Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Prolonged Trading Halts and Need for a Different Approach to Investor Protection

Publication date Aug. 24, 2022

Summary

Recently, prolonged trading halts are becoming more frequent in Korea’s stock market. As stricter audit standards have been introduced with the amendment to the Act on External Audit of Stock Companies, a growing number of trading halts have been issued. In addition, in most cases, trading would be resumed only after a contributing cause for a trading halt is resolved. From the perspective of investor protection, this could be understood as a desirable approach to protect investors from damage arising out of misrepresentation in financial statements. However, this also sparks concerns about extremely longer halts, property infringement and greater volatility, which requires investors’ extra caution. Protracted trading halts are not found in the US market because a trading halt would be, in principle, immediately lifted after any contributing cause is fully disclosed. Accordingly, in order to protect shareholders’ property right and guarantee continuity of trading by freely trading shares, the procedures for trading resumption should be improved in the Korean stock market. Amid information asymmetries, a trading halt should be used as an incentive to encourage full disclosure of new information over the long run. To this end, the Korean market should shift to a trading pause on the condition of disclosure of any material event, rather than seeking a prolonged trading halt that requires resolution of a contributing cause.

Prolonged trading halts and market distortion

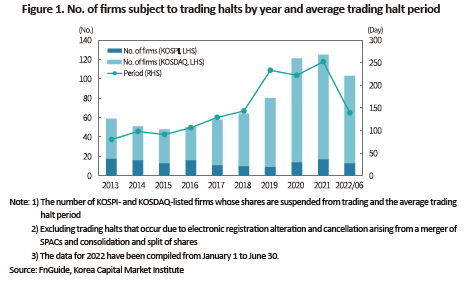

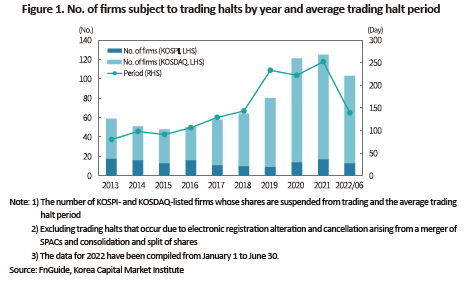

A total of 103 firms suffered a trading halt at least once in the first half of 2022 in the KOSPI and KOSDAQ markets (Figure 1).1) Among them, 29 were newly affected by trading halts starting this year, indicating that most trading halts continued to remain effective from previous fiscal years because a trigger of such halts was not resolved. The average trading halt period is 139 days out of the total 181 trading days between January 1 and June 30, 2022. As for the firms newly subject to a trading halt this year, trading in their stock was prohibited for 87 days on average, meaning that trading halt days outnumbered trading days during that period. Although such figures are compiled for the first six months of this year, the ratio of trading halt days to normal trading days (=139/181) reaches as high as 77% for firms in a trading halt, surpassing a 10-year high of 69% reported in 2021 (=252/365).

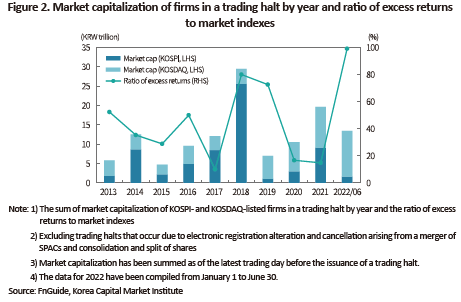

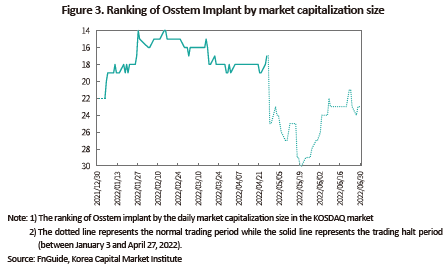

As trading halts lengthen, market distortion has been increasingly aggravated. Amid global inflationary pressures and the resultant base rate hikes by central banks, concerns about a surge in prices, interest rates and exchange rates have weighed on the market for the last several months. As the information on negative macroeconomic conditions was reflected in the stock market, most firms experienced a slump in share prices while the average stock return for those in a trading halt remained flat at -0.46% in the first half of 2022.2) This is an abnormal phenomenon that could arise from a long-term trading suspension, but Korea has repetitively witnessed it whenever a bearish market emerges amid prolonged trading halts. In the first half of this year, 99% of those whose shares were temporarily suspended from trading outperformed the market return, with their market capitalization amounting to KRW 13.4 trillion (Figure 2). In the case of Osstem Implant, trading in its stock was halted between January 3 and April 27, 2022 due to a large-scale misappropriation scandal. Despite the halt, its market capitalization jumped to 14th from 22th at some point while the KOSDAQ index declined 13.3% during the period (Figure 3).3)

