Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Post-Pandemic Excess Household Savings in Korea: Current Status and Implications

Publication date Dec. 21, 2021

Summary

In the wake of the Covid-19 pandemic, reduced consumption and transfer income growth resulting from government relief payments have sparked the accumulation of a significant amount of excess savings by households around the world. Korea is no exception to this trend. According to available estimates, Koreans stockpiled more savings from the first quarter of 2020 to the third quarter of 2021 compared to the pre-pandemic average levels, leading to excess savings worth an average of KRW 3.1 million per household over the same period. When adjusted for the entire household sector, the aggregate amount of excess household savings reaches around KRW 67 trillion, equal to 3.5% of Korea’s 2020 nominal GDP. The accumulation of excess savings has been observed in most household segments, regardless of segment-specific features. In particular, higher-income households with a stable income flow have added a large stock of excess savings, which is primarily attributable to reduced spending. On the other hand, lower-income households suffering from income instability have amassed excess savings, largely thanks to transfer income growth. Much of the excess savings accumulated by households during the pandemic have been invested in capital market products such as stocks and funds. Given the characteristics of households with larger excess savings, a considerable portion of these accumulated funds is highly likely to remain in the capital market. To hold on to these investors, it is necessary to deliver stable returns, offer a wide range of products, and strengthen confidence in the market.

It has been almost two years since the Covid-19 outbreak escalated into a global pandemic in early 2020. On the economic front, the most notable post-pandemic aspects are the implementation of social distancing designed to prevent the Covid virus from further spreading and the provision of relief payments. Social distancing measures have inevitably led to the decline in consumption, whereas relief funds have contributed to increasing individual or household transfer income levels. This phenomenon has been witnessed in most countries in varying degrees, implying that households have stockpiled excess savings in substantial parts of the world. For example, some estimates indicate that the US personal excess savings accumulated during the Covid-19 crisis approximately reached $2.7 trillion, representing around 12% to 13% of the 2020 nominal GDP.1) This is primarily attributable to a dramatic plunge in spending resulting from the US government-imposed lockdowns and a surge in transfer income owing to a great deal of relief payments and additional unemployment benefits.

Compared to the US and European countries, Korea has imposed less strict lockdowns and paid out a smaller amount of the Covid-19 relief funds. Still, it appears that prolonged social distancing and restrictions on international travel have weighed down spending on services, and relief funds have led to the growth of excess savings in the household sector. Under this context, this article tries to figure out the size of excess household savings piled up after the pandemic outbreak, and to analyze differences in excess savings by household segment. It would also examine how these accumulated funds would be spent and what implications they would have for the financial and capital markets.

Post-pandemic excess household savings in Korea

With reference to the household income and expenditure survey by Statistics Korea, this article estimated the value of excess savings accumulated by households in Korea. The survey results published on a quarterly basis give a detailed breakdown of the average monthly income and expenditure of households by item. In the survey, the amount derived by subtracting household expenses from household income is classified as a surplus, which this article defines as the saving amount.2) The saving rate expressed as a surplus rate in the survey is calculated by dividing the monthly average saving amount (a surplus) by the monthly average disposable income. This article calculated the excess saving rate and then multiplied the disposable income by the calculated excess saving rate, and defined the resulting amount as the excess saving amount. The monthly average excess saving rates by quarter from the first quarter of 2020 to the third quarter of 2021 were measured at the levels exceeding the saving rates over the same quarter in 2019.3)

