Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Korea’s Foreign Exchange Market under Covid-19: Current State and Implications

Publication date Apr. 28, 2020

Summary

A foreign currency liquidity crisis in the past used to stem from a disequilibrium in the financial markets. However, what we have today is fundamentally different. Covid-19’s fallout is first hitting the real economy to dampen firms’ ability repay their debt, which in turn raises uncertainties in the financial and foreign exchange markets. As it’s de facto impossible to predict when the pandemic will end, uncertainties around the size and period of the economic fallout could be amplified further. Under the context, signs of a crunch in the global dollar market are affecting Korea’s foreign exchange market, serving as a source of concern over the supply and demand of foreign currency. Although uncertainties surrounding Korea’s foreign exchange market are expected to linger for a considerable period of time, their destabilizing impact will be relatively limited given Korea’s external soundness and emergency liquidity sources such as currency swap lines, and the US Fed’s determination to expand its provision of offshore dollar liquidity. However, a recovery from today’s crisis relies entirely on how Covid-19 unfolds in the near future. Hence, Korea should ensure that its foreign exchange market is ready for the lengthening of the crisis. Furthermore, all-out effort is needed to closely monitor the conditions in the foreign exchange market as well as the global dollar market, and to step in to provide foreign currency liquidity whenever necessary.

The fallout of the Covid-19 pandemic has been increasing uneasiness in Korea’s foreign exchange market. As Covid-19 escalates into a global pandemic, concerns are rising about a global economic recession, with signs of a crunch creeping into the dollar market. Already hit by two foreign exchange crises, Korea remains in high alert to any signs of rising unrest in the foreign currency money market. This article first explores the current state and any potential unrest in Korea’s foreign exchange market under Covid-19, from which to derive some implications for future outlook.

