OPINION

2022 Sep/06

Direct Indexing and Personalized Passive Investing

Sep. 06, 2022

PDF

- Summary

- Known as a new paradigm in passive investing, direct indexing is accelerating personalized passive investment. With direct indexing, investors can build customized indexes to enjoy the benefits of passive investing. In overseas markets, it serves as a tool for tax savings and ESG investment. Direct indexing is expected to open up new opportunities in the passive investment ecosystem in that it helps overcome the limits of ETFs such as rigidity in the ETF market and liquidity mismatch and can promote effective behaviors of retail investors in the mid- and long-term.

Major overseas investment firms are quickly responding to such changes to preoccupy the direct indexing market by offering distinctive services. Amid the growth of the ETF market and the increasing popularity of direct investment, Korea is likely to see direct indexing taking hold in the domestic market on the back of the potential tax reform and fractional trading services. In this regard, it is necessary to build direct indexing capabilities and implement measures to properly respond to it.

A new wind of change is blowing in passive investing designed to track a certain index. Although it is common for investors to buy an index mutual fund or exchange-traded fund (ETF) already available in the market, the so-called “direct indexing” enables them to newly create their own index. Amid a growing trend of customized products and services across all industrial sectors as well as the financial service industry, passive investing is no longer the exception to the trend.

Direct indexing refers to an approach that enables benchmark indexing based on investment preference and purposes and directly managing individual component stocks within an index through an investor’s account. With this approach, investors can build customized portfolios that cannot be covered by an existing index fund. They can also seek long-term returns with fewer unnecessary transactions as their assets are passively managed. Amid the growing popularity of passive investing and direct investment, direct indexing is expected to achieve remarkable growth.1) Against this backdrop, this article intends to examine how direct indexing, a new paradigm in passive investing, has spread in the market, and to explore its current state and expected effects.

Emergence and rise of direct indexing

From the long-term perspective, the rise of direct indexing can be explained by the rapid growth of passive investing, the so-called passive revolution, and the increase in personalized asset management services. In an efficient market, investors cannot beat the market and even active fund managers who are deemed to have greater information and capabilities than retail investors hardly achieve after-fee returns that surpass the market return. As this phenomenon has repetitively occurred, passive investing has taken hold rapidly. During this process, the market has seen sharp growth in ETFs designed for low-cost investment in diversified portfolios. As EMPs (ETF Managed Portfolios), a low-cost customized investment advisory service using robo-advisors, have been widely offered since the 2010s, demand for customized asset management has surged. Over the long run, direct indexing seems to follow the same trajectory as such a growth trend.

Direct indexing has originated from an investment service provided by firms such as Parametric and Aperio Group. Initially, such firms made up portfolios tailored for a handful of high net-worth individuals holding an SMA (Separated Managed Account) in the US market. Back then, the service mainly focused on a tax-loss harvesting strategy through loss deduction and loss carry-forward in order to minimize capital gains tax for investors in the US market. To this end, they added a trading strategy designed to track an index by investing in individual stocks and to reduce capital gains tax. In the past, only high net-worth individuals were able to realize economies of scale through direct indexing because of higher transaction fees and bigger account minimums required for owning an entire index.

Since then, the competition for zero-commission trading among retail brokerages, such as Charles Schwab and Robinhood, and the rise of fractional trading have paved the ground for small investors to have access to direct indexing. In addition, it is possible to effectively analyze a vast amount of information and respond to demand from various customers thanks to improvements in IT infrastructure and automation technology, which has made direct indexing widely accepted in the market. In other words, a shift to passive investing, the increasing ubiquity of customized services and the environment allowing every investor to enjoy a direct indexing service have contributed to the expansion of direct indexing.