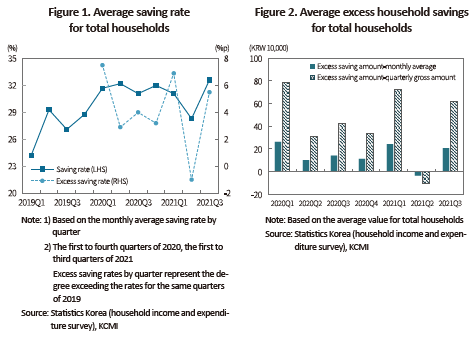

As illustrated in Figure 1, the average saving rate for Korea’s entire households remained within the range of 24% to 29% in 2019 prior to the Covid-19 pandemic. But it began to rise in the first quarter of 2020 immediately after the Covid-19 outbreak, and fluctuated in the range of 28% to 33% up until the third quarter of 2021. All the quarterly saving rates calculated from the first quarter of 2020 to the third quarter of 2021 were higher than the levels of 2019, except for the second quarter of 2021 alone. In the first quarter of 2020 when the pandemic broke out, the excess saving rate reached 7.5 percentage points compared to the first quarter of 2019, hitting the highest excess saving rate over the period analyzed.

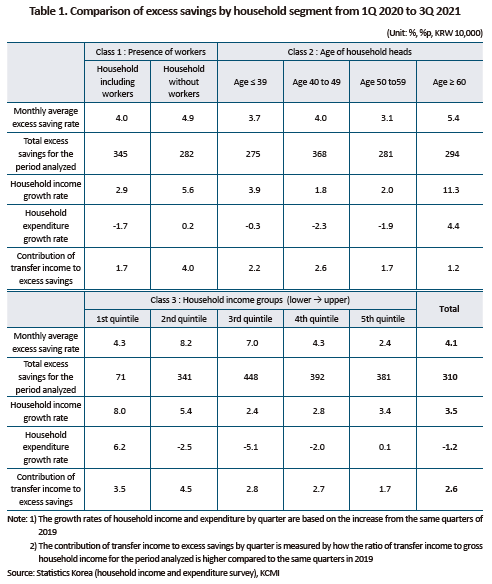

Figure 2 gives quarterly estimates of the monthly average excess saving amount, derived from the monthly average disposable income multiplied by the monthly average excess saving rate. Except for the second quarter of 2021, the monthly average excess savings for the six quarters analyzed range from KRW 100,000 to 260,000 (an average of approx. KRW 150,000). The gross monthly average excess savings converted into the quarterly gross amount add up to the cumulative excess saving amount accumulated by Korea’s household sector from the first quarter of 2020 to the third quarter of 2021, which roughly amounts to an average of KRW 3.1 million per household. When adjusted for the entire households, it is roughly equal to KRW 67 trillion,4) representing around 3.5% of Korea’s nominal GDP and 7.8% of the nominal final consumption expenditure of households. Although much smaller compared to the US personal excess savings amounting to 12% to 13% of the nominal GDP, such value of extra savings would give a significant boost to demand if households spend all these accumulated funds over the next 12 months.

Characteristics of excess savings by household segment

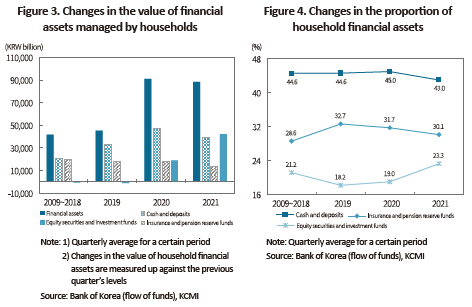

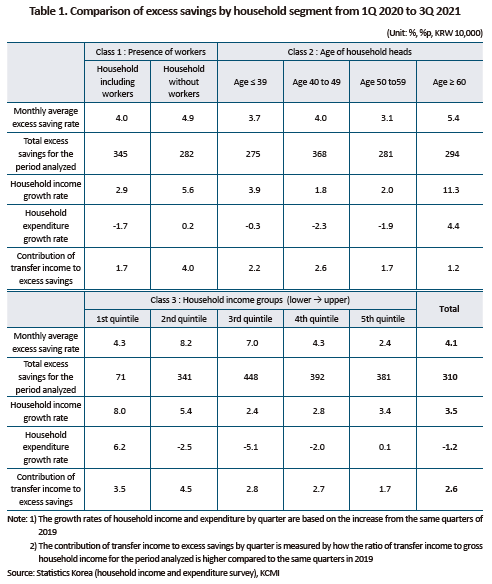

This article did a comparative analysis of the excess saving volumes amassed by each household segment to examine on which segment excess savings have been concentrated and what causes the savings disparity. The analysis result summed up in Table 1 below reveals notable characteristics.