Recent trends

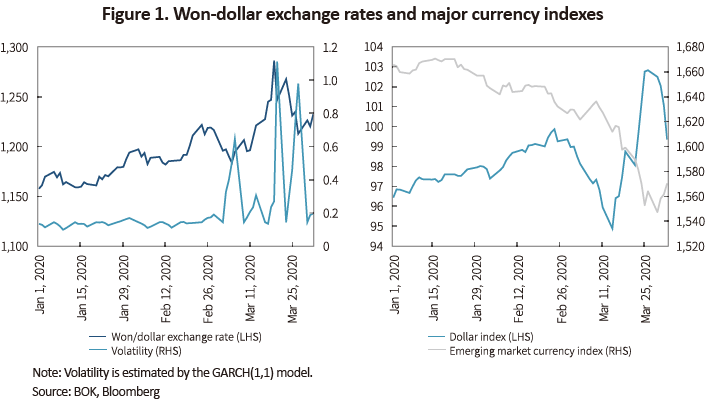

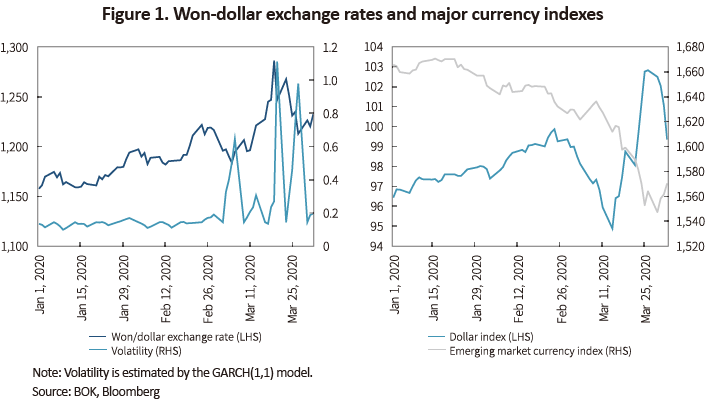

Since Korea confirmed the first Covid-19 case at the end of January, the won-dollar exchange rate has been rising. The rise became especially drastic after the WHO declared a pandemic over Covid-19 on March 11, 2020. The spread of the coronavirus abruptly pushed up demand for the US dollar that is regarded as safe assets. The dollar index, an indicator of the value of dollar against major currencies, drastically rose between March 11 and 19, with most of emerging market currencies including the Korean won depreciating during the same period. In particular, the won-dollar exchange rate hit KRW 1,285.7 on March 19, the highest level since the global financial crisis. Thankfully, it quickly abated somewhat after the Bank of Korea unveiled its currency swap agreement with the US.1) As the currency swap agreement provided liquidity to the market twice on March 31 and April 7, Korea’s foreign exchange market appears to be clawing its way back to stability.2) As of April 9, the won-dollar exchange rate stood at KRW 1,219, down 5% from its annual peak. Volatility in the won-dollar exchange rate is also on the decline recently.

Assessing Korea’s foreign exchange supply and demand

Foreign exchange rates are determined by supply and demand in the interbank foreign exchange market.3) More precisely, factors affecting foreign exchange rates include conditions in the interbank foreign currency money market4) as well as foreign currency demand and supply among firms and investors. The former depends on liquidity in the offshore dollar market and credit ratings depending on economic conditions, whereas the latter is about the demand and supply in the retail foreign currency market largely affected by the current account balance, and portfolio investment by foreign investors, etc. As the shock from Covid-19’s fallout on the real economy is spreading to the financial markets, both of the factors are imposing adverse impacts on Korea’s foreign currency supply and demand.

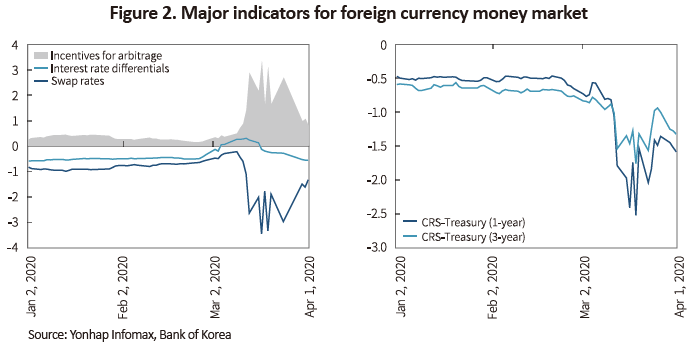

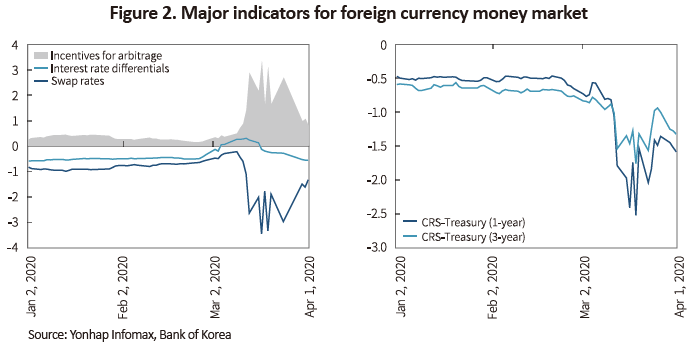

The recent rise in Korea’s foreign exchange market volatility is largely attributable to the deteriorating financing conditions in the interbank foreign exchange market. As illustrated in Figure 2, mid- to short-term financing conditions in Korea’s foreign currency market deteriorated abruptly in March 2020, with the volatility and liquidity indexes in the global financial markets (VIX, Libor-overnight index swap spread)5) also worsening dramatically during the same period. Although dollar liquidity conditions at home and abroad abated as the US Fed expanded its provision of offshore dollar liquidity after March,6) the strong dollar and the appetite for liquidity are expected to linger for some time being amid rising concerns about a global recession and increasing global credit risks.