Korea’s extended trading halts stand in stark contrast to the US trading halt system where trading was reactivated in an average of 33 minutes after a halt was issued during the same period.4) When the Securities and Exchange Commission (SEC) suspends trading in any stock due to a material issue, the suspension period cannot exceed ten business days, which makes the market less susceptible to distortion.5) However, criticism has been continuously raised over trading halts even in the US.6) Opponents argue that a trading halt requires a highly sophisticated approach because it restricts normal trading activities by temporarily driving liquidity to zero and thus, the frequency and discretionary use of trading halts should be minimized.7)

The cause for prolonged trading halts

Trading halts have lengthened especially in Korea, which is mainly attributable to the amendment to the Act on External Audit of Stock Companies that has taken effect since 2018. As stricter audit standards have been introduced since 2018, a growing number of firms have been selected for a listing eligibility review due to underlying causes for modified opinion. Among the 29 trading halts that were newly issued in the first half of 2022, only five were decided on the ground other than a qualified opinion. In most cases, multiple factors came into play including a change in audit opinion, effectiveness of the internal accounting control system and viability as a going concern, which require an in-depth review of qualification as a listed firm.

Major stock exchanges in the US and UK treat a qualified opinion equally as a failure to submit a regular report and deem it as a cause for delisting. In practice, Korea commences delisting procedures for a firm that has received a qualified opinion for two consecutive years, allowing for the improvement period. This means Korea’s stock exchange has adopted less tough requirements for delisting resulting from a qualified opinion, compared to other stock exchanges. In terms of investor protection, however, it is not desirable to permit trading without restriction if it is difficult to ensure the reliability of a firm’s basic information such as financial position and business operation. Accordingly, it is necessary to monitor how a relevant problem is remedied after imposing a trading halt. In other words, it is somewhat inevitable to issue a long-term trading halt in the case of a qualified opinion.

Notwithstanding, exceptionally longer trading halts are unacceptable considering that a total of 12 firms were subject to trading halts for more than 1,000 days as of end-June 2022. This has raised concerns about the infringement of property rights and greater volatility. The trading halt system aims to protect uninformed investors amid information asymmetries. But trading has often been restricted for a substantial period of time in Korea, which may lead to property infringement for existing investors who cannot freely sell or purchase shares. Furthermore, amid a plunge in stock market indexes, shares suspended from trading are likely to outperform market indexes, thereby widening a gap between share prices and enterprise value. If trading resumes later, this would intensify stock price volatility and thus, other issues regarding investor protection may erupt, which necessitates measures to enhance the existing trading resumption procedures.

Divergence in requirements for resumption of trading

A marked discrepancy in the trading halt period between Korea and the US is fundamentally attributable to different requirements for resumption of trading. Korea does not allow resumption of trading until a contributing cause is completely resolved, whereas the US resumes trading in shares more swiftly as long as a contributing cause is disclosed. Prolonged trading halts cannot be observed in the US because a trading halt would be, in principle, lifted immediately after any contributing cause is fully disclosed, regardless of whether the cause is resolved. Even in terms of material adverse events regarding a firm’s viability as a going concern such as bankruptcy and rehabilitation procedures, trading continuity is guaranteed on the premise that any relevant matter is disclosed in a clear and transparent manner. Any trading halt resulting from a cause other than a qualified opinion would be lifted promptly in the US, which stands in direct contrast to Korea’s lengthened trading stoppage.

Although it takes relatively considerable time to reopen trading, Korea defines the resolution of a contributing cause as a requirement for resumption of trading because there is a greater need for investor protection to prevent investors from suffering damage from market disturbances and maintain an orderly marketplace. Considering that it is hard for Korea to strictly enforce requirements for delisting without a well-functioning OTC market, a more specific regulation needs to be implemented for financially-distressed firms with an opaque accounting system. This explains why Korea has devised safeguards to actively protect inexperienced investors by designating shares for oversight, firms with inadequate disclosure and shares requiring investors’ caution and has often issued a trading halt to deal with firms’ unfavorable events in tandem with such measures.

