Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Facilitating Indirect Real Estate Investment via REITs

Publication date Jan. 05, 2021

Summary

Korea has so far employed REITs mainly for two purposes─a privately placed investment option for institutional investors, and a tool for housing policy such as public housing─instead of providing ordinary investors a greater range of indirect investment opportunities for holding real estate. However, Korea’s listed REITs market is recently gaining activity as more and more REITs are going public and drawing attention of ordinary investors.

Nevertheless, Korea’s REITs market still lacks a market structure that can meet ordinary investors’ diverse demand for indirectly investing in real estate. Currently, most REITs take the form of private placement and the market for listed REITs is quite small with a very limited range of investment targets. Currently, REITs are subject to regulatory overlaps and a tough listing standard without sufficient regulatory support and incentives for listing. Even after being listed, REITs have difficulty in purchasing new shares for growing their size due to some regulatory constraints.

For nurturing a well-functioning REITs market, the current market structure needs reshaping in a way placing listed REITs in the center. Long-term development of the market would be possible only if the market provides investors more indirect investment opportunities and proper returns that suit investor demand. This requires the market to list more REITs based on high return properties, which would widen investor choices. Also necessary is a plan to increase the size of the REITs already listed. The current “one REIT for one property” structure needs improving so that a listed REIT can include new assets. Another alternative is a regulatory improvement to permit a multi-tier FOF structure for listed REITs, which would enhance scalability. Along with that, it’s worth benchmarking overseas cases where an incentive is provided to facilitate the market for listed REITs.

Nevertheless, Korea’s REITs market still lacks a market structure that can meet ordinary investors’ diverse demand for indirectly investing in real estate. Currently, most REITs take the form of private placement and the market for listed REITs is quite small with a very limited range of investment targets. Currently, REITs are subject to regulatory overlaps and a tough listing standard without sufficient regulatory support and incentives for listing. Even after being listed, REITs have difficulty in purchasing new shares for growing their size due to some regulatory constraints.

For nurturing a well-functioning REITs market, the current market structure needs reshaping in a way placing listed REITs in the center. Long-term development of the market would be possible only if the market provides investors more indirect investment opportunities and proper returns that suit investor demand. This requires the market to list more REITs based on high return properties, which would widen investor choices. Also necessary is a plan to increase the size of the REITs already listed. The current “one REIT for one property” structure needs improving so that a listed REIT can include new assets. Another alternative is a regulatory improvement to permit a multi-tier FOF structure for listed REITs, which would enhance scalability. Along with that, it’s worth benchmarking overseas cases where an incentive is provided to facilitate the market for listed REITs.

A real estate investment trust (REIT) is an indirect investment vehicle that pools funds from a large number of investors for investing those funds in real estate or securities linked to real estate assets and distributing returns to the investors. Thus far, Korea has employed that structure mainly for two purposes—a privately placed investment option for institutional investors, and a tool for housing policy such as public housing—instead of providing ordinary investors a greater range of indirect investment opportunities for holding real estate. Accordingly, the sizable growth in Korea’s REITs market failed to promote more ordinary investors to invest indirectly in real estate.

However, Korea’s REITs market has seen a gradual change in structure since 2019: A greater number of REITs have been listed with growing investor interest in listed REITs. Such a change could have been fueled by both the government’s policy drive for facilitating the listing and public offering of REITs, and the industry’s self-inflicted effort for increasing the supply of listed REITs. Nevertheless, some REITs failed to attract enough investment to go public, whereas some other listed REITs have been priced below the offer price for a long period of time. Under the circumstances, this article tries to assess the current state and some issues in Korea’s REITs market, and proposes possible plans to facilitate the market for listed REITs.

Korea’s REITs market: Current status

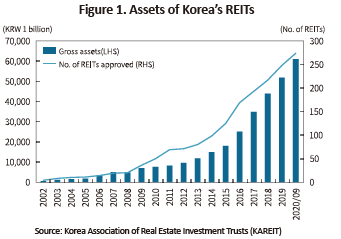

Korea’s REITs market has been first established since the Real Estate Investment Company Act was enacted in 2001.1) Since then, the market has achieved continuous growth in terms of size. Korea’s REITs market saw its gross assets surging from KRW 7.6 trillion in 2010 to KRW 61 trillion in end-September 2020, and the number of approved REITs growing from 50 in 2010 to 274 in end-September 2020.

