Our bi-weekly Opinion provides you with latest updates and analysis on major capital market and financial investment industry issues.

Long-Term Projection of Korea’s National Pension Fund and Reform of Fund Management System

Publication date Sep. 06, 2022

Summary

Korea is on the threshold of a new era of the KRW 1,000 trillion National Pension Fund (NPF). The current NPF management system was designed in 2005 when pension assets worth KRW 160 trillion were invested primarily in domestic bonds. This giant asset size of KRW 1,000 trillion requires a qualitative change to sophisticated portfolios and investment strategies, rather than quantitative growth. In this respect, the NPF has devised a long-term management strategy that aims at building a diversified global investment portfolio by increasing the weight of alternative investments and reducing home biases. But it has made little progress in implementing the strategy. The key to advanced fund management lies in an efficient decision-making system and a competent management entity. The existing NPF Management Committee consisting of representatives is regarded as a decision-making structure unfit for advanced asset management, while the management entity under the National Pension Service (NPS) exposes limitations that make it difficult to implement strategic decision making.

The reforms of foreign public pension funds imply that the desirable governance for public pension funds necessitates a top decision-making body run by a group of experts and an independent management entity. The issues arising from the proposed governance, such as government accountability and the connection between the pension scheme and fund management, could be addressed through the enhanced Asset Liability Management (ALM). If the function of the ALM Committee is assigned to the National Pension Operation Committee, it would be possible to bolster the ties between fund management and pension operation and hold accountable the government as the last resort of pension benefits payment. In line with the NPF governance reform, it is worth considering reorganizing the management entity into a dedicated fund management entity with an independent board of executive officers.

In the run-up to the fifth actuarial valuation of the NPS scheduled for 2023, discussions are underway on the pension scheme reform and the fund management system reorganization. The institutional reform aiming for the national pension scheme’s long-term financial stability should be examined alongside efficient fund management. Notably, the increase in investment returns could have a significant impact on financial stability and efficient fund management is an essential precondition for reaching a social consensus over a pension reform that may put pension holders at a disadvantage. Korea is now at a critical juncture to discuss how to reform the pension fund management system to enhance stable and long-term investment returns.

The reforms of foreign public pension funds imply that the desirable governance for public pension funds necessitates a top decision-making body run by a group of experts and an independent management entity. The issues arising from the proposed governance, such as government accountability and the connection between the pension scheme and fund management, could be addressed through the enhanced Asset Liability Management (ALM). If the function of the ALM Committee is assigned to the National Pension Operation Committee, it would be possible to bolster the ties between fund management and pension operation and hold accountable the government as the last resort of pension benefits payment. In line with the NPF governance reform, it is worth considering reorganizing the management entity into a dedicated fund management entity with an independent board of executive officers.

In the run-up to the fifth actuarial valuation of the NPS scheduled for 2023, discussions are underway on the pension scheme reform and the fund management system reorganization. The institutional reform aiming for the national pension scheme’s long-term financial stability should be examined alongside efficient fund management. Notably, the increase in investment returns could have a significant impact on financial stability and efficient fund management is an essential precondition for reaching a social consensus over a pension reform that may put pension holders at a disadvantage. Korea is now at a critical juncture to discuss how to reform the pension fund management system to enhance stable and long-term investment returns.

NPF actuarial valuation and reform on fund management

It is legally prescribed that the National Pension Service (NPS) should evaluate its long-term financial status every five years and reestablish the direction for the national pension scheme operation and the management plan of the National Pension Fund (NPF) based on evaluation results. Since the first actuarial valuation in 2003, the fifth NPF actuarial valuation is scheduled for 2023. The so-called NPF long-term projection is used in actuarial valuation to predict the NPS financial standing for the next 70 years. The fourth actuarial valuation (2018) analyzed that the NPF assets would rise to KRW 2,500 trillion or more until 2045 before being exhausted at a rapid pace within 15 years. This scenario is expected to deteriorate further in the upcoming fifth NPF actuarial valuation. This is attributable to the lack of government-wide discussions or efforts to overhaul the pension scheme and fund management system for financial stability, despite a warning about the potential fund depletion five years ago.1)