It is noteworthy that the primary goal of trading halts is to level the uneven playing field to ensure fair competition for information, rather than protecting inexperienced investors. To this end, the stock exchange should temporarily suspend trading in shares if any matter that could have a material impact on investment decisions is not fully disclosed and commence resumption procedures after a firm fully provides relevant information to the public. Also necessary is to establish an incentive system to ensure that new information is swiftly offered to the stock market.8) In addition, a trading halt should play a role in protecting uninformed investors from stock price volatility irrelevant to enterprise value by allowing time for investors to digest price-sensitive information before making investment decisions. It could also enhance price discovery by boosting information value of stock prices.9)

Need for a different approach to investor protection

Given many financially unsound firms listed on the stock exchange, it is of undeniable importance to protect inexperienced investors and maintain an orderly marketplace in Korea. If a trading halt is issued with a focus on prevention of potential damage to investors, however, it would be unavoidable to extend the trading halt period. If this happens, it would be impossible to achieve the trading halt system’s primary objective such as promoting fair competition for information and enhancing price discovery and implicit costs would be generated from market distortion. In this respect, what is needed for the long term is a different approach to investor protection to improve information provision and grant more discretion to the market.

In particular, it is worth considering the lack of communication between a firm subject to a trading halt and its shareholders. As the resolution of a contributing cause is a prerequisite for resumption of trading, a firm’s management could be more incentivized to hoard material adverse information or report such information as late as possible, rather than timely providing it to the market.10) In practice, most of the firms that are subject to a trading halt due to the occurrence of an event requiring a listing eligibility review tend to disclose improvement plans immediately before reopening of trading. In most cases, the trading halt period is extended for various reasons during the process ranging from determining whether a firm is subject to a listing eligibility review to deliberation of the corporate inspection committee. Accordingly, it generally takes several months to determine whether a firm should remain listed on the stock exchange and whether trading in its stock should be resumed. Despite a prolonged period of trading halts, information regarding details of a contributing cause, measures required for resumption of trading and a firm’s response to a halt is rarely disclosed in a timely manner, which requires additional measures to reform the trading halt scheme.

Conclusion and suggestions

In the KOSPI and KOSDAQ markets, the trading halt period has recently lengthened and the number and size of firms subject to a trading halt have been on the rise. As uncertainty for trading continuity puts a constraint on a listed company, extended trading halts could undermine the credibility of the overall stock market. Therefore, it is necessary to improve the current trading halt system.

Most of longer trading halts were due to receiving a modified audit opinion, which makes issuing a halt inevitable to a certain degree. However, the advantages and disadvantages of long-term restrictions on trading should be closely examined, regardless of financial literacy of investors. Additionally, the property right of existing shareholders should be protected by guaranteeing free disposal of shares. This requires fine adjustments for trading halts.

First, in the case where an auditor has given a series of modified opinions regarding a firm’s internal control system for the previous fiscal years and the firm is designated for a listing eligibility review, it is worth considering not imposing a trading halt on the condition of full disclosure of a contributing cause. In the case of a KOSDAQ listed firm, it is subject to a listing eligibility review when it receives a modified opinion from the review of the internal control system for two consecutive years, which results in a trading halt regardless of whether an auditor’s opinion for the corresponding year is unqualified. Furthermore, a firm could receive an unqualified opinion for the corresponding year by enhancing its’ accounting system from previous years during the accounting error correction process. As for the firm, damage arising from a trading halt is expected to outweigh benefits of investor protection despite its’ effort for improvement. Second, if an auditor’s opinion is changed only on the ground of uncertainty about a going concern, it would be desirable to let the market evaluate the firm’s sustainability under the condition of full disclosure of the changed audit opinion.

Notably, a trading halt tends to occur from multiple contributing factors and trading could not be resumed until all the factors are addressed. In this respect, the fine adjustments mentioned above may not be enough to dramatically enhance prolonged trading halts.11) Accordingly, disclosure of material information, not resolution of a contributing cause, should be a prerequisite for resumption of trading to ensure that a trading halt can be used as an incentive for firms to fully disclose new information. To this end, what is needed is improved awareness about corporate disclosure and mature investment culture. Also necessary is to facilitate the OTC market to help ineligible listed firms quickly exit the market.

