1자본시장과 금융투자업에 관련된 주요 이슈를 분석하고 최신 동향을 제공하는 격주간지

Summary

In 2024, the securities industry is projected to witness profitability improvements in key business segments, buoyed by higher economic growth rates and government policies aimed at stimulating the stock market. The brokerage segment is expected to benefit from increased trading value, fueled by expectations of economic recovery and stock market revitalization policies, leading to revenue growth. Despite potential losses associated with real estate project financing (PF), investment banking is poised for improvements, particularly in IPOs and M&A deals, supported by an expected recovery in economic activities and a relaxation of the high-interest rate regime. Proprietary trading may face lower revenue due to a slowdown in the issuance of equity linked securities (ELS) and derivatives linked securities (DLS), while the asset management segment is likely to see steady financial improvement, driven by growing demand for non-face-to-face asset management services and the expansion of retirement pensions.

Key challenges faced by the Korean securities industry in 2024 include real estate failures and losses from ELS linked to the Hong Kong Hang Seng Index (HSCEI). Structural changes such as the persistent medium to high-interest rate regime, accelerated digital finance, and increasing demand for ELS finance will also influence the industry. If the financial distress of real estate PF intensifies, it could result in greater losses for securities firms and heightened volatility in the bond market. This crisis necessitates not only short-term measures to increase provisions and manage liquidity risk but also medium to long-term efforts to lower exposure to PF. To deal with a potential reduction of HSCEI-linked ELS sales, securities firms must diversify financing channels and curtail the proportion of high-risk bond trading. Moreover, they should prepare for structural changes such as the persistence of the mid to high-interest rate regime by reinforcing corporate finance capabilities and expanding customized asset management services. Additionally, the entire securities industry should explore how to efficiently utilize and promote generative AI and security tokens to adapt to the acceleration of digital finance. It is also essential to develop, offer brokerage services to, and invest in various ESG financial instruments to meet the demand for ESG finance.

Key challenges faced by the Korean securities industry in 2024 include real estate failures and losses from ELS linked to the Hong Kong Hang Seng Index (HSCEI). Structural changes such as the persistent medium to high-interest rate regime, accelerated digital finance, and increasing demand for ELS finance will also influence the industry. If the financial distress of real estate PF intensifies, it could result in greater losses for securities firms and heightened volatility in the bond market. This crisis necessitates not only short-term measures to increase provisions and manage liquidity risk but also medium to long-term efforts to lower exposure to PF. To deal with a potential reduction of HSCEI-linked ELS sales, securities firms must diversify financing channels and curtail the proportion of high-risk bond trading. Moreover, they should prepare for structural changes such as the persistence of the mid to high-interest rate regime by reinforcing corporate finance capabilities and expanding customized asset management services. Additionally, the entire securities industry should explore how to efficiently utilize and promote generative AI and security tokens to adapt to the acceleration of digital finance. It is also essential to develop, offer brokerage services to, and invest in various ESG financial instruments to meet the demand for ESG finance.

Summary of profitability in the securities industry for the year 2023

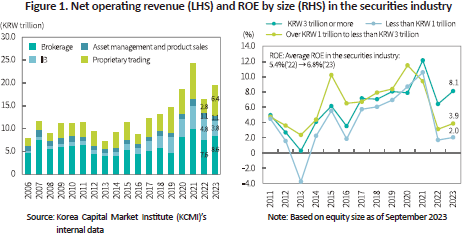

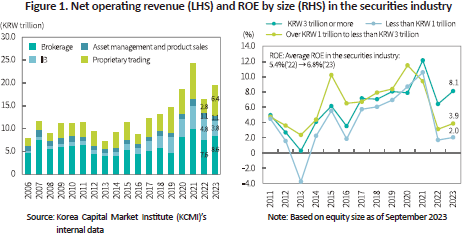

In 2023, despite rising market interest rates and an economic slowdown, the securities industry saw a rise in operating profits and Return on Equity (ROE) compared to the previous year. This growth was fueled by efforts to boost revenue in key business sectors (Figure 1). The net operating profit of Korean securities firms in 20231) climbed by 18.6% year-on-year (YoY), reaching KRW 19.4 trillion, a substantial increase from KRW 16.3 trillion in 2022. The average ROE for securities firms stood at 6.8%, reflecting a 1.4 percentage point improvement from 5.4% in 2022. By business sector, brokerage (44.3%), proprietary trading (33.1%), investment banking (17.0%), and asset management (5.7%) made significant contributions to the net operating revenue of securities firms. Notably, the net operating revenue in brokerage surged to KRW 8.6 trillion, representing a KRW 1 trillion increase from the previous year, driven by greater participation of retail investors in stock trading. The proprietary trading segment also demonstrated robust performance, recording KRW 6.4 trillion in net operating revenue, a surge of KRW 3.6 trillion driven by increased bond trading revenue amid declining market interest rates at the end of 2023. Conversely, net operating revenue in investment banking (IB) amounted to KRW 3.3 trillion, a decrease of KRW 1.5 trillion attributed to rising provisions for real estate project financing (PF) debt guarantees and a sluggish Initial Public Offering (IPO) market. An analysis of ROE by the size of securities firms reveals that large firms with equity exceeding KRW 3 trillion achieved a robust ROE of 8.1%, while medium and small-sized firms posted lower ROEs of 3.9% and 2.0%, respectively, primarily due to the real estate PF crisis.

