Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Development of Custodian Services in the Direction Towards a Healthy Fund Ecosystem

Publication date Jul. 13, 2021

Summary

Recently in Korea, more and more fund custodians are refusing services to privately placed funds. However, such a market failure is expected to be addressed given recent market improvement after a revision of the Financial Investment Services and Capital Markets Act. The improvement includes an upward trend in custodian fees, more clear guidelines on custodian responsibility, and cost effectiveness via FundNet. Nevertheless, for Korea’s fund custodians to make another leap forward, they should overcome their passive image as an ancillary service provider, and seek to come up with new strategies pursuing high-added-value business opportunities out of stronger custodian responsibility and right they will enjoy after the revised legislation takes into effect. On another front, the current market failure where custodians pick out good private funds from bad ones is elevating market entry barriers for startup private funds without track records and business history. This might undermine positive functions of Korea’s risk capital provision policy for startup private funds since 2015. To address that issue, it is necessary to bolster public institutions’ custodian services, along with prime brokerage services by the private sector.

Custody industry and trends in private funds

There have been two lines of effort to recover Korea’s fund ecosystem. One of the areas reporting progress is the dealing with the private fund fiascos via fast-paced dispute resolution to settle compensation, an important progress to end the issue. What became clear during the process, however, were immense complexity and intertwined interests in the fund ecosystem. A fund has a complex structure that goes through many hands from a distributor to a manager, and a custodian. This is starkly different from other financial investment products whose manufacturing, sales, and custody are vertically integrated. Such a structure represents a value chain prioritizing investor protection. From the perspective of a balanced ecosystem, the fund industry is a marketplace with a coordination failure in that distributors, managers, and custodians pursue their own interest which is not in the best interest of investors. The recent private fund fiascos manifested that the imbalance became problematic amid the regulatory loopholes in the imperfect laws and regulations. This gave rise to another line of effort that is seeking to realign the rights and responsibilities among fund managers, distributors, and custodians from the investor protection perspective via regulatory improvement. The Financial Investment Services and Capital Markets Act was revised and will take into effect in October, and the guidelines on custodian responsibilities were established recently. Also recently, FundNet, public risk management infrastructure for private funds, began operation. Both lines of effort are expected to enhance the soundness of the fund ecosystem, and to help normalize Korea’s private fund market.

However, the market is currently going through a turbulent time. It is facing a market failure where a fund cannot be established because custodians holding a trust license get reluctant to provide services. This article tries to assess the current status of fund custodian services after the private fund fiascos, and then present how policymakers and custodians should prepare for when the custodian market finally gets back to normal after various actions such as fee rationalization, regulatory improvement, and custodians’ own effort. Also discussed is whether there is still any regulatory loophole that needs to be addressed.

Private fund custody services measured by fund establishment

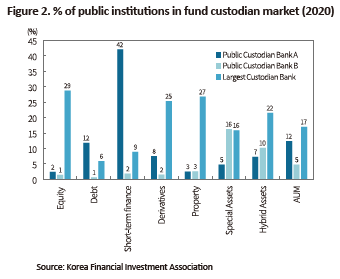

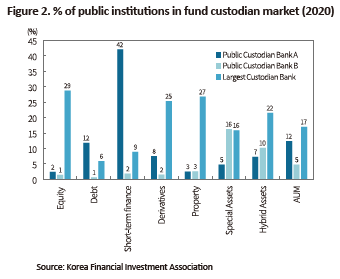

During the first quarter of 2021, the asset management industry performed well, reflecting a post-pandemic boom in the global asset market. The industry reported record-high AUM with a dramatic increase in net profits. The fees charged by fund distributors and custodians would have increased in proportion of the AUM. However, only existing funds could benefit from the capital market boom. Despite the upbeat mood in the fund industry, the establishment of new funds—an indicator for the market’s growth potential—has shown negative growth since the previous year. Figure 1 illustrates a 3-month moving average on the number of new funds established after June 2016. According to the data, about 100 publicly offered funds are being established every month, while the number for privately placed funds peaked 769 in the first half of 2019, but fell sharply by one-third to 214 at the end of May 2021.