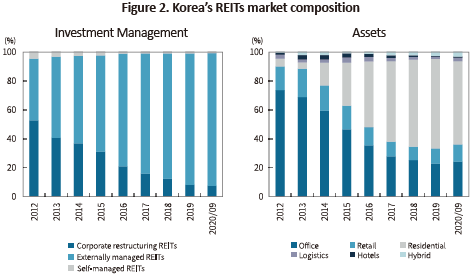

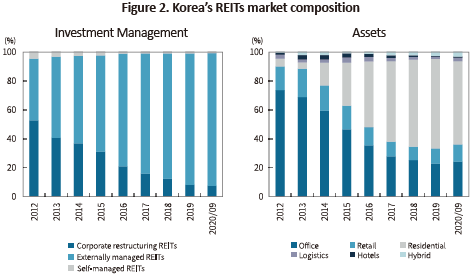

A brief look at the composition of Korea’s REITs market reveals a change in the investment structure, investment target, and product structure each of which to adapt into new market conditions and rules. In terms of how REITs are managed,2) corporate restructuring REITs accounted for a large percentage during the early days, but the share of externally-managed REITs increased gradually to reach 92.9% of REITs in Korea as of the end of September 2020.

Also found is a high proportion of residential properties in REITs’ investment target which in theory includes a diverse type of real estate such as office and retail space, residential real estate, logistics space, hotels, and other hybrid properties. In investment assets of REITs collectively, the share of residential properties rose continuously from 5.3% in 2012 to 57.5% in September 2020. Such a concentration is due to the use of REITs by Korea Land & Housing Corporation (LH Corp.) for its increased supply of public housing. It was 2014 when LH Corp. first used REITs for public housing. Most of REITs for that purpose were issued privately for institutional investors only. REITs issued by LH Corp. currently account for 36.8% of the overall REITs market. The increased use of REITs in this structure helped LH Corp. not only increase the supply of public housing, but also reduce its financial burden. Another benefit of such a policy is its role in facilitating Korea’s REITs market that was then inactive due to several factors. On the flip side, however, the low return on public housing is in effect dragging down the return on overall REITs, while the use of private placement contracted the market for publicly offered REITs.

Listed REITs: Current status

In the past, it was possible to get approval from the relevant authority for publicly offering a REIT to be listed on the exchange as long as the REIT would meet certain physical conditions. This helped numerous REITs—especially corporate restructuring REITs—to be listed during the early 2000s, and some self-managed REITs from 2010. But the 2011 scandal involving a self-managed REIT’s false payment of capital contribution exposed investor protection issues, seriously undermining the soundness of listed REITs. Accordingly, the Korea Exchange sought to regain the soundness by tightening its listing rule on REITs, which resulted in delisting of several self-managed REITs. This made asset management companies of REITs place a heavier focus on private placement for institutional investors only, which sent the publicly offered, listed REITs market to a long period of contraction. For example, only two REITs were listed as of 2015, whereas some of REITs seeking to list itself on the exchange had to turn to a private placement due to their failure to meet the stricter listing standard. When the contraction in the listed REITs market lingered, the government initiated a policy drive for improving the REITs regime and facilitating the listed REITs market. In 2016, it unveiled a plan to improve the competitiveness of the REITs industry, proposing to partially relax the listing standard and to promote more privately placed REITs to go public. Slightly later in 2018, another plan was announced, aiming to facilitate publicly offered, listed REITs and to give retail investors broader investment opportunities. This plan includes several ideas, such as an improved listing standard for REITs, more of the Housing and Urban Fund to be invested in REITs, a relaxed rule on reinvestment of funds in REITs. Furthermore, the plan proposes to introduce a credit rating system for REITs, aiming to help ordinary investors to make an informed decision to invest in REITs. Also included is a plan to allow REITs to tap into debt for acquiring investment assets for a more broad-based return profile.