Outlook for business segments in 2024

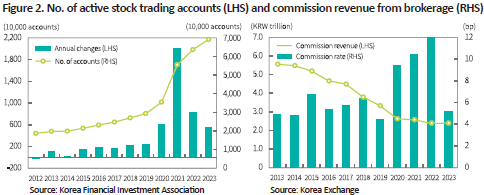

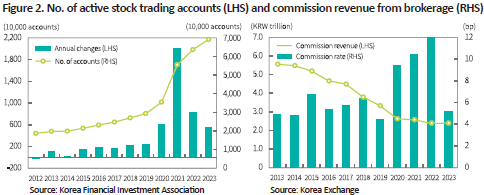

In 2024, the brokerage segment is expected to see improvement compared to 2023, buoyed by prospects of economic recovery and government policies aimed at stimulating the stock market. According to Korea Capital Market Institute (KCMI 2024a), Korea’s economic growth rate is projected to reach 1.9%, up from the previous year’s expected 1.4%. The Korean government has unveiled plans to eliminate the financial investment income tax and significantly enhance support for Individual Savings Accounts (ISAs), while also amending the current Commercial Act to better safeguard the interests of minority shareholders. With these government policies, coupled with the effects of surplus household assets, retail investors are increasingly participating in the capital market, which is expected to steadily bolster revenue for securities firms in the brokerage segment. As of the end of 2023, the number of active stock trading accounts continues to rise, reaching 69.3 million, and despite heightened competition for brokerage business among securities firms, the average brokerage commission rate in the securities industry has remained stable at 0.04% (Figure 2). In 2024, increasing demand for foreign direct investment, driven by the Fed’s interest rate cut and the listing of security tokens in Korea, will provide opportunities to further enhance brokerage business in the securities industry.

Proprietary trading is anticipated to face challenges in 2024, primarily stemming from a potential reduction in the issuance of equity linked securities (ELS) and derivatives linked securities (DLS) and the risk of rate hikes.2) Should this scenario materialize, market interest rate volatility is expected to persist at high levels, raising the possibility of a decline in revenue associated with bond trading. The Hong Kong Hang Seng Index (HSCEI), which has fallen by over 50% from its peak over the past three years, is forecasted to result in an estimated investment loss ranging from approximately KRW 4 to 6 trillion for investors in HSCEI-linked ELS in 2024.3) A significant concern emerges from the sale of HSCEI-linked ELS, where financial institutions may fail to adequately explain associated risks or may target investors who are not capable of tolerating potential losses. Consequently, the government is poised to impose stricter regulations on the sale of ELS through banking channels. If ELS and DLS sales decrease, securities firms engaged in designing and hedging these products may suffer a substantial reduction in revenue from proprietary trading. If market interest rates remain volatile due to the risk of rate hikes, securities firms may face heightened profit and loss volatility in bond trading. As of the end of September 2023, bond holdings of securities firms amount to KRW 290 trillion.4) With a bond holding duration of two years, a 100-basis point increase in market interest rates could lead to an estimated industry-wide valuation loss of approximately KRW 5.8 trillion.

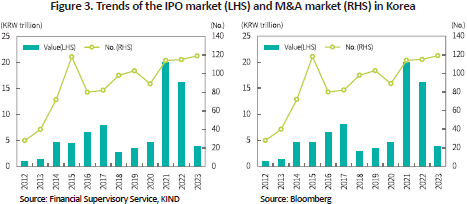

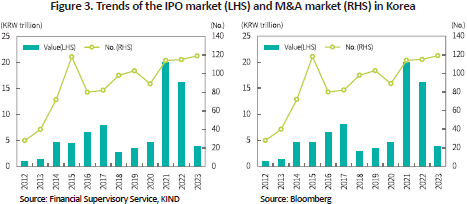

As the economy rebounds from the slowdown in 2023 and a relaxation in domestic and global high-interest rate regimes is anticipated, the IB segment is poised for financial improvements, especially in IPOs and M&A activities. In 2023, a decline in corporate valuations and a lack of large-scale deals substantially reduced the size of IPOs, driven by concerns about rising market interest rates and an economic slowdown (Figure 3). The domestic and global M&A markets witnessed a modest decline in transaction size, attributed to heightened geoeconomic risks and increased financing costs resulting from rate hikes. Amid expectations of economic recovery in 2024, several large IPOs and M&A deals that did not materialize in 2023 are highly likely to be carried out. Moreover, the rate cut by the US Fed is expected to contribute to the restoration of corporate valuations. In particular, the growing demand for large deals in the fields of artificial intelligence (AI) and environmental sustainability will increase both the size and number of transactions in the M&A market.

