Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Default Options and Target-Date Funds

Publication date Jan. 15, 2019

Summary

Low investment returns cause retirement plan participants to distrust the retirement pension system itself. That means that conservative investment does not guarantee the stability of the system. To address the structural problem that leads to low investment returns for retirement plans, it is critical to build a well-diversified portfolio aiming for long-term investment. What Korea can learn from experiences of developed countries is that participant education is a limited tool to increase efficiency in pension asset management. Under discussion is the adoption of default options as the most direct and effective tool. However, if a retirement plan offers a default option that includes a certain level of risky assets in the absence of participant investment direction, it is likely to face liability for investment losses. A relief from liability for investment losses should be thus given to a default setter. With such condition, a financial regulator needs to define and manage qualified default investment alternatives (QDIAs) which can be used as a default option. Although various types of investment strategies can be QDIAs, life-cycle funds such as target-date funds are expected to have competitive advantages over other investments considering the features of retirement plans. As steps in preparing for the adoption of default options, it is necessary to develop Korean-style target-date funds which suit local circumstances, especially in terms of sub-funds composition and glide path design, and to accumulate track records of managing such funds.

Introduction

A retirement pension scheme is a key component of a multiple pillar pension system to provide a steady stream of guaranteed income in retirement. Disappointingly, however, retirement plans in Korea earned returns of 1.88% last year, which means a reduction in the real value of the pension assets with taking inflation into account. Last year’s investment performance was due in large part to healthy returns of 6.58% for investment-linked retirement plans driven by a bull run in the stock market in 2017. On the other hand, annual returns were just 1.49% for retirement plans designed to protect the principal and interest of plan members, in which the majority of retirement pension assets are concentrated. Given the long-term nature of pensions, that is, compound accumulation, such low returns may not only weaken the intended function of a retirement plan to provide retirement income security, but also may result in a widespread distrust of the retirement pension system itself in the long term. An emphasis is placed on extremely safe investments in terms of building trust among participants in the pension system. But falling long-term returns, not short-term losses, are a real threat to pension asset management that we should be wary of.

Sharing this view, the Ministry of Employment and Labor (MOEL), the primary government body responsible for overseeing retirement plans, and the Financial Supervisory Service (FSS), which regulates and supervises pension asset management, have been pushing for a variety of policy support measures including deregulation so as to revitalize the retirement pension market where true market competition does not exist. Policy measures under discussion include the adoption of a trust-based funding structure for retirement plans,1) and the inclusion of default options in defined contribution (DC) plans, under which participants have control over investment decisions, to help plan participants make better decisions. A default option refers to an investment option that is automatically used if a participant in a plan does not give investment directions.

Against this backdrop, this article examines the current state and issues of retirement plan asset management to underscore the urgent need for Korea to adopt supplementary policy tools such as a retirement plan default option. And it explores how default investment options in retirement plans were introduced and took root successfully in such countries with well-developed pension systems as the United States and Australia. Considering the purpose of default options, the rise of life cycle or target-date funds that automatically rebalance the mix of assets on an ongoing basis is expected. Finally, this article concludes by providing recommendations on desirable institutional arrangements for Korea’s retirement pension system that has evolved from the severance pay scheme and is characterized by contract-based governance.

Importance of default options for retirement plans

Structurally low investment returns are the most urgent issue facing domestic retirement pension plans. Although financial asset returns may fluctuate depending on market conditions, listless investment performance is a structural issue that retirement plans have, not the result of short-term fluctuations. Investment-linked retirement plans represent less than 12% of retirement plans in Korea while guaranteed principal and interest plans have no choice but to offer a guaranteed rate of interest reflecting the low interest environment. As for defined benefit (DB) plans in particular, which comprise 66% of the retirement pension market, the proportion of guaranteed principal and interest plans reached nearly 95%. Consequently, DB plans are the biggest driver behind the decline in aggregate investment returns for retirement plans.

