Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

ESG Bonds: The Current State and Facilitating Policies

Publication date Jun. 15, 2021

Summary

With the rising attention to ESG investing and ESG management among firms and financial institutions, the issuance of ESG bonds went up dramatically. In Korea’s ESG market, ESG-certified social bonds represent a disproportionately dominant form of ESG bonds. Furthermore, the proceeds of ESG bonds are mainly used for existing projects instead of new ESG investing. This weakens ESG bonds’ function as a financing tool for new ESG projects. More recently, however, some private sector firms and financial institutions are increasing their ESG issuance for a diverse set of ESG projects, which is expected to increase new ESG investing via bond issuance.

A brief look at ESG bonds reveals that those bonds, except for the ESG certification process, have very similar maturities and credit ratings than ordinary bonds do. Moreover, the two types of bonds are similar in terms of price discovery, implying that market conditions and demand—instead of ESG-specific factors—have a critical impact.

Korea’s ESG market will be more sustainable only if more firms and financial institutions issue more bonds investing in new ESG projects. On top of that, the market also needs some plans to broaden the pool of ESG bond investors. Institutional investors are needed to set up socially responsible investing standards, while the market needs an investor incentive for enhanced investment performance. Also necessary are institutional tools such as a clear legal and institutional basis on ESG bonds, expanded information provision, and a stronger ESG bond certification system all of which will improve investor confidence in ESG bonds.

A brief look at ESG bonds reveals that those bonds, except for the ESG certification process, have very similar maturities and credit ratings than ordinary bonds do. Moreover, the two types of bonds are similar in terms of price discovery, implying that market conditions and demand—instead of ESG-specific factors—have a critical impact.

Korea’s ESG market will be more sustainable only if more firms and financial institutions issue more bonds investing in new ESG projects. On top of that, the market also needs some plans to broaden the pool of ESG bond investors. Institutional investors are needed to set up socially responsible investing standards, while the market needs an investor incentive for enhanced investment performance. Also necessary are institutional tools such as a clear legal and institutional basis on ESG bonds, expanded information provision, and a stronger ESG bond certification system all of which will improve investor confidence in ESG bonds.

With tougher ESG (environment, social, and governance) standards and rules in place, ESG management is no longer an option, but an essential qualitative element to business sustainability. Accordingly, many large corporations and financial institutions in Korea have already declared their commitment to ESG management with ESG-related business strategies in their bid to cope with the new business environment.

The issuance of ESG bonds also rose sharply with the increased importance of ESG management. In Korea, ESG bond issuers mainly aim to increase their exposure to corporate social responsibility, promote their corporate value via improved business sustainability, broaden the investor base of their bonds, and lower the cost of financing.

Such trends necessitate some plans to facilitate ESG bonds, which is expected to make Korea’s ESG bonds more sustainable and effective. This article tries to overview the current status and problems of ESG bonds in Korea, based on which to present plans to promote ESG bonds.

ESG bonds: The concept and structure

ESG bonds refer to any bond issued for the purpose of raising capital that is related to socially responsible investing, more widely referred to as environmental (E), social (S), and governance (G) issues.1) Without any legal or institutional basis that provides the requirements for ESG bonds, Korea has thus far defined ESG bonds based on self-regulation in the private sector. Depending on the purpose and criteria of issuance, ESG bonds are classified into green bonds, social bonds, and sustainability bonds.

The issuance procedure of ESG bonds consists of the general bond issuance procedure and the certification procedure where an external body reviews and certifies if the financing purpose and the process fit for the ESG criteria.2) Korea Exchange’s SRI Bonds website3) offers the information related to ESG bond issuance.

