Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Quick Assessment on Korea’s Foreign Equity Bias

Publication date Feb. 18, 2020

Summary

This article explores Korean investors’ foreign bias from the perspective of the efficiency of regional asset allocation. Recently, Korea’s outward equity investment rose abruptly to hit a record high, especially in major developed economies such as the US. However, if measured by a departure from the theoretical optimal asset allocation, Korea’s foreign equity bias towards each investment destination is still fairly high. More specifically, Korea’s outward investment in the US shows a underinvestment bias, although the US takes up a half Korea’s outward equity investment. Korea’s underinvestment bias is found in most of the major investment destinations, except for Vietnam. Another measure of foreign equity bias, Korea’s home bias also remains quite higher than that of major economics. What those results imply is that Korean investors fail to fully benefit from outward equity investment despite the recent rise in their foreign equity holdings. On the other hand, this also means an opportunity ahead of Korean investors. They still have a chance to improve the risk-adjusted returns by increasing their weight in foreign equity. Going forward, Korean investors should seek to improve the efficiency of asset allocation after fully taking into account the key variables behind risk distribution.

Korean investors’ portfolio investment in foreign equity has been growing rapidly. Foreign equity has garnered growing attention amid the low interest rate trend and Korea’s stagnated equity market. Another reason is the rising investment demand for foreign equity backed by the growth of Korea’s pension funds. Under the circumstances, this article explores Korean investors’ asset allocation focusing on their investment destination. The effect of foreign equity investment such as higher risk-adjusted returns could arise only if assets are efficiently allocated across regions. By assessing Korean investors’ foreign equity across investment destinations, this article could contribute to deepening investor understanding about foreign equity investment.

Korea’s outbound investment

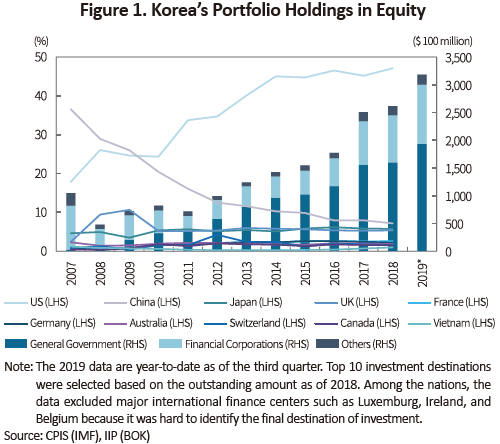

Korean investors’ portfolio investment in foreign equity has been rising quite rapidly. As of the third quarter of 2019, Korean’s portfolio investment in foreign equity outstanding stood at $318.4 billion, a three-fold increase from the pre-crisis era as of the fourth quarter of 2007. In particular, the post-crisis rise in Korean investors’ holding of foreign equity has been particularly rapid thanks to Korea’s pension funds and other public sector investors. As of the third quarter of 2019, the general government1) holds foreign equity worth of a total of $193.5 billion, approximately 61% of domestic investors’ portfolio investment in foreign equity. Currently, the US is Korea’s largest investment destination taking up about a half (47%) of Korea’s portfolio investment in foreign equity,2) followed by China (7.13%), Japan (5.73%), and the UK (5.37%). At the end of 2018, top-10 investment destinations accounted for almost 76.3% of Korean investors’ portfolio holdings in foreign equity.

Asset allocation in Korean investors’ portfolio holdings in foreign equity is observed to be highly correlated to who the investor is. In 2007 when the private sector played a key role in this area, China was the largest investment destination, with Chinese equity taking up 37% of Korea’s portfolio holdings in foreign equity. However, as the general government increased holdings in foreign equity since 2010, the US has received the largest equity portfolio investment from Korea. Also notable is Vietnam, ranked one of the top investment destinations of Korean investors. As of 2018-end, Korea’s portfolio holdings in Vietnamese equity stood at $2.6 billion or 1% of portfolio holdings in foreign equity.

1) The BOK International Investment Position categorizes domestic investors into the general government, deposit-taking institutions, and other financial corporations, etc. The general government category includes major pension funds such as the National Pension, Korea Investment Corporation, etc. As of 2018, the National Pension is estimated to hold about 80% of the general government’s portfolio investment in overseas equity.

2) Domestic investors’ outbound portfolio investment in equity is from the recent data (2018) from the Cooperated Portfolio Investment Survey (CPIS), a survey targeting central banks by the IMF. Thus, the analysis in this article does not reflect the recent rise in retail investors’ outbound investment in equity.