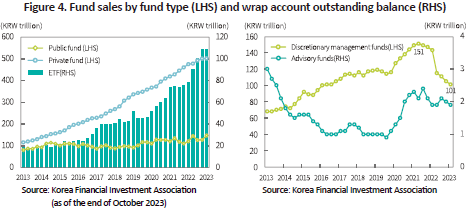

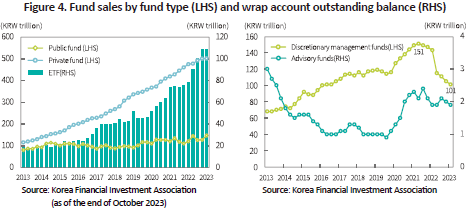

The asset management segment is anticipated to make steady improvements, driven by the widespread adoption of non-face-to-face asset management services and the growing volume of retirement pensions. In 2023, the sale of private funds climbed on the back of increased demand for personalized asset management services, and sales of exchange traded funds (ETFs) surged thanks to their low costs and global diversification benefits. Regarding public funds, their sales became sluggish in 2023, and the growth of securities wrap accounts and money trusts slowed down due to the preference for safer assets amid rising market interest rates. In 2024, with the anticipated recovery of both domestic and global economies, sales of private and public funds, wrap accounts, and money trusts are likely to achieve robust growth, propelled by the expansion of personalized asset management services and retirement pensions. However, it is essential to address unethical business practices observed during the management process of bond-type wrap accounts and money trusts in 2023. Also necessary are customized products that cater to customer preferences, aiming to restore credibility in the securities industry’s asset management business.

Key issues and challenges for the securities industry in 2024

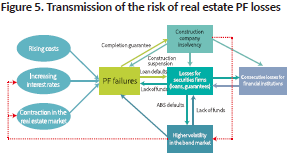

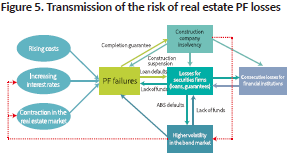

The expectations of improved economic growth and a potential shift from the high-interest rate regime present a positive outlook for the securities industry. However, it is worth noting that the deterioration of real estate PF could result in massive losses for securities firms. Furthermore, it could transfer the losses from real estate PF exposure to construction companies and non-banking institutions and intensify volatility in the bond market, thereby potentially hurting the revenue of proprietary trading in the securities industry (Figure 5). Given that rising commodity prices, high market interest rates, and a sluggish real estate market contributed to a decline in the value of major PF projects by 30% to 40%, securities firms with significant exposure to bridge loans and subordinated PF debt guarantees are likely to face increased risk of confirmed losses from their exposure to real estate PF. Hence, securities firms need to proactively raise provisions and enhance liquidity risk management by addressing short and long-term mismatches before real estate PF failures materialize. As the risk of real estate PF debt guarantees is likely to increase over the long run, the securities industry should make concerted efforts to reduce exposure to bridge loans, PF debt guarantees, and other PF exposures.