As the lack of the clear basis and procedure related to ESG bonds raised concerns about confusion, the Ministry of Environment, the Financial Services Commission, the Korea Environment Industry & Technology Institute, and the Korea Exchange joined hands to launch green bond guidelines in December 2020. Under the guidelines, a green bond is defined as a bond that qualifies the four core components of the Green Bond Principles (GBP) (the use of proceeds, the process for project evaluation and selection, the management of proceeds, and reporting) for the project that meets the six environmental targets (climate change mitigation, climate change adaptation, natural resource preservation, biodiversity preservation, prevention and management of pollution, and shift to resource recycling). The guidelines also recommend an external body to examine if any green bond issuance complies with the GBP in advance. After the issuance, the issuer is mandated to document a report regarding the management and the use of the proceeds, and the impact on environmental improvement that will be also reviewed by an external body. The introduction of such guidelines is expected to reduce the possibility of greenwashing4) and thus contribute to facilitating the green bond market as it offers a concrete example and guidance to the concept of green bonds and green projects, and the issuance criteria.

ESG bond issuance in Korea

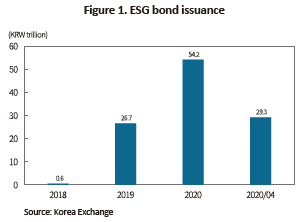

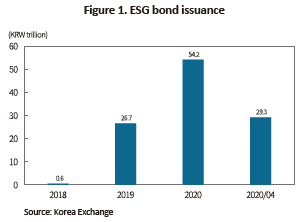

The rapid rise of ESG bond issuance has recently come to the forefront. The issuance of ESG bonds increased sharply to KRW 26.7 trillion in 2019, from KRW 600 billion from only two deals in 2018. With the issuer base expanding from the public sector to private sector firms and financial institutions, the issuance grew to KRW 54.1 trillion in 2020. Such a growth trend continued this year, with ESG bond issuance reaching KRW 29.2 trillion as of April 2021. The tremendous growth largely stems from the increase in the number of both public sector enterprises that acquired ESG certification to issue bonds, and private sector firms and financial institutions that increasingly issued ESG bonds for a larger exposure to ESG investing.

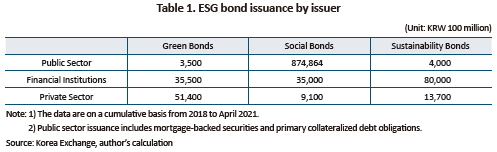

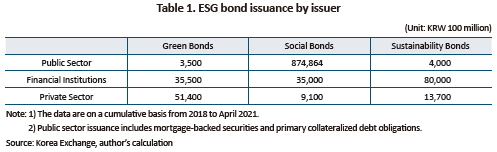

Despite the increased issuance, Korea’s ESG bonds disproportionally lean towards to a small number of sectors. In the composition of ESG bonds5) by type,6) social bonds account for an overwhelmingly large proportion at 83%. This is mostly from the dramatic increase in the number of cases where public sector enterprises—large players in the market for credit bonds—have their special bonds ESG-certified. The examples of those cases include the mortgage-backed securities by Housing Finance Corporation, the bonds issued by Korea Student Aid Foundation, Korea Deposit Insurance Corporation, and Korea SMEs and Startup Agency, and the primary collateralized debt obligations by Korea Credit Guarantee Fund, which increased the overall share of social bonds in ESG bonds.

By issuer, public sector enterprises account for an overwhelmingly high proportion at 79.7%, followed by financial institutions (13.6%) and private sector firms (6.7%). ESG bonds issued by most of the public sector enterprises usually take the form of getting ESG certification for the existing bonds whose proceeds are to finance their primary business. Hence, those bonds only have limited impact on increasing socially responsible investing.

However, ESG bonds issued by private sector firms and financial institutions show different structures and characteristics. In those bonds, sustainable bonds (41.7%) and green bonds (38.7%) take up a relatively higher proportion. More recently, there has been a formidable increase in the share of green bonds in ESG bonds issued by private sector firms and financial institutions. Those issuers too have some of their existing bonds ESG-certified, but they are also increasingly issuing green bonds to finance their green investment.