A closer look at the data reveals that the number of fund establishment remained unchanged in equity funds whose primary holdings are easily tradable, and real estate and special asset funds that are mainly established by institutional investors. However, the number fell particularly sharply in non-listed, structured, and complex funds investing in hybrid assets, bonds, and derivatives. Fund investing in hybrid assets and derivatives were hit particularly hard with the number of fund establishment abruptly plunging from over 200 to under 60. This implies that there is almost a freeze in the establishment of retail-based privately placed funds whose holdings are less tradable. Although this could have been attributable to many factors that had arisen after the private fund fiascos—for example, the lack of demand, distributors and custodians refusing services, and others. However, the impact of tougher regulation is a more probable cause behind the dull market for new funds because existing funds were unaffected and performed well persistently since the pandemic.

Such a trend is highly likely to linger for some time, but not that long. The recently established guidelines on custodians effectively mitigated the uncertainties about custodians’ responsibility that become larger under the revised law. Along with that, the introduction of FundNet will improve standardization, and significantly reduce the burden of asset reconciliation services. If Korea is equipped with infrastructure for management instructions, the process for custodian services in the private fund market will surely rank as one of the world’s best market systems in terms of automation and standardization. Also positive is the recent upward trend of custodian fees that appear to finally begin to reflect the stronger custodian responsibility based on the market principle.

Recent fee increases: A more sensible approach required

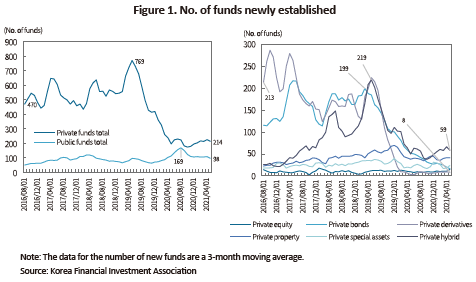

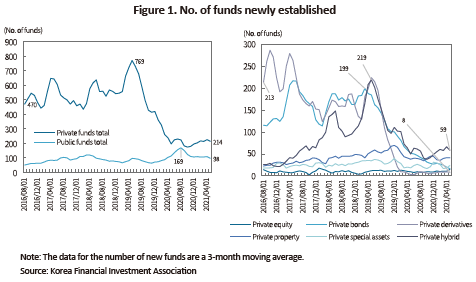

The recent increase in custodian fees is certainly positive for the industry. This could be understood as part of the process where the market price reflects the regulatory changes such as stronger custodian responsibility and the consequential shift in division of duties and responsibilities among distributors, managers, and custodians. In fact, Korea’s custodian fees were extremely lower than those of other developed fund markets (for example, over 10 bp for US mutual funds). Another problem is the market’s failure to reflect the nature of fund assets in custody. Table 1 shows that custodian fees in Korea remained the same for equity funds, real estate funds, and hybrid funds. Although the liquidity, standardization, and automation of fund assets could widely differ depending on their economy of scale, expertise, labor intensiveness, and custody risk, those factors are not fully reflected in the fees. In this regard, the recent regulatory change bolstering custodian duties and responsibilities could serve as an important trigger to advancing the industry towards a new fee scheme based on accountability, which is desirable for the market to advance further.

However, the changes in custodian fees should take place under two conditions from the perspective of the overall fund ecosystem and the market structure. The first condition is that the fee increase should not be passed on to investors only. Stronger custodian responsibility is not purposed to provide extra benefits to investors. Rather, it is part of a system that tries to allocate more responsibility to distributors, custodians, and managers failing to fully comply with their fiduciary duty. Moreover, this round of custodian fee rationalization should not lead to an overall fee increase due to some reasons. Among others, investors perceive the current changes as a new regulation for reducing the agency cost, rather than an additional service that comes with extra costs. Also, fee reduction is a global trend, and the growth in the fund market is also increasing economies of scale. The second condition is the introduction of FundNet that is public infrastructure for private funds, unprecedented elsewhere in the world. It uses social funds to absorb a substantial part of custodian’s private costs for custodian services. Because FundNet is expected to significantly reduce the custodian fees for fund administration, asset reconciliation, and other services, the level of fee rationalization would be within a reasonable range.