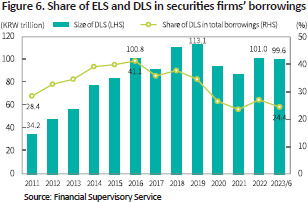

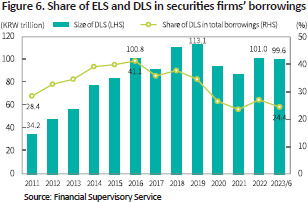

In addition, significant losses are expected from HSCEI-linked ELS in 2024, leading to a reduction in sales of ELS and DLS products, which have historically been a major revenue source for the securities industry. According to the Financial Supervisory Service (2024), the sales volume of HSCEI-linked ELS, set to mature in 2024, amounts to KRW 15.4 trillion, and assuming that the HSCEI maintains its current levels, investors in these ELS are expected to suffer losses ranging from KRW 4 to 6 trillion. HSCEI-linked ELS have primarily been sold through banking channels and thus, securities firms have been supplying such ELS to bank trusts. Accordingly, if ELS sales by banks contract due to mis-selling practices, securities firms would inevitably curtail their issuance of ELS and DLS. This presents a significant concern as funds raised by securities firms through the issuance of ELS and DLS account for 25% to 40% of their total borrowings. Consequently, a reduction in the ELS and DLS issuance may increase the funding risk for securities firms (Figure 6). Notably, they have incorporated considerable amounts of specialized credit finance bonds into their ELS and DLS hedging. The contraction of the ELS and DLS issuance could dampen demand for the purchase of specialized credit finance bonds, thereby intensifying volatility in prices of these bonds and other high-risk corporate bonds. To prepare for the contraction of ELS and DLS issuance, securities firms should diversify their funding sources into ELB, DLB, the sale of RP, CP, and corporate bills. Additionally, efforts should be put into reducing exposure to specialized credit finance bonds and other high-risk corporate bonds, aiming for managing the risk from ELS and DLS hedging.

In addition to pressing issues including burgeoning real estate PF failures and the reduction of ELS sales, structural changes in the macro-financial environment, such as the persistence of mid-to-high interest rates, the acceleration of digital finance, and the growing demand for ELS financing, pose major challenges for the securities industry in 2024.

First, Korea Capital Market Institute (2024a) forecasts that the prolonged low-interest, low-inflation regime since the 2008 global financial crisis will give way to the mid-to-high interest rate, mid-inflation regime in 2024. Although the Fed’s high-interest rate stance is anticipated to moderate to some degree, market interest rates are projected to remain at a relatively higher level due to demographic changes and rising equilibrium interest rates arising from deglobalization. In light of these prospects, the securities industry needs to proactively overhaul mid to long-term business strategies geared toward the low-interest rate regime. Initially, securities firms should mitigate exposure to high-risk proprietary trading and alternative investments while increasing the proportion of low-risk interest income. Specifically, it is essential to expand corporate finance services tailored to the mid-to-high interest rate landscape and reinforce structuring capabilities to boost revenue during periods of high interest rates and stock volatility. In response to the rising demand for direct investing of household and corporate surplus assets, they also should enhance their capabilities in personalized asset management services and outsourced chief investment officer (OCIO) services for ordinary corporations.

Second, the securities industry is expected to undergo structural changes driven by advancements in generative AI and blockchain technology. It is anticipated to actively embrace innovative services based on generative AI, as manufacturing and service industries are poised for productivity enhancement following the introduction of ChatGPT in 2023. However, it should be noted that AI-driven productivity gains come with associated costs and risks during the development and implementation process. As new generative AI models require considerable time and costs before being commercialized, financial institutions in the US and India have engaged in a race to secure talent with relevant expertise. In terms of economies of scale, this trend may increase industrial dependence on a few leading technology companies. Even after the successful development of AI models, there remain concerns about financial customer damages and legal liabilities arising from private information leaks and false information generation. In addition to generative AI, the proliferation of blockchain can be another driving force for the digitalization of the financial services industry. As the recent approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC) has heightened investor interest in virtual assets5), the utilization of blockchain and distributed ledger technology is not limited to financial investment business. Particularly, market participants take the initiative in enhancing the efficiency of Financial Market Infrastructure (FMI) through the use of distributed ledger technology.6) In response to these developments, supervisory authorities are expected to put more effort into market surveillance and regulatory improvements.

Third, as the global climate crisis escalates, Environmental, Social and Governance (ESG) finance is likely to become increasingly critical. To comply with its Nationally Determined Contribution (NDC) under the Paris Agreement, Korea should initially target a 40% reduction in greenhouse gas emissions by 2030 and then, achieve carbon neutrality by 2050. With only six years remaining to meet the first target, it should adjust its energy mix and encourage domestic companies to transition to a low-carbon production structure, which entails extensive investments in green technologies. In 2023, the European Commission introduced the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage arising from regulatory disparities between carbon-emitting countries. The CBAM applies to sectors including iron and steel, aluminum, cement, fertilizers, electricity, and hydrogen, requiring Korean companies engaging in these sectors to develop countermeasures. On top of that, more specific corporate ESG disclosures have been implemented. The International Sustainability Standards Board (ISSB), an independent standard-setting body within the International Financial Reporting Standards (IFRS), finalized and released sustainability disclosure standards for listed companies in 2023. Korea will adopt its ESG disclosure standards based on the ISSB standards. As climate changes call for immediate action amid the growing significance of ESG, there is an increasing demand for the financial services industry and financial regulatory authorities in Korea to play a pivotal role in boosting the domestic ESG financial market. Above all, domestic securities firms need to devise various financial instruments to support the transition to a low-carbon production structure in response to ESG-related regulations faced by domestic companies. These instruments encompass brokerage services in the ESG bond market as well as identifying, evaluating, investing in, and merging or acquiring eco-friendly technology companies, which are integral to securities firms’ core business activities. Korean asset management companies should design ESG funds to facilitate ESG investing among retail and institutional investors, while also enhancing the credibility of such funds. Lastly, both the private sector and the government, including financial authorities, must take part in advancing ESG finance. It is worth exploring a wide range of policies to promote ESG finance, such as covering costs for ESG bond issuers, providing tax incentives for ESG investors, and developing public-private ESG investment funds.