3) The foreign bias in this article is a normalized measure using the weight against the maximum bias, ranged between the maximum overinvestment bias ‘-1’ and the maximum underinvestment bias ‘+1’, where the bias becomes lower if getting close to zero. For details on how to measure the bias, refer to Kim (2020).

4) Investors’ home bias is commonly found in most developed markets. Since first reported by French & Poterba (1991) among US investors, home bias has been found in many studies in a wide range of economies. Obstfeld & Rogoff (2000) presented it one of the six puzzles in the international financial market.

References

French, R., Poterba J., 1991, Investor diversification and international equity markets, The American Economic Review 81(2), 222-226.

Obstfeld, M., Rogoff, K., 2000, The six major puzzles in International Macroeconomics: Is there a common cause? NBER Working Paper No.7777.

(Korean)

Kim, H.S., 2020, Korea's portfolio investment in foreign equity: Status and characteristics, Korea Capital Market Institute Issue Paper 20-02.

Korea’s outbound investment

Korean investors’ portfolio investment in foreign equity has been rising quite rapidly. As of the third quarter of 2019, Korean’s portfolio investment in foreign equity outstanding stood at $318.4 billion, a three-fold increase from the pre-crisis era as of the fourth quarter of 2007. In particular, the post-crisis rise in Korean investors’ holding of foreign equity has been particularly rapid thanks to Korea’s pension funds and other public sector investors. As of the third quarter of 2019, the general government1) holds foreign equity worth of a total of $193.5 billion, approximately 61% of domestic investors’ portfolio investment in foreign equity. Currently, the US is Korea’s largest investment destination taking up about a half (47%) of Korea’s portfolio investment in foreign equity,2) followed by China (7.13%), Japan (5.73%), and the UK (5.37%). At the end of 2018, top-10 investment destinations accounted for almost 76.3% of Korean investors’ portfolio holdings in foreign equity.

Asset allocation in Korean investors’ portfolio holdings in foreign equity is observed to be highly correlated to who the investor is. In 2007 when the private sector played a key role in this area, China was the largest investment destination, with Chinese equity taking up 37% of Korea’s portfolio holdings in foreign equity. However, as the general government increased holdings in foreign equity since 2010, the US has received the largest equity portfolio investment from Korea. Also notable is Vietnam, ranked one of the top investment destinations of Korean investors. As of 2018-end, Korea’s portfolio holdings in Vietnamese equity stood at $2.6 billion or 1% of portfolio holdings in foreign equity.

Regional bias in portfolio investment

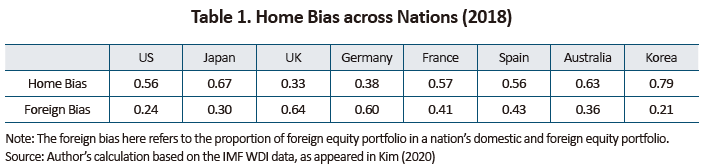

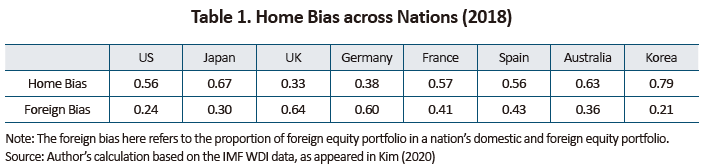

To gauge the optimal level of regional asset allocation, the capital asset pricing model suggests using the share of market capitalization in each investment destination in the global market. This article tries to look at how Korea’s foreign equity portfolio is allocated to different regions in the world, using the deviation from the theoretically optimal asset allocation. The results indicate a regional bias as follows.3) First, Korea’s home bias,4) a measure referring to the tendency of investors in a nation to slant toward foreign equity, is 0.79, higher than that in other countries analyzed. Despite the rapid growth in outward equity investment, investors in Korea are found to focus heavily on domestic equity. This shows domestic investors’ outbound equity investment is far lower than what the theoretically optimal level suggests given Korea’s equity market size. At the end of 2018, domestic investors’ holdings in foreign equity is around 21% of their holdings in equity (domestic and foreign combined), the lowest among the nations analyzed.

