Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Structural Shifts in US Dollar Funding Market and Implications

Publication date Jan. 19, 2021

Summary

Having borne the brunt of liquidity crunch during the global financial crisis, the US dollar funding market is going through diverse changes due to strengthened post-crisis prudence regulation in the banking sector. In the market, global megabanks used to act as significant intermediaries of US dollar transactions, which helped meet the global US dollar demand. More recently, however, there have been several structural shifts such as more dollar-denominated bonds issued by non-bank institutions, more money raised in the FX swap market, and lingering high-cost and low-liquidity conditions in the short-term dollar money market. Although Korea’s FX spot market has enjoyed sound liquidity thanks to Korea’s improved exports, demand has been higher than usual in Korea’s foreign currency money market whose liquidity comes from foreign bank borrowings. This appears to imply a possible impact of the structural shifts in the global dollar funding market on Korea’s foreign currency money market. Hence, it’s advisable that Korea closely monitor such structural shifts for the sake of FX market stability. Given that those structural shifts are reining in global bank’s capacity to supply dollar while increasing the imbalance in Korea’s FX swap market, continuous policy effort is needed to secure and stabilize foreign currency liquidity.

The won-dollar exchange rate once climbed steeply with the spread of Covid-19 at the beginning of 2020, but recently got stabilized as some factors to make the Korean won gain value came to the fore. However, there is still lingering foreign currency risk from diverse external factors such as a possible resurgence of Covid-19. The recent action by the Bank of Korea to extend its bilateral currency swap agreement with the US Fed could be seen as a preemptive strategy seeking to improve FX market stability in response to possible fluctuations in the global economies expected in the near future. Potential unrest about foreign currency money market liquidity has been drawing attention continuously largely due to lingering concerns that any structural shift in the global dollar funding market would give rise to some unknown risk factors triggering an abrupt change in liquidity conditions in Korea’s foreign currency money market. Under the context, this article tries to explore post-crisis structural shifts in the global US dollar funding market, and to present their implications for Korea.

Background behind the shifts

The funding market for the US dollar—that has taken a dominant position as a key currency for international trades—is the world’s largest market with abundant liquidity. Conventionally, liquidity in the market has been provided by global megabanks. In the pre-crisis period, they increased leverage and steeply expanded intermediation in dollar transactions in this market, which served to meet the US dollar demand of financial as well as non-financial firms across the globe.

Until very recently, the US dollar demand shot up particularly in the non-banking sector. This could stem from the US dollar’s key currency status in international trades. As evidenced by recent statistics, the US dollar has taken up a large proportion in major international trades, with an increase in global portfolio investments imposing upward pressure on the US dollar demand. The Bank of International Settlement (BIS) recently reported a rapid rise in Asian institutional—especially among insurers—demand for portfolio investment, which largely contributed to increasing demand for hedging and the US dollar.1)

The global financial crisis could have triggered some structural shifts in how the US dollar is financed and supplied primarily by global megabanks. Based on the recognition that those players’ somewhat excessive leverage increase helped the financial crisis spread to the globe, major developed economies and international organizations have strengthened or newly adopted various types of prudential regulation that would expectedly prevent large banks from expanding their dollar business. Notably, the BIS has newly adopted liquidity regulation for curbing banks’ excessive financing of foreign currencies in the post-crisis era. Also, it has been harder for non-US banks to raise US dollar because of tougher regulation in US money market funds—a key path via which non-US banks finance short-term US dollar. Another factor stems from global banks’ experience of dollar liquidity crunch during the crisis, which could have triggered a perception shift away from viewing the dollar business as risk-free arbitrage.

Such post-crisis regulatory reform served to improve bank prudence in developed economies, which is surely viewed positive. However, this also triggered diverse structural shifts in terms of the supply and financing in the global US dollar funding market. Although major large banks already recovered their pre-crisis prudence levels, another dollar liquidity crunch triggered by Covid-19 hit the market, which is shedding renewed light on the factors behind the structural shifts.