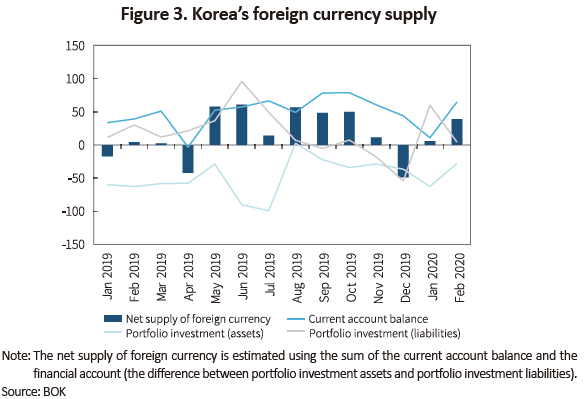

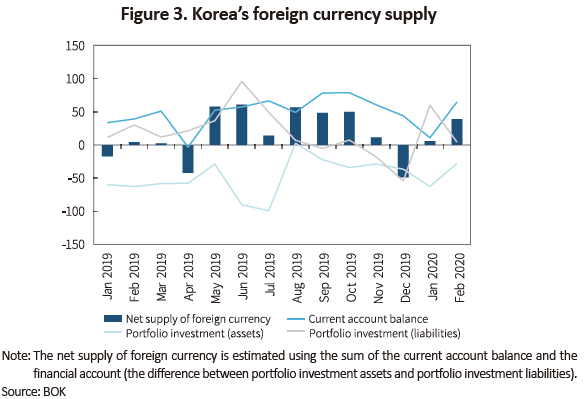

The retail foreign exchange market sees the net supply in current account transactions and in-bound foreign bond investment continue. However, some changes are taking place in foreign currency demand and supply as foreign investors are trying to exit their equity investments and more Korean securities firms are seeing an increase in margin calls related to their overseas equity-linked securities. In particular, foreign equity portfolio investments in Korea are seeing net selling for 25 consecutive trading days from March 5, as of April 9. By contrast, the net inflow of foreign currency continued via current account transactions and foreign investors’ purchase of Korean bonds. At the end of February 2020, Korea’s current account surplus reached $6.4 billion, recording a surplus for 10 consecutive months. Also, foreign investors’ net buying of Korean bonds stood at KRW 6.7 trillion at the end of March, showing an increase from the previous month.7) All in all, as of end-February, Korea’s balance of payments showed a net supply of foreign currency—the inflow dwarfing the outflow—via current account transactions and securities transactions as illustrated in Figure 3. However, the supply and demand of foreign currency in Korea’s retail foreign exchange market is expected to deteriorate after April amid Covid-19’s fallout such as the deteriorating current account balance and the continuous foreign net selling in the stock market.

Future Outlook

Although Korea’s foreign exchange market regained its stability after liquidity provision under the Korea-US currency swap agreement, uncertainties are expected to linger in the foreign exchange market for the time being. The shock arising from the Covid-19 spread is fundamentally different from past financial crises triggered by a disequilibrium in the financial sector. This time, the pandemic is causing a direct shock on the real economy by temporarily suspending economic activities in many countries. Consequently, more and more firms see their cash flows deteriorating, which could push up default risk and then volatility in the financial and foreign exchange markets. Furthermore, it’s still too hard to predict how Covid-19’s economic spillover will pan out in the future. This is closely related to the progress of Covid-19. Nevertheless, the impact of Covid-19 on Korea’s foreign exchange market seems to be relatively limited due to the following reasons.

First, the US Fed is rapidly bolstering its speed and capacity for offshore dollar provision, which will help prevent the current crisis from spreading further. On March 19, the Fed signed a bilateral currency swap agreement with nine countries including Korea. This was quickly followed on March 31 by its plan to establish the FIMA Repo Facility that allows a foreign central bank to raise the US dollar based on its US government bond holdings. Arguably, such moves came out of recognition where the Fed’s stronger role as a lender of last resort in the global financial markets is closely aligned with the nation’s own economic benefits.8) As seen in the previous financial crisis, the Fed’s provision of offshore dollar liquidity became the most effective tool preventing the crisis from escalating further. The unprecedentedly rapid action the Fed is taking to provide offshore dollar liquidity is expected to contribute greatly to helping financial and foreign exchange markets regain stability.

