Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

How the Corporate Bond Market Changes in Rate Hike Cycles

Publication date May. 17, 2022

Summary

Recently, a sharp increase in the market interest rate has dwarfed the corporate bond market. The supply and demand imbalance of credit bonds has widened credit spreads, driving up financing costs through corporate bond issuance. In particular, Korea’s corporate bond market has seen the yield on issuance climbing and maturities getting shorter amid rising market interest rates since the second half of 2021. The impact of the upward trend in market interest rates varies by bond type. It tends to have a relatively limited impact on public placement bonds, while private placement bonds are faced with a sizable increase in financing costs and shorter maturities due to rate hikes.

Looking forward, the market interest rate is likely to climb further, underpinned by changes in internal and external financial conditions. As the market for public placement bonds acts as a source of financing for companies with relatively strong credit quality, its exposure to rising interest rates would be limited. In addition, an increase in interest rates below a certain level is less likely to affect directly their financial performance. On the other hand, private placement bonds are used for financing by companies with lower ratings and thus, would be likely swayed by rate hikes.

In this regard, what is needed is to step up management efforts for the sectors with poor credit quality in response to changing interest rates. Also necessary is to examine how changing conditions in Korea and abroad such as rising interest rates would influence the entire economy including the production and export sectors and to strengthen economic fundamentals.

Looking forward, the market interest rate is likely to climb further, underpinned by changes in internal and external financial conditions. As the market for public placement bonds acts as a source of financing for companies with relatively strong credit quality, its exposure to rising interest rates would be limited. In addition, an increase in interest rates below a certain level is less likely to affect directly their financial performance. On the other hand, private placement bonds are used for financing by companies with lower ratings and thus, would be likely swayed by rate hikes.

In this regard, what is needed is to step up management efforts for the sectors with poor credit quality in response to changing interest rates. Also necessary is to examine how changing conditions in Korea and abroad such as rising interest rates would influence the entire economy including the production and export sectors and to strengthen economic fundamentals.

As Korea’s market for public placement bonds is structured around high-grade bonds, it has rarely seen a credit event taking place so far. Its total issuance volume has continued to rise, driven by a larger pool of corporate bond investors and a low interest rate environment. Amid increasing yields on treasury bonds and widening credit spreads, however, corporate bonds have recently plunged in prices, causing investors to incur losses and dampening investor sentiment. Furthermore, there is a growing concern that economic slowdown could further intensify credit risk across the corporate bond market. Against this backdrop, this article explores how recent market conditions would affect and transform Korea’s corporate bond market, and examines its soundness.

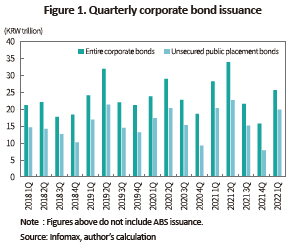

Issuance of corporate bonds

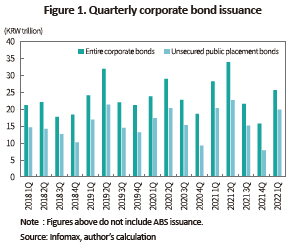

Korea’s corporate bond market has seen bond issues slowing down since the second half of 2021, owing to the increase in the risk-free rate. The corporate bond issuance had a significant decline in the third quarter of 2021, which continued well into the fourth quarter. However, the corporate bond primary market has shown signs of recovery starting from 2022 on the back of the growth of publicly-offered corporate bonds with an AA rating including contingent capital securities. Corporate bond issues for the first quarter of 2022 have been led primarily by bank holding companies, AA-rated large corporations and regional Gencos.1) A few firms and regional Gencos have issued ESG bonds actively while bank holding companies have focused on contingent capital securities.

The issuance of equity-linked bonds totaled around KRW 3 trillion every quarter until the fourth quarter of 2021, which fell drastically to KRW 1.4 trillion in the first quarter of 2022 as a result of the decline in the stock market. Private placement bonds2) have shown a downward trend in terms of issuance volume since the third quarter of 2021, which stems from the drop in P-CBO issuance. Taken together, the issuance of corporate bonds, especially unsecured public placement bonds, has staged a recovery in the first quarter of 2022, fueled by a growing amount of bonds issued by highly rated companies.