To gauge the optimal level of regional asset allocation, the capital asset pricing model suggests using the share of market capitalization in each investment destination in the global market. This article tries to look at how Korea’s foreign equity portfolio is allocated to different regions in the world, using the deviation from the theoretically optimal asset allocation. The results indicate a regional bias as follows.3) First, Korea’s home bias,4) a measure referring to the tendency of investors in a nation to slant toward foreign equity, is 0.79, higher than that in other countries analyzed. Despite the rapid growth in outward equity investment, investors in Korea are found to focus heavily on domestic equity. This shows domestic investors’ outbound equity investment is far lower than what the theoretically optimal level suggests given Korea’s equity market size. At the end of 2018, domestic investors’ holdings in foreign equity is around 21% of their holdings in equity (domestic and foreign combined), the lowest among the nations analyzed.

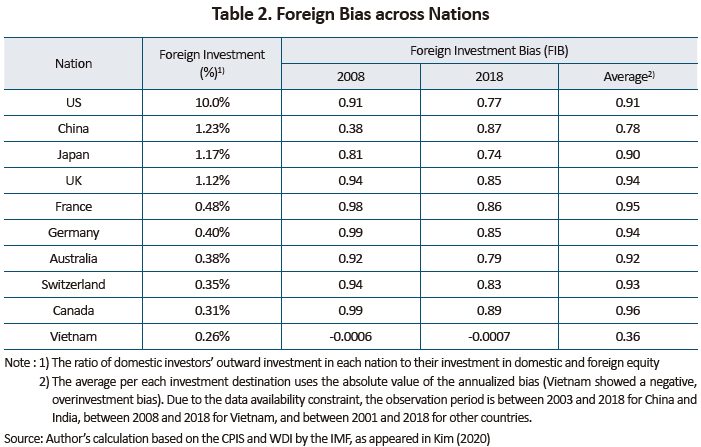

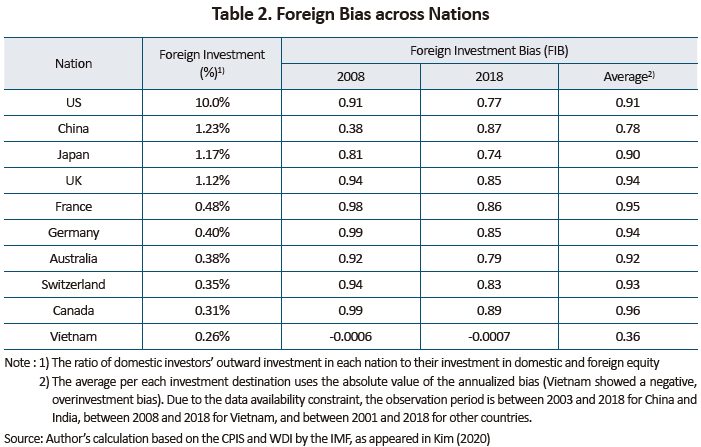

On the contrary, domestic investors show a foreign bias as illustrated in Table 2. First of all, the average foreign bias for each investment destination shows that domestic investors tend to extremely underinvest in all destinations excluding Vietnam. Their underinvestment bias is far high, exceeding 90% compared to the maximum bias in the US, UK, France, and other developed economies, with the bias toward Vietnam at the lowest (36%). What’s notable is Korean investors’ underinvestment even in the US, Korea’s largest investment destination. Except for Vietnam and China, Korean investors’ underinvestment bias remains highly positive in all nations during all observation periods. Vietnam, the only nation where Korean investors’ bias is fairly low, shows a slightly negative overinvestment bias in some periods (in 2008 and 2018).

A regional bias of Korean investors during the period between 2008 and 2018 illustrates the following changes. The most imminent change among those is Korean investors’ bias towards China, which dramatically jumped from 0.48 (2008) to 0.87 (2018). Although domestic investors’ holdings of Chinese equity rose slightly in the absolute term, their relative holdings to overall portfolio holdings in equity fell significantly from 3.4% (2008) to 1.2% (2018) during the same period. On top of that, China’s equity market increased its share in the global market, which eventually pushed up Korea’s Chinese equity bias. In the US, Korea’s portfolio investment in US equity surged significantly during the same period, which pushed down the underinvestment bias from 0.91 in 2008 to 0.77 in 2018. However, Korea’s bias towards US equity still remains high.

A regional bias of Korean investors during the period between 2008 and 2018 illustrates the following changes. The most imminent change among those is Korean investors’ bias towards China, which dramatically jumped from 0.48 (2008) to 0.87 (2018). Although domestic investors’ holdings of Chinese equity rose slightly in the absolute term, their relative holdings to overall portfolio holdings in equity fell significantly from 3.4% (2008) to 1.2% (2018) during the same period. On top of that, China’s equity market increased its share in the global market, which eventually pushed up Korea’s Chinese equity bias. In the US, Korea’s portfolio investment in US equity surged significantly during the same period, which pushed down the underinvestment bias from 0.91 in 2008 to 0.77 in 2018. However, Korea’s bias towards US equity still remains high.