In the end, custodian fee rationalization will be absorbed partially in the fund ecosystem given FundNet or a limited fee increase for investors. Table 1 shows that the proportion of custodian fees in total expenses has been stable around the 3% range regardless the type of funds. Simply put, the pricing mechanism could reflect negotiation power or other forces in the market, rather than the cost and the relevant responsibility. It is possible for the recent fee rationalization to be a driver for change in such market practices. The fee for sophisticated investors buying a private fund with lax investment solicitation regulation must be different from that for ordinary investors in a strictly-regulated mutual fund. The same goes for funds with a different level of standardization and automation required for custodian services. It is reasonable that the proportion of each fee—for example, distribution, custodian, and management fees—is determined depending on the nature of funds and assets. However, the process of market rationalization via competition cannot fully take place in the ecosystem by itself. Based on thorough understanding on the fund fee structure from the competitive policy perspective, and thorough discussion on a new fee scheme in response to new policy demand such as digitalization, policy authorities should work together with investors and the market for formulating plans for regulatory improvement on a holistic market structure for fund fees.

Role of prime brokerage services to add value to custodian services

Although fee rationalization could be an incentive for custodians to resume their custodian service, the custody industry needs to go beyond its ancillary role in the financial industry. It should aim to satisfy investors who are demanding more and more. For Korea’s custody industry to become a high-value-added one just as in developed markets. Given that, custodians should do more than focusing on greater accountability that has been toughened in the aftermath of the private fund fiascos. Rather, they should exert more effort to add value to their business by capitalizing on greater authority and more standardized, high-quality information they will have in their hand under the revised law.

Compared to other markets, Korea’s custody industry offers low-value-added services such as safekeeping, settlement, distribution of dividend and income, basic accounting, and notification of legal issues related to security issuers, and other administrative services. They are passive about more sophisticated, high-value-added services overseas custodians are actively engaged in, such as accounting, performance assessment, valuation, inquiry and confirmation of investment return, foreign exchange transactions and related activities, and securities lending transactions despite those services’ high economic value.1)

However, the recent regulatory revision is expected to improve the quantity and quality of data in the custodian market, and to enhance data objectivity and usability significantly by FundNet’s provision of more systematic and standardized data. With the rapid growth in outbound and alternative investment due to more diversified fund investment, the custody industry faces a broader window of opportunities for value-added services. Along with the hedge fund regulation, such trends are creating an environment where prime brokers can advance into high-value-added custody services. For example, hybrid funds, mostly established by hedge funds, recorded KRW 36 trillion in AUM as of the end of 2020, with 38% or KRW 14 trillion held by the securities firms providing prime brokerage service. Unfortunately, prime brokers tend to carry out high-value-added services in-house, while outsourcing low-value-added, basic custody services to external custodians. Hence, this is not helping to address the current market failure of fund custodians refusing services. All in all, internalizing basic custodian services could be a winning strategy that prevents service refusal from undermining the value-added prime brokerage business, and helps manage reputational risk and uncertainties arising from stronger accountability for custodians.

How to support custody services for new private funds

Even after the custodian market to get normalized in the near future, it may be hard to expect the market to operate the same as before because differentiation due to stronger custodian responsibility could be a trigger for raising entry barriers for start-up private funds. On top of that, distributor and manager regulations are highly likely to deepen a divide between superb private funds with accumulated track records and new private funds. However, creating a private fund ecosystem that offers free entry and exit was a primary objective behind the 2015 reform to introduce dual regulation. Since then, the entry barrier has been lowered for start-up private funds to create a ripe environment for a private fund ecosystem. This was possible thanks to national consensus on a notion that a private fund ecosystem is an important source of risk capital in an innovative economic system. All of those circumstances imply the need for some regulatory intervention aiming to address the issue of custodian service refusal to new private funds.

