Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Rationalizing Collective Investment Vehicle Taxation for Koreans’ Wealth Growth

Publication date Feb. 12, 2019

Summary

Given that collective investment vehicles (CIVs) can play a vital role in the wealth growth of people, the rationalization of the relevant tax regime is important to ensure that CIVs perform their function properly. The acceleration of population ageing leads to a sharp rise in demand for asset accumulation to prepare for retirement. A rational taxation system is increasingly necessary to smoothly and vibrantly channel the funds aimed at wealth increase for retirement into the area of indirect investment. Problems observed in the current CIV taxation are the non-taxation of certain CIV profits and losses, prohibition against loss deduction among CIVs and loss carry-forward, and the tax treatment of gains from the trade or redemption of units in a CIV as dividend income.

To rationalize the CIV taxation, it is worth considering allowing loss deduction and loss carry-forward for CIVs. Loss deduction and loss carry-forward could incentivize investors to leverage the diversification effects of indirect investment. Furthermore, it is also worth considering re-defining profits from the redemption or trading of units in a CIV as capital gains rather than dividend income. It seems desirable to recognize the income distributed from CIVs as dividend income as it is today, and to convert income from the redemption or trading of units in CIVs into capital gains, not dividend income, because it is deemed to be of a capital gains nature. This change would bring about positive impacts such as lower tax unfairness between direct investment and indirect investment through a CIV, and reduced tax imbalance between CIVs (that is, between investment trusts and investment companies). In addition, it is required to revise the tax-exemption rules for certain CIV profits and losses and the existing tax calculation method using tax bases.

To rationalize the CIV taxation, it is worth considering allowing loss deduction and loss carry-forward for CIVs. Loss deduction and loss carry-forward could incentivize investors to leverage the diversification effects of indirect investment. Furthermore, it is also worth considering re-defining profits from the redemption or trading of units in a CIV as capital gains rather than dividend income. It seems desirable to recognize the income distributed from CIVs as dividend income as it is today, and to convert income from the redemption or trading of units in CIVs into capital gains, not dividend income, because it is deemed to be of a capital gains nature. This change would bring about positive impacts such as lower tax unfairness between direct investment and indirect investment through a CIV, and reduced tax imbalance between CIVs (that is, between investment trusts and investment companies). In addition, it is required to revise the tax-exemption rules for certain CIV profits and losses and the existing tax calculation method using tax bases.

We have recently seen heated discussions about a reduction or elimination of a stock transaction tax (STT) in the Korean capital markets. Korea adopted the STT to prevent excessive speculative trading in the stock market. As the market has shown a downward trend in trading volume these days, however, it is difficult to justify the continued existence of the STT. The time has come to consider the STT cut or abolition in order to reflect the changing market landscape and strengthen the functions of the capital markets.

In addition to the STT elimination, it is necessary to streamline a capital gains tax (CGT) on the trade of financial instruments, one core component of the tax regime in the capital markets. So far, the government has expanded the taxation on capital gains from stock investments gradually. More specifically, it has strengthened the capital gains taxation by broadening the scope of majority shareholders subject to CGT on stocks. But there are a number of areas for improvement in the CGT structure. Loss deduction, loss carry-forward, and long-term investment incentives to name a few are imperative improvements in the taxation to reinforce the function of the capital markets as a supplier of long-term risk capital.

As such, discussions about how to build a more efficient tax regime for the capital markets started with the STT abolition, evolved into the CGT overhaul, and ultimately boil down to tax overhaul for collective investment vehicles. A collective investment vehicle (CIV) is the most important investment vehicle that enables investors to increase their wealth through indirect investment. Long-term holding of a CIV, which allows investors to enjoy the benefits of a diversified portfolio and systematic risk management, may be a useful investment approach that is vital to wealth accumulation. Considering that, it would be very important for the country to provide support through better tax system to make sure that CIVs offer practical help for people. This article identifies and analyzes the characteristics and problems of Korea’s CIV taxation. And it concludes by charting new directions for the rationalization of the CIV taxation to promote capital market development and support Koreans’ wealth accumulation.