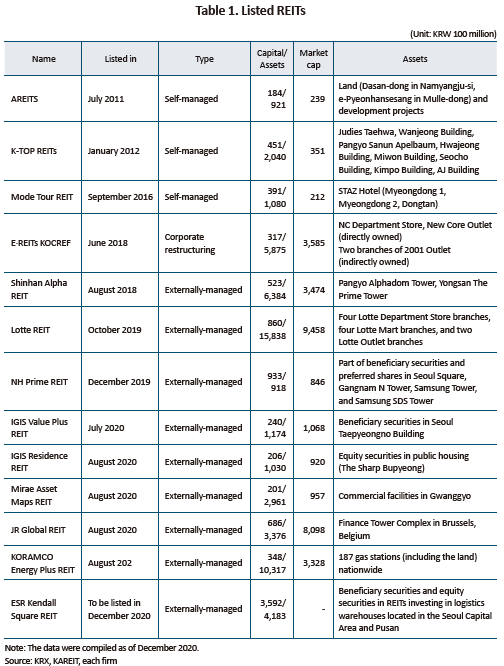

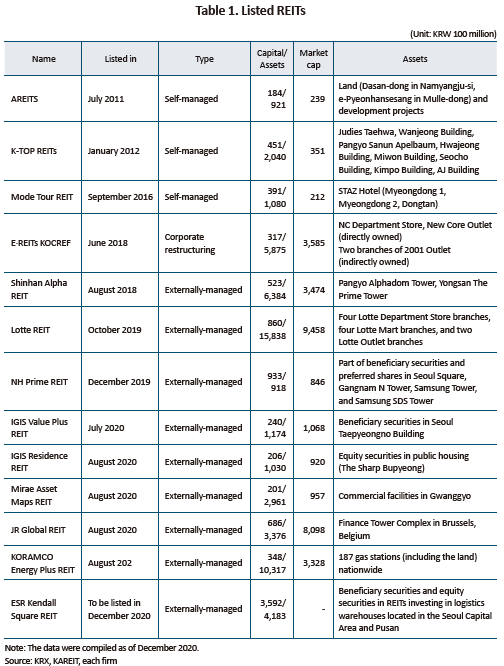

Such market-facilitating plans have served to promote more REITs to be listed since 2019. As ordinary investors have shown growing interest in indirect investment in real estate for a stable income stream in the low interest rate environment, more and more REITs based on more diversified properties have been listed on the exchange. This pushed up the number of listed REITs from 5 in 2018 to 13 in December 2020.

Notably, all of the REITs that have been newly listed since 2019 are externally managed with underlying assets being a diversified range of properties. Since Lotte REIT was issued based on retail properties in October 2019, many listed REITs have been listed on the exchange with underlying assets such as public housing, office and retail space, logistics warehouse, gas stations, and overseas properties. Also found in the market was a REIT with a multi-fund structure,3) e.g., IGIS Residence REIT, IGIS Value Plus REIT, and NH Prime REIT.

Korea’s listed REITs market: Current issues

As mentioned above, Korea’s listed REITs market has been booming backed by the recent rise in the number of listed REITs and ordinary investors’ growing interest in REITs investment. Still, however, listed REITs currently represent a low percentage in the overall REITs market. This could have been attributable to several issues described below.

Most importantly, Korea’s REITs market has yet to form a market structure that meets the legal basis and purpose originally intended when the market was first established. Although the Real Estate Investment Company Act was initially designed to give ordinary investors a broader range of opportunities for investing in real estate and to form a sound investment culture, the inactive market for listed REITs is not providing ordinary investors sufficient investment choices. The primary cause to this is a mixture of several factors: Without any incentive such as tax benefits, REITs were subject to a tough listing standard, an additional cost for soliciting investors, and high uncertainties in public offering, all of which in the end made REITs reluctant to go public. From investors’ perspective, the scandal in some of the self-managed REITs undermined investor confidence in REITs, which also served to contract investor demand for listed REITs. Also, the small size of listed REITs and the lack of diversity in the market neither provided indirect investment opportunities nor attracted investor attention, which contributed to contracting the listed REITs market.