Conclusion

In 2024, the securities industry is anticipated to experience profitability improvements in brokerage, IB, and asset management segments, buoyed by prospects for higher economic growth rates and government policies aimed at revitalizing the stock market. However, it should be noted that a further slowdown in the real estate market may lead to potential losses arising from real estate PF, and a reduction in the ELS and DLS issuance could translate into a decline in revenue from proprietary trading. If the financial distress of real estate PF intensifies, it could result in greater losses for securities firms and heightened volatility in the bond market, necessitating not only short-term measures to increase provisions and manage liquidity risk but also medium to long-term efforts to lower exposure to PF. To deal with a potential contraction of HSCEI-linked ELS sales, securities firms must diversify financing channels and curtail the proportion of high-risk bond trading. Moreover, they should prepare for structural changes such as the persistence of the mid to high-interest rate regime, by reinforcing corporate finance capabilities and expanding customized asset management services. Additionally, the securities industry should explore how to efficiently utilize and promote generative AI and security tokens to adapt to the acceleration of digital finance. It is also essential to develop, offer brokerage services to, and invest in various ESG financial instruments to meet the demand for ESG finance.

1) The data for 2023 has been compiled by aggregating financial data from Q4 2022 to Q3 2023, as the financial statements for Q4 2023 are not yet available.

2) See KCMI (2024a)

3) See Financial Supervisory Service (2024)

4) See Bank of Korea’s economic statistics system

5) Reuters (January 11, 2024)

6) In 2023, various experiments were carried out to improve the efficiency of securities finance transactions (JSFC and Tanaka Lab, 2023), establish connection independent blockchain networks (SWIFT, 2023), and enhance the efficiency of asset transaction infrastructure (DTCC, Clearstream, Euroclear, 2023).

References

DTCC, Clearstream, Euroclear, 2023. 9, Advancing the Digital Asset Era, Together.

Japan Securities Finance Co. Ltd. & Takana Laboratory, University of Tokyo, 2023. 5, Empirical Research on Securities Finance Transactions using Distributed Ledger Technology.

Reuters, 2024. 1. 11, US SEC approves bitcoin ETFs in watershed for crypto market

SWIFT, 2023. 8, Connecting blockchains: Overcoming fragmentation in tokenized assets.

[Korean]

Financial Supervisory Service, January 7, 2024, Spot inspection on major distributors of ELS linked to Hong Kong Hang Seng Index, press release.

Korea Capital Market Institute (2024a), Macroeconomic Outlook and Key Issues for 2024, KCMI policy seminar held on January 25, 2024.

Korea Capital Market Institute (2024b), Securities Industry: Outlook and Key Issues for 2024, KCMI policy seminar held on January 25, 2024.

In 2023, despite rising market interest rates and an economic slowdown, the securities industry saw a rise in operating profits and Return on Equity (ROE) compared to the previous year. This growth was fueled by efforts to boost revenue in key business sectors (Figure 1). The net operating profit of Korean securities firms in 20231) climbed by 18.6% year-on-year (YoY), reaching KRW 19.4 trillion, a substantial increase from KRW 16.3 trillion in 2022. The average ROE for securities firms stood at 6.8%, reflecting a 1.4 percentage point improvement from 5.4% in 2022. By business sector, brokerage (44.3%), proprietary trading (33.1%), investment banking (17.0%), and asset management (5.7%) made significant contributions to the net operating revenue of securities firms. Notably, the net operating revenue in brokerage surged to KRW 8.6 trillion, representing a KRW 1 trillion increase from the previous year, driven by greater participation of retail investors in stock trading. The proprietary trading segment also demonstrated robust performance, recording KRW 6.4 trillion in net operating revenue, a surge of KRW 3.6 trillion driven by increased bond trading revenue amid declining market interest rates at the end of 2023. Conversely, net operating revenue in investment banking (IB) amounted to KRW 3.3 trillion, a decrease of KRW 1.5 trillion attributed to rising provisions for real estate project financing (PF) debt guarantees and a sluggish Initial Public Offering (IPO) market. An analysis of ROE by the size of securities firms reveals that large firms with equity exceeding KRW 3 trillion achieved a robust ROE of 8.1%, while medium and small-sized firms posted lower ROEs of 3.9% and 2.0%, respectively, primarily due to the real estate PF crisis.