Overview of CIV taxation

There are two types of approaches to CIV taxation: entity theory and conduit theory. Under the entity theory, a CIV is recognized as a taxable entity like a corporation under tax law.1) It is based on the idea that different types of income belonging to the CIV are co-mingled in the asset pool of the CIV, which is an independent economic institution, before they finally belong to investors, and, after a specific period of time has elapsed, they become taxable income as profits from the CIV. In contrast, according to the conduit theory, the CIV acts as a conduit that distributes the income earned by assets to investors, and the investors who actually enjoy the gains therefore must pay tax on the income because they are deemed to have the assets.2) In the conduit theory, since the CIV is merely the conduit, income from the CIV should be divided according to their nature and be taxed accordingly.

The Korean tax regime for CIVs is based primarily on the entity theory but in part on the conduit theory as well. The current Income Tax Act treats the income of a CIV as dividend income if the CIV meets certain criteria (hereinafter referred to as “qualified CIV”) and imposes tax on the income accordingly.3) The following requirements must be satisfied to become a qualified CIV4):

· It shall be a collective investment vehicle prescribed in the Financial Investment Services and Capital Markets Act (FSCMA);

· It shall close or settle accounts and distribute dividends at least once each year from the date of its establishment;

· It shall be entrusted with money and refunded with money; and

· A CIV set up abroad shall be deemed a qualified CIV even if it fails to meet the requirements.

Where a CIV fails to meet the requirements prescribed in the Income Tax Act, profits from an investment trust are taxed according to the classification of income sources,5) and profits from an investment firm are taxable as dividend income, deeming the firm as a corporate entity. To be more specific, in case of an unqualified CIV, income from an investment trust, investment association or undisclosed investment association is taxable with the view that the income is deemed to arise from a trust other than a CIV, and income from an investment company, limited liability investment company or limited investment partnership, or a private equity fund is taxed, deeming the income as a dividend or share distributed.6)

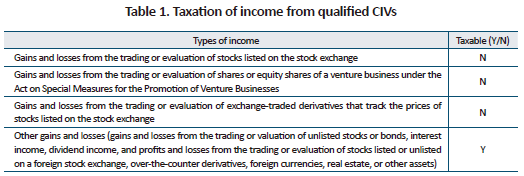

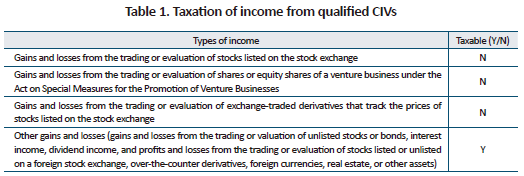

One significant characteristic observed in Korea’s CIV taxation is that some of profits generated by a qualified CIV are not taxable. Income from a qualified CIV does not include gains and losses from the trading or evaluation of i) the securities listed in the table below, among securities that a qualified CIV has acquired directly or by investing in CIV shares defined in Article 9.21 of the FSCMA, or ii) exchange-traded derivatives prescribed in the FSCMA.7) The non-taxation of some CIV profits is designed to ensure the fairness in taxation between direct and indirect investments.