The small scale of listed REITs is clearly a problem. The average asset size of Korea’s listed REITs stood at around KRW 400 billion, which is far smaller than one in developed markets such as the US, Japan, and Singapore. Those nations pushed for a policy drive for improving investor confidence with a regulatory reform to support the growth of REITs. For example, the US adopted the UPREIT structure4) to grow the overall REITs market, which attracted diverse investors and successfully facilitated the market. The Sponsored REIT regime5) in Japan and Singapore also helped the market to continuously attract more assets and funds. Such a scalability strategy—expanding the asset profile of REITs to high return properties—could be a key factor behind high confidence and growth in REITs in those markets. However, that strategy is unavailable for Korea where the “one REIT for one property” structure bans a listed REIT from increasing its capital or purchasing a new property to grow in size. The small scale of REITs certainly undermines investor confidence in this market.

Korea’s REITs market is largely driven by private placement, and thereby has low transparency and efficiency. Most countries where REITs are actively traded have an active listed market that discloses returns and costs in a transparent manner. Such a market has a high level of market transparency and efficiency with well-functioning price discovery. Most of those nations have indexes based on listed REITs, which also could be a basis for developing diverse financial products. REITs-based indexes provided by some nations and index operators could be a useful benchmark for ETFs, funds, and other derivatives. The most widely adopted global REITs index is the FTSE EPRA/Nareit Global Real Estate Index, which was jointly developed by the FTSE and the European Public Real Estate (EPRA). Tracking about 50% of global real estate, this index is adopted as a global benchmark for listed real estate. Japan first introduced its REITs market in 2000. After the market grew abruptly for a short period, it introduced in 2010 the Tokyo Stock Exchange REIT that shows the overall trend of the J-REITs market. However, Korea’s REITs market—centering on private placements without a proper real estate benchmark—hinders the provision of meaningful REITs-related information and the development of a suitable index.

Another constraint on Korea’s listed REITs market is its limited pool of investors. In other countries, listed REITs can grow in size by purchasing new assets, while ETFs and equity funds are actively investing in REITs. However, Korea’s institutional investors hardly invest in listed REITs. Seeking to address the issue, the government revised the Enforcement Decree of the Financial Investment Services and Capital Markets Act to allow a publicly offered fund-of-fund (FOF) REIT to invest in privately placed real estate funds. That regulatory reform enabled some listed REITs to adopt a multi-tier FOF structure. However, the current regulation bans a publicly offered equity fund or an equity ETF from investing in multi-tier FOF REITs.6) Such a regulatory constraint led to the underpricing of those REITs, and hindered the listing of those REITs.

How to facilitate listed REITs

For nurturing an active REITs market, Korea needs to reshape the current market structure with a focus placed on listed REITs. Compared to other investment targets, listed REITs can provide many benefits in terms of diversity, profitability, liquidity, and transparency. Hence, it is desirable to expand the supply of listed REITs that would meet ordinary investors’ demand, and to provide regulatory support for facilitating the market, both of which would help the REITs market to advance further in a long run.

More concretely, the market needs to provide more listed REITs that would better appeal to investor demand. If the market lists more REITs based on high return properties, this could surely improve investor perception on listed REITs, and widen investor choices. This could be achieved only if asset managers make utmost effort to list more REITs based on high return properties. They should enhance their capabilities for product development and investment management, aiming to discover high-return properties and to list those assets on the exchange. Also necessary is to broaden the investment targets of listed REITs. Currently, the investment target—currently limited to domestic commercial properties—should be expanded to overseas properties and other infrastructure as well. Another area that needs improving would be the scale of listed REITs. Introducing the sponsored REIT scheme would be a good start. Listed REITs could grow their scale effectively if they work with sponsors with high credibility and financial strength, for example, a large-scale financial institution, a developer, a construction firm, and a real estate owner. Also advisable is a plan to increase the size of the REITs already listed on the exchange. In particular, it’s worth revisiting the current “one REIT for one property” structure, aiming to allow a REIT to include new assets for scaling up. A useful alternative could be a regulatory reform on the multi-tier FOF structure for listed REITs. By allowing investors to invest in diverse properties, those REITs could provide a portfolio diversification effect. For facilitating those products to be introduced in the market, a regulatory reform is needed to allow equity funds or equity ETFs to invest in listed multi-tier FOF REITs.

