Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Rising Credit Risk in China’s Corporate Bond Market: Background and Implications

Publication date Nov. 23, 2021

Summary

The default risk of China Evergrande Group, one of China’s real estate giants, is raising concerns over the corporate bond market in China. Having emerged as the largest in Asia, China’s corporate bond market has grown thanks to the government policy for nurturing the market and the greater demand of firms and financial institutions for funding. However, some firms have defaulted on corporate bonds since 2015 amid growth of the credit bond market. In 2018, an increasing number of privately owned firms began to default on bond payments, and 2020 saw a rise in defaults of state-owned enterprises.

The surge in corporate bond defaults can be attributed to regulatory measures for curtailing shadow finance and the government’s greater tolerance towards defaults. As higher leverage arises from firms pursuing borrowing-based growth, such a regulatory shift has affected credit ratings in the corporate bond market. In addition to a large proportion of property-backed bonds in the market lacking advanced credit rating infrastructure, the policy to curb real estate prices serves as another factor behind the China Evergrande Group fiasco, further raising the possibility of other property firms’ bankruptcy.

Nevertheless, the ratio of defaulted bonds to China’s total corporate bond issuance amount remains low. Except for a few business categories, the overall conditions in the credit bond market show signs of improvement, which could lower concerns over the spread of systemic risks arising from a series of massive defaults. Furthermore, most corporate bonds are held by domestic investors and thus, bond defaults are likely to have a limited impact on overseas investors. However, greater credit risk posed by a growing number of firms going bankrupt could deteriorate the soundness of China’s financial institutions, potentially having an adverse impact on other economies.

The surge in corporate bond defaults can be attributed to regulatory measures for curtailing shadow finance and the government’s greater tolerance towards defaults. As higher leverage arises from firms pursuing borrowing-based growth, such a regulatory shift has affected credit ratings in the corporate bond market. In addition to a large proportion of property-backed bonds in the market lacking advanced credit rating infrastructure, the policy to curb real estate prices serves as another factor behind the China Evergrande Group fiasco, further raising the possibility of other property firms’ bankruptcy.

Nevertheless, the ratio of defaulted bonds to China’s total corporate bond issuance amount remains low. Except for a few business categories, the overall conditions in the credit bond market show signs of improvement, which could lower concerns over the spread of systemic risks arising from a series of massive defaults. Furthermore, most corporate bonds are held by domestic investors and thus, bond defaults are likely to have a limited impact on overseas investors. However, greater credit risk posed by a growing number of firms going bankrupt could deteriorate the soundness of China’s financial institutions, potentially having an adverse impact on other economies.

Amid a prediction that China Evergrande Group, one of China’s real estate giants, would default on debt payment, concerns have grown over China’s corporate bond market.1) The Chinese government has sought to reform the corporate financing framework centered on indirect financing vehicles by expanding corporate financing through the capital market, improving the corporate bond market infrastructure, and opening the bond market with the introduction of the Bond Connect scheme. China’s corporate bond market has enjoyed rapid growth, thanks to government policies and increased corporate demand for funds. However, with a sharp increase in the size of the corporate bond market, the combination of economic slowdown with policy measures to reform state-owned enterprises and to curb real estate prices has resulted in defaults of some corporate bonds, which poses an insolvency risk to issuers of massive bonds. In this regard, this article intends to take a close look at the current status of China’s corporate bond market, and to discuss the background and impact of mounting credit risk.

Current Status of China’s corporate bond market

China has nurtured the bond market since the late 1990s in a bid to address inefficiency in distribution of funds which has stemmed from the banking sector-centered financial framework. To this end, it has approved bond issuance by central and local state-owned enterprises to support financing for infrastructure construction projects, and permitted ordinary firms to raise capital by issuing bonds. Furthermore, with respect to requirements for participation in the inter-bank bond market, the previous licensing system has shifted towards the reporting system to broaden the investor base for corporate bonds and establish the corporate bond trading system. In addition, fund vehicles investing in bonds have been introduced and the bond trading platform has been established in the stock exchange. Also, the development of the corporate bond-related infrastructure has been sought through the introduction of the payment system and the credit rating scheme.