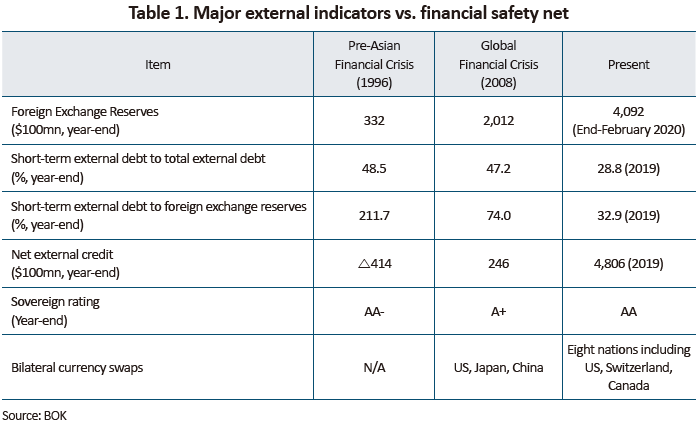

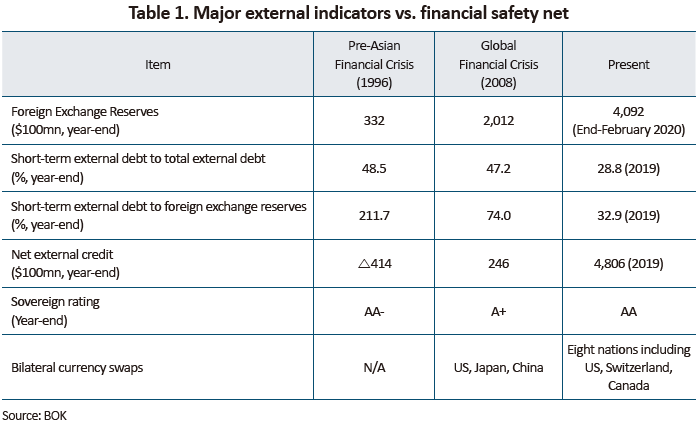

Second, Korea’s foreign exchange market is solid in terms of macroprudential conditions. Since the global financial crisis, Korea has focused on improving its macroprudential conditions by shutting off excessive inflows of foreign currency,9) which has immensely enhanced its major macroprudential indicators as shown in Table 1. Kim (2018) analyzed 22 emerging markets including Korea to see their exposure to external risk, and found out Korea has the highest external soundness among the nations analyzed.10) Such a finding suggests the low probability of a foreign currency liquidity crisis because a financial crisis in emerging economies tends to originate from a nation that is externally vulnerable.

Third, Korea has immensely improved its global financial safety net (GFSN), the last defense against a foreign currency liquidity crisis. The GFSN is a set of institutions and mechanisms which provide liquidity to countries suffering from a foreign currency liquidity problem. This includes loans from international financial bodies, regional financial safety nets, and bilateral currency swaps, etc.11) Simply put, this places a secondary shield to which a crisis-hit nation can turn to after its own foreign reserves. Currently, Korea signed a bilateral currency swap agreement with eight nations including the US, while on another front establishing a multilateral currency swap agreement (Chiang Mai Initiative) with major Asian nations. The countries with which Korea already have a bilateral currency swap agreement include Switzerland and Canada that have permanent swap arrangements with the US. Also, the currency swap line between Korea and Canada has no upper limit. The fact that Korea has already had a liquidity safety net in response to a potential crisis could serve as a key reassuring factor effectively reining in uncertainties in the foreign exchange market.

Implications

Based on its external soundness, Korea seems to see some improvements in its foreign liquidity condition as major institutions resume their external debt issuance. However, Korea should still remain vigilant for any external risk factors that could worsen its foreign currency financing conditions in the face of rising uncertainties amid the progress of Covid-19 for the time being. Particularly, the rising possibility of a crisis in emerging markets requires caution. A spillover of an emerging crisis is likely to push up uncertainties in Korea’s foreign exchange market. Hence, it’s important to thoroughly monitor the possibility of an emerging crisis in Mexico and Brazil suffering from economic hardships hit by recent oil price plunges and Covid-19, as well as in Turkey and Argentina where the likelihood of a crisis has grown significantly since 2018.

