가 실질 금리에 미치는 영향, 『경제분석』 26(1), 133-166.

김민수‧박양수, 2013, 소규모 개방경제의 특성을 고려한 중립적 실질금리 추정 및 변동요인 분석, 『경제분석』19(4), 47-86.

김재칠‧정화영, 2023, 『가계의 사적연금소득과 주택연금의 역할』, 자본시장연구원 이슈보고서 23-11.

김지연‧정규철‧허진욱, 2022, 장기경제성장률 전망과 시사점, KDI 2022 하반기 경제전망.

백인석‧장근혁, 2022, 인플레이션과 자산수익률간 관계: 인플레이션 헤지 관점』, 자본시장연구원 이슈보고서 22-25.

보건복지부, 2023.10.30., 『제5차 국민연금 종합운영계획(안)』, 보도자료.

신인석‧강현주, 2022, 한국 통화정책의 최근 기조 평가 및 쟁점, 『한국경제연구』14(4), 25-55.

오형석, 2014, 칼만필터를 이용한 우리나라의 중립금리 추정,『금융연구』28(1), 1-26.

오형석‧최지욱, 2023, 가계신용갭을 반영한 실질중립금리 추정 및 시사점, 『한국경제연구』15(4), 1-37.

최순영, 김종민, 장근혁, 강현주, 2021, 『저금리 시대 전망 및 금융투자업 대응전략』, 자본시장연구원 연구총서 21-04.

Aksoy, Y., Basso, H.S., Smith, R.P., Grasl, T., 2019, Demographic structure and macroeconomic trends, American Economic Journal: Macroeconomics 11(1), 193-222.

Arslanalp, S., Eichengreen, B., 2023, Living with High Public Debt, Jackson Hole Symposium, August 29.

Auclert, A., Rognlie, M., 2018, Inequality and Aggregate Demand, NBER working paper No.24280.

Bailey, A., 2022, The economic landscape: Structural change, global R* and the missing-investment puzzle, speech at the Official Monetary and Financial Institutions Forum.

Bauer, M., Rudebusch, 2020, Interest Rates under Falling Stars, American Economic Review 110(5), 1316-1354.

Beaudry, P., Lahiri, A., Carter, T.J., 2023, The Central Bank’s Dilemma: Look Through Supply Shocks or Control Inflation Expectations? NBER working paper No.31741.

Berg, A., Ostry, J.D., 2017, Inequality and Unsustainable Growth: Two Sides of the Same Coin? IMF Economic Review 65(4), 792-815.

Bernanke, S.B., 2005, The global saving glut and the U.S. current account deficit, speech at the Sandridge Lecture, Virginia Association of Economists.

Bielecki, M., Brzoza-Brezezina, M., Kolasa, M., 2020, Demographics and the natural interest rate in the euro area, European Economic Review 129, 103535.

BlackRock, 2023, New regime, new portfolio approach, Weekly Commentary, April 17.

Blanchard, O., 2023, Secular stagnation is not over, Peterson Institute for International Economics Realtime Economics, 24 January.

Blanchard, O., Summers, L., 2023, Summers and Blanchard debate the future of interest rates, Peterson Institute for International Economics, 7 March.

Blinder, A.S., 1999, Central Banking in Theory and Practice, MIT Press.

Borio, C., Disyatat, P., Juselius, M., Rungcharoenkitkul, P., 2017, Why so low for so long? A long-term view of real interest rates, BIS working papers No.685.

Brandt, C., Goy, G., Lemke, W., 2021, Natural rate chimera and bond pricing reality, ECB working paper No.2612.

Brynjolfsson, E., Rock, D., Syverson, C., 2021, The Productivity J-Curve: How Intangibles Complement General Purpose Technologies, American Economic

Journal: Macroeconomics 13(1), 333-372.

Capital Economics, 2023, AI, Economies and Markets – How artificial intelligence will transform the global economy.