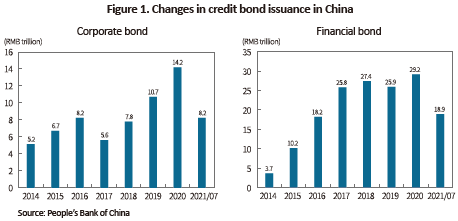

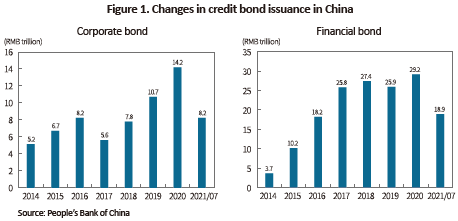

China has seen its credit bond market emerge as the largest in the Asian region, which is attributable to policy measures to foster the corporate bond market and increased financing of firms and financial institutions through the bond market. The value of corporate bond issuance rose to RMB 8.2 trillion in 2016 from RMB 5.2 trillion in 2014. However, 2017 saw a YoY decline of 31.6% in corporate bond issuance. This is because the Chinese government implemented policies to cut down corporate debts, including a debt to equity swap of corporate bonds held by banks and the elimination of zombie companies, as some corporate bonds fell into default in the latter half of 2016. But the corporate bond issuance soared again from 2018, reaching RMB 14.2 trillion in 2020. Financial bonds issued by financial institutions have also continued to grow. The value of issued financial bonds stood at RMB 3.7 trillion in 2014, jumping up to RMB 25.8 trillion in 2017. Since then, a growing trend in financial bond issuance has persisted despite yearly fluctuations, with the issuance value reaching RMB 29.2 trillion in 2020.

China’s credit bond market has steeply increased on the back of leverage-based growth strategies pursued by Chinese firms. Having emerged as a global production base, China has taken advantage of debts such as borrowed funds or corporate bonds to supplement its insufficient capital accumulation. It is notable that under the low interest rate environment from 2015 to 2016, the Chinese government adopted an easing monetary policy, encouraging firms to raise capital through corporate bonds. More recently, the growth of corporate bonds issuance shows no signs of abating, thanks to refinancing of the previously issued corporate bonds and greater demand for new funds.

The increase in real estate prices has served as another primary factor in expanding corporate bond-driven money supply for Chinese firms. With the rise in property prices, real estate developers raised funds from a large-scale corporate bond issuance to pursue business expansion while seeking business diversification by making inroads into other sectors. Ordinary firms also issued more corporate bonds secured on their property of which prices went up. With lower confidence in credit ratings of Chinese firms, asset-backed corporate bonds represent 65% of the total bond issuance, and most of such assets provided as security are real estate. The property price hike has increased borrowing capacity, leading to a stronger dependence on asset-backed corporate bonds.

Rising credit risk in China’s corporate bond market

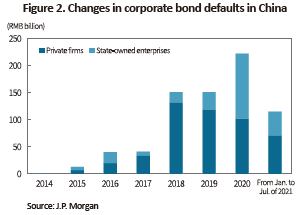

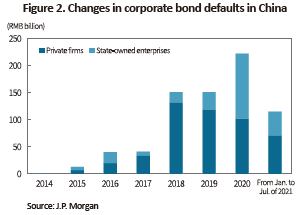

Amid a boom in the credit bond market, some firms began to default on their bonds in 2015. A growing number of private firms went bankrupt in 2018, while 2020 saw an increase in insolvent state-owned enterprises. According to the JP Morgan data, the amount in default of both state-owned enterprises and private firms climbed from RMB 41 billion in 2017 to RMB 151 billion in 2018 and RMB 222 billion in 2020. Firms in various sectors went bankrupt in China in 2020, including the state-owned enterprise Yongcheng Coal and Electricity Holding Group based in Henan Province, the semiconductor manufacturer Tsinghua Unigroup, Brilliance China Automotive Holdings (the partner of BMW China-led joint venture), the property developer Tahoe Real Estate, and the Chinese airliner Hainan Airlines. This trend has continued well into 2021 as there is growing concern that the nation’s biggest non-performing loan management firm Huarong Asset Management Company and the second-largest real estate enterprise China Evergrande Group might default on debt payment, which further contracts China’s corporate bond market.