Current state and characteristics of direct indexing services

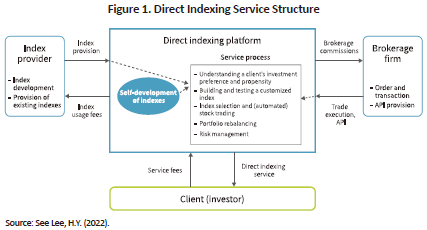

As illustrated in Figure 1, direct indexing services are mainly structured around platforms, index providers, brokerage firms and clients.2) A direct indexing platform plays a key role in the service while an index provider and a brokerage firm contribute to the delivery of the service. In terms of index provision, it is possible to use the one offered by existing index providers but direct indexing platforms also could develop their own indexes. Direct indexing service providers present a customized portfolio (or index) and test results after analyzing a client’s preference or investment propensity based on the information collected from the client and platform data. If the client decides to invest in the index, the trading order is executed by a brokerage firm linked to the service provider. A change in portfolio composition, or a deposit or withdrawal regarding investment funds may give rise to rebalancing activities. Furthermore, the client can keep investing in the selected index by using fractional trading and the API service offered by brokerage firms, regardless of the size of investment assets. The operation of such a platform necessitates the collection and management of a vast amount of individual stock-level information, optimized portfolios and test modules.

Korea is still in its early stage of direct indexing as a fintech startup3) has just launched Korea’s first direct indexing investment platform for retail investors. As mentioned above, direct indexing has grown in popularity, especially in the US market. The AUM of direct indexing in the US is estimated at nearly $350 billion as of the first quarter of 2021.4) Key market participants have recognized the growth potential of direct indexing within the passive investment market and are competing to gain a bigger market share by taking over relevant business entities.5) It is especially notable that Vanguard, an asset management firm that launched the world’s first index fund, signed its first acquisition with direct indexing solution developer JustInvest in its history of 46 years, which offers significant implications for the industry.6)

The response to direct indexing varies by business category as follows. Firms primarily dealing with retail investors like Charles Schwab are offering various direct investment services and one of the services is direct indexing (Schwab Personalized Indexing). Also, Charles Schwab acquired Motif, a direct indexing firm in June 2020 to sophisticate its tax-saving strategy. After a failure to gain a presence in the passive investment market, Morgan Stanley bought Eaton Vance—the parent company of Parametric that has provided a direct indexing service in the US for the longest period—for approximately $7 billion. This move aims at securing dominance in the passive investment market monopolized by BlackRock and Vanguard. BlackRock and Vanguard are also properly adjusting to changes in the passive investment market by taking over Aperio Group and JustInvest, respectively. Schwab Personalized Indexing charges a service fee of 0.35%, higher than ordinary ETF fees but lower than what active funds charge.

In the US, direct indexing services provided by major financial investment firms can be largely categorized into tax-saving and personalized index investing. In particular, tax-saving is a core service provided by all direct indexing firms and can be characterized by strategic tax-loss harvesting for minimizing capital gains tax arising out of stock investment. Tax-loss harvesting is a strategy of selling a stock that has lost value and buying another stock similar to the ones within an index in order to minimize realized gains by summing up gains and losses arising from the sale of assets. It has been found to yield excess gains ranging from 0.82% to 1.08% (Chaudhuri et al., 2020), and direct indexing has been verified as a tool of realizing such gains (Sosner et al., 2021).

Offering a personalized index is somewhat similar to the direct indexing service launched in Korea and generally, personalized indexes are constructed in the form of a mixture of a factor7) and ESG. On top of that, direct indexing enables screening of certain business types or firms and also allows modifying an index through a change in the weight of stocks within the same index. Notably, considering that retail investors tend to show indifference to EGS matters (Moss et al., 2020), major overseas direct indexing services try to facilitate ESG investment by individuals by adding a wide range of ESG options to the creation of personalized indexes.