Problems in the CIV taxation

The CIV taxation is closely related to the capital gains taxation of financial products and the global taxation of financial income. That is because CIVs generate profits mainly by holding or trading financial instruments, and earn interest and dividends if they hold investment products. The most frequently mentioned problem with the CIV taxation is that investors sometimes have to pay tax even though they made losses from a CIV. Taxing on the investment losses is closely linked to the tax-exemption rule for specific CIV profits and losses discussed above. To ensure the fairness in taxation between direct and indirect investments in listed stocks, capital gains from the trade of listed stocks among CIV profits are not taxed under the existing Income Tax Act. In such case, when the CIV made losses from investments in listed stocks, it may be subject to income tax even if the CIV posted net losses. For example, when a particular CIV suffered KRW 10 million in losses from investments in domestic listed stocks and generated KRW 5 million in gains from investment in domestic bonds and foreign listed stocks, it would report net investment losses of KRW 5 million in total. Due to the tax-exemption of certain CIV profits and losses, however, the KRW 10 million losses from domestic listed stocks would be excluded from the calculation of the CIV’s taxable income, and only the KRW 5 million gains from domestic bonds and foreign listed stocks would be recognized as taxable income. As a result, investors in the CIV must pay 15.4% income tax (KRW 770,000) on the KRW 5 million gains despite the overall losses of the CIV.

Another problem is that loss deduction and loss carry-forward are not allowed for CIVs. Many investors in CIVs prefer using multiple CIVs according to their investment purposes to putting their money in just one CIV. The use of multiple CIVs is widely used for indirect investment because it enables investors to allocate their investments to different assets. However, the current Income Tax Act does not allow the loss deduction among CIVs. For instance, there is an investor who invests in two different CIVs called Fund A and Fund B. If the investor posts losses from Fund A and profits from Fund B, both of which can be included in the computation of taxable income, he or she does not need to pay income tax for Fund A, but has to do so for Fund B. That means that incentives are not sufficient to encourage investors to diversify their investments for asset accumulation by using various CIVs.

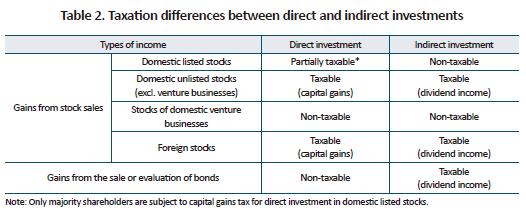

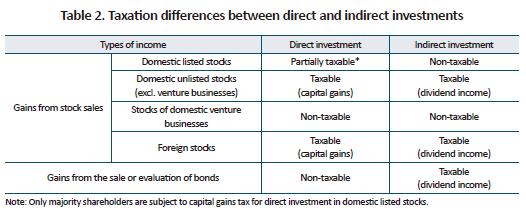

The recognition of profits from the redemption or trading of units in a CIV as taxable dividend income is also considered problematic. CIVs have a wide range of income sources. Bond interest and stock dividends are common income streams for CIVs. In practice, however, the largest portion of CIV income comes from capital gains. Capital gains from the sale or evaluation of bonds, the sale of foreign stocks, or foreign exchange transactions constitute the majority of taxable income of CIVs. The conversion of capital gains into dividend income and subsequent overlapping with aggregate taxation on financial income (global taxation) make the tax regime for CIVs more complex and at the same time make the CIV taxation more difficult to understand for investors. The income recognition approach applying to CIVs serves as an obstacle to achieving the fairness in taxation between direct and indirect investments in certain financial products. The table below shows taxation differences between direct and indirect investments according to types of income.

Koreans’ wealth accumulation through the rationalization of the CIV taxation

Given that CIVs can play a vital role in the wealth growth of people, the rationalization of the relevant tax regime is important for CIVs to perform their function properly. The acceleration of population ageing leads to a sharp rise in demand for asset accumulation to prepare for retirement. A well-functioning taxation system is increasingly necessary to smoothly and vibrantly channel the funds aimed at wealth accumulation for retirement into the area of indirect investment. The rationalization of the CIV taxation should be geared towards promoting indirect investment, and creating a market environment where flagship financial products for wealth accumulation could emerge on the back of consistent tax support.

For tax rationalization, it is worth considering allowing loss deduction and loss carry-forward for CIVs. In other words, it is necessary to allow the deduction of losses from investment in one CIV against profits from investment in the other CIVs, and the carry-forward of any loss remaining after the loss deduction to future years. Loss deduction and loss carry-forward could incentivize investors to leverage the diversification effects of indirect investment and help the capital markets better function as the supplier of risk capital. For the implementation of loss deduction and loss carry-forward for CIVs, an investor registration scheme should be considered from a technical perspective.