It’s worth noting that any regulatory reform towards the aforementioned direction should be effective, delivering substantial results. What’s necessary is to maintain or strengthen the rules that help listed REITs to remain their listed status and stability, while eliminating any irrational or overlapping rules. More concretely, the listing standard should be relaxed further, aiming to facilitate more REITs to go public. For example, the government already exempted externally managed REITs that are non-developers from a preliminary review that is part of the listing process, seeking to facilitate the listed REITs market. Still, however, externally managed REITs are faced with strict requirements such as business performance above a certain level and excessive minimum capital. Taking into account the nature of indirect investment, it is reasonable to apply a much looser listing standard to those externally managed REITs. Also desirable is to permit diverse structures and arrangements where the market can provide investors the best indirect investment vehicle after fully considering investor appetite and the nature of properties. In a long run, Korea’s REIT market should go beyond the form of a corporation a real estate fund usually takes, and permit a trust-based REIT as long as the market is equipped with sufficient infrastructure and professionals with enhanced capabilities for managing real estate investment.

A fully-functioning market for listed REITs surely requires a regulatory incentive, for example, a cut in corporate tax and acquisition tax, a deferred capital gains tax, and a tax benefit for dividends. It’s worth reviewing overseas cases mentioned above before designing a proper incentive for listed REITs. The best starting point could be the US case for UPREITs that provide any REIT purchasing a new property or merging with another REIT diverse benefits such as a capital gains tax deferral and a streamlined process. Such arrangements would be useful to induce more REITs to merge for scaling up.

1) The Real Estate Investment Company Act governs the overall REITs regime, prescribing detailed rules on the type of REITs, and the license and business scope of a REIT firm, securities issuance, and others related to a REIT firm.

2) REITs are classified into self-managed, externally managed, and corporate restructuring REITs depending on how they are managed. A self-managed REIT is a firm that manages its own investment, employing regular workers including asset management professionals. By contrast, an externally managed REIT delegates an external asset management company to manage the investment. Lastly, a corporate restructuring REIT invests in real estate that is sold for the purpose of corporate restructuring.

3) This means a REIT whose parent fund invests in more than two child funds.

4) An UPREIT has a unique structure that allows a property owner to participate in a REIT as an operating partnership. By allowing properties owned by individuals or businesses to be included in a REIT, this structure helped the market to grow immensely.

5) A sponsor in this regime refers to a firm that plays a leading role in creating and operating an investment conduit such as a REIT. By providing broad-based support such as transferring assets, raising funds, managing investments and providing back-office support, the sponsor serves to stabilize the operation of a REIT, and to improve investor confidence.

6) Under the FSCMA, any publicly offered FOF that invests over 40% of its assets in a privately placed fund cannot be invested by another publicly offered fund. Because a REIT is regarded as a collective investment scheme under the FSCMA, a listed multi-tier FOF REIT cannot be invested by a publicly offered equity fund or an equity ETF unless specified otherwise.

However, Korea’s REITs market has seen a gradual change in structure since 2019: A greater number of REITs have been listed with growing investor interest in listed REITs. Such a change could have been fueled by both the government’s policy drive for facilitating the listing and public offering of REITs, and the industry’s self-inflicted effort for increasing the supply of listed REITs. Nevertheless, some REITs failed to attract enough investment to go public, whereas some other listed REITs have been priced below the offer price for a long period of time. Under the circumstances, this article tries to assess the current state and some issues in Korea’s REITs market, and proposes possible plans to facilitate the market for listed REITs.