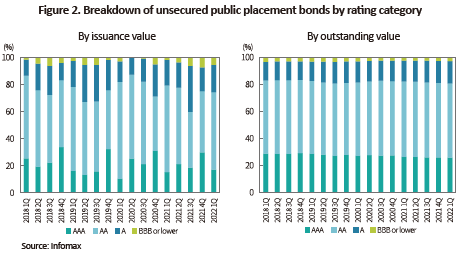

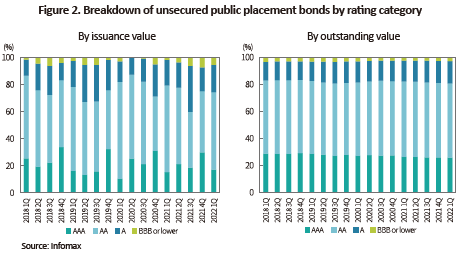

Issuers with strong credit quality have dominated the corporate bond market. The share of unsecured public placement bonds with an AA rating or higher sild temporarily to as low as 59.7% during the third quarter of 2021, which, however, surged to 74.1% in the first quarter of 2022. This implies that in response to additional rate hikes, highly rated issuers raise long-term financing by using corporate bonds while seeking capital expansion through the issuance of contingent capital securities. In terms of outstanding balance, higher-grade corporate bonds with an AA rating or higher represent 80.7% of total unsecured bonds as of the end of the first quarter in 2022, whereas the bonds with a BBB rating or lower just account for 3%. As such, Korea’s market for unsecured corporate bonds serves mainly as a financing source for highly rated companies. On the other hand, those with poor credit quality face difficulties in entering the market.

Corporate bond yields linked to rising interest rates

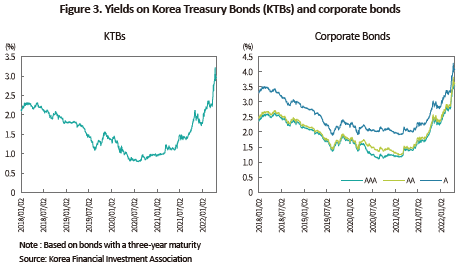

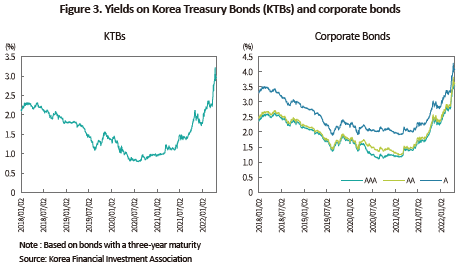

More recently, the yield on risk-free bonds has risen steeply. The market interest rate is greatly affected by the reduction of liquidity supplied to cope with the Covide-19 crisis and the increase in base rates. Another factor behind interest rate hikes is mounting inflationary pressure stemming from supply chain bottlenecks from the Covid-19 pandemic and higher resource prices induced by the Russia-Ukraine war.

The rising yield on risk-free bonds is having an impact on corporate bond yields and credit spreads. As shown in the change in corporate bond yields, the yield on AA-rated, 3-year corporate bonds continued to climb from 1.24% in early 2021 to 3.82% in early April 2022 before remaining flat.

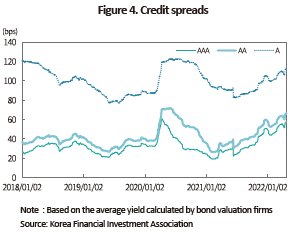

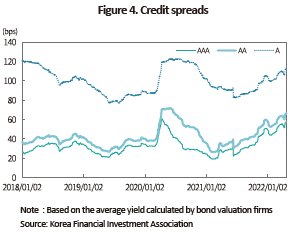

With higher yields on risk-free bonds, credit spreads are widening further. The credit spread became stable after widening temporarily in early 2020 in the wake of the Covid-19 crisis but has shown an upward movement again since the second half of 2021. The spread between AA-rated corporate bonds and KTBs widened to 63.8 bps in late March 2022 from 26.2 bps in February 2021.

The widening credit spread can be attributable to rising interest rates and other external factors, rather than to deteriorating fundamentals of credit bonds. Amid weaker investor demand for bonds resulting from inflation and a KTB supply and demand imbalance, rising risk-free rates have lowered investors’ preference for risk assets, thereby pushing up credit spreads. In the meantime, the supply and demand conditions for all credit bonds also have an effect on credit spreads. Korea Electric Power Corporation (KEPCO) has issued a large volume of KEPCO bonds3) since the second half of 2021, contributing to considerable growth of the supply of public nonfinancial corporation bonds. The increase in KEPCO bond issuance leads to widening spreads of public nonfinancial corporation bonds, which affects the credit spread of corporate bonds.

The impact of rate hikes on corporate bond issuance

Rising interest rates and widening credit spreads are likely to affect the maturity structure, yields on coupon bonds and other conditions for corporate bond issuance. This article analyzes the maturity structure and how the yield on bond issuance changes for both unsecured public placement bonds and private placement bonds to understand the implications of recent rate hikes for corporate bond issuance.