Benefits and expected effects of direct indexing

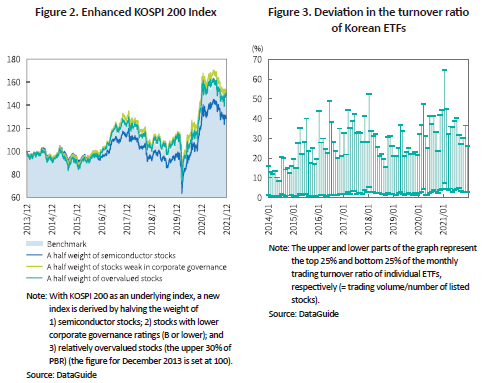

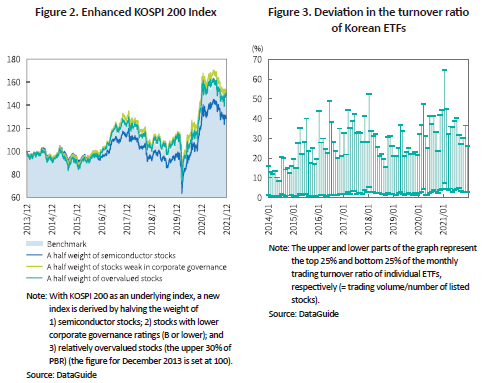

One of the biggest perks of direct indexing is that it could personalize investment strategies without any barriers. While robo-advisors provide ETF portfolios tailored for investors’ risk appetite, direct indexing enables them to build and manage an index that meets their various needs through a portfolio made up of individual stocks, thereby allowing more flexible passive investment. For instance, an investor who works in the semiconductor industry can lower the weight of semiconductor stocks in the index to gain a balance between labor income and investment income. Furthermore, investors can reduce the weight of stocks that are affected by vulnerable corporate governance or relatively overvalued by using data provided by direct indexing platforms. With this approach, they can engage in passive investing by tracking an enhanced index against a benchmark (Figure 2). In addition, it is possible to construct a portfolio comprised of stocks other than major market indexes such as KOSPI 200, and a benchmark index can also be created by incorporating foreign stocks, instead of domestic ones.

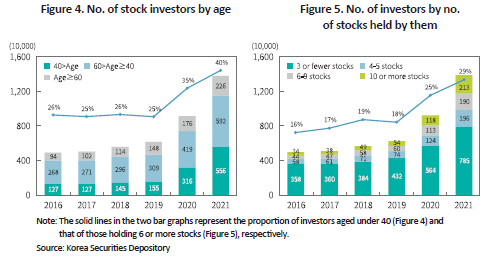

Such customization techniques of direct indexing can help overcome weaknesses of the ETF market. Although various types of ETFs have recently been launched including thematic or active ETFs, they cannot be viewed as a customized portfolio. In principle, ETF investors have to buy ETFs offered by fund management firms. And in some cases, the stocks they want to invest in may not be found among listed ETFs and even if an investor finds a similar ETF listed on the exchange, it may have lower trading volume. Figure 3 shows the top 25% and bottom 25% of the monthly trading turnover ratio for Korea’s listed ETFs, indicating a wider gap in liquidity between ETFs. Among listed ETFs, the bottom 25% in the monthly trading turnover ratio is 5%, which is hardly traded in the market. This means an investor may not invest in a certain index because of the unavailability of relevant products or a severe liquidity mismatch8) between individual stocks incorporated into ETFs. In this case, direct indexing allows the investor to construct an index comprised of relatively easy-to-trade stocks and invest in the index.

Conclusion

With securities transaction tax still being imposed, the effect of direct indexing technology could be reduced in Korea. Considering the introduction of financial investment income tax, the abolition of securities transaction tax and more active fractional trading, however, the use of direct indexing is anticipated to increase going forward. In direct indexing, an index can be tracked through trading of individual component stocks and thus, a sophisticated trading strategy should be implemented to minimize implicit transaction costs such as slippage.10) In this respect, it is worth noting changes in the passive investment environment, and the relevant market players should build direct indexing-related capabilities and devise measures to deal with such changes.

Direct indexing can open up new opportunities in the passive investment market. Particularly, the expected effects of direct indexing would be greater in a market like Korea where many retail investors are participating and direct investment becomes ubiquitous. Investors’ greater preference for ETFs is also expected to help facilitate direct indexing. But it is notable that direct indexing is managed by investors themselves, probably leading to an excessive risk-seeking behavior and that it cannot always outperform the market return. Accordingly, it is desirable to conduct extensive research into index investing and promote public awareness of its characteristics.

1) Oliver Wyman forecasts that the AUM of direct indexing will rise to about $1.5 trillion in five years from $350 billion reported in 2020. Cerulli Associates projects that direct indexing will achieve an annual growth rate of 12.4%, surpassing that of ETFs (11.3%) and mutual funds (3.3%).

2) See Lee, H.Y. (2022).