Korea’s REITs market: Current status

Korea’s REITs market has been first established since the Real Estate Investment Company Act was enacted in 2001.1) Since then, the market has achieved continuous growth in terms of size. Korea’s REITs market saw its gross assets surging from KRW 7.6 trillion in 2010 to KRW 61 trillion in end-September 2020, and the number of approved REITs growing from 50 in 2010 to 274 in end-September 2020.

Also found is a high proportion of residential properties in REITs’ investment target which in theory includes a diverse type of real estate such as office and retail space, residential real estate, logistics space, hotels, and other hybrid properties. In investment assets of REITs collectively, the share of residential properties rose continuously from 5.3% in 2012 to 57.5% in September 2020. Such a concentration is due to the use of REITs by Korea Land & Housing Corporation (LH Corp.) for its increased supply of public housing. It was 2014 when LH Corp. first used REITs for public housing. Most of REITs for that purpose were issued privately for institutional investors only. REITs issued by LH Corp. currently account for 36.8% of the overall REITs market. The increased use of REITs in this structure helped LH Corp. not only increase the supply of public housing, but also reduce its financial burden. Another benefit of such a policy is its role in facilitating Korea’s REITs market that was then inactive due to several factors. On the flip side, however, the low return on public housing is in effect dragging down the return on overall REITs, while the use of private placement contracted the market for publicly offered REITs.

In the past, it was possible to get approval from the relevant authority for publicly offering a REIT to be listed on the exchange as long as the REIT would meet certain physical conditions. This helped numerous REITs—especially corporate restructuring REITs—to be listed during the early 2000s, and some self-managed REITs from 2010. But the 2011 scandal involving a self-managed REIT’s false payment of capital contribution exposed investor protection issues, seriously undermining the soundness of listed REITs. Accordingly, the Korea Exchange sought to regain the soundness by tightening its listing rule on REITs, which resulted in delisting of several self-managed REITs. This made asset management companies of REITs place a heavier focus on private placement for institutional investors only, which sent the publicly offered, listed REITs market to a long period of contraction. For example, only two REITs were listed as of 2015, whereas some of REITs seeking to list itself on the exchange had to turn to a private placement due to their failure to meet the stricter listing standard. When the contraction in the listed REITs market lingered, the government initiated a policy drive for improving the REITs regime and facilitating the listed REITs market. In 2016, it unveiled a plan to improve the competitiveness of the REITs industry, proposing to partially relax the listing standard and to promote more privately placed REITs to go public. Slightly later in 2018, another plan was announced, aiming to facilitate publicly offered, listed REITs and to give retail investors broader investment opportunities. This plan includes several ideas, such as an improved listing standard for REITs, more of the Housing and Urban Fund to be invested in REITs, a relaxed rule on reinvestment of funds in REITs. Furthermore, the plan proposes to introduce a credit rating system for REITs, aiming to help ordinary investors to make an informed decision to invest in REITs. Also included is a plan to allow REITs to tap into debt for acquiring investment assets for a more broad-based return profile.

Such market-facilitating plans have served to promote more REITs to be listed since 2019. As ordinary investors have shown growing interest in indirect investment in real estate for a stable income stream in the low interest rate environment, more and more REITs based on more diversified properties have been listed on the exchange. This pushed up the number of listed REITs from 5 in 2018 to 13 in December 2020.

Notably, all of the REITs that have been newly listed since 2019 are externally managed with underlying assets being a diversified range of properties. Since Lotte REIT was issued based on retail properties in October 2019, many listed REITs have been listed on the exchange with underlying assets such as public housing, office and retail space, logistics warehouse, gas stations, and overseas properties. Also found in the market was a REIT with a multi-fund structure,3) e.g., IGIS Residence REIT, IGIS Value Plus REIT, and NH Prime REIT.

As mentioned above, Korea’s listed REITs market has been booming backed by the recent rise in the number of listed REITs and ordinary investors’ growing interest in REITs investment. Still, however, listed REITs currently represent a low percentage in the overall REITs market. This could have been attributable to several issues described below.