Furthermore, it’s necessary to closely watch for a possible spread of global credit risks amid the Covid-19 pandemic. Major credit rating agencies have already downgraded ratings of major nations and firms citing uncertain economic outlook. On another front, home bias among investors has been more prevalent recently. All of those circumstances strongly call for Korea to cautiously monitor the conditions in Korea’s foreign exchange market as well as the global dollar market, and to step in to provide foreign currency whenever necessary.

1) At 22:00 on March 19, the Bank of Korea announced that it entered a $60 bilateral currency swap agreement with the US Fed.

2) The Bank of Korea used the currency swap with the Fed for two auctions on March 31 and April 7. The total bids ($13.13 billion) far undershot the auction target ($20.5 billion), with the average bid rate (1st auction only) at 0.91% (84-day) and 0.52% (7-day), which is far lower than 6.84% (1st auction only) during the global financial crisis.

3) The foreign exchange market consists of an interbank market (wholesale) and a retail market. Foreign exchange rates we see are determined by trades in the interbank foreign exchange market. The net supply of foreign currency (a current account surplus, a capital inflow into the stock market from foreign investors, etc.) changes the foreign exchange position of banks, and thus serves to affect the interbank market.

4) The foreign currency money market is a place where foreign currency is borrowed and lent based on interest rates. This is different from the foreign exchange market where the Korean won and foreign currency are traded based on foreign exchange rates (Bin, K.B., 2009, Differences between foreign exchange market and foreign currency money market and importance of the KRX currency market, KCMI Issue Paper 09-03).

5) In March, both the global volatility index (VIX) and the dollar liquidity index (Libor-OIS spread) hit the highest since the global financial crisis.

6) Currently, the US Fed has thus far provided $365.8 billion via currency swap lines with a total of 14 central banks (including those in five jurisdictions with permanent US dollar liquidity swap arrangements). All of the nations in the swap lines saw their short-term dollar liquidity indicator (basis swaps, 3-month) return to the pre-March level (Korea Center for International Finance, April 7, 2020, US liquidity provision to countries with currency swap lines).

7) KOFIA, Press Release, April 9, 2020, OTC bond market trend in March 2020.

8) The US has an incentive to provide offshore dollar liquidity because a crunch in the dollar market could spark a sell-off of US government bonds by central banks in major economies. The stronger role of the Fed as a lender of last resort could help the US dollar reinforce its key currency position.

9) In the post-crisis era, Korea has implemented a series of macroprudential policies aimed at preventing excessive foreign capital from flowing in, e.g., macroprudential stability levy, caps on foreign exchange forward positions, foreign currency liquidity coverage ratio (LCR) regulation, etc.

10) Kim, H.S., 2108, Recent financial unrest in emerging markets: Background and assessment, KCMI Issue Paper 18-07.

11) For details, refer to Chapter 12: Global Financial Safety Net of Understanding and Predicting Foreign Exchange Rates by Lee, S.H.(2020, forthcoming).

Recent trends

Since Korea confirmed the first Covid-19 case at the end of January, the won-dollar exchange rate has been rising. The rise became especially drastic after the WHO declared a pandemic over Covid-19 on March 11, 2020. The spread of the coronavirus abruptly pushed up demand for the US dollar that is regarded as safe assets. The dollar index, an indicator of the value of dollar against major currencies, drastically rose between March 11 and 19, with most of emerging market currencies including the Korean won depreciating during the same period. In particular, the won-dollar exchange rate hit KRW 1,285.7 on March 19, the highest level since the global financial crisis. Thankfully, it quickly abated somewhat after the Bank of Korea unveiled its currency swap agreement with the US.1) As the currency swap agreement provided liquidity to the market twice on March 31 and April 7, Korea’s foreign exchange market appears to be clawing its way back to stability.2) As of April 9, the won-dollar exchange rate stood at KRW 1,219, down 5% from its annual peak. Volatility in the won-dollar exchange rate is also on the decline recently.