3) Doomoolmori has launched the first direct indexing business in Korea (www.doomoolmori.com).

4) This figure has been derived from direct indexing data compiled through SMAs, the customized asset management account (Oliver Wyman, 2021).

5) See Samsung Securities (2021).

6) Financial Times, 2021.7.14, Vanguard makes first acquisition with JustInvest deal.

7) A factor means various key aspects based on which the total investment portfolio is classified, including the size, value, quality and dividend of a company.

8) The liquidity mismatch between ETFs and real assets originally means low liquidity of real assets and high liquidity of ETFs. But in this article, it refers to the opposite case (low liquidity of ETFs).

9) Although the number of stocks held by investors does not correspond with the size of investment, these two variables are highly correlated. According to the press release of the Korea Securities Depository (regarding the net worth of retail individuals investing in listed corporations as of December 2020), the number of investors with a net worth of KRW 100 million to 1 billion grew the most in 2020, compared with the 2019 figure.

10) Slippage refers to the difference between the expected price of a trade and the executed price. When a strategy of tracking a certain index is tested, a benchmark price, arbitrarily set for calculation of returns on component stocks of the index (ex. an initial price or closing price), may be different from the price at which the strategy is put into action. If there may be insufficient trading volume or high price volatility, implicit transaction costs could arise from slippage.

References

Cerulli Associates, 2021, Improving Client Experience: Customizing with Direct Indexing.

Chaudhuri, S.E., Burnham, T.C., Lo, A.W., 2020, An empirical evaluation of tax-loss-harvesting alpha, Financial Analysts Journal 76(3), 99-108.

Moss, A., Naughton, J.P., Wang, C., 2020, The irrelevance of ESG disclosure to retail investors: Evidence from Robinhood, Working Paper.

Oliver Wyman, 2021, Competing For Growth.

Sosner, N., Gromis, M. Krasner S., 2021, The tax benefits of direct indexing, and How they are affected by the Biden tax plan, Journal of Index Investing, Forthcoming.

[Korean]

Kim, M.K. & Kim. J.S., 2021, Retail investors in the face of the Covid-19 crisis: Investor behaviors and performance, Korea Capital Market Institute Issue Paper 21-11.

Samsung Securities, 2021, Direct (Bespoke) Indexing.

Lee, H.Y., 2022, Direct indexing service: Current state and prospects, Asset Management Review 10(1), 71-82.

Direct indexing refers to an approach that enables benchmark indexing based on investment preference and purposes and directly managing individual component stocks within an index through an investor’s account. With this approach, investors can build customized portfolios that cannot be covered by an existing index fund. They can also seek long-term returns with fewer unnecessary transactions as their assets are passively managed. Amid the growing popularity of passive investing and direct investment, direct indexing is expected to achieve remarkable growth.1) Against this backdrop, this article intends to examine how direct indexing, a new paradigm in passive investing, has spread in the market, and to explore its current state and expected effects.

Emergence and rise of direct indexing

From the long-term perspective, the rise of direct indexing can be explained by the rapid growth of passive investing, the so-called passive revolution, and the increase in personalized asset management services. In an efficient market, investors cannot beat the market and even active fund managers who are deemed to have greater information and capabilities than retail investors hardly achieve after-fee returns that surpass the market return. As this phenomenon has repetitively occurred, passive investing has taken hold rapidly. During this process, the market has seen sharp growth in ETFs designed for low-cost investment in diversified portfolios. As EMPs (ETF Managed Portfolios), a low-cost customized investment advisory service using robo-advisors, have been widely offered since the 2010s, demand for customized asset management has surged. Over the long run, direct indexing seems to follow the same trajectory as such a growth trend.

Direct indexing has originated from an investment service provided by firms such as Parametric and Aperio Group. Initially, such firms made up portfolios tailored for a handful of high net-worth individuals holding an SMA (Separated Managed Account) in the US market. Back then, the service mainly focused on a tax-loss harvesting strategy through loss deduction and loss carry-forward in order to minimize capital gains tax for investors in the US market. To this end, they added a trading strategy designed to track an index by investing in individual stocks and to reduce capital gains tax. In the past, only high net-worth individuals were able to realize economies of scale through direct indexing because of higher transaction fees and bigger account minimums required for owning an entire index.