The NPS is a defined benefit (DB)-type public pension scheme without an automatic adjustment mechanism (AAM)2) designed for securing financial stability. In such a public pension scheme, a parametric pension reform such as adjustment of the contribution rate and the benefit ratio must be conducted on a permanent basis. Nevertheless, the reform needed for financial stability has been repeatedly thwarted or delayed in Korea on the ground of the absence of a social consensus. This is because the reform of a public pension scheme is supposed to entail a cutback on welfare benefits generated from post-retirement income security that the government has promised to fulfill. This means the current generation has to make any concession or sacrifice to some extent. What is needed to reach a social consensus about the pension reform unfavorable to pension holders is the public trust in the efficiency of pension fund management. This is well evidenced by how the Canada Pension Plan (CPP) dealt with disastrous financial projection results in 1995.3) Back then, the CPP managed to raise the contribution rate from 6.6% to 9.9% by establishing the Canada Pension Plan Investment Board (CPPIB), the world’s most efficient public pension management entity. The increase in the long-term return on public pension plans can make a direct contribution to stabilizing the financial status of a pension scheme. It can also contribute indirectly to alleviating social resistance to a parametric reform that puts pension holders at a disadvantage, based on the public trust in efficient pension asset management. In the run-up to the fifth NPF actuarial valuation, the reform on how to manage the KRW 1,000 trillion NPF is an essential and urgent task to reinforce the expertise and independence of a top decision-making body and the management entity.

The current NPF management system was designed in 2005 when pension assets amounted to just KRW 160 trillion. As asset portfolios have been highly diversified since then, the NPF governance structure has become inefficient, exposing many problems. The NPF’s top decision-making body (NPF Management Committee) consisting of representatives of the government and pension holders has been criticized for its lack of independence and expertise. In addition, the subcommittees set up to remedy such drawbacks seem to have an equally inefficient decision-making structure. The NPS Investment Management responsible for executing investments based on a strategic decision-making mechanism should act as a universal owner who invests KRW 1,000 trillion in assets globally. However, it currently faces structural difficulties in securing asset management capabilities. Accordingly, this article suggests reforming the NPF management system by reorganizing the NPF Management Committee into a body comprised of experts for maximizing stability and profitability of fund management with a primary focus on asset management. In line with the reorganization, the fund management entity (NPS Investment Management) should strive to achieve global investment competency as an entity specializing in pension asset management.

Reorganization of the top decision-making body

As the NPF’s asset amount approaches KRW 1,000 trillion and investment portfolios have been diversified, structural problems that cannot be solved under the current NPF governance have emerged in terms of not only stability and profitability but also independence and public nature. The NPF financial division managed KRW 924 trillion in pension assets as of end-2021, which increased by KRW 100 trillion annually from KRW 639 trillion as of end-2018. In 2005 when the current management system was first adopted, domestic bonds took up more than 90% of the asset portfolio. But the NPF investment portfolio is currently made up of stocks (45%) and alternative investments (12%), with over 52% of risk assets and around 40% of overseas investments by region. The NPF is exposed to a wide range of challenges including improvement in asset allocation strategies for early-stage management of a giant pension fund, restrictions on exercising a shareholder right, the need for performing independently from the government and the market, demand for greater contribution to the national economy and the capital markets, and difficulties in retaining and administering key personnel of the fund management entity. In the face of such challenges, the NPF hardly seems to follow the basic principles of pension fund management.

A recent case reveals that discussions about the NPF management system reform are urgently needed. Among the principles of pension fund management, independence is a prerequisite for gaining higher returns and stability. Although independence might conflict with other principles that put public interest first, it should be prioritized in aligning public interest with other pension fund management principles. This means every investment decision should be made solely by the NPF without any intervention. Aside from being independent of the government, winning independence from the market (including relevant industries and investors) has recently come to the fore. In the case of domestic stocks, the Korean government’s need for boosting its stock market and complaints filed by or collective action conducted by some retail investors have increasingly made it difficult for the NPF to independently set a mid- and long-term target weight of domestic stocks in its portfolio.