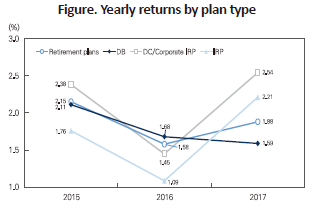

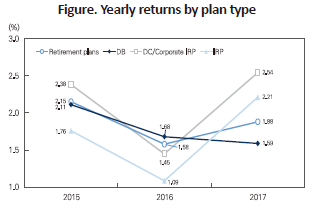

As the figure below shows, DB plans returned 1.59% in 2017, posting a continued drop from 2.11% in 2015. In contrast, DC plans with a relatively high proportion of investment-linked plans returned 2.54%.2) These findings confirm that investment-linked plans achieved higher returns, although moving up and down under different market conditions, when measured by long-term returns rather than annual returns given the nature of retirement plans as long-term investors.3) Aggregate returns for retirement plans exhibited similar pattern to returns for DB plans, which are the most prevalent type of plan, but seeing a slight rebound in 2017 thanks to the stock market boom. Aggregate retirement plan returns, however, are projected to decline again when the stock market slump in 2018 is reflected.

The private pension structure dominated by DB plans in Korea, in contrast to other countries, is attributed primarily to path dependency resulting from the severance pay system. Because a transition toward the retirement pension system has been led by large corporations until recently, DB plans similar to the previous severance pay scheme have constituted the majority of retirement plans. Small and medium sized enterprises (SMEs) are switching to the retirement pension system from the severance pay system at a faster pace, and thus DC plans are expected to increase rapidly. With DC plans, the share of guaranteed principal and interest plans is also very high while investment-linked plans that account for the rest of DC plans produced unsatisfactory returns. The primary reason for the low returns of investment-linked DC plans is the absence of long-term investment portfolios well-suited to pension funds due to indifference from plan participants and regulations over investment management.

According to retirement plan participant surveys conducted in 2014 and 2018 by Korea Financial Investment Association (KOFIA), only 31% DC plan members made investment choices for their own. The 2014 survey found 34% of respondents relied on recommendations from their plan sponsors, which is the biggest factor affecting the investment decisions of plan participants. But the 2018 survey found that this portion dropped to 16% and instead the portion of the plan members dependent on recommendations from plan providers rose significantly to 45%. That suggests a reduction in the responsibility or role of plan sponsors with respect to investment of employee assets in appropriate vehicles. Continuous and ongoing portfolio rebalancing is more important than portfolio construction for management of long-term retirement plan assets. However, the surveys revealed that 83% of DC plan participants have never changed their portfolios throughout the year. Only 22% of the respondents who did not rebalanced their asset allocation were satisfied with the current asset mix. On the other hand, 63% replied they did not rebalanced their portfolios because they were not familiar with rebalancing procedures or methods, or were not interested in pension asset management. Overall, employees appear to have been satisfied with plan providers’ explanation of investment choices,4) but most of them have failed to give direction on how to build and manage their portfolio. This situation necessitates the introduction of default options in retirement plans.

Overseas cases: Default options and qualified default investment alternatives (QDIAs)

Even in countries with a large proportion of DC plans, investment of pension assets in appropriate vehicles by employees who lack financial knowledge has been a challenge facing the society. The United Kingdom and many other countries tried to tackle this challenge through plan participant education but failed to reap satisfactory results. Recent studies in behavioral finance pointed out that the reasons for the failed attempts are ultra-long-term investment horizon of pension funds and individuals’ limited rationality. A number of countries with advanced pension systems are therefore striving to address this issue by strengthening financial literacy education and adopting well-designed default options for retirement plans. In Australia and the US whose plan asset returns are higher than in Korea, investment products used as default options function as flagship vehicles for plans. This can be indirectly demonstrated by the fact that in developed countries whose financial illiteracy is lower than that in Korea, most DC plan members tend to invest their pension assets in default products.5) A strong preference for default options helps improve returns for retirement plans and plays a role in making pension assets more risk tolerant toward short-term market disruptions such as a financial crisis. For example, it is well known that Australia experienced only a modest decline in the share of risky assets in superannuation funds during the financial crisis in 2008 thanks to the effects of default options built on the premise that plan participants must be indifferent.