Carvalho, C., Ferrero, A., Nechio, F., 2016, Demographics and real interest rates: Inspecting the mechanism, European Economic Review 88, 208-256.

Cerdeiro, D.A., Eugster, J., Mano, R.C., Muir, D., Peiris, S.J., 2021, Sizing Up the Effects of Technological Decoupling, IMF working paper WP/21/69.

Cesa-Bianchi, A., Harrison, R., Sajedi, R., 2022, Decomposing the drivers of Global R*, Bank of England staff working paper No.990.

Davis, J., Fuenzalida, C., Taylor, A., 2021, The Natural Rate Puzzle: Global Macro Trends and the Market-Implied R*, NBER working paper 26560.

Del Negro, M., Giannoni, M.P., Giannone, D., Tambalotti, A., 2017, Safety, Liquidity and the Natural Rate of Interest, Brookings Papers on Economic Activity, Spring, 235-294.

Duval, R., Ji, L., Li, L., Oikonomou M., Pizzinelli, C., Shibata, I., Sozzi, A., Tavares, M.M., 2022, Labor Market Tightness in Advanced Economies, IMF Staff Discussion Notes 2022/001.

Favero, C., Melone, A., Tamoni, 2023, Monetary Policy and Bond Prices with Drifting Equilibrium Rates, Journal of Financial and Quantitative Analysis, 1-26.

Ferreira, T., Shousha, S., 2022, Determinants of Global Neutral Interest Rates, FRB working paper.

Fernald, J., 2014, A Quarterly, Utilization-Adjusted Series on Total Factor Productivity, Federal Reserve Bank of San Francisco working paper.

Glick, R., 2019, R* and the global economy, Federal Reserve Bank of San Francisco working paper 2019-18.

Goldman Sachs, 2022, The Path to 2075 – Slower Global Growth, But Convergence Remains Intact, Global Economics Paper, December 6.

Goldman Sachs, 2023a, What Have We Learned About the Neutral Rate? US Economic Analyst, June 5.

Goldman Sachs, 2023b, Generative AI: Hype, or truly transformative?, Top of Mind, Issue 120, July 5.

Goodhart, C., Pradhan, M., 2020, The great demographic reversal, Palgrave Macmillan.

Gourinchas, P., Rey, H., Sauzet, M., 2022, Global Real Rates: A Secular Approach, CEPR Discussion Paper DP16941.

Guillemette, Y., Turner, D., 2021, The Long Game: Fiscal Outlooks To 2060 Underline Need For Structural Reform, OECD Economic Policy Paper October 2021 No. 29.

Holston, K., Laubach, T., Williams, J., 2017, Measuring the Natural Rate of Interest: International Trends and Determinants, Journal of International Economics 108, S59-S75.

International Monetary Fund, 2023, The Natural Rate of Interest: Drivers and Implications for Policy in World Economic Outlook, 45-67, April.

Ikeda, D., Saito, M., 2014, The effects of demographic changes on the real interest rate, Japan and the World Economy 12, 37-48.

Javorcik, B.S., Kitzmuller, L., Schweiger, H., Yildirim, M.A., 2023, Economic costs of friend-shoring, European Bank for Reconstruction and Development working paper.

Jones, C., 2023, The Outlook for Long-Term Economic Growth, Jackson Hole Symposium, August 29.

Laubach, T., 2009, New evidence on the interest rate effects of budget deficits and debt, Journal of the European Economic Association 7(4), 856-885.

Laubach, T., Williams, J.C., 2003, Measuring the natural rate of interest, Review of Economics and Statistics 85(4), 1063-1070.

Lee, H., Shin, K., 2021, Decomposing effects of population aging on economic growth in OECD countries, Asian Economic Papers 20(3), 138-159

Lian, W., Novta, N., Pugacheva, E., Timmer Y., Topalova, P., 2020, The price of capital goods: a driver of investment under threat, IMF Economic Review 68, 509-549.