Foreign exchange rates are determined by supply and demand in the interbank foreign exchange market.3) More precisely, factors affecting foreign exchange rates include conditions in the interbank foreign currency money market4) as well as foreign currency demand and supply among firms and investors. The former depends on liquidity in the offshore dollar market and credit ratings depending on economic conditions, whereas the latter is about the demand and supply in the retail foreign currency market largely affected by the current account balance, and portfolio investment by foreign investors, etc. As the shock from Covid-19’s fallout on the real economy is spreading to the financial markets, both of the factors are imposing adverse impacts on Korea’s foreign currency supply and demand.

The recent rise in Korea’s foreign exchange market volatility is largely attributable to the deteriorating financing conditions in the interbank foreign exchange market. As illustrated in Figure 2, mid- to short-term financing conditions in Korea’s foreign currency market deteriorated abruptly in March 2020, with the volatility and liquidity indexes in the global financial markets (VIX, Libor-overnight index swap spread)5) also worsening dramatically during the same period. Although dollar liquidity conditions at home and abroad abated as the US Fed expanded its provision of offshore dollar liquidity after March,6) the strong dollar and the appetite for liquidity are expected to linger for some time being amid rising concerns about a global recession and increasing global credit risks.

Although Korea’s foreign exchange market regained its stability after liquidity provision under the Korea-US currency swap agreement, uncertainties are expected to linger in the foreign exchange market for the time being. The shock arising from the Covid-19 spread is fundamentally different from past financial crises triggered by a disequilibrium in the financial sector. This time, the pandemic is causing a direct shock on the real economy by temporarily suspending economic activities in many countries. Consequently, more and more firms see their cash flows deteriorating, which could push up default risk and then volatility in the financial and foreign exchange markets. Furthermore, it’s still too hard to predict how Covid-19’s economic spillover will pan out in the future. This is closely related to the progress of Covid-19. Nevertheless, the impact of Covid-19 on Korea’s foreign exchange market seems to be relatively limited due to the following reasons.

First, the US Fed is rapidly bolstering its speed and capacity for offshore dollar provision, which will help prevent the current crisis from spreading further. On March 19, the Fed signed a bilateral currency swap agreement with nine countries including Korea. This was quickly followed on March 31 by its plan to establish the FIMA Repo Facility that allows a foreign central bank to raise the US dollar based on its US government bond holdings. Arguably, such moves came out of recognition where the Fed’s stronger role as a lender of last resort in the global financial markets is closely aligned with the nation’s own economic benefits.8) As seen in the previous financial crisis, the Fed’s provision of offshore dollar liquidity became the most effective tool preventing the crisis from escalating further. The unprecedentedly rapid action the Fed is taking to provide offshore dollar liquidity is expected to contribute greatly to helping financial and foreign exchange markets regain stability.

Second, Korea’s foreign exchange market is solid in terms of macroprudential conditions. Since the global financial crisis, Korea has focused on improving its macroprudential conditions by shutting off excessive inflows of foreign currency,9) which has immensely enhanced its major macroprudential indicators as shown in Table 1. Kim (2018) analyzed 22 emerging markets including Korea to see their exposure to external risk, and found out Korea has the highest external soundness among the nations analyzed.10) Such a finding suggests the low probability of a foreign currency liquidity crisis because a financial crisis in emerging economies tends to originate from a nation that is externally vulnerable.

Third, Korea has immensely improved its global financial safety net (GFSN), the last defense against a foreign currency liquidity crisis. The GFSN is a set of institutions and mechanisms which provide liquidity to countries suffering from a foreign currency liquidity problem. This includes loans from international financial bodies, regional financial safety nets, and bilateral currency swaps, etc.11) Simply put, this places a secondary shield to which a crisis-hit nation can turn to after its own foreign reserves. Currently, Korea signed a bilateral currency swap agreement with eight nations including the US, while on another front establishing a multilateral currency swap agreement (Chiang Mai Initiative) with major Asian nations. The countries with which Korea already have a bilateral currency swap agreement include Switzerland and Canada that have permanent swap arrangements with the US. Also, the currency swap line between Korea and Canada has no upper limit. The fact that Korea has already had a liquidity safety net in response to a potential crisis could serve as a key reassuring factor effectively reining in uncertainties in the foreign exchange market.