Characteristics of ESG bonds issued by private sector firms and financial institutions

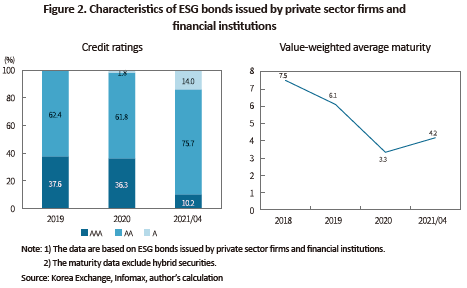

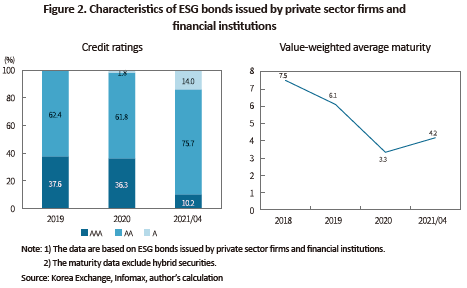

Bonds rated A or above account for most of the ESG bonds issued by private sector firms and financial institutions. This clearly shows the tendency where private sector firms and financial institutions with relatively high rating raise funds via bonds to finance relevant projects.

The system for overseeing ESG bond issuance provides useful data on how those issuers invest in ESG projects. Private sector firms tend to focus on social bonds that help green bonds or SMEs to increase investment in the environment or green energy. Banks tend to issue sustainability bonds taking the form of contingent convertibles, green bonds investing in new and renewable energy and the environment, and social bonds seeking to finance social projects. Specialized credit finance companies are issuing social bonds for helping small- and mid-sized merchants, and sustainability bonds for social and environmental lending. As such, the private sector has been issuing ESG bonds as part of their effort to increase their exposure to environmental and social investment.

The maturities of ESG bonds issued by the private sector differ wildly across issuers. Power generation subsidiaries tend to issue long-term bonds with 5-year or longer maturity. Banks issue long-term contingent convertibles while some specific projects are financed by short-term bonds with 3-year or shorter maturity. Specialized credit finance companies are issuing bonds with various maturities depending on financing purposes. The maturities of ESG bonds depend largely on the term of each project, and the maturity strategy of each issuer. This makes the average maturity of ESG bonds highly volatile depending on issuers or financing purposes.

Previous studies on ESG bond premiums show contracting claims on the financing costs of ESG bonds. The studies that support the effect of ESG bonds on reducing the financing cost argue that ESG bonds are priced higher than other bonds because investors are willing to pay premiums on the assets that create social interest. However, those against the claim assert that ESG bonds could be possibly underpriced than ordinary bonds due to ESG bonds’ limited investment base, investor pool, and the costs and time for ESG certification.

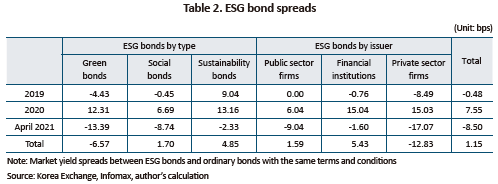

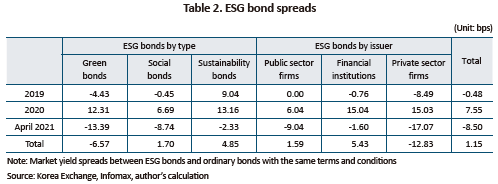

To find out the price characteristics of Korea’s ESG bonds vis-à-vis other bonds with the same terms and conditions, this article tries to compare the spread between the market yields of ESG bonds and ordinary bonds both of which have the same credit rating and maturity. The average spread between ESG bonds and ordinary bonds issued between 2019 and April 2021 with the same rating and maturity stood at 1.15 bps. This confirms underpricing of overall ESG bonds compared to ordinary bonds with the same terms and conditions.

A time series analysis on the above data shows high volatility across years. In 2019, the spread between ESG bonds and ordinary bonds was low, while ESG bonds were priced lower than ordinary bonds in 2020. In 2021, however, ESG bonds were priced higher than ordinary bonds. The recent strength of ESG bond prices could possibly stem from more than one factors such as the rising demand for ESG bonds, the improved perception on those funds among investors, and the recent changes in economic conditions and interest rates.