First, households of which heads are workers, households with their heads aged between 40 and 49, and households falling under the third and fourth income quintiles accounted for relatively larger portions in the total household excess saving amount. This appears to stem from income disparity and a stable flow of income because all segmentation methods for households reflect an income gap to a certain extent, despite slight differences among them.

Second, it appears that household segments with a relatively large share of excess savings have been primarily affected by reduced household spending, while those with a relatively small share of excess savings have been more affected by household income growth. Taken together with the first characteristic, this suggests that the reduction in household spending has had a greater impact on the accumulation of extra savings by higher-income households, while the increase in income has prominently affected the excess savings built up by lower-income households.

Third, the contribution of transfer income to the gross household income, measured from the first quarter of 2020 to the third quarter of 2021, increased compared to the levels of the same quarters in 2019, which was more evident in the household segment with a relatively smaller amount of excess savings. In other words, this segment amassed excess savings largely thanks to income growth, most of which resulted from transfer income growth backed by relief payments.5)

Utilization of accumulated excess savings and relevant implications

Household saving, defined as household income less expenditures, is retained in the financial market in any form. For example, suppose that a family purchases real estate assets by tapping into its savings. The fund used for the purchase would go through a series of transactions and end up being placed in the financial market under the name of any person. When acquiring tangible assets such as real estate property by taking out a loan, the family should undergo the same process, which has been well reflected in the flow of funds compiled by the Bank of Korea.

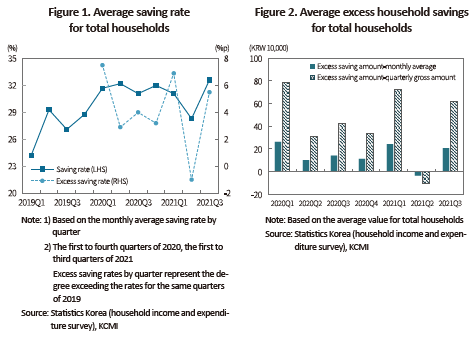

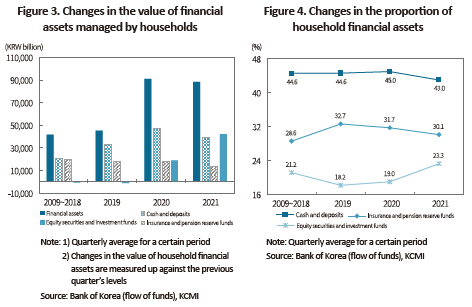

Figure 3 suggests that the size of household financial assets has shown remarkable growth between 2020 and 2021, roughly posting a two-fold increase from the previous quarterly average growth.6) Although cash and deposits have increased in value, the biggest growth has come from equity securities and investment funds. This means that a substantial share of the post-pandemic increase in excess household savings has been invested in stocks and funds in the financial market. As a result, the proportions of both equity securities and investment funds in household financial assets are rising at a rapid pace (see Figure 4).

Although the Omicron Covid variant is emerging as a new variable that could affect the global economy, 2022 would see more signs for the economy to get back on track. Accordingly, the size of excess savings accumulated by households is likely to dwindle. If so, how would the current excess saving be tapped into, and what impact would it have on the makeup of household financial assets?

First of all, there is a possibility that some part of the accumulated excess savings would be used for revenge spending, albeit in small amounts. The households that have piled up a substantial amount of excess savings tend to have high income and stable sources of income. The segment of these households exhibits a relatively lower marginal propensity to consume and higher saving rates. Higher consumption can be covered by newly generated income and thus, such high-income households rarely need to mobilize a great deal of excess savings. Since the consumption of durable goods surged dramatically in 2020 and 2021, substantial consumption growth is unlikely to occur. Once travel restrictions are lifted, travel-related spending could climb further, which, however, has become uncertain with the emergence of the new Covid variant. Excess savings directed towards consumption would be ultimately retained as corporate profits or added to the income and financial assets of the self-employed. There is a good chance that these savings would be amassed in the form of cash-like financial assets such as deposits.