Structural shifts in US dollar funding market

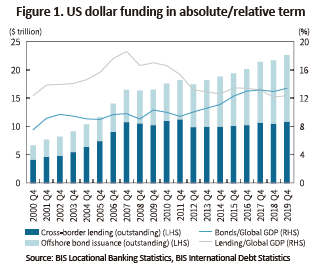

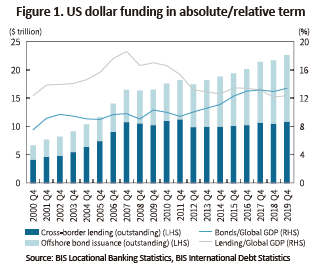

The most visible change in the US dollar funding market after the crisis is a downward trend in banks’ dollar supply. Despite the continuous rise in the US dollar demand until recently, banks—who used to play a central role in supplying the US dollar—saw their supply capacity shrinking, which appears to have been triggering some structural shifts. As illustrated in Figure 1, cross-border bank lending in terms of the amount outstanding stood up $11.6 trillion, recording an 8% decrease from the bottom reached prior to the global financial crisis. What’s notable is a marked decrease in the proportion of European banks who once led the expansion of global dollar intermediation. The downward trend forms a stark contrast to the pre-crisis period during which the banking sector’s increased dollar supply pushed up the size of the global dollar funding market. As of end-2019, the proportion of the banking sector in GDP fell more than five percentage points from the peak of 22% to 17%. Despite the growing US dollar demand, however, the banking sector’s dollar intermediation capacity has shrunk significantly.

By contrast to the decreased dollar business in the banking sector, there has been a rapid increase in the size of US dollar funding by institutions via capital markets. As shown in Figure 1, global institutions’ US dollar funding via bond issuance reached $12 trillion in aggregate as of end-2019, far exceeding the size of financing via bank lending during the same period, and the proportion of financing via bond issuance in the pre-crisis period (32%–34%). This well suggests an ongoing shift in the primary path of dollar credit away from banks towards direct financing via capital markets. Several studies have already paid tremendous attention to such a structural shift in dollar funding. One of them is Shin (2013) who reported a rise in capital market-based dollar credit as one of the major traits of the market’s structural shift.2)

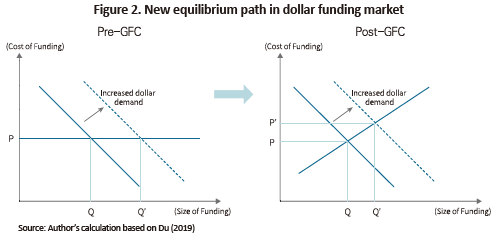

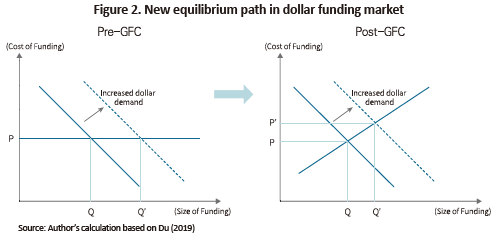

The reduced supply of the US dollar by the banking sector is found to have given rise to a new phenomenon of a constant liquidity shortage in the US dollar funding market. Notably, as non-US banks’ capacity to secure short-term capital via MMFs shrank significantly, the short-term financing demand has been concentrated in the FX swap market, creating a continued imbalance with higher demand in the short-term dollar funding market. This could have led to a long-term post-crisis imbalance in the FX market—that had been in equilibrium based on the covered interest parity,3) while the short-term dollar funding market has shifted towards a structure plagued by constantly high costs and low liquidity. In this regard, some studies such as Du (2019) have presented a new path to equilibrium in the US dollar funding market as shown in Figure 2. This implies that post-crisis regulation has shifted the dollar supply curve to the right, according to which the market’s current imbalance—from the perspective of the conventional view—could be seen as a new equilibrium due to the recent structural shift.4)

Impacts on and implications for Korea’s foreign currency money market

The structural shifts in the US dollar funding market have brought changes in global banks’ lending behavior, and imposed various impacts on Korea’s foreign currency money market. In particular, the lingering post-crisis imbalance in Korea’s FX swap market appears to have stemmed from the aforementioned structural shifts in the global markets. According to Kim and Lee (2021), Korean banks’ foreign currency borrowing is decreasing due to global banks’ reduced supply capacity, which appears to serve as a factor behind the rising imbalance in Korea’s FX swap market.

