Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

A Shift in Global Monetary Policy: Risk Factors and Implications

Publication date Jun. 14, 2022

Summary

As the US is entering a rate hike cycle, there is a growing concern about its adverse effects on Korea’s financial market. Recently, monetary policies of advanced economies are being decoupled from each other. Starting this year, the US and the UK are tightening monetary policy at a faster pace while the Eurozone and Japan still maintain the expansionary monetary policy stance. This phenomenon can be commonly observed in the US rate hikes during the early 2000s. A recent study has analyzed that monetary policy divergence between advanced economies partially offsets repercussions of the US monetary tightening such as greater capital outflow from the emerging market. Korea also has seen the effects of changing external factors diminishing since the global financial crisis. This is partly attributable to Korea’s improved external soundness and monetary policy divergence between advanced economies. In this respect, growing external uncertainties such as aggressive monetary policy tightening by the US is likely to have only a limited impact, compared to the past. However, a prolonged geopolitical conflict and a delayed recovery in global supply chains are raising the possibility that higher inflation becomes entrenched. Accordingly, thorough preparation should be made to deal with unprecedented risk factors such as simultaneous monetary tightening implemented by central banks of all advanced economies.

Major economies including the US and the UK are entering into monetary policy tightening mode this year. More recently, there is a growing possibility that the Eurozone would implement earlier-than-expected monetary tightening. A shift in the US monetary policy as well as whether the monetary policy of the US is decoupled from that of other developed countries seem to contribute to intensifying volatility in the global financial market. The fact that the US rate hikes had minor effects on the global economy in the wake of the global financial crisis can be attributed partly to monetary policy decoupling among major economies. Against this backdrop, this article aims to analyze recent changes in advanced countries’ monetary policies and previous cases of monetary policy decoupling, and to present risk factors behind a recent shift in global monetary policy and relevant implications.

A shift in major economies’ monetary policies

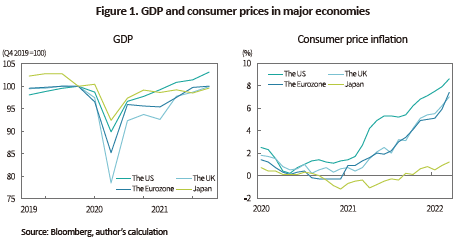

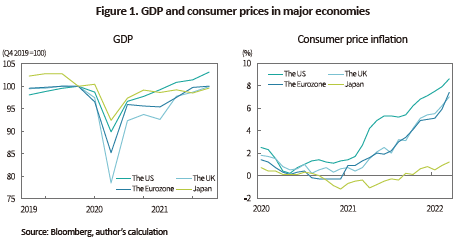

Restrictions on economic activities induced by the Covid-19 pandemic led to an economic slowdown in key countries. Recently, however, those countries continue to show signs of recovery, driven by large-scale economic stimulus packages. As illustrated in Figure 1, major economies (G4 including the US, the UK, the Eurozone and Japan) have already returned to the pre-pandemic levels and seen a sizeable increase in consumer price inflation. This stems primarily from the expansionary monetary and fiscal policy to deal with the pandemic, disruptions in global supply chains and soaring energy prices arising from the Ukraine-Russia crisis. As of March 2022, the US, the UK and the Eurozone stand at 8.6%, 7% and 7.4% in consumer price inflation, respectively, reaching their recent highs.1) In the Eurozone, however, the increase in energy prices has yet to have a significant impact on consumer prices as evidenced by its core inflation (excluding energy and other sectors) of around 2.9%. This suggests that inflationary pressure in the Eurozone remains limited, compared to other regions.