The key to making an investment decision is Strategic Asset Allocation (SAA). As part of the SAA, a mid- and long-term target weight of domestic stocks serves as a core fund management strategy determined after taking into consideration market conditions, relationships with other asset groups, and a long-term projection. The NPS has implemented a strategy of reducing the weight of domestic stocks below a certain level, considering various factors including liquidity management in preparation for a reversal in the financial balance arising from the NPF long-term projection, as well as the risk return profile of domestic stocks and correlations with other asset groups. However, pressures from the government and the market regarding the weight of domestic stocks put practical constraints on the mid- and long-term asset allocation. This phenomenon can also be observed in the currency policy that is regarded as the most important strategy for the NPS’ overseas investment worth KRW 400 trillion.4) According to a finance theory, asset allocation under restriction is placed at a disadvantage over unbridled asset allocation, implying that compromised independence in terms of pension fund management would end up causing losses to the pension fund in any manner.

In the current governance structure, the NPF Management Committee comprised of representatives of pension holders has been designed to gain independence from the government, whereas the Pension Experts Committee consisting of a panel of experts aims at acting independently from the market. However, it has turned out that the NPF Management Committee lacks expertise in dealing with unreasonable requests from the market and the Pension Experts Committee is hardly independent of the government. Members of the NPF Management Committee cannot respond properly to absurd demands and pressures from the market, due to their lack of understanding of fund management strategies that require a high level of expertise. On the other hand, members of the Pension Experts Committee whose selection and term extension are approved by the government find it hard to stand up against political judgment made by government departments. Despite the efforts and activities to address an array of practical problems faced by the NPS, the governance structure of the top decision-making body and the management entity seems to serve as a fundamental obstacle. In this respect, Keith Ambachtsheer known for his distinguished research of pension funds’ governance has argued that improved governance of pension funds would push up investment returns by 2%p or more.5)

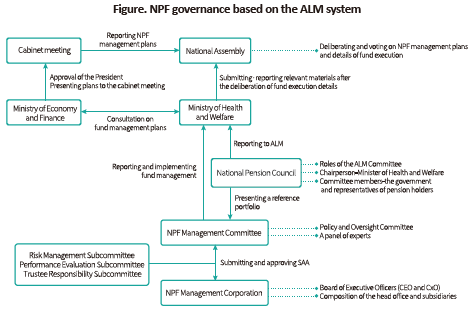

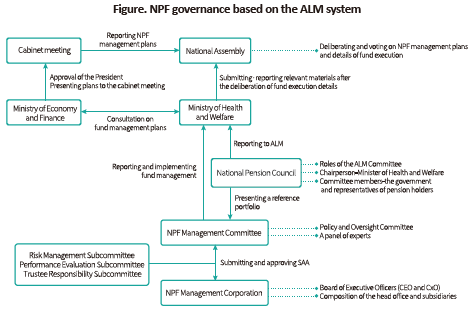

In terms of governance, it is desirable to separate the operation of a pension scheme from fund management. This ironically necessitates the establishment of a pension fund management system that takes into account a pension scheme’s characteristics in the initial stage of fund management. This system refers to Asset Liability Management (ALM). To set a fund management objective based on pension schemes’ attributes and hold the government responsible for such an objective, the ALM Committee representing pension holders should be formed within the government to administer both the pension scheme and the fund management function. A target rate of return and risk tolerance limits that independent fund management by experts needs to achieve or follow should be derived from characteristics of a pension scheme such as funding methods and goals. Under the ALM system defined as liabilities-focused asset management, the ALM Committee figures out the amount of liabilities through an NPF long-term projection, manages a funding ratio and set up a reference portfolio6) presenting a direction for long-term fund management. In this regard, it is worth considering elevating the perfunctory National Pension Council to the National Pension Operation Committee that can represent pension holders and guarantee government accountability. With this measure, the National Pension Operation Committee could also take on the function of the ALM Committee. The following Figure illustrates the potential NPF governance structure under which the overall pension scheme operation including the pension reform is implemented within the current framework consisting of the government and the National Assembly while the function of managing the pension fund is assigned to the experts-driven NPF Management Committee via the ALM Committee and a reference portfolio.