1) The data excludes trading halts that arise from electronic registration alteration and cancellation as a result of a merge of SPACs and consolidation and split of shares.

2) The rate of return has been annualized as an equally weighted return to compare different trading halt periods.

3) Yonhap News, January 29, 2022, After avoiding a market plunge, Osstem Implant in a trading halt experiences a surge in market capitalization ranking.

Maeil Business News, January 29, 2022, Why did Osstem Implant show a sharp rise in market capitalization ranking, despite the largest misappropriation scandal?

4) MarketWatch of NYSE and Nasdaq temporarily suspended 295 trades of ordinary shares from January 1 to June 30, 2022 on the ground of news pending, and trading halts arising from LULD pause and a merger deal have been excluded (http://www.nyse.com/trade-halt-historical).

5) If information regarding financial standing and business operation is not sufficiently provided due to failure to submit a regular report or it is urgently needed to protect investors from abnormal trading activities such as market manipulation, the SEC can suspend trading in any stock.

6) Wall Street Journal, 2018. 8. 12. ‘After Tesla Buyout Tweet, Some Investors Wonder: Where Was Nasdaq?’

7) Marshall, N.T., Rogers, J.L., Zechman, S.L.C., 2022, Why Can‘t I Trade? Exchange Discretion in Calling Halts Around Important Information Events, SSRN Electronic Journal.

8) Christie, W.G., Corwin, S.A., Harris, J.H., 2002, Nasdaq Trading Halts: The Impact of Market Mechanisms on Prices, Trading Activity, and Execution Costs, The Journal of Finance 57(3), 1443-1478.

9) Schwartz, A.L., 1982, The adjustment of individual stock prices during periods of unusual disequilibria, Financial Review 17(4), 228-239.

10) DeHaan, E., Shevlin, T., Thornock, J., 2015, Market (in) attention and the strategic scheduling and timing of earnings announcements, Journal of Accounting and Economics 60(1), 36-55.

11) There are two cases where a disclaimer was received on the ground of uncertainties about a going concern in the first half of 2022. In one case, a firm was subject to delisting due to a failure to meet financial requirements. In another case, a firm defaulted on payment of principal and interest after the receipt of a disclaimer and was also designated as an unfaithfully disclosing business entity due to frequent changes in financing-related disclosure, which made the firm subject to an additional trading halt.

A total of 103 firms suffered a trading halt at least once in the first half of 2022 in the KOSPI and KOSDAQ markets (Figure 1).1) Among them, 29 were newly affected by trading halts starting this year, indicating that most trading halts continued to remain effective from previous fiscal years because a trigger of such halts was not resolved. The average trading halt period is 139 days out of the total 181 trading days between January 1 and June 30, 2022. As for the firms newly subject to a trading halt this year, trading in their stock was prohibited for 87 days on average, meaning that trading halt days outnumbered trading days during that period. Although such figures are compiled for the first six months of this year, the ratio of trading halt days to normal trading days (=139/181) reaches as high as 77% for firms in a trading halt, surpassing a 10-year high of 69% reported in 2021 (=252/365).

The cause for prolonged trading halts

Trading halts have lengthened especially in Korea, which is mainly attributable to the amendment to the Act on External Audit of Stock Companies that has taken effect since 2018. As stricter audit standards have been introduced since 2018, a growing number of firms have been selected for a listing eligibility review due to underlying causes for modified opinion. Among the 29 trading halts that were newly issued in the first half of 2022, only five were decided on the ground other than a qualified opinion. In most cases, multiple factors came into play including a change in audit opinion, effectiveness of the internal accounting control system and viability as a going concern, which require an in-depth review of qualification as a listed firm.

Major stock exchanges in the US and UK treat a qualified opinion equally as a failure to submit a regular report and deem it as a cause for delisting. In practice, Korea commences delisting procedures for a firm that has received a qualified opinion for two consecutive years, allowing for the improvement period. This means Korea’s stock exchange has adopted less tough requirements for delisting resulting from a qualified opinion, compared to other stock exchanges. In terms of investor protection, however, it is not desirable to permit trading without restriction if it is difficult to ensure the reliability of a firm’s basic information such as financial position and business operation. Accordingly, it is necessary to monitor how a relevant problem is remedied after imposing a trading halt. In other words, it is somewhat inevitable to issue a long-term trading halt in the case of a qualified opinion.