Since then, the competition for zero-commission trading among retail brokerages, such as Charles Schwab and Robinhood, and the rise of fractional trading have paved the ground for small investors to have access to direct indexing. In addition, it is possible to effectively analyze a vast amount of information and respond to demand from various customers thanks to improvements in IT infrastructure and automation technology, which has made direct indexing widely accepted in the market. In other words, a shift to passive investing, the increasing ubiquity of customized services and the environment allowing every investor to enjoy a direct indexing service have contributed to the expansion of direct indexing.

Current state and characteristics of direct indexing services

As illustrated in Figure 1, direct indexing services are mainly structured around platforms, index providers, brokerage firms and clients.2) A direct indexing platform plays a key role in the service while an index provider and a brokerage firm contribute to the delivery of the service. In terms of index provision, it is possible to use the one offered by existing index providers but direct indexing platforms also could develop their own indexes. Direct indexing service providers present a customized portfolio (or index) and test results after analyzing a client’s preference or investment propensity based on the information collected from the client and platform data. If the client decides to invest in the index, the trading order is executed by a brokerage firm linked to the service provider. A change in portfolio composition, or a deposit or withdrawal regarding investment funds may give rise to rebalancing activities. Furthermore, the client can keep investing in the selected index by using fractional trading and the API service offered by brokerage firms, regardless of the size of investment assets. The operation of such a platform necessitates the collection and management of a vast amount of individual stock-level information, optimized portfolios and test modules.

Korea is still in its early stage of direct indexing as a fintech startup3) has just launched Korea’s first direct indexing investment platform for retail investors. As mentioned above, direct indexing has grown in popularity, especially in the US market. The AUM of direct indexing in the US is estimated at nearly $350 billion as of the first quarter of 2021.4) Key market participants have recognized the growth potential of direct indexing within the passive investment market and are competing to gain a bigger market share by taking over relevant business entities.5) It is especially notable that Vanguard, an asset management firm that launched the world’s first index fund, signed its first acquisition with direct indexing solution developer JustInvest in its history of 46 years, which offers significant implications for the industry.6)

The response to direct indexing varies by business category as follows. Firms primarily dealing with retail investors like Charles Schwab are offering various direct investment services and one of the services is direct indexing (Schwab Personalized Indexing). Also, Charles Schwab acquired Motif, a direct indexing firm in June 2020 to sophisticate its tax-saving strategy. After a failure to gain a presence in the passive investment market, Morgan Stanley bought Eaton Vance—the parent company of Parametric that has provided a direct indexing service in the US for the longest period—for approximately $7 billion. This move aims at securing dominance in the passive investment market monopolized by BlackRock and Vanguard. BlackRock and Vanguard are also properly adjusting to changes in the passive investment market by taking over Aperio Group and JustInvest, respectively. Schwab Personalized Indexing charges a service fee of 0.35%, higher than ordinary ETF fees but lower than what active funds charge.

In the US, direct indexing services provided by major financial investment firms can be largely categorized into tax-saving and personalized index investing. In particular, tax-saving is a core service provided by all direct indexing firms and can be characterized by strategic tax-loss harvesting for minimizing capital gains tax arising out of stock investment. Tax-loss harvesting is a strategy of selling a stock that has lost value and buying another stock similar to the ones within an index in order to minimize realized gains by summing up gains and losses arising from the sale of assets. It has been found to yield excess gains ranging from 0.82% to 1.08% (Chaudhuri et al., 2020), and direct indexing has been verified as a tool of realizing such gains (Sosner et al., 2021).

Offering a personalized index is somewhat similar to the direct indexing service launched in Korea and generally, personalized indexes are constructed in the form of a mixture of a factor7) and ESG. On top of that, direct indexing enables screening of certain business types or firms and also allows modifying an index through a change in the weight of stocks within the same index. Notably, considering that retail investors tend to show indifference to EGS matters (Moss et al., 2020), major overseas direct indexing services try to facilitate ESG investment by individuals by adding a wide range of ESG options to the creation of personalized indexes.