By ESG bond type, the average spread of green bonds stood at -6.57 bps, which means those bonds were issued at a price higher than other bonds with the same terms and conditions. On the other hand, the spreads of social bonds and sustainability bonds were 1.70 bps and 4.85 bps, respectively, implying their relatively low issuance price. Such a result indicates the differences in the premiums paid by investors depending on the timing and the type of issuance.

Issuance premiums also were widely different across issuers. For the overall analysis period, the average spread of the ESG bonds issued by the public sector and financial institutions stood at the positive territory, while the average spread with private sector firms was negative. This demonstrates that investors are paying relatively higher prices for green bonds issued for new investment, as compared to the ESG bonds that were ESG-certified after initial issuance.

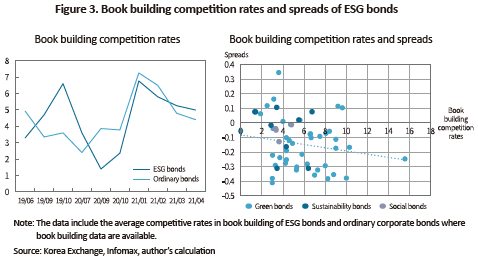

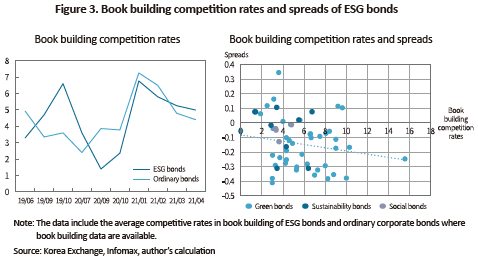

From the perspective of investors, are ESG bonds attractive as an investment target? To answer that question, an analysis was carried out on the book building competition rates of ESG bonds and comparable ordinary bonds issued by private sector firms. The result shows no consistent differences between the two types of bonds, implying that ESG bonds have yet to have sufficient demand.

A dot chart between the book building competition rates and the spreads illustrates the impact of individual ESG bond demand on the prices. The results show a tendency where the higher the book building competition rate, the lower the spread becomes. However, as illustrated in Figure 3, the correlation between the book building competition rates and the spreads varied widely across ESG bond types, with a high degree of dispersion.

The analysis results demonstrated above show that the demand for Korea’s ESG bonds is not quite high, and those bonds are not that attractive to investors. Thus far, ESG bonds have no significant premium because investors appear to buy ESG bonds based on the same criteria for ordinary bonds. Given that, it is safe to conclude that ESG bond prices are more affected by market conditions and investor demand, instead of ESG certification and the resultant labelling effect.

Challenges for facilitating ESG bonds in Korea

A brief overview on the trends and characteristics of Korea’s ESG bond issuance reveals that the form of adding ESG certification to existing bonds issued by public sector firms was dominant at the early stage before the recent increase in bonds issued for the purpose of ESG investing. Although a diverse set of structures and maturities are applied to ESG bonds depending on an issuer’s investment purpose, the investor base for those bonds is still limited as high-rated private sector firms and financial institutions are the main issuer of those bonds.

Korea should make continuous effort to facilitate the ESG bond market that is expected to help Korea’s capital markets to promote ESG management and investment in the assets that create social benefits. One important action towards that end is to broaden the issuer pool of ESG bonds. More desirably, ESG bonds should be used as a financing tool helping private sector firms and financial institutions with diverse credit ratings to increase their ESG exposure. Going forward, more ESG bonds should be issued for financing new ESG projects, shifting away from the now-prevalent structure of adding ESG certification to existing bonds and projects.

Also necessary for facilitating the ESG bond market is a broader investor base for those bonds. It is now time for taking one step forwards from a general goal of increasing ESG investment to a more concrete set of investment purposes and strategies, and more reasonable, fit-for-purpose investment standards for ESG bonds. This will be only possible with a detailed set of investment principles that help bolster investors’ social responsibility. In line with that, the National Pension Fund has sought to increase ESG investing by adding sustainability to the fund management principle since it made a resolution to facilitate social investing in 2019. Other large-scale investors are striving to come up with internal standards part of their effort to increase responsible investing. For such a trend to continue further, investment in ESG bonds should be supported by proper investment standards. Also necessary are some plans to review and improve the performance of ESG bond investment on a regular basis. The ESG bonds issued thus far fail to provide higher returns than other bonds. On the contrary, there is a higher incentive for issuers to capitalize on ESG certification for increasing the price of issuance. Under the circumstances, it is worth considering an investor incentive that assures higher returns on ESG bond investment.