Amid diverse economic conditions, key countries have taken different approaches to monetary policy since early 2022. First, the US and the UK have seen consumer price inflation emerging as a major risk, thereby accelerating monetary tightening via rate hikes and quantitative easing. The Fed has already implemented two rate hikes (75bp) this year. Furthermore, it suspended its asset purchase program in March and plans to commence quantitative tightening designed for balance sheet rundown in June, suggesting that its monetary policy normalization would pick up speed going forward.2) The UK government has raised the base rate four times (85bp) until May 2022 since the first rate hike in December 2021. It has also initiated a quantitative tightening scheme earlier this year, in which it will no longer reinvest the proceeds of its government bonds and sell corporate bonds it owned.3)

European countries and Japan still maintain the expansionary monetary policy stance. Despite being burdened with recent price rises, the EU is expected to stick to monetary easing and a step-by-step reduction in its asset purchase program by taking into account its relatively lower growth rate and core inflation.4) This strategy may have partly reflected the possibility that the Eurozone economy, being highly connected to Russia, could suffer stagflation arising from the restricted energy supply. In Japan, consumer prices are rising temporarily but core inflationary pressures (excluding energy) are limited and a weak yen boosts the profits of Japan’s export companies. Amid these positive conditions, Japan is hardly expected to turn to tighter monetary policy within a short period.

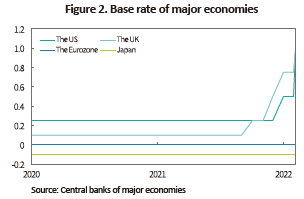

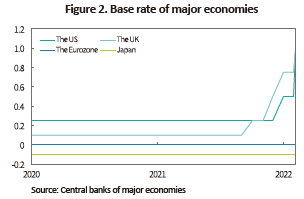

Figure 2 shows that changes in monetary policies of advanced economies have widened the global base rate divergence since early 2022. As stated above, concerns about potential stagflation triggered by energy supply disturbances as well as the risk of higher inflation have prompted each country to adopt a monetary policy suitable for their own economic conditions. Accordingly, global monetary policies are expected to evolve in different directions, depending on the possibility of prolonged geopolitical risk and the recovery pace of global supply chains.

Analysis of the impact of global monetary policy decoupling by period

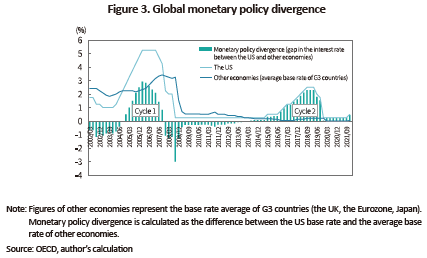

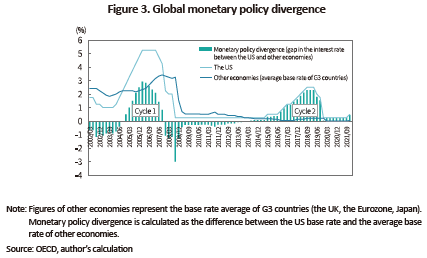

As shown in Figure 3, the tendency of monetary policy decoupling among advanced economies during the US-led rate hike cycles can be observed in the past.5) The Fed lifted the interest rate as many as 17 times (425 basis points) in the first cycle starting from December 2005 where countries other than the US revised their monetary policy measures at a slower pace, contributing to greater divergence in global monetary policy.6) During the period, emerging economies displayed a prominent growth trend and the negative effects of the US rate hikes such as rapid flows of funds invested in the stock market were limited amid rising global stock prices.

In the cycle spanning from 2016 to 2018, the US that emerged from the global financial crisis at a relatively faster pace initiated monetary policy normalization via rate hikes and quantitative tightening. During the period, the US monetary policy was decoupled from that of other major economies. The Fed tightened its monetary policy by implementing nine rate hikes (225bp), while other economies maintained a quantitative easing scheme owing to slower economic recovery. This resulted in a wide gap in the base rate between advanced economies. Notably, however, the US monetary tightening is found to have had only limited effects during that period. Although some emerging countries suffer from an economic slowdown, the global economy, especially the US and other advanced countries, continued a solid growth trend. Also, long-term interest rates became stabilized and global stock prices went up, indicating that a shift in the US monetary policy hardly had a far-reaching impact on the global economy.

It is worth noting that in the recent two cycles where global monetary policies became divergent, the effects of monetary tightening by the US were limited. This implies that monetary policy divergence among advanced economies has partially offset a repercussion of the US’s tightening policy. A recent study has analyzed that the ripple effects of monetary policy changes in the US on capital flows in the emerging market are canceled to a certain extent, depending on how major economies’ monetary policies are decoupled from that of the US.7) Korea has also seen the effects of the US rate hikes diminishing since the global financial crisis.8) The study result suggests that if monetary policy decoupling continues further among major economies, it could contribute to reducing adverse effects that external factors such as accelerated monetary tightening by major economies may have on Korea’s financial market.