Separation of NPF management entity

If the NPF Management Committee is reorganized into a body comprised of non-government experts, it is desirable to spin off the management entity in the form of a state-owned corporation (or a public enterprise). This is well demonstrated by the cases of the CPPIB which was launched as an asset management entity for the CPP and the APG functioning as a pension fund manager for public pension funds of the Netherlands including Algemeen Burgerlijk Pensioenfonds (ABP). The CPPIB and the APG indicate that if the management entity of a public pension fund improves its efficiency by seeking both stability and higher returns, it would contribute to financial stability of the pension scheme. On the other hand, Japan’s Government Pension Investment Fund (GPIF), the world’s largest public pension fund management entity, has been operated primarily by public officials as a non-professional body, which has limited its role to pension operation rather than to fund management. It is also worth looking at the California Public Employees' Retirement System (CalPERS), an occupational pension fund of the US that is often referred to as the benchmark for the NPS. The CalPERS has also been pointed out as being relatively less efficient in fund management compared with other management entities mentioned above, due to its governance of not separating pension operation from asset management.

A dedicated management entity to be newly established in Korea, the tentatively named ‘NPF Management Corporation’ is designed to perform the functions of the fund management board, acting as the oversight council, and the board of executive officers.7) Once it is launched, the corporation would rank as the world’s second largest management entity of public pension funds. As indicated by the APG’s growth path, an independent entity specializing in pension fund management can expand offshore branches that are the equivalent of global investment firms and spin off a subsidiary for heterogeneous assets including alternative investments as it can take a flexible approach to organizational constitution and operation.8) The key to a professional management entity’s higher long-term return lies in securing and retaining competent fund management experts. This requires reasonable recruiting and compensation systems that can compete with those adopted by private companies. In this respect, what is needed is less strict application of the Act on the Management of Public Institutions that applies to all public institutions without exception, to ensure that a management entity to be established in the form of a public enterprise or a state-owned corporation can create and maintain a pool of competitive fund management experts.

There are concerns about inefficiency that could arise from a massive amount of pension assets managed solely by an institution. Some suggest that it is necessary to divide functions of the NPF and implement such functions separately to strengthen competition. The so-called Big Fish in a Small Pond concept, meaning a giant asset size relative to the limited domestic capital markets, is pointed out as another contributing factor of such inefficiencies. Considering that the NPF aims to increase the proportion of overseas investment to more than half the total in the long run, it is more important to focus on a growing need for realizing economies of scale in the global market than on concerns over adverse effects of a giant fund size within the domestic market. According to an analysis of global investment patterns of large-scale pension funds or sovereign wealth funds, the NPS is likely to be required to increase the amount of its assets being solely managed, rather than to cut back on the fund size. The key factor behind the successful foreign investment is local investing. Since the launch of overseas branches in New York, London and Singapore about ten years ago, the NPS has endeavored to expand the functions and talent pool of local subsidiaries. But its intrinsic limitation of being a quasi-government institution serves as an obstacle. Against this backdrop, the establishment of a dedicated pension fund management entity could make a huge breakthrough.

Conclusion and implications

Considering that the sustainability of a public pension scheme can be achieved through financial stability, improved efficiency in managing pension assets is of significance on the following two fronts. First, continuous, long-term growth of returns on pension assets can bring about the compound interest effect, which directly contributes to financial stability. The 1%p increase in the annual rate of return can be interpreted that the depletion of the national pension fund can be delayed by five years without additional contributions. In the previous pension reforms, gaining financial stability through higher returns on pension assets was widely accepted as a precarious approach, due to a misunderstanding of risks posed by asset management. In pension asset management, a risk premium or an illiquidity premium can boost a long-term return in a structural and systematic manner. The focus of such an approach is on how to build a global investment portfolio based on risk diversification, rather than on recklessly seeking a high-risk, high-return investment. This calls for the overall reform of the current NPF management system.