In addition, policy tools should be in place to enhance the reliability of ESG bonds. For example, institutional support is needed to bolster the ESG bond certification system, to enhance the provision of data on ESG bonds, and to provide a clear legal and regulatory basis on the issuance. Such policy effort could improve the reliability of ESG bonds, which will solidify ESG bond’s position as sustainable bonds.

1) A stricter definition of ESG bonds is a bond issued based on the Green Bond Principles (GBP), Social Bond Principles (SBP), and Sustainability Bond Guidelines (SBG) unveiled by the International Capital Market Association (ICMA); or based on the Climate Bond Standards released by the Climate Bond Initiative.

2) In Korea, the certification of ESG bonds is handled by accounting firms, credit rating agencies, and other sustainability consulting firms.

3) The website offers the eligibility criteria for SRI bonds, and provides a diverse set of information such as those bonds’ issuance data, guiding principles, management framework, and external reports.

4) In general, greenwashing refers to wrongfully taking economic profits out of a false or exaggerated representation of a product’s environmental nature or efficacy. Under the context of green bonds, this refers to a green bond issuance that fails to implement the promised investment plan or to disclose the implementation.

5) The data are on a cumulative basis.

6) The Korea Exchange categorizes bonds based on the GBP into green bonds, SBP-based ones into social bonds, and SBG-based ones into sustainability bonds.

The issuance of ESG bonds also rose sharply with the increased importance of ESG management. In Korea, ESG bond issuers mainly aim to increase their exposure to corporate social responsibility, promote their corporate value via improved business sustainability, broaden the investor base of their bonds, and lower the cost of financing.

Such trends necessitate some plans to facilitate ESG bonds, which is expected to make Korea’s ESG bonds more sustainable and effective. This article tries to overview the current status and problems of ESG bonds in Korea, based on which to present plans to promote ESG bonds.

ESG bonds: The concept and structure

ESG bonds refer to any bond issued for the purpose of raising capital that is related to socially responsible investing, more widely referred to as environmental (E), social (S), and governance (G) issues.1) Without any legal or institutional basis that provides the requirements for ESG bonds, Korea has thus far defined ESG bonds based on self-regulation in the private sector. Depending on the purpose and criteria of issuance, ESG bonds are classified into green bonds, social bonds, and sustainability bonds.

The issuance procedure of ESG bonds consists of the general bond issuance procedure and the certification procedure where an external body reviews and certifies if the financing purpose and the process fit for the ESG criteria.2) Korea Exchange’s SRI Bonds website3) offers the information related to ESG bond issuance.

As the lack of the clear basis and procedure related to ESG bonds raised concerns about confusion, the Ministry of Environment, the Financial Services Commission, the Korea Environment Industry & Technology Institute, and the Korea Exchange joined hands to launch green bond guidelines in December 2020. Under the guidelines, a green bond is defined as a bond that qualifies the four core components of the Green Bond Principles (GBP) (the use of proceeds, the process for project evaluation and selection, the management of proceeds, and reporting) for the project that meets the six environmental targets (climate change mitigation, climate change adaptation, natural resource preservation, biodiversity preservation, prevention and management of pollution, and shift to resource recycling). The guidelines also recommend an external body to examine if any green bond issuance complies with the GBP in advance. After the issuance, the issuer is mandated to document a report regarding the management and the use of the proceeds, and the impact on environmental improvement that will be also reviewed by an external body. The introduction of such guidelines is expected to reduce the possibility of greenwashing4) and thus contribute to facilitating the green bond market as it offers a concrete example and guidance to the concept of green bonds and green projects, and the issuance criteria.