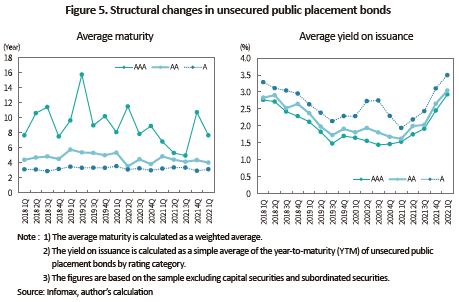

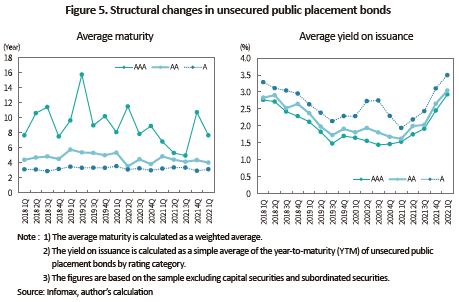

The analysis indicates that the average maturity4) of unsecured public placement bonds varies by credit rating. AAA-rated corporate bonds show greater volatility depending on the corresponding period and tend to have a longer average maturity than those with lower ratings. The lengthened maturity of AAA-rated corporate bonds in the fourth quarter of 2021 is attributable to the high-volume issuance of long-term ESG bonds by a few regional Gencos. But the average maturity of those with an AAA rating has been reduced in 2022 because the increase in interest rates has curtailed financing based on long-term bonds by highly rated companies. The average maturity of bonds with a rating of A or AA shows relatively lower volatility, which has decreased by a small margin amid rising market interest rates. This can be explained by investors’ preference for relatively short-term bonds during the rate hike cycle.

The yield on unsecured public placement bond issuance is determined by the yields from trading measured at the time of issuance and the supply and demand conditions. Accordingly, the yield from issuance is likely to become higher during the period of rising market interest rates. The yield on unsecured corporate bond issuance has shown an upward trend since the second quarter of 2021, despite minor differences by credit rating. In terms of issuance yields, A-rated corporate bonds have increased more sharply than bonds with other ratings since the second half of 2021. This probably stems from the tendency of placing a higher premium on relatively low-rated corporate bonds during the rate hike cycle.

If a firm’s credit rating is too low to participate in the market for unsecured public placement bonds, it should raise funds by taking out a loan from a financial institution or through private placement bonds. In Korea, private placement bonds are comprised of equity-linked bonds, asset-backed bonds (AB Bonds), underlying assets of P-CBOs and ordinary private placement bonds. This article takes a look at the average maturity of and issuance yield on the entire private placement bonds excluding equity-linked corporate bonds and AB Bonds.

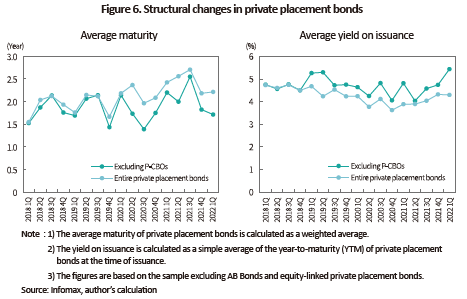

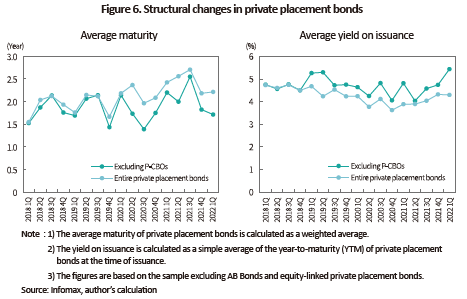

The average maturity of private placement bonds is shorter and more sensitive to interest rate fluctuations, compared to that of unsecured public placement bonds. With a recent increase in interest rates, the average maturity of ordinary private placement bonds has been reduced to 1.71 years in the first quarter of 2022 from 2.55 years in the third quarter of 2021. This phenomenon occurs presumably because during the period of rate hikes, investors have a higher sensitivity to credit risk, which drags down their demand for longer-term bonds.

Meanwhile, the average maturity of the entire private placement bonds differs from that of private placement bonds excluding underlying assets of P-CBOs. As for P-CBOs, the underlying assets have a standard maturity of two or three years while ordinary private placement bonds are issued with a wider range of maturities.