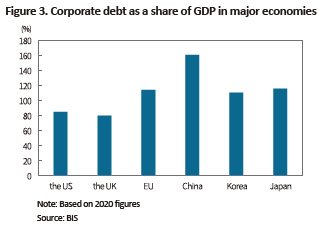

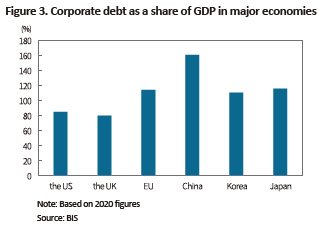

As such, the recent corporate bond market is increasingly exposed to greater credit risk because excessive leverage of Chinese firms undercuts financial solvency. China’s corporate debt as a share of GDP is one of the largest among major economies. Against this backdrop, contracted demand fueled by trade disputes between the US and China and the Covid-19 spread, plus the sudden increase in corporate debt has pushed up the number of marginal firms. In addition, multiple corporate bonds which have steeply increased in value have matured altogether, which makes a growing number of firms go into insolvency.

Another factor behind the surge in defaulted corporate bonds is a regulatory shift towards stricter management of credit risk in financial institutions. The Chinese government introduced the regulation on asset management in 2018 to deal with the proliferation of shadow finance and rising credit risk. This regulation was designed to curtail the off-balance sheet trade by financial institutions for alleviating financial risks and enhancing management soundness in financial institutions, and to limit investment in non-standardized credit assets. In particular, China attempted to induce non-sustainable firms to exit the market in an effort to facilitate the restructuring of industries with excess capacity, seek financial structure improvement through debt-to-equity conversion, and pursue deleveraging in the corporate sector. Such regulatory measures affected refinancing and new funding activities of some marginal firms with lower profitability or firms belonging to industries with excess capacity, thereby leading to an increase in insolvency events.

Furthermore, the government shows greater tolerance towards defaults of firms and even uses them as a momentum to push forward restructuring and reform of state-owned enterprises, which also contributes to the rise in corporate bond defaults. In the past, China’s state-owned enterprises were capable of borrowing a great deal of money by capitalizing on the guarantees implicitly given by the central or local governments and put the funds into infrastructure construction projects, thereby driving the economic growth in China. However, as this practice gave rise to problems like inefficient resource distribution caused by excessive investment and moral hazard, the Chinese government has stopped providing implicit guarantees to state-owned firms and permitted firms to go bankrupt, aiming for distinguishing firms in good standing from those in danger of financial insolvency. As a result, some state-owned firms which have issued corporate bonds with high credit ratings, relying on implicit support from the government, are now facing bond defaults.

As property-backed bonds take up a large proportion, the government policy to rein in real estate prices has had an impact on timely redemption of corporate bonds issued by real estate developers, which is well demonstrated in the China Evergrande Group crisis. Since side effects have increasingly arisen from a spike in property prices, the government has adopted various tougher regulatory measures regarding property and real estate financing2) to restrict real estate developers from newly raising funds and to implement the system designed to intensively manage the loans on a property offered by commercial banks. With such rigorous regulations on real estate, real estate developers who have raised a massive amount of capital through corporate bond issuance have faced financial strains, and firms that have issued property-backed corporate bonds are subject to restrictions on refinancing.

The lack of corporate bond-related infrastructure represented by the weak credit rating system has helped undermine investor confidence in the corporate bond market. Four domestic credit raters3) are taking the lead in China’s credit rating industry. Without an adequate regulatory framework for credit rating, competition in business between credit rating agencies and the mechanism in which issuers gain the upper hand in the credit rating market have continuously hindered accurate assessment of credit profiles, resulting in inflated credit ratings. Under these circumstances, state-owned enterprises with higher credit ratings have issued more corporate bonds, giving rise to moral hazard issues and zombie firms. In particular, the bankruptcy of a few state-owned firms provided with high credit ratings has dragged down confidence in the corporate bond market and credit raters and in turn, thrown investors into confusion.