Notwithstanding, exceptionally longer trading halts are unacceptable considering that a total of 12 firms were subject to trading halts for more than 1,000 days as of end-June 2022. This has raised concerns about the infringement of property rights and greater volatility. The trading halt system aims to protect uninformed investors amid information asymmetries. But trading has often been restricted for a substantial period of time in Korea, which may lead to property infringement for existing investors who cannot freely sell or purchase shares. Furthermore, amid a plunge in stock market indexes, shares suspended from trading are likely to outperform market indexes, thereby widening a gap between share prices and enterprise value. If trading resumes later, this would intensify stock price volatility and thus, other issues regarding investor protection may erupt, which necessitates measures to enhance the existing trading resumption procedures.

Divergence in requirements for resumption of trading

A marked discrepancy in the trading halt period between Korea and the US is fundamentally attributable to different requirements for resumption of trading. Korea does not allow resumption of trading until a contributing cause is completely resolved, whereas the US resumes trading in shares more swiftly as long as a contributing cause is disclosed. Prolonged trading halts cannot be observed in the US because a trading halt would be, in principle, lifted immediately after any contributing cause is fully disclosed, regardless of whether the cause is resolved. Even in terms of material adverse events regarding a firm’s viability as a going concern such as bankruptcy and rehabilitation procedures, trading continuity is guaranteed on the premise that any relevant matter is disclosed in a clear and transparent manner. Any trading halt resulting from a cause other than a qualified opinion would be lifted promptly in the US, which stands in direct contrast to Korea’s lengthened trading stoppage.

Although it takes relatively considerable time to reopen trading, Korea defines the resolution of a contributing cause as a requirement for resumption of trading because there is a greater need for investor protection to prevent investors from suffering damage from market disturbances and maintain an orderly marketplace. Considering that it is hard for Korea to strictly enforce requirements for delisting without a well-functioning OTC market, a more specific regulation needs to be implemented for financially-distressed firms with an opaque accounting system. This explains why Korea has devised safeguards to actively protect inexperienced investors by designating shares for oversight, firms with inadequate disclosure and shares requiring investors’ caution and has often issued a trading halt to deal with firms’ unfavorable events in tandem with such measures.

It is noteworthy that the primary goal of trading halts is to level the uneven playing field to ensure fair competition for information, rather than protecting inexperienced investors. To this end, the stock exchange should temporarily suspend trading in shares if any matter that could have a material impact on investment decisions is not fully disclosed and commence resumption procedures after a firm fully provides relevant information to the public. Also necessary is to establish an incentive system to ensure that new information is swiftly offered to the stock market.8) In addition, a trading halt should play a role in protecting uninformed investors from stock price volatility irrelevant to enterprise value by allowing time for investors to digest price-sensitive information before making investment decisions. It could also enhance price discovery by boosting information value of stock prices.9)

Need for a different approach to investor protection

Given many financially unsound firms listed on the stock exchange, it is of undeniable importance to protect inexperienced investors and maintain an orderly marketplace in Korea. If a trading halt is issued with a focus on prevention of potential damage to investors, however, it would be unavoidable to extend the trading halt period. If this happens, it would be impossible to achieve the trading halt system’s primary objective such as promoting fair competition for information and enhancing price discovery and implicit costs would be generated from market distortion. In this respect, what is needed for the long term is a different approach to investor protection to improve information provision and grant more discretion to the market.

In particular, it is worth considering the lack of communication between a firm subject to a trading halt and its shareholders. As the resolution of a contributing cause is a prerequisite for resumption of trading, a firm’s management could be more incentivized to hoard material adverse information or report such information as late as possible, rather than timely providing it to the market.10) In practice, most of the firms that are subject to a trading halt due to the occurrence of an event requiring a listing eligibility review tend to disclose improvement plans immediately before reopening of trading. In most cases, the trading halt period is extended for various reasons during the process ranging from determining whether a firm is subject to a listing eligibility review to deliberation of the corporate inspection committee. Accordingly, it generally takes several months to determine whether a firm should remain listed on the stock exchange and whether trading in its stock should be resumed. Despite a prolonged period of trading halts, information regarding details of a contributing cause, measures required for resumption of trading and a firm’s response to a halt is rarely disclosed in a timely manner, which requires additional measures to reform the trading halt scheme.