Implications

As the US is entering a rate hike cycle, there is a growing interest in how it would affect Korea’s economy. In light of past experience, some present an optimistic outlook that interest rate rises by the US would only have minor effects. However, recent developments should be distinguished from previous rate hikes by the US in terms of the following aspects, which requires caution.

Above all, inflationary pressure is highly likely to linger for a long time, which is quite different from the past. It is widely expected that the risk of higher inflation would hardly disappear in a short time, considering a drawn-out conflict in Ukraine and a structural shift in the global economy represented by the reorganization of global supply chains. Price rises have recently been observed in all major economies, which could be a risk factor unprecedented during the US’ previous hike cycles. Given these developments, it is hard to rule out the possibility that monetary policies of advanced countries would be synchronized in the direction toward monetary tightening.

Aside from elevated inflation, it is also notable that the risk of stagflation accompanied by a recession is recently on a steady rise. A prolonged geopolitical conflict is raising the possibility that the worst-case scenario such as Russia’s default could be realized. If that happens, it is likely to trigger a recession in all major economies including the Eurozone countries. Advanced economies have already shown signs of a slowdown in growth, as evidenced by the US’s negative growth for the first quarter of 2022. Furthermore, the IMF has recently revised its global growth forecast downward, suggesting that the global economy could fall into an economic downturn. If advanced economies slip into a recession all at once, it would intensify volatility in the financial markets of both Korea and emerging economies, regardless of monetary policy decoupling. Thus, Korea should make every preparation to weather the storm.

Since the global financial crisis, Korea has strengthened the FX soundness management system and continued to record a current account surplus, thereby significantly strengthening its economic fundamentals needed to deal with external uncertainty. Unlike previous cases, however, entrenched inflationary pressure is likely to force central banks of major economies to turn to tighter monetary policy all at once. In addition, the worst-case scenario such as a global recession may become a reality, which requires thorough preparation. What is noteworthy is that whether monetary policies of advanced economies are decoupled, as well as a shift in the US monetary policy stance, has had a certain impact on capital flows of Korea. Accordingly, any change in monetary policies of both the US and other major economies should be closely monitored.

1) In Japan, consumer prices rise by 0.9% as of March 2022 (core inflation of 1.2%) but a sharp increase in energy prices has recently curbed consumer price inflation.

2) The Fed’s quantitative tightening (QT) is carried out by adjusting the amount reinvested of the proceeds from the Fed’s securities holdings. The FOMC decided in May that the Fed would cut $47.5 billion from its holdings per month ($30 billion of Treasury bonds and $35 billion of MBS and agency debts combined) from June to August 2022 and the reduction amount would increase to $95 billion per month ($60 billion of Treasury bonds and $35 billion of MBS and agency debts combined) starting from September.

3) Given that the Bank of England plans to sell its holdings of government bonds once the bank rate hits 1%, the amount of quantitative tightening is expected to increase further in the second half of this year.

4) The European Central Bank (ECB) has maintained a quantitative easing scheme through the Asset Purchase Program (APP) and the Pandemic Emergency Purchase Program (PEPP). In the April monetary policy meeting, the EBC announced that it would implement a step-by-step reduction of asset purchases in the second quarter of 2022 and decide to end the asset purchase programs by taking into consideration further economic developments.

5) In general, central banks take a more gradual and prudent approach to interest rate adjustment during a business upturn than they do in a business downturn, which could lead to monetary policy divergence among advanced economies.

6) At that time, the Eurozone implemented a modest rate hike (150bp) while the UK and Japan maintained an expansionary monetary policy stance.

7) Advdjiev et al.(2017) find that monetary policy divergence among advanced economies can offset partially the pressure of capital flows in the emerging market, driven by the US rate hikes.

8) Kim, H.S.(to be published in 2022) presumes global monetary policy divergence to have a significant impact on capital flows in Korea.

References

Adjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017, The shifting drivers of global liquidity, BIS Working Papers(644).