Benefits and expected effects of direct indexing

One of the biggest perks of direct indexing is that it could personalize investment strategies without any barriers. While robo-advisors provide ETF portfolios tailored for investors’ risk appetite, direct indexing enables them to build and manage an index that meets their various needs through a portfolio made up of individual stocks, thereby allowing more flexible passive investment. For instance, an investor who works in the semiconductor industry can lower the weight of semiconductor stocks in the index to gain a balance between labor income and investment income. Furthermore, investors can reduce the weight of stocks that are affected by vulnerable corporate governance or relatively overvalued by using data provided by direct indexing platforms. With this approach, they can engage in passive investing by tracking an enhanced index against a benchmark (Figure 2). In addition, it is possible to construct a portfolio comprised of stocks other than major market indexes such as KOSPI 200, and a benchmark index can also be created by incorporating foreign stocks, instead of domestic ones.

Such customization techniques of direct indexing can help overcome weaknesses of the ETF market. Although various types of ETFs have recently been launched including thematic or active ETFs, they cannot be viewed as a customized portfolio. In principle, ETF investors have to buy ETFs offered by fund management firms. And in some cases, the stocks they want to invest in may not be found among listed ETFs and even if an investor finds a similar ETF listed on the exchange, it may have lower trading volume. Figure 3 shows the top 25% and bottom 25% of the monthly trading turnover ratio for Korea’s listed ETFs, indicating a wider gap in liquidity between ETFs. Among listed ETFs, the bottom 25% in the monthly trading turnover ratio is 5%, which is hardly traded in the market. This means an investor may not invest in a certain index because of the unavailability of relevant products or a severe liquidity mismatch8) between individual stocks incorporated into ETFs. In this case, direct indexing allows the investor to construct an index comprised of relatively easy-to-trade stocks and invest in the index.

On top of that, direct indexing can contribute to expanding the passive investment ecosystem and creating synergies between different business categories. Notably, it takes considerable time to launch new ETFs and implement listing evaluation and new entrants may face difficulties in advancing into the market already dominated by large fund managers. Under the circumstances, direct indexing would be able to make the passive investment ecosystem more flexible. Additionally, direct indexing platforms could be utilized by investment consulting firms, securities firms as well as asset managers across the entire financial investment industry. If coupled with consulting capabilities offered by investment consulting firms and automatic trading technology like the API of brokerage firms, direct indexing has the potential of becoming a useful passive investing solution.

Lastly, direct indexing is expected to improve the behaviors of retail investors for the mid- and long-term. Kim & Kim (2021) show that retail investors in Korea tend to engage in excessive trading, risk-seeking behaviors and less diversified investment and these aspects are especially prominent among those who first participated in the stock market during the Covid-19 crisis. If combined with fractional trading in Korea, direct indexing is likely to address chronic investor behaviors by enabling investors to build diversified portfolios, regardless of the size of investment assets, and by curtailing unnecessary transactions through passive investing strategies.

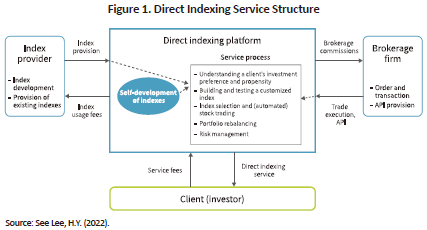

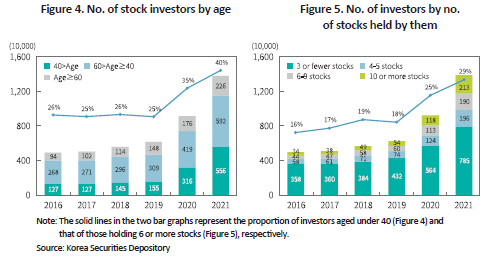

Amid a boom in stock trading during the Covid-19 pandemic, many retail investors newly entered the market. Among them, Generation MZ represents a high proportion and those holding assets over a certain size have been on the rise. As demonstrated by Figure 4, investors aged under 40 accounted for 40% of the total as of end-2021, up from a 25% proportion prior to the outbreak of Covid-19 (as of 2019). Also, the proportion of the group investing in six (or ten) or more stocks has increased most rapidly, compared to other groups (Figure 5).9) It is worth considering that investors with a larger asset holding are more likely to show higher demand for diversified portfolios. Also notable is that Generation MZ is tech-savvy and prefers using an online trading platform so that they could be potential users of direct indexing services. If newcomers unfamiliar with stock investment are informed of the benefits of passive investing and how direct indexing works, they are likely to avoid ineffective investment habits and enhance long-term returns.