Overseas cases show that default options were not well and widely accepted in retirement plans in the early years of their inception. Beginning in the 1990s, the US adopted diverse default ptions for retirement pension plans from 1990s but most employers were skeptical about default options during the early phase of their introduction due to fears about legal liability for investment losses. Default choices took root rapidly in pension plans as the Pension Protection Act (PPA) was enacted in 2006 with protections regarding default investments by providing relief to plan sponsors with respect to selecting default investments (provided that each investment meets certain criteria). The Department of Labor provides guidance regarding Qualified Default Investment Alternatives (QDIAs), which specifies types of investment products that can be set as a default option. Any plan sponsor or fiduciary who designates a default investment option may be relieved of liability for losses resulting from investing in the default option. In such a situation, it is inevitable for a financial supervisor to formulate regulation relating to QDIAs and monitor compliance with the regulation in order to prevent moral hazards among plan stakeholders.

Examples of QDIAs in the US include balanced funds geared toward a certain level of risk, managed accounts that take into account the individual’s characteristics, and target-date funds that automatically rebalance the proportion of risky assets according to the individual’s age. QDIAs tend to be safe and conservative investments as compared to publicly offered funds. Nevertheless, it is important to note that QDIAs carry some level of risk associated with the long-term nature of pension investments.6) The US case stands in contrast to the Korean case in which only guaranteed principal and interest instruments can be set as an automatic investment option stipulated under retirement pension agreement. Under the Chilean multi-fund scheme, fund options are available based on the participant’s age and risk profiles and relatively conservative funds are set up as a default option. However, it is worth noting that the most conservative fund is by no means used as a default option to match the participant’s age. That is because the importance of a risk premium taken by long-term investment should not be overlooked.

Korean-style default options

None disagree on the need for the adoption of default options for retirement plans because of a plenty of successful overseas cases. However, given the domestic labor market conditions, the institutional feature of contract-based pension governance, and the current asset management market which is not a fully- fledged market, the immediate introduction of default options could be daunting. The average employee tenure is less than 6 years and most employees tend to opt for early withdrawal from their individual retirement pension (IRP) account when they leave a job. Under these circumstances, the likelihood that loss of principal occurs as a result of investment in a default option with allocation to risky assets above a certain level is greater in Korea than in other countries. Nonetheless, the fact that pension assets are invested in the long term must be taken into account in the design of the default option scheme since there is no brilliant way to achieve satisfactory investment returns over a short investment horizon. In the contract-based pension governance dominated by plan providers, the lack of plan sponsors’ roles and capabilities is also one of impediments to the introduction of default options. As is the case in the US, plan sponsors should be responsible for setting and managing default options. But it is too early to call for plan sponsors in Korea to play such roles because their financial knowledge and investment capabilities are very limited. Hence, discussions are underway to adopt default options in a way that plan providers, which are private financial institutions, are put in the driver’s seat under the contract-based retirement scheme.

The biggest obstacle to the adoption of default options for retirement plans is a collision with investor protections under the Financial Investment Services and Capital Markets Act (FSCMA). The default option that involves automatic asset allocation for a participant who fails to explicitly direct investments makes it difficult to ensure full compliance with the suitability obligation and the duty to explain, which are required to protect investors under the FSCMA. Accordingly, one possible way for putting default options in place is to require compliance with the suitability obligation and the duty to explain upon portfolio construction and to apply the concept of a default to portfolio rebalancing. Investment management of plan assets can be largely divided into portfolio construction and ongoing portfolio rebalancing. The Korean-style default options under consideration would involve requiring plan providers in the portfolio construction phase to not only comply with the suitability obligation and the duty to explain but also to obtain blanket consent from plan members for using a default option for portfolio rebalancing in the future. In this mechanism, life-cycle funds or target date funds stand out from different QDIAs because of the need for pension asset management strategy into which long-term portfolio rebalancing is incorporated. In the countries where retirement plans offer default options, life cycle funds make up the vast majority of QDIAs.7)

In Korea, therefore, meaningful growth in the market for target-date funds is expected as a natural result of introducing default options in the retirement pension scheme. To be prepared for the adoption of default options, local asset management companies are putting a great deal of efforts into launching target-date funds and accumulating track records of managing those funds. Many target-date funds now available in the retirement pension market have not been developed by domestic asset managers but have been set up in foreign countries and redistributed to Korean investors. Target-date funds, often a fund of funds, in Korea and the US cannot be the same in the composition of sub funds and the design of glide path. Great efforts should be exerted to encourage proprietary development of target-date funds by local asset management companies or active customization of foreign target-date funds to better reflect Korea’s labor market and asset management environments.