[Korean]

Kim, N.J., Kim, H.T. & Park. H.S., December 2021, Monetary Policy Normalization of the US: Impacts and Implications, KIF Policy Analysis 2021-02.

Kim. H.S., 2022, A Shift in Global Monetary Policy: Effects on Korea’s Capital Flows and Implications, KCMI Issue Paper (to be published).

Seo, H.D. & Kang, T.S., 2019, Impacts of the US Monetary Policy on Korea’s Financial Market and Capital Flows: TNP-VAR Model Analysis, BOK Economic Analysis 25-2.

A shift in major economies’ monetary policies

Restrictions on economic activities induced by the Covid-19 pandemic led to an economic slowdown in key countries. Recently, however, those countries continue to show signs of recovery, driven by large-scale economic stimulus packages. As illustrated in Figure 1, major economies (G4 including the US, the UK, the Eurozone and Japan) have already returned to the pre-pandemic levels and seen a sizeable increase in consumer price inflation. This stems primarily from the expansionary monetary and fiscal policy to deal with the pandemic, disruptions in global supply chains and soaring energy prices arising from the Ukraine-Russia crisis. As of March 2022, the US, the UK and the Eurozone stand at 8.6%, 7% and 7.4% in consumer price inflation, respectively, reaching their recent highs.1) In the Eurozone, however, the increase in energy prices has yet to have a significant impact on consumer prices as evidenced by its core inflation (excluding energy and other sectors) of around 2.9%. This suggests that inflationary pressure in the Eurozone remains limited, compared to other regions.

European countries and Japan still maintain the expansionary monetary policy stance. Despite being burdened with recent price rises, the EU is expected to stick to monetary easing and a step-by-step reduction in its asset purchase program by taking into account its relatively lower growth rate and core inflation.4) This strategy may have partly reflected the possibility that the Eurozone economy, being highly connected to Russia, could suffer stagflation arising from the restricted energy supply. In Japan, consumer prices are rising temporarily but core inflationary pressures (excluding energy) are limited and a weak yen boosts the profits of Japan’s export companies. Amid these positive conditions, Japan is hardly expected to turn to tighter monetary policy within a short period.

Figure 2 shows that changes in monetary policies of advanced economies have widened the global base rate divergence since early 2022. As stated above, concerns about potential stagflation triggered by energy supply disturbances as well as the risk of higher inflation have prompted each country to adopt a monetary policy suitable for their own economic conditions. Accordingly, global monetary policies are expected to evolve in different directions, depending on the possibility of prolonged geopolitical risk and the recovery pace of global supply chains.

As shown in Figure 3, the tendency of monetary policy decoupling among advanced economies during the US-led rate hike cycles can be observed in the past.5) The Fed lifted the interest rate as many as 17 times (425 basis points) in the first cycle starting from December 2005 where countries other than the US revised their monetary policy measures at a slower pace, contributing to greater divergence in global monetary policy.6) During the period, emerging economies displayed a prominent growth trend and the negative effects of the US rate hikes such as rapid flows of funds invested in the stock market were limited amid rising global stock prices.

In the cycle spanning from 2016 to 2018, the US that emerged from the global financial crisis at a relatively faster pace initiated monetary policy normalization via rate hikes and quantitative tightening. During the period, the US monetary policy was decoupled from that of other major economies. The Fed tightened its monetary policy by implementing nine rate hikes (225bp), while other economies maintained a quantitative easing scheme owing to slower economic recovery. This resulted in a wide gap in the base rate between advanced economies. Notably, however, the US monetary tightening is found to have had only limited effects during that period. Although some emerging countries suffer from an economic slowdown, the global economy, especially the US and other advanced countries, continued a solid growth trend. Also, long-term interest rates became stabilized and global stock prices went up, indicating that a shift in the US monetary policy hardly had a far-reaching impact on the global economy.

Implications

As the US is entering a rate hike cycle, there is a growing interest in how it would affect Korea’s economy. In light of past experience, some present an optimistic outlook that interest rate rises by the US would only have minor effects. However, recent developments should be distinguished from previous rate hikes by the US in terms of the following aspects, which requires caution.