The excess savings could be partially used to finance the purchase of real estate assets or supply a leasehold (jeonse) deposit, along with financial assets accumulated by households and lending by financial institutions. Although these savings would also end up being financial assets of other economic agents, the funds associated with real estate transactions have a strong tendency to be accumulated in the form of cash-like financial assets. However, it is notable that the real estate market has entered a phase of stagnation, backed by strict regulations and measures to tighten relevant lending. Under these circumstances, it looks unlikely that excess savings are channeled into the real estate market and placed in cash-like financial assets for the time being.

In this regard, a sizable part of excess savings amassed by households after the pandemic started would likely remain in the financial market, taking the form of stocks, funds, and ETFs. As stated above, the households with a large stock of excess savings tend to have relatively higher income and a stable income flow. It is generally accepted that those households are less exposed to background risks and thus, highly motivated to hold stocks and other risky assets.7)

In the wake of the pandemic, households with a significant stock of extra funds have made a much-awaited comeback to the capital market. A considerable number of them can afford to disperse and take the risks intrinsic to stocks and funds traded in the capital market. The question is whether Korea’s capital market could keep holding such households. More recently, a growing number of retail investors have turned their attention toward overseas capital markets for the US ETFs, probably due to differences in market returns, diversification of products, and confidence in the market. To keep attracting such investors who have returned to the market after a long absence, Korea’s capital market should solidify fundamentals to identify valuable companies and to offer a stable stream of returns to retail investors or households.

1) Kim, J.C., 2021, The Future Direction of the US Economy and Inflation and the US Federal Reserve’s Response, KCMI Issue Paper 21-19.

2) This is equal to disposable income (gross household income after tax and other non-consumption expenditures) less consumption expenditures.

3) The excess saving rate represents the degree in excess of the average saving rate. Since 2019, the household income and expenditure survey by Statistics Korea has presented data that cover the entire households in Korea including single-person households and households engaging in agriculture, forestry, and fisheries. Accordingly, this article assumes that the average saving rate measured up against the excess saving rate is the quarterly saving rate calculated in 2019 immediately prior to the Covid-19 pandemic.

4) According to the household income and expenditure survey, the average number of household members is 2.39 from Q1 2020 to Q3 2021, and the website of Statistics Korea presents Korea’s estimated population at 51.82 million. Accordingly, if single-member households and households engaging in agriculture, forestry, and fisheries are taken into account, Korea’s overall number of households is estimated at 21.68 million.

5) As for households with heads over the age of 60 and first income quintile households, the contribution of transfer income to excess savings is lower than expected, which can be explained by the fact that the contribution of transfer income of these household segments was overwhelming higher than that of other segments prior to the pandemic.

6) The household financial assets include not only the net increase in household savings stated above but also the amount of loans used to purchase various assets including real estate property.

7) The theoretical model of household portfolio choice optimization indicates that households less exposed to background risk are more likely to choose to hold risky financial assets such as stocks (Heaton, J., Lucas, D., 2000, Portfolio Choice in the Presence of Background Risk, Economic Journal 110, 1-26.).

Compared to the US and European countries, Korea has imposed less strict lockdowns and paid out a smaller amount of the Covid-19 relief funds. Still, it appears that prolonged social distancing and restrictions on international travel have weighed down spending on services, and relief funds have led to the growth of excess savings in the household sector. Under this context, this article tries to figure out the size of excess household savings piled up after the pandemic outbreak, and to analyze differences in excess savings by household segment. It would also examine how these accumulated funds would be spent and what implications they would have for the financial and capital markets.