Efficient fund management would have an indirect impact on facilitating institutional reform. Since the NPS is a DB-type pension scheme without AAMs linked to environmental factors such as demographic changes, a parametric pension reform regarding the contribution rate and the benefit ratio is an essential element for the operation of the NPS. It is always challenging to form a social consensus on parametric pension reforms that hardly do any favor to pension members. Notably, the delayed public pension reform can create a generational conflict and efficient pension fund management is a prerequisite for social acceptance of such parametric pension reforms. In addition to such reforms, this requires discussions about how to overhaul the pension fund management system for improving long-term returns.

1) The NPS actuarial valuation commonly involves three committees including the financial projection committee for the long-term projection, the institutional development committee for parametric pension reforms and the pension fund development committee for the reorganization of the pension fund management system. The three committees discuss actuarial valuation matters and report discussion results to the National Assembly by October of the corresponding year.

2) This refers to a mechanism that automatically adjusts the public pension scheme by taking into account financial conditions such as pension benefits, retirement age and the contribution amount.

3) The key to the 1996 CPP reform is a transition to the funding system based on a higher contribution rate from the previous pay-as-you-go system and the revision to its pension act. The revision precluded the possibility of government intervention by removing the phrase saying the pension fund shall contribute to Canadian society and prescribed that the sole liability of the pension fund shall be to maximize the return against risks. This has led to the establishment of the CPPIB, an independent institution specializing in pension fund management.

4) The NPS has established a currency policy that hardly hedges against foreign currency exposure. However, amid a surge in the won-dollar exchange rate and the resultant foreign investment outflows, there is growing demand from the government and the market for revising the NPS’ overseas investment expansion plan or its currency policy.

5) See Ambachtsheer, K. P., 1998, Pension fund excellence, John Wiley & Sons.

6) A Reference Portfolio (RP), also referred to as a norm portfolio or a model portfolio, represents a simple ratio of risk assets to safe assets. The RP presents a direction for long-term pension fund management and serves as a yardstick for judging the relevance of SAA. Since 2020, the NPS has sought reorganizing the existing two-stage asset allocation method into a three-stage method including an RP.

7) The executive officers include the CEO, CIO, CRO and COO.

8) The CPPIB and the APG have built global portfolios focusing on overseas assets, with more than half their management personnel working at offshore branches. The APG founded New Holland Capital in the form of a subsidiary to facilitate investing in a hedge fund.

It is legally prescribed that the National Pension Service (NPS) should evaluate its long-term financial status every five years and reestablish the direction for the national pension scheme operation and the management plan of the National Pension Fund (NPF) based on evaluation results. Since the first actuarial valuation in 2003, the fifth NPF actuarial valuation is scheduled for 2023. The so-called NPF long-term projection is used in actuarial valuation to predict the NPS financial standing for the next 70 years. The fourth actuarial valuation (2018) analyzed that the NPF assets would rise to KRW 2,500 trillion or more until 2045 before being exhausted at a rapid pace within 15 years. This scenario is expected to deteriorate further in the upcoming fifth NPF actuarial valuation. This is attributable to the lack of government-wide discussions or efforts to overhaul the pension scheme and fund management system for financial stability, despite a warning about the potential fund depletion five years ago.1)

The NPS is a defined benefit (DB)-type public pension scheme without an automatic adjustment mechanism (AAM)2) designed for securing financial stability. In such a public pension scheme, a parametric pension reform such as adjustment of the contribution rate and the benefit ratio must be conducted on a permanent basis. Nevertheless, the reform needed for financial stability has been repeatedly thwarted or delayed in Korea on the ground of the absence of a social consensus. This is because the reform of a public pension scheme is supposed to entail a cutback on welfare benefits generated from post-retirement income security that the government has promised to fulfill. This means the current generation has to make any concession or sacrifice to some extent. What is needed to reach a social consensus about the pension reform unfavorable to pension holders is the public trust in the efficiency of pension fund management. This is well evidenced by how the Canada Pension Plan (CPP) dealt with disastrous financial projection results in 1995.3) Back then, the CPP managed to raise the contribution rate from 6.6% to 9.9% by establishing the Canada Pension Plan Investment Board (CPPIB), the world’s most efficient public pension management entity. The increase in the long-term return on public pension plans can make a direct contribution to stabilizing the financial status of a pension scheme. It can also contribute indirectly to alleviating social resistance to a parametric reform that puts pension holders at a disadvantage, based on the public trust in efficient pension asset management. In the run-up to the fifth NPF actuarial valuation, the reform on how to manage the KRW 1,000 trillion NPF is an essential and urgent task to reinforce the expertise and independence of a top decision-making body and the management entity.