1) Multiple bills have been introduced in the National Assembly to introduce a trust fund-type retirement plan.

2) The share of investment-linked plans in DC plans was 21.4% as of December 31, 2017.

3) An average annual rate of return over the past five years is 2.36% for guaranteed principal and interest plans and 2.93% for investment-linked plans. The difference in the average annual return between the two increases further with 3.28% for guaranteed principal and interest ones and 4.74% for investment-linked ones if the investment horizon is set to 10 years.

4) The 2018 survey found about 90% of respondents were somewhat satisfied or very satisfied with their plan providers' explanation of investment products.

5) The International Organization of Pension Supervisors (IOPS) reported that more than 80% of plan members in the US and Australia end up in the default option, and this percentage exceeds 90% in Sweden and Mexico.

6) QDIAs in the US also include capital preservation products where the safety of the principal is assured, such as a capital preservation fund. Capital preservation products are allowed for only the first 120 days of plan participation.

7) In the case of the US, the share of target-date funds in default options was just 16% shortly after the PPA enactment and ten years later this share rose to 83% as of December 31, 2016.

A retirement pension scheme is a key component of a multiple pillar pension system to provide a steady stream of guaranteed income in retirement. Disappointingly, however, retirement plans in Korea earned returns of 1.88% last year, which means a reduction in the real value of the pension assets with taking inflation into account. Last year’s investment performance was due in large part to healthy returns of 6.58% for investment-linked retirement plans driven by a bull run in the stock market in 2017. On the other hand, annual returns were just 1.49% for retirement plans designed to protect the principal and interest of plan members, in which the majority of retirement pension assets are concentrated. Given the long-term nature of pensions, that is, compound accumulation, such low returns may not only weaken the intended function of a retirement plan to provide retirement income security, but also may result in a widespread distrust of the retirement pension system itself in the long term. An emphasis is placed on extremely safe investments in terms of building trust among participants in the pension system. But falling long-term returns, not short-term losses, are a real threat to pension asset management that we should be wary of.

Sharing this view, the Ministry of Employment and Labor (MOEL), the primary government body responsible for overseeing retirement plans, and the Financial Supervisory Service (FSS), which regulates and supervises pension asset management, have been pushing for a variety of policy support measures including deregulation so as to revitalize the retirement pension market where true market competition does not exist. Policy measures under discussion include the adoption of a trust-based funding structure for retirement plans,1) and the inclusion of default options in defined contribution (DC) plans, under which participants have control over investment decisions, to help plan participants make better decisions. A default option refers to an investment option that is automatically used if a participant in a plan does not give investment directions.

Against this backdrop, this article examines the current state and issues of retirement plan asset management to underscore the urgent need for Korea to adopt supplementary policy tools such as a retirement plan default option. And it explores how default investment options in retirement plans were introduced and took root successfully in such countries with well-developed pension systems as the United States and Australia. Considering the purpose of default options, the rise of life cycle or target-date funds that automatically rebalance the mix of assets on an ongoing basis is expected. Finally, this article concludes by providing recommendations on desirable institutional arrangements for Korea’s retirement pension system that has evolved from the severance pay scheme and is characterized by contract-based governance.

Importance of default options for retirement plans

Structurally low investment returns are the most urgent issue facing domestic retirement pension plans. Although financial asset returns may fluctuate depending on market conditions, listless investment performance is a structural issue that retirement plans have, not the result of short-term fluctuations. Investment-linked retirement plans represent less than 12% of retirement plans in Korea while guaranteed principal and interest plans have no choice but to offer a guaranteed rate of interest reflecting the low interest environment. As for defined benefit (DB) plans in particular, which comprise 66% of the retirement pension market, the proportion of guaranteed principal and interest plans reached nearly 95%. Consequently, DB plans are the biggest driver behind the decline in aggregate investment returns for retirement plans.