Above all, inflationary pressure is highly likely to linger for a long time, which is quite different from the past. It is widely expected that the risk of higher inflation would hardly disappear in a short time, considering a drawn-out conflict in Ukraine and a structural shift in the global economy represented by the reorganization of global supply chains. Price rises have recently been observed in all major economies, which could be a risk factor unprecedented during the US’ previous hike cycles. Given these developments, it is hard to rule out the possibility that monetary policies of advanced countries would be synchronized in the direction toward monetary tightening.

Aside from elevated inflation, it is also notable that the risk of stagflation accompanied by a recession is recently on a steady rise. A prolonged geopolitical conflict is raising the possibility that the worst-case scenario such as Russia’s default could be realized. If that happens, it is likely to trigger a recession in all major economies including the Eurozone countries. Advanced economies have already shown signs of a slowdown in growth, as evidenced by the US’s negative growth for the first quarter of 2022. Furthermore, the IMF has recently revised its global growth forecast downward, suggesting that the global economy could fall into an economic downturn. If advanced economies slip into a recession all at once, it would intensify volatility in the financial markets of both Korea and emerging economies, regardless of monetary policy decoupling. Thus, Korea should make every preparation to weather the storm.

Since the global financial crisis, Korea has strengthened the FX soundness management system and continued to record a current account surplus, thereby significantly strengthening its economic fundamentals needed to deal with external uncertainty. Unlike previous cases, however, entrenched inflationary pressure is likely to force central banks of major economies to turn to tighter monetary policy all at once. In addition, the worst-case scenario such as a global recession may become a reality, which requires thorough preparation. What is noteworthy is that whether monetary policies of advanced economies are decoupled, as well as a shift in the US monetary policy stance, has had a certain impact on capital flows of Korea. Accordingly, any change in monetary policies of both the US and other major economies should be closely monitored.

1) In Japan, consumer prices rise by 0.9% as of March 2022 (core inflation of 1.2%) but a sharp increase in energy prices has recently curbed consumer price inflation.

2) The Fed’s quantitative tightening (QT) is carried out by adjusting the amount reinvested of the proceeds from the Fed’s securities holdings. The FOMC decided in May that the Fed would cut $47.5 billion from its holdings per month ($30 billion of Treasury bonds and $35 billion of MBS and agency debts combined) from June to August 2022 and the reduction amount would increase to $95 billion per month ($60 billion of Treasury bonds and $35 billion of MBS and agency debts combined) starting from September.

3) Given that the Bank of England plans to sell its holdings of government bonds once the bank rate hits 1%, the amount of quantitative tightening is expected to increase further in the second half of this year.

4) The European Central Bank (ECB) has maintained a quantitative easing scheme through the Asset Purchase Program (APP) and the Pandemic Emergency Purchase Program (PEPP). In the April monetary policy meeting, the EBC announced that it would implement a step-by-step reduction of asset purchases in the second quarter of 2022 and decide to end the asset purchase programs by taking into consideration further economic developments.

5) In general, central banks take a more gradual and prudent approach to interest rate adjustment during a business upturn than they do in a business downturn, which could lead to monetary policy divergence among advanced economies.

6) At that time, the Eurozone implemented a modest rate hike (150bp) while the UK and Japan maintained an expansionary monetary policy stance.

7) Advdjiev et al.(2017) find that monetary policy divergence among advanced economies can offset partially the pressure of capital flows in the emerging market, driven by the US rate hikes.

8) Kim, H.S.(to be published in 2022) presumes global monetary policy divergence to have a significant impact on capital flows in Korea.

References

Adjiev, S., Gambacorta, L., Goldberg, L., Schiaffi, S., 2017, The shifting drivers of global liquidity, BIS Working Papers(644).

[Korean]

Kim, N.J., Kim, H.T. & Park. H.S., December 2021, Monetary Policy Normalization of the US: Impacts and Implications, KIF Policy Analysis 2021-02.

Kim. H.S., 2022, A Shift in Global Monetary Policy: Effects on Korea’s Capital Flows and Implications, KCMI Issue Paper (to be published).

Seo, H.D. & Kang, T.S., 2019, Impacts of the US Monetary Policy on Korea’s Financial Market and Capital Flows: TNP-VAR Model Analysis, BOK Economic Analysis 25-2.