The current NPF management system was designed in 2005 when pension assets amounted to just KRW 160 trillion. As asset portfolios have been highly diversified since then, the NPF governance structure has become inefficient, exposing many problems. The NPF’s top decision-making body (NPF Management Committee) consisting of representatives of the government and pension holders has been criticized for its lack of independence and expertise. In addition, the subcommittees set up to remedy such drawbacks seem to have an equally inefficient decision-making structure. The NPS Investment Management responsible for executing investments based on a strategic decision-making mechanism should act as a universal owner who invests KRW 1,000 trillion in assets globally. However, it currently faces structural difficulties in securing asset management capabilities. Accordingly, this article suggests reforming the NPF management system by reorganizing the NPF Management Committee into a body comprised of experts for maximizing stability and profitability of fund management with a primary focus on asset management. In line with the reorganization, the fund management entity (NPS Investment Management) should strive to achieve global investment competency as an entity specializing in pension asset management.

Reorganization of the top decision-making body

As the NPF’s asset amount approaches KRW 1,000 trillion and investment portfolios have been diversified, structural problems that cannot be solved under the current NPF governance have emerged in terms of not only stability and profitability but also independence and public nature. The NPF financial division managed KRW 924 trillion in pension assets as of end-2021, which increased by KRW 100 trillion annually from KRW 639 trillion as of end-2018. In 2005 when the current management system was first adopted, domestic bonds took up more than 90% of the asset portfolio. But the NPF investment portfolio is currently made up of stocks (45%) and alternative investments (12%), with over 52% of risk assets and around 40% of overseas investments by region. The NPF is exposed to a wide range of challenges including improvement in asset allocation strategies for early-stage management of a giant pension fund, restrictions on exercising a shareholder right, the need for performing independently from the government and the market, demand for greater contribution to the national economy and the capital markets, and difficulties in retaining and administering key personnel of the fund management entity. In the face of such challenges, the NPF hardly seems to follow the basic principles of pension fund management.

A recent case reveals that discussions about the NPF management system reform are urgently needed. Among the principles of pension fund management, independence is a prerequisite for gaining higher returns and stability. Although independence might conflict with other principles that put public interest first, it should be prioritized in aligning public interest with other pension fund management principles. This means every investment decision should be made solely by the NPF without any intervention. Aside from being independent of the government, winning independence from the market (including relevant industries and investors) has recently come to the fore. In the case of domestic stocks, the Korean government’s need for boosting its stock market and complaints filed by or collective action conducted by some retail investors have increasingly made it difficult for the NPF to independently set a mid- and long-term target weight of domestic stocks in its portfolio.

The key to making an investment decision is Strategic Asset Allocation (SAA). As part of the SAA, a mid- and long-term target weight of domestic stocks serves as a core fund management strategy determined after taking into consideration market conditions, relationships with other asset groups, and a long-term projection. The NPS has implemented a strategy of reducing the weight of domestic stocks below a certain level, considering various factors including liquidity management in preparation for a reversal in the financial balance arising from the NPF long-term projection, as well as the risk return profile of domestic stocks and correlations with other asset groups. However, pressures from the government and the market regarding the weight of domestic stocks put practical constraints on the mid- and long-term asset allocation. This phenomenon can also be observed in the currency policy that is regarded as the most important strategy for the NPS’ overseas investment worth KRW 400 trillion.4) According to a finance theory, asset allocation under restriction is placed at a disadvantage over unbridled asset allocation, implying that compromised independence in terms of pension fund management would end up causing losses to the pension fund in any manner.