Future outlook

Recently, the corporate borrowing amount has gone up due to failure in adequately differentiating credit ratings, and a regulatory shift and changes in the external environment have made some marginal firms fall into insolvency. This situation is believed to have led to a surge in corporate bond defaults. Depending on external conditions, more firms are likely to face default risk going forward. This is because an escalation in trade conflicts between the US and China, the burden of inflation aggravated by the supply chain collapse, and reduction in overseas investment could further deteriorate management conditions of Chinese firms.

However, the ratio of defaulted bonds to the aggregate corporate bonds remains relatively low. Chinese firms excluding those in a few business categories boast of strong fundamentals, and China’s market shows signs of improvement as the global economy is recovering from the Covid-19 aftershocks and policy measures help boost domestic demand. Therefore, there seems to be no need to worry about the escalation of systemic risks arising from large companies going bankrupt in succession. Especially, the Chinese government focuses its policies on maintaining stability in the financial market as well as the economic reform. This means that upon the occurrence of successive bankruptcies, there is the possibility that the government would employ market intervention tools which it has refrained from using until now. But worsening market conditions could bring about a policy measure for a gradual reduction in corporate debt, leading to resumption of market intervention or implicit guarantees. In this case, the government policy direction could deviate from efforts for liquidating insolvent enterprises and seeking deleveraging, potentially undercutting confidence in China’s credit bond market in the long run.

Since most corporate bonds are held by China’s financial institutions,4) a growing number of defaulted corporate bonds would have a limited impact on foreign investors. Although mounting credit risk is highly unlikely to create a crisis in the corporate bond market in the short term, it is necessary to keep monitoring the long-term credit risk of Chinese firms. Given that the absolute amount of credit bonds has jumped up in China, if deteriorated economic conditions at home and abroad cause an increasing number of firms to go bankrupt, it would be hard to rule out the possibility that key investors in the corporate bond market such as banks and funds could become insolvent. Amid China’s growing presence in the global economy, the mounting credit risk of financial institutions driven by mass business bankruptcies could exert influence upon the global market. The potential default risk of China Evergrande Group caused jitters in the global financial markets temporarily, which can be attributed to a sharp growth of China’s credit bond market. Although chances are slim that a massive insolvency crisis occurs, some industrial sectors can be exposed to default risks, which requires continuous monitoring of China’s credit market.

1) China’s credit bonds are divided into financial bonds issued by financial institutions, enterprise bonds issued by state-owned enterprises, corporate bonds issued by joint-stock companies, and convertible bonds. In this article, the bonds mentioned above are collectively referred to as corporate bonds.

2) For more details regarding the Chinese government’s regulation on real estate loans, please see Jin, Yinhua, 2021, Corporate Bond Defaults in China: Current Status and Outlook, KCMI Capital Market Focus 2021-18.

3) China’s domestic credit rating agencies include Chengxin International Credit Rating, China Lianhe Credit Rating, Dagong Global Credit Rating, and Shanghai Brilliance Credit Rating.

4) The corporate bonds outstanding held by foreigners account for 3.4% of the total bond amount as of January 2021, most of which are composed of government bonds and financial bonds with corporate bonds representing less than 2%.

Current Status of China’s corporate bond market

China has nurtured the bond market since the late 1990s in a bid to address inefficiency in distribution of funds which has stemmed from the banking sector-centered financial framework. To this end, it has approved bond issuance by central and local state-owned enterprises to support financing for infrastructure construction projects, and permitted ordinary firms to raise capital by issuing bonds. Furthermore, with respect to requirements for participation in the inter-bank bond market, the previous licensing system has shifted towards the reporting system to broaden the investor base for corporate bonds and establish the corporate bond trading system. In addition, fund vehicles investing in bonds have been introduced and the bond trading platform has been established in the stock exchange. Also, the development of the corporate bond-related infrastructure has been sought through the introduction of the payment system and the credit rating scheme.