Implications

The analyses in this article try to assess how efficiently Korean investors allocate their assets across regions, from the perspective of portfolio diversification. The results could be somewhat different from a foreign bias from the individual and institutional point of view. However, the high foreign investment bias among domestic investors implies a departure from the strategy of enhancing risk-adjusted return by risk distribution despite the recently rising attention to foreign equity. In particular, Korea has a high underinvestment bias toward major developed markets although their outward equity investment shot up recently. In this regard, more outward investment in developed countries is the direction in which Korea is and should be heading. Also worth noting is Korea’s extremely low foreign bias towards few emerging economies. As suggested by theory, the maximized portfolio return is only possible if assets are evenly allocated to every equity market in every region. Korea’s high investment in emerging markets will expose domestic investors excessively to emerging market risks and thus adversely affect portfolio returns, which requires caution.

What's needed the most now is a paradigm shift in foreign equity investment among Korean investors. Already, many studies confirm that the largest benefit derived from outward equity investment is risk distribution by building a global portfolio. This calls for investors to enhance efficiency in asset allocation by properly taking into account many key factors behind risk distribution, e.g., an investment destination's equity market size, the correlation with the domestic market, etc. Retail investors, in particular, are expected to have limited access to relevant information, as compared to other investors. They should seek out professional advice, if necessary, to fully consider the risks arising from outward investment such as the country-specific risk and foreign exchange risk.

The analyses in this article try to assess how efficiently Korean investors allocate their assets across regions, from the perspective of portfolio diversification. The results could be somewhat different from a foreign bias from the individual and institutional point of view. However, the high foreign investment bias among domestic investors implies a departure from the strategy of enhancing risk-adjusted return by risk distribution despite the recently rising attention to foreign equity. In particular, Korea has a high underinvestment bias toward major developed markets although their outward equity investment shot up recently. In this regard, more outward investment in developed countries is the direction in which Korea is and should be heading. Also worth noting is Korea’s extremely low foreign bias towards few emerging economies. As suggested by theory, the maximized portfolio return is only possible if assets are evenly allocated to every equity market in every region. Korea’s high investment in emerging markets will expose domestic investors excessively to emerging market risks and thus adversely affect portfolio returns, which requires caution.

What's needed the most now is a paradigm shift in foreign equity investment among Korean investors. Already, many studies confirm that the largest benefit derived from outward equity investment is risk distribution by building a global portfolio. This calls for investors to enhance efficiency in asset allocation by properly taking into account many key factors behind risk distribution, e.g., an investment destination's equity market size, the correlation with the domestic market, etc. Retail investors, in particular, are expected to have limited access to relevant information, as compared to other investors. They should seek out professional advice, if necessary, to fully consider the risks arising from outward investment such as the country-specific risk and foreign exchange risk.

1) The BOK International Investment Position categorizes domestic investors into the general government, deposit-taking institutions, and other financial corporations, etc. The general government category includes major pension funds such as the National Pension, Korea Investment Corporation, etc. As of 2018, the National Pension is estimated to hold about 80% of the general government’s portfolio investment in overseas equity.

2) Domestic investors’ outbound portfolio investment in equity is from the recent data (2018) from the Cooperated Portfolio Investment Survey (CPIS), a survey targeting central banks by the IMF. Thus, the analysis in this article does not reflect the recent rise in retail investors’ outbound investment in equity.

3) The foreign bias in this article is a normalized measure using the weight against the maximum bias, ranged between the maximum overinvestment bias ‘-1’ and the maximum underinvestment bias ‘+1’, where the bias becomes lower if getting close to zero. For details on how to measure the bias, refer to Kim (2020).

4) Investors’ home bias is commonly found in most developed markets. Since first reported by French & Poterba (1991) among US investors, home bias has been found in many studies in a wide range of economies. Obstfeld & Rogoff (2000) presented it one of the six puzzles in the international financial market.

References

French, R., Poterba J., 1991, Investor diversification and international equity markets, The American Economic Review 81(2), 222-226.

Obstfeld, M., Rogoff, K., 2000, The six major puzzles in International Macroeconomics: Is there a common cause? NBER Working Paper No.7777.

(Korean)

Kim, H.S., 2020, Korea's portfolio investment in foreign equity: Status and characteristics, Korea Capital Market Institute Issue Paper 20-02.