Lisack, N., Sajedi, R., Thwaites, G., 2021, Population aging and the macroeconomy, International Journal of Central Banking 17(2), 43-80.

Lubik, T., Matthes, C., 2015, Time-Varying Parameter Vector Autoregressions: Specification, Estimation and an Application, Economic Quarterly 101(4), 323-352, Federal Reserve Bank of Richmond.

Luzzetti, M., Ryan, B., Weidner, J., Yang, A., 2022, (R-)Star gazing: Macro drivers suggest real neutral rate may have risen, SUERF Policy Brief No.472.

Keynes, J.M., 1936, The General Theory of Employment, Interest and Money, Palgrave Macmillan.

Keane, M.P., Wasi, N., 2016, Labour supply: the roles of human capital and the extensive margin, Economic Journal 592, 578-617.

McKinsey & Company, 2023, The economic potential of generative AI : The next productivity frontier, June.

Mian, A., Straub, L., Sufi, A., 2021, Indebted Demand, The Quarterly Journal of Economics 136(4), 2243-2307.

Organization for Economic Cooperation and Development, 2021, Pensions at a Glance 2021: OECD and G20 Indicators, OECD Publishing, Paris.

Pescatori, A., Turunen, J., 2016, Lower for Longer: Neutral Rate in the U.S., IMF Economic Review 64, 708-731.

Platzer, J., Peruffo, M., 2022, Secular Drivers of the Natural Rate of Interest in the United States: A Quantitative Evaluation, IMF working paper WP/22/30.

Rachel, L., Smith, T., 2017, Are low real interest rates here to stay? International Journal of Central Banking, September 1-42.

Rachel, L., Summers, L. H., 2019, On secular stagnation in the industrialized world, Brookings Papers on Economic Activity, Spring, 1-54.

Rafiq, S., 2021, What’s in the (R)-Stars for Korea? IMF working paper WP/21/93.

Sichel, D.E., Wang, J.C., 2017, The Equilibrium Real Policy Rate Through the Lens of Standard Growth Models, Federal Reserve Bank of Boston working paper.

Schnabel., I., 2022, Monetary Policy and the Great Volatility, Jackson Hole Economic Policy Symposium organised by the Federal Reserve Bank of Kansas City, 27 August.

Stock, J.H., Watson, M.H., 1993, A simple estimator of cointegrating vectors in higher order integrated systems, Econometrica 61(4), 783-820.

Stock, J.H., Watson, M.H., 2007, Why Has U.S. Inflation Become Harder to Forecast, Journal of Money, Credit and Banking 39(1), 3-33.

Syverson, 2023, Structural Shifts in the Global Economy: Structural Constraints on Growth, Jackson Hole Symposium, August 29.

Taylor, J.B., 1993, Discretion versus policy rules in practice, Carnegie-Rochester Conference Series on Public Policy 39, 195-214.

Warnock, F.E., Warnock, V.C., 2009, International capital flows and U.S. interest rates, Journal of International Money and Finance 28(6), 903-919.

Wicksell, K., 1936, Interest and Prices, (Kahn, R.F., Trans.), Sentry Press, New York (Original work published 1898)

Williams, J., 2023, Measuring the Natural Rate of Interest: Past, Present and Future, Remarks at the Thomas Laubach Research Conference, May 19.

Wynne, M.A., Zhang, R., 2018, Measuring the world natural rate of interest, Economic Inquiry 56(1), 530-544.

Yellen, J., 2017, The Economic Outlook and the Conduct of Monetary Policy, Speech at the Stanford Institute for Economic Policy Research, Stanford University, January 19.

Zaman, S., 2022, A Unified Framework to Estimate Macroeconomic Stars, Federal Reserve Bank of Cleveland, Working Paper No. 21-23R

Zhang, R., Martinez-Garcia, E., Wynne, M., Grossman, V., 2021, Ties that bind: Estimating the natural rate of interest for small open economies, Journal of International Money and Finance 113, 102315.