Post-pandemic excess household savings in Korea

With reference to the household income and expenditure survey by Statistics Korea, this article estimated the value of excess savings accumulated by households in Korea. The survey results published on a quarterly basis give a detailed breakdown of the average monthly income and expenditure of households by item. In the survey, the amount derived by subtracting household expenses from household income is classified as a surplus, which this article defines as the saving amount.2) The saving rate expressed as a surplus rate in the survey is calculated by dividing the monthly average saving amount (a surplus) by the monthly average disposable income. This article calculated the excess saving rate and then multiplied the disposable income by the calculated excess saving rate, and defined the resulting amount as the excess saving amount. The monthly average excess saving rates by quarter from the first quarter of 2020 to the third quarter of 2021 were measured at the levels exceeding the saving rates over the same quarter in 2019.3)

As illustrated in Figure 1, the average saving rate for Korea’s entire households remained within the range of 24% to 29% in 2019 prior to the Covid-19 pandemic. But it began to rise in the first quarter of 2020 immediately after the Covid-19 outbreak, and fluctuated in the range of 28% to 33% up until the third quarter of 2021. All the quarterly saving rates calculated from the first quarter of 2020 to the third quarter of 2021 were higher than the levels of 2019, except for the second quarter of 2021 alone. In the first quarter of 2020 when the pandemic broke out, the excess saving rate reached 7.5 percentage points compared to the first quarter of 2019, hitting the highest excess saving rate over the period analyzed.

Figure 2 gives quarterly estimates of the monthly average excess saving amount, derived from the monthly average disposable income multiplied by the monthly average excess saving rate. Except for the second quarter of 2021, the monthly average excess savings for the six quarters analyzed range from KRW 100,000 to 260,000 (an average of approx. KRW 150,000). The gross monthly average excess savings converted into the quarterly gross amount add up to the cumulative excess saving amount accumulated by Korea’s household sector from the first quarter of 2020 to the third quarter of 2021, which roughly amounts to an average of KRW 3.1 million per household. When adjusted for the entire households, it is roughly equal to KRW 67 trillion,4) representing around 3.5% of Korea’s nominal GDP and 7.8% of the nominal final consumption expenditure of households. Although much smaller compared to the US personal excess savings amounting to 12% to 13% of the nominal GDP, such value of extra savings would give a significant boost to demand if households spend all these accumulated funds over the next 12 months.

This article did a comparative analysis of the excess saving volumes amassed by each household segment to examine on which segment excess savings have been concentrated and what causes the savings disparity. The analysis result summed up in Table 1 below reveals notable characteristics.

First, households of which heads are workers, households with their heads aged between 40 and 49, and households falling under the third and fourth income quintiles accounted for relatively larger portions in the total household excess saving amount. This appears to stem from income disparity and a stable flow of income because all segmentation methods for households reflect an income gap to a certain extent, despite slight differences among them.

Third, the contribution of transfer income to the gross household income, measured from the first quarter of 2020 to the third quarter of 2021, increased compared to the levels of the same quarters in 2019, which was more evident in the household segment with a relatively smaller amount of excess savings. In other words, this segment amassed excess savings largely thanks to income growth, most of which resulted from transfer income growth backed by relief payments.5)

Utilization of accumulated excess savings and relevant implications

Household saving, defined as household income less expenditures, is retained in the financial market in any form. For example, suppose that a family purchases real estate assets by tapping into its savings. The fund used for the purchase would go through a series of transactions and end up being placed in the financial market under the name of any person. When acquiring tangible assets such as real estate property by taking out a loan, the family should undergo the same process, which has been well reflected in the flow of funds compiled by the Bank of Korea.

Figure 3 suggests that the size of household financial assets has shown remarkable growth between 2020 and 2021, roughly posting a two-fold increase from the previous quarterly average growth.6) Although cash and deposits have increased in value, the biggest growth has come from equity securities and investment funds. This means that a substantial share of the post-pandemic increase in excess household savings has been invested in stocks and funds in the financial market. As a result, the proportions of both equity securities and investment funds in household financial assets are rising at a rapid pace (see Figure 4).