That being said, the structural shifts in the US dollar funding market are posing the following implications for stability in Korea’s foreign currency money market. Among others, the risk factors arising from those shifts require close monitoring. One particularly notable factor is the continuously rising dollar demand in the non-banking sector. As seen during the spread of Covid-19 in 2020, non-banks’ increased appetite for safe assets amid the global economic slowdown is highly likely to push up foreign currency liquidity risk going forward. This is calling for non-bank financial institutions in Korea to strengthen their own effort to secure foreign currency liquidity, which should be desirably backed by policy effort to establish an emergency liquidity supply channel.

Also important is the recently increasing share of bond issuance in dollar funding, which reinforces the need to closely watch any change in international financial market conditions. Compared to bank lending, bond issuance, is regarded as a safer financing path. However, this path is not without risk: At the time of rollover, a market condition that could worsen issuance conditions may put the issuer in unexpected difficulties such as liquidity issues or higher cost burden. Hence, a more flexible strategy would be needed to brace for higher volatility in interest rates when developed economies begin normalizing their monetary policy. Given that the recent changes in the US dollar funding market stemmed from structural factors, Korea needs a more diversified foreign currency funding strategy in line with those factors.

* This article is a summary and excerpt from the author’s forthcoming research paper to be published by KCMI, “Analysis on Changes in Global US Dollar Funding Market and the Impact on Korea” (Kim & Lee, 2021).

1) The BIS (2020) reported that as of end-2019 the aggregate amount of portfolio investment by insurance firms in three east Asian economies (Korea, Taiwan, and Japan) reached about $1.5 trillion , with the share of dollar hedging estimated to be around 50%(Taiwan) and 60% (Japan).

2) Shin, H., 2013, The second phase of global liquidity and its impact on emerging economies, Keynote address at Federal Reserve bank of San Francisco Asia Economic Policy Conference.

3) This refers to a state of equilibrium between the interest rate differential between two currencies and the differential between the forward and spot exchange rates (swap rates) ( , evaluated in logarithms).

, evaluated in logarithms).

4) Du, W., 2019, The U.S. Treasury basis and the dollar risk factor, commentary at Federal Reserve Bank of Kansas City Jackson Hole Economic Policy Symposium.

Background behind the shifts

The funding market for the US dollar—that has taken a dominant position as a key currency for international trades—is the world’s largest market with abundant liquidity. Conventionally, liquidity in the market has been provided by global megabanks. In the pre-crisis period, they increased leverage and steeply expanded intermediation in dollar transactions in this market, which served to meet the US dollar demand of financial as well as non-financial firms across the globe.

Until very recently, the US dollar demand shot up particularly in the non-banking sector. This could stem from the US dollar’s key currency status in international trades. As evidenced by recent statistics, the US dollar has taken up a large proportion in major international trades, with an increase in global portfolio investments imposing upward pressure on the US dollar demand. The Bank of International Settlement (BIS) recently reported a rapid rise in Asian institutional—especially among insurers—demand for portfolio investment, which largely contributed to increasing demand for hedging and the US dollar.1)

The global financial crisis could have triggered some structural shifts in how the US dollar is financed and supplied primarily by global megabanks. Based on the recognition that those players’ somewhat excessive leverage increase helped the financial crisis spread to the globe, major developed economies and international organizations have strengthened or newly adopted various types of prudential regulation that would expectedly prevent large banks from expanding their dollar business. Notably, the BIS has newly adopted liquidity regulation for curbing banks’ excessive financing of foreign currencies in the post-crisis era. Also, it has been harder for non-US banks to raise US dollar because of tougher regulation in US money market funds—a key path via which non-US banks finance short-term US dollar. Another factor stems from global banks’ experience of dollar liquidity crunch during the crisis, which could have triggered a perception shift away from viewing the dollar business as risk-free arbitrage.

Such post-crisis regulatory reform served to improve bank prudence in developed economies, which is surely viewed positive. However, this also triggered diverse structural shifts in terms of the supply and financing in the global US dollar funding market. Although major large banks already recovered their pre-crisis prudence levels, another dollar liquidity crunch triggered by Covid-19 hit the market, which is shedding renewed light on the factors behind the structural shifts.