The average yield on private placement bond issuance varies by bond type and period. With P-CBO underlying assets, interest rates lower than the market rate are applied since P-CBOs supply funds through private placement bonds to provide policy support. Accordingly, private placement bonds excluding P-CBOs tend to have a lower yield on issuance for most of the period, compared to the entire private placement bonds. In an analysis by period, the entire private placement bonds exhibited an upward movement in the average issuance yield in the first quarter of 2021 and thereafter. But the yield on ordinary private placement bond issuance began to climb in the third quarter of 2021. This suggests that the relatively lower issuance yield on the entire private placement bonds is affected by the issuance yield on P-CBOs of which yields are determined by policy directions, while an increase in the market interest rate has an immediate effect on the issuance yield on private placement bonds excluding P-CBOs.

Future outlook and desirable ways forward

As central banks of major economies are poised to reduce abundant liquidity supplied to cope with the Covid-19 crisis and raise base rates, the market interest rate is likely to continue an upward movement. An increase in the market interest rate seems to affect the supply and demand and prices in the corporate bond market. Furthermore, changing market conditions may gradually transform the issuance structure of corporate bonds.

The impact of interest rate hikes differs by credit category. Lower-rated issuers are likely to see the yield on bond issuance rising and bond maturities getting shorter. In addition, the growing interest burden could have a direct impact on issuers’ financial performance. Accordingly, what is needed is to pay attention to any market change for private placement bonds which serve as a source of financing for companies with poor credit quality. Also necessary is to strengthen efforts for the analysis and management of credit ratings.

On the other hand, rising interest rates would have a limited impact on Korea’s market for unsecured public placement bonds as the bonds can be issued only by companies with strong credit quality. On top of that, rate hikes not exceeding a certain level are less likely to have a direct impact on the financial performance of unsecured public placement bond issuers.

Factors that affect directly credit ratings in the corporate bond market include rate hikes and a prolonged economic slowdown. Lingering inflationary pressure and slower economic growth also could have an impact on the fundamentals of highly rated companies. Poor financial performance would drive up the amount of borrowing, thereby leading to a decline in credit ratings. In this respect, efforts should be put into achieving healthy fundamentals and improving corporate financial stability to enhance the soundness of the corporate bond market.

1) Refers to generation companies.

2) AB Bonds and equity-linked bonds are excluded.

3) KEPCO rarely issued bonds from the second half of 2020, but resumed issuance with KRW 4.5 trillion in 3Q 2021, KRW 4.1 trillion in 4Q 2021 and KRW 6.3 trillion in 1Q 2022.

4) A weighted average maturity of issuance value

Issuance of corporate bonds

Korea’s corporate bond market has seen bond issues slowing down since the second half of 2021, owing to the increase in the risk-free rate. The corporate bond issuance had a significant decline in the third quarter of 2021, which continued well into the fourth quarter. However, the corporate bond primary market has shown signs of recovery starting from 2022 on the back of the growth of publicly-offered corporate bonds with an AA rating including contingent capital securities. Corporate bond issues for the first quarter of 2022 have been led primarily by bank holding companies, AA-rated large corporations and regional Gencos.1) A few firms and regional Gencos have issued ESG bonds actively while bank holding companies have focused on contingent capital securities.

The issuance of equity-linked bonds totaled around KRW 3 trillion every quarter until the fourth quarter of 2021, which fell drastically to KRW 1.4 trillion in the first quarter of 2022 as a result of the decline in the stock market. Private placement bonds2) have shown a downward trend in terms of issuance volume since the third quarter of 2021, which stems from the drop in P-CBO issuance. Taken together, the issuance of corporate bonds, especially unsecured public placement bonds, has staged a recovery in the first quarter of 2022, fueled by a growing amount of bonds issued by highly rated companies.

More recently, the yield on risk-free bonds has risen steeply. The market interest rate is greatly affected by the reduction of liquidity supplied to cope with the Covide-19 crisis and the increase in base rates. Another factor behind interest rate hikes is mounting inflationary pressure stemming from supply chain bottlenecks from the Covid-19 pandemic and higher resource prices induced by the Russia-Ukraine war.

The rising yield on risk-free bonds is having an impact on corporate bond yields and credit spreads. As shown in the change in corporate bond yields, the yield on AA-rated, 3-year corporate bonds continued to climb from 1.24% in early 2021 to 3.82% in early April 2022 before remaining flat.

The impact of rate hikes on corporate bond issuance

Rising interest rates and widening credit spreads are likely to affect the maturity structure, yields on coupon bonds and other conditions for corporate bond issuance. This article analyzes the maturity structure and how the yield on bond issuance changes for both unsecured public placement bonds and private placement bonds to understand the implications of recent rate hikes for corporate bond issuance.