Most importantly, Korea’s REITs market has yet to form a market structure that meets the legal basis and purpose originally intended when the market was first established. Although the Real Estate Investment Company Act was initially designed to give ordinary investors a broader range of opportunities for investing in real estate and to form a sound investment culture, the inactive market for listed REITs is not providing ordinary investors sufficient investment choices. The primary cause to this is a mixture of several factors: Without any incentive such as tax benefits, REITs were subject to a tough listing standard, an additional cost for soliciting investors, and high uncertainties in public offering, all of which in the end made REITs reluctant to go public. From investors’ perspective, the scandal in some of the self-managed REITs undermined investor confidence in REITs, which also served to contract investor demand for listed REITs. Also, the small size of listed REITs and the lack of diversity in the market neither provided indirect investment opportunities nor attracted investor attention, which contributed to contracting the listed REITs market.

The small scale of listed REITs is clearly a problem. The average asset size of Korea’s listed REITs stood at around KRW 400 billion, which is far smaller than one in developed markets such as the US, Japan, and Singapore. Those nations pushed for a policy drive for improving investor confidence with a regulatory reform to support the growth of REITs. For example, the US adopted the UPREIT structure4) to grow the overall REITs market, which attracted diverse investors and successfully facilitated the market. The Sponsored REIT regime5) in Japan and Singapore also helped the market to continuously attract more assets and funds. Such a scalability strategy—expanding the asset profile of REITs to high return properties—could be a key factor behind high confidence and growth in REITs in those markets. However, that strategy is unavailable for Korea where the “one REIT for one property” structure bans a listed REIT from increasing its capital or purchasing a new property to grow in size. The small scale of REITs certainly undermines investor confidence in this market.

Korea’s REITs market is largely driven by private placement, and thereby has low transparency and efficiency. Most countries where REITs are actively traded have an active listed market that discloses returns and costs in a transparent manner. Such a market has a high level of market transparency and efficiency with well-functioning price discovery. Most of those nations have indexes based on listed REITs, which also could be a basis for developing diverse financial products. REITs-based indexes provided by some nations and index operators could be a useful benchmark for ETFs, funds, and other derivatives. The most widely adopted global REITs index is the FTSE EPRA/Nareit Global Real Estate Index, which was jointly developed by the FTSE and the European Public Real Estate (EPRA). Tracking about 50% of global real estate, this index is adopted as a global benchmark for listed real estate. Japan first introduced its REITs market in 2000. After the market grew abruptly for a short period, it introduced in 2010 the Tokyo Stock Exchange REIT that shows the overall trend of the J-REITs market. However, Korea’s REITs market—centering on private placements without a proper real estate benchmark—hinders the provision of meaningful REITs-related information and the development of a suitable index.

Another constraint on Korea’s listed REITs market is its limited pool of investors. In other countries, listed REITs can grow in size by purchasing new assets, while ETFs and equity funds are actively investing in REITs. However, Korea’s institutional investors hardly invest in listed REITs. Seeking to address the issue, the government revised the Enforcement Decree of the Financial Investment Services and Capital Markets Act to allow a publicly offered fund-of-fund (FOF) REIT to invest in privately placed real estate funds. That regulatory reform enabled some listed REITs to adopt a multi-tier FOF structure. However, the current regulation bans a publicly offered equity fund or an equity ETF from investing in multi-tier FOF REITs.6) Such a regulatory constraint led to the underpricing of those REITs, and hindered the listing of those REITs.

How to facilitate listed REITs

For nurturing an active REITs market, Korea needs to reshape the current market structure with a focus placed on listed REITs. Compared to other investment targets, listed REITs can provide many benefits in terms of diversity, profitability, liquidity, and transparency. Hence, it is desirable to expand the supply of listed REITs that would meet ordinary investors’ demand, and to provide regulatory support for facilitating the market, both of which would help the REITs market to advance further in a long run.