China has seen its credit bond market emerge as the largest in the Asian region, which is attributable to policy measures to foster the corporate bond market and increased financing of firms and financial institutions through the bond market. The value of corporate bond issuance rose to RMB 8.2 trillion in 2016 from RMB 5.2 trillion in 2014. However, 2017 saw a YoY decline of 31.6% in corporate bond issuance. This is because the Chinese government implemented policies to cut down corporate debts, including a debt to equity swap of corporate bonds held by banks and the elimination of zombie companies, as some corporate bonds fell into default in the latter half of 2016. But the corporate bond issuance soared again from 2018, reaching RMB 14.2 trillion in 2020. Financial bonds issued by financial institutions have also continued to grow. The value of issued financial bonds stood at RMB 3.7 trillion in 2014, jumping up to RMB 25.8 trillion in 2017. Since then, a growing trend in financial bond issuance has persisted despite yearly fluctuations, with the issuance value reaching RMB 29.2 trillion in 2020.

The increase in real estate prices has served as another primary factor in expanding corporate bond-driven money supply for Chinese firms. With the rise in property prices, real estate developers raised funds from a large-scale corporate bond issuance to pursue business expansion while seeking business diversification by making inroads into other sectors. Ordinary firms also issued more corporate bonds secured on their property of which prices went up. With lower confidence in credit ratings of Chinese firms, asset-backed corporate bonds represent 65% of the total bond issuance, and most of such assets provided as security are real estate. The property price hike has increased borrowing capacity, leading to a stronger dependence on asset-backed corporate bonds.

Rising credit risk in China’s corporate bond market

Amid a boom in the credit bond market, some firms began to default on their bonds in 2015. A growing number of private firms went bankrupt in 2018, while 2020 saw an increase in insolvent state-owned enterprises. According to the JP Morgan data, the amount in default of both state-owned enterprises and private firms climbed from RMB 41 billion in 2017 to RMB 151 billion in 2018 and RMB 222 billion in 2020. Firms in various sectors went bankrupt in China in 2020, including the state-owned enterprise Yongcheng Coal and Electricity Holding Group based in Henan Province, the semiconductor manufacturer Tsinghua Unigroup, Brilliance China Automotive Holdings (the partner of BMW China-led joint venture), the property developer Tahoe Real Estate, and the Chinese airliner Hainan Airlines. This trend has continued well into 2021 as there is growing concern that the nation’s biggest non-performing loan management firm Huarong Asset Management Company and the second-largest real estate enterprise China Evergrande Group might default on debt payment, which further contracts China’s corporate bond market.

Furthermore, the government shows greater tolerance towards defaults of firms and even uses them as a momentum to push forward restructuring and reform of state-owned enterprises, which also contributes to the rise in corporate bond defaults. In the past, China’s state-owned enterprises were capable of borrowing a great deal of money by capitalizing on the guarantees implicitly given by the central or local governments and put the funds into infrastructure construction projects, thereby driving the economic growth in China. However, as this practice gave rise to problems like inefficient resource distribution caused by excessive investment and moral hazard, the Chinese government has stopped providing implicit guarantees to state-owned firms and permitted firms to go bankrupt, aiming for distinguishing firms in good standing from those in danger of financial insolvency. As a result, some state-owned firms which have issued corporate bonds with high credit ratings, relying on implicit support from the government, are now facing bond defaults.

As property-backed bonds take up a large proportion, the government policy to rein in real estate prices has had an impact on timely redemption of corporate bonds issued by real estate developers, which is well demonstrated in the China Evergrande Group crisis. Since side effects have increasingly arisen from a spike in property prices, the government has adopted various tougher regulatory measures regarding property and real estate financing2) to restrict real estate developers from newly raising funds and to implement the system designed to intensively manage the loans on a property offered by commercial banks. With such rigorous regulations on real estate, real estate developers who have raised a massive amount of capital through corporate bond issuance have faced financial strains, and firms that have issued property-backed corporate bonds are subject to restrictions on refinancing.