Furthermore, it is also worth considering re-defining profits from the redemption or trading of units in a CIV as capital gains rather than dividend income. It seems desirable to recognize the income distributed from CIVs as dividend income as it is today, and to convert income from the redemption or trading of units in CIVs into capital gains, not dividend income, because it is deemed to be of a capital gain nature. In the latter case, the income could be combined with gains and losses from other investments. This change would bring about positive impacts such as lower tax unfairness between direct investment and indirect investment through a CIV, and reduced tax imbalance between CIVs (that is, between investment trusts and investment companies).

In addition, it is required to revise the tax-exemption rules for certain CIV profits and losses and the existing tax computation method using tax bases so as to further simplify and rationalize the CIV taxation. Considering that the tax-exemption of certain CIV profits and losses plays a part in making the Korean CIV tax regime more complicated, it is time to reconsider whether to maintain the tax-exemption rules along with the overhaul of capital gains tax.

As mentioned earlier, the CIV taxation is highly related to the capital gains taxation and the aggregate taxation on financial income. Accordingly, the rationalization of the CIV taxation necessitates an extensive analysis of not only CIVs but also applicable tax laws and rules. And it is necessary to find ways to rationalize the CIV taxation from a holistic, long-term perspective, with the aims of supporting Koreans’ wealth growth and facilitating the functions of the capital markets.

1) Son, Youngcheol and Seo, Jongkoon (2016)

2) Kim, Yongmin, Park, Dongkyu, and Yang, Joongsik (2017)

3) Article 17.1.5 (Dividend Income) of the Income Tax Act.

4) Article 26.2.1-2 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

5) Article 4.2 (Classification of Income) of the Income Tax Act.

6) Article 26.2.3 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

7) Article 26.2.4 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

References

Kim, Yongmin, Park, Dongkyu, and Yang, Joongsik, 2017, Financial Products and Taxes, Tax Finance News.

Son, Youngcheol and Seo, Jongkoon, 2016, Financial Products and Tax Laws, Samil Informine.

In addition to the STT elimination, it is necessary to streamline a capital gains tax (CGT) on the trade of financial instruments, one core component of the tax regime in the capital markets. So far, the government has expanded the taxation on capital gains from stock investments gradually. More specifically, it has strengthened the capital gains taxation by broadening the scope of majority shareholders subject to CGT on stocks. But there are a number of areas for improvement in the CGT structure. Loss deduction, loss carry-forward, and long-term investment incentives to name a few are imperative improvements in the taxation to reinforce the function of the capital markets as a supplier of long-term risk capital.

As such, discussions about how to build a more efficient tax regime for the capital markets started with the STT abolition, evolved into the CGT overhaul, and ultimately boil down to tax overhaul for collective investment vehicles. A collective investment vehicle (CIV) is the most important investment vehicle that enables investors to increase their wealth through indirect investment. Long-term holding of a CIV, which allows investors to enjoy the benefits of a diversified portfolio and systematic risk management, may be a useful investment approach that is vital to wealth accumulation. Considering that, it would be very important for the country to provide support through better tax system to make sure that CIVs offer practical help for people. This article identifies and analyzes the characteristics and problems of Korea’s CIV taxation. And it concludes by charting new directions for the rationalization of the CIV taxation to promote capital market development and support Koreans’ wealth accumulation.

Overview of CIV taxation

There are two types of approaches to CIV taxation: entity theory and conduit theory. Under the entity theory, a CIV is recognized as a taxable entity like a corporation under tax law.1) It is based on the idea that different types of income belonging to the CIV are co-mingled in the asset pool of the CIV, which is an independent economic institution, before they finally belong to investors, and, after a specific period of time has elapsed, they become taxable income as profits from the CIV. In contrast, according to the conduit theory, the CIV acts as a conduit that distributes the income earned by assets to investors, and the investors who actually enjoy the gains therefore must pay tax on the income because they are deemed to have the assets.2) In the conduit theory, since the CIV is merely the conduit, income from the CIV should be divided according to their nature and be taxed accordingly.