ESG bond issuance in Korea

The rapid rise of ESG bond issuance has recently come to the forefront. The issuance of ESG bonds increased sharply to KRW 26.7 trillion in 2019, from KRW 600 billion from only two deals in 2018. With the issuer base expanding from the public sector to private sector firms and financial institutions, the issuance grew to KRW 54.1 trillion in 2020. Such a growth trend continued this year, with ESG bond issuance reaching KRW 29.2 trillion as of April 2021. The tremendous growth largely stems from the increase in the number of both public sector enterprises that acquired ESG certification to issue bonds, and private sector firms and financial institutions that increasingly issued ESG bonds for a larger exposure to ESG investing.

By issuer, public sector enterprises account for an overwhelmingly high proportion at 79.7%, followed by financial institutions (13.6%) and private sector firms (6.7%). ESG bonds issued by most of the public sector enterprises usually take the form of getting ESG certification for the existing bonds whose proceeds are to finance their primary business. Hence, those bonds only have limited impact on increasing socially responsible investing.

However, ESG bonds issued by private sector firms and financial institutions show different structures and characteristics. In those bonds, sustainable bonds (41.7%) and green bonds (38.7%) take up a relatively higher proportion. More recently, there has been a formidable increase in the share of green bonds in ESG bonds issued by private sector firms and financial institutions. Those issuers too have some of their existing bonds ESG-certified, but they are also increasingly issuing green bonds to finance their green investment.

Bonds rated A or above account for most of the ESG bonds issued by private sector firms and financial institutions. This clearly shows the tendency where private sector firms and financial institutions with relatively high rating raise funds via bonds to finance relevant projects.

The system for overseeing ESG bond issuance provides useful data on how those issuers invest in ESG projects. Private sector firms tend to focus on social bonds that help green bonds or SMEs to increase investment in the environment or green energy. Banks tend to issue sustainability bonds taking the form of contingent convertibles, green bonds investing in new and renewable energy and the environment, and social bonds seeking to finance social projects. Specialized credit finance companies are issuing social bonds for helping small- and mid-sized merchants, and sustainability bonds for social and environmental lending. As such, the private sector has been issuing ESG bonds as part of their effort to increase their exposure to environmental and social investment.

The maturities of ESG bonds issued by the private sector differ wildly across issuers. Power generation subsidiaries tend to issue long-term bonds with 5-year or longer maturity. Banks issue long-term contingent convertibles while some specific projects are financed by short-term bonds with 3-year or shorter maturity. Specialized credit finance companies are issuing bonds with various maturities depending on financing purposes. The maturities of ESG bonds depend largely on the term of each project, and the maturity strategy of each issuer. This makes the average maturity of ESG bonds highly volatile depending on issuers or financing purposes.

To find out the price characteristics of Korea’s ESG bonds vis-à-vis other bonds with the same terms and conditions, this article tries to compare the spread between the market yields of ESG bonds and ordinary bonds both of which have the same credit rating and maturity. The average spread between ESG bonds and ordinary bonds issued between 2019 and April 2021 with the same rating and maturity stood at 1.15 bps. This confirms underpricing of overall ESG bonds compared to ordinary bonds with the same terms and conditions.

A time series analysis on the above data shows high volatility across years. In 2019, the spread between ESG bonds and ordinary bonds was low, while ESG bonds were priced lower than ordinary bonds in 2020. In 2021, however, ESG bonds were priced higher than ordinary bonds. The recent strength of ESG bond prices could possibly stem from more than one factors such as the rising demand for ESG bonds, the improved perception on those funds among investors, and the recent changes in economic conditions and interest rates.

By ESG bond type, the average spread of green bonds stood at -6.57 bps, which means those bonds were issued at a price higher than other bonds with the same terms and conditions. On the other hand, the spreads of social bonds and sustainability bonds were 1.70 bps and 4.85 bps, respectively, implying their relatively low issuance price. Such a result indicates the differences in the premiums paid by investors depending on the timing and the type of issuance.

Issuance premiums also were widely different across issuers. For the overall analysis period, the average spread of the ESG bonds issued by the public sector and financial institutions stood at the positive territory, while the average spread with private sector firms was negative. This demonstrates that investors are paying relatively higher prices for green bonds issued for new investment, as compared to the ESG bonds that were ESG-certified after initial issuance.