As the figure below shows, DB plans returned 1.59% in 2017, posting a continued drop from 2.11% in 2015. In contrast, DC plans with a relatively high proportion of investment-linked plans returned 2.54%.2) These findings confirm that investment-linked plans achieved higher returns, although moving up and down under different market conditions, when measured by long-term returns rather than annual returns given the nature of retirement plans as long-term investors.3) Aggregate returns for retirement plans exhibited similar pattern to returns for DB plans, which are the most prevalent type of plan, but seeing a slight rebound in 2017 thanks to the stock market boom. Aggregate retirement plan returns, however, are projected to decline again when the stock market slump in 2018 is reflected.

According to retirement plan participant surveys conducted in 2014 and 2018 by Korea Financial Investment Association (KOFIA), only 31% DC plan members made investment choices for their own. The 2014 survey found 34% of respondents relied on recommendations from their plan sponsors, which is the biggest factor affecting the investment decisions of plan participants. But the 2018 survey found that this portion dropped to 16% and instead the portion of the plan members dependent on recommendations from plan providers rose significantly to 45%. That suggests a reduction in the responsibility or role of plan sponsors with respect to investment of employee assets in appropriate vehicles. Continuous and ongoing portfolio rebalancing is more important than portfolio construction for management of long-term retirement plan assets. However, the surveys revealed that 83% of DC plan participants have never changed their portfolios throughout the year. Only 22% of the respondents who did not rebalanced their asset allocation were satisfied with the current asset mix. On the other hand, 63% replied they did not rebalanced their portfolios because they were not familiar with rebalancing procedures or methods, or were not interested in pension asset management. Overall, employees appear to have been satisfied with plan providers’ explanation of investment choices,4) but most of them have failed to give direction on how to build and manage their portfolio. This situation necessitates the introduction of default options in retirement plans.

Overseas cases: Default options and qualified default investment alternatives (QDIAs)

Even in countries with a large proportion of DC plans, investment of pension assets in appropriate vehicles by employees who lack financial knowledge has been a challenge facing the society. The United Kingdom and many other countries tried to tackle this challenge through plan participant education but failed to reap satisfactory results. Recent studies in behavioral finance pointed out that the reasons for the failed attempts are ultra-long-term investment horizon of pension funds and individuals’ limited rationality. A number of countries with advanced pension systems are therefore striving to address this issue by strengthening financial literacy education and adopting well-designed default options for retirement plans. In Australia and the US whose plan asset returns are higher than in Korea, investment products used as default options function as flagship vehicles for plans. This can be indirectly demonstrated by the fact that in developed countries whose financial illiteracy is lower than that in Korea, most DC plan members tend to invest their pension assets in default products.5) A strong preference for default options helps improve returns for retirement plans and plays a role in making pension assets more risk tolerant toward short-term market disruptions such as a financial crisis. For example, it is well known that Australia experienced only a modest decline in the share of risky assets in superannuation funds during the financial crisis in 2008 thanks to the effects of default options built on the premise that plan participants must be indifferent.

Overseas cases show that default options were not well and widely accepted in retirement plans in the early years of their inception. Beginning in the 1990s, the US adopted diverse default ptions for retirement pension plans from 1990s but most employers were skeptical about default options during the early phase of their introduction due to fears about legal liability for investment losses. Default choices took root rapidly in pension plans as the Pension Protection Act (PPA) was enacted in 2006 with protections regarding default investments by providing relief to plan sponsors with respect to selecting default investments (provided that each investment meets certain criteria). The Department of Labor provides guidance regarding Qualified Default Investment Alternatives (QDIAs), which specifies types of investment products that can be set as a default option. Any plan sponsor or fiduciary who designates a default investment option may be relieved of liability for losses resulting from investing in the default option. In such a situation, it is inevitable for a financial supervisor to formulate regulation relating to QDIAs and monitor compliance with the regulation in order to prevent moral hazards among plan stakeholders.

Examples of QDIAs in the US include balanced funds geared toward a certain level of risk, managed accounts that take into account the individual’s characteristics, and target-date funds that automatically rebalance the proportion of risky assets according to the individual’s age. QDIAs tend to be safe and conservative investments as compared to publicly offered funds. Nevertheless, it is important to note that QDIAs carry some level of risk associated with the long-term nature of pension investments.6) The US case stands in contrast to the Korean case in which only guaranteed principal and interest instruments can be set as an automatic investment option stipulated under retirement pension agreement. Under the Chilean multi-fund scheme, fund options are available based on the participant’s age and risk profiles and relatively conservative funds are set up as a default option. However, it is worth noting that the most conservative fund is by no means used as a default option to match the participant’s age. That is because the importance of a risk premium taken by long-term investment should not be overlooked.