Along with the role of prime brokers in normalizing custodian services for new private funds, another policy direction worth mentioning here is to expand public custodian service. Already, public institutions have been engaged in Korea’s fund custodian market where the government is a major shareholder or has a stake in those institutions for certain policy drives related to financial industry. This is a condition specific to Korea, and hardly found in other markets. Those institutions’ high market share is also worth noting. Certainly, their custodian services are not for public purpose. Rather, they are ancillary as part of effort to diversify their revenue structure from their fundamental business operation to new ones. Thus far, all of those services are commercial-based.

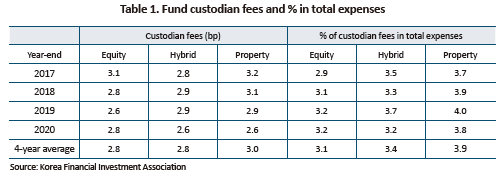

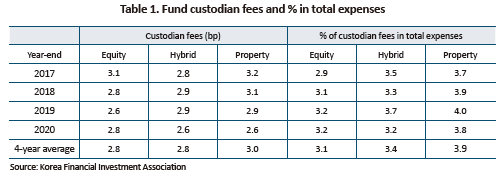

However, those public institutions are supposed to serve public purpose, playing a market maker role in the custodian market, especially amid expected changes in the market for new private funds after the revision on the Financial Investment Services and Capital Markets Act. Because they have been already engaged in custodian services for private funds with diverse asset classes, they are unlikely to face difficulties related to experiences, work force, and expertise (Figure 2). Until the current market failure of service refusal is addressed and prime brokerage service providers internalize basic custodian services, the public aspect of their custodian services could increase net utility in the overall society. In the long run, their services will complement prime brokerage services in expanding the ecosystem for start-up private funds.

1) The custody service tends to be defined narrowly, often excluding foreign exchange-related business for a unit of a fund in custody.

There have been two lines of effort to recover Korea’s fund ecosystem. One of the areas reporting progress is the dealing with the private fund fiascos via fast-paced dispute resolution to settle compensation, an important progress to end the issue. What became clear during the process, however, were immense complexity and intertwined interests in the fund ecosystem. A fund has a complex structure that goes through many hands from a distributor to a manager, and a custodian. This is starkly different from other financial investment products whose manufacturing, sales, and custody are vertically integrated. Such a structure represents a value chain prioritizing investor protection. From the perspective of a balanced ecosystem, the fund industry is a marketplace with a coordination failure in that distributors, managers, and custodians pursue their own interest which is not in the best interest of investors. The recent private fund fiascos manifested that the imbalance became problematic amid the regulatory loopholes in the imperfect laws and regulations. This gave rise to another line of effort that is seeking to realign the rights and responsibilities among fund managers, distributors, and custodians from the investor protection perspective via regulatory improvement. The Financial Investment Services and Capital Markets Act was revised and will take into effect in October, and the guidelines on custodian responsibilities were established recently. Also recently, FundNet, public risk management infrastructure for private funds, began operation. Both lines of effort are expected to enhance the soundness of the fund ecosystem, and to help normalize Korea’s private fund market.

However, the market is currently going through a turbulent time. It is facing a market failure where a fund cannot be established because custodians holding a trust license get reluctant to provide services. This article tries to assess the current status of fund custodian services after the private fund fiascos, and then present how policymakers and custodians should prepare for when the custodian market finally gets back to normal after various actions such as fee rationalization, regulatory improvement, and custodians’ own effort. Also discussed is whether there is still any regulatory loophole that needs to be addressed.