In the current governance structure, the NPF Management Committee comprised of representatives of pension holders has been designed to gain independence from the government, whereas the Pension Experts Committee consisting of a panel of experts aims at acting independently from the market. However, it has turned out that the NPF Management Committee lacks expertise in dealing with unreasonable requests from the market and the Pension Experts Committee is hardly independent of the government. Members of the NPF Management Committee cannot respond properly to absurd demands and pressures from the market, due to their lack of understanding of fund management strategies that require a high level of expertise. On the other hand, members of the Pension Experts Committee whose selection and term extension are approved by the government find it hard to stand up against political judgment made by government departments. Despite the efforts and activities to address an array of practical problems faced by the NPS, the governance structure of the top decision-making body and the management entity seems to serve as a fundamental obstacle. In this respect, Keith Ambachtsheer known for his distinguished research of pension funds’ governance has argued that improved governance of pension funds would push up investment returns by 2%p or more.5)

In terms of governance, it is desirable to separate the operation of a pension scheme from fund management. This ironically necessitates the establishment of a pension fund management system that takes into account a pension scheme’s characteristics in the initial stage of fund management. This system refers to Asset Liability Management (ALM). To set a fund management objective based on pension schemes’ attributes and hold the government responsible for such an objective, the ALM Committee representing pension holders should be formed within the government to administer both the pension scheme and the fund management function. A target rate of return and risk tolerance limits that independent fund management by experts needs to achieve or follow should be derived from characteristics of a pension scheme such as funding methods and goals. Under the ALM system defined as liabilities-focused asset management, the ALM Committee figures out the amount of liabilities through an NPF long-term projection, manages a funding ratio and set up a reference portfolio6) presenting a direction for long-term fund management. In this regard, it is worth considering elevating the perfunctory National Pension Council to the National Pension Operation Committee that can represent pension holders and guarantee government accountability. With this measure, the National Pension Operation Committee could also take on the function of the ALM Committee. The following Figure illustrates the potential NPF governance structure under which the overall pension scheme operation including the pension reform is implemented within the current framework consisting of the government and the National Assembly while the function of managing the pension fund is assigned to the experts-driven NPF Management Committee via the ALM Committee and a reference portfolio.

If the NPF Management Committee is reorganized into a body comprised of non-government experts, it is desirable to spin off the management entity in the form of a state-owned corporation (or a public enterprise). This is well demonstrated by the cases of the CPPIB which was launched as an asset management entity for the CPP and the APG functioning as a pension fund manager for public pension funds of the Netherlands including Algemeen Burgerlijk Pensioenfonds (ABP). The CPPIB and the APG indicate that if the management entity of a public pension fund improves its efficiency by seeking both stability and higher returns, it would contribute to financial stability of the pension scheme. On the other hand, Japan’s Government Pension Investment Fund (GPIF), the world’s largest public pension fund management entity, has been operated primarily by public officials as a non-professional body, which has limited its role to pension operation rather than to fund management. It is also worth looking at the California Public Employees' Retirement System (CalPERS), an occupational pension fund of the US that is often referred to as the benchmark for the NPS. The CalPERS has also been pointed out as being relatively less efficient in fund management compared with other management entities mentioned above, due to its governance of not separating pension operation from asset management.

A dedicated management entity to be newly established in Korea, the tentatively named ‘NPF Management Corporation’ is designed to perform the functions of the fund management board, acting as the oversight council, and the board of executive officers.7) Once it is launched, the corporation would rank as the world’s second largest management entity of public pension funds. As indicated by the APG’s growth path, an independent entity specializing in pension fund management can expand offshore branches that are the equivalent of global investment firms and spin off a subsidiary for heterogeneous assets including alternative investments as it can take a flexible approach to organizational constitution and operation.8) The key to a professional management entity’s higher long-term return lies in securing and retaining competent fund management experts. This requires reasonable recruiting and compensation systems that can compete with those adopted by private companies. In this respect, what is needed is less strict application of the Act on the Management of Public Institutions that applies to all public institutions without exception, to ensure that a management entity to be established in the form of a public enterprise or a state-owned corporation can create and maintain a pool of competitive fund management experts.