Outlook for business segments in 2024

In 2024, the brokerage segment is expected to see improvement compared to 2023, buoyed by prospects of economic recovery and government policies aimed at stimulating the stock market. According to Korea Capital Market Institute (KCMI 2024a), Korea’s economic growth rate is projected to reach 1.9%, up from the previous year’s expected 1.4%. The Korean government has unveiled plans to eliminate the financial investment income tax and significantly enhance support for Individual Savings Accounts (ISAs), while also amending the current Commercial Act to better safeguard the interests of minority shareholders. With these government policies, coupled with the effects of surplus household assets, retail investors are increasingly participating in the capital market, which is expected to steadily bolster revenue for securities firms in the brokerage segment. As of the end of 2023, the number of active stock trading accounts continues to rise, reaching 69.3 million, and despite heightened competition for brokerage business among securities firms, the average brokerage commission rate in the securities industry has remained stable at 0.04% (Figure 2). In 2024, increasing demand for foreign direct investment, driven by the Fed’s interest rate cut and the listing of security tokens in Korea, will provide opportunities to further enhance brokerage business in the securities industry.

Proprietary trading is anticipated to face challenges in 2024, primarily stemming from a potential reduction in the issuance of equity linked securities (ELS) and derivatives linked securities (DLS) and the risk of rate hikes.2) Should this scenario materialize, market interest rate volatility is expected to persist at high levels, raising the possibility of a decline in revenue associated with bond trading. The Hong Kong Hang Seng Index (HSCEI), which has fallen by over 50% from its peak over the past three years, is forecasted to result in an estimated investment loss ranging from approximately KRW 4 to 6 trillion for investors in HSCEI-linked ELS in 2024.3) A significant concern emerges from the sale of HSCEI-linked ELS, where financial institutions may fail to adequately explain associated risks or may target investors who are not capable of tolerating potential losses. Consequently, the government is poised to impose stricter regulations on the sale of ELS through banking channels. If ELS and DLS sales decrease, securities firms engaged in designing and hedging these products may suffer a substantial reduction in revenue from proprietary trading. If market interest rates remain volatile due to the risk of rate hikes, securities firms may face heightened profit and loss volatility in bond trading. As of the end of September 2023, bond holdings of securities firms amount to KRW 290 trillion.4) With a bond holding duration of two years, a 100-basis point increase in market interest rates could lead to an estimated industry-wide valuation loss of approximately KRW 5.8 trillion.

As the economy rebounds from the slowdown in 2023 and a relaxation in domestic and global high-interest rate regimes is anticipated, the IB segment is poised for financial improvements, especially in IPOs and M&A activities. In 2023, a decline in corporate valuations and a lack of large-scale deals substantially reduced the size of IPOs, driven by concerns about rising market interest rates and an economic slowdown (Figure 3). The domestic and global M&A markets witnessed a modest decline in transaction size, attributed to heightened geoeconomic risks and increased financing costs resulting from rate hikes. Amid expectations of economic recovery in 2024, several large IPOs and M&A deals that did not materialize in 2023 are highly likely to be carried out. Moreover, the rate cut by the US Fed is expected to contribute to the restoration of corporate valuations. In particular, the growing demand for large deals in the fields of artificial intelligence (AI) and environmental sustainability will increase both the size and number of transactions in the M&A market.

The asset management segment is anticipated to make steady improvements, driven by the widespread adoption of non-face-to-face asset management services and the growing volume of retirement pensions. In 2023, the sale of private funds climbed on the back of increased demand for personalized asset management services, and sales of exchange traded funds (ETFs) surged thanks to their low costs and global diversification benefits. Regarding public funds, their sales became sluggish in 2023, and the growth of securities wrap accounts and money trusts slowed down due to the preference for safer assets amid rising market interest rates. In 2024, with the anticipated recovery of both domestic and global economies, sales of private and public funds, wrap accounts, and money trusts are likely to achieve robust growth, propelled by the expansion of personalized asset management services and retirement pensions. However, it is essential to address unethical business practices observed during the management process of bond-type wrap accounts and money trusts in 2023. Also necessary are customized products that cater to customer preferences, aiming to restore credibility in the securities industry’s asset management business.