Structural shifts in US dollar funding market

The most visible change in the US dollar funding market after the crisis is a downward trend in banks’ dollar supply. Despite the continuous rise in the US dollar demand until recently, banks—who used to play a central role in supplying the US dollar—saw their supply capacity shrinking, which appears to have been triggering some structural shifts. As illustrated in Figure 1, cross-border bank lending in terms of the amount outstanding stood up $11.6 trillion, recording an 8% decrease from the bottom reached prior to the global financial crisis. What’s notable is a marked decrease in the proportion of European banks who once led the expansion of global dollar intermediation. The downward trend forms a stark contrast to the pre-crisis period during which the banking sector’s increased dollar supply pushed up the size of the global dollar funding market. As of end-2019, the proportion of the banking sector in GDP fell more than five percentage points from the peak of 22% to 17%. Despite the growing US dollar demand, however, the banking sector’s dollar intermediation capacity has shrunk significantly.

By contrast to the decreased dollar business in the banking sector, there has been a rapid increase in the size of US dollar funding by institutions via capital markets. As shown in Figure 1, global institutions’ US dollar funding via bond issuance reached $12 trillion in aggregate as of end-2019, far exceeding the size of financing via bank lending during the same period, and the proportion of financing via bond issuance in the pre-crisis period (32%–34%). This well suggests an ongoing shift in the primary path of dollar credit away from banks towards direct financing via capital markets. Several studies have already paid tremendous attention to such a structural shift in dollar funding. One of them is Shin (2013) who reported a rise in capital market-based dollar credit as one of the major traits of the market’s structural shift.2)

The structural shifts in the US dollar funding market have brought changes in global banks’ lending behavior, and imposed various impacts on Korea’s foreign currency money market. In particular, the lingering post-crisis imbalance in Korea’s FX swap market appears to have stemmed from the aforementioned structural shifts in the global markets. According to Kim and Lee (2021), Korean banks’ foreign currency borrowing is decreasing due to global banks’ reduced supply capacity, which appears to serve as a factor behind the rising imbalance in Korea’s FX swap market.

That being said, the structural shifts in the US dollar funding market are posing the following implications for stability in Korea’s foreign currency money market. Among others, the risk factors arising from those shifts require close monitoring. One particularly notable factor is the continuously rising dollar demand in the non-banking sector. As seen during the spread of Covid-19 in 2020, non-banks’ increased appetite for safe assets amid the global economic slowdown is highly likely to push up foreign currency liquidity risk going forward. This is calling for non-bank financial institutions in Korea to strengthen their own effort to secure foreign currency liquidity, which should be desirably backed by policy effort to establish an emergency liquidity supply channel.

Also important is the recently increasing share of bond issuance in dollar funding, which reinforces the need to closely watch any change in international financial market conditions. Compared to bank lending, bond issuance, is regarded as a safer financing path. However, this path is not without risk: At the time of rollover, a market condition that could worsen issuance conditions may put the issuer in unexpected difficulties such as liquidity issues or higher cost burden. Hence, a more flexible strategy would be needed to brace for higher volatility in interest rates when developed economies begin normalizing their monetary policy. Given that the recent changes in the US dollar funding market stemmed from structural factors, Korea needs a more diversified foreign currency funding strategy in line with those factors.

* This article is a summary and excerpt from the author’s forthcoming research paper to be published by KCMI, “Analysis on Changes in Global US Dollar Funding Market and the Impact on Korea” (Kim & Lee, 2021).

1) The BIS (2020) reported that as of end-2019 the aggregate amount of portfolio investment by insurance firms in three east Asian economies (Korea, Taiwan, and Japan) reached about $1.5 trillion , with the share of dollar hedging estimated to be around 50%(Taiwan) and 60% (Japan).

2) Shin, H., 2013, The second phase of global liquidity and its impact on emerging economies, Keynote address at Federal Reserve bank of San Francisco Asia Economic Policy Conference.

3) This refers to a state of equilibrium between the interest rate differential between two currencies and the differential between the forward and spot exchange rates (swap rates) (

4) Du, W., 2019, The U.S. Treasury basis and the dollar risk factor, commentary at Federal Reserve Bank of Kansas City Jackson Hole Economic Policy Symposium.