The Korean tax regime for CIVs is based primarily on the entity theory but in part on the conduit theory as well. The current Income Tax Act treats the income of a CIV as dividend income if the CIV meets certain criteria (hereinafter referred to as “qualified CIV”) and imposes tax on the income accordingly.3) The following requirements must be satisfied to become a qualified CIV4):

· It shall be a collective investment vehicle prescribed in the Financial Investment Services and Capital Markets Act (FSCMA);

· It shall close or settle accounts and distribute dividends at least once each year from the date of its establishment;

· It shall be entrusted with money and refunded with money; and

· A CIV set up abroad shall be deemed a qualified CIV even if it fails to meet the requirements.

Where a CIV fails to meet the requirements prescribed in the Income Tax Act, profits from an investment trust are taxed according to the classification of income sources,5) and profits from an investment firm are taxable as dividend income, deeming the firm as a corporate entity. To be more specific, in case of an unqualified CIV, income from an investment trust, investment association or undisclosed investment association is taxable with the view that the income is deemed to arise from a trust other than a CIV, and income from an investment company, limited liability investment company or limited investment partnership, or a private equity fund is taxed, deeming the income as a dividend or share distributed.6)

One significant characteristic observed in Korea’s CIV taxation is that some of profits generated by a qualified CIV are not taxable. Income from a qualified CIV does not include gains and losses from the trading or evaluation of i) the securities listed in the table below, among securities that a qualified CIV has acquired directly or by investing in CIV shares defined in Article 9.21 of the FSCMA, or ii) exchange-traded derivatives prescribed in the FSCMA.7) The non-taxation of some CIV profits is designed to ensure the fairness in taxation between direct and indirect investments.

The CIV taxation is closely related to the capital gains taxation of financial products and the global taxation of financial income. That is because CIVs generate profits mainly by holding or trading financial instruments, and earn interest and dividends if they hold investment products. The most frequently mentioned problem with the CIV taxation is that investors sometimes have to pay tax even though they made losses from a CIV. Taxing on the investment losses is closely linked to the tax-exemption rule for specific CIV profits and losses discussed above. To ensure the fairness in taxation between direct and indirect investments in listed stocks, capital gains from the trade of listed stocks among CIV profits are not taxed under the existing Income Tax Act. In such case, when the CIV made losses from investments in listed stocks, it may be subject to income tax even if the CIV posted net losses. For example, when a particular CIV suffered KRW 10 million in losses from investments in domestic listed stocks and generated KRW 5 million in gains from investment in domestic bonds and foreign listed stocks, it would report net investment losses of KRW 5 million in total. Due to the tax-exemption of certain CIV profits and losses, however, the KRW 10 million losses from domestic listed stocks would be excluded from the calculation of the CIV’s taxable income, and only the KRW 5 million gains from domestic bonds and foreign listed stocks would be recognized as taxable income. As a result, investors in the CIV must pay 15.4% income tax (KRW 770,000) on the KRW 5 million gains despite the overall losses of the CIV.

Another problem is that loss deduction and loss carry-forward are not allowed for CIVs. Many investors in CIVs prefer using multiple CIVs according to their investment purposes to putting their money in just one CIV. The use of multiple CIVs is widely used for indirect investment because it enables investors to allocate their investments to different assets. However, the current Income Tax Act does not allow the loss deduction among CIVs. For instance, there is an investor who invests in two different CIVs called Fund A and Fund B. If the investor posts losses from Fund A and profits from Fund B, both of which can be included in the computation of taxable income, he or she does not need to pay income tax for Fund A, but has to do so for Fund B. That means that incentives are not sufficient to encourage investors to diversify their investments for asset accumulation by using various CIVs.