There are concerns about inefficiency that could arise from a massive amount of pension assets managed solely by an institution. Some suggest that it is necessary to divide functions of the NPF and implement such functions separately to strengthen competition. The so-called Big Fish in a Small Pond concept, meaning a giant asset size relative to the limited domestic capital markets, is pointed out as another contributing factor of such inefficiencies. Considering that the NPF aims to increase the proportion of overseas investment to more than half the total in the long run, it is more important to focus on a growing need for realizing economies of scale in the global market than on concerns over adverse effects of a giant fund size within the domestic market. According to an analysis of global investment patterns of large-scale pension funds or sovereign wealth funds, the NPS is likely to be required to increase the amount of its assets being solely managed, rather than to cut back on the fund size. The key factor behind the successful foreign investment is local investing. Since the launch of overseas branches in New York, London and Singapore about ten years ago, the NPS has endeavored to expand the functions and talent pool of local subsidiaries. But its intrinsic limitation of being a quasi-government institution serves as an obstacle. Against this backdrop, the establishment of a dedicated pension fund management entity could make a huge breakthrough.

Conclusion and implications

Considering that the sustainability of a public pension scheme can be achieved through financial stability, improved efficiency in managing pension assets is of significance on the following two fronts. First, continuous, long-term growth of returns on pension assets can bring about the compound interest effect, which directly contributes to financial stability. The 1%p increase in the annual rate of return can be interpreted that the depletion of the national pension fund can be delayed by five years without additional contributions. In the previous pension reforms, gaining financial stability through higher returns on pension assets was widely accepted as a precarious approach, due to a misunderstanding of risks posed by asset management. In pension asset management, a risk premium or an illiquidity premium can boost a long-term return in a structural and systematic manner. The focus of such an approach is on how to build a global investment portfolio based on risk diversification, rather than on recklessly seeking a high-risk, high-return investment. This calls for the overall reform of the current NPF management system.

Efficient fund management would have an indirect impact on facilitating institutional reform. Since the NPS is a DB-type pension scheme without AAMs linked to environmental factors such as demographic changes, a parametric pension reform regarding the contribution rate and the benefit ratio is an essential element for the operation of the NPS. It is always challenging to form a social consensus on parametric pension reforms that hardly do any favor to pension members. Notably, the delayed public pension reform can create a generational conflict and efficient pension fund management is a prerequisite for social acceptance of such parametric pension reforms. In addition to such reforms, this requires discussions about how to overhaul the pension fund management system for improving long-term returns.

1) The NPS actuarial valuation commonly involves three committees including the financial projection committee for the long-term projection, the institutional development committee for parametric pension reforms and the pension fund development committee for the reorganization of the pension fund management system. The three committees discuss actuarial valuation matters and report discussion results to the National Assembly by October of the corresponding year.

2) This refers to a mechanism that automatically adjusts the public pension scheme by taking into account financial conditions such as pension benefits, retirement age and the contribution amount.

3) The key to the 1996 CPP reform is a transition to the funding system based on a higher contribution rate from the previous pay-as-you-go system and the revision to its pension act. The revision precluded the possibility of government intervention by removing the phrase saying the pension fund shall contribute to Canadian society and prescribed that the sole liability of the pension fund shall be to maximize the return against risks. This has led to the establishment of the CPPIB, an independent institution specializing in pension fund management.

4) The NPS has established a currency policy that hardly hedges against foreign currency exposure. However, amid a surge in the won-dollar exchange rate and the resultant foreign investment outflows, there is growing demand from the government and the market for revising the NPS’ overseas investment expansion plan or its currency policy.

5) See Ambachtsheer, K. P., 1998, Pension fund excellence, John Wiley & Sons.

6) A Reference Portfolio (RP), also referred to as a norm portfolio or a model portfolio, represents a simple ratio of risk assets to safe assets. The RP presents a direction for long-term pension fund management and serves as a yardstick for judging the relevance of SAA. Since 2020, the NPS has sought reorganizing the existing two-stage asset allocation method into a three-stage method including an RP.

7) The executive officers include the CEO, CIO, CRO and COO.

8) The CPPIB and the APG have built global portfolios focusing on overseas assets, with more than half their management personnel working at offshore branches. The APG founded New Holland Capital in the form of a subsidiary to facilitate investing in a hedge fund.