Based on its external soundness, Korea seems to see some improvements in its foreign liquidity condition as major institutions resume their external debt issuance. However, Korea should still remain vigilant for any external risk factors that could worsen its foreign currency financing conditions in the face of rising uncertainties amid the progress of Covid-19 for the time being. Particularly, the rising possibility of a crisis in emerging markets requires caution. A spillover of an emerging crisis is likely to push up uncertainties in Korea’s foreign exchange market. Hence, it’s important to thoroughly monitor the possibility of an emerging crisis in Mexico and Brazil suffering from economic hardships hit by recent oil price plunges and Covid-19, as well as in Turkey and Argentina where the likelihood of a crisis has grown significantly since 2018.

Furthermore, it’s necessary to closely watch for a possible spread of global credit risks amid the Covid-19 pandemic. Major credit rating agencies have already downgraded ratings of major nations and firms citing uncertain economic outlook. On another front, home bias among investors has been more prevalent recently. All of those circumstances strongly call for Korea to cautiously monitor the conditions in Korea’s foreign exchange market as well as the global dollar market, and to step in to provide foreign currency whenever necessary.

1) At 22:00 on March 19, the Bank of Korea announced that it entered a $60 bilateral currency swap agreement with the US Fed.

2) The Bank of Korea used the currency swap with the Fed for two auctions on March 31 and April 7. The total bids ($13.13 billion) far undershot the auction target ($20.5 billion), with the average bid rate (1st auction only) at 0.91% (84-day) and 0.52% (7-day), which is far lower than 6.84% (1st auction only) during the global financial crisis.

3) The foreign exchange market consists of an interbank market (wholesale) and a retail market. Foreign exchange rates we see are determined by trades in the interbank foreign exchange market. The net supply of foreign currency (a current account surplus, a capital inflow into the stock market from foreign investors, etc.) changes the foreign exchange position of banks, and thus serves to affect the interbank market.

4) The foreign currency money market is a place where foreign currency is borrowed and lent based on interest rates. This is different from the foreign exchange market where the Korean won and foreign currency are traded based on foreign exchange rates (Bin, K.B., 2009, Differences between foreign exchange market and foreign currency money market and importance of the KRX currency market, KCMI Issue Paper 09-03).

5) In March, both the global volatility index (VIX) and the dollar liquidity index (Libor-OIS spread) hit the highest since the global financial crisis.

6) Currently, the US Fed has thus far provided $365.8 billion via currency swap lines with a total of 14 central banks (including those in five jurisdictions with permanent US dollar liquidity swap arrangements). All of the nations in the swap lines saw their short-term dollar liquidity indicator (basis swaps, 3-month) return to the pre-March level (Korea Center for International Finance, April 7, 2020, US liquidity provision to countries with currency swap lines).

7) KOFIA, Press Release, April 9, 2020, OTC bond market trend in March 2020.

8) The US has an incentive to provide offshore dollar liquidity because a crunch in the dollar market could spark a sell-off of US government bonds by central banks in major economies. The stronger role of the Fed as a lender of last resort could help the US dollar reinforce its key currency position.

9) In the post-crisis era, Korea has implemented a series of macroprudential policies aimed at preventing excessive foreign capital from flowing in, e.g., macroprudential stability levy, caps on foreign exchange forward positions, foreign currency liquidity coverage ratio (LCR) regulation, etc.

10) Kim, H.S., 2108, Recent financial unrest in emerging markets: Background and assessment, KCMI Issue Paper 18-07.

11) For details, refer to Chapter 12: Global Financial Safety Net of Understanding and Predicting Foreign Exchange Rates by Lee, S.H.(2020, forthcoming).