Key issues and challenges for the securities industry in 2024

The expectations of improved economic growth and a potential shift from the high-interest rate regime present a positive outlook for the securities industry. However, it is worth noting that the deterioration of real estate PF could result in massive losses for securities firms. Furthermore, it could transfer the losses from real estate PF exposure to construction companies and non-banking institutions and intensify volatility in the bond market, thereby potentially hurting the revenue of proprietary trading in the securities industry (Figure 5). Given that rising commodity prices, high market interest rates, and a sluggish real estate market contributed to a decline in the value of major PF projects by 30% to 40%, securities firms with significant exposure to bridge loans and subordinated PF debt guarantees are likely to face increased risk of confirmed losses from their exposure to real estate PF. Hence, securities firms need to proactively raise provisions and enhance liquidity risk management by addressing short and long-term mismatches before real estate PF failures materialize. As the risk of real estate PF debt guarantees is likely to increase over the long run, the securities industry should make concerted efforts to reduce exposure to bridge loans, PF debt guarantees, and other PF exposures.

In addition, significant losses are expected from HSCEI-linked ELS in 2024, leading to a reduction in sales of ELS and DLS products, which have historically been a major revenue source for the securities industry. According to the Financial Supervisory Service (2024), the sales volume of HSCEI-linked ELS, set to mature in 2024, amounts to KRW 15.4 trillion, and assuming that the HSCEI maintains its current levels, investors in these ELS are expected to suffer losses ranging from KRW 4 to 6 trillion. HSCEI-linked ELS have primarily been sold through banking channels and thus, securities firms have been supplying such ELS to bank trusts. Accordingly, if ELS sales by banks contract due to mis-selling practices, securities firms would inevitably curtail their issuance of ELS and DLS. This presents a significant concern as funds raised by securities firms through the issuance of ELS and DLS account for 25% to 40% of their total borrowings. Consequently, a reduction in the ELS and DLS issuance may increase the funding risk for securities firms (Figure 6). Notably, they have incorporated considerable amounts of specialized credit finance bonds into their ELS and DLS hedging. The contraction of the ELS and DLS issuance could dampen demand for the purchase of specialized credit finance bonds, thereby intensifying volatility in prices of these bonds and other high-risk corporate bonds. To prepare for the contraction of ELS and DLS issuance, securities firms should diversify their funding sources into ELB, DLB, the sale of RP, CP, and corporate bills. Additionally, efforts should be put into reducing exposure to specialized credit finance bonds and other high-risk corporate bonds, aiming for managing the risk from ELS and DLS hedging.

In addition to pressing issues including burgeoning real estate PF failures and the reduction of ELS sales, structural changes in the macro-financial environment, such as the persistence of mid-to-high interest rates, the acceleration of digital finance, and the growing demand for ELS financing, pose major challenges for the securities industry in 2024.

First, Korea Capital Market Institute (2024a) forecasts that the prolonged low-interest, low-inflation regime since the 2008 global financial crisis will give way to the mid-to-high interest rate, mid-inflation regime in 2024. Although the Fed’s high-interest rate stance is anticipated to moderate to some degree, market interest rates are projected to remain at a relatively higher level due to demographic changes and rising equilibrium interest rates arising from deglobalization. In light of these prospects, the securities industry needs to proactively overhaul mid to long-term business strategies geared toward the low-interest rate regime. Initially, securities firms should mitigate exposure to high-risk proprietary trading and alternative investments while increasing the proportion of low-risk interest income. Specifically, it is essential to expand corporate finance services tailored to the mid-to-high interest rate landscape and reinforce structuring capabilities to boost revenue during periods of high interest rates and stock volatility. In response to the rising demand for direct investing of household and corporate surplus assets, they also should enhance their capabilities in personalized asset management services and outsourced chief investment officer (OCIO) services for ordinary corporations.

Second, the securities industry is expected to undergo structural changes driven by advancements in generative AI and blockchain technology. It is anticipated to actively embrace innovative services based on generative AI, as manufacturing and service industries are poised for productivity enhancement following the introduction of ChatGPT in 2023. However, it should be noted that AI-driven productivity gains come with associated costs and risks during the development and implementation process. As new generative AI models require considerable time and costs before being commercialized, financial institutions in the US and India have engaged in a race to secure talent with relevant expertise. In terms of economies of scale, this trend may increase industrial dependence on a few leading technology companies. Even after the successful development of AI models, there remain concerns about financial customer damages and legal liabilities arising from private information leaks and false information generation. In addition to generative AI, the proliferation of blockchain can be another driving force for the digitalization of the financial services industry. As the recent approval of a Bitcoin ETF by the US Securities and Exchange Commission (SEC) has heightened investor interest in virtual assets5), the utilization of blockchain and distributed ledger technology is not limited to financial investment business. Particularly, market participants take the initiative in enhancing the efficiency of Financial Market Infrastructure (FMI) through the use of distributed ledger technology.6) In response to these developments, supervisory authorities are expected to put more effort into market surveillance and regulatory improvements.