Korean-style default options

None disagree on the need for the adoption of default options for retirement plans because of a plenty of successful overseas cases. However, given the domestic labor market conditions, the institutional feature of contract-based pension governance, and the current asset management market which is not a fully- fledged market, the immediate introduction of default options could be daunting. The average employee tenure is less than 6 years and most employees tend to opt for early withdrawal from their individual retirement pension (IRP) account when they leave a job. Under these circumstances, the likelihood that loss of principal occurs as a result of investment in a default option with allocation to risky assets above a certain level is greater in Korea than in other countries. Nonetheless, the fact that pension assets are invested in the long term must be taken into account in the design of the default option scheme since there is no brilliant way to achieve satisfactory investment returns over a short investment horizon. In the contract-based pension governance dominated by plan providers, the lack of plan sponsors’ roles and capabilities is also one of impediments to the introduction of default options. As is the case in the US, plan sponsors should be responsible for setting and managing default options. But it is too early to call for plan sponsors in Korea to play such roles because their financial knowledge and investment capabilities are very limited. Hence, discussions are underway to adopt default options in a way that plan providers, which are private financial institutions, are put in the driver’s seat under the contract-based retirement scheme.

The biggest obstacle to the adoption of default options for retirement plans is a collision with investor protections under the Financial Investment Services and Capital Markets Act (FSCMA). The default option that involves automatic asset allocation for a participant who fails to explicitly direct investments makes it difficult to ensure full compliance with the suitability obligation and the duty to explain, which are required to protect investors under the FSCMA. Accordingly, one possible way for putting default options in place is to require compliance with the suitability obligation and the duty to explain upon portfolio construction and to apply the concept of a default to portfolio rebalancing. Investment management of plan assets can be largely divided into portfolio construction and ongoing portfolio rebalancing. The Korean-style default options under consideration would involve requiring plan providers in the portfolio construction phase to not only comply with the suitability obligation and the duty to explain but also to obtain blanket consent from plan members for using a default option for portfolio rebalancing in the future. In this mechanism, life-cycle funds or target date funds stand out from different QDIAs because of the need for pension asset management strategy into which long-term portfolio rebalancing is incorporated. In the countries where retirement plans offer default options, life cycle funds make up the vast majority of QDIAs.7)

In Korea, therefore, meaningful growth in the market for target-date funds is expected as a natural result of introducing default options in the retirement pension scheme. To be prepared for the adoption of default options, local asset management companies are putting a great deal of efforts into launching target-date funds and accumulating track records of managing those funds. Many target-date funds now available in the retirement pension market have not been developed by domestic asset managers but have been set up in foreign countries and redistributed to Korean investors. Target-date funds, often a fund of funds, in Korea and the US cannot be the same in the composition of sub funds and the design of glide path. Great efforts should be exerted to encourage proprietary development of target-date funds by local asset management companies or active customization of foreign target-date funds to better reflect Korea’s labor market and asset management environments.

1) Multiple bills have been introduced in the National Assembly to introduce a trust fund-type retirement plan.

2) The share of investment-linked plans in DC plans was 21.4% as of December 31, 2017.

3) An average annual rate of return over the past five years is 2.36% for guaranteed principal and interest plans and 2.93% for investment-linked plans. The difference in the average annual return between the two increases further with 3.28% for guaranteed principal and interest ones and 4.74% for investment-linked ones if the investment horizon is set to 10 years.

4) The 2018 survey found about 90% of respondents were somewhat satisfied or very satisfied with their plan providers' explanation of investment products.

5) The International Organization of Pension Supervisors (IOPS) reported that more than 80% of plan members in the US and Australia end up in the default option, and this percentage exceeds 90% in Sweden and Mexico.

6) QDIAs in the US also include capital preservation products where the safety of the principal is assured, such as a capital preservation fund. Capital preservation products are allowed for only the first 120 days of plan participation.

7) In the case of the US, the share of target-date funds in default options was just 16% shortly after the PPA enactment and ten years later this share rose to 83% as of December 31, 2016.