The analysis indicates that the average maturity4) of unsecured public placement bonds varies by credit rating. AAA-rated corporate bonds show greater volatility depending on the corresponding period and tend to have a longer average maturity than those with lower ratings. The lengthened maturity of AAA-rated corporate bonds in the fourth quarter of 2021 is attributable to the high-volume issuance of long-term ESG bonds by a few regional Gencos. But the average maturity of those with an AAA rating has been reduced in 2022 because the increase in interest rates has curtailed financing based on long-term bonds by highly rated companies. The average maturity of bonds with a rating of A or AA shows relatively lower volatility, which has decreased by a small margin amid rising market interest rates. This can be explained by investors’ preference for relatively short-term bonds during the rate hike cycle.

The yield on unsecured public placement bond issuance is determined by the yields from trading measured at the time of issuance and the supply and demand conditions. Accordingly, the yield from issuance is likely to become higher during the period of rising market interest rates. The yield on unsecured corporate bond issuance has shown an upward trend since the second quarter of 2021, despite minor differences by credit rating. In terms of issuance yields, A-rated corporate bonds have increased more sharply than bonds with other ratings since the second half of 2021. This probably stems from the tendency of placing a higher premium on relatively low-rated corporate bonds during the rate hike cycle.

The average maturity of private placement bonds is shorter and more sensitive to interest rate fluctuations, compared to that of unsecured public placement bonds. With a recent increase in interest rates, the average maturity of ordinary private placement bonds has been reduced to 1.71 years in the first quarter of 2022 from 2.55 years in the third quarter of 2021. This phenomenon occurs presumably because during the period of rate hikes, investors have a higher sensitivity to credit risk, which drags down their demand for longer-term bonds.

Meanwhile, the average maturity of the entire private placement bonds differs from that of private placement bonds excluding underlying assets of P-CBOs. As for P-CBOs, the underlying assets have a standard maturity of two or three years while ordinary private placement bonds are issued with a wider range of maturities.

The average yield on private placement bond issuance varies by bond type and period. With P-CBO underlying assets, interest rates lower than the market rate are applied since P-CBOs supply funds through private placement bonds to provide policy support. Accordingly, private placement bonds excluding P-CBOs tend to have a lower yield on issuance for most of the period, compared to the entire private placement bonds. In an analysis by period, the entire private placement bonds exhibited an upward movement in the average issuance yield in the first quarter of 2021 and thereafter. But the yield on ordinary private placement bond issuance began to climb in the third quarter of 2021. This suggests that the relatively lower issuance yield on the entire private placement bonds is affected by the issuance yield on P-CBOs of which yields are determined by policy directions, while an increase in the market interest rate has an immediate effect on the issuance yield on private placement bonds excluding P-CBOs.

As central banks of major economies are poised to reduce abundant liquidity supplied to cope with the Covid-19 crisis and raise base rates, the market interest rate is likely to continue an upward movement. An increase in the market interest rate seems to affect the supply and demand and prices in the corporate bond market. Furthermore, changing market conditions may gradually transform the issuance structure of corporate bonds.

The impact of interest rate hikes differs by credit category. Lower-rated issuers are likely to see the yield on bond issuance rising and bond maturities getting shorter. In addition, the growing interest burden could have a direct impact on issuers’ financial performance. Accordingly, what is needed is to pay attention to any market change for private placement bonds which serve as a source of financing for companies with poor credit quality. Also necessary is to strengthen efforts for the analysis and management of credit ratings.

On the other hand, rising interest rates would have a limited impact on Korea’s market for unsecured public placement bonds as the bonds can be issued only by companies with strong credit quality. On top of that, rate hikes not exceeding a certain level are less likely to have a direct impact on the financial performance of unsecured public placement bond issuers.

Factors that affect directly credit ratings in the corporate bond market include rate hikes and a prolonged economic slowdown. Lingering inflationary pressure and slower economic growth also could have an impact on the fundamentals of highly rated companies. Poor financial performance would drive up the amount of borrowing, thereby leading to a decline in credit ratings. In this respect, efforts should be put into achieving healthy fundamentals and improving corporate financial stability to enhance the soundness of the corporate bond market.

1) Refers to generation companies.

2) AB Bonds and equity-linked bonds are excluded.

3) KEPCO rarely issued bonds from the second half of 2020, but resumed issuance with KRW 4.5 trillion in 3Q 2021, KRW 4.1 trillion in 4Q 2021 and KRW 6.3 trillion in 1Q 2022.

4) A weighted average maturity of issuance value