Third, as the global climate crisis escalates, Environmental, Social and Governance (ESG) finance is likely to become increasingly critical. To comply with its Nationally Determined Contribution (NDC) under the Paris Agreement, Korea should initially target a 40% reduction in greenhouse gas emissions by 2030 and then, achieve carbon neutrality by 2050. With only six years remaining to meet the first target, it should adjust its energy mix and encourage domestic companies to transition to a low-carbon production structure, which entails extensive investments in green technologies. In 2023, the European Commission introduced the Carbon Border Adjustment Mechanism (CBAM) to prevent carbon leakage arising from regulatory disparities between carbon-emitting countries. The CBAM applies to sectors including iron and steel, aluminum, cement, fertilizers, electricity, and hydrogen, requiring Korean companies engaging in these sectors to develop countermeasures. On top of that, more specific corporate ESG disclosures have been implemented. The International Sustainability Standards Board (ISSB), an independent standard-setting body within the International Financial Reporting Standards (IFRS), finalized and released sustainability disclosure standards for listed companies in 2023. Korea will adopt its ESG disclosure standards based on the ISSB standards. As climate changes call for immediate action amid the growing significance of ESG, there is an increasing demand for the financial services industry and financial regulatory authorities in Korea to play a pivotal role in boosting the domestic ESG financial market. Above all, domestic securities firms need to devise various financial instruments to support the transition to a low-carbon production structure in response to ESG-related regulations faced by domestic companies. These instruments encompass brokerage services in the ESG bond market as well as identifying, evaluating, investing in, and merging or acquiring eco-friendly technology companies, which are integral to securities firms’ core business activities. Korean asset management companies should design ESG funds to facilitate ESG investing among retail and institutional investors, while also enhancing the credibility of such funds. Lastly, both the private sector and the government, including financial authorities, must take part in advancing ESG finance. It is worth exploring a wide range of policies to promote ESG finance, such as covering costs for ESG bond issuers, providing tax incentives for ESG investors, and developing public-private ESG investment funds.

Conclusion

In 2024, the securities industry is anticipated to experience profitability improvements in brokerage, IB, and asset management segments, buoyed by prospects for higher economic growth rates and government policies aimed at revitalizing the stock market. However, it should be noted that a further slowdown in the real estate market may lead to potential losses arising from real estate PF, and a reduction in the ELS and DLS issuance could translate into a decline in revenue from proprietary trading. If the financial distress of real estate PF intensifies, it could result in greater losses for securities firms and heightened volatility in the bond market, necessitating not only short-term measures to increase provisions and manage liquidity risk but also medium to long-term efforts to lower exposure to PF. To deal with a potential contraction of HSCEI-linked ELS sales, securities firms must diversify financing channels and curtail the proportion of high-risk bond trading. Moreover, they should prepare for structural changes such as the persistence of the mid to high-interest rate regime, by reinforcing corporate finance capabilities and expanding customized asset management services. Additionally, the securities industry should explore how to efficiently utilize and promote generative AI and security tokens to adapt to the acceleration of digital finance. It is also essential to develop, offer brokerage services to, and invest in various ESG financial instruments to meet the demand for ESG finance.

1) The data for 2023 has been compiled by aggregating financial data from Q4 2022 to Q3 2023, as the financial statements for Q4 2023 are not yet available.

2) See KCMI (2024a)

3) See Financial Supervisory Service (2024)

4) See Bank of Korea’s economic statistics system

5) Reuters (January 11, 2024)

6) In 2023, various experiments were carried out to improve the efficiency of securities finance transactions (JSFC and Tanaka Lab, 2023), establish connection independent blockchain networks (SWIFT, 2023), and enhance the efficiency of asset transaction infrastructure (DTCC, Clearstream, Euroclear, 2023).

References

DTCC, Clearstream, Euroclear, 2023. 9, Advancing the Digital Asset Era, Together.

Japan Securities Finance Co. Ltd. & Takana Laboratory, University of Tokyo, 2023. 5, Empirical Research on Securities Finance Transactions using Distributed Ledger Technology.

Reuters, 2024. 1. 11, US SEC approves bitcoin ETFs in watershed for crypto market

SWIFT, 2023. 8, Connecting blockchains: Overcoming fragmentation in tokenized assets.

[Korean]

Financial Supervisory Service, January 7, 2024, Spot inspection on major distributors of ELS linked to Hong Kong Hang Seng Index, press release.

Korea Capital Market Institute (2024a), Macroeconomic Outlook and Key Issues for 2024, KCMI policy seminar held on January 25, 2024.

Korea Capital Market Institute (2024b), Securities Industry: Outlook and Key Issues for 2024, KCMI policy seminar held on January 25, 2024.