Conclusion and suggestions

In the KOSPI and KOSDAQ markets, the trading halt period has recently lengthened and the number and size of firms subject to a trading halt have been on the rise. As uncertainty for trading continuity puts a constraint on a listed company, extended trading halts could undermine the credibility of the overall stock market. Therefore, it is necessary to improve the current trading halt system.

Most of longer trading halts were due to receiving a modified audit opinion, which makes issuing a halt inevitable to a certain degree. However, the advantages and disadvantages of long-term restrictions on trading should be closely examined, regardless of financial literacy of investors. Additionally, the property right of existing shareholders should be protected by guaranteeing free disposal of shares. This requires fine adjustments for trading halts.

First, in the case where an auditor has given a series of modified opinions regarding a firm’s internal control system for the previous fiscal years and the firm is designated for a listing eligibility review, it is worth considering not imposing a trading halt on the condition of full disclosure of a contributing cause. In the case of a KOSDAQ listed firm, it is subject to a listing eligibility review when it receives a modified opinion from the review of the internal control system for two consecutive years, which results in a trading halt regardless of whether an auditor’s opinion for the corresponding year is unqualified. Furthermore, a firm could receive an unqualified opinion for the corresponding year by enhancing its’ accounting system from previous years during the accounting error correction process. As for the firm, damage arising from a trading halt is expected to outweigh benefits of investor protection despite its’ effort for improvement. Second, if an auditor’s opinion is changed only on the ground of uncertainty about a going concern, it would be desirable to let the market evaluate the firm’s sustainability under the condition of full disclosure of the changed audit opinion.

Notably, a trading halt tends to occur from multiple contributing factors and trading could not be resumed until all the factors are addressed. In this respect, the fine adjustments mentioned above may not be enough to dramatically enhance prolonged trading halts.11) Accordingly, disclosure of material information, not resolution of a contributing cause, should be a prerequisite for resumption of trading to ensure that a trading halt can be used as an incentive for firms to fully disclose new information. To this end, what is needed is improved awareness about corporate disclosure and mature investment culture. Also necessary is to facilitate the OTC market to help ineligible listed firms quickly exit the market.

1) The data excludes trading halts that arise from electronic registration alteration and cancellation as a result of a merge of SPACs and consolidation and split of shares.

2) The rate of return has been annualized as an equally weighted return to compare different trading halt periods.

3) Yonhap News, January 29, 2022, After avoiding a market plunge, Osstem Implant in a trading halt experiences a surge in market capitalization ranking.

Maeil Business News, January 29, 2022, Why did Osstem Implant show a sharp rise in market capitalization ranking, despite the largest misappropriation scandal?

4) MarketWatch of NYSE and Nasdaq temporarily suspended 295 trades of ordinary shares from January 1 to June 30, 2022 on the ground of news pending, and trading halts arising from LULD pause and a merger deal have been excluded (http://www.nyse.com/trade-halt-historical).

5) If information regarding financial standing and business operation is not sufficiently provided due to failure to submit a regular report or it is urgently needed to protect investors from abnormal trading activities such as market manipulation, the SEC can suspend trading in any stock.

6) Wall Street Journal, 2018. 8. 12. ‘After Tesla Buyout Tweet, Some Investors Wonder: Where Was Nasdaq?’

7) Marshall, N.T., Rogers, J.L., Zechman, S.L.C., 2022, Why Can‘t I Trade? Exchange Discretion in Calling Halts Around Important Information Events, SSRN Electronic Journal.

8) Christie, W.G., Corwin, S.A., Harris, J.H., 2002, Nasdaq Trading Halts: The Impact of Market Mechanisms on Prices, Trading Activity, and Execution Costs, The Journal of Finance 57(3), 1443-1478.

9) Schwartz, A.L., 1982, The adjustment of individual stock prices during periods of unusual disequilibria, Financial Review 17(4), 228-239.

10) DeHaan, E., Shevlin, T., Thornock, J., 2015, Market (in) attention and the strategic scheduling and timing of earnings announcements, Journal of Accounting and Economics 60(1), 36-55.

11) There are two cases where a disclaimer was received on the ground of uncertainties about a going concern in the first half of 2022. In one case, a firm was subject to delisting due to a failure to meet financial requirements. In another case, a firm defaulted on payment of principal and interest after the receipt of a disclaimer and was also designated as an unfaithfully disclosing business entity due to frequent changes in financing-related disclosure, which made the firm subject to an additional trading halt.