A dot chart between the book building competition rates and the spreads illustrates the impact of individual ESG bond demand on the prices. The results show a tendency where the higher the book building competition rate, the lower the spread becomes. However, as illustrated in Figure 3, the correlation between the book building competition rates and the spreads varied widely across ESG bond types, with a high degree of dispersion.

The analysis results demonstrated above show that the demand for Korea’s ESG bonds is not quite high, and those bonds are not that attractive to investors. Thus far, ESG bonds have no significant premium because investors appear to buy ESG bonds based on the same criteria for ordinary bonds. Given that, it is safe to conclude that ESG bond prices are more affected by market conditions and investor demand, instead of ESG certification and the resultant labelling effect.

A brief overview on the trends and characteristics of Korea’s ESG bond issuance reveals that the form of adding ESG certification to existing bonds issued by public sector firms was dominant at the early stage before the recent increase in bonds issued for the purpose of ESG investing. Although a diverse set of structures and maturities are applied to ESG bonds depending on an issuer’s investment purpose, the investor base for those bonds is still limited as high-rated private sector firms and financial institutions are the main issuer of those bonds.

Korea should make continuous effort to facilitate the ESG bond market that is expected to help Korea’s capital markets to promote ESG management and investment in the assets that create social benefits. One important action towards that end is to broaden the issuer pool of ESG bonds. More desirably, ESG bonds should be used as a financing tool helping private sector firms and financial institutions with diverse credit ratings to increase their ESG exposure. Going forward, more ESG bonds should be issued for financing new ESG projects, shifting away from the now-prevalent structure of adding ESG certification to existing bonds and projects.

Also necessary for facilitating the ESG bond market is a broader investor base for those bonds. It is now time for taking one step forwards from a general goal of increasing ESG investment to a more concrete set of investment purposes and strategies, and more reasonable, fit-for-purpose investment standards for ESG bonds. This will be only possible with a detailed set of investment principles that help bolster investors’ social responsibility. In line with that, the National Pension Fund has sought to increase ESG investing by adding sustainability to the fund management principle since it made a resolution to facilitate social investing in 2019. Other large-scale investors are striving to come up with internal standards part of their effort to increase responsible investing. For such a trend to continue further, investment in ESG bonds should be supported by proper investment standards. Also necessary are some plans to review and improve the performance of ESG bond investment on a regular basis. The ESG bonds issued thus far fail to provide higher returns than other bonds. On the contrary, there is a higher incentive for issuers to capitalize on ESG certification for increasing the price of issuance. Under the circumstances, it is worth considering an investor incentive that assures higher returns on ESG bond investment.

In addition, policy tools should be in place to enhance the reliability of ESG bonds. For example, institutional support is needed to bolster the ESG bond certification system, to enhance the provision of data on ESG bonds, and to provide a clear legal and regulatory basis on the issuance. Such policy effort could improve the reliability of ESG bonds, which will solidify ESG bond’s position as sustainable bonds.

1) A stricter definition of ESG bonds is a bond issued based on the Green Bond Principles (GBP), Social Bond Principles (SBP), and Sustainability Bond Guidelines (SBG) unveiled by the International Capital Market Association (ICMA); or based on the Climate Bond Standards released by the Climate Bond Initiative.

2) In Korea, the certification of ESG bonds is handled by accounting firms, credit rating agencies, and other sustainability consulting firms.

3) The website offers the eligibility criteria for SRI bonds, and provides a diverse set of information such as those bonds’ issuance data, guiding principles, management framework, and external reports.

4) In general, greenwashing refers to wrongfully taking economic profits out of a false or exaggerated representation of a product’s environmental nature or efficacy. Under the context of green bonds, this refers to a green bond issuance that fails to implement the promised investment plan or to disclose the implementation.

5) The data are on a cumulative basis.

6) The Korea Exchange categorizes bonds based on the GBP into green bonds, SBP-based ones into social bonds, and SBG-based ones into sustainability bonds.