The lack of corporate bond-related infrastructure represented by the weak credit rating system has helped undermine investor confidence in the corporate bond market. Four domestic credit raters3) are taking the lead in China’s credit rating industry. Without an adequate regulatory framework for credit rating, competition in business between credit rating agencies and the mechanism in which issuers gain the upper hand in the credit rating market have continuously hindered accurate assessment of credit profiles, resulting in inflated credit ratings. Under these circumstances, state-owned enterprises with higher credit ratings have issued more corporate bonds, giving rise to moral hazard issues and zombie firms. In particular, the bankruptcy of a few state-owned firms provided with high credit ratings has dragged down confidence in the corporate bond market and credit raters and in turn, thrown investors into confusion.

Future outlook

Recently, the corporate borrowing amount has gone up due to failure in adequately differentiating credit ratings, and a regulatory shift and changes in the external environment have made some marginal firms fall into insolvency. This situation is believed to have led to a surge in corporate bond defaults. Depending on external conditions, more firms are likely to face default risk going forward. This is because an escalation in trade conflicts between the US and China, the burden of inflation aggravated by the supply chain collapse, and reduction in overseas investment could further deteriorate management conditions of Chinese firms.

However, the ratio of defaulted bonds to the aggregate corporate bonds remains relatively low. Chinese firms excluding those in a few business categories boast of strong fundamentals, and China’s market shows signs of improvement as the global economy is recovering from the Covid-19 aftershocks and policy measures help boost domestic demand. Therefore, there seems to be no need to worry about the escalation of systemic risks arising from large companies going bankrupt in succession. Especially, the Chinese government focuses its policies on maintaining stability in the financial market as well as the economic reform. This means that upon the occurrence of successive bankruptcies, there is the possibility that the government would employ market intervention tools which it has refrained from using until now. But worsening market conditions could bring about a policy measure for a gradual reduction in corporate debt, leading to resumption of market intervention or implicit guarantees. In this case, the government policy direction could deviate from efforts for liquidating insolvent enterprises and seeking deleveraging, potentially undercutting confidence in China’s credit bond market in the long run.

Since most corporate bonds are held by China’s financial institutions,4) a growing number of defaulted corporate bonds would have a limited impact on foreign investors. Although mounting credit risk is highly unlikely to create a crisis in the corporate bond market in the short term, it is necessary to keep monitoring the long-term credit risk of Chinese firms. Given that the absolute amount of credit bonds has jumped up in China, if deteriorated economic conditions at home and abroad cause an increasing number of firms to go bankrupt, it would be hard to rule out the possibility that key investors in the corporate bond market such as banks and funds could become insolvent. Amid China’s growing presence in the global economy, the mounting credit risk of financial institutions driven by mass business bankruptcies could exert influence upon the global market. The potential default risk of China Evergrande Group caused jitters in the global financial markets temporarily, which can be attributed to a sharp growth of China’s credit bond market. Although chances are slim that a massive insolvency crisis occurs, some industrial sectors can be exposed to default risks, which requires continuous monitoring of China’s credit market.

1) China’s credit bonds are divided into financial bonds issued by financial institutions, enterprise bonds issued by state-owned enterprises, corporate bonds issued by joint-stock companies, and convertible bonds. In this article, the bonds mentioned above are collectively referred to as corporate bonds.

2) For more details regarding the Chinese government’s regulation on real estate loans, please see Jin, Yinhua, 2021, Corporate Bond Defaults in China: Current Status and Outlook, KCMI Capital Market Focus 2021-18.

3) China’s domestic credit rating agencies include Chengxin International Credit Rating, China Lianhe Credit Rating, Dagong Global Credit Rating, and Shanghai Brilliance Credit Rating.

4) The corporate bonds outstanding held by foreigners account for 3.4% of the total bond amount as of January 2021, most of which are composed of government bonds and financial bonds with corporate bonds representing less than 2%.