First of all, there is a possibility that some part of the accumulated excess savings would be used for revenge spending, albeit in small amounts. The households that have piled up a substantial amount of excess savings tend to have high income and stable sources of income. The segment of these households exhibits a relatively lower marginal propensity to consume and higher saving rates. Higher consumption can be covered by newly generated income and thus, such high-income households rarely need to mobilize a great deal of excess savings. Since the consumption of durable goods surged dramatically in 2020 and 2021, substantial consumption growth is unlikely to occur. Once travel restrictions are lifted, travel-related spending could climb further, which, however, has become uncertain with the emergence of the new Covid variant. Excess savings directed towards consumption would be ultimately retained as corporate profits or added to the income and financial assets of the self-employed. There is a good chance that these savings would be amassed in the form of cash-like financial assets such as deposits.

The excess savings could be partially used to finance the purchase of real estate assets or supply a leasehold (jeonse) deposit, along with financial assets accumulated by households and lending by financial institutions. Although these savings would also end up being financial assets of other economic agents, the funds associated with real estate transactions have a strong tendency to be accumulated in the form of cash-like financial assets. However, it is notable that the real estate market has entered a phase of stagnation, backed by strict regulations and measures to tighten relevant lending. Under these circumstances, it looks unlikely that excess savings are channeled into the real estate market and placed in cash-like financial assets for the time being.

In this regard, a sizable part of excess savings amassed by households after the pandemic started would likely remain in the financial market, taking the form of stocks, funds, and ETFs. As stated above, the households with a large stock of excess savings tend to have relatively higher income and a stable income flow. It is generally accepted that those households are less exposed to background risks and thus, highly motivated to hold stocks and other risky assets.7)

In the wake of the pandemic, households with a significant stock of extra funds have made a much-awaited comeback to the capital market. A considerable number of them can afford to disperse and take the risks intrinsic to stocks and funds traded in the capital market. The question is whether Korea’s capital market could keep holding such households. More recently, a growing number of retail investors have turned their attention toward overseas capital markets for the US ETFs, probably due to differences in market returns, diversification of products, and confidence in the market. To keep attracting such investors who have returned to the market after a long absence, Korea’s capital market should solidify fundamentals to identify valuable companies and to offer a stable stream of returns to retail investors or households.

1) Kim, J.C., 2021, The Future Direction of the US Economy and Inflation and the US Federal Reserve’s Response, KCMI Issue Paper 21-19.

2) This is equal to disposable income (gross household income after tax and other non-consumption expenditures) less consumption expenditures.

3) The excess saving rate represents the degree in excess of the average saving rate. Since 2019, the household income and expenditure survey by Statistics Korea has presented data that cover the entire households in Korea including single-person households and households engaging in agriculture, forestry, and fisheries. Accordingly, this article assumes that the average saving rate measured up against the excess saving rate is the quarterly saving rate calculated in 2019 immediately prior to the Covid-19 pandemic.

4) According to the household income and expenditure survey, the average number of household members is 2.39 from Q1 2020 to Q3 2021, and the website of Statistics Korea presents Korea’s estimated population at 51.82 million. Accordingly, if single-member households and households engaging in agriculture, forestry, and fisheries are taken into account, Korea’s overall number of households is estimated at 21.68 million.

5) As for households with heads over the age of 60 and first income quintile households, the contribution of transfer income to excess savings is lower than expected, which can be explained by the fact that the contribution of transfer income of these household segments was overwhelming higher than that of other segments prior to the pandemic.

6) The household financial assets include not only the net increase in household savings stated above but also the amount of loans used to purchase various assets including real estate property.

7) The theoretical model of household portfolio choice optimization indicates that households less exposed to background risk are more likely to choose to hold risky financial assets such as stocks (Heaton, J., Lucas, D., 2000, Portfolio Choice in the Presence of Background Risk, Economic Journal 110, 1-26.).