Private fund custody services measured by fund establishment

During the first quarter of 2021, the asset management industry performed well, reflecting a post-pandemic boom in the global asset market. The industry reported record-high AUM with a dramatic increase in net profits. The fees charged by fund distributors and custodians would have increased in proportion of the AUM. However, only existing funds could benefit from the capital market boom. Despite the upbeat mood in the fund industry, the establishment of new funds—an indicator for the market’s growth potential—has shown negative growth since the previous year. Figure 1 illustrates a 3-month moving average on the number of new funds established after June 2016. According to the data, about 100 publicly offered funds are being established every month, while the number for privately placed funds peaked 769 in the first half of 2019, but fell sharply by one-third to 214 at the end of May 2021.

A closer look at the data reveals that the number of fund establishment remained unchanged in equity funds whose primary holdings are easily tradable, and real estate and special asset funds that are mainly established by institutional investors. However, the number fell particularly sharply in non-listed, structured, and complex funds investing in hybrid assets, bonds, and derivatives. Fund investing in hybrid assets and derivatives were hit particularly hard with the number of fund establishment abruptly plunging from over 200 to under 60. This implies that there is almost a freeze in the establishment of retail-based privately placed funds whose holdings are less tradable. Although this could have been attributable to many factors that had arisen after the private fund fiascos—for example, the lack of demand, distributors and custodians refusing services, and others. However, the impact of tougher regulation is a more probable cause behind the dull market for new funds because existing funds were unaffected and performed well persistently since the pandemic.

Recent fee increases: A more sensible approach required

The recent increase in custodian fees is certainly positive for the industry. This could be understood as part of the process where the market price reflects the regulatory changes such as stronger custodian responsibility and the consequential shift in division of duties and responsibilities among distributors, managers, and custodians. In fact, Korea’s custodian fees were extremely lower than those of other developed fund markets (for example, over 10 bp for US mutual funds). Another problem is the market’s failure to reflect the nature of fund assets in custody. Table 1 shows that custodian fees in Korea remained the same for equity funds, real estate funds, and hybrid funds. Although the liquidity, standardization, and automation of fund assets could widely differ depending on their economy of scale, expertise, labor intensiveness, and custody risk, those factors are not fully reflected in the fees. In this regard, the recent regulatory change bolstering custodian duties and responsibilities could serve as an important trigger to advancing the industry towards a new fee scheme based on accountability, which is desirable for the market to advance further.

However, the changes in custodian fees should take place under two conditions from the perspective of the overall fund ecosystem and the market structure. The first condition is that the fee increase should not be passed on to investors only. Stronger custodian responsibility is not purposed to provide extra benefits to investors. Rather, it is part of a system that tries to allocate more responsibility to distributors, custodians, and managers failing to fully comply with their fiduciary duty. Moreover, this round of custodian fee rationalization should not lead to an overall fee increase due to some reasons. Among others, investors perceive the current changes as a new regulation for reducing the agency cost, rather than an additional service that comes with extra costs. Also, fee reduction is a global trend, and the growth in the fund market is also increasing economies of scale. The second condition is the introduction of FundNet that is public infrastructure for private funds, unprecedented elsewhere in the world. It uses social funds to absorb a substantial part of custodian’s private costs for custodian services. Because FundNet is expected to significantly reduce the custodian fees for fund administration, asset reconciliation, and other services, the level of fee rationalization would be within a reasonable range.

In the end, custodian fee rationalization will be absorbed partially in the fund ecosystem given FundNet or a limited fee increase for investors. Table 1 shows that the proportion of custodian fees in total expenses has been stable around the 3% range regardless the type of funds. Simply put, the pricing mechanism could reflect negotiation power or other forces in the market, rather than the cost and the relevant responsibility. It is possible for the recent fee rationalization to be a driver for change in such market practices. The fee for sophisticated investors buying a private fund with lax investment solicitation regulation must be different from that for ordinary investors in a strictly-regulated mutual fund. The same goes for funds with a different level of standardization and automation required for custodian services. It is reasonable that the proportion of each fee—for example, distribution, custodian, and management fees—is determined depending on the nature of funds and assets. However, the process of market rationalization via competition cannot fully take place in the ecosystem by itself. Based on thorough understanding on the fund fee structure from the competitive policy perspective, and thorough discussion on a new fee scheme in response to new policy demand such as digitalization, policy authorities should work together with investors and the market for formulating plans for regulatory improvement on a holistic market structure for fund fees.