The recognition of profits from the redemption or trading of units in a CIV as taxable dividend income is also considered problematic. CIVs have a wide range of income sources. Bond interest and stock dividends are common income streams for CIVs. In practice, however, the largest portion of CIV income comes from capital gains. Capital gains from the sale or evaluation of bonds, the sale of foreign stocks, or foreign exchange transactions constitute the majority of taxable income of CIVs. The conversion of capital gains into dividend income and subsequent overlapping with aggregate taxation on financial income (global taxation) make the tax regime for CIVs more complex and at the same time make the CIV taxation more difficult to understand for investors. The income recognition approach applying to CIVs serves as an obstacle to achieving the fairness in taxation between direct and indirect investments in certain financial products. The table below shows taxation differences between direct and indirect investments according to types of income.

Given that CIVs can play a vital role in the wealth growth of people, the rationalization of the relevant tax regime is important for CIVs to perform their function properly. The acceleration of population ageing leads to a sharp rise in demand for asset accumulation to prepare for retirement. A well-functioning taxation system is increasingly necessary to smoothly and vibrantly channel the funds aimed at wealth accumulation for retirement into the area of indirect investment. The rationalization of the CIV taxation should be geared towards promoting indirect investment, and creating a market environment where flagship financial products for wealth accumulation could emerge on the back of consistent tax support.

For tax rationalization, it is worth considering allowing loss deduction and loss carry-forward for CIVs. In other words, it is necessary to allow the deduction of losses from investment in one CIV against profits from investment in the other CIVs, and the carry-forward of any loss remaining after the loss deduction to future years. Loss deduction and loss carry-forward could incentivize investors to leverage the diversification effects of indirect investment and help the capital markets better function as the supplier of risk capital. For the implementation of loss deduction and loss carry-forward for CIVs, an investor registration scheme should be considered from a technical perspective.

Furthermore, it is also worth considering re-defining profits from the redemption or trading of units in a CIV as capital gains rather than dividend income. It seems desirable to recognize the income distributed from CIVs as dividend income as it is today, and to convert income from the redemption or trading of units in CIVs into capital gains, not dividend income, because it is deemed to be of a capital gain nature. In the latter case, the income could be combined with gains and losses from other investments. This change would bring about positive impacts such as lower tax unfairness between direct investment and indirect investment through a CIV, and reduced tax imbalance between CIVs (that is, between investment trusts and investment companies).

In addition, it is required to revise the tax-exemption rules for certain CIV profits and losses and the existing tax computation method using tax bases so as to further simplify and rationalize the CIV taxation. Considering that the tax-exemption of certain CIV profits and losses plays a part in making the Korean CIV tax regime more complicated, it is time to reconsider whether to maintain the tax-exemption rules along with the overhaul of capital gains tax.

As mentioned earlier, the CIV taxation is highly related to the capital gains taxation and the aggregate taxation on financial income. Accordingly, the rationalization of the CIV taxation necessitates an extensive analysis of not only CIVs but also applicable tax laws and rules. And it is necessary to find ways to rationalize the CIV taxation from a holistic, long-term perspective, with the aims of supporting Koreans’ wealth growth and facilitating the functions of the capital markets.

1) Son, Youngcheol and Seo, Jongkoon (2016)

2) Kim, Yongmin, Park, Dongkyu, and Yang, Joongsik (2017)

3) Article 17.1.5 (Dividend Income) of the Income Tax Act.

4) Article 26.2.1-2 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

5) Article 4.2 (Classification of Income) of the Income Tax Act.

6) Article 26.2.3 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

7) Article 26.2.4 (Scope, etc. of Collective Investment Schemes) of the Enforcement Decree of the Income Tax Act.

References

Kim, Yongmin, Park, Dongkyu, and Yang, Joongsik, 2017, Financial Products and Taxes, Tax Finance News.

Son, Youngcheol and Seo, Jongkoon, 2016, Financial Products and Tax Laws, Samil Informine.