Lastly, direct indexing is expected to improve the behaviors of retail investors for the mid- and long-term. Kim & Kim (2021) show that retail investors in Korea tend to engage in excessive trading, risk-seeking behaviors and less diversified investment and these aspects are especially prominent among those who first participated in the stock market during the Covid-19 crisis. If combined with fractional trading in Korea, direct indexing is likely to address chronic investor behaviors by enabling investors to build diversified portfolios, regardless of the size of investment assets, and by curtailing unnecessary transactions through passive investing strategies.

Conclusion

Direct indexing can open up new opportunities in the passive investment market. Particularly, the expected effects of direct indexing would be greater in a market like Korea where many retail investors are participating and direct investment becomes ubiquitous. Investors’ greater preference for ETFs is also expected to help facilitate direct indexing. But it is notable that direct indexing is managed by investors themselves, probably leading to an excessive risk-seeking behavior and that it cannot always outperform the market return. Accordingly, it is desirable to conduct extensive research into index investing and promote public awareness of its characteristics.

1) Oliver Wyman forecasts that the AUM of direct indexing will rise to about $1.5 trillion in five years from $350 billion reported in 2020. Cerulli Associates projects that direct indexing will achieve an annual growth rate of 12.4%, surpassing that of ETFs (11.3%) and mutual funds (3.3%).

2) See Lee, H.Y. (2022).

3) Doomoolmori has launched the first direct indexing business in Korea (www.doomoolmori.com).

4) This figure has been derived from direct indexing data compiled through SMAs, the customized asset management account (Oliver Wyman, 2021).

5) See Samsung Securities (2021).

6) Financial Times, 2021.7.14, Vanguard makes first acquisition with JustInvest deal.

7) A factor means various key aspects based on which the total investment portfolio is classified, including the size, value, quality and dividend of a company.

8) The liquidity mismatch between ETFs and real assets originally means low liquidity of real assets and high liquidity of ETFs. But in this article, it refers to the opposite case (low liquidity of ETFs).

9) Although the number of stocks held by investors does not correspond with the size of investment, these two variables are highly correlated. According to the press release of the Korea Securities Depository (regarding the net worth of retail individuals investing in listed corporations as of December 2020), the number of investors with a net worth of KRW 100 million to 1 billion grew the most in 2020, compared with the 2019 figure.

10) Slippage refers to the difference between the expected price of a trade and the executed price. When a strategy of tracking a certain index is tested, a benchmark price, arbitrarily set for calculation of returns on component stocks of the index (ex. an initial price or closing price), may be different from the price at which the strategy is put into action. If there may be insufficient trading volume or high price volatility, implicit transaction costs could arise from slippage.

References

Cerulli Associates, 2021, Improving Client Experience: Customizing with Direct Indexing.

Chaudhuri, S.E., Burnham, T.C., Lo, A.W., 2020, An empirical evaluation of tax-loss-harvesting alpha, Financial Analysts Journal 76(3), 99-108.

Moss, A., Naughton, J.P., Wang, C., 2020, The irrelevance of ESG disclosure to retail investors: Evidence from Robinhood, Working Paper.

Oliver Wyman, 2021, Competing For Growth.

Sosner, N., Gromis, M. Krasner S., 2021, The tax benefits of direct indexing, and How they are affected by the Biden tax plan, Journal of Index Investing, Forthcoming.

[Korean]

Kim, M.K. & Kim. J.S., 2021, Retail investors in the face of the Covid-19 crisis: Investor behaviors and performance, Korea Capital Market Institute Issue Paper 21-11.

Samsung Securities, 2021, Direct (Bespoke) Indexing.

Lee, H.Y., 2022, Direct indexing service: Current state and prospects, Asset Management Review 10(1), 71-82.