More concretely, the market needs to provide more listed REITs that would better appeal to investor demand. If the market lists more REITs based on high return properties, this could surely improve investor perception on listed REITs, and widen investor choices. This could be achieved only if asset managers make utmost effort to list more REITs based on high return properties. They should enhance their capabilities for product development and investment management, aiming to discover high-return properties and to list those assets on the exchange. Also necessary is to broaden the investment targets of listed REITs. Currently, the investment target—currently limited to domestic commercial properties—should be expanded to overseas properties and other infrastructure as well. Another area that needs improving would be the scale of listed REITs. Introducing the sponsored REIT scheme would be a good start. Listed REITs could grow their scale effectively if they work with sponsors with high credibility and financial strength, for example, a large-scale financial institution, a developer, a construction firm, and a real estate owner. Also advisable is a plan to increase the size of the REITs already listed on the exchange. In particular, it’s worth revisiting the current “one REIT for one property” structure, aiming to allow a REIT to include new assets for scaling up. A useful alternative could be a regulatory reform on the multi-tier FOF structure for listed REITs. By allowing investors to invest in diverse properties, those REITs could provide a portfolio diversification effect. For facilitating those products to be introduced in the market, a regulatory reform is needed to allow equity funds or equity ETFs to invest in listed multi-tier FOF REITs.

It’s worth noting that any regulatory reform towards the aforementioned direction should be effective, delivering substantial results. What’s necessary is to maintain or strengthen the rules that help listed REITs to remain their listed status and stability, while eliminating any irrational or overlapping rules. More concretely, the listing standard should be relaxed further, aiming to facilitate more REITs to go public. For example, the government already exempted externally managed REITs that are non-developers from a preliminary review that is part of the listing process, seeking to facilitate the listed REITs market. Still, however, externally managed REITs are faced with strict requirements such as business performance above a certain level and excessive minimum capital. Taking into account the nature of indirect investment, it is reasonable to apply a much looser listing standard to those externally managed REITs. Also desirable is to permit diverse structures and arrangements where the market can provide investors the best indirect investment vehicle after fully considering investor appetite and the nature of properties. In a long run, Korea’s REIT market should go beyond the form of a corporation a real estate fund usually takes, and permit a trust-based REIT as long as the market is equipped with sufficient infrastructure and professionals with enhanced capabilities for managing real estate investment.

A fully-functioning market for listed REITs surely requires a regulatory incentive, for example, a cut in corporate tax and acquisition tax, a deferred capital gains tax, and a tax benefit for dividends. It’s worth reviewing overseas cases mentioned above before designing a proper incentive for listed REITs. The best starting point could be the US case for UPREITs that provide any REIT purchasing a new property or merging with another REIT diverse benefits such as a capital gains tax deferral and a streamlined process. Such arrangements would be useful to induce more REITs to merge for scaling up.

1) The Real Estate Investment Company Act governs the overall REITs regime, prescribing detailed rules on the type of REITs, and the license and business scope of a REIT firm, securities issuance, and others related to a REIT firm.

2) REITs are classified into self-managed, externally managed, and corporate restructuring REITs depending on how they are managed. A self-managed REIT is a firm that manages its own investment, employing regular workers including asset management professionals. By contrast, an externally managed REIT delegates an external asset management company to manage the investment. Lastly, a corporate restructuring REIT invests in real estate that is sold for the purpose of corporate restructuring.

3) This means a REIT whose parent fund invests in more than two child funds.

4) An UPREIT has a unique structure that allows a property owner to participate in a REIT as an operating partnership. By allowing properties owned by individuals or businesses to be included in a REIT, this structure helped the market to grow immensely.

5) A sponsor in this regime refers to a firm that plays a leading role in creating and operating an investment conduit such as a REIT. By providing broad-based support such as transferring assets, raising funds, managing investments and providing back-office support, the sponsor serves to stabilize the operation of a REIT, and to improve investor confidence.

6) Under the FSCMA, any publicly offered FOF that invests over 40% of its assets in a privately placed fund cannot be invested by another publicly offered fund. Because a REIT is regarded as a collective investment scheme under the FSCMA, a listed multi-tier FOF REIT cannot be invested by a publicly offered equity fund or an equity ETF unless specified otherwise.