Although fee rationalization could be an incentive for custodians to resume their custodian service, the custody industry needs to go beyond its ancillary role in the financial industry. It should aim to satisfy investors who are demanding more and more. For Korea’s custody industry to become a high-value-added one just as in developed markets. Given that, custodians should do more than focusing on greater accountability that has been toughened in the aftermath of the private fund fiascos. Rather, they should exert more effort to add value to their business by capitalizing on greater authority and more standardized, high-quality information they will have in their hand under the revised law.

Compared to other markets, Korea’s custody industry offers low-value-added services such as safekeeping, settlement, distribution of dividend and income, basic accounting, and notification of legal issues related to security issuers, and other administrative services. They are passive about more sophisticated, high-value-added services overseas custodians are actively engaged in, such as accounting, performance assessment, valuation, inquiry and confirmation of investment return, foreign exchange transactions and related activities, and securities lending transactions despite those services’ high economic value.1)

However, the recent regulatory revision is expected to improve the quantity and quality of data in the custodian market, and to enhance data objectivity and usability significantly by FundNet’s provision of more systematic and standardized data. With the rapid growth in outbound and alternative investment due to more diversified fund investment, the custody industry faces a broader window of opportunities for value-added services. Along with the hedge fund regulation, such trends are creating an environment where prime brokers can advance into high-value-added custody services. For example, hybrid funds, mostly established by hedge funds, recorded KRW 36 trillion in AUM as of the end of 2020, with 38% or KRW 14 trillion held by the securities firms providing prime brokerage service. Unfortunately, prime brokers tend to carry out high-value-added services in-house, while outsourcing low-value-added, basic custody services to external custodians. Hence, this is not helping to address the current market failure of fund custodians refusing services. All in all, internalizing basic custodian services could be a winning strategy that prevents service refusal from undermining the value-added prime brokerage business, and helps manage reputational risk and uncertainties arising from stronger accountability for custodians.

How to support custody services for new private funds

Even after the custodian market to get normalized in the near future, it may be hard to expect the market to operate the same as before because differentiation due to stronger custodian responsibility could be a trigger for raising entry barriers for start-up private funds. On top of that, distributor and manager regulations are highly likely to deepen a divide between superb private funds with accumulated track records and new private funds. However, creating a private fund ecosystem that offers free entry and exit was a primary objective behind the 2015 reform to introduce dual regulation. Since then, the entry barrier has been lowered for start-up private funds to create a ripe environment for a private fund ecosystem. This was possible thanks to national consensus on a notion that a private fund ecosystem is an important source of risk capital in an innovative economic system. All of those circumstances imply the need for some regulatory intervention aiming to address the issue of custodian service refusal to new private funds.

Along with the role of prime brokers in normalizing custodian services for new private funds, another policy direction worth mentioning here is to expand public custodian service. Already, public institutions have been engaged in Korea’s fund custodian market where the government is a major shareholder or has a stake in those institutions for certain policy drives related to financial industry. This is a condition specific to Korea, and hardly found in other markets. Those institutions’ high market share is also worth noting. Certainly, their custodian services are not for public purpose. Rather, they are ancillary as part of effort to diversify their revenue structure from their fundamental business operation to new ones. Thus far, all of those services are commercial-based.

However, those public institutions are supposed to serve public purpose, playing a market maker role in the custodian market, especially amid expected changes in the market for new private funds after the revision on the Financial Investment Services and Capital Markets Act. Because they have been already engaged in custodian services for private funds with diverse asset classes, they are unlikely to face difficulties related to experiences, work force, and expertise (Figure 2). Until the current market failure of service refusal is addressed and prime brokerage service providers internalize basic custodian services, the public aspect of their custodian services could increase net utility in the overall society. In the long run, their services will complement prime brokerage services in expanding the ecosystem for start-up private funds.